UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-12317

NATIONAL OILWELL VARCO, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 76-0475815 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

7909 Parkwood Circle Drive

Houston, Texas

77036-6565

(Address of principal executive offices)

(713) 346-7500

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☑ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of July 21, 2017 the registrant had 380,038,518 shares of common stock, par value $0.01 per share, outstanding.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

NATIONAL OILWELL VARCO, INC.

CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

| June 30, | December 31, | |||||||

| 2017 | 2016 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 1,530 | $ | 1,408 | ||||

| Receivables, net |

2,086 | 2,083 | ||||||

| Inventories, net |

3,207 | 3,325 | ||||||

| Costs in excess of billings |

599 | 665 | ||||||

| Prepaid and other current assets |

319 | 395 | ||||||

|

|

|

|

|

|||||

| Total current assets |

7,741 | 7,876 | ||||||

| Property, plant and equipment, net |

3,052 | 3,150 | ||||||

| Deferred income taxes |

70 | 86 | ||||||

| Goodwill |

6,129 | 6,067 | ||||||

| Intangibles, net |

3,438 | 3,530 | ||||||

| Investment in unconsolidated affiliates |

306 | 307 | ||||||

| Other assets |

151 | 124 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 20,887 | $ | 21,140 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 448 | $ | 414 | ||||

| Accrued liabilities |

1,489 | 1,568 | ||||||

| Billings in excess of costs |

337 | 440 | ||||||

| Current portion of long-term debt and short-term borrowings |

506 | 506 | ||||||

| Accrued income taxes |

71 | 119 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

2,851 | 3,047 | ||||||

| Long-term debt |

2,708 | 2,708 | ||||||

| Deferred income taxes |

999 | 1,064 | ||||||

| Other liabilities |

307 | 318 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

6,865 | 7,137 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies |

||||||||

| Stockholders’ equity: |

||||||||

| Common stock—par value $.01; 1 billion shares authorized; 380,052,282 and 378,637,403 shares issued and outstanding at June 30, 2017 and December 31, 2016 |

4 | 4 | ||||||

| Additional paid-in capital |

8,163 | 8,103 | ||||||

| Accumulated other comprehensive loss |

(1,258 | ) | (1,452 | ) | ||||

| Retained earnings |

7,044 | 7,285 | ||||||

|

|

|

|

|

|||||

| Total Company stockholders’ equity |

13,953 | 13,940 | ||||||

| Noncontrolling interests |

69 | 63 | ||||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

14,022 | 14,003 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 20,887 | $ | 21,140 | ||||

|

|

|

|

|

|||||

See notes to unaudited consolidated financial statements.

2

NATIONAL OILWELL VARCO, INC.

CONSOLIDATED STATEMENTS OF LOSS (UNAUDITED)

(In millions, except per share data)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenue |

$ | 1,759 | $ | 1,724 | $ | 3,500 | $ | 3,913 | ||||||||

| Cost of revenue |

1,528 | 1,689 | 3,060 | 3,634 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

231 | 35 | 440 | 279 | ||||||||||||

| Selling, general and administrative |

293 | 305 | 599 | 738 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating loss |

(62 | ) | (270 | ) | (159 | ) | (459 | ) | ||||||||

| Interest and financial costs |

(26 | ) | (30 | ) | (51 | ) | (55 | ) | ||||||||

| Interest income |

4 | 3 | 8 | 8 | ||||||||||||

| Equity loss in unconsolidated affiliates |

(2 | ) | (7 | ) | (2 | ) | (13 | ) | ||||||||

| Other income (expense), net |

(2 | ) | (34 | ) | (13 | ) | (55 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(88 | ) | (338 | ) | (217 | ) | (574 | ) | ||||||||

| Provision for income taxes |

(14 | ) | (121 | ) | (23 | ) | (239 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(74 | ) | (217 | ) | (194 | ) | (335 | ) | ||||||||

| Net income attributable to noncontrolling interests |

1 | — | 3 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to Company |

$ | (75 | ) | $ | (217 | ) | $ | (197 | ) | $ | (336 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to Company per share: |

||||||||||||||||

| Basic |

$ | (0.20 | ) | $ | (0.58 | ) | $ | (0.52 | ) | $ | (0.90 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | (0.20 | ) | $ | (0.58 | ) | $ | (0.52 | ) | $ | (0.90 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash dividends per share |

$ | 0.05 | $ | 0.05 | $ | 0.10 | $ | 0.51 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Basic |

377 | 375 | 377 | 375 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

377 | 375 | 377 | 375 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to unaudited consolidated financial statements.

3

NATIONAL OILWELL VARCO, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

(In millions)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Net loss |

$ | (74 | ) | $ | (217 | ) | $ | (194 | ) | $ | (335 | ) | ||||

| Currency translation adjustments |

76 | (46 | ) | 166 | 97 | |||||||||||

| Changes in derivative financial instruments, net of tax |

23 | 29 | 28 | 131 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income (loss) |

25 | (234 | ) | — | (107 | ) | ||||||||||

| Comprehensive income attributable to noncontrolling interest |

1 | — | 3 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income (loss) attributable to Company |

$ | 24 | $ | (234 | ) | $ | (3 | ) | $ | (108 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to unaudited consolidated financial statements.

4

NATIONAL OILWELL VARCO, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(In millions)

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: |

||||||||

| Net loss |

$ | (194 | ) | $ | (335 | ) | ||

| Adjustments to reconcile net loss to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

349 | 353 | ||||||

| Deferred income taxes |

19 | (288 | ) | |||||

| Equity loss in unconsolidated affiliates |

2 | 13 | ||||||

| Other, net |

90 | 201 | ||||||

| Change in operating assets and liabilities, net of acquisitions: |

||||||||

| Receivables |

(9 | ) | 858 | |||||

| Inventories |

122 | 320 | ||||||

| Costs in excess of billings |

65 | 460 | ||||||

| Prepaid and other current assets |

82 | 70 | ||||||

| Accounts payable |

37 | (190 | ) | |||||

| Accrued liabilities |

(96 | ) | (514 | ) | ||||

| Billings in excess of costs |

(103 | ) | (132 | ) | ||||

| Income taxes payable |

(54 | ) | (190 | ) | ||||

| Other assets/liabilities, net |

(31 | ) | 123 | |||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

279 | 749 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchases of property, plant and equipment |

(85 | ) | (161 | ) | ||||

| Business acquisitions, net of cash acquired |

(82 | ) | (36 | ) | ||||

| Other |

19 | 3 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(148 | ) | (194 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Borrowings against lines of credit and other debt |

— | 2,963 | ||||||

| Payments against lines of credit and other debt |

(3 | ) | (3,748 | ) | ||||

| Cash dividends paid |

(38 | ) | (192 | ) | ||||

| Activity under stock incentive plans |

10 | 1 | ||||||

| Other |

— | (14 | ) | |||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(31 | ) | (990 | ) | ||||

| Effect of exchange rates on cash |

22 | 16 | ||||||

|

|

|

|

|

|||||

| Increase (decrease) in cash and cash equivalents |

122 | (419 | ) | |||||

| Cash and cash equivalents, beginning of period |

1,408 | 2,080 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 1,530 | $ | 1,661 | ||||

|

|

|

|

|

|||||

| Supplemental disclosures of cash flow information: |

||||||||

| Cash payments (receipts) during the period for: |

||||||||

| Interest |

$ | 48 | $ | 53 | ||||

| Income taxes |

$ |

97 |

|

$ | 120 | |||

See notes to unaudited consolidated financial statements.

5

NATIONAL OILWELL VARCO, INC.

Notes to Consolidated Financial Statements (Unaudited)

1. Basis of Presentation

The preparation of financial statements in conformity with generally accepted accounting principles (“GAAP”) in the United States requires management to make estimates and assumptions that affect reported and contingent amounts of assets and liabilities as of the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The accompanying unaudited consolidated financial statements of National Oilwell Varco, Inc. (“NOV” or the “Company”) present information in accordance with GAAP in the United States for interim financial information and the instructions to Form 10-Q and applicable rules of Regulation S-X. They do not include all information or footnotes required by GAAP in the United States for complete consolidated financial statements and should be read in conjunction with our 2016 Annual Report on Form 10-K.

In our opinion, the consolidated financial statements include all adjustments, which are of a normal recurring nature, unless otherwise disclosed, necessary for a fair presentation of the results for the interim periods. The results of operations for the three and six months ended June 30, 2017 are not necessarily indicative of the results to be expected for the full year.

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, receivables, and payables approximated fair value because of the relatively short maturity of these instruments. Cash equivalents include only those investments having a maturity date of three months or less at the time of purchase. See Note 7 for the fair value of long-term debt and Note 10 for the fair value of derivative financial instruments.

2. Inventories, net

Inventories consist of (in millions):

| June 30, | December 31, | |||||||

| 2017 | 2016 | |||||||

| Raw materials and supplies |

$ | 786 | $ | 961 | ||||

| Work in process |

517 | 561 | ||||||

| Finished goods and purchased products |

1,904 | 1,803 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 3,207 | $ | 3,325 | ||||

|

|

|

|

|

|||||

6

3. Accrued Liabilities

Accrued liabilities consist of (in millions):

| June 30, | December 31, | |||||||

| 2017 | 2016 | |||||||

| Compensation |

$ | 237 | $ | 181 | ||||

| Customer prepayments and billings |

236 | 222 | ||||||

| Vendor costs |

221 | 235 | ||||||

| Warranty |

161 | 172 | ||||||

| Taxes (non-income) |

142 | 176 | ||||||

| Insurance |

92 | 103 | ||||||

| Commissions |

55 | 57 | ||||||

| Fair value of derivative financial instruments |

20 | 66 | ||||||

| Interest |

7 | 8 | ||||||

| Other |

318 | 348 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 1,489 | $ | 1,568 | ||||

|

|

|

|

|

|||||

Service and Product Warranties

The Company provides service and warranty policies on certain of its products. The Company accrues liabilities under service and warranty policies based upon specific claims and a review of historical warranty and service claim experience in accordance with Accounting Standards Codification (“ASC”) Topic 450 “Contingencies”. Adjustments are made to accruals as claim data and historical experience change. In addition, the Company incurs discretionary costs to service its products in connection with product performance issues and accrues for them when they are encountered.

The changes in the carrying amount of service and product warranties are as follows (in millions):

| Balance at December 31, 2016 |

$ | 172 | ||

|

|

|

|||

| Net provisions for warranties issued during the year |

24 | |||

| Amounts incurred |

(42 | ) | ||

| Currency translation adjustments and other |

7 | |||

|

|

|

|||

| Balance at June 30, 2017 |

$ | 161 | ||

|

|

|

4. Costs and Estimated Earnings on Uncompleted Contracts

Costs and estimated earnings on uncompleted contracts consist of (in millions):

| June 30, | December 31, | |||||||

| 2017 | 2016 | |||||||

| Costs incurred on uncompleted contracts |

$ | 7,157 | $ | 8,132 | ||||

| Estimated earnings |

3,350 | 3,869 | ||||||

|

|

|

|

|

|||||

| 10,507 | 12,001 | |||||||

| Less: Billings to date |

10,245 | 11,776 | ||||||

|

|

|

|

|

|||||

| $ | 262 | $ | 225 | |||||

|

|

|

|

|

|||||

| Costs and estimated earnings in excess of billings on uncompleted contracts |

$ | 599 | $ | 665 | ||||

| Billings in excess of costs and estimated earnings on uncompleted contracts |

(337 | ) | (440 | ) | ||||

|

|

|

|

|

|||||

| $ | 262 | $ | 225 | |||||

|

|

|

|

|

|||||

7

5. Accumulated Other Comprehensive Income (Loss)

The components of accumulated other comprehensive income (loss) are as follows (in millions):

| Currency Translation Adjustments |

Derivative Financial Instruments, Net of Tax |

Defined Benefit Plans, Net of Tax |

Total | |||||||||||||

| Balance at December 31, 2016 |

$ | (1,376 | ) | $ | (39 | ) | $ | (37 | ) | $ | (1,452 | ) | ||||

| Accumulated other comprehensive income (loss) before reclassifications |

166 | 26 | — | 192 | ||||||||||||

| Amounts reclassified from accumulated other comprehensive income (loss) |

— | 2 | — | 2 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at June 30, 2017 |

$ | (1,210 | ) | $ | (11 | ) | $ | (37 | ) | $ | (1,258 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

The components of amounts reclassified from accumulated other comprehensive income (loss) are as follows (in millions):

| Three Months Ended June 30, | ||||||||||||||||||||||||||||||||

| 2017 | 2016 | |||||||||||||||||||||||||||||||

| Currency Translation Adjustments |

Derivative Financial Instruments |

Defined Benefit Plans |

Total | Currency Translation Adjustments |

Derivative Financial Instruments |

Defined Benefit Plans |

Total | |||||||||||||||||||||||||

| Revenue |

$ | — | $ | 1 | $ | — | $ | 1 | $ | — | $ | (2 | ) | $ | — | $ | (2 | ) | ||||||||||||||

| Cost of revenue |

— | 8 | — | 8 | — | 46 | — | 46 | ||||||||||||||||||||||||

| Tax effect |

— | (2 | ) | — | (2 | ) | — | (12 | ) | — | (12 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | — | $ | 7 | $ | — | $ | 7 | $ | — | $ | 32 | $ | — | $ | 32 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Six Months Ended June 30, | ||||||||||||||||||||||||||||||||

| 2017 | 2016 | |||||||||||||||||||||||||||||||

| Currency Translation Adjustments |

Derivative Financial Instruments |

Defined Benefit Plans |

Total | Currency Translation Adjustments |

Derivative Financial Instruments |

Defined Benefit Plans |

Total | |||||||||||||||||||||||||

| Revenue |

$ | — | $ | (4 | ) | $ | — | $ | (4 | ) | $ | — | $ | (3 | ) | $ | — | $ | (3 | ) | ||||||||||||

| Cost of revenue |

— | 4 | — | 4 | — | 122 | — | 122 | ||||||||||||||||||||||||

| Tax effect |

— | 2 | — | 2 | — | (35 | ) | — | (35 | ) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | — | $ | 2 | $ | — | $ | 2 | $ | — | $ | 84 | $ | — | $ | 84 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

The Company’s reporting currency is the U.S. dollar. For a majority of the Company’s international entities in which there is a substantial investment, the local currency is their functional currency. As a result, currency translation adjustments resulting from the process of translating the entities’ financial statements into the reporting currency are reported in other comprehensive income or loss in accordance with ASC Topic 830 “Foreign Currency Matters” (“ASC Topic 830”). For the three months ended June 30, 2017, a majority of these local currencies strengthened against the U.S. dollar resulting in net other comprehensive income of $76 million, upon the translation from local currencies to the U.S. dollar. For the six months ended June 30, 2017, a majority of these local currencies strengthened against the U.S. dollar resulting in net other comprehensive income of $166 million, upon the translation from local currencies to the U.S. dollar. For the three months ended June 30, 2016, a majority of these local currencies weakened against the U.S. dollar resulting in net other comprehensive loss of $46 million upon the translation from local currencies to the U.S. dollar. For the six months ended June 30, 2016, a majority of these local currencies strengthened against the U.S. dollar resulting in net other comprehensive income of $97 million, upon the translation from local currencies to the U.S. dollar.

The effect of changes in the fair values of derivatives designated as cash flow hedges are accumulated in other comprehensive income or loss, net of tax, until the underlying transactions to which they are designed to hedge are realized. The movement in other comprehensive income or loss from period to period will be the result of the combination of changes in fair value for open derivatives and the outflow of other comprehensive income or loss related to cumulative changes in the fair value of derivatives that have settled in the current or prior periods. The accumulated effect was other comprehensive income of $23 million (net of tax of $6 million) and $28 million (net of tax of $7 million) for the three and six months ended June 30, 2017, respectively. The accumulated effect was other comprehensive income of $29 million (net of tax of $12 million) and $131 million (net of tax of $52 million) for the three and six months ended June 30, 2016, respectively.

8

6. Business Segments

Operating results by segment are as follows (in millions):

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenue: |

||||||||||||||||

| Rig Systems |

$ | 346 | $ | 564 | $ | 739 | $ | 1,490 | ||||||||

| Rig Aftermarket |

341 | 364 | 662 | 755 | ||||||||||||

| Wellbore Technologies |

614 | 511 | 1,169 | 1,142 | ||||||||||||

| Completion & Production Solutions |

652 | 538 | 1,300 | 1,096 | ||||||||||||

| Eliminations |

(194 | ) | (253 | ) | (370 | ) | (570 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

$ | 1,759 | $ | 1,724 | $ | 3,500 | $ | 3,913 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating profit (loss): |

||||||||||||||||

| Rig Systems |

$ | (7 | ) | $ | 7 | $ | 2 | $ | 74 | |||||||

| Rig Aftermarket |

76 | 62 | 137 | 131 | ||||||||||||

| Wellbore Technologies |

(24 | ) | (146 | ) | (81 | ) | (237 | ) | ||||||||

| Completion & Production Solutions |

27 | (33 | ) | 35 | (71 | ) | ||||||||||

| Eliminations and corporate costs |

(134 | ) | (160 | ) | (252 | ) | (356 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating profit (loss) |

$ | (62 | ) | $ | (270 | ) | $ | (159 | ) | $ | (459 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating profit (loss)%: |

||||||||||||||||

| Rig Systems |

(2.0 | %) | 1.2 | % | 0.3 | % | 5.0 | % | ||||||||

| Rig Aftermarket |

22.3 | % | 17.0 | % | 20.7 | % | 17.4 | % | ||||||||

| Wellbore Technologies |

(3.9 | %) | (28.6 | %) | (6.9 | %) | (20.8 | %) | ||||||||

| Completion & Production Solutions |

4.1 | % | (6.1 | %) | 2.7 | % | (6.5 | %) | ||||||||

| Total operating profit (loss) % |

(3.5 | %) | (15.7 | %) | (4.5 | %) | (11.7 | %) | ||||||||

Sales from one segment to another generally are priced at estimated equivalent commercial selling prices; however, segments originating an external sale are credited with the full profit to the Company. Eliminations include intercompany transactions conducted between the four reporting segments that are eliminated in consolidation. Intercompany transactions within each reporting segment are eliminated within each reporting segment.

Included in operating profit (loss) are other items primarily related to costs associated with severance, facility closures, and Voluntary Early Retirement Plans (“VERP”) established by the Company during the first quarter of 2016. As of June 30, 2017, the Company had approximately $45 million accrued for the VERP postretirement medical benefits.

9

7. Debt

Debt consists of (in millions):

| June 30, | December 31, | |||||||

| 2017 | 2016 | |||||||

| $500 million in Senior Notes, interest at 1.35% payable semiannually, principal due on December 1, 2017 |

$ | 499 | $ | 499 | ||||

| $1.4 billion in Senior Notes, interest at 2.60% payable semiannually, principal due on December 1, 2022 |

1,392 | 1,391 | ||||||

| $1.1 billion in Senior Notes, interest at 3.95% payable semiannually, principal due on December 1, 2042 |

1,087 | 1,087 | ||||||

| Other |

236 | 237 | ||||||

|

|

|

|

|

|||||

| Total debt |

3,214 | 3,214 | ||||||

| Less current portion |

506 | 506 | ||||||

|

|

|

|

|

|||||

| Long-term debt |

$ | 2,708 | $ | 2,708 | ||||

|

|

|

|

|

|||||

On June 27, 2017, the Company entered into a new $3.0 billion credit agreement evidencing a five-year unsecured revolving credit facility, which expires on June 27, 2022, with a syndicate of financial institutions. This new credit facility replaced the Company’s previous $4.5 billion revolving credit facility. The Company has the right to increase the aggregate commitments under this new agreement to an aggregate amount of up to $4.0 billion upon the consent of only those lenders holding any such increase. Interest under the new multicurrency facility is based upon LIBOR, NIBOR or CDOR plus 1.125% subject to a ratings-based grid or the U.S. prime rate. The new credit facility contains a financial covenant regarding maximum debt-to-capitalization ratio of 60%. As of June 30, 2017, the Company was in compliance with a debt-to-capitalization ratio of 18.6%.

The Company has a commercial paper program under which borrowings are classified as long-term since the program is supported by the $3.0 billion, five-year credit facility. At June 30, 2017, there were no commercial paper borrowings, and there were no outstanding letters of credit issued under the credit facility, resulting in $3.0 billion of funds available under this credit facility.

The Company had $833 million of outstanding letters of credit at June 30, 2017 that are under various bilateral letter of credit facilities. Letters of credit are issued as bid bonds, advanced payment bonds and performance bonds.

The fair value of the Company’s debt is estimated using Level 2 inputs in the fair value hierarchy and is based on quoted prices for those or similar instruments. At June 30, 2017 and December 31, 2016, the fair value of the Company’s unsecured Senior Notes approximated $2,766 million and $2,669 million, respectively. At June 30, 2017 and December 31, 2016, the carrying value of the Company’s unsecured Senior Notes approximated $2,978 million and $2,977 million, respectively.

10

8. Tax

The effective tax rate for the three and six months ended June 30, 2017 was 15.9% and 10.6%, respectively, compared to 35.8% and 41.6% for the same periods in 2016. Market conditions continued to negatively impact our business in the second quarter of 2017. As a result of these conditions, we continue to establish valuation allowances on deferred tax assets for losses and tax credits generated in the current year, which, when applied to losses resulted in a lower effective tax rate than the U.S. statutory rate. For the three and six months ended June 30, 2016, the effect of lower tax rates on income earned in foreign jurisdictions and a reduction in tax reserves due to audit settlements, when applied to losses, resulted in a higher effective tax rate.

For the three and six months ended June 30, 2016, the Company utilized the discrete-period method to compute its interim tax provision due to significant variations in the relationship between income tax expense and pre-tax accounting income or loss; consequently, the actual effective rate for the interim period was reported. For the three and six months ended June 30, 2017, the Company has returned to estimating and recording a full year effective tax rate.

9. Stock-Based Compensation

The Company has a stock-based compensation plan known as the National Oilwell Varco, Inc. Long-Term Incentive Plan (the “Plan”). The Plan provides for the granting of stock options, performance-based share awards, restricted stock, phantom shares, stock payments and stock appreciation rights (“SARs”). The number of shares authorized under the Plan is 69.4 million. The Plan is subject to a fungible ratio concept, such that the issuance of stock options and SARs reduces the number of available shares under the Plan on a 1-for-1 basis, and the issuance of other awards reduces the number of available shares under the Plan on a 3-for-1 basis. At June 30, 2017, 20,318,747 shares remain available for future grants under the Plan, all of which are available for grants of stock options, performance-based share awards, restricted stock awards, phantom shares, stock payments and SARs.

On February 22, 2017, the Company granted 3,362,460 stock options with a fair value of $10.98 per share and an exercise price of $38.86 per share; 1,504,450 shares of restricted stock and restricted stock units with a fair value of $38.86 per share; performance share awards to senior management employees with potential payouts varying from zero to 388,380 shares; and 14,400 SARs. The stock options vest over a three-year period from the grant date. The restricted stock and restricted stock units vest on the third anniversary of the date of grant or in three equal annual installments commencing on the first anniversary of the date of grant. The performance share awards can be earned based on performance against established goals over a three-year performance period. The performance share awards are based entirely on a TSR (total shareholder return) goal. Performance against the TSR goal is determined by comparing the performance of the Company’s TSR with the TSR performance of the members of the OSX index for the three-year performance period. The SARs are cash-settled awards and vest over a three-year period from the grant date. We account for the SARs as liability awards, which requires the awards to be revalued at each reporting period.

On May 17, 2017, the Company granted 36,701 restricted stock awards with a fair value of $33.38 per share. The awards were granted to non-employee members of the board of directors and vest on the first anniversary of the grant date.

Total stock-based compensation for all stock-based compensation arrangements under the Plan was $22 million and $52 million for the three and six months ended June 30, 2017, respectively, and $21 million and $50 million for the three and six months ended June 30, 2016, respectively. Included in stock-based compensation for the six months ended June 30, 2016 is $5 million related to the Voluntary Early Retirement Plan established by the Company in the first quarter of 2016. The total income tax benefit recognized in the Consolidated Statements of Loss for all stock-based compensation arrangements under the Plan was $5 million and $9 million for the three and six months ended June 30, 2017, respectively, and $5 million and $12 million for the three and six months ended June 30, 2016, respectively.

.

11

10. Derivative Financial Instruments

ASC Topic 815, “Derivatives and Hedging” requires a company to recognize all of its derivative instruments as either assets or liabilities in the Consolidated Balance Sheet at fair value. The accounting for changes in the fair value (i.e., gains or losses) of a derivative instrument depends on whether it has been designated and qualifies as part of a hedging relationship and further, on the type of hedging relationship. For those derivative instruments that are designated and qualify as hedging instruments, a company must designate the hedging instrument, based upon the exposure being hedged, as a fair value hedge, cash flow hedge, or a hedge of a net investment in a foreign operation.

The Company is exposed to certain risks relating to its ongoing business operations. The primary risk managed by using derivative instruments is foreign currency exchange rate risk. Forward contracts against various foreign currencies are entered into to manage the foreign currency exchange rate risk on forecasted revenues and expenses denominated in currencies other than the functional currency of the operating unit (cash flow hedge). In addition, the Company will enter into non-designated forward contracts against various foreign currencies to manage the foreign currency exchange rate risk on recognized nonfunctional currency monetary accounts (non-designated hedge).

The Company records all derivative financial instruments at their fair value in its Consolidated Balance Sheet. Except for certain non-designated hedges discussed below, all derivative financial instruments that the Company holds are designated as cash flow hedges and are highly effective in offsetting movements in the underlying risks. Such arrangements typically have terms between 2 and 24 months, but may have longer terms depending on the underlying cash flows being hedged, typically related to the projects in our backlog. The Company may also use interest rate contracts to mitigate its exposure to changes in interest rates on anticipated long-term debt issuances.

At June 30, 2017, the Company has determined that the fair value of its derivative financial instruments representing assets of $26 million and liabilities of $21 million (primarily currency related derivatives) are determined using level 2 inputs (inputs other than quoted prices in active markets for identical assets and liabilities that are observable either directly or indirectly for substantially the full term of the asset or liability) in the fair value hierarchy as the fair value is based on publicly available foreign exchange and interest rates at each financial reporting date. At June 30, 2017, the net fair value of the Company’s foreign currency forward contracts totaled a net asset of $5 million.

At June 30, 2017, the Company did not have any interest rate swaps and its financial instruments do not contain any credit-risk-related or other contingent features that could cause accelerated payments when the Company’s financial instruments are in net liability positions. We do not use derivative financial instruments for trading or speculative purposes.

Cash Flow Hedging Strategy

To protect against the volatility of forecasted foreign currency cash flows resulting from forecasted revenues and expenses, the Company has instituted a cash flow hedging program. The Company hedges portions of its forecasted revenues and expenses denominated in nonfunctional currencies with forward contracts. When the U.S. dollar strengthens or weakens against the foreign currencies, the change in present value of future foreign currency revenues and expenses is offset by changes in the fair value of the forward contracts designated as hedges.

For derivative instruments that are designated and qualify as a cash flow hedge (i.e., hedging the exposure to variability in expected future cash flows that is subject to a particular currency risk), the effective portion of the gain or loss on the derivative instrument is reported as a component of other comprehensive income (loss) and reclassified into earnings in the same line item associated with the forecasted transaction and in the same period or periods during which the hedged transaction affects earnings (e.g., in “revenues” when the hedged transactions are cash flows associated with forecasted revenues). The remaining gain or loss on the derivative instrument in excess of the cumulative change in the present value of future cash flows of the hedged item, if any (i.e., the ineffective portion), or hedge components excluded from the assessment of effectiveness, is recognized in the Consolidated Statements of Loss during the current period.

For the three and six months ended June 30, 2017, the Company recognized a loss of $2 million and a gain of $13 million, respectively, as a result of the discontinuance of certain cash flow hedges when it became probable that the original forecasted transactions would not occur by the end of the originally specified time period. At June 30, 2017, there were $14 million in pre-tax losses recorded in accumulated other comprehensive income (loss). Significant changes in forecasted operating levels or delays in large capital construction projects, whereby certain hedged transactions associated with these projects are no longer probable of occurring by the end of the originally specified time period, could result in additional losses due to the de-designation of existing hedge contracts.

12

The Company had the following outstanding foreign currency forward contracts that were entered into to hedge nonfunctional currency cash flows from forecasted revenues and expenses (in millions):

| Currency Denomination | ||||||||||||||||

| Foreign Currency |

June 30, 2017 |

December 31, 2016 |

||||||||||||||

| Norwegian Krone |

NOK | 4,762 | NOK | 5,621 | ||||||||||||

| Japanese Yen |

JPY | 1,142 | JPY | 1,462 | ||||||||||||

| U.S. Dollar |

USD | 275 | USD | 321 | ||||||||||||

| Euro |

EUR | 88 | EUR | 279 | ||||||||||||

| Danish Krone |

DKK | 29 | DKK | 29 | ||||||||||||

| British Pound Sterling |

GBP | 12 | GBP | 1 | ||||||||||||

| Singapore Dollar |

SGD | 1 | SGD | 2 | ||||||||||||

Non-designated Hedging Strategy

The Company enters into forward exchange contracts to hedge certain nonfunctional currency monetary accounts. The purpose of the Company’s foreign currency hedging activities is to protect the Company from risk that the eventual U.S. dollar equivalent cash flows from the nonfunctional currency monetary accounts will be adversely affected by changes in the exchange rates.

For derivative instruments that are non-designated, the gain or loss on the derivative instrument subject to the hedged risk (i.e., nonfunctional currency monetary accounts) is recognized in other income (expense), net in current earnings.

The Company had the following outstanding foreign currency forward contracts that hedge the fair value of nonfunctional currency monetary accounts (in millions):

| Currency Denomination | ||||||||||||||||

| Foreign Currency |

June 30, 2017 |

December 31, 2016 |

||||||||||||||

| Russian Ruble |

RUB | 2,417 | RUB | 1,893 | ||||||||||||

| Norwegian Krone |

NOK | 1,115 | NOK | 538 | ||||||||||||

| U.S. Dollar |

USD | 461 | USD | 457 | ||||||||||||

| South African Rand |

ZAR | 150 | ZAR | 150 | ||||||||||||

| Euro |

EUR | 84 | EUR | 272 | ||||||||||||

| Danish Krone |

DKK | 17 | DKK | 49 | ||||||||||||

| Singapore Dollar |

SGD | 4 | SGD | 7 | ||||||||||||

| British Pound Sterling |

GBP | 2 | GBP | 3 | ||||||||||||

| Canadian Dollar |

CAD | 1 | CAD | 1 | ||||||||||||

13

The Company has the following gross fair values of its derivative instruments and their balance sheet classifications:

| Asset Derivatives |

Liability Derivatives |

|||||||||||||||||||

| Fair Value | Fair Value | |||||||||||||||||||

| Balance Sheet Location |

June 30, 2017 |

December 31, 2016 |

Balance Sheet |

June 30, 2017 |

December 31, 2016 |

|||||||||||||||

| Derivatives designated as hedging instruments under ASC Topic 815 |

||||||||||||||||||||

| Foreign exchange contracts |

Prepaid and other current assets | $ | 8 | $ | 24 | Accrued liabilities | $ | 8 | $ | 37 | ||||||||||

| Foreign exchange contracts |

Other Assets | 6 | 6 | Other liabilities | 1 | 11 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total derivatives designated as hedging instruments under ASC Topic 815 |

$ | 14 | $ | 30 | $ | 9 | $ | 48 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Derivatives not designated as hedging instruments under ASC Topic 815 |

||||||||||||||||||||

| Foreign exchange contracts |

Prepaid and other current assets | $ | 12 | $ | 32 | Accrued liabilities | $ | 12 | $ | 29 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total derivatives not designated as hedging instruments under ASC Topic 815 |

$ | 12 | $ | 32 | $ | 12 | $ | 29 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total derivatives |

$ | 26 | $ | 62 | $ | 21 | $ | 77 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

The Effect of Derivative Instruments on the Consolidated Statements of Income

($ in millions)

|

Derivatives in ASC Relationships |

Amount of Gain (Loss) Recognized in OCI on Derivative (Effective Portion) (a) |

Location of Gain (Loss) Accumulated OCI into Income (Effective Portion) |

Amount of Gain (Loss) Reclassified from Accumulated OCI into Income (Effective Portion) |

Location of Gain (Loss) Testing) |

Amount of Gain (Loss) Recognized in Income on Derivative (Ineffective Portion and Amount Excluded from Effectiveness Testing) (b) |

|||||||||||||||||||||||||||

| Six Months Ended June 30, |

Six Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||||||||||||

| Revenue Cost of revenue |

|

4 | 3 | Cost of revenue Other income (expense), net |

|

13 |

|

(17 | ) | |||||||||||||||||||||||

| Foreign exchange contracts |

34 | 65 | (17 | ) | (105 | ) | 5 | 1 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

34 | 65 | (13 | ) | (102 | ) | 18 | (16 | ) | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Derivatives Not Designated |

Location of Gain (Loss) Recognized in Income on Derivative |

Amount of Gain (Loss) Income on Derivative |

||||||||||||||||||||||||||||||

| Six Months Ended June 30, |

||||||||||||||||||||||||||||||||

| 2017 |

2016 | |||||||||||||||||||||||||||||||

| Foreign exchange contracts |

|

Other income (expense), net |

|

46 | 3 | |||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||

| Total |

46 | 3 | ||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||

| (a) | The Company expects that $8 million of the accumulated other comprehensive income (loss) will be reclassified into earnings within the next twelve months with an offset by gains from the underlying transactions resulting in no impact to earnings or cash flow. |

| (b) | The amount of gain (loss) recognized in income represents $13 million and $(17) million related to the ineffective portion of the hedging relationships for the six months ended June 30, 2017 and 2016, respectively, and $5 million and $1 million related to the amount excluded from the assessment of the hedge effectiveness for the six months ended June 30, 2017 and 2016, respectively. |

14

11. Net Loss Attributable to Company Per Share

The following table sets forth the computation of weighted average basic and diluted shares outstanding (in millions, except per share data):

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Numerator: |

||||||||||||||||

| Net loss attributable to Company |

$ | (75 | ) | $ | (217 | ) | $ | (197 | ) | $ | (336 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator: |

||||||||||||||||

| Basic—weighted average common shares outstanding |

377 | 375 | 377 | 375 | ||||||||||||

| Dilutive effect of employee stock options and other unvested stock awards |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted outstanding shares |

377 | 375 | 377 | 375 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to Company per share: |

||||||||||||||||

| Basic |

$ | (0.20 | ) | $ | (0.58 | ) | $ | (0.52 | ) | $ | (0.90 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | (0.20 | ) | $ | (0.58 | ) | $ | (0.52 | ) | $ | (0.90 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash dividends per share |

$ | 0.05 | $ | 0.05 | $ | 0.10 | $ | 0.51 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

ASC Topic 260, “Earnings Per Share” requires companies with unvested participating securities to utilize a two-class method for the computation of net income attributable to Company per share. The two-class method requires a portion of net income attributable to Company to be allocated to participating securities, which are unvested awards of share-based payments with non-forfeitable rights to receive dividends or dividend equivalents, if declared. Net loss attributable to Company allocated to these participating securities was immaterial for the three and six months ended June 30, 2017 and therefore not excluded from net income attributable to Company per share calculation.

The Company had stock options outstanding that were anti-dilutive totaling 18 million shares and 13 million shares for of the three and six months ended June 30, 2017, respectively, and 14 million shares for each of the three and six months ended June 30, 2016.

12. Cash Dividends

On May 18, 2017, the Company’s Board of Directors approved a cash dividend of $0.05 per share. The cash dividend was paid on June 30, 2017, to each stockholder of record on June 16, 2017. Cash dividends were $19 million and $38 million for the three and six months ended June 30, 2017, respectively, and $19 million and $192 million for the three and six months ended June 30, 2016, respectively. The declaration and payment of future dividends is at the discretion of the Company’s Board of Directors and will be dependent upon the Company’s results of operations, financial condition, capital requirements and other factors deemed relevant by the Company’s Board of Directors.

15

13. Commitments and Contingencies

We are involved in various claims, internal investigations, regulatory agency audits and pending or threatened legal actions involving a variety of matters. Predicting the ultimate outcome of such matters involves subjective judgment, estimates and inherent uncertainties. As of June 30, 2017, the Company recorded an amount for contingent liabilities representing all contingencies believed to be probable. The Company has also assessed the potential for additional losses above the amounts accrued as well as potential losses for matters that are not probable but are reasonably possible. The total potential loss on these matters cannot be determined; however, in our opinion, any ultimate liability, to the extent not otherwise provided for and except for the cases referred to herein, will not materially affect our financial position, cash flow or results of operations. As it relates to the cases referred to herein, we currently anticipate that any judgment, arbitral award, administrative fine or penalty agreed to as part of a resolution would be within established accruals, and would not have a material effect on our financial position or results of operations. These estimated liabilities are based on the Company’s assessment of the nature of these matters, their progress toward resolution, the advice of legal counsel and outside experts as well as management’s intention and experience.

Our business is affected both directly and indirectly by governmental laws and regulations relating to the oilfield service industry in general, as well as by trade, environmental and safety regulations that specifically apply to our business. Although we have not incurred material costs in connection with our compliance with such laws, there can be no assurance that other developments, such as new trade regulations, trade sanctions, environmental laws, regulations and enforcement policies hereunder may not result in additional, presently unquantifiable, costs or liabilities to us.

Further, in some instances, direct or indirect consumers of our products and services, entities providing financing for purchases of our products and services or members of the supply chain for our products and services may become involved in governmental investigations, internal investigations, political or other enforcement matters. In such circumstances, such investigations may adversely impact the ability of consumers of our products, entities providing financial support to such consumers or entities in the supply chain to timely perform their business plans or to timely perform under agreements with us. For example, the on-going, publicly disclosed investigations in Brazil have adversely impacted our shipyard customers, their customers, entities providing financing for our shipyard customers and/or entities in the supply chain. The investigations in Brazil have led to, and are expected to continue to lead to, delays in deliveries to our shipyard customers in Brazil, along with temporary suspension of performance under our supply contracts, and have resulted in cancellations and could result in further attempted cancellation or other breaches of our contracts by our shipyard customers.

In other jurisdictions, our shipyard customers’ customers in some instances have sought, and may in the future seek, suspension, delay or cancellation of the contracts or payment due between our shipyard customers and their customers. To the extent our shipyard customers and their customers become engaged in disputes or litigation related to any such suspensions, delays or cancellations, we may also become involved, either directly or indirectly, in such disputes or litigation, as we enforce the terms of our contracts with our shipyard customers. As the result of such disputes, payments to us may be delayed or jeopardized. Further, customers in other markets may seek delay or suspension of deliveries, the extension of delivery into future periods, or may attempt cancellations. While we manage deliveries and collection of payment to achieve milestone payments that mitigate our financial risk, such delays, suspensions, attempted cancellations, breaches of contract or other similar circumstances, could adversely affect our operating results, collections of accounts receivable and financial condition and could reduce our backlog.

16

14. New Accounting Pronouncements

Recently Adopted Accounting Standards

In July 2015, the FASB issued Accounting Standard Update No. 2015-11 “Simplifying the Measurement of Inventory” (ASU 2015-11). This update requires inventory measured using the first in, first out (FIFO) or average cost methods to be subsequently measured at the lower of cost and net realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less reasonably predictable cost of completion, disposal and transportation. ASU 2015-11 is effective for fiscal years beginning after December 15, 2016, and for interim periods within those fiscal years. The Company adopted this update on January 1, 2017 with no material impact.

In March 2016, the FASB issued Accounting Standard Update No. 2016-09 “Improvements to Employee Share-Based Payment Accounting” (ASU 2016-09). This update simplifies several aspects of accounting for share-based payment transactions, including the income tax consequences, forfeitures, and the classification on the statement of cash flows. ASU 2016-09 is effective for fiscal periods beginning after December 15, 2016, and for interim periods within those fiscal years. The Company adopted this update on January 1, 2017. The cumulative impact of the adoption of this standard was $1 million to retained earnings, and the classification on the statement of cash flows was applied on a prospective basis. The Company also recorded a $4 million increase to tax expense in the first quarter of 2017 due to the impact of the adoption of this standard.

In October 2016, the FASB issued Accounting Standard Update No. 2016-16 “Intra-Entity Transfers of Assets Other Than Inventory” (ASU 2016-16). This update requires an entity to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs. ASU 2016-16 is effective for fiscal years beginning after December 15, 2017, and for interim reporting periods within those fiscal years. The Company has early adopted this update on January 1, 2017 and recorded a $5 million reduction to retained earnings and receivables. The effect of the change on net income is not significant.

Recently Issued Accounting Standards

In March 2017, the FASB issued Accounting Standard Update No. 2017-07 “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost” (ASU 2017-07). This update requires that an employer report the service cost component in the same line item as other compensation costs and separately from other components of net benefit cost. ASU 2017-04 is effective for fiscal periods beginning after December 15, 2017, and for interim periods within those fiscal years. The Company is currently assessing the impact of the adoption of ASU No. 2017-04 on its consolidated financial position and results of operations.

In January 2017, the FASB issued Accounting Standard Update No. 2017-04 “Simplifying the Test for Goodwill Impairment” (ASU 2017-04). This update eliminates the requirement to compute the implied fair value of goodwill under Step 2 of the goodwill impairment test. ASU 2017-04 is effective for fiscal periods beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The Company is currently assessing the impact of the adoption of ASU No. 2017-04 on its consolidated financial position and results of operations.

In August 2016, the FASB issued Accounting Standard Update No. 2016-15 “Classification of Certain Cash Receipts and Cash Payments” (ASU 2016-15). This update amends Accounting Standard Codification Topic No. 230 “Statement of Cash Flows” and provides guidance and clarification on presentation of certain cash flow issues. ASU No. 2016-15 is effective for fiscal years beginning after December 15, 2017, and for interim periods within those fiscal years. The Company is currently assessing the impact of the adoption of ASU No. 2016-15 on its consolidated statement of cash flows.

In March 2016, the FASB issued ASC Topic 842, “Leases” (ASC Topic 842), which supersedes the lease requirements in ASC Topic No. 840 “Leases” and most industry-specific guidance. This update increases transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. ASC Topic 842 is effective for fiscal years beginning after December 15, 2018, and for interim periods within those fiscal years.

In preparing for the adoption of this new standard, the Company has established an internal team to centralize the implementation process as well as engaged external resources to assist in our approach. We are currently utilizing a software program to consolidate and accumulate our existing leases with documentation as required by the new standard. We have assessed the changes to the Company’s current accounting practices and are currently investigating the related tax impact and process changes. We are also in process of quantifying the impact of the new standard on our balance sheet.

In May 2014, the FASB issued Accounting Standard Update No. 2014-09, “Revenue from Contracts with Customers” (ASU 2014-09), which supersedes the revenue recognition requirements in FASB ASC Topic 605, “Revenue Recognition,” and most industry-specific guidance. This ASU proscribes

17

a five-step model for determining when and how revenue is recognized. Under the model, an entity will recognize revenue to depict the transfer of goods or services to a customer at an amount reflecting the consideration it expects to receive in exchange for those goods or services.

The standard permits either a full retrospective adoption, in which the standard is applied to all the periods presented, or a modified retrospective adoption, in which the standard is applied only to the current period with a cumulative-effect adjustment reflected in retained earnings. ASU 2014-09 is effective for fiscal periods beginning after December 15, 2017. The Company currently anticipates following the modified retrospective adoption, but will not make a final decision on the adoption method until early 2018.

In 2015, the Company assembled an internal team to study the provisions of ASU 2014-09, began assessing the potential impacts on the Company and educating the organization. In 2016, the Company engaged external resources to complete the assessment of potential changes to current accounting practices related to material revenue streams. Potential impacts were identified based on required changes to current processes to accommodate provisions in the new standard. During 2017, we will quantify the potential impacts as well as design and implement required process, system, control and data requirements to address the impacts identified in the assessments.

Based on an analysis of first-quarter 2017 transactions against the requirements of ASU 2014-09, the Company does not expect a material change in the timing or other impacts to revenue recognition across most of our businesses. We are still evaluating certain revenue streams, which may change from point-in-time to over-time revenue recognition, and reviewing the impact of the new disclosure requirements.

18

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Introduction

National Oilwell Varco, Inc. (the “Company”) is a leading oilfield equipment manufacturer and technology provider. The breadth and depth of our product and technology portfolio supports customers’ full-field development needs, from drilling to completion to production, in basins around the world, land or offshore. As a leading provider of technology and industrial capabilities to the oilfield, we have a long tradition of pioneering innovations that improve the cost-effectiveness, efficiency, safety and environmental impact of oil and gas operations.

Unless indicated otherwise, results of operations data are presented in accordance with accounting principles generally accepted in the United States (“GAAP”). To provide investors with additional information regarding our results of operations, certain non-GAAP financial measures are provided. See Non-GAAP Financial Measures and Reconciliations in Results of Operations for an explanation of our use of non-GAAP financial measures and reconciliations to their corresponding measures calculated in accordance with GAAP.

Rig Systems

The Company’s Rig Systems segment makes and supports the capital equipment and integrated systems needed to drill oil and gas wells on land and offshore. The segment designs, manufactures, and sells land rigs, complete offshore drilling equipment packages, and drilling rig components that mechanize, improve and automate many complex rig processes.

Equipment and technologies in Rig Systems include: power transmission systems, like drives and generators; substructures, derricks, and masts; pipe lifting, racking, rotating, and assembly systems; pressure control equipment, including blowout preventers; cranes; and rig instrumentation and control systems.

Rig Systems supports land and offshore drillers. Demand for the segment’s products depends on drilling contractors’ and oil and gas companies’ capital spending plans, specifically capital expenditures on rig construction and refurbishment.

Rig Aftermarket

The Company’s Rig Aftermarket segment provides comprehensive aftermarket products and services to support a large installed base of land and offshore rigs, and drilling rig components manufactured by the Company’s Rig Systems segment. The segment provides spare parts, repair, and rentals as well as technical support, field service and first well support, field engineering, and customer training through a network of aftermarket service and repair facilities strategically located in major areas of drilling operations.

Rig Aftermarket supports land and offshore drillers. Demand for the segment’s products and services depends on overall levels of oilfield drilling activity, which drives demand for spare parts, service, and repair for Rig Systems’ large installed base of equipment; and secondarily on drilling contractors’ and oil and gas companies’ capital spending plans, specifically capital expenditures on rig refurbishments and re-certifications.

Wellbore Technologies

The Company’s Wellbore Technologies segment designs, manufactures, rents, and sells a variety of equipment and technologies used to perform drilling operations, and offers services that optimize their performance. Key technologies and services include: drilling optimization and automation services; instrumentation, measuring and monitoring systems; drill bits; downhole tools, like downhole drilling motors and other steerable technologies; solids control and waste management equipment and services; drilling fluids; premium drill pipe, wired pipe and drill string accessories; tubular inspection, repair and coating services; fishing tools and hole openers; and portable power generation.

The Wellbore Technologies segment focuses on oil and gas companies and supports drilling contractors, oilfield service companies, and oilfield rental companies. Additional customers include steel mills and industrial companies. Demand for Wellbore Technologies’ products and services primarily depends on the level of oilfield drilling activity by oil and gas companies, drilling contractors, and oilfield service companies, as measured by rig count, well count, and footage drilled.

19

Completion & Production Solutions

The Company’s Completion & Production Solutions segment integrates technologies for well completions and oil and gas production. The segment designs, manufactures, and sells equipment and technologies needed for hydraulic stimulation, including pressure pumping trucks, blenders, sanders, hydration units, injection units, flowline, manifolds and completion tools; well intervention, including coiled tubing units, coiled tubing, and wireline units and tools; offshore production, including process equipment, conductor pipe connectors, floating production systems and subsea production technologies; and, onshore production including surface transfer and progressive cavity pumps, positive displacement reciprocating pumps, pressure vessels, composite pipe, and artificial lift systems.

Completion & Production Solutions supports service companies and oil and gas companies. Demand for Completion & Production Solutions’ products depends on the level of oilfield completions and workover activity by oilfield service companies and drilling contractors and capital spending plans by oil and gas companies and oilfield service companies.

Critical Accounting Policies and Estimates

In our annual report on Form 10-K for the year ended December 31, 2016, we identified our most critical accounting policies. In preparing the financial statements, we make assumptions, estimates and judgments that affect the amounts reported. We periodically evaluate our estimates and judgments that are most critical in nature which are related to revenue recognition under long-term construction contracts; allowance for doubtful accounts; inventory reserves; impairment of long-lived assets (excluding goodwill and other indefinite-lived intangible assets); goodwill and other indefinite-lived intangible assets; purchase price allocation of acquisitions; service and product warranties; and income taxes. Our estimates are based on historical experience and on our future expectations that we believe are reasonable. The combination of these factors forms the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results are likely to differ from our current estimates and those differences may be material.

20

EXECUTIVE SUMMARY

For its second quarter ended June 30, 2017, the Company had a $75 million net loss attributable to Company, or $(0.20) per fully diluted share, on $1.8 billion in revenue. Compared to the first quarter of 2017, revenue increased $18 million or 1% and net loss attributable to Company decreased $47 million or 39%. Compared to the second quarter of 2016, revenue increased $35 million or 2%, and net loss attributable to Company decreased $142 million or 65%.

Operating loss for the second quarter of 2017 was $62 million, or (3.5)% of sales. Excluding other items from all periods, operating loss was $32 million or (1.8)% of sales in the second quarter of 2017, compared to operating loss of $70 million or (4.0)% of sales in the first quarter of 2017, and operating loss of $153 million or (8.9)% of sales in the second quarter of 2016.

During the second quarter of 2017, first quarter of 2017, and second quarter of 2016, pre-tax other items (severance, facility closures, write-downs, and other) included in operating loss were $30 million, $27 million and $117 million, respectively. Excluding other items from all periods, second quarter 2017 earnings (losses) were $(0.14) per fully diluted share, compared to $(0.17) per fully diluted share in the first quarter of 2017 and $(0.30) per fully diluted share in the second quarter of 2016.

Oil & Gas Equipment and Services Market

Over the past two decades, technological advancements in the oilfield equipment and service space unlocked production from formations that were previously deemed uneconomic, especially in North America. From 2004 to 2014 global oil and liquids supply increased dramatically from U.S. unconventional resources, deep-water (defined as water depths greater than 400 feet) resources and from other sources. The advances in technology combined with relatively high commodity prices caused by growing demand enabled and sustained an increase in global drilling activity. Global supply started to catch up to demand, and in the latter half of 2014, demand growth in areas such as Asia, Europe and the U.S. weakened while drilling activity remained strong and production continued to grow. As a result, global inventories of crude and refined products grew and the price of oil declined significantly during early 2015, remaining depressed throughout the year and undergoing another major reduction toward the end of 2015. In early 2016, the market witnessed oil trading in the high $20 per barrel range, prices not seen since 2003.

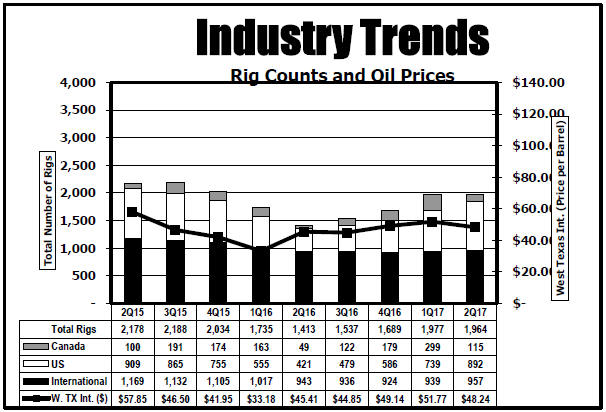

In response to rapidly deteriorating market conditions, operators acutely reduced both operating and capital expenditures. Orders for our equipment and services slowed and rig counts declined rapidly with active U.S. drilling rig counts hitting 70 year lows and international rig counts reaching decade lows during the second quarter of 2016. As a result of the sharp cutback in activity, production began to decline in certain areas of the world and commodity prices started to rebound as oil markets commenced the process of re-balancing. The market downturn began to stabilize during the second half of 2016 and showed early signs of improvement during the fourth quarter of 2016. During the first half of 2017, land drilling activity in North America continued to increase, while international markets stabilized and offshore activity neared bottom. The average price of West Texas Intermediate Cushing Crude for the second quarter of 2017 was $48.24 a barrel.

Segment Performance

The Rig Systems segment generated $346 million in revenue and $(7) million in operating loss or (2.0)% of sales in the second quarter of 2017. Compared to the prior quarter, revenue decreased $47 million or 12%, and operating profit decreased $16 million or 178%. Compared to the second quarter of 2016, segment revenue decreased $218 million or 39%, and operating profit decreased $14 million or 200%. Second quarter 2017 revenue out of backlog for the Rig Systems segment decreased 21% sequentially and 49% year-over-year on fewer shipments of offshore projects. During the second quarter of 2017, the segment received $124 million in new orders. Backlog for capital equipment orders for the Rig Systems segment at June 30, 2017 was $2.2 billion.

The Rig Aftermarket segment generated $341 million in revenue and $76 million in operating profit or 22.3% of sales in the second quarter of 2017. Compared to the prior quarter, revenue increased $20 million or 6%, and operating profit increased $15 million or 25%. Compared to the second quarter of 2016, segment revenue decreased $23 million or 6%, and operating profit increased $14 million or 23%. Revenue increased over the first quarter of 2017 as land drilling activity increased and customers ordered to replenish depleted spare parts inventories.

The Wellbore Technologies segment generated $614 million in revenue and a $(24) million operating loss, or (3.9)% of sales, for the second quarter of 2017. Compared to the prior quarter, revenue increased $59 million or 11%, and operating loss decreased $33 million or 58%. Compared to the second quarter of 2016, revenue increased $103 million or 20%, and operating loss decreased $122 million or 84%. The increase in revenue from the prior year was driven primarily by activity increases in North America.

21

The Completion & Production Solutions segment generated $652 million in revenue and $27 million in operating profit or 4.1% of sales during the second quarter of 2017. Compared to the prior quarter, revenue increased $4 million or 1%, and operating profit increased $19 million or 238%. Compared to the second quarter of 2016, revenue increased $114 million or 21%, and operating profit increased $60 million or 182%. Revenue and operating profit increased year-over-year on higher levels of worldwide activity. Backlog for capital equipment orders for the Completion & Production Solutions segment at June 30, 2017 was $881 million.

Outlook

Activity in North America increased sharply off historical lows during the last two quarters of 2016 and first half of 2017 and declines in supply, assisted by OPEC production cuts, appear to be rebalancing the market; however, global stocks of crude oil and refined product remain bloated and challenging conditions persist. Consequently, we are cautious in our outlook for the second half of 2017, and anticipate that our customers will continue to moderate capital expenditures until there is more certainty in a sustainable recovery in commodity prices.

While North America land drilling has increased, activity levels remain well below prior cyclical highs. International activity, which had been slower to fall than North American activity, appears to be at or approaching a bottom with many markets stabilizing. Offshore activity, which has longer project cycle times and, in certain instances, more challenged economics, may continue to decline through the second half of 2017. Although the Company believes offshore activity is approaching a bottom.

Low activity levels result in an oversupply of service capacity and capital equipment, creating challenging prospects for many of our customers and sharply reducing demand for our products. In this environment, contractors are hesitant to invest in their existing equipment to conserve as much capital as possible. Equipment is neglected and idle fleets are often stripped of parts to sustain assets that remains active. Additionally, certain equipment becomes less desirable and obsolete as equipment manufacturers develop new technologies and produce more efficient equipment that lowers the marginal cost of supply for oil and gas operating companies. We believe the very tight spending reductions our customers have had in place for an extended period have created pent up demand for our products that is beginning to show in certain areas where industry activity levels have begun to improve.

Our global customer base includes national oil companies, international oil companies, independent oil and gas companies, onshore and offshore service companies and others whose strategies and reactions to low commodity prices vary. Likewise, we expect the slope and timing of revenue decline, stabilization and recovery will be different across our operating regions and our four business segments. Elements of our Wellbore Technologies and Rig Aftermarket segments are expected to see a faster recovery as drilling of new wells increases, while a strong recovery for the more capital equipment oriented businesses within our Completion & Production Solutions and Rig Systems segments may come later in the cycle.

We will continue to focus on what we can control, in the form of sizing our operations with anticipated levels of activity while continuing to invest in developing and acquiring new products, technologies and operations that advance our longer term strategic goals. The Company has a history of implementing cost-control measures and downsizing in response to depressed market conditions as well as cost effectively ramping operations to capitalize on rapidly increasing demand. The Company has closed, or is in the process of closing, 374 locations over the past three years. It has reduced its annual expenses relating to salaries, wages, outside services, contractors, travel and entertainment by approximately $3.0 billion. The Company remains optimistic regarding longer-term market fundamentals as existing oil and gas fields continue to deplete and numerous major projects to replenish supply have been deferred or canceled while global demand is expected to continue to grow.

22

Operating Environment Overview