Nuveen New Jersey Municipal Bond Fund

Summary Prospectus | June 30, 2015

Ticker: Class A–NNJAX, Class C–NJCCX, Class C2–NNJCX, Class I–NMNJX

This summary prospectus is designed to provide investors with key Fund information in a clear and concise format. Before you invest, you may want to review the Fund’s complete prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at www.nuveen.com/prospectus. You can also get this information at no cost by calling (800) 257-8787 or by sending an e-mail request to mutualfunds@nuveen.com. If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the prospectus and other information will also be available from your financial intermediary. The Fund’s prospectus and statement of additional information, both dated June 30, 2015, are incorporated by reference into this summary prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

Investment Objective

The investment objective of the Fund is to provide you with as high a level of current interest income exempt from regular federal, New Jersey state and, in some cases, New Jersey local income taxes as is consistent with preservation of capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund or in other Nuveen Mutual Funds. More information about these and other discounts, as well as eligibility requirements for each share class, is available from your financial advisor and in “What Share Classes We Offer” on page 39 of the Fund’s prospectus, “How to Reduce Your Sales Charge” on page 41 of the prospectus and “Purchase and Redemption of Fund Shares” on page S-75 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

| Class A | Class C | Class C2 | Class I | |||||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 4.20% | None | None | None | ||||||||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of purchase price or redemption proceeds)1 |

None | 1.00% | 1.00% | None | ||||||||||||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends | None | None | None | None | ||||||||||||

| Exchange Fee | None | None | None | None | ||||||||||||

| Annual Low Balance Account Fee (for accounts under $1,000)2 | $15 | $15 | $15 | $15 | ||||||||||||

| Annual Fund Operating Expenses | ||||||||||||||||

| (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||

| Class A | Class C | Class C2 | Class I | |||||||||||||

| Management Fees | 0.51% | 0.51% | 0.51% | 0.51% | ||||||||||||

| Distribution and/or Service (12b-1) Fees | 0.20% | 1.00% | 0.75% | 0.00% | ||||||||||||

| Other Expenses | 0.10% | 0.10% | 0.10% | 0.10% | ||||||||||||

| Total Annual Fund Operating Expenses | 0.81% | 1.61% | 1.36% | 0.61% | ||||||||||||

| 1 | The contingent deferred sales charge on Class C shares and Class C2 shares applies only to redemptions within 12 months of purchase. |

| 2 | Fee applies to the following types of accounts under $1,000 held directly with the Fund: accounts established pursuant to the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA). |

| Nuveen Investments | 1 |

Example

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then either redeem or do not redeem your shares at the end of a period. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Redemption | No Redemption | |||||||||||||||||||||||||||||||||||

| A | C | C2 | I | A | C | C2 | I | |||||||||||||||||||||||||||||

| 1 Year | $ | 499 | $ | 164 | $ | 138 | $ | 62 | $ | 499 | $ | 164 | $ | 138 | $ | 62 | ||||||||||||||||||||

| 3 Years | $ | 668 | $ | 508 | $ | 431 | $ | 195 | $ | 668 | $ | 508 | $ | 431 | $ | 195 | ||||||||||||||||||||

| 5 Years | $ | 851 | $ | 876 | $ | 745 | $ | 340 | $ | 851 | $ | 876 | $ | 745 | $ | 340 | ||||||||||||||||||||

| 10 Years | $ | 1,380 | $ | 1,911 | $ | 1,635 | $ | 762 | $ | 1,380 | $ | 1,911 | $ | 1,635 | $ | 762 | ||||||||||||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 11% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in municipal bonds that pay interest that is exempt from regular federal and New Jersey personal income tax. These municipal bonds include obligations issued by the State of New Jersey and its subdivisions, authorities, instrumentalities and corporations, as well as obligations issued by U.S. territories (such as Puerto Rico, the U.S. Virgin Islands and Guam) that pay interest that is exempt from regular federal and New Jersey personal income tax. The Fund may invest without limit in securities that generate income subject to the alternative minimum tax. The Fund is a long-term bond fund and, as such, will generally maintain, under normal market conditions, an investment portfolio with an overall weighted average maturity of greater than 10 years.

Under normal market conditions, the Fund invests at least 80% of its net assets in investment grade municipal bonds rated BBB/Baa or higher at the time of purchase by at least one independent rating agency, or, if unrated, judged by the Fund’s sub-adviser to be of comparable quality. The Fund may invest up to 20% of its net assets in below investment grade municipal bonds, commonly referred to as “high yield” or “junk” bonds.

The Fund may invest in all types of municipal bonds, including general obligation bonds, revenue bonds and participation interests in municipal leases. The Fund may invest in zero coupon bonds, which are issued at substantial discounts from their value at maturity and pay no cash income to their holders until they mature.

The Fund may invest up to 15% of its net assets in municipal securities whose interest payments vary inversely with changes in short-term tax-exempt interest rates (“inverse floaters”). Inverse floaters are derivative securities that provide leveraged exposure to underlying municipal bonds. The Fund’s investments in inverse floaters are designed to increase the Fund’s income and returns through this leveraged exposure. These investments are speculative, however, and also create the possibility that income and returns will be diminished.

The Fund may utilize futures contracts, swap contracts, options on futures contracts and options on swap contracts in an attempt to manage market risk, credit risk and yield curve risk, and to manage the effective maturity or duration of securities in the Fund’s portfolio.

The Fund’s sub-adviser uses a value-oriented strategy and looks for higher-yielding and undervalued municipal bonds that offer above-average total return. The sub-adviser may choose to sell municipal bonds with deteriorating credit or limited upside potential compared to other available bonds.

| 2 | Nuveen Investments |

Principal Risks

The price and yield of this Fund will change daily. You could lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The principal risks of investing in the Fund, listed alphabetically, include:

Alternative Minimum Tax Risk—The Fund has no limit as to the amount that can be invested in alternative minimum tax bonds. Therefore, all or a portion of the Fund’s otherwise exempt-interest dividends may be taxable to those shareholders subject to the federal alternative minimum tax.

Call Risk—If an issuer calls higher-yielding debt instruments held by the Fund, performance could be adversely impacted.

Credit Risk—Credit risk is the risk that an issuer of a debt security may be unable or unwilling to make interest and principal payments when due and the related risk that the value of a debt security may decline because of concerns about the issuer’s ability or willingness to make such payments. The Fund’s investments in inverse floaters will increase the Fund’s credit risk.

Credit Spread Risk—Credit spread risk is the risk that credit spreads (i.e., the difference in yield between securities that is due to differences in their credit quality) may increase when the market believes that bonds generally have a greater risk of default. Increasing credit spreads may reduce the market values of the Fund’s securities. Credit spreads often increase more for lower rated and unrated securities than for investment grade securities. In addition, when credit spreads increase, reductions in market value will generally be greater for longer-maturity securities.

Cybersecurity Risk—Cybersecurity breaches may allow an unauthorized party to gain access to Fund assets, customer data, or proprietary information, or cause the Fund and/or its service providers to suffer data corruption or lose operational functionality.

Derivatives Risk—The use of derivatives involves additional risks and transaction costs which could leave the Fund in a worse position than if it had not used these instruments. Derivative instruments can be used to acquire or to transfer the risk and returns of a security or other asset without buying or selling the security or asset. These instruments may entail investment exposures that are greater than their cost would suggest. As a result, a small investment in derivatives can result in losses that greatly exceed the original investment. Derivatives can be highly volatile, illiquid and difficult to value. A derivative transaction also involves the risk that a loss may be sustained as a result of the failure of the counterparty to the contract to make required payments.

High Yield Securities Risk—High yield securities, which are rated below investment grade and commonly referred to as “junk” bonds, are high risk investments that may cause income and principal losses for the Fund. They generally have greater credit risk, are less liquid and have more volatile prices than investment grade securities.

Income Risk—The Fund’s income could decline during periods of falling interest rates. Also, if the Fund invests in inverse floaters, the Fund’s income may decrease if short-term interest rates rise.

Interest Rate Risk—Interest rate risk is the risk that the value of the Fund’s portfolio will decline because of rising interest rates. The Fund may be subject to a greater risk of rising interest rates than would normally be the case due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. When interest rates change, the values of longer-duration debt securities usually change more than the values of shorter-duration debt securities. Interest rate risk may be increased by the Fund’s investment in inverse floaters because of the leveraged nature of these investments.

Inverse Floaters Risk—The use of inverse floaters by the Fund creates effective leverage. Due to the leveraged nature of these investments, they will typically be more volatile and involve greater risk than the fixed rate municipal bonds underlying the inverse floaters. An investment in certain inverse floaters will involve the risk that the Fund could lose more than its original principal investment. Distributions on inverse floaters bear an inverse relationship to short-term municipal bond interest rates. Thus, distributions paid to the Fund on its inverse floaters will be reduced or even eliminated as short-term municipal interest rates rise and will increase when short-term municipal interest rates fall. Inverse floaters generally will underperform the market for fixed rate municipal bonds in a rising interest rate environment.

Municipal Bond Market Liquidity Risk—Inventories of municipal bonds held by brokers and dealers have decreased in recent years, lessening their ability to make a market in these securities. This reduction in market making capacity has the potential to decrease the Fund’s ability to buy or sell bonds, and increase bond price volatility and trading costs, particularly during periods of economic or market stress. In addition, recent federal

| Nuveen Investments | 3 |

banking regulations may cause certain dealers to reduce their inventories of municipal bonds, which may further decrease the Fund’s ability to buy or sell bonds. As a result, the Fund may be forced to accept a lower price to sell a security, to sell other securities to raise cash, or to give up an investment opportunity, any of which could have a negative effect on performance. If the Fund needed to sell large blocks of bonds to raise cash (such as to meet heavy shareholder redemptions), those sales could further reduce the bonds’ prices and hurt performance.

Municipal Lease Obligations Risk—Participation interests in municipal leases pose special risks because many leases and contracts contain “non-appropriation” clauses that provide that the governmental issuer has no obligation to make future payments under the lease or contract unless money is appropriated for this purpose by the appropriate legislative body.

Political and Economic Risks—The values of municipal securities held by the Fund may be adversely affected by local political and economic conditions and developments. Adverse conditions in an industry significant to a local economy could have a correspondingly adverse effect on the financial condition of local issuers. Because the Fund primarily purchases municipal bonds from New Jersey or U.S. territories, such as Puerto Rico, the Fund is more susceptible to adverse economic, political or regulatory changes affecting municipal bond issuers in those locations. Certain municipal bond issuers in Puerto Rico have recently experienced financial difficulties and rating agency downgrades.

Tax Risk—Income from municipal bonds held by the Fund could be declared taxable because of, among other things, unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or noncompliant conduct of a bond issuer. Investments in certain derivatives utilized by the Fund may cause the Fund to have taxable investment income.

Valuation Risk—The debt securities in which the Fund invests typically are valued by a pricing service utilizing a range of market-based inputs and assumptions, including readily available market quotations obtained from broker-dealers making markets in such instruments, cash flows and transactions for comparable instruments. There is no assurance that the Fund will be able to sell a portfolio security at the price established by the pricing service, which could result in a loss to the Fund. Pricing services generally price debt securities assuming orderly transactions of an institutional “round lot” size, but some trades may occur in smaller, “odd lot” sizes, often at lower prices than institutional round lot trades.

Zero Coupon Bonds Risk—Zero coupon bonds do not pay interest on a current basis and may be highly volatile as interest rates rise or fall. In addition, while such bonds generate income for purposes of generally accepted accounting standards, they do not generate cash flow and thus could cause the Fund to be forced to liquidate securities at an inopportune time in order to distribute cash, as required by tax laws.

Fund Performance

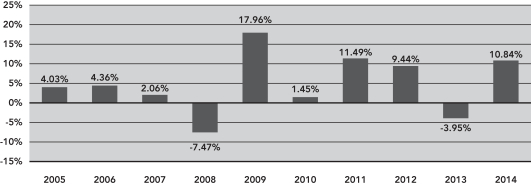

The following bar chart and table provide some indication of the potential risks of investing in the Fund. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at www.nuveen.com/performance or by calling (800) 257-8787.

The bar chart below shows the variability of the Fund’s performance from year to year for Class A shares. The bar chart and highest/lowest quarterly returns that follow do not reflect sales charges, and if these charges were reflected, the returns would be less than those shown.

Class A Annual Total Return*

| * | Class A year-to-date total return as of March 31, 2015 was 1.02%. The performance of the other share classes will differ due to their different expense structures. |

| 4 | Nuveen Investments |

During the ten-year period ended December 31, 2014, the Fund’s

highest and lowest quarterly returns were 8.90% and

-5.38%, respectively, for the quarters ended September 30, 2009 and December 31, 2010.

The table below shows the variability of the Fund’s average annual returns and how they compare over the time periods indicated with those of a broad measure of market performance and an index of funds with similar investment objectives. All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. After-tax returns are shown for Class A shares only; after-tax returns for other share classes will vary. Your own actual after-tax returns will depend on your specific tax situation and may differ from what is shown here.

Both the bar chart and the table assume that all distributions have been reinvested. Performance reflects fee waivers, if any, in effect during the periods presented. If any such waivers had not been in place, returns would have been reduced.

Prior to February 10, 2014, Class C2 shares were designated Class C shares.

Performance is not shown for Class C shares, which have not been offered for a full calendar year.

| Average Annual Total Returns for the Periods Ended December 31, 2014 |

||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class A (return before taxes) | 6.20 | % | 4.78 | % | 4.32 | % | ||||||

| Class A (return after taxes on distributions) | 6.19 | % | 4.77 | % | 4.30 | % | ||||||

| Class A (return after taxes on distributions and sale of Fund shares) | 5.04 | % | 4.57 | % | 4.22 | % | ||||||

| Class C2 (return before taxes) | 10.30 | % | 5.09 | % | 4.20 | % | ||||||

| Class I (return before taxes) | 11.14 | % | 5.87 | % | 4.97 | % | ||||||

| S&P Municipal Bond Index1 (reflects no deduction for fees, expenses or taxes) | 9.26 | % | 5.33 | % | 4.75 | % | ||||||

| Lipper New Jersey Municipal Debt Funds Classification Average2 (reflects no deduction for taxes or sales loads) | 10.02 | % | 4.77 | % | 4.04 | % | ||||||

| 1 | An unleveraged, market value-weighted index designed to measure the performance of the tax-exempt, investment-grade U.S. municipal bond market. |

| 2 | Represents the average annualized returns for all reporting funds in the Lipper New Jersey Municipal Debt Funds Classification. |

Management

Investment Adviser

Nuveen Fund Advisors, LLC

Sub-Adviser

Nuveen Asset Management, LLC

Portfolio Manager

| Name |

Title |

Portfolio Manager of Fund Since | ||

| Paul L. Brennan, CFA | Senior Vice President | January 2011 |

| Nuveen Investments | 5 |

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or other financial intermediary or directly from the Fund. Class C2 shares are available only through exchanges from other Nuveen Municipal Bond Funds and dividend reinvestments by current Class C2 shareholders. The Fund’s initial and subsequent investment minimums generally are as follows, although the Fund may reduce or waive the minimums in some cases:

| Class A and Class C | Class I | |||

| Eligibility and Minimum Initial Investment | $3,000 | Available only through fee-based programs and to other limited categories of investors as described in the prospectus.

$100,000 for all accounts except:

• $250 for clients of financial intermediaries and family offices that have accounts holding Class I shares with an aggregate value of at least $100,000 (or that are expected to reach this level).

• No minimum for certain other categories of eligible investors as described in the prospectus. | ||

| Minimum Additional Investment | $100 | No minimum. |

Tax Information

The Fund intends to make interest income distributions that are exempt from regular federal and New Jersey state income tax. However, a portion of the Fund’s distributions may be subject to regular federal and New Jersey state income tax, and all or a portion of these distributions may be subject to the federal alternative minimum tax.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund, its distributor or its investment adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary’s website for more information.

MPM-NJ-0615P

| 6 | Nuveen Investments |