Exhibit 10.32

ENDORSEMENT NO. 1

to the

CASUALTY CATASTROPHE EXCESS OF LOSS

REINSURANCE CONTRACT

(the “Contract”)

issued to

AMERICAN INTERSTATE INSURANCE COMPANY

DeRidder, Louisiana

and

AMERICAN INTERSTATE INSURANCE COMPANY OF TEXAS

Austin, Texas

and

SILVER OAK CASUALTY, INC.

DeRidder, Louisiana

and

any other insurance companies which are now or hereafter come under the ownership, control

or management of Amerisafe, Inc.

(the “Company”)

IT IS HEREBY AGREED, effective January 1, 2014, that the Company listing in the Contract's preamble shall be amended to read as follows:

AMERICAN INTERSTATE INSURANCE COMPANY

SILVER OAK CASUALTY, INC.

both of Omaha, Nebraska

and

AMERICAN INTERSTATE INSURANCE COMPANY OF TEXAS

Austin, Texas

and

any other insurance companies which arc now or hereafter come under the ownership, control

or management of Amerisafe, Inc.

(the “Company”)

IT IS FURTHER AGREED that the GOVERNING LAW ARTICLE shall be amended to read as follows:

This Contract shall be governed as to performance, administration and interpretation by the laws of the State of Nebraska, exclusive of that state’s rules with respect to conflicts of law, except as to rules with respect to credit for reinsurance in which case the applicable rules of all states shall apply.

IT IS FURTHER AGREED that paragraph E. of the ARBITRATION ARTICLE shall be amended to read as follows:

| E. | Within 30 days after notice of appointment of all arbitrators, the panel shall meet and determine timely periods for briefs, discovery procedures and schedules for hearings. The panel shall be relieved of all judicial formality and shall not be bound by the strict rules of procedure and evidence. Unless the panel agrees otherwise, arbitration shall take place in Omaha, Nebraska but the venue may be changed when deemed by the panel to be in the best interest of the arbitration |

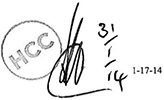

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Cat XOL Endt 1 |

1-17-14 |

| proceeding. Insofar as the arbitration panel looks to substantive law, it shall consider the law of the State of Nebraska. The decision of any 2 arbitrators when rendered in writing shall be final and binding. The panel is empowered to grant interim relief as it may deem appropriate. |

The provisions of this Contract shall remain otherwise unchanged.

IN WITNESS WHEREOF, the Company by its duly authorized representative has executed this Endorsement as of the date specified below:

Signed this 27th day of January, 2014.

| AMERICAN INTERSTATE INSURANCE COMPANY SILVER OAK CASUALTY, INC. AMERICAN INTERSTATE INSURANCE COMPANY OF TEXAS | ||

| By | /s/ C. Allen Bradley, Jr | |

| Printed Name | C. Allen Bradley, Jr | |

| Title | Chairman & Chief Executive Officer | |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Cat XOL Endt 1 |

1-17-14 |

AMERICAN INTERSTATE INSURANCE COMPANY

DeRidder, Louisiana

and

AMERICAN INTERSTATE INSURANCE COMPANY OF TEXAS

Austin, Texas

and

SILVER OAK CASUALTY, INC.

DeRidder, Louisiana

and

any other insurance companies which are now or hereafter come under the ownership,

control or management of Amerisafe Insurance Group

CASUALTY CATASTROPHE EXCESS OF LOSS

REINSURANCE CONTRACT

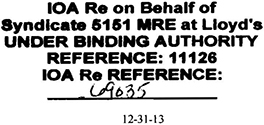

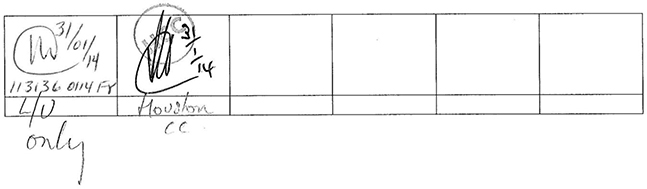

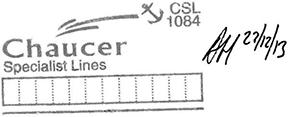

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

12-31-13 |

TABLE OF CONTENTS

| ARTICLE |

PAGE | |||||

| I | BUSINESS COVERED | 1 | ||||

| II | TERM | 2 | ||||

| III | SPECIAL TERMINATION | 2 | ||||

| IV | DEFINITIONS | 4 | ||||

| Act of Terrorism |

4 | |||||

| Declaratory Judgment Expense |

4 | |||||

| Extra Contractual Obligations/Loss in Excess of Policy Limits |

4 | |||||

| Loss Adjustment Expense |

5 | |||||

| Loss Occurrence |

5 | |||||

| Net Earned Premium |

6 | |||||

| Policy |

6 | |||||

| V | TERRITORY | 6 | ||||

| VI | EXCLUSIONS | 7 | ||||

| VII | TERRORISM ACT RECOVERIES | 9 | ||||

| VIII | COVERAGE | 9 | ||||

| IX | REINSTATEMENT | 10 | ||||

| X | SPECIAL ACCEPTANCE | 10 | ||||

| XI | ACCOUNTING BASIS | 11 | ||||

| XII | REINSURANCE PREMIUM | 11 | ||||

| XIII | NOTICE OF LOSS AND LOSS SETTLEMENTS | 11 | ||||

| XIV | LIABILITY OF REINSURERS | 12 | ||||

| XV | LATE PAYMENTS | 12 | ||||

| XVI | ANNUITIES AT THE COMPANY’S OPTION | 13 | ||||

| XVII | AGENCY AGREEMENT | 14 | ||||

| XVIII | SUBROGATION | 14 | ||||

| XIX | ERRORS AND OMISSIONS | 14 | ||||

| XX | OFFSET | 14 | ||||

| XXI | CURRENCY | 15 | ||||

| XXII | TAXES | 15 | ||||

| XXIII | FEDERAL EXCISE TAX | 15 | ||||

| XXIV | RESERVES AND FUNDING | 15 | ||||

| XXV | NET RETAINED LINES | 17 | ||||

| XXVI | THIRD PARTY RIGHTS | 18 | ||||

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

12-31-13 |

| XXVII | SEVERABILITY | 18 | ||||

| XXVIII | GOVERNING LAW | 18 | ||||

| XXIX | INSPECTION OF RECORDS | 18 | ||||

| XXX | CONFIDENTIALITY | 19 | ||||

| XXXI | SUNSET AND COMMUTATION | 20 | ||||

| XXXII | INSOLVENCY | 21 | ||||

| XXXIII | ARBITRATION | 22 | ||||

| XXXIV | EXPEDITED ARBITRATION | 24 | ||||

| XXXV | SERVICE OF SUIT | 24 | ||||

| XXXVI | ENTIRE AGREEMENT | 25 | ||||

| XXXVII | MODE OF EXECUTION | 26 | ||||

| XXXVIII | INTERMEDIARY | 26 | ||||

| Nuclear Incident Exclusion Clause - Liability - Reinsurance - U.S.A. | ||||||

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

12-31-13 |

CASUALTY CATASTROPHE EXCESS OF LOSS

REINSURANCE CONTRACT

(the “Contract”)

between

AMERICAN INTERSTATE INSURANCE COMPANY

DeRidder, Louisiana

and

AMERICAN INTERSTATE INSURANCE COMPANY OF TEXAS

Austin, Texas

and

SILVER OAK CASUALTY, INC.

DeRidder, Louisiana

and

any other insurance companies which are now or hereafter come under the ownership,

control or management of Amerisafe Insurance Group

(collectively the “Company”)

and

THE SUBSCRIBING REINSURER(S) EXECUTING THE

INTERESTS AND LIABILITIES AGREEMENT(S)

ATTACHED HERETO

(the “Reinsurer”)

ARTICLE I

BUSINESS COVERED

| A. | By this Contract the Reinsurer agrees to reinsure the excess liability of the Company under its Policies that are in force at the effective time and date hereof or issued or renewed at or after that time and date, and classified by the Company as Workers’ Compensation, Employers Liability, including but not limited to coverage provided under the U.S. Longshore and Harbor Workers’ Compensation Act, Jones Act, Outer Continental Shelf Lands Act and any other Federal Coverage extensions, subject to the terms, conditions and limitations hereafter set forth. |

| B. | The Reinsurer further agrees to reinsure the excess liability of the Company under Policies issued by Cooperative Mutual Insurance Company that are in force at the effective time and date hereof or issued or renewed at or after that time and date, and classified by the Company as Workers’ Compensation, Employers Liability, including but not limited to coverage provided under the U.S. Longshore and Harbor Workers’ Compensation Act, Jones Act, Outer Continental Shelf Lands Act and any other Federal Coverage extensions, subject to the terms, conditions and limitations hereafter set forth. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

1 | 12-31-13 |

ARTICLE II

TERM

| A. | This Contract will apply to all losses occurring during the period January 1, 2014, 12:01 a.m. Standard Time (as set forth in the Company’s policies), to January 1, 2015, 12:01 a.m. Standard Time. |

| B. | Upon the expiration or termination of this Contract, the entire liability of the Reinsurer for losses occurring subsequent to the date of expiration shall cease concurrently with the date of expiration of this Contract. |

| C. | Notwithstanding the above, upon expiration or termination of this Contract, the Company shall have the option of requiring that the Reinsurer shall remain liable for losses occurring under Policies in force on the expiration or termination date of this Contract until the next renewal, termination, or natural expiration date of such Policies or until 12 months (plus “odd time,” not to exceed 18 months in all) following the date of expiration (whichever occurs first). |

| D. | If this Contract expires while a Loss Occurrence covered hereunder is in progress, the Reinsurer’s liability hereunder shall, subject to the other terms and conditions of this Contract, be determined as if the entire Loss Occurrence had occurred prior to the expiration of this Contract, provided that no part of such Loss Occurrence is claimed against any renewal or replacement of this Contract. |

ARTICLE III

SPECIAL TERMINATION

| A. | The Company may terminate a subscribing reinsurer’s share in this Contract by giving written notice to the subscribing reinsurer upon the happening of any one of the following circumstances: |

| 1. | A State Insurance Department or other legal authority orders the subscribing reinsurer to cease writing business, or |

| 2. | The subscribing reinsurer has become insolvent or has been placed into liquidation or receivership (whether voluntary or involuntary), or there has been instituted against it proceedings for the appointment of a receiver, liquidator, rehabilitator, conservator, or trustee in bankruptcy, or other agent known by whatever name, to take possession of its assets or control of its operations, or |

| 3. | For any period not exceeding 12 months which commences no earlier than 12 months prior to the inception of this Contract, the subscribing reinsurer’s policyholders’ surplus, as reported in the financial statements of the subscribing reinsurer, has been reduced by 20.0% or more, or |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

2 | 12-31-13 |

| 4. | The subscribing reinsurer has become merged with, acquired or controlled by any company, corporation, or individual(s) not controlling the subscribing reinsurer’s operations previously, or |

| 5. | The subscribing reinsurer has reinsured its entire liability under this Contract without the Company’s prior written consent, or |

| 6. | The subscribing reinsurer receives an A. M. Best rating of lower than A-, or an S&P financial strength rating of lower than A-, or |

| 7. | The subscribing reinsurer has ceased writing new and renewal reinsurance for the lines of business covered hereunder. |

| B. | In the event of such termination, the liability of the subscribing reinsurer shall be terminated, at the Company’s option, either in accordance with the cutoff provisions of paragraph B of the TERM ARTICLE or in accordance with the runoff provisions of paragraph C of the TERM ARTICLE, and such termination shall be effective as of the date the subscribing reinsurer receives written notice of termination pursuant to paragraph A above. |

| C. | In the event the Company terminates a subscribing reinsurer’s share in this Contract under the provisions of this Article, the Company shall have the option to commute the excess liabilities of the subscribing reinsurer. If this commutation option is exercised, the provisions of the paragraphs B through G of the SUNSET AND COMMUTATION ARTICLE shall apply. |

| D. | In the event the Company terminates a subscribing reinsurer’s share in this Contract under the provision of this Article, the Company shall have the option to require the subscribing reinsurer to fund its share of ceded unearned premium, outstanding loss and Loss Adjustment Expense reserves, reserves for losses and Loss Adjustment Expense incurred but not reported to the Company (IBNR as determined by the Company) and any other balances or financial obligations. Within 30 days of the Company’s written request to fund, the subscribing reinsurer shall provide to the Company a clean, unconditional, evergreen, irrevocable letter of credit or a trust agreement which establishes a trust account for the benefit of the Company. The method of funding must be acceptable to the Company, shall be established with a financial institution suitable to the Company, shall comply with any applicable state or federal laws or regulations involving the Company’s ability to recognize these agreements as assets or offsets to liabilities in such jurisdictions and shall be at the sole expense of the subscribing reinsurer. The Company and the subscribing reinsurer may mutually agree on alternative methods of funding or the use of a combination of methods. This option is available to the Company at any time there remains any outstanding liabilities of the subscribing reinsurer. Notwithstanding the foregoing, the Company shall not require funding in accordance with this subparagraph in the event the subscribing reinsurer has otherwise fully funded its obligations under this Contract in a manner acceptable to the Company. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

3 | 12-31-13 |

ARTICLE IV

DEFINITIONS

| A. | Act of Terrorism |

“Act of Terrorism” as used herein shall follow the definition provided under the Terrorism Risk Insurance Act of 2002 (TRIA) and as amended by the Terrorism Risk Insurance Extension Act of 2005 (TRIEA) and the Terrorism Risk Insurance Program Reauthorization Act of 2007 (TRIPRA), together and including any extensions or replacement thereof, the “Terrorism Act.”

In the event the Terrorism Act is not extended or renewed, Act of Terrorism shall mean a violent act or an act that is dangerous to human life; property; or infrastructure that 1) has resulted in damage within the United States, or outside of the United States in the case of an air carrier or vessel, 2) was committed by an individual or individuals as part of an effort to coerce the civilian population of the United States or to influence the policy or affect the conduct of the United States Government by coercion. The Company shall determine the application of the above definition.

An “Act of Terrorism” may include an act involving the use and/or dispersal of nuclear, chemical, biological or radiological agents.

| B. | Declaratory Judgment Expense |

“Declaratory Judgment Expense” as used herein shall mean all expenses incurred by the Company in connection with a declaratory judgment action brought to determine the Company’s defense and/or indemnification obligations that are allocable to a specific claim subject to this Contract. Declaratory Judgment Expense shall be deemed to have been incurred on the date of the original loss (if any) giving rise to the declaratory judgment action.

| C. | Extra Contractual Obligations/Loss in Excess of Policy Limits |

| 1. | Extra Contractual Obligations |

This Contract shall protect the Company for any “Extra Contractual Obligations” which as used herein shall mean any punitive, exemplary, compensatory or consequential damages, other than Loss in Excess of Policy Limits, paid or payable by the Company as a result of an action against it by its insured, its insured’s assignee or a third party claimant, by reason of alleged or actual negligence, fraud or bad faith on the part of the Company in handling a claim under a Policy subject to this Contract.

An Extra Contractual Obligation shall be deemed to have occurred on the same date as the loss covered or alleged to be covered under the Policy.

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

4 | 12-31-13 |

| 2. | Loss in Excess of Policy Limits |

This Contract shall protect the Company for any “Loss in Excess of Policy Limits” which as used herein shall mean an amount that the Company would have been contractually liable to pay had it not been for the limit of the original Policy as a result of an action against it by its insured, its insured’s assignee or a third party claimant. Such loss in excess of the limit shall have been incurred because of failure by the Company to settle within the Policy limit, or by reason of alleged or actual negligence, fraud, or bad faith in rejecting an offer of settlement or in the preparation of the defense or in the trial of any action against its insured or in the preparation or prosecution of an appeal consequent upon such action.

| 3. | This paragraph C shall not apply where an Extra Contractual Obligation and/or Loss in Excess of Policy Limits has been incurred due to an adjudicated finding of fraud committed by a member of the Board of Directors or a corporate officer of the Company acting individually or collectively or in collusion with a member of the Board of Directors or a corporate officer or a partner of any other corporation or partnership. |

| D. | Loss Adjustment Expense |

“Loss Adjustment Expense” as used herein shall mean all costs and expenses allocable to a specific claim that are incurred by the Company in the investigation, appraisal, adjustment, settlement, litigation, defense or appeal of a specific claim, including court costs and costs of supersedeas and appeal bonds, and including 1) pre-judgment interest, unless included as part of the award or judgment; 2) post-judgment interest; 3) legal expenses and costs incurred in connection with coverage questions and legal actions connected thereto, including Declaratory Judgment Expense; and 4) a pro rata share of salaries and expenses of Company field employees, and expenses of other Company employees who have been temporarily diverted from their normal and customary duties and assigned to the field adjustment of losses covered by this Contract. Loss Adjustment Expense does not include unallocated loss adjustment expense. Unallocated loss adjustment expense includes, but is not limited to, salaries and expenses of employees, other than (4) above, and office and other overhead expenses.

| E. | Loss Occurrence |

“Loss Occurrence” as used in this Contract shall mean any one disaster or casualty or accident or loss or series of disasters or casualties or accidents or losses arising out of or caused by one event. The Company shall be the sole judge of what constitutes one event as outlined herein and in the original Policy.

As respects losses resulting from Occupational or Industrial Disease or Cumulative Trauma, each employee shall be considered a separate Loss Occurrence subject to the following:

Losses resulting from Occupational or Industrial Disease or Cumulative Trauma suffered by employees of an insured for which the employer is liable, as a result of a sudden and accidental event not exceeding 72 hours in duration, shall be considered one Loss Occurrence and may be combined with losses classified as other than Occupational or Industrial Disease or Cumulative Trauma which arise out of the same event and the combination of such losses shall be considered as one Loss Occurrence within the meaning hereof.

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

5 | 12-31-13 |

A loss with respect to each employee affected by an Occupational Disease or Cumulative Trauma shall be deemed to have been sustained by the Company on the date of the beginning of the disability for which compensation is payable.

The terms “Occupational or Industrial Disease” and “Cumulative Trauma” as used in this Contract shall be as defined by applicable statutes or regulations.

| F. | Net Earned Premium |

“Net Earned Premium” as used herein is defined as gross earned premium of the Company for the classes of business reinsured hereunder, less the earned portion of premiums ceded by the Company for reinsurance which inures to the benefit of this Contract and less dividends paid or accrued.

| G. | Policy |

“Policy” or “Policies” as used herein shall mean the Company’s or Cooperative Mutual Insurance Company’s binders, policies and contracts providing insurance or reinsurance on the classes of business covered under this Contract.

| H. | Ultimate Net Loss |

“Ultimate Net Loss” shall mean the actual loss, including any pre-judgment interest which is included as part of the award or judgment, “Second Injury Fund” assessments that can be allocated to specific claims, Loss Adjustment Expense, 90% of Loss in Excess of Policy Limits, and 90% of Extra Contractual Obligations, paid or to be paid by the Company on its net retained liability after making deductions for all recoveries, subrogations and all claims on inuring reinsurance, whether collectible or not; provided, however, that in the event of the insolvency of the Company, payment by the Reinsurer shall be made in accordance with the provisions of the INSOLVENCY ARTICLE. Nothing herein shall be construed to mean that losses under this Contract are not recoverable until the Company’s Ultimate Net Loss has been ascertained.

Notwithstanding the definition of “Ultimate Net Loss” herein, the provisions of paragraph H of the COVERAGE ARTICLE as respects the Minnesota Workers’ Compensation Reinsurance Association shall apply.

ARTICLE V

TERRITORY

The territorial limits of this Contract shall be identical with those of the Company’s Policies.

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

6 | 12-31-13 |

ARTICLE VI

EXCLUSIONS

| A. | This Contract does not apply to and specifically excludes the following: |

| 1. | Reinsurance assumed by the Company under obligatory reinsurance agreements, except: |

| a. | Agency reinsurance where the policies involved are to be reunderwritten in accordance with the underwriting standards of the Company and reissued as Company policies at the next anniversary or expiration date; and |

| b. | Intercompany reinsurance between any of the reinsured companies under this Contract. |

| c. | Reinsurance assumed through Policies issued by Cooperative Mutual Insurance Company. |

| 2. | Nuclear risks as defined in the “Nuclear Incident Exclusion Clause – Liability – Reinsurance – U.S.A.” (NMA 1590 21/9/67) attached hereto. |

| 3. | Liability as a member, subscriber or reinsurer of any Pool, Syndicate or Association, including Assigned Risk Plans or similar plans; however, this exclusion shall not apply to liability under a Policy specifically designated to the Company from an Assigned Risk Plan or similar plan. |

| 4. | All liability of the Company arising by contract, operation of law, or otherwise, from its participation or membership, whether voluntary or involuntary, in any Insolvency Fund. “Insolvency Fund” includes any guaranty fund, insolvency fund, plan, pool, association, fund or other arrangement, however denominated, established or governed, which provides for any assessment of or payment or assumption by the Company of part or all of any claim, debt, charge, fee or other obligation of an insurer, or its successors or assigns, which has been declared by any competent authority to be insolvent, or which is otherwise deemed unable to meet any claim, debt, charge, fee or other obligation in whole or in part. |

| 5. | Loss caused directly or indirectly by war, whether or not declared, civil war, insurrection, rebellion or revolution, or any act or condition incidental to any of the foregoing. This exclusion shall not apply to any Policy that contains a standard war exclusion. |

| 6. | Workers’ Compensation where the principal exposure, as defined by the governing class code, is: |

| a. | Operation of aircraft, but only if the annual estimated policy premium is $250,000 or more; |

| b. | Operation of Railroads, subways or street railways; |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

7 | 12-31-13 |

| c. | Manufacturing, assembly, packing or processing of fireworks, fuses, nitroglycerine, magnesium, pyroxylin, ammunition or explosives. This exclusion does not apply to the assembly, packing or processing of explosives when the estimated annual premium is under $250,000 and does not apply to the commercial use of explosives; |

| d. | Underground mining. |

| 7. | Professional sports teams. |

| B. | Notwithstanding the foregoing, insureds regularly engaged in operations not excluded under paragraph A above, but whose operations may include one or more perils excluded therein, shall not be excluded from coverage afforded by this Contract, provided said operations are incidental to the main operations of the insured. Notwithstanding the foregoing, coverage extended under this paragraph for incidental operations of an insured shall not apply to exposures excluded under subparagraphs 1 through 5 of paragraph A above. The Company shall be the judge of what constitutes an incidental part of the insured’s operation. |

| C. | Except for subparagraphs 1 through 5 of paragraph A above, if the Company is inadvertently bound or is unknowingly exposed (due to error or automatic provisions of policy coverage) on a risk otherwise excluded in paragraph A above, such exclusion shall be waived. The duration of said waiver will not extend beyond the time that notice of such coverage has been received by a responsible underwriting authority of the Company and for a period not exceeding 30 days thereafter, or such longer period required to conform with any notice of cancellation provisions prescribed by regulatory authorities, such period not to exceed 12 months plus odd time (not exceeding 18 months). |

| D. | If the Company is required to accept an assigned risk which conflicts with one or more of the exclusions set forth in subparagraph 5 of paragraph A, reinsurance shall apply, but only for the difference between the Company’s retention and the limit required by the applicable state statute, and in no event shall the Reinsurer’s liability exceed the limit set forth in the Coverage Article. |

| E. | Notwithstanding the foregoing, any reinsurance falling within the scope of one or more of the exclusions set forth above that is specially accepted by the Reinsurer from the Company shall be covered under this Contract and be subject to the terms hereof. |

| F. | Except for subparagraphs 1 through 5 of paragraph A above, should a court of competent jurisdiction invalidate any exclusion or expand coverage of the original Policy of the Company, any amount of Loss for which the Company would not be liable, except for such invalidation or expansion of coverage, shall not be subject to any of the exclusions, conditions and limitations hereinafter set forth under this Contract. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

8 | 12-31-13 |

ARTICLE VII

TERRORISM ACT RECOVERIES

| A. | Any financial assistance the Company receives under the Terrorism Act, shall apply as follows: |

| 1. | Except as provided in subparagraph 2 below, any such financial assistance shall inure solely to the benefit of the Company and shall be entirely disregarded in applying all of the provisions of this Contract. |

| 2. | If losses occurring hereunder result in recoveries made by the Company both under this Contract and under the Terrorism Act, and such recoveries, together with any other reinsurance recoverables made by the Company applicable to said losses, exceed the total amount of the Company’s insured losses, any amount in excess thereof shall reduce the Ultimate Net Loss subject to this Contract for the losses to which the Terrorism Act assistance applies. These recoveries shall be returned in proportion to each Reinsurer’s paid share of the loss. |

| B. | Nothing herein shall be construed to mean that the losses under this Contract are not recoverable until the Company has received financial assistance under the Terrorism Act. |

ARTICLE VIII

COVERAGE

| A. | The Reinsurer shall be liable for the Ultimate Net Loss in excess of $10,000,000 as a result of any one Loss Occurrence. The Reinsurer’s liability in respect of any one Loss Occurrence shall not exceed $60,000,000. |

| B. | The Reinsurer’s liability in respect of Ultimate Net Loss amounts recoverable hereunder for an Act of Terrorism (as defined in the definition of “Act of Terrorism”) occurring during the term of this Contract shall not exceed $60,000,000. This paragraph is not subject the REINSTATEMENT ARTICLE. |

| C. | The Reinsurer’s liability in respect of all losses occurring during the term of this Contract shall not exceed $120,000,000. |

| D. | As respects the statutory portion of any Workers’ Compensation Policy, the Company’s Ultimate Net Loss subject to this Contract shall not exceed $10,000,000 as respects any one life, each Loss Occurrence |

| E. | The Company shall be permitted to purchase (or maintain) other reinsurance which inures to the benefit of this Contract. |

| F. | The Company shall be permitted to carry underlying reinsurance, recoveries under which shall inure solely to the benefit of the Company and be entirely disregarded in applying all of the provisions of this Contract. |

| G. | As respects Employers Liability, the maximum net subject Policy limit (except statutory where required by law) as respects any one Policy shall be $2,000,000 or the Company shall be deemed to have purchased inuring excess facultative reinsurance for subject Policy limits in excess of $2,000,000. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

9 | 12-31-13 |

| H. | The Company shall be permitted to carry excess of loss reinsurance applying to Workers’ Compensation risks in the State of Minnesota, actual recoveries under which shall inure to the benefit of this Contract. Such coverage shall be provided through the Minnesota Workers’ Compensation Reinsurance Association. Notwithstanding the treatment of inuring coverage in the definition of Ultimate Net Loss, the liability of the Reinsurer for Minnesota Workers’ Compensation risks is not released. |

ARTICLE IX

REINSTATEMENT

| A. | Should all or any part of the Reinsurer’s limit of liability be exhausted as a result of a Loss Occurrence, the sum so exhausted shall be reinstated from the date the Loss Occurrence commenced. |

| B. | For each amount so reinstated, the Company agrees to pay an additional premium at the time of the Reinsurer’s payment of the loss calculated in accordance with the following formula: |

| 1. | The percentage of the Reinsurer’s limit of liability exhausted for the Loss Occurrence; times |

| 2. | The Net Earned Premium for the term of this Contract (exclusive of reinstatement premium). |

The dollar amount resulting from the multiplication of subparagraphs 1 and 2 above shall equal the reinstatement premium. If at the time of the Reinsurer’s payment of a loss hereon, the reinsurance premium as calculated under this Contract is unknown, the calculation of the reinstatement premium shall be based upon the deposit premium subject to adjustment when the reinsurance premium is finally established.

| C. | Nevertheless, the Reinsurer’s liability hereunder shall not exceed $60,000,000 in respect of any one Loss Occurrence, and shall be further limited to $120,000,000 in respect of all losses occurring during the term of this Contract. |

ARTICLE X

SPECIAL ACCEPTANCE

From time to time the Company may request a special acceptance applicable to this Contract. For purposes of this Contract, in the event each subscribing reinsurer whose share in the interests and liabilities of the Reinsurer is 20% or greater agree to a special acceptance, such agreement shall be binding on all subscribing reinsurers. If such agreement is not achieved, such special acceptance shall be made to this Contract only with respect to the interests and liabilities of each subscribing reinsurer who agrees to the special acceptance. Should denial for special acceptance not be received within 10 working days of said request, the special acceptance shall be deemed automatically agreed. In the event a reinsurer becomes a party to this Contract subsequent to one or more special acceptances hereunder, the new reinsurer shall automatically accept such special acceptance(s) as being covered hereunder.

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

10 | 12-31-13 |

ARTICLE XI

ACCOUNTING BASIS

All premiums and losses under this Contract shall be reported on an “accident year” accounting basis. Unless specified otherwise herein, all premiums shall be credited to the period during which they earn, and all losses shall be charged to the period during which they occur.

ARTICLE XII

REINSURANCE PREMIUM

| A. | As premium for the reinsurance provided hereunder, the Company shall pay the Reinsurer 0.5453% times its Net Earned Premium for the term of this Contract subject to a Minimum Premium of $1,440,000. |

| B. | The Company shall pay the Reinsurer a Deposit Premium of $1,800,000 payable in quarterly installments on January 1, April 1, July 1 and October 1. |

| C. | Within 90 days after the expiration of this Contract, the Company shall provide a report to the Reinsurer setting forth the premium due hereunder, computed in accordance with paragraph A, and if the premium so computed is greater than the previously paid Deposit Premium, the balance shall be remitted by the Company with its report. |

| D. | If this Contract expires on a runoff basis, the Company shall pay to the Reinsurer a premium for the runoff period equal to the expiring rate times its Net Earned Premium for the runoff period. The runoff premium shall be calculated and paid within 90 days after the end of each three-month period during the runoff period. There shall be no minimum premium requirement for the runoff period. |

ARTICLE XIII

NOTICE OF LOSS AND LOSS SETTLEMENTS

| A. | As soon as practicable, the Company shall advise the Reinsurer of all bodily injury claims or losses involving any of the following: |

| 1. | Any claim or loss reserved at 50.0% or more of the Company’s retention under this Contract. |

| 2. | Any claim involving any of the following injuries where the Company’s incurred loss is greater than or equal to $1,000,000: |

| a. | Fatality. |

| b. | Spinal cord injuries (e.g., quadriplegia, paraplegia). |

| c. | Brain damage (e.g., seizure, coma or physical/mental impairment). |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

11 | 12-31-13 |

| d. | Severe burn injuries resulting in disfigurement or scarring. |

| e. | Total or partial blindness in one or both eyes. |

| f. | Major organ (e.g., heart, lungs). |

| g. | Amputation of a limb or multiple fractures. |

| B. | The Company shall also advise the Reinsurer promptly of all losses which, in the opinion of the Company, may result in a claim hereunder and of all subsequent developments thereto which, in the opinion of the Company, may materially affect the position of the Reinsurer. |

| C. | When so requested in writing, the Company shall afford the Reinsurer or its representatives an opportunity to be associated with the Company, at the expense of the Reinsurer, in the defense of any claim, suit or proceeding involving this reinsurance, and the Company and the Reinsurer shall cooperate in every respect in the defense of such claim, suit or proceeding. |

| D. | All loss settlements made by the Company that are within the terms and conditions of this Contract (including but not limited to ex gratia payments) shall be binding upon the Reinsurer. Upon receipt of satisfactory proof of loss, the Reinsurer agrees to promptly pay or allow, as the case may be, its share of each such settlement in accordance with this Contract. |

ARTICLE XIV

LIABILITY OF REINSURERS

All reinsurances for which the Reinsurer shall be liable by virtue of this Contract shall be subject in all respects to the same rates, terms, conditions, interpretations and waivers and to the same modifications, alterations, and cancellations, as the respective policies to which such reinsurances relate, the true intent of the parties to this Contract being that the Reinsurer shall follow the fortunes of the Company.

ARTICLE XV

LATE PAYMENTS

| A. | In the event any premium, loss or other payment due either party is not received by the Intermediary hereunder by the payment due date, the party to whom payment is due may, by notifying the Intermediary in writing, require the debtor party to pay, and the debtor party agrees to pay, an interest penalty on the amount past due calculated for each such payment on the last business day of each month as follows: |

| 1. | The number of full days which have expired since the due date or the last monthly calculation, whichever the lesser; times |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

12 | 12-31-13 |

| 2. | 1/365ths of a rate equal to the 90-day Treasury Bill rate as published in The Wall Street Journal on the first business day following the date a remittance becomes due; times |

| 3. | The amount past due, including accrued interest. |

It is agreed that interest shall accumulate until payment of the original amount due plus interest penalties have been received by the Intermediary.

| B. | The establishment of the due date shall, for purposes of this Article, be determined as follows: |

| 1. | As respects the payment of deposits and premiums due the Reinsurer, the due date shall be as provided for in the applicable section of this Contract. |

| 2. | Any claim or loss payment due the Company hereunder shall be deemed due 10 business days after the proof of loss or demand for payment is transmitted to the Reinsurer. If such loss or claim payment is not received within the10 days, interest will accrue on the payment or amount overdue in accordance with the interest penalty calculation above, from the date the proof of loss or demand for payment was transmitted to the Reinsurer. |

| 3. | As respects any payment, adjustment or return due either party not otherwise provided for in subparagraphs 1 and 2 of this paragraph, the due date shall be as provided for in the applicable section of this Contract. |

| C. | For purposes of interest calculation only, amounts due hereunder shall be deemed paid upon receipt by the Intermediary. The validity of any claim or payment may be contested under the provisions of this Contract. If the debtor party prevails in an arbitration, or any other proceeding, there shall be no interest penalty due. Otherwise, any interest will be calculated and due as outlined above. |

| D. | Interest penalties arising out of the application of this Article that are $100 or less from any party shall be waived unless there is a pattern of late payments consisting of three or more items over the course of any 12-month period. |

ARTICLE XVI

ANNUITIES AT THE COMPANY’S OPTION

| A. | Whenever the Company is required, or elects, to purchase an annuity or to negotiate a structured settlement, either in satisfaction of a judgment or in an out-of-court settlement or otherwise, the cost of the annuity or the structured settlement, as the case may be, shall be deemed part of the Company’s Ultimate Net Loss. |

| B. | The terms “annuity” or “structured settlement” shall be understood to mean any insurance policy, lump sum payment, agreement or device of whatever nature resulting in the payment of a lump sum by the Company in settlement of any or all future liabilities which may attach to it as a result of an occurrence. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

13 | 12-31-13 |

| C. | In the event the Company purchases an annuity which inures in whole or in part to the benefit of the Reinsurer, it is understood that the liability of the Reinsurer is not released thereby. In the event the Company is required to provide benefits not provided by the annuity for whatever reason, the Reinsurer shall pay its share of any loss. |

ARTICLE XVII

AGENCY AGREEMENT

If more than one reinsured company is named as a party to this Contract, the first named company will be deemed the agent of the other reinsured companies for purposes of sending or receiving notices required by the terms and conditions of this Contract and for purposes of remitting or receiving any monies due any party.

ARTICLE XVIII

SUBROGATION

The Reinsurer shall be credited with subrogation recoveries (i.e., reimbursement obtained or recovery made by the Company, less Loss Adjustment Expense incurred in obtaining such reimbursement or making such recovery) on account of claims and settlements involving reinsurance hereunder. Subrogation recoveries thereon shall always be used to reimburse the excess carriers in the reverse order of their priority according to their participation before being used in any way to reimburse the Company for its primary loss. The Company, at its sole option and discretion, may enforce its rights to subrogation relating to any loss, a part of which loss was sustained by the Reinsurer, and may prosecute all claims arising out of such rights.

ARTICLE XIX

ERRORS AND OMISSIONS

Any inadvertent delay, omission or error shall not be held to relieve either party hereto from any liability which would attach to it hereunder if such delay, omission or error had not been made, provided such omission or error is rectified upon discovery. Nothing contained in this Article shall be held to override the specific loss reporting deadline of the SUNSET AND COMMUTATION ARTICLE.

ARTICLE XX

OFFSET

The Company and the Reinsurer may offset any balance or amount due from one party to the other under this Contract or any other contract heretofore or hereafter entered into between the Company and the Reinsurer, whether acting as assuming reinsurer or ceding company. The party asserting the right of offset may exercise such right any time whether the balances due are on account of premiums or losses or otherwise.

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

14 | 12-31-13 |

ARTICLE XXI

CURRENCY

| A. | Whenever the word “Dollars” or the “$” sign appears in this Contract, they shall be construed to mean United States Dollars and all transactions under this Contract shall be in United States Dollars. |

| B. | Amounts paid or received by the Company in any other currency shall be converted to United States Dollars at the rate of exchange at the date such transaction is entered on the books of the Company. |

ARTICLE XXII

TAXES

In consideration of the terms under which this Contract is issued, the Company will not claim a deduction in respect of the premium hereon when making tax returns, other than income or profits tax returns, to any state or territory of the United States of America, the District of Columbia or Canada.

ARTICLE XXIII

FEDERAL EXCISE TAX

(Applicable to those subscribing reinsurers who are domiciled outside the United States of America, excepting subscribing reinsurers exempt from Federal Excise Tax.)

| A. | The subscribing reinsurer has agreed to allow for the purpose of paying the Federal Excise Tax the applicable percentage of the premium payable hereon (as imposed under Section 4371 of the Internal Revenue Code) to the extent such premium is subject to the Federal Excise Tax. |

| B. | In the event of any return of premium becoming due hereunder the subscribing reinsurer will deduct the applicable percentage from the return premium payable hereon and the Company or its agent should take steps to recover the tax from the United States Government. |

ARTICLE XXIV

RESERVES AND FUNDING

| A. | A subscribing reinsurer will provide funding under the terms of this Article only if the Company will be denied statutory credit for reinsurance ceded to that subscribing reinsurer pursuant to the credit for reinsurance law or regulations in any applicable jurisdiction. In the event any of the provisions of this Article conflict with or otherwise fail to satisfy the requirements of the appropriate credit for reinsurance statute or regulation, this Article will be deemed amended to conform to the appropriate statute or regulation; the intent of this Article being that the Company will be permitted to realize full credit for the reinsurance ceded to the Reinsurer under this Contract. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

15 | 12-31-13 |

| B. | As regards Policies or bonds issued by the Company coming within the scope of this Contract, the Company agrees that when it shall file with the insurance regulatory authority or set up on its books reserves for losses covered hereunder which it shall be required by law to set up, it will forward to the subscribing reinsurer a statement showing the proportion of such reserves which is applicable to the subscribing reinsurer. The subscribing reinsurer hereby agrees to fund such reserves in respect of known outstanding losses that have been reported to the subscribing reinsurer and allocated Loss Adjustment Expense relating thereto, losses and allocated Loss Adjustment Expense paid by the Company but not recovered from the subscribing reinsurer, plus reserves for losses incurred but not reported, as shown in the statement prepared by the Company (hereinafter referred to as “subscribing reinsurer’s obligations”) by funds withheld, cash advances or a Letter of Credit. The subscribing reinsurer shall have the option of determining the method of funding provided it is acceptable to the Company and to the insurance regulatory authorities having jurisdiction over the Company’s reserves. |

| C. | When funding by a Letter of Credit, the subscribing reinsurer agrees to apply for and secure timely delivery to the Company of a clean, irrevocable and unconditional Letter of Credit issued by a bank and containing provisions acceptable to the insurance regulatory authorities having jurisdiction over the Company’s reserves in an amount equal to the subscribing reinsurer’s proportion of said reserves. Such Letter of Credit shall be issued for a period of not less than one year, and shall be automatically extended for one year from its date of expiration or any future expiration date unless 30 days (60 days where required by insurance regulatory authorities) prior to any expiration date the issuing bank shall notify the Company by certified or registered mail that the issuing bank elects not to consider the Letter of Credit extended for any additional period. |

| D. | The subscribing reinsurer and Company agree that the Letters of Credit provided by the subscribing reinsurer pursuant to the provisions of this Contract may be drawn upon at any time, notwithstanding any other provision of this Contract, and be utilized by the Company or any successor, by operation of law, of the Company including, without limitation, any liquidator, rehabilitator, receiver or conservator of the Company for the following purposes, unless otherwise provided for in a separate Trust Agreement: |

| 1. | To reimburse the Company for the subscribing reinsurer’s obligations, the payment of which is due under the terms of this Contract and which has not been otherwise paid; |

| 2. | To make refund of any sum which is in excess of the actual amount required to pay the subscribing reinsurer’s obligations under this Contract; |

| 3. | To fund an account with the Company for the subscribing reinsurer’s obligations. Such cash deposit shall be held in an interest bearing account separate from the Company’s other assets, and interest thereon not in excess of the prime rate shall accrue to the benefit of the subscribing reinsurer; |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

16 | 12-31-13 |

| 4. | To pay the subscribing reinsurer’s share of any other amounts the Company claims are due under this Contract. |

In the event the amount drawn by the Company on any Letter of Credit is in excess of the actual amount required for subparagraph 1 or 3, or in the case of subparagraph 4, the actual amount determined to be due, the Company shall promptly return to the subscribing reinsurer the excess amount so drawn. All of the foregoing shall be applied without diminution because of insolvency on the part of the Company or the subscribing reinsurer.

| E. | The issuing bank shall have no responsibility whatsoever in connection with the propriety of withdrawals made by the Company or the disposition of funds withdrawn, except to ensure that withdrawals are made only upon the order of properly authorized representatives of the Company. |

| F. | At annual intervals, or more frequently as agreed but never more frequently than quarterly, the Company shall prepare a specific statement of the subscribing reinsurer’s obligations, for the sole purpose of amending the Letter of Credit, in the following manner: |

| 1. | If the statement shows that the subscribing reinsurer’s obligations exceed the balance of credit as of the statement date, the subscribing reinsurer shall, within 30 days after receipt of notice of such excess, secure delivery to the Company of an amendment to the Letter of Credit increasing the amount of credit by the amount of such difference. |

| 2. | If, however, the statement shows that the subscribing reinsurer’s obligations are less than the balance of credit as of the statement date, the Company shall, within 30 days after receipt of written request from the subscribing reinsurer, release such excess credit by agreeing to secure an amendment to the Letter of Credit reducing the amount of credit available by the amount of such excess credit. |

| G. | Should the subscribing reinsurer be in breach of its obligations under this Article, notwithstanding anything to the contrary elsewhere in this Contract, the Company may seek relief in respect of said breach from any court having competent jurisdiction of the parties hereto. |

ARTICLE XXV

NET RETAINED LINES

| A. | This Contract applies only to that portion of any Policy which the Company retains net for its own account (prior to deduction of any underlying reinsurance specifically permitted in this Contract), and in calculating the amount of any loss hereunder and also in computing the amount or amounts in excess of which this Contract attaches, only loss or losses in respect of that portion of any Policy which the Company retains net for its own account shall be included. |

| B. | The amount of the Reinsurer’s liability hereunder in respect of any loss or losses shall not be increased by reason of the inability of the Company to collect from any other reinsurer(s), whether specific or general, any amounts which may have become due from such reinsurer(s), whether such inability arises from the insolvency of such other reinsurer(s) or otherwise. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

17 | 12-31-13 |

ARTICLE XXVI

THIRD PARTY RIGHTS

This Contract is solely between the Company and the Reinsurer, and in no instance shall any other party have any rights under this Contract except as expressly provided otherwise in the INSOLVENCY ARTICLE.

ARTICLE XXVII

SEVERABILITY

If any provision of this Contract shall be rendered illegal or unenforceable by the laws or regulations of any state, such provision shall be considered void in such state, but this shall not affect the validity or enforceability of any other provision of this Contract or the enforceability of such provision in any other jurisdiction.

ARTICLE XXVIII

GOVERNING LAW

This Contract shall be governed as to performance, administration and interpretation by the laws of the State of Louisiana, exclusive of that state’s rules with respect to conflicts of law, except as to rules with respect to credit for reinsurance in which case the applicable rules of all states shall apply.

ARTICLE XXIX

INSPECTION OF RECORDS

| A. | The Reinsurer or its designated representative(s) approved by the Company, upon providing reasonable advance notice to the Company, shall have access at the offices of the Company or at a location to be mutually agreed, at a time to be mutually agreed, to inspect the Company’s underwriting, accounting, or claim files pertaining to the subject matter of this Contract, other than proprietary information or privileged communications. The Company shall determine the manner in which files shall be accessed by the Reinsurer. The Reinsurer may, at its own expense, reasonably request copies of such files and agrees to pay the Company’s reasonable costs incurred in procuring such copies. |

| B. | If any undisputed amounts are overdue from the Reinsurer to the Company, the Reinsurer shall have access to such records only upon payment of all such overdue amounts. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

18 | 12-31-13 |

| C. | If the Reinsurer makes any inspection of the Company’s books and records involving specific claims under this Contract and, as a result of the inspection the claim is contested or disputed, the Reinsurer shall provide the Company, at the Company’s request, a summary of any reports, other than proprietary information or privileged communications, completed by the Reinsurer’s personnel or by third parties on behalf of the Reinsurer outlining the reasons for contesting or disputing the subject claim. |

ARTICLE XXX

CONFIDENTIALITY

| A. | The Reinsurer hereby acknowledges that the documents, information, and data provided to the Reinsurer by the Company, whether directly or through an authorized agent, in connection with the placement and execution of this Contract (“Confidential Information”) are proprietary and confidential to the Company. |

| B. | Absent the written consent of the Company, the Reinsurer will not disclose any Confidential Information to any third parties, except when: |

| 1. | The disclosure is to professional advisors or to authorized agents of the Reinsurer performing underwriting, claim handling, pricing, placement and/or evaluation services for the Reinsurer; or |

| 2. | The Confidential Information is publicly known or has become publicly known through no unauthorized act of the Reinsurer; or |

| 3. | Required by retrocessionaires subject to the business ceded to this Contract; or |

| 4. | Required by state regulators performing an audit of the Reinsurer’s records and/or financial condition; or |

| 5. | Required by auditors performing an audit of the Reinsurer’s records in the normal course of business. |

| C. | Further, the Reinsurer agrees not to use any Confidential Information for any purpose not permitted by this Contract or not related to the performance of their obligations or enforcement of their rights under this Contract. |

| D. | Notwithstanding the above, in the event that the Reinsurer is required by court order, other legal process, or any regulatory authority to release or disclose any or all of the Confidential Information, the Reinsurer agrees to provide the Company by written or electronic mail, reasonable advance notice of same prior to such release or disclosure and to use their reasonable best efforts to assist the Company in maintaining the confidentiality provided for in this Article. |

| E. | The provisions of this Article will extend to the officers, directors, shareholders, and employees of the Reinsurer and its affiliates, who have received Confidential Information in accordance with this Contract and will be binding upon their successors and assigns. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

19 | 12-31-13 |

ARTICLE XXXI

SUNSET AND COMMUTATION

| A. | Ten years after the expiration of this Contract, the Company shall advise the Reinsurer of any Loss Occurrences attaching to this Contract which have not been finally settled and which may result in a claim by the Company under this Contract. No liability shall attach hereunder for any claim or claims not reported to the Reinsurer within this ten year period. If a loss arising out of a Loss Occurrence is reported during this period, all losses arising out of the same Loss Occurrence shall be deemed reported under this paragraph regardless of when notification of loss is provided. |

| B. | If both parties agree to commute the unsettled losses subject to the Contract, then the Reinsurer’s liability for all such unsettled losses shall then be commuted. |

| C. | It is understood that commutation of all such losses shall be made using tabular reserving methods. For each loss, the nominal ultimate value of the Company’s Ultimate Net Loss shall be established by projecting out future medical and indemnity payments and loss expenses by year based on appropriate trends and escalations applied to annual cost estimates. The Contract limit and retention (where applicable) shall then be applied to the nominal ultimate value of the Company’s Ultimate Net Loss to determine the nominal ultimate Contract loss. Mortality factors and discount factors shall then be applied by year to the nominal ultimate Contract loss. The discounted, mortality adjusted projected annual loss payments shall be summed to determine the present value (“commutation price”) of the ultimate Contract loss. The medical escalation, discount and mortality factors are described in paragraph C. |

| D. | The following factors shall be utilized in establishing the commutation price: |

| 1. | Medical Escalation Rate |

The medical escalation rate shall be a reasonable estimate of future medical inflation.

| 2. | Discount Rate |

The discount rate shall be the annualized 10-year US Treasury Bill rate at the Valuation Date.

| 3. | Mortality Tables |

Mortality factors shall be based on the most recent mortality table at the Valuation Date from the “Vital Statistics of the United States” as published by the US Department of Health and Human Services, Center for Disease Control and Prevention. Factors for extension beyond age 85 shall also be included.

| 4. | Impairment |

Impairment factors shall be based on the individual claim characteristics.

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

20 | 12-31-13 |

Any other method of calculating the commutation price of one or more losses subject to this Contract may be used as mutually agreed between the Company and the Reinsurer.

| E. | If the Company and the Reinsurer cannot agree on a commutation value, the effort can be abandoned. Alternatively, the Company and the Reinsurer may mutually agree to settle any difference using a panel of three actuaries, one to be chosen by each party and the third by the two so chosen. If either party refuses or neglects to appoint an actuary within 30 days, the other party may appoint two actuaries. If the two actuaries fail to agree on the selection of a third actuary within 30 days of their appointment, each of them shall name two, of whom the other shall decline one and the decision shall be made by drawing lots. All the actuaries shall be regularly engaged in the valuation of Workers’ Compensation claims and shall be Fellows of the Casualty Actuarial Society or members of the American Academy of Actuaries. All of the actuaries shall be independent of either party to this Contract. |

| F. | The settlement agreed upon by a majority of the panel of actuaries shall be final and binding on both parties and set forth in a sworn written document expressing their professional opinion that said value is fair for the complete mutual release of all liabilities in respect of such reserves. |

| G. | The Reinsurer’s commutation payment shall be due within 7 days following the date the Company and the Reinsurer agree to the commutation price. Such payment by the Reinsurer shall constitute both a complete release of the Reinsurer of its liability for all losses, known or unknown, under this Contract, and a complete release of the Company of its liabilities and obligations, known or unknown, under this Contract. |

| H. | This Article shall survive the expiration of this Contract. |

ARTICLE XXXII

INSOLVENCY

| A. | In the event of the insolvency of the Company, this reinsurance shall be payable directly to the Company or to its liquidator, receiver, conservator or statutory successor, with reasonable provision for verification, on the basis of the liability of the Company without diminution because of the insolvency of the Company or because the liquidator, receiver, conservator or statutory successor of the Company has failed to pay all or a portion of any claim. It is agreed, however, that the liquidator, receiver, conservator or statutory successor of the Company shall give written notice to the Reinsurer of the pendency of a claim against the Company indicating the Policy or bond reinsured which claim would involve a possible liability on the part of the Reinsurer within a reasonable time after such claim is filed in the conservation or liquidation proceeding or in the receivership, and that during the pendency of such claim, the Reinsurer may investigate such claim and interpose, at its own expense, in the proceeding where such claim is to be adjudicated, any defense or defenses that it may deem available to the Company or its liquidator, receiver, conservator or statutory successor. The expense thus incurred by the Reinsurer shall be chargeable, subject to the approval of the Court, against the Company as part of the expense of conservation or liquidation to the extent of a proportionate share of the benefit which may accrue to the Company solely as a result of the defense undertaken by the Reinsurer. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

21 | 12-31-13 |

| B. | Where two or more subscribing reinsurers are involved in the same claim and a majority in interest elect to interpose defense to such claim, the expense shall be apportioned in accordance with the terms of this Contract as though such expense had been incurred by the Company. |

| C. | It is further agreed that, in the event of the insolvency of the Company, the reinsurance under this Contract shall be payable directly by the Reinsurer to the Company or its liquidator, receiver, conservator, or statutory successor, except as provided by Section 4118(a) of the New York Insurance Law or except 1) where this Contract specifically provides another payee of such reinsurance in the event of the insolvency of the Company or 2) where the Reinsurer with the consent of the direct insured or insureds has assumed such Policy obligations of the Company as direct obligations of the Reinsurer to the payee under such Policies and in substitution for the obligations of the Company to such payees. |

| D. | In the event of the insolvency of any company or companies listed in the designation of “Company” under this Contract, this Article shall apply only to the insolvent company or companies. |

ARTICLE XXXIII

ARBITRATION

| A. | As a condition precedent to any right of action hereunder, any irreconcilable dispute arising out of the interpretation, performance or breach of this Contract, including the formation or validity thereof, whether arising before or after the expiry or termination of the Contract, shall be submitted for decision to a panel of 3 arbitrators. Notice requesting arbitration will be in writing and sent by certified mail, return receipt requested, or such reputable courier service as is capable of returning proof of receipt of such notice by the recipient to the party demanding arbitration. |

| B. | The Company shall have the option to either litigate or arbitrate where: |

| 1. | The Reinsurer makes any allegation of misrepresentation, non-disclosure, concealment, fraud or bad faith; or |

| 2. | The Reinsurer experiences any of the circumstances set forth in subparagraphs 1 through 7 of paragraph A of the SPECIAL TERMINATION ARTICLE. |

| C. | One arbitrator shall be appointed by each party. If either party fails to appoint its arbitrator within 30 days after being requested to do so by the other party, the latter, after 10 days notice by certified mail or reputable courier as provided above of its intention to do so, may appoint the second arbitrator. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

22 | 12-31-13 |

| D. | The two arbitrators shall, before instituting the hearing, appoint an impartial third arbitrator who shall preside at the hearing. Should the two arbitrators fail to choose the third arbitrator within 30 days of the appointment of the second arbitrator, the parties shall appoint the third arbitrator pursuant to the AIDA Reinsurance and Insurance Arbitration Society – U.S. (ARIAS) Umpire Selection Procedure. All arbitrators shall be disinterested active or former senior executives of insurance or reinsurance companies or Underwriters at Lloyd’s, London. |

| E. | Within 30 days after notice of appointment of all arbitrators, the panel shall meet and determine timely periods for briefs, discovery procedures and schedules for hearings. The panel shall be relieved of all judicial formality and shall not be bound by the strict rules of procedure and evidence. Unless the panel agrees otherwise, arbitration shall take place in DeRidder, Louisiana but the venue may be changed when deemed by the panel to be in the best interest of the arbitration proceeding. Insofar as the arbitration panel looks to substantive law, it shall consider the law of the State of Louisiana. The decision of any 2 arbitrators when rendered in writing shall be final and binding. The panel is empowered to grant interim relief as it may deem appropriate. |

| F. | In the event an arbitrator is unable to serve due to death, disability or other incapacity, a replacement arbitrator shall be chosen in accordance with the procedures set forth in this Article for the original selection of the arbitrator appointed and the newly constituted panel shall take all necessary and/or reasonable measures to continue the arbitration proceedings without additional delay. |

| G. | The panel shall make its decision considering the custom and practice of the applicable insurance and reinsurance business as promptly as possible following the termination of the hearings. Judgment upon the award may be entered in any court having jurisdiction thereof. |

| H. | If more than one subscribing reinsurer is involved in arbitration where there are common questions of law or fact and a possibility of conflicting awards or inconsistent results, all such subscribing reinsurers shall constitute and act as one party for purposes of this Article and communications shall be made by the Company to each of the subscribing reinsurers constituting the one party; provided, however, that nothing therein shall impair the rights of such subscribing reinsurers to assert several, rather than joint defenses or claims, nor be construed as changing the liability of the subscribing reinsurers under the terms of this Contract from several to joint. |

| I. | Each party shall bear the expense of its own arbitrator and shall jointly and equally bear with the other party the cost of the third arbitrator. The remaining costs of the arbitration shall be allocated by the panel. The panel may, at its discretion, award such further costs and expenses as it considers appropriate, including but not limited to attorneys fees, to the extent permitted by law. However, the panel may not award any Exemplary or Punitive Damages and Enhanced Compensatory Damages. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

23 | 12-31-13 |

ARTICLE XXXIV

EXPEDITED ARBITRATION

| A. | Notwithstanding the provisions of the ARBITRATION ARTICLE, in the event an amount in dispute hereunder is $500,000 or less, the Company may elect to require an expedited arbitration process with the use of a single arbitrator. The arbitrator will be chosen in accordance with the procedures for selecting an arbitrator in force on the date the arbitration is demanded, established by the AIDA Reinsurance and Insurance Arbitration Society – U.S. (ARIAS). |

| B. | Each party’s case will be submitted to the arbitrator within 100 days of the date of determination of the arbitrator. Discovery will be limited to exchanging only those documents directly relating to the issue in dispute, subject to a limit of two discovery depositions from each party, unless otherwise authorized by the arbitrator upon a showing of good cause. |

| C. | Within 120 days of the date of determination of the arbitrator, the hearing will be completed and a written award will be issued by the arbitrator. The arbitrator will have all the powers conferred on the arbitration panel as provided in the ARBITRATION ARTICLE, and said Article will apply to all matters not specifically addressed above. |

ARTICLE XXXV

SERVICE OF SUIT

(This Article is applicable if the subscribing reinsurer is not domiciled in the United States of America and/or is not authorized in any State, Territory or District of the United States where authorization is required by insurance regulatory authorities. This Article is not intended to conflict with or override the obligation of the parties to arbitrate their disputes in accordance with the ARBITRATION ARTICLE.)

| A. | In the event of the failure of the subscribing reinsurer to pay any amount claimed to be due hereunder, the subscribing reinsurer, at the request of the Company, shall submit to the jurisdiction of a court of competent jurisdiction within the United States. Nothing in this Article constitutes or should be understood to constitute a waiver of the subscribing reinsurer’s rights to commence an action in any court of competent jurisdiction in the United States, to remove an action to a United States District Court, or to seek a transfer of a case to another court as permitted by the laws of the United States or of any state in the United States. The subscribing reinsurer, once the appropriate court is selected, whether such court is the one originally chosen by the Company and accepted by subscribing reinsurer or is determined by removal, transfer, or otherwise, as provided for above, shall comply with all requirements necessary to give said court jurisdiction and, in any suit instituted against it upon this Contract, and shall abide by the final decision of such court or of any appellate court in the event of an appeal. |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

24 | 12-31-13 |

| B. | Service of process in such suit may be made upon the agent for the service of process (“agent”) named below, depending on the jurisdiction where the Company chooses to bring suit: |

| 1. | If the suit is brought in the State of California, the law firm of Mendes and Mount, 601 South Figueroa Street, Suite 4676, Los Angeles, California 90017 shall be authorized and directed to accept service of process on behalf of the subscribing reinsurer in any such suit; |

| 2. | If the suit is brought in the State of New York, the law firm of Mendes and Mount, 750 Seventh Avenue, New York, New York 10019 shall be authorized and directed to accept service of process on behalf of the subscribing reinsurer in any such suit; |

| 3. | If the suit is brought in any state other than California or New York, either of the agents described in subparagraphs 1 or 2 above shall be authorized and directed to accept service of process on behalf of the subscribing reinsurer in any such suit; or |

| 4. | If the subscribing reinsurer has designated an agent in the subscribing reinsurer’s Interests and Liabilities Agreement attached hereto, then that agent shall be authorized and directed to accept service of process on behalf of the subscribing reinsurer in any suit. However, if an agent is designated in the subscribing reinsurer’s Interests and Liabilities Agreement and the agent is not located in California as respects a suit brought in California or New York as respects a suit brought in New York, in keeping with the laws of the states of California and New York which require that service be made on an agent located in the respective state if a suit is brought in that state, the applicable office of Mendes and Mount stipulated in subparagraphs 1 and 2 above must be used for service of suit unless the provisions of paragraph C of this Article apply. |

| C. | Further, pursuant to any statute of any state, territory or district of the United States that makes provision therefor, the subscribing reinsurer hereby designates the Superintendent, Commissioner or Director of Insurance, or other officer specified for that purpose in the statute, or his successor or successors in office, as its true and lawful attorney upon whom may be served any lawful process in any action, suit or proceedings instituted by or on behalf of the Company or any beneficiary hereunder arising out of this Contract, and hereby designates the above-named as the person to whom the said officer is authorized to mail such process or a true copy thereof. |

ARTICLE XXXVI

ENTIRE AGREEMENT

This Contract shall constitute the entire agreement between the parties with respect to the business being reinsured hereunder. There are no understandings between the parties other than as expressed in this Contract. Any change or modification to this Contract shall be null and void unless made by amendment to this Contract and signed by both parties. This Article shall not be construed as limiting in any way the admissibility in the context of an arbitration or any other legal proceeding, evidence regarding the formation, interpretation, purpose or intent of this Contract.

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

25 | 12-31-13 |

ARTICLE XXXVII

MODE OF EXECUTION

This Contract may be executed either by an original written ink signature of paper documents, by an exchange of facsimile copies showing the original written ink signature of paper documents, or by electronic signature by either party employing appropriate software technology as to satisfy the parties at the time of execution that the version of the document agreed to by each party shall always be capable of authentication and satisfy the same rules of evidence as written signatures. The use of any one or a combination of these methods of execution shall constitute a legally binding and valid signing of this Contract. This Contract may be executed in one or more counterparts, each of which, when duly executed, shall be deemed an original.

ARTICLE XXXVIII

INTERMEDIARY

Willis Re Inc., 15305 North Dallas Parkway, Suite 1100, Colonnade III, Addison, Texas 75001 is hereby recognized as the intermediary negotiating this Contract and through whom all communications relating thereto shall be transmitted to the Company or the Reinsurer. However, all communications concerning accounts, claim information, funds and inquiries related thereto shall be transmitted to the Company or the Reinsurer through Willis Re Inc., 5420 Millstream Road, Suite 200, McLeansville, North Carolina 27301. Payments by the Company to Willis Re Inc. shall be deemed to constitute payment to the Reinsurer and payments by the Reinsurer to Willis Re Inc. shall be deemed to constitute payment to the Company only to the extent that such payments are actually received by the Company.

IN WITNESS WHEREOF, the Company by its duly authorized representative has executed this Contract as of the date specified below:

Signed this 15th day of January, 2014.

| AMERICAN INTERSTATE INSURANCE COMPANY AMERICAN INTERSTATE INSURANCE COMPANY OF TEXAS SILVER OAK CASUALTY, INC. | ||

| By | /s/ C. Allen Bradley, Jr | |

| Print Name | C. Allen Bradley, Jr | |

| Title | Chairman & CEO | |

| American Interstate Insurance Company 93948003-14 (Eff: 1-1-14) Casualty Catastrophe XOL Contract |

26 | 12-31-13 |

NUCLEAR INCIDENT EXCLUSION CLAUSE-LIABILITY—REINSURANCE—U.S.A

(1) This reinsurance does not cover any loss or liability accruing to the Reassured as a member of, or subscriber to, any association of insurers or reinsurers formed for the purpose of covering nuclear energy risks or as a direct or indirect reinsurer of any such member, subscriber or association.

(2) Without in any way restricting the operation of paragraph (1) of this Clause it is understood and agreed that for all purposes of this reinsurance all the original policies of the Reassured (new, renewal and replacement) of the classes specified in Clause II of this paragraph (2) from the time specified in Clause III in this paragraph (2) shall be deemed to include the following provision (specified as the Limited Exclusion Provision):

Limited Exclusion Provision.*

(1) Except for those classes of policies specified in Clause II of paragraph (2) and without in any way restricting the operation of paragraph (1) of this Clause, it is understood and agreed that for all purposes of this reinsurance the original liability policies of the Reassured (new, renewal and replacement) affording the following coverages:

| I. | It is agreed that the policy does not apply under any liability coverage, |