false--12-31FY20190001022079☐P10Y000.950.950.20015000000150000000.450.450.450.500.500.530.530.010.016000000006000000002170000002170000000.0112500.05750.04750.04700.0470.0420.04250.06950.0350.03450.0250.0272040-01-302020-01-302021-04-012045-03-302029-06-302024-04-012037-07-012025-03-302026-06-302020-03-302030-06-302019-04-01P5Y0.03391000000P31Y6MP5YP5Y8200000084000000

0001022079

2019-01-01

2019-12-31

0001022079

2020-01-31

0001022079

2019-06-30

0001022079

2019-12-31

0001022079

2018-12-31

0001022079

2018-01-01

2018-12-31

0001022079

2017-01-01

2017-12-31

0001022079

2017-12-31

0001022079

2016-12-31

0001022079

us-gaap:CommonStockMember

2016-12-31

0001022079

us-gaap:CommonStockMember

2019-12-31

0001022079

us-gaap:CommonStockMember

2017-01-01

2017-12-31

0001022079

us-gaap:AdditionalPaidInCapitalMember

2017-12-31

0001022079

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-12-31

0001022079

us-gaap:RetainedEarningsMember

2018-12-31

0001022079

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-12-31

0001022079

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-12-31

0001022079

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0001022079

us-gaap:AdditionalPaidInCapitalMember

2016-12-31

0001022079

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0001022079

us-gaap:AdditionalPaidInCapitalMember

2017-01-01

2017-12-31

0001022079

us-gaap:TreasuryStockMember

2019-01-01

2019-12-31

0001022079

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0001022079

us-gaap:RetainedEarningsMember

2017-01-01

2017-12-31

0001022079

us-gaap:NoncontrollingInterestMember

2018-01-01

2018-12-31

0001022079

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-01

2018-12-31

0001022079

us-gaap:RetainedEarningsMember

2019-12-31

0001022079

us-gaap:TreasuryStockMember

2017-12-31

0001022079

us-gaap:RetainedEarningsMember

2018-01-01

2018-12-31

0001022079

us-gaap:CommonStockMember

2018-01-01

2018-12-31

0001022079

us-gaap:TreasuryStockMember

2018-01-01

2018-12-31

0001022079

us-gaap:NoncontrollingInterestMember

2017-12-31

0001022079

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-12-31

0001022079

us-gaap:CommonStockMember

2018-12-31

0001022079

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-12-31

0001022079

us-gaap:RetainedEarningsMember

2016-12-31

0001022079

us-gaap:TreasuryStockMember

2019-12-31

0001022079

us-gaap:NoncontrollingInterestMember

2019-01-01

2019-12-31

0001022079

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-12-31

0001022079

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001022079

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-12-31

0001022079

us-gaap:NoncontrollingInterestMember

2019-12-31

0001022079

us-gaap:RetainedEarningsMember

2017-12-31

0001022079

us-gaap:NoncontrollingInterestMember

2018-12-31

0001022079

us-gaap:NoncontrollingInterestMember

2016-12-31

0001022079

us-gaap:TreasuryStockMember

2018-12-31

0001022079

us-gaap:NoncontrollingInterestMember

2017-01-01

2017-12-31

0001022079

us-gaap:TreasuryStockMember

2017-01-01

2017-12-31

0001022079

us-gaap:CommonStockMember

2017-12-31

0001022079

us-gaap:TreasuryStockMember

2016-12-31

0001022079

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-01-01

2017-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:GovernmentPayersMember

2017-01-01

2017-12-31

0001022079

srt:MaximumMember

dgx:LaboratoryEquipmentAndFurnitureAndFixturesMember

2019-01-01

2019-12-31

0001022079

srt:MaximumMember

2019-01-01

2019-12-31

0001022079

us-gaap:OtherAssetsMember

2018-12-31

0001022079

us-gaap:OtherAssetsMember

2019-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:GovernmentPayersMember

2018-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:GovernmentPayersMember

2019-12-31

0001022079

srt:MaximumMember

2019-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:GovernmentPayersMember

2019-01-01

2019-12-31

0001022079

srt:MaximumMember

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2019-01-01

2019-12-31

0001022079

2019-01-01

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:GovernmentPayersMember

2018-01-01

2018-12-31

0001022079

srt:MinimumMember

2019-12-31

0001022079

srt:MinimumMember

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2019-01-01

2019-12-31

0001022079

srt:MinimumMember

dgx:LaboratoryEquipmentAndFurnitureAndFixturesMember

2019-01-01

2019-12-31

0001022079

srt:MinimumMember

2019-01-01

2019-12-31

0001022079

srt:MaximumMember

us-gaap:BuildingAndBuildingImprovementsMember

2019-01-01

2019-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:PatientMember

2017-01-01

2017-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

2017-01-01

2017-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2019-01-01

2019-12-31

0001022079

dgx:FeeforserviceMember

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2018-01-01

2018-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:ClientPayersMember

2018-01-01

2018-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:ClientPayersMember

2017-01-01

2017-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

2018-01-01

2018-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

2019-01-01

2019-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:PatientMember

2019-01-01

2019-12-31

0001022079

dgx:CapitatedMember

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2019-01-01

2019-12-31

0001022079

dgx:CapitatedMember

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2017-01-01

2017-12-31

0001022079

us-gaap:AllOtherSegmentsMember

dgx:DSBusinessesMember

2018-01-01

2018-12-31

0001022079

dgx:FeeforserviceMember

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2019-01-01

2019-12-31

0001022079

us-gaap:AllOtherSegmentsMember

dgx:DSBusinessesMember

2019-01-01

2019-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:PatientMember

2018-01-01

2018-12-31

0001022079

us-gaap:AllOtherSegmentsMember

dgx:DSBusinessesMember

2017-01-01

2017-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2018-01-01

2018-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:ClientPayersMember

2019-01-01

2019-12-31

0001022079

dgx:CapitatedMember

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2018-01-01

2018-12-31

0001022079

dgx:FeeforserviceMember

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2017-01-01

2017-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2017-01-01

2017-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

2019-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:ClientPayersMember

2019-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:ClientPayersMember

2018-12-31

0001022079

us-gaap:AllOtherSegmentsMember

dgx:DSBusinessesMember

2019-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:PatientMember

2019-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

2018-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2018-12-31

0001022079

us-gaap:AllOtherSegmentsMember

dgx:DSBusinessesMember

2018-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:PatientMember

2018-12-31

0001022079

dgx:DiagnosticInformationServicesBusinessMember

dgx:HealthcareInsurersMember

2019-12-31

0001022079

dgx:GovernmentPayersMember

2019-01-01

2019-12-31

0001022079

srt:MaximumMember

dgx:PatientMember

2019-01-01

2019-12-31

0001022079

srt:MinimumMember

dgx:PatientMember

2019-01-01

2019-12-31

0001022079

srt:MinimumMember

dgx:DSBusinessesMember

2019-01-01

2019-12-31

0001022079

srt:MaximumMember

dgx:HealthcareInsurersMember

2019-01-01

2019-12-31

0001022079

srt:MinimumMember

dgx:DiagnosticInformationServicesBusinessMember

2019-01-01

2019-12-31

0001022079

srt:MinimumMember

dgx:HealthcareInsurersMember

2019-01-01

2019-12-31

0001022079

2018-10-01

2018-12-31

0001022079

srt:MaximumMember

dgx:ClientPayersMember

2019-01-01

2019-12-31

0001022079

srt:MinimumMember

dgx:ClientPayersMember

2019-01-01

2019-12-31

0001022079

srt:MaximumMember

dgx:DSBusinessesMember

2019-01-01

2019-12-31

0001022079

srt:MinimumMember

dgx:DiagnosticInformationServicesBusinessMember

2018-01-01

2018-12-31

0001022079

srt:MinimumMember

dgx:DiagnosticInformationServicesBusinessMember

2017-01-01

2017-12-31

0001022079

dgx:InvigorateProgramMember

2017-01-01

2017-12-31

0001022079

dgx:InvigorateProgramMember

2018-01-01

2018-12-31

0001022079

dgx:InvigorateProgramMember

2019-01-01

2019-12-31

0001022079

us-gaap:FacilityClosingMember

2018-01-01

2018-12-31

0001022079

us-gaap:EmployeeSeveranceMember

2019-01-01

2019-12-31

0001022079

us-gaap:FacilityClosingMember

2017-12-31

0001022079

us-gaap:FacilityClosingMember

2018-12-31

0001022079

us-gaap:EmployeeSeveranceMember

2017-12-31

0001022079

us-gaap:FacilityClosingMember

2019-01-01

2019-12-31

0001022079

us-gaap:EmployeeSeveranceMember

2018-12-31

0001022079

us-gaap:EmployeeSeveranceMember

2018-01-01

2018-12-31

0001022079

us-gaap:FacilityClosingMember

2019-12-31

0001022079

us-gaap:EmployeeSeveranceMember

2019-12-31

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

dgx:InvigorateProgramMember

2017-01-01

2017-12-31

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

dgx:InvigorateProgramMember

2018-01-01

2018-12-31

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

dgx:InvigorateProgramMember

2019-01-01

2019-12-31

0001022079

us-gaap:CostOfSalesMember

dgx:InvigorateProgramMember

2018-01-01

2018-12-31

0001022079

us-gaap:CostOfSalesMember

dgx:InvigorateProgramMember

2017-01-01

2017-12-31

0001022079

dgx:ShielHoldingsLLCShielMember

us-gaap:CustomerRelationshipsMember

2017-12-07

0001022079

dgx:ClevelandHeartLabInc.CHLMember

2017-12-01

2017-12-01

0001022079

dgx:PeaceHealthPHLMember

us-gaap:CustomerRelationshipsMember

2017-05-01

0001022079

dgx:OxfordImmunotecInc.Member

2019-09-01

2019-09-30

0001022079

dgx:ClevelandHeartLabInc.CHLMember

2017-12-01

0001022079

dgx:MobileMedicalExaminationServicesInc.MedXMMember

2018-02-01

0001022079

dgx:ClevelandHeartLabInc.CHLMember

us-gaap:CustomerRelationshipsMember

2017-12-01

2017-12-01

0001022079

dgx:OxfordImmunotecInc.Member

2018-11-06

0001022079

dgx:ReproSourceInc.Member

us-gaap:FairValueInputsLevel3Member

2018-09-19

0001022079

dgx:ClevelandHeartLabInc.CHLMember

us-gaap:CustomerRelationshipsMember

2017-12-01

0001022079

dgx:MedFusionandClearPointMember

2017-07-14

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

2019-02-11

2019-02-11

0001022079

dgx:ReproSourceInc.Member

us-gaap:FairValueInputsLevel3Member

2019-12-31

0001022079

dgx:CapeCodHealthcareInc.Member

2018-06-18

2018-06-18

0001022079

dgx:OxfordImmunotecInc.Member

2018-11-06

2018-11-06

0001022079

dgx:MobileMedicalExaminationServicesInc.MedXMMember

us-gaap:FairValueInputsLevel3Member

2018-12-31

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

us-gaap:FairValueInputsLevel3Member

2019-02-11

0001022079

dgx:OxfordImmunotecInc.Member

us-gaap:CustomerRelationshipsMember

2018-11-06

2018-11-06

0001022079

dgx:PeaceHealthPHLMember

us-gaap:CustomerRelationshipsMember

2017-05-01

2017-05-01

0001022079

dgx:MedFusionandClearPointMember

us-gaap:CapitalLeaseObligationsMember

2017-07-14

0001022079

dgx:ShielHoldingsLLCShielMember

2017-12-07

0001022079

dgx:PeaceHealthPHLMember

2017-05-01

2017-05-01

0001022079

dgx:MedFusionandClearPointMember

us-gaap:CustomerRelationshipsMember

2017-07-14

0001022079

dgx:MobileMedicalExaminationServicesInc.MedXMMember

us-gaap:CustomerRelationshipsMember

2018-02-01

2018-02-01

0001022079

dgx:MedFusionandClearPointMember

us-gaap:CustomerRelationshipsMember

2017-07-14

2017-07-14

0001022079

dgx:ShielHoldingsLLCShielMember

2017-12-07

2017-12-07

0001022079

dgx:ShielHoldingsLLCShielMember

us-gaap:CustomerRelationshipsMember

2017-12-07

2017-12-07

0001022079

dgx:TheWilliamW.BackusHospitalandTheHospitalofCentralConnecticutMember

2017-09-28

2017-09-28

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

us-gaap:CustomerRelationshipsMember

2019-02-11

0001022079

dgx:OxfordImmunotecInc.Member

dgx:ContractRelatedMember

2018-11-06

2018-11-06

0001022079

dgx:MedFusionandClearPointMember

2017-07-14

2017-07-14

0001022079

dgx:MobileMedicalExaminationServicesInc.MedXMMember

2018-02-01

2018-02-01

0001022079

dgx:PeaceHealthPHLMember

2017-05-01

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

2019-02-11

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

us-gaap:FairValueInputsLevel3Member

2019-12-31

0001022079

dgx:ReproSourceInc.Member

2018-09-19

2018-09-19

0001022079

dgx:MobileMedicalExaminationServicesInc.MedXMMember

us-gaap:FairValueInputsLevel3Member

2018-02-01

0001022079

dgx:MobileMedicalExaminationServicesInc.MedXMMember

us-gaap:OtherOperatingIncomeExpenseMember

2018-01-01

2018-12-31

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

us-gaap:OtherOperatingIncomeExpenseMember

2019-01-01

2019-12-31

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

us-gaap:CustomerRelationshipsMember

2019-02-11

2019-02-11

0001022079

dgx:ShielHoldingsLLCShielMember

us-gaap:MeasurementInputDiscountRateMember

2019-12-31

0001022079

dgx:ReproSourceInc.Member

2019-12-31

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

dgx:MeasurementInputComparableCompanyRevenueVolatilityMember

2019-12-31

0001022079

dgx:ShielHoldingsLLCShielMember

dgx:MeasurementInputComparableCompanyRevenueVolatilityMember

2019-12-31

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

2019-12-31

0001022079

dgx:ReproSourceInc.Member

dgx:MeasurementInputComparableCompanyRevenueVolatilityMember

2019-12-31

0001022079

dgx:ShielHoldingsLLCShielMember

2019-12-31

0001022079

dgx:BoyceBynumPathologyLaboratoriesP.C.BoyceBynumMember

us-gaap:MeasurementInputDiscountRateMember

2019-12-31

0001022079

dgx:ReproSourceInc.Member

us-gaap:MeasurementInputDiscountRateMember

2019-12-31

0001022079

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001022079

us-gaap:InterestRateSwapMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001022079

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001022079

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001022079

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001022079

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001022079

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001022079

us-gaap:InterestRateSwapMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001022079

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001022079

us-gaap:InterestRateSwapMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001022079

us-gaap:InterestRateSwapMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001022079

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001022079

us-gaap:InterestRateSwapMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001022079

us-gaap:InterestRateSwapMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001022079

us-gaap:InterestRateSwapMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001022079

us-gaap:InterestRateSwapMember

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0001022079

us-gaap:FairValueInputsLevel3Member

2019-12-31

0001022079

us-gaap:FairValueInputsLevel3Member

dgx:ContingentConsiderationMember

us-gaap:OtherOperatingIncomeExpenseMember

2018-01-01

2018-12-31

0001022079

dgx:UMassJointVentureMember

2015-07-01

0001022079

us-gaap:FairValueInputsLevel3Member

dgx:ContingentConsiderationMember

us-gaap:OtherOperatingIncomeExpenseMember

2019-01-01

2019-12-31

0001022079

us-gaap:FairValueInputsLevel3Member

dgx:ContingentConsiderationMember

2017-12-31

0001022079

us-gaap:FairValueInputsLevel3Member

dgx:ContingentConsiderationMember

2018-01-01

2018-12-31

0001022079

us-gaap:FairValueInputsLevel3Member

dgx:ContingentConsiderationMember

2018-12-31

0001022079

us-gaap:FairValueInputsLevel3Member

dgx:ContingentConsiderationMember

2019-01-01

2019-12-31

0001022079

us-gaap:FairValueInputsLevel3Member

dgx:ContingentConsiderationMember

2019-12-31

0001022079

us-gaap:ForeignCountryMember

2019-12-31

0001022079

us-gaap:DomesticCountryMember

2018-01-01

2018-12-31

0001022079

us-gaap:DomesticCountryMember

2017-01-01

2017-12-31

0001022079

us-gaap:StateAndLocalJurisdictionMember

2019-12-31

0001022079

us-gaap:DomesticCountryMember

2019-12-31

0001022079

dgx:AmortizationofIntangibleAssetsMember

2018-01-01

2018-12-31

0001022079

dgx:AmortizationofIntangibleAssetsMember

2017-01-01

2017-12-31

0001022079

dgx:AmortizationofIntangibleAssetsMember

2019-01-01

2019-12-31

0001022079

us-gaap:BuildingAndBuildingImprovementsMember

2019-12-31

0001022079

dgx:LaboratoryEquipmentFurnitureAndFixturesMember

2019-12-31

0001022079

us-gaap:ConstructionInProgressMember

2019-12-31

0001022079

us-gaap:LandMember

2018-12-31

0001022079

us-gaap:BuildingAndBuildingImprovementsMember

2018-12-31

0001022079

dgx:LaboratoryEquipmentFurnitureAndFixturesMember

2018-12-31

0001022079

us-gaap:ConstructionInProgressMember

2018-12-31

0001022079

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2018-12-31

0001022079

us-gaap:LandMember

2019-12-31

0001022079

us-gaap:LeaseholdImprovementsMember

2019-12-31

0001022079

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2019-12-31

0001022079

us-gaap:LeaseholdImprovementsMember

2018-12-31

0001022079

us-gaap:OtherOperatingIncomeExpenseMember

2019-01-01

2019-12-31

0001022079

dgx:TotalAmortizingIntangibleAssetsMember

2019-01-01

2019-12-31

0001022079

us-gaap:NoncompeteAgreementsMember

2018-12-31

0001022079

us-gaap:CustomerRelationshipsMember

2018-12-31

0001022079

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-12-31

0001022079

us-gaap:TechnologyBasedIntangibleAssetsMember

2018-12-31

0001022079

us-gaap:NoncompeteAgreementsMember

2019-12-31

0001022079

us-gaap:UnclassifiedIndefinitelivedIntangibleAssetsMember

2019-12-31

0001022079

us-gaap:TradeNamesMember

2018-12-31

0001022079

dgx:TotalAmortizingIntangibleAssetsMember

2018-12-31

0001022079

us-gaap:NoncompeteAgreementsMember

2019-01-01

2019-12-31

0001022079

dgx:TotalAmortizingIntangibleAssetsMember

2019-12-31

0001022079

us-gaap:OtherIntangibleAssetsMember

2019-12-31

0001022079

us-gaap:OtherIntangibleAssetsMember

2018-12-31

0001022079

us-gaap:UnclassifiedIndefinitelivedIntangibleAssetsMember

2018-12-31

0001022079

us-gaap:CustomerRelationshipsMember

2019-12-31

0001022079

us-gaap:TradeNamesMember

2019-12-31

0001022079

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-01-01

2019-12-31

0001022079

us-gaap:OtherIntangibleAssetsMember

2019-01-01

2019-12-31

0001022079

us-gaap:CustomerRelationshipsMember

2019-01-01

2019-12-31

0001022079

dgx:TwoPointSevenPercentSeniorNotesDue2019Member

2018-12-31

0001022079

dgx:SixPointNineFivePercentSeniorNotesDue2037Member

2019-12-31

0001022079

dgx:ThreePointFiveZeroPercentSeniorNotesdueMarch2025Member

2018-12-31

0001022079

us-gaap:SecuredDebtMember

2019-12-31

0001022079

dgx:TwoPointFiveZeroPercentSeniorNotesdueMarch2020Member

2018-12-31

0001022079

dgx:FourpointtwofivepercentSeniorNotesDue2024Member

2019-12-31

0001022079

dgx:FourPointSevenZeroPercentSeniorNotesdueMarch2045Member

2018-12-31

0001022079

dgx:FourPointTwoZeroPercentSeniorNotesdueJune2029Member

2019-12-31

0001022079

dgx:FourPointSevenZeroPercentSeniorNotesdue2021Member

2019-12-31

0001022079

dgx:TwoPointNineFivePercentSeniorNotesdueJune2030Member

2018-12-31

0001022079

dgx:TwoPointNineFivePercentSeniorNotesdueJune2030Member

2019-12-31

0001022079

dgx:FourPointSevenZeroPercentSeniorNotesdueMarch2045Member

2019-12-31

0001022079

dgx:CapitalLeaseObligationsandOtherMember

2018-12-31

0001022079

dgx:ThreePointFourFivePercentSeniorNotesdueJune2026Member

2018-12-31

0001022079

dgx:FourPointSevenFivePercentSeniorNotesDue2020Member

2019-12-31

0001022079

dgx:ThreePointFiveZeroPercentSeniorNotesdueMarch2025Member

2019-12-31

0001022079

dgx:ThreePointFourFivePercentSeniorNotesdueJune2026Member

2019-12-31

0001022079

dgx:FivePointSevenFivePercentSeniorNotesDue2040Member

2018-12-31

0001022079

dgx:TwoPointFiveZeroPercentSeniorNotesdueMarch2020Member

2019-12-31

0001022079

dgx:FourpointtwofivepercentSeniorNotesDue2024Member

2018-12-31

0001022079

dgx:FourPointSevenZeroPercentSeniorNotesdue2021Member

2018-12-31

0001022079

dgx:FinanceLeaseObligationsandOtherMember

2019-12-31

0001022079

us-gaap:SecuredDebtMember

2018-12-31

0001022079

dgx:FourPointTwoZeroPercentSeniorNotesdueJune2029Member

2018-12-31

0001022079

dgx:FivePointSevenFivePercentSeniorNotesDue2040Member

2019-12-31

0001022079

dgx:FourPointSevenFivePercentSeniorNotesDue2020Member

2018-12-31

0001022079

dgx:TwoPointSevenPercentSeniorNotesDue2019Member

2019-12-31

0001022079

dgx:SixPointNineFivePercentSeniorNotesDue2037Member

2018-12-31

0001022079

srt:MaximumMember

us-gaap:SecuredDebtMember

dgx:CommercialRatesforHighlyRatedIssuersorLondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0001022079

dgx:FourPointTwoZeroPercentSeniorNotesdueJune2029Member

2019-03-31

0001022079

us-gaap:LetterOfCreditMember

us-gaap:SecuredDebtMember

2019-12-31

0001022079

dgx:LoancommitmentmaturingOctober2020Member

us-gaap:SecuredDebtMember

2019-12-31

0001022079

us-gaap:SecuredDebtMember

2019-10-25

0001022079

us-gaap:LetterOfCreditMember

us-gaap:RevolvingCreditFacilityMember

2019-12-31

0001022079

us-gaap:LineOfCreditMember

us-gaap:SecuredDebtMember

2018-12-31

0001022079

dgx:LoancommitmentmaturingOctober2021Member

us-gaap:SecuredDebtMember

2019-12-31

0001022079

us-gaap:RevolvingCreditFacilityMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0001022079

us-gaap:RevolvingCreditFacilityMember

2018-03-31

0001022079

us-gaap:RevolvingCreditFacilityMember

2019-12-31

0001022079

srt:MinimumMember

us-gaap:SecuredDebtMember

dgx:CommercialRatesforHighlyRatedIssuersorLondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0001022079

us-gaap:LineOfCreditMember

us-gaap:SecuredDebtMember

2019-12-31

0001022079

dgx:FivePointSevenFivePercentSeniorNotesDue2040Member

2019-01-01

2019-12-31

0001022079

dgx:ThreePointFourFivePercentSeniorNotesdueJune2026Member

2019-01-01

2019-12-31

0001022079

dgx:TwoPointSevenPercentSeniorNotesDue2019Member

2019-01-01

2019-12-31

0001022079

dgx:SixPointNineFivePercentSeniorNotesDue2037Member

2019-01-01

2019-12-31

0001022079

dgx:FourPointSevenFivePercentSeniorNotesDue2020Member

2019-01-01

2019-12-31

0001022079

dgx:FourPointSevenZeroPercentSeniorNotesdue2021Member

2019-01-01

2019-12-31

0001022079

dgx:FourPointSevenZeroPercentSeniorNotesdueMarch2045Member

2019-01-01

2019-12-31

0001022079

dgx:FourpointtwofivepercentSeniorNotesDue2024Member

2019-01-01

2019-12-31

0001022079

dgx:TwoPointNineFivePercentSeniorNotesdueJune2030Member

2019-01-01

2019-12-31

0001022079

dgx:TwoPointFiveZeroPercentSeniorNotesdueMarch2020Member

2019-01-01

2019-12-31

0001022079

dgx:FourPointTwoZeroPercentSeniorNotesdueJune2029Member

2019-01-01

2019-12-31

0001022079

dgx:ThreePointFiveZeroPercentSeniorNotesdueMarch2025Member

2019-01-01

2019-12-31

0001022079

us-gaap:RevolvingCreditFacilityMember

2018-12-31

0001022079

us-gaap:RevolvingCreditFacilityMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2018-01-01

2018-12-31

0001022079

us-gaap:OtherLiabilitiesMember

us-gaap:InterestRateSwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-12-31

0001022079

us-gaap:OtherLiabilitiesMember

us-gaap:InterestRateSwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0001022079

us-gaap:LongTermDebtMember

us-gaap:FairValueHedgingMember

2018-12-31

0001022079

us-gaap:LongTermDebtMember

us-gaap:FairValueHedgingMember

2019-12-31

0001022079

us-gaap:CashFlowHedgingMember

2019-12-31

0001022079

dgx:ForwardstartingInterestRateSwapAgreementsMember

us-gaap:CashFlowHedgingMember

2019-12-31

0001022079

srt:MaximumMember

us-gaap:FairValueHedgingMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-12-31

0001022079

dgx:ForwardstartingInterestRateSwapAgreementsMember

us-gaap:CashFlowHedgingMember

2019-01-01

2019-12-31

0001022079

us-gaap:CashFlowHedgingMember

2018-12-31

0001022079

srt:ScenarioForecastMember

us-gaap:CashFlowHedgingMember

2020-01-01

2020-12-31

0001022079

us-gaap:TreasuryLockMember

us-gaap:CashFlowHedgingMember

2019-02-28

0001022079

us-gaap:TreasuryLockMember

us-gaap:CashFlowHedgingMember

2019-03-01

2019-03-31

0001022079

srt:MinimumMember

us-gaap:FairValueHedgingMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-12-31

0001022079

dgx:ThreePointFourFivePercentSeniorNotesdueJune2026Member

us-gaap:FairValueHedgingMember

2019-12-31

0001022079

dgx:ThreePointFiveZeroPercentSeniorNotesdueMarch2025Member

us-gaap:FairValueHedgingMember

2018-12-31

0001022079

dgx:ThreePointFourFivePercentSeniorNotesdueJune2026Member

us-gaap:FairValueHedgingMember

2018-12-31

0001022079

us-gaap:FairValueHedgingMember

2018-12-31

0001022079

dgx:FourpointtwofivepercentSeniorNotesDue2024Member

us-gaap:FairValueHedgingMember

2019-12-31

0001022079

us-gaap:FairValueHedgingMember

2019-12-31

0001022079

dgx:FourpointtwofivepercentSeniorNotesDue2024Member

us-gaap:FairValueHedgingMember

2018-12-31

0001022079

dgx:ThreePointFiveZeroPercentSeniorNotesdueMarch2025Member

us-gaap:FairValueHedgingMember

2019-12-31

0001022079

us-gaap:OtherNonoperatingIncomeExpenseMember

2018-01-01

2018-12-31

0001022079

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-01-01

2019-12-31

0001022079

us-gaap:FairValueHedgingMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2017-01-01

2017-12-31

0001022079

us-gaap:FairValueHedgingMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2018-01-01

2018-12-31

0001022079

us-gaap:FairValueHedgingMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-01-01

2019-12-31

0001022079

us-gaap:OtherNonoperatingIncomeExpenseMember

2017-01-01

2017-12-31

0001022079

2018-01-01

2018-03-31

0001022079

2006-05-04

0001022079

2019-01-01

2019-03-31

0001022079

2019-11-30

0001022079

dgx:UMassJointVentureMember

2019-12-31

0001022079

2019-10-01

2019-12-31

0001022079

srt:ScenarioForecastMember

2020-04-01

2021-03-31

0001022079

2006-05-03

0001022079

dgx:UMassJointVentureMember

2018-12-31

0001022079

srt:ScenarioForecastMember

2020-01-01

2020-03-31

0001022079

2017-01-01

2017-03-31

0001022079

us-gaap:SubsequentEventMember

2020-01-30

0001022079

us-gaap:AccountsPayableAndAccruedLiabilitiesMember

us-gaap:TreasuryStockMember

2018-12-31

0001022079

us-gaap:AccumulatedTranslationAdjustmentMember

2018-01-01

2018-12-31

0001022079

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-01-01

2018-12-31

0001022079

dgx:OtherEquityComponentsMember

2019-12-31

0001022079

dgx:OtherEquityComponentsMember

2017-01-01

2017-12-31

0001022079

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-12-31

0001022079

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2017-12-31

0001022079

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-01-01

2019-12-31

0001022079

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-01-01

2018-12-31

0001022079

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2017-01-01

2017-12-31

0001022079

us-gaap:AccumulatedTranslationAdjustmentMember

2019-01-01

2019-12-31

0001022079

us-gaap:AccumulatedTranslationAdjustmentMember

2016-12-31

0001022079

us-gaap:AccumulatedTranslationAdjustmentMember

2017-12-31

0001022079

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-01-01

2019-12-31

0001022079

us-gaap:AccumulatedTranslationAdjustmentMember

2019-12-31

0001022079

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-12-31

0001022079

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-12-31

0001022079

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2018-12-31

0001022079

dgx:OtherEquityComponentsMember

2019-01-01

2019-12-31

0001022079

us-gaap:AccumulatedTranslationAdjustmentMember

2017-01-01

2017-12-31

0001022079

us-gaap:AccumulatedTranslationAdjustmentMember

2018-12-31

0001022079

dgx:OtherEquityComponentsMember

2017-12-31

0001022079

dgx:OtherEquityComponentsMember

2018-01-01

2018-12-31

0001022079

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2016-12-31

0001022079

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2017-01-01

2017-12-31

0001022079

dgx:OtherEquityComponentsMember

2016-12-31

0001022079

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2016-12-31

0001022079

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2017-12-31

0001022079

dgx:OtherEquityComponentsMember

2018-12-31

0001022079

2018-07-01

2018-09-30

0001022079

2017-04-01

2017-06-30

0001022079

2018-04-01

2018-06-30

0001022079

2017-10-01

2017-12-31

0001022079

2019-07-01

2019-09-30

0001022079

2017-07-01

2017-09-30

0001022079

2019-04-01

2019-06-30

0001022079

us-gaap:StockOptionMember

2019-12-31

0001022079

us-gaap:StockOptionMember

2019-01-01

2019-12-31

0001022079

us-gaap:StockOptionMember

2018-12-31

0001022079

dgx:StockAwardsMember

2017-12-31

0001022079

dgx:StockAwardsMember

2018-12-31

0001022079

dgx:StockAwardsMember

2018-01-01

2018-12-31

0001022079

dgx:StockAwardsMember

2017-01-01

2017-12-31

0001022079

dgx:StockAwardsMember

2019-01-01

2019-12-31

0001022079

dgx:StockAwardsMember

2016-12-31

0001022079

dgx:StockAwardsMember

2019-12-31

0001022079

us-gaap:EmployeeStockMember

2019-12-31

0001022079

dgx:RestatedDirectorLongTermIncentivePlanDltipMember

2019-01-01

2019-12-31

0001022079

dgx:SdcpIiMember

2019-01-01

2019-12-31

0001022079

dgx:EmployeeLongTermIncentivePlanEltipMember

2019-12-31

0001022079

dgx:SdcpIiMember

2018-12-31

0001022079

us-gaap:EmployeeStockMember

2018-01-01

2018-12-31

0001022079

dgx:EmployeeLongTermIncentivePlanEltipMember

2019-01-01

2019-12-31

0001022079

us-gaap:StockOptionMember

2018-01-01

2018-12-31

0001022079

dgx:SupplementalDeferredCompensationPlanMember

2018-12-31

0001022079

us-gaap:EmployeeStockMember

2019-01-01

2019-12-31

0001022079

dgx:RestatedDirectorLongTermIncentivePlanDltipAmendmentMember

2019-01-01

2019-12-31

0001022079

dgx:SdcpIiMember

2019-12-31

0001022079

dgx:RestatedDirectorLongTermIncentivePlanDltipMember

2017-01-01

2017-12-31

0001022079

dgx:RestatedDirectorLongTermIncentivePlanDltipMember

2019-12-31

0001022079

dgx:RestatedDirectorLongTermIncentivePlanDltipMember

2018-01-01

2018-12-31

0001022079

us-gaap:StockOptionMember

2017-01-01

2017-12-31

0001022079

srt:MaximumMember

dgx:SupplementalDeferredCompensationPlanMember

2019-01-01

2019-12-31

0001022079

dgx:SupplementalDeferredCompensationPlanMember

2019-12-31

0001022079

us-gaap:EmployeeStockMember

2017-01-01

2017-12-31

0001022079

srt:MaximumMember

dgx:SdcpIiMember

2019-01-01

2019-12-31

0001022079

dgx:SupplementalDeferredCompensationPlanMember

2019-01-01

2019-12-31

0001022079

us-gaap:LetterOfCreditMember

2019-12-31

0001022079

dgx:AMACDataSecurityIncidentMember

2019-06-03

2019-12-31

0001022079

2016-09-01

2016-09-30

0001022079

us-gaap:CorporateMember

2019-01-01

2019-12-31

0001022079

us-gaap:AllOtherSegmentsMember

2018-01-01

2018-12-31

0001022079

us-gaap:CorporateMember

2017-01-01

2017-12-31

0001022079

us-gaap:AllOtherSegmentsMember

2019-01-01

2019-12-31

0001022079

us-gaap:CorporateMember

2018-01-01

2018-12-31

0001022079

us-gaap:AllOtherSegmentsMember

2017-01-01

2017-12-31

0001022079

dgx:AllotherservicesMember

2019-01-01

2019-12-31

0001022079

dgx:GenebasedandesoterictestingservicesMember

2017-01-01

2017-12-31

0001022079

dgx:RoutineclinicaltestingservicesMember

2017-01-01

2017-12-31

0001022079

dgx:AnatomicpathologytestingservicesMember

2017-01-01

2017-12-31

0001022079

dgx:AllotherservicesMember

2018-01-01

2018-12-31

0001022079

dgx:GenebasedandesoterictestingservicesMember

2019-01-01

2019-12-31

0001022079

dgx:AnatomicpathologytestingservicesMember

2018-01-01

2018-12-31

0001022079

dgx:RoutineclinicaltestingservicesMember

2018-01-01

2018-12-31

0001022079

dgx:GenebasedandesoterictestingservicesMember

2018-01-01

2018-12-31

0001022079

dgx:RoutineclinicaltestingservicesMember

2019-01-01

2019-12-31

0001022079

dgx:AnatomicpathologytestingservicesMember

2019-01-01

2019-12-31

0001022079

dgx:AllotherservicesMember

2017-01-01

2017-12-31

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

us-gaap:EquityMethodInvesteeMember

2019-01-01

2019-12-31

0001022079

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:EquityMethodInvesteeMember

2018-12-31

0001022079

us-gaap:EquityMethodInvesteeMember

2018-12-31

0001022079

us-gaap:EquityMethodInvesteeMember

2017-01-01

2017-12-31

0001022079

us-gaap:EquityMethodInvesteeMember

2019-12-31

0001022079

us-gaap:CorporateJointVentureMember

2019-12-31

0001022079

us-gaap:EquityMethodInvesteeMember

2019-01-01

2019-12-31

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

us-gaap:EquityMethodInvesteeMember

2017-01-01

2017-12-31

0001022079

us-gaap:CorporateJointVentureMember

2019-01-01

2019-12-31

0001022079

us-gaap:EquityMethodInvesteeMember

2018-01-01

2018-12-31

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

us-gaap:EquityMethodInvesteeMember

2018-01-01

2018-12-31

0001022079

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:EquityMethodInvesteeMember

2019-12-31

0001022079

dgx:NidMember

2019-01-01

2019-12-31

0001022079

dgx:BlueprintGeneticsOyMember

us-gaap:SubsequentEventMember

2020-01-21

0001022079

dgx:BlueprintGeneticsOyMember

us-gaap:SubsequentEventMember

2020-01-21

2020-01-21

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-10-01

2018-12-31

0001022079

us-gaap:OtherOperatingIncomeExpenseMember

2019-07-01

2019-09-30

0001022079

dgx:AmortizationofIntangibleAssetsMember

2018-04-01

2018-06-30

0001022079

dgx:AmortizationofIntangibleAssetsMember

2019-01-01

2019-03-31

0001022079

dgx:EquityinEarningsofEquityMethodInvesteesMember

2019-10-01

2019-12-31

0001022079

us-gaap:CostOfSalesMember

2018-04-01

2018-06-30

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-01-01

2019-03-31

0001022079

us-gaap:OtherOperatingIncomeExpenseMember

2019-04-01

2019-06-30

0001022079

dgx:AmortizationofIntangibleAssetsMember

2019-04-01

2019-06-30

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-01-01

2018-03-31

0001022079

dgx:AmortizationofIntangibleAssetsMember

2019-07-01

2019-09-30

0001022079

us-gaap:OtherOperatingIncomeExpenseMember

2018-01-01

2018-03-31

0001022079

us-gaap:CostOfSalesMember

2019-07-01

2019-09-30

0001022079

dgx:EquityinEarningsofEquityMethodInvesteesMember

2019-04-01

2019-06-30

0001022079

dgx:EquityinEarningsofEquityMethodInvesteesMember

2018-04-01

2018-06-30

0001022079

dgx:AmortizationofIntangibleAssetsMember

2018-01-01

2018-03-31

0001022079

dgx:EquityinEarningsofEquityMethodInvesteesMember

2018-10-01

2018-12-31

0001022079

us-gaap:OtherOperatingIncomeExpenseMember

2018-04-01

2018-06-30

0001022079

us-gaap:CostOfSalesMember

2019-01-01

2019-03-31

0001022079

dgx:AmortizationofIntangibleAssetsMember

2019-10-01

2019-12-31

0001022079

dgx:NidMember

2019-04-01

2019-06-30

0001022079

dgx:EquityinEarningsofEquityMethodInvesteesMember

2018-01-01

2018-03-31

0001022079

us-gaap:CostOfSalesMember

2018-01-01

2018-03-31

0001022079

dgx:AmortizationofIntangibleAssetsMember

2018-10-01

2018-12-31

0001022079

us-gaap:CostOfSalesMember

2018-07-01

2018-09-30

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-10-01

2019-12-31

0001022079

dgx:EquityinEarningsofEquityMethodInvesteesMember

2019-01-01

2019-03-31

0001022079

us-gaap:OtherOperatingIncomeExpenseMember

2019-01-01

2019-03-31

0001022079

us-gaap:CostOfSalesMember

2019-04-01

2019-06-30

0001022079

dgx:EquityinEarningsofEquityMethodInvesteesMember

2018-07-01

2018-09-30

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-07-01

2018-09-30

0001022079

us-gaap:CostOfSalesMember

2018-10-01

2018-12-31

0001022079

us-gaap:CostOfSalesMember

2019-10-01

2019-12-31

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-04-01

2019-06-30

0001022079

dgx:AmortizationofIntangibleAssetsMember

2018-07-01

2018-09-30

0001022079

dgx:EquityinEarningsofEquityMethodInvesteesMember

2019-07-01

2019-09-30

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-07-01

2019-09-30

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-10-01

2019-12-31

0001022079

us-gaap:OtherOperatingIncomeExpenseMember

2018-07-01

2018-09-30

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-07-01

2019-09-30

0001022079

us-gaap:OtherOperatingIncomeExpenseMember

2019-10-01

2019-12-31

0001022079

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-04-01

2018-06-30

0001022079

us-gaap:AllowanceForCreditLossMember

2017-01-01

2017-12-31

0001022079

us-gaap:AllowanceForCreditLossMember

2019-01-01

2019-12-31

0001022079

us-gaap:AllowanceForCreditLossMember

2019-12-31

0001022079

us-gaap:AllowanceForCreditLossMember

2018-01-01

2018-12-31

0001022079

us-gaap:AllowanceForCreditLossMember

2016-12-31

0001022079

us-gaap:AllowanceForCreditLossMember

2017-12-31

0001022079

us-gaap:AllowanceForCreditLossMember

2018-12-31

iso4217:USD

iso4217:USD

xbrli:shares

xbrli:pure

xbrli:shares

dgx:claim

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2019

Or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 001-12215

Quest Diagnostics Incorporated

|

| | | | | |

Delaware | | | 16-1387862 |

(State of Incorporation) | | | (I.R.S. Employer Identification Number) |

500 Plaza Drive | | | |

Secaucus, | NJ | 07094 | | | |

(973) | 520-2700 | | | |

|

| | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Common Stock, $.01 par value | DGX | New York Stock Exchange |

|

| |

Securities registered pursuant to Section 12(g) of the Act: | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes X No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes No X

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes X No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

As of June 30, 2019, the aggregate market value of the approximately 134 million shares of voting and non-voting common equity held by non-affiliates of the registrant was approximately $13.7 billion, based on the closing price on such date of the registrant's Common Stock on the New York Stock Exchange.

As of January 31, 2020, there were outstanding 133,455,068 shares of the registrant’s common stock, $.01 par value.

|

| |

Documents Incorporated by Reference | Part of Form 10-K into which incorporated |

Document |

Portions of the registrant's Proxy Statement to be filed by April 29, 2020 | Part III |

Such Proxy Statement, except for the portions thereof which have been specifically incorporated by reference, shall not be deemed “filed” as part of this report on Form 10-K.

TABLE OF CONTENTS

|

| | |

| Item | Page |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 1A. | | |

| | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

Item 15. | | |

Item 16. | | |

| |

| |

| |

| |

| |

| |

| |

The discussion in Item 1 below includes several defined terms:

ACA - Affordable Care Act

ACO - Accountable Care Organization

CAP - The College of American Pathologists

CLIA - Clinical Laboratory Improvement Act

CMS - Centers for Medicare and Medicaid Services

FDA - U.S. Food and Drug Administration

IDN - Independent Delivery Network (including hospital health systems)

IPA - Independent Physician Association

LAB Act - Laboratory Access for Beneficiaries Act

LDT - Laboratory-Developed Test

PAMA - The Protecting Access to Medicare Act of 2014

The discussion also includes several tables, indexed in the following guide.

|

| | |

Guide to Tables |

Services Portfolio | Table 1 | |

Approaches to Accelerate Growth | Table 2 | |

Key Professional Laboratory Services Offerings | Table 3 | |

Clinical Franchises | Table 4 | |

Consumer-Centric Initiatives | Table 5 | |

Major Themes to Drive Operational Excellence | Table 6 | |

Our Strengths | Table 7 | |

Assets and Capabilities | Table 8 | |

2019 Net Revenues | Table 9 | |

Clinical Testing Industry | Table 10 | |

Key Trends | Table 11 | |

Reducing Healthcare Costs and Improving Care | Table 12 | |

Customers | Table 13 | |

Potential Factors Considered When Selecting a Diagnostics Information Services Provider | Table 14 | |

2019 Medicare and Medicaid Revenues as % of Consolidated Net Revenues | Table 15 | |

Key Regulatory Schemes | Table 16 | |

Information Available at Our Corporate Governance Webpage | Table 17 | |

Executive Officers | Table 18 | |

Item 1. Business

INTRODUCTION

Quest Diagnostics Incorporated is the world's leading provider of diagnostic information services. We play a crucial role in the healthcare ecosystem, empowering people to take action to improve health outcomes. Derived from the world's largest database of clinical lab results, our diagnostic insights reveal new avenues to identify and treat disease, inspire healthy behaviors and improve health care management. In the right hands and with the right context, our diagnostic insights can inspire actions that transform lives.

Quest Diagnostics was incorporated in Delaware in 1990; its predecessor companies date back to 1967. We conduct business through our headquarters in Secaucus, New Jersey, and our laboratories, patient service centers, offices and other facilities around the United States and in selected locations outside the United States. Unless the context otherwise requires, the terms “Quest Diagnostics,” the “Company,” “we” and “our” mean Quest Diagnostics Incorporated and its consolidated subsidiaries.

The patients we serve comprise approximately one-third of the adult population of the United States annually, and approximately one-half of the adult population in the United States over a three-year period. We estimate that annually we serve approximately half of the physicians and half of the hospitals in the United States.

During 2019, we generated net revenues of $7.7 billion. Additional financial information concerning Quest Diagnostics, including our consolidated subsidiaries and businesses, for each of the years ended December 31, 2019, 2018 and 2017 is included in the consolidated financial statements and notes thereto in “Financial Statements and Supplementary Data” in Part II, Item 8.

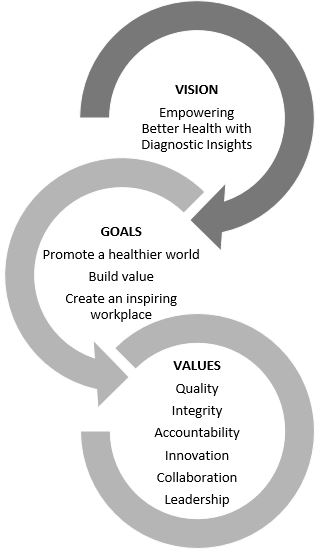

Our vision, aspirational goals and values are set forth below.

We believe that our vision, aspirational goals and strategy (discussed below) align very well with, and our strong value proposition supports, the triple aim of healthcare: improving medical quality and the patient experience while reducing the cost of care.

OUR STRATEGY

We have a two-point business strategy, reviewed by our Board of Directors, to achieve our vision and our goals.

Accelerate Growth

|

| | | |

Our strategy to accelerate revenue growth is based on the Company’s portfolio of services.

|

Services Portfolio (Table 1) |

Activity | Key Characteristics | At A Glance | Quest Value Proposition |

General Diagnostics | Testing services generating strong cash flows and steady growth | • Routine and non-routine testing services • Largest revenue stream • Essential portion of health care delivery | • Scale • Operational excellence • Access and convenience

|

Advanced Diagnostics | Testing services targeting faster growth through innovation testing model | • Genetic and advanced molecular testing services • An important part of precision medicine • Innovation-based competitors | • Rich clinical, scientific and medical innovation expertise • Quality and reliability of new assays • Ability to manage potential new regulatory requirements |

Diagnostic Services | Laboratory and data-related healthcare opportunities targeting faster growth | • Enables partners to deliver health care more efficiently (e.g., risk assessment; Professional Laboratory Services; wellness) • Services to support population health (e.g., data analytics; extended care services) | • Extensive diagnostic capability • Large and growing database and analytics expertise • Partnerships with industry leaders across healthcare landscape |

|

|

We have identified the following five approaches to accelerate growth. |

Approaches to Accelerate Growth (Table 2) |

1. Delivering a compound annual revenue growth rate of more than 2% through accretive, strategic acquisitions |

Plus organic growth through: |

2. Partnering with health plans, IDNs and other risk bearing entities |

3. Offering the broadest access to diagnostic innovation |

4. Being recognized as the consumer-friendly provider of choice of diagnostic information services |

5. Supporting population health with data analytics and extended care services |

1. Growing through acquisitions. We have maintained a strategy since November 2018 to grow revenue each year by more than 2% compound annual growth rate through accretive, strategic acquisitions. Our approach to acquisitions is discussed below under the heading Deliver disciplined capital deployment.

2. Partnering with health plans, IDNs and other risk bearing entities. To help accelerate growth, we focus on large opportunities to partner with outside entities. We strengthen our relationships with health plans and increase the volume of our services for their members by driving value with employers and providing strong value propositions for members and clinicians. This includes building an information platform to help health plans manage utilization and population health, and enhancing processes to help plans keep laboratory testing in network. Effective January 1, 2019, the Company established a long-term strategic partnership with UnitedHealthcare, including collaborating on a variety of value-based programs, became a preferred provider to Horizon Blue Cross Blue Shield of New Jersey for most products and became a participating provider to Blue Cross Blue Shield of Georgia. Effective July 1, 2019, the Company was selected to be one of only five lab companies named participants in the UnitedHealthcare Preferred Lab Network, meeting exceptional criteria for access, cost, data, quality and service.

We believe that the growing market challenges faced by IDNs, including continued price transparency, cost and utilization pressure, evolving healthcare payment models, capital needs, changing technology and limited resources, provides us with an opportunity to more effectively partner with them as they consider their laboratory testing strategy and will drive demand for our expertise. We have deployed a dedicated health systems team to strengthen our relationships with IDNs, including with respect to their reference testing. We provide reference testing for approximately 50% of hospitals in the U.S., and are the leading provider of this testing in the country. In 2019, we implemented new Professional Laboratory Services relationships with Catholic Health Services of Long Island and Regional Medical Center of Orangeburg, S.C.

|

| |

Our industry-leading Professional Laboratory Services suite of solutions help IDNs build and execute their laboratory strategy, improve quality, reduce the cost of care and focus on core competencies. |

Key Professional Laboratory Services Offerings (Table 3) |

Lab management outsourcing | Advanced data solutions |

Joint venture | Reference testing, including advanced diagnostics |

Outreach acquisition | Supply chain management and purchasing |

Test menu optimization and spend consolidation | Blood utilization management |

3. Offering the broadest access to diagnostic innovation. Our diagnostic solutions deliver high clinical value to the medical community nationwide. We create value through scientific and product innovation and solution delivery for major clinical opportunities. Starting with a clinical focus on a specific disease state or clinical problem, we take advantage of advanced technology for more precise, comprehensive and actionable information, and deliver the information to the medical community in a meaningful way. We make innovative diagnostic solutions available to community physicians through our connectivity solutions, operational footprint and by making complex results actionable. We plan to expand our innovative diagnostic solutions through research and development, as well as partnerships with academic institutions, other technology and healthcare leaders and public health agencies.

|

| |

Our clinical franchises enable us to perform like a boutique while maintaining our scale advantages, and work with our research and development and commercial organizations to identify/deliver new and improved solutions. |

Clinical Franchises (Table 4) |

Cardiovascular, Metabolic and Endocrinology | Oncology |

General Health and Wellness | Prescription Drug Monitoring and Toxicology |

Infectious Diseases and Immunology | Sports Science and Human Performance |

Neurology | Women’s and Reproductive Health |

The continued growth of our tuberculosis and sexually transmitted disease testing in our infectious disease and immunology offerings, prescription drug monitoring and toxicology testing, HemePath blood cancer testing and Cardio IQ® testing are examples of the power of our clinical franchises to foster growth in 2019.

4. Being recognized as the consumer-friendly provider of choice of diagnostic information services. We are focused on the consumer. The Company has a long history of focusing on consumer interests, including being the first national diagnostic information services provider to offer on-line patient appointment scheduling and a patient connectivity solution. |

| |

Increasing consumer expectations inform our design for our consumer experience. |

Consumer-Centric Initiatives (Table 5) |

Consumer reminders | • Consumers whose physicians have ordered a test for them electronically can receive email reminders to complete the test.

• Consumers who have made appointments can receive appointment reminders via text messaging. |

Enhanced consumer experience | • Electronic check-in at patient service centers.

• Improved on-line pre-registration and appointment scheduling.

• Real-time payment determination for payers. |

Convenient access | • Partnerships with Walmart and Safeway to expand convenient access to testing services at select Walmart and Safeway locations across the United States (>200 locations at year end). |

Consumer-initiated testing | • QuestDirectTM, our consumer-initiated testing service, is available in nearly all states.

• Consumers can choose from test packages (e.g., general health, men's and women's health, digestive health, heart health, infectious disease, sexually transmitted disease) expanded in 2019 to include testing for Lyme disease. |

Consumer connectivity and access to information | • >8.7 million registered users in our MyQuest® health portal and mobile connectivity solution.

• MyQuest® supports Health Records using the Apple Health app.

• Using MyQuest,® consumers can manage healthcare for a group of individuals.

|

Expanded access to basic health care services | • Partnership with Walmart to expand access to basic health care services. |

|

| |

Self-collection technology | • Proprietary, consumer-friendly self-collection technology offered to consumers at home. |

Consumer awareness | • Multi-year global collaboration with Ancestry to provide genotyping test services. |

Consumer satisfaction | • We are measuring consumer satisfaction, including Net Promoter Score based on experience at our patient service centers. |

5. Supporting population health with data analytics and extended care services. We support population health by offering services (e.g., home-based health risk assessments and related services) designed to identify gaps in care in a population, provide clinical solutions to close the gaps and foster consumer engagement with a solution. Our services help healthcare providers, health plans, sponsors and IDNs deliver better care to their patient populations by identifying and filling gaps in care for their patient populations and by enabling them to deliver the most effective healthcare to the right populations and individuals. Our offerings leverage the power of our assets and capabilities (e.g., call centers; patient service centers; and mobile workforce, including professionals) and integrate our extensive clinical data, and include data analytics and extended care services. Our 2019 introduction of Quest Lab StewardshipTM, an innovative new service that employs machine learning to help optimize laboratory test utilization, is an example of our offerings.

Drive operational excellence

|

| |

We strive to enhance operational excellence and improve our quality and efficiency across every portion of our value chain and operations, from the time that we interact with a potential customer until the time we receive payment. |

Major Themes to Drive Operational Excellence (Table 6) |

Reduce denials and patient concessions | Standardize and automate |

Digitize the customer experience | Optimize |

Improving our operations will yield many benefits, including: enhancing customer experience; improving our quality and competitiveness; strengthening our foundation for growth; and increasing employee engagement and shareholder value. We are building a superior experience, at lower cost, for all of our customers, including consumers, health plans, IDNs and clinicians. We endeavor to improve our processes and effectiveness at the same time. We are guided by a service dashboard that focuses throughout our operations on quality for consumers, health care providers and employees, including medical quality, on-time delivery, competitive costs and employee safety.

In 2019, we made strong progress on our initiatives. For example, we continued to drive productivity improvements (e.g., improved electronic order rates; increased electronic enabling of our workflow) across logistics, consumer services and lab services, enabling us to reduce our overall costs per lab requisition. In addition, we are consolidating and simplifying our immunoassay platforms, moving to a single supplier to provide greater throughput, autonomy and a more efficient footprint. Also, we are optimizing our lab network through investments in our new 250,000 square foot flagship laboratory under construction in Clifton, New Jersey, which will provide greater capacity, increased throughput and improved productivity.

Our cost excellence program, Invigorate, includes structured plans to drive savings and improve performance across the value chain, including in such areas as revenue services, information technology and procurement. We currently aim annually to save approximately 3% of our costs, and in 2019 we achieved that goal.

OUR STRENGTHS

|

| |

We offer high value diagnostic information services and diagnostic solutions that are attractive to our customers. |

Our Strengths (Table 7) |

Quality | Strong Operating Principles |

Assets and Capabilities to Deliver Value | Health Information Technology Solutions and Information Assets |

Innovation | Medical and Scientific Expertise |

Collaboration | Customer Focus |

Quality

Our goal is to provide every patient with services and products of superior quality. We strive to accomplish that through commitment, leadership, and establishing rigorous processes which we measure and continually seek to improve, and by using the Quest Management System, which provides best-in-class business performance tools to create and implement effective and sustainable quality processes. The Quest Diagnostics Quality Program includes policies and procedures to document, measure and monitor the effectiveness of our laboratory operations in providing and improving quality and meeting applicable regulatory requirements. The Quality Program is designed so that the quality of laboratory services is monitored objectively and evaluated systematically to deliver superior quality care, identify opportunities to improve patient care and resolve identified problems. To help achieve our goal of becoming recognized as the undisputed quality leader in the diagnostics information services industry, we have implemented our Quality System Framework, which serves as a reference guide for our employees and describes our Quality System Elements, which provide the structure for each laboratory to achieve and maintain quality processes. We also have a robust Supplier Quality Program designed to ensure we have a high quality supplier network and to raise the bar of quality expectations across that network. Being chosen by UnitedHealthcare as a participant in the UnitedHealthcare Preferred Lab Network reflects the strength of our quality. For additional information about our commitment to quality, see "General - Quality Assurance" on page 21.

Strong operating principles

We have a foundation of three strong operating principles:

| |

• | strengthen organizational capabilities; |

| |

• | remain focused on diagnostic information services; and |

| |

• | deliver disciplined capital deployment. |

Strengthen organizational capabilities. We continuously strive to strengthen our organizational capabilities to support our two-point strategy, enable growth and productivity, better focus on our customers, speed decision-making and empower employees. Highlights include:

| |

• | Align for Growth, Execution and Efficiency. Our organization is designed to align around future growth opportunities, coordinate business units for seamless execution and leverage our company-wide infrastructure to gain more capability, value and efficiency. The value creation side of our business includes product and commercial marketing and is organized by clinical franchise and focuses on customer solutions for the marketplace, including new test development and diagnostic insights. The value delivery side includes sales, laboratory operations, field operations, logistics and client services. |

| |

• | Quest Management System. This system provides a foundation for day-to-day management, and includes best-in-class business performance tools to help develop new capabilities to improve our Company. The system enables us to run the Company with a common language, approach and philosophy, and supports our efforts as we build a high-performance culture, with employees focused on behaviors to make us more agile, transparent, customer-focused, collaborative and performance oriented. |

| |

• | Everyday Excellence Program. This program includes guiding principles for our entire organization to support a superior customer experience and inspire employees to be their best every day, with every person and with every customer interaction. It is integrated into performance assessments and frontline employee behavioral standards. |

| |

• | Leading Quest Academy. The Academy is designed to strengthen our more senior employee leaders through a highly experiential leadership development program to create a high-performance culture and sharpen the capabilities needed to lead our organization. We also offer leadership training programs for other employees. |

| |

• | Code of Ethics. Our Code reinforces our commitment to integrity, and aligns with our vision, values, goals and brand. |

Remain focused on diagnostic information services. We maintain a sharp focus on providing diagnostic information services.

Deliver disciplined capital deployment. Our disciplined capital deployment framework includes investment in our business, dividends and share repurchases. The framework is grounded in maintaining an investment grade credit rating. We expect to return a majority of our free cash flow to investors through a combination of dividends and share repurchases. Consistent with that expectation, in January 2020 we announced that we increased our quarterly common stock cash dividend by approximately 6%, from $0.53 per common share to $0.56 per common share. This represents our ninth increase in the dividend since 2011. For many years, we have maintained a common stock repurchase program. Since the beginning of 2013, we have returned approximately $3.1 billion to stockholders through repurchases of our common stock. Our share repurchases, dividends and capital expenditures in each of the last five years are presented in Selected Historical Financial Data of Our Company beginning on page 52.

The Company's strategy includes generating growth through value-creating, strategically-aligned acquisitions using disciplined investment criteria. We screen potential acquisitions using guidelines that assess strategic fit and financial considerations, including value creation, return on invested capital and impact on our earnings. In 2019, we consummated the acquisition of certain assets of the clinical laboratory services business of Boyce & Bynum Pathology Laboratories, P.C. Our material acquisitions in each of the last three years are further discussed in Note 6 to the audited consolidated financial statements (Part II, Item 8 of this Report).

We will continue to invest in our business in a disciplined manner, including focusing on enhancing our solid foundation of strategic assets and capabilities, accelerating growth and driving operational excellence. Our near-term investments in growth are likely to focus on the strategies to accelerate growth set forth in table 2 above. Our near-term investments to drive operational excellence are likely to focus on improving the customer experience and gaining efficiency, systems standardization, digital enablement of our processes and footprint optimization.

Assets and capabilities to deliver value

|

| |

We use our unmatched size, scale and capabilities to deliver a very attractive value proposition to our customers. |

Assets and Capabilities (Table 8) |

Connectivity | ● Provide healthcare connectivity solutions to >364,000 clinician and hospital accounts and interface with approximately 720 electronic health records systems |

Data | ● The largest private database of de-identified laboratory test results: >50 billion patient data points |

Logistics | ● Strong logistics capabilities • make approximately 76,000 stops daily • approximately 4,000 courier vehicles • 23 aircraft serving the U.S.

|

Medical and Scientific Staff | ● One of the largest medical and scientific staffs in the industry to provide interpretive consultation • >600 M.D.s and Ph.Ds, many of whom are recognized leaders in their field • Genetic counselors

|

Other Healthcare Professionals | ● Approximately 22,000 phlebotomists, paramedics, nurses and other health and wellness professionals

|

|

| |

Consumer Access | ● >7,000 patient access points, the most extensive network in the U.S., including phlebotomists in physician offices and >2,275 of our own patient service centers |

Health Plan Participation | ● Access to approximately 90% of U.S. insured lives

|

Processing Volume | ● Processed approximately 175 million test requisitions in 2019

|

Range of Testing | ● Industry-leading test menu

|

Patents | ● Own or control approximately 1100 issued and 500 pending patents worldwide in 2019

|

Innovation