Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| ) | ||||

| In re: | ) | Chapter 11 | ||

| ) | ||||

| ENERGY FUTURE HOLDINGS CORP., et al.,1 | ) | Case No. 14-10979 (CSS) | ||

| ) | ||||

| Debtors. | ) | (Jointly Administered) | ||

| ) |

DISCLOSURE STATEMENT

FOR THE SIXTH AMENDED JOINT PLAN

OF REORGANIZATION OF ENERGY FUTURE HOLDINGS

CORP., ET AL., PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY

CODE AS IT APPLIES TO THE EFH DEBTORS AND EFIH DEBTORS

| KIRKLAND & ELLIS LLP | RICHARDS, LAYTON & FINGER, P.A. | |

| 601 Lexington Avenue | 920 North King Street | |

| New York, New York 10022 | Wilmington, Delaware 19801 | |

| Telephone: (212) 446-4800 | Telephone: (302) 651-7700 | |

| Facsimile: (212) 446-4900 | Facsimile: (302) 651-7701 | |

| —and— | ||

| 300 North LaSalle | ||

| Chicago, Illinois 60654 | ||

| Telephone: (312) 862-2000 | ||

| Facsimile: (312) 862-2200 | ||

| Counsel to the Debtors and Debtors in Possession | ||

| —and— | ||

| PROSKAUER ROSE LLP | BIELLI & KLAUDER LLC | |

| Three First National Plaza 70 W. Madison Street, Suite 3800 Chicago, Illinois 60602 |

1204 North King Street Wilmington, Delaware 19801 Telephone: (302) 778-4000 | |

| Telephone: (312) 962-3550 | Facsimile: (302) 295-2873 | |

| Facsimile: (312) 962-3551 | ||

| Co-Counsel to the Debtor Energy Future Holdings Corp. | ||

| 1 | The last four digits of Energy Future Holdings Corp.’s tax identification number are 8810. The location of the debtors’ service address is 1601 Bryan Street, Dallas, Texas 75201. Due to the large number of debtors in the Chapter 11 Cases, which are being jointly administered, a complete list of the debtors and the last four digits of their federal tax identification numbers is not provided herein. A complete list of such information may be obtained on the website of the debtors’ claims and noticing agent at http://www.efhcaseinfo.com. |

| —and— | ||

| CRAVATH, SWAINE AND MOORE LLP | STEVENS & LEE, P.C. | |

| Worldwide Plaza 825 Eighth Avenue New York, New York 10019 |

1105 North Market Street, Suite 700 Wilmington, Delaware 19801 Telephone: (302) 425-3310 | |

| Telephone: (212) 474-1978 | Facsimile: (610) 371-7927 | |

| Facsimile: (212) 474-3700 | ||

| JENNER & BLOCK LLP 919 Third Avenue New York, New York 10022 Telephone: (212) 891-1600 Facsimile: (212) 891-1699 |

||

| Co-Counsel to the Debtor Energy Future Intermediate Holding Company LLC | ||

| —and— | ||

| MUNGER, TOLLES & OLSON LLP | MCELROY, DEUTSCH, MULVANEY & CARPENTER, LLP | |

| 355 South Grand Avenue, 35th Floor Los Angeles, California 90071 Telephone: (213) 683-9100 |

300 Delaware Avenue, Suite 770 Wilmington, Delaware 19801 Telephone: (302) 300-4515 | |

| Facsimile: (213) 683-4022 | Facsimile: (302) 654-4031 | |

| Co-Counsel to the TCEH Debtors | ||

THIS IS NOT A SOLICITATION OF AN ACCEPTANCE OR REJECTION OF THE PLAN AS IT RELATES TO THE EFH DEBTORS AND EFIH DEBTORS WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE AND WITH RESPECT TO HOLDERS OF CLASS B3, B4, AND B6 CLAIMS.

ACCEPTANCES OR REJECTIONS OF THE PLAN AS IT RELATES TO THE EFH DEBTORS AND EFIH DEBTORS MAY NOT BE SOLICITED WITH RESPECT TO HOLDERS OF CLASS B3, B4, AND B6 CLAIMS UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED FOR THE EFH DEBTORS AND EFIH DEBTORS WITH RESPECT TO HOLDERS OF CLASS B3, B4, AND B6 CLAIMS BY THE BANKRUPTCY COURT.

THIS DRAFT DISCLOSURE STATEMENT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT.2

Dated: [ ], 2016

| 2 | This Disclosure Statement for the Sixth Amended Joint Plan of Reorganization of Energy Future Holdings Corp. et al., Pursuant to Chapter 11 of the Bankruptcy Code as it Applies to the EFH Debtors and EFIH Debtors supersedes the disclosure statement approved by the Bankruptcy Court on September 19, 2016 [Docket No. 9585] solely with respect to Class B3, B4, and Class B6 and without prejudice to the EFH Debtors’ and EFIH Debtors’ ability to file further amended versions in the future. This Disclosure Statement does not have any effect on the disclosure statement approved with respect to the TCEH Debtors and EFH Shared Services Debtors on June 17, 2016 [D.I. 8761] or the disclosure statement approved on September 19, 2016 with respect to all Classes of Claims and Interests against the EFH Debtors and EFIH Debtors other than Class B3, B4, and B6. |

IMPORTANT INFORMATION REGARDING THIS DISCLOSURE STATEMENT,

DATED [ ], 2016

SOLICITATION OF VOTES

ON THE SIXTH AMENDED JOINT PLAN OF REORGANIZATION OF

ENERGY FUTURE HOLDINGS CORP., ET AL.,

PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE

From the Holders of Outstanding:

| Voting Class |

Name of Class Under the Plan | |

| Class B3 | EFIH First Lien Note Claims | |

| Class B4 | EFIH Second Lien Note Claims | |

| Class B6 | General Unsecured Claims Against the EFIH Debtors |

IF YOU ARE IN CLASS B3, B4, OR B6, YOU ARE RECEIVING THIS DOCUMENT AND THE ACCOMPANYING MATERIALS BECAUSE YOU ARE ENTITLED TO VOTE ON THE PLAN.

RECOMMENDATION BY THE EFIH DEBTORS

THE BOARD OF MANAGERS OR DIRECTORS (AS APPLICABLE) OR THE SOLE MEMBER OF

EACH OF THE EFIH DEBTORS HAS APPROVED THE TRANSACTIONS CONTEMPLATED BY THE

PLAN AND DESCRIBED IN THIS DISCLOSURE STATEMENT AND RECOMMEND THAT ALL

HOLDERS OF CLASS B3, B4, OR B6 CLAIMS SUBMIT BALLOTS TO ACCEPT THE PLAN.

DELIVERY OF BALLOTS

BALLOTS AND MASTER BALLOTS, AS APPLICABLE, MUST BE ACTUALLY RECEIVED BY THE

SOLICITATION AGENT BY THE VOTING DEADLINE, WHICH IS 4:00 P.M. (PREVAILING

EASTERN TIME) ON [FEBRUARY 6,] 2017 AT THE FOLLOWING ADDRESSES:

FOR ALL BALLOTS OTHER THAN MASTER BALLOTS

VIA FIRST CLASS MAIL:

EFH BALLOT PROCESSING

C/O EPIQ BANKRUPTCY SOLUTIONS, LLC

P.O. BOX 4422

BEAVERTON, OREGON 97076-4422

VIA OVERNIGHT COURIER OR HAND DELIVERY:

EFH BALLOT PROCESSING

C/O EPIQ BANKRUPTCY SOLUTIONS, LLC

10300 SW ALLEN BOULEVARD

BEAVERTON, OREGON 97005

FOR MASTER BALLOTS

VIA FIRST CLASS MAIL, OVERNIGHT COURIER, OR HAND DELIVERY:

EFH BALLOT PROCESSING

C/O EPIQ BANKRUPTCY SOLUTIONS, LLC

777 THIRD AVENUE, 12TH FLOOR

NEW YORK, NEW YORK 10017

IF YOU RECEIVED AN ENVELOPE ADDRESSED TO YOUR NOMINEE, PLEASE ALLOW ENOUGH

TIME WHEN YOU RETURN YOUR BALLOT FOR YOUR NOMINEE TO CAST YOUR VOTE ON A

MASTER BALLOT BEFORE THE VOTING DEADLINE.

BALLOTS RECEIVED VIA EMAIL OR FACSIMILE WILL NOT BE COUNTED.

IF YOU HAVE ANY QUESTIONS ON THE PROCEDURE FOR VOTING ON THE PLAN, PLEASE

CALL THE DEBTORS’ RESTRUCTURING HOTLINE AT:

(877) 276-7311

READERS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE AND ARE URGED TO CONSULT WITH THEIR OWN ADVISORS BEFORE CASTING A VOTE WITH RESPECT TO THE PLAN.

THE SECURITIES TO BE ISSUED PURSUANT TO THE PLAN HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 (THE “SECURITIES ACT”) OR SIMILAR STATE SECURITIES OR “BLUE SKY” LAWS.

THE SECURITIES TO BE ISSUED IN CONNECTION WITH THE PLAN HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR BY ANY STATE SECURITIES COMMISSION OR SIMILAR PUBLIC, GOVERNMENTAL, OR REGULATORY AUTHORITY, AND NEITHER THE SEC NOR ANY SUCH AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN.

SEE SECTION IX OF THE DISCLOSURE STATEMENT FOR IMPORTANT SECURITIES LAW DISCLOSURES.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING PROJECTED FINANCIAL INFORMATION AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS ARE PROVIDED IN THIS DISCLOSURE STATEMENT PURSUANT TO THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND SHOULD BE EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBED IN THIS DISCLOSURE STATEMENT.

FURTHER, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS IN THIS DISCLOSURE STATEMENT ARE BASED ON ASSUMPTIONS THAT ARE BELIEVED TO BE REASONABLE, BUT ARE SUBJECT TO A WIDE RANGE OF RISKS, INCLUDING RISKS ASSOCIATED WITH THE FOLLOWING: (I) FUTURE FINANCIAL RESULTS AND LIQUIDITY, INCLUDING THE ABILITY TO FINANCE OPERATIONS IN THE ORDINARY COURSE OF BUSINESS; (II) VARIOUS FACTORS THAT MAY AFFECT THE VALUE OF THE SECURITIES TO BE ISSUED UNDER THE PLAN; (III) THE RELATIONSHIPS WITH AND PAYMENT TERMS PROVIDED BY TRADE CREDITORS; (IV) ADDITIONAL FINANCING REQUIREMENTS POST-RESTRUCTURING; (V) FUTURE DISPOSITIONS AND ACQUISITIONS; (VI) THE EFFECT OF COMPETITIVE PRODUCTS, SERVICES, OR PROCURING BY COMPETITORS; (VII) CHANGES TO THE COSTS OF COMMODITIES AND RAW MATERIALS; (VIII) THE PROPOSED RESTRUCTURING AND COSTS ASSOCIATED THEREWITH; (IX) THE EFFECT OF CONDITIONS IN THE ENERGY MARKET ON THE DEBTORS; (X) THE CONFIRMATION AND CONSUMMATION OF THE PLAN; (XI) CHANGES IN LAWS AND REGULATIONS FROM GOVERNMENT AGENCIES; AND (XII) EACH OF THE OTHER RISKS IDENTIFIED IN THIS DISCLOSURE STATEMENT. DUE TO THESE UNCERTAINTIES, READERS CANNOT BE ASSURED THAT ANY FORWARD-LOOKING STATEMENTS WILL PROVE TO BE CORRECT. THE DEBTORS ARE UNDER NO OBLIGATION TO (AND EXPRESSLY DISCLAIM ANY OBLIGATION TO) UPDATE OR ALTER ANY FORWARD-LOOKING STATEMENTS WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE BANKRUPTCY COURT.

THE TERMS OF THE PLAN GOVERN IN THE EVENT OF ANY INCONSISTENCY BETWEEN THE PLAN AND THE SUMMARIES CONTAINED IN THIS DISCLOSURE STATEMENT.

THE INFORMATION IN THIS DISCLOSURE STATEMENT IS BEING PROVIDED SOLELY FOR THE PURPOSES OF VOTING TO ACCEPT OR REJECT THE PLAN OR OBJECTING TO CONFIRMATION. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PARTY FOR ANY OTHER PURPOSE.

ALL EXHIBITS TO THE DISCLOSURE STATEMENT, ALONG WITH ALL OTHER DOCUMENTS FILED WITH THE SEC BY THE DEBTORS AND THEIR AFFILIATES, ARE INCORPORATED INTO AND ARE A PART OF THIS DISCLOSURE STATEMENT AS IF SET FORTH IN FULL IN THIS DISCLOSURE STATEMENT. THE DOCUMENTS FILED WITH THE SEC BY THE DEBTORS AND

THEIR AFFILIATES ARE AVAILABLE FREE OF CHARGE ONLINE AT THE DEBTORS’ WEBPAGE, HTTP://WWW.ENERGYFUTUREHOLDINGS.COM/FINANCIAL/DEFAULT.ASPX, AT THE DEBTORS’ RESTRUCTURING WEBPAGE, WWW.EFHCASEINFO.COM, AND AT THE SEC’S WEBPAGE, HTTP://WWW.SEC.GOV/EDGAR.SHTML.

TABLE OF CONTENTS

| Page | ||||||||

| I. | Executive Summary |

1 | ||||||

| A. |

Purpose of this Disclosure Statement and the Plan |

1 | ||||||

| B. |

Overview of EFH |

3 | ||||||

| C. |

Overview of the Plan |

5 | ||||||

| D. |

Makewhole and Postpetition Interest Claims Discussion. |

20 | ||||||

| E. |

Timing and Calculation of Amounts to be Distributed to Holders of Allowed Claims Against the EFH Debtors and EFIH Debtors. |

22 | ||||||

| F. |

Settlement and Release of Debtor Claims |

24 | ||||||

| G. |

Summary of Treatment of Claims and Interests and Description of Recoveries Under the Plan |

24 | ||||||

| H. |

Voting on the Plan |

27 | ||||||

| I. |

Confirmation Process. |

29 | ||||||

| J. |

The Plan Supplement |

29 | ||||||

| II. | EFH’s Business Operations and Capital Structure |

30 | ||||||

| A. |

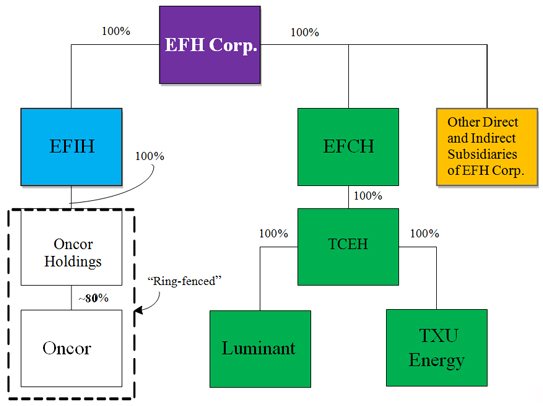

Overview of EFH’s Corporate Structure |

30 | ||||||

| B. |

EFH’s Business Operations |

31 | ||||||

| C. |

Capital Structure |

41 | ||||||

| III. | The Events Leading to the Debtors’ Financial Difficulties |

46 | ||||||

| A. |

History of EFH Corp. |

46 | ||||||

| B. |

The 2007 Acquisition |

46 | ||||||

| C. |

EFH Following the 2007 Acquisition |

47 | ||||||

| D. |

The Result of Low Natural Gas Prices on EFH’s Financial Performance Following the 2007 Acquisition |

49 | ||||||

| E. |

Other Market Conditions Affecting TCEH’s Performance |

56 | ||||||

| F. |

EFH’s Financial Outlook and Business Strategy Going Forward |

57 | ||||||

| G. |

EFH’s Reorganization Efforts |

58 | ||||||

| IV. | Material Events in the Chapter 11 Cases |

62 | ||||||

| A. |

Venue |

62 | ||||||

| B. |

Appointment of Official Committees |

62 | ||||||

| C. |

First and Second Day Motions |

63 | ||||||

| D. |

Protocol for Certain Case Matters |

69 | ||||||

| E. |

Retention of Professionals |

70 | ||||||

| F. |

Motions Related to the Restructuring Support Agreement |

71 | ||||||

| G. |

Exploring the EFH/EFIH Transaction |

74 | ||||||

| H. |

Retention of Conflicts Matter Advisors |

77 | ||||||

| I. |

Legacy Discovery |

78 | ||||||

| J. |

TCEH First Lien Investigation. |

78 | ||||||

| K. |

Makewhole Litigation |

79 | ||||||

| L. |

EFIH Second Lien Partial Repayment Motion |

84 | ||||||

| M. |

Original Confirmed Plan Confirmation Settlements. |

85 | ||||||

| N. |

Other Ongoing Litigation Items |

86 | ||||||

| O. |

Exclusivity |

87 | ||||||

| P. |

Other Bankruptcy Motions, Applications, and Filings |

88 | ||||||

| V. | Summary of the Plan |

93 | ||||||

| A. |

Sources of Consideration for Plan Distributions |

93 | ||||||

| B. |

Restructuring Transactions |

94 | ||||||

| C. |

Administrative Claims, Priority Tax Claims, DIP Claims, and Statutory Fees |

98 | ||||||

| D. |

Classification of Claims and Interests |

102 | ||||||

i

| E. |

Treatment of Classified Claims and Interests |

103 | ||||||

| F. |

Other Selected Provisions of the Plan |

115 | ||||||

| G. |

Effect of Confirmation |

121 | ||||||

| H. |

Settlement, Release, Injunction, and Related Provisions |

123 | ||||||

| VI. | Confirmation of the Plan |

145 | ||||||

| A. |

The Confirmation Hearing |

145 | ||||||

| B. |

Requirements for Confirmation |

145 | ||||||

| C. |

Conditions Precedent to Confirmation of a Plan as to the EFH Debtors and EFIH Debtors. |

149 | ||||||

| D. |

Conditions Precedent to the EFH Effective Date. |

150 | ||||||

| E. |

Waiver of Conditions |

151 | ||||||

| F. |

Effect of Failure of Conditions. |

151 | ||||||

| VII. | Voting Instructions |

152 | ||||||

| A. |

Overview |

152 | ||||||

| B. |

Holders of Claims and Interests Entitled to Vote on the Plan |

152 | ||||||

| C. |

Voting Record Date |

152 | ||||||

| D. |

Voting on the Plan |

152 | ||||||

| E. |

Ballots Not Counted |

153 | ||||||

| VIII. | Risk Factors |

155 | ||||||

| A. |

Risks Related to the Restructuring |

155 | ||||||

| B. |

Risks Related to Confirmation and Consummation of the Plan |

162 | ||||||

| C. |

Risks Related to Recoveries Under the Plan |

164 | ||||||

| D. |

Risk Factors Related to the Business Operations of the Debtors, the Reorganized Debtors, and Oncor Electric |

166 | ||||||

| E. |

Miscellaneous Risk Factors and Disclaimers |

174 | ||||||

| IX. | Important Securities Laws Disclosures |

180 | ||||||

| A. |

Section 1145 of the Bankruptcy Code |

180 | ||||||

| B. |

Subsequent Transfers of Securities Not Covered by the Section 1145(a) Exemption |

181 | ||||||

| X. |

Certain U.S. Federal Income Tax Consequences of the Plan |

182 | ||||||

| A. |

Introduction |

182 | ||||||

| B. |

Certain U.S. Federal Income Tax Consequences of the Plan to the Debtors |

183 | ||||||

| C. |

Certain U.S. Federal Income Tax Consequences of the Plan to the Debtors |

185 | ||||||

| D. |

Withholding and Reporting |

189 | ||||||

| XI. | Recommendation of the Debtors |

191 | ||||||

ii

EXHIBITS

| Exhibit A | List of EFH Debtors and EFIH Debtors | |

| Exhibit B | Plan of Reorganization | |

| Exhibit C | Corporate Structure of the Debtors and Certain Non-Debtor Affiliates | |

| Exhibit D | Reorganized EFH-EFIH Financial Projections | |

| Exhibit E | Liquidation Analysis | |

| Exhibit F-1 | September 2016 Disclosure Statement Order | |

| Exhibit F-2 | Supplemental Disclosure Statement Order | |

| Exhibit G | Tax Matters Agreement | |

THE DEBTORS HEREBY ADOPT AND INCORPORATE EACH EXHIBIT ATTACHED TO THIS

DISCLOSURE STATEMENT BY REFERENCE AS THOUGH FULLY SET FORTH HEREIN.

iii

I. Executive Summary

| A. | Purpose of this Disclosure Statement and the Plan. |

Energy Future Holdings Corp. (“EFH Corp.” and, together with certain of its direct and indirect subsidiaries listed on Exhibit A attached hereto, the “EFH Debtors”), the ultimate parent company of each of the entities that comprise the EFH corporate group (collectively, “EFH”), and Energy Future Intermediate Holding Company LLC (“EFIH” and, together with EFIH Finance, Inc., the “EFIH Debtors”) are providing Holders of Class B3, B4, and B6 Claims with the information in this disclosure statement (the “Disclosure Statement”) on the date hereof (the “Solicitation Date”) pursuant to section 1125 of chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in connection with the chapter 11 cases (the “Chapter 11 Cases”) commenced by the Debtors on April 29, 2014 (the “Petition Date”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”).

Consistent with the definitions set forth in the Plan, the term “Debtors” as used herein shall refer to (a) the EFH Debtors, when referencing the plan of reorganization of the EFH Debtors, (b) the EFIH Debtors, when referencing the plan of reorganization of the EFIH Debtors, (c) the TCEH Debtors, when referencing the plan of reorganization of the TCEH Debtors, and (d) the EFH Shared Services Debtors, when referencing the plan of the reorganization of the EFH Shared Services Debtors.

The EFH Debtors and EFIH Debtors seek to confirm the Sixth Amended Joint Plan of Reorganization of Energy Future Holdings Corp., et al., Pursuant to Chapter 11 of the Bankruptcy Code (the “Plan”) as it relates to the EFH Debtors and EFIH Debtors3 including the Plan Supplement as it relates to the EFH Debtors and EFIH Debtors, to effect a comprehensive restructuring of their respective balance sheets (the “Restructuring”).

The Bankruptcy Court previously approved a disclosure statement with respect to the EFH Debtors and the EFIH Debtors for solicitation with respect to the Plan on September 21, 2016 [Docket No. 9585] (the “September 2016 Disclosure Statement”). Following that approval, and for the reasons described in greater detail herein, the EFH Debtors and EFIH Debtors made certain modifications to the Plan. As a result of those changes, the EFH Debtors and EFIH Debtors filed the current Plan and sought approval of this Disclosure Statement, solely with respect to Holders of Class B3, B4, and B6 Claims. The September 2016 Disclosure Statement continues to be in full force and effect for all other Holders of Claims and Interests against the EFH Debtors and EFIH Debtors.

The Bankruptcy Court approved this Disclosure Statement, authorized solicitation of votes to accept or reject the Plan as it relates to the EFH Debtors and EFIH Debtors from Holders of Class B3, B4, and B6 Claims, and scheduled the hearing to confirm the Plan as it relates to the EFH Debtors and EFIH Debtors (the “Confirmation Hearing”) for February 14, 2017 at 1:00 p.m. (Eastern Standard Time). It is important that Holders of Class B3, B4, and B6 Claims carefully read this Disclosure Statement and all of the materials attached to this Disclosure Statement and incorporated into this Disclosure Statement by reference to fully understand the business operations of all of the Debtors and their non-Debtor affiliates.

As described in this Disclosure Statement, the EFH Debtors and EFIH Debtors believe that the Plan as it applies to the EFH Debtors and EFIH Debtors provides for a comprehensive restructuring and recapitalization of the

| 3 | The Plan is attached hereto as Exhibit B and incorporated into this Disclosure Statement by reference. Capitalized terms used but not otherwise defined in this Disclosure Statement have the meanings ascribed to such terms in the Plan, and capitalized terms used but not otherwise defined in this Executive Summary have the meanings ascribed to them in the remainder of this Disclosure Statement or the Plan. Additionally, this Disclosure Statement incorporates the rules of interpretation set forth in Article I.B of the Plan. The summaries provided in this Disclosure Statement of any documents attached to this Disclosure Statement, including the Plan, the exhibits, and the other materials referenced in the Plan, the Plan Supplement, and any other documents referenced or summarized herein, are qualified in their entirety by reference to the applicable document. In the event of any inconsistency between the discussion in this Disclosure Statement and the documents referenced or summarized herein, the applicable document being referenced or summarized shall govern. In the event of any inconsistencies between any document and the Plan, the Plan shall govern. |

EFH Debtors’ pre-bankruptcy obligations and corporate form, preserves the going-concern value of the Debtors’ businesses, maximizes recoveries available to all constituents, provides for an equitable distribution to the EFH Debtors’ and EFIH Debtors’ stakeholders, and ensures the smooth delivery of electricity to the entire state through the TCEH Debtors’ generation activities.

A bankruptcy court’s confirmation of a plan of reorganization binds the debtor, any entity or person acquiring property under the plan, any creditor of or interest holder in a debtor, and any other entities and persons as may be ordered by the bankruptcy court to the terms of the confirmed plan, whether or not such creditor or interest holder is impaired under or has voted to accept the plan or receives or retains any property under the plan, through an order confirming the plan (as defined in the Plan, the “EFH Confirmation Order”). Among other things (subject to certain limited exceptions and except as otherwise provided in the Plan or the EFH Confirmation Order), the EFH Confirmation Order will discharge the EFH Debtors and the EFIH Debtors from any Claim (as that term is defined in the Plan) arising before the Effective Date and substitute the obligations set forth in the Plan for those pre-bankruptcy Claims. Under the Plan, Claims and Interests are divided into groups called “Classes” according to their relative priority and other criteria.

Each of the Debtors is a proponent of the Plan within the meaning of section 1129 of the Bankruptcy Code. The Plan does not contemplate the substantive consolidation of the Debtors’ estates. Except to the extent that a Holder of an Allowed Claim agrees to a less favorable treatment of such Claim, in full and final satisfaction, settlement, release, and discharge of and in exchange for such Claim, each Holder of an Allowed Claim or Allowed Interest with regard to each of the Debtors will receive the same recovery (if any) provided to other Holders of Allowed Claims or Allowed Interests in the applicable Class according to the respective Debtor against which they hold a Claim or Interest, and will be entitled to their Pro Rata share of consideration available for distribution to such Class (if any).

The EFH Debtors and EFIH Debtors believe that their businesses and assets have significant value that would not be realized under any alternative reorganization option or in a liquidation. Consistent with the valuation, liquidation, and other analyses prepared by the EFH Debtors and EFIH Debtors with the assistance of their advisors, the going concern value of such Debtors is substantially greater than their liquidation value. The EFH Debtors and EFIH Debtors believe that all alternative transactions that have been presented to them to date would result in significant delays, litigation, and additional risks and costs, and could negatively affect the Debtors’ value by, among other things, increasing administrative costs and causing unnecessary uncertainty with the Debtors’ key constituencies, which could ultimately lower the recoveries for all Holders of Allowed Claims and Allowed Interests.

Notwithstanding any other provision in the Disclosure Statement or EFH/EFIH Disclosure Statement Order, the Court makes no finding or ruling in the EFH/EFIH Disclosure Statement Order,4 other than with respect to the adequacy of the Disclosure Statement pursuant to Section 1125 of the Bankruptcy Code, with respect to (a) the negotiations, reasonableness, business purpose, or good faith of the Plan, or as to the terms of the Plan (or the treatment of any class of claims thereunder and whether those claims are or are not impaired) for any purpose, (b) whether the Plan satisfies any of the requirements for confirmation under section 1129 of the Bankruptcy Code, or (c) the standard of review or any factor required for approval of the Confirmation of the Plan. Any objections or requests served in connection with the Plan are hereby reserved and not waived by entry of the EFH/EFIH Disclosure Statement Order; provided, however, that nothing in the Disclosure Statement or the EFH/EFIH Disclosure Statement Order shall preclude the Debtors or any other party in interest that is the subject of such objection or discovery requests from seeking to overrule such objections or limit or otherwise overrule such discovery requests.

Any rights of UMB Bank, N.A., in its capacity as indenture trustee for the unsecured 11.25%/12.25% Senior Toggle Notes due 2018 and the 9.75% Senior Notes due 2019, to object to confirmation of the Plan are hereby fully reserved and not waived.

| 4 | The term “EFH/EFIH Disclosure Statement Order” shall mean (a) when referring to Holders of Class B3, B4, and B6 Claims, the order entered approving this Disclosure Statement (the Supplemental Disclosure Statement Order) and (b) when referring to all other Holders of Claims and Interests against the EFH Debtors and EFIH Debtors, the September 2016 Disclosure Statement Order. |

2

The Plan as it relates to the TCEH Debtors and the EFH Shared Services Debtors was confirmed on August 29, 2016, pursuant to the Order Confirming the Third Amended Joint Plan of Reorganization of Energy Future Holdings Corp., et al., Pursuant to Chapter 11 of the Bankruptcy Code as it Applies to the TCEH Debtors and EFH Shared Services Debtors [D.I. 9421] (the “TCEH Confirmation Order”). The TCEH Confirmation Order authorized the EFH/EFIH Debtors to (i) enter into certain agreements with the TCEH Debtors and/or EFH Shared Services Debtors, as applicable and (ii) take certain actions in order to effectuate the transactions contemplated thereunder (collectively, the “Required E-Side Agreements and Actions”). These agreements include, without limitation, the (i) Tax Matters Agreement (filed on August 16, 2016 at Docket No. 9307), (ii) Separation Agreement, and (iii) Transition Services Agreement (which documents described in clauses (ii)-(iii) were filed on July 27, 2016 at Docket No. 9100, as required by the order approving the TCEH Disclosure Statement). The EFH Debtors and/or EFIH Debtors will also be required to, among other things, take certain actions to effectuate the Spin-Off (including the Contribution).

The TCEH Confirmation Order provide that upon execution thereof, the (a) Tax Matters Agreement shall be binding and enforceable against all of the Debtors, all parties in interest in the Debtors’ chapter 11 cases, any chapter 11 trustee or chapter 7 trustee appointed in any of the chapter 11 cases, and each of their respective successors and permitted assigns, and (b) no plan of reorganization, liquidation, asset sale or other transaction for any Debtor shall be approved that is inconsistent with, or that would result in a violation of, the Tax Matters Agreement. These provisions, and any actions taken pursuant thereto, shall survive entry of any order which may be entered: (1) confirming any plan of reorganization or liquidation in any of the Debtors’ chapter 11 cases; (2) converting any of the chapter 11 cases to a case under chapter 7 of the Bankruptcy Code; (3) dismissing any of the chapter 11 cases or any case that has been converted to a case under chapter 7 of the Bankruptcy Code; or (4) pursuant to which the Bankruptcy Court abstains from hearing any of the Chapter 11 Cases. The EFH Confirmation Order will reaffirm that all of the Debtors are bound to the Tax Matters Agreement.

Prior to voting on the Plan, you are encouraged to read this Disclosure Statement and all documents attached to this Disclosure Statement in their entirety, as well as the various reports and other filings filed with the SEC by the Debtors and their Affiliates (collectively, the “EFH Public Filings”). The EFH Public Filings include those reports filed by EFH Corp., EFIH, and EFCH, as well as those filed by the non-Debtor Entity Oncor Electric Delivery Company LLC (“Oncor Electric”) and Oncor Electric Delivery Transition Bond Company LLC (“Oncor BondCo”). The EFH Public Filings are available free of charge online at http://www.energyfutureholdings.com/financial/default.aspx, http://www.sec.gov/edgar.shtml, and www.efhcaseinfo.com. This Disclosure Statement expressly incorporates the EFH Public Filings by reference. As reflected in the EFH Public Filings and this Disclosure Statement, there are risks, uncertainties, and other important factors that could cause the Debtors’ actual performance or achievements to be materially different from those they may project, and the Debtors undertake no obligation to update any such statement. Certain of these risks, uncertainties, and factors are described in Section VIII of this Disclosure Statement, entitled “Risk Factors,” which begins on page 155.

| B. | Overview of EFH. |

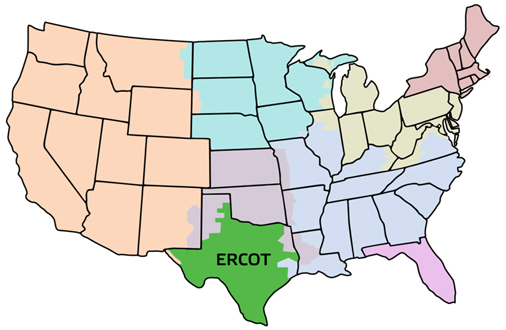

EFH’s businesses include the largest generator, distributor, and certified retail provider of electricity (or “REP”) in Texas.5 EFH conducts substantially all of its business operations in the electricity market overseen by the Electric Reliability Council of Texas (“ERCOT”), which covers the majority of Texas. The Texas electricity market, in turn, is subject to oversight and regulation by the Public Utility Commission of Texas (the “PUCT”). As of December 31, 2015, EFH had approximately 8,860 employees, approximately 5,300 of whom are employed by the Debtors and the remainder of which are employed by the non-Debtor, Oncor Electric. EFH has three distinct business units:

| • | EFH’s competitive electricity generation, mining, wholesale electricity sales, and commodity risk management and trading activities, conducted by the TCEH Debtors composing “Luminant”; |

| 5 | For financial reporting under Generally Accepted Accounting Principles (“US GAAP”), EFH Corp. reports information for two segments: the Competitive Electric and Regulated Delivery business segments. The Competitive Electric segment includes both Luminant and TXU Energy. The Regulated Delivery segment is composed of Oncor. The Competitive Electric segment is essentially engaged in the production of electricity and the sale of electricity in wholesale and retail channels. |

3

| • | EFH’s competitive retail electricity sales and related operations, mainly conducted by the TCEH Debtors composing “TXU Energy”;6 and |

| • | EFH’s rate-regulated electricity transmission and distribution operations, conducted by the non-Debtor Oncor Electric Delivery Company LLC (“Oncor Electric”). EFIH, which is 100% owned by EFH Corp., indirectly owns approximately 80% of Oncor Electric. As described below, Oncor Holdings and Oncor Electric are not Debtors in the Chapter 11 Cases. |

EFH and its management team have significant experience as leaders in the electricity industry.

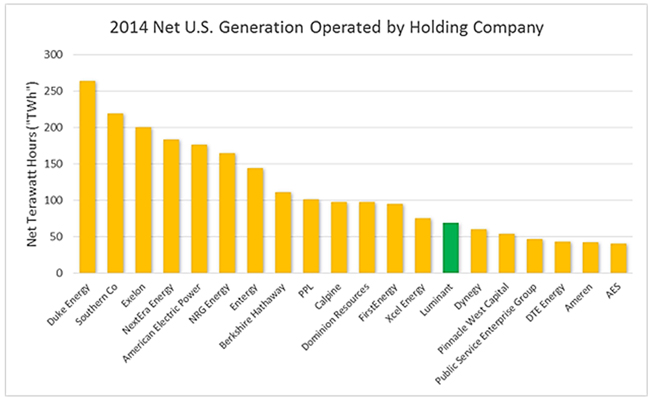

With the addition of two natural gas combined cycle gas turbine (CCGT) plants acquired in April of 2016, Luminant currently owns and operates 15 power plants comprising 50 electricity generation units.7 Luminant’s total electricity generation of 16,760 megawatts (“MW”) accounts for approximately 19% of the generation capacity in the ERCOT market. Luminant sells approximately 66% of its electricity generation output to TXU Energy, and sells the remainder through bilateral sales to third parties or through sales directly to ERCOT. Luminant also owns and operates 12 surface lignite coal mines in Texas that supply coal to Luminant’s lignite/coal-fueled units.8 Luminant is the largest coal miner in Texas and the ninth-largest coal miner in the United States.9

TXU Energy sells electricity to approximately 1.7 million residential and business customers, and is the single largest REP by customer count in Texas. TXU Energy serves approximately 25% of the residential customers and approximately 17% of the business customers in the areas of the ERCOT market that are open to competition. TXU Energy generally purchases all of its electricity requirements from Luminant. TXU Energy maintains a strong position in the highly competitive ERCOT retail electricity market due to its industry-leading customer care performance and technological innovation.

Oncor Electric is engaged in rate-regulated electricity transmission and distribution activities in Texas. Oncor Electric provides these services at rates approved by the PUCT to REPs (including TXU Energy) that sell electricity to residential and business customers, as well as to electricity distribution companies, cooperatives, and municipalities. Oncor Electric operates the largest transmission and distribution system in Texas, delivering electricity to more than 3.3 million homes and businesses and operating more than 121,000 miles of transmission and distribution lines. Oncor Electric has the largest geographic service territory of any transmission and distribution utility within the ERCOT market, covering 91 counties and over 400 incorporated municipalities. Importantly, however, Oncor Electric is “ring-fenced” from the Debtors: it has an independent board of directors, and it is operated, financed, and managed independently. As a result, its financial results of operation are not consolidated into EFH Corp.’s financial statements. A significant portion of Oncor Electric’s revenues are attributable to TXU Energy, which is Oncor Electric’s largest customer. Oncor Holdings, Oncor Electric, and their ring-fenced subsidiaries are not Debtors in the Chapter 11 Cases.

EFH largely adopted its current organizational structure, and issued a significant portion of the debt that composes its capital structure, in October 2007, as a result of the private acquisition of a public company, TXU Corp. (the “2007 Acquisition”). At the time, investment funds affiliated with Kohlberg Kravis Roberts & Co. L.P. (“KKR”), TPG Capital, L.P. (“TPG”) and Goldman, Sachs & Co. (“Goldman Sachs”) (together with KKR and TPG, the “Sponsor Group”), together with certain co-investors, contributed approximately $8.3 billion of equity capital into EFH

| 6 | The Debtors also conduct a relatively small amount of retail electricity operations through their 4Change Energy brand and another entity, Luminant ET Services Company, which provides retail electricity service to one municipality and to some of Luminant’s mining operations, and a small amount of retail gas operations through Luminant Energy Company LLC. |

| 7 | Of those units, 49 units are in active year-round operation, and one unit is subject to seasonal operation. |

| 8 | Of these mines, eight are active, two are in development, and two are currently idle. |

| 9 | Based on tons of coal mined in 2013. |

4

through Texas Energy Future Holdings Limited Partnership (“Texas Holdings”). And, like many other private acquisitions, EFH issued significant new debt and assumed existing debt and liabilities in connection with the 2007 Acquisition. Immediately following the 2007 Acquisition, the Debtors’ total funded indebtedness was approximately $36.13 billion, comprised of approximately $28.8 billion at TCEH, $128 million at EFCH, and $7.2 billion at EFH Corp.

As of the Petition Date, the principal amount of the Debtors’ total funded indebtedness was nearly $42 billion, including:

| • | approximately $24.385 billion of TCEH First Lien Debt (excluding amounts due under canceled TCEH First Lien Interest Rate Swaps and TCEH First Lien Commodity Hedges, which the TCEH Debtors estimate total approximately $1.235 billion), $1.571 billion of TCEH Second Lien Notes, $5.237 billion of TCEH Unsecured Notes, and $875 million of Pollution Control Revenue Bonds; |

| • | approximately $61 million of Tex-La Obligations that are obligations of EFCH, which are guaranteed by EFH Corp., and secured by an interest in certain assets owned by the TCEH Debtors and Oncor, and approximately $9 million of EFCH 2037 Notes; |

| • | approximately $1.929 billion of EFH Unsecured Notes (including $1.282 billion of EFH Legacy Notes held by EFIH); and |

| • | approximately $3.985 billion of EFIH First Lien Notes, $2.156 billion of EFIH Second Lien Notes, and $1.568 billion of EFIH Unsecured Notes. |

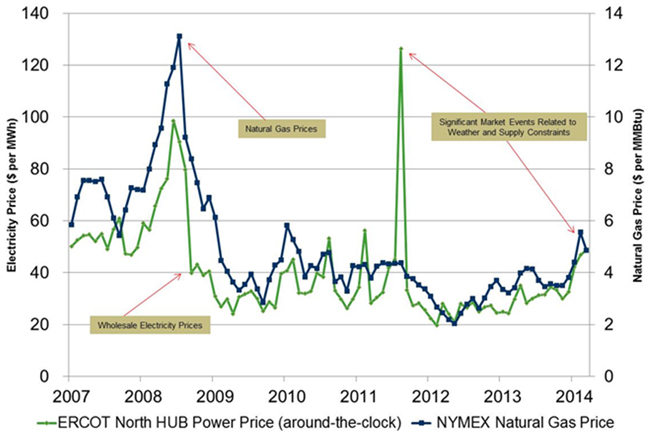

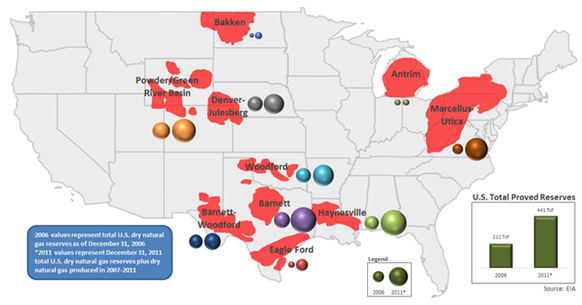

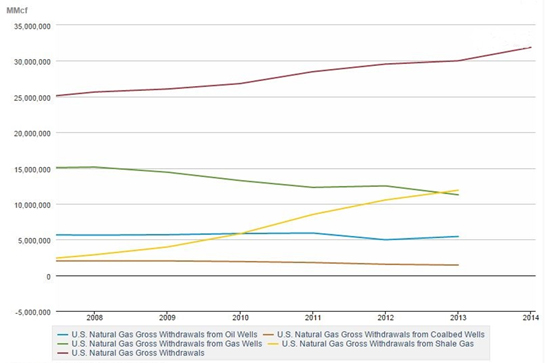

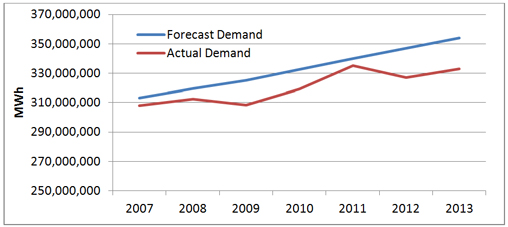

Although the Debtors’ core business operations are strong, and TCEH and EFIH have historically been and will continue to be cash flow positive before debt service, low wholesale electricity prices in the Texas electricity market have made it impossible for the TCEH Debtors to support their current debt load. In October 2007, the main ingredients for EFH’s financial success were robust. Since 2007, however, overall economic growth was reduced because of the economic recession in 2008 and 2009 and wholesale electricity prices have significantly declined. The material and unexpected reduction in wholesale electricity prices was caused, in large part, by an increase in the supply of natural gas caused by the rise of hydraulic fracturing (known as “fracking”) and advances in directional drilling techniques. This increase in the supply of natural gas caused a significant decline in natural gas prices, and because the wholesale price of electricity in the ERCOT market is closely tied to the price of natural gas, the wholesale price of electricity in the ERCOT market has significantly declined since 2007. As a result of this significant decline in wholesale electricity prices in ERCOT coupled with higher fuel and environmental compliance costs, the profitability of the TCEH Debtors’ generation assets has substantially declined.

Separately, EFIH and EFH Corp. have significant funded indebtedness and had insufficient cash flows to service those obligations. Before the Petition Date, EFIH—which is a holding company that has no independent business operations—relied on dividend distributions from Oncor Electric and intercompany interest payments (relating to debt issued by EFH Corp. and the TCEH Debtors that EFIH acquired in exchange offers) to satisfy its funded debt obligations. These sources of cash, however, were not sufficient to service EFIH’s obligations. EFH Corp. also has minimal cash flow. As a result, both EFIH and EFH Corp. faced significant liquidity constraints that prompted their chapter 11 filings.

| C. | Overview of the Plan. |

| 1. | Events Leading Up to the Plan. |

| A. | The Restructuring Support Agreement and Bidding Procedures. |

The Debtors commenced their Chapter 11 Cases on April 29, 2014, after signing a restructuring support agreement (the “Restructuring Support Agreement”) with certain of their significant stakeholders. The Restructuring Support Agreement was the product of arm’s-length negotiations with the Debtors’ stakeholders and more than two years of efforts to evaluate available restructuring alternatives. At the time the Debtors signed the Restructuring Support Agreement, the Restructuring Support Agreement represented the best available, value-maximizing

5

restructuring alternative. The Restructuring Support Agreement contemplated, among other things, an EFIH Second Lien DIP Facility, under which certain Holders of EFIH Unsecured Notes would have become the majority owners of Reorganized EFH. After the Debtors filed the Chapter 11 Cases, however, the Debtors received competing offers to acquire EFH Corp.’s economic ownership interest in Oncor Electric, including from third party strategic buyers. These bids offered new alternatives to maximize the value of the Debtors’ estates, and the Debtors opted to terminate the Restructuring Support Agreement in July 2014 to pursue these potential offers, consistent with their fiduciary duties.

After terminating the Restructuring Support Agreement, the Debtors then worked diligently with their advisors and stakeholders to develop a process to maximize estate recoveries resulting from the market interest in EFH Corp.’s indirect economic ownership interest in Oncor Electric (the “Bidding Procedures”). The Bankruptcy Court entered an order approving the Bidding Procedures and related auction process for the selection of the highest or otherwise best bid (the “Bidding Procedures Order”). As described in Section IV.G., entitled “Exploring the EFH/EFIH Transaction,” which begins on page 69, following entry of the Bidding Procedures Order, the Debtors received Round 1 Bids and Round 2 Bids (each as defined herein) from various strategic and third-party bidders, engaged in extensive diligence sessions with interested bidders, and exchanged drafts of proposed definitive documentation. Ultimately, however, the Debtors did not receive an actionable and value-maximizing proposal in connection with the auction process.

| B. | The Disinterested Director Settlement. |

At the same time, the Debtors and their advisors took a number of key steps to advance plan negotiations and set the stage for the negotiations and settlements that led to the filing of Joint Plan of Reorganization of Energy Future Holdings Corp. et al., Pursuant to Chapter 11 of the Bankruptcy Code filed on April 14, 2015 [D.I. 4142] and accompanying disclosure statement (the “Original Confirmed Plan” and Sixth Disclosure Statement,” respectively).

In November 2014, each of EFH Corp., EFIH, and EFCH/TCEH, retained counsel and financial advisors (together, the “Conflicts Matter Advisors”) to advise and represent them in reviewing and analyzing actual conflicts matters among those Debtors’ estates, including potential intercompany Claims among the Debtors, at the direction of the disinterested directors and managers at each of EFH, EFIH, and EFCH/TCEH, respectively.10

Additionally, to allow the disinterested directors or managers and the Conflicts Matter Advisors to fully engage in restructuring discussions on actual conflict matters, the Debtors expended significant efforts to provide the Conflicts Matter Advisors with diligence regarding potential conflicts matters and actual conflicts matters. This included frequent telephonic and in-person diligence sessions, and involved the Debtors or their advisors providing materials or presentations that helped inform the Conflicts Matter Advisors on key factual and legal issues and the Debtors’ historical transactions.

The Debtors’ co-chief restructuring officers (“co-CROs”) led the development of a plan term sheet that was based on proposals and feedback received from the Debtors’ creditors following numerous meetings and telephone conferences the Debtors and their advisors participated in with their stakeholders where the parties discussed various plan of reorganization concepts and issues. Numerous stakeholders made their own proposals, which the Debtors closely reviewed and analyzed.

Following nearly a month of discussions and negotiations with their stakeholders about the plan term sheet and alternative proposals, on March 9, 2015, the Debtors circulated to the same stakeholder groups a revised draft of the plan term sheet and a revised proposed confirmation timeline that set forth preliminary illustrative settlement numbers based on feedback the co-CRO’s had received from stakeholders. The substantive content of the plan term sheet and confirmation timeline were approved by the co-CROs and the numbers were intended to strike a preliminary but appropriate balance among the various interests reflected in the various proposals that had been discussed. As had

| 10 | The EFH Notes Indenture Trustee asserts that the disinterested directors and managers at each of EFH, EFIH, and EFCH/TCEH are not disinterested with respect to the Plan because such disinterested directors and managers are Released Parties and Exculpated Parties. The Debtors disagree with such assertions and believe that the burden is on the challenging party to create reasonable doubt that a director is not disinterested. See, e.g., Beam v. Stewart, 845 A.2d 1040, 1049 (Del. 2004). Consequently, the Debtors and the EFH Notes Indenture Trustee reserve all rights in connection with these issues. |

6

been the case with the term sheet circulated on February 11, 2015, while the Debtors had not sought and received approval from their boards of the substantive content of the revised plan term sheet, the circulation of the revised plan term sheet and confirmation timeline was supported by each of the Debtors’ boards, including the disinterested directors and managers in consultation with their respective Conflicts Matter Advisors.

Following the engagement of the Conflicts Matter Advisors and while all of the above was taking place, the Debtors’ disinterested directors and managers undertook a comprehensive process to prepare for and participate in negotiations with each other regarding the various inter-Debtor issues and claims that would necessarily affect any plan of reorganization. This included in-person and telephonic discussions and negotiation sessions over the course of multiple weeks and culminated in a settlement among the Debtors’ disinterested directors and managers (the “Disinterested Director Settlement”). This settlement is based on independent analyses and diligence conducted by the Debtors’ disinterested directors and managers after consultation with the Conflicts Matter Advisors and was the product of significant and deliberate negotiations among the Debtors’ disinterested directors and managers.

In sum, the co-CROs led the formulation and the negotiation of the Original Confirmed Plan as a whole, subject to the Debtors’ disinterested directors’ and managers’ formulation and negotiation of the Plan with respect to actual conflict matters.

| C. | The “Standalone Plan” and Pursuit of the REIT-Merger Transaction. |

Approximately one year after the Petition Date, and following months of discussions with their stakeholders and following good faith, arm’s length negotiations among the Debtors’ disinterested directors and managers, the Debtors filed initial versions of the Original Confirmed Plan and Sixth Amended Disclosure Statement on April 14, 2015 in a continued effort to negotiate a consensual, value-maximizing Plan.

The versions of the Original Confirmed Plan and Sixth Amended Disclosure Statement filed on April 14, 2015 provided for a Spin-Off and one of three forms of transaction for Reorganized EFH: a merger, an equity investment, or a standalone reorganization (such contemplated transactions, the “EFH/EFIH Transaction”). As described in Section IV.G., entitled “Exploring the EFH/EFIH Transaction” which begins on page 2, following the filing of the initial versions of the Original Confirmed Plan and the Sixth Amended Disclosure Statement, the Debtors continued to evaluate the possibility of executing a potential EFH/EFIH Transaction through the formal auction process governed by the Bidding Procedures Order. Ultimately, the Debtors determined that they were not prepared to enter into a definitive agreement for any of the Round 2 Bids they received in connection with the auction.

At the same time the Debtors explored potential bids in connection with the formal auction process, the Debtors continued to engage in discussions with their various creditor constituencies regarding the possibility of converting EFIH’s interest in Oncor Electric into a real estate investment trust (a “REIT” and the transactions and commercial arrangements necessary to implement a REIT structure for EFH, Reorganized EFH, EFIH, Reorganized EFIH, and/or any direct or indirect subsidiary of EFIH or Reorganized EFIH (or a successor of any of these entities), the “REIT Reorganization”) under the IRC of 1986 (the “IRC”), a possibility that has long been known to the Debtors and their creditors as a potential option for unlocking significant value for the EFIH Debtors but which requires certain rulings from, among others, the Internal Revenue Service (“IRS”) and the PUCT.

Based on these discussions, the Debtors and various of their constituencies discussed several potential paths forward, described in greater detail in Section IV.G. entitled “Exploring the EFH/EFIH Transaction,” which begins on page 73. Ultimately, the Debtors determined to pursue two aspects of the EFH/EFIH Transaction alternatives provided for in the versions of the Original Confirmed Plan and Sixth Amended Disclosure Statement filed on April 14, 2015: (a) a merger and investment structure, in which certain investors (including, potentially, existing creditor constituencies) would provide a new-money contribution that would be used to provide a full recovery to Allowed Claims against EFH and EFIH, in cash (excluding Makewhole Claims) and (b) the Spin-Off. As a condition to effectiveness of the REIT-Merger (as described below and in the Original Confirmed Plan), Reorganized EFH (or a successor entity) would be required to successfully obtain certain approvals and rulings, including PUCT approvals and IRS rulings, necessary for the REIT Reorganization.

Ultimately, the Debtors, certain plan sponsors, which included existing and strategic investors, the TCEH Supporting First Lien Creditors, the TCEH First Lien Agent, the TCEH Supporting Second Lien Creditors, the TCEH Committee, and the TCEH Unsecured Ad Hoc Group, executed a plan support agreement, dated as of August 9, 2015

7

(as amended on September 11, 2015 and as may be amended, supplemented, or otherwise modified from time to time in accordance therewith, including all exhibits and schedules attached thereto, the “Original Plan Support Agreement”) which required, among other things, that the parties to the Original Plan Support Agreement support the Original Confirmed Plan and seek prompt confirmation and consummation of the Restructuring Transactions contemplated therein, and subject to the conditions set forth therein. The Original Plan Support Agreement also contained certain provisions agreed to by the parties to the Original Plan Support Agreement in the event the Debtors had to pursue an alternative restructuring other than that contemplated by the Original Confirmed Plan (as defined in the Original Plan Support Agreement, the “Alternative Restructuring”).

Among other terms, the Alternative Restructuring contemplates the TCEH Cash Payment. The TCEH Cash Payment (as defined in the Original Plan Support Agreement) is the $550 million in Cash (subject to certain reductions described in the TCEH Disclosure Statement), payable to the Holders of Allowed TCEH First Lien Deficiency Claims, Allowed TCEH Unsecured Note Claims, Allowed TCEH Second Lien Note Claims, Allowed PCRB Claims, and Allowed General Unsecured Claims Against the TCEH Debtors Other Than EFCH, and subject to certain reductions (including as a result of the EFH Settlement, as described herein).

Additionally, the Original Confirmed Plan contemplated a merger (the “REIT-Merger”) pursuant to that certain Purchase Agreement and Plan of REIT-Merger, dated as of August 9, 2015, as may be amended, supplemented, or otherwise modified from time to time in accordance therewith, including all exhibits attached thereto (the “REIT Merger and Purchase Agreement”) by and among EFH Corp., EFIH, and two acquisition vehicles controlled by certain purchasers on the Effective Date of Reorganized EFH with and into New EFH in a transaction intended to qualify as a tax-free reorganization, under section 368(a) of the Internal Revenue Code, with New EFH continuing as the surviving corporation. The REIT-Merger would be funded through equity investments made pursuant to an equity commitment letter, rights offering, and backstop agreement (collectively, the “Equity Investment”), each of which would be used to fund certain distributions under the Plan.

The Bankruptcy Court approved the Debtors’ entry into the Original Plan Support Agreement on September 18, 2015 [D.I. 6097]. The Bankruptcy Court confirmed the Original Confirmed Plan on December 9, 2015 [D.I. 7285]. The Bankruptcy Court also authorized the Debtors to enter into the REIT-Merger and Purchase Agreement and the related equity commitments.

| D. | Issues Related to Closing of the REIT-Merger. |

The Effective Date of the Original Confirmed Plan and consummation of the REIT-Merger and Purchase Agreement included various conditions precedent to consummation of the transactions contemplated thereby, including a condition that certain approvals and rulings be obtained, including from the PUCT and the IRS.

Under the terms of the Original Plan Support Agreement, the parties’ obligations to support the Original Confirmed Plan and the transactions contemplated therein could terminate on April 30, 2016 (the “Plan Support Outside Date”) unless (a) all required approvals from the Public Utility Commission of Texas (the “PUCT”) with respect to consummation of the Original Confirmed Plan and the transactions contemplated by the REIT-Merger and Purchase Agreement have been obtained by such date, in which case the April 30, 2016 date would be automatically extended by 60 days or (b) all such required approvals have not been obtained, but the investors party to the REIT-Merger and Purchase Agreement could submit a written request by April 30, 2016 to extend such date by 30 days in exchange for a $50 million reduction of the TCEH Cash Payment.

Following confirmation of the Original Confirmed Plan, the Debtors and the purchasers under the REIT-Merger and Purchase Agreement diligently worked to effectuate the Original Confirmed Plan.

On March 24, 2016, the Public Utilities Commission of Texas (the “PUCT”), entered an order related to the proposed transfer of control of Oncor and the related REIT Reorganization contemplated by the REIT-Merger and Purchase Agreement (the “PUCT Order”). The PUCT Order did not include all of the approvals required from the PUCT with respect to consummation of the Original Confirmed Plan and the REIT-Merger and Purchase Agreement, including with respect to the terms of the initial lease between Oncor AssetCo and OEDC (requiring a separate proceeding for such approval). See, e.g., PUCT Order, ¶ 191-92.11

| 11 | On May 18, 2016, Ovation Acquisition II, L.L.C., et al., filed a notice of withdrawal of the application and a request to vacate the PUCT Order and dismiss the proceedings without prejudice. On May 19, 2016, instead of dismissing the proceedings, the PUCT denied a pending rehearing request, resulting in the PUCT Order becoming final. |

8

Because the PUCT Order did not include all of the approvals required for consummation of the Original Confirmed Plan and the REIT-Merger and Purchase Agreement, the Plan Support Outside Date was not automatically extended. On April 30, 2016, the investor parties that are party to the Original Plan Support Agreement indicated that they would not elect to extend the Plan Support Outside Date. As a result, the Ad Hoc TCEH First Lien Committee delivered a Plan Support Termination Notice (as defined in the Original Plan Support Agreement) to the Debtors and the Required Investor Parties (as defined in the Original Plan Support Agreement), which caused the Original Confirmed Plan to be null and void.

Importantly, the occurrence of a Plan Support Termination Event (as defined in the Original Plan Support Agreement), does not terminate the Original Plan Support Agreement, but rather only terminates the parties’ obligations with respect to the Original Confirmed Plan. In other words, the Original Plan Support Agreement continues to bind the parties to the Original Plan Support Agreement with respect to certain key terms that would be set forth in any Alternative Restructuring (including as contemplated by the Plan).

| E. | Filing of the Plan and Bifurcation of T-Side and E-Side Path to Emergence. |

Immediately following the delivery by the Ad Hoc TCEH First Lien Committee of the Plan Support Termination Notice, the Debtors filed the Plan, which contemplated (a) with respect to the TCEH Debtors, the Alternative Restructuring Terms including the TCEH Cash Payment and (b) with respect to the EFH/EFIH Debtors, either an investment from third party or existing creditors or a standalone transaction.

Recognizing that the certainty provided by the Alternative Restructuring Terms would allow the TCEH Debtors to confirm the Plan as it relates to them on a more expeditious basis as compared to the EFH Debtors and EFIH Debtors, the Debtors determined to seek entry of a scheduling order that bifurcated the timeline to emergence for the TCEH Debtors from the EFH Debtors and EFIH Debtors. The Bankruptcy Court entered the scheduling order on May 24, 2016 [D.I. 8514] (the “First Scheduling Order”), and contemplated a Plan confirmation hearing for (a) the TCEH Debtors and the EFH Shared Services Debtors commencing on August 17, 2016 and (b) the EFH Debtors and EFIH Debtors on September 26, 2016.12 Because the Plan filed on May 1, 2016 (as modified on May 11, 2016 at D.I. 8422) did not identify a definitive path forward with respect to the Plan as it related to the EFH Debtors and EFIH Debtors, the First Scheduling Order required the Debtors to file an amended Plan on July 8, 2016 and request a telephonic status conference no later than two business days after filing such amended Plan.

Following the May 1, 2016 filing of the Plan, the Debtors circulated a process letter on May 24, 2016 to those parties who had expressed interest in the formal 2015 auction process. The Debtors invited those parties that had executed confidentiality agreements in connection with the 2015 process to execute new confidentiality agreements, receive refreshed financial information, and discuss their potentially renewed interest in participating in a transaction for EFH Corp.’s indirect economic interest in Oncor. Ultimately, approximately eight parties determined to re-engage with the Debtors. As the Debtors engaged in robust discussions with multiple interested parties, it became clear that the Debtors would not be in a position to select the most value-maximizing path forward with respect to a restructuring of the EFH Debtors and EFIH Debtors by the July 8th deadline set forth in the First Scheduling Order. Consequently, the Debtors requested, and obtained, entry of an order suspending the dates and deadlines in the First Scheduling Order with respect to the EFH Debtors and EFIH Debtors on and after July 8, 2016 [D.I. 8883].

| 12 | Consistent with the First Scheduling Order, the TCEH Debtors and EFH Shared Services obtained approval of a disclosure statement for the Plan as it applies to such Debtors on June 17, 2016 [D.I. 8761] (the “TCEH Disclosure Statement”) |

9

The extra time obtained by suspending the Plan confirmation schedule with respect to the EFH/EFIH Debtors proved fruitful. Exactly three weeks later, the Debtors executed the following definitive documentation with NextEra Energy, Inc. (“NextEra”):

| • | Merger Agreement. EFH Corp. and EFIH entered into an agreement and plan of merger with NextEra and EFH Merger Co., LLC (“Merger Sub”), a wholly-owned subsidiary of NEE (the “Merger Agreement”). Pursuant to the Merger Agreement, on the EFH Effective Date, EFH Corp. will merge with and into Merger Sub, with Merger Sub surviving as a wholly owned subsidiary of NEE. The consideration payable by NextEra pursuant to the Merger Agreement consists primarily of cash, with a portion of the distribution to be in the form of common stock of NEE (as defined in the Plan, the NextEra Class A Common Stock and NextEra Class B Common Stock). |

| • | The Merger Agreement contains various conditions precedent to consummation of the transactions contemplated therein, including, among others, various regulatory rulings from the PUCT and certain supplemental rulings from the IRS related to the effect (if any) of the Merger on the TCEH Transactions. |

| • | In addition, the Merger Agreement requires the following TCEH transactions to have occurred prior to the EFH Effective Date: (a) the execution of a transaction that will result in a step-up in the tax basis of certain TCEH assets and (b) the spin-off of reorganized TCEH and certain of its direct and indirect subsidiaries (the “TCEH Transactions”). The TCEH Transactions themselves are not dependent on the closing of the Merger and may occur separately from the Merger Agreement. |

| • | Plan Support Agreement. The EFH/EFIH Debtors and NextEra also executed a plan support agreement that sets forth the commitments, representations, the termination rights of each of the Parties (including certain key milestone dates), and the parties’ obligations to support the Plan, as amended to reflect the transaction with NextEra (as amended or modified from time to time, the “Plan Support Agreement”). |

| • | The Plan Support Agreement and the Merger Agreement contain terms governing the parameters of the Debtors’ ‘go shop’ and ‘no shop’ rights. Following approval of the Merger Agreement by the Bankruptcy Court and until confirmation of the Plan as it relates to the EFH Debtors and EFIH Debtors by the Bankruptcy Court, the EFH Debtors and EFIH Debtors may continue or have discussions or negotiations with respect to acquisition proposals for Reorganized EFH (a) with persons that were in active negotiation at the time of approval of the Merger Agreement by the Bankruptcy Court and (b) with persons that submit an unsolicited acquisition proposal that is, or is reasonably likely to lead to, a Superior Proposal (as defined in the Merger Agreement). Following the filing of the Merger Agreement and Plan Support Agreement with the Bankruptcy Court on August 3, 2016, NextEra and the EFH/EFIH Debtors continued to engage in negotiations on ensuring the Merger Agreement provided a value-maximizing transaction to the EFH/EFIH Debtors’ estates. These discussions were productive and on September 18, 2016, NextEra agreed to increase the purchase price by $300 million to $4.4 billion (i.e., a total contribution of $9.8 bilion, after accounting for the satisfaction of EFIH First Lien DIP Facility obligations). |

| • | As a result of this additional distributable value for the benefit of the EFH/EFIH Debtors’ constituencies, Fidelity, the largest single Holder of EFH unsecured Claims, became party to the Plan Support Agreement. |

| • | With the support of Fidelity in hand, the Bankruptcy Court approved the EFH Debtors’ and EFIH Debtors’ entry into, and performance under, the Plan Support Agreement and approved the Merger Agreement on September 19, 2016 [D.I. 9584]. |

| • | If the EFH/EFIH Debtors terminate the Plan Support Agreement in favor of a higher or otherwise better offer, the pursuit of such higher or otherwise better offer could affect |

10

| distributions to Holders of Allowed Claims against, and Interests in, the EFH Debtors and EFIH Debtors. The EFH/EFIH Debtors do not intend to resolicit votes on an amended version of the Plan that implements the terms of such higher or otherwise better offer unless specifically required to do so under section 1127 of the Bankruptcy Code. |

On July 28, 2016, the Debtors received the Private Letter Ruling (as defined in the Plan). The Private Letter Ruling addresses certain aspects of the qualification of the Contribution, the Reorganized TCEH Conversion, and the Distribution as a “reorganization” within the meaning of Sections 368(a)(1)(G), 355, and 356 of the IRC, as well as certain other matters. Following receipt of the Private Letter Ruling, the Debtors amended the Plan of Reorganization to eliminate certain references to the receipt of “Fundamental Rulings” with respect to the Private Letter Ruling.

The Merger is conditioned upon the Debtors’ receipt of certain Supplemental Rulings (as defined in the Merger Agreement). The Supplemental Rulings relate to the effect of the Merger (if any) on certain of the rulings obtained in the Private Letter Ruling. The Supplemental Rulings were sought in a supplemental ruling request to be filed with the IRS.

| F. | Approval of September 2016 Disclosure Statement Order and Third Circuit Decision. |

In connection with the execution of the Merger Agreement and the Plan Support Agreement, the Debtors prepared an amended version of the Plan that implemented the terms of the Merger Agreement and related disclosure statement as it relates to the EFH Debtors and EFIH Debtors. The Bankruptcy Court approved such a disclosure statement pursuant to the Order (A) Approving the EFH/EFIH Disclosure Statement, (B) Establishing the EFH/EFIH Voting Record Date, EFH/EFIH Voting Deadline, and Other Dates, (C) Approving Procedures for Soliciting, Receiving, and Tabulating Votes on the Plan, and (D) Approving the Manner and Forms of Notice and Other Related Documents [D.I. 9585] (the “September 2016 Disclosure Statement Order”) (attached hereto as Exhibit F-1).

Following entry of the September 2016 Disclosure Statement Order, the EFH Debtors and EFIH Debtors commenced and completed solicitation of all Holders of Claims and Interests against the EFH Debtors or EFIH Debtors who were entitled to vote under the Plan. With solicitation complete, the EFH Debtors and EFIH Debtors prepared to commence a hearing to consider confirmation of the Plan as it relates to the EFH Debtors and EFIH Debtors on December 1, 2016 (as contemplated by the scheduling order entered by the Bankruptcy Court on August 24, 2016 [D.I. 9381] (the “EFH/EFIH Scheduling Order”).

On November 17, 2016, the United States Court of Appeals for the Third Circuit (the “Third Circuit”) issued a memorandum opinion that reversed the decisions of the lower courts regarding the allowance of the Makewhole Claims asserted by Holders of EFIH First Lien Notes and Holders of EFIH Second Lien Notes (the “EFIH First Lien Makewhole Claims” and “EFIH Second Lien Makewhole Claims,” respectively, and the “Third Circuit Makewhole Decision”). As a result of the Third Circuit Makewhole Decision, the EFIH First Lien Makewhole Claims and EFIH Second Lien Makewhole Claims are neither Disallowed Makewhole Claims nor Allowed Makewhole Claims. Because such claims are no longer Disallowed Makewhole Claims, a condition precedent to consummation of the Plan as it relates to the EFH Debtors and EFIH Debtors could not be satisfied (although the Plan Sponsor could waive such condition in its sole and absolute discretion).

Following the issuance of the Third Circuit Decision, the EFH Debtors, EFIH Debtors, and their advisors began evaluating how to reallocate the consideration being provided by NextEra pursuant to the Merger Agreement. In order to evaluate all possible options, the EFH Debtors and EFIH Debtors suspended the remainder of the EFH/EFIH Scheduling Order and adjourned the Plan confirmation hearing.

| G. | Discussions Following the Third Circuit Decision and Plan Modifications. |

In connection with their evaluation of paths forward, the EFH Debtors the EFIH Debtors, and their advisors engaged in discussions with, among others, NextEra, and certain key EFIH constituencies. Ultimately, the EFH Debtors and EFIH Debtors reached consensus with NextEra on certain Plan modificiations.

Specifically, the Plan filed on December 1, 2016 was amended to reflect the following key changes:

| • | Deletion of Makewhole Condition Precedent. The condition precedent to consummation of the Plan requiring the EFIH First Lien Makewhole Claims and EFIH Second Lien Makewhole Claims to be Disallowed Makewhole Claims is eliminated. |

11

| • | Limited Liens for the Benefit of the EFIH First Lien Trustee and EFIH Second Lien Trustee. As set forth in Article III.B.19 and Article III.B.20 of the Plan, the EFIH First Lien Notes Trustee and EFIH Second Lien Notes Trustee will be granted Liens on the EFH/EFIH Distribution Account, up to the asserted amount of their respective Makewhole Claims. Such Liens will survive for the benefit of the respective Indenture Trustee until such time their respective Makewhole Claim has either been (a) Allowed, and paid in full, in Cash from the EFH/EFIH Distribution Account or (b) disallowed by Final Order. The Lien will not extend to the value of any EFH cash included in the EFH/EFIH Distribution Account. |

| • | Elimination of Class B6 “Top Up”. As set forth in Article VI.A. of the Plan, recoveries to Holders of Allowed Class B6 Claims may be reduced to first satisfy any Allowed EFIH First Lien Makewhole Claims or EFIH Second Lien Makewhole Claims. |

| • | Satisfaction of Allowed Makewhole Claims. As set forth in Article VI.A. of the Plan, any Allowed EFIH First Lien Makewhole Claims or Allowed EFIH Second Lien Makewhole Claims will be satisfied from the EFH/EFIH Distribution Account. |

| H. | EFIH First Lien Settlement and EFIH Second Lien Settlement. |

Following the Third Circuit Makewhole Decision, the EFH/EFIH Debtors and their advisors developed a proposed term sheet, reflecting a potential settlement of the EFIH First Lien Makewhole Claims and EFIH Second Lien Makewhole Claims (the “CRO EFIH Term Sheet”). The CRO EFIH Term Sheet contemplated two settlement structures: (a) in the event that Holders of EFIH Unsecured Note Claims (in an amount sufficient to ensure that Class B6 votes, as a Class, to accept the Plan) agreed to a settlement of their Claims under the Plan, (x) supporting Holders of EFIH First Lien Note Claims and EFIH Second Lien Note Claims would agree to settle their respective Makewhole Claims at a lower percentage and (y) the Plan Sponsor may determine to increase its purchase price, in each case to increase, on a Pro Rata basis, the recoveries under the Plan to Holders of EFIH Unsecured Note Claims and (b) in the event that Holders of EFIH Unsecured Note Claims did not agree to a settlement of their Claims under the Plan, supporting Holders of EFIH First Lien Note Claims and EFIH Second Lien Note Claims would agree to settle their respective Makewhole Claims at a higher percentage and Holders of EFIH Unsecured Note Claims would not receive the benefit of any such settlement of Makewhole Claims.

On November 30, 2016, the EFH/EFIH Debtors’ chief restructuring officer and the EFH/EFIH Debtors’ respective Boards approved the CRO EFIH Term Sheet for distribution to those Holders of EFIH First Lien Note Claims, Holders of EFIH Second Lien Note Claims, and Holders of EFIH Unsecured Note Claims that agreed to enter into confidentiality agreements temporarily restricting their ability to freely trade EFIH securities.

Following circulation of the CRO Term Sheet, members of the EFH/EFIH Debtors’ senior management team and their advisors discussed the economic terms of the CRO Term Sheet with the restricted Holders of EFIH Claims. Those discussions yielded the EFIH First Lien Settlement and EFIH Second Lien Settlement described below. On December 14, 2016, certain Holders of EFIH First Lien Note Claims and EFIH Second Lien Note Claims accepted the EFIH First Lien Settlement and EFIH Second Lien Settlement (respectively), subject to approval by the EFH/EFIH Debtors’ respective Boards, and subject to the execution of acceptable documentation reflecting the respective settlements. The EFH/EFIH Debtors’ respective Boards approved the EFIH First Lien Settlement and EFIH Second Lien Settlement on December 16, 2016 (the “EFIH Settlement Board Approval”).

Key Terms of EFIH First Lien Settlement and EFIH Second Lien Settlement. The EFIH First Lien Settlement and EFIH Second Lien Settlement (collectively, the “EFIH Secured Settlement”) include the following key terms:

| • | Documentation. Holders of EFIH First Lien Note Claims, Holders of EFIH Second Lien Note Claims, and the EFH/EFIH Debtors are currently negotiating the EFIH Secured Creditor Plan Support |

12

| Agreement, consistent with the EFIH First Lien Settlement and EFIH Second Lien Settlement terms described below. The parties expect that the EFIH Secured Creditor Plan Support Agreement will include the EFIH First Lien Settlement and EFIH Second Lien Settlement, although approval of both settlements will be pursuant to a separate order (as defined in the Plan, the “EFIH Settlement Approval Order”) on a timeline separate from approval of the EFIH Secured Creditor Plan Support Agreement. The parties also expect that the EFIH Secured Creditor Plan Support Agreement will contain a traditional “fiduciary out,” allowing the Board of Directors or Board of Managers, as applicable, of each of the EFH/EFIH Debtors to terminate their support of the EFIH Secured Creditor Plan Support Agreement until entry of the EFIH Settlement Approval Order, if any such Board of Directors or Board of Managers determines that proceeding with the EFIH Secured Creditor Plan Support Agreement (including the EFIH First Lien Settlement and EFIH Settlement) is inconsistent with its applicable fiduciary duties (the “Fiduciary Duty Provision”). |

| • | Timing. |

| • | The settlements include a “toggle” whereby recoveries to Holders of EFIH First Lien Note Claims and Holders of EFIH Second Lien Note Claims are modified based on whether Holders of EFIH Unsecured Note Claims agree to support the Plan and, if so, when they agree to support the Plan. |

| • | In addition, the parties expect that the Plan Sponsor Plan Support Agreement will include a limited opt-in period during which additional Holders of EFIH Claims may consent in writing to support the Plan Support Agreement. |

| • | Makewhole Litigation. The EFIH Secured Creditor Plan Support Agreement will also reflect agreement on holding the existing Makewhole Litigation on EFIH First Lien Note Claims and EFIH Second Lien Note Claims in abeyance. |

| • | Key Economic Terms of EFIH First Lien Settlement and EFIH Second Lien Settlement.13 |

| If Holders of EFIH Unsecured Note Claims Agree to Support the Plan Within 24 Hours of the EFIH Settlement Board Approval |

If Class B6 Votes to Accept the Plan |

If Class B6 Votes to Reject the Plan | ||||

| Holders of EFIH First Lien Note Claims | 94% recovery on EFIH First Lien Makewhole Claims; 100% of unpaid interest, fees, and expenses | 95% recovery on EFIH First Lien Makewhole Claims; 100% of unpaid interest, fees, and expenses | 97% recovery on EFIH First Lien Makewhole Claims; 100% of unpaid interest, fees, and expenses | |||

| Holders of EFIH Second Lien Note Claims | 85% recovery on EFIH First Lien Makewhole Claims; 100% of unpaid interest, fees, and expenses | 87.5% recovery on EFIH First Lien Makewhole Claims; 100% of unpaid interest, fees, and expenses | 92% recovery on EFIH First Lien Makewhole Claims; 100% of unpaid interest, fees, and expenses | |||

The restricted Holders of EFIH Unsecured Note Claims did not accept the EFIH First Lien Settlement and EFIH Second Lien Settlement within 24 hours of the EFIH Settlement Board Approval.

| 13 | This summary is being provided for illustrative purposes only and is qualified in its entirety by the EFIH Secured Creditor Plan Support Agreement, the EFIH Creditor PSA Order, and the EFIH Settlement Approval Order. |

13

| I. | Path Forward with EFIH PIK Noteholders. |

On December 16, 2016, professionals representing an ad hoc group of Holders of EFIH Unsecured Note Claims (approximately 60% of the aggregate, outstanding principal amount of the EFIH Unsecured Note Claims) (the “EFIH PIK Group”) communicated to the EFH/EFIH Debtors and their legal and financial advisors that, subject to the execution of a plan support agreement (the “EFIH Unsecured Creditor Plan Support Agreement”), the ad hoc group would be willing to support an amended Plan with certain modified terms.

The EFH/EFIH Debtors, their advisors, and the professionals for the EFIH PIK Group negotiated the terms of such proposal, ultimately agreeing upon the following key terms, subject to execution of the EFIH Unsecured Creditor Plan Support Agreement (collectively, the “PIK Proposal”):