UNITED STATES

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

||

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

|

||

|

(Address of principal executive offices, including zip code)

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

||

|

|

|

|

|

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☐

|

Smaller reporting company

|

|

|

Emerging growth company

|

|

Page

|

|||

|

1

|

|||

|

ITEM 1.

|

1

|

||

|

1

|

|||

|

3

|

|||

|

7

|

|||

|

7

|

|||

|

13

|

|||

|

13

|

|||

|

14

|

|||

|

15

|

|||

|

ITEM 1A.

|

16

|

||

|

ITEM 1B.

|

38

|

||

|

ITEM 2.

|

39

|

||

|

ITEM 3.

|

39

|

||

|

ITEM 4.

|

39

|

||

|

40

|

|||

|

ITEM 5.

|

40

|

||

|

ITEM 6.

|

41

|

||

|

ITEM 7.

|

42 | ||

|

ITEM 7A.

|

53 | ||

|

ITEM 8.

|

55 | ||

|

ITEM 9.

|

86 | ||

|

ITEM 9A.

|

86

|

||

|

ITEM 9B.

|

86

|

||

|

ITEM 9C.

|

86 | ||

| 87 | |||

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

87 | |

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

87 | |

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

87 | |

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

87 | |

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

87 | |

| 87 | |||

|

ITEM 15.

|

87 | ||

|

ITEM 16.

|

89 | ||

| 90 | |||

|

Year Ended December 31,

|

||||||||||||||||||||||||

|

Product Category

|

2021

|

2020

|

2019

|

|||||||||||||||||||||

|

Beauty(1)

|

$

|

1,442.7

|

53.5

|

%

|

$

|

1,491.8

|

57.8

|

%

|

$

|

1,423.5

|

58.8

|

%

|

||||||||||||

|

Wellness(1)

|

1,062.5

|

39.4

|

%

|

922.6

|

35.7

|

%

|

863.1

|

35.7

|

%

|

|||||||||||||||

|

Other(2)

|

190.5

|

7.1

|

%

|

167.5

|

6.5

|

%

|

133.8

|

5.5

|

%

|

|||||||||||||||

|

$

|

2,695.7

|

100.0

|

%

|

$

|

2,581.9

|

100.0

|

%

|

$

|

2,420.4

|

100.0

|

%

|

|||||||||||||

| (1) |

Includes sales of beauty and wellness products in our core Nu Skin business. The beauty category includes $658 million, $712 million, $618 million in sales of devices and related

consumables for the years ended December 31, 2021, 2020 and 2019, respectively.

|

| (2) |

Other includes the external revenue from our Rhyz companies along with a limited number of other products and services, including household products and technology services.

|

| ● |

Global consumer research to identify needs and insights and refine product concepts;

|

| ● |

Internal research, product development and quality testing;

|

| ● |

Joint research projects, collaborations and clinical studies;

|

| ● |

Identification and assessment of technologies for potential licensing arrangements; and

|

| ● |

Acquisition of technologies.

|

| ● |

our sales force has rapid reach to potential customers through their social networks and the social networks of those to whom they are connected;

|

| ● |

our sales force can personally educate and share company content with consumers about our products, which we believe is more effective for differentiating our products than using traditional mass-media

advertising;

|

| ● |

our distribution channel allows for personalized product demonstrations and trial by potential consumers;

|

| ● |

our distribution channel allows our sales force to provide personal testimonials of product efficacy; and

|

| ● |

our sales force has the opportunity to provide consumers personalized service based on consumers’ needs, including through providing personalized purchasing offers, discounts and regimens.

|

|

As of December 31, 2021

|

As of December 31, 2020

|

As of December 31, 2019

|

||||||||||||||||||||||

|

Customers

|

Sales Leaders

|

Customers

|

Sales Leaders

|

Customers

|

Sales Leaders

|

|||||||||||||||||||

|

Mainland China

|

315,418

|

17,658

|

381,460

|

21,990

|

292,812

|

17,987

|

||||||||||||||||||

|

Americas

|

336,564

|

10,340

|

366,688

|

12,754

|

195,646

|

6,573

|

||||||||||||||||||

|

South Korea

|

146,354

|

7,108

|

158,953

|

7,059

|

168,972

|

7,251

|

||||||||||||||||||

|

Southeast Asia/Pacific

|

169,601

|

10,386

|

192,622

|

10,588

|

160,919

|

8,514

|

||||||||||||||||||

|

EMEA

|

210,414

|

6,124

|

258,587

|

7,063

|

153,330

|

4,619

|

||||||||||||||||||

|

Japan

|

122,813

|

5,872

|

128,400

|

6,318

|

125,557

|

5,916

|

||||||||||||||||||

|

Hong Kong/Taiwan

|

66,395

|

4,027

|

70,592

|

4,663

|

65,669

|

3,900

|

||||||||||||||||||

|

Total

|

1,367,559

|

61,515

|

1,557,302

|

70,435

|

1,162,905

|

54,760

|

||||||||||||||||||

| ● |

“Brand Affiliate-Direct Consumers”—Individuals who purchase products directly from a Brand Affiliate at a price established by the Brand Affiliate.

|

| ● |

“Company-Direct Consumers”—Individuals who purchase products directly from the company. These consumers are typically referred by a Brand Affiliate and may purchase at retail price or at a

discount. These individuals do not have the right to build a Nu Skin business by reselling product or by recruiting others.

|

| ● |

“Basic Brand Affiliates”—Brand Affiliates who purchase products for personal or family use or for resale to other consumers. These individuals are not eligible to receive compensation on a multi-level basis unless they elect to qualify as a Sales Leader under our global sales compensation plan. We consider these individuals to be part of our consumer group, as we believe a significant majority of these

Brand Affiliates are purchasing products for personal use and not actively recruiting others.

|

| ● |

“Sales Leaders and Qualifiers”—Brand Affiliates who have qualified or are trying to qualify as a Sales Leader. These Brand Affiliates have elected to pursue the business opportunity as a Sales Leader and are

actively attracting consumers, recruiting Brand Affiliates and building a sales network under our global sales compensation plan and constitute our sales network.

|

| ● |

through retail markups on resales of products purchased from the company; and

|

| ● |

through sales compensation earned on the sale of products under our global sales compensation plan.

|

|

Year Ended December 31,

|

||||||||||||||||||||||||

|

(U.S. dollars in millions)

|

2021

|

2020

|

2019

|

|||||||||||||||||||||

|

Nu Skin

|

||||||||||||||||||||||||

|

Mainland China

|

$

|

568.8

|

21

|

%

|

$

|

625.5

|

24

|

%

|

$

|

722.5

|

30

|

%

|

||||||||||||

|

Americas

|

547.8

|

20

|

453.0

|

18

|

304.4

|

12

|

||||||||||||||||||

|

South Korea

|

354.3

|

13

|

326.5

|

13

|

330.0

|

14

|

||||||||||||||||||

|

Southeast Asia/Pacific

|

336.7

|

13

|

361.6

|

14

|

346.3

|

14

|

||||||||||||||||||

|

EMEA

|

283.2

|

11

|

230.2

|

9

|

167.2

|

7

|

||||||||||||||||||

|

Japan

|

266.2

|

10

|

273.7

|

10

|

260.0

|

11

|

||||||||||||||||||

|

Hong Kong/Taiwan

|

162.6

|

6

|

161.1

|

6

|

166.3

|

7

|

||||||||||||||||||

|

Other

|

1.4

|

—

|

0.1

|

—

|

1.7

|

—

|

||||||||||||||||||

|

Total Nu Skin

|

2,521.0

|

94

|

2,431.7

|

94

|

2,298.4

|

95

|

||||||||||||||||||

| Rhyz Investments |

||||||||||||||||||||||||

|

Manufacturing

|

172.1

|

6

|

149.3

|

6

|

121.9

|

5

|

||||||||||||||||||

|

Grow Tech

|

2.1

|

—

|

0.9

|

—

|

0.1

|

—

|

||||||||||||||||||

|

Rhyz other

|

0.5

|

—

|

—

|

—

|

—

|

—

|

||||||||||||||||||

|

Total Rhyz Investments

|

174.7

|

6

|

150.2

|

6

|

122.0

|

5

|

||||||||||||||||||

|

Total

|

$

|

2,695.7

|

100

|

%

|

$

|

2,581.9

|

100

|

%

|

$

|

2,420.4

|

100

|

%

|

||||||||||||

| ● |

impose requirements related to order cancellations, product returns, inventory buy-backs and cooling-off periods for our sales force and consumers;

|

| ● |

require us, or our sales force, to register with government agencies;

|

| ● |

impose limits on the amount of sales compensation we can pay;

|

| ● |

impose reporting requirements; and

|

| ● |

require that our sales force is compensated for sales of products and not for recruiting others.

|

|

● A force for good

● Accountable and empowered

● Bold innovators

● Customer obsessed

|

● Direct and decisive

● Exceptional

● Fast speed

● One global team

|

| 1. |

Support the transformation of our business and culture to align with our business strategies and the Nu Skin Way;

|

| 2. |

Leverage global diversity and build inclusion; and

|

| 3. |

Simplify the employee experience through global alignment and optimization.

|

|

Name

|

Age

|

Position

|

||

|

Steven J. Lund

|

68

|

Executive Chairman of the Board

|

||

|

Ryan S. Napierski

|

48

|

President and Chief Executive Officer

|

||

|

Connie M. Tang

|

51

|

Executive Vice President, Chief Global Growth and Customer Experience Officer

|

||

|

Mark H. Lawrence

|

52

|

Executive Vice President and Chief Financial Officer

|

||

|

Joseph Y. Chang

|

69

|

Executive Vice President and Chief Scientific Officer

|

||

|

Chayce D. Clark

|

39

|

Executive Vice President and General Counsel

|

||

|

Steven K. Hatchett

|

50

|

Executive Vice President and Chief Product Officer

|

| ● |

Challenges to the form of our network marketing system could harm our business.

|

| ● |

Laws and regulations may prohibit or severely restrict direct selling and cause our revenue and profitability to decline, and regulators could adopt new regulations that harm our business.

|

| ● |

Improper sales force actions could harm our business.

|

| ● |

Social media platforms’ decisions to prohibit, block or decrease the prominence of our sales force’s content could harm our business.

|

| ● |

If our business practices or policies or the actions of our sales force are deemed to be in violation of applicable local regulations regarding foreigners, then we could be sanctioned and/or required to

change our business model, which could significantly harm our business.

|

| ● |

Our sales compensation plans or other incentives could be viewed negatively by some of our sales force, could fail to achieve desired long-term results and have a negative impact on revenue.

|

| ● |

Limits on the amount of sales compensation we pay could inhibit our ability to attract and retain our sales force, negatively impact our revenue and cause regulatory risks.

|

| ● |

We may be held responsible for certain taxes or assessments relating to the activities of our sales force, which could harm our financial condition and operating results.

|

| ● |

Our operations in Mainland China are subject to significant government scrutiny, and we could be subject to fines or other penalties.

|

| ● |

If direct selling regulations in Mainland China are modified, interpreted or enforced in a manner that results in negative changes to our business model or the imposition of a range of potential penalties,

our business could be significantly negatively impacted.

|

| ● |

Our ability to expand our business in Mainland China could be negatively impacted if we are unable to obtain additional necessary national and local government approvals in Mainland China.

|

| ● |

If we are not able to register products for sale in Mainland China, our business could be harmed.

|

| ● |

Our markets are intensely competitive, and market conditions and the strengths of competitors may harm our business.

|

| ● |

Adverse publicity concerning our business, marketing plan, products or people could harm our business and reputation.

|

| ● |

Inability of products, platforms, business opportunities and other initiatives to gain or maintain sales force and market acceptance could harm our business.

|

| ● |

Product diversion may have a negative impact on our business.

|

| ● |

Epidemics, including COVID-19, and other crises have and may continue to negatively impact our business.

|

| ● |

Our ability to conduct business in international markets may be affected by political, legal, tax and regulatory risks.

|

| ● |

We are subject to financial risks as a result of our international operations, including exposure to foreign-currency fluctuations, currency controls and inflation in foreign markets, all of which could

impact our financial position and results of operations.

|

| ● |

Potential changes to tariff and import/export regulations, and ongoing trade disputes between the United States and other jurisdictions may have a negative effect on global economic conditions and our

business, financial results and financial condition.

|

| ● |

If we are unable to retain our existing sales force and recruit additional people to join our sales force, our revenue may not increase and may even decline.

|

| ● |

We depend on our key personnel and Sales Leaders, and the loss of the services provided by any of our executive officers, other key employees or key Sales Leaders could harm our business and results of

operations.

|

| ● |

Production difficulties, quality control problems, inaccurate forecasting, shortages in ingredients, and reliance on our suppliers could harm our business.

|

| ● |

The loss of or a disruption in our manufacturing and distribution operations, or significant expenses or violations incurred by such operations, could adversely affect our business.

|

| ● |

Our business could be negatively impacted if we fail to execute our product launch process or ongoing product sales due to difficulty in forecasting or increased pressure on our supply chain, information

systems and management.

|

| ● |

If we are unable to effectively manage our growth in certain markets, our operations could be harmed.

|

| ● |

System failures, capacity constraints and other information technology difficulties could harm our business.

|

| ● |

Any acquired companies or future acquisitions may expose us to additional risks.

|

| ● |

Regulations governing our products, including the formulation, registration, pre-approval, marketing and sale of our products, could harm our business.

|

| ● |

Government regulations and private party actions relating to the marketing and advertising of our products and services may restrict, inhibit or delay our ability to sell our products and harm our business.

|

| ● |

Our operations could be harmed if we fail to comply with Good Manufacturing Practices.

|

| ● |

If our current or any future device products are determined to be medical devices in a particular geographic market, or if our sales force uses these products for medical purposes or makes improper medical

claims, our ability to continue to market and distribute such devices could be harmed, and we could face legal or regulatory actions.

|

| ● |

We may incur product liability claims that could harm our business.

|

| ● |

We may become involved in legal proceedings and other matters that could adversely affect our operations or financial results.

|

| ● |

Non-compliance with anti-corruption laws could harm our business.

|

| ● |

A failure of our internal controls over financial reporting or our regulatory compliance efforts could harm our stock price and our financial and operating results or could result in fines or penalties.

|

| ● |

Government authorities may question our tax or customs positions or change their laws in a manner that could increase our effective tax rate or otherwise harm our business.

|

| ● |

We could be subject to changes in our tax rates, the adoption of new U.S. or international tax legislation or exposure to additional tax liabilities, which could have a material and adverse impact on our

operating results, cash flows and financial condition.

|

| ● |

Transition from LIBOR to an alternative benchmark interest rate could have an adverse effect on our overall financial position.

|

| ● |

We may be subject to claims of infringement on the intellectual property rights or trade secrets of others, resulting in costly litigation.

|

| ● |

If we are unable to protect our intellectual property rights or our proprietary information and know-how, our ability to compete could be negatively impacted and the value of our products could be adversely

affected.

|

| ● |

Cyber security risks and the failure to maintain the integrity of company, employee, sales force or guest data could expose us to data loss, litigation, liability and harm to our reputation.

|

| ● |

Our business could be negatively impacted by corporate citizenship and sustainability matters.

|

| ● |

The market price of our Class A common stock is subject to significant fluctuations due to a number of factors that are beyond our control.

|

| ● |

Difficult economic conditions could harm our business.

|

| ● |

In 2015, the FTC took aggressive actions against a multi-level marketing company, alleging an illegal business model and inappropriate earnings claims.

|

| ● |

In 2016, the FTC entered into a settlement with a multi-level marketing company, requiring the company to modify its business model, including basing sales compensation and qualification only on sales to retail and preferred customers

and on purchases by a distributor for personal consumption within allowable limits. Although this settlement does not represent judicial precedent or a new FTC rule, the FTC has indicated that the industry should look at this settlement,

and the principles underlying its specific measures, for guidance.

|

| ● |

In 2019, the FTC entered into a settlement with a multi-level marketing company, alleging an illegal business model and compensation structure and inappropriate earnings claims. The company agreed to a prohibition from engaging in

multi-level marketing. The FTC and another multi-level marketing company are currently in litigation, and that company had indicated the FTC was seeking to limit the levels of payment in its compensation structure as a condition to

settlement.

|

| ● |

During 2020 and 2021, the FTC issued letters that warned several direct-selling companies to remove and address claims that they or members of their sales force were making about their products’ ability to treat or prevent COVID-19

and/or about the earnings that people who have recently lost income could make.

|

| ● |

In 2021, the FTC sent a notice to more than 1,100 companies, including us and two of our subsidiaries (Pharmanex, LLC and Big Planet, Inc.), that outlined several practices that the FTC determined to be unfair or deceptive in prior

administrative cases. These practices relate to earnings claims, other money-making opportunity claims, and endorsements and testimonials. Pursuant to the FTC’s “penalty offense authority,” companies that received the notice are expected to

comply with the standards set in the prior administrative cases and could incur significant civil penalties if they or their representatives fail to do so. The penalties could be up to $43,792 per violation, and there is some ambiguity in

how a “violation” would be defined for these purposes.

|

| ● |

impose requirements related to sign-up, order cancellations, product returns, inventory buy-backs and cooling-off periods for our sales force and consumers;

|

| ● |

require us, or our sales force, to register with government agencies;

|

| ● |

impose limits on the amount of sales compensation we can pay;

|

| ● |

impose reporting requirements; and

|

| ● |

require that our sales force is compensated for selling products and not for recruiting others.

|

| ● |

During 2020 and 2021, the FTC issued letters that warned several direct-selling companies to remove and address claims that they or members of their sales force were making about their products’

ability to treat or prevent COVID-19 and/or about the earnings that people who have recently lost income could make.

|

| ● |

In 2021, the FTC sent a notice to more than 1,100 companies, including us and two of our subsidiaries (Pharmanex, LLC and Big Planet, Inc.), that outlined several practices that the FTC determined to be unfair or deceptive in prior

administrative cases. These practices relate to earnings claims, other money-making opportunity claims, and endorsements and testimonials. Pursuant to the FTC’s “penalty offense authority,” companies that received the notice are expected to comply with the standards set in the prior administrative cases and could incur significant civil penalties if they or their representatives fail to do so. The penalties could be up to

$43,792 per violation, and there is some ambiguity in how a “violation” would be defined for these purposes.

|

| ● |

suspicions about the legality and ethics of network marketing;

|

| ● |

media or regulatory scrutiny regarding our business and our business models, including in Mainland China;

|

| ● |

the safety or effectiveness of our or our competitors’ products or the ingredients in such products;

|

| ● |

inquiries, investigations, fines, legal actions, or mandatory or voluntary product recalls involving us, our competitors, our business models or our respective products;

|

| ● |

the actions of our current or former sales force and employees, including any allegations that our sales force or employees have overstated or made false product claims or earnings representations, or engaged

in unethical or illegal activity;

|

| ● |

misperceptions about the types and magnitude of economic benefits offered at different levels of sales engagement in our business; and

|

| ● |

public, governmental or media perceptions of the direct selling, beauty product, or wellness product industries generally.

|

| ● |

the possibility that a government might ban or severely restrict our sales compensation and business models;

|

| ● |

the possibility that local civil unrest, political instability, or changes in diplomatic or trade relationships might disrupt our operations in one or more markets;

|

| ● |

the lack of well-established or reliable legal systems in certain areas where we operate;

|

| ● |

the presence of high inflation in the economies of international markets in which we operate;

|

| ● |

the possibility that a government authority might impose legal, tax, customs, or other financial burdens on us or our sales force, due, for example, to the structure of our operations in various markets;

|

| ● |

the possibility that a government authority might challenge the status of our sales force as independent contractors or impose employment or social taxes on our sales force; and

|

| ● |

the possibility that governments may impose currency remittance restrictions limiting our ability to repatriate cash.

|

| ● |

any adverse publicity or negative public perception regarding us, our products or ingredients, our distribution channel, or our industry or competitors;

|

| ● |

lack of interest in, dissatisfaction with, or the technical failure of, existing or new products;

|

| ● |

lack of compelling products or income opportunities, including through our sales compensation plans and incentive trips and other offerings;

|

| ● |

negative sales force reaction to changes in our sales compensation plans or to our failure to make changes that would be necessary to keep our compensation competitive with the market;

|

| ● |

interactions with our company, including our actions to enforce our policies and procedures and the quality of our customer service;

|

| ● |

any regulatory actions or charges against us or others in our industry, as well as regulatory changes that impact product formulations and sales viability;

|

| ● |

general economic, business and public health conditions, including employment levels, employment trends such as the gig and sharing economies, and pandemics or other conditions that curtail person-to-person

interactions;

|

| ● |

changes in the policies of social media platforms used to prospect or recruit potential consumers and sales force participants;

|

| ● |

recruiting efforts of our competitors and changes in consumer-loyalty trends; and

|

| ● |

potential saturation or maturity levels in a given market, which could negatively impact our ability to attract and retain our sales force in such market.

|

| ● |

difficulties in integrating acquired operations or products;

|

| ● |

the difficulties of imposing financial and operating controls on the acquired companies and their management and the potential costs of doing so;

|

| ● |

the potential loss of key employees, customers, suppliers or distributors from acquired businesses and disruption to our direct selling channel;

|

| ● |

diversion of management’s attention from our core business;

|

| ● |

the failure to achieve the strategic objectives of these acquisitions;

|

| ● |

increased fixed costs;

|

| ● |

the failure of the acquired businesses to achieve the results we have projected in either the near or long term;

|

| ● |

the assumption of unexpected liabilities, including litigation risks;

|

| ● |

adverse effects on existing business relationships with our suppliers, sales force or consumers; and

|

| ● |

risks associated with entering markets or industries in which we have limited or no prior experience, including limited expertise in running the business, developing the technology, and selling and servicing

the products.

|

| ● |

delays, or altogether prohibitions, in introducing or selling a product or ingredient in one or more markets;

|

| ● |

delays and expenses associated with the registration and approval process for a product;

|

| ● |

limitations on our ability to import products into a market;

|

| ● |

delays and expenses associated with compliance, such as record keeping, documentation of the properties of certain products, labeling, and scientific substantiation;

|

| ● |

limitations on the claims we can make regarding our products; and

|

| ● |

product reformulations, or the recall or discontinuation of certain products that cannot be reformulated to comply with new regulations.

|

| ● |

fluctuations in our operating results;

|

| ● |

government investigations of our business;

|

| ● |

trends or adverse publicity related to our business, products, industry or competitors;

|

| ● |

the sale of shares of Class A common stock by significant stockholders;

|

| ● |

demand, and general trends in the market, for our products;

|

| ● |

acquisitions by us or our competitors;

|

| ● |

economic or currency exchange issues in markets in which we operate;

|

| ● |

changes in estimates of our operating performance or changes in recommendations by securities analysts;

|

| ● |

speculative trading, including short selling and options trading; and

|

| ● |

general economic, business, regulatory and political conditions.

|

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

(a)

|

(b)

|

(c)

|

(d)

|

|||||||||||||

|

Period

|

Total

Number

of Shares

Purchased

|

Average

Price Paid

per Share

|

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

|

Approximate Dollar

Value of Shares that May

Yet Be Purchased Under

the Plans or Programs

(in millions)(1)

|

||||||||||||

|

October 1 – 31, 2021

|

244,482

|

$

|

40.92

|

244,482

|

$

|

245.4

|

||||||||||

|

November 1 – 30, 2021

|

—

|

—

|

—

|

$

|

245.4

|

|||||||||||

|

December 1 – 31, 2021

|

—

|

—

|

—

|

$

|

245.4

|

|||||||||||

|

Total

|

244,482

|

$

|

40.92

|

244,482

|

||||||||||||

| (1) |

In August 2018, we announced that our board of directors approved a stock repurchase plan. Under this plan, our board of directors authorized the repurchase of up to $500 million of our outstanding Class A

common stock on the open market or in privately negotiated transactions.

|

|

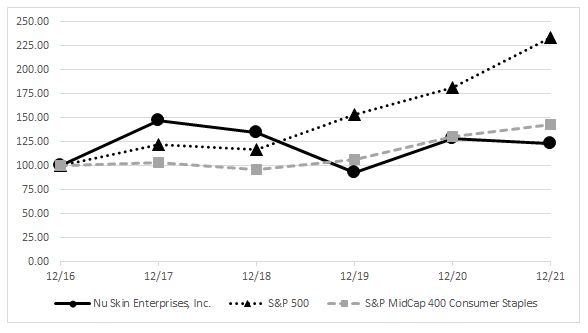

Measured Period

|

Nu Skin

|

S&P 500 Index

|

S&P MidCap 400 Consumer Staples

Index

|

|||

|

December 31, 2016

|

100.00

|

100.00

|

100.00

|

|||

|

December 31, 2017

|

146.54

|

121.83

|

103.28

|

|||

|

December 31, 2018

|

134.34

|

116.49

|

95.90

|

|||

|

December 31, 2019

|

92.69

|

153.17

|

106.30

|

|||

|

December 31, 2020

|

128.63

|

181.35

|

129.94

|

|||

|

December 31, 2021

|

123.05

|

233.41

|

143.04

|

| ● |

developing and marketing innovative, technologically and scientifically advanced products;

|

| ● |

providing compelling initiatives and strong support; and

|

| ● |

offering an attractive sales compensation structure.

|

| ● |

cost of products purchased from third-party vendors;

|

| ● |

costs of self-manufactured products;

|

| ● |

cost of adjustments to inventory carrying value;

|

| ● |

freight cost of shipping products to our sales force and import duties for the products; and

|

| ● |

royalties and related expenses for licensed technologies.

|

| ● |

wages and benefits;

|

| ● |

rents and utilities;

|

| ● |

depreciation and amortization;

|

| ● |

promotion and advertising;

|

| ● |

professional fees;

|

| ● |

travel;

|

| ● |

research and development; and

|

| ● |

other operating expenses.

|

|

Year Ended December 31,

|

||||||||||||

|

2021

|

2020

|

2019

|

||||||||||

|

Revenue

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||||||

|

Cost of sales

|

25.0

|

25.5

|

24.0

|

|||||||||

|

Gross profit

|

75.0

|

74.5

|

76.0

|

|||||||||

|

Operating expenses:

|

||||||||||||

|

Selling expenses

|

39.6

|

39.5

|

39.5

|

|||||||||

|

General and administrative expenses

|

24.7

|

25.0

|

25.4

|

|||||||||

|

Restructuring and impairment expenses

|

2.0

|

—

|

—

|

|||||||||

|

Total operating expenses

|

66.3

|

64.5

|

64.9

|

|||||||||

|

Operating income

|

8.7

|

10.0

|

11.0

|

|||||||||

|

Other income (expense), net

|

(0.1

|

)

|

(0.1

|

)

|

(0.5

|

)

|

||||||

|

Income before provision for income taxes

|

8.6

|

9.9

|

10.5

|

|||||||||

|

Provision for income taxes

|

3.1

|

2.5

|

3.4

|

|||||||||

|

Net income

|

5.5

|

%

|

7.4

|

%

|

7.2

|

%

|

||||||

|

Constant

|

||||||||||||||||

|

Year Ended December 31,

|

Currency

|

|||||||||||||||

|

2021

|

2020

|

Change

|

Change(1)

|

|||||||||||||

|

Nu Skin

|

||||||||||||||||

|

Mainland China

|

$

|

568,774

|

$

|

625,538

|

(9

|

)%

|

(15

|

)%

|

||||||||

|

Americas

|

547,755

|

453,022

|

21

|

%

|

20

|

%

|

||||||||||

|

South Korea

|

354,252

|

326,478

|

9

|

%

|

6

|

%

|

||||||||||

|

Southeast Asia/Pacific

|

336,651

|

361,627

|

(7

|

)%

|

(9

|

)%

|

||||||||||

|

EMEA

|

283,200

|

230,246

|

23

|

%

|

18

|

%

|

||||||||||

|

Japan

|

266,216

|

273,681

|

(3

|

)%

|

—

|

|||||||||||

|

Hong Kong/ Taiwan

|

162,611

|

161,117

|

1

|

%

|

(2

|

)%

|

||||||||||

|

Other

|

1,549

|

(17

|

)

|

9,212

|

%

|

9,212

|

%

|

|||||||||

|

Total Nu Skin

|

2,521,008

|

2,431,692

|

4

|

%

|

1

|

%

|

||||||||||

|

Rhyz Investments

|

||||||||||||||||

|

Manufacturing

|

172,120

|

149,339

|

15

|

%

|

15

|

%

|

||||||||||

|

Grow Tech

|

2,104

|

903

|

133

|

%

|

133

|

%

|

||||||||||

|

Rhyz Other

|

437

|

—

|

||||||||||||||

|

Total Rhyz Investments

|

174,661

|

150,242

|

16

|

%

|

16

|

%

|

||||||||||

|

Total

|

$

|

2,695,669

|

$

|

2,581,934

|

4

|

%

|

2

|

%

|

||||||||

| (1) |

Constant-currency revenue change is a non-GAAP financial measure. See “Non-GAAP Financial Measures,” below.

|

|

Year Ended December 31,

|

||||||||||||

|

2021

|

2020

|

Change

|

||||||||||

|

Nu Skin

|

||||||||||||

|

Mainland China

|

$

|

151,645

|

$

|

181,024

|

(16

|

)%

|

||||||

|

Americas

|

116,265

|

86,386

|

35

|

%

|

||||||||

|

South Korea

|

114,034

|

100,933

|

13

|

%

|

||||||||

|

Southeast Asia/Pacific

|

81,779

|

87,753

|

(7

|

)%

|

||||||||

|

EMEA

|

41,988

|

24,078

|

74

|

%

|

||||||||

|

Japan

|

67,511

|

68,027

|

(1

|

)%

|

||||||||

|

Hong Kong/Taiwan

|

37,330

|

33,466

|

12

|

%

|

||||||||

|

Total Nu Skin

|

610,552

|

573,039

|

7

|

%

|

||||||||

|

Rhyz Investments

|

||||||||||||

|

Manufacturing

|

18,346

|

21,168

|

(13

|

)%

|

||||||||

|

Grow Tech

|

(83,907

|

)

|

(22,430

|

)

|

(274

|

)%

|

||||||

|

Rhyz Other

|

(1,813

|

)

|

—

|

|||||||||

|

Total Rhyz Investments

|

(67,374

|

)

|

(1,262

|

)

|

(5,236

|

)%

|

||||||

|

As of December 31, 2021

|

As of December 31, 2020

|

% Increase (Decrease)

|

||||||||||||||||||||||

|

Customers

|

Sales Leaders

|

Customers

|

Sales Leaders

|

Customers

|

Sales Leaders

|

|||||||||||||||||||

|

Mainland China

|

315,418

|

17,658

|

381,460

|

21,990

|

(17

|

)%

|

(20

|

)%

|

||||||||||||||||

|

Americas

|

336,564

|

10,340

|

366,688

|

12,754

|

(8

|

)%

|

(19

|

)%

|

||||||||||||||||

|

South Korea

|

146,354

|

7,108

|

158,953

|

7,059

|

(8

|

)%

|

1

|

%

|

||||||||||||||||

|

Southeast Asia/Pacific

|

169,601

|

10,386

|

192,622

|

10,588

|

(12

|

)%

|

(2

|

)%

|

||||||||||||||||

|

EMEA

|

210,414

|

6,124

|

258,587

|

7,063

|

(19

|

)%

|

(13

|

)%

|

||||||||||||||||

|

Japan

|

122,813

|

5,872

|

128,400

|

6,318

|

(4

|

)%

|

(7

|

)%

|

||||||||||||||||

|

Hong Kong/Taiwan

|

66,395

|

4,027

|

70,592

|

4,663

|

(6

|

)%

|

(14

|

)%

|

||||||||||||||||

|

Total

|

1,367,559

|

61,515

|

1,557,302

|

70,435

|

(12

|

)%

|

(13

|

)%

|

||||||||||||||||

| ● |

Cash requirements for operating activities. Our operating expenses typically total approximately 85%-90% of our revenue, with compensation to our sales force constituting 40%-42% of our core Nu Skin revenue.

These compensation expenses consist primarily of commission payments, which we generally pay to our sales force within approximately one to two months of the sale. Inventory purchases have historically constituted approximately 15%-20% of

our revenue. On average, we purchase our inventory approximately three to six months prior to sale. While our actual cash usage may vary based on the timing of payments, we currently expect these approximate percentages and payment

practices to continue in 2022. In addition, we expect our 2022 lease payments will be approximately $38 million.

|

| ● |

Cash requirements for investing activities. As discussed in more detail below, our capital expenditures are expected to be $85-105 million for 2022.

|

| ● |

Cash requirements for financing activities. In 2022 we are obligated to make a total of $37.5 million in quarterly principal payments plus the associated interest on our term loan. We also anticipate paying

quarterly cash dividends throughout 2022, approximating $19-20 million per quarter depending on the number of shares outstanding as of record date. Additional details about our dividends and term loan are provided below.

|

| ● |

purchases and expenditures for computer systems and equipment, software, and application development;

|

| ● |

the expansion and upgrade of facilities in our various markets; and

|

| ● |

a new manufacturing plant in Mainland China.

|

|

2021

|

2020

|

|||||||||||||||||||||||||||||||

|

4th Quarter

|

3rd Quarter

|

2nd Quarter

|

1st Quarter

|

4th Quarter

|

3rd Quarter

|

2nd Quarter

|

1st Quarter

|

|||||||||||||||||||||||||

|

Argentina

|

100.5

|

97.4

|

93.9

|

88.8

|

79.5

|

73.0

|

67.4

|

61.4

|

||||||||||||||||||||||||

|

Australia

|

1.4

|

1.4

|

1.3

|

1.3

|

1.4

|

1.4

|

1.5

|

1.5

|

||||||||||||||||||||||||

|

Canada

|

1.3

|

1.3

|

1.2

|

1.3

|

1.3

|

1.3

|

1.4

|

1.3

|

||||||||||||||||||||||||

|

Colombia

|

3,882.7

|

3,840.4

|

3,690.7

|

3,560.4

|

3,694.6

|

3,717.7

|

3,694.6

|

3,515.3

|

||||||||||||||||||||||||

|

Chile

|

827.4

|

773.6

|

716.8

|

724.0

|

757.0

|

780.5

|

818.1

|

801.1

|

||||||||||||||||||||||||

|

Eurozone countries

|

0.9

|

0.8

|

0.8

|

0.8

|

0.8

|

0.9

|

0.9

|

0.9

|

||||||||||||||||||||||||

|

Hong Kong

|

7.8

|

7.8

|

7.8

|

7.8

|

7.8

|

7.8

|

7.8

|

7.8

|

||||||||||||||||||||||||

|

Indonesia

|

14,274

|

14,373

|

14,393

|

14,202

|

14,339

|

14,722

|

14,880

|

14,265

|

||||||||||||||||||||||||

|

Japan

|

113.6

|

110.1

|

109.5

|

106.0

|

104.4

|

106.1

|

107.6

|

108.9

|

||||||||||||||||||||||||

|

Mainland China

|

6.4

|

6.5

|

6.5

|

6.5

|

6.6

|

6.9

|

7.1

|

7.0

|

||||||||||||||||||||||||

|

Malaysia

|

4.2

|

4.2

|

4.1

|

4.1

|

4.1

|

4.2

|

4.3

|

4.2

|

||||||||||||||||||||||||

|

Mexico

|

20.7

|

20.0

|

20.0

|

20.4

|

20.6

|

22.1

|

23.2

|

19.8

|

||||||||||||||||||||||||

|

Philippines

|

50.4

|

50.2

|

48.2

|

48.3

|

48.3

|

48.9

|

50.4

|

50.9

|

||||||||||||||||||||||||

|

Singapore

|

1.4

|

1.4

|

1.3

|

1.3

|

1.3

|

1.4

|

1.4

|

1.4

|

||||||||||||||||||||||||

|

South Africa

|

15.4

|

14.6

|

14.1

|

15.0

|

15.6

|

16.9

|

17.7

|

15.3

|

||||||||||||||||||||||||

|

South Korea

|

1,183.8

|

1,159.7

|

1,121.2

|

1,115.3

|

1,117.2

|

1,188.8

|

1,219.9

|

1,192.3

|

||||||||||||||||||||||||

|

Taiwan

|

27.8

|

27.9

|

28.0

|

28.1

|

28.4

|

29.3

|

29.9

|

30.1

|

||||||||||||||||||||||||

|

Thailand

|

33.3

|

32.9

|

31.4

|

30.3

|

30.6

|

31.3

|

31.9

|

31.3

|

||||||||||||||||||||||||

|

Vietnam

|

22,780

|

22,889

|

23,041

|

23,052

|

23,154

|

23,182

|

23,353

|

23,235

|

||||||||||||||||||||||||

| 1. |

Financial Statements. Set forth below is the index to the Financial Statements included in this Item 8:

|

|

Page

|

|

|

Consolidated Balance Sheets at December 31, 2021 and 2020

|

56

|

|

Consolidated Statements of Income for the years ended December 31, 2021,

2020 and 2019

|

57

|

|

Consolidated Statements of Comprehensive Income for the years ended December 31, 2021,

2020 and 2019

|

58

|

|

Consolidated Statements of Stockholders’ Equity for the years ended December 31, 2021,

2020 and 2019

|

59

|

|

Consolidated Statements of Cash Flows for the years ended December 31, 2021,

2020 and 2019

|

60

|

|

61

|

|

| 84 |

|

2.

|

Financial Statement Schedules: Financial statement schedules have been omitted because they are not required or are not applicable, or because the required information is shown in the financial

statements or notes thereto.

|

|

December 31,

|

||||||||

|

2021

|

2020

|

|||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash and cash equivalents

|

$

|

|

$

|

|

||||

|

Current investments

|

|

|

||||||

|

Accounts receivable, net

|

|

|

||||||

|

Inventories, net

|

|

|

||||||

|

Prepaid expenses and other

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

Property and equipment, net

|

|

|

||||||

|

Operating lease right-of-use assets

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Other intangible assets, net

|

|

|

||||||

|

Other assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts payable

|

$

|

|

$

|

|

||||

|

Accrued expenses

|

|

|

||||||

|

Current portion of long-term debt

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

Operating lease liabilities

|

|

|

||||||

|

Long-term debt

|

|

|

||||||

|

Other liabilities

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Commitments and contingencies (Notes 7 and 16)

|

|

|

||||||

|

Stockholders’ equity

|

||||||||

|

Class A common stock –

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Treasury stock, at cost –

|

(

|

)

|

(

|

)

|

||||

|

Accumulated other comprehensive loss

|

(

|

)

|

(

|

)

|

||||

|

Retained earnings

|

|

|

||||||

|

Total stockholders’ equity

|

|

|

||||||

|

Total liabilities and stockholders’ equity

|

$

|

|

$

|

|

||||

|

Year Ended December 31,

|

||||||||||||

|

2021

|

2020

|

2019

|

||||||||||

|

Revenue

|

$

|

|

$

|

|

$

|

|

||||||

|

Cost of sales

|

|

|

|

|||||||||

|

Gross profit

|

|

|

|

|||||||||

|

Operating expenses:

|

||||||||||||

|

Selling expenses

|

|

|

|

|||||||||

|

General and administrative expenses

|

|

|

|

|||||||||

|

Restructuring and impairment expenses

|

|

|

|

|||||||||

|

Total operating expenses

|

|

|

|

|||||||||

|

Operating income

|

|

|

|

|||||||||

|

Other income (expense), net (Note 17)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Income before provision for income taxes

|

|

|

|

|||||||||

|

Provision for income taxes

|

|

|

|

|||||||||

|

Net income

|

$

|

|

$

|

|

$

|

|

||||||

|

Net income per share:

|

||||||||||||

|

Basic

|

$

|

|

$

|

|

$

|

|

||||||

|

Diluted

|

$

|

|

$

|

|

$

|

|

||||||

|

Weighted-average common shares outstanding (000s):

|

||||||||||||

|

Basic

|

|

|

|

|||||||||

|

Diluted

|

|

|

|

|||||||||

|

Year Ended December 31,

|

||||||||||||

|

2021

|

2020

|

2019

|

||||||||||

|

Net income

|

$

|

|

$

|

|

$

|

|

||||||

|

Other comprehensive income (loss):

|

||||||||||||

|

Foreign currency translation adjustment, net of taxes of $

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net unrealized gains/(losses) on cash flow hedges, net of taxes of $(

|

|

|

|

|||||||||

|

Less: Reclassification adjustment for realized losses/(gains) in current earnings, on cash flow hedges, net of taxes of $(

|

|

|

|

|||||||||

|

(

|

)

|

|

(

|

)

|

||||||||

|

Comprehensive income

|

$

|

|

$

|

|

$

|

|

||||||

|

Class A

Common Stock

|

Additional

Paid-in Capital

|

Treasury

Stock, at cost

|

Accumulated Other

Comprehensive Loss

|

Retained

Earnings

|

Total

|

|||||||||||||||||||

|

Balance at January 1, 2019

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

$

|

|

||||||||||

|

Cumulative effect adjustment from adoption of ASC Topic 842

|

|

|

|

|

|

|

||||||||||||||||||

|

Net income

|

|

|

|

|

|

|

||||||||||||||||||

|

Other comprehensive loss, net of tax

|

|

|

|

(

|

)

|

|

(

|

)

|

||||||||||||||||

|

Repurchase of Class A common stock (Note 8)

|

|

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||||

|

Exercise of employee stock options (

|

|

(

|

)

|

|

|

|

(

|

)

|

||||||||||||||||

|

Stock-based compensation

|

|

|

|

|

|

|

||||||||||||||||||

|

Cash dividends

|

|

|

|

|

(

|

)

|

(

|

)

|

||||||||||||||||

|

Balance at December 31, 2019

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

$

|

|

||||||||||

|

Net income

|

|

|

|

|

|

|

||||||||||||||||||

|

Other comprehensive income, net of tax

|

|

|

|

|

|

|

||||||||||||||||||

|

Repurchase of Class A common stock (Note 8)

|

|

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||||

|

Exercise of employee stock options (

|

|

(

|

)

|

|

|

|

|

|||||||||||||||||

|

Stock-based compensation

|

|

|

|

|

|

|

||||||||||||||||||

|

Cash dividends

|

|

|

|

|

(

|

)

|

(

|

)

|

||||||||||||||||

|

Balance at December 31, 2020

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

$

|

|

||||||||||

|

Net income

|

|

|

|

|

|

|

||||||||||||||||||

|

Other comprehensive loss, net of tax

|

|

|

|

(

|

)

|

|

(

|

)

|

||||||||||||||||

|

Repurchase of Class A common stock (Note 8)

|

|

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||||

|

Exercise of employee stock options (

|

|

(

|

)

|

|

|

|

|

|||||||||||||||||

|

Stock-based compensation

|

|

|

|

|

|

|

||||||||||||||||||

|

Cash dividends

|

|

|

|

|

(

|

)

|

(

|

)

|

||||||||||||||||

|

Balance at December 31, 2021

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

$

|

|

||||||||||

|

Year Ended December 31,

|

||||||||||||

|

2021

|

2020

|

2019

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net income

|

$

|

|

$

|

|

$

|

|

||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

|

|

|

|||||||||

|

Non-cash lease expense

|

|

|

|

|||||||||

|

Stock-based compensation

|

|

|

|

|||||||||

|

Foreign currency (gains)/losses

|

|

(

|

)

|

|

||||||||

|

Loss on disposal of assets

|

|

|

|

|||||||||

|

Impairment of fixed assets

|

|

|

|

|||||||||

|

Unrealized (gain)/losses on equity investments

|

( |

) | ||||||||||

|

Deferred taxes

|

|

(

|

)

|

|

||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Accounts receivable, net

|

|

(

|

)

|

|

||||||||

|

Inventories, net

|

(

|

)

|

(

|

)

|

|

|||||||

|

Prepaid expenses and other

|

|

(

|

)

|

(

|

)

|

|||||||

|

Other assets

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Accounts payable

|

(

|

)

|

|

(

|

)

|

|||||||

|

Accrued expenses

|

(

|

)

|

|

(

|

)

|

|||||||

|

Other liabilities

|

|

|

|

|||||||||

|

Net cash provided by operating activities

|

|

|

|

|||||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Purchases of property and equipment

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Proceeds on investment sales

|

|

|

|

|||||||||

|

Purchases of investments

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Acquisitions (net of cash acquired)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net cash used in investing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Exercise of employee stock options and taxes paid related to the net shares settlement of stock awards

|

( |

) | ||||||||||

|

Payment of cash dividends

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Repurchase of shares of common stock

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Finance lease principal payments

|

(

|

)

|

(

|

)

|

|

|||||||

|

Payments on debt

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Proceeds from debt

|

|

|

|

|||||||||

|

Net cash used in financing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Effect of exchange rate changes on cash

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net increase (decrease) in cash and cash equivalents

|

(

|

)

|

|

(

|

)

|

|||||||

|

Cash and cash equivalents, beginning of period

|

|

|

|

|||||||||

|

Cash and cash equivalents, end of period

|

$

|

|

$

|

|

$

|

|

||||||

| 1. |

The Company

|

| 2. |

Summary of Significant Accounting Policies

|

|

December 31,

|

||||||||

|

2021

|

2020

|

|||||||

|

Raw materials

|

$

|

|

$

|

|

||||

|

Finished goods

|

|

|

||||||

|

Total inventory, net

|

$

|

|

$

|

|

||||

|

2021

|

2020

|

2019

|

||||||||||

|

Beginning balance

|

$

|

|

$

|

|

$

|

|

||||||

|

Additions

|

|

|

|

|||||||||

|

Write-offs

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Ending balance

|

$

|

|

$

|

|

$

|

|

||||||

|

December 31,

|

||||||||

|

2021

|

2020

|

|||||||

|

Deferred charges

|

$

|

|

$

|

|

||||

|

Prepaid income tax

|

|

|

||||||

|

Prepaid inventory and import costs

|

|

|

||||||

|

Prepaid rent, insurance and other occupancy costs

|

|

|

||||||

|

Prepaid promotion and event cost

|

|

|

||||||

|

Prepaid other taxes

|

|

|

||||||

|

Prepaid software license

|

|

|

||||||

|

Deposits

|

|

|

||||||

|

Other

|

|

|

||||||

|

Total prepaid expense and other

|

$

|

|

$

|

|

||||

|

Buildings

|

|

|

Furniture and fixtures

|

|

|

Computers and equipment

|

|

|

Leasehold improvements

|

|

|

Scanners

|

|

|

Vehicles

|

|

|

December 31,

|

||||||||

|

2021

|

2020

|

|||||||

|

Deferred taxes

|

$

|

|

$

|

|

||||

|

Deposits for noncancelable operating leases

|

|

|

||||||

|

Cash surrender value for life insurance policies

|

|

|

||||||

|

|

|

|

||||||

| Long-term investments | ||||||||

|

Other

|

|

|

||||||

|

Total other assets

|

$

|

|

$

|

|

||||

|

December 31,

|

||||||||

|

2021

|

2020

|

|||||||

|

Accrued sales force commissions and other payments

|

$

|

|

$

|

|

||||

|

Accrued income taxes

|

|

|

||||||

|

Accrued other taxes

|

|

|

||||||

|

Accrued payroll and other employee expenses

|

|

|

||||||

|

Accrued payable to vendors

|

|

|

||||||

|

|

|

|

||||||

|

Accrued royalties

|

|

|

||||||

|

Sales return reserve

|

|

|

||||||

|

Deferred revenue

|

|

|

||||||

|

Other

|

|

|

||||||

|

Total accrued expenses

|

$

|

|

$

|

|

||||

|

December 31,

|

||||||||

|

2021

|

2020

|

|||||||

|

Deferred tax liabilities

|

$

|

|

$

|

|

||||

|

Reserve for other tax liabilities

|

|

|

||||||

|

Liability for deferred compensation plan

|

|

|

||||||

|

Contingent consideration

|

|

|

||||||

|

|

|

|

||||||

|

Asset retirement obligation

|

|

|

||||||

|

Other

|

|

|

||||||

|

Total other liabilities

|

$

|

|

$

|

|

||||

|

2021

|

2020

|

2019

|

||||||||||

|

Gross balance at January 1

|

$

|

|

$

|

|

$

|

|

||||||

|

Increases related to prior year tax positions

|

|

|

|

|||||||||

|

Increases related to current year tax positions

|

|

|

|

|||||||||

|

Settlements

|

(

|

)

|

(

|

)

|

|

|||||||

|

Decreases due to lapse of statutes of limitations

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Currency adjustments

|

(

|

)

|

|

|

||||||||

|

Gross balance at December 31

|

$

|

|

$

|

|

$

|

|

||||||

| ● |

Level 1 – quoted prices in active markets for identical assets or liabilities;

|

| ● |

Level 2 – inputs, other than the quoted prices in active markets, that are observable either directly or indirectly;

|

| ● |

Level 3 – unobservable inputs based on the Company’s own assumptions.

|

| 3. |

Property and Equipment

|

|

December 31,

|

||||||||

|

2021

|

2020

|

|||||||

|

Land

|

$

|

|

$

|

|

||||

|

Buildings

|

|

|

||||||

|

Construction in progress(1)

|

|

|

||||||

|

Furniture and fixtures

|

|

|

||||||

|

Computers and equipment

|

|

|

||||||

|

Leasehold improvements

|

|

|

||||||

|

Scanners

|

|

|

||||||

|

Vehicles

|

|

|

||||||

|

|

|

|||||||

|

Less: accumulated depreciation

|

(

|

)

|

(

|

)

|

||||

|

$

|

|

$

|

|

|||||

| (1) |

|

| 4. |

Goodwill

|

|

December 31,

|

||||||||

|

2021

|

2020

|

|||||||

|

Nu Skin

|

||||||||

|

Mainland China

|

$

|

|

$

|

|

||||

|

Americas

|

|

|

||||||

|

South Korea

|

|

|

||||||

|

Southeast Asia/Pacific

|

|

|

||||||

|

EMEA

|

|

|

||||||

|

Japan

|

|

|

||||||

|

Hong Kong/Taiwan

|

|

|

||||||

| Rhyz Investments |

||||||||

|

Manufacturing

|

|

|

||||||

|

Grow Tech

|

|

|

||||||

| Rhyz Other |

||||||||

|

Total

|

$

|

|

$

|

|

||||

| 5. |

Other Intangible Assets

|

|

Carrying Amount at December 31,

|

||||||||

|

2021

|

2020

|

|||||||

|

Indefinite life intangible assets:

|

||||||||

|

Trademarks and trade names

|

$

|

|

$

|

|

||||

|

Other indefinite lived intangibles

|

|

|

||||||

|

$

|

|

$

|

|

|||||

|

December 31, 2021

|

December 31, 2020

|

||||||||||||||||

|

Finite life intangible assets:

|

Gross Carrying

Amount

|

Accumulated

Amortization

|

Gross Carrying

Amount

|

Accumulated

Amortization

|

Weighted-

average

Amortization

Period

|

||||||||||||

|

Scanner technology

|

$

|

|

$

|

|

$

|

|

$

|

|