UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

GRANDPARENTS.COM, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No: |

| 3) | Filing party: |

| 4) | Date Filed: |

GRANDPARENTS.COM, INC.

589 Eighth Avenue, 6th Floor

New York, New York 10018

November 2, 2016

To Our Stockholders:

You are cordially invited to attend a virtual special meeting of stockholders of Grandparents.com, Inc. to be held at 10:00 A.M. Eastern Time, on Tuesday, November 29, 2016. The virtual special meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will not be able to attend the virtual special meeting in person. You will be able to attend the virtual special meeting of stockholders online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/GPCM. You also will be able to vote your shares electronically at the virtual special meeting. Details regarding how to attend the meeting online and the business to be conducted at the virtual special meeting are more fully described in this proxy statement.

Details regarding the meeting, the business to be conducted at the meeting, and information about Grandparents.com, Inc. that you should consider when you vote your shares are described in this proxy statement.

At the virtual special meeting, we will ask stockholders to consider the following proposals:

| 1. | To approve an amendment to our third amended and restated certificate of incorporation to increase the number of our authorized shares of common stock by 1,806,500,000, from 350,000,000 to 2,156,500,000 shares; |

| 2. | To approve an amendment to our third amended and restated certificate of incorporation to effect a reverse stock split of our issued and outstanding shares of common stock, at a ratio of one-for-ten, to occur after giving effect to any increase in the number of our authorized shares of common stock approved by our stockholders pursuant to Proposal 1; and |

| 3. | To approve an adjournment of the virtual special meeting of stockholders, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Proposals referred to in clauses (1) and (2). |

The Board of Directors recommends the approval of each of these proposals. Such other business will be transacted as may properly come before the virtual special meeting.

We hope you will be able to attend the virtual special meeting. Whether you plan to attend the virtual special meeting or not, it is important that you cast your vote either at the virtual meeting or by proxy. You may vote over the Internet as well as by telephone or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in this proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of Grandparents.com, Inc. We look forward to seeing you at the virtual special meeting.

| Sincerely, | ||

| /s/ Steven E. Leber | ||

| Steven E. Leber | ||

| Chief Executive Officer | ||

| Grandparents.com, Inc. |

2

GRANDPARENTS.COM, INC.

589 Eighth Avenue, 6th Floor

New York, New York 10018

November 2, 2016

NOTICE OF VIRTUAL SPECIAL MEETING OF STOCKHOLDERS

TIME: 10:00 A.M., local time

DATE: Tuesday, November 29, 2016

PLACE: Online at www.virtualshareholdermeeting.com/GPCM

PURPOSES:

| 1. | To approve an amendment to our third amended and restated certificate of incorporation to increase the number of our authorized shares of common stock by 1,806,500,000, from 350,000,000 to 2,156,500,000 shares; |

| 2. | To approve an amendment to our third amended and restated certificate of incorporation to effect a reverse stock split of our issued and outstanding shares common stock, at a ratio of one-for-ten, to occur after giving effect to any increase in the number of our authorized shares of common stock approved by our stockholders pursuant to Proposal 1; and |

| 3. | To approve an adjournment of the virtual special meeting of stockholders, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Proposals referred to in clauses (1) and (2). |

WHO MAY VOTE:

You may vote if you were the record owner of our common stock or our Series C Redeemable Convertible 7.5% Preferred Stock, which we refer to as our Series C Preferred, at the close of business on November 2, 2016. A list of stockholders of record will be available at the virtual special meeting and, during the 10 days prior to the virtual special meeting, at our principal executive offices located at 589 Eighth Avenue, 6th Floor, New York, New York 10018.

All stockholders are cordially invited to attend the virtual special meeting. Whether you plan to attend the virtual special meeting or not, we urge you to vote and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

| Sincerely, | ||

| /s/ Steven E. Leber | ||

| Steven E. Leber | ||

| Chief Executive Officer | ||

| Grandparents.com, Inc. |

3

TABLE OF CONTENTS

Appendices

| Appendix A — | Form of Certificate of Amendment to Third Amended and Restated Certificate of Incorporation to Effect an Increase in Authorized Shares |

| Appendix B — | Form of Certificate of Amendment to Third Amended and Restated Certificate of Incorporation to Effect Reverse Stock Split |

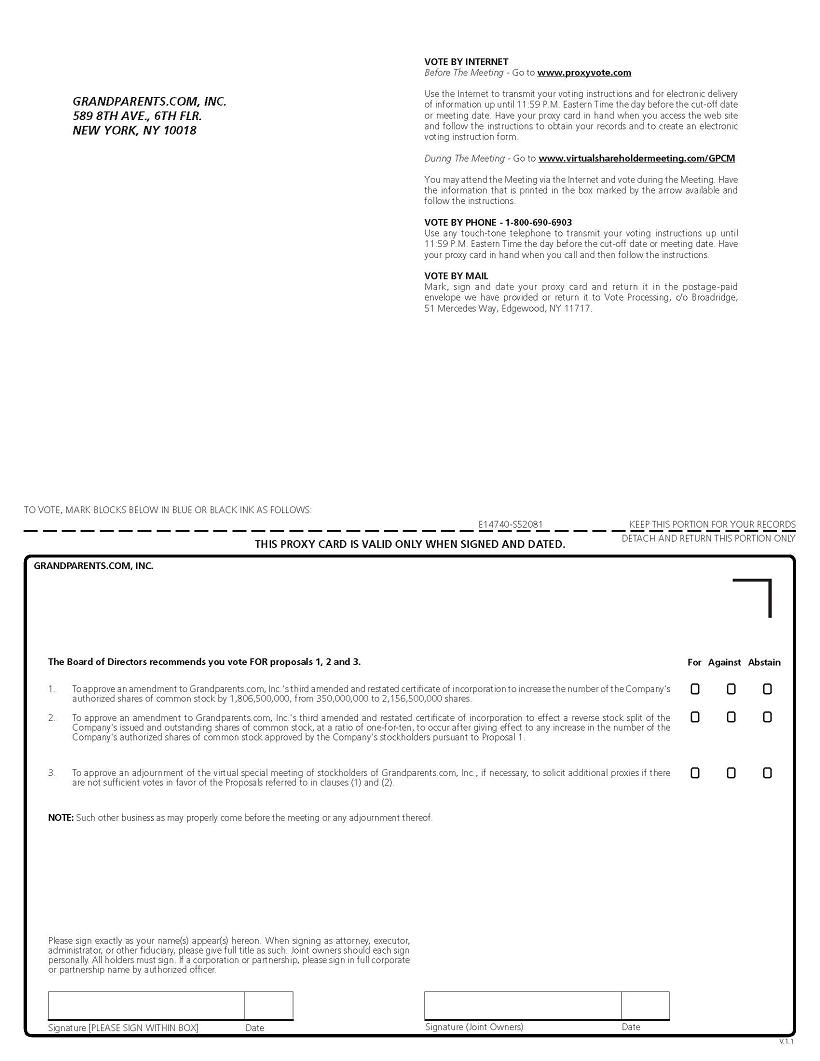

| Appendix C — | Form of Proxy Card |

4

GRANDPARENTS.COM, INC.

589 Eighth Avenue, 6th Floor

New York, New York 10018

PROXY STATEMENT FOR THE GRANDPARENTS.COM, INC.

VIRTUAL SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 29, 2016

This proxy statement, along with the accompanying notice of the virtual special meeting of stockholders, contains information about the virtual special meeting of stockholders of Grandparents.com, Inc., including any adjournments or postponements of the virtual special meeting. We are holding the virtual special meeting at 10:00 A.M. Eastern Time, on Tuesday, November 29, 2016. The virtual special meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will not be able to attend the virtual special meeting in person.

In this proxy statement, we refer to Grandparents.com, Inc. as “Grandparents.com,” “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our Board of Directors for use at the virtual special meeting.

On or about November 7, 2016, we began sending this proxy statement, the attached Notice of Virtual Special Meeting of Stockholders and the enclosed proxy card to all stockholders entitled to vote at the virtual special meeting.

5

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON NOVEMBER 29, 2016

This proxy statement is available for viewing, printing and downloading at www.proxyvote.com. To view these materials please have your 12-digit control number(s) available that appears on your proxy card. On this website, you can also elect to receive future distributions of our proxy statements and reports to stockholders by electronic delivery.

6

IMPORTANT INFORMATION ABOUT THE VIRTUAL SPECIAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

The Board of Directors of Grandparents.com, Inc. is soliciting your proxy to vote at the virtual special meeting of stockholders to be held on Tuesday, November 29, 2016, at 10:00 A.M. Eastern Time, and any adjournments or postponements of the meeting, which we refer to as the virtual special meeting. The proxy statement along with the accompanying Notice of Virtual Special Meeting of Stockholders summarizes the purposes of the meeting and the information you need to know to vote at the virtual special meeting.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Virtual Special Meeting of Stockholders and the proxy card because you owned shares of our common stock on the record date. We intend to commence distribution of the proxy materials to stockholders on or about November 7, 2016.

Why is the Company seeking approval for the increase in authorized shares?

On September 15, 2016, we entered into a securities purchase agreement with VB Funding, LLC. Pursuant to the terms of the transaction, we agreed that we will solicit the vote of our stockholders for an increase in the number of shares of common stock that we are authorized to issue to 2,156,500,000 shares. In the event we implement the reverse stock split and determine the increase in the authorized shares is not in the best interest of our stockholders, we reserve the right not to adopt the increase in the authorized shares.

Pursuant to the terms of the transaction, VB Funding, LLC, required as a condition to closing that the holders of Series C Preferred shall have the option to convert their shares of Series C Preferred into shares of the Company's common stock at a discounted rate of $0.05 per share. Additionally, VB Funding, LLC, required as a condition to closing that all shares of Series C Preferred held by directors, officers and executives of the Company be converted into shares of the Company's common stock at a discounted rate of $0.05 per share. The Series C Preferred was issued in 2015 for $2.00 per share, with an initial conversion price of $0.20. This option to convert therefore represents a discount of $0.15 per share from the original conversion price. The option shall take effect immediately following the effective date of the amendments to the Company's third amended and restated certificate of incorporation, which will be filed in the event that Proposals 1 and 2 are approved by the Company's stockholders at the virtual special meeting. The option to convert does not affect the voting rights of the holders of Series C Preferred at the virtual special meeting. For more information, please see the section entitled "How Many Votes Do I Have?" below.

For more information, see “Proposal 1: Approval of Increase in Authorized Shares” contained elsewhere in this proxy statement.

Why is the Company seeking approval for the reverse stock split?

On September 15, 2016, we entered into a securities purchase agreement with VB Funding, LLC. Pursuant to the terms of the transaction, we agreed that we will solicit the vote of our stockholders for the reverse stock split. The Board of Directors has approved the reverse stock split in connection with its obligations under the securities purchase agreement.

For more information, see “Proposal 2: Approval of Reverse Stock Split” contained elsewhere in this proxy statement.

Who Can Vote?

Only stockholders who owned shares of our common stock or our Series C Preferred at the close of business on November 2, 2016 are entitled to vote at the virtual special meeting. On this record date, there were 202,268,582 shares of our common stock outstanding and entitled to vote and 875,000 shares of our Series C Preferred outstanding and entitled to vote on an as-converted basis, such that our Series C Preferred stockholders are entitled to a total of 8,750,000 votes. Our common stock and our Series C Preferred are our only classes of voting stock and vote together as a single class on each of the proposals described in this proxy statement.

You do not need to attend the virtual special meeting to vote your shares. Shares represented by valid proxies, received in time for the virtual special meeting and not revoked prior to the virtual special meeting, will be voted at the virtual special meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote. Each share of our Series C Preferred that you own entitles you to the number of votes equal to the number of shares of common stock into which your shares of Series C Preferred could have been converted on the record date. This number is obtained by dividing the stated value of your Series C Preferred ($2.00) by the conversion price in effect on the record date ($0.20).

7

How Do I Vote?

Whether you plan to attend the virtual special meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares should be voted for, against or abstain with respect to each of the proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with our Board of Directors’ recommendations as noted below. Voting by proxy will not affect your right to attend the virtual special meeting. If your shares are registered directly in your name through our stock transfer agent, Computershare Trust Company, N.A., or you have stock certificates registered in your name, you may vote:

| · | By Internet or by telephone. Follow the instructions included in the proxy card to vote by Internet or telephone. |

| · | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with our Board of Directors’ recommendations as noted below. |

| · | At the meeting. The virtual special meeting will be held entirely online to allow greater participation. Stockholders may participate in the virtual special meeting by visiting the following website: www.virtualshareholdermeeting.com/GPCM. To participate in the virtual special meeting, you will need the 12-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. Shares held in your name as the stockholder of record and shares for which you are the beneficial owner but not the stockholder of record may be voted electronically during the virtual special meeting. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on November 28, 2016.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares at the virtual special meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The Board of Directors recommends that you vote as follows:

| · | “FOR” the amendment to our third amended and restated certificate of incorporation to increase the number of shares of our authorized shares of common stock by 1,806,500,000, from 350,000,000 to 2,156,500,000 shares; |

| · | “FOR” the amendment to our third amended and restated certificate of incorporation to effect a reverse stock split of our common stock, par value $0.01 per share, at a ratio of one-for-ten, to occur after giving effect to any increase in the number of our authorized shares of common stock approved by our stockholders pursuant to Proposal 1; and |

| · | “FOR” adjournment of our virtual special meeting of stockholders, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Proposals referred to in bullet points (1) and (2). |

If any other matter is presented at the virtual special meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the virtual special meeting, other than those discussed in this proxy statement.

8

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the virtual special meeting. You may change or revoke your proxy in any one of the following ways:

| · | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| · | by re-voting by Internet or by telephone as instructed above; |

| · | by notifying our Secretary in writing before the virtual special meeting that you have revoked your proxy; or |

| · | by attending the virtual special meeting and voting there. Attending the virtual special meeting will not in and of itself revoke a previously submitted proxy. You must specifically request at the virtual special meeting that it be revoked. |

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares on the increase to the number of our authorized shares (Proposal 1 of this proxy statement) and the reverse stock split (Proposal 2 of this proxy statement) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the virtual special meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

| Proposal 1: Approval of Increase in Number of Authorized Shares | The affirmative vote of the holders of a majority of the outstanding shares of our common stock and Series C Preferred (voting on an as-converted basis) entitled to vote on the matter either in person or by proxy at the virtual special meeting, voting together as a single class, is required to approve the amendment to our third amended and restated certificate of incorporation to increase the number of our authorized shares of common stock. Abstentions will be treated as votes against this proposal. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. | |

| Proposal 2: Approval of Reverse Stock Split | The affirmative vote of the holders of a majority of the outstanding shares of our common stock and Series C Preferred (voting on an as-converted basis) entitled to vote on the matter either in person or by proxy at the virtual special meeting, voting together as a single class, is required to approve the amendment to our third amended and restated certificate of incorporation to effect a reverse stock split of our common stock. Abstentions will be treated as votes against this proposal. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. |

9

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspector of Election examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make, on the proxy card or otherwise provide.

Where Can I Find the Voting Results of the Virtual Special Meeting?

The preliminary voting results will be announced at the virtual special meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the virtual special meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Virtual Special Meeting?

The presence, in person or by proxy, of the holders of shares of our common stock and Series C Preferred representing a majority of the voting power of all outstanding shares of our common stock and Series C Preferred, voting together as a single class, entitled to vote at the virtual special meeting is necessary to constitute a quorum at the virtual special meeting. Votes of stockholders of record who are present at the virtual special meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Attending the Virtual Special Meeting

The virtual special meeting will be held at 10:00 A.M. Eastern Time, on Tuesday, November 29, 2016. The virtual special meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will not be able to attend the virtual special meeting in person. You will be able to attend the virtual special meeting of stockholders online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/GPCM. You need not attend the virtual special meeting in order to vote.

Householding of Disclosure Documents

SEC rules concerning the delivery of disclosure documents allow us or your broker to send a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family.

This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

10

If your household received a single set of proxy materials, but you would prefer to receive your own copy, please contact Elena Fries via email at ir@grandparents.com or by calling 1-646-839-8800.

If you do not wish to participate in “householding” and would like to receive your own set of our proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another of our stockholder and together both of you would like to receive only a single set of proxy materials, follow these instructions:

| · | If your shares are registered in your own name, please contact Computershare Trust Company, N.A., and inform them of your request by calling them at 502-301-6093. |

| · | If a broker or other nominee holds your shares, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number. |

Electronic Delivery of Company Stockholder Communications

Most stockholders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail.

You can choose this option and save the Company the cost of producing and mailing these documents by:

| · | following the instructions provided on your proxy card; |

| · | following the instructions provided when you vote over the Internet; or |

| · | going to www.proxyvote.com and following the instructions provided. |

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding shares of our common stock and Series C Preferred beneficially owned as of November 2, 2016, for (i) each named executive officer and each director, (ii) all current executive officers and directors as a group and (iii) each stockholder known to be the beneficial owner of five percent (5%) or more of our outstanding shares of our common stock or Series C Preferred. A person is considered to beneficially own any shares of common stock or Series C Preferred over which such person, directly or indirectly, exercises sole or shared voting or investment power, or of which such person has the right to acquire beneficial ownership at any time within sixty (60) days. For purposes of computing the percentage of shares of common stock or Series C Preferred beneficially owned by each person or group of persons named above, any shares that such person or group of persons has the right to acquire within sixty (60) days of November 2, 2016 are deemed to be outstanding, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, voting and investment power relating to the shares shown in the table for directors and executive officers will be exercised solely by the beneficial owner or shared by the owner and the owner’s spouse or children.

| Number of Shares of Common Stock Beneficially Owned | Percent of Shares of Common Stock Beneficially Owned(1) | Number of Shares of Common Stock Underlying Series C Preferred Beneficially Owned | Percent of Shares of Common Stock Underlying Series C Preferred Beneficially Owned(1) | |||||||||||||

| Named Executive Officers and Directors: | ||||||||||||||||

| Steven E. Leber(8) | 22,449,380 | (2) | 11.1 | % | 0 | * | ||||||||||

| Mel Harris | 17,786,500 | (3) | 8.8 | % | 3,487,500 | (3) | 25.7 | % | ||||||||

| Dr. Robert Cohen(8) | 16,293,531 | (4) | 8.1 | % | 0 | * | ||||||||||

| Louis P. Karol | 88,000 | (5) | * | 0 | * | |||||||||||

| Lee Lazarus | 5,120,000 | (6) | 2.5 | % | 0 | * | ||||||||||

| Ellen Breslau | 1,282,500 | (7) | * | 0 | * | |||||||||||

| Directors and Executive Officers as a Group (6 persons) (8) | 61,597,378 | (9) | 30.5 | % | 3,487,500 | (9) | * | |||||||||

| Other 5% Stockholders: | ||||||||||||||||

| CV Starr & Co. Inc. | 21,079,216 | (10) | 10.4 | % | 0 | * | ||||||||||

| Joseph E. Bernstein | 19,669,291 | (11) | 9.7 | % | 0 | * | ||||||||||

| VB Funding, LLC | 90,000,000 | (12) | 44.5 | % | 0 | * | ||||||||||

| SQP Limited | 0 | * | 1,937,500 | (13) | 14.3 | % | ||||||||||

| Paris Investments Limited | 0 | * | 1,937,500 | (14) | 14.3 | % | ||||||||||

| The Thomas K. Ireland Revocable Trust | 0 | * | 3,875,000 | (15) | 28.6 | % | ||||||||||

| JSK Partnership LLC | 0 | * | 2,325,000 | (16) | 17.1 | % | ||||||||||

* Less than 1%

| 1) | Based on 202,268,582 shares of common stock issued and outstanding as of November 2, 2016 and 13,562,500 shares of common stock underlying Series C Preferred issued and outstanding as of November 2, 2016. |

12

| 2) | Includes (i) 13,546,847 shares of common stock, (ii) 6,000,000 shares of common stock underlying options that have vested as of November 2, 2016, (iii) an aggregate of 1,480,000 shares of common stock underlying warrants that are presently exercisable and (iv) 1,422,533 shares of common stock in his capacity as a member of the board of managers of GP.com Holding Company, LLC (“GP Holding”). |

| 3) | Includes (i) 274,000 shares of common stock owned by Mr. Harris’ spouse, (ii) 2,020,000 shares of common stock owned by Mr. Harris, (iii) 105,000 shares of common stock held by a trust of which Mr. Harris is the sole trustee, (iv) 500,000 shares of common stock underlying options that have vested as of November 2, 2016, (v) an aggregate of 11,200,000 shares of common stock underlying warrants held by a trust of which Mr. Harris is the sole trustee and that are presently exercisable, (vi) 100,000 shares of common stock underlying warrants held by Mr. Harris that are presently exercisable, (vii) 2,362,500 shares of common stock underlying 225,000 shares of convertible preferred stock plus paid-in-kind accrued interest and (viii) 1,225,000 shares of common stock underlying warrants issued in connection with preferred stock. |

| 4) | Includes (i) 20,000 shares of common stock owned by Dr. Cohen, (ii) 12,510,998 shares of common stock held by Meadows Capital, LLC (“Meadows”), an entity controlled by Dr. Cohen, (iii) 1,000,000 shares of common stock underlying options that have vested as of November 2, 2016, (iv) an aggregate of 1,340,000 shares of common stock underlying warrants held of record by Dr. Cohen and Meadows that are presently exercisable and (v) 1,422,533 shares of common stock in his capacity as a member of the board of managers of GP Holding. |

| 5) | Includes 88,000 shares of common stock owned by Mr. Karol. |

| 6) | Includes (i) 20,000 shares of common stock owned by Mr. Lazarus, (ii) 4,100,000 shares of common stock underlying options that have vested as of November 2, 2016 and (iii) 1,000,000 shares of common stock underlying warrants that are presently exercisable. |

| 7) | Includes an aggregate of 1,282,500 shares of common stock underlying options that are exercisable or will become exercisable within sixty (60) days of November 2, 2016. |

| 8) | The board of managers of GP Holding has voting and investment power with respect to securities owned by GP Holding. Mr. Leber and Dr. Cohen, as the members of the board of managers of GP Holding, have the power to direct the receipt of dividends from, and the proceeds from the sale of, the securities beneficially owned by GP Holding. As a result, Mr. Leber and Dr. Cohen both may be deemed to have shared voting and investment power with respect to securities owned by GP Holding. |

| 9) | Includes (i) an aggregate of 30,007,378 shares of common stock beneficially owned by those listed, (ii) an aggregate of 12,862,500 shares of common stock underlying options that have vested as of November 2, 2016 for those listed, (iii) an aggregate of 20,000 shares of common stock underlying options that will vest within sixty (60) days of November 2, 2016 for those listed, (iv) an aggregate of 2,362,500 shares of common stock underlying 225,000 shares of convertible preferred stock plus paid-in-kind interest for those listed and (v) an aggregate of 16,345,000 shares of common stock underlying warrants that are exercisable or will become exercisable within sixty (60) days of November 2, 2016 by those listed. Mr. Leber and Dr. Cohen both share voting and dispositive power with respect to 1,422,533 shares of common stock in their capacities as members of the board of managers of GP Holding. |

| 10) | Includes (i) 4,000,000 shares of common stock owned by CV Starr & Co. Inc. and (ii) an aggregate of 17,079,216 shares of common stock underlying warrants issued to Starr Indemnity & Liability Company that are presently exercisable. The principal business address of each of CV Starr & Co. Inc. and Starr Indemnity & Liability Company is 399 Park Avenue, 17th Floor, New York, NY 10022. |

| 11) | Includes (i) 1,324,514 shares of common stock owned by Mr. Bernstein, (ii) 15,589,777 shares of common stock held by Bernstein-Nasser Investors, LLC, an entity beneficially owned by a trust whose trustee is Mr. Bernstein (“BNI”), (iii) 1,000,000 shares of common stock underlying options held of record by Mr. Bernstein that have vested as of November 2, 2016, (iv) an aggregate of 1,275,000 shares of common stock underlying warrants held of record by Mr. Bernstein that are presently exercisable and (v) an aggregate of 480,000 shares of common stock underlying warrants held of record by BNI that are presently exercisable. Based solely on information contained in Amendment No. 1 to Schedule 13D filed by GP Holding with the SEC on November 14, 2014. The principal address of Joseph E. Bernstein is 6663 Casa Grande Way, Delray Beach, Florida 33446. |

13

| 12) | Includes (i) 70,000,000 shares of common stock owned by VB Funding, LLC and its managing member, Vincent J. Dowling, Jr. based on information contained in Schedule 13G filed jointly by VB Funding, LLC and Vincent J. Dowling, Jr. with the SEC on September 26, 2016 and (ii) an aggregate of 20,000,000 shares of common stock underlying warrants held of record by VB Funding LLC that are presently exercisable. The principal address of each of VB Funding, LLC and Vincent J. Dowling, Jr. is 190 Farmington Avenue, Farmington, Connecticut 06032. |

| 13) | Includes (i) 1,312,500 shares of common stock underlying 125,000 shares of convertible preferred stock plus paid-in-kind accrued interest and (ii) 625,000 shares of common stock underlying warrants issued in connection with preferred stock. |

| 14) | Includes (i) 1,312,500 shares of common stock underlying 125,000 shares of convertible preferred stock plus paid-in-kind accrued interest and (ii) 625,000 shares of common stock underlying warrants issued in connection with preferred stock. |

| 15) | Includes (i) 2,625,000 shares of common stock underlying 125,000 shares of convertible preferred stock plus paid-in-kind accrued interest and (ii) 1,250,000 shares of common stock underlying warrants issued in connection with preferred stock. |

| 16) | Includes (i) 1,575,000 shares of common stock underlying 125,000 shares of convertible preferred stock plus paid-in-kind accrued interest and (ii) 750,000 shares of common stock underlying warrants issued in connection with preferred stock. |

14

PROPOSAL NO. 1: To approve an amendment to our third amended and restated certificate of incorporation to increase the number of our authorized shares of common stock by 1,806,500,000, from 350,000,000 to 2,156,500,000 shares

(Notice Item 1)

The Board of Directors has determined that it is advisable to increase our authorized common stock from 350,000,000 shares to 2,156,500,000 shares, pursuant to our obligation under the securities purchase agreement, dated as of September 15, 2016, by and between the Company and VB Funding, LLC (the “Purchase Agreement”), and has voted to recommend that the stockholders adopt an amendment to our third amended and restated certificate of incorporation effecting the proposed increase. The full text of the proposed amendment to the third amended and restated certificate of incorporation is attached to this proxy statement as Appendix A.

As of November 2, 2016, approximately 202,268,582 shares of our common stock were issued and outstanding and approximately an additional 121,164,586 shares were reserved for issuance upon the conversion of existing debt securities, exercise of warrants and exercise of options granted and vesting of restricted stock units granted. Accordingly, a total of approximately 26,566,832 shares of common stock is available for future issuance.

The Board of Directors believes it continues to be in our best interest to have sufficient additional authorized but unissued shares of common stock available in order to provide flexibility for corporate action in the future. Management believes that the availability of additional authorized shares for issuance from time to time in the Board of Directors’ discretion in connection with future financings, acquisitions, investment opportunities, stock splits or dividends or for other corporate purposes is desirable in order to avoid repeated separate amendments to our third amended and restated certificate of incorporation and the delay and expense incurred in holding special meetings of the stockholders to approve such amendments, however, we seek stockholders approval for the increase of the authorized shares due to our obligation under the Purchase Agreement. In the event we implement the reverse stock split and determine the increase in the authorized shares is not in the best interest of our stockholders, we reserve the right not to adopt the increase in the authorized shares.

We will not solicit further authorization by vote of the stockholders for the issuance of the additional shares of common stock proposed to be authorized, except as required by law, regulatory authorities or rules of the OTCQB or any other stock exchange on which our shares may then be listed. The issuance of additional shares of common stock could have the effect of diluting existing stockholder earnings per share, book value per share and voting power. Our stockholders do not have any preemptive right to purchase or subscribe for any part of any new or additional issuance of our securities.

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their ownership of shares of our common stock and Series C Preferred.

Vote Required and Board of Directors’ Recommendation

The affirmative vote of the holders of a majority of the shares of our common stock and Series C Preferred (voting on an as-converted basis) outstanding and entitled to vote on the matter either in person or by proxy at the virtual special meeting, voting together as a single class, is required to approve the amendment to our third amended and restated certificate of incorporation to effect the proposed increase in our authorized shares.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE TO APPROVE THE AMENDMENT TO OUR THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION, AND PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED IN FAVOR OF THE AMENDMENT UNLESS A STOCKHOLDER INDICATES OTHERWISE ON THE PROXY.

15

Proposal

No. 2: To approve an amendment to our third amended and restated certificate of incorporation to effect a reverse stock split of

our issued and outstanding shares of common stock, at a ratio of one-for-ten, to occur after giving effect to any increase in the

number of our authorized shares of common stock approved by our stockholders pursuant to Proposal 1

(Notice Item 2)

General

At our 2016 virtual special meeting of stockholders, holders of our common stock are being asked to approve the proposal that our Third Amended and Restated Certificate of Incorporation be amended to effect a reverse stock split of the issued and outstanding shares of common stock (such split to combine ten (10) of our outstanding shares of common stock into one (1) share of common stock). The full text of the proposed amendment to our Third Amended and Restated Certificate of Incorporation is attached to this proxy statement as Appendix B. If approved by the stockholders, the reverse stock split would become effective at a time to be designated by the Board of Directors, after giving effect to the increase in the number of our authorized shares of common stock discussed in Proposal 1, if such proposal is approved by our stockholders. The Board of Directors may effect only one reverse stock split as a result of this authorization. The Board of Directors’ decision as to whether and when to effect the reverse stock split will be based on a number of factors, including market conditions and existing and expected trading prices for our common stock. Even if the stockholders approve the reverse stock split, the Company reserves the right not to effect the reverse stock split if the Board of Directors does not deem it to be in the best interests of the Company and its stockholders to effect the reverse stock split. The reverse stock split, if authorized pursuant to this resolution and if deemed by the Board of Directors to be in the best interests of the Company and its stockholders, will be effected, if at all, at a time that is not later than December 15, 2016.

The proposed amendment to our Third Amended and Restated Certificate of Incorporation to effect the reverse stock split, as more fully described below, will effect the reverse stock split but will not change the number of authorized shares of common stock or preferred stock, or the par value of common stock or preferred stock. As of the date of this proxy statement, we do not have any current arrangements or understandings relating to the issuance of any additional shares of common stock following the reverse stock split, other than pursuant to a Securities Purchase Agreement, dated as of September 15, 2016, by and between us and VB Funding, LLC.

Purpose

On October 3, 2016, the Board of Directors approved the proposal authorizing the reverse stock split in order to comply with the terms of the securities purchase agreement, by and between the Company and VB Funding, LLC, dated as of September 15, 2016, pursuant to which the Company agreed to solicit the vote of the stockholders for the reverse stock split.

Principal Effects of the Reverse Stock Split

If the stockholders approve the proposal to authorize the Board of Directors to implement the reverse stock split and the Board of Directors implements the reverse stock split, we will amend the existing provision of Article Fourth of our Third Amended and Restated Certificate of Incorporation by adding the following paragraphs:

“Upon the effectiveness of this Certificate of Amendment of the Third Amended and Restated Certificate of Incorporation of the Corporation, the shares of the Corporation’s common stock issued and outstanding prior to the Effective Time and the shares of common stock issued and held in treasury of the Corporation immediately prior to the Effective Time shall automatically be reclassified into a smaller number of shares such that each ten (10) shares of the Corporation’s issued and outstanding common stock immediately prior to the Effective Time are reclassified into one (1) validly issued, fully paid and nonassessable share of common stock, without any further action by the Corporation or the holder thereof. No fractional shares of Corporation common stock will be issued as a result of the reverse stock split. Instead, stockholders of record who otherwise would be entitled to receive fractional shares, will be entitled to rounding up of their fractional share to the nearest whole share.

16

Each stock certificate that, immediately prior to the Effective Time, represented shares of common stock that were issued and outstanding immediately prior to the Effective Time shall, from and after the Effective Time, automatically and without the necessity of presenting the same for exchange, represent that the number of whole shares of common stock after the Effective Time into which the shares of common stock formerly represented by such certificate shall have been reclassified (as well as the right to receive a whole share in lieu of a fractional share of common stock), provided, however, that each person of record holding a certificate that represented shares of common stock that were issued and outstanding immediately prior to the Effective Time shall receive, upon surrender of such certificate, a new certificate evidencing and representing the number of whole shares of common stock after the Effective Time into which the shares of common stock formerly represented by such certificate shall have been reclassified (including the right to receive a whole share in lieu of a fractional share of common stock).

This Certificate of Amendment shall be effective on December 9, 2016 at 5:00 p.m., or at such other time as determined by the Board of Directors (the “Effective Time”).”

The reverse stock split will be effected simultaneously for all issued and outstanding shares of common stock and the exchange ratio will be the same for all issued and outstanding shares of common stock. The reverse stock split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, except to the extent that the reverse stock split results in any of our stockholders owning a fractional share that would be rounded up to the next highest whole share. Common stock issued pursuant to the reverse stock split will remain fully paid and nonassessable. The reverse stock split will not affect the Company continuing to be subject to the periodic reporting requirements of the Exchange Act. Following the reverse stock split, our common stock will continue to be listed on the OTCQB, under the symbol “GPCM,” although it would receive a new CUSIP number.

By approving this amendment, stockholders will approve the combination of ten (10) shares of common stock into one (1) share. The reverse stock split would take effect after giving effect to the increase in the number of our authorized shares of common stock discussed in Proposal 1, if such proposal is approved by our stockholders.

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates

If the certificate of amendment is approved by the Company’s stockholders, and if at such time the Board of Directors still believes that a reverse stock split is in the best interests of the Company and its stockholders, the Company will file the certificate of amendment with the Secretary of State of the State of Delaware at such time as the Board of Directors has determined the appropriate effective time for the reverse stock split. The Board of Directors may delay effecting the reverse stock split, if at all, until a time that is not later than December 15, 2016 without re-soliciting stockholder approval. The reverse stock split will become effective on the date that is one day after the date of filing of the certificate of amendment with the Secretary of State of the State of Delaware. Beginning on the effective date of the split, each certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares.

Book-Entry Shares

If the reverse stock split is effected, stockholders who hold uncertificated shares (i.e., shares held in book-entry form and not represented by a physical stock certificate), either as direct or beneficial owners, will have their holdings electronically adjusted automatically by our transfer agent (and, for beneficial owners, by their brokers or banks that hold in “street name” for their benefit, as the case may be) to give effect to the reverse stock split. Stockholders who hold uncertificated shares as direct owners will be sent a statement of holding from our transfer agent that indicates the number of post-reverse stock split shares of our common stock owned in book-entry form.

Certificated Shares

As soon as practicable after the effective date of the split, stockholders will be notified that the reverse stock split has been effected. We expect that our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders of pre-split shares will be asked to surrender to the exchange agent certificates representing pre-split shares in exchange for certificates representing post-split shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by us or our exchange agent. No new certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. Any pre-split shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-split shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

17

Fractional Shares

No fractional shares will be issued in connection with the reverse stock split. Stockholders of record on the effective date of the split who otherwise would be entitled to receive fractional shares because they hold a number of pre-split shares not evenly divisible by the number of pre-split shares for which each post-split share is to be exchanged, will in lieu of a fractional share, be entitled upon surrender to the exchange agent of certificates representing such pre-split shares, to receive one (1) whole share of common stock by virtue of rounding up such fractional share to the next highest whole share. The ownership of such a whole share will give the holder thereof the same voting, dividend, and other rights as are held by other holders of common stock.

Stockholders should be aware that receipt of a whole share of common stock resulting from the rounding up of a fractional share interest to the next highest whole share may have tax consequences. Each holder should seek advice based on the holder’s particular circumstances from an independent tax advisor.

Accounting Matters

The par value per share of our common stock will remain unchanged at $0.01 per share after the reverse stock split. As a result, on the effective date of the reverse stock split, the stated capital on our consolidated balance sheet attributable to our common stock will be reduced and the additional paid-in-capital account will be increased by the amount by which the stated capital is reduced. Per share net income or loss will be increased because there will be fewer shares of our common stock outstanding. We do not anticipate that any other accounting consequences will arise as a result of the reverse stock split.

Effect on Par Value

The proposed amendment to our Third Amended and Restated Certificate of Incorporation will not affect the par value of our common stock, which will remain at $0.01 per share.

Potential Anti-Takeover Effect

Although the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Board of Directors or contemplating a tender offer or other transaction for the combination of the Company with another company), the reverse stock split proposal is not being proposed in response to any effort of which we are aware to accumulate shares of our common stock or obtain control of the Company, nor is it part of a plan by management to recommend a series of similar amendments to the Board of Directors and stockholders. Other than the reverse stock split proposal, the Board of Directors does not currently contemplate recommending the adoption of any other actions that could be construed to affect the ability of third parties to take over or change control of the Company.

No Dissenters’ Rights

Under the Delaware General Corporation Law, the Company’s stockholders are not entitled to dissenters’ rights with respect to the reverse stock split, and the Company will not independently provide stockholders with any such right.

Material United States Federal Income Tax Consequences of the Reverse Stock Split

The following is not intended as tax or legal advice. Each holder should seek advice based on his, her or its particular circumstances from an independent tax advisor.

18

The following discussion describes the anticipated material United States federal income tax consequences to “U.S. holders” (as defined below) of our capital stock relating to the reverse stock split. This discussion is based upon the Internal Revenue Code of 1986, as amended (the “Code”), Treasury Regulations promulgated thereunder, judicial authorities, published positions of the Internal Revenue Service (“IRS”), and other applicable authorities, all as currently in effect and all of which are subject to change or differing interpretations (possibly with retroactive effect). We have not obtained a ruling from the IRS or an opinion of legal or tax counsel with respect to the tax consequences of the reverse stock split and there can be no assurance the IRS will not challenge the statements set forth below or that a court would not sustain any such challenge. The following discussion is for information purposes only and is not intended as tax or legal advice.

For purposes of this discussion, the term “U.S. holder” means a beneficial owner of our capital stock that is for United States federal income tax purposes:

| (i) | an individual citizen or resident of the United States; |

| (ii) | a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) organized under the laws of the United States, any state or the District of Columbia; |

| (iii) | an estate with income subject to United States federal income tax regardless of its source; or |

| (iv) | a trust that (a) is subject to primary supervision by a United States court and for which United States persons control all substantial decisions or (b) has a valid election in effect under applicable Treasury Regulations to be treated as a United States person. |

This discussion assumes that a U.S. holder holds our capital stock as a capital asset within the meaning of Code Section 1221. This discussion does not address all of the tax consequences that may be relevant to a particular stockholder or to stockholders that are subject to special treatment under United States federal income tax laws including, but not limited to, financial institutions, tax-exempt organizations, insurance companies, regulated investment companies, persons that are broker-dealers, traders in securities who elect the mark-to-market method of accounting for their securities, or stockholders holding their shares of our capital stock as part of a “straddle,” “hedge,” “conversion transaction” or other integrated transaction. In addition, this discussion does not address other United States federal taxes (such as gift or estate taxes or alternative minimum taxes), the tax consequences of the reverse stock split under state, local or foreign tax laws or certain tax reporting requirements that may be applicable with respect to the reverse stock split.

If a partnership (or other entity treated as a partnership for United States federal income tax purposes) is a stockholder, the tax treatment of a partner in the partnership or any equity owner of such other entity will generally depend upon the status of the person and the activities of the partnership or other entity treated as a partnership for United States federal income tax purposes.

Tax Consequences of the Reverse Stock Split Generally

We believe that the reverse stock split should qualify as a “recapitalization” under Section 368(a)(1)(E) of the Code. Accordingly:

| · | A U.S. holder will not recognize any gain or loss as a result of the reverse stock split. |

| · | A U.S. holder’s aggregate tax basis in his, her or its post-reverse stock split shares will be equal to the aggregate tax basis in the pre-reverse stock split shares exchanged therefor. |

| · | A U.S. holder’s holding period for the post-reverse stock split shares will include the period during which such stockholder held the pre-reverse stock split shares surrendered in the reverse stock split. |

Treasury Regulations promulgated under the Code provide detailed rules for allocating the tax basis and holding period of the shares of our common stock surrendered to the shares of our common stock received pursuant to the reverse stock split. Holders of shares of our common stock who acquired their shares on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares among their post-reverse stock split shares.

19

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their ownership of shares of our common stock.

Reservation of Right to Abandon Reverse Stock Split

We reserve the right to not file the Certificate of Amendment and to abandon any reverse stock split without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of State of the State of Delaware of the Certificate of Amendment, even if the authority to effect these amendments is approved by our stockholders at the virtual special meeting. By voting in favor of a reverse stock split, you are expressly also authorizing the Board of Directors to delay, not proceed with, and abandon, these proposed amendments if it should so decide, in its sole discretion, that such action is in the best interests of our stockholders.

Vote Required and Board of Directors’ Recommendation

The affirmative vote of the holders of a majority of the shares of our common stock and Series C Preferred (voting on an as-converted basis) outstanding and entitled to vote on the matter either in person or by proxy at the virtual special meeting, voting together as a single class, is required to approve the amendment to our third amended and restated certificate of incorporation to effect a reverse stock split of our common stock.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE TO AUTHORIZE THE BOARD OF DIRECTORS IN ITS DISCRETION TO AMEND THE THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF THE ISSUED AND OUTSTANDING SHARES OF OUR COMMON STOCK (SUCH SPLIT TO COMBINE TEN (10) OUTSTANDING SHARES OF OUR COMMON STOCK INTO ONE (1) SHARE OF OUR COMMON STOCK), to occur after giving effect to any increase in the number of our authorized shares of common stock approved by our stockholders pursuant to Proposal 1, AND PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED IN FAVOR OF THE AMENDMENT UNLESS A STOCKHOLDER INDICATES OTHERWISE ON THE PROXY.

20

PROPOSAL NO. 3: TO APPROVE THE ADJOURNMENT

OF THE VIRTUAL SPECIAL MEETING,

IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES

IN FAVOR OF PROPOSALS 1 AND 2

(Notice Item 3)

We are asking our stockholders to vote on a proposal to approve the adjournment of the virtual special meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposals 1 and 2.

Vote Required and Board of Directors’ Recommendation

Approval of the adjournment of the virtual special meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Proposals 1 and 2 requires the affirmative vote of the holders of a majority of the shares of common stock and Series C Preferred (voting on an as-converted basis) present and entitled to vote either in person or by proxy at the virtual special meeting, voting together as a single class. A “broker non-vote” or a failure to submit a proxy or vote at the virtual special meeting will have no effect on the outcome of the vote for this Proposal No. 3. For purposes of the vote on this Proposal No. 3, an abstention will have the same effect as a vote “AGAINST” such proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADJOURNMENT OF THE VIRTUAL SPECIAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES IN FAVOR OF PROPOSALS 1 AND 2.

21

The Board of Directors knows of no other business which will be presented to the virtual special meeting. If any other business is properly brought before the virtual special meeting, proxies will be voted in accordance with the judgment of the persons named therein.

To be considered for inclusion in the proxy statement relating to our next annual meeting of stockholders, we must receive stockholder proposals (including for director nominations) a reasonable time before we begin to print and send our proxy materials and in accordance with the relevant provisions of our By-Laws. Proposals that are not received in a timely manner will not be voted on at the next annual meeting. If a proposal is received on time, the proxies that management solicits for the meeting may still exercise discretionary voting authority on the proposal under circumstances consistent with the proxy rules of the SEC. All stockholder proposals should be marked for the attention of Grandparents.com, Inc., Office of the Secretary, 589 Eighth Avenue, 6th Floor, New York, New York 10018.

New York, New York

November 2, 2016

22

APPENDIX A

FORM OF CERTIFICATE OF AMENDMENT

OF THE

THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

GRANDPARENTS.COM, INC.

Grandparents.com, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), hereby certifies as follows:

| 1. | The name of the Corporation is “Grandparents.com, Inc.” |

| 2. | The date of filing of the Corporation’s original Certificate of Incorporation with the Secretary of State of the State of Delaware (the “Secretary of State”) was May 9, 1996, under the name Pacific Biometrics, Inc. (the “Original Certificate of Incorporation”). The Original Certificate of Incorporation was amended and restated by the Amended and Restated Certificate of Incorporation of the Corporation filed with the Secretary of State on July 29, 1996 (the “First Amended and Restated Certificate of Incorporation”). The First Amended and Restated Certificate of Incorporation was amended and restated by the Second Amended and Restated Certificate of Incorporation of the Corporation filed with the Secretary of State on December 17, 2009 (the “Second Amended and Restated Certificate of Incorporation”). On September 1, 2011, the Corporation filed an amendment to the Second Amended and Restated Certificate of Incorporation with the Secretary of State to change its corporate name to NorWesTech, Inc. On February 22, 2012, the Corporation filed Certificates of Designation with the Secretary of State designating the rights, preferences and terms of the Corporation’s Series A Convertible Preferred Stock, par value $0.01 per share (the “Series A Certificate of Designation”), and a Certificate of Designation designating the rights, preferences and terms of the Corporation’s Series B Convertible Preferred Stock, par value $0.01 per share (the “Series B Certificate of Designation”). On February 23, 2012, the Corporation filed a Certificate of Ownership and Merger with the Secretary of State to effect a short form merger of its wholly owned subsidiary with and into the Corporation and, in connection therewith, to further amend the Second Amended and Restated Certificate of Incorporation, as amended, to change its corporate name to Grandparents.com, Inc. On May 9, 2012, the Corporation filed a Second Certificate of Amendment to the Second Amended and Restated Certificate of Incorporation, as amended, with the Secretary of State to increase its authorized shares of capital stock. On March 4, 2014, the Corporation filed Certificates of Elimination with the Secretary of State to eliminate the Series A Certificate of Designation and the Series B Certificate of Designation from the Second Amended and Restated Certificate of Incorporation, as amended. The Second Amended and Restated Certificate of Incorporation was amended and restated by the Third Amended and Restated Certificate of Incorporation of the Corporation filed with the Secretary of State on March 2, 2014 (the “Third Amended and Restated Certificate of Incorporation”). On September 28, 2015, the Corporation filed a Certificate of Designation with the Secretary of State designating the rights, preferences and terms of the Corporation’s Series C Convertible Preferred Stock, par value $0.01 per share (the “Series C Certificate of Designation”). |

| 3. | The Board of Directors of the Corporation (the “Board”), acting in accordance with the provisions of Sections 141 and 242 of the General Corporation Law of the State of Delaware (the “DGCL”), adopted resolutions amending the Corporation’s Third Amended and Restated Certificate of Incorporation as follows: |

The first sentence of Article Fourth of the Corporation’s Third Amended and Restated Certificate of Incorporation is hereby amended and restated in its entirety to read as follows:

“The total number of shares of capital stock which the Corporation shall have the authority to issue is two billion, one hundred sixty-one million, five hundred thousand (2,161,500,000) shares, two billion, one hundred fifty-six million, five hundred thousand (2,156,500,000) shares of which shall be Common Stock and five million (5,000,000) shares of which shall be Preferred Stock.

This Certificate of Amendment shall be effective on [ ], 2016 at [ ] p.m. (the “Effective Time”).”

| 4. | Thereafter, pursuant to a resolution of the Board, this Certificate of Amendment was submitted to the stockholders of the Corporation for their approval, and was duly adopted in accordance with the provisions of Sections 222 and 242 of the DGCL. |

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be duly executed on its behalf by an authorized officer on this [ ] day of [ ], 2016.

| GRANDPARENTS.COM, INC. | ||

| By: | ||

| Name: | ||

| Title | ||

APPENDIX B

FORM OF CERTIFICATE OF AMENDMENT

OF THE

THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

GRANDPARENTS.COM, INC.

Grandparents.com, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), hereby certifies as follows:

| 1. | The name of the Corporation is “Grandparents.com, Inc.” |

| 2. | The date of filing of the Corporation’s original Certificate of Incorporation with the Secretary of State of the State of Delaware (the “Secretary of State”) was May 9, 1996, under the name Pacific Biometrics, Inc. (the “Original Certificate of Incorporation”). The Original Certificate of Incorporation was amended and restated by the Amended and Restated Certificate of Incorporation of the Corporation filed with the Secretary of State on July 29, 1996 (the “First Amended and Restated Certificate of Incorporation”). The First Amended and Restated Certificate of Incorporation was amended and restated by the Second Amended and Restated Certificate of Incorporation of the Corporation filed with the Secretary of State on December 17, 2009 (the “Second Amended and Restated Certificate of Incorporation”). On September 1, 2011, the Corporation filed an amendment to the Second Amended and Restated Certificate of Incorporation with the Secretary of State to change its corporate name to NorWesTech, Inc. On February 22, 2012, the Corporation filed Certificates of Designation with the Secretary of State designating the rights, preferences and terms of the Corporation’s Series A Convertible Preferred Stock, par value $0.01 per share (the “Series A Certificate of Designation”), and a Certificate of Designation designating the rights, preferences and terms of the Corporation’s Series B Convertible Preferred Stock, par value $0.01 per share (the “Series B Certificate of Designation”). On February 23, 2012, the Corporation filed a Certificate of Ownership and Merger with the Secretary of State to effect a short form merger of its wholly owned subsidiary with and into the Corporation and, in connection therewith, to further amend the Second Amended and Restated Certificate of Incorporation, as amended, to change its corporate name to Grandparents.com, Inc. On May 9, 2012, the Corporation filed a Second Certificate of Amendment to the Second Amended and Restated Certificate of Incorporation, as amended, with the Secretary of State to increase its authorized shares of capital stock. On March 4, 2014, the Corporation filed Certificates of Elimination with the Secretary of State to eliminate the Series A Certificate of Designation and the Series B Certificate of Designation from the Second Amended and Restated Certificate of Incorporation, as amended. The Second Amended and Restated Certificate of Incorporation was amended and restated by the Third Amended and Restated Certificate of Incorporation of the Corporation filed with the Secretary of State on March 2, 2014 (the “Third Amended and Restated Certificate of Incorporation”). On September 28, 2015, the Corporation filed a Certificate of Designation with the Secretary of State designating the rights, preferences and terms of the Corporation’s Series C Convertible Preferred Stock, par value $0.01 per share (the “Series C Certificate of Designation”). |

| 3. | The Board of Directors of the Corporation (the “Board”), acting in accordance with the provisions of Sections 141 and 242 of the General Corporation Law of the State of Delaware (the “DGCL”), adopted resolutions amending the Corporation’s Third Amended and Restated Certificate of Incorporation as follows: |

Article Fourth of the Corporation’s Third Amended and Restated Certificate of Incorporation is hereby amended by adding the following language to the end of Article Fourth:

“Upon the effectiveness of this Certificate of Amendment of the Third Amended and Restated Certificate of Incorporation of the Corporation, the shares of the Corporation’s common stock issued and outstanding prior to the Effective Time and the shares of common stock issued and held in treasury of the Corporation immediately prior to the Effective Time shall automatically be reclassified into a smaller number of shares such that each ten (10) shares of the Corporation’s issued and outstanding common stock immediately prior to the Effective Time are reclassified into one (1) validly issued, fully paid and nonassessable share of common stock, without any further action by the Corporation or the holder thereof. No fractional shares of Corporation common stock will be issued as a result of the reverse stock split. Instead, stockholders of record who otherwise would be entitled to receive fractional shares, will be entitled to rounding up of their fractional share to the nearest whole share.

Each stock certificate that, immediately prior to the Effective Time, represented shares of common stock that were issued and outstanding immediately prior to the Effective Time shall, from and after the Effective Time, automatically and without the necessity of presenting the same for exchange, represent that the number of whole shares of common stock after the Effective Time into which the shares of common stock formerly represented by such certificate shall have been reclassified (as well as the right to receive a whole share in lieu of a fractional share of common stock), provided, however, that each person of record holding a certificate that represented shares of common stock that were issued and outstanding immediately prior to the Effective Time shall receive, upon surrender of such certificate, a new certificate evidencing and representing the number of whole shares of common stock after the Effective Time into which the shares of common stock formerly represented by such certificate shall have been reclassified (including the right to receive a whole share in lieu of a fractional share of common stock).

This Certificate of Amendment shall be effective on [ ], 2016 at [ ] p.m. (the “Effective Time”).”

| 4. | Thereafter, pursuant to a resolution of the Board, this Certificate of Amendment was submitted to the stockholders of the Corporation for their approval, and was duly adopted in accordance with the provisions of Sections 222 and 242 of the DGCL. |

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be duly executed on its behalf by an authorized officer on this [ ] day of [ ], 2016.

| GRANDPARENTS.COM, INC. | ||

| By: | ||

| Name: | ||

| Title: | ||

APPENDIX C

PROXY CARD