10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

— OR —

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-12833

Energy Future Holdings Corp.

(Exact name of registrant as specified in its charter)

|

| | |

Texas | | 46-2488810 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

1601 Bryan Street, Dallas, TX 75201-3411 | | (214) 812-4600 |

(Address of principal executive offices) (Zip Code) | | (Registrant's telephone number, including area code) |

__________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

__________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-Accelerated filer x (Do not check if a smaller reporting company)

Smaller reporting company o

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

At February 29, 2016, there were 1,669,861,379 shares of common stock, without par value, outstanding of Energy Future Holdings Corp. (substantially all of which were owned by Texas Energy Future Holdings Limited Partnership, Energy Future Holdings Corp.’s parent holding company, and none of which is publicly traded).

________________________________________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

|

| | |

| | PAGE |

| | |

| | |

Items 1. and 2. | | |

Item 1A. | | |

Item 1B. | | |

Item 3. | | |

Item 4. | | |

| | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

Item 15. | | |

Energy Future Holdings Corp.'s (EFH Corp.) annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports are made available to the public, free of charge, on the EFH Corp. website at http://www.energyfutureholdings.com, as soon as reasonably practicable after they have been filed with or furnished to the Securities and Exchange Commission. The information on EFH Corp.'s website shall not be deemed a part of, or incorporated by reference into, this annual report on Form 10-K. The representations and warranties contained in any agreement that we have filed as an exhibit to this annual report on Form 10-K or that we have or may publicly file in the future may contain representations and warranties made by and to the parties thereto at specific dates. Such representations and warranties may be subject to exceptions and qualifications contained in separate disclosure schedules, may represent the parties' risk allocation in the particular transaction, or may be qualified by materiality standards that differ from what may be viewed as material for securities law purposes.

This annual report on Form 10-K and other Securities and Exchange Commission filings of EFH Corp. and its subsidiaries occasionally make references to EFH Corp. (or "we," "our," "us" or "the Company"), EFCH, EFIH, TCEH, TXU Energy, Luminant, Oncor Holdings or Oncor when describing actions, rights or obligations of their respective subsidiaries. These references reflect the fact that the subsidiaries are consolidated with, or otherwise reflected in, their respective parent company's financial statements for financial reporting purposes. However, these references should not be interpreted to imply that the parent company is actually undertaking the action or has the rights or obligations of the relevant subsidiary company or vice versa.

GLOSSARY

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below.

|

| | |

ancillary services | | Refers to services necessary to support the transmission of energy and maintain reliable operations for the entire transmission system. These services include monitoring and providing for various types of reserve generation to ensure adequate electricity supply and system reliability. |

| | |

Chapter 11 Cases | | Cases being heard in the US Bankruptcy Court for the District of Delaware (Bankruptcy Court) concerning voluntary petitions for relief under Chapter 11 of the US Bankruptcy Code (Bankruptcy Code) filed on April 29, 2014 by the Debtors |

| | |

CAIR | | Clean Air Interstate Rule |

| | |

CFTC | | US Commodity Futures Trading Commission |

| | |

CO2 | | carbon dioxide |

| | |

CPNPC | | Refers to Comanche Peak Nuclear Power Company LLC, which was formed for the purpose of developing two new nuclear generation units and obtaining a combined operating license from the NRC for the units. |

| | |

Competitive Electric segment | | the EFH Corp. business segment that consists principally of TCEH |

| | |

Consolidated EBITDA | | Consolidated EBITDA means TCEH EBITDA adjusted to exclude noncash items, unusual items and other adjustments allowable under the agreement governing the TCEH DIP Facility. See the definition of EBITDA below. Consolidated EBITDA and EBITDA are not recognized terms under US GAAP and, thus, are non-GAAP financial measures. We are providing Consolidated EBITDA in this Form 10-K (see reconciliation in Exhibit 99(b)) solely because of the important role that Consolidated EBITDA plays in respect of covenants contained in the agreement governing the TCEH DIP Facility. We do not intend for Consolidated EBITDA (or EBITDA) to be an alternative to net income as a measure of operating performance or an alternative to cash flows from operating activities as a measure of liquidity or an alternative to any other measure of financial performance presented in accordance with US GAAP. Additionally, we do not intend for Consolidated EBITDA (or EBITDA) to be used as a measure of free cash flow available for management's discretionary use, as the measure excludes certain cash requirements such as adequate assurance payments, interest payments, tax payments and other debt service requirements. Because not all companies use identical calculations, our presentation of Consolidated EBITDA (and EBITDA) may not be comparable to similarly titled measures of other companies. |

| | |

Confirmation Order | | The Bankruptcy Court's December 2015 order confirming the Plan of Reorganization |

| | |

CREZ | | Competitive Renewable Energy Zone |

| | |

CSAPR | | the final Cross-State Air Pollution Rule issued by the EPA in July 2011 |

| | |

DIP Facilities | | Refers, collectively, to TCEH's debtor-in-possession financing and EFIH's debtor-in-possession financing. See Note 12 to the Financial Statements. |

| | |

Debtors | | EFH Corp. and the substantial majority of its direct and indirect subsidiaries, including EFIH, EFCH and TCEH but excluding the Oncor Ring-Fenced Entities |

| | |

Disclosure Statement | | Fifth Amended Disclosure Statement for the Debtors' Fifth Amended Joint Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code approved by the Bankruptcy Court in September 2015 |

| | |

D.C. Circuit Court | | US Court of Appeals for the District of Columbia Circuit |

| | |

DOE | | US Department of Energy |

| | |

EBITDA | | earnings (net income) before interest expense, income taxes, depreciation and amortization |

| | |

EFCH | | Energy Future Competitive Holdings Company LLC, a direct, wholly owned subsidiary of EFH Corp. and the direct parent of TCEH, and/or its subsidiaries, depending on context |

| | |

EFH Acquisition | | The acquisition of reorganized EFH Corp. financed by existing TCEH creditors and third-party investors as proposed in the Plan of Reorganization |

| | |

|

| | |

EFH Corp. | | Energy Future Holdings Corp., a holding company, and/or its subsidiaries, depending on context, whose major subsidiaries include TCEH and Oncor |

| | |

EFIH | | Energy Future Intermediate Holding Company LLC, a direct, wholly owned subsidiary of EFH Corp. and the direct parent of Oncor Holdings |

| | |

EFIH Debtors | | EFIH and EFIH Finance |

| | |

EFIH Finance | | EFIH Finance Inc., a direct, wholly owned subsidiary of EFIH, formed for the sole purpose of serving as co-issuer with EFIH of certain debt securities |

| | |

EFIH First Lien Notes | | EFIH's and EFIH Finance's $503 million principal amount of 6.875% Senior Secured First Lien Notes and $3.482 billion principal amount of 10.000% Senior Secured First Lien Notes, collectively |

| | |

EFIH PIK Notes | | EFIH's and EFIH Finance's $1.566 billion principal amount of 11.25%/12.25% Senior Toggle Notes |

| | |

EFIH Second Lien Notes | | EFIH's and EFIH Finance's $322 million principal amount of 11% Senior Secured Second Lien Notes and $1.389 billion principal amount of 11.75% Senior Secured Second Lien Notes, collectively |

| | |

EPA | | US Environmental Protection Agency |

| | |

ERCOT | | Electric Reliability Council of Texas, Inc., the independent system operator and the regional coordinator of various electricity systems within Texas |

| | |

ERISA | | Employee Retirement Income Security Act of 1974, as amended |

| | |

Federal and State Income Tax Allocation Agreements | | EFH Corp. and certain of its subsidiaries (including EFCH, EFIH and TCEH, but not including Oncor Holdings and Oncor) are parties to a Federal and State Income Tax Allocation Agreement, executed on May 15, 2012 but effective as of January 1, 2010. EFH Corp., Oncor Holdings, Oncor, Texas Transmission, and Oncor Management Investment LLC are parties to a separate Federal and State Income Tax Allocation Agreement dated November 5, 2008. See Note 7 to the Financial Statements and Management's Discussion and Analysis, under Financial Condition. |

| | |

FERC | | US Federal Energy Regulatory Commission |

| | |

Fifth Circuit Court | | US Court of Appeals for the Fifth Circuit |

| | |

GAAP | | generally accepted accounting principles |

| | |

GHG | | greenhouse gas |

| | |

GWh | | gigawatt-hours |

| | |

ICE | | the IntercontinentalExchange, an electronic commodity derivative exchange |

| | |

IRS | | US Internal Revenue Service |

| | |

kWh | | kilowatt-hours |

| | |

LIBOR | | London Interbank Offered Rate, an interest rate at which banks can borrow funds, in marketable size, from other banks in the London interbank market |

| | |

Luminant | | subsidiaries of TCEH engaged in competitive market activities consisting of electricity generation and wholesale energy sales and purchases as well as commodity risk management and trading activities, all largely in Texas |

| | |

market heat rate | | Heat rate is a measure of the efficiency of converting a fuel source to electricity. Market heat rate is the implied relationship between wholesale electricity prices and natural gas prices and is calculated by dividing the wholesale market price of electricity, which is based on the price offer of the marginal supplier in ERCOT (generally natural gas plants), by the market price of natural gas. Forward wholesale electricity market price quotes in ERCOT are generally limited to two or three years; accordingly, forward market heat rates are generally limited to the same time period. Forecasted market heat rates for time periods for which market price quotes are not available are based on fundamental economic factors and forecasts, including electricity supply, demand growth, capital costs associated with new construction of generation supply, transmission development and other factors. |

| | |

MATS | | the Mercury and Air Toxics Standard established by the EPA |

|

| | |

| | |

Merger | | the transaction referred to in the Agreement and Plan of Merger, dated February 25, 2007, under which Texas Holdings agreed to acquire EFH Corp., which was completed on October 10, 2007 |

| | |

MMBtu | | million British thermal units |

| | |

Moody's | | Moody's Investors Services, Inc. |

| | |

MSHA | | US Mine Safety and Health Administration |

| | |

MW | | megawatts |

| | |

MWh | | megawatt-hours |

| | |

NERC | | North American Electric Reliability Corporation |

| | |

NOX | | nitrogen oxide |

| | |

NRC | | US Nuclear Regulatory Commission |

| | |

NYMEX | | the New York Mercantile Exchange, a commodity derivatives exchange |

| | |

Oncor | | Oncor Electric Delivery Company LLC, a direct, majority-owned subsidiary of Oncor Holdings and an indirect subsidiary of EFH Corp., and/or its consolidated bankruptcy-remote financing subsidiary, Oncor Electric Delivery Transition Bond Company LLC, depending on context, that is engaged in regulated electricity transmission and distribution activities |

| | |

Oncor Holdings | | Oncor Electric Delivery Holdings Company LLC, a direct, wholly owned subsidiary of EFIH and the direct majority owner of Oncor, and/or its subsidiaries, depending on context |

| | |

Oncor Ring-Fenced Entities | | Oncor Holdings and its direct and indirect subsidiaries, including Oncor |

| | |

OPEB | | postretirement employee benefits other than pensions |

| | |

Petition Date | | April 29, 2014, the date the Debtors made the Bankruptcy Filing |

| | |

Plan of Reorganization | | Sixth Amended Joint Plan of Reorganization, as amended, Pursuant to Chapter 11 of the Bankruptcy Code confirmed by the Bankruptcy Court in December 2015, including the Plan Supplement

|

| | |

Plan Support Agreement | | Third Amendment to the Amended and Restated Plan Support Agreement, entered into in December 2015, amending and restating the Plan Support Agreement approved by the Bankruptcy Court in September 2015 |

| | |

PUCT | | Public Utility Commission of Texas |

| | |

PURA | | Texas Public Utility Regulatory Act |

| | |

purchase accounting | | The purchase method of accounting for a business combination as prescribed by US GAAP, whereby the cost or "purchase price" of a business combination, including the amount paid for the equity and direct transaction costs are allocated to identifiable assets and liabilities (including intangible assets) based upon their fair values. The excess of the purchase price over the fair values of assets and liabilities is recorded as goodwill. |

| | |

Regulated Delivery segment | | the EFH Corp. business segment that consists primarily of our investment in Oncor |

| | |

REP | | retail electric provider |

| | |

RCT | | Railroad Commission of Texas, which among other things, has oversight of lignite mining activity in Texas |

| | |

S&P | | Standard & Poor's Ratings (a credit rating agency) |

| | |

SEC | | US Securities and Exchange Commission |

| | |

Securities Act | | Securities Act of 1933, as amended |

| | |

SG&A | | selling, general and administrative |

| | |

|

| | |

Settlement Agreement | | Amended and Restated Settlement Agreement among the Debtors, the Sponsor Group, settling TCEH first lien creditors, settling TCEH second lien creditors, settling TCEH unsecured creditors and the official committee of unsecured creditors of TCEH (collectively, the Settling Parties), filed by the Debtors with the Bankruptcy Court in December 2015. See Note 2 to the Financial Statements. |

| | |

Settlement Agreement Order | | The Bankruptcy Court's December 2015 order approving the Settlement Agreement |

| | |

SO2 | | sulfur dioxide |

| | |

Sponsor Group | | Refers, collectively, to certain investment funds affiliated with Kohlberg Kravis Roberts & Co. L.P., TPG Global, LLC (together with its affiliates, TPG) and GS Capital Partners, an affiliate of Goldman, Sachs & Co., that have an ownership interest in Texas Holdings. |

| | |

TCEH | | Texas Competitive Electric Holdings Company LLC, a direct, wholly owned subsidiary of EFCH and an indirect subsidiary of EFH Corp., and/or its subsidiaries, depending on context, that are engaged in electricity generation and wholesale and retail energy market activities, and whose major subsidiaries include Luminant and TXU Energy |

| | |

TCEH Debtors | | EFCH, TCEH and the subsidiaries of TCEH that are Debtors in the Chapter 11 Cases |

| | |

TCEH Demand Notes | | Refers to certain loans from TCEH to EFH Corp. in the form of demand notes to finance EFH Corp. debt principal and interest payments and, until April 2011, other general corporate purposes of EFH Corp. that were guaranteed on a senior unsecured basis by EFCH and EFIH and were settled by EFH Corp. in January 2013. |

| | |

TCEH DIP Facility | | TCEH's $3.375 billion debtor-in-possession financing facility approved by the Bankruptcy Court in June 2014. See Note 12 to the Financial Statements.

|

| | |

TCEH Finance | | TCEH Finance, Inc., a direct, wholly owned subsidiary of TCEH, formed for the sole purpose of serving as co-issuer with TCEH of certain debt securities |

| | |

TCEH Senior Notes | | Refers, collectively, to TCEH's and TCEH Finance's 10.25% Senior Notes and 10.25% Senior Notes, Series B (collectively, TCEH 10.25% Notes) and TCEH's and TCEH Finance's 10.50%/11.25% Senior Toggle Notes (TCEH Toggle Notes) with a total principal amount of $4.874 billion. |

| | |

TCEH Senior Secured Facilities | | Refers, collectively, to the TCEH First Lien Term Loan Facilities, TCEH First Lien Revolving Credit Facility and TCEH First Lien Letter of Credit Facility with a total principal amount of $22.616 billion. |

| | |

TCEH Senior Secured Notes | | TCEH's and TCEH Finance's $1.750 billion principal amount of 11.5% First Lien Senior Secured Notes |

| | |

TCEH Senior Secured Second Lien Notes | | Refers, collectively, to TCEH's and TCEH Finance's 15% Senior Secured Second Lien Notes and TCEH's and TCEH Finance's 15% Senior Secured Second Lien Notes, Series B with a total principal amount of $1.571 billion. |

| | |

TCEQ | | Texas Commission on Environmental Quality |

| | |

Texas Holdings | | Texas Energy Future Holdings Limited Partnership, a limited partnership controlled by the Sponsor Group, that owns substantially all of the common stock of EFH Corp. |

| | |

Texas Holdings Group | | Texas Holdings and its direct and indirect subsidiaries other than the Oncor Ring-Fenced Entities |

| | |

Texas Transmission | | Texas Transmission Investment LLC, a limited liability company that owns a 19.75% equity interest in Oncor and is not affiliated with EFH Corp., any of EFH Corp.'s subsidiaries or any member of the Sponsor Group |

| | |

TRE | | Texas Reliability Entity, Inc., an independent organization that develops reliability standards for the ERCOT region and monitors and enforces compliance with NERC standards and monitors compliance with ERCOT protocols |

| | |

TXU Energy | | TXU Energy Retail Company LLC, a direct, wholly owned subsidiary of TCEH that is a REP in competitive areas of ERCOT and is engaged in the retail sale of electricity to residential and business customers |

| | |

US | | United States of America |

| | |

VIE | | variable interest entity |

PART I.

Items 1. and 2. BUSINESS AND PROPERTIES

References in this report to "we," "our," "us" and "the Company" are to EFH Corp. and/or its subsidiaries, as apparent in the context. See Glossary for descriptions of major subsidiaries and other defined terms.

EFH Corp. Business

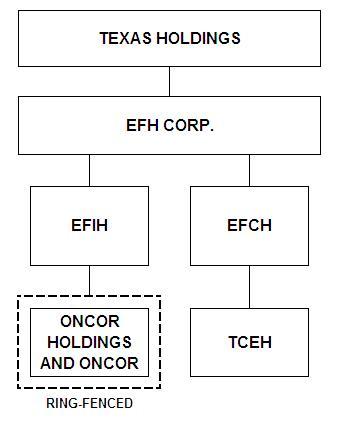

We are a Dallas, Texas-based energy company with a portfolio of competitive and regulated energy businesses. EFH Corp. is a holding company conducting its operations principally through its TCEH and Oncor subsidiaries. Collectively with its operating subsidiaries, EFH Corp. is the largest generator, retailer and distributor of electricity in Texas. Immediately below is an organization chart of the key subsidiaries discussed in this report.

Texas Holdings, which is controlled by the Sponsor Group, owns substantially all of the common stock of EFH Corp.

EFCH and EFIH are wholly owned by EFH Corp. TCEH is wholly owned by EFCH. EFIH indirectly holds an approximate 80% equity interest in Oncor.

EFCH's principal asset is its investment in TCEH. EFCH is a guarantor of a significant portion of TCEH's debt and $60 million principal amount of EFH Corp.'s debt.

TCEH, through its subsidiaries, is engaged in competitive electricity market activities largely in Texas, including electricity generation, wholesale energy sales and purchases, commodity risk management activities and retail electricity operations. Collectively, with its operating subsidiaries, TCEH is the largest generator and retailer of electricity in Texas.

TCEH owns 13,772 MW of electricity generation capacity in Texas, which consists of lignite/coal, nuclear and natural gas fueled generation facilities and accounts for approximately 16% of the generation capacity in ERCOT. TCEH provides competitive electricity and related services to approximately 1.7 million retail electricity customers in Texas.

EFIH's principal asset consists of its investment in Oncor Holdings, which owns 80% of the equity in Oncor. EFIH is also a guarantor of $60 million principal amount of EFH Corp.'s debt.

Oncor is engaged in regulated electricity transmission and distribution operations in Texas that are primarily regulated by the PUCT and, in certain instances, the FERC. Oncor provides transmission and distribution services to REPs, which sell electricity to residential and business consumers, as well as transmission services to electricity distribution companies, cooperatives and municipalities. Oncor operates the largest transmission and distribution system in Texas, delivering electricity to more than 3.3 million homes and businesses and operating more than 121,000 miles of transmission and distribution lines. A significant portion of Oncor's revenues represent fees for services provided to TCEH's retail electricity operations. Revenues from services provided to TCEH represented approximately 25% of Oncor's total reported consolidated revenues for each of the years ended December 31, 2015 and 2014.

EFH Corp. and Oncor have implemented certain structural and operational ring-fencing measures based on commitments made by Texas Holdings and Oncor to the PUCT as part of the Merger in 2007 to further enhance the credit quality of Oncor Holdings and Oncor. These measures serve to mitigate Oncor's and Oncor Holdings' credit exposure to the Texas Holdings Group with the intent to minimize the risk that a court would order any of the assets and liabilities of the Oncor Ring-Fenced Entities to be substantively consolidated with the assets and liabilities of any member of the Texas Holdings Group in the event any such member were to become a debtor in a bankruptcy case. As a result of these measures, EFH Corp. and EFIH do not control and do not consolidate Oncor Holdings and Oncor for financial reporting purposes. See Notes 1 and 4 to the Financial Statements for a description of the material features of these ring-fencing measures.

At December 31, 2015, we had approximately 8,860 full-time employees (including approximately 3,520 at Oncor). Approximately 2,510 employees are under collective bargaining agreements (including approximately 670 at Oncor).

Chapter 11 Cases

On April 29, 2014 (the Petition Date), EFH Corp. and the substantial majority of its direct and indirect subsidiaries, including EFIH, EFCH and TCEH but excluding the Oncor Ring-Fenced Entities (the Debtors), filed voluntary petitions for relief (the Bankruptcy Filing) under Chapter 11 of the United States Bankruptcy Code (the Bankruptcy Code) in the United States Bankruptcy Court for the District of Delaware (the Bankruptcy Court). During the pendency of the Bankruptcy Filing (the Chapter 11 Cases), the Debtors have operated, and continue to operate, their businesses as debtors-in-possession under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code. We intend to conduct our business operations in the normal course and maintain our focus on achieving excellence in customer service and meeting the needs of electricity consumers in Texas. In December 2015, the Bankruptcy Court entered the Confirmation Order approving the Debtors' Plan of Reorganization. The effectiveness of the Plan of Reorganization and our emergence from the Chapter 11 Cases is subject to several events and conditions that are not within our control. As a result, we cannot predict whether the Plan of Reorganization will become effective and/or when we will ultimately emerge from the Chapter 11 Cases.

Consistent with the ring-fencing measures discussed above, the assets and liabilities of the Oncor Ring-Fenced Entities have not been, and are not expected to be, substantively consolidated with the assets and liabilities of the Debtors in the Chapter 11 Cases.

For additional discussion of the Chapter 11 Cases and the effects on us, see Note 2 to the Financial Statements and Item 1A, Risk Factors – Risks Related to Chapter 11 Cases. See Note 12 to the Financial Statements for discussion of the DIP Facilities.

EFH Corp.'s Market

We operate primarily within the ERCOT electricity market. This market represents approximately 90% of the electricity consumption in Texas. ERCOT is the regional reliability coordinating organization for member electricity systems in Texas and the Independent System Operator of the interconnected transmission grid for those systems. ERCOT's membership consists of approximately 300 corporate and associate members, including electric cooperatives, municipal power agencies, independent generators, independent power marketers, investor-owned utilities, REPs and consumers.

The ERCOT market operates under reliability standards set by the NERC. The PUCT has primary jurisdiction over the ERCOT market to ensure adequacy and reliability of power supply across Texas' main interconnected transmission grid. ERCOT is responsible for scheduling power on the grid and maintaining reliable operations of the electricity supply system. Its responsibilities include centralized dispatch of the power pool and ensuring that electricity production and delivery are accurately accounted for among the generation resources and wholesale buyers and sellers. ERCOT also serves as agent for procuring ancillary services for those members who elect not to provide their own ancillary services.

Oncor, along with other owners of transmission and distribution facilities in Texas, assists ERCOT in its operations. Oncor has planning, design, construction, operation and maintenance responsibility for the portion of the transmission grid and for the load-serving substations it owns, primarily within its certificated distribution service area. Oncor participates with ERCOT and other ERCOT utilities in obtaining regulatory approvals and planning, designing, constructing and upgrading transmission lines in order to remove existing constraints and interconnect generation on the ERCOT transmission grid. The transmission line projects are necessary to meet reliability needs, support energy production and increase bulk power transfer capability.

Installed generation capacity in the ERCOT market for the year 2015 totaled approximately 87,400 MW, including approximately 750 MW of mothballed (idled) capacity and approximately 16,900 MW of wind and other resources that may not be available coincident with system need. Texas has more installed wind generation capacity than any other state in the US. In 2015, ERCOT's hourly demand peaked at 69,877 MW as compared to peak hourly demand of 66,454 MW in 2014. Of ERCOT's total installed capacity, approximately 53% is natural gas fueled generation, approximately 22% is lignite/coal fueled generation, approximately 6% is nuclear fueled generation and approximately 19% is generated by wind and other renewable resources.

The ERCOT market has limited interconnections to other markets in the US and Mexico, which currently limits potential imports into, and exports out of, the ERCOT market to 1,120 MW of generation capacity (or approximately 2% of peak demand). In addition, wholesale transactions within the ERCOT market are generally not subject to regulation by the FERC.

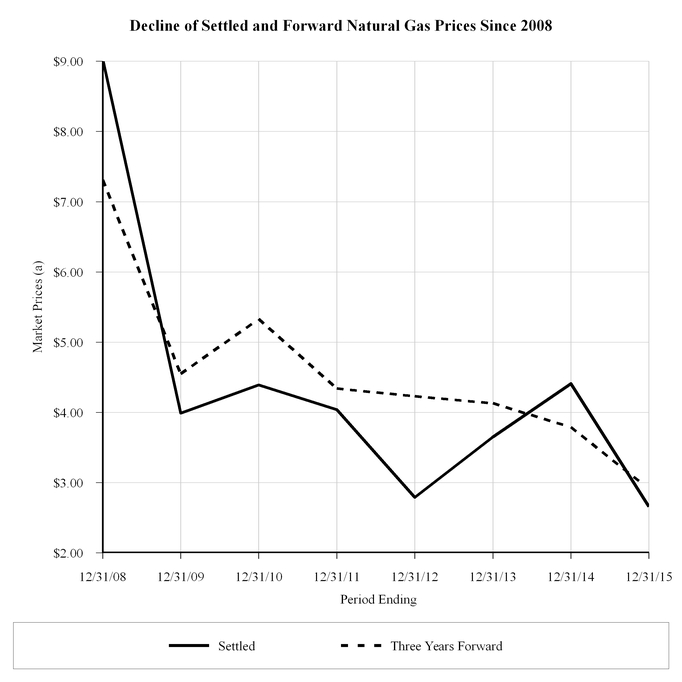

Natural gas fueled generation is the predominant electricity capacity resource (approximately 53%) in the ERCOT market and accounted for approximately 48% of the electricity produced in the ERCOT market in 2015. Because of the significant amount of natural gas fueled capacity and the ability of such facilities to more readily increase or decrease production when compared to nuclear and lignite/coal fueled generation, marginal demand for electricity in ERCOT is usually met by natural gas fueled facilities. As a result, wholesale electricity prices in ERCOT have generally moved with natural gas prices.

EFH Corp.'s Business Focus

Each of our businesses focuses its operations on key safety, reliability, economic and environmental drivers for that business, as described below:

| |

• | TCEH focuses on optimizing and developing its generation fleet to safely provide reliable electricity supply in a cost-effective manner and in consideration of environmental impacts, hedging its commodity price and volume exposure and providing high quality service and innovative energy products to retail and wholesale customers. |

| |

• | Oncor focuses on delivering electricity in a safe and reliable manner, minimizing service interruptions and investing in its transmission and distribution infrastructure to maintain its system, serving its growing customer base with a modernized grid and supporting energy production. |

Seasonality

Our revenues and results of operations are subject to seasonality, weather conditions and other electricity usage drivers, with revenues being highest in the summer.

Operating Segments

We have aligned and report our business activities as two operating segments: the Competitive Electric segment, consisting largely of TCEH and its subsidiaries, and the Regulated Delivery segment, consisting largely of our investment in Oncor. See Note 20 to the Financial Statements for additional financial information for the segments.

Competitive Electric Segment

Key activities, including risk management related to commodity price and availability, as well as electricity sourcing for our retail and wholesale customers, are performed on an integrated basis. This integration strategy, the execution of which is discussed below in describing the activities of our wholesale operations, is a key consideration in our operating segment determination. Our ability to balance the electricity demand requirements of our retail and wholesale customers along with the supply from our generation sources is a critical activity that has significant impacts on our profitability. For purposes of market identity and operational accountability, our operations are grouped and identified as Luminant, which is engaged in electricity generation and wholesale market activities, and TXU Energy, which is engaged in retail electricity activities. These activities are conducted through separate legal entities.

Luminant — Luminant's existing fleet consists of 36 electricity generation units in Texas, all of which are owned, with total installed nameplate generating capacity as shown in the table below:

|

| | | | | | | | |

Fuel Type | Installed Nameplate Capacity (MW) | | Number of

Plant Sites | | Number of

Units |

Nuclear | 2,300 |

| | 1 |

| | 2 |

|

Lignite/coal | 8,017 |

| | 5 |

| | 12 |

|

Natural gas (a) | 3,455 |

| | 7 |

| | 22 |

|

Total | 13,772 |

| | 13 |

| | 36 |

|

___________

| |

(a) | See La Frontera CCGTs below for discussion of an agreement to purchase 2,988 MW of natural gas fueled generation capacity not included above. |

Our generation units are located primarily on owned land. Nuclear and lignite/coal fueled units are generally scheduled to run at capacity except for periods of scheduled maintenance activities; however, we reduce production from certain lignite/coal fueled generation units, referred to as economic backdown, during periods when wholesale electricity prices are less than the unit's variable production costs. In addition, we have implemented seasonal suspensions of operations of certain lignite/coal fueled generation units because of the low wholesale electricity price environment. The natural gas fueled generation units supplement the nuclear and lignite/coal fueled generation capacity in meeting consumption in peak demand periods as production from certain of these units, particularly combustion-turbine units, can be more readily ramped up or down as demand warrants.

Nuclear Generation Operations — Luminant operates two nuclear generation units at the Comanche Peak plant site, each of which is designed for a capacity of 1,150 MW. Comanche Peak Unit 1 and Unit 2 went into commercial operation in 1990 and 1993, respectively, and are generally operated at full capacity. Refueling (nuclear fuel assembly replacement) outages for each unit are scheduled to occur every eighteen months during the spring or fall off-peak demand periods. Every three years, the refueling cycle results in the refueling of both units during the same year, the latest of which occurred in 2014. While one unit is undergoing a refueling outage, the remaining unit is intended to operate at full capacity. During a refueling outage, other maintenance, modification and testing activities are completed that cannot be accomplished when the unit is in operation. Over the last three years the refueling outage period per unit has ranged from 22 to 54 days. The Comanche Peak facility operated at a capacity factor of 99%, 92.5% and 101.7% in 2015, 2014 and 2013, respectively.

Luminant has contracts in place for the majority of its nuclear fuel requirements for 2016. Luminant has contracts in place for substantially all of its nuclear fuel fabrication and enrichment services through 2018. As part of the Chapter 11 Cases, Luminant has terminated or renegotiated certain nuclear fuel contracts to provide for better economic or operational terms and conditions. Luminant does not anticipate any significant difficulties in acquiring uranium and contracting for associated conversion, enrichment and fabrication services in the foreseeable future.

The nuclear industry has developed ways to store used nuclear fuel on site at nuclear generation facilities, primarily through the use of dry cask storage, since there are no facilities for reprocessing or disposal of used nuclear fuel currently in operation in the US. Luminant stores its used nuclear fuel on-site in storage pools or dry cask storage facilities and believes its on-site used nuclear fuel storage capability is sufficient for the foreseeable future.

Luminant expects decommissioning activities to begin in 2050 for Comanche Peak Unit 1 and 2053 for Unit 2 and common facilities. Decommissioning costs will be paid from a decommissioning trust that, pursuant to Texas law, is intended to be fully funded from Oncor's customers through an ongoing delivery surcharge. (See Note 21 to the Financial Statements for discussion of the decommissioning trust fund.) Under applicable law, the Chapter 11 Cases are not expected to have any effect on the collection of such surcharge or the ongoing viability of the decommissioning trust.

Nuclear insurance provisions are discussed in Note 14 to the Financial Statements.

Nuclear Generation Development — In 2008, we filed a combined operating license application with the NRC for two new nuclear generation units, each with approximately 1,700 MW (gross capacity), at our existing Comanche Peak nuclear plant site. In connection with the filing of the application, in 2009, subsidiaries of TCEH and Mitsubishi Heavy Industries Ltd. (MHI) formed a joint venture, Comanche Peak Nuclear Power Company LLC (CPNPC), to further the development of the two new nuclear generation units using MHI's US-Advanced Pressurized Water Reactor (US-APWR) technology. In the fourth quarter 2014, MHI withdrew from the joint venture, and the TCEH subsidiary now owns 100% of CPNPC.

As a result of MHI's withdrawal, Luminant suspended all reviews by the NRC associated with the combined operating license application. MHI expressed to the NRC its continuing commitment to obtaining an NRC design certification for its technology. See Note 9 to the Financial Statements for discussion of impairment of the joint venture's assets in 2013.

Lignite/Coal Fueled Generation Operations — Luminant's lignite/coal fueled generation fleet capacity totals 8,017 MW and consists of the Big Brown (2 units), Monticello (3 units), Martin Lake (3 units), Oak Grove (2 units) and Sandow (2 units) plant sites. Maintenance outages at these units are scheduled during the spring or fall off-peak demand periods. Over the last three years, the total annual scheduled and unscheduled outages per unit averaged 33 days in duration. Luminant's lignite/coal fueled generation fleet operated at a capacity factor of 59.5% in 2015, 69.6% in 2014 and 74.1% in 2013. This performance reflects increased economic backdown of the units and the seasonal suspension of certain units due to the persistent low wholesale power price environment in ERCOT.

Luminant meets all of its fuel requirements at its Oak Grove and Sandow generation facilities with lignite that it mines. Luminant meets its fuel requirements for its Big Brown, Monticello and Martin Lake generation units by blending lignite it mines with coal purchased from multiple suppliers under contracts of various lengths and transported from the Powder River Basin to Luminant's generation plants by railcar. In 2015, approximately 48% of the fuel used at the Big Brown, Monticello and Martin Lake generation facilities and 69% of the fuel used at all of Luminant's lignite/coal fueled generation facilities was supplied from surface minable lignite reserves dedicated to our generation plants, which are located adjacent to the reserves.

As a result of projected mining development costs, current economic forecasts and regulatory uncertainty, in 2014, Luminant decided to transition the fuel plans at its Big Brown and Monticello generation facilities to be fully fueled with coal from the Powder River Basin. As a result, it plans to discontinue lignite mining operations at these sites once mining and reclamation of current mine sites is complete. Lignite mining and the majority of reclamation activities at these facilities is expected to be completed by the end of 2020 unless economic forecasts and increased regulatory certainty justify additional mine development. See Note 9 to the Financial Statements for discussion of the impairment of certain generation facilities and related mining facilities and the write off of certain mine development costs.

See Environmental Regulations and Related Considerations – Sulfur Dioxide, Nitrogen Oxide and Mercury Air Emissions for discussion of potential effects of recent EPA rules on future operations of our generation units.

Natural Gas Fueled Generation Operations — Luminant owns a fleet of 22 natural gas fueled generation units, of which 7 are steam generation units totaling 2,480 MW of capacity and 15 are combustion turbine generation units totaling 975 MW of capacity. The natural gas fueled units predominantly serve as peaking units that can be ramped up or down to balance electricity supply and demand.

La Frontera CCGTs — In November 2015, Luminant entered into a purchase and sale agreement with La Frontera Ventures, LLC, a subsidiary of NextEra Energy, Inc., to purchase all of the membership interests in La Frontera Holdings, LLC, the indirect owner of two combined cycle gas turbine (CCGT) natural gas fueled generation facilities totaling 2,988 MW of capacity located in ERCOT. The closing of this transaction is subject to several customary closing conditions. For additional discussion, see Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations – Significant Activities and Events and Items Influencing Future Performance – La Frontera CCGTs.

Natural Gas Fueled Generation Development — In recent years, the TCEQ granted air permits to Luminant to build natural gas fueled generation units at certain of our existing plant sites. We believe current market conditions do not provide adequate economic returns for the development or construction of these facilities; however, we believe additional generation resources will be needed in the future to support electricity demand growth and reliability in the ERCOT market. The following table summarizes the potential facilities that form the basis of such air permits.

|

| | | | | | | |

Plant Site | | Type of Generation Technology | | Number of Units | Total Capacity | | Status of Air and Greenhouse Gas Permits Filed with TCEQ |

DeCordova | | Combustion Turbine | | 2 | 420 MW to 460 MW | | Granted |

DeCordova (a) | | Combined Cycle | | 1 | 730 MW to 810 MW | | Pending |

Eagle Mountain | | Combined Cycle | | 1 | 730 MW to 810 MW | | Pending |

Lake Creek | | Combustion Turbine | | 2 | 420 MW to 460 MW | | Granted |

Permian Basin | | Combustion Turbine | | 2 | 420 MW to 460 MW | | Granted |

Tradinghouse | | Combustion Turbine | | 2 | 420 MW to 460 MW | | Granted |

Tradinghouse (a) | | Combined Cycle | | 2 | 1460 MW to 1620 MW | | Pending |

Valley | | Combustion Turbine | | 2 | 420 MW to 460 MW | | Granted |

___________

| |

(a) | These potential units would be an alternative to the potential combustion turbine units at such sites, respectively. |

Wholesale Operations — Luminant's wholesale operations play a pivotal role in our Competitive Electric segment by optimally dispatching the generation fleet, procuring fuels for the generation fleet, sourcing all of TXU Energy's electricity requirements and managing commodity risk for the retail and wholesale electricity sales operations.

Our electricity price exposure is managed across the complementary generation, wholesale and retail operations on an integrated basis. Under this approach, Luminant's wholesale operations manage the risks of imbalances between generation supply and sales demand of both wholesale and retail customers, as well as exposures to natural gas price movements and market heat rate changes (variations in the relationships between natural gas prices and wholesale electricity prices), through wholesale market activities that include physical purchases and sales and transacting in financial instruments.

Luminant's wholesale operations provide TXU Energy and other retail and wholesale customers with electricity-related services to meet their demands and the operating requirements of ERCOT. In consideration of electricity generation resource availability and consumer demand levels that can be highly variable, as well as opportunities to meet longer-term objectives of larger wholesale market participants, Luminant buys and sells electricity in short-term transactions and executes longer-term forward electricity purchase and sales agreements. Luminant is also a significant purchaser of wind-generated electricity in Texas and the US with approximately 390 MW of existing wind power under contract.

Fuel price exposure, primarily relating to Powder River Basin coal, natural gas, uranium and fuel oil, as well as fuel transportation costs, is managed primarily through short- and long-term contracts for physical delivery of fuel as well as financial contracts utilized to hedge price risk.

In its hedging activities, Luminant enters into contracts for the physical delivery of electricity and fuel commodities, exchange traded and over-the-counter financial contracts and bilateral contracts with other wholesale market participants, including generators and end-use customers. A significant element of these activities involves natural gas hedging, designed to reduce exposure to changes in future electricity prices due to changes in the price of natural gas, principally utilizing natural gas-related financial instruments.

The wholesale operations also dispatch Luminant's available generation capacity. These dispatching activities include economic backdown of lignite/coal fueled units and ramping up and down of natural gas fueled units as market conditions warrant. Luminant's dispatching activities are performed on a centrally managed real-time basis optimizing operational activities across the fleet and interfacing with various wholesale market channels. In addition, the wholesale operations manage the fuel procurement requirements for Luminant's fossil fuel and nuclear generation facilities.

Luminant's wholesale operations manage exposure to wholesale commodity and credit-related risk within established transactional risk management policies, limits and controls. These policies, limits and controls have been structured so that they are practical in application and consistent with stated business objectives. Risk management processes include capturing transaction data, monitoring transaction types and notional limits, reviewing and managing credit risk, performing and validating valuations and reporting exposures on a daily basis using risk management information systems designed to support a large transactional portfolio. Risk management also includes a disciplinary program to address any violations of the policies and periodic reviews of these policies to ensure they are responsive to changing market and business conditions.

TXU Energy — TXU Energy serves approximately 1.7 million residential and commercial retail electricity customers in Texas. Approximately 65% of our reported retail revenues in 2015 represented sales to residential customers. Texas is one of the fastest growing states in the nation with a diverse economy and, as a result, has attracted a number of competitors into the retail electricity market; consequently, competition is robust. TXU Energy, as an active participant in this competitive market, provides retail electric service to all areas of the ERCOT market now open to competition, including the Dallas/Fort Worth area, Houston, Corpus Christi, and certain other parts of south Texas, and holds an approximately 25% and 17% share of the residential and business customers in ERCOT, respectively. TXU Energy competitively markets its services to add new customers and retain its existing customer base, as well as opportunistically acquire customers from other REPs. There are more than 100 REPs certified to compete within the ERCOT region.

TXU Energy's strategy focuses on providing its customers with high quality customer service and creating new products and services to meet customer needs; accordingly, customer care enhancements are implemented on an ongoing basis to continually improve customer satisfaction. TXU Energy offers a wide range of innovative residential products to meet varying customer needs.

Regulation — Luminant is an exempt wholesale generator under the Energy Policy Act of 2005 and is subject to the jurisdiction of the NRC with respect to its nuclear generation plant. NRC regulations govern the granting of licenses for the construction and operation of nuclear fueled generation facilities and subject such facilities to continuing review and regulation. In addition, Luminant is subject to the jurisdiction of the RCT's oversight of its lignite mining and reclamation operations.

Luminant is also subject to the jurisdiction of the PUCT's oversight of the competitive ERCOT wholesale electricity market. PUCT rules establish a framework for and robust oversight of wholesale electricity pricing and market behavior. Luminant is also subject to the requirements of the ERCOT Nodal Protocols as well as reliability standards adopted and enforced by the TRE and the NERC, including NERC critical infrastructure protection (CIP) standards. Luminant is also subject to the authority of the CFTC as it continues to implement rules and provide oversight vested in the agency by the Wall Street Reform and Consumer Protection Act of 2010, particularly Title VII, which deals with over-the-counter derivative markets.

TXU Energy is a licensed REP under the Texas Electric Choice Act and is subject to the jurisdiction of the PUCT with respect to provision of electricity service in ERCOT. PUCT rules govern the granting of licenses for REPs, including oversight but not setting of retail prices. TXU Energy is also subject to the requirements of the ERCOT Nodal Protocols.

Regulated Delivery Segment

The Regulated Delivery segment consists largely of our investment in Oncor. Oncor is a regulated electricity transmission and distribution company that provides the service of delivering electricity safely, reliably and economically to end-use consumers through its electrical systems, as well as providing transmission grid connections to merchant generation facilities and interconnections to other transmission grids in Texas. Oncor's service territory comprises 91 counties and more than 400 incorporated municipalities, including Dallas/Fort Worth and surrounding suburbs, as well as Waco, Wichita Falls, Odessa, Midland, Tyler and Killeen. Oncor's transmission and distribution assets are located principally in the north-central, eastern and western parts of Texas. Most of Oncor's power lines have been constructed over lands of others pursuant to easements or along public highways, streets and rights-of-way as permitted by law. Oncor's transmission and distribution rates are regulated by the PUCT.

Oncor is not a seller of electricity, nor does it purchase electricity for resale. It provides transmission services to electricity distribution companies, cooperatives and municipalities. It provides distribution services to REPs, including subsidiaries of TCEH, which sell electricity to residential, business and other consumers. Oncor is also subject to the requirements of the ERCOT Nodal Protocols as well as reliability standards adopted and enforced by the TRE and the NERC, including NERC CIP standards.

Performance — Oncor achieved or exceeded market performance protocols in 12 out of 14 PUCT market metrics in 2015. These metrics measure the success of transmission and distribution companies in facilitating customer transactions in the competitive Texas electricity market.

Investing in Infrastructure and Technology — In 2015, Oncor invested approximately $1.2 billion in its network to upgrade the transmission system and associated facilities, to extend the distribution infrastructure and to pursue certain initiatives in infrastructure maintenance and information technology.

Electricity Transmission — Oncor's electricity transmission business is responsible for the safe and reliable operations of its transmission network and substations. These responsibilities consist of the construction and maintenance of transmission facilities and substations and the monitoring, controlling and dispatching of high-voltage electricity over Oncor's transmission facilities in coordination with ERCOT.

Oncor is a member of ERCOT, and its transmission business actively assists the operations of ERCOT and market participants. Through its transmission business, Oncor participates with ERCOT and other member utilities to plan, design, construct and operate new transmission lines, with regulatory approval, necessary to maintain reliability, interconnect to merchant generation facilities, increase bulk power transfer capability and minimize limitations and constraints on the ERCOT transmission grid.

Transmission revenues are provided under tariffs approved by either the PUCT or, to a small degree related to an interconnection to other markets, the FERC. Other services offered by Oncor through its transmission business include system impact studies, facilities studies, transformation service and maintenance of transformer equipment, substations and transmission lines owned by other parties.

PURA allows Oncor to update its transmission rates periodically to reflect changes in invested capital. This capital tracker provision encourages investment in the transmission system to help ensure reliability and efficiency by allowing for timely recovery of and return on new transmission investments.

At December 31, 2015, Oncor's transmission facilities included 6,410 circuit miles of 345kV transmission lines and 9,536 circuit miles of 138kV and 69kV transmission lines. Sixty-nine generation facilities totaling 36,991 MW were directly connected to Oncor's transmission system at December 31, 2015, and 298 transmission stations and 717 distribution substations were served from Oncor's transmission system.

At December 31, 2015, Oncor's transmission facilities had the following connections to other transmission grids in Texas:

|

| | | | | | | | |

| Number of Interconnected Lines |

Grid Connections | 345kV | | 138kV | | 69kV |

Brazos Electric Power Cooperative, Inc. | 8 |

| | 112 |

| | 25 |

|

Rayburn Country Electric Cooperative, Inc. | — |

| | 40 |

| | 6 |

|

Lower Colorado River Authority | 9 |

| | 27 |

| | 2 |

|

Texas New Mexico Power | 4 |

| | 10 |

| | 12 |

|

Tex-La Electric Cooperative of Texas, Inc. | — |

| | 12 |

| | 1 |

|

American Electric Power Company, Inc. (a) | 5 |

| | 5 |

| | 8 |

|

Texas Municipal Power Agency | 7 |

| | 6 |

| | — |

|

Lone Star Transmission | 12 |

| | — |

| | — |

|

Centerpoint Energy Inc. | 8 |

| | — |

| | — |

|

Sharyland Utilities, L.P. | 1 |

| | 4 |

| | — |

|

Electric Transmission Texas, LLC | 8 |

| | 1 |

| | — |

|

Other small systems operating wholly within Texas | 6 |

| | 6 |

| | 3 |

|

___________

| |

(a) | One of the 345kV lines is an asynchronous high-voltage direct current connection with the Southwest Power Pool. |

Electricity Distribution — Oncor's electricity distribution business is responsible for the overall safe and efficient operation of distribution facilities, including electricity delivery, power quality and system reliability. These responsibilities consist of the ownership, management, construction, maintenance and operation of the distribution system within Oncor's certificated service area. Oncor's distribution system receives electricity from the transmission system through substations and distributes electricity to end-users and wholesale customers through 3,237 distribution feeders.

The Oncor distribution system included over 3.3 million points of delivery at December 31, 2015. Over the past five years, the number of distribution system points of delivery served by Oncor, excluding lighting sites, grew an average of 1.39% per year. Oncor added approximately 49,200 points of delivery in 2015.

The Oncor distribution system consists of 56,956 miles of overhead primary conductors, 21,323 miles of overhead secondary and street light conductors, 16,834 miles of underground primary conductors and 10,415 miles of underground secondary and street light conductors. The majority of the distribution system operates at 25kV and 12.5kV.

Oncor's distribution revenues from residential and small business users are based on actual monthly consumption (kWh), and, depending on size and annual load factor, revenues from large commercial and industrial users are based either on actual monthly demand (kilowatts) or the greater of actual monthly demand (kilowatts) or 80% of peak monthly demand during the prior eleven months.

The PUCT allows Oncor to file, under certain circumstances, up to four rate adjustments between rate reviews to recover distribution-related investments on an interim basis. Oncor has not filed any such distribution-related rate adjustments to date.

Customers — Oncor's transmission customers consist of municipalities, electric cooperatives and other distribution companies. Oncor's distribution customers consist of approximately 80 REPs, including TCEH's retail sales operations and certain electric cooperatives in Oncor's certificated service area. Revenues from services provided to TCEH represented approximately 25% of Oncor's total reported consolidated revenues for 2015. Revenues from REP subsidiaries of one nonaffiliated entity collectively represented approximately 17% of Oncor's total reported consolidated revenues for 2015. No other customer represented more than 10% of Oncor's total operating revenues. The consumers of the electricity delivered by Oncor are free to choose their electricity supplier from REPs who compete for their business.

Regulation and Rates — As its operations are wholly within Texas, Oncor is not a public utility as defined in the Federal Power Act and, as a result, it is not subject to general regulation under that Act. However, Oncor is subject to reliability standards adopted and enforced by the TRE and the NERC, including NERC CIP standards, under the Federal Power Act.

The PUCT has original jurisdiction over transmission and distribution rates and services in unincorporated areas and in those municipalities that have ceded original jurisdiction to the PUCT and has exclusive appellate jurisdiction to review the rate and service orders and ordinances of municipalities. Generally, PURA prohibits the collection of any rates or charges by a public utility (as defined by PURA) that does not have the prior approval of the appropriate regulatory authority (i.e., the PUCT or the municipality with original jurisdiction).

At the state level, PURA requires owners or operators of transmission facilities to provide open-access wholesale transmission services to third parties at rates and terms that are nondiscriminatory and comparable to the rates and terms of the utility's own use of its system. The PUCT has adopted rules implementing the state open-access requirements for all utilities that are subject to the PUCT's jurisdiction over transmission services, including Oncor.

Securitization Bonds — Oncor's operations include its wholly owned, bankruptcy-remote financing subsidiary, Oncor Electric Delivery Transition Bond Company LLC. This financing subsidiary was organized for the limited purpose of issuing certain securitization (transition) bonds in 2003 and 2004. Oncor Electric Delivery Transition Bond Company LLC issued $1.3 billion principal amount of transition bonds to recover generation-related regulatory asset stranded costs and other qualified costs under an order issued by the PUCT in 2002. At December 31, 2015, aggregate principal amounts of transition bonds outstanding, which mature in May 2016, totaled $41 million.

Environmental Regulations and Related Considerations

Global Climate Change

Background — There is a debate nationally and internationally about global climate change and how greenhouse gas (GHG) emissions, such as CO2, might contribute to global climate change. GHG emissions from the combustion of fossil fuels, primarily by our lignite/coal fueled generation plants, represent the substantial majority of our total GHG emissions. CO2, methane and nitrous oxide are emitted in this combustion process, with CO2 representing the largest portion of these GHG emissions. We estimate that our generation facilities produced 50 million short tons of CO2 in 2015. Our financial condition, liquidity or results of operations could be materially affected by the enactment of statutes or regulations that mandate a reduction in GHG emissions or that impose financial penalties, costs or taxes on those that produce GHG emissions. See Item 1A, Risk Factors for additional discussion of risks posed to us regarding global climate change regulation.

Greenhouse Gas Emissions Regulation — Federal Level — Over the past several years, the EPA has taken a number of actions regarding GHG emissions. In December 2009, the EPA issued a finding that GHG emissions endanger human health and the environment and that emissions from motor vehicles contribute to that endangerment. The EPA's finding required it to begin regulating GHG emissions from motor vehicles, and the EPA ultimately extended regulation of GHG emissions to stationary sources under existing provisions of the federal Clean Air Act (CAA). In March 2010, the EPA determined that the CAA's Prevention of Significant Deterioration (PSD) program permit requirements would apply to newly identified pollutants such as GHGs when a nation-wide rule requiring the control of a pollutant takes effect. Under this determination, PSD permitting requirements became applicable to GHG emissions from planned stationary sources or planned modifications to stationary sources that had not been issued a PSD permit by January 2011. In June 2010, the EPA finalized its so-called "tailoring rule" that established new thresholds of GHG emissions for the applicability of permits under the CAA for stationary sources, including our electricity generation facilities. The EPA's tailoring rule defined a threshold of GHG emissions for determining applicability of the CAA's PSD and Title V permitting programs at levels greater than the emission thresholds contained in the CAA. In June 2014, the US Supreme Court ruled that the EPA's regulation of GHG emissions from motor vehicles did not mandate that the EPA implement permit requirements for stationary source GHGs, but upheld the EPA's permitting program in situations where the source is already required to permit emissions that have historically been covered under the CAA. The case was remanded to the D.C. Circuit Court for further proceedings consistent with the US Supreme Court's decision. In an April 2014 order, the D.C. Circuit ordered that the EPA's regulations be vacated to the extent that they require a "GHG-only" stationary source to obtain a PSD or Title V permit. It further ordered the EPA to rescind or revise its regulations as soon as practical and to consider whether any further regulatory changes are needed to implement the US Supreme Court's ruling. In May 2014, the EPA issued a direct final rule to provide a mechanism for rescinding permits issued that were issued because of "GHG-only" emission triggers. The EPA has projected that it will propose a rule in early 2016 establishing modification thresholds for GHG emissions increases that are concurrent with emissions increases of historically covered pollutants. Current EPA guidance prescribes the use of tailoring rule thresholds.

The EPA has finalized two rules to address greenhouse gas (GHG) emissions from new, modified and reconstructed units, and existing electricity generation plants. The final rules for new and modified or reconstructed units were released in August 2015. The final rule for existing plants, also released in August 2015, would establish state-specific emission rate goals to reduce nationwide CO2 emissions related to affected electricity generation units by over 30% from 2012 emission levels by 2030. In October 2015, the final rules, including the rule for existing plants, were published in the Federal Register. In August 2015, the EPA proposed model rules and federal plan requirements for states to consider as they develop state plans to comply with the rules for GHG emissions. A federal plan would then be deemed final for a state if a state fails to submit a state plan by the deadlines established in the CAA for existing plants or if the EPA disapproves a submitted state plan. We filed comments on the federal plan proposal in January 2016. The EPA is expected to finalize the model rule by the summer of 2016. While we cannot predict the outcome of this rulemaking and legal proceedings on our results of operations, liquidity or financial condition, the impacts could be material. See the discussion of existing litigation related to GHG emissions rulemaking in Note 14 to the Financial Statements.

A number of members of the US Congress from both parties have introduced legislation to either block or delay EPA regulation of GHGs under the CAA, and legislative activity in this area in the future is possible.

State and Regional Level — There are currently no Texas state regulations in effect concerning GHGs, except for permitting in situations where the source is already required to permit emissions that have been traditionally covered by the CAA, and there are no regional initiatives concerning GHGs in which the State of Texas is a participant.

EFH Corp.'s Voluntary Energy Efficiency, Renewable Energy, and Global Climate Change Efforts — We are actively engaged in, considering, or expect to be actively engaged in, business activities that could result in reduced GHG emissions including:

| |

• | Investing in Energy Efficiency and Related Initiatives by Our Competitive Businesses — Since the Merger, our competitive businesses have invested more than $100 million in energy efficiency and related initiatives, including software- and hardware-based services deployed behind the meter. These programs leverage advanced meter interval data and in-home devices to provide usage and other information to customers. Examples of these initiatives include: the TXU Energy MyEnergy DashboardSM, a set of online tools that show residential customers how and when they use electricity; the Online Energy Store providing customers cost-effective energy-saving products; the iThermostat, a web-enabled programmable thermostat; TXU Energy Right Time Pricing ProductsSM, including time-based electricity rates; the provision of GreenBack rebates to business customers for purchasing new energy efficient equipment for their facilities; the TXU Energy Electricity Usage Report, a weekly email that contains charts and graphs that give customers insight to better control their electricity usage and bills; and home warranty service plans that cover repair or replacement for various appliances such as heating and cooling systems in homes. |

| |

• | Purchasing Electricity from Renewable Sources — We provide electricity from renewable sources by purchasing wind and solar power. Our total wind power portfolio is currently approximately 390 MW. In addition, we have agreed to purchase up to 116 MW of solar power beginning in late 2016. We also purchase additional renewable energy credits (RECs) to support sales of renewable power to our customers. |

| |

• | Promoting the Use of Solar Power — TXU Energy provides qualified customers, through its TXU Solar program, the ability to purchase or finance the addition of solar panels to their homes. TXU Energy also purchases surplus renewable distributed generation from qualified customers with on-site renewable generation. In addition, customers ineligible for solar panels can enroll in rate plans such as TXU Energy Solar AdvantageSM,, backed by 100% solar energy through RECs purchased from Texas solar plants. |

| |

• | New Energy Technologies — We continue to evaluate the development and commercialization of cleaner power facility technologies, including technologies that support capture and/or reduction of CO2; incremental renewable sources of electricity, including wind and solar power; energy storage, including advanced battery and compressed air storage, as well as related technologies that seek to lower emissions intensity. Additionally, we continue to explore and participate in opportunities to accelerate the adoption of electric cars and plug-in hybrid electric vehicles that have the potential to reduce overall GHG emissions and are furthering the advance of such vehicles by supporting, and helping develop infrastructure for, networks of charging stations for electric vehicles. |

| |

• | Offsetting GHG Emissions by Planting Trees — We are engaged in a number of tree planting programs that offset GHG emissions, resulting in the planting of over 1.2 million trees in 2015. The majority of these trees were planted as part of our mining reclamation efforts but also include TXU Energy's Urban Tree Farm program, which has planted more than 218,000 trees since its inception in 2002. |

| |

• | Investing in Energy Efficiency Initiatives by Oncor — Oncor's technology upgrade initiatives include development of a modernized grid through advanced digital communication, data management, real-time monitoring and outage detection capabilities to take advantage of Oncor's deployment of advanced digital metering equipment. Advanced meters facilitate automated demand side management, which allows consumers to monitor the amount of electricity they are consuming and adjust their electricity consumption habits. |

| |

• | Participating in the CREZ Program — Oncor has largely completed construction of CREZ transmission facilities (at a cost of approximately $2.0 billion) that are designed to connect existing and future renewable energy facilities to the electricity transmission system in ERCOT. |

Sulfur Dioxide, Nitrogen Oxide and Mercury Air Emissions

Air Transport Regulations: Cross-State Air Pollution Rule (CSAPR) — The CSAPR implements the provisions of the Clean Air Act requiring states to reduce emissions of sulfur dioxide (SO2) and nitrogen oxide (NOX) that significantly contribute to other states failing to attain or maintain compliance with the EPA's National Ambient Air Quality Standards (NAAQS) for fine particulate matter and/or ozone.

The CSAPR became effective January 1, 2015. In July 2015, following a remand of the case from the US Supreme Court to consider further legal challenges, the D.C. Circuit Court unanimously ruled in favor of us and other petitioners, holding that the CSAPR emissions budgets over-controlled Texas and other states. The D.C. Circuit Court remanded those states' budgets to the EPA for reconsideration. While we planned to participate in the EPA's reconsideration process to develop increased budgets that do not over-control Texas, the EPA instead responded to the remand by updating the budget for the 2008 ozone standard with a new rulemaking without explicitly addressing the issues of over-control of the 1997 standard. Comments on the EPA's proposal were submitted by Luminant in February 2016. While we cannot predict the outcome of future proceedings related to the CSAPR, including the EPA's reconsideration of the CSAPR emissions budgets for affected states, based upon our current operating plans, we do not believe that the CSAPR will cause any material impacts on our operations, liquidity or financial condition.

In November 2015, the EPA proposed an update to the CSAPR to address interstate emission transport to areas projected to be in nonattainment with the 2008 eight-hour ozone standard in 2017. Texas is modeled to contribute significantly to several metropolitan areas in northern and northeastern states. The proposed rule would reduce our ozone season CSAPR NOX allowances by approximately 10% in 2017. Luminant submitted comments on the proposal in February 2016.

Mercury and Air Toxics Standard (MATS) — The MATS rule regulates the emissions of mercury, nonmercury metals, hazardous organic compounds and acid gases. Any additional control equipment retrofits on our lignite/coal fueled generation units required to comply with the MATS rule were required to be installed by April 2015 unless a one-year extension was granted. The TCEQ granted one-year MATS compliance extensions for our Big Brown, Martin Lake, Monticello and Sandow 4 generation facilities, which require those facilities to begin compliance in April 2016.

In June 2015, the US Supreme Court reversed and remanded the MATS rule back to the D.C. Circuit Court for further action after considering the question of whether the EPA unreasonably refused to consider costs in determining whether it is appropriate to regulate hazardous air pollutants emitted by electric utilities. The US Supreme Court held that the EPA must consider cost, including cost of compliance, before deciding whether regulation is appropriate and necessary. In September 2015, certain states and industry petitioners, including a subsidiary of TCEH, filed a motion in the D.C. Circuit Court requesting that the court vacate the MATS rule. In December 2015, the D.C. Circuit Court issued an order remanding the MATS rule without vacatur to the EPA for further consideration based on the EPA's representation that it will finalize the necessary and appropriate finding by April 2016. The MATS rule remains in effect, and generation units must continue to comply pending further action from the EPA. While we cannot predict the outcome of future proceedings related to the MATS rule, we do not expect the MATS rule will have any material impact on our results of operations, liquidity or financial condition.

Regional Haze — The Regional Haze Program of the CAA establishes "as a national goal the prevention of any future, and the remedying of any existing, impairment of visibility in mandatory Class I federal areas, like national parks, which impairment results from man-made pollution." There are two components to the Regional Haze Program. First, states must establish goals for reasonable progress for Class I federal areas within the state and establish long-term strategies to reach those goals and to assist Class I federal areas in neighboring states to achieve reasonable progress set by those states towards a goal of natural visibility by 2064. Second, electricity generation units built between 1962 and 1977 are subject to best available retrofit technology (BART) standards designed to improve visibility. BART reductions of SO2 and NOX are required either on a unit-by-unit basis or are deemed satisfied by state participation in an EPA-approved regional trading program such as the CSAPR. In February 2009, the TCEQ submitted a State Implementation Plan (SIP) concerning regional haze (Regional Haze SIP) to the EPA. In December 2011, the EPA proposed a limited disapproval of the Regional Haze SIP due to its reliance on the Clean Air Interstate Rule (CAIR) instead of the EPA's replacement CSAPR program. In August 2012, we filed a petition for review in the US Court of Appeals for the Fifth Circuit (Fifth Circuit Court) challenging the EPA's limited disapproval of the Regional Haze SIP on the grounds that the CAIR continued in effect pending the D.C. Circuit Court's decision in the CSAPR litigation. In September 2012, we filed a petition to intervene in a case filed by industry groups and other states and private parties in the D.C. Circuit Court challenging the EPA's limited disapproval and issuance of a Federal Implementation Plan (FIP) regarding the regional haze BART program. The Fifth Circuit Court case has since been transferred to the D.C. Circuit Court and consolidated with other pending BART program regional haze appeals. No schedule has been set in the consolidated cases now in the D.C. Circuit Court.

In response to a lawsuit by environmental groups, the D.C. Circuit Court issued a consent decree in March 2012 that required the EPA to propose a decision on the Regional Haze SIP by May 2012 and finalize that decision by November 2012. The consent decree requires a FIP for any provisions that the EPA disapproves. The D.C. Circuit Court has amended the consent decree several times to extend the dates for the EPA to propose and finalize a decision on the Regional Haze SIP. The consent decree was modified in December 2015 to extend the deadline for the EPA to finalize action on the determination and adoption of requirements for BART for electricity generation. Under the amended consent decree the EPA has until December 2016 to finalize a FIP for BART for Texas electricity generation sources, if the EPA determines that BART requirements have not been met.