0001020710DEF 14Afalse00010207102023-01-012023-12-31000102071012023-01-012023-12-31000102071022023-01-012023-12-31000102071032023-01-012023-12-31iso4217:USD00010207102022-01-012022-12-3100010207102021-01-012021-12-310001020710dxpe:StockAwardsAdjustmentsMemberecd:PeoMember2023-01-012023-12-310001020710dxpe:StockAwardsAdjustmentsMemberecd:PeoMember2022-01-012022-12-310001020710dxpe:StockAwardsAdjustmentsMemberecd:PeoMember2021-01-012021-12-310001020710dxpe:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2023-01-012023-12-310001020710dxpe:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2022-01-012022-12-310001020710dxpe:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2021-01-012021-12-310001020710ecd:PeoMemberdxpe:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001020710ecd:PeoMemberdxpe:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001020710ecd:PeoMemberdxpe:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001020710ecd:PeoMemberdxpe:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001020710ecd:PeoMemberdxpe:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001020710ecd:PeoMemberdxpe:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001020710dxpe:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310001020710dxpe:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310001020710dxpe:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310001020710dxpe:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001020710dxpe:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001020710dxpe:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001020710dxpe:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001020710dxpe:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001020710dxpe:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001020710ecd:NonPeoNeoMemberdxpe:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001020710ecd:NonPeoNeoMemberdxpe:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001020710ecd:NonPeoNeoMemberdxpe:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

☑ Filed by the Registrant

☐ Filed by a Party other than the Registrant

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

DXP Enterprises, Inc.

______________________________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

N/A

________________________________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0–11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined).

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

☐ Fee paid previously with preliminary materials.

| | | | | | | | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | | Amount previously paid: |

| (2) | | Form, Schedule or Registration Statement No.: |

| (3) | | Filing Party: |

| (4) | | Date Filed: |

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 2

DXP ENTERPRISES, INC.

5301 Hollister St.

Houston, Texas 77040

(713) 996-4700

LETTER FROM OUR CEO

April 29, 2024

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of DXP Enterprises, Inc. to be held at 10:00 a.m., Central Time, on Friday, June 14, 2024 at the Company's principal executive offices located at 5301 Hollister St., Houston, Texas 77040.

This year you will be asked to consider proposals concerning the election of directors. Shareholders will also be asked to consider and act upon an advisory non-binding resolution approving the Company’s named executive officers compensation and the ratification of the appointment of PricewaterhouseCoopers, LLP, as the independent registered public accounting firm for the Company for fiscal 2024. These matters are explained more fully in the attached proxy statement, which you are encouraged to read.

The Board of Directors recommends that you approve the proposals and urges you to vote at your earliest convenience, whether or not you plan to attend the Annual Meeting.

Thank you for your cooperation.

Sincerely,

/s/ David R. Little

David R. Little

Chairman of the Board,

President and Chief Executive Officer

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 3

DXP ENTERPRISES, INC.

5301 Hollister St.

Houston, Texas 77040

Notice of Annual Meeting of Shareholders to be Held June 14, 2024

ITEMS OF BUSINESS

The Annual Meeting of the Shareholders (the "Annual Meeting") of DXP Enterprises, Inc., a Texas corporation (the "Company"), will be held on Friday, June 14, 2024, at 10:00 a.m., Central Time, at the Company's principal executive offices located at 5301 Hollister St., Houston, Texas 77040,* for the following purposes:

| | | | | |

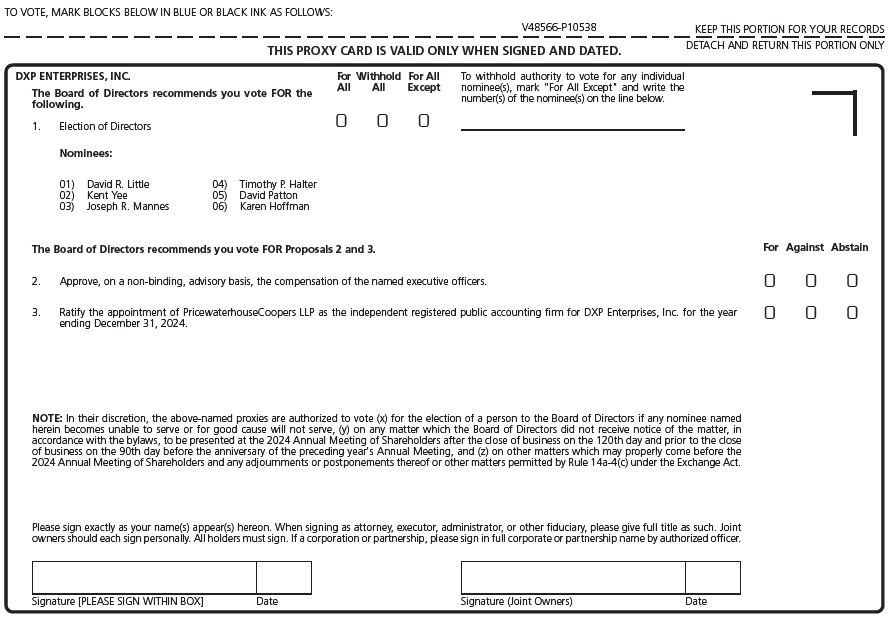

| 1 | Elect six board of director nominees to hold office as directors until the next Annual Meeting and until their respective successors are duly elected and qualified. |

| 2 | Approve, on a non-binding, advisory basis, the compensation of the named executive officers. |

| 3 | Ratify the appointment of PricewaterhouseCoopers, LLP, as the independent registered public accounting firm of the Company for the year ended December 31, 2024. |

| 4 | Transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

WHO CAN VOTE?

The holders of record of Common Stock, Series A Preferred Stock, and Series B Preferred Stock at the close of business on April 19, 2024, will be entitled to vote at the Annual Meeting. Please note that there are separate forms of proxy cards for each class of stock.

By Order of the Board of Directors,

/s/ David R. Little

David R. Little

Chairman of the Board,

President and Chief Executive Officer

April 29, 2024

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 4

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 5

PROXY STATEMENT SUMMARY

To assist you in reviewing the proposals to be acted upon at our 2024 Annual Meeting, below is a summary of information regarding the meeting, each proposal to be voted upon at the meeting and DXP Enterprises, Inc. business and corporate governance highlights. The following description is only a summary and does not contain all of the information you should consider before voting. For more information about these topics, please review DXP's Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and the complete Proxy Statement. In this Proxy Statement, the terms "DXP", "We" or the "Company" refer to DXP Enterprises, Inc., and its consolidated subsidiaries or the consolidated subsidiaries of DXP Enterprises, Inc. as the context requires.

| | | | | | | | | | | | | | |

| | | | |

2024 Annual Meeting of Shareholders |

| DATE AND TIME: June 14, 2024, 10:00 am Central Time |

| PLACE: DXP Enterprises, Inc.'s Corporate Headquarters, 5301 Hollister St., Houston, TX 77040 |

| RECORD DATE: April 19, 2024 | |

| We are mailing to shareholders of record a Notice of Internet Availability of Proxy Materials and will make this proxy statement and our annual report, which contains audited financial statements for the fiscal year ended December 31, 2023, available to our shareholders of record on or about May 9, 2024. |

Voting Matters

| | | | | | | | | | | | | | | | | |

| PROPOSAL | DESCRIPTION | BOARD RECOMMENDATION |

| | | | | |

Proposal 1: Election of directors | We are asking shareholders to elect each of the six directors identified to serve until the next Annual Meeting and until their respective successors are duly elected and qualified. | FOR each nominee | ☑ |

Proposal 2: Advisory vote to approve named executive officer compensation | We are asking shareholders to consider and act upon an approval of a non-binding, advisory vote on the compensation of the Company’s named executive officers. | FOR | ☑ |

Proposal 3: Ratification of the appointment of the independent registered public accounting firm | We are asking shareholders to ratify the appointment of PricewaterhouseCoopers, LLP to act as the independent registered public accounting firm for the fiscal year ended December 31, 2024. | FOR | ☑ |

| | | | | | | | | | | | | | | | | |

| Review Your Proxy Statement and Vote in One of the Following Ways: | |

| | | | | |

: VIA THE INTERNET | ( BY TELEPHONE | *+ BY MAIL | |

| Visit the website listed on your Notice of Internet Availability, proxy card or voting instruction form | Call the telephone number on your proxy card or voting instruction form | Sign, date and return your proxy card or voting instruction form in the enclosed envelope | |

|

| Please refer to the enclosed proxy materials or the information forwarded by your bank, broker, trustee or other intermediary to see which voting methods are available to you. |

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 6

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR

THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON

JUNE 14, 2024

Pursuant to rules promulgated by the Securities and Exchange Commission (“SEC”) related to the internet availability of proxy materials, DXP Enterprises, Inc., is providing access to its proxy materials by notifying you of the availability of its proxy materials on the internet. DXP’s proxy statement for the Annual Meeting to be held on June 14, 2024 and Annual Report on Form 10-K are available at http://materials.proxyvote.com/233377, which does not have “cookies” that identify visitors to the site. This website is not a form for voting and presents only an overview of the more complete proxy materials. Shareholders are encouraged to access and review the proxy materials before voting. This website will also have directions to attend the meeting and vote in person. You may obtain such reports from the SEC’s website at www.sec.gov. We will provide, free of charge, a copy of any of our corporate documents listed above (i) by internet at www.proxyvote.com (ii) by email request at sendmaterial@proxyvote.com, (iii) by calling toll free at 1-800-579-1639 or (iv) upon written request to our Corporate Secretary at the Company's offices at 5301 Hollister St., Houston, Texas 77040.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 7

FISCAL YEAR 2023 BUSINESS HIGHLIGHTS

DXP Enterprises, Inc. works to conduct business in ways that are principled, transparent, and accountable to our shareholders and other key stakeholders. We believe doing so generates long-term value.

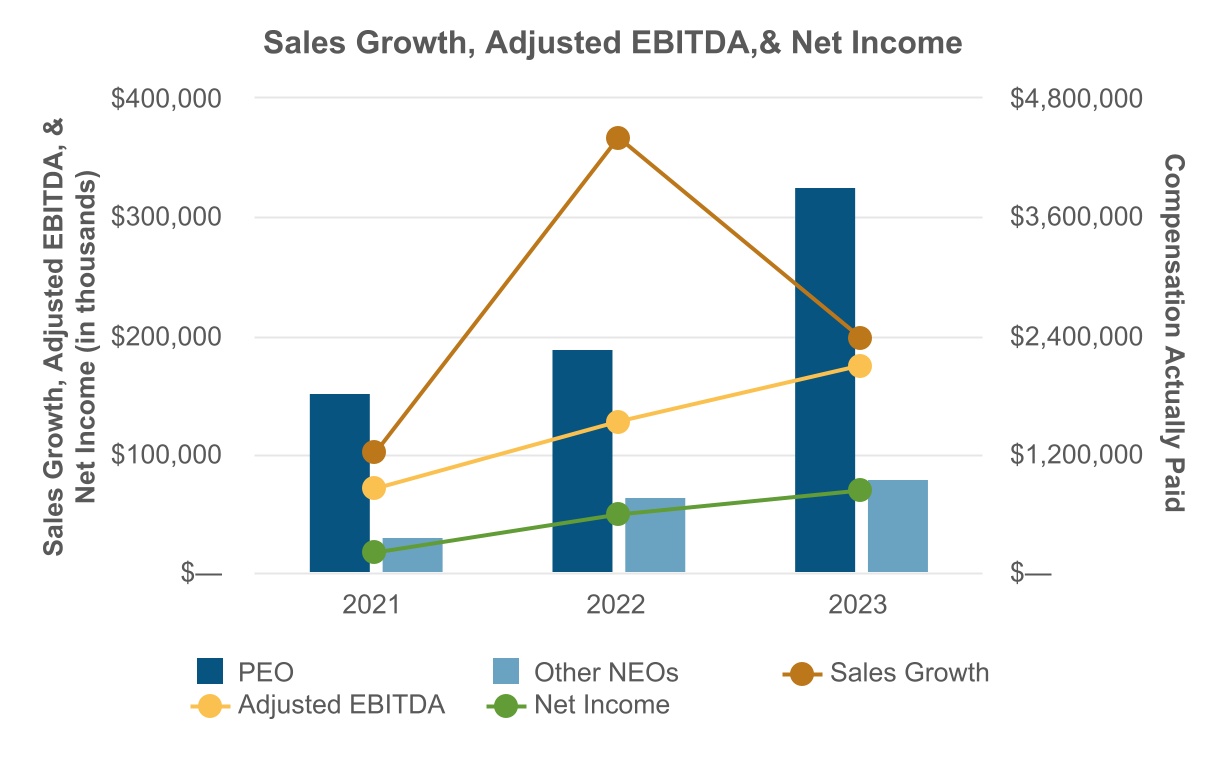

In fiscal 2023, DXP achieved record sales and adjusted EBITDA. During fiscal 2023, DXP remained focused on growing its business in the near-term while continuing to invest in long-term growth.

Specifically in 2023 DXP:

•Sales and Adjusted EBITDA grew 13.4 percent and 37.5 percent, respectively,

•Completed three acquisitions investing $13.4 million, and

•Returned $54.7 million in capital to shareholders via share repurchases.

Sales for FY 2023 increased to approximately $1.7 billion with Net Income of $68.7 million. The Return on Invested Capital (ROIC) for the full year 2023 was 5.8%. Adjusted EBITDA was $174.3 million for the full year. Management uses the aforementioned non-GAAP financial measures to assist in comparing our performance on a consistent basis for purposes of business decision making by removing the impact of certain items that management believes do not directly reflect our underlying operations. We believe that the presentation of these non-GAAP financial measures, provides investors with additional understanding of the factors and trends affecting our business than could be obtained absent these disclosures

Our fiscal year 2023 business performance highlights include:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Business Performance |

|

| GAAP | | GAAP | | Non-GAAP |

| $1.7 billion Sales | | $68.7 million Net Income | | $174.3 million Adjusted EBITDA** |

These performance results should be read together with the information in our Annual Report on Form 10-K, and the risk factors contained in that Annual Report and our subsequent periodic reports.

** Adjusted EBITDA is a non-GAAP measure. Adjusted EBITDA is defined as the sum of consolidated net income in such period, plus to the extent deducted from consolidated net income: (i) income tax expense, (ii) franchise tax expense, (iii) consolidated interest expense, (iv) amortization and depreciation during such period, (v) all non-cash charges and adjustments, and (vi) non-recurring cash expenses related to the Term Loan; in addition to these adjustments, we exclude, when they occur, the impacts of impairment losses and losses/(gains) on the sale of a business. EBITDA is a tool that can assist management and investors in comparing our performance on a consistent basis by removing the impact of certain items that management believes do not directly reflect our underlying operations. See pages 29-30 of our Annual Report on Form 10-K for the year ended December 31, 2023 that has been filed with the SEC for a more detailed reconciliation of Adjusted EBITDA to EBITDA.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 8

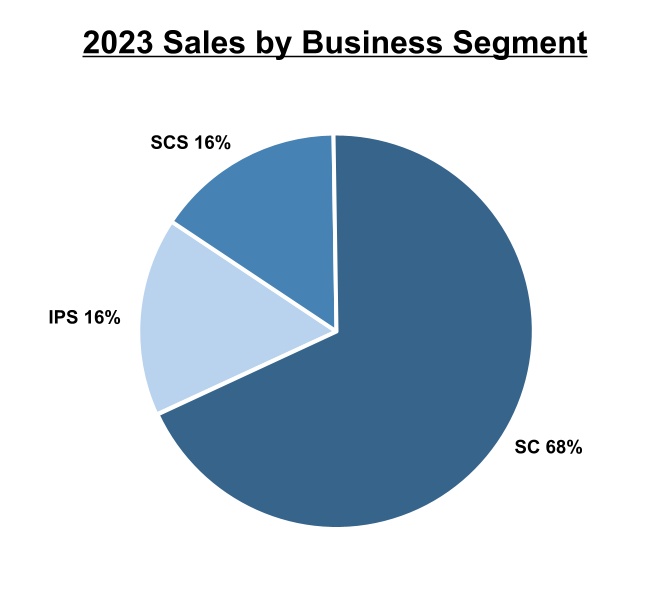

Fiscal 2023 Sales Performance by business segment and end market

Below is a summary of fiscal 2023 sales by business segment1 and end market2:

1 Sales by Business Segment : SC = Service Center, IPS = Innovative Pumping Solutions, and SCS = Supply Chain Services

2 Sales by End Market reflect management estimates as of fiscal year 2023

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 9

CORPORATE GOVERNANCE HIGHLIGHTS

Our Board of Directors recognizes that DXP's success over the long-term requires a robust framework of corporate governance that serves the best interests of all our shareholders. Below are highlights of our corporate governance framework.

| | | | | | | | | | | | | | | | | |

| ☑ | Board refreshment remains a focus, as evidenced by the 2021 addition of Karen Hoffman and Kent Yee, 2020 addition of Joseph R. Mannes and the 2016 addition of David Patton, to our Board. | ☑ | All committees of the Board are comprised exclusively of independent directors. |

| ☑ | All of our directors are elected annually. | ☑ | The Board is responsible for overseeing DXP's risk management. As part of this oversight, the Board regularly reviews DXP's policies and practices with respect to risk assessment and management, including discussing with management DXP's major risk exposures and the steps that have been taken to monitor and mitigate such exposures. |

| ☑ | Our independent directors regularly meet in private executive sessions without management present. | ☑ | All members of our Audit, Compensation and Nominating and Governance Committees are independent as defined by the NASDAQ listing standards and applicable SEC rules. |

Shareholder Engagement and Proxy Advisor Outreach

We have a long-standing history of an active shareholder outreach and engagement program. The Board and management continue to place a high priority on listening to and considering the views of our shareholders. Engaging with our shareholders is fundamental to our commitment to good governance practices and has resulted in changes and enhancements to our governance and disclosures over time. Throughout the year, we seek opportunities to connect with our investors to gain and share valuable insights. We also have, over the past three years, a process of outreach to our top shareholders prior to our annual meeting to solicit feedback on our corporate governance practices, executive compensation, environmental and social goals, as well as our long-term business strategy and other issues specific to our industry. In addition, certain of our directors have participated in direct shareholder engagement when requested and deemed appropriate. The results of these conversations are summarized and discussed with both the Board and our management.

In 2023, these included our annual stockholder meeting, investor conferences, quarterly earnings calls and engaging a third party proxy solicitor to assist with stakeholder engagement. Under these efforts, we engaged with shareholders regarding the Company's common stock performance as well as broader governance issues. Our 2023 engagement with stakeholders focused on investor concerns regarding executive compensation, diversity and inclusion, environmental impact and ESG initiatives, disclosures and oversight.

We actively seek and value feedback from our shareholders. In addition to our traditional investor relations outreach efforts, we engage from time-to-time with significant shareholders on topics including our business strategy and financial performance, governance and executive compensation programs and other initiatives. We shared feedback received during these meetings with our Nominating and Governance Committee and Compensation Committee, informing their decision-making.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 10

Board of Directors

Below is an overview of each of the director nominees you are being asked to elect at the 2024 Annual Meeting.

| | | | | | | | | | | | | | |

| NAME | DIRECTOR SINCE | PRINCIPAL PROFESSIONAL EXPERIENCE | COMMITTEE MEMBERSHIPS | OTHER PUBLIC COMPANY BOARDS |

| David R. Little | 1996 | Chairman, President and CEO, DXP | — | — |

| Kent Yee | 2021 | SVP CFO and Secretary, DXP | — | — |

| Timothy P. Halter* | 2001 | CEO, Halter Financial Group | A, N, C | — |

| David Patton* | 2016 | Partner, law firm Locke Lord. Chair Emeritus Energy Practice | A, N, C | — |

| Joseph R. Mannes* | 2020 | President and Board member of SAMCO Capital Markets, Inc. | A, N, C | — |

| Karen Hoffman* | 2021 | Global Tax Director, Transocean Ltd | A, N, C | — |

**= Independent director N = Nominating and Governance Committee

A = Audit Committee C = Compensation Committee

Highly-Skilled Board of Directors

The board has taken a thoughtful and deliberate approach to board composition to ensure that our directors have backgrounds that collectively add significant value to the strategic decisions made by the Company and enable them to provide oversight of management to ensure accountability to our shareholders.

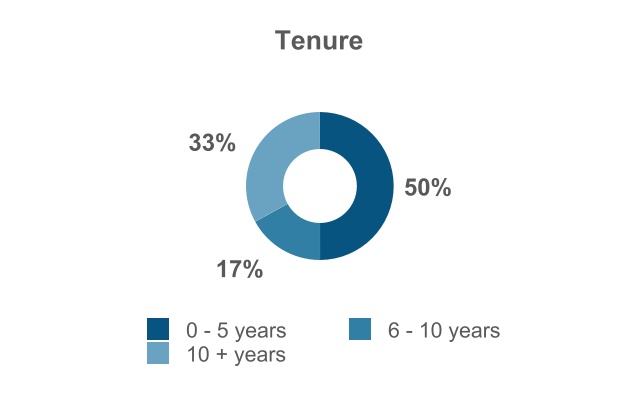

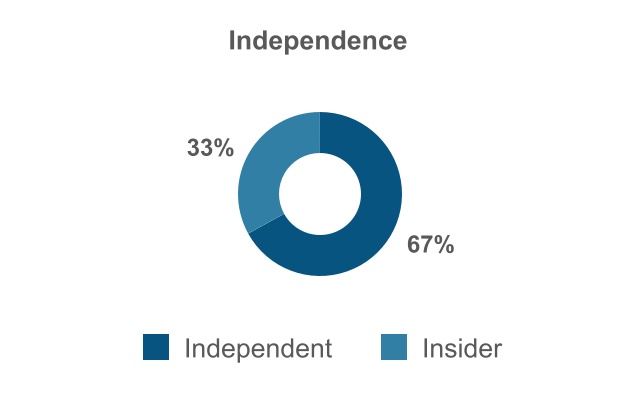

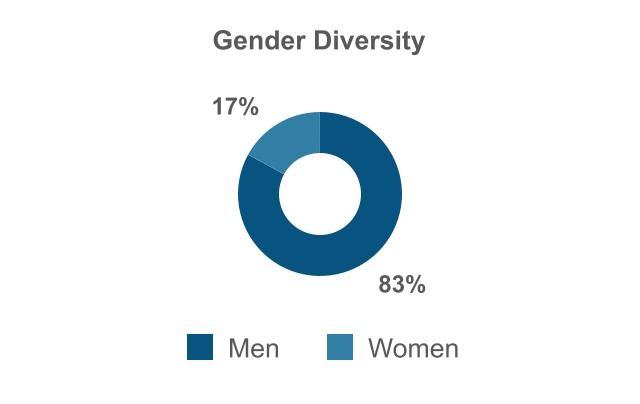

The composition of our director nominees consists of:

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 11

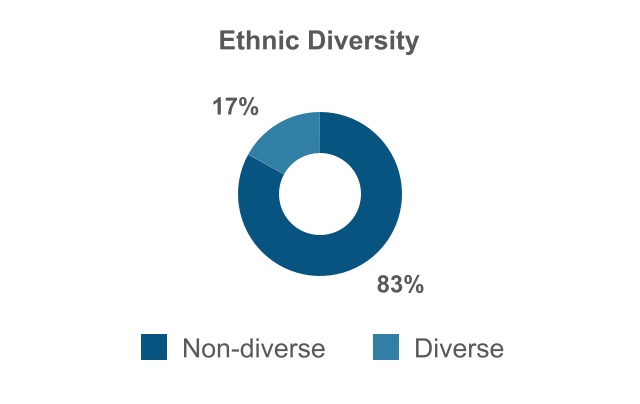

Board Diversity Matrix

The following chart summarizes certain self-identified personal characteristics of our directors in accordance with NASDAQ Listing Rule 5605 (f). Each term used in the table has the meaning given to it in the rule and related instructions.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix for DXP Enterprises, Inc. | | | | |

| Current Year | Prior Year |

| | | | | | | | |

| Total Number of Directors | 6 | 6 |

| Part I : Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender | Female | Male | Non-Binary | Did Not Disclose Gender |

| Directors | 1 | 5 | | | 1 | 5 | | |

| Part II : Demographic Background | | | | |

| African American or Black | | | | | | | | |

| Alaskan Native or American Indian | | | | | | | | |

| Asian | | | | | | | | |

| Hispanic or Latinx | | | | | | | | |

| Native Hawaiian or Pacific Islander | | | | | | | | |

| White | 1 | 4 | | | 1 | 4 | | |

| Two or More Races or Ethnicities | | 1 | | | | 1 | | |

| LGBTQ+ | | | | | | | | |

| Did Not Disclose Demographic Background | | | | | | | | |

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 12

Specific Experience, Qualifications, Attributes and Skills of Directors

The Nominating and Governance Committee seeks Directors with experience, qualifications, attributes and skills that align with our business strategy. The following table describes key experience and expertise that our Director nominees collectively possess and that we consider most relevant to the decision to nominate candidates to serve on the Board.

The Nominating and Governance Committee has reviewed with the Board the specific experience, qualifications, attributes and skills each Director nominee standing for election as a Director at this Annual Meeting. The Committee has concluded that each Director nominee has the appropriate skills and qualifications required of Board membership and that each possesses an in-depth knowledge of the Company's businesses and strategy. The Committee further believes that our Board is composed of well-qualified and well-respected Directors who possess strength in business, finance and the capital markets.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 13

Director - Skills Matrix

A mark in the Director skills matrix below indicates a specific or specialized area of focus or expertise that each Director nominee brings to the Board. Not having a mark does not mean that the Director does not possess that qualification or skill.

Skills, Experience & Qualifications

| | | | | | | | | | | | | | | | | | | | |

| Halter | Hoffman | Little | Mannes | Patton | Yee |

| Active Executive | ☑ | ☑ | ☑ | ☑ | ☑ | ☑ |

| CEO Leadership Experience | ☑ | | ☑ | ☑ | | |

| Accounting & Finance | ☑ | ☑ | ☑ | ☑ | | ☑ |

| Operations | | | ☑ | ☑ | | ☑ |

| Risk Management | | | ☑ | ☑ | ☑ | ☑ |

| Strategic, Planning & Business Development | ☑ | ☑ | ☑ | ☑ | | ☑ |

| Industry : Oil & Gas | | ☑ | ☑ | | ☑ | |

| Corporate Governance | ☑ | | ☑ | ☑ | ☑ | ☑ |

| Mergers & Acquisitions | ☑ | | ☑ | ☑ | ☑ | ☑ |

| HR/Talent Management | | ☑ | ☑ | ☑ | | ☑ |

Additional information regarding the biography, experience and key competencies of each individual Director nominee and current Director, as reviewed and considered by the Committee, is provided on page 18 of this Proxy Statement

Environmental, Social and Governance Matters

ESG Highlights

DXP Enterprises, Inc. is dedicated to a global stewardship, focusing on sustainable environmental, social practices and responsible governance activities. We utilize a comprehensive continuous improvement business mindset, in all aspects of our business. Our team is committed to meeting the performance needs of end users while maintaining the highest standards of conduct.

At DXP, doing good is good for business and our global community. We monitor and manage our environmental, social, and governance (“ESG”) opportunities and impacts and engage with shareholders and other stakeholders to help create a better tomorrow and to assure the long-term viability of our Company.

The Board is committed to supporting the Company’s efforts to conduct its business in a principled, transparent, and accountable manner. The Board believes that its effective oversight of Environmental, Social and Governance matters is central to its risk oversight function. The Nominating and Governance Committee is responsible for oversight of significant ESG matters.

DXP reduces environmental impact through responsible operations that include a focus on energy conservation, waste reduction, and minimizing emissions.

DXP is powered by our people and talent growth is our mindset. We embrace inclusion and diversity as catalysts for innovation and provide equal opportunities for all. We believe our investment in our global team contributes to long-term value for our shareholders and creates a work environment that benefits every employee.

DXP believes that our collaborative philanthropic endeavors engage customers and employees and contribute to the Company’s long-term value. DXP is committed to responsible corporate governance that we believe promotes

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 14

the long-term interests of our shareholders and strengthens Board and management accountability. DXP continues to focus on expanding and elevating our oversight and management of ESG matters.

In 2021, DXP published its first ESG report, which is based on the Global Reporting Initiative (GRI) framework with cross-references to relevant Sustainability Accounting Standards Board (SASB) principles. More information about DXP’s initial corporate 2021 Sustainability Report can be found at https://www.dxpe.com/about-us/corporate-sustainability. The report includes important information gathered from across our operations regarding environmental and safety practices, including how we support energy transition efforts and support clean water and wastewater metrics and efforts. We are continually monitoring and strategically implementing actions to improve our environmental, social and safety impact.

Our employees are our greatest asset, and each employee plays an important role in the success of our Company and the overall business. Stakeholders and interested parties are key to fulfilling our corporate responsibilities which includes sustainability.

The 2023 ESG Report is available on our website at www.dxpe.com/about-us/corporate-sustainability/. The 2023 ESG Report provides detail on DXP’s ESG-related annual goals, progress updates, metrics, and initiatives.

Information on the Company’s website, including our ESG Reports, is not incorporated by reference into, and does not form part of, this Proxy Statement or any other report or document DXP files with the SEC.

Environmental Sustainability

DXP Enterprises monitors and seeks to incorporate environmental sustainability practices in its operations and supply chain. Several of our facilities are certified ISO 9001.

Social Responsibility

DXP is committed to providing a safe and health work environment. The Company instructs its employees to be responsible for observing the health and safety rules, policies, practices, laws and regulations and taking necessary precautions to protect themselves and co-workers including wearing safety equipment. We encourage employees to immediately report accidents, injuries, occupational illnesses and unsafe practices or conditions. We also ensure that first aid kits are available to all employees

Corporate Governance

DXP's governance practices serve an important role in the Company's ability to conduct its operations in a responsible and ethical manner. Over governance practices include:

•Declassified Board;

•All non-employee directors are independent in accordance with the NASDAQ listing standards; and

•Three standing Board Committees - Audit, Compensation and Nominating and Governance Committees.

Further details are outlined under the heading "Corporate Governance and Other Board Matters."

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 15

DXP ENTERPRISES, INC.

Proxy Statement

For Annual Meeting of Shareholders

to be Held June 14, 2024

Annual Meeting of Stockholders

This proxy statement is furnished to the shareholders of DXP Enterprises, Inc. (the “Company” or “DXP”), 5301 Hollister St., Houston, Texas 77040 (Tel. No. 713 996-4700), in connection with the solicitation by the Board of Directors of DXP (the “Board”) of proxies to be voted at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Friday, June 14, 2024, at 10:00 a.m., Central Time, at DXP’s principal executive offices, 5301 Hollister St., Houston, Texas 77040, or any adjournment thereof.

Proxies appointing David R. Little and Kent Yee to serve as proxies, in the form enclosed, properly executed by shareholders and received in time for the meeting, will be voted as specified therein, unless revoked in the manner provided below. The Board recommends a vote “FOR” the election of nominees for director listed in this proxy statement and the accompanying proxy card, “FOR” approval, on a non-binding, advisory basis, the compensation of the CEO and named executive officers and “FOR” ratification of the appointment of PricewaterhouseCoopers, LLP, as the independent registered public accounting firm of the Company for the fiscal year ended December 31, 2024. If a shareholder does not specify otherwise in the proxy, the shares represented by his or her proxy will be voted as recommended by the Board.

The giving of a proxy does not preclude the right to vote in person should the person giving the proxy so desire. The proxy of a record holder may be revoked at any time before it is exercised by written notice delivered to the Corporate Secretary at 5301 Hollister St., Houston, Texas 77040, at or prior to the meeting. We are mailing to shareholders of record a Notice of Internet Availability of Proxy Materials and will make this proxy statement and our annual report, which contains audited financial statements for the fiscal year ended December 31, 2023, available to our shareholders of record on or about May 9, 2024. If your shares of common stock are held in “street name,” your ability to vote over the Internet depends on your broker’s or intermediary's voting process. You should follow the instructions on your broker’s or intermediary’s voting instruction card. To vote the shares that you hold in “street name” in person at the Annual Meeting, you must bring a legal proxy from your broker, bank or other nominee.

Record Date

At the close of business on April 19, 2024 (the “Record Date”) there were outstanding and entitled to vote 15,928,305 shares of Common Stock, par value $0.01 per share (the “Common Stock”), 1,122 shares of Series A Preferred Stock, par value $1.00 per share (the “Series A Preferred Stock”), and 15,000 shares of Series B Preferred Stock, par value $1.00 per share (the “Series B Preferred Stock”), and only the holders of record on the Record Date are entitled to vote at the meeting.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 16

Right to Vote

The holders of record of Common Stock on the Record Date will be entitled to one vote per share on each matter presented to such holders at the meeting. The holders of record of Series A Preferred Stock and Series B Preferred Stock on the Record Date will be entitled to one-tenth of one vote per share on each matter presented to such holders at the meeting voting together with the holders of Common Stock as a single class. No holders have cumulative voting rights. The presence at the meeting, in person or by proxy, of the holders of a majority of the aggregate outstanding shares of Common Stock, Series A Preferred Stock and Series B Preferred Stock is necessary to constitute a quorum for the transaction of business at the meeting.

Shares of Common Stock, Series A Preferred Stock and Series B Preferred Stock voting together as a class, held by shareholders present in person or represented by proxy, including shares held by shareholders that abstain or do not vote with respect to one or more of the matters presented for shareholder approval, will be counted for purposes of determining whether a quorum is present at the meeting.

If a broker does not have discretionary voting authority to vote shares for which it is the holder of record with respect to a particular matter at the meeting, the broker cannot vote the shares, they will return a broker non-vote as to that matter, and the broker non-votes will only be counted as present in determining whether a quorum is present. Broker non-votes will have no effect on matters that require approval by the affirmative vote of a majority of the shares present and entitled to vote on the matter. Abstentions will have the same effect as votes against a proposal for matters that require approval by the affirmative vote of a majority of the shares present and entitled to vote on the matter. Broker non-votes and any abstentions would not be treated as, and would have no effect on, a vote for or against a matter that requires the affirmative vote of a certain percentage of the votes cast on that matter. Broker non-votes and any withhold votes will have no effect on the plurality vote on the election of directors. As the ratification of auditors is a routine matter no broker non-votes are expected.

The affirmative vote of the holders of shares representing a plurality of the votes cast by the holders of our Common Stock, Series A Preferred Stock and Series B Preferred Stock voting together as a single class and entitled to vote at the meeting is required for the election of directors. The affirmative vote of the holders of shares representing at least a majority of the shares of our Common Stock, Series A Preferred Stock and Series B Preferred Stock, voting together as a single class, that are entitled to vote at the meeting and that are represented at the meeting, by person or proxy, is required for approval of the non-binding, advisory vote on executive compensation and the ratification of the appointment of PricewaterhouseCoopers, LLP, as the independent registered public accounting firm of the Company for the year ended December 31, 2024.

MATTERS TO COME BEFORE THE MEETING

PROPOSAL 1: ELECTION OF DIRECTORS

The holders of Common Stock, Series A Preferred Stock and Series B Preferred Stock, voting together as a single class, are entitled to vote with respect to each of the six nominees for election to the Board. All directors hold office until the next Annual Meeting of Shareholders and until their respective successors are duly elected and qualified or their earlier resignation or removal.

It is the intention of the persons named in the proxies for the holders of Common Stock, Series A Preferred Stock and Series B Preferred Stock to vote the proxies “FOR” the election of each of the nominees named below, unless otherwise specified in any particular proxy. Management of DXP does not contemplate that any of the nominees will become unavailable for any reason, but if that should occur before the meeting, proxies will be voted for another nominee, or other nominees, to be selected by the Board. In accordance with DXP’s Bylaws and Texas law, a shareholder entitled to vote for the election of directors may withhold authority to vote for certain nominees for directors or may withhold authority to vote for all nominees for directors. The director nominees receiving a plurality of the votes of the holders of shares of Common Stock, Series A Preferred Stock and Series B Preferred Stock, voting together as a single class, present in person or by proxy at the meeting and entitled to vote on the election of directors will be elected directors.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 17

The persons listed below have been nominated for election to fill the six director positions.

| | | | | | | | | | | | | | | | | | | | |

| NOMINEE | | AGE | | POSITION | | SINCE |

| David R. Little | | 72 | | Chairman of the Board, President and CEO | | 1996 |

| Kent Yee | | 49 | | Senior Vice President/Chief Financial Officer | | 2021 |

| Timothy P. Halter | | 57 | | Director | | 2001 |

| David Patton | | 74 | | Director | | 2016 |

| Joseph R. Mannes | | 65 | | Director | | 2020 |

| Karen Hoffman | | 45 | | Director | | 2021 |

Board Recommendation

| | | | | | | | | | | | | | |

☑ Our Board recommends that you vote "FOR" each of or "FOR ALL" the election of the above nominees. |

Information Regarding Board Nominees and Directors

Background of Board Nominees for Director

| | | | | | | | | | | | | | |

| SKILLS AND QUALIFICATIONS | | |

| • Public company CEO and President | • M&A |

| • Strategy and operations | • Finance |

| • Distribution, manufacturing | • Human capital |

Mr. Little has served as Chairman of the Board, President and Chief Executive Officer of DXP since its organization in 1996 and also has held these positions with SEPCO Industries, Inc., predecessor to the Company (“SEPCO”), since he acquired a controlling interest in SEPCO in 1986.

Mr. Little has been employed by SEPCO since 1975 in various capacities, including Staff Accountant, Controller, Vice President/Finance and President. Mr. Little gives our Board insight and in-depth knowledge of our industry and our specific operations and strategies. He also provides leadership skills and knowledge of our local community and business environment, which he has gained through his long career with DXP and its predecessor companies.

| | | | | | | | | | | | | | |

| SKILLS AND QUALIFICATIONS | | |

| • Finance and accounting | • M&A |

| • Strategy and operations | • Human resources |

| • Distribution, manufacturing | • Capital markets |

Mr. Yee has served as a Director of DXP since April 2021. Mr. Yee was appointed Senior Vice President/Chief Financial Officer in June 2017. Currently, Mr. Yee is responsible for acquisitions, finance, accounting, business integrations and human resources of DXP. From March 2011 to June 2017, Mr. Yee served as Senior Vice President Corporate Development and led DXP's mergers and acquisitions, business integration and internal strategic project activities.

During March 2011, Mr. Yee joined DXP from Stephens Inc.'s Industrial Distribution and Services team where he served in various positions and most recently as Vice President from August 2005 to February 2011. Prior to Stephens, Mr. Yee was a member of The Home Depot’s Strategic Business Development Group with a primary focus on acquisition activity for HD Supply. Mr. Yee was also an Associate in the Global Syndicated Finance Group at JPMorgan Chase. He has executed over 55 transactions including more than $1.6 billion in M&A and $3.9 billion in financing transactions primarily for change of control deals and numerous industrial and distribution acquisition

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 18

and sale assignments. He holds a Bachelors of Arts in Urban Planning from Morehouse College and an MBA from Harvard University Graduate School of Business.

| | | | | | | | | | | | | | |

| SKILLS AND QUALIFICATIONS | | |

| • M&A | • Global / international experience |

| • Capital markets | • Compensation / incentives |

| • Strategic planning | • Entrepreneurship |

| • Strategy | |

Mr. Halter has served as a Director of DXP since July 2001. Mr. Halter is the Chairman and Chief Executive Officer of Halter Financial Group, Inc., a position he has held since 1995. Halter Financial Group is a Dallas, Texas based consulting firm specializing in the areas of mergers, acquisitions and corporate finance. Mr. Halter brings to our Board extensive experience in the area of strategic planning, corporate finance, compensation and entrepreneurship.

| | | | | | | | | | | | | | |

| SKILLS AND QUALIFICATIONS | | |

| • CEO and executive leadership | • Capital markets |

| • Strategy and operations | • Corporate governance |

| • Finance and technology | • Accounting and Finance |

Mr. Mannes has served as a Director of DXP since February 2020. Mr. Mannes is the President and a member of the board of directors of SAMCO Capital Markets, Inc., a position he has held since 2010. Prior to that he was the Chief Operating Officer and Managing Director (Corporate Finance) of SAMCO Capital Markets, Inc., which is a regional broker/dealer based in Austin, Texas, specializing in underwriting, financial advisory, and corporate finance. Mr. Mannes brings extensive experience across multiple industries, including banking, investment banking, technology, retail, distribution and manufacturing. Mr. Mannes graduated with an AB from Dartmouth College and an MBA from the Wharton School, graduate division. His experience includes time as a chief financial officer with Clearwire Technologies and E-Certify. He was formerly the Chairman of the Board of Tandy Leather Factory, is currently President of the Provincial Foundation and serves on the boards of various private companies. Mr. Mannes is a Chartered Financial Analyst. Mr. Mannes is the Chair of the Audit Committee.

| | | | | | | | | | | | | | |

| SKILLS AND QUALIFICATIONS | | |

| • Legal | • General management |

| • Corporate governance | • Risk management |

| • Oil and gas | • Compensation/Incentives |

Mr. Patton has served as a Director of DXP since July 2016. Mr. Patton is a partner at Locke Lord LLP and Chair-Emeritus of the Locke Lord LLP’s Energy Practice Group where he began his career in 1977. He has over 40 years of experience in various legal aspects of the oil and gas industry, including acquisitions and sales of assets or equity interests, drafting and negotiating leases, contracts, and agreements related to field operations. David has represented clients in connection with surface use conflicts, day to day exploration and development activities, and the resolution of oil and gas disputes. He is a frequent speaker on oil and gas issues and is active in the Rocky Mountain Mineral Law Foundation and the State Bar of Texas. Mr. Patton brings to our Board a diverse business background including extensive knowledge in the oil and gas industry, experience with acquisitions and overall familiarity with issues surrounding managing and leading publicly held companies. Mr. Patton is Chair of the Compensation Committee.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 19

| | | | | | | | | | | | | | |

| SKILLS AND QUALIFICATIONS | | |

| • Accounting | • General management |

| • Corporate governance | • Oil and gas |

| • Tax | • Risk management |

Mrs. Hoffman has served as a Director of DXP since November 2021. Mrs. Hoffman is the Global Tax Director for Transocean Ltd., a position she has held since 2020. Prior to Transocean Ltd, she spent eighteen years with PricewaterhouseCoopers LLP with experience in tax accounting and the energy industry. Mrs. Hoffman started her career at PricewaterhouseCoopers LLP.

Mrs. Hoffman graduated with a B.A. from The University of Texas in Business Administration and a Masters in Professional Accounting from the graduate division. Mrs. Hoffman is a Certified Public Accountant (CPA). Mrs. Hoffman is the Chair of the Nominating and Governance Committee.

Corporate Governance and Other Board Matters

DXP is committed to having sound corporate governance principles. Having such principles is essential to running DXP’s business efficiently and maintaining DXP’s integrity in the marketplace.

DXP's Internet address is www.dxpe.com. The following corporate governance documents are available on our website by clicking on tabs “Investors” and “Corporate Governance”:

•Code of Conduct

•Cybersecurity Policy

•Anti-Corruption Policy

•Conflict Minerals Policy

•Code of Ethics for Senior Financial Officers, and

•Charters for the Audit, Compensation and Nominating and Governance of our board

•The information included in our website is not incorporated herein by reference

Board Independence

The Board has determined that each of the current directors standing for re-election, except David R. Little and Kent Yee, the Chairman of the Board and Chief Executive Officer and Chief Financial Officer, respectively, have no material relationship with DXP (either directly or as a partner, shareholder or officer of an organization that has a relationship with DXP) and is “independent” within the requirements of the NASDAQ listing standards. Furthermore, the Board has determined that each of the members of each of the committees of the Board of Directors has no material relationship with DXP (directly or as a partner, shareholder or officer of an organization that has a relationship with DXP) and is “independent” within the requirements of the NASDAQ listing standards.

Board Structure and Committee Composition

The Board does not have a policy on whether or not the roles of Chairman of the Board and Chief Executive Officer should be separate or combined and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee. The directors serving on the Board possess considerable professional and industry experience and a unique knowledge of the challenges and opportunities that DXP faces. As such, the Board believes that it is in the best position to evaluate the needs of DXP and to determine how best to organize DXP’s leadership structure to meet those needs. The Board believes that the most effective leadership structure for DXP at the present time is for Mr. Little to serve as both Chairman of the Board and Chief Executive Officer.

This model has succeeded because it makes clear that the Chairman of the Board and Chief Executive Officer is responsible for managing our business, under the oversight and review of our Board. This structure also enables our Chief Executive Officer to act as a bridge between management and the Board, helping both to act together in

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 20

pursuing the best interests of shareholders. Mr. Little has been our Chairman of the Board and Chief Executive Officer since DXP’s organization in 1996 and has been with DXP and its predecessor companies for over 40 years.

There is no specific lead independent director. The Board believes that there is already substantial independent oversight of DXP’s management and a strong counterbalancing governance structure in place, as demonstrated by the following:

•We have a majority of independent directors: Four out of the six directors meet the criteria for independence required by NASDAQ; only Mr. Little and Mr. Yee are deemed not to be independent.

•All committees are composed solely of independent directors: Our Audit, Compensation and Nominating and Governance Committees are each composed solely of independent directors. Each of our independent directors serves on each of the committees.

•Non-employee directors meet regularly: Our non-employee directors typically meet in executive sessions without our employee directors (Mr. Little and Yee) at each regularly scheduled Board meeting.

The Board has established an Audit Committee, a Nominating and Governance Committee and a Compensation Committee. The Board met four times in 2023. Each director attended (whether in person or telephonically) all of the meetings of the Board and committees of which he or she was a member. DXP does not have a policy regarding director attendance at Annual Meetings of Shareholders. One director attended the last Annual Meeting of Shareholders.

Messrs. Halter, Mannes, Patton and Mrs. Hoffman are the members of the Audit, Compensation and Nominating and Governance Committees.

Voting Matters

Ensuring continuity in leadership all directors nominated for re-election at the 2023 Annual Shareholders meeting received unanimous shareholder approval. The Board remains committed to diligent oversight and creating long-term shareholder value for all shareholders. Given the outcome of last years Annual Shareholders meeting, and our governance model, each director will stand for re-election this year.

Majority Voting Standard

General

Our Bylaws provide for majority voting in uncontested director elections effective January 1, 2022 in response to previous years stakeholder feedback. If an incumbent director is not elected by a majority of the votes cast in an uncontested election, our Nominating and Governance Committee will submit for prompt consideration by the Board a recommendation whether to accept or reject the director’s resignation. The Board expects the director whose resignation is under consideration to abstain from participating in any decision regarding that resignation.

Contested Elections

At any meeting of shareholders for which the number of nominees for director at a meeting of shareholders exceeds the number of directors to be elected at such meeting or if the Secretary of the Company receives a notice that a shareholder has nominated a person for election to the Board of Directors in compliance with the Company’s Bylaws and such nomination has not been withdrawn on or before the fourteenth day before the Company first files its definitive proxy statement with respect to such meeting with the Securities and Exchange Commission the directors will be elected by a plurality of the votes cast. This means that the nominees who receive the most affirmative votes would be elected to serve as directors.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 21

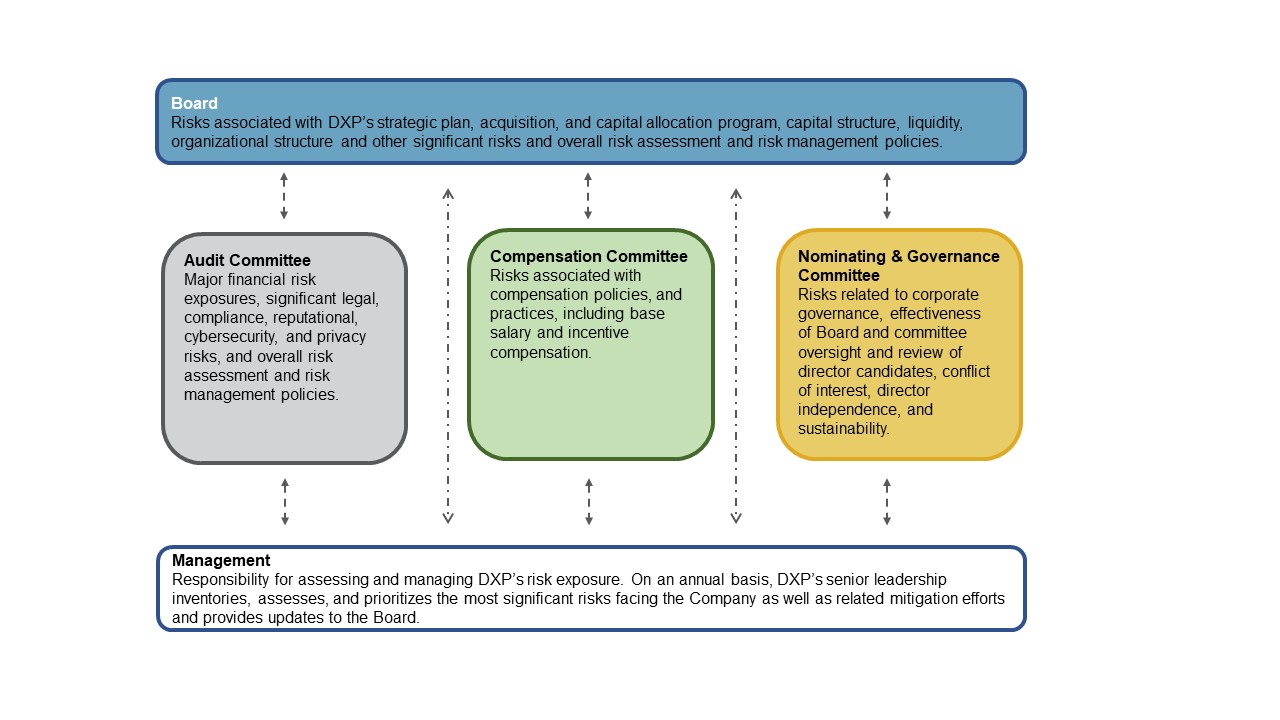

Board’s Role in Risk Oversight

Strategy

One of the Board’s primary responsibilities is overseeing management’s development and execution of the Company’s strategy.

At least quarterly, the CEO, our executive leadership team and other business leaders provide detailed business and strategy updates to the Board. The Board annually conducts an even more in-depth review of the Company’s overall strategy. At these reviews, the Board engages with our executive leadership team and other business leaders regarding business objectives, the competitive landscape, economic trends and other developments. On an annual basis the Board also reviews the Company’s human capital, risk assessment/risk management, compliance and sustainability programs as well as the Company’s operating budget, and at meetings occurring throughout the year the Board reviews acquisitions, strategic investments and other capital allocation topics as well as the Company’s operating and financial performance, among other matters. The Board also looks to the expertise of its committees to inform strategic oversight in their areas of focus.

| | | | | | | | | | | | | | |

| SPOTLIGHT: OVERSIGHT OF STRATEGIC ACQUISITIONS |

| | | | |

The Board oversees DXP's strategic acquisition process. DXP views acquisitions as an important element of our strategy to deliver long-term shareholder value. Our Board includes members with extensive business combination experience. That depth of experience allows the Board to constructively engage with management and effectively evaluate acquisitions for alignment with our strategy, culture and financial goals. Management is charged with identifying potential acquisition targets, executing transactions, and managing integration, and our Board's oversight extends to each of these elements. Management and the Board regularly discuss potential acquisitions and their role in the Company's overall business strategy. These discussions address acquisitions in process and potential future acquisitions, and cover a broad range of matters which may include valuation, due diligence, risk and anticipated synergies with DXP's businesses and strategy. The Board's acquisition oversight also extends across transactions and over time; the Board reviews and provides feedback regarding the operational and financial performance of our historical acquisitions. |

|

|

|

|

|

|

|

Risk

Risk is inherent in every business, and DXP faces many risks of varying size and intensity. While management is responsible for day-to-day management of those risks, the Board, as a whole and through its committees, oversees and monitors risk management. In this role, the Board is responsible for determining that the risk management processes designed and implemented by management are adequate and functioning as designed.

Our Board administers its risk oversight function primarily by receiving regular reports from Mr. Little, our Chairman of the Board and Chief Executive Officer, and other members of our senior management who supervise various aspects of our business, including operations, finance, compliance, investor relations and safety and environmental matters, on risk management. The Audit Committee and the Compensation Committee review risks related to the Company’s financial and compensation practices, respectively. By having these committees engaged in aspects of risk oversight, the Board intends to have a focus on financial, enterprise and compensation risks. The Board believes that its administration of risk management oversight has not affected the Board’s leadership structure, as described above.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 22

The Board’s role in risk oversight at the Company is consistent with our leadership structure, with management having day-to-day responsibility for assessing and managing our risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company. The Board administers its risk oversight responsibilities both through active review and discussion of key risks facing the Company and by delegating certain risk oversight responsibilities to the Board committees. Generally, the Board delegates risk oversight responsibility to its committees where it believes the committee’s focused domain expertise will support efficient and effective oversight, and each committee typically has responsibility with respect to risks that are associated with the purpose of, and responsibilities delegated to, that committee. Each of the Audit, Compensation, and Nominating and Governance Committees reports to the full Board on a regular basis, including as appropriate with respect to the committee’s risk oversight activities. The timeframe over which the Board and its committees evaluate risk typically varies depending on the nature of the risk. From time to time, the Board and/or its committees may consider inputs from outside advisors with respect to certain risks and risk trends. With respect to the manner in which the Board’s risk oversight function impacts the Board’s leadership structure, as described above, our Board believes that Mr. Little's management experience and tenure help the Board to more effectively exercise its risk oversight function.

The graphic below summarizes the primary areas of risk overseen by the Board and by each of its committees.

While the Board is ultimately responsible for risk oversight, the committees assist the Board in the areas described below.

•The Audit Committee assists with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements.

•The Compensation Committee assists with respect to management of risks related to executive succession and retention and arising from our executive compensation policies and programs.

•The Nominating and Governance Committee assists with respect to management of risks associated with Board organization and membership, and other corporate governance matters, as well as company culture and ethical compliance.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 23

We have assessed the risks arising from DXP's compensation policies and practices for employees, including the executive officers. The findings were reviewed with the Compensation Committee. Based on the assessment, we believe our compensation policies and practices do not encourage excessive risk-taking and are not reasonably likely to have a material adverse effect on DXP.

| | | | | | | | | | | | | | |

| SPOTLIGHT: OVERSIGHT OF CYBERSECURITY RISK |

| | | | |

DXP's cybersecurity strategy and risk management program focuses on maintaining a secure environment for our data that complies with applicable legal requirements and effectively supports our business objectives and customer needs. Our commitment to cybersecurity emphasizes cultivation of a security-minded culture through education and training, and a programmatic and layered approach to prevention and detection of, and response to, cybersecurity threats. Key elements of our program include:

•cybersecurity policies that articulate our expectations and requirements with respect to topics such as acceptable use of technology and data, data privacy, risk management, education and awareness and event and incident management;

•regular education of and sharing best practices with our associates to raise awareness of cybersecurity threats;

•assessment of information technology/cybersecurity risks as part of DXP’s annual Enterprise Risk Management program;

•maintenance of cyber insurance in amounts and subject to coverage terms that are typical for companies of our type and size (however, such insurance may not be sufficient in type or amount to cover us against claims related to security breaches, cyber-attacks and other related breaches); and

•periodic engagement of external consultants to assess our cybersecurity program.

We also strive to implement and maintain layered controls designed to prevent and, where necessary, detect and respond to cybersecurity threats, including controls designed to facilitate identification of third-party cybersecurity risks.

At the management level, DXP’s cybersecurity program is led by the Company’s Chief Information Officer (“CIO”), who reports to DXP’s Chief Executive Officer (“CEO”). At the Board level, DXP’s Board of Directors has delegated to the Audit Committee of the Board responsibility for oversight of risks relating to cybersecurity, as set forth in the Committee’s charter. Multiple members of DXP’s Audit Committee have prior work experience overseeing or assessing a cybersecurity function. DXP’s CIO updates the Audit Committee regarding DXP’s cybersecurity program, including key program metrics, initiatives and developments. The Audit Committee regularly briefs the full Board on these matters. In addition, in the event of a significant cybersecurity incident, DXP's policy and process requires timely engagement of and consultation with the Audit Committee.

|

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 24

Audit Committee

DXP has an Audit Committee, which assists the Board in fulfilling its responsibilities for general oversight of the integrity of DXP’s financial statements, DXP’s compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence and the performance of DXP’s independent auditors. Among other things, the Audit Committee prepares the Audit Committee report for inclusion in the annual proxy statement; annually reviews the Audit Committee charter; appoints, evaluates and determines the compensation of DXP’s independent auditors; reviews and approves the financial statements, the audit fee and the scope of the annual audit; reviews DXP’s disclosure controls and procedures, internal controls and corporate policies with respect to financial information; oversees investigations into complaints concerning financial matters; and reviews other risks that may have a significant impact on DXP’s financial statements. The Audit Committee works closely with management as well as DXP’s independent auditors. Furthermore, the Audit Committee has the responsibility of overseeing DXP’s Business Ethics Policy. The Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding from DXP for outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

The Board has determined that Audit Committee Chairman Joseph R. Mannes is an audit committee financial expert as defined by Item 407(d)(5)(ii) of Regulation S-K, as adopted by the Securities and Exchange Commission, and was independent within the meaning of the NASDAQ listing standards. The report of the Audit Committee is included herein. A current copy of the charter of the Audit Committee is available under the "Investors" tab of DXP’s website at http://www.dxpe.com.

Compensation Committee

The Compensation Committee discharges the Board’s responsibilities relating to compensation of DXP’s executive officers and directors; produces an annual report on executive compensation for inclusion in DXP’s proxy statement; provides general oversight of equity compensation plans; and retains and approves the terms of the retention of any compensation consultants and other compensation experts. Other specific duties and responsibilities of the Compensation Committee include: reviewing and approving objectives relevant to executive officer compensation, evaluating performance and determining the compensation of executive officers in accordance with those objectives; approving employment agreements for executive officers; approving and amending DXP’s incentive compensation for executive officers and share compensation programs (subject to shareholder approval if required); recommending director compensation to the Board; monitoring director and executive stock ownership; and annually evaluating its charter.

The Compensation Committee charter provides that the Compensation Committee may delegate any of its duties and responsibilities to a subcommittee of the Compensation Committee consisting of not less than two members of the Compensation Committee. No such delegation of duties and responsibilities occurred in 2023. In addition, the Compensation Committee may delegate to one or more individuals the administration of equity incentive or employee benefit plans, unless otherwise prohibited by law or applicable stock exchange rules. Any such delegation may be revoked by the Compensation Committee at any time.

A current copy of the charter for the Compensation Committee is available under the "Investors" tab of DXP’s website at http://www.dxpe.com.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 25

Nominating and Governance Committee

The Nominating and Governance Committee identifies individuals qualified to become Board members, consistent with criteria approved by the Board; oversees the organization of the Board to discharge the Board’s duties and responsibilities properly and efficiently; and identifies best practices and recommends corporate governance principles, including giving proper attention and making effective responses to shareholder concerns regarding corporate governance. Other specific duties and responsibilities of the Nominating and Governance Committee include: annually assessing the size and composition of the Board; developing membership qualifications for Board committees; defining specific criteria for director independence; monitoring compliance with Board and Board committee membership criteria; coordinating and assisting management and the Board in recruiting new members to the Board; annually, and together with the Chairman of the Compensation Committee, evaluating the performance of the Chairman of the Board and Chief Executive Officer and presenting the results of the review to the Board and to the Chairman of the Board and Chief Executive Officer; reviewing and recommending proposed changes to DXP’s charter or bylaws and Board committee charters; recommending Board committee assignments; reviewing governance-related shareholder proposals and recommending Board responses; and conducting a preliminary review of director independence and the financial literacy and expertise of Audit Committee members.

A current copy of the charter for the Nominating and Governance Committee is available under the "Investors" tab of DXP’s website at http://www.dxpe.com.

Consideration of Shareholder Recommendations

The policy of the Nominating and Governance Committee is to consider properly submitted shareholder recommendations for candidates for membership on the Board as described below under “Identifying and Evaluating Nominees for Directors.” In evaluating such recommendations, the Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth below under “Director Qualifications.” Any shareholder recommendations proposed for consideration by the Nominating and Governance Committee should include the nominee’s name and qualifications for board membership and should be addressed to:

Corporate Secretary

DXP Enterprises, Inc.

5301 Hollister St.

Houston, Texas 77040

Director Qualifications

Members of the Board should have the highest professional and personal ethics and values, consistent with longstanding DXP values and standards. They should have broad experience at the policy-making level in business, government, education or public interest. They should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform all director duties responsibly. The Nominating and Governance Committee does not have a specific policy regarding diversity and believes that the backgrounds and qualifications of the directors, considered as a group, should provide a diverse mix of experiences, knowledge, attributes and abilities that will allow the Board to fulfill its responsibilities.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 26

Identifying and Evaluating Nominees for Director

The Nominating and Governance Committee uses a variety of methods for identifying and evaluating nominees for director. The Nominating and Governance Committee regularly assesses the appropriate size of the Board, the make-up of the board, and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Nominating and Governance Committee will consider various potential candidates for director. Candidates may come to the attention of the Nominating and Governance Committee through current board members, professional search firms, shareholders or other persons. These candidates will be evaluated at regular or special meetings of the Nominating and Governance Committee and may be considered at any point during the year. The Nominating and Governance Committee will consider properly submitted shareholder nominations for candidates for the Board as set forth in the Company’s bylaws, and the procedures described in the section entitled “Proposals for Next Annual Meeting” in this proxy statement. Following verification of the shareholder status of persons proposing candidates, recommendations will be aggregated and considered by the Nominating and Governance Committee at a regularly scheduled meeting prior to the issuance of the proxy statement for DXP’s Annual Meeting. If any materials are provided by a shareholder in connection with the nomination of a director candidate, such materials will be forwarded to the Nominating and Governance Committee. In evaluating such nominations, the Nominating and Governance Committee will seek to achieve a balance of knowledge, experience and capability on the Board.

Executive Sessions

Executive sessions of non-management directors are held at least four times a year. The sessions are scheduled and chaired by the Chair of the Audit Committee. Any non-management director may request that an additional executive session be scheduled.

Communications with the Board

Shareholders may communicate with the Board by submitting an e-mail to the attention of the Board at dxpboardcom@dxpe.com or by mailing correspondence to the Board c/o Human Resources, 5301 Hollister St., Houston, Texas 77040. All such correspondence will be forwarded to the Board. Communications that are intended specifically for non-management directors should be sent to the attention of the Audit Committee. All such correspondence will be forwarded to the Chairman of the Audit Committee, or if unavailable, to the other members of the Audit Committee.

COMMITTEES AND MEETINGS OF THE BOARD

Committees

The Board appoints committees to help carry out its duties. The Board has the following standing committees: Audit, Compensation, and Nominating and Corporate Governance. The following table sets forth the committees of the Board and their members as of the date of this proxy statement, as well as the number of meetings each committee held during 2023:

| | | | | | | | | | | |

| Director | Audit Committee | Compensation Committee | Nomination/Corporate Governance Committee |

| David Little | — | — | — |

| Kent Yee | — | — | — |

| Timothy Halter | ü | ü | ü |

| David Patton | ü | † | ü |

| Joseph R. Mannes | † | ü | ü |

| Karen Hoffman | ü | ü | † |

Number of meetings held in 2023 | 4 | 4 | 4 |

† - Denotes chair

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 27

COMPENSATION OF DIRECTORS

We use a combination of cash and equity-based compensation to attract and retain qualified candidates to serve on the Board. In setting director compensation, the Board and the Compensation Committee are guided by the following principles:

•compensation should fairly pay directors for work required in a company of our size and scope, and differentiate among directors where appropriate to reflect different levels of responsibilities;

•a significant portion of the total compensation should be paid in stock-based awards to align directors' interest with the long-term interests of our shareholders; and

•the structure of the compensation program should be simple and transparent.

Director’s Fees. During 2023, each of our independent directors received a fee of $12,500 for each quarterly board meeting. Our directors who are our employees or otherwise are not independent do not receive any compensation for attending board or committee meetings. Additionally, during fiscal 2021, the Board of Directors engaged Longnecker & Associates to review both directors and executive compensation and pay. Effective, January 1, 2022, it was determined that the board would receive an increase in fees from $3,000 for each quarterly board meeting to $12,500 per quarterly board meeting. The following table summarizes the annual fees in cash for the Board.

| | | | | | | | |

| | |

| Amount |

| Annual fee | $50,000 |

| Annual fee for Audit Committee Chair | 15,000 |

| Annual fee for Compensation Committee Chair | 10,000 |

| Annual fee for Nominating & Governance Chair | 10,000 |

Restricted Stock. In addition to the compensation set forth above, each non-employee director receives restricted stock granted under the 2016 Omnibus Incentive Plan. The number of whole shares granted each July 1 is calculated by dividing $75,000 by the closing price of the Common Stock on such July 1. The fair value of restricted stock awards is measured based upon the closing prices of DXP’s Common Stock on the grant dates and is recognized as compensation expense over the vesting period of the awards.

On July 1, 2023, Mannes, Halter, Patton and Hoffman each received 2,008 shares of restricted stock. The shares of restricted stock vest one year on the anniversary of the date of grant.

Indemnification

The Company has entered into indemnification agreements with each of its directors. These agreements require the Company to indemnify such individuals for certain liabilities to which they may become subject as a result of their affiliation with the Company, to the extent permitted by applicable law.

Other Items

The Company reimburses all directors for reasonable travel expenses incurred when attending Board and committee meetings.

The table below summarizes the compensation paid by the Company to our Directors, other than Mr. Little and Mr. Yee, for the fiscal year ended December 31, 2023.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 28

FY2023 Director Compensation

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees

Earned or

Paid in

Cash

($) | | Stock Awards ($)(1) | | Option

Awards

($) | | Non-Equity

Incentive

Plan

Compensation

($) | Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($) | | All

Other

Compensation

($) | | Total

($) |

| Joseph R. Mannes | | 65,000 | | 75,000 | | — | | — | — | | — | | 140,000 |

| Timothy Halter | | 50,000 | | 75,000 | | — | | — | — | | — | | 125,000 |

| David Patton | | 60,000 | | 75,000 | | — | | — | — | | — | | 135,000 |

| Karen Hoffman | | 60,000 | | 75,000 | | — | | — | — | | — | | 135,000 |

(1) The amounts shown in the Stock Awards column reflect the full grant date fair value of restricted stock awards (“RSA”) awarded in 2023, calculated pursuant to FASB ASC Topic 718. See also Note 11, Share-Based Compensation, to our audited financial statements included in our annual report on form 10-K for the year ended December 31, 2023 filed with the SEC on March 11, 2024. Mannes, Halter, Patton, and Hoffman, have 49,063, 21,565, 12,685 and 4,407 RSAs outstanding, respectively, as of December 31, 2023.

Code of Conduct and Code of Ethics for Senior Financial Officers

DXP has adopted a code of conduct for directors, officers (including DXP’s principal executive officer, principal financial and accounting officer and controller) and employees. Also, DXP has adopted a code of ethics for senior financial officers which includes executive financial officers (including DXP’s principal executive officer, principal financial and accounting officer and controller) and key financial managers. The Code of Conduct and Code of Ethics for Senior Financial Officers are available on DXP’s website at http://ir.dxpe.com/corporate-governance/governance-documents/default.aspx. DXP intends to post amendments to or waivers (to the extent applicable to DXP’s principal executive officer, principal financial officer or controller, or persons performing similar functions), if any, from its Code of Ethics for Senior Financial Officers at the same location on the DXP website.

Policy Regarding Restricted Transactions

Our directors and executive officers are prohibited from engaging in speculative transactions in Company securities, such as trading in puts and calls, or selling securities short. We have adopted a pledging limitation policy for our directors and executive officers restricting directors and executive officers from pledging shares of the Company and holding shares of the Company in margin accounts. Directors and executive officers of the Company may pledge shares or hold shares in margin accounts so long as all of the following policy requirements are met: (i) prior to pledging shares or holding shares in a margin account such director or executive officer shall obtain approval from the Chief Financial Officer, and (ii) in no event shall the total number of shares collectively pledged by our directors and executive officers exceed 10% of the Company’s total outstanding Common Stock.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 29

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of April 19, 2024 with respect to (i) persons known to DXP to be beneficial holders of five percent or more of the outstanding shares of either Common Stock, Series A Preferred Stock or Series B Preferred Stock, (ii) named executive officers, directors and director nominees of DXP and (iii) all executive officers and directors of DXP as a group. Unless otherwise indicated, the beneficial owners have sole voting and investment power, as applicable, over the shares of Common Stock, Series A Preferred Stock and Series B Preferred Stock listed below. We calculated the percentage of shares outstanding based on 15,928,305 shares of Common Stock, 1,122 shares of Series A Preferred Stock, and 15,000 shares of Series B Preferred Stock outstanding as of April 19, 2024. In accordance with SEC regulations, we also include shares issuable upon exercise of options or settlement of restricted stock units (“RSUs”) or other derivative securities that are vested or exercisable, or will become vested or exercisable, within 60 days of April 19, 2024 (the “table date”). Those shares are deemed to be outstanding and beneficially owned by the person holding such option, RSU or other derivative security for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

DXP ENTERPRISES, INC. 2024 PROXY STATEMENT 30

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NAME OF BENEFICIAL OWNER (1) | | COMMON

STOCK | | % | | SERIES A PREFERRED STOCK | | % | | SERIES B PREFERRED STOCK | | % |

| David R. Little | | 1,234,669 | | | 7.8 | % | | — | | | — | | | — | | | — | % |

| Nick Little | | 857,597 | | | 5.4 | % | | — | | | — | | | 5,000 | | | 33.33 | % |

| Paz Maestas | | 625,867 | | | 3.9 | % | | — | | | — | | | 5,000 | | | 33.33 | % |

| Kent Yee | | 72,287 | | | * | | — | | | — | | | — | | | — | % |

| Timothy P. Halter, Director | | 47,055 | | | * | | — | | | — | | | — | | | — | % |

| Chris Gregory | | 30,606 | | | * | | — | | | — | | | — | | | — | % |

| John Jeffery | | 25,184 | | | * | | — | | | — | | | — | | | — | % |

| David Patton, Director | | 19,557 | | | * | | — | | | — | | | — | | | — | % |

| Joseph R. Mannes, Director | | 10,677 | | | * | | — | | | — | | | — | | | — | % |