The following chart summarizes our steel operations primary products and the estimated percentage of tons sold by end market:

9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act.

Title of each class | Trading Symbol | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated file ◻ | Non-accelerated filer ◻ | Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the voting stock held by non-affiliates of the registrant computed by reference to the price at which the common equity was last sold as of June 28, 2019, was approximately $

As of February 20, 2020, Registrant had outstanding

DOCUMENTS INCORPORATED BY REFERENCE

Portions of registrant’s definitive proxy statement referenced in Part III, Items 10 through 14 of this report, to be filed prior to April 30, 2020, are incorporated herein by reference.

STEEL DYNAMICS, INC.

Table of Contents

PART I

Special Note Regarding Forward-Looking Statements

Throughout this report, or in other reports or registration statements filed from time to time with the Securities and Exchange Commission under the Securities Exchange Act of 1934, or under the Securities Act of 1933, as well as in documents we incorporate by reference herein or herefrom, or in press releases or oral statements made by our officers or Regulation FD authorized representatives, we may make statements that express our opinions, expectations, or projections regarding future events or future results, in contrast with statements that reflect present or historical facts. These predictive statements, which we generally precede or accompany by such typical conditional words as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project” or “expect,” or by the words “may,” “will,” or “should,” are intended to operate as “forward-looking statements” of the kind permitted by the Private Securities Litigation Reform Act of 1995, incorporated in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements involve both known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. That legislation protects such predictive and cautionary statements by creating a “safe harbor” from liability in the event that a particular prediction does not turn out as anticipated.

While we always intend to express our best judgment when we make statements about what we believe will occur in the future, and although we base these statements on assumptions that we believe to be reasonable when made, these forward-looking statements are not a guarantee of performance, and you should not place undue reliance on such statements. Forward-looking statements are subject to many uncertainties and other variable circumstances, many of which are outside of our control, that could cause our actual results and experience to differ materially from those we thought would occur.

The following listing represents some, but not necessarily all, of the factors that may cause actual results to differ from those we may have anticipated or predicted:

| ● | United States or foreign trade policy affecting the amount of, or tariffs on, foreign steel imported into the United States, or adverse or less than satisfactory outcomes of pending and future trade cases alleging unlawful practices in connection with steel imports; |

| ● | increased price competition brought about by global steelmaking overcapacity; |

| ● | increased price and other forms of competition from other steel producers, scrap processors and alternative materials; |

| ● | margin compression resulting from falling selling prices with no offsetting reduction in raw material costs, or our inability to pass increases in costs of raw materials and supplies, if any, onto our customers; |

| ● | the adverse impact of periods of slower than anticipated economic growth or the risk of a recession, resulting in a general decrease of demand for our products; |

| ● | the weakening of demand for steel products within the non-residential and residential construction, automotive, manufacturing, appliance, pipe and tube, and other steel-consuming industries; |

| ● | conditions affecting steel or recycled metals consumption; |

| ● | cyclical changes in market supply and demand for steel and recycled metals; |

| ● | changes in the availability or cost of raw materials, such as scrap metal, scrap substitute products such as pig iron and pelletized iron, and other supplies such as zinc, graphite electrodes and ferroalloys, or other raw materials, which we use in our production processes; |

| ● | periodic fluctuations in the availability and cost of electricity, natural gas, oil, or other energy resources; |

1

| ● | the impact of, or changes in, environmental law or in the application of other legal or regulatory requirements upon our production processes or costs of production or upon those of our suppliers or customers, including actions by government agencies, such as the United States Environmental Protection Agency or related state agencies, upon our receipt of pending or future environmentally related construction or operating permits; |

| ● | the impact of United States government or various other governmental agencies introducing laws or regulatory changes in response to the subject of climate change and greenhouse gas emissions, including the introduction of carbon emissions limitations or trading mechanisms; |

| ● | increased cybersecurity threats and vulnerabilities and increased global information technology security requirements, and a rise in sophisticated cybercrimes that pose a risk to the security and functionality of our systems and information networks and to the confidentiality, availability, and integrity of sensitive data, including intellectual property, proprietary information, financial information, customer, supplier and business partner information, and personally identifiable information; |

| ● | changes in our business strategies or development plans which we have adopted or may adopt, and any difficulty or inability to timely, cost efficiently and successfully consummate, implement, integrate or operate any current, planned or potential construction or other projects, acquisitions, joint ventures or strategic alliances; |

| ● | the impact of impairment charges; |

| ● | private or governmental liability claims or litigation, or the impact of any adverse litigation costs or outcome of any litigation on the adequacy of our reserves or the availability or adequacy of our insurance coverage; |

| ● | the occurrence of unanticipated equipment failures and plant outages; |

| ● | costs to idle facilities, idled facility carrying costs, or increased costs to resume production at idled facilities; and |

| ● | uncertainties involving new products or new technologies. |

We also refer you to and urge you to carefully read the section entitled Risk Factors at Item 1A of this report to better understand some of the principal risks and uncertainties inherent in our businesses or in owning our securities, as well as the section entitled Management Discussion and Analysis of Financial Condition and Results of Operations at Item 7. You should also review the notes to consolidated financial statements under headings in Note 1. Use of Estimates and in Note 9. Commitments and Contingencies.

Any forward-looking statements which we make in this report, or in any of the documents that are incorporated by reference herein or herefrom, speak only as of the date of such statement, and we undertake no ongoing obligation to update such statements. Comparisons of results between current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

2

ITEM 1. BUSINESS

Our Company

Steel Dynamics, Inc. is one of the largest domestic steel producers and metal recyclers in the United States, based on current estimated steelmaking and coating capacity of approximately 13 million tons and actual metals recycling volumes, with one of the most diversified, high-margin steel product portfolios. The company’s primary sources of revenue are from the manufacture and sale of steel products, the processing and sale of recycled ferrous and nonferrous metals, and the fabrication and sale of steel joists and deck products.

We believe our strategic focus to create value for our teams, customers, communities and shareholders is differentiated through our six Core Operating and Leadership Principles. These six pillars bring us together with a common focus and provide us the foundation upon which we operate and grow. Our six pillars and our team’s execution of them each day has driven our success and sustainability.

| ● | Safety – Creating and maintaining a safe work environment is our number one value and first priority. We want every individual to go home safely at the end of each day and to take an active role in remaining safe both on the job and at home. Our goal is no accidents, no lost workdays, no injuries. |

| ● | Sustaining Superior Operating Culture – Our entrepreneurial culture fosters a team of energetic, positive, driven and innovative individuals by utilizing open communication and meaningful performance-based compensation aligned to our strategic focus. This results in our safe, low-cost, and highly efficient operations, which drive “best-in-class” operating and financial performance. |

| ● | Enhancing Customer Relationships and Commitment – We focus on being a preferred partner providing outstanding products and supply-chain solutions that exceed expectations, as we anticipate our customer’s future needs and deliver greater value. |

| ● | Strategic Growth, Intentional Margin Expansion and Consistency “Through the Cycle” – Our intentional, value-driven growth has propelled our diversification in both end markets and product offerings to sustain continued higher volume and profitability throughout both strong and weak market environments. We are squarely focused on continued strategic and responsible growth. |

| ● | Driving Innovation – Through individual creativity and ingenuity, our teams drive innovation to improve safety, quality, productivity and resource sustainability. We utilize innovative technologies and processes in order to perform at the highest level, and consistently achieve excellence in all that we do. |

| ● | Financial Strength and Flexibility – We have one of the most diversified steel product offerings in the industry. Coupled with high variability of our operating costs and our vertically connected business platforms, this results in higher utilization and lower costs, providing strong cash flow generation through both strong and weak market cycles. |

Competitive Strengths / Business Strategies

We believe our financial strength and flexibility, coupled with our competitive advantages of maintaining a low, highly variable cost structure, producing a diversified value-added product offering, controlling a secure supply of recycled ferrous metals, fostering an entity-wide entrepreneurial culture and having an experienced senior management team and work force, positions us well to continue to strengthen our leadership position and execute our growth strategy.

Differentiated Business Model / Diversified Product Mix / Expanded Product Offerings

We are one of the most diversified steel companies in the United States, with very broad value-added steel product offerings. We offer a wide range of steel products (more specifically enumerated in the Steel Operations Products and Tons Sold by End Market discussion later in this section). We have a proven track record of growing and developing premium, value-added steel product capabilities and unlocking value within our operations. Additionally, by adding high-margin downstream manufacturing businesses, we are able to provide base-load “pull-through” volume for our steel operations, increasing “through-cycle” steel mill utilization. We are also identifying new ways to provide value to our customers by providing supply-chain solutions. Our differentiated business

3

model and performance-driven culture demonstrate our through-cycle earnings capability through our three vertically connected operating segments.

Steel Operations:

Sheet Products. Hot roll, cold roll and coated steel, including a wide variety of value-added products, such as light gauge hot roll, and galvanized, galvanneal, Galvalume®, Galfan®, and painted products.

Long Products. Structural steel beams, pilings, and standard and premium grade rail; engineered special-bar-quality of an expanding range of sizes and chemistries; various merchant-bar-quality products including rounds, angles, flats, reinforcing bar, channels and specialty steel sections.

Steel Finishing. Turning, polishing, straightening, chamfering, threading, precision saw-cutting, cold draw and heat treating of bar products; and cutting to length, additional straightening, hole punching, shot blasting, welding and coating of beams, channels and specialty steel sections.

Metals Recycling Operations. An array of both ferrous and nonferrous scrap recycling, scrap management, transportation, and brokerage products and services.

Steel Fabrication Operations. Steel joists, girders and steel deck, including specialty deck. Our steel fabrication operations provide “pull-through” volume optionality for our steel operations, as many of the products that we make utilize our own internally produced steel.

This diversified portfolio of products enables us to access a broad range of markets, serve a large customer base, and helps mitigate our market exposure to any one product or sector, resulting in increased through-cycle steel mill utilization. In addition, our value-added steel product offerings help to balance our exposure to commodity grade products supplied by other manufacturers. We will continue to seek additional opportunities and to collaborate with our customers to anticipate their future needs by further expanding our range of products and offerings, which may allow our customers the ability to more effectively and efficiently navigate their supply chain.

One such opportunity is our planned $1.9 billion “next-generation” electric arc furnace (EAF) flat roll steel mill – Southwest-Sinton Flat Roll Division. Our new steel mill will have an estimated 3.0 million tons of annual steel production capacity, including value-added coating lines comprised of a galvanizing line with planned annual coating capacity of 550,000 tons with galvalume capability and a paint line with annual coating capacity of 250,000 tons. By leveraging our construction and operating expertise, we are building a “next-generation” EAF flat roll steel mill with planned production capabilities beyond existing EAF flat roll steel producers, competing even more effectively with the integrated steel model and foreign competition. Our new steel mill will have the capability to provide higher-strength, tougher grades of flat roll steel for the energy and automotive markets. These ultra-high-strength steel products are not currently readily available from other domestic steel producers. By locating our new steel mill in Sinton, Texas we are strategically targeting underserved markets that are largely reliant on imports with long lead times and lower product quality capabilities, providing customers throughout the Southwest United States and Mexico significant freight benefits and shorter lead times allowing them to realize working capital advantages. Additionally, our new steel mill site has sufficient acreage to allow for customers to locate on-site, providing them with logistics savings and our steel mill with volume base-loading opportunities. Based on current expectations, operations are planned to begin mid-2021.

One of the Lowest Cost Steel Producers in the United States; State-of-the-Art Facilities / Allowing for Low Production Costs

We are focused on maintaining one of the lowest operating cost structures in the North American steel industry. Our low operating costs are primarily a result of our efficient plant designs and operations, our high productivity rate, low ongoing maintenance cost requirements and strategic locations near our customers and sources of our primary raw material, ferrous scrap.

We will continue to develop innovative ways to use our equipment, enhance our productivity and explore new technologies to further improve our unit costs of production at each of our facilities. As one of the lowest cost producers in each of our three primary operating segments, we are able to better manage through all market cycles, and to consistently maximize our profitability. We continuously seek to maximize the variability of our cost structure and to reduce per unit and fixed costs. Our highly performance-based incentive compensation plans at all employee levels are based on both divisional and consolidated company performance. Performance-based incentive compensation is designed to reward high productivity and efficient use of physical resources and capital

4

employed. Additionally, effectively leveraging our existing facilities through capital effective organic growth and diversified product offerings allows us to maximize utilization.

Secure Supply of High Quality Just-in-Time Ferrous Raw Materials

We maintain a secure supply of ferrous raw material resources through the benefit of our metals recycling operations and Iron Dynamics (IDI). Ferrous materials represent the single largest raw material component of our steel operations’ manufacturing costs, at approximately 55 to 60 percent of such costs. During 2019, 2018, and 2017, OmniSource, our metals recycling operations, provided our steel operations with 37%, 39%, and 38%, respectively, of its ferrous scrap requirements. This represented 66%, 65%, and 63% of OmniSource’s total ferrous scrap shipments during 2019, 2018, and 2017, respectively. During 2019, 2018, and 2017, our steel operations consumed 10.6 million, 10.9 million, and 10.3 million tons, respectively, of metallic materials, of which iron units, other than scrap, represented approximately 13% in 2019 and 2017, and 14% in 2018. IDI supplies 100% of its production to the Butler Flat Roll Division, representing 63%, 64%, and 72% of their iron units other than scrap in 2019, 2018, and 2017, respectively, through the transfer of liquid pig iron and hot briquetted iron, which are higher quality, energy-saving ferrous raw materials. We believe our metals recycling operations and IDI provide us with a high quality, cost effective, and secure raw material platform for effective working capital management.

Strategic Geographic Locations / Enter New Geographic Markets

The majority of our steelmaking operations are in locations near sustainable sources of scrap materials and near our customer base, allowing us to realize freight savings for inbound scrap as well as for outbound steel products destined for our customers. This also allows us to provide consistent on-time delivery to our customer base with relatively short lead times, further solidifying our customer relationships. Recycled ferrous scrap and iron units represent the most significant component of our cost of steel manufacturing. Approximately three-fourths of our recycled ferrous scrap needs are sourced within 250 miles of our steel mill locations, minimizing the amount of energy expended on transportation. We believe that our metals recycling facilities are in the regions that account for a majority of the total ferrous scrap produced in the United States. Our steel fabrication operations have a national footprint allowing us to serve the entire joist and deck domestic market and national accounts.

Sustainability

We have had a focus toward sustainability since our inception, valuing our teams, partners and communities while producing steel using EAF technology which utilizes recycled ferrous scrap as the primary raw material, requiring the use of far fewer natural resources and consuming significantly less energy than traditional blast furnace technology, resulting in lower levels of air emissions and much less environmental impact. For melting and casting steel, our energy intensity for our six EAF steel mills is only approximately 11% of the World Steel Association average energy intensity. Our CO2 emissions from our six EAF steel mills are only approximately 13% of the World Steel Association average CO2 emissions. We reuse over 99% of our total system water demand.

We have continuously innovated, further strengthening our company, becoming vertically connected with a looped manufacturing life cycle. We are one of the largest ferrous and nonferrous scrap metals recyclers in the United States. Our metals recycling platform collects and processes industrial scrap from manufacturers and obsolete scrap derived from end-of-life items, such as automobiles, appliances and machinery. This processed scrap is then sold to end users, including our electric arc furnace steel mills. Our steel mills utilize recycled ferrous scrap as their primary raw material input to produce new steel. Our steel is then sold internally to our steel manufacturing operations and to external steel customers.

Through our vertically connected manufacturing life cycle, we reintroduced 1.1 billion pounds of recycled nonferrous scrap and 11 million tons of recycled ferrous scrap into the manufacturing life cycle in 2019. Additionally, our vertically connected manufacturing life cycle allowed for 1.4 million tons of our steel to be used internally.

At Steel Dynamics, we recognize the importance of being good stewards of our environment and the communities where we work and live. We continually evaluate opportunities to improve our processes, equipment and technology to reduce our physical impact on the environment. To us, it is more than simply meeting applicable requirements, but going beyond with a commitment to higher environmental standards. Both our Butler and Columbus Flat Roll Divisions’ environmental management systems are certified with the International Organization for Standardization 14001. These facilities represent over 65% of our 2019 steel production.

Each of our steel mills has an environmental engineering group focused on regulatory compliance, and our employees are trained on how to properly handle waste streams and engage in responsible environmental practices. Being environmentally conscious is part of our culture. We see ourselves as members of the communities in which we do business. Every day, our teams take the initiative to protect the environment, simply because it is the right thing to do.

5

Experienced Leadership Team and Unique Culture / Foster Entrepreneurial Culture

Our senior leadership team is highly experienced and has a proven track record in the steel, metals recycling, and steel fabrication industries. Our leadership objectives are closely aligned with our stockholders through meaningful stock ownership positions and performance-based incentive compensation programs that are correlated to the company’s profitability and operational performance in relationship to its steel manufacturing peers. Our entrepreneurial culture resonates throughout each of our operating segments. We emphasize decentralized decision making, with corporate risk oversight, and have established incentive compensation programs specifically designed to reward our individual teams for their efforts toward identifying innovative ways to enhance productivity, improve profitability, and control costs.

We foster our entrepreneurial culture and emphasize decentralized operational decision making and responsibility, while continuing to maintain appropriate corporate governance and risk oversight. We reward teamwork, innovation, and operating efficiency, and focus on maintaining the effectiveness of our performance-driven incentive bonus plans that are designed to maximize overall productivity and align the interests of our leadership and teams with our stockholders.

Experienced Senior Leadership Team

Name | Age | Position | ||

Mark D. Millett | 60 | President and Chief Executive Officer | ||

Theresa E. Wagler | 49 | Executive Vice President, Chief Financial Officer, and Corporate Secretary | ||

Russ B. Rinn | 62 | Executive Vice President, Metals Recycling | ||

Miguel Alvarez | 52 | Senior Vice President, Southwest United States and Mexico | ||

Chris A. Graham | 55 | Senior Vice President, Long Products Steel Group | ||

Glenn A. Pushis | 54 | Senior Vice President, Special Projects | ||

Barry T. Schneider | 51 | Senior Vice President, Flat Roll Steel Group | ||

James S. Anderson | 59 | Vice President, Steel Fabrication |

Mark D. Millett, a co-founder of our company and director since inception, has been our President and Chief Executive Officer since January 2012. Prior to that, Mr. Millett has held various positions, including President and Chief Operating Officer, Executive Vice President of Metals Recycling and Ferrous Resources, President and Chief Operating Officer of OmniSource Corporation (now OmniSource, LLC), and Executive Vice President and Chief Operating Officer for Flat Rolled Steels and Ferrous Resources. Mr. Millett was responsible for the design, construction, and start-up operation of our Butler, Indiana flat roll, melting and casting operations. Mr. Millett, prior to his co-founding of Steel Dynamics, served from 1981 to 1985 as chief metallurgist for Nucor Corporation’s Darlington, South Carolina, division, charged with developing the world’s first commercially viable thin-slab-casting process as the manager of that project at Nucor’s Hazelett facility. In 1987, Mr. Millett was given the responsibility by Nucor for the design, construction, staffing, and operation of the melting and casting facility at Nucor’s world’s-first thin-slab casting facility at Crawfordsville, Indiana. Mr. Millett holds a bachelor’s degree in metallurgy from the University of Surrey in England. Mr. Millett was named Steelmaker of the Year in 2014 by the Association of Iron and Steel Technology.

Theresa E. Wagler has been our Executive Vice President, Chief Financial Officer and Corporate Secretary since May 2007. Ms. Wagler joined the Steel Dynamics corporate finance team in 1998, and has held various finance and accounting positions, including Chief Accounting Officer and Vice President and Corporate Controller, and was appointed to her current position in May 2007. She is responsible for and oversees accounting and taxation, treasury, risk management, legal, information technology and cyber security, safety and human resources, and strategic business development functions, as well as investor relations, and corporate communications. Ms. Wagler also has operational responsibilities beginning January 2019. Prior to joining Steel Dynamics, Ms. Wagler served as a certified public accountant with Ernst & Young LLP. She graduated cum laude from Taylor University with a bachelor’s degree in accounting and systems analysis. In addition, Ms. Wagler serves as a director and chair of the audit committee of CF Industries Holdings, Inc., a public company, and also serves as a director and audit committee chair for Trine University.

Russell B. Rinn has been our Executive Vice President for Metals Recycling since July 2011. Mr. Rinn is responsible for OmniSource’s ferrous and nonferrous metals recycling operations in the eastern half of the United States, as well as sourcing, marketing, trading, and logistics activities spanning the nation. OmniSource procures metal scrap, processes it, and markets these recycled metals to external customers and supplies ferrous scrap to the company’s steel mills. Prior to joining Steel Dynamics, Mr. Rinn was an Executive Vice President of Commercial Metals Company (CMC), a Texas-based mini-mill steel company. He has more than 30 years of experience in the steel and metals recycling industries. Mr. Rinn is a graduate of the Executive Program of the Stanford University Graduate School of Business and of the Management Development Program at the University of Michigan’s Business School. He holds a bachelor’s degree in Finance, Marketing and Business Administration from Texas Lutheran University.

6

Miguel Alvarez joined the company as our Senior Vice President, Southwest United States and Mexico in February 2019. In this position Mr. Alvarez is responsible for the comprehensive business development and partnerships in the regions, encompassing both steel and recycled metals. Prior to joining Steel Dynamics, since 2000 Mr. Alvarez served in leadership positions at BlueScope, a global engineered steel solutions provider and flat roll steel producer, focused on the global building and construction sectors. Mr. Alvarez’s responsibilities included leading BlueScope’s North American metal buildings business, with manufacturing facilities in the United States and Mexico, as President of BlueScope Buildings North America, since 2017. From 2010 to 2017, he served as the President of North Star BlueScope Steel, responsible for BlueScope’s only North American electric arc furnace flat roll steel mill. Mr. Alvarez earned a bachelor’s degree in industrial engineering and a Masters of Business Administration from the Technological Institute of Superior Studies in Monterrey, Mexico.

Chris A. Graham is our Senior Vice President, Long Products Steel Group, since February 2019. In this role, Mr. Graham is responsible for the company’s four long product steel mills, which combined have over 4 million tons of annual steel shipping capacity, producing specialized engineered bars, structural steel, railroad rail, merchant and reinforcing steel bars, and other specialty steels. Since 2016, Mr. Graham served as Senior Vice President, Downstream Manufacturing and President of New Millennium Building Systems, responsible for the company’s steel fabrication and downstream manufacturing operations. Prior to that, Mr. Graham served as a Vice President of Steel Dynamics and the President of New Millennium Building Systems fabrication operations. Mr. Graham was part of the team that constructed the company’s first steel mill in 1994. He held various leadership positions within the company’s steel group prior to moving into the fabrication operations in 2007. He was responsible for four operating fabrication plants from 2007 to 2010, at which point he also became the team leader responsible for overseeing the restructuring and integration of three acquired fabrication facilities, and in 2014 was made responsible for the integration of the Columbus Flat Roll Division. Mr. Graham is a graduate of Harvard Business School Advanced Management Program and earned a bachelor’s degree in business management from Western Governors University and an MBA from the University of Saint Francis.

Glenn A. Pushis is our Senior Vice President, Special Projects, since February 2019. In this position, Mr. Pushis is responsible for the successful design and construction of the company’s new Southwest-Sinton Flat Roll Division developed to serve the Southwestern United States and Mexico. He has extensive experience in this capacity and has been instrumental in numerous construction projects for Steel Dynamics since its foundation. Since 2016, Mr. Pushis served as Senior Vice President, Long Products Steel Group, responsible for the company’s four long product steel mills. Prior to that, Mr. Pushis served as Vice President overseeing the company’s Butler Flat Roll Division and six flat roll coating facilities. He has been with Steel Dynamics since 1994, holding various operational and leadership roles, and he was part of the team that constructed the company’s first steel mill in 1994 - Butler Flat Roll Division. He held various leadership positions within the company’s steel group, including the positions of General Manager for the Engineered Bar Products Division from 2003 to 2007 and more recently, the Butler Flat Roll Division from 2007 to 2014. Mr. Pushis earned a bachelor’s degree in mechanical engineering from Purdue University and his MBA from Indiana University.

Barry T. Schneider has been our Senior Vice President, Flat Roll Steel Group since March 2016. Mr. Schneider is responsible for the company’s two flat roll steel mills and numerous flat roll coating lines, including The Techs and Heartland Flat Roll Division, which together have approximately 8.4 million tons of annual steel shipping capacity, producing hot roll, cold roll and coated steel products, including a wide variety of specialty products, such as light gauge hot roll, galvanized and painted products. Since 2014, Mr. Schneider served as a Vice President overseeing the company’s Engineered Bar Products and Roanoke Bar steel divisions. Mr. Schneider was also part of the team that constructed the company’s first steel mill in 1994, serving in several engineering and operational roles in the melt shop during the company’s first five years of operations. He was the manager of the Butler Flat Roll Division’s hot strip mill and later the cold rolling and coating facilities from 2000 to 2007. Mr. Schneider then held the position of General Manager for the Engineered Bar Products Division from 2007 to 2014. Mr. Schneider earned a bachelor’s degree in mechanical engineering and a Master of Science in engineering management from Rose-Hulman Institute of Technology.

James S. Anderson is our Vice President, Steel Fabrication, and President of New Millennium Building Systems, since February 2019. In this role, Mr. Anderson is responsible for the company's steel fabrication operations, comprised of seven manufacturing facilities, located throughout the United States and in Northern Mexico. Since 2015, Mr. Anderson served as the Chief Operating Officer of New Millennium Building Systems. Prior to that, Mr. Anderson was the general manager of the company's three flat roll galvanizing lines located in Pittsburgh, Pennsylvania (The Techs). Steel Dynamics purchased The Techs in 2007, where Mr. Anderson then served as its Managing Partner. Mr. Anderson earned a bachelor’s degree in Metallurgical Engineering from Grove City College and a Masters of Business Administration from the University of Pittsburgh.

7

Industry Segments

We have three reporting segments: steel operations, metals recycling operations, and steel fabrication operations. Refer to Notes 1 and 13 in the notes to consolidated financial statements in Part II, Item 8 of this Form 10-K for additional segment information.

Steel Operations Segment |

Steel operations consist of our six electric arc furnace steel mills, producing steel from ferrous scrap and scrap substitutes, utilizing continuous casting, automated rolling mills and numerous steel coating and processing lines, and IDI, our liquid pig iron production facility, that supplies solely the Butler Flat Roll Division. Our steel operations sell directly to end-users, steel fabricators, and service centers. These products are used in numerous industry sectors, including the construction, automotive, manufacturing, transportation, heavy and agriculture equipment, and pipe and tube (including OCTG) markets. Our steel operations accounted for 76%, 75%, and 72% of our consolidated net sales during 2019, 2018 and 2017, respectively. We are predominantly a domestic steel company, with only 4% of our revenues generated from exported sales during 2019, and 5% in 2018 and 2017.

Our steel operations consist primarily of steelmaking and coating operations. We have approximately 8.4 million tons of flat roll steel shipping capacity, comprised of 6.4 million tons of flat roll steel production capacity at our Butler and Columbus Flat Roll Divisions and an additional 2.0 million tons of flat roll steel processing capacity at our Techs and Heartland divisions. We also have annual flat roll galvanizing capability of 3.6 million tons and painting capability of 750,000 tons.

We have approximately 4.6 million tons of long product steel shipping capacity, as follows:

Structural and Rail Division | 2,200,000 | ||

Engineered Bar Products Division | 950,000 | ||

Roanoke Bar Division | 720,000 | ||

Steel of West Virginia | 555,000 | ||

Vulcan Threaded Products Division | 135,000 |

Steelmaking capacities represent manufacturing capabilities based on steel mill configuration and related employee support. These capacities do not represent expected volumes in a given year. In addition, estimates of steel mill capacity are highly dependent on the specific product mix manufactured. Each of our steel mills can and do roll many different types and sizes of products; therefore, our capacity estimates assume a typical product mix.

8

The following chart summarizes our steel operations primary products and the estimated percentage of tons sold by end market:

9

SHEET STEEL PRODUCTS

Our sheet steel products, consisting of hot roll, cold roll and coated steel products are produced by our Butler and Columbus Flat Roll Divisions, and our numerous downstream coating lines, including The Techs, Heartland Flat Roll Division – acquired June 29, 2018; and United Steel Supply (USS) – acquired 75% equity interest March 1, 2019. Our sheet steel operations represented 70% of steel operations net sales in 2019 and 2018, and 71% in 2017. We produced 7.8 million, 7.5 million, and 7.1 million tons of sheet steel at these facilities in 2019, 2018, and 2017, respectively.

IDI produces liquid pig iron and hot briquetted iron (HBI) that serves as a substitute for a portion of the metallic raw material mix that goes directly into our Butler Flat Roll Division electric arc furnaces to produce steel. IDI’s primary focus is to maximize liquid pig iron production, due to the inherent economic benefits achieved at the steel mill when the material is used in the steelmaking process, such as reduced energy cost, reduced materials cost, and quicker melting cycles. During 2019, 2018, and 2017, respectively, IDI produced 259,000, 262,000 and 259,000 metric tons, of which 96% in 2019 and 2018, and 90% in 2017, was liquid pig iron. We have used, and plan to continue to use, all of the facility’s output internally.

The following chart summarizes the types of sheet steel products sold by sales dollars, during the respective years:

Customers. Steel processors and service centers typically act as intermediaries between primary sheet steel producers and the many end-user manufacturers that require further processing of hot roll coils. The additional processing performed by the intermediate steel processors and service centers include pickling, galvanizing, cutting to length, slitting to size, leveling, blanking, shape correcting, edge rolling, shearing and stamping. We believe that our intermediate steel processor and service center customers will remain an integral part of our customer base. The Columbus Flat Roll Division allows us to capitalize on the industrial markets in the Southern United States and Mexico, as well as further expand our customer base in painted, and line and other pipe products. Galvanized flat roll products produced by our Butler and Columbus Flat Roll Divisions are similar and are sold to a similar customer base. The Techs and Heartland Flat Roll Division specialize in the galvanizing of specific types of flat roll steels in primarily non-automotive applications, servicing a variety of customers in the heating, ventilation and air conditioning (HVAC), construction, agriculture and consumer goods markets. The addition of United Steel Supply adds a new, complementary distribution channel for pre-painted and coated flat roll steel coils to the niche regional roll-former market, serving the roofing and siding industry. This connects us to a rapidly growing industry segment with customers that do not traditionally purchase steel directly from a steel producer. USS provides continued growth to one of our highest-margin flat roll steel products. Our sheet steel operations also provide a substantial portion of the sheet steel utilized in our steel fabrication operations.

10

The following chart summarizes the types of end-customers who purchased our sheet steel products, by sales dollars, during the respective years:

LONG PRODUCTS

Our Structural and Rail Division produces a variety of parallel flange sections such as wide flange beams, American Standard Beams, manufactured housing beams, and H Piling, and channel sections for the construction, transportation and industrial machinery markets, as well as flat bars and large unequal leg angles used in construction markets. We also produce standard strength carbon, intermediate alloy hardness, and premium grade rails in 40 to 320 feet length for the railroad industry. Our state-of-the-art heat treating system allows us to produce high quality premium rail, which has been certified by all Class I railroads. In addition, our rail-welding facility has the ability to weld (Continuous Welded Rail) in lengths up to 1,600 feet, which offers substantial savings to the railroads both in terms of initial capital cost and through reduced maintenance. In early 2019, we completed and commissioned our expansion to utilize existing excess melting and casting capability to produce up to 240,000 tons of various sizes of reinforcing bar including custom cut-to-length, smooth bar, and coiled. We also utilize our excess melting capacity to supply our Engineered Bar Products Division with pull-through volume of billets to utilize its excess rolling capacity.

Our Engineered Bar Products Division produces a broad array of engineered special-bar-quality (SBQ), merchant-bar-quality (MBQ), rounded-cornered squares, and smaller-diameter engineered round bars. We have a bar finishing facility at this mill, which provides various downstream finishing operations for our SBQ steel bars. Processing operations include turning, polishing, straightening, chamfering, precision saw-cutting and heat-treating capabilities. In addition, non-destructive testing services are available, including eddy current, flux leakage and ultrasonic inspection. Vulcan Threaded Products, Inc. (Vulcan), produces threaded rod product, and cold drawn and heat treated bar, creating strategic pull-through demand of special-bar-quality products provided from our Engineered Bar Products Division.

Our Roanoke Bar Division primarily produces merchant bar products, including channels, angles, flats, merchant rounds, and reinforcing bar. During 2018, we completed our rolling line expansion project to utilize existing excess melting and casting capability to produce up to 200,000 tons of reinforcing bar, with multi-strand slitting and finishing capabilities.

Steel of West Virginia primarily sells beams, channels, specialty steel sections and flats, and frequently performs fabrication and finishing operations on its products, such as cutting to length, additional straightening, hole punching, shot blasting, welding, galvanizing, and coating. Through this additional finishing, we create custom finished products that are generally placed directly into our customers’ assembly operations.

11

We produced the following long steel products at these facilities (tons):

2019 | 2018 | 2017 | ||||||

Structural and Rail Division | 1,493,880 | 1,637,574 | 1,353,699 | |||||

Rail production (included above) | 307,675 | 288,194 | 250,921 | |||||

Engineered Bar Products Division | 655,108 | 824,428 | 698,951 | |||||

Roanoke Bar Division | 528,257 | 575,078 | 473,097 | |||||

Steel of West Virginia | 357,051 | 307,013 | 285,397 |

Customers. The principal customers for our structural steel products are steel service centers, steel fabricators and various manufacturers. Service centers, though not the ultimate end-user, provide valuable mill distribution functions to the fabricators and manufacturers, including small quantity sales, repackaging, cutting, preliminary processing and warehousing. The steel rail marketplace in the United States, Canada and Mexico is specialized and defined, with eight Class I railroads and a large distribution network.

SBQ products are principally consumed by cold finishers, forgers, intermediate processors, OEM manufacturers, steel service centers, and distributors, as well as pull-through volume to Vulcan. Our MBQ products are sold primarily to steel service centers, as well as reinforcing bar distributors, joist producers, and OEMs. Some of the excess steel billet production at the Roanoke Bar Division is sold to mills without sufficient melting capacities, including our Steel of West Virginia facility. Our steel fabrication operations also purchase angles from Roanoke Bar Division. Steel of West Virginia’s customers are primarily OEMs producing truck trailers, industrial lift trucks, merchant products, guardrail posts, manufactured housing, mining, and off-highway construction equipment. Steel of West Virginia’s flexible manufacturing capabilities enable us to meet demand for a variety of custom-ordered and designed products. Many of these products are produced in small quantities for low volume end-uses resulting in a wide variety of customers, the largest of which are in the truck trailer and industrial lift truck industries.

Steel Competition. The markets in which we conduct business are highly competitive with an abundance of competition in the carbon steel industry from North American and foreign integrated and mini-mill steelmaking and processing operations. We compete in numerous industry sections, most significantly tied to the construction, automotive, and other manufacturing sectors. In many applications within these industry sections, steel competes with other materials, such as aluminum, cement, composites, plastics, carbon fiber, glass and wood. Some of our products are commodities, subject to their own cyclical fluctuations in supply and demand. However, we are focused on providing a broader range of diversified value-added products that de-emphasize commodity steel. The primary competitive influences on products we sell are price, quality and value-added services.

Metals Recycling Operations Segment |

The metals recycling operations consists solely of OmniSource and includes both ferrous and nonferrous scrap metal processing, transportation, marketing, and brokerage services strategically located primarily in close proximity to our steel mills and other end-user scrap consumers throughout the eastern half of the United States. In addition, OmniSource designs, installs, and manages customized scrap management programs for industrial manufacturing companies at hundreds of locations throughout North America. Our metals recycling operations accounted for 11%, 13% and 15% of our consolidated net sales during 2019, 2018 and 2017, respectively. Our steel mills utilize a large portion (approximately 65%) of the ferrous scrap sold by OmniSource as raw material in our steelmaking operations, and the remainder is sold to other consumers. This strategic symbiotic relationship with our own steelmaking operations provides valuable pull-through demand to OmniSource’s ferrous scrap operations. In 2019, 2018, and 2017, OmniSource provided our steel operations with 37%, 39%, and 38%, respectively, of its ferrous scrap requirements.

12

We shipped the following from our metals recycling operations:

2019 | 2018 | 2017 | ||||||

Ferrous metal total (gross tons) | 4,627,214 | 5,123,553 | 4,952,973 | |||||

Shipments to our steel mills | 3,061,257 | 3,346,135 | 3,108,858 | |||||

Percent of total to our steel mills | 66% | 65% | 63% | |||||

Nonferrous metals (thousands of pounds) | 1,068,208 | 1,131,412 | 1,086,799 |

We sell various grades of processed ferrous scrap primarily to steel mills and foundries. Ferrous scrap metal is the primary raw material for electric arc furnaces, such as our steel mills. In addition, we sell various grades of nonferrous metals such as copper, brass, aluminum and stainless steel, to aluminum, steel and ingot manufacturers, brass and bronze ingot makers, copper refineries and mills, smelters, specialty mills, alloy manufacturers, and other consumers.

We purchase processed and unprocessed ferrous and nonferrous scrap metals, in a variety of forms for our metals recycling facilities.

Ferrous scrap comes from two primary sources:

| ● | Manufacturers and industrial plants, metal fabrication plants, machine shops and factories, which generate ferrous scrap referred to as prompt or industrial scrap, and |

| ● | Scrap dealers, retail individuals, auto wreckers, demolition firms and others who provide steel and iron scrap, referred to as obsolete scrap. Obsolete scrap includes scrap recycled from items such as end-of-life automobiles, appliances, railroad cars and railroad track materials, agricultural machinery and demolition scrap from obsolete structures, containers and machines and represents a significant source of scrap generation. |

Nonferrous scrap comes from three primary sources:

| ● | Manufacturers and other nonferrous scrap sources, which generate or sell scrap aluminum, copper, stainless steel, and other nonferrous metals, |

| ● | Producers of items such as electric wire, telecommunication service providers, aerospace, defense and recycling companies that generate nonferrous scrap consisting primarily of copper wire, aluminum beverage cans, and various other metals and alloys, and |

| ● | Retail individuals who sell material directly to our facilities, which they collect from a variety of sources. |

We do not purchase a significant amount of scrap metal from a single source or from a limited number of major sources. Market demand and the composition, quality, size, weight, and location of the materials are the primary factors that determine prices.

Products. Our metals recycling operations primarily involve the purchase, processing, and resale of ferrous and nonferrous scrap metals into reusable forms and grades. We process an array of ferrous products through a variety of methods, including sorting, shredding, shearing, cutting, torching, baling, briquetting, and breaking. Our major ferrous products include heavy melting steel, busheling, bundled scrap, shredded scrap and other scrap metal products, such as steel turnings and cast iron. These products vary in properties or attributes related to cleanness, size of individual pieces, and residual alloys. The necessary characteristics of the ferrous products are determined by the specific needs and requirements of the consumer and affect the individual product’s relative value. We process numerous grades of nonferrous products, including aluminum, brass, copper, stainless steel, and other nonferrous metals. Additionally, we provide transportation logistics (truck, rail, and river barge), marketing, brokerage, and scrap management services, providing competitive price and cost advantages to our suppliers and customers.

Customers. We sell various grades of processed ferrous scrap to end-users, such as electric arc furnace steel mills, integrated steelmakers, foundries, secondary smelters, and metal brokers, who aggregate materials for other large users. Ferrous scrap metal is the primary raw material for electric arc furnaces, such as our steel mills. Most of our ferrous scrap customers purchase processed scrap through negotiated spot sales contracts which establish a quantity purchase for the month. The price we charge for ferrous scrap depends upon market demand and pricing, transportation costs, as well as the quality and grade of the scrap. We sell various grades of processed nonferrous scrap to end-users such as aluminum sheet and ingot manufacturers, brass and bronze ingot makers, copper refineries, mills, smelters, specialty steelmakers, alloy manufacturers, wire and cable producers, utilities, and telephone networks. The

13

price we charge for nonferrous scrap also depends upon market demand and pricing, transportation costs, as well as the quality and grade of the scrap.

Competition. Scrap is a global commodity influenced by conditions in a number of industrialized and emerging markets throughout Asia, Europe and North America. The markets for scrap metals are highly competitive, both in the purchase of raw or unprocessed scrap, and the sale of processed scrap. With regard to the purchase of unprocessed scrap, we compete with numerous independent recyclers, as well as smaller scrap companies engaged only in collecting obsolete scrap. In many cases, we also purchase unprocessed scrap metal from smaller scrap dealers and other processors. Successful procurement of materials is determined primarily by the price offered by the purchaser for the raw scrap and the proximity of our processing facility to the source of the raw scrap. Both ferrous and nonferrous scrap sells as a commodity in both domestic and international markets, which are affected, sometimes significantly, by relative economic conditions, currency fluctuations, and the availability and cost of transportation. Competition for sales of processed scrap is based primarily on the price, quality, and location of the scrap metals, as well as the level of service provided in terms of reliability and timing of delivery.

We also face potential competition for sales of processed scrap from other producers of steel products, such as electric arc furnace and integrated steel mills, some of which like us are also vertically integrated in the scrap metals recycling business. In addition, other steel mills may compete with us in attempting to secure scrap supply through direct purchasing from our scrap suppliers. Scrap metal processors also face competition from substitutes for prepared ferrous scrap, such as pig iron, pelletized iron, HBI, direct reduced iron (DRI), and other forms of processed iron. The availability and relative prices of substitutes for ferrous scrap could result in a decreased demand for processed ferrous scrap and could result in lower prices and/or lower demand for our scrap products.

The industry is highly fragmented with many smaller, regional, national and global companies, which have multiple locations in areas in which OmniSource also operates. No single scrap metals recycler has a significant market share in the domestic market.

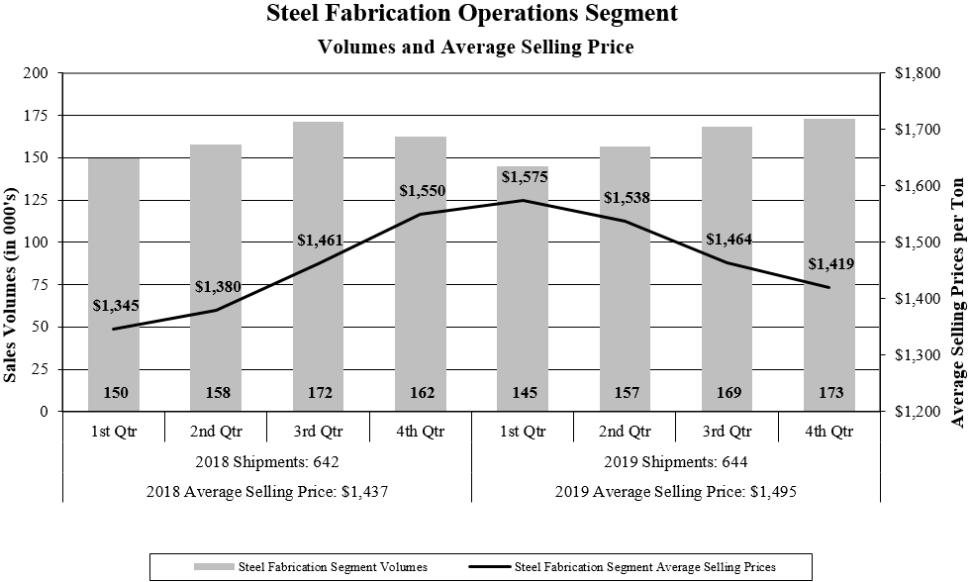

Steel Fabrication Operations Segment |

Our steel fabrication operations include seven New Millennium Building Systems plants that primarily serve the non-residential construction industry throughout the United States. We have a national operating footprint that allows us to serve the entire domestic construction market, as well as national accounts, such as large retail chains.

Steel fabrication operations accounted for 9%, 8%, and 9% of our consolidated net sales during 2019, 2018, and 2017, respectively. We sold 644,000, 642,000, and 627,000 tons of joist and deck products during 2019, 2018, and 2017, respectively. Our steel operations supply a substantial portion, approximately 67%, 58% and 51% in 2019, 2018, and 2017, respectively, of the steel utilized in our steel fabrication operations, providing strategic pull-through demand.

Products. Our steel fabrication operations produce steel building components, including steel joists, girders, and trusses at six locations, and steel deck at five locations. Our joist products include bowstring, arched, scissor, double-pitched and single-pitched joists. Our deck products include a full range of steel decking: roof, form, composite floor, specialty architectural, floor systems, and bridge deck.

Customers and Markets. Our primary steel fabrication operations customers are non-residential steel fabricators, such as metal building companies, general construction contractors, developers, brokers and governmental entities. Our customers are located throughout the United States, including national accounts. The steel joist and deck market in the United States was approximately 2.1 million tons in 2019, and 2018, and 2.0 million tons in 2017, based on trade association estimates. Based on this information, our steel fabrication operations continue to maintain approximately one-third of the total steel joist and deck market. We believe we are well positioned with our national footprint as the non-residential construction market continues to expand, and we have available capacity that can be deployed as needed.

Competition. We compete with other North American joist and steel deck producers primarily on the basis of price, quality, customer service, and proximity to the customer. Our national footprint allows us to service the entire domestic non-residential construction market, as well as national accounts such as large retail chains, and certain specialty deck customers.

14

Other Information |

Sources, Availability, and Cost of Steel and Other Operations’ Raw Materials

Scrap Metals. The principal raw material of our steel operations is scrap metal derived from, among other sources “home scrap”, generated internally at steel mills themselves; industrial scrap, generated as a by-product of manufacturing; and obsolete scrap recycled from end-of-life automobiles, appliances, railroad cars and railroad track materials, agricultural machinery and demolition scrap from obsolete structures, containers and machines.

Ferrous scrap typically comprises more than 80% of the metallic melt mix in electric arc furnace steelmaking, in contrast to integrated mill steelmaking, where the proportion of scrap has traditionally been approximately 25% to 35%. Depending upon the scrap substitute material that may be available from time to time, and the relative cost of such material, the percentage of scrap used in our steelmaking operations could be increased or reduced in our metallic melt mix.

Many variables can impact ferrous scrap prices, all of which reflect the pushes and pulls of the supply demand equation. These factors include the level of domestic steel production (high quality low-residual scrap is a by-product of steel manufacturing activity), the level of exports of scrap from the United States, and the amount of obsolete scrap production. In addition, domestic ferrous scrap prices generally have a strong correlation and spread to global pig iron pricing. Generally, as domestic steel demand increases, so does scrap demand and resulting scrap prices. The reverse is also normally, but not always, true with scrap prices following steel prices downward when supply exceeds demand. When scrap prices greatly accelerate, this can challenge one of the principal elements of an electric arc furnace based steel mill’s traditional lower cost structure—the cost of its metallic raw material.

The following table provides pricing per gross ton from American Metal Market (AMM) and Ryan’s Notes (Pig Iron) estimates for ferrous materials used in steel production:

Iron Units. In addition to scrap, pig iron, DRI, HBI, and iron nuggets are used in our electric arc furnace steel mill production. During 2019, 2018, and 2017, we consumed 10.6 million, 10.9 million and 10.3 million tons, respectively, of metallic materials in our steelmaking furnaces, of which, iron units other than scrap, represented approximately 13%, 14% and 13% of the tons, respectively. Of these iron substitute units consumed, our IDI operation supplies 100% of its production to the Butler Flat Roll Division mill, representing 63%, 64% and 72% of their iron units in 2019, 2018, and 2017, respectively.

15

Energy Resources

Electricity. Electricity is a significant input required in the electric arc furnaces in our steelmaking operations, representing between 4% and 6% of steel production costs of goods sold in 2019, 2018 and 2017. We have entered into fixed price electricity contracts for the Butler Flat Roll Division, Columbus Flat Roll Division, Roanoke Bar Division and Steel of West Virginia, while our Engineered Bar Products Division has a combination of fixed pricing and market pricing for the various components of the electrical services (demand charge, energy charge, riders, etc.). Our Structural and Rail Division purchases electricity at current market prices and through fixed price forward contracts.

Patents and Trademarks

We currently do not own any material patents or patent applications for technologies that are in use in our production processes. We have the following major registered trademarks, as follows:

| ● | the mark “SDI” and a chevron alone; |

| ● | the mark “SDI” and a chevron and “Steel Dynamics, Inc.” to the right of the chevron; |

| ● | the mark “SDI” and a chevron and “Steel Dynamics” to the right of the chevron; |

| ● | the mark “OmniSource” with the circle logo design; |

| ● | the slogan “The Best in Metals Recycling”; |

| ● | the mark “The Techs”; and |

| ● | the mark “New Millennium Building Systems, LLC.” |

Research and Development

Our research and development activities have consisted of efforts to expand, develop and improve our steel products and operating processes, and our efforts to develop and improve alternative ironmaking technologies through IDI. Most of these research and development efforts have been conducted in-house by our employees.

Environmental Matters

Our operations are subject to substantial and evolving local, state, and federal environmental, health and safety laws and regulations concerning, among other things, emissions to the air, discharges to surface and ground water and to sewer systems, and the generation, handling, storage, transportation, treatment and disposal of solid and hazardous wastes and secondary materials. Our operations are dependent upon permits regulating discharges into the environment or the use and handling of by-products in order to operate our facilities. We dedicate considerable resources aimed at achieving compliance with federal, state and local laws concerning the environment. While we do not currently believe that our future compliance efforts with such provisions will have a material adverse effect on our results of operations, cash flows or financial condition, this is subject to change in the ever-evolving regulatory environment in which we operate.

Since the interpretation and enforcement of environmental laws and regulations that may be enacted from time to time are subject to changing social or political pressures, our environmental capital expenditures and costs for environmental compliance may increase in the future. In addition, due to the possibility of unanticipated regulatory or other developments, the amount and timing of future environmental expenditures may vary substantially from those currently anticipated. The cost of current and future environmental compliance may also place United States steel producers at a competitive disadvantage with respect to foreign steel producers, which may not be required to undertake equivalent costs in their operations.

Pursuant to the Resource Conservation and Recovery Act, or RCRA, which governs the treatment, handling and disposal of solid and hazardous wastes, the United States Environmental Protection Agency, or United States EPA, and authorized state or local environmental agencies may conduct inspections to identify alleged violations or areas where there may have been releases of solid or hazardous constituents into the environment and require the facilities to take corrective action to address any such releases. RCRA also allows citizens to bring certain suits against regulated facilities for potential damages and cleanup. Our steelmaking and certain

16

other facilities generate wastes subject to RCRA. Our operations produce various by-products, some of which, for example electric arc furnace or EAF dust, are often categorized as hazardous waste, requiring special handling for disposal or for the recovery of metallics. We collect such by-products in pollution control equipment, such as baghouses, and either recycle or appropriately dispose of the unusable by-products. While we cannot predict the future actions of the regulators or other interested parties, the potential exists for required corrective action at these facilities, the costs of which could be substantial.

Under the Comprehensive Environmental Response, Compensation and Liability Act, known as “CERCLA” or “Superfund,” the United States EPA, state agencies and, in some instances, private parties have the authority to impose joint and several liability for the remediation of contaminated properties upon generators of waste, current and former site owners and operators, transporters and other potentially responsible parties, regardless of fault or the legality of the original disposal activity. Many states have statutes and regulatory authorities similar to CERCLA that can also apply. We have a number of material handling agreements with various contractors to properly dispose of or recycle our EAF dust and certain other by-products of our operations. However, we cannot assure that, even if there has been no fault by us, we may not still be cited as a waste generator by reason of an environmental cleanup at a site to which our by-products were transported.

The Clean Water Act and similar state and local laws apply to aspects of our operations and impose regulatory restrictions related to the discharge of wastewater, storm water and dredged or fill material. The United States EPA, state agencies and, in certain instances, private parties have the ability to bring suit alleging violations and seeking penalties and damages. The Clean Water Act’s provisions can require new or expanded water treatment investments to be made and can limit or even prohibit certain current or planned activities at our operations.

The Clean Air Act and analogous state and local laws require many of our facilities to obtain and maintain air permits in order to operate. Air permits can impose new or expanded obligations to limit or prevent current or future emissions and to add costly pollution control equipment. Enforcement for alleged violations can be brought by the United States EPA, state agencies, and in certain instances private parties, and can result in substantial penalties and injunctive relief.

In addition, there are a number of other environmental, health and safety laws and regulations that apply to our facilities and may affect our operations. By way of example and not of limitation, certain portions of the federal Toxic Substances Control Act, Oil Pollution Act, Safe Drinking Water Act and Emergency Planning and Community Right-to-Know Act, as well as state and local laws and regulations implemented by the regulatory agencies, apply to aspects of our facilities’ operations. In some instances, we may also be subject to foreign governments’ regulations and international treaties and laws. Many of these laws allow both the governments and citizens to bring certain suits against regulated facilities for alleged environmental violations. Finally, our operations could be subject to certain toxic tort suits brought by citizens or other third parties alleging causes of action such as nuisance, negligence, trespass, infliction of emotional distress, or other claims alleging personal injury or property damage.

Employees

Our work force consisted of approximately 8,385 full time employees at December 31, 2019, of which approximately 9% were represented by collective bargaining agreements.

Available Information

Our internet website address is www.steeldynamics.com. We make available on our internet website, under “Investors,” free of charge, as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the Securities and Exchange Commission, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, as well as press releases, ownership reports pursuant to Section 16(a) of the Securities Act of 1933, our Code of Ethics for Principal Executive Officers and Senior Financial Officers, our Code of Business Conduct and Ethics, and any amendments thereto or waivers thereof, as well as our Audit, Compensation, and Corporate Governance and Nominating Committee Charters. We do not intend to incorporate the contents of our or any other website into this report.

17

ITEM 1A. RISK FACTORS

Many factors could have an effect on our business, results of operations, financial condition and cash flows. We are subject to various risks resulting from changing economic, environmental, political, industry, business and financial conditions. The factors described below represent our principal risks.

Risks Related to our Industry

Global steelmaking overcapacity and imports of steel into the United States have adversely affected, and may continue to adversely affect, United States steel prices, which may adversely affect our business, results of operations, financial condition and cash flows.

Global steelmaking capacity currently exceeds global consumption of steel products, which adversely affects United States and global steel prices. Such excess capacity sometimes results in steel manufacturers in certain countries exporting steel and steel products, including pre-fabricated long product steel, at prices that are lower than prevailing domestic prices, and sometimes at or below their cost of production. Excessive imports of steel and steel products, including pre-fabricated steel, into the United States, have exerted, and may continue to exert, downward pressure on United States steel and steel products prices, which adversely affects our business, results of operations, financial condition and cash flows. Furthermore, anticipated additional domestic steel capacity could increase this global overcapacity. This, in turn, may also adversely impact domestic demand for ferrous scrap and our ferrous metallics margins. United States steel producers compete with many foreign producers, including those in China, Vietnam and other Asian and European countries. Competition from foreign producers is typically strong and is periodically exacerbated by weakening of the economies of certain foreign steelmaking countries. Additionally, low iron ore prices, resulting in disruption of the scrap price correlation to iron ore, leads to reduced global costs to produce steel, further depressing steel import prices. A higher volume of steel imports into the United States tends to occur at depressed prices when steel producing countries experience periods of economic difficulty, decreased demand for steel products or excess capacity. The global steelmaking overcapacity is exacerbated by Chinese steel production capacity that far exceeds that country’s demand and has made China a major global exporter of steel, resulting in weakened global steel pricing than otherwise would be expected. While tariffs pursuant to Section 232 of the Trade Expansion Act of 1962, as amended (“Section 232”), other measures to curb unfair trade such as duties or quotas, and the renegotiation of trade agreements with other countries, including the recently signed United States-Mexico-Canada Agreement (“USMCA”), have decreased the volume of steel and steel products imports in the United States, domestic steel and steel products prices remain negatively impacted by excessive imports of steel and steel products into the United States. Should the Section 232 tariffs, duties or quotas expire or be relaxed, repealed or circumvented by importers of steel and steel products, or should trade agreements be renegotiated, downward pressure may be exerted on United States steel and steel products prices, which adversely affects our business, results of operations, financial condition and cash flows.

In addition, we believe the downward pressure on, and periodically depressed levels of, United States steel prices in recent years have been further accentuated through imports of steel involving dumping and subsidy abuses by foreign steel producers. Some foreign steel producers are owned, controlled or subsidized by foreign governments. As a result, decisions by these producers with respect to their production, sales and pricing are sometimes influenced to a greater degree by political and economic policy considerations than by prevailing market conditions, realities of the marketplace or consideration of profit or loss. However, while some tariffs, duties and quotas, including those imposed under Section 232, have been put into effect for steel and certain steel products imported from a number of countries that have been found to have been unfairly pricing steel imports to the United States, some foreign steel subject to these duties, tariffs and quotas circumvent the penalties by processing in or transporting through a foreign country not subject to the penalties. Additionally, there is no assurance that the Section 232 tariffs or other already imposed tariffs, duties and quotas will remain in place or that new ones, even if justified, will be levied, and even when imposed many of these are only short-lived. If such tariffs, duties or quotas expire or if others are further relaxed or repealed, or if relatively higher United States steel prices make it attractive for foreign steelmakers to export their steel products to the United States, despite the presence of tariffs, duties or quotas, the resurgence of substantial imports of foreign steel could create downward pressure on United States steel prices.

Our industry, as well as the industries of many of our customers and suppliers upon whom we are dependent, is affected by domestic and global economic factors including periods of slower than anticipated economic growth and the risk of a new recession.

Our financial results are substantially dependent not only upon overall economic conditions in the United States and globally, including North America, Europe and in Asia, but also as they may affect one or more of the industries upon which we depend for the sale of our products. Global or domestic actions or conditions, including political actions, trade policies or restrictions, such as the recently signed USMCA, changes in tax laws, terrorism, natural disasters, or widespread illness or other health issues, such as the recent Coronavirus outbreak, could result in changing economic conditions in the United States and globally, disruptions to or

18

slowdowns in our business or our global or domestic industry, or those of our customers or suppliers upon whom we are dependent, or changes in our pre-tax and post-tax financial performance. Additionally, periods of slower than anticipated economic growth could reduce customer confidence and adversely affect demand for our products and further adversely affect our business, results of operations, financial condition and cash flows. Metals industries have historically been vulnerable to significant declines in consumption and product pricing during periods of economic downturn or continued uncertainty, including the pace of domestic non-residential construction activity.

Our business is also dependent upon certain industries, such as construction, automotive, manufacturing, transportation, heavy and agriculture equipment, and pipe and tube (including OCTG) markets, and these industries are also cyclical in nature. Therefore, these industries may experience their own fluctuations in demand for our products based on such things as economic conditions, raw material and energy costs, consumer demand and infrastructure funding decisions by governments. Many of these factors are beyond our control. As a result of volatility in our industry or in the industries we serve, we may have difficulty increasing or maintaining our level of sales or profitability. If our industry or the industries we serve were to suffer a downturn, then we may experience an adverse effect on our business, results of operations, financial condition and cash flows.