12

Certain Relationships and Related

Transactions and Director Independence

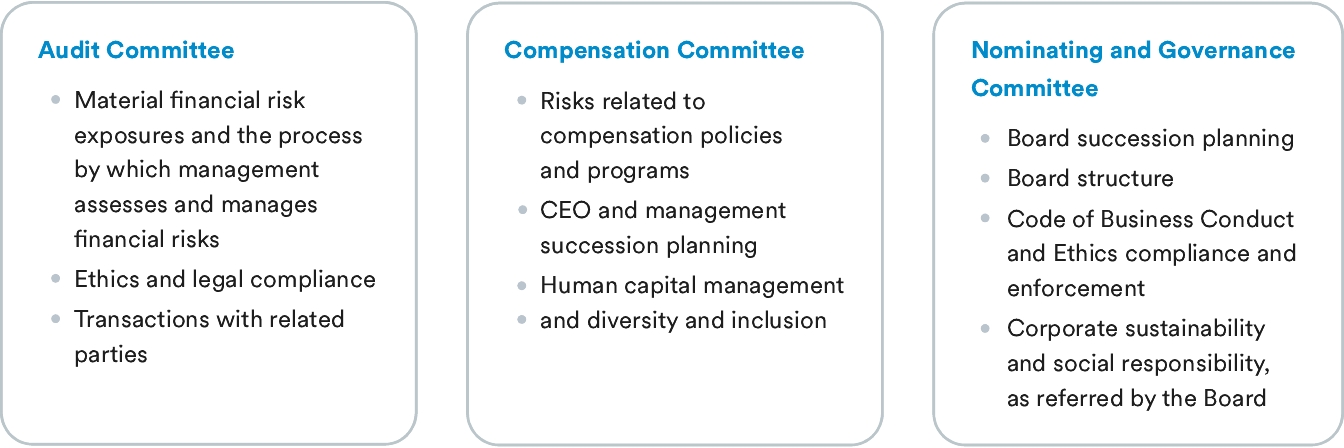

The Audit Committee, or another appropriate independent committee, and, where appropriate, our Board of Directors review all transactions between us and any related person, which includes, all of our nominees for director, directors and executive officers and their immediate family members and all persons known to us to be the beneficial owner of more than five percent of our voting securities and their immediate family members, that exceed $120,000 and in which the related person has a direct or indirect material interest. Although we do not maintain a written policy or have written procedures for such review, our Code of Business Conduct and Ethics imposes an obligation on each of our directors and senior executive officers to disclose any actual or apparent conflict of interest involving such person and Lithia. Further, each of our directors and NEOs signs a detailed questionnaire used in the preparation of this proxy statement that requires the disclosure of, among other things, any related-person transaction. The Audit Committee or other independent committee and our Board of Directors review and determine whether to approve or disapprove such transactions in accordance with the Code of Business Conduct and Ethics, based on (i) whether the proposed transaction is on terms that are no less favorable to us than the terms generally made available by us to an unaffiliated third party under similar circumstances and (ii) the extent of the related party’s interest in the proposed transaction.

Sidney B. DeBoer is the father of Bryan B. DeBoer, who is a Director and our Chief Executive Officer, and Mark DeBoer, who is the Company’s Vice President of Real Estate. There are no other family relationships between our executive officers and directors.

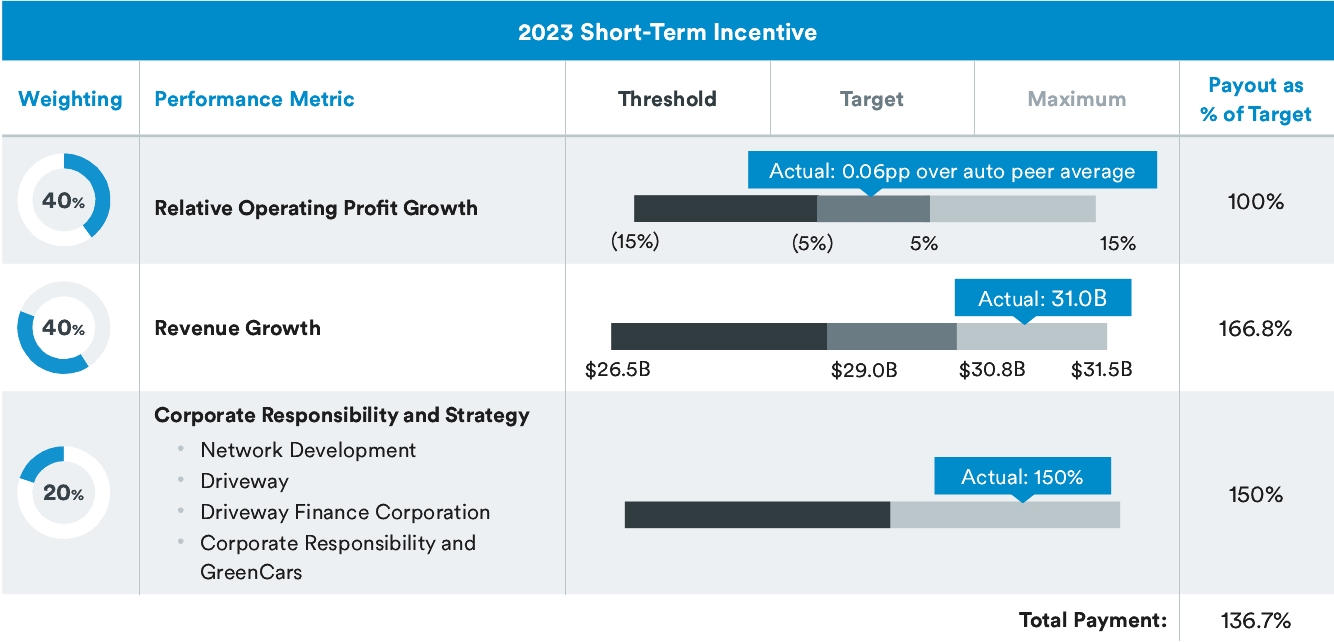

On September 14, 2015, the Company entered into a Transition Agreement with Sidney B. DeBoer, the Chairman of the Company, to reflect Mr. DeBoer’s changing role at the Company. Under the agreement, effective December 31, 2015, Mr. DeBoer ceased to be an executive officer of the Company, and the Company ceased paying Mr. DeBoer a base salary and contributing to his account under the Company’s Executive Management Non-Qualified Deferred Compensation and SERP. Mr. DeBoer also ceased to be eligible to participate in performance-based compensation arrangements, including under the Company’s Short-Term Incentive Plan and under its Stock Incentive Plan. Under the Transition Agreement the Company pays Mr. DeBoer annual amounts for his prior services rendered as an employee of the Company equal to $1,050,000 and a $42,000 vehicle allowance, and the Company reimburses Mr. DeBoer for amounts payable under the four split-dollar insurance policies described below in this section. A Special Meeting of Shareholders was held on January 21, 2019, where 99.95% of voting shareholders agreed that adding a sunset to the Transition Agreement was in the best interests of the shareholders. Under the amendment to the Transition Agreement that adds the sunset, the Transition Agreement ends on the earlier of Mr. DeBoer’s death or December 31, 2035.

The Company entered into a Director Service Agreement, effective January 1, 2016, with Sidney B. DeBoer. Under the agreement, for so long as Mr. DeBoer serves as a member of the Board of Directors, the Company will pay him the same compensation, in the same form (cash or equity), as the Company pays to its non-employee directors (as that amount is established by the Board of Directors from time to time).

We maintain four split-dollar “whole-life” insurance policies covering Sidney B. DeBoer, each worth $3,727,600 on maturity and Mr. DeBoer has the right to designate the beneficiary or beneficiaries of the death benefit of each policy. Lithia owns and pays the premium for each of the four policies, and pursuant to the amended Transition Agreement described above, Lithia will continue to pay the premiums for each of the four policies until the earlier of Mr. DeBoer’s death or December 31, 2035. Lithia will receive the greater of the cash surrender value or cumulative premiums paid at the maturity of each policy.

No “golden parachute” gross-ups

No “golden parachute” gross-ups