UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

|

☒ |

|

|

|

|

|

|||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The NASDAQ Stock Market on June 30, 2021, was approximately $

The number of shares of Registrant’s Common Stock outstanding as of March 7, 2022 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement related to its 2022 Annual Stockholders’ Meeting to be filed subsequently -- Part III of this Form 10-K.

FORRESTER RESEARCH, INC.

INDEX TO FORM 10-K

|

|

Page |

PART I |

|

|

Item 1. |

3 |

|

Item 1A. |

7 |

|

Item 1B. |

9 |

|

Item 2. |

10 |

|

Item 3. |

10 |

|

Item 4. |

10 |

|

|

|

|

PART II |

|

|

Item 5. |

11 |

|

Item 6. |

12 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

13 |

Item 7A. |

23 |

|

Item 8. |

24 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

58 |

Item 9A. |

58 |

|

Item 9B. |

58 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

58 |

|

|

|

PART III |

|

|

Item 10. |

59 |

|

Item 11. |

60 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

60 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

60 |

Item 14. |

60 |

|

|

|

|

PART IV |

|

|

Item 15. |

61 |

|

Item 16 |

61 |

|

|

|

|

|

64 |

2

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “anticipates,” “intends,” “plans,” “estimates,” or similar expressions are intended to identify these forward-looking statements. Reference is made in particular to our statements about changing stakeholder expectations, product development, holding hybrid events, possible acquisitions, future dividends, future share repurchases, future growth rates, operating income and cash from operations, future deferred revenue, future compliance with financial covenants under our credit facility, future interest expense, anticipated increases in, and productivity of, our sales force and headcount, changes to our customer engagement model, the adequacy of our cash, and cash flows to satisfy our working capital and capital expenditures, and the anticipated impact of accounting standards. These statements are based on our current plans and expectations and involve risks and uncertainties. Important factors that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements are discussed below under “Risk Factors.” We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

PART I

Item 1. Business

General

Forrester Research, Inc. is a global independent research and advisory firm. We help leaders across technology, customer experience, marketing, sales and product functions use customer obsession to accelerate growth. Through Forrester’s proprietary research, consulting, and events, leaders from around the globe are empowered to be bold at work, navigate change, and put their customers at the center of their leadership, strategy, and operations. Our unique insights are grounded in annual surveys of more than 700,000 consumers, business leaders, and technology leaders worldwide, rigorous and objective research methodologies, 70 million real-time feedback votes, and the shared wisdom of our clients.

Our common stock is listed on Nasdaq Global Select Market under the symbol "FORR".

Market Overview

We believe that market dynamics — from empowered customers to the COVID-19 pandemic — have fundamentally changed business and technology. These dynamics continue to change stakeholder expectations.

Consumers and buyers have new demands and requirements. To win, serve, and retain customers in this environment, we believe that companies require a higher level of customer obsession. Customer obsessed firms put their customers at the center of their leadership, strategy, and operations. Our research has shown that customer-obsessed firms grow faster and are more profitable.

Organizations and leaders require a continuous stream of guidance and analysis to adapt to these ever-changing behaviors and realities. We believe that there is an increasing need for objective external sources of this guidance and analysis, fueling what we call the “golden age of research.”

Forrester’s Strategy and Business Model

The foundation of our business model is our ability to help business and technology leaders tackle their most pressing priorities and drive growth through customer obsession. Forrester helps clients solve problems, make decisions, and take action to deliver results. With our proprietary research, consulting, and events, our business model provides multiple sources of value to our clients and creates a system to expand contract value ("CV"), which we view as our most significant business metric.

Generally speaking, we define CV products as those services that our clients use over a year’s time and that are renewable periodically, usually on an annual basis. Our CV products primarily consist of our subscription research products, while our non-CV businesses, consulting and events, play critical complementary roles in driving our CV growth.

With respect to our clients, we believe that it has become difficult for large companies to run multi-year strategy and change management projects on their own as customers are changing faster and competitors are increasingly aggressive. Multi-year CV product relationships enable us to help our clients formulate their vision for the future and then translate those plans into implementation and outcomes over time. For our investors, we believe that CV growth will result in predictable and profitable revenue streams.

Our business model is built on the premise that an increase in CV generates more cash which can then be invested in improving our go-to-market structure (activities including sales, product, marketing and acquisitions) and creating CV products that clients renew year after year—repeating the cycle and driving the model forward. We refer to this model as our "CV growth engine."

3

Our Products and Services

We strive to be an indispensable source that business and technology leaders across functions, including technology, customer experience, marketing, sales, and product, worldwide turn to for ongoing guidance to plan and operate more effectively.

We deliver our products and services globally through three business segments – Research, Consulting and Events.

Research

For more than 35 years, Forrester has been providing objective, independent and data-driven research insights utilizing both qualitative and quantitative data. We adhere to rigorous, unbiased research methodologies that are transparent and publicly available to ensure consistent research quality across markets, technologies, and geographies.

Our primary subscription research services include Forrester Research, SiriusDecisions Research, and Forrester Decisions. This portfolio of research services is designed to provide business and technology leaders with a proven path to growth through customer obsession. Key content available via online access includes:

Our research services also include time with our analysts to apply research to their context.

Launched in 2021, Forrester Decisions is a portfolio of 15 standardized research services combining key features of Forrester Research with key features of SiriusDecisions Research. Over time, we believe Forrester Decisions will become Forrester’s flagship research product.

Consulting

Our Consulting business includes consulting projects and advisory services. We deliver focused insights and recommendations to assist clients in developing and executing their technology and business strategies. Our consulting projects help clients with challenges addressed in our published research. Our consulting projects include conducting maturity assessments, prioritizing best practices, developing strategies, building business cases, selecting technology vendors, structuring organizations, developing content marketing strategies and collateral, and sales tools. Consulting plays an important role in supporting our CV growth, as we have found that clients that purchase consulting projects from us renew their CV contracts at higher rates compared to clients that do not purchase consulting.

Events

We host multiple events across North America, Europe, and the Asia-Pacific region throughout the year. Forrester Events are thoughtfully designed and curated experiences to provide clients with insights and actionable advice to achieve accelerated business growth. Forrester Events focus on business imperatives of significant interest to clients, including business-to-business marketing, sales and product leadership, customer experience, security and risk, new technology and innovation, and data strategies and insights. One of the primary purposes of our Events business is to help drive our CV growth, and we have found that prospective clients that have attended one of our events convert into clients at higher rates compared to those that have not attended an event.

Due to the COVID-19 pandemic, in 2021 we continued to offer our events as live virtual experiences, though we currently plan to hold our events in 2022 as hybrid events, consisting of both in-person and virtual experiences. These virtual events allowed us to offer added attendee benefits such as on demand sessions, more networking opportunities and more content, leading to higher attendee engagement.

Sales and Marketing

We believe we have a strong alignment across our sales, marketing and product functions.

We sell our products and services through our direct sales force in various locations in North America, Europe and the Asia Pacific region. Our sales organization is organized into groups based on client size, geography, and market potential. Our Premier groups focus on our largest vendor and end user clients across the globe while our Core group focuses on small to mid-sized vendor

4

clients. Our European and Asia Pacific groups focus on both end user and vendor clients in their respective geographies. Our International Business Development group sells our products and services through independent sales representatives in select international locations. We also have a group dedicated to event sales.

We employed 637 sales personnel as of December 31, 2021 compared to 701 sales personnel employed as of December 31, 2020.

We also sell select Research products directly online through our website.

Our marketing activities are designed to elevate the Forrester brand, differentiate and promote Forrester’s products and services, improve the client experience, and drive growth. We achieve these outcomes by combining the value of analytics, brand campaigns, content, social media, public relations, creative, and field marketing, delivering multi-channel campaigns, Forrester Events, and high-quality digital experiences.

As of December 31, 2021, our products and services were delivered to more than 3,000 client companies. No single client company accounted for more than 3% of our 2021 revenues.

Pricing and Contracts

We report our revenue from client contracts in three categories of revenue: (1) research, (2) consulting, and (3) events. We classify revenue from subscriptions to, and licenses of, our research products and services as research revenue. We classify revenue from our consulting projects and standalone advisory services as consulting revenue. We classify revenue from tickets to and sponsorships of events as events revenue.

Contract pricing for annual subscription-based products is principally a function of the number of licensed users at the client. Pricing of contracts is a fixed fee for the consulting project or shorter-term advisory service. We periodically review and increase the list prices for our products and services.

We track contract value as a significant business indicator. Contract value is defined as the value attributable to all of our recurring research-related contracts. Contract value is calculated as the annualized value of all contracts in effect at a specific point in time, without regard to how much revenue has already been recognized. Contract value increased 15% to $345.8 million at December 31, 2021 from $301.3 million at December 31, 2020.

Competition

We believe our focus on helping business and technology leaders use customer obsession to drive growth sets us apart from our competition. In addition, we believe we compete favorably due to:

Our principal direct competitors include other independent providers of research and advisory services, such as Gartner, as well as marketing agencies, general business consulting firms, survey-based general market research firms, providers of peer networking services, and digital media measurement services. In addition, our indirect competitors include the internal planning and marketing staffs of our current and prospective clients, as well as other information providers such as electronic and print publishing companies. We also face competition from free sources of information available on the Internet, such as Google. Our indirect competitors could choose to compete directly against us in the future. In addition, there are relatively few barriers to entry into certain segments of our market, and new competitors could readily seek to compete against us in one or more of these market segments. Increased competition could adversely affect our operating results through pricing pressure and loss of market share. There can be no assurance that we will be able to continue to compete successfully against existing or new competitors.

Intellectual Property

Our proprietary research, methodologies and other intellectual property play a significant role in the success of our business. We rely on a combination of copyright, trademark, trade secret, confidentiality, and other contractual provisions to protect our intellectual property. We actively monitor compliance by our employees, clients and third parties with our policies and agreements relating to confidentiality, ownership, and the use and protection of Forrester’s intellectual property.

5

Employees

Attracting, retaining, and developing the best and brightest talent around the globe is critical to the ongoing success of our company. As of December 31, 2021, we employed a total of 1,781 persons. Of these employees, 1,316 were in the United States and Canada; 267 in Europe, Middle East and Africa (“EMEA”); and 198 in the Asia Pacific region.

Culture. Our culture emphasizes certain key values — including client, courage, collaboration, integrity, and quality — that we believe are critical to deliver Forrester’s unique value proposition of helping business and technology leaders use customer obsession to drive growth. In addition, we seek to foster a culture where employees can be creative, feel supported and empowered, and are encouraged to think boldly about new ideas. As a reflection of these efforts, in 2021, for the fourth time in five years, Forrester was honored with a Glassdoor Employees’ Choice Award, recognizing the Best Places to Work in 2021. Forrester’s CEO, Founder, and Chairman George F. Colony was also named one of Glassdoor’s Top CEOs in 2021.

Anywhere Work. In 2021, based on employees’ feedback and our research, we made the decision to shift to a fully flexible work model that we call “anywhere work.” As the COVID-19 pandemic wanes and our offices fully reopen, our employees and their teams will be empowered to decide when they will be in the office based on their work needs.

Diversity and Inclusion (D&I). We focus on attracting, hiring, and the inclusion of all backgrounds and perspectives, with the goals of improving employee retention and engagement, strengthening the quality of our research, and improving client retention and customer experience. We field regular surveys to all of our employees to measure our progress against our goals. In 2021, in addition to the ongoing activities of our D&I Council and regional D&I Networks, examples of our efforts with respect to D&I included:

Learning and Development. We have a robust learning and development program and celebrate and enrich the Forrester culture through frequent recognition of achievements. To keep employees and teams connected and inspired to do their best work in an anywhere work environment, we have enhanced the learning and development opportunities for our employees across a broad range of initiatives including new hire and onboarding, D&I, and leadership training.

Available Information

Forrester Research Inc. was incorporated in Massachusetts on July 7, 1983 and reincorporated in Delaware on February 16, 1996. Forrester’s corporate offices are located in Cambridge, Massachusetts.

Our Internet address is www.forrester.com. We make available free of charge, on or through the investor information section of our website, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file documents electronically.

6

Item 1A. Risk Factors

We operate in a rapidly changing and competitive environment that involves risks and uncertainties, certain of which are beyond our control. These risks and uncertainties could have a material adverse effect on our business and our results of operations and financial condition. These risks and uncertainties include, but are not limited to:

Risk Factors Specific to our Business

A Decline in Renewals or Demand for Our Subscription-Based Research Services. Our success depends in large part upon retaining (on both a client company and dollar basis) and enriching existing subscriptions for our Research products and services. Future declines in client retention and wallet retention, or failure to generate demand for and new sales of our subscription-based products and services due to competition, changes in our offerings, or otherwise, could have an adverse effect on our results of operations and financial condition.

Demand for Our Consulting Services. Consulting revenues comprised 33% of our total revenues in 2021 and 32% of our total revenues in 2020. Consulting engagements generally are project-based and non-recurring. A decline in our ability to fulfill existing or generate new consulting engagements could have an adverse effect on our results of operations and financial condition.

Our Business May be Adversely Affected by the Economic Environment. Our business is in part dependent on technology spending and is impacted by economic conditions such as inflation and supply chain issues that may impact us and our customers. The economic environment may materially and adversely affect demand for our products and services. If conditions in the United States and the global economy were to lead to a decrease in technology spending, or in demand for our products and services, this could have an adverse effect on our results of operations and financial condition. Although we do not have any employees or material client relationships in Russia or Ukraine, if the Russian military invasion of Ukraine that commenced in February 2022 were to escalate or spread to other regions, there may be negative effects on both the United States and the global economy that could materially and adversely affect our business.

Our International Operations Expose Us to a Variety of Operational Risks which Could Negatively Impact Our Results of Operations. As of December 31, 2021, we have clients in approximately 76 countries and approximately 23% of our revenues come from international sales. Our operating results are subject to the risks inherent in international business activities, including challenges in staffing and managing foreign operations, changes in regulatory requirements, compliance with numerous foreign laws and regulations, differences between U.S. and foreign tax rates and laws, fluctuations in currency exchange rates, difficulty of enforcing client agreements, collecting accounts receivable and protecting intellectual property rights in international jurisdictions, and potential disruptions caused by foreign wars and conflicts. Furthermore, we rely on local independent sales representatives in some international locations. If any of these arrangements are terminated by our representatives or us, we may not be able to replace the arrangement on beneficial terms or on a timely basis, or clients sourced by the local sales representative may not want to continue to do business with us or our new representative.

We Face Risks Related to Health Epidemics That Could Adversely Impact Our Business. Our business has been, and could continue to be, adversely affected by the effects of a widespread outbreak of contagious disease, including the ongoing COVID-19 pandemic. Any outbreak of contagious diseases, and other adverse public health developments, could have a material and adverse effect on our business operations. This could include disruptions or restrictions on the ability of our employees or our customers to travel and a slowdown in the global economy, which could adversely affect our ability to sell or fulfill, and a reduction in demand for, our products, services, or events. Any disruption or delay of our customers or third-party service providers, including due to inflation or supply chain issues, would likely impact our operating results. The COVID-19 pandemic significantly affected us beginning in March 2020 primarily through lower contract bookings and a reduction in revenues from the conversion of our events from in-person events to virtual events. Our Events business generated $27.0 million of revenue during 2019 and due to considerations of the effect of COVID-19, we held all of our events as virtual events during 2020 and 2021 and generated only $10.1 million and $12.9 million of revenue, respectively, during those years. While the duration and severity of the pandemic is uncertain, the Company did experience a rebound in contract bookings in the fourth quarter of 2020 and continuing through all of 2021. While our Events business continues to be negatively affected by the pandemic, we intend to hold our events during 2022 as hybrid events, consisting of both in-person and virtual experiences. The extent to which the COVID-19 pandemic ultimately impacts our business, financial condition, results of operations, cash flows, and liquidity may differ from our current estimates due to inherent uncertainties regarding the duration and further spread of the outbreak, its severity, actions taken to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume.

Ability to Develop and Offer New Products and Services. Our future success will depend in part on our ability to offer new products and services. These new products and services must successfully gain market acceptance by anticipating and identifying changes in client requirements and changes in the technology industry and by addressing specific industry and business organization sectors. The process of internally researching, developing, launching, and gaining client acceptance of a new product or service, or assimilating and marketing an acquired product or service, is risky and costly. We may not be able to introduce new, or assimilate

7

acquired, products or services successfully. Our failure to do so would adversely affect our ability to maintain a competitive position in our market and continue to grow our business.

Loss of Key Management. Our future success will depend in large part upon the continued services of a number of our key management employees. The loss of any one of them, in particular George F. Colony, our founder, Chairman of the Board and Chief Executive Officer, could adversely affect our business.

The Ability to Attract and Retain Qualified Professional Staff. Our future success will depend in large measure upon the continued contributions of our senior management team, research professionals, consultants, and experienced sales and marketing personnel. Thus, our future operating results will be largely dependent upon our ability to retain the services of these individuals and to attract additional professionals from a limited pool of qualified candidates. Our future success will also depend in part upon the effectiveness of our sales leadership in hiring and retaining sales personnel and in improving sales productivity. We experience competition in hiring and retaining professionals from developers of Internet and emerging-technology products, other research firms, management consulting firms, print and electronic publishing companies, and financial services companies, many of which have substantially greater ability, either through cash or equity, to attract and compensate professionals. If we lose professionals or are unable to attract new talent, we will not be able to maintain our position in the market or grow our business.

Failure to Anticipate and Respond to Market Trends. Our success depends in part upon our ability to anticipate rapidly changing technologies and market trends and to adapt our research and consulting services, and other related products and services to meet the changing needs of our clients. The technology and commerce sectors that we analyze undergo frequent and often dramatic changes. The environment of rapid and continuous change presents significant challenges to our ability to provide our clients with current and timely analysis, strategies, and advice on issues of importance to them. Meeting these challenges requires the commitment of substantial resources. Any failure to continue to provide insightful and timely analysis of developments, technologies, and trends in a manner that meets market needs could have an adverse effect on our market position and results of operations.

We Have Outstanding Debt Which Could Materially Restrict our Business and Adversely Affect our Financial Condition, Liquidity, and Results of Operations. In December of 2021, we entered into an amendment of our existing credit agreement to eliminate our term loan facility, increase the available amount of our revolving credit facility to $150.0 million, and extend the maturity date to December 2026 (as so amended, “the Facility”). As of December 31, 2021, we had outstanding debt of $75.0 million under the Facility (refer to Note 5 – Debt in the Notes to Consolidated Financial Statements for further information). The obligations incurred under this Facility could impair our future financial condition and operating results. In addition, the affirmative, negative, and financial covenants of the Facility could limit our future financial flexibility. A failure to comply with these covenants could result in acceleration of all amounts outstanding, which could materially impact our financial condition unless accommodations could be negotiated with our lenders. No assurance can be given that we would be successful in doing so, or that any accommodations that we were able to negotiate would be on terms as favorable as those currently. The outstanding debt may limit the amount of cash or additional credit available to us, which could restrain our ability to expand or enhance products and services, respond to competitive pressures or pursue future business opportunities requiring substantial investments of additional capital.

Competition. We compete principally in the market for research and advisory services, with an emphasis on customer behavior and customer experience, and the impact of technology on our clients’ business and service models. Our principal direct competitors include other independent providers of research and advisory services, such as Gartner, as well as marketing agencies, general business consulting firms, survey-based general market research firms, providers of peer networking services, and digital media measurement services. Some of our competitors have substantially greater financial and marketing resources than we do. In addition, our indirect competitors include the internal planning and marketing staffs of our current and prospective clients, as well as other information providers such as electronic and print publishing companies. We also face competition from free sources of information available on the Internet, such as Google. Our indirect competitors could choose to compete directly against us in the future. In addition, there are relatively few barriers to entry into certain segments of our market, and new competitors could readily seek to compete against us in one or more of these market segments. Increased competition could adversely affect our operating results through pricing pressure and loss of market share. There can be no assurance that we will be able to continue to compete successfully against existing or new competitors.

Fluctuations in Our Operating Results. Our revenues and earnings may fluctuate from quarter to quarter based on a variety of factors, many of which are beyond our control, and which may affect our stock price. These factors include, but are not limited to:

8

As a result, our operating results in future quarters may be below the expectations of securities analysts and investors, which could have an adverse effect on the market price for our common stock. Factors such as announcements of new products, services, offices, acquisitions or strategic alliances by us, our competitors, or in the research and professional services industries generally, may have a significant impact on the market price of our common stock. The market price for our common stock may also be affected by movements in prices of stocks in general.

Concentration of Ownership. Our largest stockholder is our Chairman and CEO, George F. Colony, who owns approximately 40% of our outstanding stock. This concentration of ownership enables Mr. Colony to strongly influence or effectively control matters requiring stockholder approval, including the election of directors, amendment of our certificate of incorporation, adoption or amendment of equity plans, and approval of significant transactions such as mergers, acquisitions, consolidations, and sales or purchases of assets. This concentration of ownership may also limit the liquidity of our stock. As a result, efforts by stockholders to change the direction, management, or ownership of Forrester may be unsuccessful, and stockholders may not be able to freely purchase and sell shares of our stock.

General Risk Factors

We Face Risks from Network Disruptions or Security Breaches that Could Damage Our Reputation and Harm Our Business and Operating Results. We face risks from network disruptions or security breaches caused by computer viruses, illegal break-ins or hacking, sabotage, acts of vandalism by third parties, or terrorism. To date, none have resulted in any material adverse impact to our business, operations, products, services or customers. However, our security measures or those of our third-party service providers may not detect or prevent such security breaches. Any such compromise of our information security could result in the unauthorized publication of our confidential business or proprietary information, cause an interruption in our operations, result in the unauthorized release of customer or employee data, result in a violation of privacy or other laws, expose us to a risk of litigation, or damage our reputation, which could harm our business and operating results.

Failure to Enforce and Protect our Intellectual Property Rights. We rely on a combination of copyright, trademark, trade secret, confidentiality, and other contractual provisions to protect our intellectual property. Unauthorized third parties may obtain or use our proprietary information despite our efforts to protect it. The laws of certain countries do not protect our intellectual property to the same extent as the laws of the United States and accordingly we may not be able to protect our intellectual property against unauthorized use or distribution, which could adversely affect our business.

Privacy Laws. Privacy laws and regulations, and the interpretation and application of these laws and regulations, in the U.S, Europe and other countries around the world where we conduct business are sometimes inconsistent and frequently changing. This includes, but is not limited to, the European Union General Data Protection Regulation (GDPR), the California Consumer Privacy Act, and the California Privacy Rights Act which is scheduled to be effective January 1, 2023. Compliance with these laws, or changing interpretations and application of these laws, could cause us to incur substantial costs or require us to take action in a manner that would be adverse to our business.

Taxation Risks. We operate in numerous jurisdictions around the world. A portion of our income is generated outside of the United States and is taxed at lower rates than rates applicable to income generated in the U.S. or in other jurisdictions in which we do business. Our effective tax rate in the future, and accordingly our results of operations and financial position, could be adversely affected by changes in applicable tax law or if more of our income becomes taxable in jurisdictions with higher tax rates.

Any Weakness Identified in Our System of Internal Controls by Us and Our Independent Registered Public Accounting Firm Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 Could Have an Adverse Effect on Our Business. Section 404 of the Sarbanes-Oxley Act of 2002 requires that companies evaluate and report on their systems of internal control over financial reporting. In addition, our independent registered public accounting firm must report on its evaluation of those controls. There can be no assurance that no weakness in our internal control over financial reporting will occur in future periods, or that any such weakness will not have a material adverse effect on our business or financial results, including our ability to report our financial results in a timely manner.

Item 1B. Unresolved Staff Comments

We have not received written comments from the Securities and Exchange Commission that remain unresolved.

9

Item 2. Properties

Our corporate headquarters building is comprised of approximately 190,000 square feet of office space in Cambridge, Massachusetts, substantially all of which is currently occupied by the Company. This facility accommodates research, marketing, sales, consulting, technology, and operations personnel. The lease term of this facility expires February 28, 2027.

We also rent office space in San Francisco, New York City, McLean (VA), Nashville, Norwalk (CT), Austin, Frankfurt, London, Paris, New Delhi, Singapore, and Sydney. We also lease office space on a relatively short-term basis in various other locations in North America, Europe, and Asia.

We believe that our existing facilities are adequate for our current needs and that additional facilities are available for lease to meet future needs.

Item 3. Legal Proceedings

From time to time, we may be subject to legal proceedings and civil and regulatory claims that arise in the ordinary course of our business activities. Regardless of the outcome, litigation can have a material adverse effect on us because of defense and settlement costs, diversion of management resources, and other factors.

Item 4. Mine Safety Disclosures

Not applicable.

10

PART II

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Our common stock is listed on the Nasdaq Global Select Market under the symbol “FORR”. On November 27, 2018, in conjunction with the announcement of the acquisition of SiriusDecisions, Forrester announced the indefinite suspension of its quarterly dividend program beginning in 2019. The actual declaration of any potential future dividends, and the establishment of the per share amount and payment dates for any such future dividends, are subject to the discretion of the Board of Directors.

As of March 7, 2022 there were approximately 31 stockholders of record of our common stock. On March 7, 2022 the closing price of our common stock was $52.40 per share.

As of December 31, 2021, our Board of Directors authorized an aggregate $585.0 million to purchase common stock under our stock repurchase program, which includes an additional $50.0 million authorized in October 2021. As of December 31, 2021, we had repurchased approximately 16.7 million shares of common stock at an aggregate cost of $494.9 million.

During the quarter ended December 31, 2021, we repurchased the following shares of our common stock under the stock repurchase program:

|

|

|

|

|

|

|

|

|

|

|

Maximum Approximate Dollar |

|

||||

|

|

|

|

|

|

|

|

Total Number of Shares |

|

|

Value of Shares that May |

|

||||

|

|

Total Number of |

|

|

Average Price |

|

|

Purchased as Part of Publicly |

|

|

Yet be Purchased |

|

||||

|

|

Shares Purchased |

|

|

Paid per Share |

|

|

Announced Plans or Programs |

|

|

Under the Plans or Programs |

|

||||

Period |

|

(#) |

|

|

($) |

|

|

(#) |

|

|

(In thousands) |

|

||||

October 1 - October 31 |

|

|

13,116 |

|

|

$ |

49.53 |

|

|

|

13,116 |

|

|

$ |

98,848 |

|

November 1 - November 30 |

|

|

107,900 |

|

|

$ |

58.79 |

|

|

|

107,900 |

|

|

$ |

92,505 |

|

December 1 - December 31 |

|

|

42,000 |

|

|

$ |

57.78 |

|

|

|

42,000 |

|

|

$ |

90,078 |

|

Total for the quarter |

|

|

163,016 |

|

|

|

|

|

|

163,016 |

|

|

|

|

||

See “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” for information on our equity compensation plans.

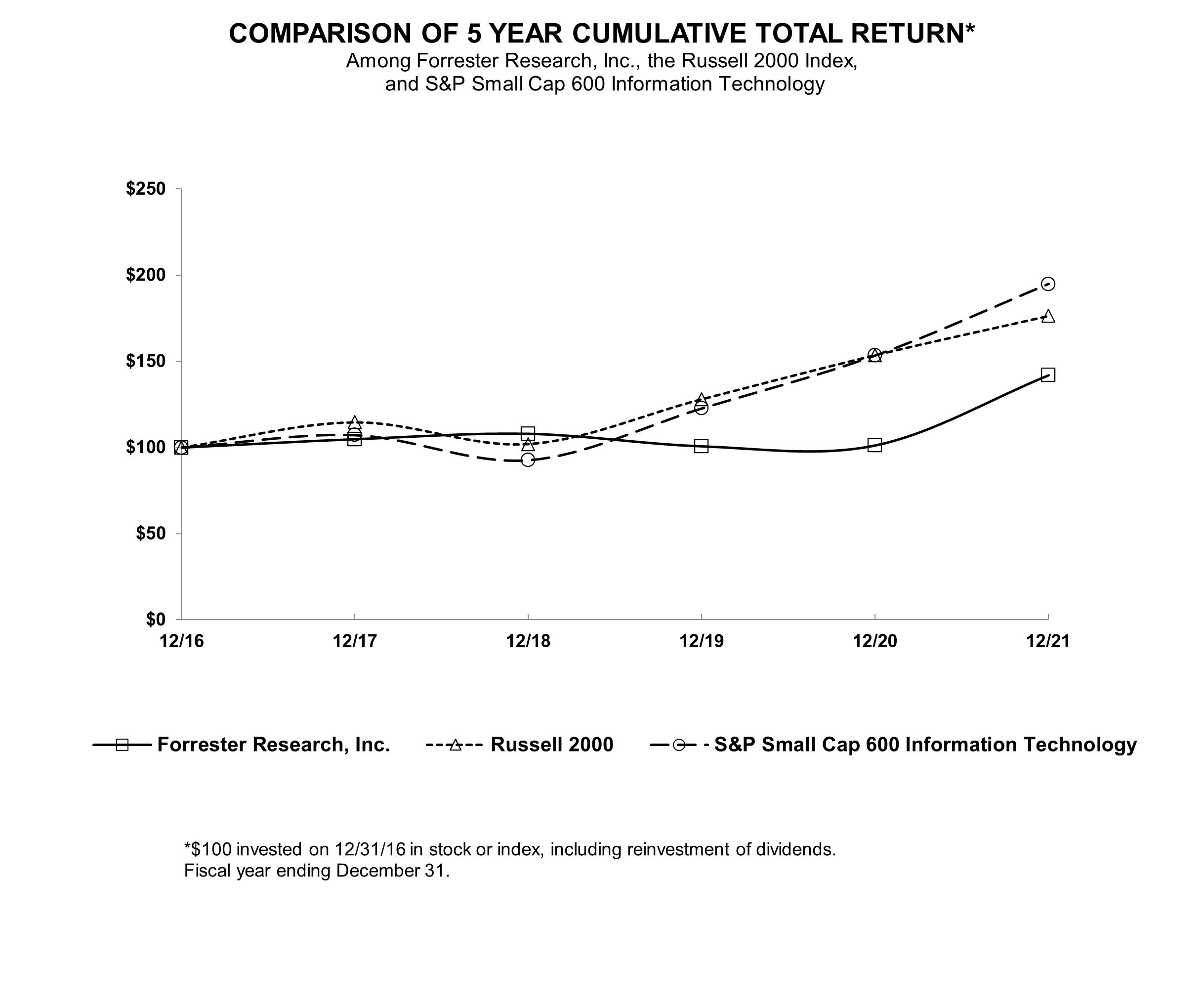

The following graph contains the cumulative stockholder return on our common stock during the period from December 31, 2016 through December 31, 2021 with the cumulative return during the same period for the Russell 2000 and the S&P 600 Small Cap Information Technology Index, and assumes that the dividends, if any, were reinvested.

11

Item 6. [Reserved]

12

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

We derive revenues from subscriptions to our Research products and services, licensing electronic “reprints” of our Research, performing consulting projects and advisory services, and hosting events. We offer contracts for our Research products that are typically renewable annually and payable in advance. Subscription products are recognized as revenue over the term of the contract. Accordingly, a substantial portion of our billings are initially recorded as deferred revenue. Reprints include an obligation to deliver a customer-selected research document and certain usage data provided through an on-line platform, which represents two performance obligations. We recognize revenue for the performance obligation for the data portion of the reprint ratably over the license term. We recognize revenue for the performance obligation for the research document at the time of providing access to the document. Billings for licensing of reprints are initially recorded as deferred revenue. Clients purchase consulting projects and advisory services independently and/or to supplement their access to our subscription-based products. Consulting project revenues, which are based upon fixed-fee agreements, are recognized as the services are provided. Advisory service revenues, such as speeches and advisory days, are recognized when the service is complete or the customer receives the agreed upon deliverable. Billings attributable to consulting projects and advisory services are initially recorded as deferred revenue. Events revenues consist of ticket and sponsorship sales for a Forrester-hosted event. Billings for events are also initially recorded as deferred revenue and are recognized as revenue upon completion of each event.

The COVID-19 pandemic significantly affected us beginning in March 2020 primarily through lower contract bookings and a reduction in revenues from the conversion of our events from in-person events to virtual events. While the duration and severity of the pandemic is uncertain, we did experience a rebound in contract bookings in the fourth quarter of 2020 and continuing through all of 2021. Our Events business continues to be negatively affected by the pandemic. All events held in 2021 have been held as virtual events. We intend to hold our events during 2022 as hybrid events, consisting of both in-person and virtual experiences.

The extent to which the COVID-19 pandemic ultimately impacts our business, financial condition, results of operations, cash flows, and liquidity may differ from our current estimates due to inherent uncertainties regarding the duration and further spread of the outbreak, its severity, actions taken to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume.

Our primary operating expenses consist of cost of services and fulfillment, selling and marketing expenses, and general and administrative expenses. Cost of services and fulfillment represents the costs associated with the production and delivery of our products and services, including salaries, bonuses, employee benefits, and stock-based compensation expense for all personnel that produce and deliver our products and services, including all associated editorial, travel, and support services. Selling and marketing expenses include salaries, sales commissions, bonuses, employee benefits, stock-based compensation expense, travel expenses, promotional costs, and other costs incurred in marketing and selling our products and services. General and administrative expenses include the costs of the technology, operations, finance, and human resources groups and our other administrative functions, including salaries, bonuses, employee benefits, and stock-based compensation expense. Overhead costs such as facilities, net of sublease income, and annual fees for cloud-based information technology systems are allocated to these categories according to the number of employees in each group.

Effective from the first quarter of 2021, we modified our key metrics to focus on our contract value (“CV”) products (as described below) in comparison to our prior metrics which included measures of our broader product portfolio. For 2021, we have focused on increasing our CV product bookings and have modified our compensation programs and metrics accordingly. We are focusing on CV products as these products are our most profitable products and historically our contracts for CV products have renewed at high rates (as measured by our client retention and wallet retention metrics). Our CV products make up essentially all of our research revenues.

We have included the historical calculation of the metrics below on the investor relations section of our website.

Contract value, client retention, wallet retention, and number of clients are metrics that we believe are important to understanding our research business. We define these metrics as follows:

13

Client retention and wallet retention are not necessarily indicative of the rate of future retention of our revenue base. A summary of our key metrics is as follows (dollars in millions):

|

|

As of |

|

|

Absolute |

|

|

Percentage |

|

|||||||

|

|

December 31, |

|

|

Increase |

|

|

Increase |

|

|||||||

|

|

2021 |

|

|

2020 |

|

|

(Decrease) |

|

|

(Decrease) |

|

||||

Contract value |

|

$ |

345.8 |

|

|

$ |

301.3 |

|

|

$ |

44.5 |

|

|

|

15 |

% |

Client retention |

|

|

78 |

% |

|

|

72 |

% |

|

|

6 |

|

|

|

8 |

% |

Wallet retention |

|

|

102 |

% |

|

|

86 |

% |

|

|

16 |

|

|

|

19 |

% |

Number of clients |

|

|

3,005 |

|

|

|

2,808 |

|

|

|

197 |

|

|

|

7 |

% |

Contract value increased 15% at December 31, 2021 compared to the prior year period. Client retention and wallet retention increased 8% and 19%, respectively, at December 31, 2021 compared to the prior year period. These metrics were at their lows during the second and third quarters of 2020 as contract bookings declined during 2020 due to the pandemic. We have seen an improvement in these metrics from their lows in the middle of 2020 as contract bookings expanded during the second half of 2020 and through all of 2021.

Critical Accounting Estimates

Management’s discussion and analysis of financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including but not limited to, those related to our revenue recognition, goodwill, intangible and other long-lived assets, and income taxes. Management bases its estimates on historical experience, data available at the time the estimates are made, and various assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We consider the following accounting estimates to be those that require the most subjective judgment or that involve uncertainty that could have a material impact on our financial statements. If actual results differ significantly from management’s estimates and projections, there could be a material effect on our financial statements.

Our contracts may include either a single promise (referred to as a performance obligation) to transfer a product or service or a combination of multiple promises to transfer products or services. We evaluate the existence of multiple performance obligations within our products and services by using judgment to determine if: (1) the customer can benefit from each contractual promise on its own or together with other readily available resources; and (2) the transfer of each contractual promise is separately identifiable from other promises in a contract. When both criteria are met, each promise is accounted for as a separate performance obligation. Revenues from contracts that contain multiple products or services are allocated among the separate performance obligations on a relative basis according to their standalone selling prices. We obtain the standalone selling prices of our products and services based upon an analysis of standalone sales of these products and services. When there is an insufficient history of standalone sales, we use judgment to estimate the standalone selling price, taking into consideration available market conditions, factors used to set list prices, pricing of similar products, and

14

internal pricing objectives. Standalone selling prices are typically analyzed and updated on an annual basis, or as business conditions change.

Consulting project revenues are recognized over time as the services are provided, based on an input method that calculates the total hours expended compared to the estimated hours required to satisfy the performance obligation. This method requires the use of judgement in determining the required number of hours to complete the project.

We are required to estimate the amount of prepaid performance obligations that will expire unused and recognize revenue for that estimate over the same period the related rights are exercised by our customers. This assessment requires judgment, including estimating the percentage of prepaid rights that will go unexercised and anticipating the impact that future changes to products, pricing, and customer engagement will have on actual expirations. We update the estimates used to recognize unexercised rights on a quarterly basis.

When acquiring a business, as of the acquisition date, we determine the estimated fair values of the assets acquired and liabilities assumed, which may include a significant amount of intangible assets and goodwill. Goodwill is required to be assessed for impairment at least annually or whenever events or circumstances indicate that there may be an impairment. An impairment assessment requires evaluating the potential impairment at the reporting unit level using either a qualitative assessment, to determine if it is more likely than not that the fair value of any reporting unit is less than its carrying amount, or a quantitative analysis, to determine and compare the fair value of each reporting unit to its carrying value, or a combination of both. Judgement is required in determining the use of a qualitative or quantitative assessment, as well as in determining each reporting unit’s estimated fair value as it requires us to make estimates of market conditions and operational performance, including projected financial results, discount rates, control premium, and valuation multiples for key financial metrics.

Absent an event that indicates a specific impairment may exist, we have selected November 30th as the date to perform the annual goodwill impairment test. We completed the annual goodwill impairment testing as of November 30, 2021 utilizing a qualitative assessment to determine if it was more likely than not that the fair values of each of our reporting units was less than their respective carrying values and concluded that no impairments existed. Future events could cause us to conclude that impairment indicators exist and that goodwill is impaired. Any resulting impairment loss could have a material adverse impact on our results of operations.

Intangible assets with finite lives as of December 31, 2021 consist of acquired customer relationships, acquired technology, and acquired trademarks and were valued according to the future cash flows they were estimated to produce or the estimated costs to replace the assets. These assigned values are amortized on a basis which best matches the periods in which the economic benefits are expected to be realized. Tangible assets with finite lives consist of property and equipment, which are depreciated over their estimated useful lives. Other long-lived assets consist primarily of operating lease right-of-use assets as described in the Leases critical accounting policies and estimates above.

We continually evaluate whether events or circumstances have occurred that indicate the estimated remaining useful life of any of our intangible assets, tangible assets, or operating lease right-of-use assets may warrant revision, or that the carrying value of these assets may be impaired. To compute whether these assets have been impaired, we estimate the undiscounted future cash flows for the estimated remaining useful life of the assets and compare that to the carrying value. To the extent that the future cash flows are less than the carrying value, the assets are written down to their estimated fair value.

During 2020, we recorded $2.3 million of right-of-use asset impairments and $1.1 million of leasehold improvement impairments related to a facility lease we no longer used as a result of the integration of SiriusDecisions.

15

Results of Operations for the years ended December 31, 2021 and 2020

The following table sets forth our Consolidated Statements of Operations as a percentage of total revenues for the years noted.

|

|

Years Ended |

|

|||||

|

|

December 31, |

|

|||||

|

|

2021 |

|

|

2020 |

|

||

Revenues: |

|

|

|

|

|

|

||

Research revenues |

|

|

65.8 |

% |

|

|

67.2 |

% |

Consulting revenues |

|

|

31.6 |

|

|

|

30.6 |

|

Events revenues |

|

|

2.6 |

|

|

|

2.2 |

|

Total revenues |

|

|

100.0 |

|

|

|

100.0 |

|

Operating expenses: |

|

|

|

|

|

|

||

Cost of services and fulfillment |

|

|

40.8 |

|

|

|

40.3 |

|

Selling and marketing |

|

|

34.6 |

|

|

|

37.0 |

|

General and administrative |

|

|

11.7 |

|

|

|

11.2 |

|

Depreciation |

|

|

1.9 |

|

|

|

2.2 |

|

Amortization of intangible assets |

|

|

3.1 |

|

|

|

4.4 |

|

Acquisition and integration costs |

|

|

0.1 |

|

|

|

1.3 |

|

Income from operations |

|

|

7.8 |

|

|

|

3.6 |

|

Interest expense |

|

|

(0.9 |

) |

|

|

(1.2 |

) |

Other expense, net |

|

|

(0.2 |

) |

|

|

(0.1 |

) |

Gains on investments, net |

|

|

— |

|

|

|

0.6 |

|

Income before income taxes |

|

|

6.7 |

|

|

|

2.9 |

|

Income tax expense |

|

|

1.7 |

|

|

|

0.7 |

|

Net income |

|

|

5.0 |

% |

|

|

2.2 |

% |

16

2021 compared to 2020

Revenues

|

|

|

|

|

|

|

|

Absolute |

|

|

Percentage |

|

||||

|

|

|

|

|

|

|

|

Increase |

|

|

Increase |

|

||||

|

|

2021 |

|

|

2020 |

|

|

(Decrease) |

|

|

(Decrease) |

|

||||

|

|

(dollars in millions) |

|

|

|

|

|

|

|

|||||||

Total revenues |

|

$ |

494.3 |

|

|

$ |

449.0 |

|

|

$ |

45.3 |

|

|

|

10 |

% |

Research revenues |

|

$ |

325.3 |

|

|

$ |

301.5 |

|

|

$ |

23.8 |

|

|

|

8 |

% |

Consulting revenues |

|

$ |

156.1 |

|

|

$ |

137.3 |

|

|

$ |

18.8 |

|

|

|

14 |

% |

Events revenues |

|

$ |

12.9 |

|

|

$ |

10.1 |

|

|

$ |

2.7 |

|

|

|

27 |

% |

Revenues attributable to customers outside of the U.S. |

|

$ |

112.7 |

|

|

$ |

92.7 |

|

|

$ |

20.0 |

|

|

|

22 |

% |

Percentage of revenue attributable to customers |

|

|

23 |

% |

|

|

21 |

% |

|

|

2 |

|

|

|

10 |

% |

Total revenues increased 10% during 2021 compared to 2020, with 1% of the increase due to changes in foreign currency. Revenues from customers outside of the U.S. increased 22% during 2021 compared to the prior year. The increase in revenues attributable to customers outside of the U.S. was primarily due to an increase in revenues in Europe, the United Kingdom, Asia Pacific region, and Canada. Approximately 4% of the increase was due to changes in foreign currency.

Research revenues are recognized as revenue primarily on a ratable basis over the term of the contracts, which are generally twelve-month periods. Research revenues increased 8% during 2021 compared to 2020, with 1% of the increase due to changes in foreign currency. The increase in revenues was primarily due to increased contract value, which was driven by strong demand for our products and an increase in our wallet retention rate.

Consulting revenues increased 14% during 2021 compared to 2020, with 1% of the increase due to changes in foreign currency. The increase in revenues was primarily due to continued strong demand for our content marketing and strategy consulting offerings.

Events revenues increased 27% during 2021 compared to 2020, with 1% of the increase due to changes in foreign currency. The increase in revenues was primarily due to higher sponsorship revenues.

Refer to the “Segment Results” section below for a discussion of revenue and expenses by segment.

Cost of Services and Fulfillment

|

|

|

|

|

|

|

|

Absolute |

|

|

Percentage |

|

||||

|

|

|

|

|

|

|

|

Increase |

|

|

Increase |

|

||||

|

|

2021 |

|

|

2020 |

|

|

(Decrease) |

|

|

(Decrease) |

|

||||

Cost of services and fulfillment (dollars in millions) |

|

$ |

201.8 |

|

|

$ |

180.9 |

|

|

$ |

20.9 |

|

|

|

12 |

% |

Cost of services and fulfillment as a percentage of |

|

|

40.8 |

% |

|

|

40.3 |

% |

|

|

0.5 |

|

|

|

1 |

% |

Service and fulfillment employees (at end of period) |

|

|

822 |

|

|

|

783 |

|

|

|

39 |

|

|

|

5 |

% |

Cost of services and fulfillment expenses increased 12% in 2021 compared to 2020, with 1% of the increase due to changes in foreign currency. The increase was primarily due to (1) a $10.4 million increase in compensation and benefit costs due to reinstating incentive bonus programs and other benefits that were eliminated as part of the cost-reduction measures implemented in 2020 as a result of the impact of the COVID-19 pandemic and merit increases, partially offset by a decrease in severance costs and headcount in the first half of the year compared to the prior year period, (2) a $9.5 million increase in professional services costs primarily due to increases in outsourced services related to revenue delivery, contractor costs, product enhancements and survey costs, and (3) a $2.1 million increase in facilities costs primarily as a result of a lease incentive for early termination of an office lease that reduced expense in 2020. These increases were partially offset by a $1.4 million decrease in travel and entertainment expenses due to reduced travel as a result of the COVID-19 pandemic.

17

Selling and Marketing

|

|

|

|

|

|

|

|

Absolute |

|

|

Percentage |

|

||||

|

|

|

|

|

|

|

|

Increase |

|

|

Increase |

|

||||

|

|

2021 |

|

|

2020 |

|

|

(Decrease) |

|

|

(Decrease) |

|

||||

Selling and marketing expenses (dollars in millions) |

|

$ |

170.9 |

|

|

$ |

166.2 |

|

|

$ |

4.7 |

|

|

|

3 |

% |

Selling and marketing expenses as a percentage of |

|

|

34.6 |

% |

|

|

37.0 |

% |

|

|

(2.4 |

) |

|

|

(6 |

%) |

Selling and marketing employees (at end of period) |

|

|

720 |

|

|

|

781 |

|

|

|

(61 |

) |

|

|

(8 |

%) |

Selling and marketing expenses increased 3% in 2021 compared to 2020, with 1% of the increase due to changes in foreign currency. The increase was primarily due to (1) a $2.6 million increase in compensation and benefit costs due to reinstating incentive bonus programs and other benefits that were eliminated as part of the cost-reduction measures implemented in 2020 as a result of the impact of the COVID-19 pandemic, merit increases and an increase in commissions expense, partially offset by a decrease in headcount, (2) a $2.2 million increase in professional services costs primarily due to an increase in advertising and marketing expenses, and (3) a $1.1 million increase in facilities costs primarily as a result of a lease incentive for early termination of an office lease that reduced expense in 2020. These increases were partially offset by a $0.5 million decrease in bad debt expense.

General and Administrative

|

|

|

|

|

|

|

|

Absolute |

|

|

Percentage |

|

||||

|

|

|

|

|

|

|

|

Increase |

|

|

Increase |

|

||||

|

|

2021 |

|

|

2020 |

|

|

(Decrease) |

|

|

(Decrease) |

|

||||

General and administrative expenses (dollars in |

|

$ |

58.1 |

|

|

$ |

50.4 |

|

|

$ |

7.7 |

|

|

|

15 |

% |

General and administrative expenses as a percentage |

|

|

11.7 |

% |

|

|

11.2 |

% |

|

|

0.5 |

|

|

|

4 |

% |

General and administrative employees (at end |

|

|

239 |

|

|

|

234 |

|

|

|

5 |

|

|

|

2 |

% |

General and administrative expenses increased 15% in 2021 compared to 2020, with 1% of the increase due to changes in foreign currency. The increase was primarily due to (1) a $5.1 million increase in compensation and benefit costs due to reinstating incentive bonus programs and other benefits that were eliminated as part of the cost-reduction measures implemented in 2020 as a result of the impact of the COVID-19 pandemic and merit increases, (2) a $1.7 million increase in professional services costs, (3) a $0.7 million increase in facilities costs primarily as a result of a lease incentive for early termination of an office lease that reduced expense in 2020, and (4) a $0.5 million increase in recruiting expense. These increases were partially offset by a $0.7 million decrease in stock compensation expense.

Depreciation

Depreciation expense decreased by $0.5 million in 2021 compared to 2020 primarily due to software assets becoming fully depreciated.

Amortization of Intangible Assets

Amortization expense decreased by $4.6 million in 2021 compared to 2020 primarily due to a certain intangible asset becoming fully amortized in 2020. We expect amortization expense related to our intangible assets to be approximately $13.2 million for the year ending December 31, 2022.

Acquisition and Integration Costs

We did not have any acquisitions in 2021 and had one acquisition, SiriusDecisions, at the beginning of 2019. Acquisition and integration costs consist of direct and incremental costs to acquire and integrate acquired companies and primarily consist of certain fair value adjustments, consulting, severance, accounting and tax professional fees, and lease expense for unused leased facilities.

18

Acquisition and integration costs decreased by $5.4 million in 2021 compared to 2020 due to the substantial completion of the integration of SiriusDecisions during 2020. Integration costs in 2021 relate to unused lease facilities from the SiriusDecisions acquisition.

Interest Expense

Interest expense consists of interest on our borrowings used to finance the acquisition of SiriusDecisions and realized gains (losses) on the related interest rate swap. Interest expense decreased by $1.1 million in 2021 compared to 2020 due to lower average outstanding borrowings and a lower effective interest rate. We expect to incur interest expense of approximately $2.5 million for the year ending December 31, 2022.

Other Expense, Net

Other expense, net primarily consists of gains (losses) on foreign currency, gains (losses) on foreign currency forward contracts, and interest income. Other expense, net increased by $0.9 million in 2021 compared to 2020 due to an increase in foreign currency losses.

Gains on Investments, Net

Gains on investments, net primarily represents our share of equity method investment gains and losses from our technology-related investment funds. Gains on investments, net decreased by $2.5 million in 2021 compared to 2020 primarily due to a decrease in investment gains generated by the underlying funds.

Income Tax Expense

|

|

|

|

|

|

|

|

Absolute |

|

|

Percentage |

|

||||

|

|

|

|

|

|

|

|

Increase |

|

|

Increase |

|

||||

|

|

2021 |

|

|

2020 |

|

|

(Decrease) |

|

|

(Decrease) |

|

||||

Provision for income taxes (dollars in millions) |

|

$ |

8.3 |

|

|

$ |

2.9 |

|

|

$ |

5.4 |

|

|

|

184 |

% |

Effective tax rate |

|

|

25.1 |

% |

|

|

22.8 |

% |

|

|

2.3 |

|

|

|

10 |

% |

The increase in the effective tax rate during 2021 as compared to 2020 was primarily due to the utilization of a valuation allowance on capital assets during 2020 that did not recur in 2021, an increase in foreign subsidiary income subject to U.S. tax in 2021, and a change in tax legislation in 2021 which was less impactful than 2020. These increases were partially offset by increased tax deductions related to stock compensation in 2021 that did not occur in 2020.

Segment Results

We operate in three segments: Research, Consulting, and Events. These segments, which are also our reportable segments, are based on our management structure and how management uses financial information to evaluate performance and determine how to allocate resources. Our products and services are delivered through each segment as described below. Additionally, the tables below include the reclassification of revenues for the components of our CV subscription research products, as described further in Note 1: Summary of Significant Accounting Policies in the Notes to the Consolidated Financial Statements.

The Research segment includes the revenues from all of our research products as well as consulting revenues from advisory services (such as speeches and advisory days) delivered by our research organization. Research segment costs include the cost of the organizations responsible for developing and delivering these products in addition to the cost of the product management organization that is responsible for product pricing and packaging and the launch of new products.

The Consulting segment includes the revenues and the related costs of our project consulting organization. The project consulting organization delivers a majority of our project consulting revenue and certain advisory services.

The Events segment includes the revenues and the costs of the organization responsible for developing and hosting in-person and virtual events.

We evaluate reportable segment performance and allocate resources based on segment revenues and expenses. Segment expenses include the direct expenses of each segment organization and exclude selling and marketing expenses, general and administrative expenses, stock-based compensation expense, depreciation expense, adjustments to incentive bonus compensation from target amounts, amortization of intangible assets, interest and other expense, and gains on investments. The accounting policies used by the segments are the same as those used in the consolidated financial statements. We do not review or evaluate assets as part of segment performance. Accordingly, we do not identify or allocate assets by reportable segment.

19

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Research |

|

|

Consulting |

|

|

Events |

|

|

Consolidated |

|

||||

Year Ended December 31, 2021 |

|

(In thousands, except percentages) |

|

|||||||||||||

Research revenues |

|

$ |

325,340 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

325,340 |

|

Consulting revenues |

|

|

47,247 |

|

|

|

108,867 |

|

|

|

— |

|

|

|

156,114 |

|

Events revenues |

|

|

— |

|

|

|

— |

|

|

|

12,861 |

|

|

|

12,861 |

|

Total segment revenues |

|

|

372,587 |

|

|

|

108,867 |

|

|

|

12,861 |

|

|

|

494,315 |

|

Segment expenses |

|

|

(118,155 |

) |

|

|

(51,770 |

) |

|

|

(8,518 |

) |

|

|

(178,443 |

) |

Year over year revenue change |

|

|

6 |

% |

|

|

25 |

% |

|

|

27 |

% |

|

|

10 |

% |

Year over year expense change |

|

|

7 |

% |

|

|

29 |

% |

|

|

3 |

% |

|

|

12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Research |

|

|

Consulting |

|

|

Events |

|

|

Consolidated |

|

||||

Year Ended December 31, 2020 |

|

(In thousands) |

|

|||||||||||||

Research revenues |

|

$ |

301,544 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

301,544 |

|

Consulting revenues |

|

|

50,406 |

|

|

|

86,897 |

|

|

|

— |

|

|

|

137,303 |

|

Events revenues |

|

|

— |

|

|

|

— |

|

|

|

10,137 |

|

|

|

10,137 |

|

Total segment revenues |

|

|

351,950 |

|

|

|

86,897 |

|

|

|

10,137 |

|

|

|

448,984 |

|

Segment expenses |

|

|

(110,843 |

) |

|

|

(40,168 |

) |

|

|

(8,231 |

) |

|

|

(159,242 |

) |

Research segment revenues increased 6% during 2021 compared to 2020. Research product revenues within this segment increased 8% which primarily resulted from increased contract value during the period. Consulting product revenues within this segment decreased 6% primarily due to decreased delivery of consulting and advisory services by our research analysts as they shifted more of their efforts to developing and delivering our CV products.