Exhibit 99.1

A Specialty Pharmaceutical Company NASDAQ: ANIP GENERIC AND BRANDED PRESCRIPTION DRUG PRODUCTS Corporate Presentation November 2016

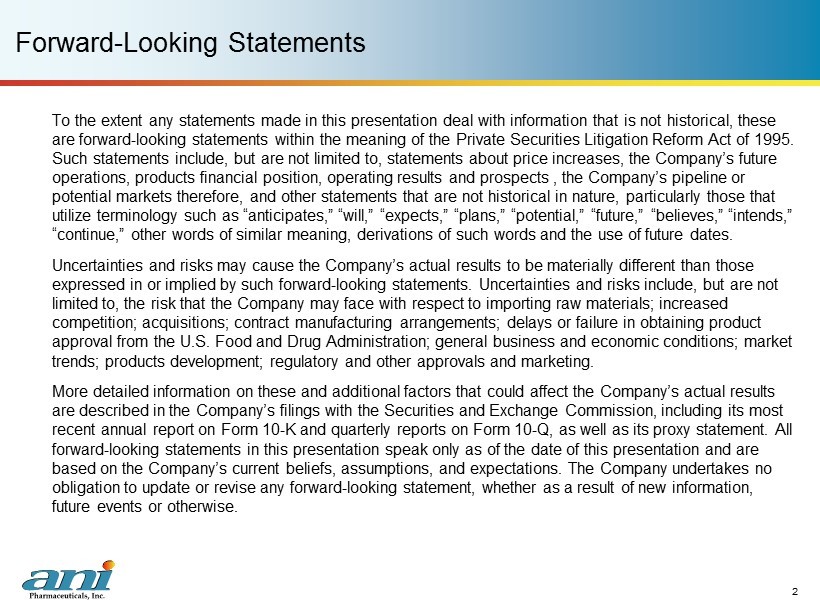

Forward - Looking Statements To the extent any statements made in this presentation deal with information that is not historical, these are forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about price increases, the Company’s future operations, products financial position, operating results and prospects , the Company’s pipeline or potential markets therefore, and other statements that are not historical in nature, particularly those that utilize terminology such as “anticipates,” “will,” “expects,” “plans,” “potential,” “future,” “believes,” “intends,” “continue,” other words of similar meaning, derivations of such words and the use of future dates. Uncertainties and risks may cause the Company’s actual results to be materially different than those expressed in or implied by such forward - looking statements. Uncertainties and risks include, but are not limited to, the risk that the Company may face with respect to importing raw materials; increased competition; acquisitions; contract manufacturing arrangements; delays or failure in obtaining product approval from the U.S. Food and Drug Administration; general business and economic conditions; market trends; products development; regulatory and other approvals and marketing. More detailed information on these and additional factors that could affect the Company’s actual results are described in the Company’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10 - K and quarterly reports on Form 10 - Q, as well as its proxy statement. All forward - looking statements in this presentation speak only as of the date of this presentation and are based on the Company’s current beliefs, assumptions, and expectations. The Company undertakes no obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise. 2

3 Mission and Strategy ANI Pharmaceuticals is an integrated specialty pharmaceutical company focused on delivering value to our customers by developing , manufacturing and marketing high quality branded and generic prescription pharmaceuticals. Our dedicated team of R&D, business development, manufacturing, sales and regulatory compliance personnel focus on niche and high barrier to entry opportunities including controlled substances, anti - cancer (oncolytics), hormones and steroids, and complex formulations. We manufacture diverse product offerings in two facilities with combined manufacturing, packaging, warehouse and laboratory space totaling 116,000 square feet.

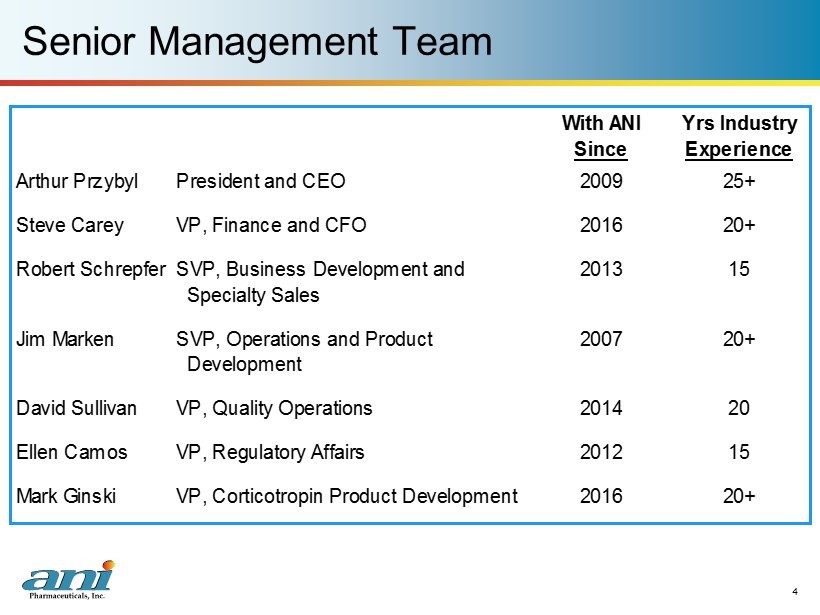

Senior Management Team 4 With ANI Yrs Industry Since Experience Arthur Przybyl President and CEO 2009 25+ Steve Carey VP, Finance and CFO 2016 20+ Robert Schrepfer SVP, Business Development and 2013 15 Specialty Sales Jim Marken SVP, Operations and Product 2007 20+ Development David Sullivan VP, Quality Operations 2014 20 Ellen Camos VP, Regulatory Affairs 2012 15 Mark Ginski VP, Corticotropin Product Development 2016 20+

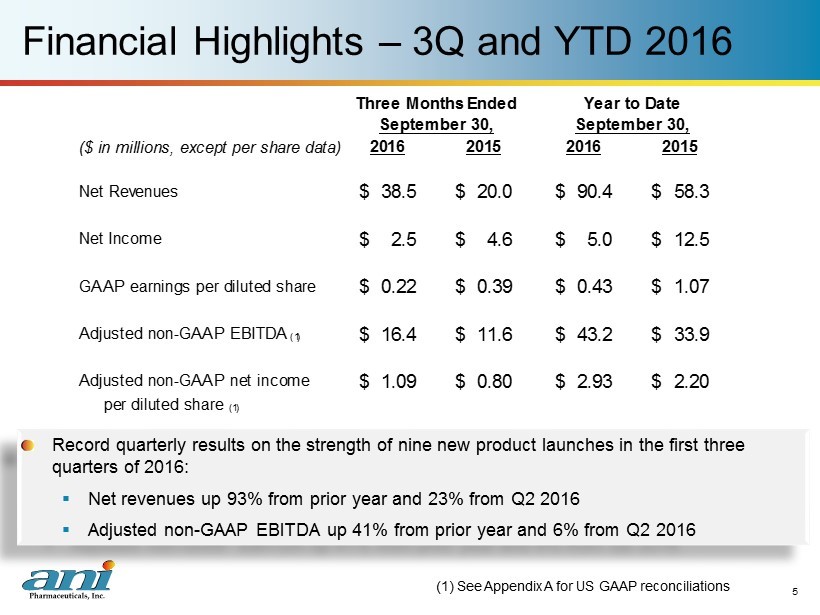

Financial Highlights – 3Q and YTD 2016 Record quarterly results on the strength of nine new product launches in the first three quarters of 2016: ▪ Net revenues up 93% from prior year and 23% from Q2 2016 ▪ Adjusted non - GAAP EBITDA up 41% from prior year and 6% from Q2 2016 (1) See Appendix A for US GAAP reconciliations 5 ($ in millions, except per share data) 2016 2015 2016 2015 Net Revenues 38.5$ 20.0$ 90.4$ 58.3$ Net Income 2.5$ 4.6$ 5.0$ 12.5$ GAAP earnings per diluted share 0.22$ 0.39$ 0.43$ 1.07$ Adjusted non-GAAP EBITDA (1) 16.4$ 11.6$ 43.2$ 33.9$ Adjusted non-GAAP net income 1.09$ 0.80$ 2.93$ 2.20$ per diluted share (1) Three Months Ended Year to Date September 30, September 30,

Financial Highlights – 3Q Net Revenues Generic sales gains driven by 10 product launches between the fourth quarter of 2015 and the first nine months of 2016 Brand sales reflect April 2016 launch of Inderal ® LA Contract services previously reflected royalty income on authorized generic of Vancocin ® , which is now sold directly by ANI and reflected in Generic sales 6 Note: Figures may not foot due to rounding. ($ in millions) 2016 2015 $ % Generic pharmaceutical products 30.2$ 15.1$ 15.1$ 100% Brand pharmaceutical products 6.8 2.3 4.6 203% Contract manufacturing 1.4 1.3 0.1 12% Contract services and other income 0.1 1.3 (1.3) -95% Total net revenues 38.5$ 20.0$ 18.6$ 93% Three Months Ended Variance September 30, to Prior Year

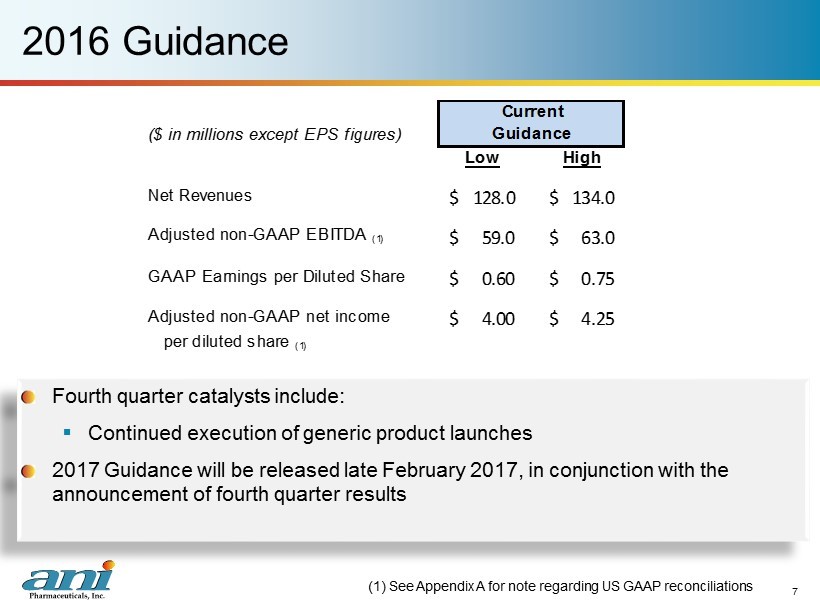

2016 Guidance Fourth quarter catalysts include: ▪ Continued execution of generic product launches 2017 Guidance will be released late February 2017, in conjunction with the announcement of fourth quarter results (1) See Appendix A for note regarding US GAAP reconciliations 7 ($ in millions except EPS figures) Low High Net Revenues 128.0$ 134.0$ Adjusted non-GAAP EBITDA (1) 59.0$ 63.0$ GAAP Earnings per Diluted Share 0.60$ 0.75$ Adjusted non-GAAP net income 4.00$ 4.25$ per diluted share (1) Current Guidance

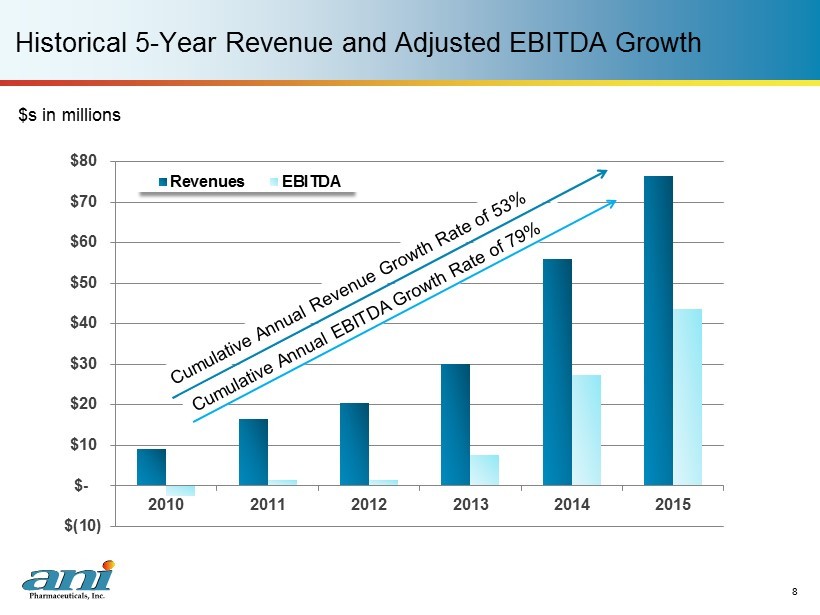

$(10) $- $10 $20 $30 $40 $50 $60 $70 $80 2010 2011 2012 2013 2014 2015 Revenues EBITDA Historical 5 - Year Revenue and Adjusted EBITDA Growth 8 $s in millions

9 Sales and Marketing Overview

Generic Rx Product Portfolio 2016 Launches Benztropine Mesylate Erythromycin Ethylsuccinate Fenofibrate Capsules (AG) HC Cream, for rectal use Hydroxyprogesterone Caproate Injection USP Mesalamine Enema (AG) Nilutamide Tablets Oxycodone Capsules Propranolol ER Capsules (AG) 10 Continued broadening of our product offerings ▪ Nine generic launches to date ▪ Twenty - one generic product families in total ▪ $30.2M of total generic Q3 2016 n et sales (AG) = Authorized Generic

Generic Rx Product Portfolio Foundational Products (launched prior to 2016) 11 (AG) = Authorized Generic EE/MT Tablets Etodolac Capsules Flecainide Tablets Fluvoxamine Maleate Tablets (AG) HC Enema (AG) Methazolamide Tablets Metoclopramide Solution Nimodipine Capsules Opium Tincture Oxycodone Oral Solution Propafenone Tablets Vancomycin Capsules (AG)

Brand Rx Product Portfolio Lithobid ® Tablets Bipolar Disorder Vancocin ® Capsules C. difficile - Associated Diarrhea Cortenema ® U lcerative Colitis Reglan ® Tablets Gastroesophageal Reflux Inderal ® LA Capsules Hypertension ▪ Inderal ® LA launched April 2016 ▪ $6.8 million of total brand Q3 2016 net sales 12

Contract Manufacturing and Other 13 Contract manufacturing ▪ $1.4 million of Q3 2016 net revenues ▪ Four customers – Seven products and seventeen SKUs – Contract manufacturing and contract packaging Contract services and other ▪ $0.1 million of Q3 2016 net revenues ▪ Product development services, laboratory services, and royalties received

14 Business and Product Development Overview

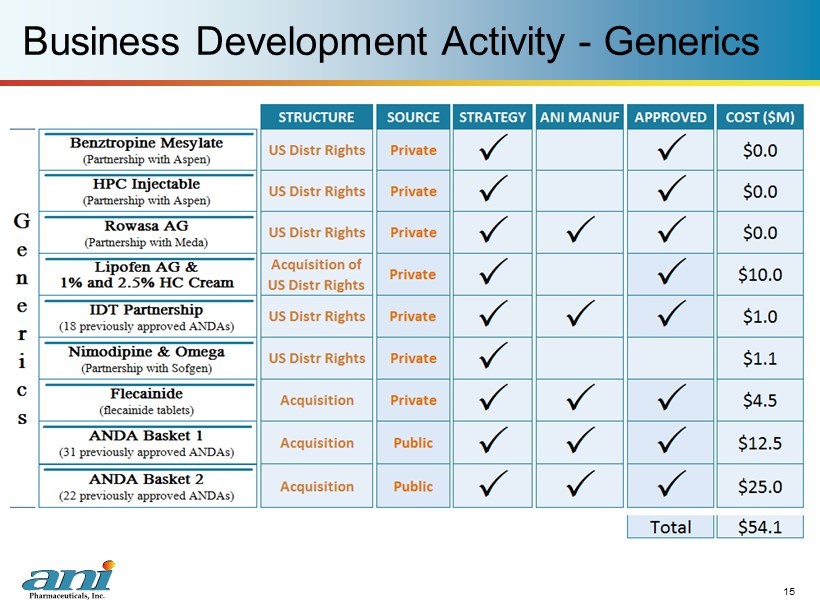

Business Development Activity - Generics 15

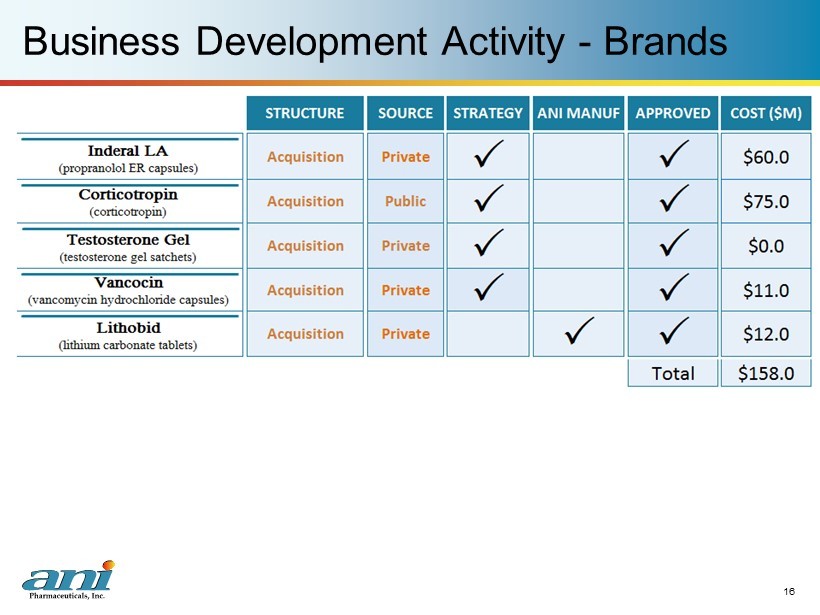

Business Development Activity - Brands 16

17 Product Development Pipeline ANI Pipeline ▪ 78 products in development, total combined current market: $3.7 billion (1) ▪ 53 products were acquired and of those, ANI believes 46 can be commercialized based on either a CBE - 30 or PAS Corticotropin Re - commercialization Update ▪ Expert team assembled ▪ Dedicated lab established for analytical method development ▪ Identified and initiated the development of analytical methods required for the sNDA filing ▪ Porcine pituitary supply secured for small and commercial scale API ▪ API manufacturer secured (1) Based on Company estimates, and recent IMS and NSP Audit data

18 Manufacturing Overview

19 Manufacturing – Main Street Facility Location: Baudette , Minnesota ▪ 52,000 square feet of manufacturing , packaging, and warehouse facilities ▪ Rx solutions , suspensions , topicals , tablets , and capsules ▪ DEA - licensed for Schedule II controlled substances ▪ 17,000 square feet of laboratory space for product development and analytical testing

20 Manufacturing – IDC Road Facility Location: Baudette, Minnesota ▪ Fully - contained h igh potency facility with capabilities to manufacture h ormone , steroid , and oncolytic products ▪ 47,000 square feet of manufacturing, packaging , and warehouse facilities ▪ 100 nano - gram per eight - hour weighted average maximum exposure limit to ensure employee safety ▪ DEA Schedule IIIN capability

Summary ANI is an integrated specialty generic pharmaceutical company with: ▪ Profitable base business generating organic growth – 2016 Annual guidance (1) □ Net revenues of $128 million to $134 million □ Adjusted non - GAAP EBITDA (2) of $59 million to $63 million □ Adjusted non - GAAP Net Income Per Diluted Share (2) of $4.00 to $4.25 ▪ Strong capital position ▪ Experienced management team ANI is focused on delivering value through: ▪ Partnerships / strategic alliances ▪ Accretive acquisitions ▪ Internal product development 21 (1) November 3, 2016 press release (2) See Appendix A for note regarding US GAAP reconciliations

22 Appendix A

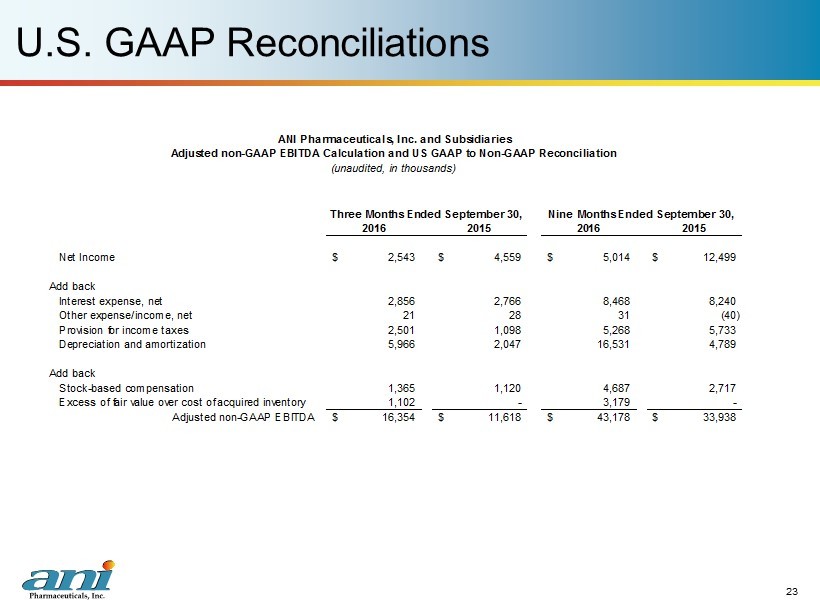

U.S. GAAP Reconciliations 23 2016 2015 2016 2015 Net Income 2,543$ 4,559$ 5,014$ 12,499$ Add back Interest expense, net 2,856 2,766 8,468 8,240 Other expense/income, net 21 28 31 (40) Provision for income taxes 2,501 1,098 5,268 5,733 Depreciation and amortization 5,966 2,047 16,531 4,789 Add back Stock-based compensation 1,365 1,120 4,687 2,717 Excess of fair value over cost of acquired inventory 1,102 - 3,179 - Adjusted non-GAAP EBITDA 16,354$ 11,618$ 43,178$ 33,938$ Nine Months Ended September 30, ANI Pharmaceuticals, Inc. and Subsidiaries Adjusted non-GAAP EBITDA Calculation and US GAAP to Non-GAAP Reconciliation (unaudited, in thousands) Three Months Ended September 30,

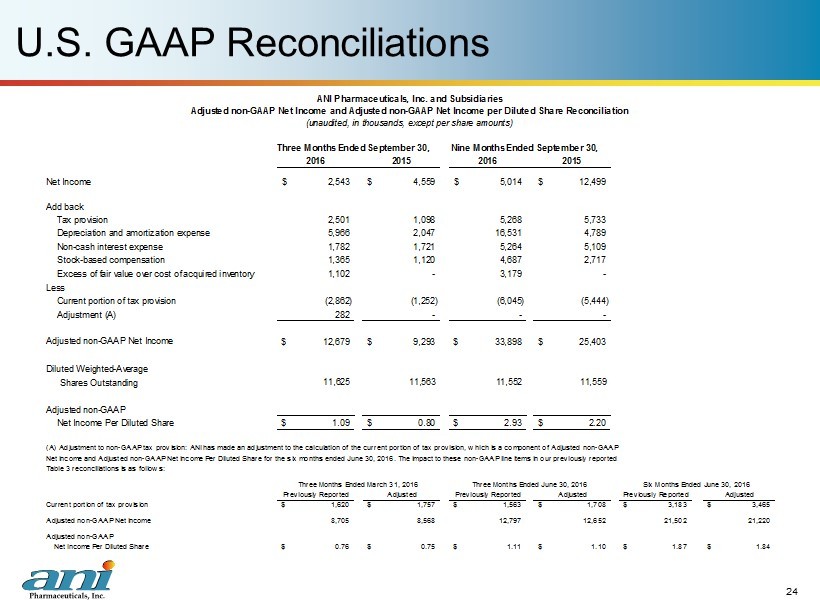

U.S. GAAP Reconciliations 24 2016 2015 2016 2015 Net Income 2,543$ 4,559$ 5,014$ 12,499$ Add back Tax provision 2,501 1,098 5,268 5,733 Depreciation and amortization expense 5,966 2,047 16,531 4,789 Non-cash interest expense 1,782 1,721 5,264 5,109 Stock-based compensation 1,365 1,120 4,687 2,717 Excess of fair value over cost of acquired inventory 1,102 - 3,179 - Less Current portion of tax provision (2,862) (1,252) (6,045) (5,444) Adjustment (A) 282 - - - Adjusted non-GAAP Net Income 12,679$ 9,293$ 33,898$ 25,403$ Diluted Weighted-Average Shares Outstanding 11,625 11,563 11,552 11,559 Adjusted non-GAAP Net Income Per Diluted Share 1.09$ 0.80$ 2.93$ 2.20$ (A) Adjustment to non-GAAP tax provision: ANI has made an adjustment to the calculation of the current portion of tax provision, which is a component of Adjusted non-GAAP Net Income and Adjusted non-GAAP Net Income Per Diluted Share for the six months ended June 30, 2016. The impact to these non-GAAP line items in our previously reported Table 3 reconciliations is as follows: Previously Reported Adjusted Previously Reported Adjusted Previously Reported Adjusted Current portion of tax provision 1,620$ 1,757$ 1,563$ 1,708$ 3,183$ 3,465$ Adjusted non-GAAP Net Income 8,705 8,568 12,797 12,652 21,502 21,220 Adjusted non-GAAP Net Income Per Diluted Share 0.76$ 0.75$ 1.11$ 1.10$ 1.87$ 1.84$ Three Months Ended March 31, 2016 Three Months Ended June 30, 2016 Six Months Ended June 30, 2016 Nine Months Ended September 30, Three Months Ended September 30, ANI Pharmaceuticals, Inc. and Subsidiaries Adjusted non-GAAP Net Income and Adjusted non-GAAP Net Income per Diluted Share Reconciliation (unaudited, in thousands, except per share amounts)

U.S. GAAP Reconciliations 25 Non - GAAP Financial Measures included in 2016 Guidance The Company's fiscal 2016 guidance for adjusted non - GAAP EBITDA and adjusted non - GAAP net income per diluted share is not reconciled to the most comparable GAAP measure. This is due to the inherent difficulty of forecasting the timing or amount of items that would be included in a reconciliation to the most directly comparable forward - looking GAAP financial measures. Because a reconciliation is not available without unreasonable effort, it is not included in this presentation.