UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-7803

Name of Registrant: Vanguard Scottsdale Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: August 31

Date of reporting period: September 1, 2010 – August 31, 2011

Item 1: Reports to Shareholders

| Annual Report | August 31, 2011 |

| Vanguard Sector Bond Index Funds |

| Vanguard Short-Term Government Bond Index Fund |

| Vanguard Intermediate-Term Government Bond Index Fund |

| Vanguard Long-Term Government Bond Index Fund |

| Vanguard Short-Term Corporate Bond Index Fund |

| Vanguard Intermediate-Term Corporate Bond Index Fund |

| Vanguard Long-Term Corporate Bond Index Fund |

| Vanguard Mortgage-Backed Securities Index Fund |

> For the 12 months ended August 31, 2011, Vanguard’s Sector Bond Index Funds produced solid returns in a period marked by pronounced ups and downs.

> Vanguard Intermediate-Term Corporate Bond Index Fund delivered the highest return of the group; Vanguard Short-Term Government Bond Index Fund delivered the lowest.

> In general, bond yields finished the period below their yields at the start.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 4 |

| Short-Term Government Bond Index Fund. | 10 |

| Intermediate-Term Government Bond Index Fund. | 26 |

| Long-Term Government Bond Index Fund. | 42 |

| Short-Term Corporate Bond Index Fund. | 57 |

| Intermediate-Term Corporate Bond Index Fund. | 87 |

| Long-Term Corporate Bond Index Fund. | 116 |

| Mortgage-Backed Securities Index Fund. | 141 |

| About Your Fund’s Expenses. | 159 |

| Trustees Approve Advisory Arrangement. | 162 |

| Glossary. | 163 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Vanguard was named for the HMS Vanguard, flagship of British Admiral Horatio Nelson. A ship—whose performance and safety depend on the work of all hands—has served as a fitting metaphor for the Vanguard crew as we strive to help clients reach their financial goals.

Your Fund’s Total Returns

| Fiscal Year Ended August 31, 2011 | ||||

| 30-Day SEC | Income | Capital | Total | |

| Yields | Returns | Returns | Returns | |

| Vanguard Short-Term Government Bond Index Fund | ||||

| Signal® Shares | 0.18% | 0.67% | 0.73% | 1.40% |

| Institutional Shares | 0.18 | 0.72 | 0.71 | 1.43 |

| ETF Shares | 0.17 | |||

| Market Price | 1.35 | |||

| Net Asset Value | 1.39 | |||

| Barclays Capital U.S. 1–3 Year Government Float | ||||

| Adjusted Index | 1.53 | |||

| Short U.S. Government Funds Average | 1.35 | |||

| Short U.S. Government Funds Average: Derived from data provided by Lipper Inc. | ||||

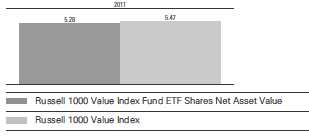

| Vanguard Intermediate-Term Government Bond Index Fund | ||||

| Signal® Shares | 1.11% | 2.18% | 3.13% | 5.31% |

| Institutional Shares | 1.12 | 2.22 | 3.14 | 5.36 |

| ETF Shares | 1.11 | |||

| Market Price | 5.41 | |||

| Net Asset Value | 5.30 | |||

| Barclays Capital U.S. 3–10 Year Government Float | ||||

| Adjusted Index | 5.53 | |||

| Intermediate U.S. Government Funds Average | 3.53 | |||

| Intermediate U.S. Government Funds Average: Derived from data provided by Lipper Inc. | ||||

| Vanguard Long-Term Government Bond Index Fund | ||||

| Signal® Shares | 3.24% | 3.85% | 0.81% | 4.66% |

| Institutional Shares | 3.24 | 3.90 | 0.77 | 4.67 |

| ETF Shares | 3.26 | |||

| Market Price | 4.61 | |||

| Net Asset Value | 4.63 | |||

| Barclays Capital U.S. Long Government Float | ||||

| Adjusted Index | 5.11 | |||

| General U.S. Government Funds Average | 3.06 | |||

| General U.S. Government Funds Average: Derived from data provided by Lipper Inc. | ||||

Signal Shares and Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria. The Vanguard ETF® Shares shown are traded on the Nasdaq exchange and are available only through brokers. The table provides ETF returns based on both the Nasdaq market price and the net asset value for a share. U.S. Pat. No. 6,879,964 B2; 7,337,138; 7,720,749; 7,925,573.

1

Your Fund’s Total Returns

| Fiscal Year Ended August 31, 2011 | ||||

| 30-Day SEC | Income | Capital | Total | |

| Yields | Returns | Returns | Returns | |

| Vanguard Short-Term Corporate Bond Index Fund | ||||

| Signal® Shares (Inception: 11/18/2010) | 1.92% | 1.96% | 0.32% | 2.28% |

| Institutional Shares | 1.95 | 2.42 | 0.59 | 3.01 |

| ETF Shares | 1.93 | |||

| Market Price | 3.31 | |||

| Net Asset Value | 2.94 | |||

| Barclays Capital U.S. 1–5 Year Corporate Bond | ||||

| Index | 3.45 | |||

| Short-Intermediate Investment-Grade Debt Funds | ||||

| Average | 2.99 | |||

| Short-Intermediate Investment-Grade Debt Funds Average: Derived from data provided by Lipper Inc. | ||||

| Vanguard Intermediate-Term Corporate Bond Index Fund | ||||

| Signal® Shares | 3.66% | 4.19% | 1.46% | 5.65% |

| Institutional Shares | 3.68 | 4.25 | 1.45 | 5.70 |

| ETF Shares | 3.67 | |||

| Market Price | 6.25 | |||

| Net Asset Value | 5.65 | |||

| Barclays Capital U.S. 5–10 Year Corporate Bond | ||||

| Index | 6.19 | |||

| Intermediate Investment-Grade Debt Funds | ||||

| Average | 4.19 | |||

| Intermediate Investment-Grade Debt Funds Average: Derived from data provided by Lipper Inc. | ||||

Signal Shares and Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria. The Vanguard ETF® Shares shown are traded on the Nasdaq exchange and are available only through brokers. The table provides ETF returns based on both the Nasdaq market price and the net asset value for a share. U.S. Pat. No. 6,879,964 B2; 7,337,138; 7,720,749; 7,925,573.

2

Your Fund’s Total Returns

| Fiscal Year Ended August 31, 2011 | ||||

| 30-Day SEC | Income | Capital | Total | |

| Yields | Returns | Returns | Returns | |

| Vanguard Long-Term Corporate Bond Index Fund | ||||

| Signal® Shares | 5.25% | 5.31% | -1.10% | 4.21% |

| Institutional Shares | 5.26 | 5.37 | -1.12 | 4.25 |

| ETF Shares | 5.23 | |||

| Market Price | 4.42 | |||

| Net Asset Value | 4.19 | |||

| Barclays Capital U.S. 10+ Year Corporate Bond | ||||

| Index | 5.18 | |||

| Corporate A-Rated Debt Funds Average | 4.27 | |||

| Corporate A-Rated Debt Funds Average: Derived from data provided by Lipper Inc. | ||||

| Vanguard Mortgage-Backed Securities Index Fund | ||||

| Signal® Shares | 2.81% | 2.33% | 2.83% | 5.16% |

| ETF Shares | 2.81 | |||

| Market Price | 5.02 | |||

| Net Asset Value | 5.14 | |||

| Barclays Capital U.S. MBS Float Adjusted Index | 5.11 | |||

| U.S. Mortgage Funds Average | 5.05 | |||

| U.S. Mortgage Funds Average: Derived from data provided by Lipper Inc. | ||||

Signal Shares and Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria. The Vanguard ETF® Shares shown are traded on the Nasdaq exchange and are available only through brokers. The table provides ETF returns based on both the Nasdaq market price and the net asset value for a share. U.S. Pat. No. 6,879,964 B2; 7,337,138; 7,720,749; 7,925,573.

For the ETF Shares, the market price is determined by the midpoint of the bid-offer spread as of the closing time of the New York Stock Exchange (generally 4 p.m., Eastern time). The net asset value is also determined as of the NYSE closing time. For more information about how the ETF Shares' market prices have compared with their net asset value, visit vanguard.com, select your ETF, and then select the Price and Performance tab. The ETF premium/discount analysis there shows the percentages of days on which the ETF Shares' market price was above or below the NAV.

3

Chairman’s Letter

Dear Shareholder,

The Vanguard Sector Bond Index Funds captured the returns of their respective market segments during a period marked by swift and dramatic changes in investor sentiment and prevailing interest rates. For the full 12 months, returns ranged from 1.39% for Vanguard Short-Term Government Bond Index Fund’s ETF Shares (as calculated by changes in net asset value, adjusted for distributions) to 5.70% for the Institutional Shares of Vanguard Intermediate-Term Corporate Bond Index Fund.

The 30-day SEC yields of the short- and intermediate-term funds declined over the period; the yields of the mortgage-backed securities fund and the two long-term funds were unchanged or slightly higher.

The Vanguard Short- and Long-Term Corporate Bond Index Funds finished the period a step behind the average returns of their peer groups; the rest of the sector bond index funds outperformed their peer-group averages.

As expected, there were differences between fund and index returns that can be attributed to the real impact of operating and transaction costs and to the funds’ sampling strategy. (It’s impractical to own every single security in the indexes; instead, we use a sophisticated sampling method-ology to capture the indexes’ investment characteristics.) We expect these gaps to moderate, though not necessarily disappear, as the funds’ asset bases increase. The gaps also reflect differences in the bond-pricing models used by the

4

index provider and Vanguard. These gaps generally disappear in the normal course of bond market trading.

Solid 12-month returns in a tale of two markets

Even as yields hovered near generational lows, the U.S. bond market produced solid returns in a fiscal year marked by distinct periods of weakness and strength.

In the first half of the year, yields rose (and prices declined) as the prospect of improved economic growth and inflationary pressures set the market’s tone. In the second half, risk aversion was on the rise. Investors bid up Treasuries, trimming the yield of the 10-year Treasury note to barely 2%.

The rush into investment-grade bonds (Treasuries, in particular) boosted near-term returns, even as declining yields implied more modest results on subsequent bond purchases. For the full year, the taxable investment-grade U.S. bond market returned 4.62%; the broad municipal bond market returned 2.66%.

The yields of money market instruments remained near zero, consistent with the Federal Reserve’s target for short-term interest rates. Toward the end of the period, the Fed indicated that it expected to maintain this exceptionally low target at least through mid-2013.

| Market Barometer | |||

| Average Annual Total Returns | |||

| Periods Ended August 31, 2011 | |||

| One | Three | Five | |

| Year | Years | Years | |

| Bonds | |||

| Barclays Capital U.S. Aggregate Bond Index (Broad | |||

| taxable market) | 4.62% | 7.23% | 6.56% |

| Barclays Capital Municipal Bond Index (Broad tax-exempt | |||

| market) | 2.66 | 6.00 | 4.94 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.12 | 0.24 | 1.69 |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 19.06% | 0.84% | 1.11% |

| Russell 2000 Index (Small-caps) | 22.19 | 0.83 | 1.53 |

| Dow Jones U.S. Total Stock Market Index | 19.16 | 1.18 | 1.52 |

| MSCI All Country World Index ex USA (International) | 10.34 | -0.97 | 0.79 |

| CPI | |||

| Consumer Price Index | 3.77% | 1.12% | 2.13% |

5

A stock market rally followed by a partial retreat

The bond market’s midyear pivot was mirrored in the stock market. During the first six months, stock prices surged, with the broad U.S. stock market returning about 29%. As the slow, grinding economic recovery seemed to gather momentum, energy and industrial stocks, which are keenly sensitive to the rhythms of the business cycle, produced the best returns.

In the second six months, growth decelerated and stock market volatility spiked, amplified by Europe’s sovereign-debt drama, political wrangling over the U.S. debt ceiling, and Standard & Poor’s decision to downgrade the U.S. credit rating. (Vanguard’s confidence in the “full faith and credit” of the U.S. government remains unshaken.) Stock prices retreated, and those sectors that led the market in the first half lost ground in the second, displaced by defensive sectors such as utilities and consumer staples.

Same dynamics, different degrees of response

The performance of both investment- grade corporate and government bonds responded to similar dynamics in the 12 months ended August 31. In part because

Expense Ratios

Your Fund Compared With Its Peer Group

| Signal | Institutional | ETF | Peer Group | |

| Shares | Shares | Shares | Average | |

| Short-Term Government Bond Index Fund | 0.15% | 0.09% | 0.15% | 0.86% |

| Intermediate-Term Government Bond Index | ||||

| Fund | 0.15 | 0.09 | 0.15 | 0.93 |

| Long-Term Government Bond Index Fund | 0.15 | 0.09 | 0.15 | 1.14 |

| Short-Term Corporate Bond Index Fund | 0.15 | 0.09 | 0.15 | 0.87 |

| Intermediate-Term Corporate Bond Index | ||||

| Fund | 0.15 | 0.09 | 0.15 | 0.91 |

| Long-Term Corporate Bond Index Fund | 0.15 | 0.09 | 0.15 | 1.05 |

| Mortgage-Backed Securities Index Fund | 0.15 | — | 0.15 | 0.92 |

The fund expense ratios shown are from the prospectus dated December 28, 2010, and represent estimated costs for the current fiscal year. For the fiscal year ended August 31, 2011, the funds’ expense ratios were: for the Short-Term Government Bond Index Fund, 0.14% for Signal Shares, 0.09% for Institutional Shares, and 0.14% for ETF Shares; for the Intermediate-Term Government Bond Index Fund, 0.13% for Signal Shares, 0.09% for Institutional Shares, and 0.14% for ETF Shares; for the Long-Term Government Bond Index Fund, 0.14% for Signal Shares, 0.09% for Institutional Shares, and 0.14% for ETF Shares; for the Short-Term Corporate Bond Index Fund, 0.09% for Institutional Shares, and 0.14% for ETF Shares; for the Intermediate-Term Corporate Bond Index Fund, 0.14% for Signal Shares, 0.09% for Institutional Shares, and 0.14% for ETF Shares; for the Long-Term Corporate Bond Index Fund, 0.14% for Signal Shares, 0.09% for Institutional Shares, and 0.14% for ETF Shares; and for the Mortgage-Backed Securities Index Fund, 0.15% for Signal Shares and 0.15% for ETF Shares. For the Short-Term Corporate Bond Index Fund Signal Shares, the annualized expense ratio from inception on November 18, 2010, through August 31, 2011, was 0.14%. Peer-group expense ratios are derived from data provided by Lipper Inc. and capture information through year-end 2010.

Peer groups: For the Short-Term Government Bond Index Fund, Short U.S. Government Funds; for the Intermediate-Term Government Bond Index Fund, Intermediate U.S. Government Funds; for the Long-Term Government Bond Index Fund, General U.S. Government Funds; for the Short-Term Corporate Bond Index Fund, Short-Intermediate Investment-Grade Debt Funds; for the Intermediate-Term Corporate Bond Index Fund, Intermediate Investment-Grade Debt Funds; for the Long-Term Corporate Bond Index Fund, Corporate A-Rated Debt Funds; for the Mortgage-Backed Securities Index Fund, U.S. Mortgage Funds.

6

of their greater liquidity, which makes them a better barometer of fast-changing investor sentiment, government bonds responded to these dynamics in a more dramatic fashion.

In the first half of the fiscal year, as economic reports and the surprising strength of corporate earnings encouraged investors to seek opportunities beyond the relatively scant yields on longer-term investment-grade bonds, Vanguard Long-Term Corporate Bond Index Fund returned about –3%; the long-term government fund returned about –10%. Vanguard Intermediate-Term Government Bond Index Fund, also produced a negative return. The other intermediate- and short-term funds held up better as interest income offset negative price returns.

In the second half of the year, gathering economic gloom cast a shadow on the stock market and other riskier assets. Investors sought safety in investment-grade bonds. Vanguard Long-Term Government Bond Index Fund returned more than 16% for the six-month period; its corporate counterpart returned almost 8%. The shorter-maturity funds also registered strong returns as investors bid up prices.

Over the full 12 months, the funds’ weak start and strong finish added up to modestly positive returns at the short end of the yield curve, respectable 5%-plus returns for the intermediate-term government and corporate bond funds, and 4%-plus returns at the long end. Vanguard Mortgage-Backed Securities Index Fund

| Yields of U.S. Treasury Securities | ||

| August 31, | August 31, | |

| Maturity | 2010 | 2011 |

| 2 years | 0.48% | 0.19% |

| 3 years | 0.70 | 0.32 |

| 5 years | 1.34 | 0.95 |

| 10 years | 2.48 | 2.22 |

| 30 years | 3.53 | 3.59 |

| Source: Vanguard. | ||

7

kept pace with Vanguard Intermediate-Term Government Bond Index Fund, a surprising result in a period of declining rates.

When mortgage rates tumble, as they did over the fiscal year, the returns of mortgage-backed securities can be restrained as homeowners refinance into lower-cost, and thus lower-returning, mortgages. As the economy and the housing market struggled and mortgage lending standards tightened, however, homeowners have been less able to take advantage of lower mortgage rates, reducing the securities’ prepayment risk.

A balanced response to unnerving shocks

Since their introduction almost two years ago, the Vanguard Sector Bond Index Funds have provided exposure to narrow segments of the investment-grade U.S. bond market, allowing investors to round out incomplete portfolios or execute strategies tailored to a unique goal. Like Vanguard’s more broadly diversified index funds, the Sector Bond Index Funds benefit from the Fixed Income Group’s pioneering work in index fund management and from the funds’ low costs.

Over the past year, these timeless benefits have been eclipsed by disappointing economic reports, policymaking strife, and investors’ swift reactions in the stock and bond markets. As always, the most effective preparation for these shocks is to maintain a diversified portfolio balanced between riskier assets such as stock funds and risk-reducing assets such as bond and money market funds. An investment mix consistent with your goals and risk tolerance can help reinforce your resolve to stick with a sensible plan through good times and bad.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

September 14, 2011

8

Your Fund’s Performance at a Glance

August 31, 2010 , Through August 31, 2011

| Distributions Per Share | ||||

| Starting | Ending | Income | Capital | |

| Share Price | Share Price | Dividends | Gains | |

| Vanguard Short-Term Government Bond Index | ||||

| Fund | ||||

| Signal Shares | $20.25 | $20.39 | $0.135 | $0.008 |

| Institutional Shares | 25.45 | 25.62 | 0.183 | 0.010 |

| ETF Shares | 60.70 | 61.11 | 0.405 | 0.024 |

| Vanguard Intermediate-Term Government | ||||

| Bond Index Fund | ||||

| Signal Shares | $21.49 | $21.94 | $0.441 | $0.208 |

| Institutional Shares | 26.65 | 27.21 | 0.558 | 0.258 |

| ETF Shares | 63.58 | 64.91 | 1.304 | 0.616 |

| Vanguard Long-Term Government Bond Index | ||||

| Fund | ||||

| Signal Shares | $22.75 | $22.91 | $0.781 | $0.021 |

| Institutional Shares | 28.87 | 29.06 | 1.004 | 0.027 |

| ETF Shares | 67.61 | 68.07 | 2.324 | 0.063 |

| Vanguard Short-Term Corporate Bond Index | ||||

| Fund | ||||

| Signal Shares (Inception: 11/18/2010) | $21.21 | $21.26 | $0.410 | $0.018 |

| Institutional Shares | 25.90 | 26.03 | 0.618 | 0.022 |

| ETF Shares | 77.68 | 78.06 | 1.813 | 0.065 |

| Vanguard Intermediate-Term Corporate Bond | ||||

| Index Fund | ||||

| Signal Shares | $21.76 | $21.98 | $0.875 | $0.093 |

| Institutional Shares | 26.90 | 27.17 | 1.097 | 0.114 |

| ETF Shares | 80.67 | 81.49 | 3.248 | 0.343 |

| Vanguard Long-Term Corporate Bond Index | ||||

| Fund | ||||

| Signal Shares | $22.00 | $21.69 | $1.100 | $0.064 |

| Institutional Shares | 27.32 | 26.93 | 1.379 | 0.080 |

| ETF Shares | 81.96 | 80.80 | 4.095 | 0.239 |

| Vanguard Mortgage-Backed Securities Index | ||||

| Fund | ||||

| Signal Shares | $20.52 | $20.76 | $0.456 | $0.329 |

| ETF Shares | 51.31 | 51.90 | 1.142 | 0.822 |

9

Short-Term Government Bond Index Fund

Fund Profile

As of August 31, 2011

| Share-Class Characteristics | |||

| Signal | Institutional | ETF | |

| Shares | Shares | Shares | |

| Ticker Symbol | VSBSX | VSBIX | VGSH |

| Expense Ratio1 | 0.15% | 0.09% | 0.15% |

| 30-Day SEC Yield | 0.18% | 0.18% | 0.17% |

| Financial Attributes | |||

| Barclays | |||

| 1–3 Year | |||

| Gov’t | Barclays | ||

| Float Adj | Aggregate | ||

| Fund | Index | FA Index | |

| Number of Bonds | 127 | 420 | 7,873 |

| Yield to Maturity | |||

| (before expenses) | 0.2% | 0.3% | 2.3% |

| Average Coupon | 1.7% | 1.8% | 4.1% |

| Average Duration | 1.8 years | 1.8 years | 5.1 years |

| Average Effective | |||

| Maturity | 1.9 years | 1.9 years | 7.3 years |

| Short-Term | |||

| Reserves | 0.8% | — | — |

| Sector Diversification (% of portfolio) | |||

| Treasury/Agency | 100.0% | ||

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are not backed by the full faith and credit of the U.S. government.

| Distribution by Maturity (% of portfolio) | |

| Under 1 Year | 3.9% |

| 1 - 3 Years | 95.9 |

| 3 - 5 Years | 0.2 |

| Distribution by Credit Quality (% of portfolio) | |

| U.S. Government | 100.0% |

| For information about these ratings, see the Glossary entry for Credit Quality. | |

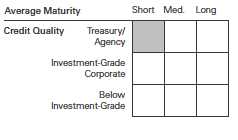

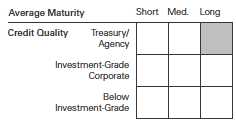

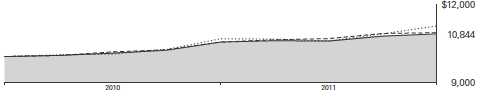

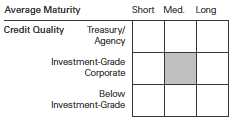

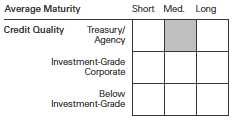

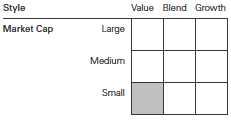

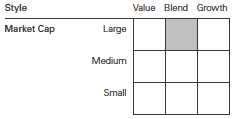

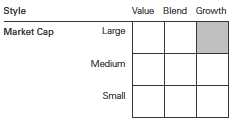

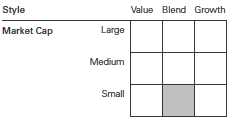

Investment Focus

1 The expense ratios shown are from the prospectus dated December 28, 2010, and represent estimated costs for the current fiscal year. For the fiscal year ended August 31, 2011, the expense ratios were 0.14% for Signal Shares, 0.09% for Institutional Shares, and 0.14% for ETF Shares.

10

Short-Term Government Bond Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

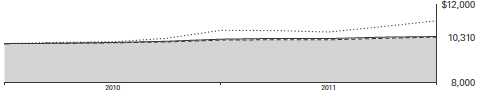

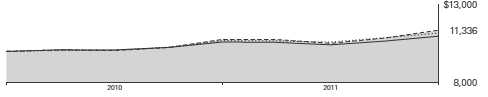

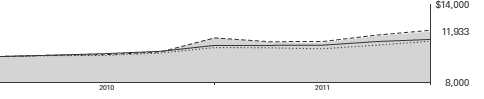

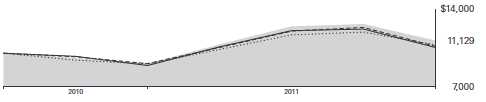

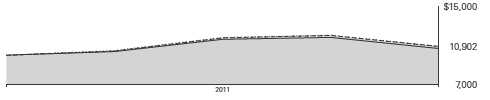

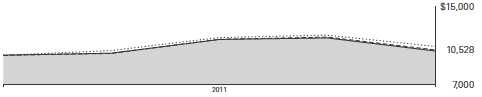

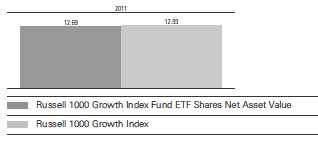

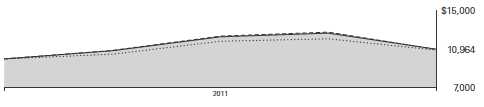

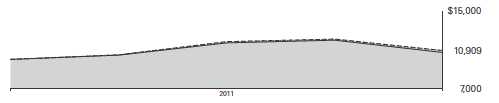

Cumulative Performance: November 19, 2009, Through August 31, 2011

Initial Investment of $10,000

| Average Annual Total Returns | |||

| Periods Ended August 31, 2011 | |||

| Since | Final Value | ||

| One | Inception | of a $10,000 | |

| Year | (11/19/2009) | Investment | |

| Short-Term Government Bond Index | |||

| Fund ETF Shares Net Asset Value | 1.39% | 1.73% | $10,310 |

| Short-Term Government Bond Index | |||

| Fund ETF Shares Market Price | 1.35 | 1.77 | 10,317 |

| Spliced Barclays Capital U.S. | |||

| Aggregate Float Adjusted Index | 4.62 | 6.49 | 11,184 |

| Barclays Capital U.S. 1–3 Year | |||

| Government Float Adjusted Index | 1.53 | 1.88 | 10,338 |

| Short U.S. Government Funds Average | 1.35 | 2.05 | 10,369 |

"Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards.

Spliced Barclays Capital U.S. Aggregate Float Adjusted Index: Barclays Capital U.S. Aggregate Bond Index through December 31, 2009; Barclays Capital U.S. Aggregate Float Adjusted Index thereafter.

Short U.S. Government Funds Average: Derived from data provided by Lipper Inc.

See Financial Highlights for dividend and capital gains information.

11

Short-Term Government Bond Index Fund

| Average Annual Total Returns | |||

| Periods Ended August 31, 2011 | |||

| Since | Final Value | ||

| One | Inception | of a $10,000 | |

| Year | (12/28/2009) | Investment | |

| Short-Term Government Bond | |||

| Index Fund Signal Shares | 1.40% | 2.13% | $10,360 |

| Spliced Barclays Capital U.S. | |||

| Aggregate Float Adjusted Index | 4.62 | 7.58 | 11,300 |

| Barclays Capital U.S. 1–3 Year | |||

| Government Float Adjusted Index | 1.53 | 2.27 | 10,382 |

| "Since Inception" performance is calculated from the Signal Shares’ inception date for both the fund and its comparative standards. | |||

| Since | Final Value | ||

| One | Inception | of a $5,000,000 | |

| Year | (8/23/2010) | Investment | |

| Short-Term Government Bond Index | |||

| Fund Institutional Shares | 1.43% | 1.43% | $5,073,306 |

| Barclays Capital U.S. Aggregate | |||

| Float Adjusted Index | 4.62 | 4.91 | 5,250,873 |

| Barclays Capital U.S. 1–3 Year | |||

| Government Float Adjusted Index | 1.53 | 1.54 | 5,078,561 |

| "Since Inception" performance is calculated from the Institutional Shares’ inception date for both the fund and its comparative standards. | |||

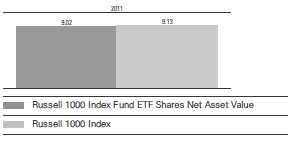

| Cumulative Returns of ETF Shares: November 19, 2009, Through August 31, 2011 | ||

| Since | ||

| One | Inception | |

| Year | (11/19/2009) | |

| Short-Term Government Bond Index Fund | ||

| ETF Shares Market Price | 1.35% | 3.17% |

| Short-Term Government Bond Index Fund | ||

| ETF Shares Net Asset Value | 1.39 | 3.10 |

| Barclays Capital U.S. 1–3 Year Government Float | ||

| Adjusted Index | 1.53 | 3.38 |

| "Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards. | ||

12

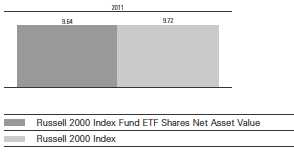

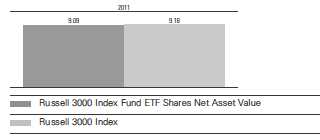

Short-Term Government Bond Index Fund

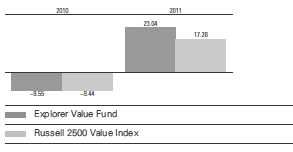

| Fiscal-Year Total Returns (%): November 19, 2009, Through August 31, 2011 | ||

| Barclays | ||

| 1–3 Year | ||

| Gov’t | ||

| Float Adj | ||

| ETF Shares Net Asset Value | Index | |

| Fiscal Year | Total Returns | Total Returns |

| 2010 | 1.69% | 1.83% |

| 2011 | 1.39 | 1.53 |

Average Annual Total Returns: Periods Ended June 30, 2011

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| Since Inception | |||||

| Inception Date | One Year | Income | Capital | Total | |

| Signal Shares | 12/28/2009 | 1.18% | 0.71% | 1.26% | 1.97% |

| Institutional Shares | 8/23/2010 | — | 0.68 | 0.20 | 0.88 |

| ETF Shares | 11/19/2009 | ||||

| Market Price | 1.19 | 1.60 | |||

| Net Asset Value | 1.22 | 1.55 |

13

Short-Term Government Bond Index Fund

Financial Statements

Statement of Net Assets

As of August 31, 2011

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Face | Market | |||

| Maturity | Amount | Value | ||

| Coupon | Date | ($000) | ($000) | |

| U.S. Government and Agency Obligations (98.6%) | ||||

| U.S. Government Securities (79.4%) | ||||

| United States Treasury Note/Bond | 1.750% | 8/15/12 | 2,201 | 2,235 |

| United States Treasury Note/Bond | 4.375% | 8/15/12 | 1,305 | 1,358 |

| United States Treasury Note/Bond | 0.375% | 8/31/12 | 841 | 843 |

| United States Treasury Note/Bond | 4.125% | 8/31/12 | 1,144 | 1,189 |

| United States Treasury Note/Bond | 1.375% | 9/15/12 | 2,560 | 2,592 |

| United States Treasury Note/Bond | 0.375% | 9/30/12 | 2,014 | 2,019 |

| United States Treasury Note/Bond | 4.250% | 9/30/12 | 902 | 942 |

| United States Treasury Note/Bond | 1.375% | 10/15/12 | 2,890 | 2,929 |

| United States Treasury Note/Bond | 0.375% | 10/31/12 | 1,311 | 1,314 |

| United States Treasury Note/Bond | 3.875% | 10/31/12 | 3,533 | 3,685 |

| United States Treasury Note/Bond | 1.375% | 11/15/12 | 2,381 | 2,416 |

| United States Treasury Note/Bond | 4.000% | 11/15/12 | 767 | 802 |

| United States Treasury Note/Bond | 0.500% | 11/30/12 | 2,296 | 2,306 |

| United States Treasury Note/Bond | 3.375% | 11/30/12 | 855 | 889 |

| United States Treasury Note/Bond | 1.125% | 12/15/12 | 3,352 | 3,393 |

| United States Treasury Note/Bond | 0.625% | 12/31/12 | 1,753 | 1,763 |

| United States Treasury Note/Bond | 3.625% | 12/31/12 | 2,900 | 3,033 |

| United States Treasury Note/Bond | 1.375% | 1/15/13 | 2,275 | 2,312 |

| United States Treasury Note/Bond | 0.625% | 1/31/13 | 2,285 | 2,299 |

| United States Treasury Note/Bond | 2.875% | 1/31/13 | 1,440 | 1,495 |

| United States Treasury Note/Bond | 1.375% | 2/15/13 | 2,584 | 2,628 |

| United States Treasury Note/Bond | 3.875% | 2/15/13 | 1,644 | 1,732 |

| United States Treasury Note/Bond | 0.625% | 2/28/13 | 2,475 | 2,491 |

| United States Treasury Note/Bond | 2.750% | 2/28/13 | 1,325 | 1,376 |

| United States Treasury Note/Bond | 1.375% | 3/15/13 | 2,656 | 2,704 |

| United States Treasury Note/Bond | 0.750% | 3/31/13 | 2,564 | 2,586 |

| United States Treasury Note/Bond | 2.500% | 3/31/13 | 2,579 | 2,672 |

| United States Treasury Note/Bond | 1.750% | 4/15/13 | 1,241 | 1,272 |

| United States Treasury Note/Bond | 0.625% | 4/30/13 | 2,414 | 2,431 |

| United States Treasury Note/Bond | 3.125% | 4/30/13 | 1,517 | 1,591 |

| United States Treasury Note/Bond | 1.375% | 5/15/13 | 3,707 | 3,781 |

| United States Treasury Note/Bond | 3.625% | 5/15/13 | 1,405 | 1,487 |

| United States Treasury Note/Bond | 0.500% | 5/31/13 | 3,375 | 3,393 |

| United States Treasury Note/Bond | 3.500% | 5/31/13 | 1,355 | 1,433 |

| United States Treasury Note/Bond | 1.125% | 6/15/13 | 2,133 | 2,168 |

| United States Treasury Note/Bond | 0.375% | 6/30/13 | 4,750 | 4,766 |

| United States Treasury Note/Bond | 3.375% | 6/30/13 | 2,387 | 2,525 |

14

| Short-Term Government Bond Index Fund | ||||

| Face | Market | |||

| Maturity | Amount | Value | ||

| Coupon | Date | ($000) | ($000) | |

| United States Treasury Note/Bond | 1.000% | 7/15/13 | 2,809 | 2,851 |

| United States Treasury Note/Bond | 0.375% | 7/31/13 | 3,100 | 3,110 |

| United States Treasury Note/Bond | 3.375% | 7/31/13 | 2,312 | 2,452 |

| United States Treasury Note/Bond | 0.750% | 8/15/13 | 3,440 | 3,477 |

| United States Treasury Note/Bond | 4.250% | 8/15/13 | 2,938 | 3,169 |

| United States Treasury Note/Bond | 0.125% | 8/31/13 | 2,200 | 2,197 |

| United States Treasury Note/Bond | 3.125% | 8/31/13 | 1,335 | 1,412 |

| United States Treasury Note/Bond | 0.750% | 9/15/13 | 1,498 | 1,514 |

| United States Treasury Note/Bond | 3.125% | 9/30/13 | 1,631 | 1,730 |

| United States Treasury Note/Bond | 0.500% | 10/15/13 | 981 | 987 |

| United States Treasury Note/Bond | 2.750% | 10/31/13 | 1,807 | 1,905 |

| United States Treasury Note/Bond | 0.500% | 11/15/13 | 2,094 | 2,106 |

| United States Treasury Note/Bond | 4.250% | 11/15/13 | 1,923 | 2,093 |

| United States Treasury Note/Bond | 2.000% | 11/30/13 | 627 | 652 |

| United States Treasury Note/Bond | 0.750% | 12/15/13 | 1,979 | 2,003 |

| United States Treasury Note/Bond | 1.500% | 12/31/13 | 1,581 | 1,627 |

| United States Treasury Note/Bond | 1.000% | 1/15/14 | 1,776 | 1,808 |

| United States Treasury Note/Bond | 1.750% | 1/31/14 | 834 | 864 |

| United States Treasury Note/Bond | 1.250% | 2/15/14 | 2,311 | 2,368 |

| United States Treasury Note/Bond | 4.000% | 2/15/14 | 2,254 | 2,460 |

| United States Treasury Note/Bond | 1.875% | 2/28/14 | 1,616 | 1,681 |

| United States Treasury Note/Bond | 1.250% | 3/15/14 | 1,183 | 1,213 |

| United States Treasury Note/Bond | 1.750% | 3/31/14 | 2,004 | 2,080 |

| United States Treasury Note/Bond | 1.250% | 4/15/14 | 2,131 | 2,186 |

| United States Treasury Note/Bond | 1.875% | 4/30/14 | 2,275 | 2,371 |

| United States Treasury Note/Bond | 1.000% | 5/15/14 | 2,420 | 2,468 |

| United States Treasury Note/Bond | 4.750% | 5/15/14 | 1,859 | 2,083 |

| United States Treasury Note/Bond | 2.250% | 5/31/14 | 3,802 | 4,005 |

| United States Treasury Note/Bond | 0.750% | 6/15/14 | 2,300 | 2,329 |

| United States Treasury Note/Bond | 0.625% | 7/15/14 | 4,770 | 4,813 |

| United States Treasury Note/Bond | 0.500% | 8/15/14 | 7,000 | 7,036 |

| 153,900 | ||||

| Agency Bonds and Notes (19.2%) | ||||

| 1 Ally Financial Inc. | 1.750% | 10/30/12 | 550 | 559 |

| 1 Citibank NA | 1.750% | 12/28/12 | 450 | 458 |

| 1 Citigroup Funding Inc. | 1.875% | 10/22/12 | 675 | 686 |

| 2 Federal Agricultural Mortgage Corp. | 1.250% | 12/6/13 | 45 | 46 |

| 2 Federal Farm Credit Bank | 1.750% | 2/21/13 | 200 | 204 |

| 2 Federal Farm Credit Bank | 1.375% | 6/25/13 | 60 | 61 |

| 2 Federal Farm Credit Bank | 1.125% | 2/27/14 | 100 | 102 |

| 2 Federal Farm Credit Bank | 2.625% | 4/17/14 | 550 | 581 |

| 2 Federal Home Loan Banks | 1.625% | 9/26/12 | 690 | 700 |

| 2 Federal Home Loan Banks | 4.625% | 10/10/12 | 600 | 629 |

| 2 Federal Home Loan Banks | 1.625% | 11/21/12 | 410 | 417 |

| 2 Federal Home Loan Banks | 1.750% | 12/14/12 | 50 | 51 |

| 2 Federal Home Loan Banks | 1.500% | 1/16/13 | 25 | 25 |

| 2 Federal Home Loan Banks | 1.625% | 3/20/13 | 25 | 26 |

| 2 Federal Home Loan Banks | 1.000% | 3/27/13 | 900 | 910 |

| 2 Federal Home Loan Banks | 3.875% | 6/14/13 | 50 | 53 |

| 2 Federal Home Loan Banks | 1.875% | 6/21/13 | 1,700 | 1,747 |

| 2 Federal Home Loan Banks | 0.500% | 8/28/13 | 1,300 | 1,304 |

| 2 Federal Home Loan Banks | 4.000% | 9/6/13 | 250 | 268 |

| 2 Federal Home Loan Banks | 0.875% | 12/27/13 | 1,910 | 1,929 |

| 2 Federal Home Loan Banks | 2.500% | 6/13/14 | 100 | 105 |

| 2 Federal Home Loan Banks | 5.500% | 8/13/14 | 700 | 803 |

15

| Short-Term Government Bond Index Fund | |||||

| Face | Market | ||||

| Maturity | Amount | Value | |||

| Coupon | Date | ($000) | ($000) | ||

| 2 | Federal Home Loan Mortgage Corp. | 2.125% | 9/21/12 | 650 | 663 |

| 2 | Federal Home Loan Mortgage Corp. | 0.375% | 11/30/12 | 250 | 250 |

| 2 | Federal Home Loan Mortgage Corp. | 0.625% | 12/28/12 | 1,310 | 1,315 |

| 2 | Federal Home Loan Mortgage Corp. | 0.750% | 12/28/12 | 150 | 151 |

| 2 | Federal Home Loan Mortgage Corp. | 0.750% | 3/28/13 | 1,675 | 1,687 |

| 2 | Federal Home Loan Mortgage Corp. | 1.625% | 4/15/13 | 2,780 | 2,840 |

| 2 | Federal Home Loan Mortgage Corp. | 4.500% | 7/15/13 | 375 | 404 |

| 2 | Federal Home Loan Mortgage Corp. | 0.875% | 10/28/13 | 745 | 753 |

| 2 | Federal Home Loan Mortgage Corp. | 2.500% | 1/7/14 | 265 | 278 |

| 2 | Federal Home Loan Mortgage Corp. | 4.500% | 1/15/14 | 200 | 219 |

| 2 | Federal Home Loan Mortgage Corp. | 1.375% | 2/25/14 | 1,065 | 1,089 |

| 2 | Federal Home Loan Mortgage Corp. | 2.500% | 4/23/14 | 190 | 200 |

| 2 | Federal Home Loan Mortgage Corp. | 3.000% | 7/28/14 | 285 | 306 |

| 2 | Federal Home Loan Mortgage Corp. | 1.000% | 7/30/14 | 325 | 330 |

| 2 | Federal Home Loan Mortgage Corp. | 1.000% | 8/27/14 | 800 | 811 |

| 2 | Federal Home Loan Mortgage Corp. | 0.500% | 9/19/14 | 475 | 474 |

| 2 | Federal National Mortgage Assn. | 4.375% | 9/15/12 | 945 | 985 |

| 2 | Federal National Mortgage Assn. | 0.625% | 9/24/12 | 200 | 201 |

| 2 | Federal National Mortgage Assn. | 0.500% | 10/30/12 | 500 | 501 |

| 2 | Federal National Mortgage Assn. | 0.375% | 12/28/12 | 1,155 | 1,156 |

| 2 | Federal National Mortgage Assn. | 0.750% | 2/26/13 | 1,200 | 1,208 |

| 2 | Federal National Mortgage Assn. | 4.375% | 3/15/13 | 1,570 | 1,668 |

| 2 | Federal National Mortgage Assn. | 1.750% | 5/7/13 | 25 | 26 |

| 2 | Federal National Mortgage Assn. | 1.500% | 6/26/13 | 475 | 485 |

| 2 | Federal National Mortgage Assn. | 3.875% | 7/12/13 | 280 | 298 |

| 2 | Federal National Mortgage Assn. | 0.500% | 8/9/13 | 1,125 | 1,128 |

| 2 | Federal National Mortgage Assn. | 1.250% | 8/20/13 | 550 | 560 |

| 2 | Federal National Mortgage Assn. | 2.875% | 12/11/13 | 80 | 84 |

| 2 | Federal National Mortgage Assn. | 0.750% | 12/18/13 | 2,065 | 2,080 |

| 2 | Federal National Mortgage Assn. | 2.750% | 2/5/14 | 370 | 391 |

| 2 | Federal National Mortgage Assn. | 1.250% | 2/27/14 | 600 | 612 |

| 2 | Federal National Mortgage Assn. | 2.750% | 3/13/14 | 225 | 238 |

| 2 | Federal National Mortgage Assn. | 1.125% | 6/27/14 | 475 | 484 |

| 2 | Federal National Mortgage Assn. | 0.875% | 8/28/14 | 1,250 | 1,263 |

| 1 | General Electric Capital Corp. | 2.000% | 9/28/12 | 115 | 117 |

| 1 | General Electric Capital Corp. | 2.125% | 12/21/12 | 255 | 261 |

| 37,180 | |||||

| Total U.S. Government and Agency Obligations (Cost $189,485) | 191,080 | ||||

| Shares | |||||

| Temporary Cash Investment (0.8%) | |||||

| Money Market Fund (0.8%) | |||||

| 3 | Vanguard Market Liquidity Fund (Cost $1,465) | 0.132% | 1,464,608 | 1,465 | |

| Total Investments (99.4%) (Cost $190,950) | 192,545 | ||||

| Other Assets and Liabilities (0.6%) | |||||

| Other Assets | 13,577 | ||||

| Liabilities | (12,398) | ||||

| 1,179 | |||||

| Net Assets (100%) | 193,724 | ||||

16

| Short-Term Government Bond Index Fund | |

| Market | |

| Value | |

| ($000) | |

| Statement of Assets and Liabilities | |

| Assets | |

| Investments in Securities, at Value | 192,545 |

| Receivables for Investment Securities Sold | 12,568 |

| Other Assets | 1,009 |

| Total Assets | 206,122 |

| Liabilities | |

| Payables for Investment Securities Purchased | 12,057 |

| Other Liabilities | 341 |

| Total Liabilities | 12,398 |

| Net Assets | 193,724 |

| At August 31, 2011, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 191,857 |

| Overdistributed Net Investment Income | (9) |

| Accumulated Net Realized Gains | 281 |

| Unrealized Appreciation (Depreciation) | 1,595 |

| Net Assets | 193,724 |

| Signal Shares—Net Assets | |

| Applicable to 521,107 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 10,624 |

| Net Asset Value Per Share—Signal Shares | $20.39 |

| Institutional Shares—Net Assets | |

| Applicable to 1,302,610 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 33,375 |

| Net Asset Value Per Share—Institutional Shares | $25.62 |

| ETF Shares—Net Assets | |

| Applicable to 2,450,000 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 149,725 |

| Net Asset Value Per Share—ETF Shares | $61.11 |

See Note A in Notes to Financial Statements.

1 Guaranteed by the Federal Deposit Insurance Corporation (FDIC) as part of the Temporary Liquidity Guarantee Program.

2 The issuer operates under a congressional charter; its securities are not backed by the full faith and credit of the U.S. government.

3 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

See accompanying Notes, which are an integral part of the Financial Statements.

17

Short-Term Government Bond Index Fund

Statement of Operations

| Year Ended | |

| August 31, 2011 | |

| ($000) | |

| Investment Income | |

| Income | |

| Interest1 | 1,110 |

| Total Income | 1,110 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 8 |

| Management and Administrative—Signal Shares | 8 |

| Management and Administrative—Institutional Shares | 10 |

| Management and Administrative—ETF Shares | 74 |

| Marketing and Distribution—Signal Shares | 3 |

| Marketing and Distribution—Institutional Shares | — |

| Marketing and Distribution—ETF Shares | 30 |

| Custodian Fees | 2 |

| Auditing Fees | 41 |

| Shareholders’ Reports—Signal Shares | — |

| Shareholders’ Reports—Institutional Shares | — |

| Shareholders’ Reports—ETF Shares | 7 |

| Total Expenses | 183 |

| Net Investment Income | 927 |

| Realized Net Gain (Loss) on Investment Securities Sold | 360 |

| Change in Unrealized Appreciation (Depreciation) of Investment Securities | 887 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 2,174 |

| 1 Interest income from an affiliated company of the fund was $3,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

18

Short-Term Government Bond Index Fund

Statement of Changes in Net Assets

| November 19, | ||

| Year Ended | 20091 to | |

| August 31, | August 31, | |

| 2011 | 2010 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 927 | 283 |

| Realized Net Gain (Loss) | 360 | 44 |

| Change in Unrealized Appreciation (Depreciation) | 887 | 708 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 2,174 | 1,035 |

| Distributions | ||

| Net Investment Income | ||

| Signal Shares | (72) | (25) |

| Institutional Shares | (127) | (6) |

| ETF Shares | (737) | (252) |

| Realized Capital Gain2 | ||

| Signal Shares | (5) | — |

| Institutional Shares | (4) | — |

| ETF Shares | (41) | — |

| Total Distributions | (986) | (283) |

| Capital Share Transactions | ||

| Signal Shares | 4,982 | 5,526 |

| Institutional Shares | 25,172 | 8,005 |

| ETF Shares | 69,867 | 78,232 |

| Net Increase (Decrease) from Capital Share Transactions | 100,021 | 91,763 |

| Total Increase (Decrease) | 101,209 | 92,515 |

| Net Assets | ||

| Beginning of Period | 92,515 | — |

| End of Period3 | 193,724 | 92,515 |

1 Inception.

2 Includes fiscal 2011 short-term gain distributions totaling $50,000. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

3 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($9,000) and $0.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Short-Term Government Bond Index Fund

Financial Highlights

| Signal Shares | ||

| Year | Dec. 28, | |

| Ended | 20091 to | |

| August 31, | Aug. 31, | |

| For a Share Outstanding Throughout Each Period | 2011 | 2010 |

| Net Asset Value, Beginning of Period | $20.25 | $19.92 |

| Investment Operations | ||

| Net Investment Income | .134 | .101 |

| Net Realized and Unrealized Gain (Loss) on Investments | .149 | .329 |

| Total from Investment Operations | .283 | .430 |

| Distributions | ||

| Dividends from Net Investment Income | (.135) | (.100) |

| Distributions from Realized Capital Gains | (.008) | — |

| Total Distributions | (.143) | (.100) |

| Net Asset Value, End of Period | $20.39 | $20.25 |

| Total Return | 1.40% | 2.16% |

| Ratios/Supplemental Data | ||

| Net Assets, End of Period (Millions) | $11 | $6 |

| Ratio of Total Expenses to Average Net Assets | 0.14% | 0.15%2 |

| Ratio of Net Investment Income to Average Net Assets | 0.66% | 0.84%2 |

| Portfolio Turnover Rate3 | 69% | 69% |

1 Inception.

2 Annualized.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

20

Short-Term Government Bond Index Fund

Financial Highlights

| Institutional Shares | ||

| Year | Aug. 23, | |

| Ended | 20101 to | |

| August 31, | Aug. 31, | |

| For a Share Outstanding Throughout Each Period | 2011 | 2010 |

| Net Asset Value, Beginning of Period | $25.45 | $25.46 |

| Investment Operations | ||

| Net Investment Income | .183 | .005 |

| Net Realized and Unrealized Gain (Loss) on Investments | .180 | .003 |

| Total from Investment Operations | .363 | .008 |

| Distributions | ||

| Dividends from Net Investment Income | (.183) | (.018) |

| Distributions from Realized Capital Gains | (.010) | — |

| Total Distributions | (.193) | (.018) |

| Net Asset Value, End of Period | $25.62 | $25.45 |

| Total Return | 1.43% | 0.03% |

| Ratios/Supplemental Data | ||

| Net Assets, End of Period (Millions) | $33 | $8 |

| Ratio of Total Expenses to Average Net Assets | 0.09% | 0.09%2 |

| Ratio of Net Investment Income to Average Net Assets | 0.71% | 0.90%2 |

| Portfolio Turnover Rate3 | 69% | 69% |

1 Inception.

2 Annualized.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Short-Term Government Bond Index Fund

Financial Highlights

| ETF Shares | ||

| Year | Nov. 19, | |

| Ended | 20091 to | |

| August 31, | Aug. 31, | |

| For a Share Outstanding Throughout Each Period | 2011 | 2010 |

| Net Asset Value, Beginning of Period | $60.70 | $60.04 |

| Investment Operations | ||

| Net Investment Income | .405 | .349 |

| Net Realized and Unrealized Gain (Loss) on Investments | .434 | .660 |

| Total from Investment Operations | .839 | 1.009 |

| Distributions | ||

| Dividends from Net Investment Income | (.405) | (.349) |

| Distributions from Realized Capital Gains | (.024) | — |

| Total Distributions | (.429) | (.349) |

| Net Asset Value, End of Period | $61.11 | $60.70 |

| Total Return | 1.39% | 1.69% |

| Ratios/Supplemental Data | ||

| Net Assets, End of Period (Millions) | $150 | $79 |

| Ratio of Total Expenses to Average Net Assets | 0.14% | 0.15%2 |

| Ratio of Net Investment Income to Average Net Assets | 0.66% | 0.84%2 |

| Portfolio Turnover Rate3 | 69% | 69% |

1 Inception.

2 Annualized.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

22

Short-Term Government Bond Index Fund

Notes to Financial Statements

Vanguard Short-Term Government Bond Index Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers three classes of shares: Signal Shares, Institutional Shares, and ETF Shares. Signal Shares and Institutional Shares are designed for investors who meet certain administrative, service, and account-size criteria. ETF Shares are listed for trading on Nasdaq; they can be purchased and sold through a broker.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Bonds, and temporary cash investments acquired over 60 days to maturity, are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Other temporary cash investments are valued at amortized cost, which approximates market value. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (August 31, 2010–2011), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

4. Other: Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees, if any, assessed on purchases of capital shares are credited to paid-in capital.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At August 31, 2011, the fund had contributed capital of $29,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.01% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

23

Short-Term Government Bond Index Fund

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the fund’s investments as of August 31, 2011, based on the inputs used to value them:

| Level 1 | Level 2 | Level 3 | |

| Investments | ($000) | ($000) | ($000) |

| U.S. Government and Agency Obligations | — | 191,080 | — |

| Temporary Cash Investments | 1,465 | — | — |

| Total | 1,465 | 191,080 | — |

D. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the year ended August 31, 2011, the fund realized $64,000 of net capital gains resulting from in-kind redemptions—in which shareholders exchanged fund shares for securities held by the fund rather than for cash. Because such gains are not taxable to the fund, and are not distributed to shareholders, they have been reclassified from accumulated net realized gains to paid-in capital.

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from realized capital gains. Accordingly, the fund has reclassified $9,000 from accumulated net realized gains to paid-in capital.

For tax purposes, at August 31, 2011, the fund had short-term and long-term capital gains of $156,000 and $125,000, respectively, available for distribution. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

At August 31, 2011, the cost of investment securities for tax purposes was $190,950,000. Net unrealized appreciation of investment securities for tax purposes was $1,595,000, consisting of unrealized gains of $1,598,000 on securities that had risen in value since their purchase and $3,000 in unrealized losses on securities that had fallen in value since their purchase.

24

Short-Term Government Bond Index Fund

E. During the year ended August 31, 2011, the fund purchased $205,391,000 of investment securities and sold $102,350,000 of investment securities, other than temporary cash investments.

F. Capital share transactions for each class of shares were:

| Year Ended | Inception1 to | |||

| August 31, 2011 | August 31, 2010 | |||

| Amount | Shares | Amount | Shares | |

| ($000) | (000) | ($000) | (000) | |

| Signal Shares | ||||

| Issued | 11,614 | 574 | 5,501 | 275 |

| Issued in Lieu of Cash Distributions | 77 | 4 | 25 | 1 |

| Redeemed | (6,709) | (333) | — | — |

| Net Increase (Decrease)—Signal Shares | 4,982 | 245 | 5,526 | 276 |

| Institutional Shares | ||||

| Issued | 25,041 | 983 | 7,999 | 314 |

| Issued in Lieu of Cash Distributions | 131 | 5 | 6 | — |

| Redeemed | — | — | — | — |

| Net Increase (Decrease)—Institutional Shares | 25,172 | 988 | 8,005 | 314 |

| ETF Shares | ||||

| Issued | 78,970 | 1,300 | 78,232 | 1,300 |

| Issued in Lieu of Cash Distributions | — | — | — | — |

| Redeemed | (9,103) | (150) | — | — |

| Net Increase (Decrease)—ETF Shares | 69,867 | 1,150 | 78,232 | 1,300 |

1 Inception was November 19, 2009, for ETF Shares, December 28, 2009, for Signal Shares, and August 23, 2010, for Institutional Shares.

G. In preparing the financial statements as of August 31, 2011, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

25

Intermediate-Term Government Bond Index Fund

Fund Profile

As of August 31, 2011

| Share-Class Characteristics | |||

| Signal | Institutional | ETF | |

| Shares | Shares | Shares | |

| Ticker Symbol | VSIGX | VIIGX | VGIT |

| Expense Ratio1 | 0.15% | 0.09% | 0.15% |

| 30-Day SEC Yield | 1.11% | 1.12% | 1.11% |

| Financial Attributes | |||

| Barclays | |||

| 3–10 Year | |||

| Gov’t | Barclays | ||

| Float Adj | Aggregate | ||

| Fund | Index | FA Index | |

| Number of Bonds | 142 | 416 | 7,873 |

| Yield to Maturity | |||

| (before expenses) | 1.2% | 1.2% | 2.3% |

| Average Coupon | 3.0% | 3.0% | 4.1% |

| Average Duration | 5.3 years | 5.3 years | 5.1 years |

| Average Effective | |||

| Maturity | 5.7 years | 5.8 years | 7.3 years |

| Short-Term | |||

| Reserves | 2.2% | — | — |

| Sector Diversification (% of portfolio) | |||

| Treasury/Agency | 100.0% | ||

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are not backed by the full faith and credit of the U.S. government.

| Distribution by Maturity (% of portfolio) | |

| Under 1 Year | 1.4% |

| 1 - 3 Years | 0.7 |

| 3 - 5 Years | 44.1 |

| 5 - 10 Years | 53.8 |

| Distribution by Credit Quality (% of portfolio) | |

| U.S. Government | 100.0% |

| For information about these ratings, see the Glossary entry for Credit Quality. | |

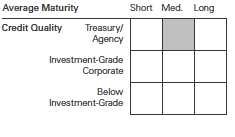

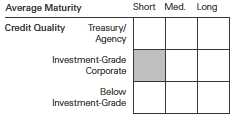

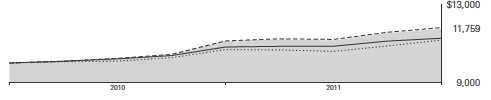

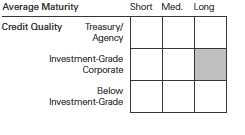

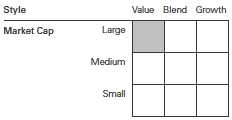

Investment Focus

1 The expense ratios shown are from the prospectus dated December 28, 2010, and represent estimated costs for the current fiscal year. For the fiscal year ended August 31, 2011, the expense ratios were 0.13% for Signal Shares, 0.09% for Institutional Shares, and 0.14% for ETF Shares.

26

Intermediate-Term Government Bond Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

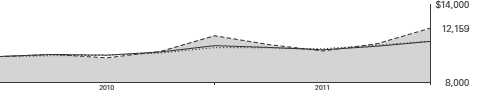

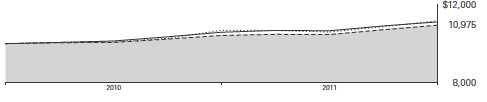

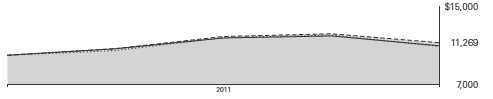

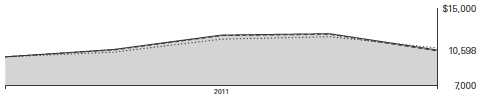

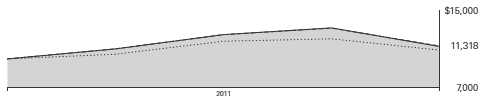

Cumulative Performance: November 19, 2009, Through August 31, 2011

Initial Investment of $10,000

| Average Annual Total Returns | |||

| Periods Ended August 31, 2011 | |||

| Since | Final Value | ||

| One | Inception | of a $10,000 | |

| Year | (11/19/2009) | Investment | |

| Intermediate-Term Government Bond | |||

| Index Fund ETF Shares Net Asset | |||

| Value | 5.30% | 7.30% | $11,336 |

| Intermediate-Term Government Bond | |||

| Index Fund ETF Shares Market Price | 5.41 | 7.38 | 11,352 |

| Spliced Barclays Capital U.S. | |||

| Aggregate Float Adjusted Index | 4.62 | 6.49 | 11,184 |

| Barclays Capital U.S. 3–10 Year | |||

| Government Float Adjusted Index | 5.53 | 7.48 | 11,372 |

| Intermediate U.S. Government Funds | |||

| Average | 3.53 | 5.40 | 10,982 |

"Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards.

Spliced Barclays Capital U.S. Aggregate Float Adjusted Index: Barclays Capital U.S. Aggregate Bond Index through December 31, 2009; Barclays Capital U.S. Aggregate Float Adjusted Index thereafter.

Intermediate U.S. Government Funds Average: Derived from data provided by Lipper Inc.

See Financial Highlights for dividend and capital gains information.

27

Intermediate-Term Government Bond Index Fund

| Average Annual Total Returns | |||

| Periods Ended August 31, 2011 | |||

| Since | Final Value | ||

| One | Inception | of a $10,000 | |

| Year | (8/4/2010) | Investment | |

| Intermediate-Term Government | |||

| Bond Index Fund Signal Shares | 5.31% | 6.87% | $10,740 |

| Barclays Capital U.S. | |||

| Aggregate Float Adjusted Index | 4.62 | 5.70 | 10,613 |

| Barclays Capital U.S. 3–10 Year | |||

| Government Float Adjusted Index | 5.53 | 7.05 | 10,759 |

| "Since Inception" performance is calculated from the Signal Shares’ inception date for both the fund and its comparative standards. | |||

| Since | Final Value | ||

| One | Inception | of a $5,000,000 | |

| Year | (3/19/2010) | Investment | |

| Intermediate-Term Government Bond | |||

| Index Fund Institutional Shares | 5.36% | 9.09% | $5,673,488 |

| Barclays Capital U.S. Aggregate | |||

| Float Adjusted Index | 4.62 | 7.12 | 5,525,177 |

| Barclays Capital U.S. 3–10 Year | |||

| Government Float Adjusted Index | 5.53 | 9.27 | 5,687,245 |

| "Since Inception" performance is calculated from the Institutional Shares’ inception date for both the fund and its comparative standards. | |||

| Cumulative Returns of ETF Shares: November 19, 2009, Through August 31, 2011 | ||

| Since | ||

| One | Inception | |

| Year | (11/19/2009) | |

| Intermediate-Term Government Bond Index Fund | ||

| ETF Shares Market Price | 5.41% | 13.52% |

| Intermediate-Term Government Bond Index Fund | ||

| ETF Shares Net Asset Value | 5.30 | 13.36 |

| Barclays Capital U.S. 3–10 Year Government Float | ||

| Adjusted Index | 5.53 | 13.72 |

| "Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards. | ||

28

Intermediate-Term Government Bond Index Fund

| Fiscal-Year Total Returns (%): November 19, 2009, Through August 31, 2011 | ||

| Barclays | ||

| 3–10 Year | ||

| Gov’t | ||

| Float Adj | ||

| ETF Shares Net Asset Value | Index | |

| Fiscal Year | Total Returns | Total Returns |

| 2010 | 7.65% | 7.76% |

| 2011 | 5.30 | 5.53 |

Average Annual Total Returns: Periods Ended June 30, 2011

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| Since Inception | |||||

| Inception Date | One Year | Income | Capital | Total | |

| Signal Shares | 8/4/2010 | — | 1.96% | 0.49% | 2.45% |

| Institutional Shares | 3/19/2010 | 3.47% | 2.35 | 4.04 | 6.39 |

| ETF Shares | 11/19/2009 | ||||

| Market Price | 3.40 | 5.04 | |||

| Net Asset Value | 3.39 | 4.99 |

29

Intermediate-Term Government Bond Index Fund

Financial Statements

Statement of Net Assets

As of August 31, 2011

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Face | Market | |||

| Maturity | Amount | Value | ||

| Coupon | Date | ($000) | ($000) | |

| U.S. Government and Agency Obligations (98.1%) | ||||

| U.S. Government Securities (90.0%) | ||||

| United States Treasury Note/Bond | 2.625% | 6/30/14 | 16 | 17 |

| United States Treasury Note/Bond | 2.625% | 7/31/14 | 656 | 700 |

| United States Treasury Note/Bond | 2.375% | 8/31/14 | 481 | 510 |

| United States Treasury Note/Bond | 2.375% | 9/30/14 | 2,034 | 2,159 |

| United States Treasury Note/Bond | 2.375% | 10/31/14 | 2,704 | 2,873 |

| United States Treasury Note/Bond | 2.125% | 11/30/14 | 2,695 | 2,844 |

| United States Treasury Note/Bond | 2.625% | 12/31/14 | 2,560 | 2,746 |

| United States Treasury Note/Bond | 2.250% | 1/31/15 | 2,254 | 2,391 |

| United States Treasury Note/Bond | 4.000% | 2/15/15 | 1,027 | 1,151 |

| United States Treasury Note/Bond | 11.250% | 2/15/15 | 461 | 631 |

| United States Treasury Note/Bond | 2.375% | 2/28/15 | 3,584 | 3,821 |

| United States Treasury Note/Bond | 2.500% | 3/31/15 | 2,180 | 2,335 |

| United States Treasury Note/Bond | 2.500% | 4/30/15 | 1,877 | 2,011 |

| United States Treasury Note/Bond | 4.125% | 5/15/15 | 1,710 | 1,934 |

| United States Treasury Note/Bond | 2.125% | 5/31/15 | 2,246 | 2,377 |

| United States Treasury Note/Bond | 1.875% | 6/30/15 | 2,010 | 2,109 |

| United States Treasury Note/Bond | 1.750% | 7/31/15 | 2,080 | 2,172 |

| United States Treasury Note/Bond | 4.250% | 8/15/15 | 633 | 723 |

| United States Treasury Note/Bond | 10.625% | 8/15/15 | 613 | 853 |

| United States Treasury Note/Bond | 1.250% | 8/31/15 | 1,696 | 1,738 |

| United States Treasury Note/Bond | 1.250% | 9/30/15 | 1,724 | 1,765 |

| United States Treasury Note/Bond | 1.250% | 10/31/15 | 1,767 | 1,808 |

| United States Treasury Note/Bond | 4.500% | 11/15/15 | 1,113 | 1,288 |

| United States Treasury Note/Bond | 9.875% | 11/15/15 | 158 | 218 |

| United States Treasury Note/Bond | 1.375% | 11/30/15 | 2,234 | 2,296 |

| United States Treasury Note/Bond | 2.125% | 12/31/15 | 794 | 841 |

| United States Treasury Note/Bond | 2.000% | 1/31/16 | 1,633 | 1,720 |

| United States Treasury Note/Bond | 4.500% | 2/15/16 | 1,085 | 1,262 |

| United States Treasury Note/Bond | 9.250% | 2/15/16 | 266 | 365 |

| United States Treasury Note/Bond | 2.125% | 2/29/16 | 800 | 848 |

| United States Treasury Note/Bond | 2.625% | 2/29/16 | 736 | 796 |

| United States Treasury Note/Bond | 2.250% | 3/31/16 | 1,913 | 2,037 |

| United States Treasury Note/Bond | 2.375% | 3/31/16 | 1,182 | 1,265 |

| United States Treasury Note/Bond | 2.000% | 4/30/16 | 1,870 | 1,969 |

| United States Treasury Note/Bond | 2.625% | 4/30/16 | 2,337 | 2,526 |

| United States Treasury Note/Bond | 5.125% | 5/15/16 | 746 | 893 |

| United States Treasury Note/Bond | 7.250% | 5/15/16 | 123 | 159 |

30

| Intermediate-Term Government Bond Index Fund | ||||

| Face | Market | |||

| Maturity | Amount | Value | ||

| Coupon | Date | ($000) | ($000) | |

| United States Treasury Note/Bond | 1.750% | 5/31/16 | 2,686 | 2,795 |

| United States Treasury Note/Bond | 3.250% | 5/31/16 | 387 | 430 |

| United States Treasury Note/Bond | 1.500% | 6/30/16 | 2,150 | 2,210 |

| United States Treasury Note/Bond | 3.250% | 6/30/16 | 1,660 | 1,845 |

| United States Treasury Note/Bond | 1.500% | 7/31/16 | 1,890 | 1,941 |

| United States Treasury Note/Bond | 3.250% | 7/31/16 | 1,177 | 1,308 |

| United States Treasury Note/Bond | 4.875% | 8/15/16 | 172 | 205 |

| United States Treasury Note/Bond | 1.000% | 8/31/16 | 2,200 | 2,203 |

| United States Treasury Note/Bond | 3.000% | 8/31/16 | 772 | 849 |

| United States Treasury Note/Bond | 3.000% | 9/30/16 | 950 | 1,044 |

| United States Treasury Note/Bond | 3.125% | 10/31/16 | 707 | 782 |

| United States Treasury Note/Bond | 4.625% | 11/15/16 | 555 | 656 |

| United States Treasury Note/Bond | 7.500% | 11/15/16 | 315 | 419 |

| United States Treasury Note/Bond | 2.750% | 11/30/16 | 3,005 | 3,265 |

| United States Treasury Note/Bond | 3.250% | 12/31/16 | 223 | 248 |

| United States Treasury Note/Bond | 3.125% | 1/31/17 | 2,670 | 2,954 |

| United States Treasury Note/Bond | 4.625% | 2/15/17 | 705 | 836 |

| United States Treasury Note/Bond | 3.000% | 2/28/17 | 927 | 1,020 |

| United States Treasury Note/Bond | 3.250% | 3/31/17 | 2,359 | 2,626 |

| United States Treasury Note/Bond | 3.125% | 4/30/17 | 863 | 955 |

| United States Treasury Note/Bond | 4.500% | 5/15/17 | 669 | 792 |

| United States Treasury Note/Bond | 8.750% | 5/15/17 | 387 | 550 |

| United States Treasury Note/Bond | 2.750% | 5/31/17 | 1,204 | 1,307 |

| United States Treasury Note/Bond | 2.500% | 6/30/17 | 1,646 | 1,762 |

| United States Treasury Note/Bond | 2.375% | 7/31/17 | 1,523 | 1,618 |

| United States Treasury Note/Bond | 4.750% | 8/15/17 | 724 | 870 |

| United States Treasury Note/Bond | 8.875% | 8/15/17 | 1,320 | 1,904 |

| United States Treasury Note/Bond | 1.875% | 8/31/17 | 1,536 | 1,587 |

| United States Treasury Note/Bond | 1.875% | 9/30/17 | 1,658 | 1,711 |

| United States Treasury Note/Bond | 1.875% | 10/31/17 | 1,550 | 1,599 |

| United States Treasury Note/Bond | 4.250% | 11/15/17 | 288 | 339 |

| United States Treasury Note/Bond | 2.250% | 11/30/17 | 2,795 | 2,944 |

| United States Treasury Note/Bond | 2.750% | 12/31/17 | 1,111 | 1,204 |

| United States Treasury Note/Bond | 2.625% | 1/31/18 | 909 | 978 |

| United States Treasury Note/Bond | 3.500% | 2/15/18 | 1,176 | 1,329 |

| United States Treasury Note/Bond | 2.750% | 2/28/18 | 1,006 | 1,090 |

| United States Treasury Note/Bond | 2.875% | 3/31/18 | 1,162 | 1,267 |

| United States Treasury Note/Bond | 2.625% | 4/30/18 | 1,567 | 1,683 |

| United States Treasury Note/Bond | 3.875% | 5/15/18 | 811 | 937 |

| United States Treasury Note/Bond | 9.125% | 5/15/18 | 171 | 256 |

| United States Treasury Note/Bond | 2.375% | 5/31/18 | 1,682 | 1,778 |

| United States Treasury Note/Bond | 2.375% | 6/30/18 | 1,805 | 1,905 |

| United States Treasury Note/Bond | 4.000% | 8/15/18 | 985 | 1,148 |

| United States Treasury Note/Bond | 1.500% | 8/31/18 | 1,300 | 1,294 |

| United States Treasury Note/Bond | 3.750% | 11/15/18 | 2,057 | 2,365 |

| United States Treasury Note/Bond | 9.000% | 11/15/18 | 133 | 201 |

| United States Treasury Note/Bond | 2.750% | 2/15/19 | 1,802 | 1,943 |

| United States Treasury Note/Bond | 8.875% | 2/15/19 | 494 | 749 |

| United States Treasury Note/Bond | 3.125% | 5/15/19 | 2,298 | 2,535 |

| United States Treasury Note/Bond | 3.625% | 8/15/19 | 2,223 | 2,531 |

| United States Treasury Note/Bond | 8.125% | 8/15/19 | 1,184 | 1,750 |

| United States Treasury Note/Bond | 3.375% | 11/15/19 | 2,885 | 3,225 |

| United States Treasury Note/Bond | 3.625% | 2/15/20 | 4,910 | 5,575 |

| United States Treasury Note/Bond | 8.500% | 2/15/20 | 295 | 449 |

| United States Treasury Note/Bond | 3.500% | 5/15/20 | 3,204 | 3,602 |

31

| Intermediate-Term Government Bond Index Fund | ||||

| Face | Market | |||

| Maturity | Amount | Value | ||

| Coupon | Date | ($000) | ($000) | |

| United States Treasury Note/Bond | 8.750% | 5/15/20 | 621 | 962 |

| United States Treasury Note/Bond | 2.625% | 8/15/20 | 3,014 | 3,157 |

| United States Treasury Note/Bond | 8.750% | 8/15/20 | 410 | 638 |

| United States Treasury Note/Bond | 2.625% | 11/15/20 | 3,712 | 3,873 |

| United States Treasury Note/Bond | 3.625% | 2/15/21 | 3,566 | 4,021 |

| United States Treasury Note/Bond | 7.875% | 2/15/21 | 306 | 458 |

| United States Treasury Note/Bond | 3.125% | 5/15/21 | 3,867 | 4,182 |

| United States Treasury Note/Bond | 8.125% | 5/15/21 | 207 | 316 |

| United States Treasury Note/Bond | 2.125% | 8/15/21 | 1,925 | 1,906 |

| 163,032 | ||||

| Agency Bonds and Notes (8.1%) | ||||

| 1 Federal Agricultural Mortgage Corp. | 2.125% | 9/15/15 | 50 | 52 |

| 1 Federal Agricultural Mortgage Corp. | 2.000% | 7/27/16 | 50 | 51 |

| 1 Federal Farm Credit Bank | 1.625% | 11/19/14 | 50 | 52 |

| 1 Federal Farm Credit Bank | 1.500% | 11/16/15 | 50 | 51 |

| 1 Federal Farm Credit Bank | 4.875% | 1/17/17 | 500 | 587 |

| 1 Federal Home Loan Banks | 4.500% | 11/14/14 | 100 | 112 |

| 1 Federal Home Loan Banks | 2.750% | 12/12/14 | 675 | 721 |

| 1 Federal Home Loan Banks | 3.125% | 3/11/16 | 425 | 463 |

| 1 Federal Home Loan Banks | 5.375% | 5/18/16 | 485 | 579 |

| 1 Federal Home Loan Banks | 4.750% | 12/16/16 | 240 | 281 |

| 1 Federal Home Loan Banks | 4.125% | 3/13/20 | 660 | 738 |

| 1 Federal Home Loan Banks | 5.625% | 6/11/21 | 400 | 495 |

| 1 Federal Home Loan Mortgage Corp. | 4.500% | 1/15/15 | 660 | 745 |

| 1 Federal Home Loan Mortgage Corp. | 5.050% | 1/26/15 | 50 | 57 |

| 1 Federal Home Loan Mortgage Corp. | 2.875% | 2/9/15 | 450 | 484 |

| 1 Federal Home Loan Mortgage Corp. | 1.750% | 9/10/15 | 1,150 | 1,189 |

| 1 Federal Home Loan Mortgage Corp. | 2.500% | 5/27/16 | 575 | 610 |

| 1 Federal Home Loan Mortgage Corp. | 5.500% | 7/18/16 | 250 | 301 |

| 1 Federal Home Loan Mortgage Corp. | 2.000% | 8/25/16 | 525 | 544 |

| 1 Federal Home Loan Mortgage Corp. | 5.000% | 2/16/17 | 100 | 118 |

| 1 Federal Home Loan Mortgage Corp. | 5.000% | 4/18/17 | 200 | 237 |

| 1 Federal Home Loan Mortgage Corp. | 5.125% | 11/17/17 | 225 | 270 |

| 1 Federal Home Loan Mortgage Corp. | 3.750% | 3/27/19 | 425 | 477 |

| 1 Federal National Mortgage Assn. | 2.625% | 11/20/14 | 600 | 639 |

| 1 Federal National Mortgage Assn. | 5.000% | 4/15/15 | 460 | 530 |

| 1 Federal National Mortgage Assn. | 2.375% | 7/28/15 | 1,075 | 1,140 |

| 1 Federal National Mortgage Assn. | 4.375% | 10/15/15 | 175 | 199 |

| 1 Federal National Mortgage Assn. | 1.625% | 10/26/15 | 75 | 77 |

| 1 Federal National Mortgage Assn. | 5.000% | 3/15/16 | 25 | 29 |

| 1 Federal National Mortgage Assn. | 2.375% | 4/11/16 | 100 | 105 |

| 1 Federal National Mortgage Assn. | 4.875% | 12/15/16 | 100 | 118 |

| 1 Federal National Mortgage Assn. | 5.000% | 2/13/17 | 380 | 450 |

| 1 Federal National Mortgage Assn. | 5.000% | 5/11/17 | 465 | 552 |

| 1 Federal National Mortgage Assn. | 5.375% | 6/12/17 | 535 | 647 |

| 1 Federal National Mortgage Assn. | 0.000% | 10/9/19 | 450 | 334 |

| 1 Financing Corp. Fico | 10.700% | 10/6/17 | 100 | 150 |

| Private Export Funding Corp. | 3.050% | 10/15/14 | 175 | 187 |

| Private Export Funding Corp. | 2.250% | 12/15/17 | 25 | 26 |

| 1 Tennessee Valley Authority | 5.500% | 7/18/17 | 125 | 151 |

| 1 Tennessee Valley Authority | 3.875% | 2/15/21 | 75 | 83 |

| 14,631 | ||||

| Total U.S. Government and Agency Obligations (Cost $168,171) | 177,663 | |||

32

| Intermediate-Term Government Bond Index Fund | |||

| Market | |||

| Value | |||

| Coupon | Shares | ($000) | |

| Temporary Cash Investment (2.2%) | |||

| Money Market Fund (2.2%) | |||

| 2 Vanguard Market Liquidity Fund (Cost $4,051) | 0.132% | 4,050,914 | 4,051 |

| Total Investments (100.3%) (Cost $172,222) | 181,714 | ||

| Other Assets and Liabilities (-0.3%) | |||

| Other Assets | 4,947 | ||

| Liabilities | (5,449) | ||

| (502) | |||

| Net Assets (100%) | 181,212 | ||

| At August 31, 2011, net assets consisted of: | |||

| Amount | |||

| ($000) | |||

| Paid-in Capital | 171,492 | ||

| Overdistributed Net Investment Income | (6) | ||

| Accumulated Net Realized Gains | 234 | ||

| Unrealized Appreciation (Depreciation) | 9,492 | ||

| Net Assets | 181,212 | ||

| Signal Shares—Net Assets | |||

| Applicable to 380,536 outstanding $.001 par value shares of | |||

| beneficial interest (unlimited authorization) | 8,348 | ||

| Net Asset Value Per Share—Signal Shares | $21.94 | ||

| Institutional Shares—Net Assets | |||

| Applicable to 4,325,977 outstanding $.001 par value shares of | |||

| beneficial interest (unlimited authorization) | 117,694 | ||

| Net Asset Value Per Share—Institutional Shares | $27.21 | ||

| ETF Shares—Net Assets | |||

| Applicable to 850,000 outstanding $.001 par value shares of | |||

| beneficial interest (unlimited authorization) | 55,170 | ||

| Net Asset Value Per Share—ETF Shares | $64.91 | ||

See Note A in Notes to Financial Statements.

1 The issuer operates under a congressional charter; its securities are not backed by the full faith and credit of the U.S. government.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

See accompanying Notes, which are an integral part of the Financial Statements.

33

Intermediate-Term Government Bond Index Fund

Statement of Operations

| Year Ended | |