UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the Fiscal Year Ended September 30, 2013

OR

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from N/A to N/A

Commission File Number: 000-28745

Cloud Medical Doctor Software Corporation

(Name of small business issuer as specified in its charter)

(Formerly National Scientific Corporation)

| Texas | 86-0837077 | |

| State of Incorporation | IRS Employer Identification No. |

1291 Galleria Drive, Suite 200

Henderson, NV 89014

(Address of principal executive offices)

(702) 818-9011

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.01 par value per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [x] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [x] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [ ] Yes [x] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ] Yes [x] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non–Accelerated filer | [ ] | Small reporting company | [x] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b–2 of the Exchange Act). [ ] Yes [x] No

Aggregate market value of the voting stock held by non-affiliates: $5,219,871 as based on the closing price of the stock on March 30, 2013 (the last business day of the Registrant’s prior second fiscal quarter). The voting stock held by non-affiliates on that date consisted of 173,995,712 shares of common stock.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of January 31, 2014, there were 215,159,216 shares of common stock, par value $0.01, issued and outstanding 4,000,000 shares of preferred stock, par value $0.01.

Documents Incorporated by Reference: None

Cloud Medical Doctor Software Corporation

FORM 10-K ANNUAL REPORT

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2013 and 2012

| PART I | ||||

| ITEM 1. | BUSINESS | 2 | ||

| ITEM 1A. | RISK FACTORS | 10 | ||

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 16 | ||

| ITEM 2. | PROPERTIES | 16 | ||

| ITEM 3. | LEGAL PROCEEDINGS | 16 | ||

| ITEM 4. | REMOVED AND RESERVED | 17 | ||

| PART II | ||||

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 18 | ||

| ITEM 6. | SELECTED FINANCIAL DATA | 22 | ||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 22 | ||

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 27 | ||

| ITEM 8. | CONSOLIDATED FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 27 | ||

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 48 | ||

| ITEM 9A. | CONTROLS AND PROCEDURES | 48 | ||

| ITEM 9B. | OTHER INFORMATION | 49 | ||

| PART III | ||||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE | 50 | ||

| ITEM 11. | EXECUTIVE COMPENSATION | 52 | ||

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 54 | ||

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 56 | ||

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 56 | ||

| PART IV | ||||

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 58 | ||

| SIGNATURES | 59 | |||

| CERTIFICATIONS | ||||

| Exhibit 31 | Management Certifications | |||

| Exhibit 32 | Sarbanes-Oxley Act | |||

Special Note Regarding Forward-Looking Statements

Some of our statements under "Business," "Properties," "Legal Proceedings," "Management's Discussion and Analysis of Financial Condition and Results of Operations,"" the Notes to Financial Statements and elsewhere in this report constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are subject to certain events, risks and uncertainties that may be outside our control. Some of these forward-looking statements include statements of:

| · | management's plans, objectives and budgets for its future operations and future economic performance; | |

| · | capital budget and future capital requirements; | |

| · | meeting future capital needs; | |

| · | realization of any deferred tax assets; | |

| · | the level of future expenditures; | |

| · | impact of recent accounting pronouncements; | |

| · | the outcome of regulatory and litigation matters; | |

| · | the assumptions described in this report underlying such forward-looking statements; and | |

| · | Actual results and developments may materially differ from those expressed in or implied by such statements due to a number of factors, including: |

| o | those described in the context of such forward-looking statements; | |

| o | future service costs; | |

| o | changes in our incentive plans; | |

| o | the markets of our domestic operations; | |

| o | the impact of competitive products and pricing; | |

| o | the political, social and economic climate in which we conduct operations; and | |

| o | the risk factors described in other documents and reports filed with the Securities and Exchange Commission. |

In some cases, forward-looking statements are identified by terminology such as "may," "will," "should," "could," "would," "expects," "plans," "intends," "anticipates," "believes," "estimates," "approximates," "predicts," "potential" or "continue" or the negative of such terms and other comparable terminology.

Although we believe that the expectations reflected in these forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor anyone else assumes responsibility for the accuracy and completeness of such statements and is under no duty to update any of the forward-looking statements after the date of this report.

PART I

ITEM 1. BUSINESS.

General

The financial statements presented in this report are of Cloud Medical Doctor Software Corporation, a Texas corporation. When the terms “Cloud”, the “Company,” “we,” “us” or “our” are used in this document, those terms refer to Cloud Medical Doctor Software Corporation.

Our Company

The Company was incorporated in Texas on June 22, 1953 as American Mortgage Company. On May 16, 1996, the Company changed its name to National Scientific Corporation. On April 3, 2012, the Company changed its name to Cloud Medical Doctor Software Corporation (“Cloud-MD”). During 1996, the Company acquired the operations of Eden Systems, Inc. (“Eden”) as a wholly owned subsidiary. Eden was engaged in water treatment and the retailing of cleaning products. Eden’s operations were sold on October 1, 1997. From September 30, 1997 through the year ended September 30, 2001, we aimed our efforts in the research and development of semiconductor proprietary technology and processes and in raising capital to fund its operations and research.

Beginning in calendar 2002, we focused our efforts on the development, acquisition, enhancement and marketing of location device technologies. Our revenue was derived from sales of electronic devices.

On February 4, 2010, the prior Board members, Mr. Michael Grollman and Mr. Greg Szabo, voted to discontinue and wind down the operation of the Company's Mobile DVR and Location Products business. These Company assets were transferred to a Limited Liability Company named NSC Labs, LLC controlled and owned by Mr. Grollman. Mr. Grollman and NSC Labs, LLC agreed to pay the Company 2% of future revenues and $100,000. However, neither Mr. Grollman nor NSC Labs, LLC have paid any consideration for this transaction. The Company discontinued these operations in 2011.

On November 19, 2010, the prior management of the Company was terminated and a new management team began working on operations related to the Company’s medical billing software. In fiscal 2011, the year of termination of prior management, the new management team deemed that the above transaction transferring prior operations to NSC Labs, LLC was transacted in full and final settlement of the liabilities owed to the former management. Since the transaction was related to the former management team, who had the ability to affect the terms and outcomes of the liabilities, the settlement of the liabilities has been subsequently recorded as an increase to additional paid in capital.

Item 1. Description of Business

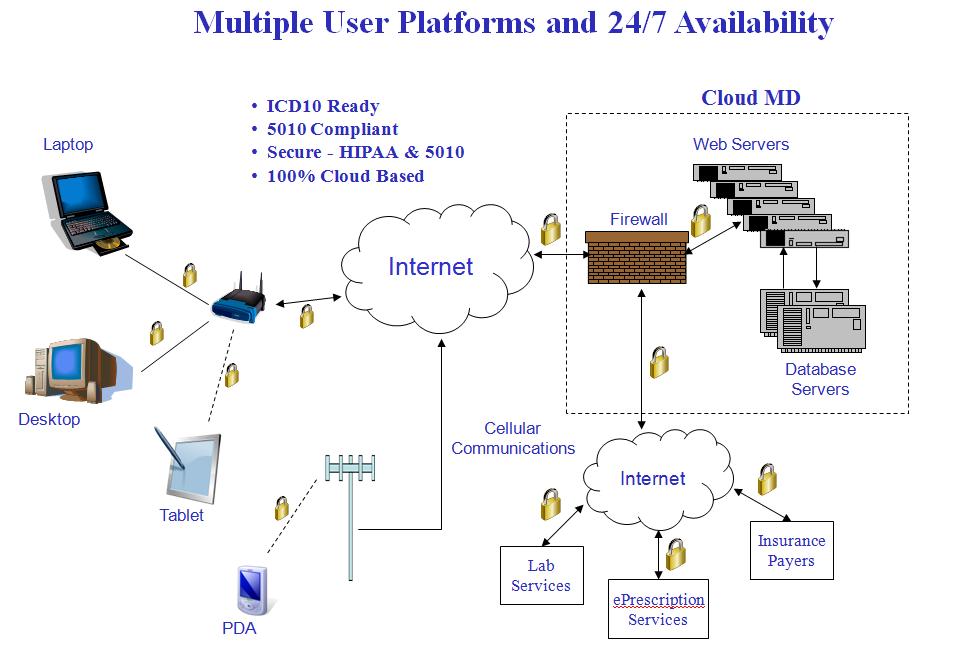

Cloud Doctor Medical Software Corporation

In 2011, Cloud introduced the Cloud-MD Office, a “Cloud Based”, 5010 ready and ICD-10 compliant, fully integrated and interoperable suite of medical software and services, designed by experienced healthcare analysts and programmers for healthcare providers, that produces “Actionable Information” to help Independent Physician Practices, New Care Delivery Models (ACO), Healthcare Systems and Billing Services optimize a wide range of business processes resulting in Increased Profits, Higher Quality, Greater Efficiency, Noticeable Cost Reductions and Better Patient Care. Current software product offerings include Practice Management, Electronic Medical Records, Revenue Management, Patient Financial Solutions, Medical and Pharmaceutical Supply Management, Claims Management and PHI Exchange.

In 2012, Cloud launched Cloud-MD Billing Services which provides management of medical claims from posting physician charges and payments into our medical billing software. The software uses a continuous insurance claim follow-up system to track and research all rejected or denied medical claims; a Comprehensive Reporting module that includes monthly financial statements sent to our clients so they can see how their practice is performing and a variety of detailed reports giving our clients the necessary information and tools used to assist in the increased production which leads to more profit; and patient account inquiries & support to assist patients with their billing and insurance questions.

Products and Services

Cloud-MD™ Software Products

Our applications and platforms provide real value to the individual clinician making their job easier, while at the same time benefiting other players in the health care system continuum. Cloud-MD™ has differentiated itself by using the Software as a Service (“SaaS”) Cloud Computing based business model in order to:

| • | Lower software and hardware startup cost for providers | |

| · | Lower per patient visit cost | |

| · | Lower IT maintenance and support cost for providers | |

| · | Lower days in account receivable | |

| · | Increase practice revenue per patient | |

| · | Lower costs for Cloud-MD™ while preserving high-value, high-margin aspects of the acquisition models for CloudMD™ | |

| · | Provide a solution that makes it extremely unlikely that customers will leave for other software systems or billing services | |

| · | Offer data mining of the extremely valuable data that is captured by Cloud-MD™ software | |

| · | Offer a software solution suitable for both independent medical providers or medical billing companies desiring a Meaningful Use certified product with a feature set designed for billing companies | |

| · | Build a business model designed for fast growth and high profitability |

|

Physician financial and clinical systems are rapidly evolving and are the main driving force to meet a heightened demand for a growing need to increase efficiencies so physicians can make better patient care and profitability decisions. Cloud-MD™’s interoperable systems optimize the physician’s ability to increase revenues, increase efficiencies, lower costs, and increase profitability.

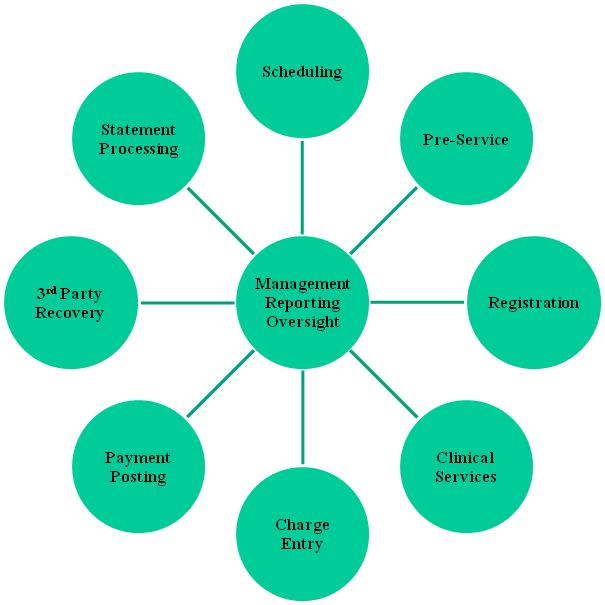

This business process management within healthcare is better known as Revenue Cycle Management (RCM) and has the following major components:

|

|

Cloud-MD™ Office is a fully INTEGRATED and INTEROPERABLE suite of SaaS products and medical practice services that provide the flexibility to address the ever changing business and production requirements within a medical practice setting. Physicians and their management teams prefer to have interoperable systems and services delivered by one company that also provides the installation, training, and support of those systems.

|

By combining an interoperable suite of systems, billing management and other services, Cloud-MD™ Office can help to increase the physician’s profitability and office efficiency by electronically: (1) documenting patient encounters; (2) automatically coding those encounters with a billing logic that is designed to maximize income; (3) analyzing the financial and clinical performance of the practice; (4) notifying the physician. By reducing paper based errors, increasing speed and accuracy of collections, and improving operational decision making, Cloud-MD™ enables the physician to improve their performance and their financial position. |

|

Physicians use a multitude of products and services in their daily operations. Cloud-MD™ Office offers products and services to physicians that meet HIPAA, 5010, ICD-10 and Meaningful Use criteria and include, but are not limited to, the following:

| 1. | Cloud-MD™ Electronic Medical Records (“EMR”) Cloud-MD™’s EMR software can also help streamline coding and billing, appointment scheduling, prescription writing – and ultimately patient safety. | |

| 2. | Cloud-MD™’ Business Intelligence (“BI”) dashboard tool for physician practices is being developed internally for both clinical and financial applications. Business Intelligence is used to analyze the financial health of the practice and proactively address trends. Cloud-MD™’s BI has been in development for the past two years and is currently in Beta testing. The product utilizes dashboards to provide a visual display of the practice’s business health, with over 20 Key Performance Indicators (“KPI”). By streamlining these functions, the physician can better focus on having a more profitable practice. Test markets have widely applauded the product. It is anticipated that the product will be ready to market in mid-2014. | |

| 3. | Practice Management (“PM”) Software, out of all of the different kinds of medical software available, PM is the system that is most useful to every physician on a daily basis. The main reason: it is the only system that generates income from the medical services provided to patients. In addition, while some programs are designed to facilitate surgical procedures or help doctors make more accurate diagnoses, practice management programs deal with organizing the ins and outs of the daily occurrences in a medical office. | |

| 4. | Revenue Cycle Management (“RCM”) Software consists of a suite of capabilities that will help a physician’s practice identify and prevent revenue cycle losses. RCM facilitates the efficient performance of the complex financial and administrative transaction processes that healthcare groups face every day. The Cloud-MD™ solution is EHNAC, HDX, ANSI HL 7, EDI and ASP/Cloud Computing model compliant and delivered through a HIPAA secure, high-performance, high-volume web portal. Components of the Revenue Cycle Management solution include: |

| a. | Cloud-MD™ Claims Manager provides the most advanced and efficient Claim Lifecycle Management Solutions for all of a practice’s insurance claims during every step of the processing cycle, ensuring you receive every dollar to which you are entitled. The Claims Manager significantly improves the way physicians communicate with payers, optimize revenue capture, shorten payment cycle time, improve operational efficiencies, collect additional revenue and better manage their revenue stream and resources. | |

| b. | Cloud-MD™ Real-Time Insurance Eligibility Verification improves practice profitability by solving the problems with eligibility verification, the cause of three out of four insurance denials. With real-time access to approximately all electronically accessible plans, the Cloud-MD™ Eligibility Verification and Benefit Inquiry permits a provider to determine if a patient is currently eligible for coverage from a payer. | |

| c. | Cloud-MD™ Patient Credit is a totally new concept in patient collections for the HealthCare Provider - it shifts the burden of lost revenue from the provider to the patient. It utilizes a proven system for managing the collection process from the moment of creation of the debt through the final payment, all without costing the provider any money or resources. It fully automates the payment process and benefits include: Increased Collections; Reduced A/R; Reduced Patient Bad Debt; Reduced Patient Billing Expenses; No Collection Calls; Expedites Cash Flow. | |

| d. | Cloud-MD™ e-Payment Solution offers multiple ways to process Credit, Debit and Check transactions. It offers the lowest rates for merchant processing through either a credit card point of sale terminal or through our Virtual e-terminal. It will accept all of the major Credit and Debit cards so that you can provide more payment options to your patients. | |

| e. | Cloud-MD™ Billing Services stands out from the crowd of medical billing companies. Cloud-MD™ Billing Services offers a complete medical billing solution, offers best-of-breed technology, an air tight medical billing process, actionable reporting and broad experience and can work its clients' medical billing systems. Cloud-MD™ Billing Services is a major component of Revenue Cycle Management and will assist physicians in maximizing their revenues as they see patients. Physicians typically pay more than they should for billing – either internal or outside services. Because Cloud-MD™ can combine the Company systems and processes within the billing company; we can quickly reduce expenses of the operation and increase profitability of the physician’s practice. |

| 5. | Patient Health Information Exchange (“PHI”) offers a new concept in referrals management, physician-to-physician communications and physician-to-patient communications. With complete HIPAA compliant security and use of already familiar electronic tools such as an Electronic Medical Records (“EMR”)/Electronic Health Records (“EHR”), email or a FAX machine, Patient Health Information can be easily and securely transmitted and retrieved by only the intended parties. |

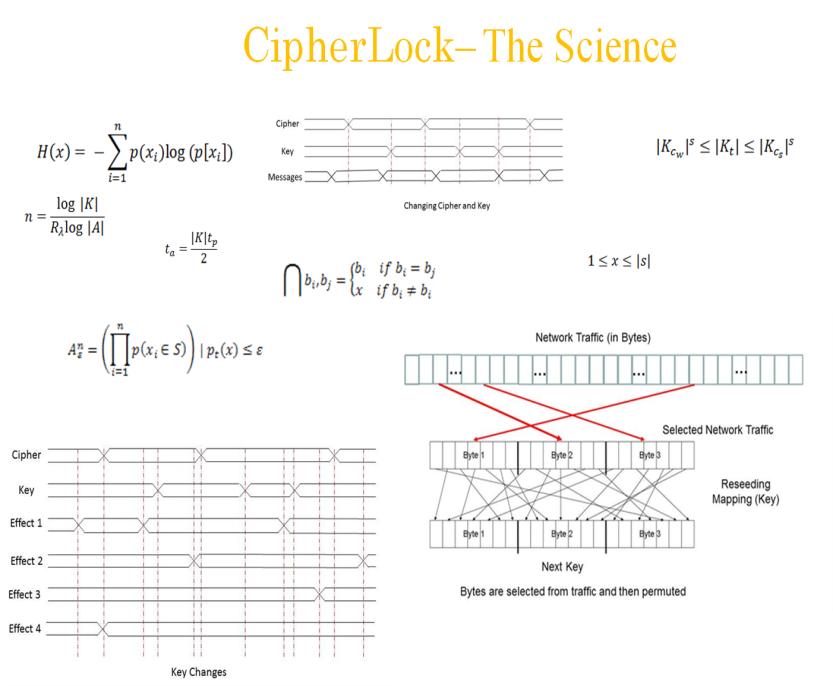

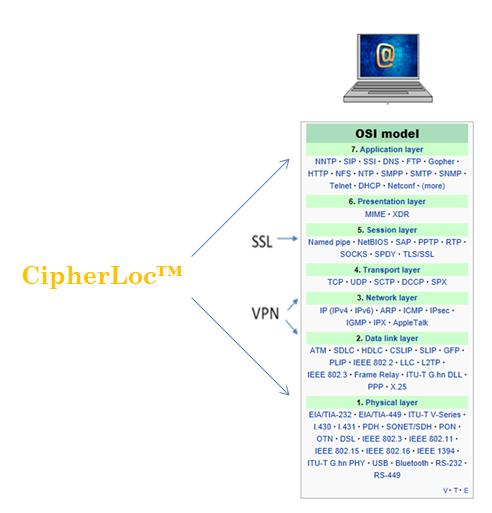

| 6. | Information Security (“IS”) offers CipherLoc™, the most comprehensive security coverage available and easily complies with HIPAA guidelines. CipherLoc™ is a patent pending, state-of-the-art Polymorphic Cipher Engine that was created as an advance Polymorphic Key Progression Algorithm (“PKPA”) cipher engine. CipherLoc™ is an industry changing, ground breaking and innovative solution for making all digital communications virtually impenetrable, thus, giving any corporation or individual the capability to achieve virtually the same security offered by a One Time Pad (OTP), the most secure cipher solution known, without all of the disadvantages. The CipherLoc™ | |

| 7. | Healthcare Inventory Management (“IM”) is a sophisticated, yet easy-to-use, solution for inventory management and product acquisition as well as a resource for accessing detailed, actionable information about specific product usage in order to help streamline current processes and procedures to manage the costs and complexities of the internal inventory cycle of a healthcare business. | |

| 8. | Practice Optimization Consulting is an audit based service performed on the individual practice in order to make recommendations on ways to improve efficiencies and increase revenues. Our team of experts will analyze how your practice functions and looks at your specific systems and needs. Based on our findings, we will help you develop a program that will improve the efficiency of your practice, leading to higher profits. | |

| 9. | Cloud MD Cross Border Verticals provides ancillary income to its members and will provide physician members the opportunity to increase their personal revenue by receiving dividends from the Company for buying goods and services they are required to have. As mentioned earlier, physicians indirectly control 50 – 60% of all healthcare spending. Cloud MD Cross Border Verticals gives the physician the opportunity to benefit financially from this type of spending. | |

| 10. | Company Owned Services offers opportunities for physicians to potentially share in the revenue generated by the various divisions of the company. | |

| 11. | Recurring Income Opportunities from various third party vendors like insurance purchases or group supply purchases will be negotiated and made available to share among the Cloud MD members. |

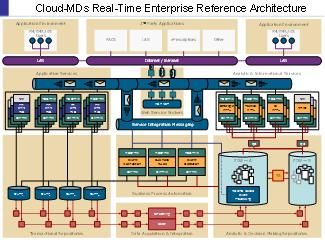

Cloud-MD™ software products are fully

integrated, designed as cloud based computing solutions deployed using the following

architectural and physical models:

|

|

We have already attracted physician investors and have already begun the process of developing our “Cross Border Verticals” initiative which includes services such as Inventory Management of medical supplies and pharmaceuticals as well as program development for a Concierge Medicine initiative.

In addition, we are in negotiations with several major healthcare and healthcare solution providers, cumulatively representing several thousand medical providers, to offer a variety of products and services.

CipherLoc™ “To Defeat the Attacker” Software Product

CipherLoc™ is the first truly Polymorphic Cipher Engine that can be used in commercial, security sensitive applications and is far more secure than any cipher by itself. This PKPA Engine eliminates replay attacks because the cipher morphs quickly over time. It also rejects data access and injection, false commands, and data alteration. All such methods are keys to cyber intrusion, spoofing, and electronic attacks. CipherLoc™ is one facet of a layered defense in depth protection plan for any organization. Cost effective and easy to use, the CipherLoc™ Polymorphic Cipher Engine provides an electronic gate that restricts access to vital assets, production facilities, and distribution systems that comprise the backbone of today’s electronics based organizations.

|

This morphing cipher engine features low latency, minimal memory requirements, and small size. It is able to morph, or change at least 3,000 times per second. This is a cipher that gets stronger as technology improves rather than easier to break. While no measure cures all problems, CipherLoc™ will protect communications, networks and electronic assets better than any other cipher currently available, and just as well as the One Time Pad (OTP) without the prohibitive expense and time latency associated with the OTP.

|

|

What is a “Polymorphic Cipher”?

A polymorphic cipher has the ability to change an encryption to another method of encryption or key on the fly and is more commonly known as a “mutating” cipher. Polymorphic ciphers are a revolutionary idea based on the information content in a message rather than the difficulty of the key. Using advanced set theory and information theory, this encryption method does not rely exclusively on large keys and complicated permutation/obscuring techniques. This makes the algorithm faster, thus, allowing cipher changes to occur VERY quickly, and requires less memory than other encryptions. Polymorphic changes take place at a rate no slower than the effective “unicity distance” (that certain amount of information needed in order to decrypt an encrypted message) of the cipher, more frequently than enough information can be collected to break the code. Most other ciphers are easily broken as hardware gets faster because it is easier to check all possible keys in the cipher key space. However, if a polymorphic cipher is implemented properly, the speed of the encryption will increase as the hardware gets faster. Thus, unlike other ciphers, this type of software becomes safer as computers get faster.

CipherLoc™ - Key Facts:

| 1. | CipherLoc™ was created as an advance Polymorphic Key Progression Algorithm (“PKPA”) cipher engine that achieves essentially the same security as a One Time Pad (“OTP”), the most secure cipher known, without all of the disadvantages. | |

| 2. | CipherLoc™ will eliminate dependence on a single type of cipher. | |

| 3. | The estimated number of keys is greater than 2.5x101500 per second. Even then the person breaking the cipher must know EVERY bit that crosses the network during the transmission period. At 100 Mbps transmission rates, this means recording a GB of information to analyze every 10 seconds. | |

| 4. | CipherLoc™ works on all operating systems and for all computing environments. More than just an obscuring algorithm, CipherLoc™ extends security without expending additional resources. It is the pinnacle of cipher technology. | |

| 5. | CipherLoc™ works using the information content of the message. | |

| 6. | CipherLoc™ prevents a cryptographer from getting enough information to recover data. | |

| 7. | CipherLoc™ keys are randomized from network traffic. | |

| 8. | CipherLoc™ prevents replay attacks because improperly encrypted messages are rejected. | |

| 9. | CipherLoc™ can use any (and all) ciphers that are peer reviewed and judged to be strong. | |

| 10. | CipherLoc™ changes block size randomly. | |

| 11. | Keys change at over 3,000 changes per second (“cps”). | |

| 12. | CipherLoc™ gets stronger with hardware and software advances. | |

| 13. | CipherLoc™ can be keyed to local or global entropy for additional security. | |

| 14. | CipherLoc™ has no need for key distribution (like an OTP) since keys are electronically determined. | |

| 15. | CipherLoc™ messages are always different. Repeating messages does not result in the same encrypted text and the same letters in different slots encrypt differently. |

| 16. CipherLoc™ can be used at Layers 2-7 of the OSI Protocol Stack or within user applications. It can be run as an independent program and added as a module to the program it secures. Operation is transparent to the end user. No new transmission protocol is needed because CipherLoc™ works on the contents of the packets and does not provide a “chosen plaintext” scenario for analysis. 17. CipherLoc™ is achievable in hardware, software, or a mix of the two. 18. CipherLoc™ is ideal for internet and private networks. 19. CipherLoc™ works extremely well for Real Time Operating Systems and control systems. |

|

| 20. | CipherLoc™ automated key generation from a randomized source means that even if the first key is compromised the next key is not formed until the network provides the data. This prevents the so-called “rubber hose” attack. | |

| 21. | CipherLoc™ is infinitely configurable and mathematically provably secure. It allows you to have security as good as a government without the same cost and vast array of equipment. |

CipherLoc™ - Development

CipherLoc™ is not a static product and because of its very nature will always be a “work-in-progress” so that it can always be one step ahead of contemporary hacking approaches. The CipherLoc™ initial proof-of-concept was done in conjunction with a major U.S. university recognized for its excellence in security instruction and research by the US Government. Today’s CipherLoc™ team consists of several PhD’s (math, computer science, electrical engineering and statistics), elite professors, one of whom is a Fulbright Scholar, graduate students and commercial software developers specializing in operating systems, networking and security. Collectively the development team has specialties and experience in computer science, information theory, ciphers, cryptography, set theory, tactical and strategic electronic warfare, wireless communications, networking, control systems, communications electronics, commercial telecommunications and military telecommunications. Members of the team have worked for some of the largest and most admired engineering companies in existence, have military security expertise, have designed security programs, audited utilities and other infrastructure facilities, designed legal chain of custody applications, created anti-piracy and HIPAA (defined below) programs, protected credit card information, and worked in defense industries. Cooperative research takes place at several different universities with innovative cyber security programs. Each professor leads research teams composed of specially selected researchers specializing in cutting edge mathematics and cryptography techniques for randomization and decryption. Both are used to simplify encryption algorithms and proactively “attack the hack.” The goal is to make hackers react to attacking methods in the cipher rather than to react to new attack methodologies used by the hackers. Members of the research and development team have published papers and books on cryptography and set theory, are Critical Infrastructure Protection (“CIP”) certified, are developing university programs in cyber security, and are considered experts in the field of cryptography.

The Market and Industry

Cloud-MD™ Marketing

CloudMD participates in the rapidly growing US Healthcare industry, which is expected to grow from nearly $2.0 trillion today to approximately $2.9 trillion in the next 2-5 years. Research by The American Medical Association, The Gartner Group, Datamonitor and Forrester Research and others makes it clear that healthcare provider spending has been growing annually since 2005 and is expected to continue growing through 2016, led by the IT services segment, whose annual growth rate is expected to be 6.6% compound annual growth rate.

Recent industry changes have added many challenges and complexities to the business of the medical practice (EHR transition, Patient Protection and Affordable Care Act (“PPACA”), HIPAA revisions, Accountable Care Organizations (“ACO”), ICD-10, Electronic Prescribing “eRX”, Physician Quality Reporting Solutions “PQRS”, declining reimbursement rates, increased patient payment responsibility, etc.). As such, many practices have started to reevaluate the idea of partnering with a professional medical billing or revenue cycle management firm as a possible resource for addressing some of the challenges.

As medical practices evaluate the option of outsourcing the medical billing functions verses performing the process internally, the related cost of each option should be considered. The analysis involves more than simply comparing the billing firm fee to the salary of internal billing staff. A proper analysis can illustrate a substantial price difference between the two options.

When evaluating the cost of performing billing and reimbursement functions internally, a practice should quantify: 1) Salary and Wages; 2) Benefits; 3) Training Costs; 4) Space / Real Estate / Opportunity Costs; 5) EDI Costs; 6) Patient Statement Costs; 7) Office equipment; 8) Office Supplies; 9) Communication Costs; 10) Theft/Embezzlement; 11) Billing Errors.

The fees for outsourcing are typically in the 6% - 9% range - less than the fees the practice may incur to perform billing in house. Furthermore, the cost of medical billing errors can be very expensive to the average medical practice.

If a medical billing firm can cause even a slight increase in the quality of the medical billing process, the practice may realize a double benefit in the form of increased revenue as well as decreased total overhead expenses.

Billing firms (i.e. Cloud-MD) can afford to charge less because of economies of scale.

Furthermore, if the billing firm is able to collect more for the practice, the cost as a percentage of total collections can be less because total collections have increased.

Given the recent increase in industry complexities, the partner billing firm can also be used as an additional resource helpful for addressing or assisting with new rules and regulations.

Cloud-MD™ has products and services that participate in this ever expanding market and the size of the market is growing as other expenses incurred by healthcare providers rise over time.

CipherLoc™ Marketing

A new concentration of risks in the cloud is driving the creation of new threat vectors. These new threats, in turn, create uncertainty about the Internet-fueled growth plans of Intel, Google, Microsoft, Yahoo, Apple, Facebook, AT&T, Verizon and just about any tech hardware, software or services company you care to name.

The market for CipherLoc™ spans the entire spectrum of digital communications and covers every industry across the globe. Potential licenses for the CipherLoc™ family of encryption technology are in the 100’s of millions of client licenses.

REGULATIONS

HIPAA - General Information

The Administrative Simplification provisions of the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”, Title II) require the Department of Health and Human Services (HHS) to adopt national standards for electronic health care transactions and national identifiers for providers, health plans, and employers. To date, the implementation of HIPAA standards has increased the use of electronic data interchange. Provisions under the Affordable Care Act of 2010 will further these increases and include requirements to adopt:

| · | operating rules for each of the HIPAA covered transactions | |

| · | a unique, standard Health Plan Identifier (“HPID”) | |

| · | a standard and operating rules for electronic funds transfer (“EFT”) and electronic remittance advice (“RA”) and claims attachments. |

In addition, health plans will be required to certify their compliance. The Act provides for substantial penalties for failures to certify or comply with the new standards and operating rules.

For more information regarding HIPAA including additional provisions under the Patient Protections and Affordable Care Act (Affordable Care Act or “ACA”) of 2010, go to the "Related Links Outside CMS".

Related LinksPrivate and Community Cloud IaaS and PaaS Infrastructure v1.0, Published February 1, 2013

Private and Community Cloud IaaS and PaaS Infrastructure Supplement defines the enterprise-wide standard architecture for building, configuring, and deploying Infrastructure-as-a-Service (“IaaS”) and Platform-as-a-Service (“PaaS”) Cloud Infrastructure. An effective cloud infrastructure enhances productivity by providing a standards-based platform to securely manage the full system life cycle from initial provisioning through eventual retirement and de-provisioning of virtual resources, including virtual machines, storage, and networks.

This TRA supplement defines terminology and presents the business rules for use of IaaS and PaaS in private and community clouds at Center for Medicare and Medicaid Services (“CMS”). The document describes the essential characteristics of Cloud services, including on-demand service, resource pooling, rapid elasticity, and measured services, and how these services operate within the CMS multi-zone architecture. This supplement also presents guidance about planning for and deploying IaaS and PaaS-based applications that meet the expectations of CMS and its stakeholders.

Release Management Supplement, v1.0, Published June 28, 2013

This CMS Technical Reference Architecture – Release Management Supplement, Version 1.0 complements the CMS TRA by providing rules and engineering guidance for developing, testing, and hosting CMS distributed systems and business applications within the agency’s data center Development, Test, Implementation, and Production Processing environments.

This supplement provides the rules governing the support and use of CMS data center environments for the conduct of pre-approved, scheduled Development, Validation Testing, and Implementation Testing of distributed CMS systems, infrastructure, and business applications.

The CMS Chief Technology Officer authorizes and approves the publication of the Release Management Supplement and its contents. This supplement augments and aligns with the CMS TRA Foundation 3.0, and CMS will update it on an as-needed basis.

Personnel

As of the date of this report, we have fifteen full-time employees.

WHERE YOU CAN FIND MORE INFORMATION

You are advised to read this Form 10-K in conjunction with other reports and documents that we file from time to time with the SEC. In particular, please read our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we file from time to time. You may obtain copies of these reports directly from us or from the SEC at the SEC’s Public Reference Room at 100 F. Street, N.E. Washington, D.C. 20549, and you may obtain information about obtaining access to the Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains information for electronic filers at its website http://www.sec.gov.

In an effort to keep our stockholders and the public informed about our business, we may make “forward-looking statements.” Forward-looking statements usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of our operations or operating results. As indicated previously, forward-looking statements are often identified by words, “will”, “may”, “should”, “continue”, “anticipate”, “believe”, “expect”, “plan”, “forecast”, “project”, “estimate”, “intend” and words of similar nature. Forward-looking statements generally include statements containing:

| • | projections about accounting and finances; | |

| • | plans and objectives for the future; | |

| • | projections or estimates about assumptions relating to our performance; or | |

| • | our opinions, views or beliefs about the effects of current or future events, circumstances or performance. |

You should view those statements with caution. Those statements are not guarantees of future performance, circumstances or events. They are based on facts and circumstances known to us as of the date the statements are made. All phases of our business are subject to uncertainties, risks and other influences, many of which we do not control. Any of these factors either alone or taken together, could have a material adverse effect on us and could change whether any forward-looking statement ultimately turns out to be true. Additionally, we assume no obligation to update any forward-looking statement as a result of future events, circumstances or developments.

ITEM 1A. RISK FACTORS

Outlined below are some of the risks that we believe could affect our business and financial statements. An investment in our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this Annual Report on Form 10-K, before investing in our common stock. If any of the events anticipated by the risks described below occur, our results of operations and financial condition could be adversely affected which could result in a decline in the market price of our common stock, causing you to lose all or part of your investment.

The report of our independent registered public accounting firm contains explanatory language that substantial doubt exists about our ability to continue as a going concern.

The independent auditor’s report on our financial statements for the year ended September 30, 2013 contains explanatory language that substantial doubt exists about our ability to continue as a going concern. We have an accumulated deficit at September 30, 2013 of $26,542,265 and need additional cash flows to maintain our operations. We depend on the continued contributions of our executive officers to finance our operations and need to obtain additional funding sources to explore potential strategic relationships and to provide capital and other resources for the further development and marketing of our products and business. If we are unable to obtain sufficient financing in the near term or achieve profitability, then we would, in all likelihood, experience severe liquidity problems and may have to curtail or cease our operations altogether. If we curtail our operations or cease our operations, we may be placed into bankruptcy or undergo liquidation, the result of which will adversely affect the value of our common shares.

Because we are quoted on the OTC Markets formerly known as “Pinks Sheets” instead of an exchange or national quotation system, our investors may have a tougher time selling their stock or experience negative volatility on the market price of our stock.

Our common stock is traded on the OTCBB “OTC Markets”. The OTCBB “OTC Markets” is often highly illiquid, in part because it does not have a national quotation system by which potential investors can follow the market price of shares except through information received and generated by a limited number of broker-dealers that make markets in particular stocks. There is a greater chance of volatility for securities that trade on the OTCBB “OTC Markets” as compared to a national exchange or quotation system. This volatility may be caused by a variety of factors, including the lack of readily available price quotations, the absence of consistent administrative supervision of bid and ask quotations, lower trading volume, and market conditions. Investors in our common stock may experience high fluctuations in the market price and volume of the trading market for our securities. These fluctuations, when they occur, have a negative effect on the market price for our securities. Accordingly, our stockholders may not be able to realize a fair price from their shares when they determine to sell them or may have to hold them for a substantial period of time until the market for our common stock improves.

We depend significantly upon the continued involvement of our present management.

The Company’s success depends significantly upon the involvement of our present management, who is in charge of our strategic planning and operations. We may need to attract and retain additional talented individuals in order to carry out our business objectives. The competition for individuals with expertise in this industry could be intense and there are no assurances that these individuals will be available to us.

Our common stock is subject to penny stock regulation.

Our shares are subject to the provisions of Section 15(g) and Rule 15g-9 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), commonly referred to as the "penny stock" rule. Section 15(g) sets forth certain requirements for transactions in penny stocks and Rule 15g-9(d)(1) incorporates the definition of penny stock as that used in Rule 3a51-1 of the Exchange Act. The Commission generally defines penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. Rule 3a51-1 provides that any equity security is considered to be penny stock unless that security is: registered and traded on a national securities exchange meeting specified criteria set by the Commission; authorized for quotation on the NASDAQ Stock Market; issued by a registered investment company; excluded from the definition on the basis of price (at least $5.00 per share) or the registrant's net tangible assets; or exempted from the definition by the Commission. Since our shares are deemed to be "penny stock", trading in the shares will be subject to additional sales practice requirements on broker/dealers who sell penny stock to persons other than established customers and accredited investors.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses and pose challenges for our management.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations promulgated there under, the Sarbanes-Oxley Act and SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the U.S. public markets. Our management team will need to devote significant time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

The Company’s directors and officers may control the outcome of most matters submitted to a vote of shareholders.

Our directors and officers control 21.21% of the issued and outstanding common shares of the Company. They also control 100% of the supermajority convertible preferred Series A shares which allows the officers and directors to vote 150 common shares for one preferred shares they holds which is 600,000,000 common shares. The Series Preferred shareholders may also have the right to convert those shares to common shares once they have sent notice to the Board of Directors.

Also the officers and directors have change in control provisions that allows for the full payment of salary and stock in case the company is taken over by a third party. In addition to the ability of these directors and officers of the Company to vote shares representing a significant majority of the total voting power of the Company’s common shares. (See the officers’ employment agreements).

Under Texas law, common shares of the Company owned by the officers and directors may be voted in a manner in which those votes are determined by the two directors Michael De La Garza and Pamela J. Thompson. Those directors, should they choose to act together, will be able to control substantially all matters affecting the Company, and to block a number of matters relating to any potential change of control of the Company. See Item 12–Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Risks Relating To Our Industry

There are substantial inherent risks in attempting to commercialize new technological applications, and, as a result, we may not be able to successfully develop products or technology for commercial use.

Our company conducts ongoing development on our medical billing software. Our product development team is working on developing technology and products in various stages. Software development requires significant amounts of capital and takes an extremely long time to reach commercial viability, if at all. During the development of our software, we may experience technological barriers that we may be unable to overcome. Because of these uncertainties, it is possible that none of our product candidates will be successfully developed.

The cloud-based computing model presents execution and competitive risks.

Our competitors are rapidly developing and deploying cloud-based services for consumers and business customers. Pricing and delivery models are evolving. Devices and form factors influence how users access services in the cloud. We are devoting significant resources to develop our own competing cloud-based software plus services strategies. While we believe our expertise, investments in infrastructure, and the breadth of our cloud-based services provides us with a strong foundation to compete, it is uncertain whether our strategies will attract the users or generate the revenue required to be successful. In addition to software development costs, we are incurring costs to build and maintain infrastructure to support cloud computing services. These costs may reduce the operating margins we have previously achieved. Whether we are successful in this new business model depends on our execution in a number of areas, including:

| • | continuing to innovate and bring to market compelling cloud-based experiences that generate increasing traffic and market share; | |

| • | maintaining the utility, compatibility and performance of our cloud-based services on the growing array of computing devices, including smartphones, handheld computers, netbooks, tablets and television set top devices; and | |

| • | continuing to enhance the attractiveness of our cloud platforms to third-party developers. |

We face intense competition.

We continue to experience intense competition across all markets for our products and services. Our competitors range in size from Fortune 100 companies to small, specialized single-product businesses and open source community-based projects. Although we believe the breadth of our businesses and product portfolio is a competitive advantage, our competitors that are focused on narrower product lines may be more effective in devoting technical, marketing, and financial resources to compete with us. In addition, barriers to entry in our businesses generally are low and products, once developed, can be distributed broadly and quickly at relatively low cost. Open source software vendors are devoting considerable efforts to developing software that mimics the features and functionality of our products. In response to competition, we continue to develop versions of our products with basic functionality that are sold at lower prices than the standard versions. These competitive pressures may result in decreased sales volumes, price reductions, and/or increased operating costs, such as for marketing and sales incentives, resulting in lower revenue, gross margins, and operating income.

We may not be able to protect our source code from copying if there is an unauthorized disclosure of source code.

Source code, the detailed program commands for our operating systems and other software programs, is critical to our business. Although we license portions of our application and operating system source code to a number of licensees, we take significant measures to protect the secrecy of large portions of our source code. If an unauthorized disclosure of a significant portion of our source code occurs, we could potentially lose future trade secret protection for that source code. This could make it easier for third parties to compete with our products by copying functionality, which could adversely affect our revenue and operating margins. Unauthorized disclosure of source code also could increase the security risks described in the next paragraph.

Security vulnerabilities in our products and services could lead to reduced revenues or to liability claims. Maintaining the security of computers and computer networks is a critical issue for us and our customers. Hackers develop and deploy viruses, worms, and other malicious software programs that attack our products and gain access to our networks and data centers. Although this is an industry-wide problem that affects computers across all platforms, it affects our products in particular because hackers tend to focus their efforts on the most popular operating systems and programs and we expect them to continue to do so. We devote significant resources to address security vulnerabilities through:

| • | engineering more secure products and services; | |

| • | enhancing security and reliability features in our products and services; | |

| • | helping our customers make the best use of our products and services to protect against computer viruses and other attacks; | |

| • | improving the deployment of software updates to address security vulnerabilities; | |

| • | investing in mitigation technologies that help to secure customers from attacks even when such software updates are not deployed; and | |

| • | providing customers online automated security tools, published security guidance, and security software such as firewalls and anti-virus software. |

The cost of these steps could reduce our operating margins. Despite these efforts, actual or perceived security vulnerabilities in our products could lead some customers to seek to return products, to reduce or delay future purchases, or to use competing products. Customers may also increase their expenditures on protecting their existing computer systems from attack, which could delay adoption of new technologies. Any of these actions by customers could adversely affect our revenue. In addition, if third parties gain access to our networks or data centers they could obtain and exploit confidential business information and harm our competitive position.

Our business depends on our ability to attract and retain talented employees.

Our business is based on successfully attracting and retaining talented employees. The market for highly skilled workers and leaders in our industry is extremely competitive. We are limited in our ability to recruit internationally by restrictive domestic immigration laws. If we are less successful in our recruiting efforts, or if we are unable to retain key employees, our ability to develop and deliver successful products and services may be adversely affected. Effective succession planning is also important to our long-term success. Failure to ensure effective transfer of knowledge and smooth transitions involving key employees could hinder our strategic planning and execution.

Delays in product development schedules may adversely affect our revenues.

The development of software products is a complex and time-consuming process. New products and enhancements to existing products can require long development and testing periods. Our increasing focus on cloud-based software plus services also presents new and complex development issues. Significant delays in new product or service releases or significant problems in creating new products or services could adversely affect our revenue.

Acquisitions and joint ventures may have an adverse effect on our business.

We expect to continue making acquisitions or entering into joint ventures as part of our long-term business strategy. These transactions involve significant challenges and risks including that the transaction does not advance our business strategy, that we don't realize a satisfactory return on our investment, or that we experience difficulty in the integration of new employees, business systems, and technology, or diversion of management's attention from our other businesses. These events could harm our operating results or financial condition.

Risks Related to our Securities

The market price for our common stock may be volatile, and you may not be able to sell our stock at a favorable price or at all.

Many factors could cause the market price of our common stock to rise and fall, including:

| • | actual or anticipated variations in our quarterly results of operations; | |

| • | changes in market valuations of companies in our industry; | |

| • | changes in expectations of future financial performance; | |

| • | fluctuations in stock market prices and volumes; | |

| • | issuances of dilutive common stock or other securities in the future; | |

| • | the addition or departure of key personnel; | |

| • | announcements by us or our competitors of acquisitions, investments or strategic alliances; and | |

| • | it is possible that the proceeds from sales of our common stock may not equal or exceed the prices you paid for the shares after including the costs and fees of making the sales |

Substantial sales of our common stock, or the perception that such sales might occur, could depress the market price of our common stock.

We cannot predict whether future issuances of our common stock or resale in the open market will decrease the market price of our common stock. The consequence of any such issuances or resale of our common stock on our market price may be increased as a result of the fact that our common stock is thinly, or infrequently, traded. The exercise of any options, or the vesting of any restricted stock that we may grant to directors, executive officers and other employees in the future, the issuance of common stock in connection with acquisitions and other issuances of our common stock may decrease the market price of our common stock.

Holders of our common stock have a risk of potential dilution if we issue additional shares of common stock in the future.

Although our Board of Directors intends to utilize its reasonable business judgment to fulfill its fiduciary obligations to our then existing stockholders in connection with any future issuance of our common stock, the future issuance of additional shares of our common stock would cause immediate, and potentially substantial, dilution to the net tangible book value of those shares of common stock that are issued and outstanding immediately prior to such transaction. Any future decrease in the net tangible book value of our issued and outstanding shares could have a material adverse effect on the market value of our shares.

We do not intend to pay cash dividends to our stockholders, so you will not receive any return on your investment in our Company prior to selling your interest in the Company.

The Company has never paid any cash dividends to our stockholders. We currently intend to retain any future earnings for funding growth and, therefore, do not expect to pay any cash dividends in the foreseeable future. As a result, you will not receive any return on your investment prior to selling your shares in our Company and, for the other reasons discussed in this “Risk Factors” section, you may not receive any return on your investment even when you sell your shares in our Company.

Certain shares of our common stock are restricted from immediate resale. The lapse of those restrictions, coupled with the sale of the related shares in the market, or the market’s expectation of such sales, could result in an immediate and substantial decline in the market price of our common stock.

Most of our shares of common stock are restricted from immediate resale in the public market. The restricted shares are restricted in accordance with Rule 144, which states that if unregistered, restricted securities are to be sold, a minimum of one year must elapse between the later of the date of acquisition of the securities from the issuer or from an affiliate of the issuer, and any resale of those securities in reliance on Rule 144. The Rule 144 restrictive legend remains on the stock until the holder of the stock holds the stock for longer than six months (unless an affiliate) and meets the other requirements of Rule 144 to have the restriction removed. The sale or resale of those shares in the public market, or the market’s expectation of such sales, may result in an immediate and substantial decline in the market price of our shares. Such a decline will adversely affect our investors, and make it more difficult for us to raise additional funds through equity offerings in the future.

Our common stock is subject to restrictions on sales by broker-dealers and penny stock rules, which may be detrimental to investors.

Our common stock is subject to Rules 15g-1 through 15g-9 under the Exchange Act, which imposes certain sales practice requirements on broker-dealers who sell our common stock to persons other than established customers and “accredited investors” (as defined in Rule 501(a) of the Securities Act). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. This rule adversely affects the ability of broker-dealers to sell our common stock and purchasers of our common stock to sell their shares of our common stock.

Additionally, our common stock is subject to SEC regulations applicable to “penny stocks.” Penny stocks include any non-Nasdaq equity security that has a market price of less than $5.00 per share, subject to certain exceptions. The regulations require that prior to any non-exempt buy/sell transaction in a penny stock; a disclosure schedule proscribed by the SEC relating to the penny stock market must be delivered by a broker-dealer to the purchaser of such penny stock. This disclosure must include the amount of commissions payable to both the broker-dealer and the registered representative and current price quotations for our common stock. The regulations also require that monthly statements be sent to holders of a penny stock that disclose recent price information for the penny stock and information of the limited market for penny stocks. These requirements adversely affect the market liquidity of our common stock.

Our Articles of Incorporation allow us to sell preferred stock without shareholder approval.

Our Board of Directors has the authority to issue up to 4,000,000 shares of preferred stock and to determine the price, rights, preferences, privileges and restrictions, including voting rights, of those shares without any additional vote or action by our shareholders. The rights of the holders of the common stock will be subject to, and could be materially adversely affected by, the rights of the holders of any preferred stock that may be issued in the future. For example we could issue preferred stock that has superior rights to dividends or is convertible into shares of common stock. This might adversely affect the market price of the common stock.

If we experience delays and/or defaults in customer payments, we could be unable to recover all expenditures.

Because of the nature of our contracts, at times we commit resources to projects prior to receiving payments from the customer in amounts sufficient to cover expenditures on projects as they are incurred. Delays in customer payments may require us to make a working capital investment. If a customer defaults in making their payments on a project in which we have devoted resources, it could have a material negative effect on our results of operations.

If we do not effectively manage our growth, our existing infrastructure may become strained, and we may be unable to increase revenue growth.

Our past growth that we have experienced, and in the future may experience, may provide challenges to our organization, requiring us to expand our personnel and our operations. Future growth may strain our infrastructure, operations and other managerial and operating resources. If our business resources become strained, our earnings may be adversely affected and we may be unable to increase revenue growth. Further, we may undertake contractual commitments that exceed our labor resources, which could also adversely affect our earnings and our ability to increase revenue growth.

SHOULD ONE OR MORE OF THE FOREGOING RISKS OR UNCERTAINTIES MATERIALIZE, OR SHOULD THE UNDERLYING ASSUMPTIONS PROVE INCORRECT, ACTUAL RESULTS MAY DIFFER SIGNIFICANTLY FROM THOSE ANTICIPATED, BELIEVED, ESTIMATED, EXPECTED, INTENDED OR PLANNED

ITEM 1B. UNRESOLVED STAFF COMMENTS

This Item is not applicable to us as we are not an accelerated filer, a large accelerated filer, or a well-seasoned issuer.

ITEM 2. PROPERTIES

Starting in January 2012, the Company began sharing an office with a shareholder at 1291 Galleria Drive, Suite 200, Henderson, Nevada 89014. The office is at no cost to the Company.

ITEM 3. LEGAL PROCEEDINGS

We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results of operations.

On July 5, 2013, the Company filed a complaint against Krooss Medical Management Systems, LLC, William F. Krooss and Marie W. Krooss ( the “Defendants”) in the United States District Court, District of Nevada Case No. 2013-CV-01187-ABG-VCF for the collection of approximately $200,000 of unpaid medical billing fees that were seriously delinquent.

After many attempts by the Company to begin collections, the Defendants refused to pay the outstanding balances, however they expected the Company to continue to bill for them. The Complaint includes causes of action for Breach of the Permanent Asset Transfer and Purchase Agreement (“PTAPA”), Breach of Billing and Collections Contracts, Negligence, Breach of the Duty of Good Faith and Fair Dealing, Tortious Interference with Business Relations, Fraud, and other causes of action.

On August 13, 2013, Krooss Medical Management Systems et al filed a Complaint in Chancery Court of Rankin County, Mississippi Case No. 13-1372 apparently as a strategy to keep the collection matter in Mississippi Chancery Court.

Case No. 13-1372 was remanded to the United States District Court, Southern District of Mississippi Jackson Division Case No. 3:13CV507-HTW-LRA.

This litigation is a collection matter of unpaid fees by the Defendants and the Company denies the allegations (Breach of the PTAPA, Rescission of the PTAPA, Breach of Billing and Collections Contracts, Negligence, Quantum Meruit, Restitution, and Estoppel, Breach of the Duty of Good Faith and Fair Dealing, Tortious Interference with Business Relations, and other causes of action) filed in Mississippi Chancery Court related to this collection matter. The Company does not expect the cost to litigate this matter to adversely affect the Company’s operations. However, the Company has discontinued operations in DNA-Cloud in Mississippi as the Company believes the Defendants have interfered with the billing contracts purchased which is one of the causes of action in the Complaint, among others. The Company believes many of the contracts have been terminated due to the interference by the Defendants, and DNA-Cloud has not been able to expand the business because of the reputation of the Defendants in Jackson, Mississippi and the surrounding area.

ITEM 4. REMOVED AND RESERVED

PART II

ITEM 5. MARKET FOR REGISTANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Cloud’s common stock is traded in the over-the-counter market, and quoted in the National Association of Securities Dealers Inter-dealer Quotation System (“Electronic Bulletin Board) and can be accessed on the Internet at OTCmarkets.com under the symbol “NSCT.”

At September 30, 2013, there were 214,624,216 shares of common stock of Cloud outstanding and there were in excess of 902 shareholders of record of the Company’s common stock.

The following table sets forth for the periods indicated the high and low bid quotations for Cloud’s common stock. These quotations represent inter-dealer quotations, without adjustment for retail markup, markdown or commission and may not represent actual transactions.

| Periods | High | Low | ||||||

| Fiscal Year 2013 | ||||||||

| First Quarter (October – December 2012) | $ | 0.04 | $ | 0.02 | ||||

| Second Quarter (January – March 2013) | $ | 0.04 | $ | 0.03 | ||||

| Third Quarter (April - June 2013) | $ | 0.04 | $ | 0.02 | ||||

| Fourth Quarter (July – September 2013) | $ | 0.04 | $ | 0.02 | ||||

| Fiscal Year 2012 | ||||||||

| First Quarter (October – December 2011) | $ | 0.01 | $ | 0.01 | ||||

| Second Quarter (January – March 2012) | $ | 0.01 | $ | 0.01 | ||||

| Third Quarter (April - June 2012) | $ | 0.03 | $ | 0.02 | ||||

| Fourth Quarter (July – September 2012) | $ | 0.03 | $ | 0.03 | ||||

On January 24, 2014, the closing bid price of our common stock was $0.029.

Dividends

We may never pay any dividends to our shareholders. We did not declare any dividends for the year ended September 30, 2013. Our Board of Directors does not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the Board of Directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the Board of Directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend.

Transfer Agent

Cloud’s Transfer Agent and Registrar for the common stock is Pacific Stock Transfer located in Las Vegas, Nevada.

Recent sales of Unregistered Securities

Fiscal Year Ending September 30, 2014

In October 2013, the Company issued 25,000 shares of common stock for net cash proceeds of $5,000.

In October 2013, the Company issued 200,000 shares of common stock for purchase of assets from Antree Systems Limited. These shares were valued at $6,000 based on the market price on the date of grant.

In November 2013, the Company issued 180,000 shares of common stock as replacement shares for the 160,000 shares of common stock issued to Antree Systems Limited and 20,000 shares of common stock to Kimberly Ilicerl. The Company intends to cancel the original shares because the shares were lost during delivery to Antree Systems. The Company replaced those lost shares and canceled the shares that were lost when delivered to Ireland at the office of Antree Systems.

On December 4, 2013, the Company issued 120,000 shares of common stock valued at $3,600 based on the market price on the date of grant, for the purchase of software in accordance with the software licensing and subscription agreements.

On January 12, 2014, the Company issued 10,000 shares of common stock for net cash proceeds of $10,000.

Fiscal Year Ended September 30, 2013

During the year ended September 30, 2013, the Company issued 217,500 shares of common stock for $143,000 in net cash proceeds as follows:

| Date | Number of Shares | Proceeds | ||||||||

| October 14, 2012 | 20,000 | $ | 20,000 | |||||||

| October 14, 2012 | 15,000 | 3,000 | ||||||||

| October 14, 2012 | 18,750 | 2,500 | ||||||||

| October 14, 2012 | 18,750 | 2,500 | ||||||||

| December 6, 2012 | 15,000 | 3,000 | ||||||||

| March 12, 2013 | 20,000 | 20,000 | ||||||||

| March 12, 2013 | 20,000 | 20,000 | ||||||||

| March 31, 2013 | 50,000 | 50,000 | ||||||||

| April 17, 2013 | 20,000 | 20,000 | ||||||||

| August 26, 2013 | 20,000 | 2,000 | ||||||||

| Total | 217,500 | $ | 143,000 | |||||||

Stock Issued in Connection with Software Licensing and Subscription Agreements

During the year ended September 30, 2013, the Company issued 400,000 shares of common stock valued at $13,563 based on the market price on the date of grant, to customers, in regards to the purchase of software from the Company in accordance with the Software Licensing and Subscription Agreements. The fair values of the shares issued were recorded against software revenue recognized during the year ended September 30, 2013.

| Date | Number of Shares | Fair Value | ||||||||

| October 14, 2012 | 50,000 | $ | 1,300 | |||||||

| December 6, 2012 | 100,000 | 2,800 | ||||||||

| March 12, 2013 | 50,000 | 1,750 | ||||||||

| March 21, 2013 | 50,000 | 1,750 | ||||||||

| March 21, 2013 | 50,000 | 1,750 | ||||||||

| April 17, 2013 | 25,000 | 838 | ||||||||

| April 17, 2013 | 50,000 | 1,675 | ||||||||

| June 26, 2013 | 25,000 | 450 | ||||||||

| September 30, 2013 | 50,000 | 1,250 | ||||||||

| Total | 400,000 | $ | 13,563 | |||||||

Stock Issued for Services

During the year ended September 30, 2013, the Company issued 1,165,500 shares of common stock as compensation. The fair values of the shares were a total of $36,629 and were recorded at the market price on the date of grant. The issuances of stock were as follows:

| Date | Number of Shares | Fair Value | Description of Services | |||||||||

| October 14, 2012 | 10,000 | $ | 260 | Commission | ||||||||

| December 6, 2012 | 100,000 | 2,800 | Software Agreement | |||||||||

| March 12, 2013 | 50,000 | 1,750 | Consulting | |||||||||

| March 21, 2013 | 167,000 | 5,845 | Compensation | |||||||||

| March 21, 2013 | 500,000 | 17,500 | Compensation | |||||||||

| April 17, 2013 | 78,500 | 2,630 | Compensation | |||||||||

| May 1, 2013 | 20,000 | 522 | Programming | |||||||||

| May 10, 2013 | 20,000 | 522 | Programming | |||||||||

| August 26, 2013 | 100,000 | 1,800 | Software Sales | |||||||||

| September 30, 2013 | 60,000 | 1,500 | Programming | |||||||||

| September 30, 2013 | 60,000 | 1,500 | Programming | |||||||||

| Total | 1,165,500 | 36,629 | ||||||||||

Stock Issued for Assets Acquisition

On April 17, 2013, the Company issued 300,000 shares of common stock valued at $6,000, based on the market price on the date of grant, to Krooss Family Trust LLP for the acquisition of Doctors Network of America in Flowood, Mississippi and all of the assets of that company.

During year ended September 30, 2013, the Company issued 500,004 shares of common stock for the acquisition of CipherSmith software. Those shares were valued at $15,800 based on the market price on the dates of grant.

Fiscal Year Ended September 30, 2012

During year ended September 30, 2012, the Company issued 190,000 shares of common stock for proceeds of $68,000 as follows:

| Date | Number of Shares | Proceeds | ||||||||

| October 15, 2011 | 25,000 | $ | 5,000 | |||||||

| December 29, 2011 | 100,000 | 50,000 | ||||||||

| June 21, 2012 | 65,000 | 13,000 | ||||||||

| Total | 190,000 | $ | 68,000 | |||||||

Stock Issued in Connection with Software Licensing and Subscription Agreements

During the year ended September 30, 2012, the Company issued 941,333 shares of common stock valued at $19,301 based on the market price on the date of grant, to customers, in regards to the purchase of software from the Company in accordance with the Software Licensing and Subscription Agreements. The fair values of the shares issued were recorded against software revenue recognized during the year ended September 30, 2012.

| Date | Number of Shares | Fair Value | ||||||||

| December 29, 2011 | 100,000 | $ | 1,150 | |||||||

| May 29, 2012 | 25,000 | 400 | ||||||||

| May 29, 2012 | 50,000 | 800 | ||||||||

| May 29, 2012 | 100,000 | 1,600 | ||||||||

| May 29, 2012 | 150,000 | 2,400 | ||||||||

| May 29, 2012 | 181,333 | 2,901 | ||||||||

| August 9, 2012 | 300,000 | 9,000 | ||||||||

| August 9, 2012 | 35,000 | 1,050 | ||||||||

| Total | 941,333 | $ | 19,301 | |||||||

Stock Issued for Services

During the year ended September 30, 2012, the Company issued 33,000 shares of common stock for compensation. The fair values of the shares were a total of $624 and were recorded at the market price on the date of grant. The issuances of stock were as follows:

| Date | Number of Shares | Fair Value | Description of Services | |||||||||

| December 5, 2011 | 8,000 | $ | 82 | Legal services | ||||||||

| December 5, 2011 | 10,000 | 102 | Advisory service | |||||||||

| June 21, 2012 | 1,000 | 20 | Commission | |||||||||

| August 9, 2012 | 14,000 | 420 | Commission | |||||||||

| Total | 33,000 | $ | 624 | |||||||||

Stock Issued for Debt Settlement

On October 15, 2011, the Company issued 30,000,000 shares of common stock for the conversion of debt from our CEO in the principal amount of $1,200,106.

Stock Issued for Assets Acquisition

The Company issued 200,000 shares of common stock on June 21, 2012 to Krooss Medical Management in accordance with the acquisition agreement for Doctors Network of America and recorded it at the market price of the common shares of $0.020 and as an investment in Krooss Medical Management of $4,000.

The Company issued 100,000 shares of common stock to MediSouth LLC in accordance with the acquisition agreement and recorded it at the market price of the common shares of $0.025 and as an investment in MediSouth LLC of $2,500.

Common Stock