UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☐ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Pursuant to Rule 14a-12

|

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required.

|

| ☐ |

Fee paid previously with preliminary materials.

|

||

| ☐ |

Check computed on table in exhibit rquired by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

||

Notice of 2023 Annual Meeting of Shareholders

and

Proxy Statement

EPLUS INC.

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS

|

When:

|

Where:

|

|

September 14, 2023

8:30 a.m. ET

|

The Westin Washington Dulles Airport

2520 Wasser Terrace

Herndon, Virginia 20171

|

We at ePlus inc. (“ePlus”

or the “Company”) are pleased to invite you to our 2023 Annual Meeting of Shareholders (the “2023 Annual Meeting”).

Items of Business:

| 1. |

Elect as directors the nine nominees named in the attached proxy statement, each to serve an annual term, or until their successors have been duly elected

and qualified;

|

| 2. |

Approve an advisory vote on our named executive officers’ compensation as disclosed in the proxy statement;

|

| 3. |

Ratify the selection of our independent registered accounting firm;

|

| 4. |

Approve an amendment to ePlus’s Amended and Restated Certificate of Incorporation (our “Charter”) to limit the

personal liability of certain officers of ePlus as permitted by recent amendments to the General Corporation Law of the State of Delaware; and

|

| 5. |

Transact such other business as may properly come before the 2023 Annual Meeting, and any postponements or

adjournments thereof.

|

Record Date:

All shareholders are welcome to attend the 2023 Annual Meeting. Holders of our common stock as of the close of business on July 21,

2023, are entitled to notice of, and to vote at, the 2023 Annual Meeting.

How to Vote:

Your vote is important to us. Please see “Voting Information” on page 3 for instructions on how to vote your shares.

These proxy materials are first being distributed on or about July 31, 2023.

|

July 31, 2023

|

By Order of the Board of Directors

|

|

|

|

|

Erica S. Stoecker

|

|

|

Corporate Secretary, General Counsel & Chief Compliance Officer

|

|

IMPORTANT NOTICE

Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on September 14, 2023:

ePlus’ proxy statement for the 2023 Annual Meeting and its Annual Report for the Fiscal Year Ended March 31, 2023,

are Available Online at www.edocumentview.com/plus.

|

|

1

|

|

|

1

|

|

| 2 | |

|

2

|

|

|

2

|

|

|

3

|

|

|

3

|

|

|

3

|

|

|

3

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

4

|

|

|

5

|

|

|

5

|

|

|

6

|

|

|

7

|

|

|

8

|

|

|

8

|

|

|

9

|

|

|

9

|

|

|

9

|

|

|

9

|

|

|

10

|

|

|

10

|

|

|

11

|

|

|

12

|

|

|

12

|

|

|

12

|

|

|

13

|

|

|

13

|

|

|

18

|

|

|

19

|

|

20

|

|

|

20

|

|

|

20

|

|

|

21

|

|

|

22

|

|

|

23

|

|

|

23

|

|

|

24

|

|

|

25

|

|

|

25

|

|

|

25

|

|

|

26

|

|

|

27

|

|

|

27

|

|

|

27

|

|

|

28

|

|

|

28

|

|

|

28

|

|

|

28

|

|

|

30

|

|

|

32

|

|

|

34

|

|

|

34

|

|

| 34 |

|

|

35

|

|

|

35

|

|

|

36

|

|

|

36

|

|

|

37

|

|

|

38

|

|

|

38

|

|

|

42

|

|

|

43

|

|

|

46

|

|

|

47

|

|

47

|

|

|

48

|

|

|

49

|

|

|

51

|

|

|

54

|

|

|

54

|

|

|

54

|

|

|

54

|

|

|

54

|

|

|

55

|

|

|

55

|

|

|

55

|

|

|

A-1

|

|

Who:

|

Shareholders as of the Record Date, July 21, 2023

|

|

What:

|

See detailed Proposals on pages 12, 23, 47, and 49, and summaries below

|

|

When:

|

September 14, 2023, 8:30 a.m. ET

|

|

Where:

|

The Westin Washington Dulles Airport, 2520 Wasser Terrace, Herndon, Virginia, 20171

|

|

How:

|

Internet/Mobile, Telephone, Mail, In Person (see Voting Information beginning on page 3 for details)

|

ePlus has an unwavering and relentless focus on leveraging

technology to create inspired and transformative business outcomes for its customers. Offering a robust portfolio of solutions, as well as a full set of consultative and managed services across the technology spectrum, ePlus has proudly achieved more than 30 years of success in the business, carrying customers forward through adversity, rapidly changing environments,

and other obstacles. ePlus is a trusted advisor, bringing expertise, credentials, talent and a thorough understanding of innovative

technologies, spanning security, cloud, data center, networking, collaboration, artificial intelligence and emerging solutions, to domestic and foreign organizations across all industry segments. With complete lifecycle management services and

flexible payment solutions, ePlus’ more than 1,700 associates are focused on cultivating positive customer experiences and are dedicated to

their craft, harnessing new knowledge while applying decades of proven experience. ePlus is headquartered in Virginia, with locations in

the United States, UK, Europe, and Asia‐Pacific. For more information, visit www.eplus.com.

PROPOSAL 1 – ELECTION OF DIRECTORS

ePlus’ Board of Directors (the “Board of Directors” or “Board”) is currently composed of eight directors who are “independent,” and one director, our Chief Executive Officer, Mark Marron, who is not “independent,” within the meaning of Nasdaq’s listing standards.

C. Thomas Faulders continued as our board Chairman during the fiscal year 2023.

The Board’s Nominating and Corporate Governance Committee has recommended to the Board, and the Board has nominated, each of our sitting

directors for election at our 2023 Annual Meeting, having found they each possess the requisite knowledge, skills, and abilities to oversee the Company’s long-term business objectives.

|

ePlus Director Nominees for the 2023 Annual Meeting

|

||||||

|

Board Committees

|

||||||

|

Name

|

Age

|

Audit

|

Compensation

|

Nominating& Corporate

Governance

|

Number of

Other Public

Company Boards

|

Independent

Director

|

|

Renée Bergeron

|

60

|

✔

|

✔

|

0

|

✔

|

|

|

Bruce M. Bowen

|

71

|

0

|

✔

|

|||

|

John E. Callies

|

69

|

✔

|

Chair

|

0

|

✔

|

|

|

C. Thomas Faulders, III, Chairman

|

73

|

✔

|

✔

|

0

|

✔

|

|

|

Eric D. Hovde

|

59

|

✔

|

✔

|

0

|

✔

|

|

|

Ira A. Hunt, III

|

67

|

✔

|

✔

|

0

|

✔

|

|

|

Mark P. Marron, CEO and President

|

62

|

0

|

||||

|

Maureen F. Morrison

|

69

|

Chair

|

✔

|

1

|

✔

|

|

|

Ben Xiang

|

38

|

✔

|

Chair

|

0

|

✔

|

|

More information about our Board, including their biographies, is available in Proposal 1 – Election of

Directors.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE DIRECTOR NOMINEES

PROPOSAL 2 – ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICERS’ COMPENSATION

Our executive compensation philosophy is to reward performance in alignment with our shareholders’ long-term interests, and to promote and

maintain stability within the executive team by issuing restricted stock with multi-year vesting terms.

For the fiscal year ended March 31, 2023, our named executive officers were Chief Executive Officer (“CEO”)

and President, Mark P. Marron; Chief Financial Officer (“CFO”), Elaine D. Marion; and Chief Operating Officer (“COO”), Darren S. Raiguel. Each received a base salary,

short- and long-term cash incentive compensation, and long-term equity-based incentive compensation. Detailed information about our executive compensation practices is available in our Compensation Discussion and Analysis.

Last year, our shareholders approved the Company’s say-on-pay proposal with approximately 98% of the votes cast in its favor. The Compensation

Committee considered this approval in determining that our executive compensation philosophies and objectives continue to be appropriate, and did not require changes in response to the 2022 say-on-pay vote.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR APPROVAL OF EXECUTIVE COMPENSATION

PROPOSAL 3 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board’s Audit Committee has selected Deloitte & Touche LLP (“Deloitte”) as the Company’s

independent registered accounting firm for the fiscal year ending March 31, 2024. Deloitte has served as the Company’s independent registered public accounting firm since 1990, and the Board unanimously recommends that shareholders vote to ratify

the appointment of Deloitte as the Company’s independent registered public accounting firm. More information about Deloitte is available in Proposal 3 – Ratification of the Selection of Deloitte & Touche LLP

as our Independent Registered Public Accounting Firm for our Fiscal Year Ending March 31, 2024.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF DELOITTE

PROPOSAL 4 – AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

The Board recommends that our shareholders approve an amendment to ePlus’ Amended and Restated Certificate of Incorporation

(our “Charter”) to limit the personal liability of certain officers of ePlus as permitted by recent amendments to the Delaware General Corporation Law.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE AMENDMENT TO OUR CHARTER

We are using the “Notice and Access” method of furnishing proxy materials to you over the Internet. The Securities and Exchange Commission’s (“SEC”) Notice and Access rules permit us to furnish our shareholders with proxy materials, including this proxy statement and our Annual Report including the Form 10-K for fiscal year 2023 (the “2023 Form 10-K”), by providing access to such documents on the Internet instead of mailing printed copies. We believe that this process will provide you with convenient and efficient access to your proxy

materials so you may vote your shares, while allowing us to reduce the environmental impact of our 2023 Annual Meeting and the costs of printing and distributing the proxy materials. On or about July 31, 2023, we mailed our shareholders a Notice

of Internet Availability of Proxy Materials (the “Notice”) with instructions for accessing our proxy statement and Annual Report. The Notice also identifies the items to be voted on at the 2023 Annual

Meeting and provides instructions for voting and instructions for requesting a printed copy of the proxy materials. Most shareholders will not receive printed copies of the proxy materials unless they request them. If you would like to receive

printed or electronic copies of our proxy materials, you should follow the instructions in the Notice for requesting such materials. Any request to receive proxy materials by mail will remain in effect until you revoke it.

You are eligible to vote at the 2023 Annual Meeting if you were a shareholder of record of ePlus inc.

as of the close of business on July 21, 2023, the record date (“Record Date”) for our 2023 Annual Meeting.

Cast your vote as soon as possible on each of the proposals listed below to ensure your shares are represented.

|

Proposal

|

More Information

|

Board Recommendation

|

|

|

1

|

Election of Directors |

Page 12

|

FOR each Director Nominee

|

|

2

|

Advisory Vote to Approve Named Executive Officers’ Compensation |

Page 23

|

FOR

|

|

3

|

Ratification of Independent Registered Public Accounting Firm |

Page 47

|

FOR

|

|

4

|

Amendment to the ePlus inc. Charter |

Page 49

|

FOR

|

Even if you plan to attend the 2023 Annual Meeting in person, read this proxy statement with care and cast your vote as soon as possible, as

described below. For shareholders of record, have your Notice or proxy card in hand and follow the instructions. If you hold your shares through a broker, bank, or other nominee, you will receive voting instructions from your broker, bank, or

other nominee, including whether telephone or Internet voting options are available.

| • |

Vote your shares online at www.investorvote.com/plus until 8:30 a.m. ET on September 14, 2023.

|

| • |

Vote your shares by toll-free telephone call by calling 1-800-652-VOTE (8683) until 8:30 a.m. ET on September 14, 2023.

|

| • |

Vote your shares by mail; mark, sign, and date your proxy card, and return it in the postage-paid envelope (must be received by 8:30 a.m. ET on September 14, 2023).

|

A proxy that is signed and dated, but which does not contain voting instructions, will be voted as recommended by our Board on each proposal.

You may vote in person at the 2023 Annual Meeting, which will be held on September 14, 2023, at 8:30 a.m. ET at the Westin Washington Dulles

Airport, 2520 Wasser Terrace, Herndon, Virginia, 20171.

If you hold your shares through a broker, bank, or other nominee and would like to vote in person at the 2023 Annual Meeting, you must first

obtain a proxy issued in your name from the institution that holds your shares.

The presence, in person or by proxy, of a majority of the voting power of the outstanding capital stock entitled to vote at the 2023 Annual

Meeting is necessary to constitute a quorum at the 2023 Annual Meeting.

Shareholders’ votes will be tabulated by a representative of the Company’s Transfer Agent, Computershare. Shareholders who vote and/or attend

the 2023 Annual Meeting by following the instructions in this proxy statement will be considered to be attending the 2023 Annual Meeting.

If you are the beneficial owner of shares held for you by a broker, your broker must vote those shares in accordance with your instructions. If

you do not give instructions, whether the broker or other nominee can vote your shares depends on whether the proposal is considered “discretionary” or “non-discretionary”. If a proposal is discretionary, a broker or other entity holding shares

for an owner in street name may vote on the proposal without voting instructions from the owner. If a proposal is non-discretionary, the broker or other nominee may vote on the proposal only if the owner has provided voting instructions. A

“broker non-vote” occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker or other nominee does not have discretionary voting power for that item and has not received

instructions from the beneficial owner. Proposal 3 is the only discretionary proposal; therefore, brokers or other nominees only have discretion to vote customers’ unvoted shares held by such firms in street name on Proposal 3.

Both abstentions and broker non-votes will be treated as shares present for purposes of determining the presence of a quorum at the 2023 Annual

Meeting.

|

Proposal

|

Vote Required

for Approval(1)

|

Effect of

Abstentions

|

Effect of

Broker Non-Votes

|

||||

| 1 |

Election of Directors

|

“FOR” votes of a plurality of the shares present in person or represented by proxy and entitled to vote

|

None; not counted

as a “vote cast”

|

None; not counted as a “vote cast”

|

|||

| 2 |

Advisory Vote to Approve Named Executive Officers’ Compensation

|

“FOR” votes of a majority of the shares present in person or represented by proxy and entitled to vote

|

Vote AGAINST

|

None; not counted as a “vote cast”

|

|||

| 3 |

Ratification of Independent Registered Public Accounting Firm

|

“FOR” votes of a majority of the shares present in person or represented by proxy and entitled to vote

|

Vote AGAINST

|

Brokers and other nominees may vote;(2) Broker non-votes are not expected

|

|||

| 4 |

Amendment to the ePlus inc. Charter

|

“FOR” votes of the holders of a majority of the outstanding shares entitled to vote

|

Vote AGAINST

|

Vote AGAINST

|

|||

(1) Assuming the presence of a quorum at the 2023 Annual Meeting.

(2) If a broker or other nominee does not exercise this discretion, such broker

non-votes will have no effect on the results of this vote.

Our Board of Directors has adopted Corporate Governance Guidelines and Policies (the “Guidelines”) that

provide a framework for effective corporate governance. The Guidelines outline our Board of Directors’ operating principles, and the composition and working processes of our Board and its committees. Our Nominating and Corporate Governance

Committee periodically reviews our Guidelines and developments in corporate governance, and, if appropriate, recommends proposed changes for Board approval.

Our Guidelines and other corporate governance documents, including the Charter, bylaws, committee charters, and our Code of Conduct and Business Partner Code of

Conduct, are all available on our website at https://www.eplus.com/investors/corporate-governance-legal.

Under our Guidelines and Nasdaq’s listing standards, a majority of our Board members must be “independent.” The Board of Directors annually

determines whether each of our directors is independent. In determining independence, the Board follows the independence criteria set forth in Nasdaq’s listing standards, and considers all relevant facts and circumstances.

Pursuant to Nasdaq’s independence criteria, a director is not “independent” if she or he has one or more of the relationships specifically

enumerated in Nasdaq’s listing standards. In addition, the Board must affirmatively determine that a director does not have a relationship that, in the Board’s opinion, would interfere with that director’s exercise of independent judgment in

carrying out the responsibilities of a director. The Board has affirmatively determined that Messrs. Bowen, Callies, Faulders, Hovde, Hunt, and Xiang, and Mses. Bergeron and Morrison, are “independent” under the applicable Nasdaq listing

standards.

The Board regularly reviews the effectiveness of the Company’s structure, and on at least an annual basis, examines what form of structure is in

the best interest of our shareholders. The Board has determined that a structure with a separation of the Chairman and CEO roles will enable the Board to best carry out its roles and responsibilities on behalf of ePlus’ shareholders, and currently, C. Thomas Faulders serves as our Chairman. Additionally, the Board believes that this structure further supports the CEO focusing on operating and managing ePlus,

while leveraging the Chairman’s experience and perspective.

The Board also regularly reviews its committee structure. Each of the Board’s standing committees—Audit, Compensation, and Nominating and

Corporate Governance—are comprised entirely of independent directors, which further complements the Board’s oversight role.

Our Board has three standing committees: (1) Audit, (2) Compensation, and (3) Nominating and Corporate Governance. Each committee’s charter is available on our

website at https://www.eplus.com/investors/corporate-governance-legal/committee-charters. Additional information about each committee is below.

|

Audit Committee

|

|

|

Chair:

Maureen F. Morrison

Other Committee Members:

John E. Callies, C. Thomas Faulders, Ben Xiang

Meetings Held in Fiscal Year 2023: 7

Independence:

Each Audit Committee member meets the audit committee independence requirements of Nasdaq and the rules of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) .

Qualifications:

Each member of the Audit Committee is financially literate, knowledgeable, and qualified to review financial statements.

In addition, the Board has determined that C. Thomas Faulders and Maureen F. Morrison meet the definition of an “audit committee financial expert” under the Exchange Act rules.

|

Primary Responsibilities:

Our Audit Committee is responsible for, among other things: (1) appointing, compensating, retaining, and overseeing the work of the independent auditor engaged to prepare or issue audit

reports and perform other audit, review, or attest services for the Company; (2) discussing the annual audited financial statements with management and the Company’s independent auditor, including the Company’s disclosures under

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” (“MD&A”), and recommending to the Board whether the audited financial statements should be included in the

Company’s Annual Report on Form 10-K; (3) discussing the Company’s unaudited financial statements and related footnotes and the MD&A portion of the Company’s Form 10-Q for each interim quarter with management and the independent

auditor; (4) overseeing the Company’s internal audit function; and (5) discussing the earnings press releases and financial information and earnings guidance, if any, provided to analysts and rating agencies with management and/or the

independent auditor, as appropriate.

|

|

Compensation Committee

|

|

|

Chair:

John E. Callies

Other Committee Members:

Renée Bergeron, C. Thomas Faulders, Eric D. Hovde, Ira A. Hunt

Renée Bergeron’s service on the Compensation Committee began on November 8, 2022.

Ben Xiang also served on the Compensation Committee during the fiscal year ended March 31, 2023, until June 13, 2023.

Meetings Held in Fiscal Year 2023: 7

Independence:

Each member of the Compensation Committee meets the compensation committee independence requirements of Nasdaq and the Exchange Act rules, as well as the non-employee director

requirements of Exchange Act Rule 16b-3, and the outside director requirements under the Internal Revenue Code (“IRC”) Section 162(m).

|

Primary Responsibilities:

Our Compensation Committee is responsible for, among other things: (1) reviewing and approving, and recommending for Board ratification (as relates to the CEO), the corporate goals and

objectives applicable to the compensation of the Company’s CEO and other executive officers; (2) reviewing and approving and, if required by law, recommending for Board approval incentive compensation and equity-based plans, and, where

appropriate or required, recommending such plans for shareholder approval; (3) reviewing the Company’s incentive compensation arrangements relating to executive officer compensation to determine whether they encourage excessive risk-taking,

reviewing and discussing the relationship between risk management policies and practices related to executive compensation, and evaluating policies and practices that could mitigate any such risk; (4) reviewing and discussing with

management the Compensation Discussion and Analysis (“CD&A”) and related executive compensation information, and recommending the same for inclusion in the Company’s proxy statement or Annual

Report; (5) reviewing and recommending for Board approval the frequency with which the Company conducts Say on Pay votes, and approving proposals regarding the Say on Pay Vote; (6) directly responsible for the appointing, compensating, and

overseeing of any work of any compensation consultant, legal counsel, or other advisor the Committee retains; (7) overseeing management’s development and succession planning and reviewing and discussing the same with the Board; and (8)

reviewing and approving, and recommending for Board ratification, employment agreements and severance/change in control agreements for the Company’s executive officers.

|

|

Nominating and Corporate Governance Committee

|

|

|

Chair:

Ben Xiang (effective June 13, 2023)

Other Committee Members:

Renée Bergeron, Eric D. Hovde (chair until June 13, 2023), Ira A. Hunt, Maureen F. Morrison

Renée Bergeron’s service on the Nominating and Corporate Governance Committee began on November 8, 2022.

Ben Xiang’s service on the Nominating and Corporate Governance Committee began on June 13, 2023.

Meetings Held in Fiscal Year 2023: 4

Independence:

Each member of the Nominating and Corporate Governance Committee meets Nasdaq’s independence requirements.

|

Primary Responsibilities:

Our Nominating and Corporate Governance Committee is responsible for, among other things: (1) selecting and recommending nominees for director to the Board; (2) recommending committee composition to the

Board; (3) overseeing the annual performance self-assessment of the Board and each of its committees; (4) reviewing and recommending compensation of non-employee directors to the Board; (5) reviewing our related person transaction policy,

and any related person transactions; and (6) reviewing and assessing the adequacy of our corporate governance framework, including our Charter, Bylaws, and Corporate Governance Guidelines, and making recommendations to the Board as

appropriate.

|

Our directors are expected to attend meetings of the Board and applicable committees. During our fiscal year ended March 31, 2023, the Board

held eight meetings. Each of our directors attended at least 95 percent of the meetings of the Board and the committees on which she or he served. Although we do not have a formal policy requiring directors to attend our Annual Meetings, we

encourage their attendance. Seven of our then eight directors attended our September 2022 Annual Meeting of Shareholders (the “2022 Annual Meeting”).

The Board oversees the Company’s enterprise risk management process. Management reviews the process with the Board on a periodic basis,

including identifying key risks and steps taken to monitor or mitigate those risks. In addition, the Board’s standing committees—Audit, Compensation, and Nominating and Corporate Governance—assist the Board in discharging its oversight duties as

described below. Accordingly, while each of the committees contributes to the risk management oversight function by assisting the Board in the manner outlined below, the Board itself remains responsible for overseeing the Company’s risk

management program.

The Audit Committee discusses with management and/or the independent auditor and/or internal audit

function, as appropriate, risks related to the Committee’s roles and responsibilities as described in its charter.

The Compensation Committee reviews risks related to the subject matters for which it is responsible,

primarily our executive compensation program and incentive plans.

The Nominating and Corporate Governance Committee considers risks related to the subject matters for

which it is responsible, primarily corporate governance matters and related person transactions.

We are committed to behaving ethically. Our Code of Conduct, which applies to all our directors and employees, including our principal executive officer and

principal financial and accounting officer, is available on our website at https://www.eplus.com/investors/corporate-governance-legal/code-of-conduct. If we make any substantive amendments to the Code of Conduct, or grant any waiver from

a provision to our executive officers, it is our intention to disclose the nature of such amendment or waiver on our website if such disclosure is required by Exchange Act or Nasdaq rules. Our employees are annually required to acknowledge our

Code of Conduct. We also have a Business Partner Code of Conduct, which clarifies our expectations in the areas of business integrity, labor practices, health and safety, and environmental management. The Business Partner Code of Conduct

complements our Code of Conduct, and is available on our website at https://www.eplus.com/investors/corporate-governance-legal/business-partner-code-of-conduct. We expect our suppliers, vendors, contractors and subcontractors, agents, and

other providers of goods and services for ePlus-affiliated entities worldwide to follow our Business Partner Code of Conduct.

Our Insider Trading Policy applies to our directors and employees, as well as family trusts or similar entities controlled by or benefiting

individuals subject to the Insider Trading Policy. The policy prohibits directors, officers, and employees who are Insiders (as defined in the policy) from hedging transactions involving Company securities, and it also prohibits transactions that

establish downside price protection, including short sales, and buying or selling put options, call options, or other derivatives of Company securities. The policy prohibits Insiders from holding securities in a margin account or pledging

securities as collateral, except in certain circumstances with pre-approval from our Insider Trading Compliance Officer.

Shareholders who desire to communicate with the Board or its committees may do so by writing to them at the Company’s headquarters at ePlus inc., 13595 Dulles Technology Drive, Herndon, Virginia 20171. Correspondence may be addressed to the collective Board, or to any of its individual members or committees. Any such communication is

promptly distributed to the director(s) named therein unless such communication is considered, either presumptively or in the reasoned judgment of the Company’s Corporate Secretary, to be improper for submission to the intended recipient(s).

Examples of communications that would presumptively be deemed improper for submission include, without limitation, solicitations, communications that do not relate to the Company, and unsolicited advertising, spam, or junk mail.

The Compensation Committee is comprised of five independent directors. No member of the Compensation Committee is a current or former officer or

employee of the Company, or any of its subsidiaries. During the fiscal year ended March 31, 2023, no member of the Compensation Committee had a relationship that required disclosure under the SEC rules as a related person transaction. Also,

during the fiscal year, none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on our Board, or the Company’s Compensation Committee.

The Board has adopted a written policy for approval of transactions between ePlus and its directors,

director nominees, executive officers, greater than 5% beneficial owners of ePlus’ common stock, and each of their respective immediate family members, where the amount involved in the transaction exceeds

or is expected to exceed $120,000 in a single fiscal year, and the related person has or will have a direct or indirect material interest in the transaction. Under the policy, the company’s General Counsel gathers material facts and other

information necessary to assess whether a proposed transaction would constitute a related person transaction.

If the General Counsel determines that the proposed transaction will be a related person transaction, she or he submits an assessment to the

Nominating and Corporate Governance Committee. The policy directs that ePlus’ Nominating and Corporate Governance Committee reviews transactions subject to the policy and determines whether or not to

approve or ratify those transactions, considering all relevant facts and circumstances reasonably available to it, which include:

| • |

the related person’s interest in the transaction;

|

| • |

the purpose of, and the potential benefits to the Company of, the proposed transaction;

|

| • |

the impact on a director’s independence in the event the related person is a director, an immediate family member of a director, or an entity in which a director is a partner, shareholder, or executive

officer;

|

| • |

the approximate dollar value of the amount involved in the transaction;

|

| • |

the approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss;

|

| • |

the terms and conditions of the transaction;

|

| • |

whether the proposed transaction will be undertaken in the ordinary course of business of the Company and is on terms that are comparable to the terms available to an unrelated third party or to employees

generally; and

|

| • |

any other information regarding the related person transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the

particular transaction.

|

The Committee approves only those related person transactions that, under all of the circumstances, are fair to the Company, as the Committee determines in good faith,

and may, in its sole discretion, impose such conditions as it deems appropriate on the Company or the related person in connection with approval of the related person transaction.

Except for the transaction set forth below, there were no transactions since the beginning of the fiscal year beginning April 1, 2022, in which

the Company was a party, the amount involved in the transaction exceeds $120,000, and in which any director, director nominee, executive officer, holder of more than 5% beneficial owners of ePlus’ common

stock, or immediate family member of any of the foregoing individuals had or will have a direct or indirect material interest.

Mr. Marron’s daughter is a non-executive employee of a subsidiary of the Company who began her employment in June 2023. Her annual compensation is

expected to include a base salary and bonus combined in excess of $120,000, as well as standard employee benefits consistent with the total compensation provided to other employees of the same level with similar responsibilities.

As described above, all related person transactions are prohibited unless approved or ratified by the Nominating and Corporate Governance

Committee, or, in certain circumstances, the Chair of the Nominating and Corporate Governance Committee. To the extent required by our Related Person Transactions Policy, the above matter was approved by the Nominating and Corporate Governance

Committee in accordance with such Policy.

The Company does not maintain a shareholder rights plan (commonly referred to as a “poison pill”).

Adopting the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated each of its current directors—Mses.

Bergeron and Morrison, and Messrs. Bowen, Callies, Faulders, Hovde, Hunt, Marron and Xiang—to be elected to serve until the 2024 Annual Meeting of Shareholders, or until their successors are duly elected and qualified. Biographical information as

of July 21, 2023, for each nominee is provided herein.

Each of the nominees has agreed to be named in this proxy statement and serve if elected, and we know of no reason why any of the nominees would

be unable to serve. If, however, any nominee is unable or declines to serve as a director, or if a vacancy occurs before the election (such events are not anticipated), the proxy holders will vote for the election of such other person or persons

as the Board nominates.

Each of the nine nominees for director will be elected by a plurality of the shares present in person or by proxy at the 2023 Annual Meeting and

entitled to vote on the election of directors, subject to the Company’s director resignation policy should any director not receive a majority of the votes cast. Withheld votes and broker non-votes will have no effect on the vote for this proposal.

The Board of Directors is responsible for determining the appropriate number of Board members, nominating individuals for election to the Board,

and filling vacancies on the Board that may occur between annual meetings of shareholders. The Nominating and Corporate Governance Committee is responsible for identifying and screening potential candidates, and recommending qualified candidates

to the Board for nomination. Third-party search firms may be retained to identify individuals that meet the Nominating and Corporate Governance Committee’s criteria; however, during the fiscal year ended March 31, 2023, no third-party search

firms were used. The Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders in the same manner in which it evaluates candidates it identifies, if such recommendations are properly submitted to

the Company. Shareholders wishing to recommend nominees for election to the Board should submit their recommendations in writing by mail to our Corporate Secretary, at ePlus inc., 13595 Dulles Technology

Drive, Herndon, Virginia 20171.

In selecting director candidates, the Nominating and Corporate Governance Committee and the Board of Directors consider the individual

candidates’ qualifications and skills, as well as the Board’s composition as a whole. Under our Guidelines, the Nominating and Corporate Governance Committee and the Board consider the following attributes for each candidate, among other

qualifications deemed appropriate, when considering the suitability of candidates for nomination as director:

| • |

Unquestioned personal ethics and integrity;

|

| • |

Specific skills and experience that align with ePlus’ strategic direction and operational initiatives, and complements the Board’s overall composition;

|

| • |

Multiple dimensions of diversity, including with respect to race, ethnicity and gender, to strengthen and increase the diversity, breadth of skills and qualifications of the Board;

|

| • |

Core business competencies of high achievement and a record of success;

|

| • |

Financial literacy, exposure to best practices, and track-record of making good business decisions;

|

| • |

Interpersonal skills that maximize group dynamics; and

|

| • |

Enthusiasm about ePlus and sufficient time to become fully engaged.

|

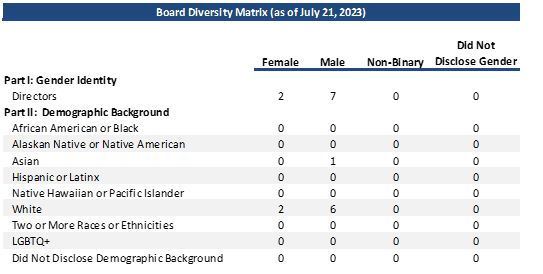

In considering multiple dimensions of diversity, ePlus’ Nominating and Corporate Governance

Committee’s practice is to include diverse candidates for consideration. Our board includes two women and one director of racial diversity, resulting in membership diversity of 33% serving on our Board. Because we use a holistic approach to

evaluate all aspects of candidates’ qualifications, we do not set arbitrary numerical goals or timelines. We are committed, however, to ensuring our candidate slates reflect our desire to further diversify our Board in service of our

shareholders. Key skills held by our directors include finance, risk oversight, cybersecurity, sales and marketing, leasing/financing, mergers and acquisitions, technology, and international business experience, as further highlighted in our

directors’ biographies below.

The below graphics provide information regarding members of our Board, including certain types of attributes, qualifications and expertise

possessed by one or more of our directors that our Board believes are relevant to our business. The graphics do not encompass all of the knowledge, skills, experiences or attributes of our directors, and the fact that a particular knowledge,

skill, experience or attribute is not listed does not mean that our Board does not possess it. In addition, the absence of a particular knowledge, skill, experience or attribute with respect to any of our directors does not mean the director in

question has no relevant experience or is unable to contribute to the decision-making process in that area. The type and degree of knowledge, skill, experience, and attribute listed may vary among the members of the Board, and the knowledge,

skills, experiences, and attributes listed below are not in any order of priority or preference.

The following biographies describe the director nominees’ business experience, including their specific experiences and qualifications that,

collectively, strengthen the Board’s qualifications, skills, and experience.

The Board expects that each of the nominees will be available for election as a director and, if elected, will serve for a term expiring at the

2024 Annual Meeting of Shareholders, and until their successors have been duly elected and qualified.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR

THE FOLLOWING NOMINEES FOR ELECTION AS DIRECTORS:

|

Renée Bergeron

Independent Director

Age 60

|

Director of ePlus since 2022

Committees:

Compensation

Nominating and Corporate Governance

Other Public Company Directorships: None

|

Ms. Bergeron is Chief Operating Officer of AppDirect, where she provides leadership and strategic vision, and oversees customer operations,

technical support, and customer success on a global basis. She joined AppDirect, one of the leading B2B commerce platforms for selling, buying, and managing recurring technology services, in March 2020. From 2010 until 2020, Ms. Bergeron held

roles at Ingram Micro, a global leader in technology and supply chain services, most recently as Senior Vice President Global Cloud. Since March 2020 she has also been a board member of FLO EV Charging, a premier manufacturer and network operator

of electric vehicle charging solutions. Ms. Bergeron has a Master of Business Administration from McGill University, and a Bachelor’s degree in Information Technology from Université de Sherbrooke.

The Board believes that, as a proven industry leader with significant experience across many of ePlus’ strategic focus areas, such as security,

cloud and services, Ms. Bergeron brings a strong knowledge base that will help ePlus be the most customer-centric, service-driven partner of choice.

|

Bruce M. Bowen

Independent Director

Age 71

|

Director of ePlus since 1990

Committees:

None

Other Public Company Directorships: None

|

Mr. Bowen founded our company in 1990 and served as our President until September 1996. Beginning in September 1996 until March 2014, Mr. Bowen

served as our Executive Vice President and from September 1996 to June 1997 also served as our Chief Financial Officer. In March 2014, Mr. Bowen stepped down as Executive Vice President, and retired as an employee of the company in May 2018

though he continues to serve on the Board.

Prior to founding the Company, he served as Senior Vice President of PacifiCorp Capital, Inc., which was an equipment leasing company. In the

past, he has also served as Chairman of the Association for Government Leasing and Finance as well as various committees of the Equipment Leasing and Finance Association, which gave him a broad understanding of issues affecting our industry.

During his leasing career, Mr. Bowen participated in equipment lease financing transactions in excess of an aggregate of $3 billion, involving many major vendors as well as government contractors. Mr. Bowen has a degree in finance from the

University of Maryland as well as a Master of Business Administration in Finance from the University of Maryland.

Mr. Bowen’s experience in the leasing industry brings to the Board depth and breadth of knowledge relating to finance and funding. He also has a

thorough knowledge of sales and operations activities and in a multitude of industry-specific areas.

|

John E. Callies

Independent Director

Age 69

|

Director of ePlus since 2010

Committees:

Audit

Compensation (Chair)

Other Public Company Directorships: None

|

Mr. Callies has been a Senior Advisor to McKinsey and Company since 2011. Previously, he was employed by IBM in various capacities for 34 years.

Mr. Callies served as General Manager of IBM Global Financing from 2004 until his retirement in June 2010. With operations in 55 countries supporting 125,000 clients, Mr. Callies led the world’s largest information technology financing and asset

management organization and was responsible for business direction and management of a portfolio of nearly $35 billion in total assets. Mr. Callies has a degree in economics from Lehigh University.

The Board believes that Mr. Callies’ knowledge of our business, including the leasing sector, along with his sales, operational and strategic

experience bring value to the Board. He additionally has international experience and qualifies as an audit committee financial expert within the meaning of SEC regulations.

|

C. Thomas Faulders, III

Independent Director and Chairman

Age 73

|

Director of ePlus since 1998

Committees:

Audit

Compensation

Other Public Company Directorships: None

|

Mr. Faulders was the President and Chief Executive Officer of the University of Virginia Alumni Association from 2006 to 2017. Prior to that,

Mr. Faulders served as the Chairman and Chief Executive Officer of LCC International, Inc. from 1999 to 2005 and as Chairman of Telesciences, Inc., an information services company, from 1998 to 1999. From 1995 to 1998, Mr. Faulders was Executive

Vice President, Treasurer, and Chief Financial Officer of BDM International, Inc., a prominent systems integration company. Mr. Faulders also served as the Vice President and Chief Financial Officer of COMSAT Corporation, an international

satellite communication company, from 1992 to 1995. He led mergers and acquisitions efforts in several roles, including at MCI, Inc., Comsat, BDM International Inc., and LCC International, Inc., all of which were publicly traded companies during

his tenure. He has served on numerous boards in the past and has held roles as chairs of compensation, audit, and governance committees. He is a graduate of the University of Virginia and received a Master of Business Administration from the

Wharton School of the University of Pennsylvania.

The Board believes Mr. Faulders’ extensive executive and financial experience in the telecommunications and hightech sectors, together with his

experience as Chief Executive Officer and Chief Financial Officer of a public company and his leasing and M&A experience, enables him to provide considerable financial expertise, business management and operational knowledge, insight and

guidance to the Board. He additionally has international experience and qualifies as an audit committee financial expert within the meaning of SEC regulations.

|

Eric D. Hovde

Independent Director

Age 59

|

Director of ePlus since 2006

Committees:

Compensation

Nominating and Corporate Governance

Other Public Company Directorships: None

|

Mr. Hovde is an entrepreneur who has established and managed numerous business enterprises. Mr. Hovde is currently the Chairman and Chief

Executive Officer of H Bancorp LLC, a private bank holding company, and has served in such role since 2014. He has served as a director on numerous bank boards throughout his career and has served on the board of H Bancorp’s largest holding,

Sunwest Bank, since 1998, where he is also the Chief Executive Officer and has served in such role since 2015. Additionally, Mr. Hovde serves as the Chief Executive Officer and co-owner of Hovde Properties, LLC, a real estate development company,

located in Madison, Wisconsin. Mr. Hovde oversees the management of the company and all large development properties.

Formerly, Mr. Hovde founded and managed Hovde Financial, an investment banking company focused on the financial services industry, and Hovde

Capital, an asset management company that managed capital for institutional clients, family offices, and high net worth individuals. Throughout his career, he has also purchased numerous banks and savings banks throughout the United States and

has served on the board of over a dozen banking companies.

Charity is a primary principle in the Hovde family and related businesses. Mr. Hovde and his brother, Steven, created and funded The Hovde

Foundation in 1998. The foundation focuses on several charitable organizations throughout the United States and worldwide. Principally, The Hovde Foundation’s focus is on assisting disadvantaged children. In this regard, Mr. Hovde founded Hovde

Homes, which provides shelter, care, education, and love to vulnerable children that were abandoned on the street or trafficked.

Mr. Hovde earned his degrees in Economics and International Relations at the University of Wisconsin – Madison.

The Board believes that Mr. Hovde’s expertise in the financial services industry, investment management areas and business operations, as well

as his experience on other company boards and with mergers and acquisitions, bring valuable insight to the Board. His deep understanding of the merger and acquisition landscape and his ability to assess synergies and growth opportunities have

been instrumental in enhancing shareholder value. He has played a pivotal role in identifying potential targets, conducting due diligence, negotiating transactions, and overseeing integration efforts.

|

Ira A. Hunt, III

Independent Director

Age 67

|

Director of ePlus since 2014

Committees:

Compensation

Nominating and Corporate Governance

Other Public Company Directorships: None

|

Mr. Hunt retired from the Central Intelligence Agency in 2013 as its Chief Technology Officer after a 28-year career in intelligence. Since his

retirement, he has returned to private consulting practice as President and CEO of Hunt Technology, LLC, which he founded. Hunt Technology, LLC focuses on strategic IT planning, cyber and data-centric security, big data analytics, and cloud

computing. From July 2016 through October 2020, he served as Managing Director and Cyber Lead for Accenture Federal Services in Arlington, Virginia, and he has also served as Chief Architect for Bridgewater Associates, the world’s largest hedge

fund. He currently serves on the Board of Directors for Mission Link, a non-profit organization, and on the Board of Advisors for Vaga Ventures and LookingGlass. He holds a Bachelor degree in Engineering and Master of Engineering in

Civil/Structural Engineering from Vanderbilt University.

The Board believes that Mr. Hunt’s extensive knowledge of the technology industry, including strategic IT planning, cyber and data-centric

security, big data analytics, cloud computing, and IT architecture and environment, bring valuable industry expertise to the Board.

|

Mark P. Marron

Director, CEO and President

Age 62

|

Director of ePlus since 2018

Committees:

None

Other Public Company Directorships: None

|

Mr. Marron became the CEO and President of ePlus inc. on August 1, 2016, and was appointed to the Board on November 14, 2018. He oversees all

corporate strategy for global operations, leading with an emphasis on our greatest asset: our people. He began his career at ePlus in 2005 as Senior Vice President of Sales and became COO in 2010. A 30+ year industry veteran, he was formerly with

NetIQ where he held the position of Senior Vice President of Worldwide Sales and Services. Prior to joining NetIQ, Mr. Marron served as General Manager of Worldwide Channel Sales for Computer Associates International Inc., a provider of software

and services that enables organizations to manage their IT environments. Through his time with both NetIQ and Computer Associates International Inc., Mr. Marron gained extensive international experience, throughout North America, Europe, the

Middle East, and Africa and holds a Bachelor of Science degree in Computer Science from Montclair State University.

The Board has determined that Mr. Marron’s role as CEO provides the Board with access to an experienced executive with a thorough understanding

of our business and extensive experience in leading sales teams, international sales, and mergers and acquisitions.

|

Maureen F. Morrison

Independent Director

Age 69

|

Director of ePlus since 2018

Committees:

Audit (Chair)

Nominating and Corporate Governance

Other Public Company Directorships: Asbury Automotive Group Inc. (NYSE: ABG)

|

Maureen F. Morrison joined the ePlus Board of Directors in June 2018. She is a highly accomplished senior executive leader who retired in 2015

from a career as an audit partner at PricewaterhouseCoopers, LLP (“PwC”). At PwC, Ms. Morrison worked with prominent private equity backed entities and multibillion-dollar global technology corporations.

She has diversified experience in software, IT-enabled solutions and consulting, hardware, and manufacturing. As a highly respected financial and accounting professional, Ms. Morrison has extensive experience in corporate boardrooms advising

Audit Committees of midcap public companies, private equity-backed entities, and Fortune 500 companies.

Ms. Morrison currently is a member of one other publicly traded board of directors: Asbury Automotive Group, where she is the Chair of the Audit

Committee and a member of the Compensation and Human Resources Committee and Capital Allocation & Risk Management Committee. She holds a Bachelor of Arts in Business Administration with a concentration in Accounting from Rutgers University.

The Board has determined that as a result of her broad experience with complex accounting, financial and risk related issues, as well as her

experience on public company boards, Ms. Morrison is well-qualified to assist in the auditor oversight function as an Audit Committee member and brings value as a member of the Board. She also qualifies as an audit committee financial expert

within the meaning of SEC regulations.

|

Ben Xiang

Independent Director

Age 38

|

Director of ePlus since 2019

Committees:

Audit

Nominating and Corporate Governance (Chair)

Other Public Company Directorships: None

|

Mr. Xiang currently serves as Senior Vice President, Corporate Development and Strategy at Veritone, an Enterprise AI company. Mr. Xiang joined

Veritone in February 2021. Along with leading Veritone’s corporate development and venture activities, Mr. Xiang drives strategy and growth. Prior to that, Mr. Xiang served as interim Chief Information Officer of Sunwest Bank from August 2019 to

December 2019. Beginning in 2015 and through the present, he serves in a consulting role through Crescent Group, where his contributions include advising start-ups and established companies in digital transformation and growth. From 2012 through

2019, Mr. Xiang held multiple roles with Ingram Micro, the world’s largest IT distributor, as Ingram’s global executive for the Internet of Things, Artificial Intelligence, and Mixed-Reality business as well as roles in strategy and corporate

development. He has extensive experience in cross-border M&A, post-merger integrations, and business operations. Prior to joining Ingram, Mr. Xiang was Managing Director of Fortress Consulting, a management consulting firm supporting Fortune

500 companies in the US, Europe, and China. In 2009, he joined the CITIC Group as Director focusing on investments in technology and media. Prior to that, Mr. Xiang worked for Sony BMG in the areas of digital strategy and transformation. Mr.

Xiang has extensive experience throughout Asia Pacific and North America and holds a degree in Finance and Management from the Wharton School at the University of Pennsylvania. Since April 2015, Mr. Xiang has also served on the board of directors

of Sunwest Bank.

The Board believes that Mr. Xiang’s expertise of go-to-market within the IT channel, knowledge of the technology industry, emerging technology

vendors and international M&A experience bring value to the Board.

The below table sets forth the compensation for the members of the Board for the fiscal year ended March 31, 2023.

Mr. Marron did not receive any additional compensation for his service as a director during our fiscal year ended March 31, 2023. Mr. Marron’s

compensation is reported under “Executive Compensation” herein.

The Board’s general policy is that compensation for the non-employee directors should be a mix of cash and equity-based compensation. Directors

also have the ability to elect to receive their compensation entirely in equity. During our fiscal year ended March 31, 2023, each non-employee director received an annual cash retainer of $86,250 (on a pro rata basis for Ms. Bergeron based on her

nomination during fiscal year 2022), reflecting four quarterly payments of $21,562.50, or, alternatively, at the director’s election, the same amount in stock in lieu of cash, rounded down to avoid a fractional share. Stock that directors receive

in lieu of cash is not subject to forfeiture or a vesting period. In September 2022, each non-employee director also received $83,413.80 in restricted stock (except for Ms. Bergeron, who received $81,182 in restricted stock upon her appointment to

the board on October 13, 2022, representing a pro rata amount), which is equal to the amount of cash compensation earned by directors during the prior fiscal year, as more fully set forth in our 2017 Non-Employee Director Long-Term Incentive Plan

(“2017 Director LTIP”). This number of shares of restricted stock granted is rounded down to avoid a fractional share award, and vests in equal installments on the first- and second-year anniversaries of the

grant. Our Board’s Chairman, Mr. Faulders, also receives an additional annual cash compensation of $50,000, which is paid quarterly in equal amounts of $12,500.

Directors are also reimbursed for out-of-pocket expenses incurred to attend Board and committee meetings and the Annual Meeting.

The tables below show compensation for all directors except for Mr. Marron, whose compensation is in the Summary Compensation

Table.

|

Name

|

Fees Earned

or Paid in Cash (1) |

Stock Awards (2)(3)

|

Option Awards

|

All Other Compensation

|

Total

|

|||||||||||||||

|

Renée Bergeron

|

$

|

40,313

|

$

|

81,182

|

$

|

-

|

$

|

-

|

$

|

121,495

|

||||||||||

|

Bruce M. Bowen

|

$

|

86,250

|

$

|

83,414

|

$

|

-

|

$

|

-

|

$

|

169,664

|

||||||||||

|

John E. Callies

|

$

|

86,250

|

$

|

83,414

|

$

|

-

|

$

|

-

|

$

|

169,664

|

||||||||||

|

C. Thomas Faulders, III

|

$

|

136,250

|

$

|

83,414

|

$

|

-

|

$

|

-

|

$

|

219,664

|

||||||||||

|

Eric D. Hovde

|

$

|

86,250

|

$

|

83,414

|

$

|

-

|

$

|

-

|

$

|

169,664

|

||||||||||

|

Ira A. Hunt, III

|

$

|

86,250

|

$

|

83,414

|

$

|

-

|

$

|

-

|

$

|

169,664

|

||||||||||

|

Maureen F. Morrison

|

$

|

86,250

|

$

|

83,414

|

$

|

-

|

$

|

-

|

$

|

169,664

|

||||||||||

|

Ben Xiang

|

$

|

86,250

|

$

|

83,414

|

$

|

-

|

$

|

-

|

$

|

169,664

|

||||||||||

| (1) |

The above table reflects fees earned during the fiscal year 2023. Pursuant to our 2017 Director LTIP, directors may make a stock fee election, through which they receive shares of stock in lieu of cash

compensation. The stock fee elections are made on a calendar year basis, and the stock grant is made on the first business day after the end of each quarter of board service. The number of shares received is determined by dividing the

cash compensation earned quarterly by directors ($21,562.50 during our fiscal year ended March 31, 2023) by the Fair Market Value of a share of common stock, as defined in the 2017 Director LTIP, and rounding down to avoid the issuance

of a fractional share.

|

Messrs. Bowen and Hovde each received stock instead of cash throughout the fiscal year. This stock is not subject to forfeiture or

a vesting period. The amount of stock granted for each quarter to Messrs. Bowen and Hovde is shown below:

|

Board Service Time |

Number of

Shares Granted |

|

April 1, 2022 - June 30, 2022

|

408

|

|

July 1, 2022 - September 30, 2022

|

507

|

|

October 1, 2022 - December 31, 2022

|

481

|

|

January 1, 2023 - March 31, 2023

|

431

|

| (2) |

The values in this column represent the aggregate grant date fair market values of the fiscal year 2023 restricted stock awards, computed in accordance with Codification Topic Compensation—Stock

Compensation.

|

| (3) |

The table below reflects the aggregate number of unvested restricted stock shares outstanding as of March 31, 2023, for each director except Mr. Marron, whose compensation is in the Summary Compensation Table.

|

|

Name

|

Unvested

Restricted Shares |

|

Renée Bergeron

|

1,874

|

|

Bruce M. Bowen

|

2,840

|

|

John E. Callies

|

2,840

|

|

C. Thomas Faulders, III

|

2,840

|

|

Eric D. Hovde

|

2,840

|

|

Ira A. Hunt, III

|

2,840

|

|

Maureen F. Morrison

|

2,840

|

|

Ben Xiang

|

2,840

|

The Board believes that to align the interests of our non-employee directors more closely with the interests of the Company’s

other shareholders, each non-employee director should maintain a minimum level of ownership in the Company’s common stock. Our Nominating and Corporate Governance Committee regularly reviews the stock ownership guidelines, and compliance

therewith. Pursuant to the stock ownership guidelines, which are part of our Corporate Governance Guidelines, non-employee directors are expected to reach a multiple of three times their annual cash board retainer fee within four years of joining

the Board. During the fiscal year ended March 31, 2023, all directors met this requirement or were within the four-year phase-in period for meeting the ownership guidelines.

The following tables show information regarding the beneficial ownership of our common stock by:

| • |

each member of our Board of Directors, each director nominee, and each of our named executive officers (“NEO”);

|

| • |

all members of our Board and our executive officers as a group; and

|

| • |

each person or group who is known by us to own beneficially more than 5% of our common stock.

|

Beneficial ownership of shares is determined under the SEC’s rules and generally includes any shares over which a person exercises sole or shared

voting or investment power. Shares of restricted stock that have not vested as of our Record Date are deemed outstanding and beneficially owned by the person and any group of which that person is a member because such holder has voting rights

with respect to those shares. Except as footnoted below, and subject to community property laws where applicable, we believe based on the information provided to us that the persons and entities named in the following table have sole voting and

investment power with respect to all shares of our common stock shown as beneficially owned by them.

The percentages of beneficial ownership were calculated on the basis of [26,944,377] shares of common stock outstanding which includes [314,519]

unvested restricted shares, which have voting rights, as of our Record Date.

Share ownership is shown as of our Record Date of July 21, 2023.

|

Name (1)

|

Aggregate

Number of

Beneficial

Shares

|

Percent of

Outstanding Shares |

Additional Information (2)

|

|

Renée Bergeron

|

1,874

|

*

|

Includes 1,874 shares of restricted stock that have not vested as of July 21, 2023.

|

|

Bruce M. Bowen

|

36,235

|

*

|

Includes 13,200 shares of common stock held by Bowen Holdings LLC, a Virginia limited liability company, which is owned by Mr. Bowen and his three adult children, of which Mr. Bowen serves as manager. Also includes (a) 2,084 shares

held by the Elizabeth Dederich Bowen Trust in which Mr. Bowen's spouse serves as trustee, (b) 17,727 shares held by the Bruce Montague Bowen Trust in which Mr. Bowen serves as trustee, and (c) 2,840 shares of restricted stock that have

not vested as of July 21, 2023.

|

|

John E. Callies

|

20,448

|

*

|

Includes 2,840 shares of restricted stock that have not vested as of July 21, 2023.

|

|

C. Thomas Faulders, III

|

44,988

|

*

|

Includes 2,840 shares of restricted stock that have not vested as of July 21, 2023.

|

|

Eric D. Hovde

|

86,599

|

*

|

Includes 2,840 shares of restricted stock that have not vested as of July 21, 2023. Mr. Hovde is the managing member of Hovde Capital, Ltd., the general partner to Financial Institution Partners III LP,

which owns 20,396 shares. Mr. Hovde is a trustee of The Eric D. and Steven D. Hovde Foundation, which owns 10,000 shares.

|

|

Ira A. Hunt, III

|

23,908

|

*

|

Includes 2,840 shares of restricted stock that have not vested as of July 21, 2023.

|

|

Maureen F. Morrison

|

9,940

|

*

|

Includes 2,840 shares of restricted stock that have not vested as of July 21, 2023.

|

|

Ben Xiang

|

8,268

|

*

|

Includes 2,840 shares of restricted stock that have not vested as of July 21, 2023.

|

|

Mark P. Marron

|

195,330

|

*

|

Includes (a) 78,874 shares of restricted stock that have not vested as of July 21, 2023, (b) 112,227 shares held in a revocable trust in which Mr. Marron serves as trustee, and (c) 4,229 shares held in

trust for Mr. Marron's dependent child.

|

|

Elaine D. Marion

|

117,781

|

*

|

Includes (a) 69,155 shares held in a revocable trust in which Ms. Marion serves as trustee, (b) 48,202 shares of restricted stock that have not vested as of July 21, 2023, and (c) 424 shares held in an

IRA.

|

|

Darren S. Raiguel

|

108,767

|

*

|

Includes (a) 60,434 shares held in a revocable trust in which Mr. Raiguel serves as trustee, and (b) 48,202 shares of restricted stock that have not vested as of July 21, 2023.

|

|

All directors and executive

officers as a group (11 persons) |

654,138

|

[2.43%]

|

| * |

Less than 1%

|

| (1) |

The business address of Mses. Bergeron, Marion and Morrison, and Messrs. Bowen, Callies, Faulders, Hovde, Hunt, Marron, Raiguel, and Xiang is ePlus inc., 13595

Dulles Technology Drive, Herndon, Virginia 20171.

|

| (2) |

Nonvested restricted shares included herein are considered beneficially owned since the owner thereof has the right to vote such shares.

|

The share ownership is shown as of the date disclosed in the Additional Information column, and percentages are calculated assuming continued

beneficial ownership at our Record Date of July 21, 2023.

|

Name of Beneficial Owner

|

Aggregate

Number

of Beneficial

Shares

|

Percent of

Outstanding

Shares

|

Additional Information

|

|

BlackRock, Inc.

55 East 52nd Street New York, NY 10055 |

4,732,927

|

[17.57%]

|

BlackRock, Inc. reported that as of December 31, 2022 it had sole voting power over 4,632,230 shares and sole dispositive power over 4,732,927 shares. This information is based on a Schedule 13G/A filed

with the SEC on January 26, 2023.

|

|

|

|

|

BlackRock indicates in its Schedule 13G/A that one entity, iShares Core S&P Small-Cap ETF, has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale

of, or has an interest in the common stock of, more than five percent of ePlus' total outstanding common stock.

|

|

The Vanguard Group

100 Vanguard Boulevard Malvern, PA 19355 |

2,111,123

|

[7.84%]

|

The Vanguard Group reported that as of December 30, 2022 it had shared voting power over 38,325 shares and sole and shared dispositive power over 2,049,488 and 61,635 shares, respectively. The information is based on a Schedule 13G/A

filed with the SEC on February 9, 2023.

|

|

River Road Asset Management, LLC

462 S. 4th Street, Suite 2000 Louisville, KY 40202 |

1,900,459

|

[7.05%]

|

River Road Asset Management, LLC reported that as of December 31, 2022 it had sole voting power over 1,860,523 shares and sole dispositive power over 1,900,459 shares. This information is based on a

Schedule 13G filed with the SEC on February 8, 2023.

|

|

Geneva Capital Management LLC

411 E Wisconsin Avenue, Suite 2320 Milwaukee, WI 53202 |

1,544,898

|

[5.73%]

|

Geneva Capital Management LLC reported that as of December 31, 2022 it had shared voting power over 1,521,323 shares and shared dispositive power over 1,544,898 shares. This information is based on a

Schedule 13G filed with the SEC on February 10, 2023.

|

|

Dimensional Fund Advisors LP

Building One

6300 Bee Cave Road Austin, TX 78746 |

1,485,138

|

[5.51%]

|

Dimensional Fund Advisors LP ("DFA") reported that as of December 30, 2022 it had sole voting power over 1,462,983 shares and sole dispositive power over 1,485,138 shares. This information is based on a

Schedule 13G/A filed with the SEC on February 10, 2023. DFA is an investment adviser registered under Section 203 of the Investment Company Act of 1940, and serves as investment manager or sub-adviser to certain other commingled funds,

group trusts and separate accounts (such companies, trusts and accounts, collectively referred to as the "Funds"). In certain cases subsidiaries of DFA may act as an adviser or sub-adviser to certain Funds. In its role as investment

advisor, sub-adviser and/or manager, DFA or its subsidiaires (collectively, "Dimensional") may possess voting and/or investment power over the securities of the Company that are owned by the Funds, and may be deemed to be the beneficial

owner of the shares of the Company held by the Funds. However, all securities reported in the Schedule 13G/A are owned by the Funds, and Dimensional disclaims beneficial ownership of such securities.

|

EXECUTIVE OFFICERS

The following biographies describe the business experience of each of the Company’s executive officers as of March 31, 2023, except for Mark P.

Marron, who is discussed under the heading “2023 Nominees for Election to the Board of Directors.”

|

Elaine D. Marion, Age 55

Chief Financial Officer

|

Officer of ePlus since 2008

|

Ms. Marion joined us in 1998 and became our CFO on September 1, 2008. From 2004 to 2008, Ms. Marion served as our Vice President of Accounting.

Prior to that, she was the Controller of ePlus Technology, inc., a subsidiary of ePlus, from 1998 to 2004. Before joining ePlus,

Ms. Marion was General Manager of Bristow Development Corporation. Ms. Marion is a board member of the Executive Advisory Board of the College of Business at the University of Mary Washington, and chair of the George Mason University School

of Business Dean’s Advisory Council. Ms. Marion is a graduate of George Mason University, where she earned a Bachelor of Science degree in Business Administration with a concentration in Accounting.

|

Darren S. Raiguel, Age 52

Chief Operating Officer

|

Officer of ePlus since 2018

|

Darren Raiguel joined us in 1997 and served in various sales and management roles until his promotion in April 2011 to Senior Vice President of

SLED (state, local and education) and northeast commercial sales. From November 2014 to May 2018, Mr. Raiguel served as our Executive Vice President of Technology Sales of ePlus Technology, inc., a

subsidiary of ePlus, and he became Chief Operating Officer of the Company and President of ePlus Technology, inc. on May 7, 2018.