SECURITIES AND EXCHANGE COMMISSION

REGISTRATION STATEMENT

(NO. 333-11763)

(NO. 811-07803)

(Address of Principal Executive Office)

Registrant’s Telephone Number (610) 669-1000

P.O. Box 876

Valley Forge, PA 19482

This prospectus contains financial data for the Fund through the fiscal year ended August 31, 2023.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $5,000,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

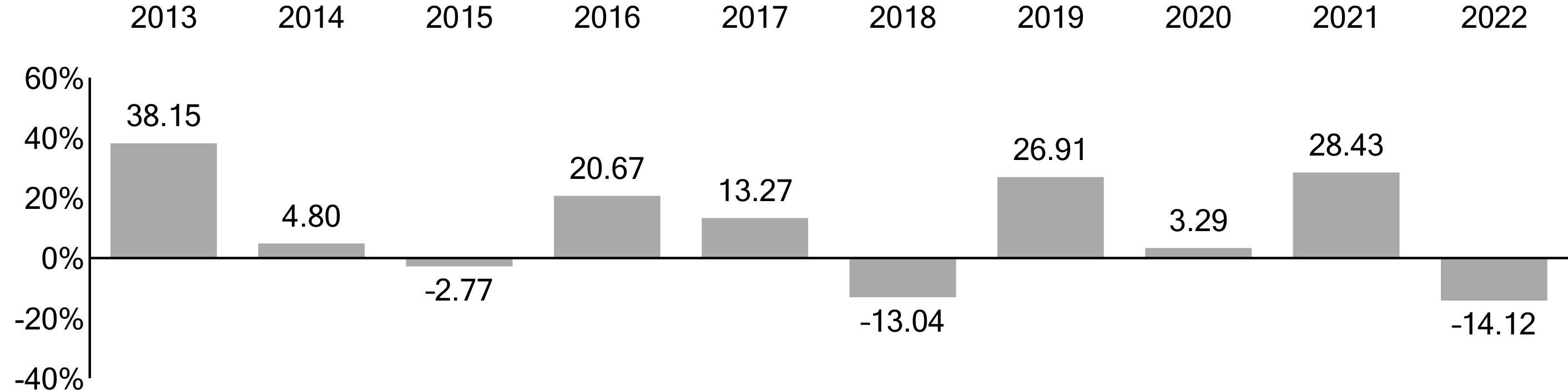

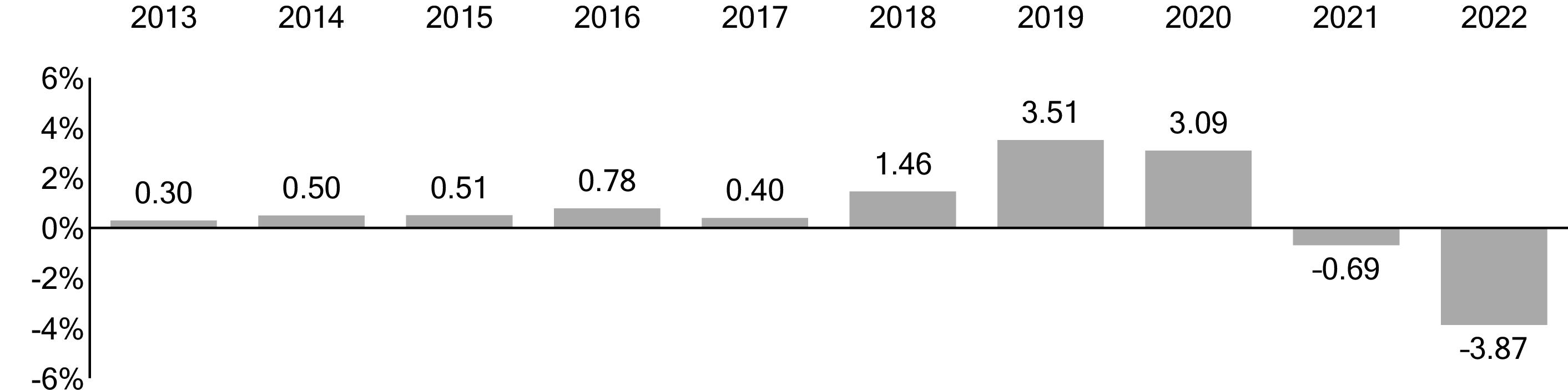

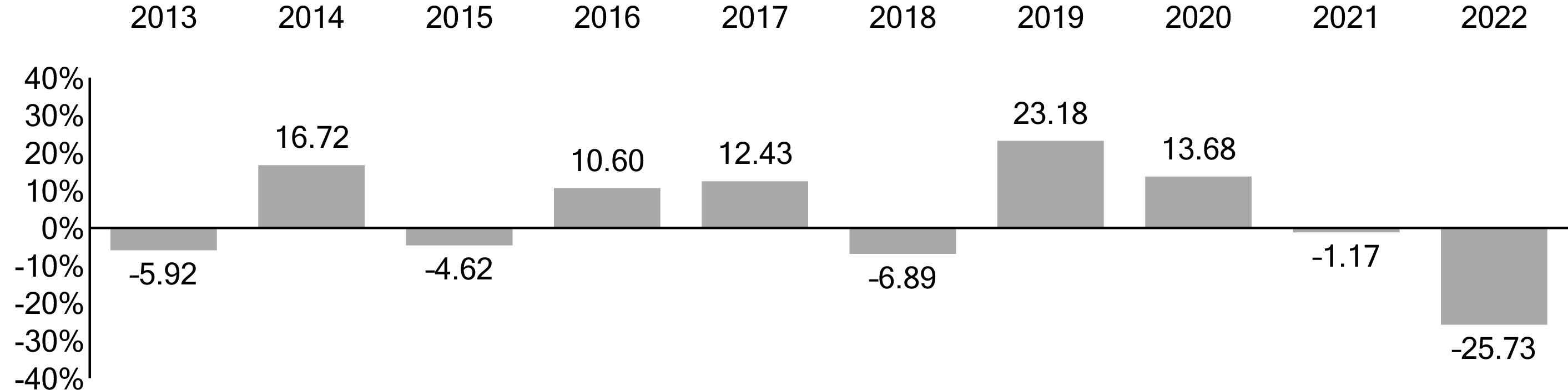

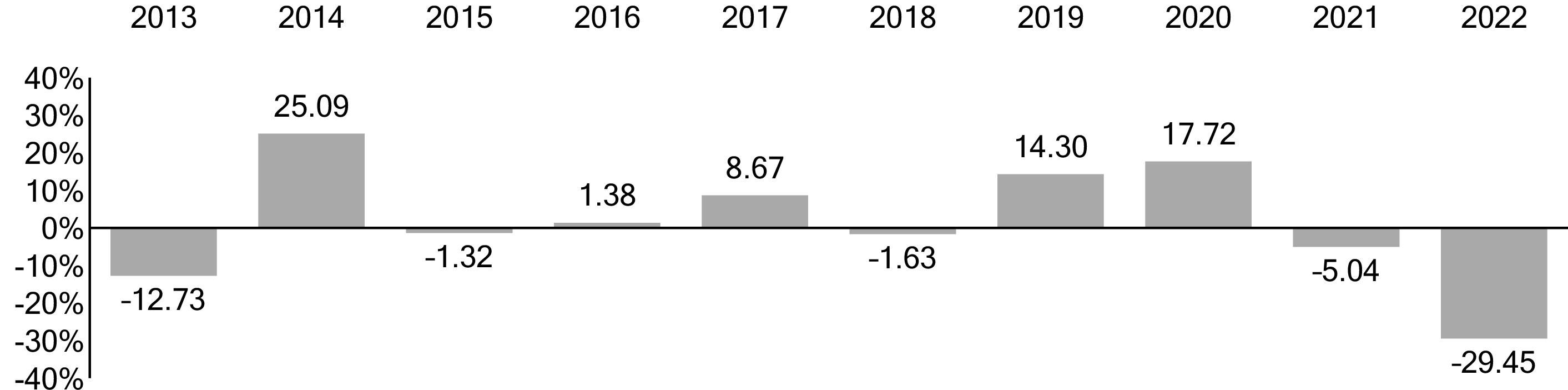

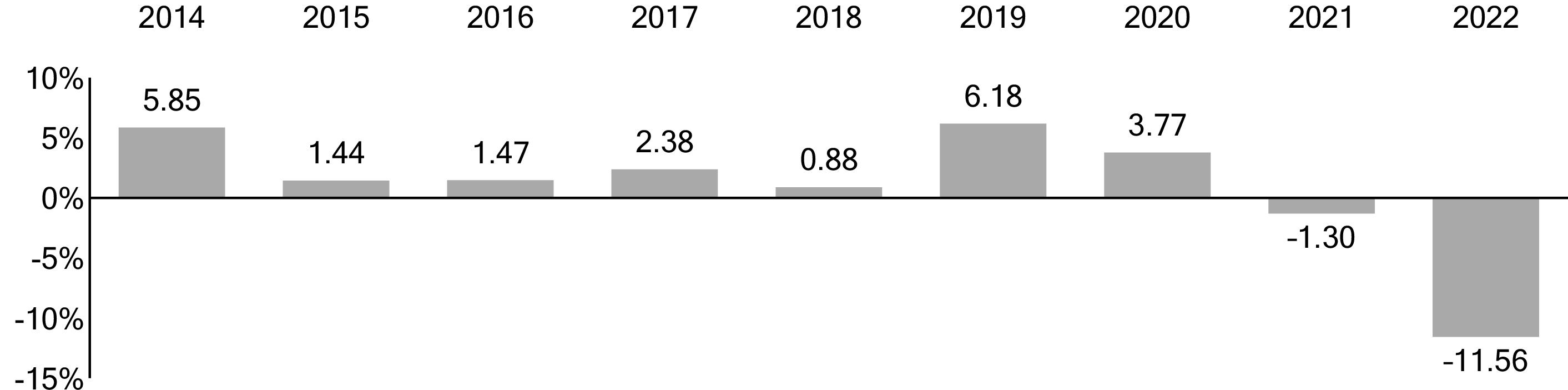

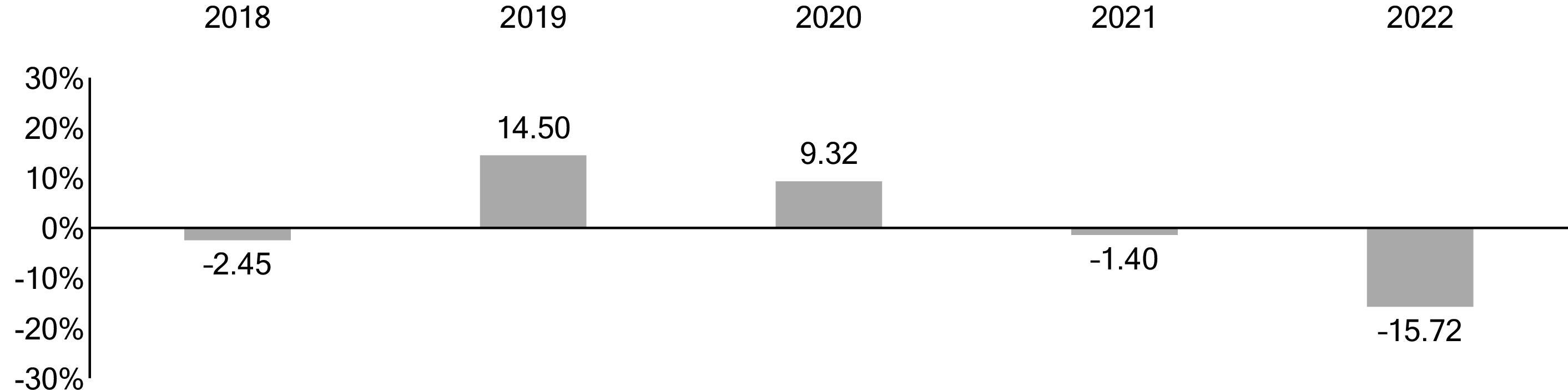

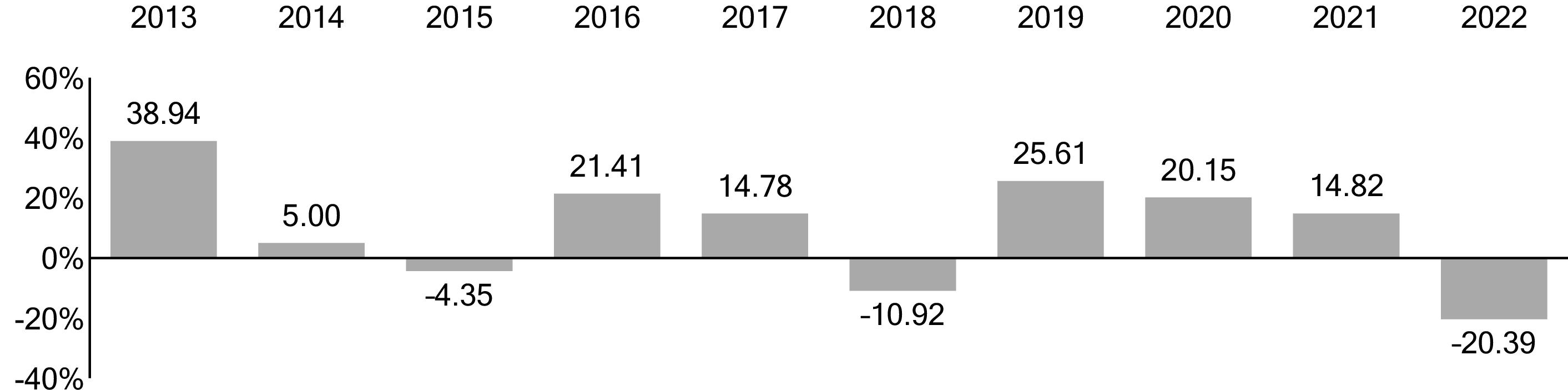

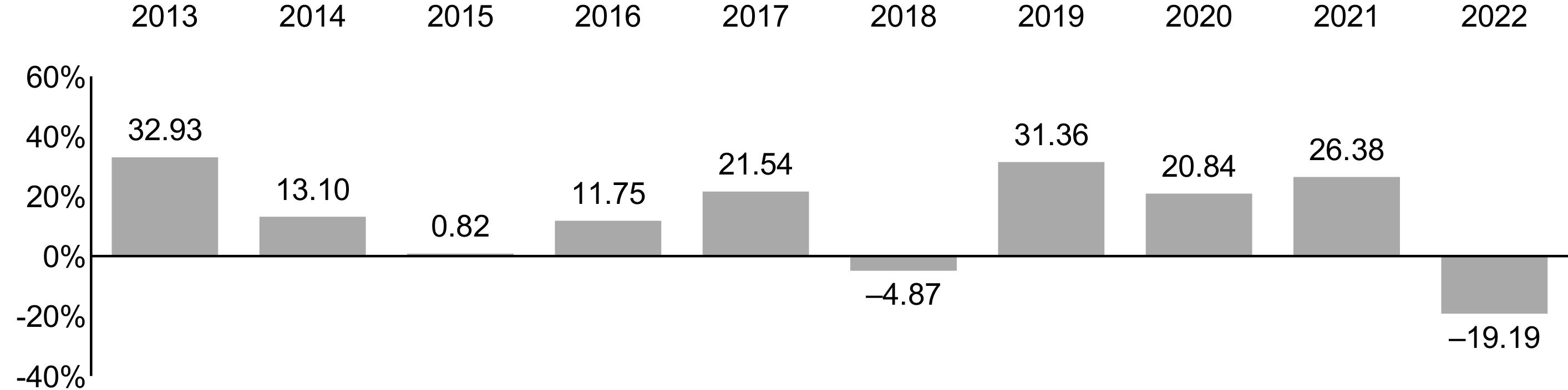

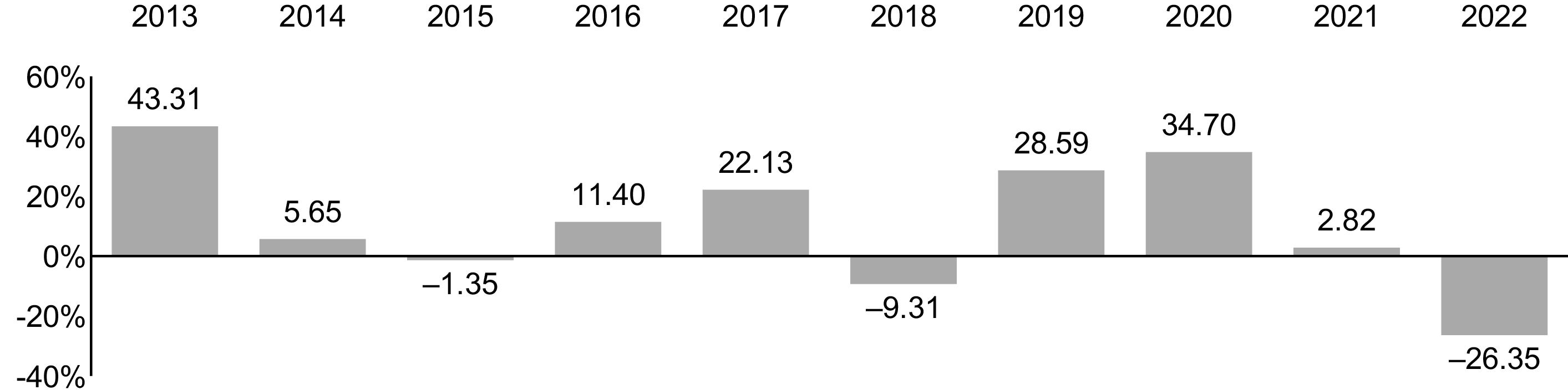

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Explorer Value Fund Investor Shares |

|

|

|

|

Return Before Taxes |

-

% |

% |

% |

|

Return After Taxes on Distributions |

- |

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

|

|

|

Russell 2500 Value Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

% |

% |

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

Cardinal Capital Management, L.L.C. (Cardinal Capital)

Frontier Capital Management Co., LLC (Frontier Capital)

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference. |

Plain Talk About Fund Expenses |

|

All mutual funds have operating expenses. These expenses, which are

deducted from a fund’s gross income, are expressed as a percentage of the

net assets of the fund. Assuming that operating expenses remain as stated in

the Fees and Expenses section, Vanguard Explorer Value Fund’s expense

ratio would be 0.49%, or $4.90 per $1,000 of average net assets. The

average expense ratio for small-cap value funds in 2022 was 1.23%, or

$12.30 per $1,000 of average net assets (derived from data provided by

Lipper, a Thomson Reuters Company, which reports on the mutual

fund industry). |

|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities. These costs can erode a substantial portion of the gross

income or the capital appreciation a fund achieves. Even seemingly small

differences in expenses can, over time, have a dramatic effect on a

fund’s performance. |

|

Plain Talk About Growth Funds and Value Funds |

|

Growth investing and value investing are two styles employed by stock-fund

managers. Growth funds generally invest in stocks of companies believed to

have above-average potential for growth in revenue, earnings, cash flow, or

other similar criteria. These stocks typically have low dividend yields, if any,

and above-average prices in relation to measures such as earnings and book

value. Value funds typically invest in stocks whose prices are below average

in relation to those measures; these stocks often have above-average

dividend yields. Value stocks also may remain undervalued by the market for

long periods of time. Growth and value stocks have historically produced

similar long-term returns, though each category has periods when it

outperforms the other. |

|

Plain Talk About Derivatives |

|

Derivatives can take many forms. Some forms of derivatives—such as

exchange-traded futures and options on securities, commodities, or

indexes—have been trading on regulated exchanges for decades. These

types of derivatives are standardized contracts that can easily be bought and

sold and whose market values are determined and published daily. On the

other hand, non-exchange-traded derivatives—such as certain swap

agreements and foreign currency exchange forward contracts—tend to be

more specialized or complex and may be more difficult to accurately value. |

|

Plain Talk About Vanguard’s Unique Corporate Structure |

|

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

|

Plain Talk About Distributions |

|

As a shareholder, you are entitled to your portion of a fund’s income from

interest and dividends as well as capital gains from the fund’s sale of

investments. Income consists of both the dividends that the fund earns from

any stock holdings and the interest it receives from any money market and

bond investments. Capital gains are realized whenever the fund sells

securities for higher prices than it paid for them. These capital gains are

either short-term or long-term, depending on whether the fund held the

securities for one year or less or for more than one year. |

|

Plain Talk About Buying a Dividend |

|

Unless you are a tax-exempt investor or investing through a tax-advantaged

account (such as an IRA or an employer-sponsored retirement or savings

plan), you should consider avoiding a purchase of fund shares shortly before

the fund makes a distribution, because doing so can cost you money in

taxes. This is known as “buying a dividend.” For example: On December 15,

you invest $5,000, buying 250 shares for $20 each. If the fund pays a

distribution of $1 per share on December 16, its share price will drop to $19

(not counting market change). You still have only $5,000 (250 shares x $19 =

$4,750 in share value, plus 250 shares x $1 = $250 in distributions), but you

owe tax on the $250 distribution you received—even if you reinvest it in more

shares. To avoid buying a dividend, check a fund’s distribution schedule

before you invest. |

|

|

Year Ended August 31, | ||||

|

2023 |

2022 |

2021 |

2020 |

2019 | |

|

Net Asset Value, Beginning of Period |

$39.93 |

$46.26 |

$30.32 |

$33.49 |

$40.53 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.586 |

.461 |

.351 |

.400 |

.494 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

2.308 |

(4.910) |

15.911 |

(3.032) |

(4.921) |

|

Total from Investment Operations |

2.894 |

(4.449) |

16.262 |

(2.632) |

(4.427) |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.495) |

(.352) |

(.322) |

(.538) |

(.366) |

|

Distributions from Realized Capital Gains |

(.979) |

(1.529) |

— |

— |

(2.247) |

|

Total Distributions |

(1.474) |

(1.881) |

(.322) |

(.538) |

(2.613) |

|

Net Asset Value, End of Period |

$41.35 |

$39.93 |

$46.26 |

$30.32 |

$33.49 |

|

Total Return2 |

7.43% |

-10.05% |

53.90% |

-8.12% |

-10.10% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$959 |

$1,083 |

$1,164 |

$563 |

$655 |

|

Ratio of Total Expenses to Average Net Assets3 |

0.49%4 |

0.53%4 |

0.52% |

0.64% |

0.55% |

|

Ratio of Net Investment Income to Average Net Assets |

1.48% |

1.05% |

0.85% |

1.28% |

1.45% |

|

Portfolio Turnover Rate |

23% |

31% |

41% |

42% |

27% |

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown.

Fund prospectuses provide information about any applicable account service fees. |

|

3 |

Includes performance-based investment advisory fee increases (decreases) of (0.04%),

0.02%, 0.01%, 0.09%, and 0.01%. |

|

4 |

The ratio of expenses to average net assets for the period net of reduction from broker

commission abatement arrangements was 0.49% and 0.53%, respectively. |

In certain circumstances, Vanguard fund shares can be held directly with Vanguard. If you hold Vanguard fund shares directly with Vanguard, you should carefully read each topic within this section that pertains to your relationship with Vanguard. Vanguard reserves the right, upon reasonable notice, to discontinue the ability to hold Vanguard fund shares directly with Vanguard for any or all investors and/or to transfer such shares to an affiliate or other financial institution.

|

Web |

|

|

Vanguard.com |

For the most complete source of Vanguard news

For fund, account, and service information

For most account transactions

For literature requests

24 hours a day, 7 days a week |

|

Phone | |

|

Investor Information 800-662-7447

(Text telephone for people with

hearing impairment at 800-749-7273) |

For fund and service information

For literature requests |

|

Client Services 800-662-2739

(Text telephone for people with

hearing impairment at 800-749-7273) |

For account information

For most account transactions |

|

Participant Services 800-523-1188

(Text telephone for people with

hearing impairment at 800-749-7273) |

For information and services for participants in

employer-sponsored plans |

|

Institutional Division

888-809-8102 |

For information and services for large institutional

investors |

|

Financial Advisor and Intermediary

Sales Support 800-997-2798 |

For information and services for financial intermediaries

including financial advisors, broker-dealers, trust

institutions, and insurance companies |

|

Financial Advisory and Intermediary

Trading Support 800-669-0498 |

For account information and trading support for

financial intermediaries including financial advisors,

broker-dealers, trust institutions, and insurance

companies |

|

Vanguard Fund |

Inception

Date |

Newspaper

Abbreviation |

Vanguard

Fund Number |

CUSIP

Number |

|

Vanguard Explorer Value Fund |

3/30/2010 |

ExpValFd |

1690 |

92206C748 |

CGS identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard & Poor’s Financial Services, LLC, and are not for use or dissemination in a manner that would serve as a substitute for any CUSIP service. The CUSIP Database, © 2023 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

Telephone: 800-662-7447; Text telephone for people with hearing impairment: 800-749-7273

Telephone: 800-523-1188; Text telephone for people with hearing impairment: 800-749-7273

Telephone: 800-662-2739; Text telephone for people with hearing impairment: 800-749-7273

Vanguard Marketing Corporation, Distributor.

P 1690 122023

Vanguard Intermediate-Term Treasury Index Fund Admiral Shares (VSIGX)

Vanguard Long-Term Treasury Index Fund Admiral Shares (VLGSX)

Vanguard Short-Term Corporate Bond Index Fund Admiral Shares (VSCSX)

Vanguard Intermediate-Term Corporate Bond Index Fund Admiral Shares (VICSX)

Vanguard Long-Term Corporate Bond Index Fund Admiral Shares (VLTCX)

Vanguard Mortgage-Backed Securities Index Fund Admiral Shares (VMBSX)

This prospectus contains financial data for the Funds through the fiscal year ended August 31, 2023.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $5,000,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

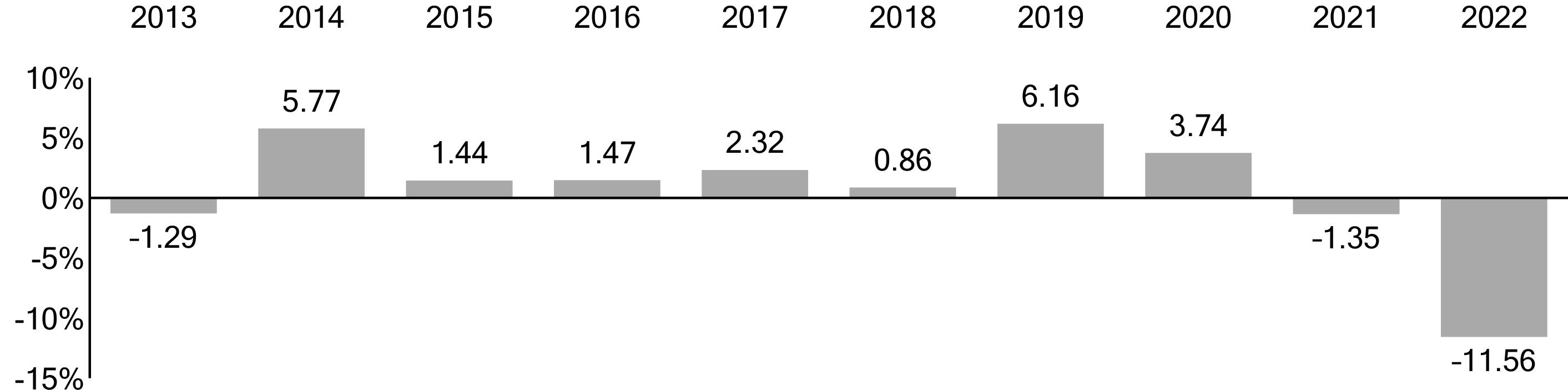

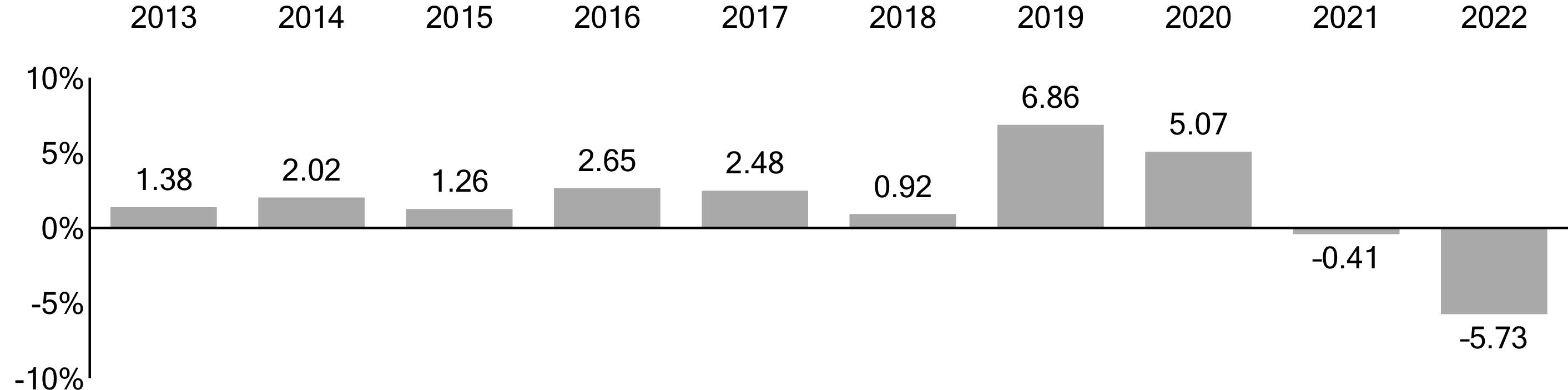

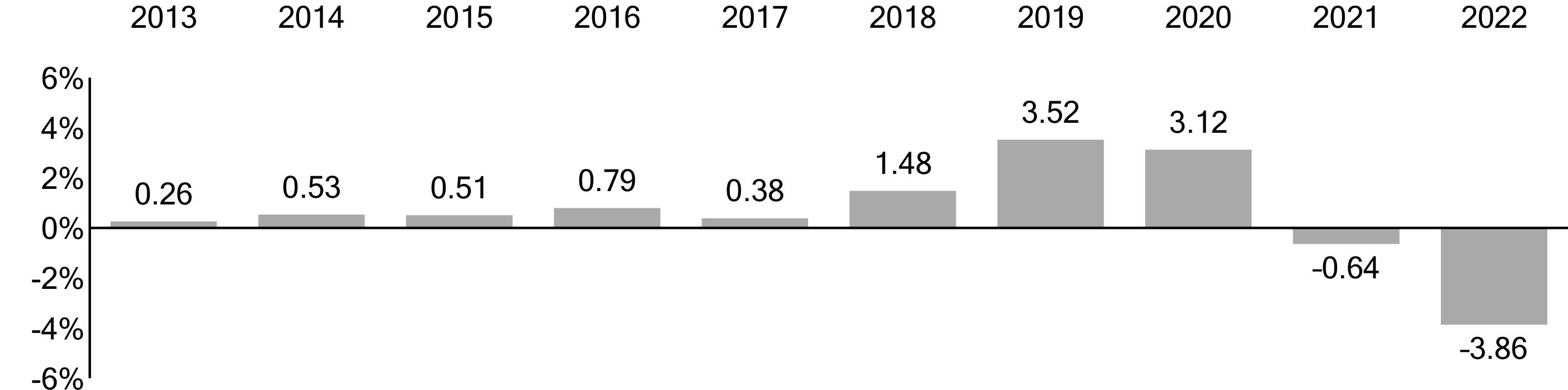

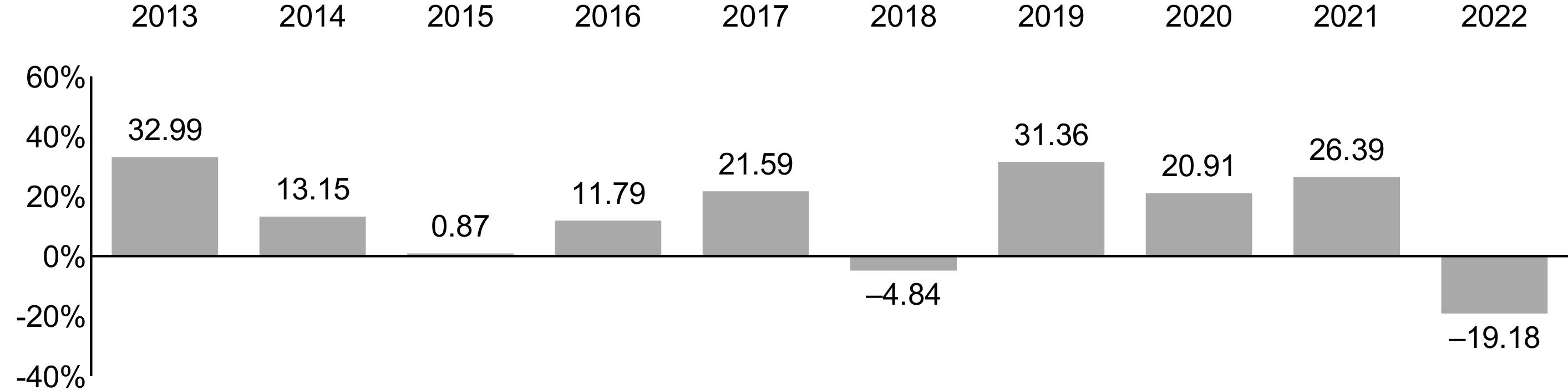

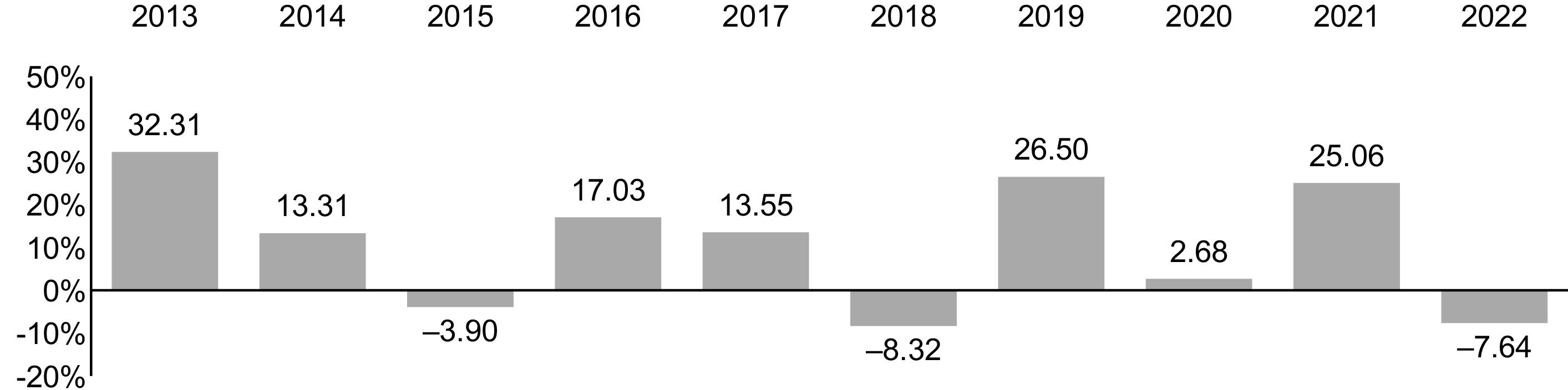

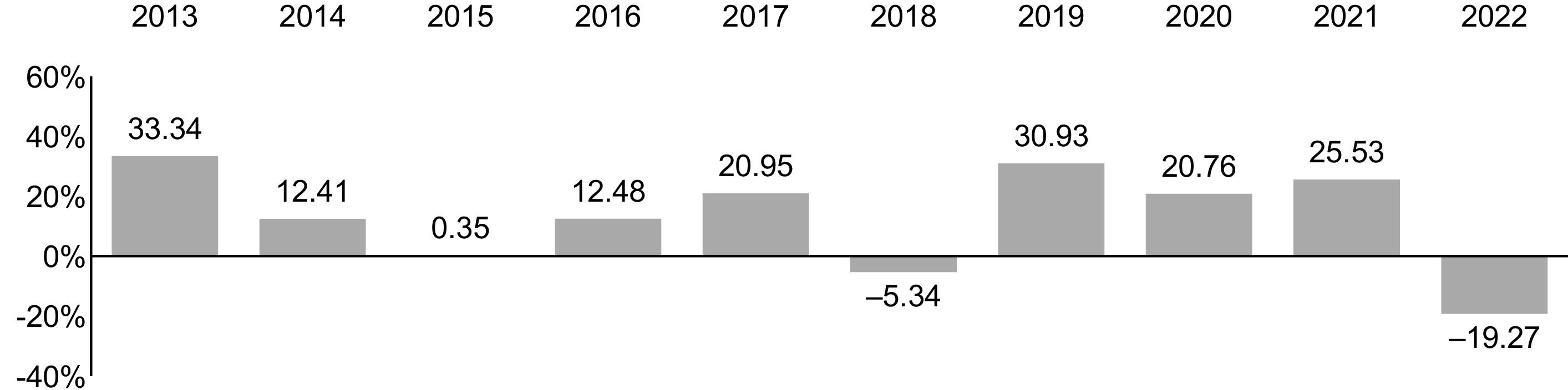

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Short-Term Treasury Index Fund

Admiral Shares |

|

|

|

|

Return Before Taxes |

-

% |

% |

% |

|

Return After Taxes on Distributions |

- |

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

|

|

|

Bloomberg U.S. Treasury 1-3 Year Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

% |

% |

|

Spliced Bloomberg U.S. Treasury 1-3 Year Index in USD

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $5,000,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

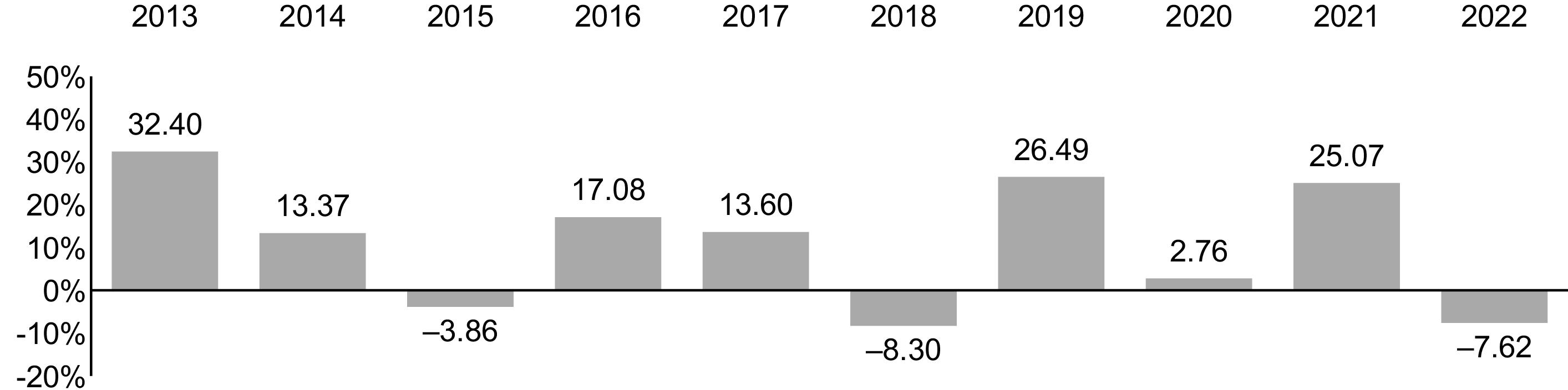

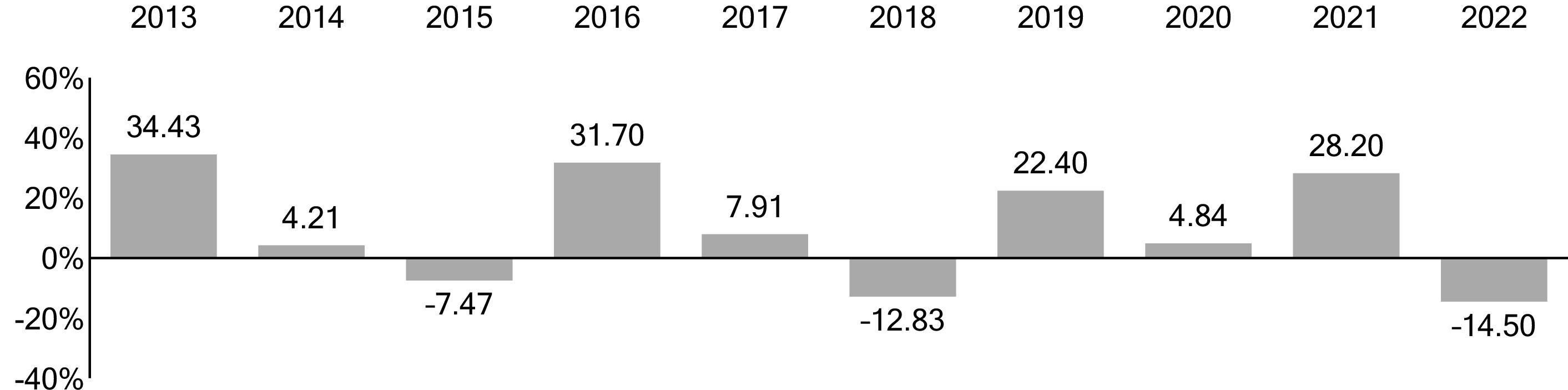

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Intermediate-Term Treasury Index Fund

Admiral Shares |

|

|

|

|

Return Before Taxes |

-

% |

% |

% |

|

Return After Taxes on Distributions |

- |

- |

- |

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

- |

|

|

Bloomberg U.S. Treasury 3-10 Year Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

% |

% |

|

Spliced Bloomberg U.S. Treasury 3-10 Year Index in USD

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $5,000,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

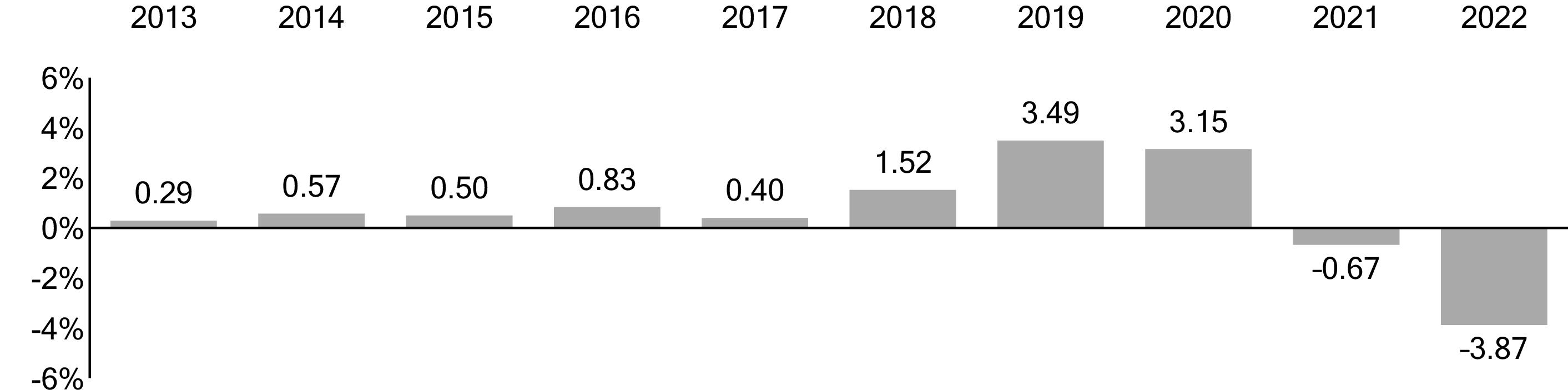

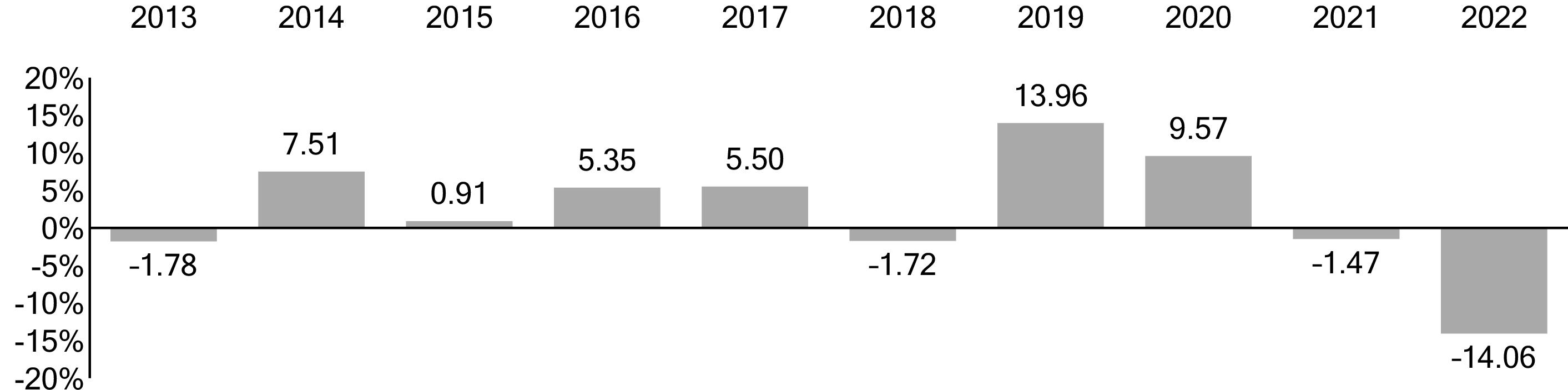

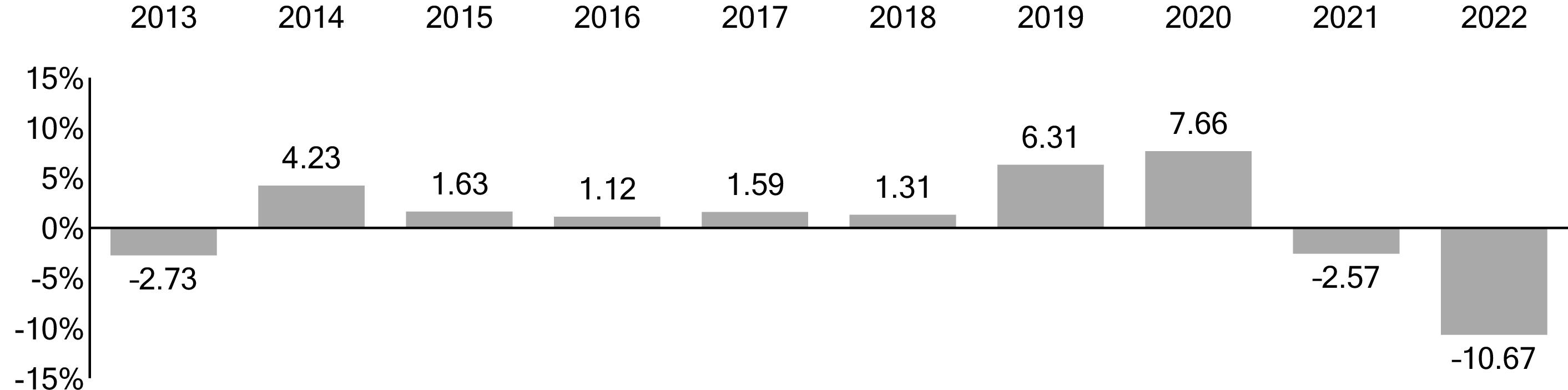

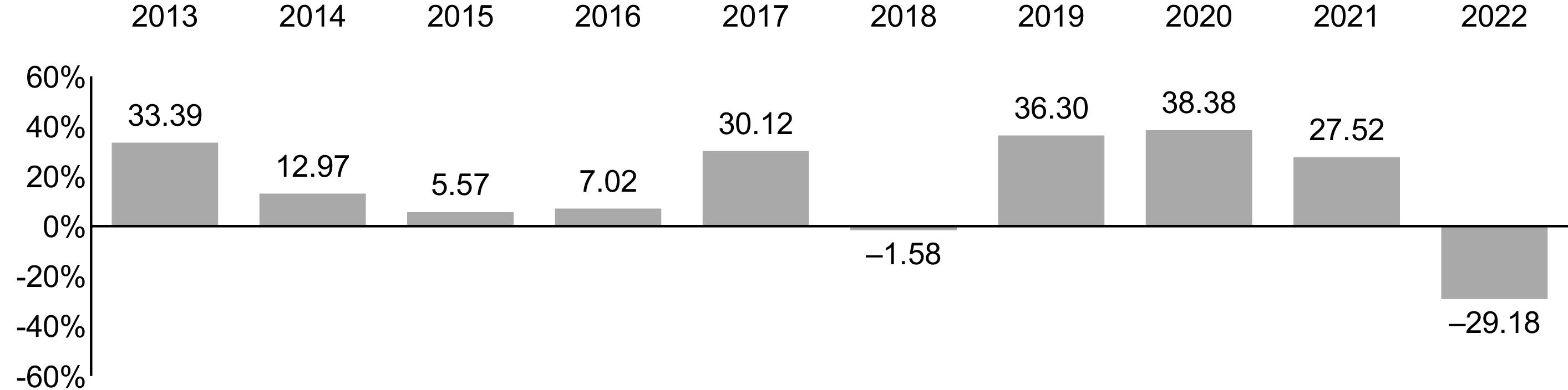

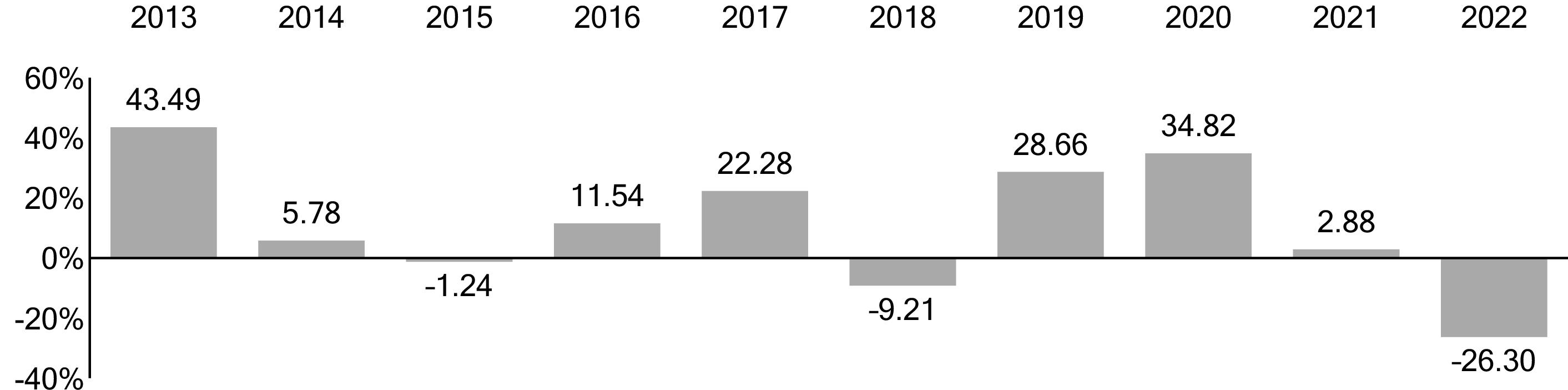

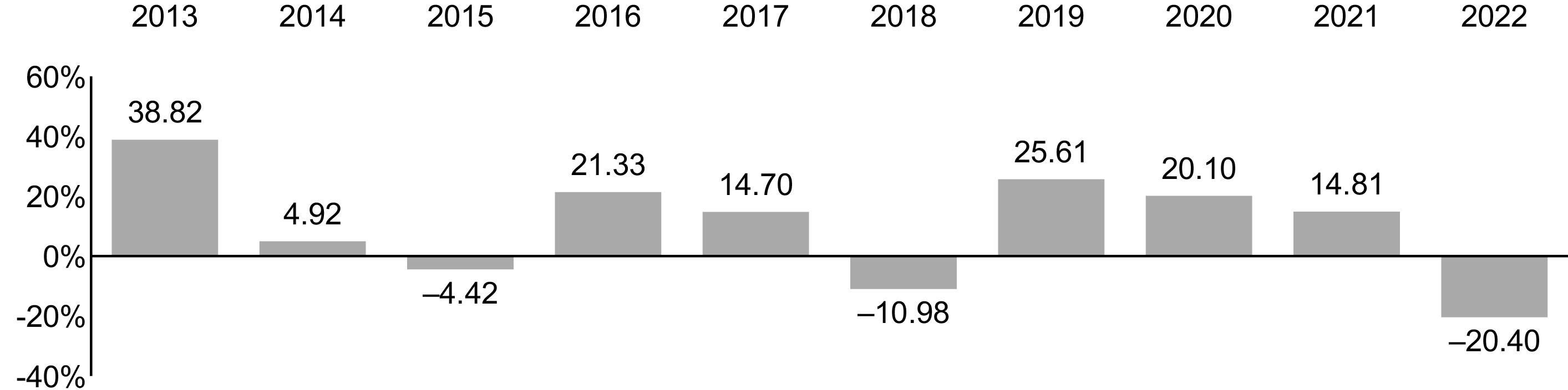

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Long-Term Treasury Index Fund

Admiral Shares |

|

|

|

|

Return Before Taxes |

-

% |

-

% |

% |

|

Return After Taxes on Distributions |

- |

- |

- |

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

- |

- |

|

Bloomberg U.S. Long Treasury Bond Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

-

% |

% |

|

Spliced Bloomberg U.S. Long Treasury Index in USD

(reflects no deduction for fees, expenses, or taxes) |

- |

- |

|

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $5,000,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

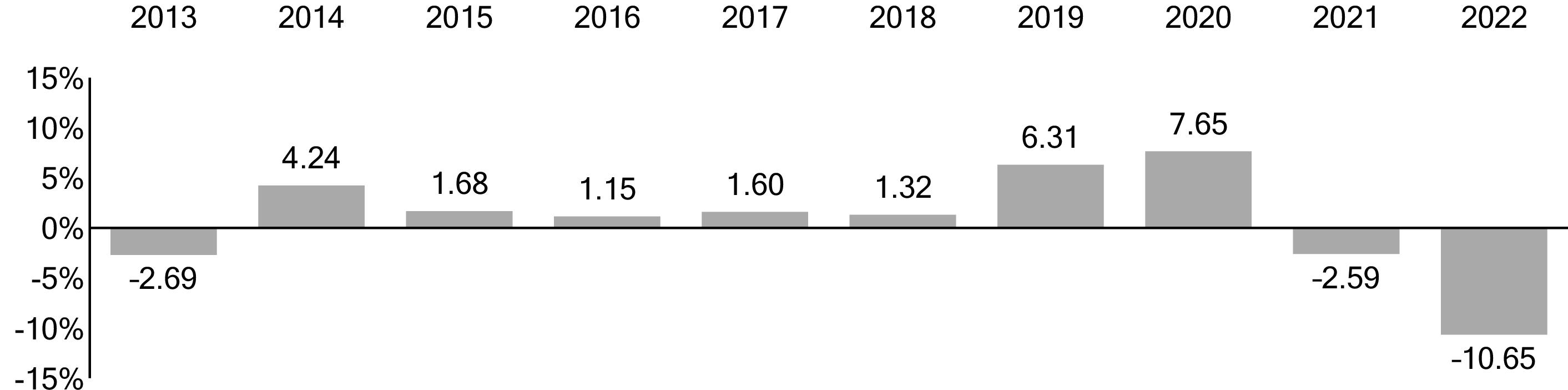

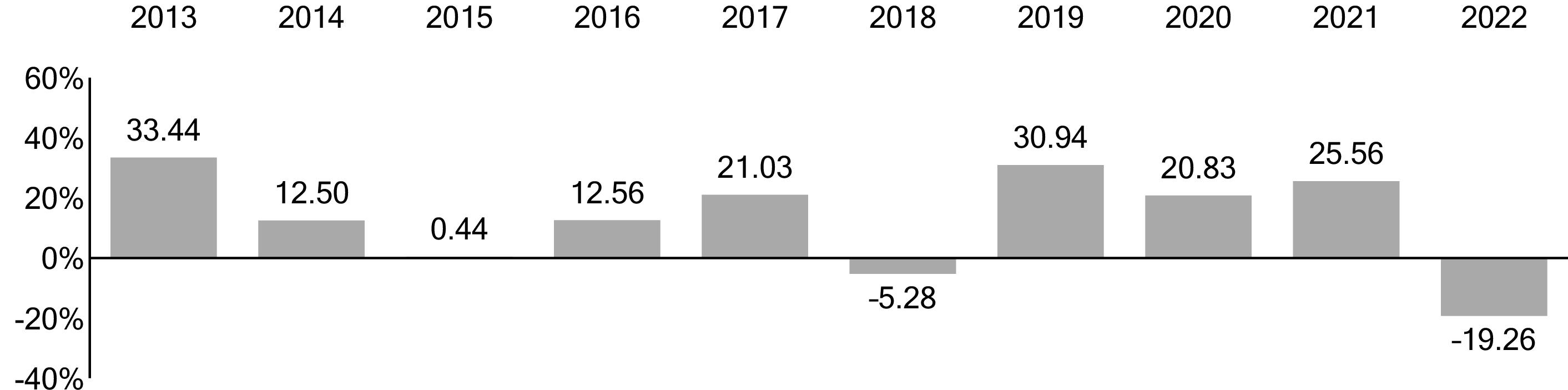

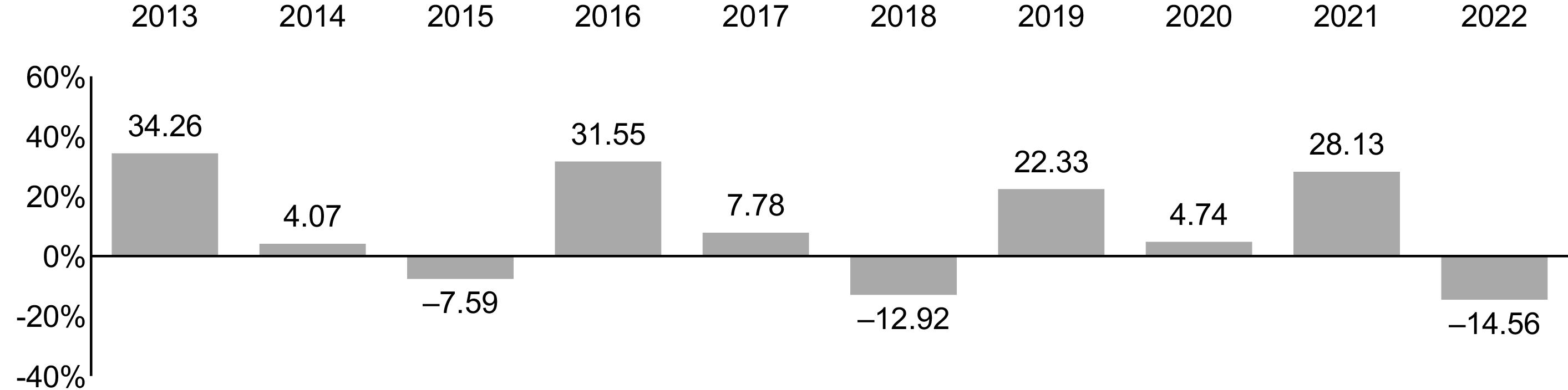

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Short-Term Corporate Bond Index Fund

Admiral Shares |

|

|

|

|

Return Before Taxes |

-

% |

% |

% |

|

Return After Taxes on Distributions |

- |

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

|

|

|

Bloomberg U.S. 1-5 Year Corporate Bond Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

% |

% |

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

% |

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $5,000,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Intermediate-Term Corporate Bond Index Fund

Admiral Shares |

|

|

|

|

Return Before Taxes |

-

% |

% |

% |

|

Return After Taxes on Distributions |

- |

- |

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

|

|

|

Bloomberg U.S. 5-10 Year Corporate Bond Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

% |

% |

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

% |

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $5,000,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

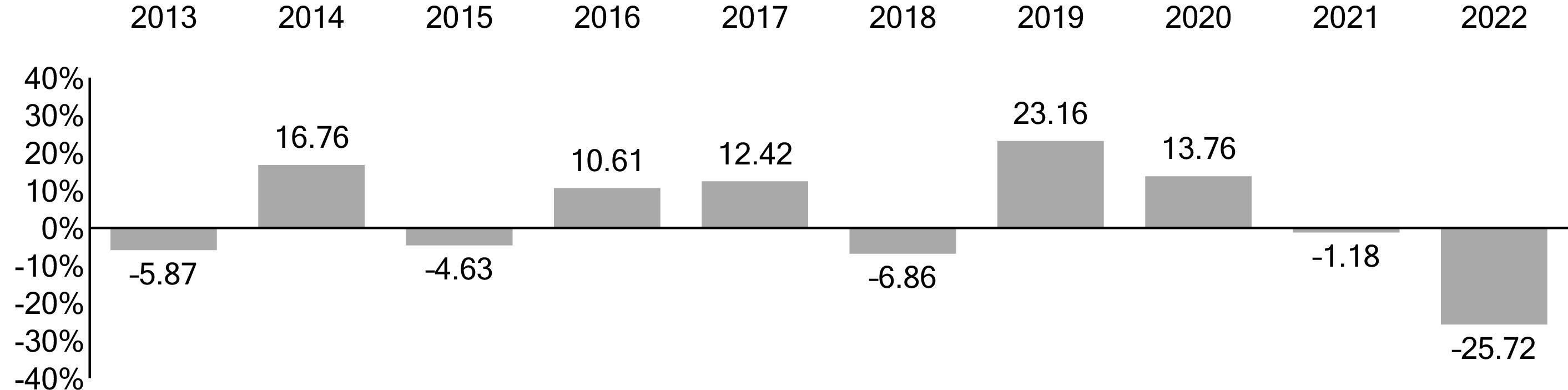

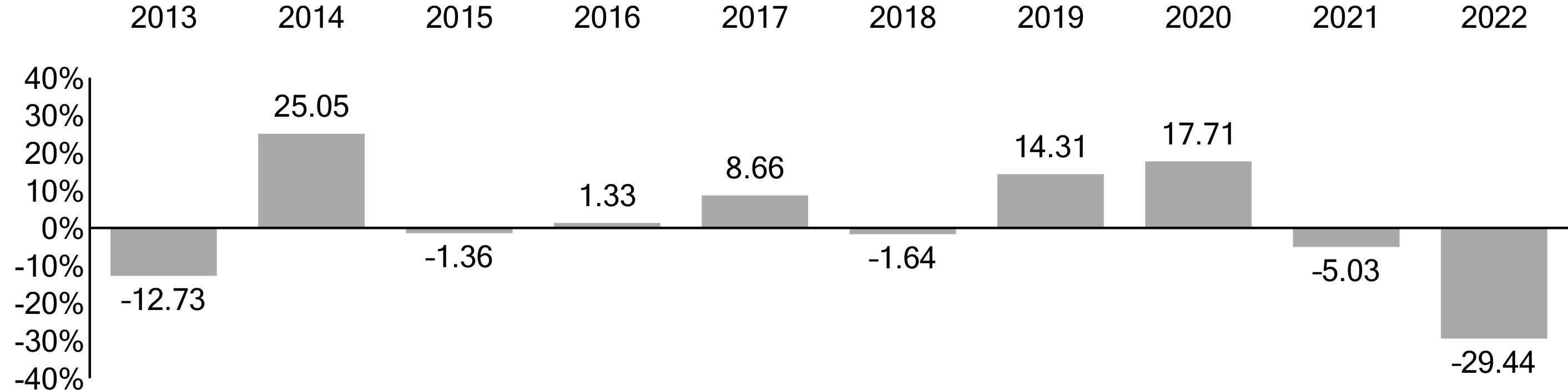

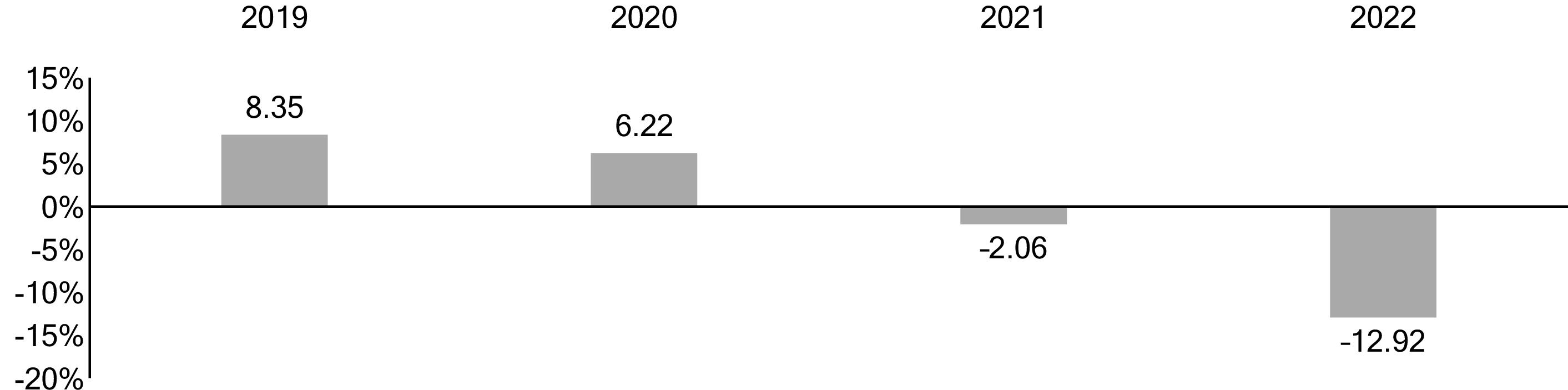

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Long-Term Corporate Bond Index Fund

Admiral Shares |

|

|

|

|

Return Before Taxes |

-

% |

-

% |

% |

|

Return After Taxes on Distributions |

- |

- |

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

- |

|

|

Bloomberg U.S. 10+ Year Corporate Bond Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

-

% |

% |

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

|

Account Service Fee Per Year

(for certain fund account balances below $5,000,000) |

$ |

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Mortgage-Backed Securities Index Fund

Admiral Shares |

|

|

|

|

Return Before Taxes |

-

% |

-

% |

% |

|

Return After Taxes on Distributions |

- |

- |

- |

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

- |

|

|

Bloomberg U.S. MBS Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

-

% |

% |

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether a Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether a Fund is the right investment for you. We suggest that you keep this prospectus for future reference.|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities, including costs generated by shareholders of other share

classes offered by the fund. These costs can erode a substantial portion of

the gross income or the capital appreciation a fund achieves. Even

seemingly small differences in expenses can, over time, have a dramatic

effect on a fund’s performance. |

|

Type of Bond (Maturity) |

After a 1%

Increase |

After a 1%

Decrease |

After a 2%

Increase |

After a 2%

Decrease |

|

Short-Term (2.5 years) |

$977 |

$1,024 |

$954 |

$1,049 |

|

Intermediate-Term (10 years) |

922 |

1,086 |

851 |

1,180 |

|

Long-Term (20 years) |

874 |

1,150 |

769 |

1,328 |

|

Plain Talk About Bonds and Interest Rates |

|

As a rule, when interest rates rise, bond prices fall. The opposite is also true:

Bond prices go up when interest rates fall. Why do bond prices and interest

rates move in opposite directions? Let’s assume that you hold a bond

offering a 4% yield. A year later, interest rates are on the rise and bonds of

comparable quality and maturity are offered with a 5% yield. With

higher-yielding bonds available, you would have trouble selling your 4% bond

for the price you paid—you would probably have to lower your asking price.

On the other hand, if interest rates were falling and 3% bonds were being

offered, you should be able to sell your 4% bond for more than you paid. |

|

How mortgage-backed securities are different: In general, declining interest

rates will not lift the prices of mortgage-backed securities—such as those

guaranteed by the Government National Mortgage Association—as much as

the prices of comparable bonds. Why? Because when interest rates fall, the

bond market tends to discount the prices of mortgage-backed securities for

prepayment risk—the possibility that homeowners will refinance their

mortgages at lower rates and cause the bonds to be paid off prior to maturity.

In part to compensate for this prepayment possibility, mortgage-backed

securities tend to offer higher yields than other bonds of comparable credit

quality and maturity. In contrast, when interest rates rise, prepayments tend

to slow down, subjecting mortgage-backed securities to extension risk—the

possibility that homeowners will repay their mortgages at slower rates. This

will lengthen the duration or average life of mortgage-backed securities held

by a fund and delay the fund’s ability to reinvest proceeds at higher interest

rates, making the fund more sensitive to changes in interest rates. |

|

Plain Talk About Bond Maturities |

|

A bond is issued with a specific maturity date—the date when the issuer must

pay back the bond’s principal (face value). Bond maturities range from less

than 1 year to more than 30 years. Typically, the longer a bond’s maturity, the

more price risk you, as a bond investor, will face as interest rates rise—but

also the higher the potential yield you could receive. Longer-term bonds are

generally more suitable for investors willing to take a greater risk of price

fluctuations to get higher and more stable interest income. Shorter-term bond

investors should be willing to accept lower yields and greater income

variability in return for less fluctuation in the value of their investment. The

stated maturity of a bond may differ from the effective maturity of a bond,

which takes into consideration that an action such as a call or refunding may

cause bonds to be repaid before their stated maturity dates. |

|

Plain Talk About Credit Quality |

|

A bond’s credit quality rating is an assessment of the issuer’s ability to pay

interest on the bond and, ultimately, to repay the principal. The lower the

credit quality, the greater the perceived chance that the bond issuer will

default, or fail to meet its payment obligations. All things being equal, the

lower a bond’s credit quality, the higher its yield should be to compensate

investors for assuming additional risk. Mortgage-backed securities typically

have higher yields than comparable-quality corporate or government bonds

to make up for their higher prepayment risk. |

Vanguard Mortgage-Backed Securities Index Fund has low credit risk. The three Treasury Index Funds invest primarily in U.S. Treasury securities and have high credit quality and low credit risk. The three Corporate Bond Index Funds are expected to have moderate credit risk as a result of their investments in investment-grade bonds. Investment-grade bonds are those rated BBB/Baa or higher by a credit rating agency, and therefore investment-grade bonds are a mixture of high-and medium-quality bonds.

|

Plain Talk About Types of Bonds |

|

Bonds are issued (sold) by many sources: Corporations issue corporate

bonds; the federal government issues U.S. Treasury bonds; agencies of the

federal government issue agency bonds; financial institutions issue

asset-backed bonds; and mortgage holders issue “mortgage-backed”

pass-through certificates. Each issuer is responsible for paying back the

bond’s initial value as well as for making periodic interest payments. Many

bonds issued by government agencies and entities are neither guaranteed

nor insured by the U.S. government. |

|

Vanguard Fund |

Number of

Bonds in Fund |

Number of Bonds

in Target Index |

|

Vanguard Short-Term Treasury Index Fund |

97 |

157 |

|

Vanguard Intermediate-Term Treasury

Index Fund |

109 |

109 |

|

Vanguard Long-Term Treasury Index Fund |

78 |

78 |

|

Vanguard Short-Term Corporate Bond

Index Fund |

2,498 |

2,704 |

|

Vanguard Intermediate-Term Corporate

Bond Index Fund |

2,085 |

2,090 |

|

Vanguard Long-Term Corporate Bond

Index Fund |

2,794 |

2,885 |

|

Vanguard Mortgage-Backed Securities

Index Fund |

1,1691 |

932 |

|

|

Treasury Index

Funds |

Corporate Bond

Index Funds |

Mortgage-Backed

Securities

Index Fund |

|

Corporate Debt Obligations |

|

• |

|

|

U.S. Government and Agency

Bonds |

• |

• |

• |

|

Mortgage-Backed Securities |

|

|

• |

|

Mortgage Dollar Rolls |

|

|

• |

|

Cash Equivalent Investments,

Including Repurchase Agreements |

• |

• |

• |

|

Futures, Options, and Other

Derivatives |

• |

• |

• |

|

International Dollar-Denominated

Bonds |

|

• |

|

|

Plain Talk About U.S. Government-Sponsored Enterprises |

|

A variety of U.S. government-sponsored enterprises (GSEs), such as the

Federal Home Loan Mortgage Corporation (FHLMC), the Federal National

Mortgage Association (FNMA), and the Federal Home Loan Banks (FHLBs),

issue debt and mortgage-backed securities. Although GSEs may be chartered

or sponsored by acts of Congress, they are not funded by congressional

appropriations. In September of 2008, the U.S. Treasury placed FNMA and

FHLMC under conservatorship and appointed the Federal Housing Finance

Agency (FHFA) to manage their daily operations. In addition, the U.S. Treasury

entered into purchase agreements with FNMA and FHLMC to provide them

with capital in exchange for senior preferred stock. Generally, a GSE’s

securities are neither issued nor guaranteed by the U.S. Treasury and are not

backed by the full faith and credit of the U.S. government. In most cases, these

securities are supported only by the credit of the GSE, standing alone. In some

cases, a GSE’s securities may be supported by the ability of the GSE to

borrow from the U.S. Treasury or may be supported by the U.S. government in

some other way. Securities issued by the Government National Mortgage

Association (GNMA), however, are backed by the full faith and credit of the

U.S. government. |

The Funds' derivative investments may include fixed income futures contracts, fixed income options, interest rate swaps, total return swaps, credit default swaps, or other derivatives. Losses (or gains) involving futures contracts can sometimes be substantial—in part because a relatively small price movement in a futures contract may result in an immediate and substantial loss (or gain) for a fund. Similar risks exist for other types of derivatives.

|

Plain Talk About Derivatives |

|

Derivatives can take many forms. Some forms of derivatives—such as

exchange-traded futures and options on securities, commodities, or

indexes—have been trading on regulated exchanges for decades. These

types of derivatives are standardized contracts that can easily be bought and

sold and whose market values are determined and published daily. On the

other hand, non-exchange-traded derivatives—such as certain swap

agreements—tend to be more specialized or complex and may be more

difficult to accurately value. |

Unlike a sales charge or load paid to a broker or a fund management company, purchase and transaction fees are paid directly to the Fund to offset the costs of buying securities.

See Investing With Vanguard for more information about fees.

|

Plain Talk About Vanguard’s Unique Corporate Structure |

|

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

|

Plain Talk About Distributions |

|

As a shareholder, you are entitled to your portion of a fund’s income from

interest as well as capital gains from the fund’s sale of investments. Income

consists of interest the fund earns from its money market and bond

investments. Capital gains are realized whenever the fund sells securities for

higher prices than it paid for them. These capital gains are either short-term

or long-term, depending on whether the fund held the securities for one year

or less or for more than one year. |

event. By contrast, an exchange between classes of shares of different funds is a taxable event.

|

For a Share Outstanding Throughout Each Period |

Year Ended August 31, | ||||

|

2023 |

2022 |

2021 |

2020 |

2019 | |

|

Net Asset Value, Beginning of Period |

$19.50 |

$20.51 |

$20.71 |

$20.35 |

$19.95 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.529 |

.114 |

.095 |

.312 |

.472 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

(.294) |

(.949) |

(.078) |

.375 |

.384 |

|

Total from Investment Operations |

.235 |

(.835) |

.017 |

.687 |

.856 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.515) |

(.112) |

(.093) |

(.327) |

(.456) |

|

Distributions from Realized Capital Gains |

— |

(.063) |

(.124) |

— |

— |

|

Total Distributions |

(.515) |

(.175) |

(.217) |

(.327) |

(.456) |

|

Net Asset Value, End of Period |

$19.22 |

$19.50 |

$20.51 |

$20.71 |

$20.35 |

|

Total Return2 |

1.22% |

-4.09% |

0.08% |

3.41% |

4.34% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$2,925 |

$2,506 |

$2,430 |

$2,748 |

$1,596 |

|

Ratio of Total Expenses to Average Net Assets |

0.07%3 |

0.07%3 |

0.07% |

0.07% |

0.07% |

|

Ratio of Net Investment Income to Average Net Assets |

2.74% |

0.57% |

0.46% |

1.52% |

2.35% |

|

Portfolio Turnover Rate4 |

81% |

59% |

66% |

67% |

55% |

|

|

|

|

|

|

|

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown.

Fund prospectuses provide information about any applicable account service fees. |

|

3 |

The ratio of expenses to average net assets for the period net of reduction from custody fee

offset arrangements was 0.07%. |

|

4 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases

or redemptions of the fund’s capital shares, including ETF Creation Units. |

|

For a Share Outstanding Throughout Each Period |

Year Ended August 31, | ||||

|

2023 |

2022 |

2021 |

2020 |

2019 | |

|

Net Asset Value, Beginning of Period |

$20.35 |

$23.04 |

$23.78 |

$22.68 |

$21.13 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.490 |

.283 |

.267 |

.416 |

.507 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

(.741) |

(2.575) |

(.577) |

1.101 |

1.540 |

|

Total from Investment Operations |

(.251) |

(2.292) |

(.310) |

1.517 |

2.047 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.479) |

(.274) |

(.265) |

(.417) |

(.497) |

|

Distributions from Realized Capital Gains |

— |

(.124) |

(.165) |

— |

— |

|

Total Distributions |

(.479) |

(.398) |

(.430) |

(.417) |

(.497) |

|

Net Asset Value, End of Period |

$19.62 |

$20.35 |

$23.04 |

$23.78 |

$22.68 |

|

Total Return2 |

-1.24% |

-10.05% |

-1.31% |

6.76% |

9.83% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$3,165 |

$2,886 |

$2,646 |

$2,740 |

$1,887 |

|

Ratio of Total Expenses to Average Net Assets |

0.07%3 |

0.07%3 |

0.07% |

0.07% |

0.07% |

|

Ratio of Net Investment Income to Average Net Assets |

2.46% |

1.31% |

1.15% |

1.79% |

2.34% |

|

Portfolio Turnover Rate4 |

36% |

36% |

33% |

28% |

29% |

|

|

|

|

|

|

|

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown.

Fund prospectuses provide information about any applicable account service fees. |

|

3 |

The ratio of expenses to average net assets for the period net of reduction from custody fee

offset arrangements was 0.07%. |

|

4 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases

or redemptions of the fund’s capital shares, including ETF Creation Units. |

|

For a Share Outstanding Throughout Each Period |

Year Ended August 31, | ||||

|

2023 |

2022 |

2021 |

2020 |

2019 | |

|

Net Asset Value, Beginning of Period |

$22.98 |

$30.35 |

$33.24 |

$30.28 |

$24.95 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.659 |

.565 |

.545 |

.637 |

.706 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

(2.873) |

(7.380) |

(2.799) |

2.955 |

5.316 |

|

Total from Investment Operations |

(2.214) |

(6.815) |

(2.254) |

3.592 |

6.022 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.646) |

(.555) |

(.538) |

(.632) |

(.692) |

|

Distributions from Realized Capital Gains |

— |

— |

(.098) |

— |

— |

|

Total Distributions |

(.646) |

(.555) |

(.636) |

(.632) |

(.692) |

|

Net Asset Value, End of Period |

$20.12 |

$22.98 |

$30.35 |

$33.24 |

$30.28 |

|

Total Return2 |

-9.73% |

-22.69% |

-6.78% |

12.00% |

24.67% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$1,089 |

$1,369 |

$1,947 |

$1,800 |

$1,053 |

|

Ratio of Total Expenses to Average Net Assets |

0.07%3 |

0.07%3 |

0.07% |

0.07% |

0.07% |

|

Ratio of Net Investment Income to Average Net Assets |

3.10% |

2.09% |

1.79% |

2.01% |

2.73% |

|

Portfolio Turnover Rate4 |

20% |

19% |

22% |

29% |

16% |

|

|

|

|

|

|

|

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown.

Fund prospectuses provide information about any applicable account service fees. |

|

3 |

The ratio of expenses to average net assets for the period net of reduction from custody fee

offset arrangements was 0.07%. |

|

4 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases

or redemptions of the fund’s capital shares, including ETF Creation Units. |

|

For a Share Outstanding Throughout Each Period |

Year Ended August 31, | ||||

|

2023 |

2022 |

2021 |

2020 |

2019 | |

|

Net Asset Value, Beginning of Period |

$20.70 |

$22.49 |

$22.55 |

$22.06 |

$21.28 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.566 |

.351 |

.385 |

.578 |

.625 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

(.126) |

(1.741) |

(.063) |

.485 |

.777 |

|

Total from Investment Operations |

.440 |

(1.390) |

.322 |

1.063 |

1.402 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.570) |

(.350) |

(.382) |

(.573) |

(.622) |

|

Distributions from Realized Capital Gains |

— |

(.050) |

— |

— |

— |

|

Total Distributions |

(.570) |

(.400) |

(.382) |

(.573) |

(.622) |

|

Net Asset Value, End of Period |

$20.57 |

$20.70 |

$22.49 |

$22.55 |

$22.06 |

|

Total Return2 |

2.17% |

-6.24% |

1.44% |

4.90% |

6.70% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$4,060 |

$4,647 |

$5,435 |

$4,703 |

$4,312 |

|

Ratio of Total Expenses to Average Net Assets |

0.07%3 |

0.07%3 |

0.07% |

0.07% |

0.07% |

|

Ratio of Net Investment Income to Average Net Assets |

2.75% |

1.63% |

1.71% |

2.61% |

2.90% |

|

Portfolio Turnover Rate4 |

63% |

50% |

42% |

56% |

51% |

|

|

|

|

|

|

|

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown.

Fund prospectuses provide information about any applicable account service fees. |

|

3 |

The ratio of expenses to average net assets for the period net of reduction from custody fee

offset arrangements was 0.07%. |

|

4 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases

or redemptions of the fund’s capital shares, including ETF Creation Units. |

|

For a Share Outstanding Throughout Each Period |

Year Ended August 31, | ||||

|

2023 |

2022 |

2021 |

2020 |

2019 | |

|

Net Asset Value, Beginning of Period |

$21.49 |

$25.75 |

$25.86 |

$24.71 |

$22.61 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.752 |

.577 |

.578 |

.747 |

.839 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

(.429) |

(4.098) |

(.062) |

1.138 |

2.097 |

|

Total from Investment Operations |

.323 |

(3.521) |

.516 |

1.885 |

2.936 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.753) |

(.579) |

(.572) |

(.735) |

(.836) |

|

Distributions from Realized Capital Gains |

— |

(.160) |

(.054) |

— |

— |

|

Total Distributions |

(.753) |

(.739) |

(.626) |

(.735) |

(.836) |

|

Net Asset Value, End of Period |

$21.06 |

$21.49 |

$25.75 |

$25.86 |

$24.71 |

|

Total Return2 |

1.55% |

-13.90% |

2.03% |

7.79% |

13.30% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$1,156 |

$1,139 |

$1,587 |

$1,549 |

$1,381 |

|

Ratio of Total Expenses to Average Net Assets |

0.07%3 |

0.07%3 |

0.07% |

0.07% |

0.07% |

|

Ratio of Net Investment Income to Average Net Assets |

3.56% |

2.44% |

2.25% |

3.01% |

3.63% |

|

Portfolio Turnover Rate4 |

76% |

58% |

53% |

72% |

59% |

|

|

|

|

|

|

|

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include transaction or account service fees that may have applied in the

periods shown. Fund prospectuses provide information about any applicable transaction and

account service fees. |

|

3 |

The ratio of expenses to average net assets for the period net of reduction from custody fee

offset arrangements was 0.07%. |

|

4 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases

or redemptions of the fund’s capital shares, including ETF Creation Units. |

|

For a Share Outstanding Throughout Each Period |

Year Ended August 31, | ||||

|

2023 |

2022 |

2021 |

2020 |

2019 | |

|

Net Asset Value, Beginning of Period |

$21.56 |

$29.03 |

$28.68 |

$27.55 |

$23.65 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.984 |

.875 |

.877 |

.988 |

1.053 |

|

Net Realized and Unrealized Gain (Loss) on Investments2 |

(1.260) |

(7.473) |

.345 |

1.125 |

3.895 |

|

Total from Investment Operations |

(.276) |

(6.598) |

1.222 |

2.113 |

4.948 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.964) |

(.872) |

(.872) |

(.983) |

(1.048) |

|

Distributions from Realized Capital Gains |

— |

— |

— |

— |

— |

|

Total Distributions |

(.964) |

(.872) |

(.872) |

(.983) |

(1.048) |

|

Net Asset Value, End of Period |

$20.32 |

$21.56 |

$29.03 |

$28.68 |

$27.55 |

|

Total Return3 |

-1.25% |

-23.10% |

4.37% |

7.87% |

21.64% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$319 |

$272 |

$314 |

$320 |

$256 |

|

Ratio of Total Expenses to Average Net Assets |

0.07%4 |

0.07%4 |

0.07% |

0.07% |

0.07% |

|

Ratio of Net Investment Income to Average Net Assets |

4.75% |

3.44% |

3.08% |

3.58% |

4.34% |

|

Portfolio Turnover Rate5 |

33% |

31% |

36% |

62% |

47% |

|

|

|

|

|

|

|

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Includes increases from purchase fees of $.01, $.00, $.01, $.00, and $.00. |

|

3 |

Total returns do not include transaction or account service fees that may have applied in the

periods shown. Fund prospectuses provide information about any applicable transaction and

account service fees. |

|

4 |

The ratio of expenses to average net assets for the period net of reduction from custody fee

offset arrangements was 0.07%. |

|

5 |

Excludes the value of portfolio securities received or delivered as a result of in-kind purchases

or redemptions of the fund’s capital shares, including ETF Creation Units. |

|

For a Share Outstanding Throughout Each Period |

Year Ended August 31, | ||||

|

2023 |

2022 |

2021 |

2020 |

2019 | |

|

Net Asset Value, Beginning of Period |

$18.98 |

$21.37 |

$21.72 |

$21.26 |

$20.51 |

|

Investment Operations |

|

|

|

|

|

|

Net Investment Income1 |

.563 |

.328 |

.211 |

.470 |

.622 |

|

Net Realized and Unrealized Gain (Loss) on Investments |

(.934) |

(2.391) |

(.292) |

.463 |

.742 |

|

Total from Investment Operations |

(.371) |

(2.063) |

(.081) |

.933 |

1.364 |

|

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income |

(.559) |

(.327) |

(.225) |

(.473) |

(.614) |

|

Distributions from Realized Capital Gains |

— |

— |

(.044) |

— |

— |

|

Total Distributions |

(.559) |

(.327) |

(.269) |

(.473) |

(.614) |

|

Net Asset Value, End of Period |

$18.05 |

$18.98 |

$21.37 |

$21.72 |

$21.26 |

|

Total Return2 |

-1.96% |

-9.72% |

-0.38% |

4.43% |

6.77% |

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

$1,242 |

$1,219 |

$1,419 |

$1,159 |

$841 |

|

Ratio of Total Expenses to Average Net Assets |

0.07%3 |

0.07%3 |

0.07% |

0.07% |

0.07% |

|

Ratio of Net Investment Income to Average Net Assets |

3.07% |

1.62% |

0.98% |

2.18% |

2.99% |

|

Portfolio Turnover Rate4 |

101% |

170% |

316% |

218% |

190% |

|

|

|

|

|

|

|

|

|

|

|

1 |

Calculated based on average shares outstanding. |

|

2 |

Total returns do not include account service fees that may have applied in the periods shown.

Fund prospectuses provide information about any applicable account service fees. |

|

3 |

The ratio of expenses to average net assets for the period net of reduction from custody fee

offset arrangements was 0.07%. |

|

4 |

Includes 80%, 113%, 237%, 11%, and 34%, respectively, attributable to mortgage-dollar-

roll activity. |

In certain circumstances, Vanguard fund shares can be held directly with Vanguard. If you hold Vanguard fund shares directly with Vanguard, you should carefully read each topic within this section that pertains to your relationship with Vanguard. Vanguard reserves the right, upon reasonable notice, to discontinue the ability to hold Vanguard fund shares directly with Vanguard for any or all investors and/or to transfer such shares to an affiliate or other financial institution.

Purchase fees will not apply to Vanguard fund account purchases in the following circumstances: (1) purchases of shares through reinvested dividends or capital gains distributions; (2) share transfers, rollovers, or reregistrations within the same fund; (3) conversions of shares from one share class to another in the same fund; (4) purchases in kind; and (5) share rollovers in an IRA within the same Vanguard fund for plans in which Vanguard serves as a recordkeeper. Unlike a sales charge or load paid to a broker or a fund management company, purchase and transaction fees are paid directly to the Fund to offset the costs of buying securities.

below the account minimum for any reason, including market fluctuation. This

liquidation policy applies to nonretirement fund accounts and accounts that are held through intermediaries. Any such liquidation will be preceded by written notice to the investor.

|

Web |

|

|

Vanguard.com |

For the most complete source of Vanguard news

For fund, account, and service information

For most account transactions

For literature requests

24 hours a day, 7 days a week |

|

Phone | |

|

Investor Information 800-662-7447

(Text telephone for people with

hearing impairment at 800-749-7273) |

For fund and service information

For literature requests |

|

Client Services 800-662-2739

(Text telephone for people with

hearing impairment at 800-749-7273) |

For account information

For most account transactions |

|

Participant Services 800-523-1188

(Text telephone for people with

hearing impairment at 800-749-7273) |

For information and services for participants in

employer-sponsored plans |

|

Institutional Division

888-809-8102 |

For information and services for large institutional

investors |

|

Financial Advisor and Intermediary

Sales Support 800-997-2798 |

For information and services for financial intermediaries

including financial advisors, broker-dealers, trust

institutions, and insurance companies |

|

Financial Advisory and Intermediary

Trading Support 800-669-0498 |

For account information and trading support for

financial intermediaries including financial advisors,

broker-dealers, trust institutions, and insurance

companies |

|

Vanguard Fund |

Inception

Date |

Newspaper

Abbreviation |

Vanguard

Fund Number |

CUSIP

Number |

|

Vanguard Short-Term Treasury Index Fund | ||||

|

Admiral Shares |

12/28/2009 |

STGovIxAdm |

1942 |

92206C300 |

|

Vanguard Intermediate-Term Treasury Index Fund | ||||

|

Admiral Shares |

8/4/2010 |

ITGovIxAdm |

1943 |

92206C888 |

|

Vanguard Long-Term Treasury Index Fund | ||||

|

Admiral Shares |

3/1/2010 |

LTGovIxAdm |

1944 |

92206C821 |

|

Vanguard Short-Term Corporate Bond Index Fund | ||||

|

Admiral Shares |

11/18/2010 |

STCorpIxAdm |

1945 |

92206C607 |

|

Vanguard Intermediate-Term Corporate Bond Index Fund | ||||

|

Admiral Shares |

3/2/2010 |

ITCorpIxAdm |

1946 |

92206C854 |

|

Vanguard Long-Term Corporate Bond Index Fund | ||||

|

Admiral Shares |

1/19/2010 |

LTCorpIxAdm |

1947 |

92206C789 |

|

Vanguard Mortgage-Backed Securities Index Fund | ||||

|

Admiral Shares |

12/3/2009 |

MrgBkdIxAdm |

1948 |

92206C755 |

CGS identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by Standard & Poor’s Financial Services, LLC, and are not for use or dissemination in a manner that would serve as a substitute for any CUSIP service. The CUSIP Database, © 2023 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association.

Telephone: 800-662-7447; Text telephone for people with hearing impairment: 800-749-7273

Telephone: 800-523-1188; Text telephone for people with hearing impairment: 800-749-7273

Telephone: 800-662-2739; Text telephone for people with hearing impairment: 800-749-7273

Vanguard Marketing Corporation, Distributor.

P 1942 122023

Vanguard Intermediate-Term Treasury Index Fund Institutional Shares (VIIGX)

Vanguard Long-Term Treasury Index Fund Institutional Shares (VLGIX)

Vanguard Short-Term Corporate Bond Index Fund Institutional Shares (VSTBX)

Vanguard Intermediate-Term Corporate Bond Index Fund Institutional Shares (VICBX)

Vanguard Long-Term Corporate Bond Index Fund Institutional Shares (VLCIX)

Vanguard Mortgage-Backed Securities Index Fund Institutional Shares (VMBIX)

This prospectus contains financial data for the Funds through the fiscal year ended August 31, 2023.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Short-Term Treasury Index Fund

Institutional Shares |

|

|

|

|

Return Before Taxes |

-

% |

% |

% |

|

Return After Taxes on Distributions |

- |

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

|

|

|

Bloomberg U.S. Treasury 1-3 Year Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

% |

% |

|

Spliced Bloomberg U.S. Treasury 1-3 Year Index in USD

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Intermediate-Term Treasury Index Fund

Institutional Shares |

|

|

|

|

Return Before Taxes |

-

% |

% |

% |

|

Return After Taxes on Distributions |

- |

- |

- |

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

- |

|

|

Bloomberg U.S. Treasury 3-10 Year Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

% |

% |

|

Spliced Bloomberg U.S. Treasury 3-10 Year Index in USD

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Long-Term Treasury Index Fund

Institutional Shares |

|

|

|

|

Return Before Taxes |

-

% |

-

% |

% |

|

Return After Taxes on Distributions |

- |

- |

- |

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

- |

- |

|

Bloomberg U.S. Long Treasury Bond Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

-

% |

% |

|

Spliced Bloomberg U.S. Long Treasury Index in USD

(reflects no deduction for fees, expenses, or taxes) |

- |

- |

|

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Short-Term Corporate Bond Index Fund

Institutional Shares |

|

|

|

|

Return Before Taxes |

-

% |

% |

% |

|

Return After Taxes on Distributions |

- |

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

|

|

|

Bloomberg U.S. 1-5 Year Corporate Bond Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

% |

% |

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

% |

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Intermediate-Term Corporate Bond Index Fund

Institutional Shares |

|

|

|

|

Return Before Taxes |

-

% |

% |

% |

|

Return After Taxes on Distributions |

- |

- |

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

|

|

|

Bloomberg U.S. 5-10 Year Corporate Bond Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

% |

% |

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

% |

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

10 Years |

|

Vanguard Long-Term Corporate Bond Index Fund

Institutional Shares |

|

|

|

|

Return Before Taxes |

-

% |

-

% |

% |

|

Return After Taxes on Distributions |

- |

- |

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

- |

|

|

Bloomberg U.S. 10+ Year Corporate Bond Index

(reflects no deduction for fees, expenses, or taxes) |

-

% |

-

% |

% |

|

Bloomberg U.S. Aggregate Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

- |

|

|

(Fees paid directly from your investment)

|

| |

|

Sales Charge (Load) Imposed on Purchases |

|

|

Purchase Fee |

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

Redemption Fee |

|

(Expenses that you pay each year as a percentage of the value of your investment)

|

| |

|

Management Fees |

% |

|

12b-1 Distribution Fee |

|

|

Other Expenses |

% |

|

Total Annual Fund Operating Expenses |

% |

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

|

|

Total Return |

Quarter |

|

|

% |

|

|

|

-

% |

|

|

|

1 Year |

5 Years |

Since

Fund

Inception |

Fund

Inception

Date |

|

Vanguard Mortgage-Backed Securities

Index Fund Institutional Shares |

|

|

|

|

|

Return Before Taxes |

-

% |

-

% |

% |

|

|

Return After Taxes on Distributions |

- |

- |

- |

|

|

Return After Taxes on Distributions and Sale

of Fund Shares |

- |

- |

|

|

|

Bloomberg U.S. MBS Float Adjusted Index

(reflects no deduction for fees, expenses,

or taxes) |

-

% |

-

% |

% |

|

|

Bloomberg U.S. Aggregate Float Adjusted

Index

(reflects no deduction for fees, expenses,

or taxes) |

- |

|

|

|

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether a Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether a Fund is the right investment for you. We suggest that you keep this prospectus for future reference.|

Plain Talk About Costs of Investing |

|

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities, including costs generated by shareholders of other share

classes offered by the fund. These costs can erode a substantial portion of

the gross income or the capital appreciation a fund achieves. Even

seemingly small differences in expenses can, over time, have a dramatic

effect on a fund’s performance. |

|

Type of Bond (Maturity) |

After a 1%

Increase |

After a 1%

Decrease |

After a 2%

Increase |

After a 2%

Decrease |

|

Short-Term (2.5 years) |

$977 |

$1,024 |

$954 |

$1,049 |

|

Intermediate-Term (10 years) |

922 |

1,086 |

851 |

1,180 |

|

Long-Term (20 years) |

874 |

1,150 |

769 |

1,328 |

|

Plain Talk About Bonds and Interest Rates |

|

As a rule, when interest rates rise, bond prices fall. The opposite is also true:

Bond prices go up when interest rates fall. Why do bond prices and interest

rates move in opposite directions? Let’s assume that you hold a bond

offering a 4% yield. A year later, interest rates are on the rise and bonds of