SHAREHOLDER UPDATE

A PUBLIC COMPANY TRADING UNDER

THE SYMBOL “RMLX”

BUSINESS STRATEGY REPORT

JULY 2015

433 HACKENSACK AVENUE

HACKENSACK, NEW JERSEY 07601

(201) 968-9797

SHAREHOLDER UPDATE

1. STRATEGY EXECUTION update

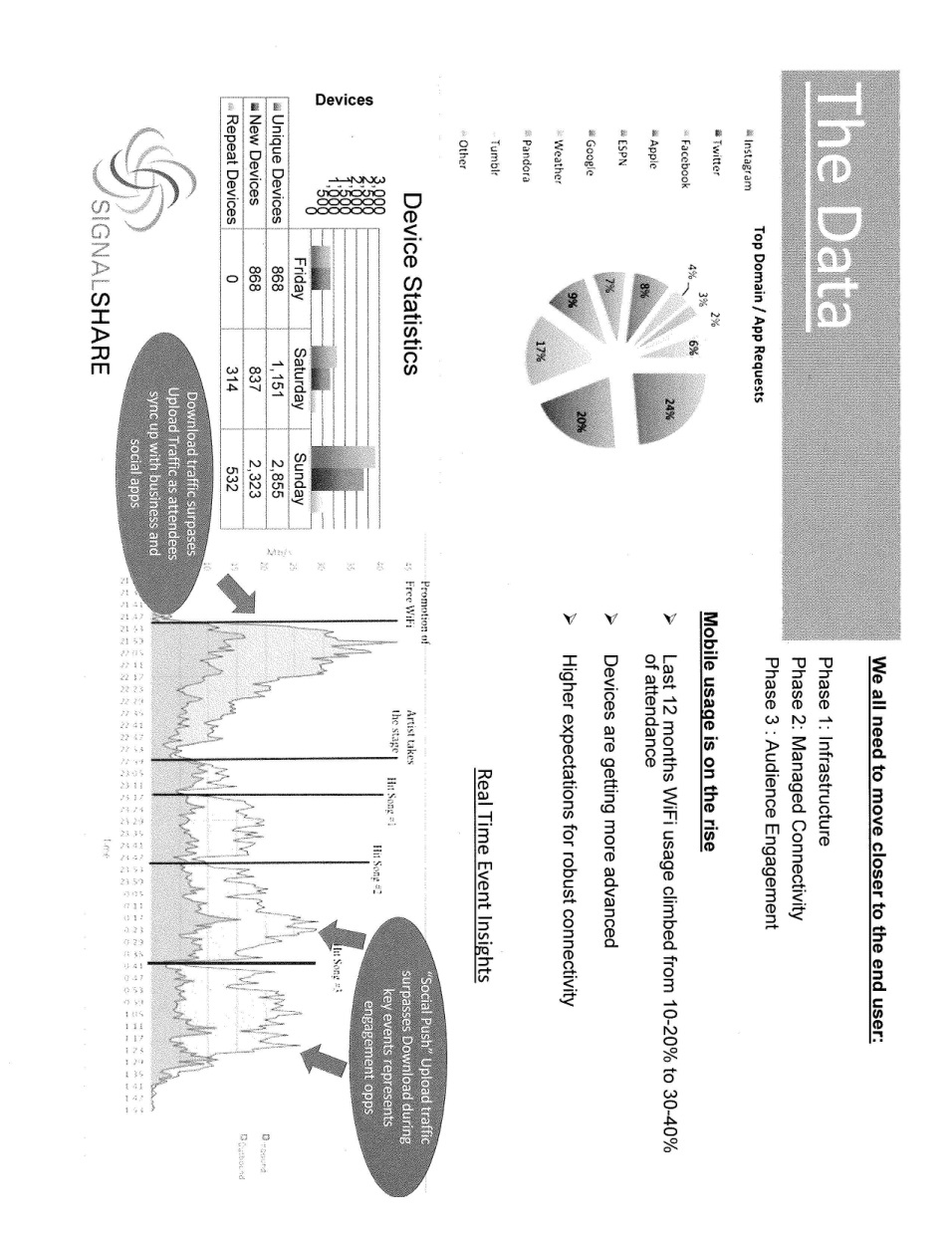

Now that the merger of Signal Point and Roomlinx is complete, the Company intends to file for a name change and stock symbol change from RMLX to SSMG as soon as practical. The new name of the parent company will change to SignalShare Media Group, Inc. (from Roomlinx, Inc). With our merger and purchase of Incubite, we believe we are now a uniquely positioned company; sitting at the crossroads of WiFi based connectivity and the massive advertising and sponsorship industry for sports and entertainment. With our Proprietary platform LiveFi and it’s two core components nGage and mPower we are able to provide a unique content and user experience that will become groundbreaking to the $14 Billion Online Advertising industry. To put this in perspective, the sports and entertainment sector is one of the most coveted aspects of the advertising world, as the concentration of users, the targeted demographic and length of time spent at these events allows brands access to these customers in a way other advertising and content networks cannot provide. The real issue for digital advertisers is getting the most for their advertising dollars in terms of how many people actually see their advertisements. As noted in the Wall Street Journal in June 2015, over 54% of online display ads were not seen by anyone. Viewed Ads have become the new measure of success for online campaigns. Just recently Google announced that it would begin to allow customers to pay for only “Viewed Ads” and is taking steps to better define what that metric means. A person that is on our LiveFi enabled network generates 100% “Viewed Ads” meaning that any impression is a guaranteed human eyeball viewing that ad or content on our launch page.

With our platform we have achieved login rates of over 50% compared to industry standard of 7%, and we can assure advertisers that are on our launch page, that they will be seen by 100% of those that log on, thus providing real value (ROI) for advertisers. As described below, we are approaching 50 million potential “eyeballs” and utilizing our own proprietary technology, which places us in a unique position as a market leader, thus allowing us to be valued as other media eyeball companies. Using similar industry valuations, 50 Mil "eyeballs" could be valued at approximately $13 per eyeball all the way up to $167 (see below chart from Wall Street Journal).

It should be noted that in order to project revenues and/or profitability for the Company, certain assumptions and estimates are completely dependent on future events and transactions covering an extended period of time which may be significantly affected by changes in circumstances over which the Company may not have control. In addition, the Company’s current operations were recently combined and the Company has no prior experience in making projections.

Some of the venues we have been successful in winning are

|

-

|

In the NBA the Houston Rockets, Indiana Pacers. Denver Nuggets, the Sacramento Kings and the World Champion Golden State Warriors.

|

|

-

|

In the NHL just this year we have installed the Detroit Red Wings and the Colorado Avalanche.

|

|

-

|

In the NFL, in addition to working with the New England Patriots, we have recently installed the Jacksonville Jaguars.

|

|

-

|

In the college leagues, some of our recent wins have been with the University of Maryland, University of Michigan VIP areas and Temple University.

|

In addition, we continue to work very closely with the Venetian, Palazzo Casinos and Sands Convention Center in Las Vegas where we have our network covering several million square feet, and that network can generate revenues by selling valued added services to conference center sponsors and attendees.

While there are various subsidiaries under our parent Company, the overall focus and mission of the Company is to provide access to consumer information by providing network infrastructure, data analytics, content and advertising sponsorship required to monetize the “eyeballs” on your network.

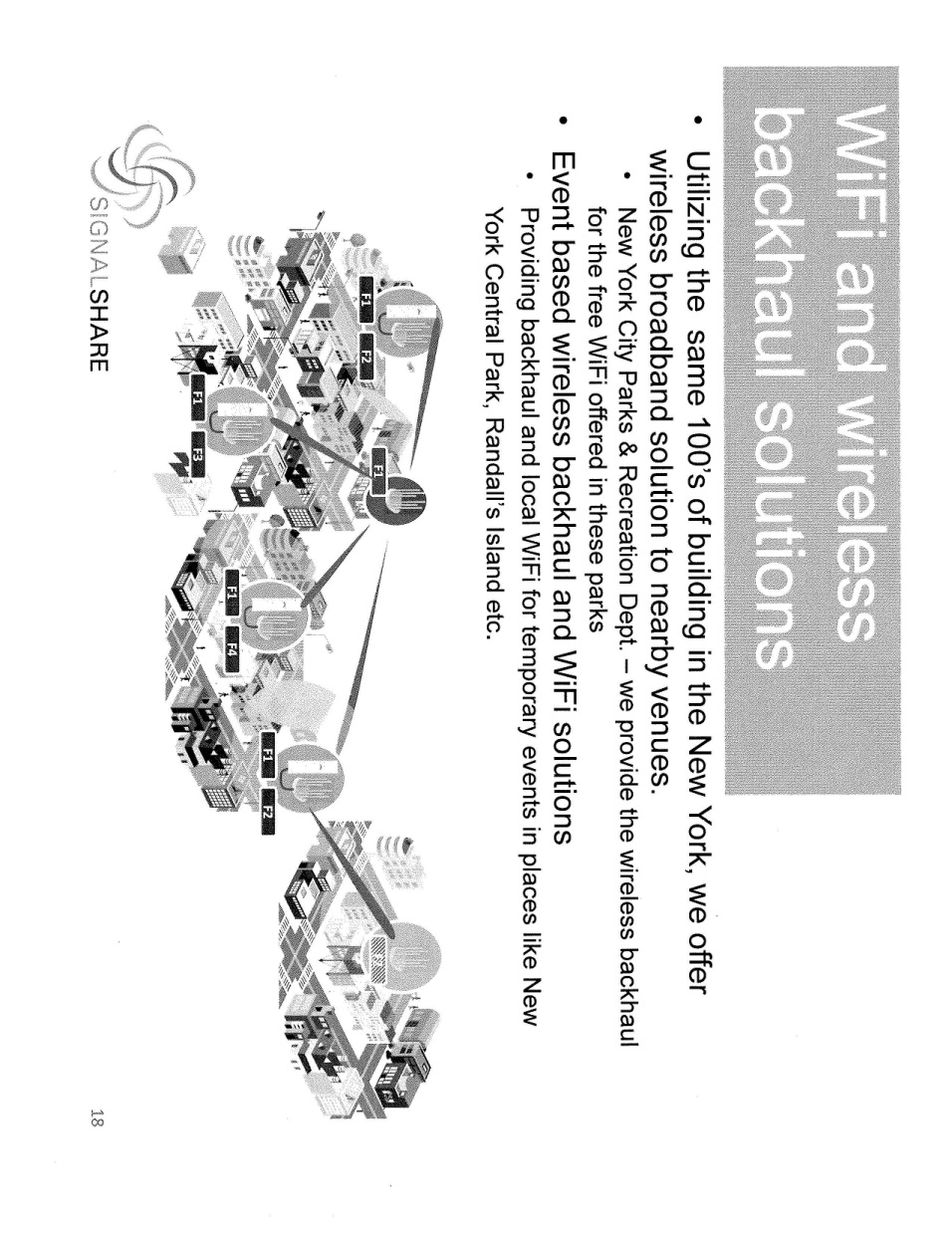

Just to remind you that we are achieving this goal by executing on both aspects of our business. The first, being our Wi-Fi networking and media business serving the sports, entertainment and convention center market and the other is our communications business where we provide broadband, VoIP services and value added services to the commercial enterprise market, primarily in the New York Tri-state area and Chicago. We have found that truly successful businesses find ways of taking fixed assets and generating multiple revenue opportunities with those fixed assets, preferably on a contractual monthly recurring revenue model, thereby improving profitability.

Our communications business provides our business customers with their basic broadband and VoIP services, and then as a trusted vendor to these customers, to provide them with additional value added. Since we are paying for the infrastructure required to provide these services with the revenues generated from these customers, each additional valued added service we provide allows us to generate an increased profit margin as we are utilizing the infrastructure already in place. Our customers enter into 1,2 or 3 year contracts with us thus providing monthly recurring revenue.

Our Wi-Fi and media business is considered our high growth business. The business started as a provider of High Density Wi-Fi networks for large audiences. What we have figured out is a way to provide a high quality of service in extremely densely populated stadiums, arena and convention centers. The technology we own and have developed internally, we believe is unique in how we provide network management of hundreds of wi-fi access points in a single installation, while at the same time collecting all the information for a comprehensive data analytics monetization program.

The data analytics monetization program takes advantage of controlling the wireless network by collecting all of the data analytics of what happens on the network and utilizes these analytics to sell advertising sponsorship opportunities through our Live-Fi & nGage media products. Live-Fi and Engage are our brands we use for our data analytics and sponsorship software platform. We have tested both the technology and our ability to sell these sponsorship opportunities during the NBA playoffs last season and we were extremely pleased with the results. This has given us the confidence to now approach our existing customers, as well as all the new stadiums and venues we are working with, and offer our advertising sponsorship services whereby we jointly sell with the venue and we have a revenue sharing agreement alongside our network installation agreement. In theory, we are acting as a partner to the teams. Our software platform also serves as a Fan Engagement portal that allows the team to connect with the fans before, during and after the game, and we are working on plans to expand those fan engagement opportunities to the many fans not attending the games in-stadium, which is something teams have told us they are looking for, but have not found the way to do.

This business model of providing wi-fi network infrastructure along with providing the data analytics and media sales has gained some great traction. The value of these networks really starts to shine when you look at how many potential eyeballs or users we have for the networks we install. Based on our existing installations, venues in preparation to install and new opportunities we are working on, we are approaching 50 Million eyeballs, which starts to become an attractive outlet for major media buyers and for the overall value of the company.

Through this unique approach of combining network infrastructure installation with media sales, we have started to gain momentum in the market and are building brand awareness.

We continue to aggressively push new sales and installation opportunities, and are in discussions with many NHL, NBA, NFL and NCAA teams. We also believe that after a lengthy pursuit of Major League Baseball (MLB) teams and venues, we will be successful this year in providing our services to several teams. While we can of course not guarantee that we will conclude these contracts, these opportunities represent potentially millions of dollars of revenues over the life of the contracts.

Another related area we have expanded this year is our music festival and corporate events business. This utilizes the same technology we use in the large stadiums and arenas, but whereas those are permanent installations, theses music and corporate events are installed as temporary installations. What we do is bring in and build the temporary wi-fi networks capable of handling high density performance, and then again plan to sell sponsorship and advertising packages in conjunction with the event owners based on the data analytics that we collect. Some of the events we have done in the past, just to name a few are the Dave Mathews Band, The Black Eyed Peas, and the US Open Tennis Tournament, as well as corporate events for IBM, SAP and others.

Finally adding to the success of our deployment at the Venetian, Palazzo and Sands Hotel, Casino & Convention Center we are aggressively working with Hyatt and other hospitality company contracts acquired with our recent merger, in order to bring them the same advantages that we are currently providing to our sports, entertainment and hospitality customers.

We trust that this strategy update has given you a good overview of our progress and look forward to keeping you updated as we go into the second half of the year with some exciting sales opportunities.

SAFE HARBOR CAUTIONARY STATEMENT

This release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements regarding future events, developments, future performance, as well as management's expectations, beliefs, intentions, plans, estimates or projections relating to the future are forward-looking statements within the meaning of these laws. These forward-looking statements are subject to a number of risks and uncertainties, some of which are outlined below. As a result, actual results may vary materially from those anticipated by the forward-looking statements. Among the important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are: the merged entity's successful implementation of new products and services (either generally or with specific key customers), the merged entity's ability to satisfy the contractual terms of key customer contracts, demand for the new products and services, the merged entity's ability to successfully compete against competitors offering similar products and services, general economic and business conditions; unexpected changes in technologies and technological advances; ability to commercialize and manufacture products; results of experimental studies and research and development activities; changes in, or failure to comply with, governmental regulations; the ability to obtain adequate financing in the future; the merged entity's ability to establish and maintain strategic relationships, including the risk that key customer contracts may be terminated before their full term; the possibility of product-related liabilities; the merged entity's ability to attract and retain qualified personnel; the merged entity's ability to maintain its intellectual property rights and litigation involving intellectual property rights; risks related to third-party suppliers; the merged entity's ability to obtain, use or successfully integrate third-party licensed technology; breach of the merged entity's security by third parties; risks related to the merger not closing for any reason and the potential effects on customers, suppliers and other stakeholders, including Company creditors; and the risk factors detailed from time to time in the merged entity's reports filed with the Securities and Exchange Commission, available through the web site maintained by the Securities and Exchange Commission at www.sec.gov. Roomlinx undertakes no obligation to update publicly any forward-looking statement, whether as a result of new information, future events or otherwise.