Investing Today for Tomorrow’s Energy Infrastructure Investor Introduction and Overview March 2013 NYSE: CNP investors.centerpointenergy.com NYSE: OGE oge.com/investor-relations

2 investors.centerpointenergy.com March 2013 oge.com/investor-relations Forward Looking Statement This document does not constitute an offer to sell or a solicitation of an offer to buy any securities described herein, nor shall there be any sale of such securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any such offering may be made only by means of a prospectus. This document includes forward-looking statements. Actual events and results may differ materially from those projected. The statements in this document regarding the anticipated closing of the partnership formation, including the anticipated benefits and a possible initial public offering of the partnership, and other statements that are not historical facts are forward-looking statements. Each forward looking statement contained in this document speaks only as of the date of this document. Factors that could affect actual results include the satisfaction or waiver of the conditions to closing the transaction, the receipt of applicable regulatory approvals and the termination rights of the parties under the master formation agreement for the transaction, and other factors discussed in CenterPoint Energy’s and its subsidiaries’ and OGE Energy Corp.’s Form 10-Ks for the fiscal year ended December 31, 2012, and other filings with the SEC. Pursuant to a registration rights agreement to be entered into upon the closing of the transaction, OGE and CenterPoint Energy will agree to initiate the process for the sale of an equity interest in the Midstream Partnership in an initial public offering (IPO) after formation. The parties can give no assurances that the IPO will be consummated. Prior to consummating the IPO, OGE, CenterPoint Energy and the partnership will determine the financial and other terms of the offering in conjunction with ArcLight. In addition, consummation of the IPO is subject to market conditions.

3 investors.centerpointenergy.com March 2013 oge.com/investor-relations CenterPoint Energy (“CNP”), OGE Energy Corp. (“OGE”) and ArcLight Capital (“ArcLight”) are forming a midstream partnership composed of CNP’s Field Services and Interstate Pipelines and OGE’s and ArcLight’s Enogex Midstream business – An existing subsidiary of CenterPoint Energy Resources Corp. will become the Midstream partnership – 100% of CNP Field Services and Interstate Pipelines and 100% of OGE’s and ArcLight’s Enogex will be contributed Transaction Overview Transaction Summary Partnership Structure Private master limited partnership upon formation Control and governance of the General Partner will be equally managed by CNP and OGE Sponsors intend to pursue an IPO of the partnership, creating a publicly traded MLP Timing & Approvals Normal regulatory approvals expected Anticipate transaction closure in second or third quarter 2013 Sponsor Ownership Accounting Treatment Limited partner ownership expected to be 59% CNP, 28% OGE and 13% ArcLight Incentive distribution rights of the general partner: CNP 40%, OGE 60% CNP and OGE expect to account for their investment in the partnership using the equity method of accounting Gain associated with the step-up of asset value, if any, will be determined at the time of formation Financing & Credit Target leverage of 2.5x LTM EBITDA Expected to be self-financing with adequate liquidity provided by $1.4 billion revolving credit facility $1.05 billion three-year bank term loan expected to be used to repay debt owed to CNP subsidiary Anticipate receiving investment grade credit ratings

4 investors.centerpointenergy.com March 2013 oge.com/investor-relations 50% Governance (NYSE:OGE) (NYSE:CNP) Midstream Partnership General Partner Midstream Partnership Formation 50% Governance 40% IDR Interest 60% IDR Interest CNP Assets: Pipelines and Field Services Enogex Assets 59% LP Interest 28% LP Interest 13% LP Interest

5 investors.centerpointenergy.com March 2013 oge.com/investor-relations CenterPoint Energy Resources Corp. (CERC) A Subsidiary of CenterPoint Energy General Partner Strong Credit Metrics and Liquidity Midstream Partnership (1) The Midstream Partnership Term Loan will have a limited guarantee of collection from CenterPoint Energy Resources Corp. (2) Liquidity is expected to be provided by a $1.4 billion Five-Year Senior Unsecured Revolving Credit Facility which is anticipated to be syndicated prior to transaction close. Approximately $144 million is expected to be drawn under such facility at transaction close assuming the close occurs on June 1, 2013. Enogex’s existing revolver will be terminated commensurate with the closing of the $1.4 billion facility. (3) The Enogex Senior Notes and Enogex Term Loan will be guaranteed by the Midstream Partnership. DEBT Three-Year Bank Term Loan $1,050(1) Notes to CERC Sub 363 Enogex Sr Notes 450(3) Enogex Term Loan 250(3) Total $2,113 LIQUIDITY Five-Year Revolver $1,400(2) Total $1,400

6 investors.centerpointenergy.com March 2013 oge.com/investor-relations Benefits of the Partnership Enhanced scale, with more than $10.7 billion of combined assets Geographic diversification, with operations in major natural gas and liquids- rich producing areas of Oklahoma, Texas, Arkansas and Louisiana Significant asset positions in a broad range of basins, including the Granite Wash, Tonkawa, Mississippi Lime, Cana Woodford, Haynesville, Fayetteville, Barnett and Woodford plays Enhanced supply and market access Meaningful operating and commercial synergies Stable and predictable cash flows from a balanced and diversified portfolio of assets Independent access to capital

7 investors.centerpointenergy.com March 2013 oge.com/investor-relations Midstream Partnership Increased Scale, Scope and Supply Diversity

8 investors.centerpointenergy.com March 2013 oge.com/investor-relations Diversified Asset Base Source: SEC Form 10-K as of December 31, 2012 and other Company materials. Area CNP Midstream Enogex New Midstream Partnership 8,400 miles Interstate pipelines Nearly 2,300 miles Intrastate pipelines 8,400 miles Interstate pipelines Nearly 9 TBtu/d throughput capacity Nearly 2,300 miles Intrastate pipelines 3.7 TBtu/d throughput volume 2.1 TBtu/d throughput volume Nearly 9 TBtu/d throughput capacity Perryville Hub™ 5.8 TBtu/d throughput volume Perryville Hub™ 4,600 miles of gathering 6,640 miles of gathering 11,240 miles of gathering 2.5 Bcf/d gathered 1.4 Bcf/d gathered 3.9 Bcf/d gathered 2 major plants 9 major plants 11 major plants 0.6 Bcf/d inlet capacity 1.3 Bcf/d inlet capacity 1.9 Bcf/d inlet capacity Rich Gas Header System Rich Gas Header System 6 storage facilities 2 storage facilities 8 storage facilities 67 Bcf of storage 24 Bcf storage 91 Bcf/d storage Barnett Haynesville Granite Wash Cana Woodford Fayetteville Cana Woodford Fayetteville Woodford Mississippi Lime Granite Wash Barnett Tonkawa Haynesville Cana Woodford Mississippi Lime Tonkawa Woodford 2012 EBITDA $566 Million $292 Million $858 Million Total Assets $6.5 Billion $4.2 Billion $10.7 Billion Net PPE $4.7 Billion $2.3 Billion $7 Billion Storage Key Gathering Basins Pipelines Gathering Processing

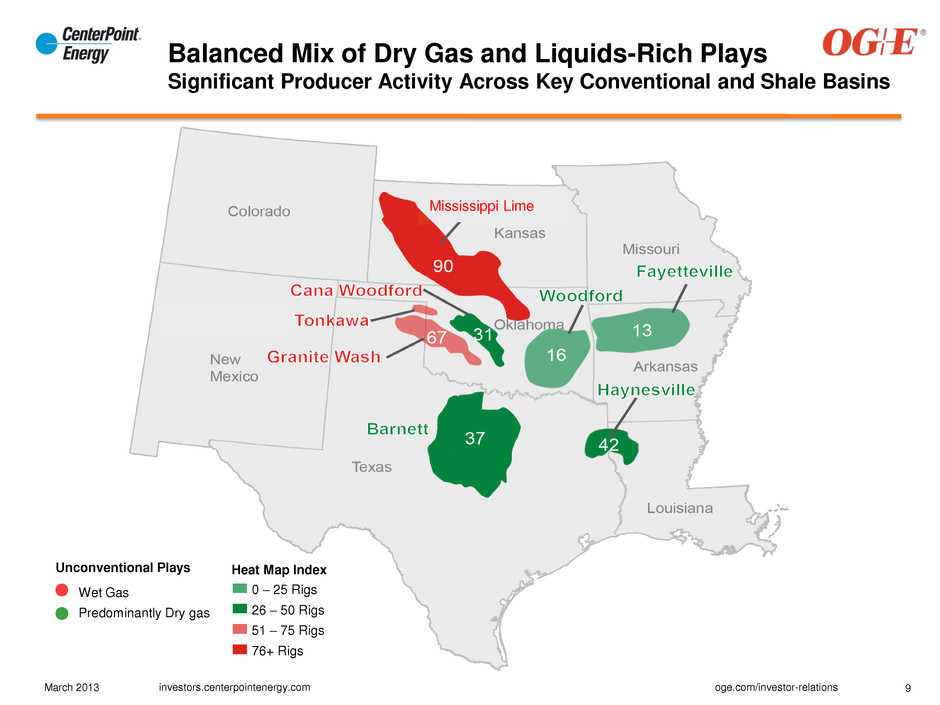

9 investors.centerpointenergy.com March 2013 oge.com/investor-relations Mississippi Lime Balanced Mix of Dry Gas and Liquids-Rich Plays Significant Producer Activity Across Key Conventional and Shale Basins Unconventional Plays Wet Gas Predominantly Dry gas Heat Map Index 0 – 25 Rigs 26 – 50 Rigs 51 – 75 Rigs 76+ Rigs

10 investors.centerpointenergy.com March 2013 oge.com/investor-relations Expanded High Quality Producer Customer Base Minimal Customer Overlap Average Throughput, MMBtu/d Table reflects each Company’s top ten producer throughput as of December 31, 2012 CenterPoint Energy Field Services Enogex

11 investors.centerpointenergy.com March 2013 oge.com/investor-relations APPENDIX: Background Information

12 investors.centerpointenergy.com March 2013 oge.com/investor-relations CenterPoint Energy Background Information

13 investors.centerpointenergy.com March 2013 oge.com/investor-relations CenterPoint Energy, Inc (NYSE: CNP) Domestic Energy Delivery with 147 Year Operating History Strategically located assets and attractive service territories that provide operating scale and diversification of risk Regulated and fee-based operations provide over 90 percent of operating income with stable earnings and cash flow Opportunity to leverage market position as a leading provider of gas infrastructure services, particularly in shale plays Organic growth opportunities across all businesses Committed to a secure, competitive dividend with growth Houston, TX headquartered Regional offices in AR, LA, MS, MN, OK, TX

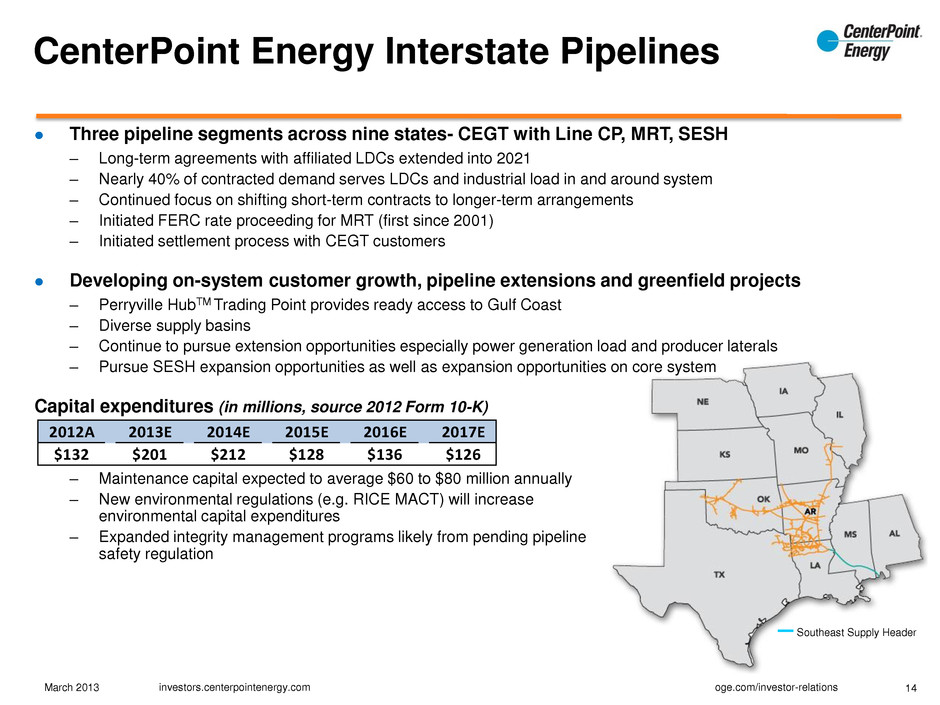

14 investors.centerpointenergy.com March 2013 oge.com/investor-relations Three pipeline segments across nine states- CEGT with Line CP, MRT, SESH – Long-term agreements with affiliated LDCs extended into 2021 – Nearly 40% of contracted demand serves LDCs and industrial load in and around system – Continued focus on shifting short-term contracts to longer-term arrangements – Initiated FERC rate proceeding for MRT (first since 2001) – Initiated settlement process with CEGT customers Developing on-system customer growth, pipeline extensions and greenfield projects – Perryville HubTM Trading Point provides ready access to Gulf Coast – Diverse supply basins – Continue to pursue extension opportunities especially power generation load and producer laterals – Pursue SESH expansion opportunities as well as expansion opportunities on core system Capital expenditures (in millions, source 2012 Form 10-K) – Maintenance capital expected to average $60 to $80 million annually – New environmental regulations (e.g. RICE MACT) will increase environmental capital expenditures – Expanded integrity management programs likely from pending pipeline safety regulation Southeast Supply Header CenterPoint Energy Interstate Pipelines 2012A 2013E 2014E 2015E 2016E 2017E $132 $201 $212 $128 $136 $126

15 investors.centerpointenergy.com March 2013 oge.com/investor-relations Secure core business through superior customer service and product offerings – Attractive margins despite highly competitive business dynamics – Relatively low risk business model utilizing volume commitments and guaranteed return contract terms – Strategic footprint in both traditional and shale basins with operational flexibility for both dry and wet processing Significant increase in throughput driven primarily by shale gas infrastructure investments – Average throughput of 2.5 Bcf per day in 2012 and anticipate similar levels in 2013 – Attractive long-term contracts position business for solid long-term growth Haynesville – 2 Bcf per day gathering and treating capacity Fayetteville – 800 MMcf per day gathering capacity Woodford – 500 MMcf per day gathering, 400 MMcf per day treating capacity Amoruso – 200 MMcf per day gathering Waskom – 0.3 Bcf processing, over 200 MMcf per day gathering and 14,500 barrels per day fractionation plant Actively pursuing other opportunities in liquids-rich shale plays – Bakken Open Season initiated February 19, 2013 Capital expenditures (in millions, source 2012 Form 10-K) CenterPoint Energy Field Services (1) Includes capital expenditures and acquisitions 2012A(1) 2013E 2014E 2015E 2016E 2017E $414 $271 $114 $88 $70 $71

16 investors.centerpointenergy.com March 2013 oge.com/investor-relations OGE Background Information

17 investors.centerpointenergy.com March 2013 oge.com/investor-relations OGE Energy Corp. (NYSE: OGE) Domestic Energy Delivery with 111 Year Operating History Key financial objectives: − 5% to 7% long-term earnings growth rate − Stable and growing dividend − Strong credit metrics − Reduce earnings volatility by growing fee-based business Headquartered in Oklahoma City Vertically integrated electric utility (OG&E) and natural gas midstream business (Enogex) Over 90% of earnings derived from utility or fee-based midstream business Strategically located assets in a stable and growing service territory, prolific natural gas basins and wind corridor

18 investors.centerpointenergy.com March 2013 oge.com/investor-relations Enogex, LLC Expanding midcontinent footprint primarily in the gathering and processing businesses − Over 2.5 million acres of long-term acreage dedications in Western Oklahoma, the Texas Panhandle and the Southeast Cana regions − Since 2011, over $1 billion of capital invested in gathering, compression, processing facilities and acquisitions − Super processing header system allows for optimization and high system reliability Transportation and storage are stable fee-based businesses with high quality utility customers − Delivers natural gas to 15 gas-fired power plants in Oklahoma including OG&E and AEP’s Public Service Company of Oklahoma − Interconnections with 13 long-haul interstate pipelines allows customers to access multiple markets in the U.S. − 24 Bcf of working storage is primarily fee-based on a long- term and short-term basis

19 investors.centerpointenergy.com March 2013 oge.com/investor-relations Detailed Asset Overview CenterPoint Energy Midstream

20 investors.centerpointenergy.com March 2013 oge.com/investor-relations CenterPoint Energy Midstream Asset Overview

21 investors.centerpointenergy.com March 2013 oge.com/investor-relations Diverse supply sources from Haynesville, Fayetteville, Woodford and Barnett shale plays Access to Gulf Coast via Perryville Hub™ / SESH Diverse customer base with strong credit profile Note: The above data does not reflect shippers on CEGT’s Line CP CenterPoint Energy Gas Transmission (CEGT) Line CP CEGT Top Customers (% Revenues) CNP Gas Operations Laclede Group Southwestern Electric Power Oneok Energy Services ANR pipeline Other

22 investors.centerpointenergy.com March 2013 oge.com/investor-relations Sub-segment of CEGT with its own fixed fuel treatment running from Carthage, TX to Perryville, LA Provides market access for supply from the Barnett and Haynesville Shales Access to Gulf Coast and other off-system markets via Perryville Hub™ / SESH provides key differentiator in oversupplied corridor Note: The above data only reflects shippers on Line CP and does not reflect shippers on the rest of CEGT as a whole CNP’s Line CP Line CP Line CP Top Customers (% Revenues) Chesapeake Energy Exxon Mobil/ XTO EOG Resources PetroHawk BP Energy Other

23 investors.centerpointenergy.com March 2013 oge.com/investor-relations SONAT PV Core CGT PV Core SESH FM-65 Core TENN 800 Core SESH / SONAT Header GSPL Header MEP Header CGT CP ANR CP TGC CP TGT CP TGT PV core TENN 100 Core TGC Core ANR PV Core TETCO W Monroe Core GSPL W Monroe Core MRT PV Core Storage Header (4Q 2013) Delhi Alto LGS Sterlington Core Midla Core CEGT Core Line CP Perryville Hub Header Bi-directional Meters Delivery Meters (Receipts by Displacement) Delivery Meter Receipt Meter (Deliveries by Displacement) Diverse supply sources – Barnett, Fayetteville, Woodford, Haynesville, Cana-Woodford, Mississippi Lime, and Granite Wash shale plays – Traditional Arkoma, Ark-La-Tex, and Anadarko Basins ANR: ANR Pipeline CGT: Columbia Gulf Transmission GSPL: Gulf South Pipeline CNP’s Perryville Hub® (PVH) Access to multiple end user markets Highly liquid delivery/receipt point – Substantial Volume Accessibility – Over 30 Bcf/d of receipt & delivery capacity – Supply & Market Optionality – more than 20 separate interconnects with 7 bi-directional – Established Perryville Hub™ Trading Point MEP: Midcontinent Express TGT: Texas Gas Transmission TGC: Trunkline Gas Company

24 investors.centerpointenergy.com March 2013 oge.com/investor-relations Barnett Shale Woodford Shale Fayetteville Shale Haynesville Shale Access to key supply source shale plays Significant demand from large LDC customer Access to Gulf Coast via Perryville Hub™ / SESH CNP’s Mississippi River Transmission (MRT) MRT Top Customers (% of Revenues) Laclede Group CEGT Ameren Illinois CenterPoint Energy Services US Steel Other

25 investors.centerpointenergy.com March 2013 oge.com/investor-relations CNP’s Southeast Supply Header (SESH) 50/50 joint venture between CenterPoint and Spectra Energy − CenterPoint provides field operations − Spectra provides commercial operations − SONAT undivided interest in first 115 miles (500 MM/d capacity entitlement) Pipeline capacity of 1.5 Bcf/d Gwinville (Sonat) and 1.0 Bcf/d to Florida 11 interconnections with existing natural gas pipelines Access to 3 high deliverability storage facilities, with another 2 facilities expected Pipeline Summary

26 investors.centerpointenergy.com March 2013 oge.com/investor-relations – Anadarko basin – Arkoma basin (includes Woodford and Fayetteville shales) – Ark-La-Tex basin (includes Haynesville shale) CenterPoint Energy Field Services (CEFS) Statistics reflect July 2012 Anadarko Basin Arkoma Basin Ark-La-Tex Basin Basin Revenues (%) ARK-LA-TEX ARKOMA ANADARKO Assets in three major gas traditional and shale basins

27 investors.centerpointenergy.com March 2013 oge.com/investor-relations Detailed Asset Overview Enogex LLC

28 investors.centerpointenergy.com March 2013 oge.com/investor-relations Enogex Asset Overview

29 investors.centerpointenergy.com March 2013 oge.com/investor-relations Large acreage dedications Western Oklahoma, the Texas Panhandle and Mississippi Lime Greater Granite Wash (Tonk/Clev/Marm/GW) (rich) Apache PVR Chesapeake Questar Devon Cimarex NW Cana (less rich) Devon Cimarex Continental Questar SE Cana (rich) Continental Newfield Marathon EagleRock Chevron Chesapeake Mississippi Lime (oil / rich gas) Devon Slawson Various Others

30 investors.centerpointenergy.com March 2013 oge.com/investor-relations Enogex Rich Gas Header System Source: Enogex management presentation (November 2012)

31 investors.centerpointenergy.com March 2013 oge.com/investor-relations Enogex Processing Plants Nameplate Processing Year Capacity Plant Installed Type of Plant (MMcf/d) Calumet 1969 Lean Oil 250 Thomas 1981 Cryogenic 135 Wetumka 1983 Cryogenic 60 Cox City 1994 Cryogenic 60 Canute 1996 Cryogenic 60 Roger Mills 2008 Refrigeration 100 Clinton 2009 Cryogenic 120 Cox City Train 4 2011 Cryogenic 120 South Canadian 2011 Cryogenic 200 Wheeler 2012 Cryogenic 200 McClure* 2013 Cryogenic 200 Total Pro Forma Capacity 1,505 *Presently under construction. Source: Enogex management presentation (November 2012)

32 investors.centerpointenergy.com March 2013 oge.com/investor-relations Enogex Expanding Position in the Mid-Continent

33 investors.centerpointenergy.com March 2013 oge.com/investor-relations ● Strategically located transportation assets − ~2,250 miles intrastate transportation pipelines Average throughput of ~2.1 TBtu/d − OG&E and PSO are two largest customers − Deliver natural gas to 15 electric generation facilities in Oklahoma ● Two natural gas storage facilities − Approximately 24 Bcf of aggregate working gas capacity ● Well positioned with multiple outlet alternatives − Connected to 13 major third-party pipelines at 64 pipeline interconnect points Enogex Transportation

34 investors.centerpointenergy.com March 2013 oge.com/investor-relations Enogex Storage Overview The two natural gas storage facilities on the east side of the Enogex system provide approximately 24 Bcf of working gas capacity to customers. The Wetumka storage field − Services the majority of the power plant load on the system. − In operation since 1973 − Total working storage capacity is 18 Bcf − Consists of 34 active injection/withdrawal wells, which equates to a maximum deliverability and injection capacity of 450 MMcf/d The Stuart storage field − In operation since 1994 − Total working storage capacity is 6 Bcf − Contains 11 active storage wells for injection and withdrawal. Maximum deliverability and injection capacity is 200 MMcf/d. Both fields have historically been fully contracted.

35 investors.centerpointenergy.com March 2013 oge.com/investor-relations CenterPoint Energy, Inc (CNP) and OGE Energy Corp (OGE) have included the non-GAAP financial measure EBITDA based on information in their respective 2012 Form 10-K and the combined partnership. EBITDA is a supplemental non- GAAP financial measure used by external users of the Company's financial statements such as investors, commercial banks and others, to assess: • The financial performance of assets without regard to financing methods, capital structure or historical cost basis; • Operating performance and return on capital as compared to other companies in the midstream energy sector, without regard to financing or capital structure; and • The viability of acquisitions and capital expenditure projects and the overall rates of return on alternative investment opportunities. CNP provides a reconciliation of EBITDA to its operating income attributable to CNP’s Field Services and Pipelines business reported in CNP and CenterPoint Energy Resources Corp. 2012 Form 10-K, which is considered to be most directly comparable financial measure as calculated and presented in accordance with GAAP. OGE provides a reconciliation of EBITDA to net income attributable to Enogex Holdings, which Enogex considers to be its most directly comparable financial measure as calculated and presented in accordance with GAAP. The non-GAAP financial measure of EBITDA should not be considered as an alternative to GAAP accounting attributable to each company. EBITDA is not a presentation made in accordance with GAAP and has important limitations as an analytical tool. EBITDA should not be considered in isolation or as a substitute for analysis of each company’s results as reported under GAAP. Because EBITDA excludes some, but not all, items that affect each company’s reported financial results and is defined differently by different companies in the midstream energy sector, each company’s definition of EBITDA may not be comparable to a similarly titled measure of other companies. To compensate for the limitations of EBITDA as an analytical tool, CNP and OGE believe it is important to review the comparable GAAP measure and understand the differences between the measures. Non-GAAP Financial Measure

36 investors.centerpointenergy.com March 2013 oge.com/investor-relations Reconciliation of EBITDA to GAAP (A) As of November 1, 2010, Enogex Holdings' earnings are no longer subject to tax (other than Texas state margin taxes) and are taxable at the individual partner level. (B) Includes amortization of certain customer-based intangible assets associated with the acquisition from Cordillera in November 2011, which is included in gross margin for financial reporting purposes. As reported ($ millions) Field Services Interstate Pipelines Midstream Group Operating Income 214$ 207$ 421$ Add: Depreciation and amortization 50 56 106 Equity in earnings of unconsolidated affiliates 5 26 31 Distributions in excess of earnings 3 5 8 EBITDA 272$ 294$ 566$ Net Income attributable to Enogex Holdings 147.8$ Add: Interest expense, net 32.6 Income tax expense (A) 0.2 Depreciation and amortization expense (B) 111.6 EBITDA 292.2$ Combined EBITDA 858.2$ Year Ended December 31, 2012 CenterPoint Energy Enogex Holdings