UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☑ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Pursuant to §240.14a-12

|

|

NU SKIN ENTERPRISES, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

☑

|

No fee required.

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how

it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

|

|

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF

NU SKIN ENTERPRISES, INC.

|

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Nu Skin Enterprises,

Inc., a Delaware corporation, will be held at 11:00 a.m., Mountain Daylight Time, on June 3, 2020. At the Annual Meeting, you will be asked to consider and vote on the following matters, which are more fully described in the Proxy Statement:

| 1. |

To elect the eight directors named in the Proxy Statement;

|

| 2. |

To hold an advisory vote to approve our executive compensation;

|

| 3. |

To approve our Third Amended and Restated 2010 Omnibus Incentive Plan;

|

| 4. |

To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020; and

|

| 5. |

To transact such other business as may properly come before the Annual Meeting.

|

The Board of Directors has fixed the close of business on April 6, 2020, as the record date for determining the stockholders

entitled to receive notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

|

Attending and Voting at the Annual Meeting

In response to the COVID-19 outbreak and public health concerns with in-person gatherings, the Annual Meeting will be held

virtually, with attendance via live audio webcast. You will not be able to attend the Annual Meeting in person. You may attend the online meeting by visiting https://web.lumiagm.com/290670911 and

doing the following

|

||||

| − | Registered stockholders. Click on “I have a control number” and enter the 11-digit control number and meeting code that are provided on your proxy card or Notice of Internet Availability of Proxy Materials. | |||

| − | Beneficial stockholders (i.e., stockholders who hold their shares through a broker, bank or other nominee). Click on “General Access” and enter your name and email address. | |||

|

Means for submitting written questions,

voting and viewing a list of stockholders entitled to vote at the meeting will be provided under both entrance methods. Beneficial stockholders who wish to vote at the meeting will need to obtain a “legal proxy” from their broker, bank

or other nominee before the meeting and send it to an email address that will be provided at the meeting. In some cases, a legal proxy may be obtained by visiting www.proxyvote.com and entering the control number provided by the broker, bank or other nominee.

Entrance to the Annual Meeting will open 30 minutes before the designated start time. We recommend that you access

the meeting website prior to the designated start time to ensure that you are logged in when the meeting begins. You will need to use the latest version of your web browser.

|

||||

You are cordially invited to attend the virtual Annual Meeting. However, to ensure your representation at the Annual Meeting,

please mark, sign, date and return the accompanying proxy card as promptly as possible in the enclosed postage-paid envelope, or use the internet or telephone methods that are described on the proxy card. If you attend the Annual Meeting, you may,

if you wish, withdraw your proxy and vote in person.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be

Held on June 3, 2020: The proxy statement and annual report to stockholders are available at www.proxydocs.com/NUS.

|

By Order of the Board of Directors,

|

|

|

|

|

STEVEN J. LUND

|

|

|

Chairman of the Board

|

|

|

Provo, Utah

April 13, 2020

|

|

|

|

PROXY SUMMARY

|

The following summary provides quick information for purposes of Nu Skin’s 2020 Annual Meeting. It

does not contain all of the information provided elsewhere in the proxy statement; therefore, you should read the entire proxy statement carefully before voting. This proxy statement and form of proxy are first being sent or given to our

stockholders on or about April 22, 2020.

ANNUAL MEETING INFORMATION

|

Date:

|

June 3, 2020

|

|

Time:

|

11:00 a.m., Mountain Daylight Time

|

|

Access:

|

In response to the COVID-19 outbreak and public health concerns with in-person gatherings, the Annual Meeting will be held

virtually, with attendance via live audio webcast at https://web.lumiagm.com/290670911. You will not be able to attend the Annual Meeting in person. Details for accessing the meeting are provided in

this proxy statement.

|

|

Record date:

|

April 6, 2020

|

PROPOSALS

|

Proposal

|

Board

Recommendation

|

More

Information

|

|

|

1.

|

Election of the eight directors named in this Proxy Statement

|

For each director nominee

|

Page 3

|

|

2.

|

Approval of our executive compensation*

|

For

|

Page 47

|

|

3.

|

Approval of our Third Amended and Restated 2010 Omnibus Incentive Plan

|

For

|

Page 49

|

|

4.

|

Ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020*

|

For

|

Page 62

|

* Advisory vote

CORPORATE GOVERNANCE AND COMPENSATION HIGHLIGHTS

See pages 7 and 19, respectively.

BOARD COMPOSITION

|

Average tenure:

Average age:

|

11.6 years

62

|

Independence

Standing committee independence

Gender diversity

|

|

DIRECTOR NOMINEES

|

Name and Primary Occupation

|

Tenure

|

Age*

|

Independent

|

Committee Membership**

|

|||

|

A

|

EC

|

NCG

|

|||||

|

Daniel W. Campbell

Lead Independent Director

Managing General Partner of EsNet, Ltd.

|

1997

|

65

|

✔

|

✔

|

✔

|

||

|

Andrew D. Lipman

Partner, Morgan, Lewis & Bockius LLP

|

1999

|

68

|

✔

|

✔

|

✔

|

||

|

Steven J. Lund

Executive Chairman of the Board

|

1996

|

66

|

|||||

|

Laura Nathanson

Retired

|

2019

|

62

|

✔

|

✔

|

✔

|

||

|

Thomas R. Pisano

Retired

|

2008

|

75

|

✔

|

✔

|

✔

|

||

|

Zheqing (Simon) Shen

Founding Member, ZQ Capital Limited

|

2016

|

40

|

✔

|

✔

|

|||

|

Ritch N. Wood

CEO, Nu Skin Enterprises, Inc.

|

2017

|

54

|

|||||

|

Edwina D. Woodbury

President and CEO, The Chapel Hill Press, Inc.

|

2015

|

68

|

✔

|

✔

|

✔

|

||

* As of April 1, 2020

** A = Audit; EC = Executive Compensation; NCG = Nominating and Corporate Governance

|

1

|

||

|

1

|

||

|

3

|

||

|

7

|

||

|

7

|

||

|

8

|

||

|

8

|

||

|

8

|

||

|

9

|

||

|

9

|

||

|

10

|

||

|

10

|

||

|

12

|

||

|

12

|

||

|

12

|

||

|

13

|

||

|

13

|

||

|

14

|

||

|

16

|

||

|

16

|

||

|

21

|

||

|

21

|

||

|

28

|

||

|

30

|

||

|

32

|

||

|

33

|

||

|

45

|

||

|

45

|

||

|

45

|

||

|

47

|

||

|

49

|

||

|

62

|

||

|

62

|

||

|

63

|

||

|

64

|

||

|

65

|

||

|

66

|

||

|

68

|

||

|

68

|

||

|

69

|

||

|

69

|

||

|

A-1

|

||

|

|

PROXY STATEMENT

|

The accompanying proxy is solicited on behalf of the Board of Directors of Nu Skin Enterprises, Inc. (“Nu Skin,” “we,” “us,” or

“the company”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) on June 3, 2020, at 11:00 a.m., Mountain Daylight Time, and at any adjournment or postponement thereof. In response to the COVID-19 outbreak and public health

concerns with in-person gatherings, the Annual Meeting will be held virtually, with attendance via live audio webcast at https://web.lumiagm.com/290670911. You will not be able to attend the Annual Meeting

in person.

At the Annual Meeting, you will be asked to consider and vote on the following matters, which are more fully described in this

Proxy Statement:

| 1. |

To elect the eight directors named in the Proxy Statement;

|

| 2. |

To hold an advisory vote to approve our executive compensation;

|

| 3. |

To approve our Third Amended and Restated 2010 Omnibus Incentive Plan;

|

| 4. |

To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020; and

|

| 5. |

To transact such other business as may properly come before the Annual Meeting.

|

This proxy statement and form of proxy are first being sent or given to our stockholders on or about April 22, 2020. We will bear

the cost of solicitation of proxies. Expenses include reimbursements paid to brokerage firms and others for their expenses incurred in forwarding solicitation material regarding the Annual Meeting to beneficial owners of our voting stock. Our

regular employees may further solicit proxies by telephone, by mail, in person or by electronic communication and will not receive additional compensation for such solicitation.

Record Date; Shares Outstanding. Only stockholders of

record at the close of business on April 6, 2020 are entitled to vote at the Annual Meeting. As of this record date, 52,636,681 shares of our Class A Common Stock were issued and outstanding. Each outstanding share of Class A Common Stock will be

entitled to one vote on each matter submitted to a vote of the stockholders at the Annual Meeting.

How Proxies Will Be Voted. All shares represented by each properly executed, unrevoked proxy received in time for the Annual Meeting will be voted as directed by the stockholder. In the absence of specific instructions, proxies will be voted in accordance

with the Board of Directors’ recommendations “FOR” the election of each director nominee and “FOR” Proposals 2, 3 and 4. Although it is anticipated that each nominee will be able to serve as a director, should any nominee become unavailable to

serve, proxies will be voted for such other person or persons as may be designated by the Board of Directors. If any other matters properly come before the Annual Meeting, including, among other things, consideration of a motion to adjourn the

Annual Meeting to another time or place, the persons named in the accompanying proxy will vote on such matters in accordance with their best judgment.

Revocability of Proxy. Any proxy duly given pursuant to

this solicitation may be revoked by the person or entity giving it at any time before it is voted by delivering a written notice of revocation to our Corporate Secretary, by executing a later-dated proxy and delivering it to our Corporate

Secretary, or by voting at the Annual Meeting (although attendance at the Annual Meeting will not in and of itself constitute a revocation of the proxy). If you hold shares through a broker, bank or other nominee, you must follow the instructions

of your broker, bank or other nominee to change or revoke your voting instructions, and if you wish to vote at the Annual Meeting you will be required to present a “legal proxy” from your broker, bank or other nominee, as described below.

Attending and Voting at the Annual Meeting.

You may attend the online meeting by visiting https://web.lumiagm.com/290670911 and doing the following:

| − |

Registered stockholders. Click on “I have a control number” and enter the 11-digit

control number and meeting code that are provided on your proxy card or Notice of Internet Availability of Proxy Materials.

|

| − |

Beneficial stockholders (i.e., stockholders who hold their shares through a broker, bank or other nominee). Click on “General Access” and enter your name and email address.

|

Means for submitting written questions, voting and viewing a list of stockholders entitled to vote at the meeting will be provided

under both entrance methods. Beneficial stockholders who wish to vote at the meeting will need to obtain a “legal proxy” from their broker, bank or other nominee before the meeting and send it to an email address that will be provided at the

meeting. In some cases, a legal proxy may be obtained by visiting www.proxyvote.com and entering the control number provided by the broker, bank or other nominee.

Entrance to the Annual Meeting will open 30 minutes before the designated start time. We recommend that you access the meeting

website prior to the designated start time to ensure that you are logged in when the meeting begins. You will need to use the latest version of your web browser.

Quorum. In order to constitute a quorum for the conduct of

business at the Annual Meeting, a majority of the issued and outstanding shares of the Class A Common Stock entitled to vote at the Annual Meeting must be represented, either in person or by proxy, at the Annual Meeting. Under Delaware law,

shares represented by proxy that reflect abstentions or “broker non-votes” (which are shares held by a broker or nominee that are represented at the Annual Meeting, but with respect to which such broker or nominee is not permitted to vote on a

particular proposal without instructions from the beneficial owner and instructions are not given) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum. However, broker non-votes

will not be voted on proposals on which your broker or other nominee does not have discretionary authority to vote under the rules of the New York Stock Exchange (the “NYSE”), including Proposals 1, 2 and 3.

Voting Standards and Effects. Pursuant to our bylaws, for a

director nominee to be elected or for a proposal to be approved, such director nominee or proposal must receive more “for” votes than “against” votes. Except as discussed below with respect to Proposal 3, shares not represented in person or by

proxy at the Annual Meeting, abstentions and broker non-votes will have no effect on the determination of any of the proposals. Additional provisions applying to the matters to be acted upon at the Annual Meeting are as follows:

| − |

Proposal 1. If an incumbent director does not receive the required majority, the director

shall resign pursuant to an irrevocable resignation that was required to be tendered prior to his or her nomination and effective upon (i) such person failing to receive the required majority vote and (ii) the Board’s acceptance of

such resignation. Within 90 days after the date of the certification of the election results, the Board will determine whether to accept or reject the resignation or whether other action should be taken, and the Board will publicly

disclose its decision.

|

| − |

Proposals 2 and 4. Proposals 2 and 4 are stockholder advisory votes and will not be

binding on the Board of Directors.

|

| − |

Proposal 3. Under NYSE listing standards, approval of Proposal 3 will require approval by

a majority of the votes cast at the meeting in person or by proxy, and for purposes of the NYSE listing standards, abstentions will have the effect of votes cast against Proposal 3.

|

Directors are elected at each annual meeting of stockholders and hold office until their successors are duly elected and

qualified at the next annual meeting of stockholders or until their earlier death, resignation or removal. Our Bylaws provide that the Board of Directors will consist of a minimum of three and a maximum of fifteen directors, with the number being

designated by the Board. The current number of authorized directors is eight.

Set forth below are the name, age as of April 1, 2020, business experience and other qualifications of each of our eight director

nominees, listed in alphabetical order. All of our current directors were previously elected to their present term of office at our 2019 annual meeting of stockholders, and all of the director nominees are current directors of our company. We are

not aware of any family relationships among any of our directors, director nominees or executive officers.

|

Daniel W. Campbell

|

|

|

Director since 1997

|

Lead Independent Director

|

|

Audit Committee

|

|

|

Executive Compensation Committee

|

|

Daniel W. Campbell, 65, has been a Managing General Partner of EsNet, Ltd., a privately held investment company, since 1994. He

served on the Utah State Board of Regents for Higher Education from 2010 to 2019, having served as its Vice Chair from 2012 to 2014 and as Chair from 2014 to 2018. From 1992 to 1994, Mr. Campbell was the Senior Vice President and Chief Financial

Officer of WordPerfect Corporation, a software company, and prior to that was a partner of Price Waterhouse LLP. He received a B.S. degree from Brigham Young University.

Mr. Campbell is a recognized business leader with expertise in the areas of finance, accounting, transactions, corporate governance and management. In

addition, through his experience as a partner of an international accounting firm, and later as Chief Financial Officer of a large technology company, Mr. Campbell has developed deep insight into the management, operations, finances and governance

of public companies.

|

Andrew D. Lipman

|

|

|

Director since 1999

|

Executive Compensation Committee

|

|

Nominating and Corporate Governance Committee (Chair)

|

|

Andrew D. Lipman, 68, is a partner and head of the Telecommunications, Media and Technology Group at Morgan, Lewis & Bockius

LLP, an international law firm that he joined in 2014. He previously held similar positions with Bingham McCutchen LLP from 2006 to 2014 and Swidler Berlin LLP from 1988 to 2006. From 2000 to 2013, Mr. Lipman served as a member of the board of

directors of The Management Network Group, Inc., a telecommunications related consulting firm, and from 2007 to 2013, he served as a member of the board of directors of Sutron Corporation, a provider of hydrological and meteorological monitoring

products. He received a B.A. degree from the University of Rochester and a J.D. degree from Stanford Law School.

Mr. Lipman is a highly experienced senior lawyer and business advisor with over 40 years of experience dealing with international regulatory,

technology and marketing issues in multiple countries. In addition, he has extensive experience in corporate governance and related legal and transactional issues. Mr. Lipman has worked closely with dozens of public companies, including service on

the boards of a variety of companies in several industries. His experience also includes managing and implementing strategic initiatives and launching new products and markets globally in competitive industries.

|

Steven J. Lund

|

|

|

Director since 1996

(includes three-year leave

of absence)

|

Executive Chairman of the Board

|

Steven J. Lund, 66, has served as the Chairman of the Board since 2012. Mr. Lund previously served as Vice Chairman of the Board

from 2006 to 2012. Mr. Lund served as President, Chief Executive Officer and a director of our company from 1996, when our company went public, until 2003, when he took a three-year leave of absence. Mr. Lund was a founding stockholder of our

company. Mr. Lund is a trustee of the Force for Good Foundation, a charitable organization that our company established in 1996 to help encourage and drive the philanthropic efforts of our company, its employees, its sales force and its customers

to enrich the lives of others. Mr. Lund worked as an attorney in private practice prior to joining our company as Vice President and General Counsel. He received a B.A. degree from Brigham Young University and a J.D. degree from Brigham Young

University’s J. Reuben Clark Law School.

Mr. Lund brings to the Board over 30 years of company and industry knowledge and experience as a senior executive, including service as our General

Counsel, Executive Vice President, and President and Chief Executive Officer. He played an integral role in managing our growth from start-up through his term as President and Chief Executive Officer. Mr. Lund also served on the executive board of

the United States Direct Selling Association. A respected business and community leader, he currently serves on the Utah State Board of Regents for Higher Education and previously served as chairman of the board of trustees of Utah Valley

University.

|

Laura Nathanson

|

|

|

Director since 2019

|

Executive Compensation Committee

|

|

Nominating and Corporate Governance Committee

|

|

Laura Nathanson, 62, recently retired from The Walt Disney Company in July 2019 after 21 years of service in

sales and advertising positions. From 2017 to 2019, she served as Executive Vice President of Revenue and Operations at Disney Advertising Sales, and from 2002 to 2017, she served as Executive Vice President of Sales and Marketing at ABC

Family/Freeform. Prior to 2002, she served in various other sales and advertising positions with ABC Network Sales, Fox Broadcasting and media agencies. She received a B.A. from Wesleyan University.

Ms. Nathanson is an experienced leader who brings to the Board her expertise in sales and advertising, as well as a strong customer focus that is built

on a 40-year career in connecting with and communicating with customers. Business strategy is also one of Ms. Nathanson’s strengths; during her career, she has recognized and understood shifts in the business landscape, such as the rise of the

millennial demographic and the trend toward digital advertising, and has quickly adapted to these shifts, enabling her companies to capitalize on them at an early stage. She also has experience in streamlining business processes and in promoting

sales through digital and social media.

|

Thomas R. Pisano

|

|

|

Director since 2008

|

Audit Committee

|

|

Executive Compensation Committee (Chair)

|

|

Thomas R. Pisano, 75, served as Chief Executive Officer and a director of Overseas Military Sales Corp., a marketer of motor

vehicles, from 2005 until his retirement in 2010. From 1998 to 2004, he served as the Chief Operating Officer and a director of Overseas Military Sales Corp. From 1995 to 1997, he served as Vice President and Head of the International Division for

The Topps Company, Inc., a sports publications and confectionery products company. Prior to that, he served in various positions, including Vice President of Global New Business Development, for Avon Products, Inc., a direct seller of personal care

products, from 1969 to 1994. He received a B.S. from the Georgia Institute of Technology and an M.B.A. from Dartmouth College.

Mr. Pisano is an experienced senior executive who is an expert in the direct selling, personal care, beauty products and other consumer goods

industries. During his 25-year career at Avon Products, Inc., he was responsible for global new business development, which included new geographic market openings and launching new product lines globally. He was also responsible for the operation

of international businesses in Latin America, Europe and Asia. During his international business career at Avon, Topps and OMSC, he traveled to and conducted business in 50 countries.

|

Zheqing (Simon) Shen

|

|

|

Director since 2016

|

Nominating and Corporate Governance Committee

|

Zheqing (Simon) Shen, 40, is the founding member of ZQ Capital Limited, a boutique investment and advisory firm. Prior to founding

ZQ Capital in 2015, Mr. Shen was managing director and head of the China Financial Institutions Business at Barclays from 2011 to 2015. From 2004 to 2010, he worked with Goldman Sachs as an investment banker in its New York and Hong Kong offices.

In addition to his service on our Board, Mr. Shen has also served since 2016 on the board of directors and the Audit, Remuneration and Nomination Committees of KFM Kingdom Holdings Limited, a precision metals engineering and manufacturing company

that is listed on the Hong Kong Stock Exchange. Mr. Shen has a B.A. in mathematics and economics from Wesleyan University.

Mr. Shen brings to the Board valuable expertise in helping global companies realize their growth potential in Mainland China, which is one of our

company’s key markets. He has spent much of his career working in Asia capital markets, and he has a strong network in Mainland China and valuable local knowledge of Mainland China. His depth of experience with financial and investment matters is

also valuable to the Board.

|

Ritch N. Wood

|

|

|

Director since 2017

|

|

Ritch N. Wood, 54, was appointed to serve as our Chief Executive Officer in 2017. He previously served as our Chief Financial

Officer since 2002. He was named CFO of the Year by Utah Business Magazine in 2010. Mr. Wood joined our company in 1993 and served in various capacities before his appointment as Chief Financial Officer, including Vice President of Finance and Vice

President of New Market Development. Mr. Wood is a trustee of the Force for Good Foundation, a charitable organization that our company established to help drive our philanthropic efforts. Prior to joining us, he worked for the accounting firm of

Grant Thornton LLP. Mr. Wood earned a B.S. and a M.Acc. degree from Brigham Young University.

Mr. Wood brings to the Board expertise in accounting, finance, investor relations and management. With his service as our Chief Executive Officer and

as our Chief Financial Officer for 14 years, Mr. Wood also has a deep understanding of our business globally, including our markets, financial matters, products and product development, personnel, compensation plans and sales force. He has played

an important role in managing the growth of our business while prioritizing profitability and stockholder value; during his tenure as Chief Financial Officer from 2002 to 2017, our revenue more than doubled and our earnings per share tripled. Mr.

Wood’s leadership has been integral to the success of several of our key initiatives in recent years.

|

Edwina D. Woodbury

|

|

|

Director since 2015

|

Audit Committee (Chair)

|

|

Nominating and Corporate Governance Committee

|

|

Edwina D. Woodbury, 68, has been President and Chief Executive Officer of The Chapel Hill Press, Inc., a publishing services

company, since 1999. Ms. Woodbury has over 20 years of experience in the direct selling and personal care products industries, having served at Avon Products, Inc. as Chief Financial and Administrative Officer and in other finance and operations

positions from 1977 to 1998. From 1997 to 2015, Ms. Woodbury served as a member of the board of directors of RadioShack Corporation, a retail consumer electronics company. In addition, from 2005 to 2010, Ms. Woodbury served as a member of the board

of directors of R.H. Donnelley Corporation, a publishing and marketing company, and from 2000 to 2005, she served as a director of Click Commerce, Inc., a research solutions company. Ms. Woodbury also served on the board of directors at the

nonprofit Medical Foundation of North Carolina from 2009 to 2018. She received a B.S.B.A from the University of North Carolina.

Ms. Woodbury has extensive experience and understanding of our industry. While serving in various roles of increasing responsibility during her 21

years at Avon Products, Inc., she gained an in-depth understanding of the financial and internal control-related issues associated with global companies in our industry. She also brings to the Board valuable perspective from her service on other

public company boards. While serving on the boards at Click Commerce, R.H. Donnelley and RadioShack, she (1) served on and chaired each board’s audit committee; (2) served on the compensation committee at R.H. Donnelley and chaired it at

RadioShack; and (3) served on the nominating and governance committee at Click Commerce and RadioShack.

Each nominee was recommended by the Nominating and Corporate Governance Committee for election and has consented to being named in this proxy

statement and to serve if elected. Although we do not know of any reason for which any nominee might become unavailable to serve on the Board, if that should happen, the Board may designate a substitute nominee. Shares represented by proxies will

be voted for any substitute nominee so designated.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE EIGHT NOMINEES TO OUR BOARD OF DIRECTORS.

Board of Directors Independence and Committee Structure

| − |

Separate Chairman of the Board and CEO. The positions of Chairman of the Board and CEO

are filled by Mr. Lund and Mr. Wood, respectively.

|

| − |

Lead Independent Director. Our independent directors have designated Mr. Campbell as Lead

Independent Director.

|

| − |

Limitation on Management Directors. All of our current directors are independent of the

company and management except for Mr. Lund, who is one of our company’s founders, and Mr. Wood, our CEO.

|

| − |

Meetings of Independent Directors. All independent directors meet regularly in executive

session. Mr. Campbell, the Lead Independent Director, chairs these sessions.

|

| − |

Independent Committees. Only independent directors serve on our Audit, Executive

Compensation, and Nominating and Corporate Governance Committees.

|

| − |

Annual Board and Committee Performance Evaluations. The performance of the Board and each

Board committee is evaluated at least annually.

|

Election of Directors

| − |

Annual Election of Directors. All of our directors are elected annually; we do not have a

staggered board.

|

| − |

Majority Voting in Uncontested Director Elections and Resignation Policy. Our Bylaws

provide that director nominees must be elected by a majority of the votes cast in uncontested elections. For an incumbent director to be nominated for re-election, she or he must tender an irrevocable resignation that will be

effective upon (i) the failure to receive the required vote for director election at the next annual meeting at which they face re-election and (ii) Board acceptance of such resignation.

|

Stock-Related Matters

| − |

Equity Retention Requirements. We have equity retention requirements that apply to our

directors and executive officers, designed to align directors’ and executive officers’ interests with those of stockholders. For a description of these requirements, see “Executive Compensation: Compensation Discussion and

Analysis—Equity Retention Guidelines.”

|

| − |

Hedging Policy. Our directors and employees, including officers, are prohibited from

engaging in any hedging transactions with respect to our securities, including through the use of short sales, put options and financial instruments such as prepaid variable forward contracts, equity swaps, collars and exchange funds.

This prohibition applies regardless of whether the director’s or employee’s securities were granted as compensation and regardless of whether the director or employee holds the securities directly or indirectly.

|

| − |

Pledging Policy. Our directors and employees, including officers, are prohibited from

pledging their securities in our company.

|

The Board of Directors has determined that each of the current directors listed below is an “independent director” under the

listing standards of the NYSE.

|

Daniel W. Campbell

|

Andrew D. Lipman

|

Laura Nathanson

|

|

Thomas R. Pisano

|

Zheqing (Simon) Shen

|

Edwina D. Woodbury

|

In assessing the independence of the directors, the Board determines whether or not any director has a material relationship with us

(either directly or as a partner, stockholder or officer of an organization that has a relationship with us). The Board considers all relevant facts and circumstances in making independence determinations, including the existence and scope of any

commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships.

We currently separate the roles of Chairman of the Board and CEO. However, the Board has not adopted a policy with regard to

whether the same person should serve as both the Chairman of the Board and CEO or, if the roles are separate, whether the Chairman of the Board should be selected from the non-employee directors or should be an employee. The Board believes it is

most appropriate to retain the discretion and flexibility to make such determinations at any given point in time in the way that it believes best to provide appropriate leadership for the company at that time. We have determined that our current

separation of the roles of Chairman of the Board and CEO is appropriate given the differences in the roles and duties of the two positions and the individuals currently serving in these positions.

The Board has created the Lead Independent Director position to provide independent leadership of the Board’s affairs on behalf of

our stockholders and to promote open communication among the independent directors. Our Corporate Governance Guidelines provide that the Lead Independent Director (i) is designated by the non-management directors; (ii) consults with the Chairman of

the Board and the CEO regarding agenda items for Board meetings; (iii) chairs executive sessions of the Board’s independent directors; and (iv) performs such other duties as the Board deems appropriate.

Our Board of Directors has primary responsibility for risk oversight. Except with regard to certain strategically significant

risks, the Board administers its risk oversight function through the Audit Committee, Nominating and Corporate Governance Committee and Executive Compensation Committee. The committee charters include the following subject-matter parameters for

risk oversight:

|

Audit Committee

|

Nominating and Corporate

Governance Committee

|

Executive Compensation

Committee

|

||

|

− Major financial risk exposures

− Operational risks related to information systems and facilities

− Public disclosure and investor related risks

|

− Corporate governance risks

− Operational risks not assigned to the Audit Committee

− Compliance and regulatory risks

− Reputational risks

|

− Compensation practices related risks

− Human resources risks

|

The committees, or the Board in the case of risks it determines to oversee directly, are responsible for overseeing and discussing with management

our risk assessment and risk management programs and plans. Management periodically reports to the Board or applicable committee on our risks and the internal processes, practices and controls attendant to the risks. Following these reports by

management, the Audit Committee periodically receives reports regarding the Nominating and Corporate Governance Committee’s and Executive Compensation Committee’s risk-oversight efforts.

Because the Board and management recognize the importance of maintaining the trust and confidence of our employees, sales force,

customers, vendors and other business partners, we have established an Information Security and Privacy group that has responsibility for executing a program to protect our data. The Board directly oversees cyber and privacy-related risks and

periodically receives reports from management on them.

Our Board and Executive Compensation Committee engage with our senior management and head of Human Resources on a regular basis.

All employees are responsible for upholding the Nu Skin Code of Conduct and for striving to perpetuate the Nu Skin Way, our global culture aspiration, which includes the following principles:

|

−

|

A force for good

|

−

|

Direct and decisive

|

|

|

−

|

Accountable and empowered

|

−

|

Exceptional

|

|

|

−

|

Bold innovators

|

−

|

Fast speed

|

|

|

−

|

Customer obsessed

|

−

|

One global team

|

These principles form the foundation of our human capital strategy and objectives. Employee feedback is considered in designing

talent programs, rewards, benefits and building the overall employee experience. The success of these human capital management objectives is essential to our business strategy and our shared mission to empower people, improve lives and uplift

culture.

The Board and Executive Compensation Committee work with the CEO and our head of Human Resources to review CEO and senior executive

succession plans, considering the qualifications and key skills that are necessary to execute Nu Skin’s strategy. Working with management, the Board and Executive Compensation Committee also oversee matters including culture, development,

compensation, benefits, key talent recruiting and retention, employee engagement, and diversity and inclusion. Additionally, each year, the Executive Compensation Committee evaluates management’s annual assessment of risk related to our

compensation policies and practices.

Evidencing the success of our human capital management initiatives, in 2020 we were recognized by the Direct Selling News as one of the best places to work in direct selling, the fifth consecutive year we have received this honor.

Our Board and senior management are engaged in our sustainability initiatives, and we endeavor to integrate sustainability-related

risks and opportunities into our business strategy. Our sustainability team reports annually to our Board of Directors and quarterly to our senior management. Focusing on three key areas—product, planet and people—some of our sustainability

initiatives are as follows:

|

Product

|

−

|

Change all of our packaging to be reusable, recyclable, recycled, refillable or recoverable by 2030

|

|

|

Planet

|

−

|

Reduce waste at our facilities through programs that encourage reducing, reusing and recycling, as well as initiatives to reduce electricity usage

|

|

|

People

|

−

|

Invest at least 50% of our Force for Good Foundation’s giving in communities and people that are providing essential resources to our planet and its inhabitants

|

In 2019, we received an award from the Communitas Awards organization for our efforts in the areas of corporate social responsibility, ethical and

environmental responsibility, and green initiatives.

The Board of Directors held eight meetings during 2019. Each director attended more than 75% of the total Board and respective

committee meetings for the period in which they served during 2019, other than Mr. Shen, who attended 73% of such meetings due to scheduling conflicts, as he lives in Hong Kong. Although we encourage Board members to attend our annual meetings of

stockholders, we do not have a formal policy regarding director attendance at annual stockholder meetings. Six of our directors who were in office at the time of our 2019 annual meeting of stockholders attended that meeting.

We have standing Audit, Executive Compensation, and Nominating and Corporate Governance Committees. Each member of the committees

is independent within the meaning of the listing standards of the NYSE. In addition, the Audit Committee and the Executive Compensation Committee are composed solely of directors who meet additional, heightened independence standards applicable to

members of these committees under the NYSE listing standards and the Securities and Exchange Commission’s rules.

The following table identifies the current membership of the committees and states the number of committee meetings held during

2019.

|

Director

|

Audit

|

Executive

Compensation

|

Nominating and

Corporate Governance

|

|

|

Daniel W. Campbell

|

✔

|

✔

|

||

|

Andrew D. Lipman

|

✔

|

Chair

|

||

|

Laura Nathanson

|

✔

|

✔

|

||

|

Thomas R. Pisano

|

✔

|

Chair

|

||

|

Zheqing (Simon) Shen

|

✔

|

|||

|

Edwina Woodbury

|

Chair

|

✔

|

||

|

2019 Meetings

|

12

|

9

|

8

|

The Board has adopted a written charter for each of the committees, which are available in the “Corporate Governance” section of

our Investor Relations website at ir.nuskin.com.

Audit Committee

The Audit Committee’s responsibilities include, among other things:

| − |

Selecting our independent auditor;

|

| − |

Overseeing the performance of our internal audit function and independent auditor;

|

| − |

Reviewing the activities and the reports of our independent auditor;

|

| − |

Approving in advance the audit and non-audit services provided by our independent auditor;

|

| − |

Reviewing our quarterly and annual financial statements and our significant accounting policies, practices and procedures;

|

| − |

Reviewing the adequacy of our internal controls and internal auditing methods and procedures;

|

| − |

Overseeing our compliance with legal and regulatory requirements;

|

| − |

Overseeing our risk assessment and risk management programs and plans related to our major financial risk exposures, operational risks related to information

systems and facilities, and public disclosure and investor related risks; and

|

| − |

Conferring with the chairs of the Nominating and Corporate Governance Committee and Executive Compensation Committee regarding their respective oversight of our

risk assessment and risk management programs and our related guidelines and policies.

|

The Board has determined that Ms. Woodbury and Mr. Campbell are Audit Committee financial experts as such term is defined in Item

407(d)(5) of Regulation S-K promulgated by the Securities and Exchange Commission.

Executive Compensation Committee

The Executive Compensation Committee’s responsibilities include, among other things:

| − |

Establishing and administering our executive compensation strategy, policies and practices;

|

| − |

Reviewing and approving corporate goals and objectives relevant to the compensation to be paid to our CEO, other executive officers and our executive chairman

of the board, evaluating the performance of these individuals in light of those goals and objectives, and determining and approving the forms and levels of compensation based on this evaluation;

|

| − |

Administering our equity incentive plans;

|

| − |

Overseeing our risk assessment and risk management programs and plans related to our compensation practices and human resources; and

|

| − |

Overseeing the reporting of executive compensation information in accordance with applicable rules and regulations.

|

Pursuant to its charter, the Executive Compensation Committee may delegate its authority to a subcommittee or subcommittees and

may delegate authority to the CEO and Chairman of the Board to approve the level of incentive awards to be granted to specific non-executive officers, employees or other grantees subject to such limitations as may be established by the Executive

Compensation Committee. For a discussion of the processes and procedures for determining executive and director compensation and the role of compensation consultants in determining or recommending the amount or form of compensation, see “Executive

Compensation: Compensation Discussion and Analysis” and “Director Compensation.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee’s responsibilities include, among other things:

| − |

Making recommendations to the Board of Directors about the size and membership criteria of the Board or any committee thereof;

|

| − |

Identifying and recommending candidates for the Board and committee membership, including evaluating director nominations received from stockholders;

|

| − |

Leading the process of identifying and screening candidates for a new CEO when necessary, and evaluating the performance of the CEO;

|

| − |

Making recommendations to the Board regarding changes in compensation of non-employee directors and overseeing the evaluation of the Board and management;

|

| − |

Developing and recommending to the Board a set of corporate governance guidelines and reviewing such guidelines at least annually;

|

| − |

Overseeing our risk assessment and risk management programs and plans related to our corporate governance risks, operational risks not assigned to the Audit

Committee, compliance and regulatory risks, and reputational risks; and

|

| − |

Overseeing our regulatory, legal and compliance obligations in the foreign countries in which we operate, as well as individual compliance programs developed to

address specific legal and regulatory issues in the United States and foreign countries.

|

Our Board believes that a strong and constructive evaluation process is an important component of good corporate governance and

helps to promote Board effectiveness. Our annual evaluation process, which is led by our Nominating and Corporate Governance Committee, focuses on both the Board and the Board committees.

The Nominating and Corporate Governance Committee reviews the format of our evaluation process each year to ensure that it remains

robust and relevant. In 2019, we used a third-party facilitator to assist in conducting the evaluation in order to receive fresh perspectives on Board effectiveness and corporate governance practices and to encourage candor in the evaluation

process. The facilitator conducted oral interviews with each director and then led a discussion at an in-person meeting.

None of the directors who served on the Executive Compensation Committee during 2019 was:

| − |

A current or former officer or employee of our company;

|

| − |

A participant during 2019 in a related-person transaction that is required to be disclosed; or

|

| − |

An executive officer of another entity at which one of our executive officers served during 2019 on either the board of directors or the compensation

committee, nor were any of our other directors an executive officer of another entity at which one of our executive officers served on the compensation committee.

|

As indicated above, the Nominating and Corporate Governance Committee of the Board of Directors oversees the director nomination

process. This committee is responsible for identifying and evaluating candidates for membership on the Board and recommending to the Board nominees to stand for election.

Minimum Criteria for Members of the Board. Each candidate

to serve on the Board must possess the highest personal and professional ethics, integrity and values, and be committed to serving the long-term interests of our stockholders. In addition, our Corporate Governance Guidelines require that, to be

nominated for re-election to our Board, an incumbent director must tender an irrevocable resignation that will be effective upon (i) the failure to receive the required vote for director election at the next annual meeting at which they face

re-election and (ii) Board acceptance of such resignation. Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating and Corporate Governance Committee may consider such other factors as it may

deem appropriate, which may include, without limitation, professional experience, diversity of backgrounds, skills and experience at policy-making levels in business, government, financial, and other areas relevant to our global operations,

experience and history with our company, and stock ownership.

We do not have a formal policy with regard to the consideration of diversity in identifying Board nominees, but the Nominating and

Corporate Governance Committee strives to nominate individuals with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee our business.

Process for Identifying, Evaluating and Recommending Candidates. The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders if properly submitted to the committee. Stockholders wishing to recommend

candidates should do so in writing to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, Nu Skin Enterprises, Inc., 75 West Center Street, Provo, Utah 84601. The committee may also consider candidates proposed by current

directors, management, employees and others. All such candidates who, after evaluation, are then recommended by the Nominating and Corporate Governance Committee and approved by the Board will be included in our recommended slate of director

nominees in our proxy statement.

Procedures for Stockholders to Nominate Director Candidates at our Annual Meetings. Stockholders of record may also nominate director candidates for our annual meetings of stockholders by following the procedures set forth in our Bylaws. Please refer to the section below titled “Stockholder Proposals for

2021 Annual Meeting” for further information.

Stockholders or other interested parties wishing to communicate with the Board of Directors, the non-management directors as a group, the Lead Independent Director or any other individual director may do so in writing by addressing the correspondence to that individual or group, c/o Corporate Secretary, Nu Skin

Enterprises, Inc., 75 West Center Street, Provo, Utah 84601. All such communications will be initially received and processed by our Corporate Secretary. Accounting, audit, internal accounting controls and other financial matters will be referred

to our Audit Committee chair. Other matters will be referred to the Board, the non-management directors, or individual directors as appropriate.

We have adopted the following:

| − |

Code of Conduct. Our code of conduct applies to all of our employees,

officers and directors, including our subsidiaries. Any amendments or waivers (including implicit waivers) regarding the Code of Conduct requiring disclosure under applicable SEC rules or NYSE listing standards will be disclosed in

the “Corporate Governance” section of our Investor Relations website at ir.nuskin.com.

|

| − |

Corporate Governance Guidelines. Our corporate governance guidelines

govern our company and our Board of Directors on matters of corporate governance, including responsibilities, committees of the Board and their charters, director independence, director qualifications, director compensation and

evaluations, director orientation and education, director access to management, director access to outside financial, business and legal advisors and management development and succession planning.

|

Both of the above are available in the “Corporate Governance” section of our Investor Relations website at ir.nuskin.com. In addition, stockholders may obtain a print copy of either of the above, free of charge, by making a written request to Investor Relations, Nu Skin Enterprises, Inc., 75 West Center Street,

Provo, Utah 84601.

Our Nominating and Corporate Governance Committee is responsible for evaluating director compensation from time to time, and when

it determines that adjustments are appropriate, it recommends them to the Board of Directors for its consideration. The Nominating and Corporate Governance Committee has retained the services of Semler Brossy Consulting Group LLC as its independent

compensation consultant to assist in the review of our director compensation program, to provide compensation data and alternatives, and to provide advice as requested. For additional information regarding our independent compensation consultant,

see “Executive Compensation: Compensation Discussion and Analysis—Role of Compensation Consultant.”

The following table summarizes our non-employee director compensation program, which applies to each director besides Messrs. Lund

and Wood because they receive compensation as executive officers of our company. The table shows the program as in effect at the beginning of 2019 and the changes that took effect as of June 1, 2019, following a review of our director compensation

program, which included an analysis of peer benchmarking data. The elimination of meeting fees and the replacement of a fixed-share award with a fixed-value award was designed to reduce the variability in director compensation and more closely

aligned our program with competitive practice.

|

Prior Program

Through 5/31/2019

|

Current Program

Effective 6/1/2019

|

||

|

Annual cash retainer

Board

Committee

|

$80,000

—

|

$85,000

$10,000 per committee

|

|

|

Additional annual cash retainer for leadership:

Lead Independent Director

Audit Committee Chair

Other committee chairs

|

$20,000

$15,000

$10,000

|

Unchanged

|

|

|

Meeting fees:

Committee chair

Other committee members

|

$2,500

$1,500

|

Meeting fees eliminated(1)

|

|

|

Annual equity compensation (restricted stock units)

|

Sum of 1,000 RSUs plus $85,000 value = 2,041 RSUs in 2018

($164,443 value)

|

$140,000 value

|

| (1) |

The Board can approve meeting fees for participation in a special committee or other extraordinary circumstances.

|

In addition, we may compensate a director $1,500 per day for corporate events or travel that we require, and we may reimburse

directors for certain expenses incurred in attending Board and committee meetings and other corporate events. We also provide company products to our directors for their use.

Pursuant to the terms of our Second Amended and Restated 2010 Omnibus Incentive Plan, the cash compensation and the aggregate grant date fair value

(computed in accordance with applicable financial accounting rules) of awards under the Plan provided to any non-employee director during any single calendar year cannot exceed $750,000.

Director Compensation Table – 2019

The table below summarizes the compensation earned by or paid to each of our directors in 2019 except Mr. Wood, whose compensation

is reported in the executive compensation tables. Mr. Wood serves as a director, but as a company employee he receives no compensation for his services as a director.

|

Name

|

Fees Earned or Paid in Cash ($)

|

Stock

Awards

($)(1) |

All Other Compensation ($)

|

Total ($)

|

||

|

Nevin N. Andersen

|

52,833

|

-

|

-

|

52,833

|

||

|

Daniel W. Campbell

|

141,583

|

136,849

|

-

|

278,432

|

||

|

Andrew D. Lipman

|

167,083

|

136,849

|

2,135

|

306,067

|

||

|

Laura Nathanson

|

73,250

|

136,849

|

-

|

210,099

|

||

|

Neil H. Offen

|

55,833

|

-

|

-

|

55,833

|

||

|

Thomas R. Pisano

|

150,583

|

136,849

|

-

|

287,432

|

||

|

Zheqing (Simon) Shen

|

97,750

|

136,849

|

-

|

234,599

|

||

|

Edwina D. Woodbury

|

150,583

|

136,849

|

-

|

287,432

|

||

|

Steven J. Lund

|

-

|

-

|

627,578

|

(2) |

627,578

|

| (1) |

On June 6, 2019, each of the directors listed above except for Mr. Lund, who is an employee, and Messrs. Andersen and Offen, who retired from our Board, was granted

2,878 restricted stock units, which will vest on April 30, 2020. The amounts reported in this column reflect the aggregate grant date fair value of the restricted stock units and do not represent amounts actually received by the

director. For this purpose, the value of the restricted stock units is discounted to reflect that no dividends are paid prior to vesting.

|

The outstanding stock and option awards held at December 31, 2019 by each of the listed individuals are as follows:

|

Name

|

Stock Awards

|

Option Awards

|

||

|

Nevin N. Andersen

|

-

|

20,000

|

||

|

Daniel W. Campbell

|

2,878

|

20,000

|

||

|

Andrew D. Lipman

|

2,878

|

20,000

|

||

|

Laura Nathanson

|

2,878

|

-

|

||

|

Neil H. Offen

|

-

|

20,000

|

||

|

Thomas R. Pisano

|

2,878

|

15,000

|

||

|

Zheqing (Simon) Shen

|

2,878

|

5,000

|

||

|

Edwina D. Woodbury

|

2,878

|

5,000

|

||

|

Steven J. Lund

|

-

|

12,500

|

| (2) |

Consists of Mr. Lund’s compensation as an employee of the company for 2019: $566,667 in salary and $60,911 in other compensation, including $19,074 in premiums for

life insurance, $11,200 in 401(k) contributions, spouse travel to a sales force event where his spouse was expected to attend and help entertain and participate in events with our sales force and their spouses, the amount reimbursed by

us for the payment of taxes with respect to such spouse travel, company products, home security monitoring, premiums for long-term disability insurance and AAA membership.

|

Our Compensation Discussion and Analysis (“CD&A”) describes our executive compensation programs and compensation decisions in

2019 for our named executive officers (“NEOs”), who for 2019 were:

|

Ritch N. Wood

|

Chief Executive Officer

|

|

Ryan S. Napierski

|

President

|

|

Mark H. Lawrence

|

Executive Vice President and Chief Financial Officer

|

|

Joseph Y. Chang

|

Executive Vice President of Product Development and

Chief Scientific Officer

|

|

D. Matthew Dorny

|

Executive Vice President and General Counsel

|

2019 Business Performance Highlights

For 2019, our revenue was $2.42 billion, down 10% from 2018, as compared to 18% growth in 2018, and the number of our sales

leaders decreased 25% compared to 2018. These decreases were due in large part to macroeconomic challenges that we faced in multiple markets, the most impactful of which was government and media scrutiny of the health products and direct selling

industries in Mainland China. We believe these headwinds had a negative impact on consumer sentiment and were key contributing factors to a decline in our stockholder value for 2019. The revenue and sales leader declines also reflect the lack of a

major product launch in 2019, which we believe may have caused some decreased engagement in our sales force. We did experience slight growth in Japan, and our manufacturing partners had a strong year. In addition, our customer-acquisition strategy

helped us to maintain our customer count above one million active customers despite the decline in sales leaders.

We continue to believe we have the correct strategy in place to drive sustained growth in our business over time. Our growth

strategy focuses on three key elements:

| − |

Engaging platforms. In 2019 we migrated our technology stack to the

cloud, which we believe will provide us with a more flexible and scalable foundation to help our sales leaders develop their businesses digitally.

|

| − |

Enabling products. In 2019 we strengthened our line of beauty device

systems by improving and extending our Galvanic Spa and LumiSpa franchises.

|

| − |

Empowering programs. In 2019 we finished implementing our Velocity

sales compensation program enhancements, which we believe will help drive increases in customer and sales leader activity.

|

Our business strategy and the successes we achieved in 2019 reflect management’s strong motivation to achieve revenue growth and

expand our customer base. Our executive compensation program and the pay-for-performance incentives that are built into it are key drivers of management’s motivation.

2019 Compensation Highlights

This CD&A discusses, among other things, the following highlights of our executive compensation in 2019:

| − |

Rigorous Performance Goals. Our NEOs’ performance-based compensation

during 2019 continued to focus on the achievement of rigorous performance goals with payouts strictly tied to financial results. Our financial results for 2019 fell below the rigorous performance goals established at the beginning of

the year, and consistent with our commitment to pay for performance, none of the performance-contingent equity or cash compensation was earned in 2019.

|

| − |

Stockholder Outreach. The current design of our compensation program is informed by the

feedback received during an extensive stockholder outreach process conducted in 2017 and includes a number of changes that were made for 2018 and 2019 in response to that feedback. We continued our stockholder outreach process in

2019.

|

| − |

Mix of Performance-Based Equity Granted. Our 2019 equity awards granted to NEOs were 60%

performance-based (based on grant date fair value). Based on stockholder feedback, the Committee generally plans to continue using an equity mix of approximately 60% performance-based awards.

|

| − |

Elimination of Quarterly Bonuses. During 2018, we determined to eliminate quarterly cash

incentive bonuses for our NEOs, effective in 2019. With this change, cash incentive bonuses for our NEOs are now paid only on achievement of annual performance goals to encourage focus on our business’s longer-term success.

|

Our Commitment to Pay for Performance

The primary objectives of our executive compensation program are:

| 1. |

To successfully recruit, motivate and retain experienced and talented executives; and

|

| 2. |

To ensure pay for performance through incentives that

|

| a. |

Are tied to corporate and individual performance,

|

| b. |

Align the financial interests of our executives with those of our stockholders and

|

| c. |

Drive superior stockholder value.

|

The program, which is administered by our Executive Compensation Committee, is intended to align actual compensation payments to

actual performance and to adjust upward during periods of strong performance and downward when performance is short of expectations.

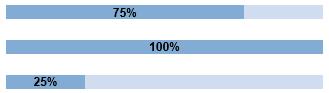

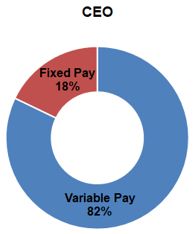

Our NEOs’ 2019 target compensation was divided into variable compensation (cash incentive bonus and equity awards) and fixed

compensation (salary) as follows:

|

|

The following table describes the metrics upon which NEOs earn each component of variable compensation.

|

Cash Incentive Bonuses

20% of Mr. Wood’s 2019 Target

Compensation

|

Long-Term Incentives

62% of Mr. Wood’s 2019 Target Compensation

|

||

|

Annual Incentive

(Quarterly Component Eliminated in

2019 Program)

|

Time-Based Restricted Stock Units (RSUs)

40% weighting

|

Performance-Based Stock

Options

60% weighting

|

|

|

Measures one-year financial

performance (2019)

|

Measures four-year stock price performance

(2019-2022)

|

Measures one-year financial

performance over three years

(2019, 2020, 2021)

|

|

|

Metric: Adjusted

revenue

|

Metric: Adjusted operating income

|

Metric: Stock price

|

Metric: Adjusted EPS

|

|

50% weighting

|

50% weighting

|

||

|

Incentivizes business growth

|

Incentivizes profitability and control of expenses

|

Aligns management with

stockholders’ interests and promotes multi-year retention

|

Aligns management with

stockholders’ interests

Provides a balance to the top-line and operating-income metrics in the cash incentive bonus program

|

|

Both metrics are calculated on a constant-currency basis from the prior-year period and are adjusted to eliminate extraneous items such as the impact of

accounting changes, losses or gains on settlements of litigation that began prior to 2019 and other unusual impacts at the Committee’s discretion.

|

Realized based on stock price.

|

Adjusted EPS is calculated to eliminate extraneous items such as the impact of accounting changes, losses or gains on settlements of litigation that began prior

to 2019 and other items that are unusual, non-recurring or outside of management’s control.

|

|

Our financial results for 2019 fell below the rigorous performance goals established at the beginning of the year, and consistent

with our commitment to pay for performance, none of the performance-contingent equity or cash compensation was earned in 2019.

|

Performance-Based Award

|

Percent of Target Earned

|

|

|

2019 Cash Incentive Bonus(1)

|

0%

|

|

|

2017 Equity Awards – Tranche 3 of 3 (measuring 2019 results)(2)

|

0%

|

|

|

2018 Equity Awards – Tranche 2 of 3 (measuring 2019 results)(2)

|

0%

|

|

|

2019 Equity Awards – Tranche 1 of 3 (measuring 2019 results)(2)

|

0%

|

| (1) |

Contingent on 2019 adjusted revenue and adjusted operating income.

|

| (2) |

Represents the tranches of the respective three-year awards that were contingent on 2019 adjusted EPS, as determined at the time of grant.

|

2019 Say-on-Pay Vote

At our 2019 annual meeting of stockholders, 98% of the votes cast were in favor of our executive compensation program. When

designing our 2020 executive compensation program, the Committee considered, among other things, the 2019 voting results and other feedback we received from our stockholders, which were viewed as supportive of our pay philosophy and incentive

framework.

Continuing Adherence to Compensation Governance Best Practices

We have a framework of strong corporate governance related to compensation, illustrated as follows:

|

What We Do

|

What We Don’t Do

|

|

|

✔

|

Link pay outcomes directly to company and share price performance in support of a pay for performance philosophy

|

û No evergreen employment agreements

û No hedging or pledging of Nu Skin shares

û No excessive perquisites

û No excise tax gross-ups for NEOs

û No payment of current dividends on unvested equity

û No repricing of stock options without stockholder approval

|

|

✔

|

Utilize multiple, complementary incentive measures in the annual and long-term incentive plans that align with key drivers of stockholder value creation

|

|

|

✔

|

Utilize double-trigger change in control benefits

|

|

|

✔

|

Employ a comprehensive clawback policy

|

|

|

✔

|

Require robust equity retention for directors and executives

|

|

|

✔

|

Assess compensation risk annually

|

|

|

✔

|

Engage an independent compensation consultant

|

|

Stockholder Outreach

Continuing a stockholder-outreach process that we initiated in 2017, during 2019 we reached out to investors representing

approximately 45% of our outstanding shares, generally covering holders of at least 1% of our outstanding shares. We value the input of our stockholders, and the outreach process is an opportunity to:

| − |

Solicit our stockholders’ feedback and better understand their perspectives on executive compensation so that the Committee can take those philosophies into

account as it evaluates possible program changes;

|

| − |

Answer any questions that stockholders may have with respect to our existing programs and practices or past decisions; and

|

| − |

Establish a platform for ongoing dialogue with our stockholders.

|

Key Changes to the Compensation Program In 2019

The following table identifies the changes made to our executive compensation program for 2019 and the primary reasons for each.

|

Cash Incentive Bonus Program

|

|||

|

Eliminated quarterly cash incentive

bonuses in 2019

|

Reasons for change

|

||

|

−

|

Cash incentive bonuses for our NEOs are now paid only on achievement of annual performance goals

|

−

−

|

Encourage focus on longer-term success of business

More consistent with peer group practices

|

|

−

|

Target bonus amounts were previously divided equally between quarterly and annual goals

|

|

|

|

Equity Awards

|

|||

|

Increased emphasis on pay for

performance in 2019

|

Reasons for change

|

||

|

−

|

2019 performance-based awards include an additional achievement level (above the previous “stretch” level) that, if achieved, provide the opportunity to vest at

200% of target (previous maximum payout was 150% for “stretch”)

|

−

−

|

Further align executive and stockholder interests

Increased reward for high performance without additional expense at time of grant

|

|

−

|

The Committee established EPS growth goals for this “super stretch” achievement that exceed peer historical 75th-percentile growth

|

|

|

|

Other

|

|||

|

Elimination of discretionary holiday

bonus in 2019

|

Reasons for change

|

||

|

−

|

Eliminated annual holiday bonus for executives, effective in 2019

|

−

|

Simplify the design, administration and transparency of the incentive program

|

|

−

|

This bonus had historically been paid annually to all corporate employees in an amount equal to approximately two weeks of salary

|

||

Objectives

The primary objectives of our compensation program are to:

| − |

Successfully recruit, motivate and retain experienced and talented executives;

|

| − |

Provide competitive compensation arrangements that are tied to corporate and individual performance in the short- and long-term;

|

| − |

Align the financial interests of our executives with those of our stockholders; and

|

| − |

Drive superior stockholder value over the long-term.

|

The Committee, in consultation with management and the Committee’s independent advisors, oversees the executive compensation and