UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the fiscal year ended | |||||

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the transition period from _________ to _________. | |||||

(Exact name of registrant as specified in its charter)

| (State of incorporation) | (Address of principal executive offices, including zip code) | (I.R.S. Employer Identification Number) | ||||||||||||

( | ||

| (Registrant's telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Exchange on which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

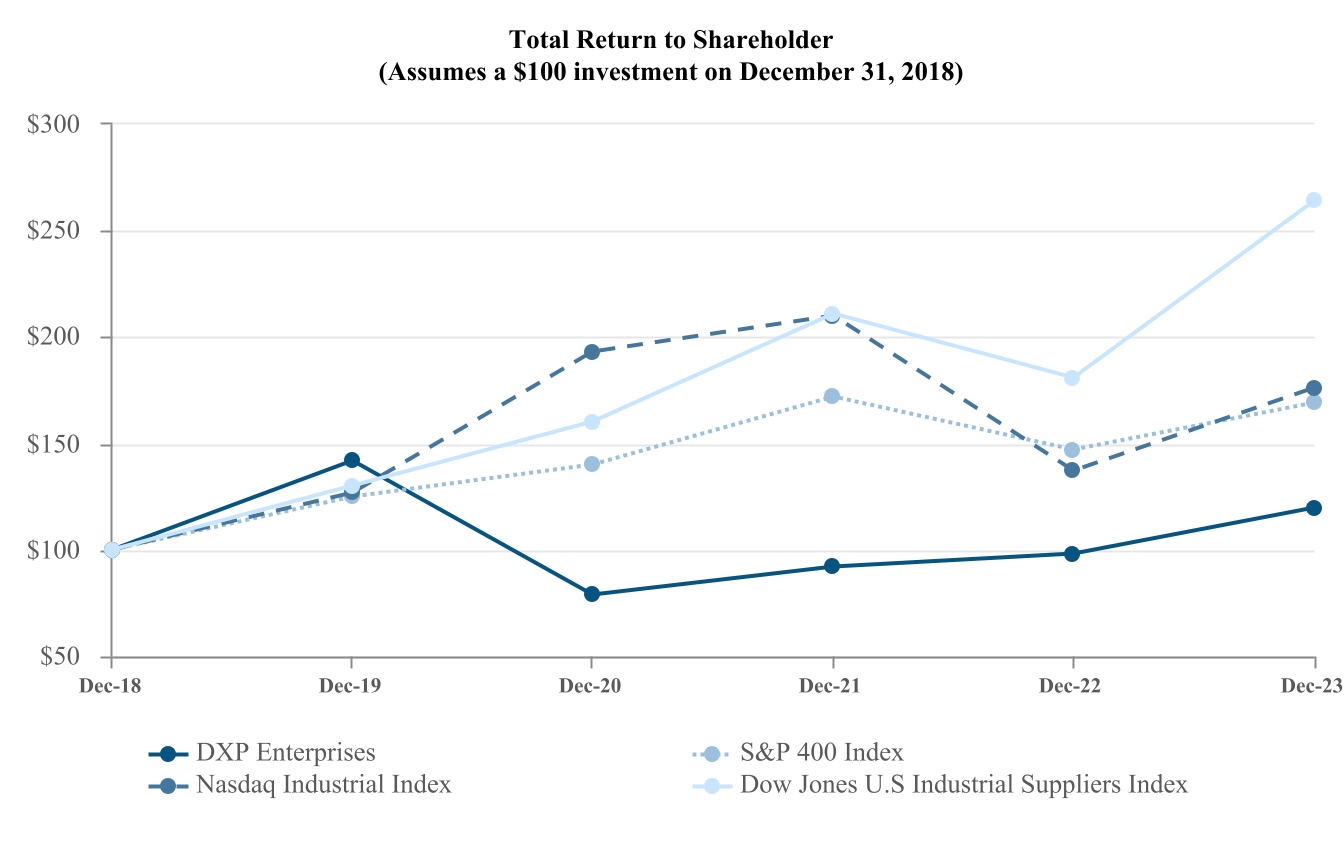

Aggregate market value of the registrant's Common Stock held by non-affiliates of registrant as of June 30, 2023 was $495.3 million based on the closing sale price as reported on the NASDAQ Stock Market System.

Number of shares of registrant's Common Stock outstanding as of March 4, 2024: 16,180,317 .

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for our 2024 annual meeting of shareholders are incorporated by reference into Part III hereof. The 2024 proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

DXP ENTERPRISES, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

TABLE OF CONTENTS

| Item | Page | |||||||

| PART I | ||||||||

| 1. | ||||||||

| 1A. | ||||||||

| 1B. | Unresolved Staff Comments | |||||||

1C. | ||||||||

| 2. | ||||||||

| 3. | ||||||||

| 4. | ||||||||

| PART II | ||||||||

| 5. | ||||||||

| 6. | ||||||||

| 7. | ||||||||

| 7A. | Quantitative and Qualitative Disclosures about Market Risk | |||||||

| 8. | ||||||||

| 9. | ||||||||

| 9A. | Controls and Procedures | |||||||

| 9B. | Other Information | |||||||

| PART III | ||||||||

| 10. | ||||||||

| 11. | ||||||||

| 12. | ||||||||

| 13. | ||||||||

| 14. | ||||||||

| PART IV | ||||||||

| 15. | ||||||||

| 16. | ||||||||

SIGNATURES | ||||||||

2

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this "Report") contains statements that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements include without limitation those about the Company’s expectations regarding the Company’s business, and the Company’s future profitability, cash flow, liquidity, and growth. Such forward-looking statements can be identified by the use of forward-looking terminology such as "believes", "expects", "may", "might", "estimates", "will", "should", "could", "would", "suspect", "potential", "current", "achieve", "plans" or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy but the absence of these words does not mean that a statement is not forward-looking. Any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and actual results may vary materially from those discussed in the forward-looking statements or historical performance as a result of various factors. These factors include, but not limited to, the effectiveness of management's strategies and decisions, our ability to implement our internal growth and acquisition growth strategies, general economic and business conditions specific to our primary customers, changes in government regulations, our ability to effectively integrate businesses we may acquire, new or modified statutory or regulatory requirements, availability of materials and labor, inability to obtain or delay in obtaining government or third-party approvals and permits, non-performance by third parties of their contractual obligations, unforeseen hazards such as weather conditions, acts of war or terrorist acts and the governmental or military response thereto, cyber-attacks adversely affecting our operations, other geological, operating and economic considerations and declining prices and market conditions, including volatility in oil and gas prices and supply or demand for maintenance, repair and operating products, equipment and service, decreases in oil and natural gas prices, decreases in oil and natural gas industry expenditure levels, our ability to manage changes and the continued health or availability of management personnel, and our ability to obtain financing on favorable terms or amend our credit facilities as needed. This Report identifies other factors that could cause such differences. We cannot assure that these are all of the factors that could cause actual results to vary materially from the forward-looking statements. This Report identifies other factors that could cause such differences. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in "Item 1A. Risk Factors", and elsewhere in this Report. Should one or more of these risk factors or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in the forward-looking statements. We assume no obligation and do not intend to update these forward-looking statements. Unless the context otherwise requires, references in this Report to the "Company", "DXP", "we" or "our" shall mean DXP Enterprises, Inc., a Texas corporation, together with its subsidiaries.

3

PART I

ITEM 1. Business

Company Overview

Founded in 1908, DXP Enterprises, Inc. (together with our subsidiaries, hereinafter referred to as "DXP" or the "Company" or by the terms such as we, our, or us) was incorporated in Texas in 1996 to be the successor to SEPCO Industries, Inc. Since our predecessor company was founded, we have primarily been engaged in the business of distributing maintenance, repair and operating ("MRO") products, equipment and service to customers in a variety of end markets including the general industrial, energy, food & beverage, chemical, transportation, water and wastewater. The Company is organized into three business segments: Service Centers ("SC"), Innovative Pumping Solutions ("IPS") and Supply Chain Services ("SCS"). Sales, operating income, and other financial information for 2023, 2022 and 2021, and identifiable assets at the close of such years for our business segments are presented in Note 20 – Segment Reporting to the Consolidated Financial Statements in Item 8. Financial Statements and Supplementary Data.

Our total sales have increased from $125 million in 1996 to $1.7 billion in 2023 through a combination of internal growth and business acquisitions. At December 31, 2023, we operated from 183 locations which included 37 states in the United States ("U.S."), 9 provinces in Canada and one location in Dubai serving customers and becoming customer driven experts in maintenance, repair and operating solutions.

4

The following table shows, as of the end of the last 10 fiscal years, our consolidated sales; total number of locations; the number of SC locations, IPS facilities, SCS customer sites, and the corresponding sales and average sales per business segment location:

| ($ in millions) | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | ||||||||||||||||||||||

| Sales | $ | 1,500 | $ | 1,247 | $ | 962 | $ | 1,007 | $ | 1,216 | $ | 1,265 | $ | 1,005 | $ | 1,114 | $ | 1,481 | $ | 1,679 | ||||||||||||

Locations | 271 | 260 | 245 | 243 | 249 | 244 | 247 | 252 | 275 | 264 | ||||||||||||||||||||||

SC sales | $ | 988 | $ | 827 | $ | 621 | $ | 641 | $ | 750 | $ | 762 | $ | 663 | $ | 816 | $ | 1,009 | $ | 1,145 | ||||||||||||

SC locations | 185 | 179 | 167 | 165 | 155 | 145 | 158 | 152 | 160 | 161 | ||||||||||||||||||||||

Avg. SC sales/location | $ | 5.3 | $ | 4.6 | $ | 3.7 | $ | 3.9 | $ | 4.8 | $ | 5.3 | $ | 4.2 | $ | 5.4 | $ | 6.3 | $ | 7.1 | ||||||||||||

IPS sales | $ | 348 | $ | 255 | $ | 187 | $ | 204 | $ | 292 | $ | 304 | $ | 188 | $ | 140 | $ | 231 | $ | 273 | ||||||||||||

IPS facilities | 12 | 12 | 11 | 11 | 11 | 10 | 10 | 18 | 20 | 22 | ||||||||||||||||||||||

Avg. IPS sales/facility | $ | 29.0 | $ | 21.3 | $ | 17.0 | $ | 18.5 | $ | 26.5 | $ | 30.4 | $ | 18.8 | $ | 7.8 | $ | 11.6 | $ | 12.4 | ||||||||||||

SCS sales | $ | 164 | $ | 166 | $ | 154 | $ | 161 | $ | 174 | $ | 201 | $ | 155 | $ | 158 | $ | 240 | $ | 260 | ||||||||||||

SCS customer sites | 74 | 69 | 67 | 67 | 83 | 89 | 79 | 82 | 95 | 81 | ||||||||||||||||||||||

Avg. SCS sales/site | $ | 2.2 | $ | 2.4 | $ | 2.3 | $ | 2.4 | $ | 2.1 | $ | 2.3 | $ | 2.0 | $ | 1.9 | $ | 2.5 | $ | 3.2 | ||||||||||||

Our principal executive office is located at 5301 Hollister St., Houston, Texas 77040 and our telephone number is (713) 996-4700. Our website address is www.dxpe.com and emails may be sent to info@dxpe.com. The reference to our website address does not constitute incorporation by reference of the information contained on the website and such information should not be considered part of this report.

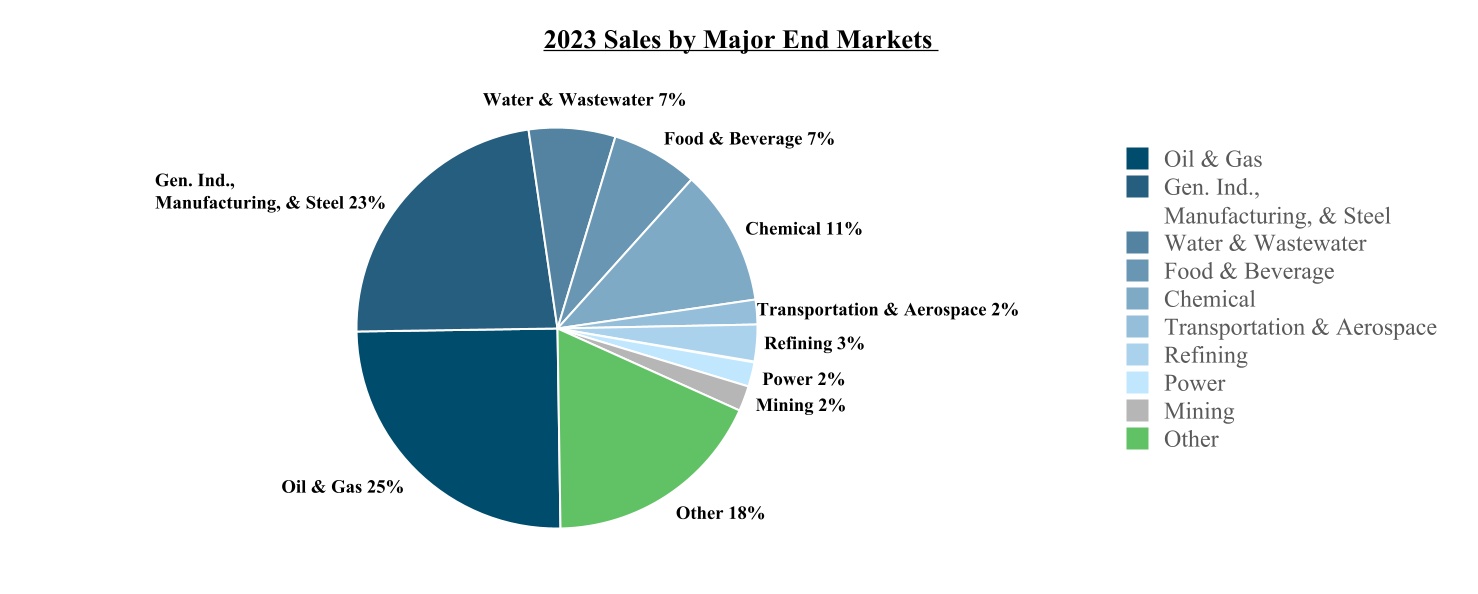

Industry Overview

The industrial distribution market is highly fragmented. Based on 2022 sales as reported by Industrial Distribution magazine, we were the 17th largest distributor of MRO products in the U.S. Most industrial customers currently purchase their industrial supplies through numerous local distribution and supply companies. These distributors generally provide the customer with repair and maintenance services, technical support and application expertise with respect to one product category. Products typically are purchased by the distributor for resale directly from the manufacturer and warehoused at distribution facilities of the distributor until sold to the customer. The customer also typically will purchase an amount of product inventory for its near term anticipated needs and store those products at its industrial site until the products are used.

We believe that the distribution system for industrial products, as described in the preceding paragraph, creates inefficiencies at both the customer and the distributor levels through excess inventory requirements and duplicative cost structures. To compete more effectively, our customers and other users of MRO products are seeking ways to enhance efficiencies and lower MRO product and procurement costs. In response to this customer desire, three primary trends have emerged in the industrial supply industry:

•Industry Consolidation. Industrial customers have reduced the number of supplier relationships they maintain to lower total purchasing costs, improve inventory management, assure consistently high levels of customer service and enhance purchasing power. This focus on fewer suppliers has led to consolidation within the fragmented industrial distribution industry.

•Customized Integrated Service. As industrial customers focus on their core manufacturing or other production competencies, they increasingly demand customized integration services, consisting of value-added traditional distribution, supply chain services, modular equipment and repair and maintenance services.

•Single Source, First-Tier Distribution. As industrial customers continue to address cost containment, there is a trend toward reducing the number of suppliers and eliminating multiple tiers of distribution. Therefore, to lower overall costs to the customer, some MRO product distributors are expanding their product coverage to eliminate second-tier distributors and become a “one stop source”.

5

We believe we have increased our competitive advantage through our traditional fabrication of integrated system pump packages and integrated supply programs, which are designed to address our customers’ specific product and procurement needs. We offer our customers various options for the integration of their supply needs, ranging from serving as a single source of supply for all our specific lines of products and product categories to offering a fully integrated supply package in which we assume procurement and management functions, which can include ownership of inventory, at the customer's location. Our approach to integrated supply allows us to design a program that best fits the needs of the customer. Customers purchasing large quantities of product are able to outsource all or most of those needs to us. For customers with smaller supply needs, we are able to combine our traditional distribution capabilities with our broad product categories and advanced ordering systems to allow the customer to engage in one-stop sourcing without the commitment required under an integrated supply contract.

Business Segments

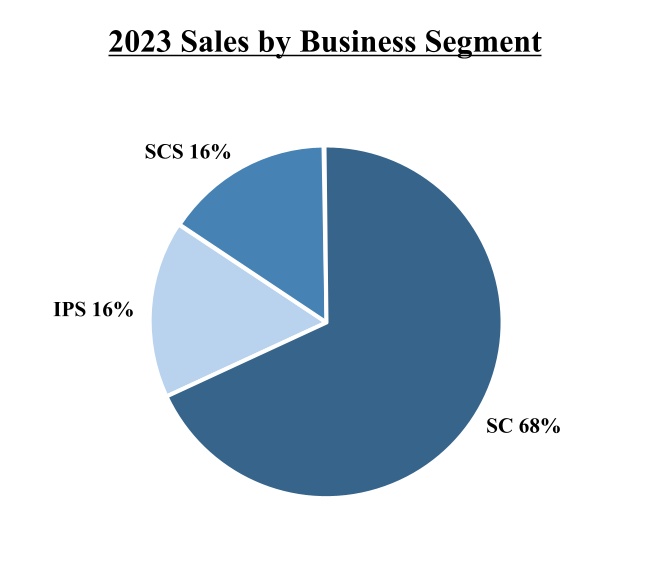

The Company is organized into three business segments: Service Centers ("SC"), Innovative Pumping Solutions ("IPS") and Supply Chain Services ("SCS"). Our segments provides the Chief Operating Decision Maker ("CODM") with a comprehensive financial view of our key businesses. Our CODM is our Chief Executive Officer. The segments enable the alignment of strategies and objectives and provide a framework for timely and rational allocation of resources within our businesses. In addition to the three business segments, our consolidated financial results include "Corporate and other expenses" which includes costs related to our centralized support functions, consisting, of accounting and finance, information technology, marketing, human resources, legal, inventory management & procurement and other support services and removes inter-company transactions. The following table sets forth the Company’s sales by business segments as of December 31, 2023. See Results of Operations under Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations for further information on our segments’ financial results.

| Segment | 2023 Sales (in millions) | % of Sales | End Markets | Locations | Employees | |||||||||||||||||||||||||||

| SC | $1,145 | 68% | General Industrial, Oil & Gas, Food & Beverage, Water & Wastewater, Chemical, Transportation, Aerospace & Other | 157 service centers, 4 distribution centers | 1,723 | |||||||||||||||||||||||||||

| IPS | $273 | 16% | Oil & Gas, Mining, Chemical, Water & Wastewater and Utilities | 16 fabrication facilities, 6 wastewater locations | 383 | |||||||||||||||||||||||||||

| SCS | $260 | 16% | Food & Beverage, Transportation, Oil & Gas, General Industrial & Chemical | 81 customer sites | 419 | |||||||||||||||||||||||||||

6

Service Centers

The Service Centers (SC) are engaged in providing MRO products, equipment and services, including technical expertise and logistics capabilities, to a variety of customers serving varied end markets with the ability to provide same day delivery. We offer our customers a single source of supply on an efficient and competitive basis by being a first-tier distributor that can purchase products directly from manufacturers. As a first-tier distributor, we are able to reduce our customers' costs and improve efficiencies in the supply chain. We offer a wide range of industrial MRO products, equipment and services through a continuum of customized and efficient MRO solutions. We also provide services such as field safety supervision, in-house and field repair and predictive maintenance.

A majority of our Service Center segment sales are derived from customer purchase orders for products. Sales are directly solicited from customers by our sales force. The Company's Service Centers are stocked and staffed with knowledgeable sales associates and backed by a centralized customer service team of experienced industry professionals. At December 31, 2023, our Service Centers’ products and services were distributed from 157 service centers and 4 distribution centers. The Company's Service Centers provide a wide range of MRO products in the rotating equipment, bearing, power transmission, hose, fluid power, metal working, industrial supply and safety product and service categories. We currently serve as a first-tier distributor of more than 1,000,000 items of which more than 60,000 are stock keeping units (SKUs) for use primarily by customers engaged in the oil and gas, food and beverage, chemical and petrochemical, transportation and other general industrial industries. Other industries served by our Service Centers include mining, construction, chemical, municipal water and wastewater, agriculture and pulp and paper.

The Service Centers segment’s long-lived assets are located in the U.S., Canada and Dubai. Approximately 5.0% of the Service Centers segment’s revenues were in Canada and the remainder was virtually all in the U.S. Our foreign operations are subject to certain unique risks, which are more fully disclosed in Item 1A "Risk Factors," "Risks Associated with Legal and Regulatory Matters".

At December 31, 2023, the Service Centers segment had 1,723 employees, all of whom were full-time.

Innovative Pumping Solutions

The Company's Innovative Pumping Solutions (IPS) segment provides integrated, custom pump skid packages, pump remanufacturing and manufactures branded private label pumps to meet the capital equipment needs of our global customer base. Additionally, our IPS segment provides project solutions and capital equipment to the water and wastewater treatment markets including potable water, bio-solid and residual management and wastewater treatment. Our IPS segment provides a single source for design, engineering, project management and systems design and fabrication for unique customer specifications.

Our sales of integrated pump packages, remanufactured pumps or branded private label pumps are generally derived from customer purchase orders containing the customers’ unique specifications. Sales are directly solicited from customers by our dedicated sales force.

The Company's engineering staff can design a complete custom pump package to meet our customers’ project specifications. Drafting programs such as Solidworks and AutoCAD® allow our engineering team to verify the design and layout of packages with our customers prior to the start of fabrication. Finite Elemental Analysis programs such as Cosmos Professional are used to design the package to meet all normal and future loads and forces. This process helps maximize the pump packages’ life and minimizes any impact to the environment.

With over 100 years of fabrication experience, the Company has acquired the technical expertise to ensure that our pumps and pump packages are built to meet the highest standards. The Company utilizes manufacturer authorized equipment and manufacturer certified personnel. Pump packages require MRO products and original equipment manufacturers’ (OEM) equipment such as pumps, motors, valves, and consumable products such as welding supplies. The Company leverages its MRO product inventories and breadth of authorized products to lower the total cost and maintain the quality of our pump packages.

At December 31, 2023, the Innovative Pumping Solutions segment operated out of 22 facilities, 20 of which are located in the U.S. and two in Canada.

All of the IPS segment’s long-lived assets are located in the U.S. Approximately 4.8% of the IPS segment’s 2023 revenues were recognized in Canada and 95.2% were in the U.S.

7

At December 31, 2023, the IPS segment had 383 employees, all of whom were full-time.

Total backlog, representing firm orders for the IPS segment products that have been received and entered into our production systems, was $138.4 million and $108.5 million at December 31, 2023 and 2022, respectively.

Supply Chain Services

The Company's Supply Chain Services (SCS) segment manages all or part of its customers’ supply chains, including procurement and inventory management. The SCS segment enters into long-term contracts with its customers that can be canceled on little or no notice under certain circumstances. The SCS segment provides fully outsourced MRO solutions for sourcing MRO products including, but not limited to, the following: inventory optimization and management; store room management; transaction consolidation and control; vendor oversight and procurement cost optimization; productivity improvement services; and customized reporting. Our mission is to help our customers become more competitive by reducing their indirect material costs and order cycle time by increasing productivity and by creating enterprise-wide inventory and procurement visibility and control.

The Company has developed assessment tools and master plan templates aimed at taking cost out of supply chain processes, streamlining operations and boosting productivity. This multi-faceted approach allows us to manage the entire MRO products channel for maximum efficiency and optimal control, which ultimately provides our customers with a low-cost solution.

The Company takes a consultative approach to determine the strengths and opportunities for improvement within a customer’s MRO products supply chain. This assessment determines if and how we can best streamline operations, drive value within the procurement process, and increase control in storeroom management.

Decades of supply chain inventory management experience and comprehensive research, as well as a thorough understanding of our customers’ businesses and industries have allowed us to design standardized programs that are flexible enough to be fully adaptable to address our customers’ unique MRO products supply chain challenges. These standardized programs include:

•SmartAgreement, a planned, pro-active MRO products procurement solution leveraging DXP’s local Service Centers.

•SmartBuy, DXP’s on-site or centralized MRO procurement solution.

•SmartSourceSM, DXP’s on-site procurement and storeroom management by DXP personnel.

•SmartStore, DXP’s customized e-Catalog solution.

•SmartVend, DXP’s industrial dispensing solution, which allows for inventory-level optimization, user accountability and item usage reduction by an initial 20-40%.

•SmartServ, DXP’s integrated service pump solution. It provides a more efficient way to manage the entire life cycle of pumping systems and rotating equipment.

The Company's SmartSolutions programs listed above help customers to cut product costs, improve supply chain efficiencies and obtain expert technical support. The Company represents manufacturers of up to 90% of all the maintenance, repair and operating products of our customers. Unlike many other distributors who buy products from second-tier sources, the Company takes customers to the source of the products they need.

At December 31, 2023, the SCS segment operated supply chain installations in 81 of our customers’ sites.

All of the SCS segment’s long-lived assets are in the U.S. and Mexico. The majority of the SCS segment’s 2023 revenues were recognized in the U.S.

At December 31, 2023, the SCS segment had 419 employees, all of whom were full-time.

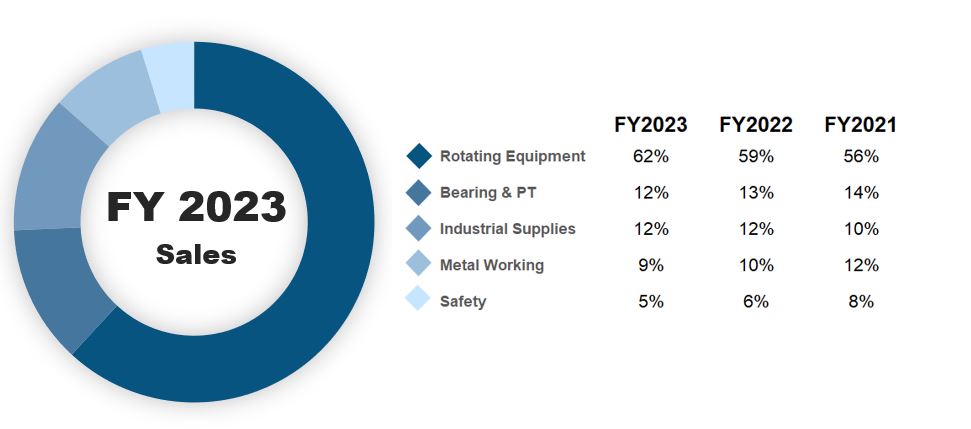

Products

Most industrial customers currently purchase their MRO products through local or national distribution companies that are focused on single or unique product categories. As a first-tier distributor, our network of service and distribution centers stock more than 60,000 SKUs and provide customers with access to more than 1,000,000 items. Given our breadth of product and our industrial distribution customers’ focus around specific product categories, we have become customer driven experts in five key product categories. Our business is supported by the following five key product categories: rotating equipment; bearings & power transmission; industrial supplies; metal working; and safety products & services. The Company tailors its inventory and leverages product experts to meet the needs of its local customers.

8

Our key product categories include:

•Rotating Equipment. Our rotating equipment products include a full line of centrifugal pumps for transfer and process service applications, such as petrochemicals, refining and crude oil production; rotary gear pumps for low- to- medium pressure service applications, such as pumping lubricating oils and other viscous liquids; plunger and piston pumps for high-pressure service applications such as disposal of produced water and crude oil pipeline service; and air-operated diaphragm pumps. We also provide a large variety of pump accessories.

•Bearings & Power Transmission. Our bearing products include several types of mounted and unmounted bearings for a variety of applications. The power transmission products we distribute include speed reducers, flexible-coupling drives, chain drives, sprockets, gears, conveyors, clutches, brakes and hoses.

•Industrial Supplies. We offer a broad range of industrial supplies, such as abrasives, tapes and adhesive products, coatings and lubricants, fasteners, hand tools, janitorial products, pneumatic tools, welding supplies and welding equipment.

•Metal Working. Our metal working products include a broad range of cutting tools, abrasives, coolants, gauges, industrial tools and machine shop supplies.

•Safety Products & Services. We sell a broad range of safety products including eye and face protection, first aid, hand protection, hazardous material handling, instrumentation and respiratory protection products. Additionally, we provide safety services including hydrogen sulfide (H2S) gas protection and safety, specialized and standby fire protection, safety supervision, training, monitoring, equipment rental and consulting. Our safety services include safety supervision, medic services, safety audits, instrument repair and calibration, training, monitoring, equipment rental and consulting.

We acquire our products through numerous OEMs. We are authorized to distribute certain manufacturers' products only in specific geographic areas. All of our distribution authorizations are subject to cancellation by the manufacturer, some upon little or no notice. For the last three fiscal years, no manufacturer accounted for 10% or more of our revenues. Over 90% of our business relates to sales of products. Service revenues are less than 10% of sales.

The Company has operations in the U.S., Canada, Mexico, and Dubai. Information regarding financial data by geographic areas is set forth in Note 19 - Revenue of the Notes to Consolidated Financial Statements.

Recent Acquisitions

A key component of our growth strategy includes acquiring businesses with complementary or desirable product lines, locations or customers. Since 2004, we have completed 51 acquisitions.

The following briefly describes the Company’s acquisition activity for the years ended December 31, 2023 and December 31, 2022.

9

On November 1, 2023, the Company completed the acquisition of Alliance Pump & Mechanical Service, Inc. (“Alliance”). Alliance is a leading municipal and industrial pump sales, service, and repair business. Alliance is included within our SC business segment. Total consideration for the transaction was approximately $1.7 million, funded with a mixture of cash on hand of $1.5 million and contingent consideration of $0.2 million. Goodwill for the transaction totaled approximately $1.3 million.

On May 1, 2023, the Company completed the acquisition of Florida Valve & Equipment, LLC and Environmental MD, Inc. (collectively, “Florida Valve EMD”), a leading provider of valve and related products and services for the municipal water markets in the state of Florida. Florida Valve EMD is included within our IPS business segment. Total consideration for the transaction was approximately $3.3 million, funded with a mixture of cash on hand of $3.0 million and contingent consideration of $0.3 million. Goodwill for the transaction totaled approximately $2.4 million.

On May 1, 2023, the Company completed the acquisition of Riordan Materials Corporation (“Riordan”), a leading provider of products for water treatment, wastewater treatment, odor control, solids handling, pumping and bio solid processes in the states of Maryland, New Jersey, Pennsylvania, Delaware and Virginia. Riordan is included within our IPS business segment. Total consideration for the transaction was approximately $8.4 million, funded with a mixture of cash on hand of $6.2 million and contingent consideration of $2.2 million. Goodwill for the transaction totaled approximately $6.1 million.

On September 1, 2022, the Company completed the acquisition of Sullivan Environmental Technologies, Inc. ("Sullivan"). Sullivan is a leading distributor for the municipal and industrial water and wastewater treatment industries in Ohio, Kentucky, and Indiana. Sullivan is included within our IPS business segment. Total consideration for the transaction was approximately $6.5 million, funded with a mixture of cash on hand of $4.6 million, the Company's common stock valued at approximately $0.9 million and contingent consideration of $1.0 million. Goodwill for the transaction totaled approximately $2.5 million.

On May 2, 2022, the Company completed the acquisition of Cisco Air Systems, Inc. ("Cisco"). Cisco is a leading distributor of air compressors and related products and services focused on serving the food and beverage, transportation and general industrial markets in the Northern California and Nevada territories. Cisco is included within our SC business segment. Total consideration for the transaction was approximately $52.3 million, funded with a mixture of cash on hand of $32 million, the Company's common stock valued at approximately $4.4 million, approximately $11 million on the ABL and contingent consideration of $4.5 million. Goodwill for the transaction totaled approximately $30.5 million.

On March 1, 2022, the Company completed the acquisition of Drydon Equipment, Inc. ("Drydon"), a distributor and manufacturers’ representative of pumps, valves, controls and process equipment focused on serving the water and wastewater industry in the Midwest. Drydon is included within our IPS business segment. The Company paid approximately $7.9 million, funded with a mixture of cash on hand of $4.9 million, the Company's common stock valued at approximately $0.4 million and contingent consideration of $2.6 million. Goodwill for the transaction totaled approximately $5.3 million.

On March 1, 2022, the Company completed the acquisition of certain assets of Burlingame Engineers, Inc. ("Burlingame"), a provider of water and wastewater equipment in the industrial and municipal sectors. Burlingame is included within our SC business segment. The Company paid approximately $1.1 million including cash, the Company's common stock and contingent consideration. Goodwill for the transaction totaled approximately $0.5 million.

Competition

Our business is highly competitive. In the Service Centers segment we compete with a variety of industrial supply distributors, some of which may have greater financial and other resources than we do. Some of our competitors are small enterprises selling to customers in a limited geographic area. We also compete with catalog distributors, large warehouse stores and, to a lesser extent, manufacturers. While certain catalog distributors provide product offerings as broad as ours, these competitors do not offer the product application, technical expertise and after-the-sale services that we provide. In the Innovative Pumping Solutions segment we compete against a variety of manufacturers, distributors and fabricators, many of which may have greater financial and other resources than we do. In the Supply Chain Services segment we compete with larger distributors that provide integrated supply programs and outsourcing services, some of which might be able to supply their products in a more efficient and cost-effective manner than we can provide. We generally compete on expertise, responsiveness and price in all of our segments.

10

Insurance

We maintain liability and other insurance that we believe to be customary and generally consistent with industry practice. We retain a portion of the risk for medical claims, general liability, worker’s compensation and property losses. The various deductibles of our insurance policies generally do not exceed $250,000 per occurrence. There are also certain risks for which we do not maintain insurance. There can be no assurance that such insurance will be adequate for the risks involved, that coverage limits will not be exceeded or that such insurance will apply to all liabilities. The occurrence of an adverse claim in excess of the coverage limits that we maintain could have a material adverse effect on our financial condition and results of operations. Additionally, we are partially self-insured for our group health plan, worker’s compensation, auto liability and general liability insurance.

Government Regulation and Environmental Matters

We are subject to various laws and regulations relating to our business and operations and various health and safety regulations including those established by the Occupational Safety and Health Administration and Canadian Occupational Health and Safety.

Certain of our operations are subject to federal, state and local laws and regulations as well as provincial regulations controlling the discharge of materials into or otherwise relating to the protection of the environment.

Although we believe that we have adequate procedures to comply with applicable discharge and other environmental laws, such laws and regulations could result in costs to remediate releases of regulated substances into the environment or costs to remediate sites to which we sent regulated substances for disposal. In some cases, these laws can impose strict liability for the entire cost of clean-up on any responsible party without regard to negligence or fault and impose liability on us for the conduct of others or conditions others have caused, or for our acts that complied with all applicable requirements when we performed them. New laws have been enacted and regulations are being adopted by various regulatory agencies on a continuing basis and the costs of compliance with these new laws can only be broadly appraised until their implementation becomes more defined.

The risks of accidental contamination or injury from the discharge of controlled or hazardous materials and chemicals cannot be eliminated completely. In the event of such a discharge, we could be held liable for any damages that result and any such liability could have a material adverse effect on us.

We are not currently aware of any environmental situation or violations of government regulations that we believe are likely to have a material adverse effect on our results of operations or financial condition.

Human Capital

The Company employed 2,837 people as of December 31, 2023. The Company is continually investing in its workforce to further talent development, increase employee safety, drive a strong workplace culture, improve compensation and benefits and diversity and inclusion to support our employees’ well-being, and foster their growth and development.

Talent Development. The Company's leaders are expected to make great strategic choices, deliver great results, be great talent managers and provide strong leadership. The Company's leaders who have expertise in the Company's business model are the critical factor in translating the potential of the Company's business model into full performance. Because this expertise develops over time and through specific experiences, the Company focuses on developing and promoting its own talent to ensure the Company's sustained business success over the long term.

Employee Safety. The safety and well-being of the Company's colleagues around the world has been, and always will be, its top priority. Guided by the Company's Safety Service offering, business and the philosophy that every accident is preventable, the Company strives every day to foster a proactive safety culture. The Company's safety strategy is based on the following core principles: (i) a goal of zero accidents, (ii) shared ownership for safety (business and individual); (iii) proactive approach focused on accident prevention; and (iv) continuous improvement philosophy.

Workplace Culture. The Company operates under a balanced centralized and decentralized entrepreneurial culture that is crucial to the Company's performance and is one of the three unique elements of the Company's business model. The Company believes its colleagues around the world thrive in this culture, as it allows them to experience significant autonomy, a sense of shared ownership with their colleagues, and a work atmosphere deeply rooted in the Company's core values.

11

Compensation and Benefits. The Company is committed to providing market-competitive compensation and benefits to attract and retain great talent across its business segments. Specific compensation and benefits vary and are based on regional practices. In the U.S., the Company focuses on providing a comprehensive, competitive benefits package that supports the health and wellness, educational endeavors, community involvement and financial stability of its colleagues.

Our key human capital measures include employee safety, turnover, absenteeism and production. We frequently benchmark our compensation practices and benefits programs against those of comparable companies and industries and in the geographic areas where our facilities are located. We believe that our compensation and employee benefits are competitive and allow us to attract and retain skilled and unskilled labor throughout our organization. Our notable health, welfare and retirement benefits include:

● | Company subsidized health insurance | |||||||

● | 401(k) Plan with Company matching contributions | |||||||

● | Paid time off | |||||||

Diversity and Inclusion. The Company believes it is at its best when it brings together unique perspectives, experiences and ideas. The Company is committed to equal employment opportunity, fair treatment and creating diverse and inclusive workplaces where all the Company's colleagues can perform to their full potential. We strive to maintain an inclusive environment free from discrimination of any kind, including sexual or other discriminatory harassment. Our employees have multiple avenues available through which inappropriate behavior can be reported, including a confidential hotline. All reports of inappropriate behavior are promptly investigated with appropriate action taken aimed at stopping such behavior.

Labor Relations. None of the Company's U.S. employees are represented by a labor union, while outside the U.S., employees in certain countries are represented by an employee representative organization, such as a union, works council or employee association.

We believe our employees are key to achieving our business objectives. The Company considers its employee relations to be excellent. Headcount by segment and country are as follows:

| Business Segment | Employees | Country | Employees | |||||||||||

| Service Centers | 1,723 | United States | 2,613 | |||||||||||

| Innovative Pumping Solutions | 383 | Canada | 213 | |||||||||||

| Supply Chain Services | 419 | Other(1) | 11 | |||||||||||

| Corporate | 312 | Total Employees | 2,837 | |||||||||||

| Total Employees | 2,837 | (1) Includes employees located in Mexico and Dubai. | ||||||||||||

Executive Officers

The following is a list of the Company's executive officers, their age, positions, and a description of each officer’s business experience as of March 11, 2024. All of our executive officers hold office at the pleasure of the Company's Board of Directors.

| NAME | AGE | TITLE | ||||||

| David R. Little | 72 | Chairman of the Board, President and Chief Executive Officer | ||||||

| Kent Yee | 48 | Senior Vice President/Chief Financial Officer/Secretary | ||||||

| Nick Little | 42 | Senior Vice President/Chief Operating Officer | ||||||

| Chris Gregory | 49 | Senior Vice President/Chief Information Technology Officer | ||||||

| Paz Maestas | 44 | Senior Vice President/Chief Marketing & Technology Officer | ||||||

| David C. Vinson | 73 | Senior Vice President/Innovative Pumping Solutions | ||||||

| John J. Jeffery | 56 | Senior Vice President/Supply Chain Services | ||||||

Todd Hamlin(1) | 52 | Senior Vice President/Service Centers | ||||||

David Molero Santos | 42 | Vice President/Chief Accounting Officer | ||||||

(1) On January 26, 2024 Mr. Hamlin departed the Company.

12

David R. Little. Mr. Little has served as Chairman of the Board, President and Chief Executive Officer of DXP since its organization in 1996 and also has held these positions with SEPCO Industries, Inc., predecessor to the Company (“SEPCO”), since he acquired a controlling interest in SEPCO in 1986. Mr. Little has been employed by SEPCO since 1975 in various capacities, including Staff Accountant, Controller, Vice President/Finance and President. Mr. Little gives our Board insight and in-depth knowledge of our industry and our specific operations and strategies. He also provides leadership skills and knowledge of our local community and business environment, which he has gained through his long career with DXP and its predecessor companies.

Kent Yee. Mr. Yee was appointed Senior Vice President/Chief Financial Officer/Secretary in June 2017. Currently, Mr. Yee is responsible for acquisitions, finance, accounting, business integrations, and human resources of DXP. From March 2011 to June 2017, Mr. Yee served as Senior Vice President Corporate Development and led DXP's mergers and acquisitions, business integration, and internal strategic project activities. During March 2011, Mr. Yee joined DXP from Stephens Inc.'s Industrial Distribution and Services team where he served in various positions, including Vice President from August 2005 to February 2011. Prior to Stephens, Mr. Yee was a member of The Home Depot’s Strategic Business Development Group with a primary focus on acquisition activity for HD Supply. Mr. Yee was also an Associate in the Global Syndicated Finance Group at JPMorgan Chase. He has executed over 52 transactions including more than $1.6 billion in M&A and $3.9 billion in financing transactions primarily for change of control deals and numerous industrial and distribution acquisition and sale assignments. He holds a Bachelors of Arts in Urban Planning from Morehouse College and an MBA from Harvard University Graduate School of Business.

Nick Little. Mr. Little was appointed Senior Vice President/Chief Operating Officer in January 2021. Mr. Little began his career with DXP nearly twenty years ago as an application engineer. During his tenure at DXP, Mr. Little has held various roles of increasing responsibility including outside sales, Director of Operations and more recently as the Regional Vice President of Sales and Operations. As Chief Operating Officer, Mr. Little is responsible for the execution of the strategic direction of the Company and oversees sales, operations, and inventory management & procurement of DXP. He holds a Bachelor of Business Administration in Finance from Baylor University.

Chris Gregory. Mr. Gregory was appointed Senior Vice President and Chief Information Officer in March of 2018. Mr. Gregory joined the Company in August 2006. From December 2014 until January 2018 he served as Vice President of IT Strategic Solutions. Prior to serving as Vice President of IT Strategic Solutions he served in various roles, including application developer, database manager as well as leading the business intelligence and application development departments. He holds a Bachelor of Business Administration and Computer Information Systems from the University of Houston and an MBA from The University of Texas at Austin, McCombs School of Business.

Paz Maestas. Mr. Maestas was appointed Senior Vice President/Chief Marketing and Technology Officer in January 2021. Mr. Maestas has been with DXP since 2002 and leads the Company's e-Commerce and Omni-Channel initiatives. In his 20 years with DXP, he has served in various roles and most recently as Vice President of Marketing and Operations. He holds a Bachelor of Science from the University of Texas at Austin.

David C. Vinson. Mr. Vinson was appointed Senior Vice President/Innovative Pumping Solutions in January 2006. He served as Senior Vice President/Operations of DXP from October 2000 to December 2005. From 1996 until October 2000, Mr. Vinson served as Vice President/Traffic, Logistics and Inventory. Mr. Vinson has served in various capacities with DXP since his employment in 1981.

John J. Jeffery. Mr. Jeffery was appointed Senior Vice President of Supply Chain Services in May 2010. He oversees the strategic direction for the Supply Chain Services business unit driving innovative business development initiatives for organizational growth and visibility. He began his career with T.L. Walker, which was later acquired by DXP in 1991. During his tenure with DXP, Mr. Jeffery has served in various significant capacities including branch, area, regional and national sales management as well as sales, marketing, information technology and Service Center vice president roles. He holds a Bachelor of Science in Industrial Distribution from Texas A&M University and is also a graduate of the Executive Business Program at Rice University.

13

Todd Hamlin. Mr. Hamlin was appointed Senior Vice President of DXP Service Centers in June of 2010. Mr. Hamlin joined the Company in 1995. From February 2006 until June 2010 he served as Regional Vice President of the Gulf Coast Region. Prior to serving as Regional Vice President of the Gulf Coast Region he served in various capacities, including application engineer, product specialist and sales representative. From April 2005 through February 2006, Mr. Hamlin worked as a sales manager for the UPS Supply Chain Services division of United Parcel Service, Inc. He holds a Bachelor’s of Science in Industrial Distribution from Texas A&M University and a Master in Distribution from Texas A&M University. Mr. Hamlin serves on the Advisory Board for Texas A&M’s Master in Distribution degree program. In 2014, Mr. Hamlin was elected to the Bearing Specialists Association’s Board of Directors.

David Molero Santos. Mr. Molero is a certified public accountant and has over 18 years of experience in accounting within a public company environment and most recently as a Chief Accounting Officer of another publicly traded company. Prior to DXP, Mr. Molero was the Chief Accounting Officer for AgileThought, Inc., a provider of digital transformation services including organizational transformations, training and certifications, and product management services. He spent over 16 years at PricewaterhouseCoopers serving in various audit and capital markets advisory roles, focused primarily on SEC reporting clients. Mr. Molero is a Certified Public Accountant in Texas and holds a Bachelor’s degree in Business Administration and Management from Loyola University in Cordoba (Spain) and a Master’s degree in Audit from the University of Alcala in Madrid (Spain).

All officers of DXP hold office until the regular meeting of the board of directors following the 2024 Annual Meeting of Shareholders or until their respective successors are duly elected and qualified or their earlier resignation or removal.

Available Information

Our internet address is www.dxpe.com and the investor relations section of our website is located at ir.dxpe.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as amended (the “Exchange Act”), are available free of charge through our internet website (www.dxpe.com) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (“SEC”). The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with SEC at http://www.sec.gov. Additionally, we make the following available free of charge through our internet website ir.dxpe.com:

•DXP Code of Ethics for Senior Financial Officers;

•DXP Code of Conduct;

•DXP Conflict Minerals Policy;

•DXP Anti-Corruption Policy;

•Compensation Committee Charter;

•Nominating and Governance Committee Charter; and

•Audit Committee Charter

•Corporate Sustainability Report

ITEM 1A. Risk Factors

We are subject to various risks and uncertainties in the course of our business. Investing in the Company involves risk. In deciding whether to invest in the Company, you should carefully consider the risk factors below as well as those matters referenced in the foregoing pages under “Disclosure Regarding Forward-Looking Statements” and other information included and incorporated by reference into this Report and other reports and materials filed by us with the Securities and Exchange Commission. Any of these risk factors could have a significant or material adverse effect on our businesses, results of operations, financial condition or liquidity. They could also cause significant fluctuations and volatility in the trading price of our securities. Readers should not consider any descriptions of these factors to be a complete set of all potential risks that could affect the Company. Further, many of these risks are interrelated and could occur under similar business and economic conditions, and the occurrence of certain of them may in turn cause the emergence or exacerbate the effects of others. Such a combination could materially increase the severity of the impact of these risks on our results of operations, liquidity and financial condition.

14

We face a variety of risks that are substantial and inherent in our businesses. The following is a summary of some of the more important factors that could affect our businesses:

Business and Operations

•Demand for our products could decrease if manufacturers decide to sell them direct.

•Changes in our customer or product mix, could cause our gross margins to fluctuate.

•Material changes in the costs of our products from manufacturers without the ability to pass price increases onto our customers could cause our gross margins to decline.

•Our manufacturers may cancel our oral or written distribution authorizations upon little or no notice, which could adversely impact our revenues and profits from distributing certain manufacturer’s products.

•We may experience unexpected supply shortages, which could adversely affect our product and service offerings and our business.

•Price reductions by our manufacturers of products that we sell could cause the value of our inventory to decline.

•We are subject to increased shipping costs as well as the potential inability of our third-party transportation providers to deliver products on a timely basis.

•Our business has substantial competition that could adversely affect our results.

•The loss of or the failure to attract and retain key personnel could adversely impact our results of operations.

•The loss of any key supplier could adversely affect the Company’s sales and profitability.

•Our future results will be impacted by our ability to implement our internal growth strategy.

•Our future results will be impacted by the effective execution of our acquisition strategy.

•Goodwill and intangible assets recorded as a result of our acquisitions could become impaired.

•Interruptions in the proper functioning of our information systems could disrupt operations and cause increases in costs and/or decreases in revenues.

•Cybersecurity breaches and other disruptions or misuse of our network and information systems could affect our ability to conduct our business effectively.

•Our backlog is subject to unexpected adjustments and potential cancellations.

•Our actual results could differ from the assumptions and estimates used to prepare our financial statements.

•If we do not successfully remediate our internal controls weaknesses, our financial statements may not be accurate and the trading price of our stock could be negatively impacted.

Market and Economy

•A general slowdown in the economy could negatively impact the Company’s sales growth and profitability.

•We could be adversely impacted by low oil prices, volatility in oil prices and downturns in the energy industry, including decreased capital expenditures, impacting our customers’ demand for our products and services.

•Adverse weather events or natural disasters could negatively disrupt our operations.

Credit and Access to Debt Capital

•We may not be able to refinance on favorable terms, extend, or repay our debt, which could adversely affect our results of operations or may result in default of our debt.

•Our failure to comply with financial covenants of our credit facilities may adversely affect our results of operations and our financial conditions.

•We may not be able to access acquisition financing, including debt capital.

•A deterioration in the oil and gas sector or other circumstances may negatively impact our business and results of operations and thus hinder our ability to comply with financial covenants under our credit facilities, including the Secured Leverage Ratio and Fixed Charge Coverage Ratio financial covenants.

•Changes in our credit profile may affect our relationship with our suppliers, which could have a material adverse effect on our liquidity.

Legal and Regulatory

•Risks associated with substantial or material claim or lawsuits that are not covered by insurance.

•The nature of our manufactured products carries the possibility of significant product liability and warranty claims, which could harm our business and future results.

•We are subject to potential shareholder litigation associated with potential volatile trading of our common stock.

•We are subject to personal injury, product liability and environmental claims involving allegedly defective products.

•We are subject to risks associated with conducting business in foreign countries.

•We are subject to environmental, health and safety laws and regulations that may lead to liabilities and negatively impact our business.

•We are subject to various government regulations, the cost of compliance of such regulations could increase our cost of conducting business and any violations of such regulations could materially adversely affect our financial condition or results of operations.

15

The following are more detailed discussions of our Risk Factors summarized above:

Risk Related to the Company's Business and Operations

Demand for our products could decrease if the manufacturers of those products sell them directly to end users.

Typically, MRO products have been purchased through distributors and not directly from the manufacturers of those products. If customers were to purchase our products directly from manufacturers, or if manufacturers sought to increase their efforts to sell directly to end users, we could experience a significant decrease in sales and earnings.

Changes in our customer and product mix, or adverse changes to the cost of goods we sell, could cause our gross margin percentage to fluctuate or decrease, and we may not be able to maintain historical margins.

Changes in our customer mix have resulted from geographic expansion, daily selling activities within current geographic markets, and targeted selling activities to new customers. Changes in our product mix have resulted from marketing activities to existing customers and needs communicated to us from existing and prospective customers. There can be no assurance that we will be able to maintain our historical gross margins. In addition, we may also be subject to price increases from vendors that we may not be able to pass along to our customers.

Our manufacturers may cancel our oral or written distribution authorizations upon little or no notice, which could adversely impact our revenues and profits from distributing certain manufacturer’s products.

We are authorized to distribute certain manufacturers’ products in specific geographic areas and all of our oral or written distribution authorizations are subject to cancellation by the manufacturer, some upon little or no notice. If certain manufacturers cancel the distribution authorizations they granted to us, our distribution of their products could be disrupted and such occurrence could have a material adverse effect on our results of operations and financial conditions.

We may experience unexpected supply shortages, which could adversely affect our product and service offerings and our business.

We distribute products from certain manufacturers and suppliers. Nevertheless, in the future we may have difficulty obtaining the products we need from suppliers and manufacturers as a result of unexpected demand, production difficulties that might extend lead times or a supplier’s decision to sell its products through other distributors. Our inability to obtain products from suppliers and manufacturers in sufficient quantities to meet customer demand, or at all, could adversely affect our product and service offerings and our business.

Price reductions by our manufacturers of products that we sell could cause the value of our inventory to decline. Also, these price reductions could cause our customers to demand lower sales prices for these products, possibly decreasing our margins and profitability on sales.

The value of our inventory could decline as a result of manufacturer price reductions with respect to products that we sell. Such a decline could have an adverse effect on our revenues. Also, decreases in the market prices of products that we sell could cause customers to demand lower sales prices from us. These price reductions could reduce our margins and profitability on sales with respect to the lower-priced products to the extent that we purchased our inventory of these products at the higher prices prior to the manufacturers price reductions. Reductions in our margins and profitability on sales could have a material adverse effect on our business.

We rely upon third-party transportation providers for our merchandise shipments and are subject to increased shipping costs as well as the potential inability of our third-party transportation providers to deliver products on a timely basis.

We rely upon independent third-party transportation providers for our merchandise shipments, including shipments to and from all of our service centers. Our utilization of these delivery services for shipments is subject to risks, including increases in fuel prices, labor availability, labor strikes and inclement weather, which may impact a shipping company’s ability to provide delivery services that adequately meet our shipping needs. If we change the shipping companies we use, we could face logistical difficulties that could adversely affect deliveries and we would incur costs and expend resources in connection with such change. In addition, we may not be able to obtain favorable terms as we have with our current third-party transportation providers.

16

Our business has substantial competition that could adversely affect our results.

Our business is highly competitive. We compete with a variety of industrial supply distributors, some of which may have greater financial and other resources than us. Although many of our traditional distribution competitors are small enterprises selling to customers in a limited geographic area, we also compete with larger distributors that provide integrated supply programs such as those offered through outsourcing services similar to those that are offered by our SCS segment. Some of these large distributors may be able to supply their products in a more timely and cost-efficient manner than us. Our competitors include catalog suppliers, large warehouse stores and, to a lesser extent, certain manufacturers. Competitive pressures could adversely affect the Company's sales and profitability.

The loss of or the failure to attract and retain key personnel could adversely impact our results of operations.

The loss of the services of any of the executive officers of the Company could have a material adverse effect on our financial condition and results of operations. In addition, our ability to grow successfully will be dependent upon our ability to attract and retain qualified management and technical and operational personnel. The failure to attract and retain such persons could materially adversely affect our financial condition and results of operations.

The loss of any key supplier could adversely affect the Company’s sales and profitability.

We have distribution rights for certain product lines and depend on these distribution rights for a substantial portion of our business. Many of these distribution rights are pursuant to contracts that are subject to cancellation upon little or no prior notice. The termination or limitation by any key supplier of its relationship with the Company could result in a temporary disruption of our business and, in turn, could adversely affect our results of operations and financial condition.

Our future results will be impacted by our ability to implement our internal growth strategy.

Our future results will depend in part on our success in implementing our internal growth strategy, which includes expanding our existing geographic areas, selling additional products to existing customers and adding new customers. Our ability to implement this strategy will depend on our success in selling more products and services to existing customers, acquiring new customers, hiring qualified sales persons, and marketing integrated forms of supply management such as those being pursued by us through our SmartSourceSM program. We may not be successful in efforts to increase sales and product offerings to existing customers. Consolidation in our industry could heighten the impacts of competition on our business and results of operations discussed above. The fact that we do not traditionally enter into long-term contracts with our suppliers or customers may provide opportunities for our competitors.

Risks associated with executing our acquisition strategy.

Our future results will depend in part on our ability to successfully implement our acquisition strategy. We may not be able to consummate acquisitions at rates similar to the past, which could adversely impact our growth rate and stock price. This strategy includes taking advantage of a consolidation trend in the industry and effecting acquisitions of businesses with complementary or desirable product lines, strategic distribution locations, attractive customer bases or manufacturer relationships. Promising acquisitions are difficult to identify and complete for a number of reasons, including high valuations, competition among prospective buyers, the need for regulatory (including antitrust) approvals and the availability of affordable funding in the capital markets. In addition, competition for acquisitions in our business areas is significant and may result in higher purchase prices. Changes in accounting or regulatory requirements or instability in the credit markets could also adversely impact our ability to consummate acquisitions. In addition, acquisitions involve a number of special risks, including possible adverse effects on our operating results, diversion of management’s attention, failure to retain key personnel of the acquired business, difficulties in integrating operations, technologies, services and personnel of acquired companies, potential loss of customers of acquired companies, preserving business relationships of the acquired companies, risks associated with unanticipated events or liabilities, and expenses associated with obsolete inventory of an acquired business, some or all of which could have a material adverse effect on our business, financial condition and results of operations. Our ability to grow at or above our historic rates depends in part upon our ability to identify and successfully acquire and integrate companies and businesses at appropriate prices and realize anticipated cost savings.

17

Goodwill and intangible assets recorded as a result of our acquisitions could become impaired.

Goodwill represents the difference between the purchase price of acquired companies and the related fair values of net assets acquired. We test goodwill for impairment annually and whenever events or changes in circumstances indicate that impairment may have occurred. Goodwill and intangibles represent a significant amount of our total assets. At December 31, 2023, our combined goodwill and intangible assets amounted to $407.9 million, net of accumulated amortization. To the extent we do not generate sufficient cash flows to recover the net amount of any investments in goodwill and other intangible assets recorded, the investment could be considered impaired and subject to write-off which would directly impact earnings. We expect to record additional goodwill and other intangible assets as a result of future business acquisitions. Future amortization of such other intangible assets or impairments, if any, of goodwill or intangible assets would adversely affect our results of operations in any given period.

Interruptions in the proper functioning of our information systems could disrupt operations and cause increases in costs and/or decreases in revenues.

The proper functioning of the Company's information systems is critical to the successful operation of our business. Our information systems are vulnerable to natural disasters, power losses, telecommunication failures and other problems despite the protection of our information systems through physical and software safeguards and remote processing capabilities. If critical information systems fail or are otherwise unavailable, The Company's ability to procure products to sell, process and ship customer orders, identify business opportunities, maintain proper levels of inventories, collect accounts receivable and pay accounts payable and expenses could be adversely affected.

Cybersecurity breaches and other disruptions or misuse of our network and information systems could affect our ability to conduct our business effectively.

Through our sales channels and electronic communications with customers generally, we collect and maintain confidential information that customers provide to us in order to purchase products or services. We also acquire and retain information about suppliers and employees in the normal course of business. Computer hackers may attempt to penetrate our information systems or our vendors' information systems and, if successful, misappropriate confidential customer, supplier, employee or other business information. In addition, one of our employees, contractors or other third party may attempt to circumvent security measures in order to obtain such information or inadvertently cause a breach involving such information. Loss of information could expose us to claims from customers, suppliers, financial institutions, regulators, payment card associations, employees and other persons, any of which could have an adverse effect on our financial condition and results of operations. We may not be able to adequately insure against cyber risks.

Despite our security measures and those of our third-party service providers, our systems may be vulnerable to interruption or damage from computer hacks, computer viruses, worms or other destructive or disruptive software, process breakdowns, denial of service attacks, malicious social engineering or other malicious activities, or any combination of the foregoing. Our computer systems have been, and will likely continue to be, subject to cyber incidents. A cyber incident is considered to be any adverse event that threatens the confidentiality, integrity or availability of our information resources. More specifically, a cyber incident is an intentional attack or an unintentional event that can include gaining unauthorized access to systems to disrupt operations, corrupt data or steal confidential information. Our three primary risks that could directly result from the occurrence of a cyber incident include operational interruption, damage to our reputation and image and private data exposure. For example, in August 2020, the Company’s computer network was the target of a cyber-attack that we believe was orchestrated by a foreign actor. The systems housing confidential vendor, customer and employee data were not breached in this attack. The costs incurred to remedy the breach were not material to the results of the Company, and the increased cost of future mitigating measures are not expected to be material to our results. However, in the future, if we suffer a more significant cyber incident, we may be required to shut off our computer systems, reboot them and reestablish our information from back up sources. In other future incidents, we may be required under various laws to notify any third parties whose data has been compromised. While we have implemented controls and taken other preventative actions to further strengthen our systems against future attacks, these controls and preventative actions may not be effective against future attacks. Any breach of network, information systems, or our data security could result in a disruption of our services or improper disclosure of personal data or confidential information, which could harm our reputation, require us to expend resources to remedy such a security breach or defend against further attacks or subject us to liability under laws that protect personal data, resulting in increased operating costs or loss of revenue.

18

Our backlog is subject to unexpected adjustments and potential cancellations

Our backlog generally consists of projects for which we have an executed contract or commitment with a client and reflects our expected revenue from the contract or commitment, which is often subject to revision over time. We cannot guarantee that the revenue projected in our backlog will be realized or profitable or will not be subject to delay or suspension. Project cancellations, scope adjustments or deferrals, may occur with respect to contracts reflected in our backlog and could reduce the dollar amount of our backlog and the revenue and profits that we actually earn; or, may cause the rate at which we perform on our backlog to decrease. Our contracts typically provide for the payment of fees earned through the date of termination and the reimbursement of costs incurred including demobilization costs. In addition, projects may remain in our backlog for an extended period of time. During periods of economic slowdown, or decreases and/or instability in oil prices, the risk of projects being suspended, delayed or canceled generally increases. Finally, poor project or contract performance could also impact our backlog. Such developments could have a material adverse effect on our business and our profits.

Our actual results could differ from the assumptions and estimates used to prepare our financial statements

In preparing our financial statements, we make estimates and assumptions that affect the reported values of assets, liabilities, revenue and expenses, and the disclosure of contingent assets and liabilities. Areas requiring significant estimates by our management include:

•recognition of revenue, costs, profits or losses;

•recognition of recoveries under contract change orders or claims;

•estimated amounts for project losses, warranty costs, contract close-out or other costs;

•income tax provisions and related valuation allowances; and

•accruals for other estimated liabilities, including litigation and insurance reserves and receivables.

Estimates are based on management's reasonable assumptions and experience, but are only estimates. Our actual business and financial results could differ from our estimates of such results due to changes in facts and circumstances, which could have a material negative impact on our financial condition and reported results of operations. Further, we recognize contract revenue as work on a contract progresses. The cumulative amount of revenue recorded on a contract at any point in time is the costs incurred to date versus the estimated total costs. Accordingly, contract revenue and total cost estimates are reviewed and revised as the work progresses. Adjustments are reflected in contract revenue in the period when such estimates are revised. Such adjustments could be material and could result in reduced profitability.

If we do not successfully remediate our internal controls weaknesses, our financial statements may not be accurate and the trading price of our stock could be negatively impacted.

As a public company, DXP Enterprises, Inc. is subject to an annual integrated audit (an audit of its financial statements and system of controls). The integrated audit expresses itself in two opinions covering the procedures and records used to produce the financial statements, i.e. the financial statement audit, and, also an opinion as to whether the company has the likelihood, possibility, or existence of a misstatement in its financial statements based upon the interplay between financial, operational and technology processes and systems, i.e. the Sarbanes-Oxley or “SOX” audit (see Item 8 and Item 9A for these opinions).

Specifically, section 404 of the Sarbanes-Oxley Act requires us to annually evaluate our internal control systems over financial reporting, which is an assessment of financial and operational processes as well as a review of the technology processes and systems. This is not a static process as we may change our processes each year or acquire new companies that have different controls than our existing controls. Upon completion of this process each year, we may identify control deficiencies of varying degrees of severity under applicable U.S. Securities and Exchange Commission (“SEC”) and Public Company Accounting Oversight Board (“PCAOB”) rules and regulations that are neither new, and or remain unremediated from previous annual assessments due to ongoing curing efforts. We are required to report, among other things, control deficiencies that constitute a “material weakness” or changes in internal controls that, or that are reasonably likely to, materially affect internal controls over financial reporting. A “material weakness” is a significant deficiency or combination of significant deficiencies in internal control over financial reporting that results in a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected and corrected on a timely basis.