Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Mar. 31, 2023 |

Mar. 31, 2022 |

Mar. 31, 2021 |

| Pay vs Performance Disclosure [Table] |

|

|

|

| Pay vs Performance [Table Text Block] |

Pay Versus Performance

As required by Section 953(a) of Dodd-Frank, and Item 402(v) of Regulation S-K, we are providing

the following information reflecting the relationship between executive compensation actually paid by the Company and the Company’s financial performance for each of the last three completed calendar years. In determining the compensation

“actually paid” to our NEOs, we are required to make various adjustments to amounts that have been previously reported in the Summary Compensation Table in previous years, as the SEC’s valuation methods for this section differ from those

required in the Summary Compensation Table. For further information concerning the Company’s pay for performance philosophy and how the Company aligns executive compensation with the Company’s performance, refer to the “Compensation

Discussion and Analysis” provided elsewhere in this proxy statement. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the fiscal years shown.

The table below summarizes compensation values both reported in our 2023 Summary Compensation Table, as well as the adjusted values required in this section for the

2021, 2022 and 2023 fiscal years.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value of Initial Fixed $100 Investment Based On:

|

|

|

|

|

|

|

|

|

Fiscal

Year

|

|

Summary Compensation Table Total to PEO

|

|

|

Compensation Actually Paid to PEO

|

|

|

Average Summary

Compensation

Table Total for

Non-PEO NEOs

|

|

|

Average

Compensation

Actually Paid to

Non-PEO NEOs

|

|

|

Company TSR

|

|

|

Peer Group TSR

|

|

|

Net Income

($ thousands)

|

|

|

Operating

Income

($ thousands)

|

|

|

|

|

(a)

|

|

|

(b)

|

|

|

(c)

|

|

|

(d)

|

|

|

(e)

|

|

|

(f)

|

|

|

(g)

|

|

|

(h)

|

|

|

2023

|

|

$

|

4,422,225

|

|

|

$

|

3,767,495

|

|

|

$

|

2,582,208

|

|

|

$

|

2,185,745

|

|

|

$

|

156.63

|

|

|

$

|

187.37

|

|

|

$

|

119,356

|

|

|

$

|

166,162

|

|

|

2022

|

|

$

|

4,900,118

|

|

|

$

|

5,466,517

|

|

|

$

|

2,769,308

|

|

|

$

|

3,119,485

|

|

|

$

|

179.05

|

|

|

$

|

197.49

|

|

|

$

|

105,600

|

|

|

$

|

147,316

|

|

|

2021

|

|

$

|

3,839,946

|

|

|

$

|

5,480,397

|

|

|

$

|

2,121,791

|

|

|

$

|

3,072,398

|

|

|

$

|

159.12

|

|

|

$

|

192.68

|

|

|

$

|

74,397

|

|

|

$

|

106,335

|

|

| (a) |

Reflects compensation amounts reported in the “2023 Summary Compensation Table” for our President and Chief Executive Officer, Mr. Marron.

|

| (b) |

Compensation actually paid to our President and Chief Executive Officer for each period presented, as computed in accordance with SEC rules, does not reflect the actual amount of compensation earned or

received during the applicable fiscal year. In accordance with SEC rules, these amounts differ from the total compensation reported in the “2023 Summary Compensation Table” for each fiscal year as shown below. The fair value of equity

awards was determined using methodologies and assumption developed in a manner substantively consistent with those used to determine the grant date fair value of such awards in accordance with Codification Topic Compensation – Stock

Compensation.

|

| |

|

|

|

Fiscal 2023

|

|

|

Fiscal 2022

|

|

|

Fiscal 2021

|

|

|

Summary Compensation Table Total

|

|

$

|

4,422,225

|

|

|

$

|

4,900,118

|

|

|

$

|

3,839,946

|

|

| |

-

|

|

Grant Date Fair Value of Stock Awards Granted in Fiscal Year

|

|

$

|

(2,199,967

|

)

|

|

$

|

(1,999,964

|

)

|

|

$

|

(1,799,979

|

)

|

| |

+

|

|

Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in Fiscal Year

|

|

$

|

1,843,266

|

|

|

$

|

2,433,116

|

|

|

$

|

2,494,089

|

|

|

±

|

|

Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior Fiscal Years

|

|

$

|

(320,280

|

)

|

|

$

|

308,818

|

|

|

$

|

815,477

|

|

|

±

|

|

Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

±

|

|

Change in Fair Value as of Vesting Date of Stock Awards Granted in Prior Fiscal Years for Which Applicable Vesting Conditions Were Satisfied During Fiscal Year

|

|

$

|

22,251

|

|

|

$

|

(175,571

|

)

|

|

$

|

130,865

|

|

| |

-

|

|

Fair Value as of Prior Fiscal Year-End of Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

| |

+

|

|

Dividends Accrued During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Compensation Actually Paid

|

|

$

|

3,767,495

|

|

|

$

|

5,466,517

|

|

|

$

|

5,480,397

|

|

| (c) |

Reflects the average compensation amounts reported in the “2023 Summary Compensation Table” for our NEOs (excluding the President and Chief Executive Officer), which included the Chief Financial Officer,

Ms. Marion, and the Chief Operating Officer, Mr. Raiguel, in each year presented.

|

| (d) |

Average compensation actually paid to our NEOs (excluding the President and Chief Executive Officer) for each period presented, as computed in accordance with SEC rules, does not reflect the actual amount

of compensation earned or received during the applicable fiscal year. In accordance with SEC rules, these amounts differ from the average total compensation reported in the “2023 Summary Compensation Table” for each fiscal year as shown

below. The fair value of equity awards was determined using methodologies and assumptions developed in a manner substantively consistent with those used to determine the grant date fair value of such awards in accordance with

Codification Topic Compensation – Stock Compensation.

|

| |

|

|

|

Fiscal 2023

|

|

|

Fiscal 2022

|

|

|

Fiscal 2021

|

|

|

Summary Compensation Table Total

|

|

$

|

2,582,208

|

|

|

$

|

2,769,308

|

|

|

$

|

2,121,791

|

|

| |

-

|

|

Grant Date Fair Value of Stock Awards Granted in Fiscal Year

|

|

$

|

(1,349,994

|

)

|

|

$

|

(1,199,923

|

)

|

|

$

|

(1,049,958

|

)

|

| |

+

|

|

Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in Fiscal Year

|

|

$

|

1,131,108

|

|

|

$

|

1,459,802

|

|

|

$

|

1,454,844

|

|

|

±

|

|

Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior Fiscal Years

|

|

$

|

(190,200

|

)

|

|

$

|

178,938

|

|

|

$

|

479,714

|

|

|

±

|

|

Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

±

|

|

Change in Fair Value as of Vesting Date of Stock Awards Granted in Prior Fiscal Years for Which Applicable Vesting Conditions Were Satisfied During Fiscal Year

|

|

$

|

12,624

|

|

|

$

|

(88,640

|

)

|

|

$

|

66,007

|

|

| |

-

|

|

Fair Value as of Prior Fiscal Year-End of Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

| |

+

|

|

Dividends Accrued During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Compensation Actually Paid

|

|

$

|

2,185,745

|

|

|

$

|

3,119,485

|

|

|

$

|

3,072,398

|

|

| (e) |

Reflects the total shareholder return (“TSR”) of a $100 investment in ePlus’ common stock. Cumulative TSR is calculated by dividing (a) the sum of (i) the

cumulative amount of any dividends for the measurement period, assuming dividend reinvestment, and (ii) the difference between the Company’s stock price at the end and the beginning of the measurement period by (b) the Company’s stock

price at the beginning of the measurement period. The beginning of the measurement period for each year in the table is April 1, 2020. Historical stock performance is not necessarily indicative of future stock performance.

|

| (f) |

Reflects the TSR of a $100 investment in the S&P 600 Small Cap Information Technology Group, which is used in the stock performance graph required by Item 201(e) of Regulation S-K included in our

Annual Report for the applicable fiscal year. Historical stock performance is not necessarily indicative of future stock performance.

|

| (g) |

The dollar amounts reported represent the amount of net income reflected in the Company’s audited financial statements for the applicable fiscal year.

|

| (h) |

The “Company-Selected Measure” (as defined in Item 402(v) of Regulation S-K) is our operating income

reflected in the Company’s audited financial statements for the applicable fiscal year.

|

|

|

|

| Company Selected Measure Name |

operating income

|

|

|

| Named Executive Officers, Footnote [Text Block] |

| (c) |

Reflects the average compensation amounts reported in the “2023 Summary Compensation Table” for our NEOs (excluding the President and Chief Executive Officer), which included the Chief Financial Officer,

Ms. Marion, and the Chief Operating Officer, Mr. Raiguel, in each year presented.

|

|

|

|

| Peer Group Issuers, Footnote [Text Block] |

| (f) |

Reflects the TSR of a $100 investment in the S&P 600 Small Cap Information Technology Group, which is used in the stock performance graph required by Item 201(e) of Regulation S-K included in our

Annual Report for the applicable fiscal year. Historical stock performance is not necessarily indicative of future stock performance.

|

|

|

|

| PEO Total Compensation Amount |

$ 4,422,225

|

$ 4,900,118

|

$ 3,839,946

|

| PEO Actually Paid Compensation Amount |

$ 3,767,495

|

5,466,517

|

5,480,397

|

| Adjustment To PEO Compensation, Footnote [Text Block] |

| (b) |

Compensation actually paid to our President and Chief Executive Officer for each period presented, as computed in accordance with SEC rules, does not reflect the actual amount of compensation earned or

received during the applicable fiscal year. In accordance with SEC rules, these amounts differ from the total compensation reported in the “2023 Summary Compensation Table” for each fiscal year as shown below. The fair value of equity

awards was determined using methodologies and assumption developed in a manner substantively consistent with those used to determine the grant date fair value of such awards in accordance with Codification Topic Compensation – Stock

Compensation.

|

| |

|

|

|

Fiscal 2023

|

|

|

Fiscal 2022

|

|

|

Fiscal 2021

|

|

|

Summary Compensation Table Total

|

|

$

|

4,422,225

|

|

|

$

|

4,900,118

|

|

|

$

|

3,839,946

|

|

| |

-

|

|

Grant Date Fair Value of Stock Awards Granted in Fiscal Year

|

|

$

|

(2,199,967

|

)

|

|

$

|

(1,999,964

|

)

|

|

$

|

(1,799,979

|

)

|

| |

+

|

|

Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in Fiscal Year

|

|

$

|

1,843,266

|

|

|

$

|

2,433,116

|

|

|

$

|

2,494,089

|

|

|

±

|

|

Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior Fiscal Years

|

|

$

|

(320,280

|

)

|

|

$

|

308,818

|

|

|

$

|

815,477

|

|

|

±

|

|

Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

±

|

|

Change in Fair Value as of Vesting Date of Stock Awards Granted in Prior Fiscal Years for Which Applicable Vesting Conditions Were Satisfied During Fiscal Year

|

|

$

|

22,251

|

|

|

$

|

(175,571

|

)

|

|

$

|

130,865

|

|

| |

-

|

|

Fair Value as of Prior Fiscal Year-End of Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

| |

+

|

|

Dividends Accrued During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Compensation Actually Paid

|

|

$

|

3,767,495

|

|

|

$

|

5,466,517

|

|

|

$

|

5,480,397

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 2,582,208

|

2,769,308

|

2,121,791

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 2,185,745

|

3,119,485

|

3,072,398

|

| Adjustment to Non-PEO NEO Compensation Footnote [Text Block] |

| (d) |

Average compensation actually paid to our NEOs (excluding the President and Chief Executive Officer) for each period presented, as computed in accordance with SEC rules, does not reflect the actual amount

of compensation earned or received during the applicable fiscal year. In accordance with SEC rules, these amounts differ from the average total compensation reported in the “2023 Summary Compensation Table” for each fiscal year as shown

below. The fair value of equity awards was determined using methodologies and assumptions developed in a manner substantively consistent with those used to determine the grant date fair value of such awards in accordance with

Codification Topic Compensation – Stock Compensation.

|

| |

|

|

|

Fiscal 2023

|

|

|

Fiscal 2022

|

|

|

Fiscal 2021

|

|

|

Summary Compensation Table Total

|

|

$

|

2,582,208

|

|

|

$

|

2,769,308

|

|

|

$

|

2,121,791

|

|

| |

-

|

|

Grant Date Fair Value of Stock Awards Granted in Fiscal Year

|

|

$

|

(1,349,994

|

)

|

|

$

|

(1,199,923

|

)

|

|

$

|

(1,049,958

|

)

|

| |

+

|

|

Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in Fiscal Year

|

|

$

|

1,131,108

|

|

|

$

|

1,459,802

|

|

|

$

|

1,454,844

|

|

|

±

|

|

Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior Fiscal Years

|

|

$

|

(190,200

|

)

|

|

$

|

178,938

|

|

|

$

|

479,714

|

|

|

±

|

|

Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

±

|

|

Change in Fair Value as of Vesting Date of Stock Awards Granted in Prior Fiscal Years for Which Applicable Vesting Conditions Were Satisfied During Fiscal Year

|

|

$

|

12,624

|

|

|

$

|

(88,640

|

)

|

|

$

|

66,007

|

|

| |

-

|

|

Fair Value as of Prior Fiscal Year-End of Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

| |

+

|

|

Dividends Accrued During Fiscal Year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Compensation Actually Paid

|

|

$

|

2,185,745

|

|

|

$

|

3,119,485

|

|

|

$

|

3,072,398

|

|

|

|

|

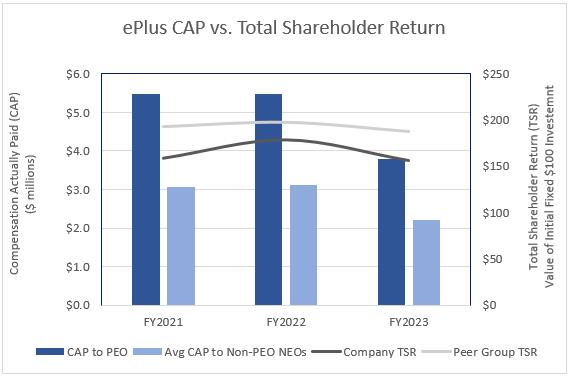

| Compensation Actually Paid vs. Total Shareholder Return [Text Block] |

The charts below illustrate the relationship between the PEO and average Non-PEO Compensation Actually Paid (“CAP”) amounts and the S&P 600 Small Cap

Information Technology Group (our “TSR Peer Group”)’s TSR during the periods ended March 31, 2021, 2022 and 2023.

|

|

|

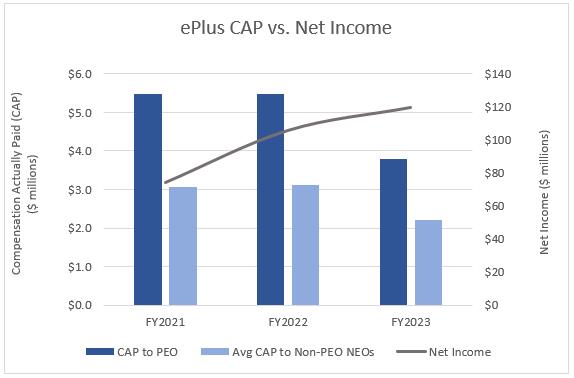

| Compensation Actually Paid vs. Net Income [Text Block] |

The chart below demonstrates the relationship between CAP amounts for our PEO and non-PEO executive officers and our net income.

|

|

|

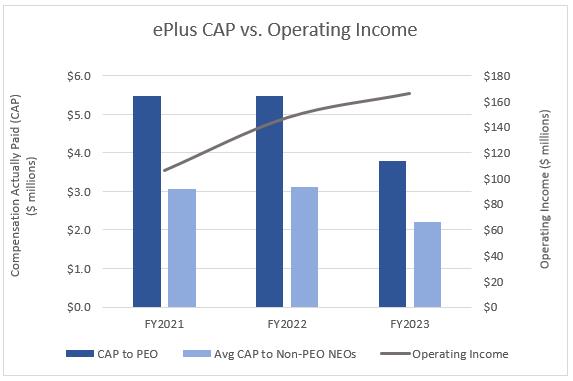

| Compensation Actually Paid vs. Company Selected Measure [Text Block] |

The chart below demonstrates the relationship between CAP amounts for our PEO and non-PEO executive officers and our operating income.

|

|

|

| Total Shareholder Return Vs Peer Group [Text Block] |

The charts below illustrate the relationship between the PEO and average Non-PEO Compensation Actually Paid (“CAP”) amounts and the S&P 600 Small Cap

Information Technology Group (our “TSR Peer Group”)’s TSR during the periods ended March 31, 2021, 2022 and 2023.

|

|

|

| Tabular List [Table Text Block] |

Financial Performance Measures

Below is an unranked list of the most important performance measures used to link executive compensation actually paid for the most recently completed fiscal

year, as described above, to the Company’s performance:

|

|

|

| Total Shareholder Return Amount |

$ 156.63

|

179.05

|

159.12

|

| Peer Group Total Shareholder Return Amount |

187.37

|

197.49

|

192.68

|

| Net Income (Loss) |

$ 119,356,000

|

$ 105,600,000

|

$ 74,397,000

|

| Company Selected Measure Amount |

166,162,000

|

147,316,000

|

106,335,000

|

| PEO Name |

Mr. Marron

|

Mr. Marron

|

Mr. Marron

|

| Measure [Axis]: 1 |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Measure Name |

Net Sales

|

|

|

| Measure [Axis]: 2 |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Measure Name |

Operating Income

|

|

|

| Measure [Axis]: 3 |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Measure Name |

Earnings Before Tax

|

|

|

| PEO [Member] | Grant Date Fair Value of Stock Awards Granted in Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

$ (2,199,967)

|

$ (1,999,964)

|

$ (1,799,979)

|

| PEO [Member] | Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

1,843,266

|

2,433,116

|

2,494,089

|

| PEO [Member] | Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior Fiscal Years [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

(320,280)

|

308,818

|

815,477

|

| PEO [Member] | Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested During Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| PEO [Member] | Change in Fair Value as of Vesting Date of Stock Awards Granted in Prior Fiscal Years for Which Applicable Vesting Conditions Were Satisfied During Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

22,251

|

(175,571)

|

130,865

|

| PEO [Member] | Fair Value as of Prior Fiscal Year-End of Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| PEO [Member] | Dividends Accrued During Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| Non-PEO NEO [Member] | Grant Date Fair Value of Stock Awards Granted in Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

(1,349,994)

|

(1,199,923)

|

(1,049,958)

|

| Non-PEO NEO [Member] | Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

1,131,108

|

1,459,802

|

1,454,844

|

| Non-PEO NEO [Member] | Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior Fiscal Years [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

(190,200)

|

178,938

|

479,714

|

| Non-PEO NEO [Member] | Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested During Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| Non-PEO NEO [Member] | Change in Fair Value as of Vesting Date of Stock Awards Granted in Prior Fiscal Years for Which Applicable Vesting Conditions Were Satisfied During Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

12,624

|

(88,640)

|

66,007

|

| Non-PEO NEO [Member] | Fair Value as of Prior Fiscal Year-End of Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

0

|

0

|

0

|

| Non-PEO NEO [Member] | Dividends Accrued During Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

| Adjustment to Compensation Amount |

$ 0

|

$ 0

|

$ 0

|