Blueprint

Exhibit

99.2

AUTOWEB, INC.

Moderator: Sean Mansouri

November 8, 2018

5:00 p.m. ET

OPERATOR:

This is Conference # 9376169.

Operator:

Good

afternoon, everyone, and thank you for participating in

today’s conference call for us to discuss AutoWeb’s

financial results for the third quarter ended September 30,

2018.

Joining

us today are AutoWeb’s CEO, Jared Rowe; the company’s

interim CFO, Wes Ozima; and the company’s outside Investor

Relations advisor, Sean Mansouri with Liolios. Following their

remarks, we’ll open the call for your questions. As a

reminder, this conference call is being recorded.

I would

now like to turn the call over to Mr. Mansouri for some

introductory comments.

Sean

Mansouri:

Thank you, Noelle. Before I introduce Jared, I remind you that

during today’s call, including the question-and-answer

session, statements that are not historical facts, including many

projections, statements regarding future events or future financial

performance or statements of intent or belief are forward-looking

statements and are covered by the Safe Harbor disclaimers contained

in today’s press release, the slides accompany this

presentation and the company’s public filings with the SEC.

Actual outcomes and results may differ materially from what is

expressed in or implied by these forward-looking

statements.

Specifically,

please refer to the company’s Form 10-Q for the third quarter

ended September 30, 2018, which was filed prior to this call as

well as other filings made by AutoWeb with the SEC from time to

time. These filings identify factors that could cause results to

differ materially from those forward-looking

statements.

There

are slides included in today’s presentation to help

illustrate some of the points being made and discussed during the

call. The slides can be accessed by visiting AutoWeb’s

website at www.autoweb.com. When there, go to Investors and then

click on Events & Presentations.

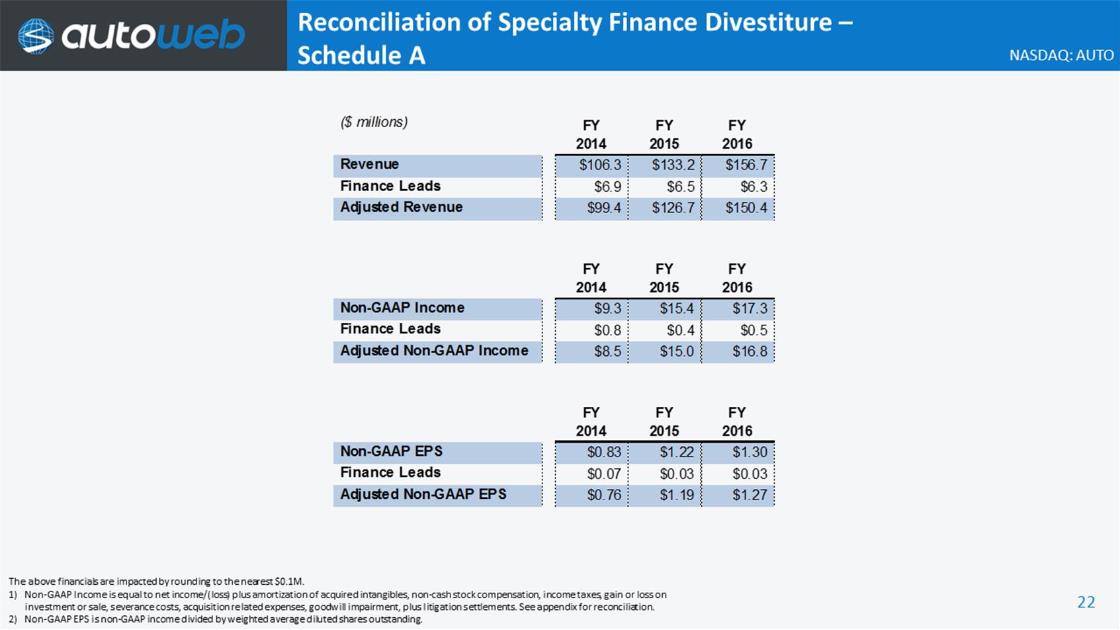

Please

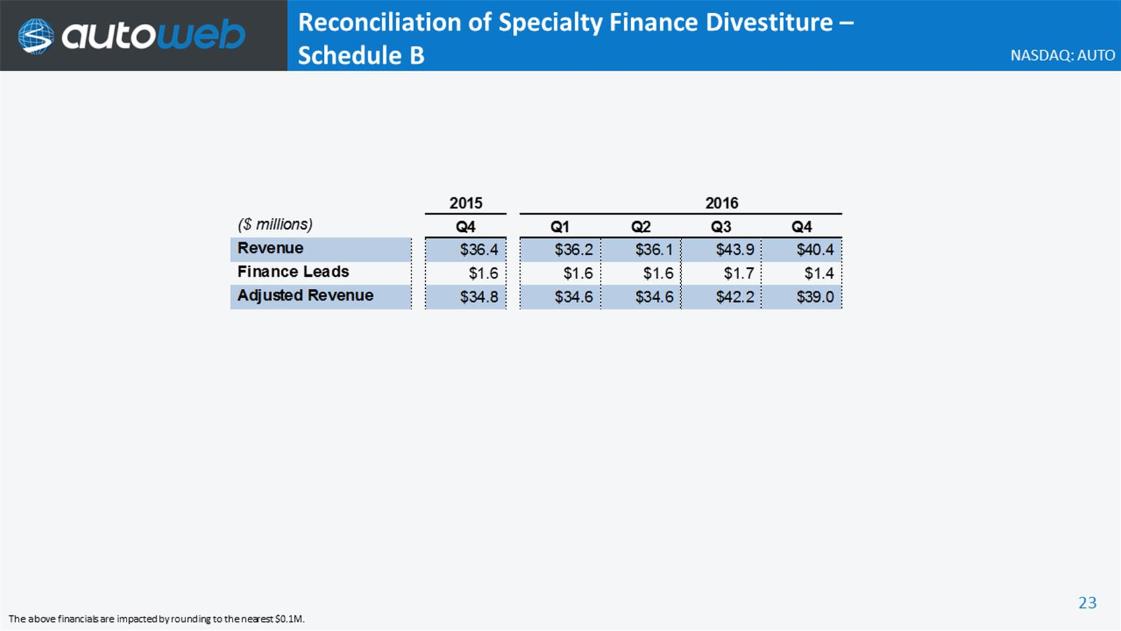

also note that during this call and/or in the accompanying slides,

management will be disclosing non-GAAP loss or income, non-GAAP

EPS, adjusted gross profit and gross margin. These are non-GAAP

financial measures as defined by SEC Regulation G. Reconciliations

of these non-GAAP financial measures to the most directly

comparable GAAP measures are included in today’s press

release and slides, which are posted on the company’s

website.

And

with that, I’ll turn the call over to Jared.

Jared

R.

Rowe:

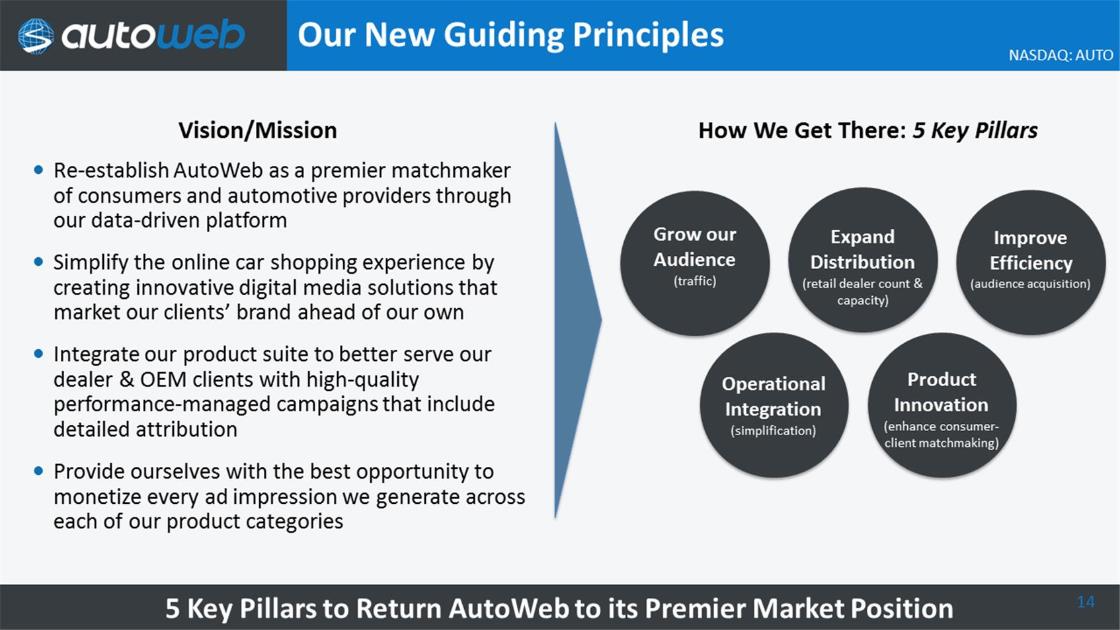

Thanks, Sean, and good afternoon, everyone. Since I joined AutoWeb

earlier this year, our team has conducted a comprehensive review of

our operations and go-to-market approach to better align with our

mission of reestablishing AutoWeb as a premier matchmaker of

consumers and automotive providers.

Now

this review included an assessment of our products, traffic

acquisition, pricing policies, distribution channels, technology

infrastructure, strategic positioning and organizational structure

as well as our long-term prospects in the future of

mobility.

Now as

an outcome of this review and in an effort to improve transparency

with our shareholders, we have introduced several new operating

metrics that we plan to report on a quarterly basis including

measures to help assess audience size, traffic acquisition

efficiency and distribution channel effectiveness. Wes will expand

upon these new metrics but they can also be found in the

presentation posted in the investor section of our

website.

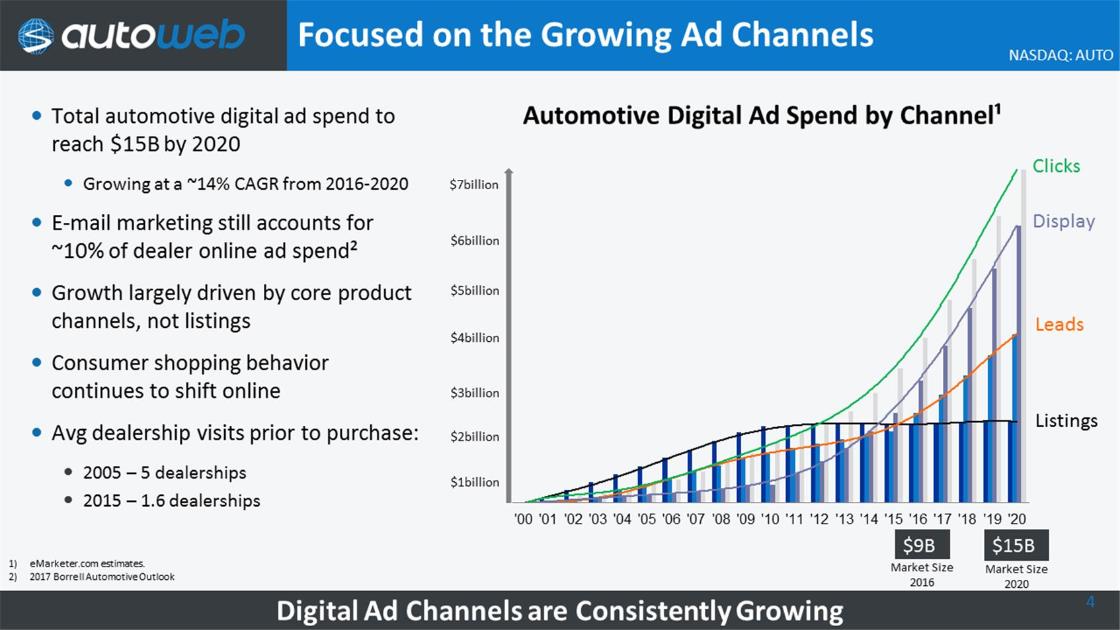

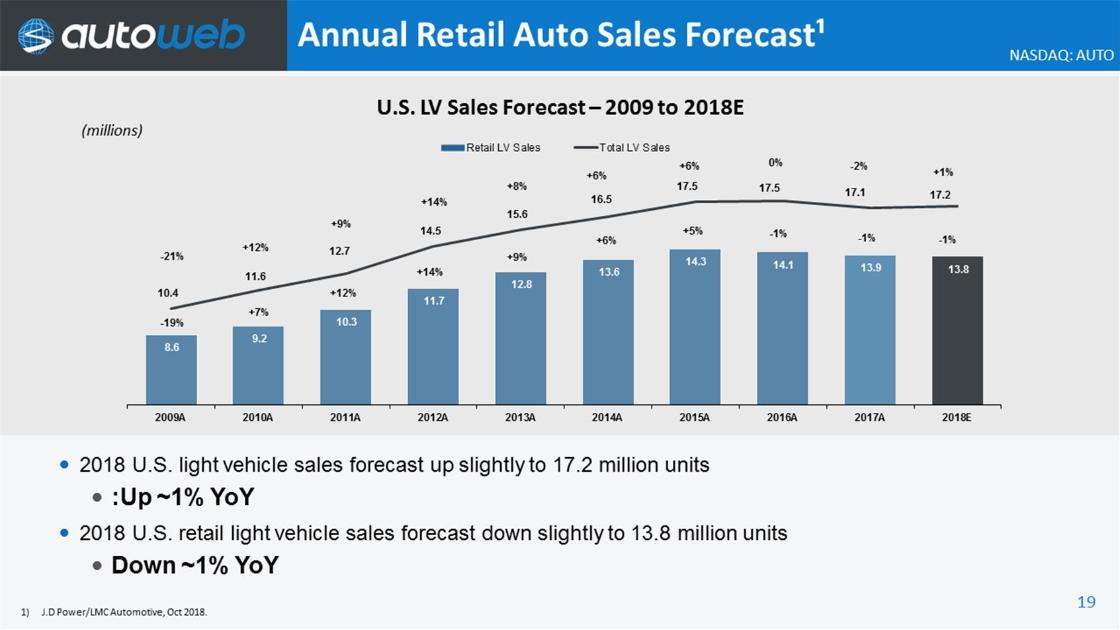

Now the

assessment of our go-to-market approach could not have come at a

more important time given recent industry dynamics in the

automotive environment at large. Interest rates have steadily been

on the rise, which is impacting the affordability of cars for

consumers.

When

the U.S. automotive industry hit record sales in 2016, the Federal

Reserve benchmark interest rate was between 0.5 percent and 0.75

percent. Now it’s between 2 percent and 2.5 percent.

According to industry reports, if the rate moves to a range of 2.75

percent to 3 percent, by next September, consumers will pay more

than $6,000 on average in interest alone to finance a

vehicle.

Now in

addition to the impact from rising interest rates, OEMs are

beginning to cut incentives considerably. In September alone, OEM

incentives declined nearly 3 percent compared to September of 2017.

Despite the slight increase in new car sales in October, we believe

that the auto environment has – we’ve experienced for

several years has been unsustainable and the reality is beginning

to settle in.

Now on

the digital media front, trends continue to shift towards mobile,

social media and voice search. While mobile and social media have

been front and center for several years now, the use of voice

assistance in the U.S. is expected to grow by 129 percent in 2018

compared to the prior year, totaling 35.6 million Americans using

the service at least once per month.

And

finally, today’s consumer. Today’s consumer is unique,

and consumers expect a unique experience for a unique vehicle. In

2018 models alone, there were more than 2,600 make, model and trim

combinations of vehicles. Couple that with the market dynamics of

search, digital media and affordability constraint and automotive

providers now find themselves in a highly complex environment to

attract, convert and retain customers.

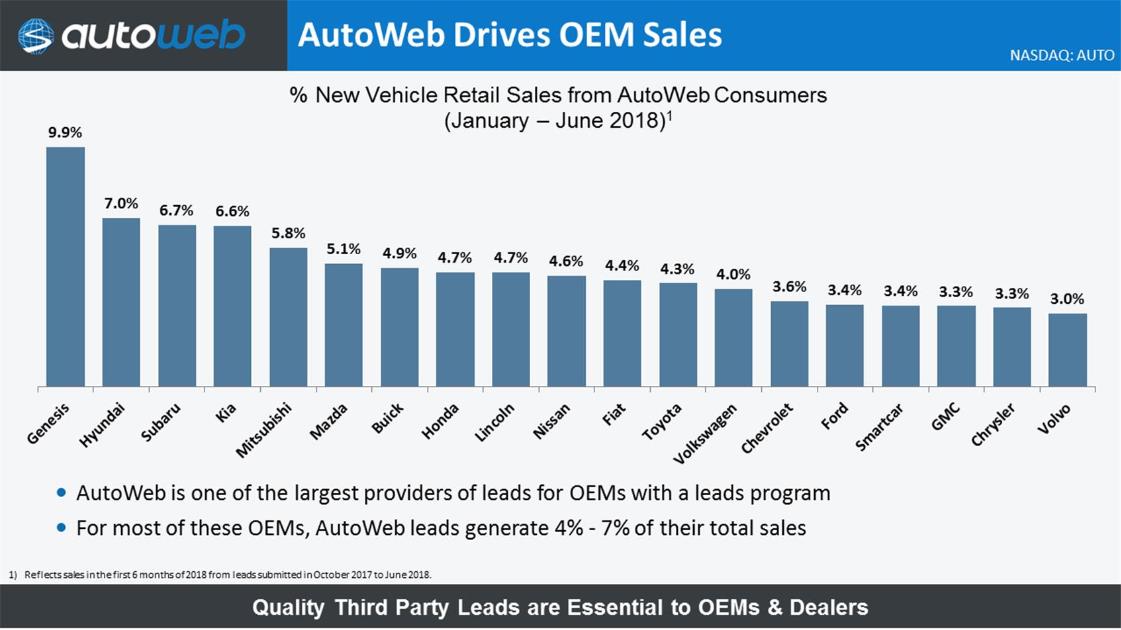

So what

does all this mean for a digital marketing platform like AutoWeb?

It means that we’re going to have to provide our dealer and

OEM clients with a better and more integrated product suite, one

that is more data informed to ensure superior customer experience:

a product suite that connects the right consumer with the right

dealer to match the expectations of both parties. This data-driven

approach is imperative as we have been underutilizing the millions

of consumer data points that we collect each month.

Equally

important, these high-quality performance managed marketing

campaigns need to include detailed attribution to ensure the value

we’re providing to our clients is abundantly clear. And by

attribution, I don’t mean telling a dealer that a consumer we

gave them bought a car within 90 days. It means showing the dealer

that we helped them achieve their monthly sales goals.

From a

consumer perspective, our products and content will have to be

optimized to suit the requirements of mobile search as well as

social media and voice search down the road, given the rapidly

growing presence of these channels.

Ultimately, if we

can simplify the online car shopping experience with innovative

digital media solutions that market our client’s brand ahead

of our own and deliver a high-quality customer experience,

we’ll be best positioned to capitalize on the new environment

in which we find ourselves. All of this was heavily considered

during our strategic review.

During

the third quarter, we began to execute against our new plan,

beginning with the reset of our senior leadership team. This

resulted in a charge that impacted the bottom line in Q3 but serves

as a catalyst for rebuilding and strengthening our organization

with key personnel that align with our new strategic

imperatives.

Our

strategic review also included an assessment of the company’s

assets and licenses. As a result of our reevaluation of the DealerX

data and consumer targeting platform, we concluded that the

effectiveness of the solution was not in line with the enhanced

consumer-to-client matchmaking that we are seeking and have thus

taken a charge to write down the platform license.

In

addition, we have impaired 2 other assets related to GoMoto and

SaleMove, neither of which align with our new strategic

rationale.

As

discussed on previous calls, we have begun to modernize and

contemporize our approach to traffic acquisition. These changes

have delivered some early results as reflected by the 8 percent

sequential improvement in lead traffic.

Further, our

pricing rationalization and revised client engagement approach has

led to our first sequential increase in retail dealer count since

Q4 2015. By growing our audience and our retail dealer count, we

have shown that our revised operating approach is having a positive

impact on 2 critical drivers of our success.

While

we’re encouraged by the early signs of improvement in our

business, we still have plenty of work to return AutoWeb to growth

and profitability. We believe that revenue growth and margin

expansion will ultimately come from: one, audience growth; two,

improved audience acquisition efficiency; three, retail dealer

count and lead capacity growth; four, operational integration and

simplification; and five, enhanced consumer-to-client matchmaking.

I’ll expand on each of these later in the call but first,

I’d like to turn it over to Wes to walk through the details

of our Q3 results. Wes?

Wesley

Ozima:

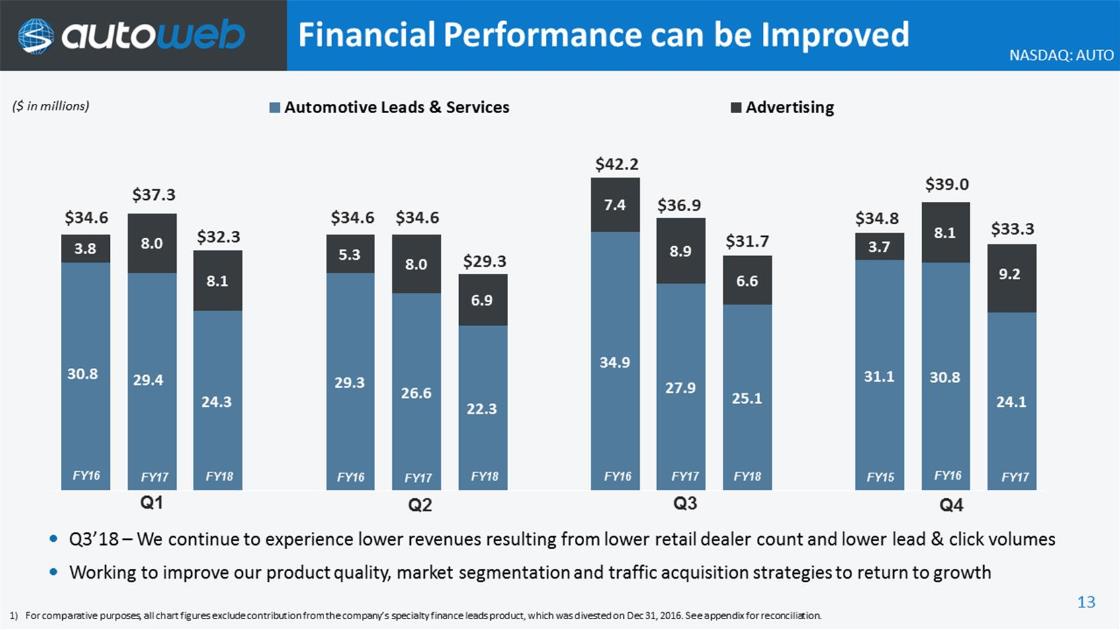

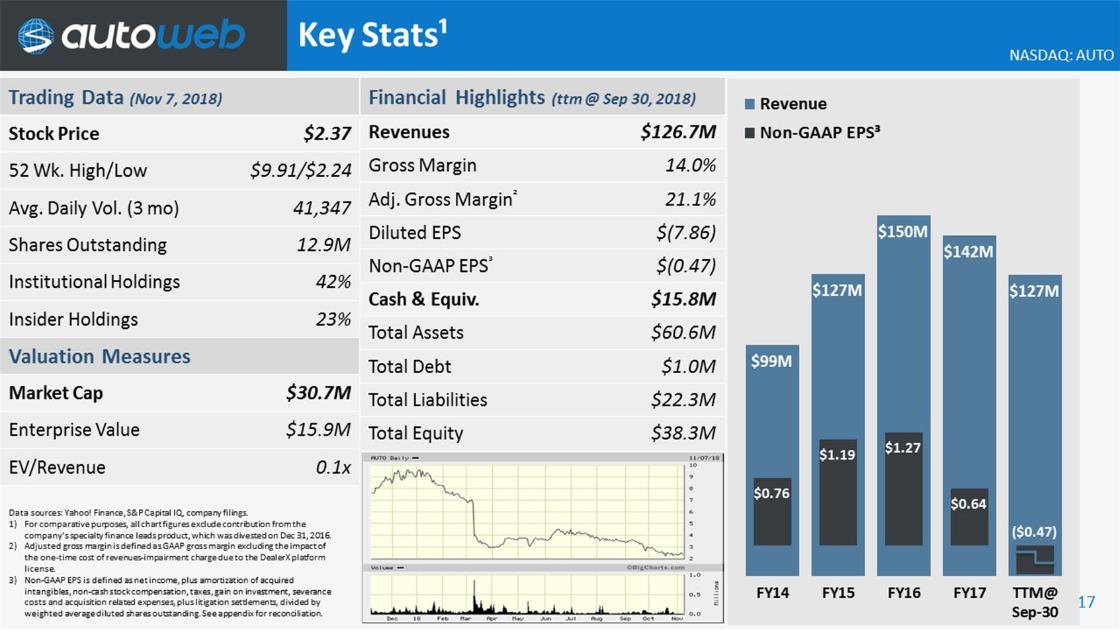

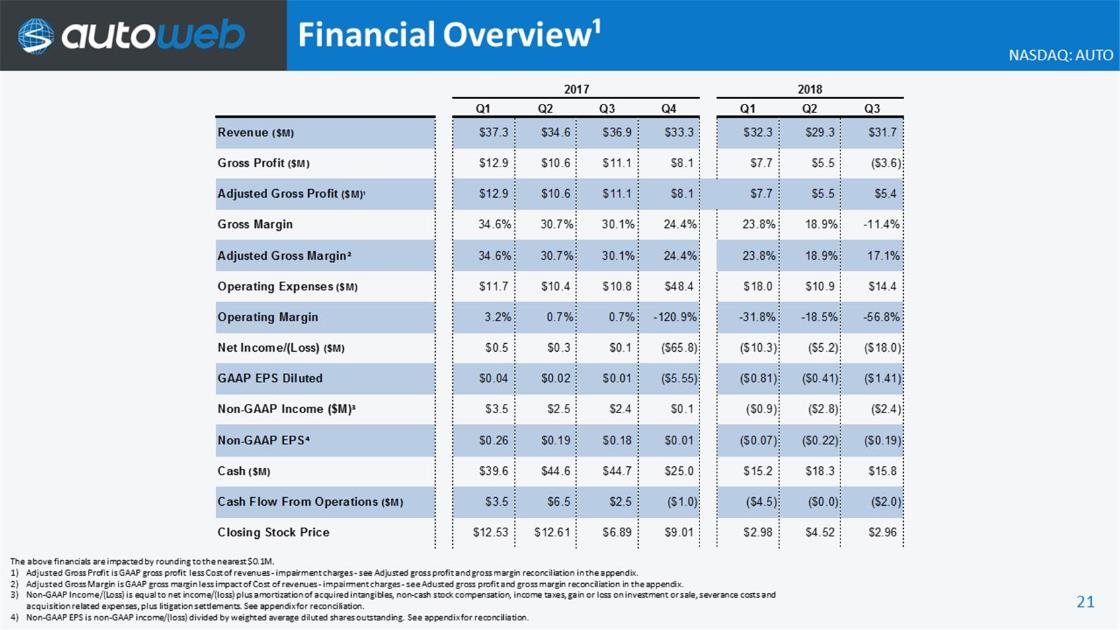

Thank you, Jared, and good afternoon, everyone. Third quarter

revenue came in at $31.7 million, down from $36.9 million in the

year-ago quarter.

Advertising

revenues were $6.6 million compared to $8.9 million in the year-ago

quarter with click revenues of $5.6 million compared to $7.4

million. These declines were primarily due to lower retail dealer

count and lower lead and click volumes.

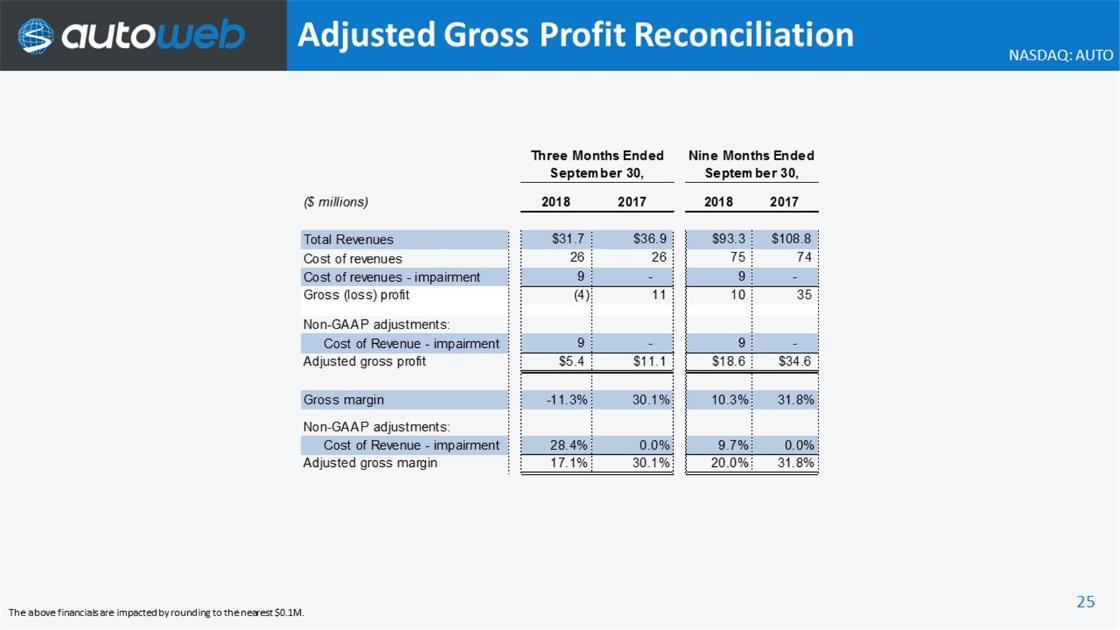

Gross

profit during the third quarter was negative $3.6 million compared

to $11.1 million in the year-ago quarter with gross margin coming

in at negative 11.4 percent compared to 30.1 percent. The decline

was primarily driven by a onetime impairment charge to cost of

revenues of $9 million associated with the dealer platform –

DealerX platform license.

Adjusted gross

profit, which excludes the onetime DealerX impairment charge of $9

million, was $5.4 million compared to gross profit of $11.1 million

in the year-ago quarter, with the decrease driven by continued

investments in traffic acquisition strategies and testing of new

traffic sources as well as in a favorable mix of retail and OEM

lead revenue, which Jared will expand upon later in the call. As a

percentage of revenue, adjusted gross profit was 17.1

percent.

Total

operating expenses in the third quarter were $14.4 million compared

to $10.8 million last year. The increase was primarily driven by

onetime severance costs related to a management reorganization as

well as onetime long-lived asset impairment charges associated with

acquired customer relationships and SaleMove.

On a

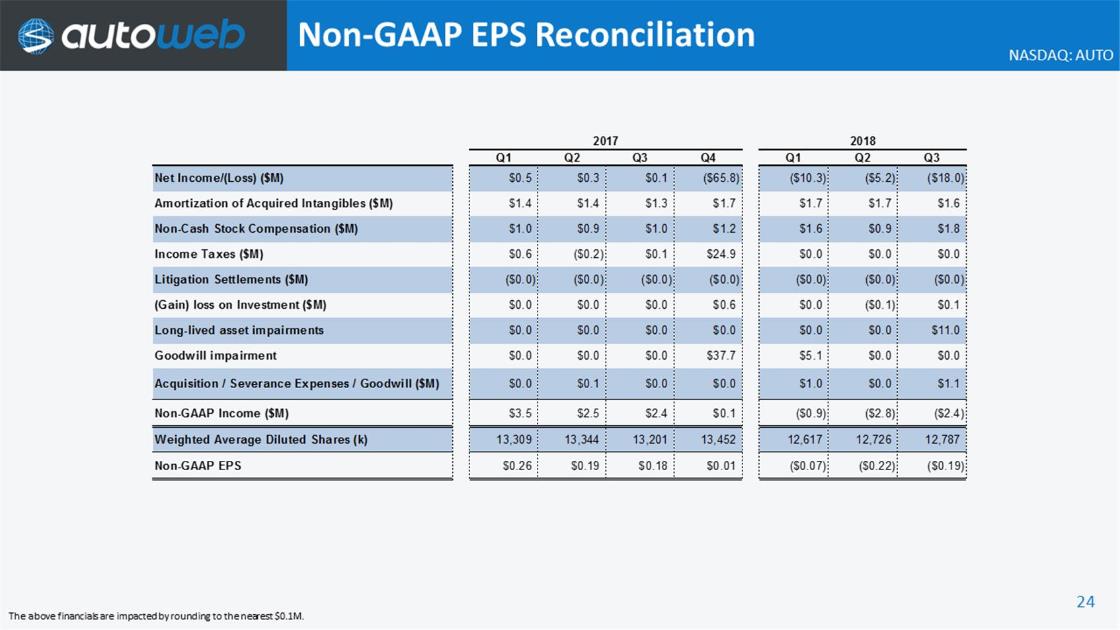

GAAP basis, net loss in the third quarter was $18 million or a

negative $1.41 per share on 12.8 million shares compared to net

income of $0.1 million or $0.01 per share on 13.2 million shares in

the year-ago quarter.

For the

third quarter, non-GAAP loss, which adds back amortization of

acquired intangibles, noncash stock-based compensation, severance

costs, gain or loss on investment or sale, litigation settlements,

goodwill impairment, long-lived asset impairments and income taxes,

was $2.4 million or negative $0.19 per share compared to non-GAAP

income of $2.4 million or $0.18 per share in the third quarter of

2017. The decline was primarily driven by the aforementioned lower

revenues and adjusted gross profit.

Cash

used by operations in the third quarter were $2 million compared to

cash provided by operations of $2.9 million in the second quarter

and $2.5 million in the prior year quarter, with the decrease

primarily driven by severance-related cost as well as professional

service fees and timing of receivables.

Note

that we currently expect incremental cash burn to continue into

next year as we invest in our people, products and technology to

enable our return to growth and margin expansion in

2019.

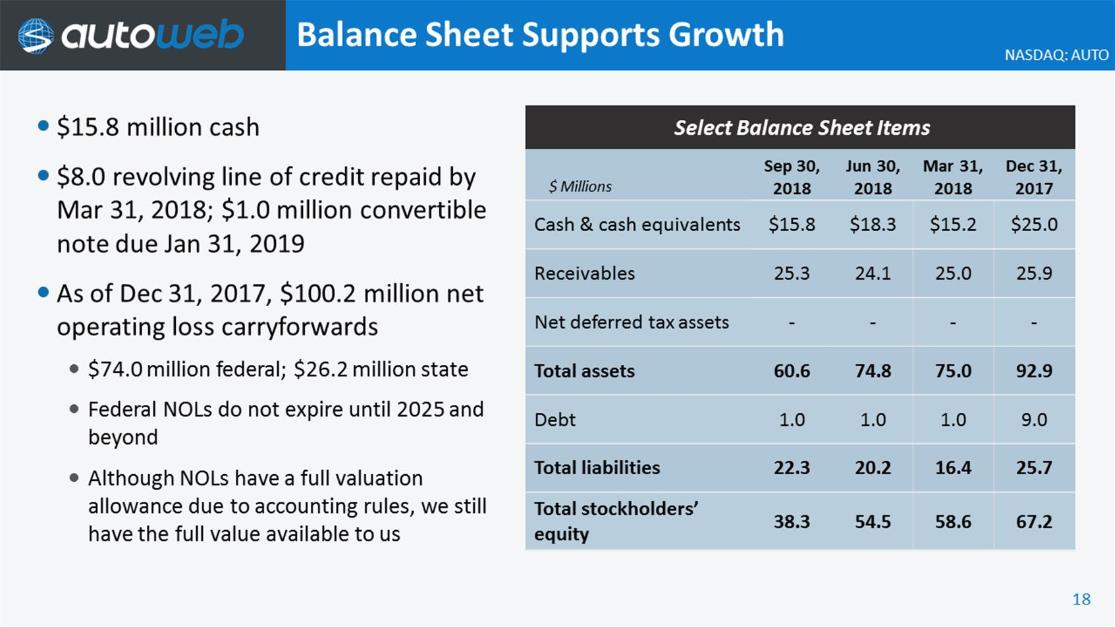

At

September 30, 2018, cash and cash equivalents stood at $15.8

million compared to $18.3 million at June 30, and $25 million at

December 31, 2017. The decrease from 2017 year-end was primarily

driven by a repayment of an $8 million revolving line of credit as

well as severance-related costs.

Total

debt at September 30, 2018 was $1 million compared to $9 million at

the end of 2017.

As

Jared mentioned, going forward we will be providing several key

operating metrics that we believe are instrumental to understanding

the new direction of our business, including lead volume at source,

lead traffic, retail dealer count and retail lead capacity as well

as click volume and revenue per click.

Note

that we also intend to provide click traffic going forward,

however, we’re still working to accumulate the historical

data. We’ll expect to have it prepared by our next quarterly

earnings report.

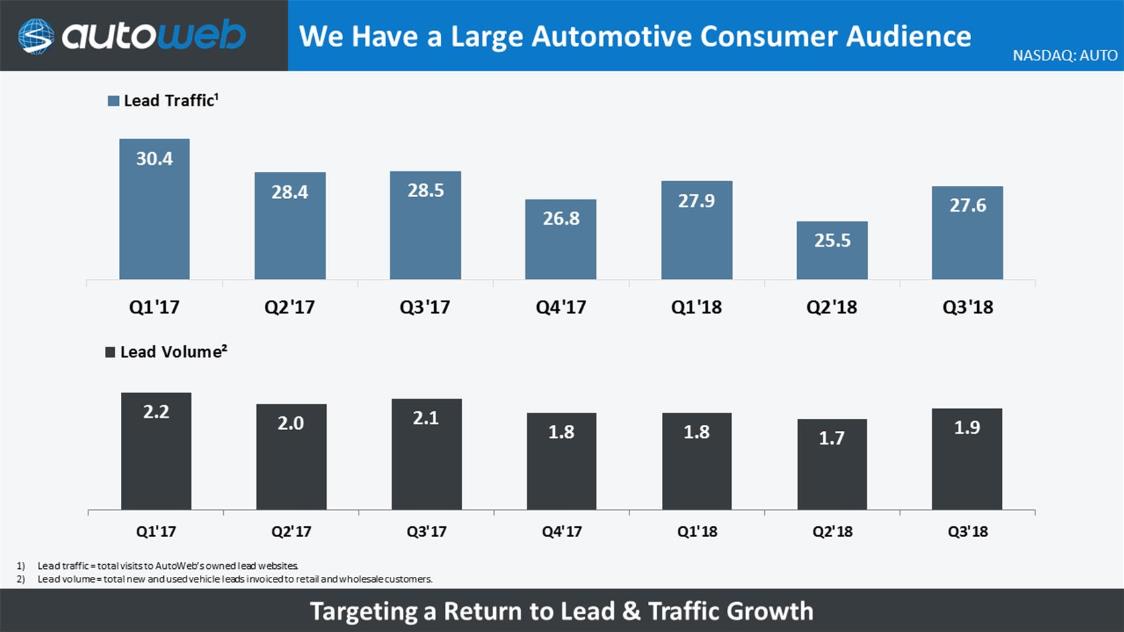

With

that, during the third quarter, we delivered approximately 1.9

million automotive leads compared to 1.7 million in the second

quarter and 2.1 million in the year-ago period. Note that this

figure includes total new and used vehicle leads invoiced at both

at our OEM and retail clients.

The

sequential improvement was largely driven by higher traffic

partially offset by conversion rate inefficiencies resulting from

historical underinvestment in our mobile environments.

Total

lead volume was also offset by our revised lead distribution

policies as we look to sell a greater mix of leads to our

higher-price retail channel.

Lead

traffic was 27.6 million visits during third quarter compared to

25.5 million in the second quarter and 28.5 million in Q3 2017. The

sequential improvement is reflective of the early benefits from

modernizing and contemporizing our approach to traffic acquisition.

Note that these visits reflect a number of consumers who visit our

entire portfolio of websites during the quarter – lead

websites during the quarter.

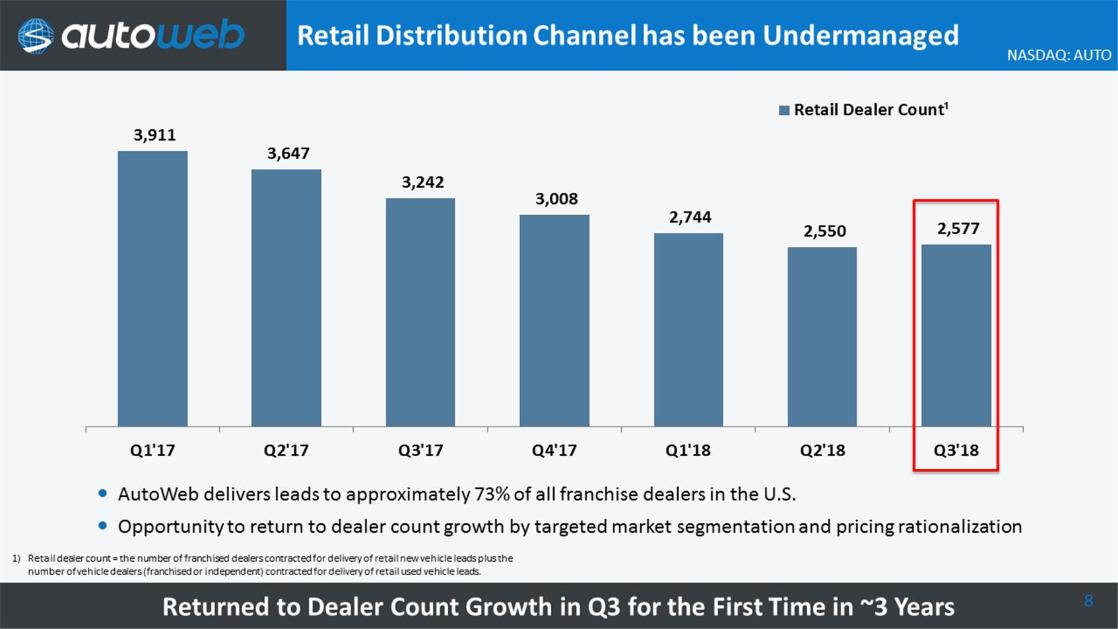

Retail

dealer count was 2,577 compared to 2,550 in the second quarter and

3,242 in Q3 2017. As Jared mentioned earlier, this marks our first

sequential increase since Q4 2015 evidencing that our new operating

approach is beginning to take root.

Note

that this dealer count figure includes a number of franchise

dealers contracted for delivery of retail new vehicle leads plus

the number of franchised or independent dealers contracted for

delivery of retail used vehicle leads.

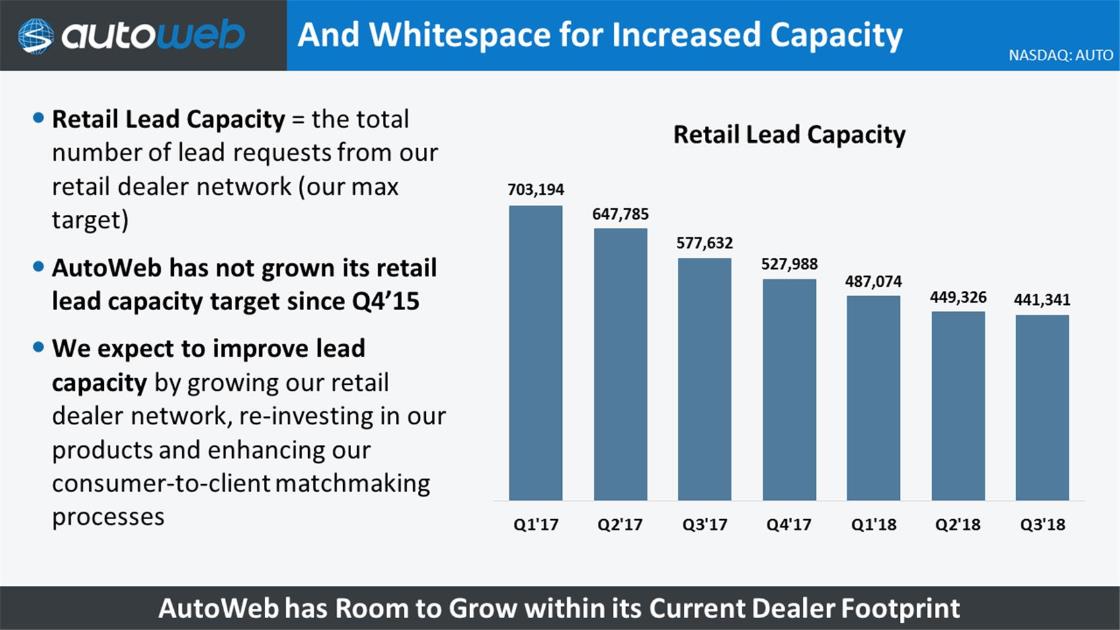

Retail

lead capacity was 441,000 lead targets compared to 449,000 in the

second quarter and 578,000 in Q3 2017. The decrease in retail lead

capacity was primarily driven by lower budgets set by our retail

dealer clients, which is reflective of the lower product quality

that we are aggressively working to improve. Note that retail lead

capacity is the sum of the number of new and used vehicle leads

that a retail dealer’s clients wish to receive each month

during the quarter.

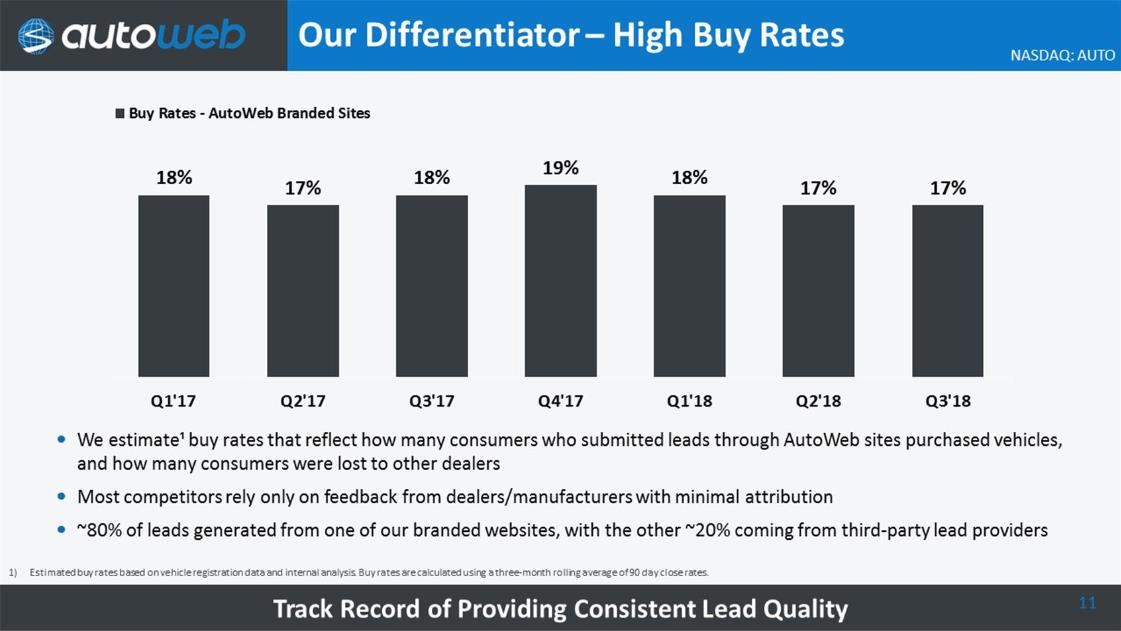

Estimated buy rates

released generated from our entire portfolio of websites for the

quarter was 17 percent. Note that this buy rate reflects the

percentage of consumers submitting leads through one of our media

properties that purchase a vehicle within 90 days of lead

submission.

Our

lead sourcing mix for the quarter also remained steady with 78

percent of leads being internally generated from our media

properties and the other 22 percent of leads coming from

third-party lead providers. We continue to believe our roughly

80-20 mix is an appropriate target to balance quality and quantity

of our core lead product.

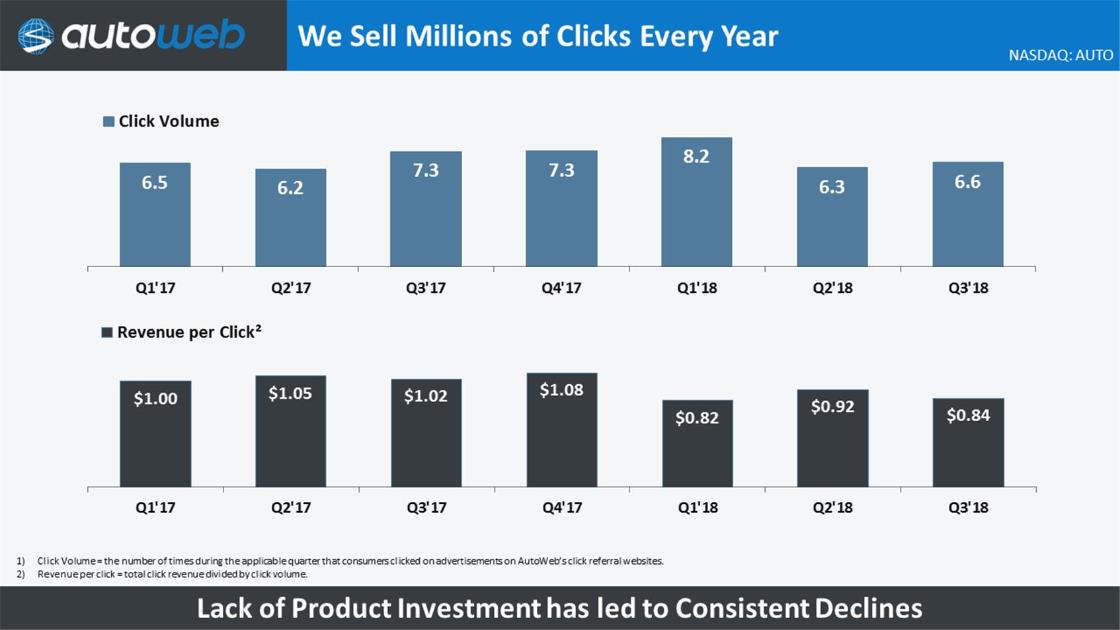

Moving

on to our click product. Click volume in the third quarter was 6.6

million clicks compared to 6.3 million in the second quarter and

7.3 million in Q3 2017. Revenue per click was $0.84 compared to

$0.92 Q2 2018 and $1.02 in Q3 2017.

With

that, I’ll now turn the call back over to Jared.

Jared

R.

Rowe:

Thanks, Wes. As I mentioned earlier, our core mission and goal as a

company is to once again become a premier matchmaker of consumers

and automotive providers through leads, click and e-mail

campaigns.

This

goal will ultimately be achieved by the execution of 5 critical

initiatives: first, we need to grow our audience; second, we need

improved audience acquisition efficiency; third, retail dealer

count and lead capacity growth; fourth, operational integration and

simplification; and fifth, enhanced consumer-to-client matchmaking.

We believe that the execution of these initiatives will return

AutoWeb to growth and margin expansion.

To grow

our audience and improve acquisition efficiency, we have begun to

deploy a series of new traffic acquisition methodologies. As I

mentioned earlier, I believe some of the company’s previous

strategies were not contemporary or optimized to consumer buying

signals and our goal is to move away from commodity matching of

buyers and sellers.

We are

now looking at more data-driven approaches to connect a specific

target buyer with a specific targeted seller. We believe this can

help us differentiate ourselves in the market as well as improve

both the margin and volume characteristic of our

business.

Further, we intend

to take advantage of modern approach just to content optimization,

of which we have not availed ourselves historically. We expect

these investments to continue over the near term as we work to

optimize our traffic acquisition methods, improve lead and click

conversion and return to growth.

For

retail dealer count and capacity, there are several elements

we’ve considered to drive growth, with the first being a

pricing rationalization of our products. For context, the company

has not the volume and pricing trade-offs between our distribution

channels. This lack of optimization has unnecessarily distressed

our retail dealer participation rates and blended

margin.

Rationalizing our

price per lead by even just a few cents will be a net positive to

both our top and bottom line. And the same distribution channel

dynamic goes for our click product.

Note

that clicks are largely driven by abandonment traffic and on our

lead forms, so a concession on click pricing in exchange for more

volume still leads to very high contribution margin. We’ve

already begun to see a modest benefit of this pricing

rationalization with an increase in retail dealer count, which is

an important metric for our business.

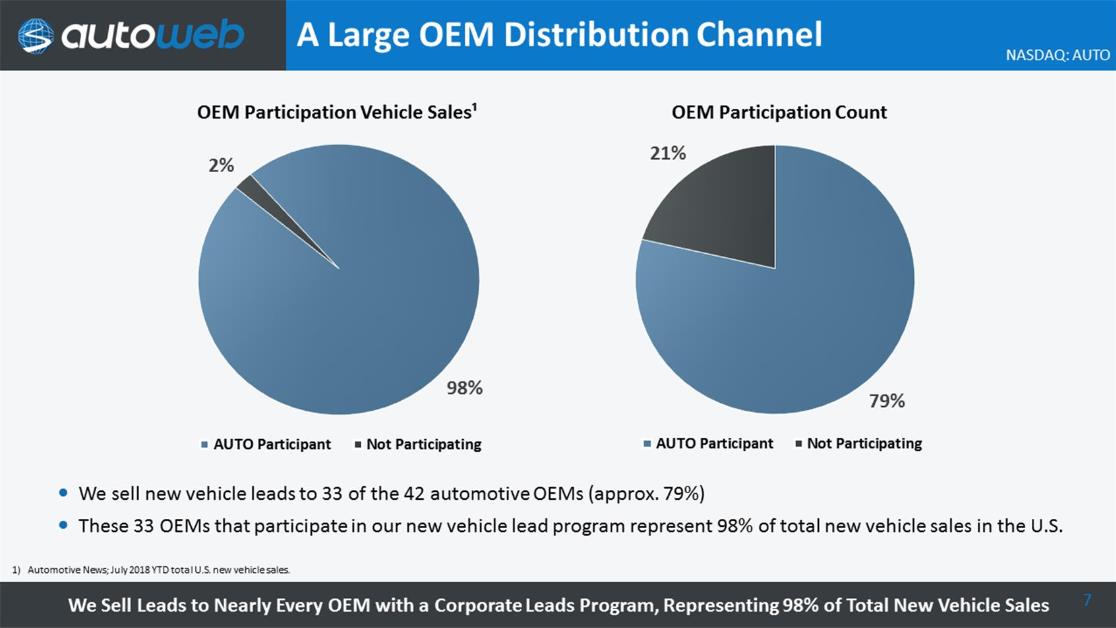

We also

plan to grow our retail dealer count capacity through better market

segmentation. Today, the top 150 dealer groups in the U.S. have a

combined 3,660 dealers. Of those 3,660 dealers, we currently sell

leads to less than 10 percent.

This

alone presents a unique opportunity with a highly under-penetrated

segment of the marketplace that spends considerable amounts on

media. We believe that we have a very compelling and cost-effective

solution for this client segment.

Our

initiative to simplify and better integrate our operations is

really geared towards corporate level efficiency. Previously,

AutoWeb was largely run like a group of loosely affiliated

companies, given the acquisitions made over the last 4

years.

We’ve also

found that the company lacked a modern IT infrastructure, which

inhibits automation and limits our ability to drive appropriate

levels of operational efficiency. We intend to invest in our IT

infrastructure and better integrate our operations so that we can

minimize redundancies, improve the velocity of change and gain

better control over internal investments and outcomes.

To

enhance consumer to client matchmaking, we are reinvesting in and

further integrating our 3 core products. At a high level,

we’re currently investing in data-driven product research to

better understand the needs of buyers and sellers. We understand

that we need to deliver value to both consumers and clients

alike.

Our

goal is to be the best matchmaker in an industry that’s

rapidly changing, and we have to invest and conduct research at a

very detailed level, so that we can better tailor our products to

best take advantage of the evolving market dynamics detailed

earlier.

For

leads, this includes better understanding of the needs and wants of

consumers, so they can be matched with a dealer that is well

positioned to meet those needs. In today’s environment,

consumers make automotive buying decisions based on dimensions

beyond just product, price and brand loyalty.

In

fact, McKinsey research shows that 90 percent of consumers make

purchasing decisions based on their shopping experience, not on any

form of loyalty. That is telling in that it highlights the

importance of buyers and sellers sharing expectations around how

the transactions should be managed.

For

clicks, on our last call, we stated that we would deploy a revised

click algorithm by the end of the year. I’m happy to report

that as of October 24, 10 percent of our click traffic was exposed

to this new algorithm that is using more than 31 data points to

match consumers and clients as opposed to the historical approach

of 3 data points. Also, this approach includes a machine learning

component that will help us stay current with the changing needs of

consumers and clients.

Up to

this point, the new click algorithm has already begun to show early

signs of improving the consumer-to-client match, which is enhancing

monetization. In fact, beginning on November 6, we began to expose

25 percent of our click traffic to the new algorithm, giving these

– given these early strong results.

And for

e-mails, this medium provides us with sequential messaging

opportunities for clients. Also, these messages can be optimized

based on the wealth of first-party data that we generate. A more

database marketing approach to managing this unleveraged asset

should help enhance our monetization efforts and the value of our

other 2 core lead and click products over time.

Equally

important to each of these individual product investments,

we’re keenly focused on the integration of our products into

a more unified solution. We want our lead data to speak to our

clicks and both sets of data to speak to our e-mail marketing

campaigns. These 3 product - key products will be working together

with the ultimate goals monetizing every add and pricing we

generate across these products.

As I

mentioned earlier, historically, we have under-invested in our

mobile experience. There is opportunity for business improvement

through mobile enablement, and ultimately, mobile optimization.

This lack of investment has led to sell-off more customer

experience, lower lead and click traffic and conversion

rates.

In

closing, I’d like to reiterate a few key points. I’m

very pleased with the progress that we’ve made and the steps

we’ve taken to address our challenges over the last 7 months.

The execution of our turnaround is proceeding according to

plan.

There

are opportunities to be more efficient with the existing resources

we have today, and to compete more effectively with – for our

clients’ marketing spend. Marketing efficiency is critical in

the automotive industry, and we aim to continue to be at the

forefront of helping our clients achieve their goals and market

their brands ahead of our own.

As we

look ahead to 2019, we have every expectation of returning to

growth and margin expansion. However, it will take some time as we

continue to integrate and invest in our products, improve our

operational execution, simplify our organization and invest in our

people.

I thank

all of our shareholders for their patience and look forward to the

journey ahead. With that, we’ll now open up the call for

questions.

Operator:

Thank you sir. Ladies and gentlemen, if you have a question at this

time please press the star then the number one key on your

touchtone telephone. If your question has been answered or you wish

to remove yourself from the queue, please press the pound key.

Again, that’s star then one to ask a question.

To

prevent any background noise, we ask that you please place your

line on mute once your question has been stated.

And our

first question will come from Sameet Sinha from B. Riley

FBR.

Lee T.

Krowl:

This is actually Lee Krowl filling in for Sameet. A lot to digest

here, especially with the new metrics, but definitely a great

overview. Just wanted to start out on the traffic acquisition

strategies.

I know

you kind of discussed them briefly but can you just maybe dive in a

little bit deeper on the specific changes you’ve made? And

just kind of surprised how quickly they’re starting to

materialize into tangible results. So may be a little more detail

would be helpful to start out.

Jared

R.

Rowe:

Wonderful. Good to chat with you, Lee. Thanks for the question. As

we think about traffic acquisition, there’s a couple of key

investments that we started to make.

One is

we’ve really started to shift our acquisition strategy away

from keyword buying and more focused on audience segmentation and

audience segmentation – or segment targeting. That’s a

fairly standard kind of macro trend that you’re seeing in

search overall and we really haven’t taken advantage of it.

So we’ve made significant investments in that

area.

The

second thing we’ve started to do is we have started to attack

not just the acquisition side but also the engagement and the

conversion side. I mentioned earlier in my prepared remarks about

some of the investments we’re making on the mobile enablement

side. We think that that’s going to bear some fruit for us as

well. And we do think that that’s some low-hanging

opportunity for us.

So a

lot of our focus has really been around rebuilding our campaigns,

focusing on revised segments of consumers and then making certain

that we’re providing them with experiences that are optimized

to click-through rate and conversion. Because like I’ve said

on previous calls, it’s not just about buying the

impressions, it’s about what you do with them once you get

them and we have to be far more efficient and effective than we

have in the past.

Lee T.

Krowl:

Got it. And then switching over to clicks. It looks like the volume

improved sequentially and it appears like that’s a function

of pricing. Just kind of your thoughts, especially because it seems

like it’s more of a priority now, your willingness to lower

price to drive volumes. Should we expect that the revenue per click

continues to trend lower as you try to attract more

volumes?

Jared

R.

Rowe:

As we think about this, there’s a couple of components to

this. One is the pricing rationalization. The second is making

certain that the clicks get into the distribution channel that we

want them to from a margin perspective.

So

we’ve talked a lot about the lead side of the business and

how there’s a margin differential between the retail side and

the OEM side. And so getting that mix right will be an important

part of how we expand margin in 2019.

The

same dynamic’s actually true inside of the clicks business as

well. We’ve got endemic buyers and we’ve got nonendemic

bars of the clicks product. As you can imagine, the endemic buyers,

the pricing is better, the margin is better as opposed to the

nonendemic buyers. And the reason is because an endemic buyer

values low funnel, high-quality automotive traffic more than an

nonendemic buyer does.

So as

we think about things, it’s about driving the volume but

it’s also about making certain that the mix is optimized as

well because we think, over time, that’ll have a positive

impact on margin. So yes, you could see the revenue per click going

down.

However, as long as

we’re managing that appropriately and it’s going into

the right channel, it could be and should be margin accretive over

time. So again, the dynamic that we’re managing on the lead

side is the same dynamic that we’re managing on the click

side.

Lee T.

Krowl:

Got it. And then just you kind of alluded to the fact that the

infrastructure is quite dated. Is there a way to quantify maybe the

quarterly CapEx required or investment that’s going to come

on in order to modernize the platform?

Jared

R.

Rowe:

We’re still working through the final 2019 investment plan.

We’ve got the forecast and we know we’re going to be

able to – or we believe we’re going to be able to get

back to growth and margin expansion and that includes the

investment associated with the technology

infrastructure.

Here’s, I

guess, the way that I would frame the technology infrastructure

investment requirements. And Lee, I’m going to try and answer

your question, but I may not answer it quite as completely as

you’d like. We believe that the infrastructure, as is sits

today, will not necessarily impair our ability to drive the early

stages of the turnaround.

We

think we can improve the financial performance of this business

with the very infrastructure we have. However, the later stages of

the turnaround, we think are going to require a more up-to-date

technology infrastructure.

So as

we think about things, we think about how we feather this

investment in over time and how do we calendarize it appropriately,

so that we can continue to turn and drive what we have said we were

going to do here today, which is we believe we’re going to be

able to grow top line growth year-over-year and margin expansion

next year. And that does include the investments that we’re

going to need to turn the technology infrastructure over, over

time.

To be

quite candid with you, Lee, the kind of work that we’re going

to have to do on our technology infrastructure is going to be a

multiyear exercise. And again, we believe that we can actually

feather the investments in as we improve the financial performance

of the business.

Operator:

Our next question comes from Eric Martinuzzi with Lake

Street.

Eric

Martinuzzi:

I wanted to take a look at the strategic review that you conducted.

I’ve got you – I understand from the press release and

your prepared remarks you’ve got new management and new

metrics, but I didn’t see anything really a fundamental pivot

or shift of divestments and acquisition, of getting out of one

business, doubling down on something else.

It all

seems kind of tactical to me as opposed to strategic. Was there a

discussion at the board, at the management level as far as things

like maybe getting out of used and doubling down on new; or getting

out of clicks and doubling down on leads; Retail versus OEM;

M&A; those kinds of things?

Jared

R.

Rowe:

Eric, yes, appreciate the question. Yes, we did. We did. And so

when you actually look at the – what we’re putting

forward here today, it actually does address some of the things you

do and maybe just not as – that you mentioned there, just

maybe not as directly as maybe we could have been,

clearly.

We are

going to continue to focus on new car. That is our dominant area of

expertise and it’s where we think we can really add some

value to the marketplace. That doesn’t mean that we

won’t have a new car – or a used car component to our

business, I’m sorry. It just means that it’ll be a much

smaller component of our business than a new car side is. So we

intend to stay focused on the new car side.

There

are fewer competitors in that space, and again, we think

we’re uniquely positioned to deliver value there. We also

intend to really integrate our products into a solution. While that

may not sound very strategic, it actually provides us with the

ability to deliver far more value to our clients than we can when

we think about our products as individual product

SKUs.

So the

clicks and the leads product working together much more closely

with a much more data-informed approach, we think will actually be

a strategic advantage for us over time, in particular, when you

layer in the e-mail component, will allow us to do sequential

messaging, multi-tier sequential messaging to the benefit of our

consumers and our clients.

Also,

we did reference early and it was a very small reference, about

mobility. We believe that mobility services and figuring out how to

connect buyers and sellers in ways other than just buying and

selling cars is going to be an important part of our future. But

that is about being a matchmaker. We also had a long conversation

about some of the emerging trends from a search

perspective.

So

while today, just about everything we do is desktop or mobile, when

you look at the search trends overall, voice search is coming

online in a big way, image search is behind it. We intend to

actually build our platform in such a way that we’re going to

be able to position ourselves to take advantage of some of those

trends over time as well.

Now,

you asked the question about divestitures. Really, the divestitures

came in the form of focus, and we mentioned a couple of those.

We’re going to stop focusing on some things that we believe

to be noncore, and we’re going to focus on really rebuilding

our foundation here. So that’s where the divestitures really

came in.

It’s not a

true divestiture in terms of we sold something, but it’s a

divestiture in the form of we’re not going to work on some

things any more. We’re going to get focused on what drives

real value. Also, in terms of acquisitions, I’m just a big

believer that if you’re going to acquire something, you

better have an operating model and a solid foundation as a business

because, as you well know, it’s easy to buy stuff, it’s

hard to actually integrate stuff.

We

bought a bunch of companies over the last 4 years. We’re

going to integrate them. We’re going to simplify this

business. And we’re going to harden our infrastructure and

our foundation in such a way so that when we want to be

opportunistic, as it relates to acquiring capabilities, we’re

better prepared to do it so that we can make the most out of those

investments.

So we

did talk about all that. This plan does encompass that thinking. A

lot of it is tactical right now to be quite candid with you. Just

understand we’re thinking strategically. We just know that

we’ve got to do a bunch of tactical work to really harden our

infrastructure and improve our financial performance, so that we

can then successfully do some of the things that you

mentioned.

Does

that answer your question?

Eric

Martinuzzi:

Yes. I have a follow-up question regarding the divestiture or the

refocusing or more intense focusing. DealerX, in October 2017,

Autobytel at the time spent $8 million for a license to

DealerX.

Did

that just go up in smoke? Or is there a potential to sell that

license and somehow monetize that $8 million investment? I know it

wasn’t on your watch, but is that over?

Jared

R.

Rowe:

Yes, I hear. That’s a good question, Eric. We don’t see

any value – any way to harvest any value out of it going

forward. We took a look at it and, quite frankly, we think

we’re better off taking our finite resources and getting the

focus back on some of the surer ways that we’ve got in front

of us to enhance our consumer acquisition and conversion

approaches.

So that

is how we think about that. You never make a business decision

based on a sunk cost and this is about how we really optimize our

approach going forward, and we’re trying to spend a little

less time, at least I am as a leader here, looking backwards. So

that would be my answer to that, Eric.

Eric

Martinuzzi:

OK. One of the other things that sometimes takes sometimes place

after a strategic review is a restructuring that impacts headcount.

I didn’t see it specifically highlighted here. I know

you’ve been tuning your work force, certainly at the senior

leadership level.

Have we

– has there been a – some summation of the cost savings

since you started implementing some of your changes? We pulled $2

million out of the cost structure on an annualized basis or we

pulled $4 million – something to that extent in this

refocusing of the effort there’s also a fine tuning of the

headcount. Has anything like that taken place or is that in the

works?

Jared

R.

Rowe:

Yes. No, it has. As we think about things, one of the reasons

– I’m a big believer that restructuring should start at

the top of an organization not the bottom. And so really what you

saw with the change, I guess, it was a couple of months ago now is

us creating capacity to reinvest back in the business and build

some capabilities that we need to build.

So as

we think about headcount, we think about it that way more than

anything, which is as we manage this business and as we need

capacity or investment dollars, we intend to find the capacity

within the organization so that we can drive the changes we need to

drive.

So it

wasn’t that the restructuring was really focused on how we

drop the money to the bottom line; it was more about how do we open

up capacity to make the investments from a headcount perspective

that we need to make, to add some capabilities to this business to

actually really drive the turn that we’re working

on.

Eric

Martinuzzi:

OK. I know you’re not in a situation where you’re

comfortable giving guidance, but you at least are talking to what I

think is a primary concern for most people. We’ve got a

contracting top line here. We actually had a decent Q3 versus

consensus estimates, but Q3 is historically a seasonally strong one

for AutoWeb.

A

return to growth in 2019. Would you care to more clearly delineate

the time line for that? Is this a first half phenomenon? Is this a

second half 2019? What’s the board and the management’s

thinking on the growth opportunity?

Jared

R.

Rowe:

I guess here is the way I would frame it, Eric, as Wes talked about

the fact that we are going to need to continue to make investments

into 2019. When you couple that with what I stated in our –

in my prepared remarks about how we’re going to get to the

annualized growth with margin expansion, I think, hopefully,

that’ll help you kind of understand how we’re thinking

about it.

We do

have some investments to make yet and we’re going to continue

to drive those investments into the business, but we don’t

believe that those investments are going to inhibit our ability to

actually get back to year-over-year growth and margin expansion in

‘19.

Eric

Martinuzzi:

OK. All right. And then the dealer count, the sequential

improvement that, obviously, you pointed that out and highlighted

that as an example of some progress here. I go back to the

seasonality question. Is partly the dealer count being up Q3 versus

Q2 a symptom of seasonality? Or another way to ask that is, in Q4,

could that dealer count decline versus Q3?

Jared

R.

Rowe:

We had 10 straight quarters of decline, and we were able to turn

that last quarter. So I don’t think that was seasonality. In

particular, since we actually made some very specific changes to

our go-to-market approach, and we saw the impact of that. So I

don’t believe it was seasonality last month. And we feel good

about the momentum we have in Q4. So we’re starting off on

the right foot here in Q4.

Operator:

Thank you. As a reminder, ladies and gentlemen, that’s star

then one to ask a question.

Our

next question comes from Ed Woo with Ascendiant

Capital.

Ed

Woo:

In terms of the restructuring or, I guess, strategic review, do you

feel that most of the major review is done and any changes would be

pretty minor, at least with the near term?

Jared

R.

Rowe:

Ed, thanks for the question. Yes, yes. We feel really good.

We’re – the way I talk about it internally is

we’re at the end of the beginning and the beginning of the

next phase here. And that’s really how we’re viewing

this.

Last

quarter, we really started to implement some of the new thinking

and is why you’re seeing some of the results you’re

seeing here in the audience and in the dealer side. We’re

really now kind of focused on the execution phase, really building

momentum towards 2019, so that we can have a much stronger 2019

than we did 2018. So yes, absolutely, I think the strategic work is

done. We’re now in the execution phase here.

Ed

Woo:

Great. And as part of your strategic view, how has the landscape,

competitive landscape impacted your outlook? And what does it mean

– does it make your job a lot tougher?

Jared

R.

Rowe:

No, we like the competitive landscape, believe it or not. And the

reason we like it is because there aren’t many folks focused

on new car, right? Most of the big players in the space are really

focused on used car. We also like the fact that we have unique

capabilities as it relates to search arbitrage and lead gen,

right?

We’re the

leader as it relates to lead gen in the new car industry. So we

like the positioning of the business. To be quite candid with you,

we also like the challenger brand aspect of this.

We

think it gives us an opportunity to really focus on delivering

value to the – to our – to the end clients and do it in

a very cost-effective way for them. So there’s a lot of big

players and there’s a lot folks who are very, very good at

what they do. We just like the way the market is laid out as we sit

today, and we like our chances to get this business back to where

it should be.

Ed

Woo: Great.

And my last question is just on your outlook for the car sales for

the – in industry car sales. It looks like the Fed is going

to keep raising rates and obviously, that’s going to be

weighing out on the outlook of the industry car sales. Do you see

that there’s going to be big changes near term or you think

it’s something likely to happen in mid-2019 before the car

sales really change from where it’s at

currently?

Jared

R.

Rowe:

I think what we’ve hit is we’ve hit the peak and I

think we’re going to start a slow decline here. When you take

that all the way back, Ed, to the question you asked previously

about the competitive landscape, that’s one of the reasons

why I like our challenger brand positioning as we sit right now is

because with demand pulling back a little bit, likely over the next

several quarters, supply it still hasn’t been trimmed down

the way you’d expect it to be.

So we

know that there’s going to be a lot of vehicles that are

going to need to be sold. And in an environment where OEMs and

dealers are competing more heavily for the consumers, that’s

actually good for us, not bad for us, because they’ll churn

the market, which actually helps drive us forward as well as it

positions us to, again, be a low-cost provider and support these

folks in their needs of selling these vehicles.

So I do

expect to see a more gradual decline over the next several

quarters, which, again, I actually think will help us a little bit

as we regain our footing.

Operator:

Our next question comes from JP Geygan with Global Value Investment

Corp.

James

Philip Geygan: I have 3 brief questions. You’ve talked

a lot about your strategic plan, but I was hoping you might

elaborate on how you arrived at this or the specific pain points it

may have addressed? And then recognizing that it seems like

you’re narrowing your focus or focusing your efforts,

won’t your strategic plan or what you’re building

internally help you to address any other markets in the

future?

Jared

R.

Rowe:

All right. Excellent. And I’m – I’m sorry, JP. I

got the first one, so it’s pain points addressed. Other

verticals was another question. I – you said you had 3 and I

think I might have missed one. My apologies.

James

Philip Geygan: Sure. Those were both parts of my first

question. My second would be if you can talk a little bit about

developing technology internally, whereas historically, the company

seems to have purchased technology. And then 3 would be fairly

straightforward. You seem to see some fairly optimistic signs. At

what point do you anticipate being able to scale this platform in a

meaningful way?

Jared

R.

Rowe:

Got it. OK. Thanks, JP. I apologize. OK. So the pain points that we

think this approach addresses. A couple. I’ll talk about

internal pain points and external pain points. From an internal

perspective, there are multiple pain points inside this business

because we really are kind of a loosely managed group of companies.

So I’m going to talk about strategically internal and

external.

Simplifying this

business, getting refocused and building a more unified operating

model, I think is going to reduce some of the complexity that

we’ve had internally and allow us to execute much more

completely.

On the

external side, when you look at what’s going on inside of the

car business, right, pricing bands have narrowed to the point where

there aren’t a lot of bad deals in the industry anymore.

Quality bands have narrowed to the point where there aren’t

bad cars anymore. We also know that loyalty is not something that

drives consumers’ purchase decisions.

Further, we see

consumers making decisions around what vehicle to buy based on

shopping experience more than other attributes. So we believe that

this business is shifting from a commodity matcher to a matchmaker

marketplace and we think we can lead that. You see a lot of folks

in the industry trying to change the way dealers do

business.

We

don’t want to do that. We don’t think that’s our

place. What we want to do is we want to help understand – or

we want to understand, I’m sorry, what makes dealers special

and unique. We want to understand what consumers value and we want

to connect those 2.

We

think that that is a real pain point in the industry, and we think

we’re uniquely positioned to actually help both buyer and

seller share expectations, so that when they actually interact to

start the transaction, they’re starting off in a much better

place than they do an awful lot these days when they don’t

share expectations or they have misalignment around how the

transaction should proceed.

So when

we talk about the kind of one of the core underpinnings of our

strategy, it really is that. This isn’t about a consumer who

wants to buy a Ford in a ZIP Code, it’s more about a consumer

who wants to buy a specific kind of vehicle in a market in a

specific way. We think we’re well-positioned to evolve our

business to be much more focused on the quality of the match as

opposed to just the volume and the geography within which a dealer

and a consumer reside.

Now,

once you’ve got that, to your point, is that extensible to

other verticals? Possibly. Absolutely possibly. We want to stay

focused on automotive as we sit here though today. We think

there’s a lot of good opportunity for us to drive growth. In

the future, if – once we have this built and we feel good

enough about it and we see other opportunities, we could absolutely

be opportunistic.

But I

can tell you as we sit right now, that’s not our focus. Our

focus is how do we be the best automotive matchmaker that we can be

because we see an awful lot of opportunity in this space if we can

just accomplish that.

The

second question you had was developing technology internally versus

externally. I tend to agree with you. I think we’ve gone

outside a bit more than we should as it relates to innovation and

there’s 2 components here.

One is

technology development and the other one, I would say, would be

just innovation in general. I think you need a balanced approach. I

think you need a mix. I think we’ve got good capabilities

internally as it relates to technology. I just don’t think

we’ve always maybe executed as effectively as we could.

That’s more of a planning and execution issue than it is a

core capabilities issue.

So I

think we can get better at just delivering technology in a more

efficient and effective way than we have historically. Because

again, I like the assets and capabilities that we have in that

regard.

Now,

external technology development, that is something that we’re

going to continue to look at as well. You need to have a blended

approach, but I think you need to be smart about build versus buy

versus rent. When we think about building technology, we’re

going to be much more focused on what gives us a unique competitive

advantage in the marketplace. That’s where we really need to

spend our energy and our effort.

If it

is more of a commodity function, I think you’ll see us focus

a little bit more on either external sourcing or having people

support us, because again, ultimately, we want to spend our energy

and focus on the things that we do best and really differentiates

us in the market.

Again,

for what it’s worth, I will tell you, I think that from a

technology development perspective, I think we’ve got some

untapped ability here that’s mainly been driven by our

execution model, and we are well down the road of assessing the

opportunities for us to improve in that regard.

And

then the last one you said is when do we get to start to scale the

platform again. I will tell you again, and I don’t mean to be

a broken record, I apologize, we expect to get to growth next year,

we expect to get to margin expansion next year. So we expect to get

to a point where we can start to rescale this platform next year,

because if we didn’t rescale it, we wouldn’t be able to

achieve those 2 objectives that we have.

James

Philip Geygan: Very good. Thank you for your time and we look

forward to watching the business continue to develop.

Jared

R.

Rowe:

Thanks, JP. Hopefully, that was helpful.

Operator:

At this time, this concludes our question-and-answer session. I

would now like to turn the call back over to Mr. Rowe for closing

remarks.

Jared

R.

Rowe:

Well, anyway – I apologize folks, (I’ve set aside my

script). Anyway, I just want to say thank you. Thanks everybody. We

very much appreciate your time. We appreciate your interest. We

very much appreciate your patience with this business. We do expect

to get this business back to growth and profitability next

year.

We know

that 2018 has not been the best year for anyone involved, but we

really like the assets and capabilities of this business, and

we’re excited about where we’re heading in 2019. So we

appreciate all the help. We appreciate the questions, and we look

forward to the journey ahead. Thank you.

Operator:

Ladies and gentlemen, this does conclude today’s

teleconference. You may disconnect your lines at this time. Thank

you for your participation.

END