Non-Director Executive Officers

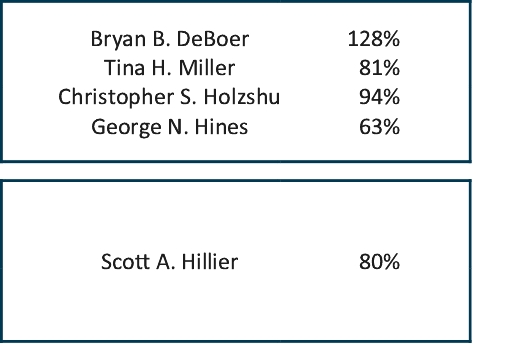

CHRISTOPHER S. HOLZSHU

Biography

Christopher S. Holzshu is our Executive Vice President and Chief Operating Officer

(COO), a role he has served in since November 2019. He previously served as Chief Financial Officer and Chief Human Resources Officer. Throughout his career with us he has gained a deep understanding of the operations of our stores and a

special talent for relating to individuals at all levels of the organization. Mr. Holzshu joined Lithia in 2003 after working for several years at KPMG LLP, where he specialized in automotive manufacturing, financial services and other retail

sectors. He holds a B.S. in Accounting from the University of Alaska.

MARGUERITE CELESTE

Biography

Marguerite Celeste joined Lithia as our Senior Vice President and Chief Marketing

Officer in July 2021. Marguerite is an alum of NBC Universal, Dream Works Animation, and The Walt Disney Company. From 2011 to 2013, Ms. Celeste served as Director of Creative Services at Lithia. Marguerite embodies the insights and innovative

acumen necessary to continue to reimagine and catapult Lithia & Driveway brands to reflect needs of the consumer. Her strong background in brand management, voice of customer, operational excellence, and creativity connect a vibrant voice

to the company's vision to provide consumers with personal transportation solutions wherever, whenever, and however they desire. Marguerite holds a BA and H.Dip.Ed from University College Cork, Ireland.

GARY GLANDON

Biography

Gary Glandon is our current Senior Vice President and Chief People Officer (CPO). As

CPO, he is responsible for leading all human resources functions and ensuring the company continues to build a culture that attracts, engages, and develops the best teams to support the 2025 Plan. Before joining LAD in February of 2021 Gary was

CHRO of many fast-growing international organizations and has more than 30 years of experience as an HR and Environmental Health and Safety executive. Most recently, he was President and CEO of Glandon Partners, an international HR consulting

and executive coaching practice and, prior to that, SVP and CHRO of Rogers Corporation, an international specialty materials business supplying advanced materials to the communications and auto industries. Mr. Glandon holds an M.S.B.A from the

University of Saint Francis, a B.S.B.A from Michigan State University (MSU) and a B.B.A. from MSU’s Broad College of Business.

SCOTT A. HILLIER

Biography

Scott A. Hillier is our Senior Vice President of Operations and has served in this role

since 2008, overseeing store leadership. Mr. Hillier joined Lithia in 1986, working in our stores in roles including Finance Manager, General Sales Manager, General Manager, and multi-store General Manager. Mr. Hillier quickly developed a

reputation for identifying talent and building teams which led to his promotion to Vice President of Human Resources in 2003. In his current role, Mr. Hillier helps foster our value of taking personal ownership for performance by mentoring

store leadership including the Lithia Partners Group. Mr. Hillier graduated from Southern Oregon University with a B.S. in Inter-Disciplinary Studies.

GEORGE N. HINES

Biography

George N. Hines is our Senior Vice President, Chief Innovation and Technology Officer

and has served in this role since July 2019. Before joining Lithia, Mr. Hines held technology and innovation leadership roles at Massage Envy Franchising and Viad Corp. Early in his career, he worked with Deloitte Consulting and Ernst &

Young Management Consulting, where he advised clients in the telecommunications industry. George brings a passion for creating pleasant, frictionless experiences and innovative technologies. Additionally, he brings a global view to his work

having lived and worked in Peru, Ecuador, Brazil, Spain, and the United Kingdom. He holds a B.S. in MIS from Millikin University and has most recently completed studies in the Stanford School for Design Thinking and Innovation.

TINA H. MILLER

Biography

Tina H. Miller is our Senior Vice President, Chief Financial Officer (CFO), leading the

accounting, tax, corporate finance, financial planning and analysis, risk management and treasury functions, and has served in this role since August 2019. She joined Lithia in 2005, working in internal audit and corporate accounting before

being promoted to Corporate Controller in 2015 and Vice President in 2018. Before Lithia, Ms. Miller worked as an auditor at Ernst & Young in their assurance practice. She graduated from Santa Clara University with a B.S. in Accounting and

is a licensed CPA in Oregon.