UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

SEACHANGE INTERNATIONAL, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

1. |

Title of each class of securities to which transaction applies: |

|

|

2. |

Aggregate number of securities to which transaction applies: |

|

|

3. |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

4. |

Proposed maximum aggregate value of transaction: |

|

|

5. |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials: |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

1. |

Amount previously paid: |

|

|

2. |

Form, Schedule or Registration Statement No.: |

|

|

3. |

Filing Party: |

|

|

4. |

Date Filed: |

500 Totten Pond Road, Suite 400

Waltham, Massachusetts 02451

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 9, 2020

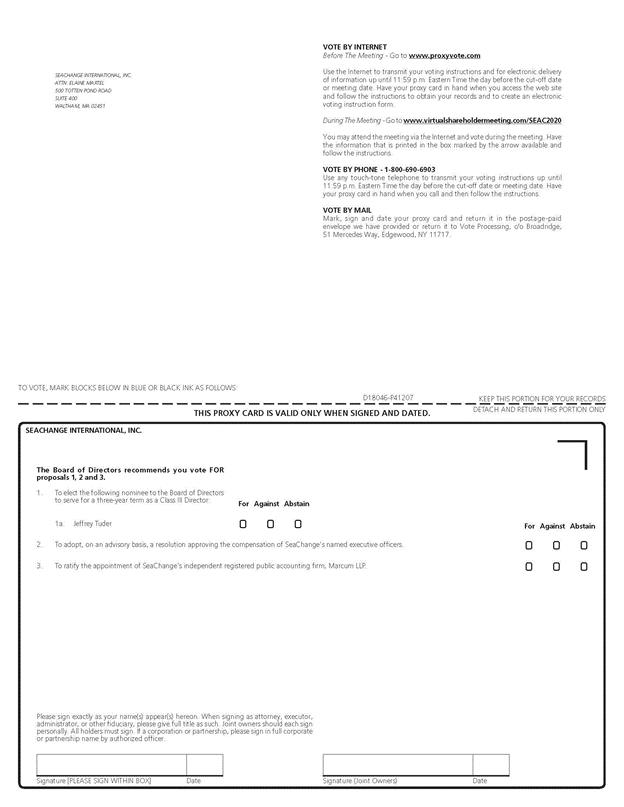

Due to the public health concerns regarding the novel coronavirus disease (“COVID-19”) pandemic, we are holding the Annual Meeting of Stockholders (the “Annual Meeting”) of SeaChange International, Inc. (“SeaChange” or the “Company”) in a virtual-only meeting format to support the health and well-being of our team members and stockholders. You will not be able to attend the Annual Meeting at a physical location, but rather you can log onto the meeting at www.virtualshareholdermeeting.com/SEAC2020. The Annual Meeting will be held on Thursday, July 9, 2020 at 10:00 a.m., Eastern Time, to consider and act upon each of the following matters:

|

|

1. |

To elect the nominee named in the proxy statement to the Board of Directors to serve for a three-year term as a Class III Director. |

|

|

2. |

To conduct an advisory vote on the compensation of the Company’s named executive officers. |

|

|

3. |

To ratify the appointment of the Company’s independent registered public accounting firm. |

|

|

4. |

To transact such other business as may properly come before the meeting and any adjournments thereof. |

Stockholders entitled to notice of and to vote at the meeting shall be determined as of the close of business on May 19, 2020, the record date fixed by the Board of Directors for such purpose.

IF YOU PLAN TO ATTEND:

If you are a registered stockholder or beneficial owner of common stock holding shares at the close of business on the record date, you may attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/SEAC2020 and logging in by entering the multi-digit control number found on your proxy card, voter instruction form, or Notice Regarding Internet Availability of Proxy Materials, as applicable. If you lost your multi-digit control number or are not a stockholder, you will be able to attend the meeting by visiting www.virtualshareholdermeeting.com/SEAC2020 and registering as a guest. If you enter the meeting as a guest, you will not be able to vote your shares or submit questions during the meeting. You may log into www.virtualshareholdermeeting.com/SEAC2020 beginning at 9:45 a.m., Eastern Time, on July 9, 2020. The Annual Meeting will begin promptly at 10:00 a.m., Eastern Time on July 9, 2020. If you experience any technical difficulties during the meeting, a toll-free number will be available on our virtual stockholder meeting site for assistance.

You may vote if you were a stockholder as of the record date. We urge you to read the proxy statement carefully and to vote in accordance with the recommendations of the Board of Directors. If voting in advance, you should vote by the deadlines specified in the proxy statement, and may do so by telephone or Internet, or, if you requested printed materials, by signing, dating, and returning the enclosed proxy card in the postage-paid envelope provided. If you do not vote in advance and instead plan to vote during the Annual Meeting, you may do so if you enter the multi-digit control number found on your proxy card, voter instruction form, or Notice Regarding Internet Availability of Proxy Materials, as applicable, at the time you log into the meeting at www.virtualshareholdermeeting.com/SEAC2020. Our list of stockholders will be available for the 10 days prior to the Annual Meeting. If you want to inspect the stockholder list, email our investor relations department at SEAC@gatewayir.com to make arrangements. The list of stockholders will also be available during the Annual Meeting through the meeting website for those stockholders who choose to attend.

If you have additional questions about the Annual Meeting, please contact Michael Prinn at michael.prinn@schange.com.

|

By Order of the Board of Directors, |

|

Michael Prinn, |

|

Chief Financial Officer, Senior Vice President and Treasurer |

Waltham, Massachusetts

May 27, 2020

Whether or not you expect to attend the meeting, we encourage you to vote promptly, following the instructions in the materials you received, to ensure that your shares are represented at the meeting.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JULY 9, 2020:

The Notice of Annual Meeting of Stockholders, Proxy Statement and the Company’s 2020 Annual Report are available at www.investors.seachange.com.

2020 ANNUAL MEETING OF STOCKHOLDERS

|

2 |

|

|

3 |

|

|

Securities Ownership Of Certain Beneficial Owners And Management |

3 |

|

6 |

|

|

6 |

|

|

7 |

|

|

8 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

11 |

|

|

11 |

|

|

11 |

|

|

11 |

|

|

12 |

|

|

12 |

|

|

12 |

|

|

Procedures for Stockholders to Recommend Director Candidates |

13 |

|

13 |

|

|

13 |

|

|

15 |

|

|

17 |

|

|

18 |

|

|

18 |

|

|

19 |

|

|

20 |

|

|

21 |

|

|

21 |

|

|

30 |

|

|

32 |

|

|

32 |

|

|

35 |

|

|

37 |

|

|

39 |

|

|

39 |

|

|

39 |

|

|

Potential Payments upon Termination Associated with a Change in Control |

39 |

|

42 |

|

|

43 |

|

|

PROPOSAL NO. II — ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS |

44 |

|

PROPOSAL NO. III — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

46 |

|

Independent Registered Public Accounting Firm for Fiscal 2021 |

46 |

|

47 |

|

|

48 |

|

|

48 |

|

|

48 |

500 Totten Pond Road, Suite 400

Waltham, Massachusetts 02451

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

July 9, 2020

May 27, 2020

This proxy statement is being furnished by the Board of Directors (the “Board”) of SeaChange International, Inc. (“SeaChange” or the “Company”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, July 9, 2020, at 10:00 a.m., Eastern Time. Due to public health concerns regarding the novel coronavirus disease (“COVID-19”) pandemic, the Annual Meeting will be held in a virtual-only format. To attend and participate in the Annual Meeting:

|

|

• |

Visit www.virtualshareholdermeeting.com/SEAC2020; and |

|

|

• |

Enter the multi-digit control number listed on your proxy card, voter instruction form, or Notice Regarding Internet Availability of Proxy Materials, as applicable. |

The Annual Meeting will begin promptly at 10:00 a.m., Eastern Time, on July 9, 2020. We encourage you to access the virtual platform prior to the start time to familiarize yourself with the virtual platform and ensure you can hear the streaming audio. You may log onto the virtual platform beginning at 9:45 a.m., Eastern Time, on July 9, 2020. The virtual meeting is supported across different online browsers and devices (desktops, laptops, tablets and cell phones). Please be certain you have the most updated version of the applicable software and plugins. Also, you should ensure that you have a strong internet connection from wherever you intend to participate in the Annual Meeting.

Only stockholders of record as of the close of business on May 19, 2020 (the “Record Date”) will be entitled to vote at the Annual Meeting and any adjournments thereof. As of the Record Date, there were 37,521,151 shares of our common stock outstanding. Each stockholder has one vote for each share of common stock held as of the Record Date.

SeaChange is pleased to take advantage of the U.S. Securities and Exchange Commission (the “SEC”) rules that allow companies to furnish their proxy materials over the Internet. We believe that this process allows SeaChange to provide its stockholders with the information they need in a timelier manner, while reducing the environmental impact and lowering the costs of printing and distributing its proxy materials. As a result, SeaChange is mailing to its stockholders of record entitled to vote at the Annual Meeting on or about May 29, 2020, a Notice Regarding Internet Availability of Proxy Materials (sometimes referred to as the “Notice”) instead of a paper copy of this proxy statement and SeaChange’s 2020 Annual Report. The Notice contains instructions on how to access those documents over the Internet. The Notice also contains instructions on how to request a paper copy of our proxy materials. All stockholders who have previously requested a paper copy of our proxy materials will continue to receive a paper copy of the proxy materials by mail. All other stockholders will not receive a printed copy of the proxy materials unless one is requested.

A number of brokers with account holders who are stockholders of SeaChange will be “householding” our proxy materials. A single copy of the Notice will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate copy of the Notice, please notify your broker and direct a written request to SeaChange International, Inc., 500 Totten Pond Road, Suite 400, Waltham, Massachusetts 02451, Attention: Secretary, or contact the Secretary by telephone at (978) 897-0100. Stockholders who currently receive multiple copies of the Notice at their address and would like to request “householding” of future communications should contact their broker. In addition, upon written or oral request to the address or telephone number set forth above, we will promptly deliver a separate copy of the Notice to any stockholder at a shared address to which a single copy of the documents was delivered.

1

Information Regarding Voting and Proxies

Stockholders may vote in one of the following ways:

|

|

2. |

By telephone, by calling the number on your proxy card, voter instruction form, or Notice Regarding of Internet Availability of Proxy Materials. |

|

|

3. |

By mail, by marking, signing, dating and mailing your proxy card if you requested printed materials, and returning it in the enclosed postage paid envelope by return mail; or |

|

|

4. |

By voting electronically during the virtual Annual Meeting at www.virtualshareholdermeeting.com/SEAC2020. |

Any proxy may be revoked by a stockholder at any time before its exercise by either delivering written revocation or a later dated proxy to the Secretary of SeaChange, entering a new vote by Internet or telephone, or by voting your shares while logged in and participating in the virtual Annual Meeting. Only your latest dated proxy will count.

All properly completed proxy forms returned in time to be cast at the Annual Meeting will be voted. Stockholders are being asked to vote with respect to the election of the Class III Director, an advisory vote on the compensation of the Company’s named executive officers and the ratification of the selection of SeaChange’s independent registered public accounting firm. Where a choice has been specified on the proxy card with respect to each proposal, the shares represented by the proxy will be voted in accordance with your specifications. If no specification is indicated on the proxy card, the shares represented by the proxy will be voted FOR the nominee named herein for election to the Board to serve as a Class III Director, FOR approval of the compensation of the Company’s named executive officers, and FOR the ratification of the selection of SeaChange’s independent registered public accounting firm.

A majority-in-interest of the outstanding shares represented at the Annual Meeting in person or by proxy shall constitute a quorum for the transaction of business. Votes withheld from any nominee, abstentions and broker “non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum for the meeting. A “non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. On all matters being submitted to stockholders at this Annual Meeting, an affirmative vote of at least a majority of the shares present, in person or represented by proxy, and voting on that matter is required for approval or ratification. An automated system administered by Broadridge Financial Solutions, Inc. tabulates the votes. The vote on each matter submitted to stockholders is tabulated separately. Abstentions, as well as broker “non-votes” are not considered to have been voted for such matters and have the practical effect of having no impact on the outcome of the vote.

The Board knows of no other matter to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote properly may be taken, shares represented by all proxies received by the Board will be voted with respect thereto in accordance with the judgment of the persons named as proxies and in accordance with the SEC’s proxy rules. See “Stockholder Proposals” herein at page 10. The persons named as proxies, Michael Prinn, Chief Financial Officer, Senior Vice President and Treasurer, and Elaine Martel, Senior Corporate Attorney, were selected by the Board.

2

Securities Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of SeaChange common stock as of May 19, 2020 by:

|

|

• |

each person or entity who is known by SeaChange to beneficially own more than five percent (5%) of the common stock of SeaChange; |

|

|

• |

each of the directors of SeaChange and each of the executive officers of SeaChange named in the Summary Compensation Table on page 32; and |

|

|

• |

all of the directors and executive officers of SeaChange as a group. |

Except for the named executive officers and directors, none of these persons or entities has a relationship with SeaChange, except as disclosed below under “Certain Relationships and Related Transactions.” Unless otherwise indicated, the address of each person or entity named in the table is c/o SeaChange International, Inc., 500 Totten Pond Road, Suite 400, Waltham, Massachusetts 02451, and each person or entity has sole voting power and investment power (or shares such power with his or her spouse), with respect to all shares of capital stock listed as owned by such person or entity.

3

The number and percentage of shares beneficially owned is determined in accordance with the rules of the SEC and is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership includes any shares as to which a person has sole or shared voting power or investment power and also any shares of common stock underlying restricted stock units (“RSUs”), performance stock units (“PSUs”), deferred stock units (“DSUs”), options or warrants that are exercisable by that person within sixty (60) days of May 19, 2020. However, the shares underlying RSUs, PSUs, DSUs, options or warrants are not treated as outstanding for the purpose of computing the percentage ownership of any other person or entity. Percentage of beneficial ownership is based on 37,521,151 shares of SeaChange’s common stock outstanding as of May 19, 2020.

|

Name |

|

Amount and Nature of Beneficial Ownership (1) (#) |

|

|

Percent of Common Stock Outstanding |

|

||

|

Yossi Aloni (2) |

|

|

197,451 |

|

|

* |

|

|

|

Michael Prinn (3) |

|

|

— |

|

|

* |

|

|

|

Marek Kielczewski |

|

|

794,602 |

|

|

|

2.1 |

% |

|

Chad Hassler (4) |

|

|

41,667 |

|

|

* |

|

|

|

Edward Terino (5) |

|

|

278,959 |

|

|

* |

|

|

|

Mark Bonney (6) |

|

|

165,442 |

|

|

* |

|

|

|

David McEvoy (7) |

|

|

263,323 |

|

|

* |

|

|

|

Peter Faubert (8) |

|

|

205,104 |

|

|

* |

|

|

|

Robert Pons (9) |

|

|

133,639 |

|

|

* |

|

|

|

Andrew Sriubas |

|

|

167,843 |

|

|

* |

|

|

|

Jeffrey Tuder (10) |

|

|

136,639 |

|

|

* |

|

|

|

Karen Singer/TAR Holdings LLC (11) 212 Vaccaro Drive Cresskill, NJ 07626 |

|

|

6,067,616 |

|

|

|

16.2 |

% |

|

Footprints Asset Management & Research, Inc. (12) 11422 Miracle Hills Drive, Suite 208 Omaha, NE 68154 |

|

|

3,054,458 |

|

|

|

8.1 |

% |

|

Dimensional Fund Advisors, LP (13) Building One 6300 Bee Cave Road Austin, TX 78746 |

|

|

2,104,846 |

|

|

|

5.6 |

% |

|

All Executive Officers and Directors as a group (7 persons) (14) |

|

|

1,471,841 |

|

|

|

3.8 |

% |

|

* |

Less than 1% |

|

(1) |

Includes shares of Common Stock which have not been issued but are subject to options which either are presently exercisable or will become exercisable within sixty (60) days of May 19, 2020, as follows: Mr. Aloni: 175,001 shares, Mr. Kielczewski: 347,280 shares and Mr. Hassler: 41,667 shares. Includes DSUs that will have vested within sixty (60) days of May 19, 2020, as follows: Mr. Pons: 59,172 DSUs; Mr. Sriubas: 59,172 DSUs; and Mr. Tuder: 59,172 DSUs. |

|

(2) |

Mr. Aloni was appointed as President and Chief Executive Officer of the Company on August 29, 2019 as previously reported on a Form 8-K filed with the SEC on August 29, 2019 after serving as the Company’s Chief Commercial Officer since January 2, 2019. Mr. Aloni was appointed as a director of the Company on October 31, 2019 as previously reported on a Form 8-K filed with the SEC on November 4, 2019. |

|

(3) |

Mr. Prinn joined the Company on October 8, 2019 as the Chief Financial Officer, Senior Vice President & treasurer of the Company as previously reported on a Form 8-K filed with the SEC on October 8, 2019. |

|

(4) |

Mr. Hassler was appointed as the Chief Commercial Officer of the Company on August 29, 2019 as previously reported on a Form 8-K filed with the SEC on August 29, 2019 after serving as the Vice President, North American Sales since February 11, 2019. |

|

(5) |

Mr. Terino resigned as the Chief Executive Officer and director of the Company on February 24, 2019 as previously reported on a Form 8-K filed with the SEC on February 26, 2019. The entry in the table above reflects Mr. Terino’s equity position as of the date of his employment termination. Information regarding any stock transactions after his employment termination date are not included. |

4

|

(7) |

Mr. McEvoy’s employment with the Company as the General Counsel, Senior Vice President & Secretary terminated on September 30, 2019. The entry in the table above reflects Mr. McEvoy’s equity position as of the date of his employment termination and post-termination continued vesting of his equity awards. Information regarding any stock transactions after his employment termination date are not included. |

|

(8) |

Mr. Faubert’s employment with the Company as the Chief Financial Officer, Senior Vice President & Treasurer terminated on October 8, 2019 as previously reported on a Form 8-K filed with the SEC on October 8, 2019. The entry in the table above reflects Mr. Faubert’s equity position as of the date of his employment termination and a post-termination vesting of one of his equity awards. Information regarding any stock transactions after his employment termination date are not included. |

|

(9) |

Mr. Pons was elected as a director to the Board on February 28, 2019 pursuant to the terms of the Cooperation Agreement, dated as of February 28, 2019 with TAR Holdings LLC and Karen Singer (collectively “TAR”) as previously reported on a Form 8-K filed with the SEC on March 1, 2019 (the “Cooperation Agreement”). |

|

(10) |

Mr. Tuder was elected as a director to the Board on February 28, 2019 pursuant to the terms of the Cooperation Agreement. |

|

(11) |

According to a Schedule 13D/A filed on August 12, 2019, Karen Singer and TAR Holdings LLC may be deemed to have sole dispositive power and sole voting power over the above-mentioned 6,067,616 shares. Ms. Singer and TAR Holdings LLC are parties to the Cooperation Agreement. |

|

(12) |

According to a Schedule 13G filed on February 14, 2019, Footprints Asset Management and Research, Inc. may be deemed to have sole dispositive power and sole voting power over the above-mentioned 3,054,458 shares. |

|

(13) |

According to an amended Schedule 13G/A filed on February 12, 2020, Dimensional Fund Advisors LP may be deemed to have sole dispositive power with respect to all 2,104,846 of the above-mentioned shares and sole voting power over 1,963,325 of the above-mentioned shares. Dimensional Fund Advisors LP serves as investment advisor to four investment companies and serves as investment manager to certain other commingled group trusts and investment accounts, which own the above-mentioned shares. Dimensional Fund Advisors LP disclaims beneficial ownership of such shares. |

|

(14) |

This group is comprised of SeaChange’s executive officers and directors as of the date of this proxy statement. Includes an aggregate of 741,464 shares of Common Stock which the directors and executive officers, as a group, have the right to acquire by exercise of stock options or will acquire upon vesting of RSUs or DSUs within sixty (60) days of May 19, 2020. |

5

SeaChange’s Board currently consists of four members, three of whom are independent, non-employee directors. The Board is divided into three classes. Each class is elected for a term of three years, with the terms of office of the directors in the respective classes expiring in successive years.

The present term of the current Class III Director, Mr. Tuder, expires at the Annual Meeting. The Board, based on the recommendation of the Corporate Governance and Nominating Committee, has nominated Mr. Tuder for re-election as a Class III Director. The nomination of Mr. Tuder is consistent with the obligations of the Company pursuant to the Cooperation Agreement, as described herein. The Board knows of no reason why the nominee should be unable or unwilling to serve, but if that should be the case, proxies may be voted for the election of some other person selected by the Board. Mr. Tuder has consented to being named in this proxy statement as a nominee to be a Class III Director and to serving in that capacity, if elected.

The Board unanimously recommends a vote “FOR” the Nominee listed below.

The following table sets forth, for the Class III nominee to be elected at the Annual Meeting and each of the other current directors, the year the nominee or director was first appointed or elected a director, the principal occupation of the nominee or director during at least the past five years, any other public company boards on which the nominee or director serves or has served in the past five years, the nominee’s or director’s qualifications to serve on the Board and the age of the nominee or director. In addition, included in the information presented below is a summary of each nominee’s or director’s specific experience, qualifications, attributes and skills that led the Board to the conclusion that he should serve as a director.

Class III Director (Term Expires at 2020 Annual Meeting)

|

Director’s Name Jeffrey Tuder (2019) |

|

Position and Principal Occupation and Business Experience During the Past Five Years Director & Vice Chairman of the Board

Jeffrey M. Tuder, 47, has served as the Vice Chairman of the Board since December 2019, Director of SeaChange since February 2019 and was appointed to the Board at that time pursuant to the terms of the Cooperation Agreement. Mr. Tuder is the founder of Tremson Capital Management, LLC and is currently a Director of Inseego Corp. (NASDAQ: INSG), where he serves as Chairman of the Audit and Compensation Committees. Previously, Mr. Tuder served as a Director of MRV Communications (NASDAQ: MRVC) where he served as Chairman of the Audit Committee prior to its sale to ADVA Optical Networking. Mr. Tuder occupied investment roles at a number of investment firms, including Fortress Investment Group, LLC, Nassau Capital, LLC (Princeton University’s endowment), KSA Capital, JHL Capital Group, CapitalSource Finance, and ABS Capital Partners (Alex. Brown & Sons). Mr. Tuder has served on the board of directors and advisory boards of numerous privately-held companies. He received a B.A. in English Literature from Yale College. Mr. Tuder’s private equity and hedge fund investment experience, his expertise in evaluating both public and private investment opportunities across numerous industries, and his ability to think creatively in considering ways to maximize long-term shareholder value provide a valuable background for him to serve as a member of the Board.

|

6

Class I Director (Term Expires at 2021 Annual Meeting)

|

|

|

|

|

Director’s Name |

|

Position and Principal Occupation and Business Experience During the Past Five Years |

|

Yossi Aloni (2019) |

|

Director, President and Chief Executive Officer

Mr. Aloni, 51, joined the Company on January 2, 2019 as Chief Commercial Officer and Senior Vice President. He was appointed to the Office of the CEO in February 2019 and served in that position until April 2019 before being appointed as the President and Chief Executive Officer in August 2019. Mr. Aloni was appointed as a Director of the Company in October 2019. Prior to joining SeaChange, Mr. Aloni was the Chief of Corporate Operations of ATEME from January 2015 to January 2019. Mr. Aloni served as the Vice President, Product Management & Marketing at Magnum Semiconductor from January 2010 to January 2015. Prior to joining Magnum Semiconductor, Mr. Aloni was the President at Optibase. Mr. Aloni has held various other positions with Ted-Ad/MGM International and HOT. Mr. Aloni also served as Lieutenant, Head of Video Section for the Israel Defense Forces. Mr. Aloni’s extensive management experience in the media industry provides a relevant and informed background for him to serve as a member of the Board. |

7

Class II Directors (Terms Expire at 2022 Annual Meeting)

|

Nominee’s Name |

|

Position and Principal Occupation and Business Experience During the Past Five Years |

|

Robert M. Pons (2019) |

|

Director and Chairman of the Board

Robert Pons, 64, has served as the Chairman of the Board since November 2019, a Director of SeaChange since February 2019, and was appointed to the Board at that time pursuant to the terms of the Cooperation Agreement. Mr. Pons is the President and Chief Executive Officer of Spartan Advisors Inc., a management consulting firm specializing in telecom and technology companies. From May 2014 until January 2017, he was Executive Vice President of Business Development and from September 2011 until June 2016 was on the board of directors, of HC2 Holdings, Inc. (“HC2”) (NYSE MKT: HCHC), a publicly traded diversified holding company with a diverse array of operating subsidiaries, including telecom/infrastructure, construction, energy, technology, gaming and life sciences. From February 2011 to April 2014, Mr. Pons was Chairman of Live Micro Systems, Inc. (formerly Livewire Mobile), a comprehensive one-stop digital content solution for mobile carriers. From January 2008 until February 2011, Mr. Pons was Senior Vice President of TMNG Global (now Cartesian), a leading provider of professional services to the telecommunications industry and the capital formation firms that support it. From January 2003 until April 2007, Mr. Pons served as President and Chief Executive Officer of Uphonia, Inc. (previously SmartServ Online, Inc.), a wireless applications service provider. From March 1999 to August 2003, Mr. Pons was President of FreedomPay, Inc., a wireless device payment processing company. During the period January 1994 to March 1999, Mr. Pons was President of Lifesafety Solutions, Inc., a software company catering to 911 call centers. Mr. Pons previously served on the boards of directors of Inseego, Inc., Network-1 Technologies, Inc., Arbinet Corporation, PTGi, Inc., HC2, Proxim Wireless Corporation, MRV Communications, Inc., DragonWave-X and Concurrent Computer Corporation. Mr. Pons holds a B.A. degree from Rowan University with Honors. Mr. Pons has over 30 years of management experience with telecommunications companies including MCI, Inc., Sprint, Inc. and Geotek, Inc. Mr. Pons’s experience serving on public company boards of directors, his knowledge and expertise as a pioneer in the telecommunications industry and his experience as a senior level executive working in the telecommunications industry provide a relevant and informed background for him to serve as a member of the Board.

|

|

|

|

|

8

|

|

Director

Andrew Sriubas, 51, has served as a Director of SeaChange since August 2017. In addition, Mr. Sriubas has served as Chief Commercial Officer of Outfront Media since August 2017, and previously served as Executive Vice President of Strategic Planning & Development from July 2014 through August 2017. Mr. Sriubas began his career with Citibank in media and tech investment banking and held managing director roles at other firms including Donaldson Lufkin Jenrette, UBS, and JP Morgan, before joining Sonifi as Chief Strategist and Head of Corporate Development. Mr. Sriubas is a member of the Advisory Committee of Palisades Growth Capital, and also serves as an advisor to Secure Mobile Contact System Co. and Tout Inc. Mr. Sriubas is also a director of the Jack Kemp Foundation. Mr. Sriubas holds a B.S. in Finance from the Carroll School of Management at Boston College. Mr. Sriubas has been an advisor to the Board since May 2016 and previously chaired the Company’s Advisory Board that works with the management team on strategic and technology matters. Mr. Sriubas’ experience as a former telecom, media and technology banker; his experience developing new technologies to advance innovative business models as he has for the digital theatre industry, hospitality industry and now in his capacity redrawing the out of home/location media landscape provide a relevant and informed background for him to serve as a member of the Board.

|

9

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

Determination of Director Independence

The Board has determined that Messrs. Pons, Sriubas and Tuder are “independent” directors, meeting all applicable independence requirements of the SEC, including Rule 10A-3(b)(1) pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Marketplace Rules of The NASDAQ Stock Market (“NASDAQ”). In making this determination, the Board affirmatively determined that none of such directors has a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. With respect to Messrs. Pons and Tuder, the Board determined that neither the identification of each as a director nominee by TAR Holdings LLC and Karen Singer, nor the terms of Cooperation Agreement, precluded a determination that each of Messrs. Pons and Tuder qualified as “independent”.

Proposals of stockholders intended to be presented at the 2021 Annual Meeting of Stockholders must be received no later than the close of business on January 29, 2021 at SeaChange’s principal executive offices in order to be included in the SeaChange proxy statement for that meeting. Any such stockholder proposals should be submitted to SeaChange International, Inc., 500 Totten Pond Road, Waltham, Massachusetts, 02451, Attention: Secretary. Under the By-Laws of SeaChange, stockholders who wish to make a proposal at the 2021 Annual Meeting — other than one that will be included in SeaChange’s proxy materials — must notify SeaChange no earlier than December 30, 2020, and no later than January 29, 2021. If a stockholder who wishes to present a proposal fails to notify SeaChange by January 29, 2021, the stockholder will not be entitled to present the proposal at the meeting. If, however, notwithstanding the requirements of the By-Laws of SeaChange, the proposal is brought before the meeting, then under the SEC’s proxy rules the proxies solicited by management with respect to the 2021 Annual Meeting will confer discretionary voting authority with respect to the stockholder’s proposal on the persons selected by management to vote the proxies. If a stockholder makes a timely notification, the proxies may still exercise discretionary voting authority under circumstances consistent with the SEC’s proxy rules.

In order to curtail controversy as to the date on which a proposal will be marked as received by SeaChange, it is suggested that stockholders submit their proposals by Certified Mail — Return Receipt Requested.

Availability of Corporate Governance Documents

SeaChange’s Code of Ethics and Business Conduct (“Ethics Policy”) for all directors and all employees of SeaChange, including executive officers, and the charters for the Audit, Compensation, and Corporate Governance and Nominating Committees of the Board are available on SeaChange’s website at www.seachange.com under the “Corporate Governance” section of the “Investor Relations” link. SeaChange will ensure that amendments, if any, to these documents are disclosed and posted on this website within four (4) business days of any such amendment.

The Board of SeaChange met twenty-three (23) times and acted by written consent twelve (12) times during the fiscal year ended January 31, 2020. During the fiscal year ended January 31, 2020, each then director attended at least seventy-five percent (75%) of the total number of meetings of the Board and meetings of all the committees of the Board on which they serve. SeaChange has a policy that each member of its Board is encouraged to attend SeaChange’s Annual Meeting of Stockholders. Last year, all of the directors attended the Annual Meeting of Stockholders that was held on July 11, 2019.

Mr. Markey served as Chairman of the Board until April 4, 2019, at which time he resigned from the position when Mr. Bonney was appointed as the Company’s Executive Chair. In connection with that appointment, Mr. Bonney fulfilled the duties of Chairman of the Board and as the Company’s principal executive officer. Effective August 29, 2019, Mr. Bonney stepped down as the Company’s principal executive officer when Yossi Aloni was appointed President and Chief Executive Officer of the Company, but remained in the position of Executive Chair.

10

Effective October 1, 2019, Mr. Bonney resigned as Executive Chair, but continued as the Chairman of the Board until his retirement on December 3, 2019. On December 4, 2019, Mr. Pons was appointed Chairman of the Board, and on December 9, 2019, Mr. Tuder was appointed Vice Chairman of the Board. In the capacity of Chairman of the Board and/or Executive Chair, Messrs. Markey, Bonney and Pons each set the agenda for Board meetings and served to facilitate and improve communication between the independent directors and the Company’s senior management.

Pursuant to the terms of the Cooperation Agreement, TAR was granted the right to cause the Board to appoint Robert Pons as a Class II Director, to appoint Jeffrey Tuder as a Class III Director, and, subject to the terms of the Cooperation Agreement, nominate, recommend, support and solicit proxies for Mr. Pons at the 2019 Annual Meeting of Stockholders. The foregoing summary of the Cooperation Agreement is qualified in its entirety by reference to the complete text of the Cooperation Agreement that is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on March 1, 2019.

The Board oversees the business and strategic risks of SeaChange, including risks related to cybersecurity. The Audit Committee oversees financial reporting, internal controls and compliance risks confronting SeaChange. The Compensation Committee oversees risks associated with SeaChange’s compensation policies and practices, including performance-based compensation and change in control plans. The Corporate Governance and Nominating Committee oversees risks relating to corporate governance and the process governing the nomination of members of the Board. SeaChange provides a detailed description of the risk factors impacting its business in its Annual Report on Form 10-K and if necessary, its Quarterly Reports on Form 10-Q filed with the SEC.

The Board has a standing Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee. The members of each committee are appointed by the Board based on the recommendation of the Corporate Governance and Nominating Committee. The members are set forth below in this proxy statement. Actions taken by any committee of the Board are reported to the Board, usually at the next Board meeting following a committee meeting. Each of these standing committees is governed by a committee-specific charter that is reviewed periodically by the applicable committee pursuant to the rules set forth in each charter. The Board annually conducts a self-evaluation of each of its committees. All members of all committees are independent directors.

The current Audit Committee members are Mr. Tuder (Chairman, effective April 4, 2019) and Messrs. Pons and Sriubas, each of whom meet the independence requirements of the SEC and NASDAQ, as described above. Mr. Bonney had previously been the Audit Committee Chairman from May 1, 2018 until his appointment as Executive Chair on April 4, 2019; Ms. Cotton served on the Audit Committee until her retirement on May 5, 2019; Mr. Markey served on the Audit Committee until his retirement on September 15, 2019. In addition, SeaChange’s Board has determined that each member of the Audit Committee is financially literate and that Mr. Tuder satisfies the requirement of the Marketplace Rules applicable to NASDAQ-listed companies that at least one member of the Audit Committee possess financial sophistication and that Mr. Tuder is an “audit committee financial expert” as defined in the rules and regulations promulgated under the Exchange Act. The Audit Committee’s oversight responsibilities include matters relating to SeaChange’s financial disclosure and reporting process, including the system of internal controls, the performance of SeaChange’s internal audit function, compliance with legal and regulatory requirements, and the appointment and activities of SeaChange’s independent auditors. The Audit Committee met eight (8) times and acted by written consent three (3) times during fiscal 2020. The responsibilities of the Audit Committee and its activities during fiscal 2020 are more fully described under the heading “Report of the Audit Committee” contained in this proxy statement.

11

The current Compensation Committee members are Mr. Sriubas (Chairman, effective April 4, 2019) and Messrs. Pons and Tuder, each of whom meet the independence requirements of the SEC and NASDAQ, as described above. Mr. Bonney had previously been a member and the Chairman of the Compensation Committee from August 17, 2017 until his appointment as Executive Chair on April 4, 2019, and Ms. Cotton served on the Compensation Committee until her retirement on May 5, 2019. Among other things, the Compensation Committee determines the compensation, including stock options, RSUs and other equity compensation, of SeaChange’s management and key employees, administers and makes recommendations concerning SeaChange’s equity compensation plans, and ensures that appropriate succession planning takes place for all levels of management, department heads and senior management. The Compensation Committee met seven (7) times and acted by unanimous written consent fourteen (14) times during fiscal 2020. The responsibilities of the Compensation Committee and its activities during fiscal 2020 are more fully described in this proxy under the heading, “COMPENSATION DISCUSSION AND ANALYSIS.”

Corporate Governance and Nominating Committee

The current Corporate Governance and Nominating Committee members are Mr. Pons (Chairman, effective September 15, 2019) and Messrs. Sriubas and Tuder, each of whom meet the independence requirements of the SEC and NASDAQ, as described above. Mr. Markey had previously served as the Corporate Governance and Nominating Committee Chairman until his retirement from the Board on September 15, 2019. Ms. Cotton served on the Corporate Governance and Nominating Committee until her retirement on May 5, 2019; and Mr. Wilson served on the Corporate Governance and Nominating Committee until the end of his term as a director on July 11, 2019. The Corporate Governance and Nominating Committee is responsible for oversight of corporate governance at SeaChange, recommending to the Board persons to be nominated for election or appointment as directors of SeaChange and monitoring compliance with SeaChange’s Code of Ethics and Business Conduct. The Corporate Governance and Nominating Committee identifies Board candidates through numerous sources, including recommendations from existing Board members, executive officers, and stockholders of SeaChange. Additionally, the Corporate Governance and Nominating Committee may identify candidates through engagements with executive search firms. The Corporate Governance and Nominating Committee met five (5) times and acted by unanimous written consent four (4) times during fiscal 2020.

Qualifications of Director Candidates

In evaluating the suitability of individuals for Board membership, the Corporate Governance and Nominating Committee takes into account many factors, including whether the individual meets the requirements for independence, his or her professional expertise and educational background, and the potential to contribute to the diversity of viewpoints, backgrounds or experiences of the Board as a whole including diversity of experience, gender, race, ethnicity and age. The Corporate Governance and Nominating Committee evaluates each individual in the context of the entire Board, with the objective of recommending nominees who can best further the success of SeaChange’s business and represent stockholder interests. The Corporate Governance and Nominating Committee assigns specific weights to particular criteria for prospective nominees. SeaChange believes that the backgrounds and qualifications of directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. As part of the consideration in fiscal 2020 by the Corporate Governance and Nominating Committee of candidates for election to the Board, these criteria were reviewed. No changes to these criteria were recommended as a result of such review.

12

Procedures for Stockholders to Recommend Director Candidates

Stockholders wishing to suggest candidates to the Corporate Governance and Nominating Committee for consideration as potential director nominees may do so by submitting the candidate’s name, experience, and other relevant information to the SeaChange Corporate Governance and Nominating Committee, 500 Totten Pond Road, Suite 400, Waltham, Massachusetts 02451. SeaChange stockholders wishing to nominate directors may do so by submitting a written notice to the Secretary of SeaChange at the same address in accordance with the nomination procedures set forth in SeaChange’s By-Laws. The procedures are summarized in this proxy statement under the heading “Stockholder Proposals.” The Secretary will provide the notice to the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee will consider candidates recommended by stockholders and does not distinguish between nominees recommended by stockholders and other nominees. All nominees must meet, at a minimum, the qualifications described in “Qualifications of Director Candidates” above.

Process for Stockholders to Communicate with Directors

Stockholders may write to the Board or a particular Board member by addressing such communication to the Chairman of the Board, if directed to the Board as whole, or to an individual director, if directed to that particular Board member, care of SeaChange’s Secretary, at SeaChange’s offices at 500 Totten Pond Road, Suite 400, Waltham, Massachusetts 02451. Unless such communication is addressed to an individual director, SeaChange will forward any such communication to each of the directors. Communication sent in any other manner, including but not limited to email, text messages or social media will be forwarded to the entire Board. The Chairman of the Board will determine the appropriate response to such communication.

Directors who are employees of SeaChange receive no compensation for their services as directors, except for reimbursement of expenses incurred in connection with attending meetings.

Non-employee directors received the following cash compensation in fiscal 2020:

|

|

• |

A cash retainer of $45,000; |

|

|

• |

The Chairman of the Board received additional cash compensation of $25,000; |

|

|

• |

Each member of the Audit Committee received additional cash compensation of $7,500, other than the Chairman of the Audit Committee, who received additional cash compensation of $15,000; |

|

|

• |

Each member of the Compensation Committee received additional cash compensation of $6,000, other than the Chairman of the Compensation Committee, who received additional cash compensation of $12,000; and |

|

|

• |

Each member of the Corporate Governance and Nominating Committee received additional cash compensation of $5,000, other than the Chairman of the Corporate Governance and Nominating Committee, who received additional cash compensation of $10,000. |

In addition, each non-employee director is entitled to receive an annual grant of RSUs valued at $100,000, granted on the date of our Annual Meeting and which vests in full one year from the grant date, subject to acceleration in the event of a Change in Control. Our non-employee directors have the option to receive stock options or DSUs in lieu of RSUs, and the shares underlying the DSU are not issued until the earlier of the director ceasing to be a member of the Board or immediately prior to consummation of a Change in Control.

Newly appointed non-employee directors receive an initial grant of RSUs valued at $100,000, granted on the date of the director’s appointment or election to the Board, which vest annually in three (3) equal tranches over a three (3) year period, subject to acceleration in the event of a Change in Control. Newly appointed non-employee directors also receive (i) 100% of the annual grant of RSUs valued at $100,000 if their appointment/election is within six (6) months of the Company’s last Annual Meeting of Stockholders or (ii) 50% of the annual grant of RSUs valued at $50,000 if their appointment/election is within six (6) months of the Company’s next Annual Meeting of Stockholders. New non-employee directors have the option to receive their initial grant in the form of stock options or DSUs rather than RSUs (as described above with respect to the annual awards).

13

Director Compensation Fiscal 2020

|

Name |

|

Fees Earned or Paid in Cash ($) |

|

|

Stock Awards (1) ($) |

|

|

Total ($) |

|

|||

|

Mark Bonney (2) |

|

|

41,333 |

|

|

|

— |

|

|

|

41,333 |

|

|

Mary Palermo Cotton (3) |

|

|

95,250 |

|

|

|

— |

|

|

|

95,250 |

|

|

William F. Markey, III (4) |

|

|

106,000 |

|

|

|

100,000 |

|

|

|

206,000 |

|

|

Robert Pons (5) |

|

|

56,021 |

|

|

|

500,000 |

|

|

|

556,021 |

|

|

Andrew Sriubas |

|

|

64,875 |

|

|

|

200,000 |

|

|

|

264,875 |

|

|

Jeffrey Tuder (6) |

|

|

58,500 |

|

|

|

500,000 |

|

|

|

558,500 |

|

|

Royce E. Wilson (7) |

|

|

25,000 |

|

|

|

— |

|

|

|

25,000 |

|

|

|

(1) |

The grant date fair value for each of these awards, aggregated in the above table, is as follows: |

|

Name |

|

Date of Grant |

|

Stock Awards (#DSUs, except as noted) |

|

|

Total Grant Date Fair Value ($) |

|

||

|

William F. Markey, III (4) |

|

7/11/2019 |

|

|

59,172 |

|

|

|

100,000 |

|

|

Robert Pons (5) |

|

2/28/2019 |

|

|

65,359 |

|

|

|

100,000 |

|

|

Robert Pons (5) |

|

2/28/2019 |

|

|

32,680 |

|

|

|

50,000 |

|

|

Robert Pons (5) |

|

7/11/2019 |

|

|

59,172 |

|

|

|

100,000 |

|

|

Robert Pons (5) |

|

12/18/2019 |

|

|

58,140 |

|

(8) |

|

250,000 |

|

|

Andrew Sriubas |

|

7/11/2019 |

|

|

59,172 |

|

|

|

100,000 |

|

|

Andrew Sriubas |

|

12/18/2019 |

|

|

23,256 |

|

(8) |

|

100,000 |

|

|

Jeffrey Tuder (6) |

|

2/28/2019 |

|

|

65,359 |

|

|

|

100,000 |

|

|

Jeffrey Tuder (6) |

|

2/28/2019 |

|

|

32,680 |

|

|

|

50,000 |

|

|

Jeffrey Tuder (6) |

|

7/11/2019 |

|

|

59,172 |

|

|

|

100,000 |

|

|

Jeffrey Tuder (6) |

|

12/18/2019 |

|

|

58,140 |

|

(8) |

|

250,000 |

|

|

|

(3) |

Ms. Cotton retired from the Board on May 5, 2019. In conjunction with her retirement, Ms. Cotton received (i) a payment of $63,500 for the Board fees that Ms. Cotton would have received through the 2020 Annual Meeting and (ii) her stock award granted on July 11, 2018 was permitted to continue vesting. The $95,250 is comprised of Ms. Cotton’s regular Board fees of $31,750 plus the $63,500 payment. |

|

|

(4) |

Mr. Markey retired from the Board on September 15, 2019. In conjunction with his retirement, Mr. Markey received (i) a payment of $51,375 (of which $17,125 was paid in fiscal 2020) for the Board fees that Mr. Markey would have received through the 2020 Annual Meeting and (ii) his stock award granted on July 11, 2019 was permitted to continue vesting. The $106,000 is comprised of Mr. Markey’s regular Board fees of $54,625 plus the $51,375 payment. |

|

|

(5) |

Mr. Pons was appointed to the Board on February 28, 2019 pursuant to and subject to the terms of the Cooperation Agreement. Mr. Pons elected to take RSUs instead of DSUs for the December 18, 2019 stock grant. |

|

|

(6) |

Mr. Tuder was appointed to the Board on February 28, 2019 pursuant to and subject to the terms of the Cooperation Agreement. |

|

|

(7) |

Mr. Wilson decided not to stand for election at the 2019 Annual Meeting of Stockholders as a Class II Director of the Company due to his increased responsibilities outside of the Company, and his term expired on July 11, 2019. |

14

The table below shows the aggregate number of unvested stock awards and options for each non-employee director as of January 31, 2020. Stock awards consist of DSUs (except as otherwise noted below) for which the minimum one-year service period has not been satisfied.

|

Name |

|

Aggregate Stock Awards Outstanding (#) |

|

|

Aggregate Stock Options Outstanding (#) |

|

||

|

Mark Bonney (1) |

|

|

70,821 |

|

|

|

— |

|

|

Mary Palermo Cotton (2) |

|

|

— |

|

|

|

— |

|

|

William F. Markey, III (3) |

|

|

59,172 |

|

|

|

— |

|

|

Robert Pons |

|

|

182,671 |

|

|

|

— |

|

|

Andrew Sriubas |

|

|

95,102 |

|

|

|

— |

|

|

Jeffrey Tuder |

|

|

182,671 |

|

|

|

— |

|

|

Royce. E. Wilson (4) |

|

|

— |

|

|

|

— |

|

|

|

(1) |

Mr. Bonney did not have any unvested stock awards relating to his compensation as a non-employee director. Stock awards relating to Mr. Bonney’s compensation as Executive Chair are fully described in this proxy under the heading “COMPENSATION DISCUSSION AND ANALYSIS” and the related tables. |

|

|

(2) |

Ms. Cotton retired from the Board on May 5, 2019, and no longer has any unvested stock awards. |

|

|

(3) |

Mr. Markey retired from the Board on September 15, 2019, and his final stock award of 59,172 DSUs continues to vest until July 11, 2020. |

|

|

(4) |

Mr. Wilson decided not to stand for election at the 2019 Annual Meeting of Stockholders as a Class II Director of the Company due to his increased responsibilities outside of the Company. His term expired on July 11, 2019, and he no longer has any unvested stock awards. |

The Audit Committee currently consists of Mr. Tuder (Chairman) and Messrs. Pons and Sriubas.

The Audit Committee’s primary duties and responsibilities are to:

|

|

• |

Appoint, compensate and retain SeaChange’s independent registered public accounting firm, and oversee the work performed by the independent registered public accounting firm; |

|

|

• |

Assist the Board in fulfilling its responsibilities by reviewing the financial reports provided by SeaChange to the SEC and SeaChange’s stockholders; |

|

|

• |

Monitor the integrity of SeaChange’s financial reporting process and systems of internal controls regarding finance, accounting, and legal compliance; |

|

|

• |

Recommend, establish and monitor procedures designed to improve the quality and reliability of the disclosure of SeaChange’s financial condition and results of operations; and |

|

|

• |

Provide an avenue of communication among the independent registered public accounting firm, management and the Board. |

The Board has adopted a written charter setting out the functions the Audit Committee is to perform. A copy of this may be found on SeaChange’s website at www.seachange.com under the “Corporate Governance” section of the “Investor Relations” link.

15

Management has primary responsibility for SeaChange’s consolidated financial statements and the overall reporting process, including SeaChange’s system of internal controls.

The independent registered public accounting firm audits the annual consolidated financial statements prepared by management, expresses an opinion as to whether those consolidated financial statements fairly present, in all material respects, the financial position, results of operations and cash flows of SeaChange in conformity with accounting principles generally accepted in the United States of America, expresses an opinion on the effectiveness of internal control over financial reporting and discusses with the Audit Committee any issues the independent registered public accounting firm believes should be raised with SeaChange.

For fiscal 2020, the Audit Committee reviewed the audited consolidated financial statements of SeaChange and met with both management and Marcum LLP and Grant Thornton LLP, SeaChange’s independent registered public accounting firms that served in fiscal 2020, to discuss those consolidated financial statements.

The Audit Committee has received from and discussed with Marcum LLP and Grant Thornton LLP the written disclosures and the letters required by the applicable requirements of the Public Company Accounting Oversight Board regarding Marcum LLP’s and Grant Thornton LLP’s communications with the Audit Committee concerning independence and has discussed with Marcum LLP and Grant Thornton LLP their independence. The Audit Committee also discussed with Marcum LLP and Grant Thornton LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC.

Based on these reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements of SeaChange be included in its Annual Report on Form 10-K for the fiscal year ended January 31, 2020. The Audit Committee also decided to retain Marcum LLP as SeaChange’s independent registered public accounting firm for the 2021 fiscal year.

RESPECTFULLY SUBMITTED BY THE AUDIT

COMMITTEE OF THE BOARD OF DIRECTORS

Jeffrey Tuder, Chairman

Robert Pons

Andrew Sriubas

The information contained in this Audit Committee Report shall not be deemed to be “soliciting material.” No portion of this Audit Committee Report shall be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, through any general statement incorporating by reference in its entirety the proxy statement in which this report appears, except to the extent that SeaChange specifically incorporates this report or any portion of it by reference. In addition, this report shall not be deemed to be filed under either the Securities Act or the Exchange Act.

16

INFORMATION CONCERNING EXECUTIVE OFFICERS

In addition to Yossi Aloni, SeaChange’s President, Chief Executive Officer and Director, whose biographical information is set forth above on page 7, SeaChange’s executive officers are:

|

Executive Officer’s Name |

|

Position and Principal Occupation and Business Experience During the Past Five Years |

|

Michael Prinn |

|

Chief Financial Officer, Senior Vice President and Treasurer

Mr. Prinn, 47, joined the Company on October 8, 2019 as Chief Financial Officer, Senior Vice President and Treasurer. Mr. Prinn previously served as the Vice President, Finance of Brightcove, Inc. (NASDAQ: BCOV) from October 2018 to September 2019. Prior to that, from October 2012 to September 2018, Mr. Prinn served as the Executive Vice President and Chief Financial Officer of Bridgeline Digital, Inc. (NASDAQ: BLIN). In addition to his duties as Chief Financial Officer, Mr. Prinn acted as Co-Interim Chief Executive Officer and President of Bridgeline Digital from December 2015 to May 2016, when a new President and Chief Executive Officer was appointed. |

|

|

|

|

|

Marek Kielczewski |

|

Chief Technology Officer and Senior Vice President

Mr. Kielczewski, 43, joined the Company on May 5, 2016 as Senior Vice President CPE Software as part of SeaChange’s acquisition of DCC Labs in May 2016. He became Senior Vice President, Global Engineering in August 2017 and became the Chief Technology Officer in November 2018, and from February 25, 2019 to April 4, 2019, served in the Office of the CEO. Prior to joining SeaChange, Mr. Kielczewski was the Chief Executive Officer of DCC Labs from December 2009 to May 2016. Mr. Kielczewski served as the Chief Operating Officer of Sentivision from March 2002 to July 2008. Mr. Kielczewski started his career at an IT Director at 7bulls S.A. |

|

|

|

|

|

Chad Hassler |

|

Chief Commercial Officer and Senior Vice President

Mr. Hassler, 46, joined the Company on February 11, 2019 as Vice President, North America, and was appointed Chief Commercial Officer on August 29, 2019. Prior to joining SeaChange, Mr. Hassler was the Vice President North America of ATEME from September 2015 to February 2019. Mr. Hassler served as the Vice President of Sales at Concurrent Computer Corporation from September 2012 to September 2015. Prior to joining Concurrent Computer, Mr. Hassler was the Director of Sales at Harmonic.

|

Executive officers of SeaChange are appointed by, and serve at the discretion of, the Board, and serve until their successors have been duly elected and qualified. There are no family relationships among any of the executive officers or directors of SeaChange. Each executive officer is a full-time employee of SeaChange.

17

COMPENSATION DISCUSSION AND ANALYSIS

We have implemented an executive compensation program that rewards performance. Our executive compensation program is designed to attract, retain and motivate the key individuals who are most capable of contributing to our success and building long-term value for our stockholders. The elements of our executives’ total compensation are base salary, incentive compensation and other employee benefits. We have designed a compensation program that makes a substantial portion of executive pay variable, subject to increase when performance targets are achieved, and subject to reduction when performance targets are not achieved, which we believe aligns the interests of our executives with that of our stockholders.

Fiscal 2020 Business Results

In fiscal 2020, we continued to address what we see as the continuing rise of multiscreen viewing. Consumer device options are evolving rapidly and viewing habits are shifting. The primary driver of our business is enabling the delivery of video assets in the changing multiscreen television environment. Through strategic collaborations, we have expanded our capabilities, products and services to address the delivery of content to devices other than television set-top boxes, namely PCs, tablets, smart phones and OTT streaming players. We believe that our strategy of expanding into adjacent product lines will also position us to further support and maintain our existing service provider customer base. Providing our customers with more scalable software platforms enables them to further reduce their infrastructure costs, improve reliability and expand service offerings to their customers.

We have initiated restructuring programs during the past three years to help us improve operations and optimize our cost structure. In fiscal 2019, we began taking steps to reduce our costs further by implementing a restructuring plan , the primary element of whicn was staff reductions across all of our functions and geographic areas and for which we expect annualized cost savings of approximately $6.0 million. In fiscal 2020, we continued to streamline our operations and closed our service organizations in Ireland and the Netherlands for wich we expect additional annualized cost savings of approximately $6.0 million. Overall, we expect to have annualized cost savings of approximately $12.0 million as a result of the restructuring programs that have been initiated over the past two fiscal years.

Our cash, cash equivalents, restricted cash and marketable securities totaled $13.9 million at January 31, 2020. Our overall financial results increased from fiscal 2019, with revenunes of $67.2 million in fiscal 2020 compared to revenues of $62.4 in fiscal 2019 and a GAAP operating loss of $8.9 million in fiscal 2020 compared to a GAAP operating loss of $35.8 million in fiscal 2019. The increase was primarily a result of our new go-to-market Framework solution.

Named Executive Officers

This Compensation Discussion and Analysis discusses compensation decisions with respect to (i) all individuals who served as our principal executive officer or in a similar capacity during fiscal 2020, (ii) SeaChange’s two most highly compensated executive officers, other than the principal executive officer, who were serving as executive officers at the end of fiscal 2020, and (iii) up to two additional individuals for whom disclosure would have been provided pursuant to clause (ii), but for the fact that the individual was not serving as an executive officer of SeaChange at the end of fiscal 2020. We refer to these executive officers collectively in this Compensation Discussion and Analysis and the related compensation tables as the “named executive officers”. For fiscal 2020, the named executive officers were:

|

|

• |

Yossi Aloni, our President and Chief Executive Officer; |

|

|

• |

Michael Prinn, our Chief Financial Officer; |

|

|

• |

Marek Kielczewski, our Chief Technology Officer and former Office of the CEO; |

|

|

• |

Chad Hassler, our Chief Commercial Officer; |

|

|

• |

Edward Terino, our former Chief Executive Officer; |

|

|

• |

Mark Bonney, our former Executive Chair; |

18

|

|

• |

David McEvoy, our former General Counsel, Senior Vice President, Secretary and Office of the CEO; and |

|

|

• |

Peter Faubert, our former Chief Financial Officer, Senior Vice President, Treasurer and Office of the CEO. |

As discussed below, each of Messrs. Terino, Bonney, Faubert and McEvoy no longer serve as executive officers of SeaChange.

Pay for Performance

Payouts under our executive compensation incentive plan in recent years have reflected the variability in our financial performance.

Historically, in addition to achieving revenue and operating income targets, our named executive officers must also meet individual performance-based objectives under the terms of our annually established short-term incentive plan in order to receive their full bonus. In both fiscal 2017 and 2019, when we did not achieve pre-established financial performance targets under the applicable short-term incentive plan, payouts were limited to the portion of the award based on individual performance objectives. In contrast, in fiscal 2018, when we experienced improved financial performance versus the prior fiscal year and financial performance above pre-established thresholds with respect to revenue and above target with respect to non-GAAP operating income, payouts were made with respect to both financial and individual performance objectives. In fiscal 2020, financial performance was above threshold with respect to non-GAAP operating income, and payouts were made with respect to that financial performance objective. Due to the extensive turnover of the membership of the Board and the management team during fiscal 2020, the Compensation Committee (the “Committee”) did not believe it appropriate to condition the receipt of the named executive officers’ short-term incentive awards on additional individualized criteria for fiscal 2020, and accordingly did not set individualized performance objectives for fiscal 2020, but elected to pay out the full amount of what would have been the payout for the individualized goals in order to retain the newly appointed management team and in recognition of their services to the Company in connection with the various management and Board transitions that occurred throughout the year. The Committee did not believe that the total bonus payout was sufficient, and the Committee exercised its right to provide supplemental discretionary bonuses in order to motivate and retain our new management team and in recognition of the management team’s successful navigation of the unique challenges posed by the significant transitions throughout the year.

With respect to the long-term incentive plan, payouts showed similar variability with respect to the performance-based stock unit (“PSU”) component of the awards, with the fiscal 2017 awards being determined based on total shareholder return, and each of the fiscal 2018 and 2019 awards being based on financial performance compared to annually established metrics. Similar to the short-term incentive awards, the vesting of the long-term incentive awards has fluctuated based on our recent financial performance, with no vesting for the portion of the fiscal 2018 and fiscal 2019 awards based on fiscal 2020 financial performance.

We believe that the variability in these payouts indicates that our annual compensation plans effectively reward our executive officers for superior performance, while appropriately adjusting compensation downward for less-than-superior performance, thereby aligning the interests of our executive team with that of our stockholders.

We structure our executive compensation to reflect individual responsibilities and contributions, while providing incentives to achieve overall business and financial objectives. The Committee has the responsibility for establishing, implementing and monitoring adherence to this philosophy. Pursuant to the Committee Charter, such responsibility could be delegated to a subcommittee, but the Committee has not delegated its authority.

The Committee has designed an executive compensation plan that rewards the achievement of specific financial and non-financial goals through a combination of cash and stock-based compensation. This bifurcation between financial and non-financial objectives and between cash and stock-based compensation creates alignment with stockholder interests and provides a structure in which executives are rewarded for achieving results that the Committee believes will enhance stockholder value.

19

The Committee believes that stockholder interests are best served by compensating our executives at industry competitive rates, recognizing superior performance and providing incentives to achieve overall business and financial objectives, which collectively align the interests of our executives and our stockholders. In addition, we believe that our ability to achieve financial and non-financial goals is enhanced.

Setting Executive Compensation

When setting the annual compensation plan for our executive officers, the Committee begins with an analysis of each compensation component for our Chief Executive Officer. This analysis includes the dollar amount of each component of compensation payable to the Chief Executive Officer related to the relevant period, together with the related metrics for performance-based compensation. The overall purpose of this analysis is to bring together all of the elements of fixed and contingent compensation, so that the Committee may analyze both the individual elements of compensation (including the compensation mix) as well as the aggregate amount of actual projected and potential compensation.

The Committee then presents this analysis to the Chief Executive Officer, who provides input to the Committee on the reasonableness, feasibility and effectiveness of the compensation components, including performance metrics, proposed by the Committee. The Chief Executive Officer then creates similar compensation component breakdowns for the other executive officers, and presents compensation recommendations of both base and performance-based compensation related to the relevant period, together with the associated performance metrics to the Committee. These recommendations are then reviewed and, once agreed upon, approved by the Committee. The Committee can and has exercised its discretion in modifying any recommended compensation to executives and exercises this discretion in active consultation with the Chief Executive Officer.

In setting executive compensation for fiscal 2020, the Committee reviewed the list of peer companies previously recommended by Frederic W. Cook & Co., Inc. (“Cook”) in fiscal 2019, subject to the removal of Guidance Software, Inc., Jive Software, Inc. and YuMe, Inc., each of which had been sold, and the exclusion of Tremor Video, Inc. and determined not to make any other changes. Cook is a compensation consulting firm that the Committee retained in fiscal 2019 to provide guidance on current executive team pay practices in our industry. The Committee concluded based on the Company’s knowledge and information provided by Cook that Cook had no conflict of interest with the Company. The list of the peer companies for fiscal 2020 was:

|

• American Software, Inc. • BSQUARE Corporation • Digital Turbine, Inc. • Limelight Networks, Inc. • Marin Software Inc. • Remark Media, Inc. • Synacor, Inc. |

|

• Brightcove, Inc. • Concurrent Computer Corporation • eGain Corporation • Marchex, Inc. • RealNetworks, Inc. • SITO Mobile, Ltd.

|

The Committee determined that this list of peer companies provided appropriate referenceable data points to aid in its decision making regarding executive compensation, based on our revenues, market capitalization, and industry focus relative to each of these companies. The Committee made reference to the compensation paid by these peer companies in establishing fiscal 2020 executive compensation but did not benchmark compensation to these companies.

20