UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07763

Litman Gregory Funds Trust

(Exact name of registrant as specified in charter)

4 Orinda Way, Suite 200-D, Orinda,

CA 94563

(Address of principal executive offices) (Zip code)

Kenneth E. Gregory

4 Orinda Way, Suite 200-D

Orinda, CA 94563

(Name and address of agent for service)

(925) 254-8999

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Item 1. Reports to Stockholders.

Litman Gregory Masters Funds Concept

| Investment Philosophy: Alternative Strategies Fund |

The Alternative Strategies Fund was created based on the following fundamental beliefs:

First, Litman Gregory believes it is possible to identify investment managers who will deliver superior long-term performance relative to their passive benchmarks and peer groups. This belief is based on Litman Gregory’s extensive experience evaluating managers and mutual funds on behalf of their clients. The four managers in this fund were chosen for their specialized and demonstrated expertise, as well as for their complementary, non-correlated investment approaches.

Second, not only do we want high-quality managers, but we want to offer access to them at an acceptable cost. We spent the last couple of years engaged in research to find the right mix of managers we believe can deliver on both fronts.

Third, this fund doesn’t seek to simply replicate what each manager is already doing elsewhere, but to bring investors additional value-add through flexibility, concentration, and the ability to be more opportunistic.

| The Litman Gregory Masters Alternative Strategies Fund Concept |

The Alternative Strategies Fund is a multi-manager fund that combines alternative and absolute-return -oriented strategies chosen based on Litman Gregory’s conviction that each individual strategy is compelling and that collectively the overall fund portfolio is well diversified. This fund is intended to complement traditional stock and bond portfolios by offering diversification, seeking to reduce volatility, and to potentially enhance returns relative to various measures of risk.

This fund will contain many risk-control factors including the selection of strategies that seek lower risk exposure than conventional stock or stock-bond strategies, the risk-sensitive nature of the managers, the skill of the managers, and the overall strategy diversification.

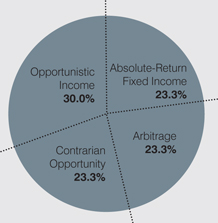

Typically, each manager will run 25% of the portfolio, but Litman Gregory may tactically alter the managers’ allocations to attempt to take advantage of particularly compelling opportunities for a specific strategy or to further manage risk. We will have a high hurdle for making a tactical allocation shift and don’t expect such top-down shifts to happen frequently.

| Investment Philosophy: The Equity Funds |

Our equity funds are based on two fundamental beliefs:

First, it is possible to identify investment managers who will deliver superior long-term performance relative to their passive benchmarks and peer groups. This belief is based on our extensive experience evaluating stock pickers and mutual funds on behalf of our investment management clients.

Second, that most stock pickers have an unusually high level of conviction in only a small number of stocks and that a portfolio limited to these stocks will, on average, outperform a more diversified portfolio over a market cycle. However, most stock pickers typically manage portfolios that are diversified beyond these highest-conviction holdings in order to reduce risk and to facilitate the management of the larger amounts of money they oversee.

| The Concept Behind Our Equity Funds |

Based on the above beliefs, these funds seek to isolate the stock-picking skills of a group of highly regarded investment managers. To meet this objective, the funds are designed with both risk and return in mind, placing particular emphasis on the following factors:

| • | We only choose stock pickers we believe to be exceptionally skilled. |

| • | Each stock picker runs a very concentrated sub-portfolio of not more than 15 of his or her “highest-conviction” stocks. In the Focused Opportunities Fund, each stock picker may own no more than seven stocks. |

| • | Although each manager’s portfolio is concentrated, our equity funds seek to manage risk partly by building diversification into each fund. |

| ° | The Equity and International funds offer diversification by including managers with differing investment styles and market-cap orientations. |

| ° | The Smaller Companies Fund brings together managers who use different investment approaches, though each focuses on the securities of smaller companies. |

| ° | The Value Fund includes managers who each take a distinct approach to assessing companies and defining value. Please note that the Value Fund is classified as a “non-diversified” fund; however, its portfolio has historically met the qualifications of a “diversified” fund. |

| ° | The Focused Opportunities Fund uses multiple managers with diverse investment styles. However, even with this diversification, the fund is classified as a “non-diversified” fund, as it may hold as few as 15 stocks and no more than 21 stocks. In the future, if more sub-advisors are added, the fund could become more diversified. |

| • | We believe that excessive asset growth often results in diminished performance. Therefore, each fund may close to new investors at a level that Litman Gregory believes will preserve each manager’s ability to effectively implement the Litman Gregory Masters Funds concept. If more sub-advisors are added to a particular fund, the fund’s closing asset level may be increased. |

Diversification does not assure a profit or protect against a loss in a declining market.

| ii Litman Gregory Funds Trust |

| Contents |

| Our Commitment to Shareholders | 2 |

| Funds’ Performance | 4 |

| Letter to Shareholders | 5 |

| Litman Gregory Masters Equity Fund | |

| Equity Fund Review | 8 |

| Equity Fund Managers | 13 |

| Equity Fund Stock Highlights | 14 |

| Equity Fund Schedule of Investments | 17 |

| Litman Gregory Masters International Fund | |

| International Fund Review | 19 |

| International Fund Managers | 25 |

| International Fund Stock Highlights | 26 |

| International Fund Schedule of Investments | 29 |

| Litman Gregory Masters Value Fund | |

| Value Fund Review | 31 |

| Value Fund Managers | 36 |

| Value Fund Stock Highlights | 37 |

| Value Fund Schedule of Investments | 38 |

| Litman Gregory Masters Smaller Companies Fund | |

| Smaller Companies Fund Review | 39 |

| Smaller Companies Fund Managers | 43 |

| Smaller Companies Fund Stock Highlights | 44 |

| Smaller Companies Fund Schedule of Investments | 47 |

| Litman Gregory Masters Focused Opportunities Fund | |

| Focused Opportunities Fund Review | 48 |

| Focused Opportunities Fund Managers | 52 |

| Focused Opportunities Fund Stock Highlights | 53 |

| Focused Opportunities Fund Schedule of Investments | 54 |

| Litman Gregory Masters Alternative Strategies Fund | |

| Alternative Strategies Fund Review | 55 |

| Alternative Strategies Fund Managers | 60 |

| Alternative Strategies Fund Highlights | 61 |

| Alternative Strategies Fund Schedule of Investments | 67 |

| Expense Examples | 84 |

| Statements of Assets and Liabilities | 86 |

| Statements of Operations | 88 |

| Statements of Changes in Net Assets | |

| Equity Fund | 89 |

| International Fund | 89 |

| Value Fund | 90 |

| Smaller Companies Fund | 90 |

| Focused Opportunities Fund | 91 |

| Alternative Strategies Fund | 91 |

| Financial Highlights | |

| Equity Fund | 92 |

| International Fund | 93 |

| Value Fund | 94 |

| Smaller Companies Fund | 95 |

| Focused Opportunities Fund | 96 |

| Alternative Strategies Fund | 97 |

| Equity Investor Class | 98 |

| International Investor Class | 99 |

| Alternative Strategies Investor Class | 100 |

| Notes to Financial Statements | 101 |

| Report of Independent Registered Public Accounting Firm | 124 |

| Other Information | 125 |

| Index Definitions | 126 |

| Industry Terms and Definitions | 128 |

| Trustee and Officer Information | 131 |

| Privacy Notice | 133 |

This report is intended for shareholders of the funds and may not be used as sales literature unless preceded or accompanied by a current prospectus for the Litman Gregory Masters Funds. Statements and other information in this report are dated and are subject to change.

Litman Gregory Fund Advisors, LLC has ultimate responsibility for the funds’ performance due to its responsibility to oversee its investment managers and recommend their hiring, termination and replacement.

| Table of Contents 1 |

| Litman Gregory Fund Advisors’ |

| Commitment to Shareholders |

We are deeply committed to making each Litman Gregory Masters Fund a highly satisfying long-term investment for shareholders. In following through on this commitment we are guided by our core values, which influence four specific areas of service:

First, we are committed to the Litman Gregory Masters concept.

| • | We will only hire managers who we strongly believe will deliver exceptional long-term returns relative to their benchmarks. We base this belief on extremely thorough due diligence research. This not only requires us to assess their stock picking skills, but also to evaluate their ability to add incremental performance by investing in a concentrated portfolio of their highest conviction ideas. |

| • | We will monitor each of the managers so that we can maintain our confidence in their ability to deliver the long-term performance we expect. In addition, our monitoring will seek to assess whether they are staying true to their Litman Gregory Masters Funds mandate. Consistent with this mandate we focus on long-term performance evaluation so that the Masters managers will not be distracted by short-term performance pressure. |

Second, we will do all we can to ensure that the framework within which our stock pickers do their work further increases the odds of success.

| • | Investments from new shareholders in each fund are expected to be limited so that each fund’s asset base remains small enough to retain flexibility to add value. |

| • | The framework also includes the diversified multi-manager structure that makes it possible for each manager to invest, when appropriate, in an opportunistic manner knowing that the potential volatility within his or her portfolio will be diluted at the fund level by the performance of the other managers. In this way the multi-manager structure seeks to provide the fund-level diversification. |

| • | We will work hard to discourage short-term speculators so that cash flows into the funds are not volatile. Lower volatility helps prevent our managers from being forced to sell stocks at inopportune times or to hold excessive cash for non-investment purposes. This is why years ago we implemented a 2% redemption fee for the first 180 days of a shareholder’s investment in any of our funds. |

Third, is our commitment to do all we can from an operational standpoint to maximize shareholder returns.

| • | We will remain attentive to fund overhead, and whenever we achieve savings we will pass them through to shareholders. For example, we have had several manager changes that resulted in lower sub-advisory fees to our funds. In every case we have passed through the full savings to shareholders in the form of fee waivers. |

| • | We will provide investors with a low minimum, no-load, no 12b-1 Institutional share class for all Litman Gregory Masters Funds, and a low minimum, no-load Investor share class for the Equity, International, and Alternative Strategies funds |

| • | We also will work closely with our managers to make sure they are aware of tax-loss selling opportunities (only to be taken if there are equally attractive stocks to swap into). We account for partial sales on a specific tax lot basis so that shareholders will benefit from the most favorable tax treatment. The goal is not to favor taxable shareholders over tax-exempt shareholders but to make sure that the managers are taking advantage of tax savings opportunities when doing so is not expected to reduce pre-tax returns. |

Fourth, is our commitment to communicate honestly about all relevant developments and expectations.

| • | We will continue to do this by providing thorough and educational shareholder reports. |

| • | We will continue to provide what we believe are realistic assessments of the investment environment. |

Our commitment to Litman Gregory Masters Funds is also evidenced by our own investment. Our employees have, collectively, substantial investments in the funds, as does our company retirement plan. In addition, we use the funds extensively in the client accounts of our investment advisor practice (through our affiliate Litman Gregory Asset Management, LLC). We have no financial incentive to do so because the fees we receive from Litman Gregory Masters Funds held in client accounts are fully offset against the advisory fees paid by our clients. In fact, we have a disincentive to use the funds in our client accounts because each Litman Gregory Masters Fund is capacity constrained (they may be closed as mentioned above), and by using them in client accounts we are using up capacity for which we may not be paid. But we believe these funds offer value that we can’t get elsewhere and this is why we enthusiastically invest in them ourselves and on behalf of clients.

While we believe highly in the ability of the Funds’ sub-advisors, our commitments are not intended as guarantees of future results.

While the funds are no-load, there are management fees and operating expenses that do apply, as well as a 12b-1 fee that applies to Investor class shares. Please refer to the prospectus for further details.

Diversification does not assure a profit or protect against loss in a declining market.

| 2 Litman Gregory Funds Trust |

Each of the funds may invest in foreign securities. Investing in foreign securities exposes investors to economic, political, and market risks and fluctuations in foreign currencies. Each of the funds may invest in the securities of small companies. Small-company investing subjects investors to additional risks, including security price volatility and less liquidity than investing in larger companies.

Litman Gregory Masters Focused Opportunities Fund & Litman Gregory Masters Value Fund are non-diversified funds, which means that they may concentrate more assets in fewer individual holdings than diversified funds. Though primarily equity funds, they may invest a portion of their assets in securities of distressed companies. Debt obligations of distressed companies typically are unrated, lower rated, in default or close to default and may become worthless. The International Fund will invest in emerging markets. Investments in emerging market countries involve additional risks such as government dependence on a few industries or resources, government-imposed taxes on foreign investment or limits on the removal of capital from a country, unstable government, and volatile markets.

Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in mortgage-backed securities include additional risks that investor should be aware of including credit risk, prepayment risk, possible illiquidity, and default, as well as increased susceptibility to adverse economic developments. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management, and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. The Alternative Strategies Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested.

Merger arbitrage investments risk loss if a proposed reorganization in which the fund invests is renegotiated or terminated.

Investments in absolute return strategies are not untended to outperform stocks and bonds during strong market rallies.

Multi-investment management styles may lead to higher transaction expenses compared to single investment management styles. Outcomes depend on the skill of the sub-advisors and advisor and the allocation of assets amongst them.

Past performance does not guarantee future results.

Mutual fund investing involves risk; loss of principal is possible.

Performance discussions for the Equity Fund, the International Fund, and the Alternative Strategies Fund are specifically related to the Institutional share class.

Some of the comments are based on current management expectation and are considered “forward- looking statements”. Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statement by words such as “estimate”, “may”, “expect”, “should”, “could”, “believe”, “plan”, and similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

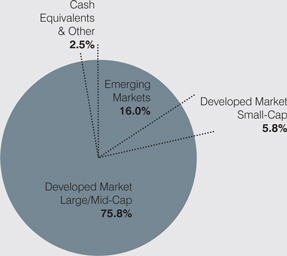

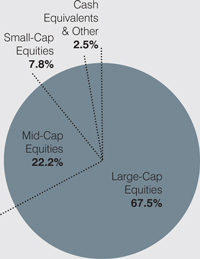

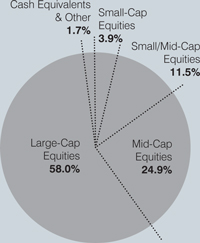

See pages 10, 21, 33, 40, 49 and 57 for each fund’s top contributors. See pages 11, 22, 34, 41, 50 and 57 for each fund’s portfolio composition. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

Diversification does not assure a profit or protect against a loss in a declining market.

Leverage may cause the effect of an increase or decrease in the value of the portfolio securities to be magnified and the fund to be more volatile than if leverage was not used.

References to other mutual funds should not be interpreted as an offer of these securities.

Please see pages 126-127 for index definitions. You cannot invest directly in an index.

Please see pages 128-129 for industry definitions.

| Funds’ Performance 3 |

| Litman Gregory Masters Funds’ Performance |

| Average Annual Total Returns | ||||||

| Since | ||||||

| Institutional Class Performance as of 12/31/2012 | 1-Year | 3-Year | 4-Year | 5-Year | 10-Year | Inception |

| Litman Gregory Masters Equity Fund (12/31/96) | 13.78% | 9.14% | 17.03% | -0.03% | 6.02% | 6.50% |

| Russell 3000 Index | 16.42% | 11.20% | 13.49% | 2.04% | 7.68% | 6.32% |

| Custom Equity Index | 16.32% | 10.52% | 17.88% | 1.64% | 7.87% | 6.25% |

| Lipper Multi-Cap Core Fund Index | 16.15% | 9.60% | 15.81% | 1.53% | 7.62% | 6.02% |

| Gross Expense Ratio: 1.28% as of 4/30/12 | ||||||

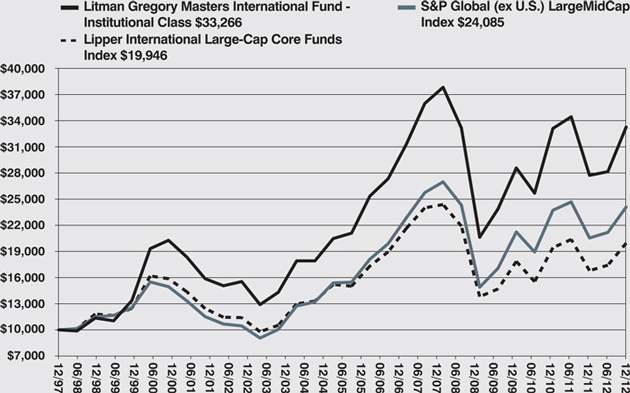

| Litman Gregory Masters International Fund (12/1/97) | 19.96% | 5.20% | 12.69% | -2.54% | 9.94% | 8.29% |

| S&P Global (ex U.S.) LargeMidCap Index | 17.24% | 4.34% | 12.82% | -2.24% | 10.27% | 6.00% |

| Lipper International Large-Cap Core Fund Index | 18.75% | 3.76% | 9.61% | -3.93% | 7.38% | 4.68% |

| MSCI EAFE Index | 17.92% | 4.03% | 10.51% | -3.22% | 8.70% | 4.82% |

| Morningstar Foreign Large Blend Category | 18.30% | 3.94% | 10.11% | -3.84% | 7.60% | 3.95% |

| Gross Expense Ratio: 1.26% Net Expense Ratio* as of 4/30/12: 1.11% | ||||||

| Litman Gregory Masters Value Fund (6/30/2000) | 13.31% | 8.36% | 16.35% | -0.71% | 5.68% | 4.39% |

| Russell 3000 Value Index | 17.55% | 10.92% | 13.07% | 0.83% | 7.54% | 5.18% |

| Lipper Large-Cap Value Fund Index | 15.88% | 8.62% | 12.50% | 0.18% | 6.42% | 2.86% |

| Gross Expense Ratio: 1.39% Net Expense Ratio* as of 4/30/12: 1.37% | ||||||

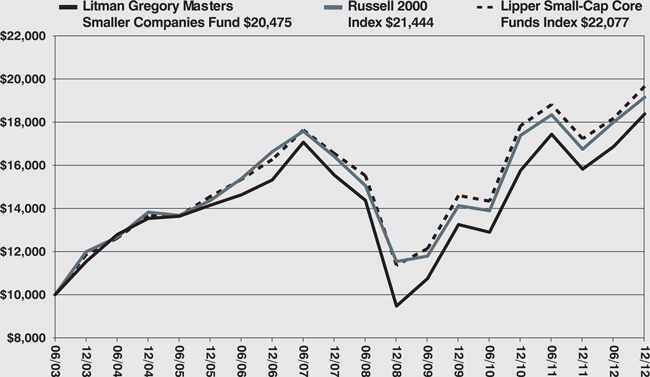

| Litman Gregory Masters Smaller Companies Fund (6/30/2003) | 18.51% | 13.33% | 21.68% | 3.88% | n/a | 7.84% |

| Russell 2000 Index | 16.35% | 12.25% | 15.81% | 3.56% | n/a | 8.36% |

| Lipper Small-Cap Core Fund Index | 15.95% | 11.91% | 17.18% | 3.96% | n/a | 8.69% |

| Gross Expense Ratio: 1.54% as of 4/30/12 | ||||||

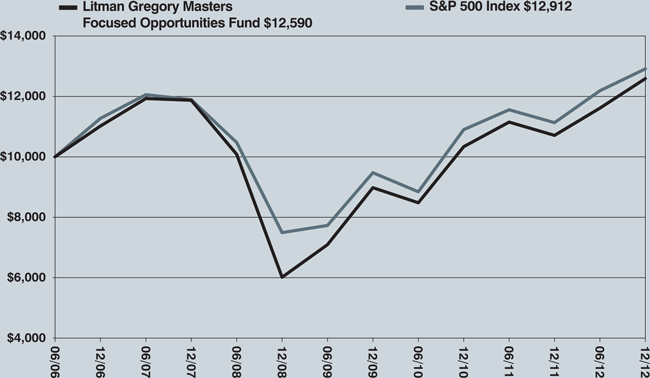

| Litman Gregory Masters Focused Opportunities Fund (6/30/2006) | 17.55% | 11.93% | 20.28% | 1.18% | n/a | 3.61% |

| S&P 500 Index | 16.00% | 10.87% | 14.57% | 1.66% | n/a | 4.01% |

| Gross Expense Ratio: 1.44% Net Expense Ratio* as of 4/30/12: 1.36% | ||||||

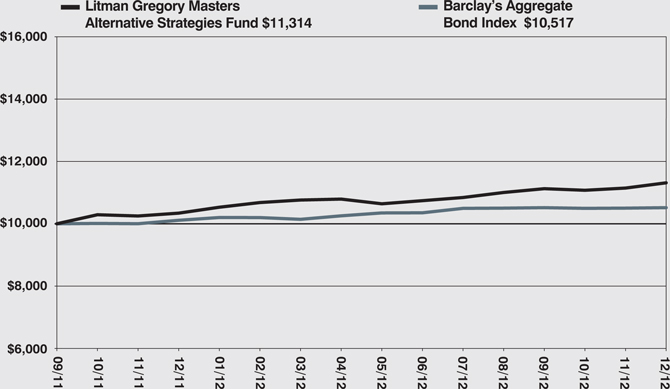

| Litman Gregory Masters Alternative Strategies Fund (9/30/2011) | 9.41% | n/a | n/a | n/a | n/a | 10.38% |

| Barclays Aggregate Bond Index | 4.23% | n/a | n/a | n/a | n/a | 4.30% |

| S&P 500 Index | 16.00% | n/a | n/a | n/a | n/a | 23.13% |

| 40/60 Blend of S&P 500 Index & Barclays Aggregate Bond Index | 8.96% | n/a | n/a | n/a | n/a | 11.71% |

| 3-Month LIBOR | 0.52% | n/a | n/a | n/a | n/a | 0.47% |

| Gross Expense Ratio: 1.98% Net Expense Ratio* as of 4/30/12: 1.75% | ||||||

Performance quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. To obtain the performance of the funds as of the most recently completed calendar month, please visit www.mastersfunds.com. The funds impose a 2.00% redemption fee on shares held less than 180 days. Performance does not reflect the redemption fee. If reflected, performance would be lower.

The performance quoted does not include a deduction for taxes that a shareholder would pay on distributions or the redemption of fund shares. Indexes are unmanaged, do not incur expenses, taxes or fees and cannot be invested in directly. See pages 126-127 for the index definitions.

*Gross and net expense ratios are for the institutional share class per the Prospectus dated 4/30/2012. Through April 30, 2014, Litman Gregory has contractually agreed to waive a portion of its advisory fees effectively reducing total advisory fees to approximately 0.95% of the average daily net assets of the International Fund, 1.08% of the average daily net assets of the Value Fund and 1.02% of the Focused Opportunities Fund. Litman Gregory may voluntarily waive a portion of its advisory fee in addition to those fees that are contractually waived. Litman Gregory has agreed not to seek recoupment of advisory fees waived. Through April 30, 2014, Litman Gregory has voluntarily agreed to waive a portion of its management fee to pass through any costs benefits resulting from sub- advisor breakpoints, changes in the sub-advisory fee schedules or allocations within the Equity Fund, the International Fund, the Value Fund, and the Focused Opportunities Fund. Through April 30, 2014, Litman Gregory has contractually agreed to waive a portion of the advisory fees and/or reimburse a portion of the Alternative Strategies Fund’s operating expenses (excluding any taxes, interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, borrowing costs (including commitment fees), dividend expenses, acquired fund fees and expenses and extraordinary expenses such as but not limited to litigation costs) through April 30, 2014 (unless otherwise sooner terminated) to ensure that the total annual fund operating expenses after fee waiver and/or expense reimbursement, exclusive of dividend and interest expense, for the Institutional Class will not exceed 1.49%.

| 4 Litman Gregory Funds Trust |

Dear Fellow Shareholder,

Despite continued subpar global economic growth and the presence of a number of macro risks, mostly debt related, the global stock market performed quite well in 2012. In this environment four out of six Litman Gregory Masters Funds out-returned their benchmarks during the year.

The year served as a reminder of the old adage about the stock market’s ability to climb a wall of worry. Worries about the fiscal cliff, Europe’s sovereign debt and banking crisis, and the possibility of a hard landing in China were all in the headlines. But even though the underlying problems largely remain, a disaster scenario did not play out and the risk of a worst case seemingly declined in the year’s second half. This was enough for investors, even though the global economy, and the developed world in particular, still face significant risks. As an example, simply avoiding (by partially delaying) the fiscal cliff with a last minute agreement, fueled a 1.7% surge in the S&P 500 on the last day of the year. According to Ned Davis Research, that was the best final-day return for the index in 38 years.

It was a particularly notable year for two of the Litman Gregory Masters Funds:

The International Fund reached its 15th anniversary in December. As of the end of 2012, the fund’s average annual return since its inception was ahead of each of its three benchmarks by a wide margin (see performance table on page 4). As of December 31, 2012 it out-returned the Morningstar Foreign Large Blend category peer group by 4.34 percentage points (average annual return) and its peer ranking within the Morningstar Foreign Blend category was in the top 7 percent among 166 funds, as of 12/31/12. Over the 15 calendar years, the fund ranked in the top quartile in 10 of the years and in five of those years returns were in the top decile. (The fund’s Morningstar percentile ranking over the one-, three-, five -, and 10-year periods is 23%, 25%, 31%, and 14% among 786, 713, 589, and 325 foreign large blend funds, respectively, based on total return as of December 31, 2012.) An April Morningstar analyst report states, “This fund has all the makings of a superior stand-alone foreign offering,” and “Litman Gregory has proven it has what it takes to oversee its sub -advisors lineups well.” (Go to www.mastersfunds.com to read the full article.) Looking under the hood reveals more to the story. See the International Fund report for more in-depth analysis beginning on page 19.

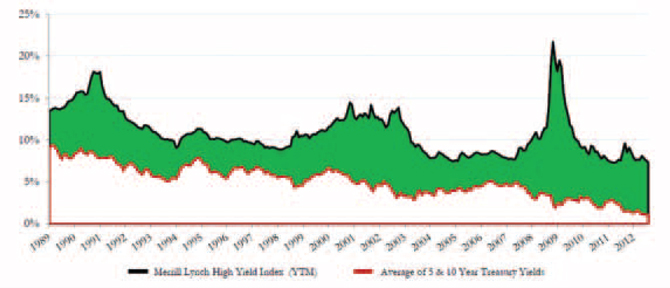

The Alternative Strategies Fund completed its first full year of operation. The fund out-returned its benchmarks for the year and also ranked in the top 15% among 203 funds in the Morningstar Multialternative category peer group for the period ending 12/31/12, based on total returns. We were particularly pleased that the fund was able to beat the 40/60 stock/bond benchmark we track in a year when stock market performance was quite strong. We’ve stated in the past that the fund may be more prone to trailing that benchmark in years of strong stock performance because the fund will typically have less exposure to the stock market. That was certainly true in 2012 with the fund’s net stock market exposure well below 40%. While we are pleased with the absolute return generated by the Alternative Strategies Fund so far in its short life, it is also important to understand that it was achieved while exhibiting very low volatility. The fund’s standard deviation of 3.1% was lower than that of all of its benchmarks, including the bond market. It was about one -sixth of the level exhibited by the S&P 500 over the same period. This contributed to a very high Sharpe ratio of 4.5. (The Sharpe ratio is a measure of risk-adjusted return.) It is still early in this fund’s life but the performance is very encouraging and we remain extremely confident in the team of sub-advisors running the fund. See page 55 for a more detailed update.

As expected, the equity funds continue to be characterized by individual stock picking, which leads to portfolios that are very different from their index benchmarks. The stocks in the fund portfolios are ones that reflect a favorable relationship between the underlying company fundamentals and the pricing of the stock, in the opinion of the sub-advisors. Here are two examples:

Fiat Industrial is owned by David Herro in the International Fund. Fiat is an Italian-listed capital goods company which was spun off from Fiat SpA early in 2011. The company includes a large majority ownership in Case New-Holland, the second-largest manufacturer of agricultural equipment worldwide and also a leading manufacturer of construction equipment. Fiat also owns Iveco, a leading manufacturer of trucks and special vehicles, and engine manufacturer Fiat Powertrain Industrial. According to Herro, the spin-off from Fiat has resulted in improved management focus, better operating efficiencies and an improved capital structure. In addition the company has developed an engine technology that Herro believes offers material advantages relative to competitors. Herro’s analysis suggests that the company’s EBIT (earnings before interest and taxes) is depressed relative to cyclical and company-specific factors and that management will continue to drive improved profitability at all points in the profit cycle. Herro’s analysis suggests the firm has the potential to achieve mid-to- high teens after- tax returns on capital through the business cycle. Moreover, Herro believes the company’s value is masked by a discount due to its Italian listing. See page 26 for more detail on Fiat Industrial.

Eagle Materials is owned by Frank Sustersic in the Smaller Companies Fund. Eagle is a diversified manufacturer of building products. The company sells four primary materials including gypsum wallboard, cement, recycled paperboard, and concrete and aggregates. Growth opportunities are primarily driven by the U.S. construction industry. The continued recovery of the housing industry is driving improved demand for gypsum wallboard, cement, and concrete and aggregates. Sustersic believes the residential housing industry is likely to experience a strong multi-year run and that this will lead to more demand growth that will directly benefit Eagle. Two-thirds of Eagle’s revenue is tied to residential construction. There is also opportunity in non-residential construction. Moreover, the wallboard industry is coming off a multi-decade pricing trough. Sustersic believes Eagle is well positioned to pick

| Funds’ Performance 5 |

up market share in this environment because Eagle has a lower cost structure that allows it to aggressively price relative to its key competitors. So Eagle is a company that Sustersic believes will pick up market share in growing markets with improved pricing. In terms of valuation, Sustersic says the company is trading at a 20% to 30% discount to its peers. See page 45 for more detail on Eagle Materials.

Looking Forward

Though we believe some of the macro risks investors have been concerned about have subsided, we continue to believe that equity markets will be challenged for several more years as developed world debt deleveraging continues. Looking ahead we continue to have confidence in the ability of the our equity sub- advisors, working within the Litman Gregory Masters Funds structure, to do well relative to each fund’s stock market benchmarks. Obviously this outcome is uncertain and each fund has experienced difficult periods at times. But we have been particularly encouraged by the performance of each equity fund post the 2008 financial crisis. The period also has been characterized by fairly stable sub-advisor line-ups for the funds after a number of sub-advisor changes were made in the 2007-2008 period.

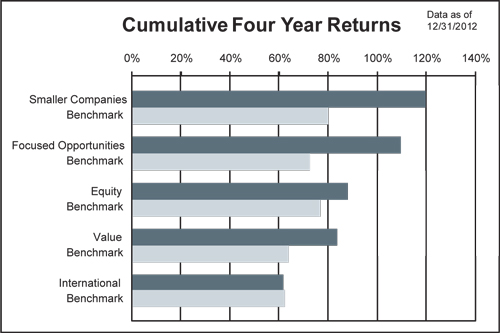

Trailing Four-Year Cumulative Performance as of December 31, 2012

The benchmarks for the Equity Fund, International Fund, Value Fund, Smaller Companies Fund, and Focused Opportunities Fund are the Russell 3000 Index, the S&P Global (ex-U.S.) LargeMid- Cap Index, the Russell 3000 Value Index, the Russell 2000 Index, and the S&P 500 Index, respectively.

Performance quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. To obtain the performance of the funds as of the most recently completed calendar month, please click www.mastersfunds.com. The funds impose a 2.00% redemption fee on shares held less than 180 days. Performance does not reflect the redemption fee. If reflected, performance would be lower.

And for investors who are looking for an alternative to the stock market that offers more potential stability and downside protection and also the potential to capture better returns than bonds, we are enthusiastic about the Alternative Strategies Fund and look forward to continuing to build its track record.

The partners, employees of Litman Gregory, and the Independent Trustees of the Litman Gregory Masters Funds continue to hold substantial investments in the funds. As of the end of 2012 the combined investment among these groups was $17.7 million. This meaningful investment reflects our confidence in and commitment to the funds.

As always we will continue to work hard to reward your trust and confidence in the Litman Gregory Masters funds.

Sincerely,

Ken Gregory and Jeremy DeGroot

| 6 Litman Gregory Funds Trust |

Morningstar Rankings represent a fund's total-return rank relative to all funds that have the same Morningstar Category.

The Morningstar percentile ranking is based on the fund's total-return percentile rank relative to all funds that have the same category for the same time period. The highest (or most favorable) percentile rank is 1%, and the lowest (or least favorable) percentile rank is 100%. Morningstar total return includes both income and capital gains or losses and is not adjusted for sales charges or redemption fees.

| MSILX | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

| Total Return % Rank Category | 23 | 82 | 7 | 17 | 66 | 7 | 66 | 4 | 85 | 15 | 25 | 16 | 6 | 5 | 59 |

| # of Funds in Category as of 12/31/12 | 786 | 817 | 829 | 823 | 778 | 743 | 657 | 608 | 551 | 504 | 482 | 439 | 396 | 340 | 302 |

Morningstar rankings are based on the MSILX class of shares. Rankings for other share classes will be different.

© 2013 Morningstar inc. All rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Funds’ Performance 7 |

| Litman Gregory Masters Equity Fund Review |

For the 2012 calendar year, the Litman Gregory Masters Equity Fund produced a total return of 13.8%, which trailed the 16.4% performance of the Russell 3000 Index benchmark as well as the 16.2% return of the Lipper Multi-Cap Core Fund Index. After a rough start to the year the fund’s performance improved significantly later in the year. During the fourth quarter the Equity Fund returned 9.2% compared to 6.5% for the Russell 3000 Index benchmark and 8.1% for the Lipper Multi-Cap Core Fund Index. This latter period also coincided with declining correlation between individual stocks and the overall stock market indexes. Correlations have been extremely high in recent years compared to the last 40 years. In our opinion this has made it more difficult for active managers to add value over an index. We don’t believe this will be a permanent condition; however it is too soon to know if the recent drop in correlations will be a sustainable trend.

| Litman Gregory Masters Equity Fund |

| Performance as of 12/31/2012 |

| Average Annual Total Returns | |||||

| 1-Year | 3-Year | 5-Year | 10-Year | Since Inception | |

| Institutional Class | 13.78% | 9.14% | -0.03% | 6.02% | 6.50% |

| Russell 3000 Index | 16.42% | 11.20% | 2.04% | 7.68% | 6.32% |

| Custom Equity Index | 16.32% | 10.52% | 1.64% | 7.87% | 6.25% |

| Lipper Multi-Cap Core Fund Index | 16.15% | 9.60% | 1.53% | 7.62% | 6.02% |

| Investor Class | 13.51% | 8.91% | n/a | n/a | 15.34% |

| Russell 3000 Index | 16.42% | 11.20% | n/a | n/a | 17.21% |

| Custom Equity Index | 16.32% | 10.52% | n/a | n/a | 16.68% |

| Lipper Multi-Cap Core Fund Index | 16.15% | 9.60% | n/a | n/a | 16.14% |

Performance quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. To obtain the performance of the funds as of the most recently completed calendar month, please visit www.mastersfunds.com. As of the prospectus dated 4/30/2012, the gross expense ratio for the Institutional Class was 1.28%; and for the Investor Class was 1.53%. Through 04/30/2014, Litman Gregory has voluntarily agreed to waive a portion of its management fee to pass through any costs benefits resulting from sub-advisor breakpoints, changes in the sub-advisory fee schedules or allocations. The inception date for the Institutional Class is 12/31/1996; for the Investor Class, 4/30/2009. See page 3 for a detailed discussion of the risks and costs associated with investing in the Litman Gregory Masters Equity Fund. All performance discussions in this report refer to the performance of the Institutional share class.

The fund’s performance has been strong since the end of the financial crisis. Although shorter-term results have been mixed since the end of 2008, over the entire four-year period from 1/1/2009 to 12/31/2012, the fund’s annualized return of 17.0% is ahead of the Russell 3000 Index benchmark by 1.7 percentage points. This period also followed manager changes made in 2008 which we view as material to the fund—particularly the removal of one sub-advisor who underperformed his benchmark by a very sizable margin during a rough stretch for the fund in the mid-to-late 2000s.

Longer term, the fund’s performance is modestly ahead of its benchmarks since inception. However, underperformance in the mid to late 2000s still is negatively impacting its trailing performance over other time periods. As of the end of 2012, the fund lagged its benchmarks over the trailing three, five, and 10 years. Breaking down the performance over the entirety of the fund’s life, performance was strong from inception through 12/31/2004 (an annualized return 2.8 percentage points better than the Russell 3000 Index), and has also been strong in the four years since 2008. However, the period from 2004 through 2008 was very poor (underperformance was in excess of five percentage points per year) and damaged the fund’s long-term record.

Another way to break down performance is to look at rolling returns. Rolling return analysis shows how the fund has tended to have much more consistent relative performance over longer time periods. For example, the Equity Fund has beaten its Russell 3000 benchmark in 55% of the 12-month rolling periods since the fund’s inception, yet over the same 16-year period it has outperformed the benchmark in 73% of rolling 10-year periods. The longer period rolling return record is much more impressive and this is not surprising to us given the fund’s high “active share” portfolio. Still it is our goal going forward to outperform in 100% of future rolling 10-year periods. We believe the manager changes we made in 2008 are a step in the right direction as we pursue this goal.

| Portfolio Commentary |

Performance of managers: Three of the fund’s seven stock pickers outperformed their respective benchmarks in 2012, in each case by at least 1.8% net of the management fee each sub-advisor charges to the fund. Two managers underperformed by less than one percentage point, and two trailed their benchmarks by wide margins. All the sub-advisors produced gains for the year, with individual returns net of fees ranging from 1.5% to 21.1% over the past 12 months. During the final quarter of 2012, six of the seven managers beat their benchmarks.

Longer-term, all four of the original managers who have been on the fund since inception have out-returned their benchmarks over their full tenure with fund. Of the other three managers currently on the fund, two have out-returned their benchmarks.i

Sector and stock-picking impact: We focus on the performance of individual stocks rather than the effect of sector allocation when discussing the performance of our funds, though at times sector exposure may provide some insight into the fund’s relative performance. Based on attribution data for 2012, the fund’s sector allocations contributed positively to relative performance, though the effect in seven of the 10 benchmark sectors was roughly neutral. The most significant benefit came from the fund’s overweight to financial stocks, adding 0.75 percentage points. This was the highest-returning sector in the Russell 3000 Index, up over 26% in 2012, and on average the fund held 24.1% in this sector compared to 22.1% for the benchmark.

| 8 Litman Gregory Funds Trust |

Stock selection was the main driver of the Equity Fund’s relative performance in 2012. The greatest value added came in the materials sector, led by a 73% gain for Cemex S.A.B. de C.V., a Mexican concrete company that was a significant detractor in 2011. On average, the fund’s materials sector holdings returned 55% compared to a return of 17.4% for this sector in the benchmark. Stock selection was also positive in the consumer discretionary and telecommunications sectors. But these could not offset the negative impact of picks in health care, energy, and financials. In each case, most of the underperformance could be traced to one stock within the sector. Health Net, Inc., Chesapeake Energy Corp., and Fairfax Financial Holdings Ltd. all suffered double-digit losses for the year. The fund’s sub-advisors continue to hold all three names.

Leaders and laggards: The table on page 10 lists the greatest contributors to and detractors from performance for the year.

For the second consecutive year, Visa was the best contributor to performance. The stock gained 50% and remains among the fund’s top holdings. It is interesting to note that the stock is owned by value manager Clyde McGregor of Harris Associates and growth manager Sands Capital. The company’s vast payment network processes over half of all credit and debit transactions globally, and this network only increases in value as the number of card holders and merchants expands. This market share and the scale of the company’s technology investments create strong barriers to competition, and both sub-advisors see potential for a sustained period of earnings growth as consumers, especially those in emerging economies, continue the shift from paper-based to electronic payments. In 2012, the stock benefitted from favorable developments with respect to the Durbin amendment, which impacted the pricing of debit card transactions, and the preliminary settlement of a class-action lawsuit brought by merchants over credit card fees. See page 14 to read Clyde McGregor’s comments on Visa.

Bank of New York Mellon rose 32% during 2012 and was the third-best contributor in 2012 after being the worst detractor in 2011. Although pricing in the company’s core asset custody business has been under pressure, sub-advisor Chris Davis believes an increase in short-term interest rates could lift the company’s earnings 20% to 25% and he is optimistic that the company’s new CEO will improve its capital allocation, including the potential for significant share repurchases at depressed valuations.

Three of the other top five contributors also gained more than 50% in 2012. HSN, Inc. and Snap-On, Inc. (up 54% and 59%, respectively) remain in the fund’s portfolio as of year-end. JDA Software Group, Inc. was added to the fund in May by McGregor, with an average cost under $28, and was tendered for $45 per share in December as a result of the firm’s merger with RedPrairie. The stock returned 63% during the fund’s holding period.

The five largest detractors in 2012 were still held in the fund as of the end of the year. The worst detractor was Dell, Inc., which lost nearly 30% of its market value. Sub-advisor Mason Hawkins thinks investors have been too focused on declining sales in the company’s PC business and do not fully appreciate the value of Dell’s higher-margin enterprise segments, which now represent more than half of its profits. A significant net cash position, including finance receivables that Southeastern believes could be sold for over $6 per share, helps provide an anchor to their valuation of Dell. At a year-end price of just over $10, the stock is selling at a low multiple of its free cash flow of more than $2 per share. Hawkins believes the intrinsic value of the stock is in the mid-20s.

Health Net, Inc. was added to the fund in 2012 and fell 35% during the period of ownership. The managed-care company posted disappointing earnings results in 2012, based on poor underwriting related to challenges in transitioning its 2011 claims processing to comply with new federal guidelines. McGregor believes management has addressed the systems issues that contributed to this problem, and because Health Net’s contracts are re-priced each year, the impact to earnings may be short-lived if management can execute more effective pricing in 2013. The company has a strong position in the California market, which could make the firm an attractive acquisition target for a larger managed-care competitor. As implied by recent private-market transactions, McGregor estimates Health Net is trading around half of its value on a per-member basis.

The stock of Chesapeake Energy Corp. declined 24% in 2012, as a combination of lower natural gas prices, questions about the company’s ability to service debt, and controversy surrounding its CEO’s financial incentives pushed the stock below $14 in May. Southeastern Asset Management and another activist investor pushed for improved corporate governance, replacing several board members and successfully lobbied for the termination of a profit-participation program they had opposed. Chesapeake also made progress in improving its balance sheet by selling non-core assets (at favorable prices, in Hawkins’ view) as well as paying down and refinancing debt at lower rates. While the stock rebounded from its low to close 2012 near $17, Hawkins believes the company has assembled the best collection of shale oil and gas assets in the United States and is worth nearly three times that price.

It is important to understand that the fact that a stock has lost (or made) money for Masters in a given period tells us nothing about how successful the holding was or will ultimately become. The fund will own some stocks for significantly longer periods and the success of these holdings must be judged over the entire holding period and therefore won’t be known until they are eventually sold.

| Fund Summary 9 |

Litman Gregory Masters Equity Fund Contribution by Holding For the Year Ended December 31, 2012

Top Contributors

| Portfolio | ||||

| Security | Contribution | |||

| Visa, Inc. - Class A | 1.35 | % | ||

| HSN, Inc. | 1.30 | % | ||

| Bank of New York Mellon Corp. | 1.11 | % | ||

| Snap-on, Inc. | 0.99 | % | ||

| Jda Software Group, Inc. | 0.88 | % | ||

| Cemex S.a.b. de C.V. - ADR | 0.82 | % | ||

| Apple, Inc. | 0.78 | % | ||

| Cheung Kong Holdings Ltd. - ADR | 0.71 | % | ||

| American Express Co. | 0.68 | % | ||

| Walt Disney Co. (The) | 0.66 | % | ||

Bottom Contributors

| Portfolio | ||||

| Security | Contribution | |||

| Dell, Inc. | -0.83 | % | ||

| Health Net, Inc. | -0.78 | % | ||

| Chesapeake Energy Corp. | -0.52 | % | ||

| Canadian Natural Resources Ltd. | -0.47 | % | ||

| Fairfax Financial Holdings, Ltd. | -0.42 | % | ||

| New Oriental Education & Technology Group | -0.30 | % | ||

| United Rentals, Inc. | -0.27 | % | ||

| Jds Uniphase Corp. | -0.22 | % | ||

| Coldwater Creek, Inc. | -0.22 | % | ||

| Newfield Exploration Co. | -0.21 | % | ||

Portfolio contribution for a holding represents the product of the average portfolio weight and the total return earned by the holding during the period.

Portfolio Mix: The Equity Fund’s sector weightings will often vary widely from those of its benchmark. This reflects the managers’ bottom-up stock selection process in which little or no consideration is given to how their sleeves’ sector weights compare to the index.

As in 2011, the fund’s largest sector deviation from the Russell 3000 Index at year-end was its allocation to consumer staples. The portfolio holds only one stock, Costco Wholesale, in this sector and has less than one percent invested in consumer staples compared to over nine percentage points for the benchmark. Exposure to health care decreased in 2012, as names such as Merck & Co., Inc. and Lab Corp. were sold from the portfolio, and the fund now has a significant underweight to this sector, with 7.1% in health care stocks compared to 11.8% for the Russell 3000 Index. The fund has no current investments in the utilities sector, which represents its third-most underweighted sector compared to the benchmark, which has about 3.5% in utilities.

The fund’s weighting in financial stocks increased during 2012, and its year-end allocation of 25.3% represents the largest overweighting versus the benchmark, which has 16.8% in the sector. Wells Fargo was added during the year, but the majority of the portfolio’s exposure continues to be in non-bank financials, including American Express Co. and insurance-related companies such as Alleghany Corp., AON Plc, and Berkshire Hathaway, Inc.. The fund also has a meaningful overweight in consumer discretionary stocks, with a weight of 16.4% compared to 12.5% for the Russell 3000 Index. The portfolio has a diverse range of holdings in this sector; examples are auto components supplier Lear Corp., media companies like Comcast Corp. and DIRECTV, homebuilder Lennar Corp., and a number of retailers including Amazon.com, Inc.. In 2012, the fund’s allocation to the industrial sector shifted from an underweight position at the beginning of the year to a sizable overweighting versus the benchmark at year-end, as Atlas Air Worldwide was added to the portfolio, and a second sub-advisor purchased FedEx.

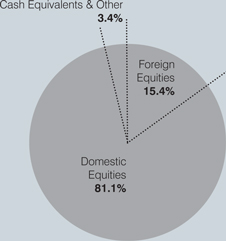

The fund’s 15.4% weighting in foreign-domiciled companies is at its highest level since late 2010. This exposure is split about evenly between large-cap and mid-cap stocks. Many of the larger foreign stocks have been held in the portfolio for years, such as Canadian Natural Resources Ltd. (since 2007) and Cenovus Energy, Inc. (since 2009) but five of the six additions in 2012 were mid-sized companies. One of these is gold miner Agnico-Eagle Mines Ltd., purchased in March by Dick Weiss. MercadoLibre, Inc., the dominant e-commerce provider in Latin America, was added by Sands Capital during the market decline in May. More recently, the Turner team bought NXP Semiconductors N.V. (based in the Netherlands) and United Tractors Tbk PT (domiciled in Indonesia). Long-time holding Cemex S.A.B. de C.V., a Mexican cement producer, was sold late in the year and replaced with French competitor LaFarge S.A..

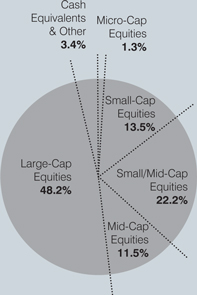

During 2012, the fund’s weighted-average market cap increased slightly to $42.2 billion, but as has been the case throughout its history, the portfolio contains companies of all sizes. These range from micro-caps such as $236 million Symmetricom, Inc. (owned by Weiss) and $558 million Computer Programs and Systems (held by Friess Associates) to mega-caps like Google, Inc. and Apple, Inc., which closed the year with a market cap over $500 billion. Just under half of the fund is in small- and mid-cap stocks, as of year-end, and we believe the sub-advisors’ flexibility to pursue opportunities across the market cap spectrum represents an advantage for the fund. The fund’s cash allocation of 3.4% is below its historical average and has not been this low since late 2008.

| 10 Litman Gregory Funds Trust |

| By Sector | ||||||||||||

| Sector Allocation | ||||||||||||

| Fund | Fund | Russell 3000 | ||||||||||

| as of | as of | as of | ||||||||||

| 12/31/12 | 12/31/11 | 12/31/12 | ||||||||||

| Consumer Discretionary | 16.4 | % | 13.7 | % | 12.5 | % | ||||||

| Consumer Staples | 0.6 | % | 0.5 | % | 9.3 | % | ||||||

| Energy | 9.4 | % | 11.2 | % | 9.9 | % | ||||||

| Finance | 25.3 | % | 22.1 | % | 16.8 | % | ||||||

| Health Care & Pharmaceuticals | 7.1 | % | 10.1 | % | 11.8 | % | ||||||

| Industrials | 13.5 | % | 9.3 | % | 11.3 | % | ||||||

| Materials | 3.8 | % | 4.2 | % | 4.1 | % | ||||||

| Technology | 18.5 | % | 22.8 | % | 18.2 | % | ||||||

| Telecom | 2.0 | % | 1.3 | % | 2.7 | % | ||||||

| Utilities | 0.0 | % | 0.0 | % | 3.4 | % | ||||||

| Cash Equivalents & Other | 3.4 | % | 4.8 | % | 0.0 | % | ||||||

| 100.0 | % | 100.0 | % | 100.0 | % | |||||||

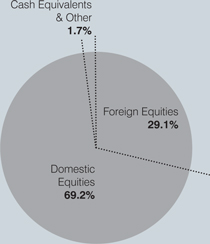

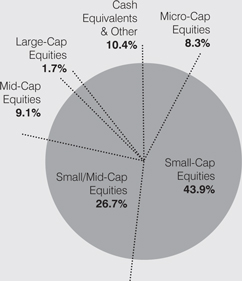

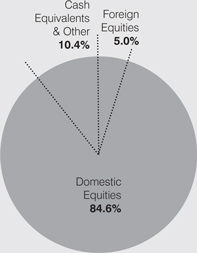

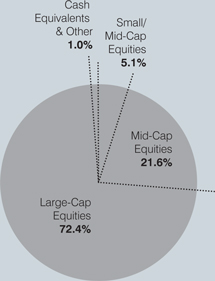

| By Domicile | By Market Capitalization |

|

|

Market Capitalization: Micro-Cap < $565 million Small-Cap $565 million - $2.61 billion Small/Mid-Cap $2.61 billion - $6.35 billion Mid-Cap $6.35 billion - $17.4 billion Large-Cap > $17.4 billion

Totals may not add up to 100% due to rounding |

| Fund Summary 11 |

| In Closing |

Litman Gregory Masters Equity Fund has beaten its benchmark over its 16-year life but not by a margin that we deem to be satisfactory. And its poor performance in the 2005 through late 2008 period is still damaging to its longer term record. Since the manager changes we made in 2008 the fund has performed better. Litman Gregory remains committed to doing all we can as we seek to deliver long-term performance that is in line with our original expectations for this fund. We seek to deliver a higher margin of outperformance than we have achieved over the past 16 years and more consistent performance over five- and 10-year periods. Pursing these goals will continue to be a key focus for our team in 2013 and beyond.

| i | The managers and their respective benchmarks are: Bill D’Alonzo: Russell 2500 Growth Index; Christopher Davis and Ken Feinberg: S&P 500 Index; Mason Hawkins: Russell 3000 Value Index; Clyde McGregor: Russell 3000 Value Index; Frank Sands Jr and Michael Sramek: Russell 1000 Growth Index; Bob Turner and Jason Schrotberger: Russell 1000 Growth Index; Dick Weiss: Russell 2000 Index. |

Earnings growth for a fund holding does not guarantee a corresponding increase in the market value of the holding or the fund.

| 12 Litman Gregory Funds Trust |

| Litman Gregory Masters Equity Fund Managers |

| MARKET | ||||

| TARGET | CAPITALIZATION | |||

| INVESTMENT | MANAGER | OF COMPANIES | STOCK-PICKING | |

| MANAGER | FIRM | ALLOCATION | IN PORTFOLIO | STYLE |

| Christopher Davis | Davis Selected Advisers, L.P. | 20% | Mostly large companies | Blend |

| Kenneth Feinberg | ||||

| Bill D’Alonzo and Team | Friess Associates, LLC | 10% | All sizes but mostly | Growth |

| small-and mid-sized | ||||

| companies | ||||

| Mason Hawkins | Southeastern Asset | 20% | All sizes and global; may | Value |

| Management, Inc. | have up to 50% in foreign | |||

| stocks | ||||

| Clyde McGregor | Harris Associates L.P. | 20% | All sizes but mostly | Value |

| large- and mid-sized | ||||

| companies | ||||

| Frank Sands, Jr. | Sands Capital | 10% | All sizes but mostly | Growth |

| A. Michael Sramek | Management, LLC | large- and mid-size | ||

| companies | ||||

| Robert Turner | Turner Investment | 10% | All sizes | Growth |

| Frank Sustersic | Partners, Inc. | |||

| Jason Shrotberger | ||||

| Richard Weiss | Wells Capital | 10% | All sizes but mostly | Blend |

| Management, Inc. | small-and mid-sized | |||

| companies |

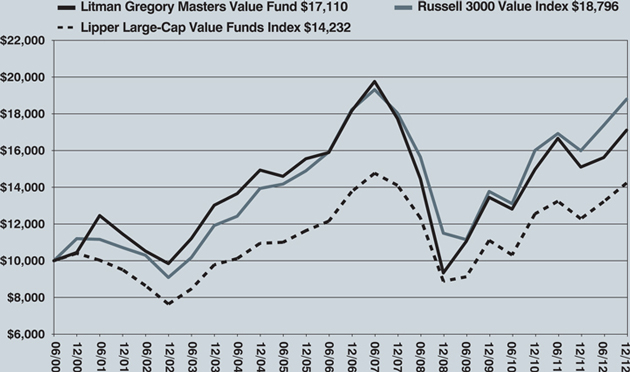

| Equity Fund Value of Hypothetical $10,000 |

The value of a hypothetical $10,000 investment in the Litman Gregory Masters Equity Fund from December 31, 1996 to December 31, 2012 compared with the Russell 3000 Index, Lipper Multi-Cap Core Funds Index and Custom Equity Index.

The hypothetical $10,000 investment at fund inception includes changes due to share price and reinvestment of dividends and capital gains. The chart does not imply future performance. Indices are unmanaged, do not incur fees, expenses or taxes and cannot be invested in directly.

| Fund Summary 13 |

| Litman Gregory Masters Equity Fund Stock Highlights |

| Canadian Natural Resources Ltd. – Chistopher Davis / Kenneth Feinberg |

The energy industry is characterized by high capital-intensity driven by the need for constant reserve replenishment (a barrel of oil produced must be replaced). Amplifying this dilemma is the fact that the industry has limited pricing power – oil and gas are tradable commodities. In looking at potential energy investments, we are careful in selecting for business attributes which we think can substantially mitigate these challenges. Specifically, we want to invest in companies which 1) have long- lived, low-cost reserves; 2) have a proven management team with a history of conservative capital allocation and 3) are trading at prices which we believe could give us a substantial margin of safety, given the inherent risks involved.

With the above criteria in mind, we purchased shares of Canadian Natural Resources Ltd. (CNQ) in late 2007. Founded in 1989, CNQ is a Canadian-based energy company which owns some of the largest unconventional oil reserves in the world, including leading positions in the Alberta tar sands. CNQ currently reports 4.8BN barrels of proven reserves, but this likely significantly underestimates the actual reserves, which are closer to 8BN+ barrels. With so many barrels in reserve, CNQ can produce at current rates for 40+ years without the need for further exploration activity. In contrast, a typical energy company can produce at current rates for at most 10-12 years before its reserves run dry. With CNQ, shareholders have very little reserve-replenishment risk.

CNQ also possesses one of the best all -around management teams in the industry. The two founders of the company own over $1BN of stock and are still active in day-to-day operations – there is little doubt that the interests of CNQ management are aligned with their shareholders. Through decades of growth, management has kept to a conservative financial philosophy, consistently keeping capital expenditures well within the cash flow generated. This has resulted in a very manageable and consistent debt-to-equity ratio of .35x. That they have managed to do this in an industry which consistently outspends cash flow in favor of debt speaks volumes about their disciplined approach to capital management.

Finally, we believe that CNQ shares are significantly undervalued. The market currently assigns CNQ with an enterprise value of $39.6BN. Using the reported 4.8BN of proven reserves as a measure, this means that the market is valuing CNQ at ~$8 per barrel of proven reserves. In comparison, recent M&A transactions in areas adjacent to CNQ’s properties have valued proven reserves well in excess of $20 per barrel. Thus, CNQ stock is being offered at a 60% discount to current market transactions. This is a value proposition we think investors will, over time, come to appreciate.

The past years have not been kind to CNQ’s share price, primarily due to lower commodity prices and some execution missteps which slowed production growth. We believe these factors to be temporary, but will reassess our investment thesis should they prove structural. Meanwhile, investors in CNQ are compensated with a cheap price for a highly valuable asset and should anticipate years of “barrel creation” to come.

| Lennar Corp. – Bill D’Alonzo |

While some homebuilders used the debt market just to stay afloat during the worst of the downturn, Lennar viewed leverage as a way to bolster its land portfolio at a considerable discount. We believe the company’s decision to use low-cost debt to buy attractive land at depressed prices should enhance profits as homebuilding activity increases and land values rise.

NYSE-listed Lennar Corp. builds and sells affordable, move-up and retirement homes in 18 states. Last year, the company delivered 10,845 homes at an average price of $ 244,000. Lennar also provides title and mortgage-related services. Outside of its core operations, the company maintains investments in a portfolio of numerous joint ventures and operates a distressed real estate unit, Rialto Investments.

August- quarter earnings grew to $0.40 from $0.11 a year ago, beating the consensus estimate by more than 40 percent. Revenue increased 34 percent due to a combination of higher average sale prices and lower incentives versus the year- ago period. Mortgage-unit revenue surged 60 percent during the quarter due to refinancing activity and programs aimed at lowering homeowner borrowing costs.

Lennar’s overall strategy remains focused on building high-quality, affordable homes in prime locations. New home closings increased 28 percent during the quarter as sales-per-community continued to rise from depressed levels.

The Friess Associates team spoke with Chief Financial Officer Bruce Gross regarding the operating leverage inherent in Lennar’s homebuilding activity. Cost reductions and controls put in place during the downturn are helping offset raw- material inflation. At the same time, the company’s land position provides an ongoing competitive advantage. We believe industry leading profit margins have room for further expansion with sales volumes expected to increase next year.

Lennar is expected to finish its fiscal year ended November 2012 with earnings of $2.98 per share, up from just $0.48 per share in the previous fiscal year.

| Visa, Inc. – Clyde McGregor |

At Harris Associates, we always prefer to own shares of companies that we understand to have protective moats surrounding their business. Visa, Inc. (V) is our portfolio’s holding that best demonstrates that attribute. Given that all of us reading this letter have at least some experience with and knowledge of Visa, it may be surprising that the financial services industry has difficulty appropriately classifying Visa. Is it a financial company? A technology company? We believe that it is best seen as a sort of technology company because the company’s above average profitability derives from the investment in its network. The network ties more than 20,000 financial institutions to millions of merchants around the world. More than two billion Visa cards exist today.

In 2012 Visa will process more than 80 billion transactions. All of this processing is routed through a single tech center in Ashburn, Virginia. This facility went live late in 2010, and it is estimated to have cost $430 million. It processes roughly 8,000 transactions per second, and it has been tested to more

| 14 Litman Gregory Funds Trust |

than 32,000. Its power, cooling, and other key features have built-in redundancies, and the facility even has food and other supplies to enable operation for 45 days. The physical layout allows for another significant hardware expansion, which could allow for multiples of increased processing capacity. It is this massive commitment to its network that makes it so difficult for competitors to enter this market. And it should be noted that the alternative payments methodologies that have entered the market have found it necessary to include Visa and MasterCard in order to enhance their legitimacy.

We also prefer to invest in companies that we believe have the wind behind their sails. In Visa’s case, it is the continual movement of merchant transactions from paper to electronic that provides the company unavoidable growth. Developed economies have seen their transactions move toward a 50:50 paper vs. electronic split, while emerging economies, though continuing to move in this direction, are not very far along in this evolution. The financial dynamics which the combination of leading market share, lowest cost network, and worldwide electronic transaction growth provide are quite powerful. This has helped to enable the company to repurchase its shares with unusual vigor, helping to enhance earnings per share growth.

Finally, the company recently announced a CEO transition that we view with favor. All in all we find Visa to be a remarkable business franchise with wonderful financial dynamics that continues to merit a place in our portfolio despite trading at a comparatively high earnings multiple.

| Schlumberger Ltd. – Sands Team |

We believe that several important secular trends have emerged over the past decade that are capable of supporting sustainable, above-average growth for well-positioned energy businesses. The first is the significant increase in global demand for oil and gas, driven by rapid economic growth and modernization in industrializing economies. The second, more important, trend is the increasing complexity associated with growing oil and gas supply to meet this higher demand.

We think Schlumberger Ltd. is uniquely poised to benefit from these trends. Its technologies are critical to enabling oil and gas companies to manage the risks, rising costs, and complexity associated with hydrocarbon production, placing Schlumberger at a key industry chokepoint. We believe Schlumberger’s integrated product suite and market-leading subsurface expertise position the company to not only benefit from its privileged position, but also expand on it to take share. While upstream capex is inherently cyclical in the short-term, this cyclicality is around an upwards secular growth trend, with upstream capex increasing 10% per year over the last 40 years.

We believe Schlumberger’s brand, scale, technology, and the depth and breadth of its product portfolios provide the company a wide competitive moat in many of the highest margin, highest value-added markets within the oil and gas industry. Furthermore, Schlumberger’s strong reputation, deeply entrenched relationships, large international footprint, and culturally diverse workforce grant the company an advantage in winning business with government-owned oil companies, who are continuously ratcheting up “local content” requirements in many of the largest and fastest-growing oilfield service markets. Finally, Schlumberger’s scale allows the company to spend more on R&D and targeted acquisitions than its competitors, which has led to the development of numerous breakthrough technologies (e.g., HiWAY channel fracturing, which has the potential to dramatically increase oil and gas production from shale, as well as the IsoMetrix family of 4D marine seismic products and services, which we believe could represent the next major evolutionary step in the way seismic data is acquired and processed). These innovations broaden Schlumberger’s potential market and deepen the company’s technological advantage. We believe that these advantages will strengthen as the industry moves into more complicated geologies, where demand for advanced technologies is stronger, standards for execution are more strenuous, and risks are higher.

We believe that growing demand for Schlumberger’s solutions, share gains, and margin expansion from the mix shift toward higher- margin services, better pricing, and increased scale will lead to an average of over 20% annual EPS growth over the next five years. In our view, relative to its historical average forward P/E of 20x, Schlumberger is attractively valued at 13x our 2013 EPS. We believe that Schlumberger remains well-positioned to add value over our investment horizon.

| Stratasys, Inc. – Turner Team |

Stratasys, Inc. develops and manufacturers 3D printers and solutions used in design, prototyping, and production. Through a computer aided design workstation, the user is able to design and manufacture products and/or models using Fused Deposition Modeling (FDM) technology. This technology utilizes a plastic or metal filament that is melted and dispensed through a nozzle to create layers which eventually build up to the end product. This “additive” technology reduces wasted material, allows for quicker production, and improved production precision and quality. 3D printing applications are found in a variety of end markets such as commercial manufacturing, aerospace, automotive, healthcare, military, education, and computer aided design (CAD). Stratasys solutions are primarily geared toward the professional market, whereas certain competitors are targeting the lower end hobbyist/consumer market. The company’s product lines include their MOJO product, aimed at desktop users and the lower end of the professional market, their uPrint product, targeted for the mid-sized market, their Dimension product, their top selling product designed for larger end products, and their Fortus product, which includes large prototypes or low quantity production of end-user products.

Growth Opportunities:

According to industry consultants, the 3D printer market was $1.7 billion last year, and is expected to exceed $6.5 billion by 2019, which implies a compound annual growth rate of 18%. Driving this growth is an increasing product awareness and adoption, improving technology, the use of new production materials such as metals and alloys, and demand for more efficient forms of production. We expect Stratasys will outpace the market given the company’s product breadth, technological leadership, up-sell opportunities, and market share gains.

Stratasys recently acquired Objet, a privately held Israeli based manufacturer of 3D printers. The complimentary nature of the two companies’ respective product lines should result in an unmatched product portfolio. Objet utilizes Poly-Jet technology, which is the process of injecting a photo-polymer through an inkjet printer head to achieve a higher resolution finish and a

| Fund Summary 15 |

better quality output. Stratasys’ Fused Deposition Modeling (FDM) technology results in a stronger end product, but Poly - Jet results in higher quality finishes. The combined company will be able to leverage each company’s technological know-how and individual sales and distribution footprints, which should result in significant channel synergy. The management team of Stratasys expects long-term growth targets for the combined company of at least 20% annual revenue growth and non-GAAP operating margins between 20 to 25%.

As the installed base of printer systems grows, we believe we will see an increasing demand for higher margin consumables. Consumables currently represent roughly 30% of Stratasys revenues, but over time we would expect the revenue mix to shift more in favor of consumables which should put an upward bias on margins. Additionally, consumables revenue trends tend to be more recurring in nature, especially if printer utilization is high. Over time this should create a more linear revenue trend on a quarter to quarter basis, improving overall earnings visibility.

Valuation:

Stratasys currently trades at 42 times the fiscal year 2013 consensus estimate of $1.87, which would represent a 34% year over year earnings growth rate based on 2012 estimates. This is above the 5 year average multiple of 30 times, but well off its peak multiple of 50 times. We believe this high valuation reflects a certain degree of scarcity value given the fact that Stratasys, and 3D Systems (DDD) are the only pure-plays within the 3D printing industry. Stratasys trades at a premium to 3D Systems, which we believe reflects stronger execution and a higher end product portfolio. Our $84 price target reflects a 38 times multiple on our fiscal year 2013 earnings estimate of $2.20. We see a possible upside bias driven by the potential for better execution on the Objet merger integration, driving higher than expected revenue/cost synergies.

| Quad Graphics, Inc. – Dick Weiss |

Quad Graphics, Inc. (QUAD) is among the largest printers in North America with a 41 year track record. Operating through three business segments: United States print, International, and Corporate, it has industry leading EBITDA margins that speak to its highly modern plant network and ability to use its scale to drive down costs. Roughly 90% of Quad’s revenue comes from printing magazines, retail flyers and catalogues. During the economic downturn in ‘07/’08, these product lines saw sharp declines which reflected a secular as well cyclical downturn. For the long term, QUAD is well positioned to maintain or grow cash flow through both synergistic acquisitions and market share gains. Long term, shareholders should benefit from QUAD’s $1.00 dividend and management’s commitment to return cash to its investors.

On October 10, 2012, QUAD announced the acquisition of Vertis, a Baltimore direct mail marketing firm, for $258.5 million or 2.8x EBITDA after adjusting for $88 million of current assets in excess of working capital. The company expects the deal to close in January 2013. With $1.1 billion in revenue, the portfolio at Vertis complements QUAD’s suite of offerings with additional retail inserts, direct-mail, and in-store marketing business. Similarly, in July of 2010 QUAD finalized the acquisition of World Color Press Inc., which prints such magazines as Sports Illustrated and Rolling Stone. From the acquisition, QUAD realized in excess of $275m in synergies vs. original guidance of $225m; the $275m in synergies accounted for 9% of trailing twelve month revenue. While management has not given expected synergy targets for the Vertis integration, their track record of maximizing cost savings from prior acquisitions gives us confidence they will be able to do the same as Vertis is integrated into QUAD’s portfolio of products.

The printing industry needs to undergo substantial consolidation because declining print volumes (due in part to online alternatives) will pressure marginal players given the high fixed cost nature of the business. QUAD could be a beneficiary of industry consolidation given its healthy balance sheet with 2.3x debt to EBITDA and easy access to debt. QUAD has begun to act as a consolidator in the industry which should maintain the utilization of its large scale, highly automated and low cost facilities.

Lastly, in recent months QUAD has unveiled its “interactive” app called Actable. Actable combines traditional advertising/ marketing with interactive software, utilizing smart phone technology to bring print advertising to life. With the original beta test in the September issue of Maxim and later in the October issue of the Milwaukee Magazine, the app has been well received by advertisers as well as users. While the monetization phase is yet ahead, we feel Actable will help drive future earnings power and represents potential upside in current models.

Utilizing our private market value process, in which we attempt to derive a potential take out price for the investments we analyze, we feel there is upside to QUAD. Despite an industry facing pressure from online alternatives, QUAD is well positioned to capitalize from a consolidating industry through its vast scale and management’s proven track record of getting the most out of acquisitions. Should QUAD’s Actable app gain additional traction, there may be upside to current EPS estimates and a narrowing of the relative gap to our implied private market value.

In keeping with Southeastern Asset Management’s disclosure policies, Mason Hawkins has not contributed commentary on his holdings in this report.

Neither the information contained herein nor any opinion expressed shall be construed to constitute an offer to sell or a solicitation to buy any securities mentioned herein. The views herein are those of the portfolio managers at the time the commentaries are written and may not be reflective of current conditions.

Earnings growth for a fund holding does not guarantee a corresponding increase in the market value of the holding or the fund.

| 16 Litman Gregory Funds Trust |

Litman Gregory Masters Equity Fund

schedule of investments in securities at December 31, 2012

| Shares | Value | |||||||

| COMMON STOCKS: 96.6% | ||||||||

| Consumer Discretionary: 16.4% | ||||||||

| 16,340 | Amazon.com, Inc.* | $ | 4,103,628 | |||||

| 78,800 | American Eagle Outfitters, Inc. | 1,616,188 | ||||||

| 55,000 | Brinker International, Inc. | 1,704,450 | ||||||

| 52,500 | Comcast Corp. | 1,887,375 | ||||||

| 85,300 | DIRECTV - Class A* | 4,278,648 | ||||||

| 62,000 | Drew Industries, Inc. | 1,999,500 | ||||||

| 141,000 | Express, Inc.* | 2,127,690 | ||||||

| 50,300 | Foot Locker, Inc. | 1,615,636 | ||||||

| 112,900 | HSN, Inc. | 6,218,532 | ||||||

| 172,500 | Interpublic Group of Companies, Inc. | 1,900,950 | ||||||

| 48,880 | Las Vegas Sands Corp. | 2,256,301 | ||||||

| 136,500 | Lear Corp. | 6,393,660 | ||||||

| 114,010 | Lennar Corp. | 4,408,767 | ||||||

| 26,250 | Michael Kors Holdings Ltd.* | 1,339,537 | ||||||

| 60,500 | Sonic Automotive, Inc. | 1,263,845 | ||||||

| 74,100 | Stage Stores, Inc. | 1,836,198 | ||||||

| 44,950,905 | ||||||||

| Consumer Staples: 0.6% | ||||||||

| 17,620 | Costco Wholesale Corp. | 1,740,327 | ||||||

| Energy: 9.4% | ||||||||

| 173,900 | Canadian Natural Resources Ltd. | 5,020,493 | ||||||

| 139,800 | Cenovus Energy, Inc. | 4,688,892 | ||||||

| 283,000 | Chesapeake Energy Corp. | 4,703,460 | ||||||

| 46,350 | Cobalt International Energy, Inc.* | 1,138,356 | ||||||

| 262,500 | Hercules Offshore, Inc.* | 1,622,250 | ||||||

| 23,000 | National Oilwell Varco, Inc. | 1,572,050 | ||||||

| 67,000 | Newfield Exploration Co.* | 1,794,260 | ||||||