Table of Contents

As filed with the U.S. Securities and Exchange Commission on February 22, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SEACHANGE INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3663 | 04-3197974 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

177 Huntington Avenue, Suite 1703

PMB 73480

Boston, MA 02115

(978) 897-0100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Peter D. Aquino

President and Chief Executive Officer

177 Huntington Avenue, Suite 1703

PMB 73480

Boston, MA 02115

(978) 897-0100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Robert S. Matlin, Esq. David A. Bartz, Esq. K&L Gates LLP 599 Lexington Avenue New York, NY 10022 |

David P. Elder Patrick Hurley Akin Gump Strauss Hauer & Feld LLP 1111 Louisiana Street, 44th Floor Houston, TX 77002 (713) 220-5800 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective and after all conditions under the Merger Agreement to consummate the proposed merger are satisfied or waived.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the “Securities Act”), check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Table of Contents

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company and emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

The information in this proxy statement/prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/CONSENT SOLICITATION STATEMENT/PROSPECTUS - DATED FEBRUARY 22, 2022

|

|

MERGER PROPOSED - YOUR VOTE IS VERY IMPORTANT

Dear Stockholders of SeaChange International, Inc.,

On December 22, 2021, SeaChange International, Inc. (“SeaChange”) and Triller Hold Co LLC (“Triller”) entered into an Agreement and Plan of Merger (the “Merger Agreement”), a copy of which is attached as Annex A to this proxy statement/prospectus. Under the terms of the Merger Agreement, Triller will be merged with and into SeaChange, and the separate existence of Triller shall cease, with SeaChange continuing as the surviving corporation. Upon the closing of the merger, the name of the combined company will be changed to “TrillerVerz Corp.”

Pursuant and subject to the terms and conditions of the Merger Agreement, in addition to other contemplated transactions, (i) SeaChange and Triller anticipate that Triller will conduct an offering of convertible notes prior to the closing of the merger in an amount in excess of $100 million (the “Triller Convertible Notes”), and (ii) the charter of the surviving company will provide for two classes of common stock, consisting of SeaChange Class A common stock and SeaChange Class B common stock (which Class B common stock is anticipated to provide for super-voting rights to provide its holders 76% or more of the total voting rights).

The stockholders of SeaChange will have the right to elect to receive either (i) their pro rata portion of $25 million cash consideration along with their pro rata portion of an aggregate $75 million in principal of notes (the “Notes Consideration”) to be issued by the surviving company to the holders of SeaChange common stock (such cash and notes consideration, the “Cash/Notes Consideration”) or (ii) a number of shares of SeaChange Class A common stock (the “Stock Consideration”), in an amount equal to that which such holder would have received if such SeaChange stockholder had purchased the Triller Convertible Notes in an aggregate amount equal to its pro rata portion of the Cash/Notes Consideration and then converted such Triller Convertible Notes at the conversion price at which such Triller Convertible Notes were issued and then participated pro-rata along with the Triller holders in the proposed merger. Assuming that (i) all holders of SeaChange common stock elect the Stock Consideration and (ii) that Triller issues $250 million of Triller Convertible Notes which convert in connection with the proposed merger at an agreed discount of 20% to an assumed $5 billion Triller valuation (before the conversion of the Triller Convertible Notes), the stockholders of SeaChange (including SeaChange optionholders and holders of SeaChange deferred stock units, performance stock units and restricted stock units) would own approximately 2.3% of the surviving company and the holders of Triller (including Triller optionholders and warrant holders) would hold approximately 97.7% of the surviving company. If all stockholders of SeaChange elected to receive the Cash/Notes Consideration, such stockholders would have no equity interest in the surviving company, and the Triller holders (including Triller optionholders and warrant holders) would collectively own 100% of the surviving company (other than SeaChange optionholders and holders of SeaChange deferred stock units, performance stock units and restricted stock units). For SeaChange stockholders that elect the Cash/Notes Consideration, each would receive their pro rata portion of such Cash/Notes Consideration which would then also reduce the resulting SeaChange stockholders’ ownership percentages by taking into account the payment of the Cash/Notes Consideration and related reduction in the Stock Consideration. The notes (the “Merger Consideration Notes”) to be issued to SeaChange stockholders who elect the Cash/Notes Consideration are payable on the one-year anniversary of issuance, bear interest at a rate of 5% per annum and will be automatically converted into SeaChange Class A common stock at such time as the market capitalization of the surviving company equals or exceeds $6 billion for ten consecutive trading days. The holders of the Merger Consideration Notes will have the option to convert into SeaChange Class A common stock if the surviving

Table of Contents

company exercises its optional redemption right, which it may do at any time, in whole or in part, on the same terms set forth above. The holders of the Merger Consideration Notes will have recourse against the surviving company and its assets only to the extent of the surviving company’s interest in certain of its subsidiaries (who will also provide guarantees of the Merger Consideration Notes). The existing subsidiaries of SeaChange prior to the proposed merger are also anticipated to provide a first lien security interest on their assets securing the Merger Consideration Notes. The Merger Consideration Notes will have limited covenants.

SeaChange cordially invites you to attend a special meeting of its stockholders (the “special meeting”) to consider matters related to the proposed merger. SeaChange and Triller cannot complete the merger unless SeaChange’s stockholders adopt the Merger Agreement and approve the transactions contemplated thereby. SeaChange is sending you this proxy statement/prospectus to ask you to vote in favor of these and the other matters described in this proxy statement/prospectus in order to obtain stockholder approvals of the proposals necessary to complete the merger, and these proposals are described in this proxy statement/prospectus.

The special meeting will be held on [ ], 2022, at [ ] local time, via a virtual meeting. In light of the novel coronavirus (referred to as “COVID-19”) pandemic and to support the well-being of SeaChange’s stockholders and partners, the special meeting will be completely virtual. You may attend the special meeting and vote your shares electronically during the special meeting via live webcast by visiting [ ]. You will need the meeting control number that is printed on your proxy card to enter the special meeting. SeaChange recommends that you log in at least 15 minutes before the special meeting to ensure you are logged in when the special meeting starts. Please note that you will not be able to attend the special meeting in person.

The obligations of SeaChange and Triller to complete the merger are subject to the satisfaction or waiver of a number of conditions set forth in the Merger Agreement, including the adoption of the Merger Agreement.

Your vote is very important, regardless of the number of shares of SeaChange common stock you own. To ensure your representation at the special meeting, please take time to vote by following the instructions contained in the accompanying proxy statement/prospectus and on your proxy card. Please vote promptly whether or not you expect to attend the special meeting. Submitting a proxy now will not prevent you from being able to vote electronically at the special meeting. A failure to vote your shares, or to provide instructions to your broker, bank or nominee as to how to vote your shares, is the equivalent of a vote against the merger proposal.

We encourage you to read this entire proxy statement/prospectus carefully, including the risk factors relating to the merger, in the section entitled “Risk Factors” beginning on page [•]. You also can obtain information about SeaChange and Triller from the documents that SeaChange has filed with the Securities and Exchange Commission.

| Sincerely, |

| /s/ Peter D. Aquino |

| Peter D. Aquino |

| President and Chief Executive Officer |

| SeaChange International, Inc. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in connection with the merger described in the accompanying proxy statement/prospectus or determined if this proxy statement/prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

The accompanying proxy statement/prospectus is dated [•], 2022, and it is first being mailed to SeaChange stockholders of record on or about [•], 2022.

Table of Contents

SEACHANGE INTERNATIONAL, INC.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD , 2022

To the Stockholders of SeaChange International, Inc.:

On December 22, 2021, SeaChange International, Inc. (“SeaChange”) and Triller Hold Co LLC (“Triller”) entered into an Agreement and Plan of Merger (the “Merger Agreement”). Under the terms of the Merger Agreement, Triller will be merged with and into SeaChange, and the separate existence of Triller shall cease, with SeaChange continuing as the surviving corporation. Upon the closing of the merger, the name of the combined company will be changed to “TrillerVerz Corp.”

Pursuant and subject to the terms and conditions of the Merger Agreement, in addition to other contemplated transactions, (i) SeaChange and Triller anticipate that Triller will conduct an offering of convertible notes prior to the closing of the merger in an amount in excess of $100 million (the “Triller Convertible Notes”), and (ii) the charter of the surviving company will provide for two classes of common stock, consisting of SeaChange Class A common stock and SeaChange Class B common stock (which Class B common stock is anticipated to provide for super-voting rights to provide its holders 76% or more of the total voting rights).

The stockholders of SeaChange will have the right to elect to receive either (i) their pro rata portion of $25 million cash consideration along with their pro rata portion of an aggregate $75 million in principal of notes (the “Notes Consideration”) to be issued by the surviving company to the holders of SeaChange common stock (such cash and notes consideration, the “Cash/Notes Consideration”) or (ii) a number of shares of SeaChange Class A common stock (the “Stock Consideration”), in an amount equal to that which such holder would have received if such SeaChange stockholder had purchased the Triller Convertible Notes in an aggregate amount equal to its pro rata portion of the Cash/Notes Consideration and then converted such Triller Convertible Notes at the conversion price at which such Triller Convertible Notes were issued and then participated pro-rata along with the Triller holders in the proposed merger. Assuming that (i) all holders of SeaChange common stock elect the Stock Consideration and (ii) that Triller issues $250 million of Triller Convertible Notes which convert in connection with the proposed merger at an agreed discount of 20% to an assumed $5 billion Triller valuation (before the conversion of the Triller Convertible Notes), the stockholders of SeaChange (including SeaChange optionholders and holders of SeaChange deferred stock units, performance stock units and restricted stock units) would own approximately 2.3% of the surviving company and the holders of Triller (including Triller optionholders and warrant holders) would hold approximately 97.7% of the surviving company. If all stockholders of SeaChange elected to receive the Cash/Notes Consideration, such stockholders would have no equity interest in the surviving company, and the Triller holders (including Triller optionholders and warrant holders) would collectively own 100% of the surviving company (other than SeaChange optionholders and holders of SeaChange deferred stock units, performance stock units and restricted stock units). For SeaChange stockholders that elect the Cash/Notes Consideration, each would receive their pro rata portion of such Cash/Notes Consideration which would then also reduce the resulting SeaChange stockholders’ ownership percentages by taking into account the payment of the Cash/Notes Consideration and related reduction in the Stock Consideration. The notes (the “Merger Consideration Notes”) to be issued to SeaChange stockholders who elect the Cash/Notes Consideration are payable on the one-year anniversary of issuance, bear interest at a rate of 5% per annum and will be automatically converted into SeaChange Class A common stock at such time as the market capitalization of the surviving company equals or exceeds $6 billion for ten consecutive trading days. The holders of the Merger Consideration Notes will have the option to convert into SeaChange Class A common stock if the surviving company exercises its optional redemption right, which it may do at any time, in whole or in part, on the same terms set forth above. The holders of the Merger Consideration Notes will have recourse against the surviving company and its assets only to the extent of the surviving company’s interest in certain of its subsidiaries (who will also provide guarantees of the Merger Consideration Notes). The existing subsidiaries of SeaChange prior to the proposed merger are also anticipated to provide a first lien security interest on their assets securing the Merger Consideration Notes. The Merger Consideration Notes will have limited covenants.

Table of Contents

At the special meeting of stockholders (the “special meeting”), which will be held will be held virtually on [ ], 2022, at [ ] , Eastern Time, our stockholders will be asked to consider and vote upon the following proposals:

(1) The Merger Proposal — a proposal to adopt the Merger Agreement and approve the merger and the other transactions contemplated by the Merger Agreement (the “Merger Proposal”); for additional information, see the section in the proxy statement/prospectus entitled “SeaChange Stockholder Meeting Proposals — Proposal 1: The Merger Proposal” and a copy of the Merger Agreement is attached to this proxy statement/prospectus as Annex A;

(2) The Reverse Stock Split Proposal — a proposal to approve an amendment of the amended and restated certificate of incorporation of SeaChange to effect a reverse stock split and reclassification of SeaChange common stock into shares of Class A common stock at a specific ratio of [10 to 1] (the “Reverse Stock Split”);

(3) The Reclassification Proposal — a proposal to approve an amendment of the amended and restated certificate of incorporation of SeaChange to (i) increase the number of authorized shares of SeaChange capital stock to [ ] shares, (ii) create two new classes of SeaChange common stock designated as Class A common stock and Class B common stock (resulting in the existing shares of SeaChange common stock being reclassified as Class A common stock concurrently with, and as a result of, the Reverse Stock Split), and authorize SeaChange to issue [ ] shares of Class A common stock, [ ] shares of Class B common stock and [ ] shares of preferred stock (the “Reclassification Proposal” and, together with the Reverse Stock Split Proposal, the “Certificate of Incorporation Amendment Proposal”);

(4) The Advisory Proposal — a proposal to approve, which is a non-binding advisory vote, an amendment of the amended and restated certificate of incorporation of SeaChange to (i) effect the name change of SeaChange to “TrillerVerz Corp.”, (ii) provide for rights of Class A common stock and Class B common stock, including voting, conversion and transfer rights, and (iii) allow stockholders to act by written consent or electronic transmission and to call special meetings of stockholders until the Trigger Date (as defined in the proxy statement/prospectus) (the “Advisory Proposal”);

(5) The Incentive Plan Proposal — a proposal to approve an increase in the number of authorized shares under the SeaChange 2021 Compensation and Incentive Plan (the “Incentive Plan Proposal”);

(6) The Omnibus Incentive Plan Proposal — a proposal to adopt the TrillerVerz Corp. 2022 Omnibus Incentive Plan, a copy of which is attached as Annex B to this proxy statement/prospectus (the “Omnibus Incentive Plan Proposal”);

(7) The Nasdaq Proposal — a proposal to, by ordinary resolution, approve, for purposes of complying with Nasdaq Listing Rule 5635, the issuance of the Stock Consideration, which amount will be determined as described in more detail in the accompanying proxy statement/prospectus (the “Nasdaq Proposal”);

(8) SeaChange Compensation Proposal — a proposal to approve, on an advisory (non-binding) basis, certain compensation arrangements for SeaChange’s named executive officers in connection with the merger contemplated by the Merger Agreement (the “SeaChange Compensation Proposal”); and

(9) to approve one or more adjournments of the special meeting to a later date or dates if necessary or appropriate to solicit additional proxies if there are insufficient votes to adopt the Merger Proposal, the Certificate of Incorporation Amendment Proposal, the Incentive Plan Proposal, the Omnibus Incentive Plan Proposal, and the Nasdaq Proposal at the time of the special meeting (the “Adjournment Proposal”).

SeaChange will transact no other business at the special meeting, except for business properly brought before the special meeting or any adjournment or postponement thereof.

The items of business listed above are more fully described elsewhere in the proxy statement/prospectus. Whether or not you intend to attend the special meeting, we urge you to read the attached proxy statement/prospectus in its entirety, including the annexes and accompanying financial statements, before voting. IN PARTICULAR, WE URGE YOU TO CAREFULLY READ THE SECTION IN THE PROXY STATEMENT/PROSPECTUS ENTITLED “RISK FACTORS.”

Table of Contents

Only holders of record of shares of SeaChange common stock at the close of business on , 2022, the record date for the special meeting, are entitled to notice of, and a vote at, the special meeting and any adjournments or postponements of the special meeting.

The closing of the merger is conditioned on approval of the Merger Proposal, the Certificate of Incorporation Amendment Proposal, the Incentive Plan Proposal, the Omnibus Incentive Plan Proposal and the Nasdaq Proposal. The Adjournment Proposal, the SeaChange Compensation Proposal and the Advisory Proposal are not conditioned on the approval of any other proposal set forth in this proxy statement/prospectus. It is important for you to note that if the Merger Proposal is not approved by our stockholders, or if each of the Certificate of Incorporation Amendment Proposal, the Incentive Plan Proposal, the Omnibus Incentive Plan Proposal and the Nasdaq Proposal is not approved by our stockholders and we and Triller do not waive the applicable closing condition under the Merger Agreement, then we will not consummate the merger.

After careful consideration, SeaChange’s board of directors has determined that each of the proposals listed is in the best interests of SeaChange and its stockholders and recommends that you vote or give instruction to vote “FOR” each of the proposals set forth above. When you consider the recommendations of SeaChange’s board of directors, you should keep in mind that SeaChange’s directors and officers may have interests in the merger that conflict with, or are different from, your interests as a shareholder of SeaChange. See the section entitled “The Merger — Interests of Certain SeaChange Directors and Executive Officers in the Merger.”

A complete list of SeaChange stockholders of record entitled to vote at the special meeting will be available for inspection by SeaChange stockholders (i) for ten days before the special meeting at the principal executive offices of SeaChange during ordinary business hours for any purpose germane to the special meeting and (ii) during the special meeting at [ ].

Your vote is important regardless of the number of shares you own. Whether you plan to attend the special meeting virtually or not, please complete, sign, date and return the enclosed proxy card (or cast your vote via the Internet as provided on your proxy card) as soon as possible in the envelope provided. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly voted and counted.

Please do not send any share certificates at this time. If the merger is consummated, we will notify you of any necessary procedures for exchanging SeaChange share certificates.

If you have any questions regarding the accompanying proxy statement/prospectus or need assistance voting your shares, please call our proxy solicitor, Morrow Sodali LLC at (i) (800) 662-5200 if you are a stockholder or (ii) collect at (203) 658-9400 if you are a broker or bank.

Thank you for your participation. We look forward to your continued support.

| By Order of the Board of Directors, |

| /s/ Elaine Martel |

| Elaine Martel |

| Vice President, General Counsel and Secretary |

| SeaChange International, Inc. |

| Boston, Massachusetts |

, 2022

IF YOU RETURN YOUR SIGNED PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS.

Table of Contents

Table of Contents

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which forms part of a registration statement on Form S-4 filed with the Securities and Exchange Commission (“SEC”) by SeaChange International, Inc. (“SeaChange”) (File No. 333- ), constitutes a prospectus of SeaChange under Section 5 of the Securities Act, as amended (the “Securities Act”), with respect to (i) the shares of SeaChange common stock to be issued to (a) SeaChange stockholders opting to receive the Stock Consideration, (b) unitholders of Triller and (c) holders of the Notes Consideration upon conversion thereof and (ii) the Notes Consideration if the merger described below is consummated. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the Exchange Act with respect to the special meeting, at which SeaChange stockholders will be asked to consider and vote upon a proposal to approve the merger by the approval and adoption of the Merger Agreement (as defined herein), among other matters.

You should rely only on the information contained or incorporated by reference into this proxy statement/prospectus. No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference into, this proxy statement/prospectus. Statements made in this proxy statement/prospectus as to the content of any contract, agreement or other document filed or incorporated by reference as an exhibit to the registration statement are not necessarily complete. With respect to those statements, you should refer to the corresponding exhibit for a more complete description of the matter involved and read all statements in this proxy statement/prospectus in light of that exhibit. This proxy statement/prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this proxy statement/prospectus is accurate as of any date other than that date. You should not assume that the information incorporated by reference into this proxy statement/prospectus is accurate as of any date other than the date of such incorporated document.

Information contained in this proxy statement/prospectus regarding SeaChange has been provided by, and is the

responsibility of, SeaChange whereas information contained in this proxy statement/prospectus regarding Triller has been provided by, and is the responsibility of, Triller.

This proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities, or the solicitation of a proxy, in any jurisdiction to or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

SeaChange files reports, proxy statements/prospectuses and other information with the SEC as required by the Securities Exchange Act of 1934, as amended. You can read SeaChange’s SEC filings, including this proxy statement/prospectus, on the Internet at the SEC’s website at http://www.sec.gov. Also, see the section entitled “Where You Can Find More Information” of the accompanying proxy statement/prospectus for further information. Information contained on our website, or any other website, is expressly not incorporated by reference into this proxy statement/prospectus.

If you would like additional copies of this proxy statement/prospectus or if you have questions about the merger or the proposals to be presented at the special meeting, you should contact us by telephone or by email:

SeaChange International, Inc.

Attn: Elaine Martel, Vice President, General Counsel and Secretary

Tel: (508) 208-9699

Email: elaine.martel@schange.com

You may also obtain these documents by requesting them in writing or by telephone from our proxy solicitor at:

Morrow Sodali LLC

470 West Avenue

Stamford, Connecticut 06902

Tel: Individuals can call toll-free at (800) 662-5200 or banks and brokers can call collect at (203) 658-9400

Email: [•]

In order for SeaChange’s stockholders to receive timely delivery of the documents in advance of the special meeting to be held on [•], 2022, you must request the information no later than [•], 2022, five business days prior to the date of the special meeting.

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE MEETING

Below are brief answers to questions you may have concerning the transactions described in this proxy statement/prospectus and the virtual special meeting. These questions and answers do not, and are not intended to, address all of the information that may be important to you. You should read carefully this entire proxy statement/prospectus and the other documents to which we refer you.

GENERAL

| Q: | Why am I receiving this document? |

| A: | This is a proxy statement being used by the SeaChange board of directors to solicit proxies of SeaChange stockholders in connection with the merger and the special meeting. In addition, this document is a prospectus being delivered to SeaChange’s stockholders because the stockholders of SeaChange will have the right to elect to receive either (i) their pro rata portion of $25 million cash consideration along with their pro rata portion of an aggregate $75 million in principal of notes (the “Notes Consideration”) to be issued by the surviving company to the holders of SeaChange common stock (such cash and notes consideration, the “Cash/Notes Consideration”) or (ii) a number of shares of SeaChange Class A common stock (the “Stock Consideration”), in an amount equal to that which such holder would have received if such holder had purchased Triller Convertible Notes in an aggregate principal amount equal to its pro rata portion of the Cash/Notes Consideration and then converted such Triller Convertible Notes at the conversion price at which such Triller Convertible Notes were issued and then participated pro-rata along with the Triller holders in the proposed merger. |

| Q: | When and where is the meeting of the stockholders? |

| A: | The special meeting will be held at [•] [a.m.], Eastern Time, on [•], 2022, virtually via the Internet at [host domain]. |

| Q: | Why is the special meeting being conducted virtually? |

| A: | The special meeting is being conducted entirely online due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our employees and stockholders. In addition, we believe the online meeting format will provide stockholders who would not otherwise be able to attend the special meeting the opportunity to do so. In addition to online attendance, stockholders will have an opportunity to hear all portions of the official meeting, submit written questions during the meeting, vote online during the open poll portion of the meeting and listen to live responses to stockholder questions immediately following the formal meeting. |

| Q: | What constitutes a quorum for the transaction of business at the special meeting? |

| A: | A majority of the voting power of the issued and outstanding common stock of SeaChange entitled to vote at the special meeting must be present, in person (including virtually) or represented by proxy, at the special meeting to constitute a quorum. Abstentions and broker non-votes will be counted as present for the purpose of determining a quorum. |

| Q: | If my shares of SeaChange common stock are held in “street name” by my bank, brokerage firm or other nominee, will my bank, brokerage firm or other nominee automatically vote those shares for me? |

| A: | Your bank, brokerage firm or other nominee will only be permitted to vote your shares of SeaChange common stock if you instruct your bank, brokerage firm or other nominee how to vote. You should follow the procedures provided by your bank, brokerage firm or other nominee regarding the voting of your shares |

2

Table of Contents

| of SeaChange common stock. In accordance with the rules of Nasdaq, banks, brokerage firms and other nominees who hold shares of SeaChange common stock in street name for their customers have authority to vote on “routine” proposals when they have not received voting instructions from beneficial owners. However, banks, brokerage firms and other nominees are precluded from exercising their voting discretion with respect to non-routine matters, such as the Merger Proposal, the Certificate of Incorporation Amendment Proposal, the Advisory Proposal, the Incentive Plan Proposal, the Omnibus Incentive Plan Proposal, the Nasdaq Proposal, the SeaChange Compensation Proposal, and the Adjournment Proposal. As a result, absent specific voting instructions from the beneficial owner of such shares, banks, brokerage firms and other nominees are not empowered to vote such shares. A so-called “broker non-vote” results when banks, brokerage firms and other nominees return a valid proxy but do not vote on a particular proposal because they do not have discretionary authority to vote on the matter and have not received specific voting instructions from the beneficial owner of such shares. The effect of not instructing your bank, brokerage firm or other nominee how you wish your shares to be voted will be the same as a vote “AGAINST” the Merger Proposal and the Certificate of Incorporation Amendment Proposal, but will not have an effect on the other proposals, except to the extent that it results in there being insufficient shares present at the special meeting to establish a quorum. |

CONCERNING THE MERGER

| Q: | What will happen in the proposed merger? |

| A: | Pursuant to the terms of the Merger Agreement, Triller will be merged with and into SeaChange, and the separate existence of Triller shall cease, with SeaChange continuing as the surviving corporation. Following the closing of the transactions contemplated by the Merger Agreement, the name of the combined company will be changed to “TrillerVerz Corp.” (“TrillerVerz”). |

Additional information on the merger is set forth beginning on page [•].

| Q: | Why is SeaChange proposing the merger? |

| A: | SeaChange management and the SeaChange board of directors regularly review the performance, strategy, competitive position, opportunities and prospects of SeaChange in light of the then-current business and economic environments, as well as developments in the industries in which we operate and the opportunities and challenges facing participants in those industries. These reviews have included consideration of and discussions with other companies from time to time regarding potential strategic alternatives, including business combinations and other strategic combinations, as well as the possibility of SeaChange remaining an independent company. Following a review by the SeaChange board of directors, the SeaChange board of directors determined that the merger is fair to and in the best interests of SeaChange and its stockholders. |

| Q: | What will I receive for my shares? |

| A: | The stockholders of SeaChange will have the right to elect to receive either (i) their pro rata portion of the Cash/Notes Consideration or (ii) the Stock Consideration in an amount equal to that which such holder would have received if such SeaChange stockholder had purchased the Triller Convertible Notes (as defined herein) in an aggregate amount equal to its pro rata portion of the Cash/Notes Consideration and then converted such Triller Convertible Notes at the conversion price at which such Triller Convertible Notes were issued and then participated pro-rata along with the Triller holders in the proposed merger. Please carefully review the information set forth in the section titled “The Merger—Merger Consideration, Exchange Ratios and Notes Merger Consideration” and “The Merger Agreement—Merger Consideration” beginning on pages [ ] and [ ] of this proxy statement/prospectus, respectively. |

3

Table of Contents

| Q: | What are the material U.S. federal income tax consequences of the merger to U.S. holders of SeaChange common stock? |

| A: | SeaChange and Triller intend that the merger will qualify as (i) an exchange under Section 351 of the Internal Revenue Code of 1986, as amended (the “Code”) in respect of the transactions described in § |

| 1.5(a)(i) of the Merger Agreement; (ii) a distribution in redemption of stock pursuant to Sections 302(a) and 302(b) of the Code in respect of the transactions described in § 1.5(a)(ii)(A) of the Merger Agreement; and (iii) a reorganization pursuant to Section 368(a)(1)(E) of the Code in respect of the transactions described in § 1.5(a)(ii)(B) of the Merger Agreement. |

Please carefully review the information set forth in the section titled “Material U.S. Federal Income Tax Considerations” beginning on page [•] of this proxy statement/prospectus for a general discussion of the material U.S. federal income tax consequences of the merger. You are strongly urged to consult your own tax advisors as to the specific tax consequences to you of the merger.

| Q: | What vote is required to approve the proposals subject to a stockholder vote at the special meeting? |

| A: | The approval of the Merger Proposal and the Certificate of Incorporation Amendment Proposal requires the affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote on such proposal. Accordingly, a stockholder’s failure to vote online or by proxy, a broker non-vote or an abstention on the Merger Proposal will have the same effect as a vote “AGAINST” such proposal. |

The approval of each of the Advisory Proposal, the Incentive Plan Proposal, the Omnibus Incentive Plan Proposal, the Nasdaq Proposal, the SeaChange Compensation Proposal and the Adjournment Proposal requires the affirmative vote of holders of a majority of the total votes cast on such proposal. Accordingly, neither a stockholder’s failure to vote online or by proxy, a broker non-vote nor an abstention will be considered a “vote cast,” and, thus, will have no effect on the outcome of the Advisory Proposal, the Incentive Plan Proposal, the Omnibus Incentive Plan Proposal, the Nasdaq Proposal, the SeaChange Compensation Proposal, or the Adjournment Proposal.

Additional information on the vote required to approve the merger is located in the section titled “SeaChange Stockholder Meeting Proposals” on page [•].

| Q: | Are the proposals conditioned on one another? |

| A: | The Merger Proposal is conditioned on the approval of the Certificate of Incorporation Amendment Proposal, the Incentive Plan Proposal, the Omnibus Incentive Plan Proposal and the Nasdaq Proposal. In addition, (i) the Certificate of Incorporation Amendment Proposal is conditioned on the approval of the Merger Proposal, the Incentive Plan Proposal, the Omnibus Incentive Plan Proposal and the Nasdaq Proposal, (ii) the Incentive Plan Proposal and the Omnibus Incentive Plan Proposal are conditioned on the approval of the Merger Proposal, the Certificate of Incorporation Amendment Proposal and the Nasdaq Proposal, and (iii) the Nasdaq Proposal is conditioned on the approval of the Merger Proposal, the Certificate of Incorporation Amendment Proposal, the Incentive Plan Proposal and the Omnibus Incentive Plan Proposal. Neither the SeaChange Compensation Proposal, the Adjournment Proposal nor the Advisory Proposal is conditioned on the approval of any other proposal set forth in the proxy statement/prospectus. It is important for you to note that if the Merger Proposal is not approved by our stockholders, or if any other proposal (except the SeaChange Compensation Proposal, the Adjournment Proposal or the Advisory Proposal) is not approved by our stockholders and we and Triller do not waive the applicable closing condition under the Merger Agreement, then the merger will not be consummated. |

Additional information on the vote required to approve the merger is located in the section titled “SeaChange Stockholder Meeting Proposals” on page [•].

4

Table of Contents

| Q: | How does the SeaChange board of directors recommend that I vote with respect to the proposals subject to a stockholder vote at the special meeting? |

| A: | On December 21, 2021, the SeaChange board of directors unanimously determined that the Merger Agreement and the transactions contemplated thereby, including the merger, were fair to, and in the best interests of, SeaChange and its stockholders, approved and declared advisable the Merger Agreement and the transactions contemplated thereby, including the merger, and directed that the Merger Agreement and the transactions contemplated thereby, including the merger, be submitted to the SeaChange stockholders for their approval. The SeaChange board of directors unanimously recommends that the stockholders of SeaChange vote “FOR” the Merger Proposal and “FOR” other matters to be considered at the special meeting. |

Additional information on the recommendation of the SeaChange board of directors is set forth in “The Merger — SeaChange Reasons for the Merger” beginning on page [•].

You should note that some SeaChange directors and executive officers, and their affiliates, have interests in the merger that are different from, or in addition to, the interests of other SeaChange stockholders. Information relating to the interests of SeaChange’s directors and executive officers, and their affiliates, in the merger is set forth in “The Merger — Interests of SeaChange Directors and Executive Officers in the Merger” beginning on page [•].

| Q: | Will TrillerVerz’s shares be traded on an exchange following the merger? |

| A: | SeaChange and Triller have agreed to use commercially reasonable efforts to obtain approval of the listing of TrillerVerz on The Nasdaq Stock Exchange (“Nasdaq”). Shares of TrillerVerz Class A common stock are expected to be listed on Nasdaq under the symbol “ILLR.” |

| Q: | When do you expect to complete the merger? |

| A: | The merger is expected to close in the [first quarter] of 2022, although we cannot assure completion by any particular date. |

| Q: | Who will serve as the directors and executive officers of TrillerVerz after the consummation of the merger? |

| A: | The Merger Agreement provides that upon consummation of the merger, the board of directors of the TrillerVerz will be composed of seven members, with all members to be designated by Triller. Upon completion of the merger, all executive officers of the surviving company will be appointed by Triller, in each case to serve in such positions until successors are duly elected or appointed. |

It is expected that Mahinda de Silva, the current chief executive officer of Triller’s wholly-owned subsidiary, Triller, Inc., will serve as the chief executive officer, executive chairman of the board of directors and a director of the combined company following the merger, Paul Kahn, the current chief financial officer of Triller and Triller, Inc., will serve as the chief financial officer of the combined company following the merger, M. Darren Traub, general counsel of Triller and Triller, Inc., will become the secretary of the combined company, and Joseph Smarr, the current chief technology officer of Triller, will serve as the chief technology officer of the combined company. It is also expected that Ryan Kavanaugh, Bobby Sarnevesht, Mahinda de Silva, Mike Lu, Carl Dorvil, Frank Schilling and Adel Ghazzawi will be appointed by Triller as directors of the combined company following the merger.

Additional information about the directors and executive officers of TrillerVerz following the consummation of the merger is set forth in “Management Following the Merger” beginning on page [•].

5

Table of Contents

| Q: | Are there risks associated with the merger? |

| A: | Yes, there are important risks associated with the merger. We encourage you to read carefully and in their entirety the sections of this proxy statement/prospectus titled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” beginning on pages [•] and [•], respectively. These risks include, among others, risks relating to the uncertainty that the merger will close and uncertainties relating to the performance of TrillerVerz after the merger. |

PROCEDURES

| Q: | What do I need to do now? |

| A: | After carefully reading and considering the information contained in this proxy statement/prospectus, please complete and sign your proxy card and return it in the enclosed postage-paid envelope as soon as possible so that your shares may be represented at the special meeting. Alternatively, you may cast your vote via the Internet by following the instructions on your proxy card. In order to ensure that your vote is recorded, please vote your proxy as instructed on your proxy card, or on the voting instruction form provided by the record holder if your shares are held in the name of your broker or other nominee, even if you currently plan to attend the virtual special meeting. |

Additional information on voting procedures is located beginning on page [•].

| Q: | What do I need to do to attend the special meeting and how do I vote my shares electronically? |

| A: | You may attend the special meeting, vote your shares and submit questions electronically during the meeting via live webcast by logging in at: [host domain]. You will need the control number that is printed on your proxy card to join the virtual special meeting. We recommend that you log in at least fifteen minutes before the meeting to ensure you are logged in when the meeting starts. |

| Q: | What should I do if I receive more than one set of voting materials? |

| A: | You may receive more than one set of voting materials, including multiple copies of this proxy statement/prospectus and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a holder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please follow the instructions and vote in accordance with each proxy card and voting instruction card you receive. |

| Q: | Should I send in my share certificates now? |

| A: | We will send the holders and, if the merger is completed, former holders of SeaChange common stock written instructions for delivery of their share certificates representing shares of SeaChange common stock. TrillerVerz shares will be in uncertificated, book-entry form unless a physical certificate is requested by the holder. Additional information on the procedures for exchanging certificates representing shares of SeaChange common stock is set forth in “The Merger— Procedure for Exchanging Certificates” beginning on page [•]. |

| Q: | What if I do not vote on the matters relating to the merger? |

| A: | Because the approval of the Merger Proposal requires the affirmative vote of a majority of the shares of SeaChange common stock outstanding and entitled to vote as of the record date, if you abstain or fail to vote your shares in favor of this matter, this will have the same effect as voting your shares against the approval |

6

Table of Contents

| of the Merger Proposal. If you fail to respond with a vote or fail to instruct your broker or other nominee how to vote on the approval of the Merger Proposal, it will have the same effect as a vote against the merger. If you respond but do not indicate how you want to vote on the approval of the Merger Proposal, your proxy will be counted as a vote in favor of the approval of the Merger Proposal. |

| Q: | What will happen if I return my proxy card without indicating how to vote? |

| A: | If you sign and return your proxy card without indicating how to vote on any particular proposal, the common stock represented by your proxy will be voted as recommended by the SeaChange board of directors with respect to that proposal. |

| Q: | What if I want to change my vote? |

| A: | If you are a stockholder of record of SeaChange, you may send a later-dated, signed proxy card so that it is received prior to the special meeting, or you may attend the special meeting and vote your shares electronically. You may also revoke your proxy card by sending a notice of revocation that is received prior to the special meeting to Elaine Martel, SeaChange’s General Counsel and Secretary, by telephone at (508) 208-9699, or by email at elaine.martel@schange.com. You may also change your vote via the Internet. You may change your vote by using any one of these methods regardless of the procedure used to cast your previous vote. |

If your shares are held in “street name” by a broker or other nominee, you should follow the instructions provided by your broker or other nominee to change your vote.

| Q: | Do I have appraisal rights? |

| A: | Holders of SeaChange common stock and Triller units are not entitled to appraisal rights in connection with the merger. |

Additional information about the SeaChange stockholders’ appraisal rights is set forth in “Information about the Special Meeting of SeaChange Stockholders—Appraisal Rights” beginning on page [•].

| Q: | Who will solicit and pay the cost of soliciting proxies? |

| A: | The board of directors of SeaChange is soliciting proxies to be voted at the special meeting. We will pay the cost of soliciting proxies for the special meeting. We have engaged Morrow Sodali LLC, to assist in the solicitation of proxies for the special meeting. We will pay Morrow Sodali LLC a fee of approximately $25,000 plus disbursements and a per call fee for any incoming or outgoing stockholder calls for such services. We will reimburse Morrow Sodali LLC for reasonable out-of-pocket expenses and will indemnify Morrow Sodali LLC and its affiliates against certain claims, liabilities, losses, damages and expenses. We will also reimburse banks, brokers and other custodians, nominees and fiduciaries representing beneficial owners of shares of our common stock for their expenses in forwarding soliciting materials to beneficial owners of our common stock and in obtaining voting instructions from those owners. Our directors, officers and employees may also solicit proxies by telephone, by facsimile, by mail, on the Internet or in person. They will not be paid any additional amounts for soliciting proxies. |

| Q: | How do I make an election as to the form of merger consideration I wish to receive in the merger? |

| A: | At the time of mailing of this proxy statement/prospectus, each record holder of SeaChange common shares that will be converted is also separately being sent an election form and letter of transmittal (an “election form”). The election form contains instructions for making a selection of merger consideration and for surrendering your SeaChange common shares in exchange for the merger consideration. Computershare, the exchange agent for the merger (the “exchange agent”), or SeaChange, as specified in your election form, |

7

Table of Contents

| must receive your properly completed and signed election form and your stock certificates or book-entry shares, and any additional documents specified in the election form, by no later than the election deadline in order for your choice as to the form of merger consideration to be considered with those timely made by the other SeaChange stockholders (including holders of SeaChange equity awards that have been converted). Triller and SeaChange currently anticipate that the “election deadline” will be 5:00 p.m., Eastern time, on [ ], 2022. Triller and SeaChange will issue a joint press release announcing the anticipated date of the election deadline at least five business days prior to the election deadline. If the SeaChange stockholders’ meeting is delayed, the election deadline will be similarly delayed to a subsequent date, and Triller and SeaChange will promptly announce any such delay and, when determined, the rescheduled election deadline. SeaChange stockholders are urged to promptly submit their properly completed and signed forms of election, together with the necessary transmittal materials, and not wait until the election deadline. |

You will be able to specify on the election form:

| • | the number of shares of SeaChange common stock with respect to which you elect to receive the Cash/Notes Consideration; or |

| • | the number of shares of SeaChange common stock with respect to which you elect to receive the Stock Consideration. |

If you do not submit an election form prior to the election deadline, you will be deemed to have indicated that you are making no election, and you will receive the Stock Consideration. A form of the election form for SeaChange stockholders is attached as Annex C to this proxy statement/prospectus. For additional information on the election procedures, see the section entitled “The Merger—Election Procedures” beginning on page [ ].

| Q: | What happens if I do not make a valid election as to the form of merger consideration before the election deadline? |

| A: | If you do not make a valid election as to the form of merger consideration before the election deadline, you will be deemed to have elected the Stock Consideration and will receive such merger consideration as is determined in accordance with the Merger Agreement. If the merger is completed, the exchange agent will send any SeaChange stockholder who does not make a valid election a new letter of transmittal that such stockholder can use to surrender its SeaChange common shares in exchange for the merger consideration. |

| Q: | Can I change my election as to the form of merger consideration? |

| A: | Yes. You can change your election as to the form of merger consideration by submitting a properly completed and signed revised election form. For a change of election to be effective, your signed revised election form must be received before the election deadline. See “The Merger—Election Procedures” beginning on page [ ]. |

| Q: | Should SeaChange stockholders send in their stock certificates with the enclosed proxy? |

| A: | No. SeaChange stockholders should not send in any stock certificates with the enclosed proxy. At the time of mailing of this proxy statement/prospectus, each record holder of SeaChange common shares is also separately being sent an election form. The election form contains instructions for surrendering your SeaChange common shares to the exchange agent in exchange for the merger consideration. For information regarding delivery of your stock certificates, if any, see “The Merger—Election Procedures” beginning on page [ ]. |

8

Table of Contents

| Q: | If I become a SeaChange stockholder of record after the SeaChange record date and want to receive the Cash/Notes Consideration, how can I elect to do so? |

| A: | Any SeaChange stockholder who does not receive an election form, whether due to the fact that they become a stockholder of record after the SeaChange record date or otherwise, may request one from SeaChange by contacting the [exchange agent or SeaChange’s corporate secretary at [ ],] and SeaChange will make an election form available to you. |

| Q: | I own shares of SeaChange common stock. Can I sell my shares of SeaChange common stock after I make my election to receive the Cash/Notes Consideration or Stock Consideration or if I do not make an election by the deadline? |

| A: | No. After a SeaChange stockholder has submitted a form of election, under the terms of the election, he or she will not be able to sell any shares of SeaChange common stock covered by his or her form of election unless he or she revokes his or her election before the deadline by written notice received by the exchange agent prior to the election deadline. In addition, once the election deadline has passed, no shares of SeaChange common stock may be sold. While the parties have agreed to establish an election deadline that is a relatively short time before the anticipated completion date of the merger, there can be no assurance that unforeseen circumstances will not cause the completion of the merger to be delayed after the deadline has been established. |

| Q: | Who can help answer my questions? |

| A: | If you have questions about the proposals or if you need additional copies of the proxy statement/prospectus or the enclosed proxy card you should contact: |

Elaine Martel, Vice President, General Counsel and Secretary

SeaChange International, Inc.

Tel: (508) 208-9699

Email: elaine.martel@schange.com

You may also contact our proxy solicitor at:

Morrow Sodali LLC

470 West Avenue

Stamford, Connecticut 06902

Tel: Individuals can call toll-free at (800) 662-5200 or banks and brokers can call collect at (203) 658-9400 Email: [•]

To obtain timely delivery, our stockholders must request the materials no later than five business days prior to the special meeting.

You may also obtain additional information about us from documents filed with the Securities and Exchange Commission (“SEC”) by following the instructions in the section entitled “Where You Can Find More Information.”

9

Table of Contents

SUMMARY OF THE PROXY STATEMENT/PROSPECTUS

This summary highlights selected information from this proxy statement/prospectus and may not contain all of the information that is important to you. To better understand the merger, the proposals being considered at the special meeting of SeaChange stockholders, you should read this entire proxy statement/prospectus carefully, including the Merger Agreement attached as Annex A and the other annexes to which you are referred herein. For more information, please see the section entitled “Where You Can Find More Information” beginning on page [•] of this proxy statement/prospectus.

The Companies (see page [•])

Triller Hold Co LLC

2121 Avenue of the Stars, Suite 2350

Los Angeles, California 90067

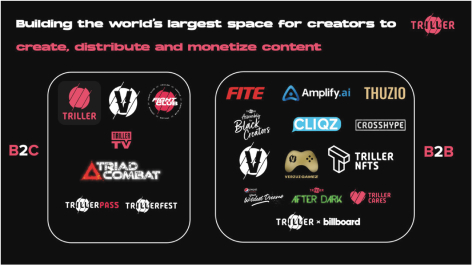

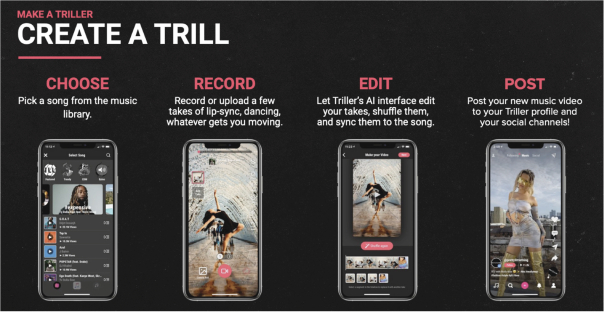

Triller Hold Co LLC (“Triller”) is an artificial intelligence (“AI”) platform for creators by creators, and one of the first “open garden” ecosystems to embrace decentralization as a leader of the movement to Web3. Since launching in 2019, Triller has grown from a single mobile app to a portfolio of AI-powered services for creators and brands, spanning content creation, measurement, conversation and engagement, and monetization. Triller is an integrated digital technology, media and entertainment company broadly engaged in the development, production, promotion, marketing and monetization of content through its mobile app, streaming platform, and virtual and live events. Triller also produces music, sports, lifestyle, fashion and entertainment content and live events that elevates culture and provides a turnkey platform for partners and customers to do the same.

SeaChange International, Inc.

177 Huntington Avenue, Suite 1703, PMB 73480

Boston, Massachusetts 02115

Founded on July 9, 1993, SeaChange International, Inc. (“SeaChange”) is an industry leader in the delivery of multiscreen, advertising and premium over-the-top (“OTT”) video management solutions. SeaChange provides first-class video streaming, linear TV, and video advertising technology for operators, content owners, and broadcasters globally. SeaChange’s technology enables operators, broadcasters, and content owners to cost-effectively launch and grow premium linear TV and direct-to-consumer streaming services to manage, curate, and monetize their content. SeaChange helps protect existing and develop new and incremental advertising revenues for traditional linear TV and streaming services with its unique advertising technology. SeaChange enjoys a rich heritage of nearly three decades of delivering premium video software solutions to its global customer base.

The Merger (see page [•])

Upon the terms and subject to the conditions of the Merger Agreement, and in accordance with the Delaware General Corporations Law (the “DGCL”) and the Delaware Limited Liability Company Act (the “Delaware LLC Act”), at the effective time, Triller will merge with and into SeaChange, with SeaChange as the surviving corporation. The combined business of Triller and SeaChange for periods following completion of the merger is sometimes referred to as the “combined company,” the “surviving company,” or “TrillerVerz Corp.”

Assuming that (i) all holders of SeaChange common stock elect the Stock Consideration and (ii) that Triller issues $250 million of Triller Convertible Notes which convert in connection with the proposed merger at an agreed discount of 20% to an assumed $5 billion Triller valuation (before the conversion of the Triller Convertible Notes), the stockholders of SeaChange (including SeaChange optionholders and holders of SeaChange deferred stock units, performance stock units and restricted stock units) would own approximately

10

Table of Contents

2.3% of the surviving company and the holders of Triller (including Triller optionholders and warrant holders) would hold approximately 97.7% of the surviving company. If all stockholders of SeaChange elect to receive the Cash/Notes Consideration, such stockholders would have no equity interest in the surviving company, and the Triller holders (including Triller optionholders and warrant holders) would collectively own 100% of the surviving company (other than SeaChange optionholders and holders of SeaChange deferred stock units, performance stock units and restricted stock units).

Reasons for the Merger (see page [•])

Each of SeaChange and Triller considered various reasons for seeking the merger. For example, SeaChange considered, among other things:

| • | the ability to obtain immediate economies of scale from an operations standpoint and access to additional revenue, working capital, and business opportunities; |

| • | the ability to capitalize on potential synergies between the businesses; |

| • | the anticipated benefits of a merger between SeaChange and Triller, taking into account the results of SeaChange’s due diligence review of Triller and information provided by Triller’s management; |

| • | the ability to realize a strategic alternative that materialized in calendar year 2021 after SeaChange ran a process to evaluate other various strategic alternatives in calendar year 2020 that did not yield any substantial results that would have been beneficial for SeaChange’s stockholders; |

| • | the form and amount of the merger consideration, including the ability of SeaChange stockholders to participate in the future performance of the combined company or receive the Cash/Notes Consideration; |

| • | the ability to realize a valuation of SeaChange of approximately $100 million that is significantly higher than the average trading price of $[ ] over the last [ ] months; |

| • | the ability to reduce and mitigate overall business execution risk that comes with being a micro-cap public company; and |

| • | the ability to expand the opportunity for strategic partnerships. |

The SeaChange board also considered the following potential risks and negative factors relating to the merger:

| • | the Merger Agreement obligates SeaChange to pay a substantial termination fee if the Merger Agreement is terminated under certain circumstances; |

| • | SeaChange will lose the autonomy and local strategic decision-making capabilities associated with being an independent entity; |

| • | while the merger is pending, SeaChange’s officers and employees will have to focus extensively on actions required to complete the merger, which could divert their attention from SeaChange’s business, and SeaChange will incur substantial costs even if the merger is not consummated; |

| • | the merger could result in employee attrition and have a negative effect on business and customer relationships; |

| • | the possibility that the regulatory and other approvals necessary for the merger contemplated by the Merger Agreement will not be received in a timely manner or at all or may contain unacceptable conditions; |

| • | the fact that there can be no assurance that all of the conditions to the parties’ obligations to complete the merger will be satisfied and that the merger will be consummated; |

| • | the fact that stockholder litigation is common in connection with public company mergers; |

| • | the fact that, subject to certain exceptions, SeaChange would be prohibited from soliciting other acquisition proposals after execution of the Merger Agreement; |

11

Table of Contents

| • | the possibility of encountering difficulties in successfully integrating SeaChange’s business, operations, and workforce with those of Triller; and |

| • | the other risks described under the sections titled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in this proxy statement/prospectus. |

Triller’s primary reasons for seeking the merger are:

| • | to obtain for its holders the liquidity advantages associated with owning common stock in a publicly traded company listed on Nasdaq (and which has a large number of street-name beneficial owners of common stock), as opposed to owning their current illiquid Triller private-company units; |

| • | to, in accordance with Nasdaq’s rules, structure a combination that enables the preservation of SeaChange’s existing Nasdaq listing by satisfying all of Nasdaq’s financial and other requirements for doing so, instead of seeking Nasdaq listing anew; |

| • | to obtain immediate economies of scale from an operations standpoint and access to additional revenue, and working capital from SeaChange, ultimately strengthening its balance sheet; |

| • | to obtain for its holders a supermajority interest in the surviving company as a vehicle, with the surviving company’s common stock listed on Nasdaq to carry forward (on a consolidated basis) Triller’s legacy and prospective business efforts; |

| • | to gain access to the public capital markets and leverage the company’s common stock as currency for future mergers and acquisitions; |

| • | to avoid the cost and risk which the method of going public by making a traditional underwritten initial public offering would entail; and |

| • | to capitalize on potential synergies between the business (e.g., digital streaming and advertising). |

Material U.S. Federal Income Tax Considerations (see page [•])

SeaChange and Triller intend that the merger will qualify as (i) an exchange under Section 351 of the Internal Revenue Code of 1986, as amended (the “Code”) in respect of the transactions described in § 1.5(a)(i) of the Merger Agreement; (ii) a distribution in redemption of stock pursuant to Sections 302(a) and 302(b) of the Code in respect of the transactions described in § 1.5(a)(ii)(A) of the Merger Agreement; and (iii) a reorganization pursuant to Section 368(a)(1)(E) of the Code in respect of the transactions described in § 1.5(a)(ii)(B) of the Merger Agreement.

Please carefully review the information set forth in the section titled “Material U.S. Federal Income Tax Considerations” beginning on page [•] of this proxy statement/prospectus for a general discussion of the material U.S. federal income tax consequences of the merger. You are strongly urged to consult your own tax advisors as to the specific tax consequences to you of the merger.

Overview of the Merger Agreement

Merger Consideration (see page [•])

The stockholders of SeaChange will have the right to elect to receive either (i) their pro rata portion of $25 million cash consideration along with their pro rata portion of an aggregate $75 million in principal of notes (the “Notes Consideration”) to be issued by the surviving company to the holders of SeaChange common stock (such cash and notes consideration, the “Cash/Notes Consideration”) or (ii) a number of shares of SeaChange Class A common stock (the “Stock Consideration”) determined by dividing the Cash/Notes Consideration that a holder would have received by the Triller Convertible Notes Conversion Price and then multiplying this quotient

12

Table of Contents

by the Company Class A/B Exchange Ratio, such consideration and exchange ratio further described in the sections entitled “The Merger—Merger Consideration, Exchange Ratios and Notes Merger Consideration” and “The Merger Agreement—Merger Consideration” beginning on pages [ ] and [ ] of this proxy statement/prospectus, respectively. If an election is not made or is not properly made with respect to any shares of SeaChange common stock, then such shares of SeaChange common stock shall be deemed to have elected to receive the Stock Consideration.

Each Triller Class A common unit and Triller Class B common unit outstanding immediately prior to the effective time of the merger will automatically convert into the right to receive shares of SeaChange Class A common stock in the amount equal to the Company Class A/B Exchange Ratio, and each Triller Class C common unit outstanding immediately prior to the effective time of the merger will automatically convert into the right to receive shares of SeaChange Class B Common Stock, in an amount equal to the Company Class C Exchange Ratio and further described in the section entitled “The Merger—Merger Consideration, Exchange Ratios and Notes Merger Consideration” beginning on page [ ] of this proxy statement/prospectus.

For a more complete description of the merger consideration, please see the sections entitled “The Merger—Merger Consideration, Exchange Ratios and Notes Merger Consideration” and “The Merger Agreement —Merger Consideration” beginning on pages [ ] and [ ] of this proxy statement/prospectus, respectively.

Treatment of Triller Service Provider Units (see page [•])

Holders of Triller service provider units would receive a number of shares of SeaChange Class A common stock calculated in accordance with the Company Class A/B Exchange Ratio and any unvested service provider units would remain subject to the vesting requirements under the applicable award agreement.

Treatment of Triller Options and Warrants (see page [•])

Each Triller warrant that is outstanding and unexercised immediately before the effective time will be converted into and become a warrant to purchase SeaChange Class A common stock and each Triller option that is outstanding immediately prior to the effective time will be assumed by SeaChange and converted into an option to purchase shares of SeaChange Class A common stock, each as further described in the section entitled “The Merger Agreement—Treatment of SeaChange and Triller Stock, Options, Other Awards and Warrants” beginning on page [ ] of this proxy statement/prospectus.

Treatment of Triller Convertible Notes (see page [•])

All Triller Convertible Notes outstanding immediately prior to the effective time will convert into Triller Class B common units immediately prior to the effective time, which will be converted into shares of SeaChange Class A common stock, as further described in the section entitled “The Merger Agreement—Treatment of SeaChange and Triller Stock, Options, Other Awards and Warrants” beginning on page [ ] of this proxy statement/prospectus.

Treatment of SeaChange Options and DSUs/PSUs/RSUs (see page [•])

Each outstanding and unexercised SeaChange option (i) whose exercise price is less than the Buyer Share Closing Price (as defined in the Merger Agreement) as of the effective time will fully vest, be cancelled as of immediately prior to the effective time and be converted into the right (net of the applicable exercise price) to receive the Stock Consideration and (ii) whose exercise price is equal to or greater than the Buyer Share Closing Price as of the effective time will become exercisable for shares of SeaChange Class A common stock and otherwise have and be subject to the same terms and conditions (including vesting and exercisability terms) as were applicable to such SeaChange option immediately before the effective time, subject to certain exceptions, as further described in the section entitled “The Merger Agreement—Treatment of SeaChange and Triller Stock, Options, Other Awards and Warrants” beginning on page [ ] of this proxy statement/prospectus.

13

Table of Contents

Each of the SeaChange deferred stock units (“DSUs”), performance stock units (“PSUs”) or restricted stock units (“RSUs”) outstanding under the SeaChange stock plans immediately prior to the effective time will vest in full and become free of restrictions and will be treated as a share of SeaChange common stock that will be cancelled and converted automatically into the right to receive the Stock Consideration, as further described in the section entitled “The Merger Agreement—Treatment of SeaChange and Triller Stock, Options, Other Awards and Warrants” beginning on page [ ] of this proxy statement/prospectus.

Election Procedures (see page [•])

At the time of mailing of this proxy statement/prospectus, each record holder of SeaChange common shares that will be converted is also separately being sent an election form and letter of transmittal (an “election form”). The election form contains instructions for making a selection of merger consideration and for surrendering your SeaChange common shares in exchange for the merger consideration. Computershare, the exchange agent for the merger (the “exchange agent”), or SeaChange, as specified in your election form, must receive your properly completed and signed election form and your stock certificates or book-entry shares, and any additional documents specified in the election form, by no later than the election deadline in order for your choice as to the form of merger consideration to be considered with those timely made by the other SeaChange stockholders (including holders of SeaChange equity awards that have been converted).

Triller and SeaChange currently anticipate that the “election deadline” will be 5:00 p.m., Eastern time, on [ ], 2022. Triller and SeaChange will issue a joint press release announcing the anticipated date of the election deadline at least five business days prior to the election deadline. SeaChange stockholders are urged to promptly submit their properly completed and signed forms of election, together with the necessary transmittal materials, and not wait until the election deadline.

You will be able to specify on the election form:

| • | the number of shares of SeaChange common stock with respect to which you elect to receive the Cash/Notes Consideration; or |

| • | the number of shares of SeaChange common stock with respect to which you elect to receive the Stock Consideration. |

If you do not submit an election form prior to the election deadline, you will be deemed to have indicated that you are making no election, and you will receive the Stock Consideration.

For a complete discussion of the election procedures, see “The Merger—Election Procedures” beginning on page [ ] of this proxy statement/prospectus.

Conditions to the Completion of the Merger (see page [•])

To consummate the merger, SeaChange stockholders must approve each of the Merger Proposal, the Certificate of Incorporation Amendment Proposal, the Incentive Plan Proposal, the Omnibus Incentive Plan Proposal and the Nasdaq Proposal.

In addition to obtaining such stockholder approvals and appropriate regulatory approvals, each of the other closing conditions set forth in the Merger Agreement is described under the section entitled “The Merger Agreement—Conditions to the Completion of the Merger” beginning on page [ ] of this proxy statement/prospectus.

No Shop (see page [•])

Each of SeaChange and Triller agreed that during the period commencing on the date of the Merger Agreement and ending on the earlier of the consummation of the merger or the termination of the Merger Agreement, except

14

Table of Contents

as described below, SeaChange and Triller will not, nor will either party authorize any of the directors, officers, employees, agents, attorneys, accountants, investment bankers, advisors or representatives retained by it to, directly or indirectly:

| • | solicit, initiate or knowingly encourage, induce or knowingly facilitate the communication, making, submission or announcement of, any “acquisition proposal” or “acquisition inquiry” (each as defined herein); |

| • | furnish any non-public information with respect to it or any of its subsidiaries to any person in connection with or in response to an acquisition proposal or acquisition inquiry; |

| • | engage in discussions or negotiations with any person with respect to any acquisition proposal or acquisition inquiry; |

| • | approve, endorse or recommend an acquisition proposal; |