Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2016

OR

|

| |

¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 1-12001

ALLEGHENY TECHNOLOGIES INCORPORATED

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 25-1792394 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| |

1000 Six PPG Place, Pittsburgh, Pennsylvania | | 15222-5479 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (412) 394-2800

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $0.10 Par Value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the Registrant is well known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

On February 10, 2017, the Registrant had outstanding 108,767,403 shares of its Common Stock.

The aggregate market value of the Registrant’s voting stock held by non-affiliates at June 30, 2016 was approximately $1.4 billion, based on the closing price per share of Common Stock on June 30, 2016 of $12.75 as reported on the New York Stock Exchange. Shares of Common Stock known by the Registrant to be beneficially owned by directors and officers of the Registrant subject to the reporting and other requirements of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are not included in the computation. The Registrant, however, has made no determination that such persons are “affiliates” within the meaning of Rule 12b-2 under the Exchange Act.

Documents Incorporated By Reference

Selected portions of the Proxy Statement for the Annual Meeting of Stockholders to be held on May 11, 2017 are incorporated by reference into Part III of this Report.

INDEX

PART I

Item 1. Business

The Company

Allegheny Technologies Incorporated is a Delaware corporation with its principal executive offices located at 1000 Six PPG Place, Pittsburgh, Pennsylvania 15222-5479, telephone number (412) 394-2800, Internet website address www.atimetals.com. References to “Allegheny Technologies,” “ATI,” the “Company,” the “Registrant,” “we,” “our” and “us” and similar terms mean Allegheny Technologies Incorporated and its subsidiaries, unless the context otherwise requires.

Our Business

ATI is a global manufacturer of technically advanced specialty materials and complex components. Over 50% of our sales are to the aerospace & defense market, particularly jet engines, and we have a strong presence in the oil & gas, electrical energy, medical, automotive, and other industrial markets. ATI is a market leader in manufacturing differentiated specialty alloys and forgings that require our unique manufacturing and precision machining capabilities and our innovative new product development competence. ATI produces nickel-based alloys and superalloys, titanium and titanium-based alloys, specialty alloys, stainless steels, and zirconium and other related alloys in many mill product forms. Our capabilities range from alloy development, to melting and hot-working, through highly engineered finished components. We are also a leader in producing nickel-based alloy and titanium-based alloy powders for use in next-generation jet engine forgings and 3D-printed products.

We operate in two business segments: High Performance Materials & Components (HPMC), and Flat Rolled Products (FRP). Our HPMC segment produces, converts and distributes a wide range of high performance materials, including titanium and titanium-based alloys, nickel- and cobalt-based alloys and superalloys, zirconium and related alloys including hafnium and niobium, advanced powder alloys and other specialty materials, in long product forms such as ingot, billet, bar, rod, wire, shapes and rectangles, and seamless tubes, plus precision forgings, castings, components and machined parts. These products are designed for the high performance requirements of major end markets such as aerospace & defense, oil & gas, electrical energy, and medical. Our FRP segment produces, converts and distributes stainless steel, nickel-based alloys, specialty alloys, and titanium and titanium-based alloys, in a variety of product forms including plate, sheet, engineered strip, and Precision Rolled Strip products. The major end markets for our flat-rolled products are oil & gas, automotive, food processing equipment and appliances, construction and mining, electronics, communication equipment and computers, and aerospace & defense.

ATI’s strategic vision is to be an aligned and integrated specialty materials and components company. Our strategies target the products and global growth markets that require and value ATI’s technical and manufacturing capability leadership. These differentiated products serve key global markets including aerospace & defense, oil & gas, electrical energy, medical and automotive, and sales to these key global markets represented 80% of total 2016 sales.

More than 50% of ATI’s 2016 sales, and 75% of the HPMC segment’s 2016 sales, are to the aerospace & defense market, led by products for commercial aerospace jet engines. Through acquisitions, alloy development, internal growth strategies, and long-term supply agreements on current and next-generation aero-engines and airframes, we are well positioned with a fully qualified asset base to meet the expected multi-year growth in demand from the commercial aerospace market. Our HPMC segment’s isothermal and hot-die forge press utilization continues to improve to meet aerospace demand growth, including new market share gains.

Strategic end use markets for our products include:

Aerospace & Defense. We are a world leader in the production of premium titanium-based alloys, nickel-based and cobalt-based alloys and superalloys, and vacuum-melted specialty alloys used in the manufacture of components for both commercial and military jet engines, as well as replacement parts for those engines. We also produce titanium-based alloys, vacuum-melted specialty alloys, and high-strength stainless alloys for use in commercial and military airframes, airframe components and missiles.

Titanium and titanium-based alloys are critical metals in aerospace and defense applications. They possess an extraordinary combination of properties, including superior strength-to-weight ratio, elevated temperature resistance, low coefficient of thermal expansion, and extreme corrosion resistance. These metals are used to produce jet engine components such as blades, vanes, discs, and casings, and airframe components such as structural members, landing gear, hydraulic systems, and fasteners. The latest and next-generation airframes and jet engines use increasing amounts of titanium and titanium alloys in component parts in order to minimize weight and maximize fuel efficiency.

Our nickel-based alloys and superalloys and specialty alloys are also widely used in aerospace and defense applications. Nickel-based alloys and superalloys remain extremely strong at high temperatures and resist degradation under extreme

conditions. Typical aerospace applications for nickel-based alloys and superalloys and advanced powder alloys include jet engine shafts, discs, blades, vanes, rings and casings. The next generation and future-generation jet engines use new generations of nickel-based superalloys and advanced powder alloys in large part due to increased fuel efficiency requirements that require hotter-burning engines. Our specialty alloys include vacuum-melted maraging steels used in the manufacture of aircraft landing gear and structural components, as well as jet engine components.

Our titanium-based alloy, nickel-based alloy, and specialty alloy precision forgings are used for components for jet engines, structural components for aircraft, helicopters, launch vehicles, and other demanding applications. We are a world leader in isothermal and hot-die forging technologies for advanced aerospace components. We produce highly sophisticated components that have differing mechanical properties in different parts of the same piece for greater resistance to fatigue and temperature effects. ATI provides a full range of post-forging inspection, machining and finishing services with the certified quality needed to meet demanding application requirements. ATI has the technology, equipment and know-how to cast titanium parts in some of the largest sizes and most complex shapes currently being manufactured for aerospace applications. ATI’s advanced manufacturing capabilities offer OEMs the freedom to design components with intricate geometries, cored passageways, cast-in features and sculpted surfaces.

ATI’s powder metal technology delivers extreme alloy compositions and refined microstructures that offer increased performance and longer useful lives in high-temperature aerospace environments. Powder metal technology boosts the efficiency of jet engines. Powder delivers the most uniform grain structure achievable, in near-net shapes. We are expanding our powder metal production capacity in Bakers, NC to better serve these markets, and we expect to qualify these assets with key strategic customers and increase our sales of these products in 2017.

We continuously seek to develop innovative new alloys to better serve the needs of this end use market. For example, ATI 718Plus® nickel-based superalloy, Rene 65 near-powder superalloy, and our powder alloys have won significant share in the current and next-generation jet engines.

Oil & Gas. The environments in which oil and gas can be found in commercial quantities have become more challenging, involving deep offshore wells, high pressure and high temperature conditions in sour wells and unconventional sources, such as shale oil and gas, and oil sands. Challenging offshore environments are in deepwater remote locations that are further off the continental shelf, including arctic and tropical locations, often one mile or more below the water’s surface, and up to two miles below the ocean floor. The requirements for equipment that can operate for up to 30 years in these environments are fulfilled by the specialty materials that we produce.

Both of our business segments produce specialty materials that are critical to the oil and gas industry. Our specialty materials, including titanium and titanium-based alloys, nickel-based alloys, zirconium alloys, stainless and duplex alloys and other specialty alloys have the strength, wear corrosion-resistant properties necessary for difficult environments.

Our Datalloy2® and DatalloyHP™ specialty stainless is used for non-magnetic drill collars that enable the most advanced directional and horizontal drilling techniques to be guided to the exact position desired for the reservoir. We have developed a family of duplex alloys, including ATI 2003® and ATI 2102® lean duplex alloys, for use in subsea and deepwater oil and gas applications. Several of our strip, plate and cast products are NORSOK qualified. The NORSOK standards are developed by the Norwegian petroleum industry and are intended to identify materials used in oil and gas applications that are safe and cost-effective.

Electrical Energy. Our specialty materials are widely used in the global electrical power generation and distribution industry. We believe energy needs and environmental policies and the electrification of developing countries will continue to drive demand for our specialty materials and products for use in this industry.

For electrical power generation, our specialty materials, including corrosion-resistant alloys (CRAs), are used in coal, nuclear, and natural gas applications. In coal-fired plants, our CRAs are used for pipe, tube, and heat exchanger applications in water systems in addition to pollution control scrubbers. Our CRAs are also used in water systems, fuel cladding components, and process equipment for nuclear power plants. For nuclear power plants, we are an industry pioneer in producing reactor-grade zirconium and hafnium alloys used in nuclear fuel cladding and structural components. We are a technology leader for large diameter nickel-based superalloys used in natural gas land-based turbines for power generation. For alternative energy generation, our alloys are used for solar, fuel cell and geothermal applications.

Medical. ATI’s advanced specialty materials are used in medical device products that save and enhance the quality of lives.

Our zirconium-niobium, titanium- and cobalt-based alloys are used for knees, hips and other prosthetic devices. These replacement devices offer the potential of lasting much longer than previous implant options.

Our biocompatible nickel-titanium shape memory alloy is used for stents to support collapsed or clogged blood vessels. Reduced in diameter for insertion, these stents expand to the original tube-like shape due to the metal’s superelasticity. Our ultra fine diameter (0.002 inch/0.051 mm) titanium wire is used for screens to prevent blood clots from entering critical areas of the body. In addition, our titanium bar and wire are used to make surgical screws for bone repairs.

Manufacturers of magnetic resonance imaging (MRI) devices rely on our niobium superconducting wire to help produce electromagnetic fields that allow physicians to safely scan the body’s soft tissue.

Automotive. For automobiles, nickel-based alloys, stainless steel and other ATI specialty materials are the choice for powertrain and structural parts, exhaust system and emission control parts, gaskets, air bag inflator housings, windshield wipers and blades, fuel systems, fasteners, hose clamps, gaskets and other components. Stainless steel is also used on exterior trim for its bright appearance and for internal components for its corrosion resistance.

ATI’s advanced nickel-based alloys and specialty alloys in flat-rolled products are used primarily in engine and exhaust applications in the automotive market. Global demand is expected to grow for our high-value precision and engineered strip for automotive applications such as gaskets, hose clamps, and turbo chargers. As automotive engine operating temperatures get hotter as a result of turbochargers, we bring our expertise in aerospace alloys to the automotive market, and our alloy mix continues to trend favorably. Our HRPF provides the capability to produce these high-value alloys in wider and longer coils.

We also provide a variety of heat-resistant and corrosion-resistant automotive exhaust alloys. Again, in this application we focus on those exhaust applications that are closer to the engine where exhaust temperatures are highest and corrosion resistance is most severe.

Business Segments

Our two business segments accounted for the following percentages of total revenues of $3.13 billion, $3.72 billion, and $4.22 billion for the years ended December 31, 2016, 2015, and 2014, respectively.

|

| | | | | | | | | |

| | 2016 | | 2015 | | 2014 |

High Performance Materials & Components | | 62 | % | | 53 | % | | 48 | % |

Flat Rolled Products | | 38 | % | | 47 | % | | 52 | % |

Information with respect to our business segments is presented below and in Note 16 of the notes to the consolidated financial statements.

High Performance Materials & Components Segment

Our HPMC segment produces, converts and distributes a wide range of high performance materials, including titanium and titanium-based alloys, nickel- and cobalt-based alloys and superalloys, zirconium and related alloys including hafnium and niobium, advanced powder alloys and other specialty materials, in long product forms such as ingot, billet, bar, rod, wire, shapes and rectangles, and seamless tubes, plus precision forgings and castings, components and machined parts. These products are designed for the high performance requirements of such major end markets as aerospace & defense (jet engines and airframes), oil & gas, electrical energy, and medical. We are integrated across these alloy systems in melt, remelt, mill product forging, finishing, investment casting, and machining processes. Most of the products in this segment are sold directly to end-use customers, and a significant portion of our HPMC segment products are sold under multi-year agreements.

75% of the HPMC segment’s 2016 revenues were derived from the aerospace & defense market. Demand for our products is driven primarily by the commercial aerospace cycle. Large aircraft and jet engines are manufactured by a small number of companies, such as The Boeing Company, Airbus S.A.S. (an Airbus Group company), Bombardier Aerospace (a division of Bombardier Inc.), and Embraer (Empresa Brasileira de Aeronáutica S.A.) for airframes, and GE Aviation (a division of General Electric Company), Rolls-Royce plc, Pratt & Whitney (a division of United Technologies Corporation), Snecma (SAFRAN Group), and various joint ventures that manufacture jet engines. These companies and their suppliers form a substantial part of our customer base in this business segment. The loss of one or more of our customers in the aerospace & defense market could have a material adverse effect on ATI’s results of operations and financial condition.

Principal competitors in the HPMC segment include Berkshire Hathaway Inc., for nickel-based alloys and superalloys and specialty steel alloys, titanium and titanium-based alloys, precision forgings and investment castings through its recent acquisition of Precision Castparts Corporation and subsidiaries; Arconic Inc., for titanium and titanium-based alloys and precision forgings through its recent acquisitions of RTI International Metals, Inc. and Firth Rixson; Carpenter Technology Corporation for nickel-based alloys and superalloys and specialty steel alloys; VSMPO-AVISMA for titanium and titanium-based alloys; and Aubert & Duval for precision forgings.

Flat Rolled Products Segment

Our FRP segment produces, converts and distributes stainless steel, nickel-based alloys, specialty alloys, and titanium and titanium-based alloys, in a variety of product forms including plate, sheet, engineered strip, and Precision Rolled Strip® products. The major end markets for our flat-rolled products are oil & gas, automotive, aerospace & defense, food processing equipment and appliances, construction and mining, electronics, communication equipment and computers. The operations in this segment are ATI Flat Rolled Products and the Chinese joint venture company known as Shanghai STAL Precision Stainless Steel Company Limited (STAL), in which we hold a 60% interest. Segment results also include our 50% interest in the industrial titanium joint venture known as Uniti LLC.

Stainless steel, nickel-based alloys and titanium sheet products are used in a wide variety of industrial and consumer applications. In 2016, approximately 65% by volume of our stainless sheet products were sold to independent service centers, which have slitting, cutting or other processing facilities, with the remainder sold directly to end-use customers.

Engineered strip and very thin Precision Rolled Strip products, which are under 0.015 inches thick, are used by customers to fabricate a variety of products primarily in the automotive, construction, and electronics markets. In 2016, approximately 90% by volume of our engineered strip and Precision Rolled Strip products were sold directly to end-use customers or through our own distribution network, with the remainder sold to independent service centers.

Stainless steel, nickel-based alloy and titanium plate products are primarily used in aerospace, corrosion and industrial markets. In 2016, approximately one-half by volume of our plate products were sold to independent service centers, with the remainder sold directly to end-use customers.

Competition in the Flat Rolled Products segment includes domestic stainless steel competitors AK Steel Corporation, North American Stainless, and Outokumpu Stainless USA, LLC, as well as imports from numerous foreign producers, including Aperam, based in Europe. Competitors for nickel-based alloys and superalloys and specialty steel alloys include Haynes International and VDM Metals GmbH.

Significant global overcapacity for stainless steel flat-rolled products has intensified the price competition in this segment over the last several years. Some of our foreign competitors are either directly or indirectly subsidized by governments. In 1999, the United States imposed anti-dumping and countervailing duties on dumped and subsidized imports of stainless steel sheet and strip in coils and stainless steel plate in coils from companies in ten foreign countries. The anti-dumping and countervailing duty orders were reviewed in 2011 by the U.S. Department of Commerce and the U.S. International Trade Commission to determine whether the orders should remain in place for another five years. The agencies decided that eight such orders against five countries will continue in effect. In July 2016, the U.S. Department of Commerce and the U.S. International Trade Commission initiated a third review of the eight orders. The four orders covering imports of stainless steel plate in coils from three countries were continued for an additional five years in December 2016. A determination concerning continuation of the four orders covering imports of stainless steel sheet and strip in coils from three countries is expected in the third quarter of 2017.

Additionally, in February 2016, ATI and the three domestic stainless steel competitors filed antidumping and countervailing duty petitions concurrently with the U.S. Department of Commerce and the U.S International Trade Commission, charging that unfairly traded imports of stainless steel sheet and strip from the People’s Republic of China are causing material injury to the domestic stainless steel industry. In February 2017, the U.S. Department of Commerce issued its final determinations, calculating antidumping duties ranging from 64% and 77% percent and countervailing duties ranging from 76% and 191%. These duties are generally applied in combination. The U.S. International Trade Commission is scheduled to announce its final determination in early March 2017. The antidumping duties and subsidy margins are expected to act as a significant deterrent to the illegal dumping of Chinese government-subsidized imports of stainless steel sheet and strip into the U.S. market. We continue to monitor imports from foreign producers for appropriate action.

Raw Materials and Supplies

Substantially all raw materials and supplies required in the manufacture of our products are available from more than one supplier and the sources and availability of raw materials essential to our businesses are currently adequate. The principal raw materials we use in the production of our specialty materials are scrap (including iron-, nickel-, chromium-, titanium-, and molybdenum-bearing scrap), nickel, titanium sponge, zirconium sand and sponge, ferrochromium, ferrosilicon, molybdenum and molybdenum alloys, manganese and manganese alloys, cobalt, niobium, vanadium and other alloying materials.

Purchase prices of certain principal raw materials have been volatile. As a result, our operating results may be subject to significant fluctuation. We use raw materials surcharge and index mechanisms to offset the impact of changes in raw material costs; however, competitive factors in the marketplace may limit our ability to institute such mechanisms, and there can be a delay between the change in the price of raw materials and the impact of such mechanisms. For example, in 2016 we used

approximately 80 million pounds of nickel; therefore a hypothetical change of a $1.00 per pound increase in nickel prices would result in increased costs of approximately $80 million. We also used approximately 300 million pounds of ferrous scrap in the production of our flat-rolled products; a hypothetical change of a $0.01 per pound increase would result in increased costs of approximately $3 million.

In August 2016, we announced the indefinite idling of our Rowley, UT titanium sponge production in the HPMC segment, which was completed in December 2016. Over the last several years, significant global capacity has been added to produce titanium sponge, which is a key raw material used to produce ATI’s titanium products. In addition, demand for industrial-grade titanium products from global markets continues to be weak. As a result of these factors, titanium sponge, including aerospace quality sponge, can now be purchased from qualified global producers under long-term supply agreements at prices lower than the production costs at ATI’s titanium sponge facility in Rowley, UT. ATI has entered into long-term cost competitive supply agreements with several producers of premium-grade and standard-grade titanium sponge. The lower cost titanium sponge purchased under these supply agreements will replace the titanium sponge produced at the Rowley facility.

Other raw materials, such as nickel, cobalt, and ferrochromium, are available to us and our specialty materials industry competitors primarily from foreign sources. Some of these foreign sources are located in countries that may be subject to unstable political and economic conditions, which could disrupt supplies or affect the price of these materials.

We purchase our nickel requirements principally from producers in Australia, Canada, Norway, Russia, and the Dominican Republic. Zirconium raw materials are primarily purchased from the United States and China. Cobalt is purchased primarily from producers in Canada. More than 80% of the world’s reserves of ferrochromium are located in South Africa, Zimbabwe, Albania, and Kazakhstan. Niobium is purchased primarily from producers in Brazil. We also purchase titanium sponge from sources in Kazakhstan and Japan.

Export Sales and Foreign Operations

Direct international sales represented approximately 41% of our total annual sales in 2016, 42% of our total sales in 2015, and 38% of our total sales in 2014. These figures include direct export sales by our U.S.-based operations to customers in foreign countries, which accounted for approximately 31% of our total sales in 2016, 33% of our total sales in 2015, and 28% of our total sales in 2014. Our overseas sales, marketing and distribution efforts are aided by our international marketing and distribution offices, ATI Europe, ATI Europe Distribution, and ATI Asia, or by independent representatives at various locations throughout the world. We believe that at least 50% of ATI’s 2016 sales were driven by global markets when we consider exports of our customers. Direct sales by geographic area in 2016, and as a percentage of total sales, were as follows:

|

| | | | | | | |

(In millions) | | | | |

United States | | $ | 1,857.5 |

| | 59 | % |

Europe | | 639.7 |

| | 21 | % |

Asia | | 418.9 |

| | 13 | % |

Canada | | 97.6 |

| | 3 | % |

South America, Middle East and other | | 120.9 |

| | 4 | % |

Total sales | | $ | 3,134.6 |

| | 100 | % |

Our HPMC segment has manufacturing capabilities for melting, remelting, forging and finishing nickel-based alloys and specialty alloys in the United Kingdom, and manufacturing capabilities for precision forging and machining in Poland, primarily serving the aerospace, construction and transportation markets. Within our FRP segment, our STAL joint venture in the People’s Republic of China produces Precision Rolled Strip products, which enables us to offer these products more effectively to markets in China and other Asian countries. Our Uniti LLC joint venture allows us to offer titanium products to industrial markets more effectively worldwide.

Backlog, Seasonality and Cyclicality

Our backlog of confirmed orders was approximately $1.7 billion at December 31, 2016 and $1.5 billion at December 31, 2015. We expect that approximately 85% of confirmed orders on hand at December 31, 2016 will be filled during the year ending December 31, 2017. Backlog of confirmed orders of our HPMC segment was approximately $1.6 billion at December 31, 2016 and $1.3 billion at December 31, 2015. We expect that approximately 83% of the confirmed orders on hand at December 31, 2016 for this segment will be filled during the year ending December 31, 2017. Backlog of confirmed orders of our FRP segment was approximately $0.1 billion at December 31, 2016 and $0.2 billion at December 31, 2015. We expect that all of the confirmed orders on hand at December 31, 2016 for this segment will be filled during the year ending December 31, 2017.

Generally, our sales and operations are not seasonal. However, demand for our products is cyclical over longer periods because specialty materials customers operate in cyclical industries and are subject to changes in general economic conditions and other factors both external and internal to those industries.

Research, Development and Technical Services

We believe that our research and development capabilities give ATI an advantage in developing new products and manufacturing processes that contribute to the profitable growth potential of our businesses on a long-term basis. We conduct research and development at our various operating locations both for our own account and, on a limited basis, for customers on a contract basis. Research and development expenditures for the years ended December 31, 2016, 2015, and 2014 included the following:

|

| | | | | | | | | | | | |

(In millions) | | 2016 | | 2015 | | 2014 |

Company-Funded: | | | | | | |

High Performance Materials & Components | | $ | 10.9 |

| | $ | 10.0 |

| | $ | 12.9 |

|

Flat Rolled Products | | 3.6 |

| | 4.0 |

| | 4.3 |

|

Corporate | | 0.2 |

| | 0.2 |

| | 0.2 |

|

| | 14.7 |

| | 14.2 |

| | 17.4 |

|

Customer-Funded: | | | | | | |

High Performance Materials & Components | | 2.2 |

| | 1.5 |

| | 2.7 |

|

Total Research and Development | | $ | 16.9 |

| | $ | 15.7 |

| | $ | 20.1 |

|

Our research, development and technical service activities are closely interrelated and are directed toward cost reduction and process improvement, process control, quality assurance and control, system development, the development of new manufacturing methods, the improvement of existing manufacturing methods, the improvement of existing products, and the development of new products.

We own hundreds of United States patents, many of which are also filed under the patent laws of other nations. Although these patents, as well as our numerous trademarks, technical information, license agreements, and other intellectual property, have been and are expected to be of value, we believe that the loss of any single such item or technically related group of such items would not materially affect the conduct of our business.

Environmental, Health and Safety Matters

We are subject to various domestic and international environmental laws and regulations that govern the discharge of pollutants, and disposal of wastes, and which may require that we investigate and remediate the effects of the release or disposal of materials at sites associated with past and present operations. We could incur substantial cleanup costs, fines, civil or criminal sanctions, third party property damage or personal injury claims as a result of violations or liabilities under these laws or non-compliance with environmental permits required at our facilities. We are currently involved in the investigation and remediation of a number of our current and former sites as well as third party sites.

We consider environmental compliance to be an integral part of our operations. We have a comprehensive environmental management and reporting program that focuses on compliance with applicable federal, state, regional and local environmental laws and regulations. Each operating company has an environmental management system that includes mechanisms for regularly evaluating environmental compliance and managing changes in business operations while assessing environmental impact.

Our Corporate Guidelines for Business Conduct and Ethics address compliance with environmental laws as well as employment and workplace safety laws, and also describe our commitment to equal opportunity and fair treatment of employees. We continued to focus on safety across ATI’s operations during 2016. Our 2016 OSHA Total Recordable Incident Rate was 2.11 and our Lost Time Case Rate was 0.44, which we believe to be competitive with world-class performance for our industry.

Employees

We have approximately 8,500 full-time employees, of which approximately 15% are located outside the United States. Approximately 40% of our workforce is covered by various collective bargaining agreements (CBAs), predominantly with the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied & Industrial Service Workers International Union, AFL-CIO, CLC (USW). On March 4, 2016, ATI announced that it had reached a four-year labor agreement with the USW

covering USW-represented employees of its ATI Flat Rolled Products business unit and at two locations in the HPMC business segment. The Company has CBAs with approximately 800 full-time employees that expire in 2017.

Available Information

Our Internet website address is www.atimetals.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as proxy and information statements and other information that we file, are available free of charge through our Internet website as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the United States Securities and Exchange Commission (“SEC”). Our Internet website and the content contained therein or connected thereto are not intended to be incorporated into this Annual Report on Form 10-K. You may read and copy materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet website at www.sec.gov, which contains reports, proxy and information statements and other information that we file electronically with the SEC.

Item 1A. Risk Factors

There are inherent risks and uncertainties associated with our business that could adversely affect our operating performance and financial condition. Set forth below are descriptions of those risks and uncertainties that we currently believe to be material, but the risks and uncertainties described are not the only risks and uncertainties that could affect our business. See the discussion under “Forward-Looking Statements” in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report on Form 10-K.

Cyclical Demand for Products. The cyclical nature of the industries in which our customers operate causes demand for our products to be cyclical, creating potential uncertainty regarding future profitability. Various changes in general economic conditions may affect the industries in which our customers operate. These changes could include decreases in the rate of consumption or use of our customers’ products due to economic downturns. Other factors that may cause fluctuation in our customers’ positions are changes in market demand, lower overall pricing due to domestic and international overcapacity, currency fluctuations, lower priced imports and increases in use or decreases in prices of substitute materials. As a result of these factors, our profitability has been and may in the future be subject to significant fluctuation.

Worldwide economic conditions deteriorated significantly in the recent past and could remain weak in the future. These conditions have had, and may continue to have, an adverse effect on demand for our customers’ products and, in turn, on demand for our products. If these conditions persist or worsen, our results of operations and financial condition could be materially adversely affected.

Volatility of Raw Material Costs. Most of our inventory is valued utilizing the LIFO costing methodology. Inventory of our non-U.S. operations is valued using average cost or FIFO methods. Under the LIFO inventory valuation method, changes in the cost of raw materials and production activities are recognized in cost of sales in the current period even though these material and other costs may have been incurred at significantly different values due to the length of time of our production cycle. In a period of rising prices, cost of sales expense recognized under LIFO is generally higher than the cash costs incurred to acquire the inventory sold. Conversely, in a period of declining raw material prices, cost of sales recognized under LIFO is generally lower than cash costs incurred to acquire the inventory sold. Generally, over time based on overall inflationary trends in raw materials, labor and overhead costs, the use of the LIFO inventory valuation method will result in a LIFO inventory valuation reserve, as the higher current period costs are included in cost of sales and the balance sheet carrying value of inventory is reduced.

The prices for many of the raw materials we use have been extremely volatile during the past several years. Since we value most of our inventory utilizing the LIFO inventory costing methodology, a fall in raw material costs results in a benefit to operating results by reducing cost of sales and increasing the inventory carrying value, while conversely, a rise in raw material costs has a negative effect on our operating results by increasing cost of sales while lowering the carrying value of inventory.

Due primarily to persistent raw material deflation over the last several years, we are in an unusual situation of having a LIFO inventory balance that exceeds replacement cost. In cases where inventory at FIFO cost is lower than the LIFO carrying value, a write-down of the inventory to market may be required, subject to a lower of cost or market evaluation. In applying the lower of cost or market principle, market means current replacement cost, subject to a ceiling (market value shall not exceed net realizable value) and a floor (market shall not be less than net realizable value reduced by an allowance for a normal profit margin). We evaluate product lines on a quarterly basis to identify inventory values that exceed estimated net realizable value. The calculation of a resulting reserve, if any, is recognized as an expense in the period that the need for the reserve is identified.

Due to the long lead times required to manufacture many of our products, volatility in raw material prices exposes us to cash costs that may not be fully recovered through surcharge and index pricing mechanisms.

Product Pricing. From time-to-time, reduced demand, intense competition and excess manufacturing capacity have resulted in reduced prices, excluding raw material surcharges, for many of our products. These factors have had and may have an adverse impact on our revenues, operating results and financial condition.

Although inflationary trends in recent years have been moderate, during most of the same period certain critical raw material costs, such as nickel, titanium sponge, chromium, and molybdenum and scrap containing iron, nickel, titanium, chromium, and molybdenum have been volatile. While we have been able to mitigate some of the adverse impact of volatile raw material costs through raw material surcharges or indices to customers, rapid changes in raw material costs may adversely affect our results of operations.

We change prices on certain of our products from time-to-time. The ability to implement price increases is dependent on market conditions, economic factors, raw material costs and availability, competitive factors, operating costs and other factors, some of which are beyond our control. The benefits of any price increases may be delayed due to long manufacturing lead times and the terms of existing contracts.

Risks Associated with Commercial Aerospace. A significant portion of the sales of our HPMC segment represents products sold to customers in the commercial aerospace industry. Fulfilling contractual arrangements to provide various products to customers in this industry often involves meeting highly exacting performance requirements and product specifications, and our failure to meet those requirements and specifications on a timely and cost efficient basis could have a material adverse effect on our results of operations, business and financial condition. The commercial aerospace industry has historically been cyclical due to factors both external and internal to the airline industry. These factors include general economic conditions, airline profitability, consumer demand for air travel, varying fuel and labor costs, execution of projected build rates, price competition, and international and domestic political conditions such as military conflict and the threat of terrorism. The length and degree of cyclical fluctuation are influenced by these factors and therefore are difficult to predict with certainty. Demand for our products in this segment is subject to these cyclical trends. A downturn in the commercial aerospace industry has had, and may in the future have, an adverse effect on the prices at which we are able to sell these and other products, and our results of operations, business and financial condition could be materially adversely affected.

Goodwill or Long-Lived Asset Impairments. We have various long-lived assets that are subject to impairment testing. We review the recoverability of goodwill annually, or more frequently whenever significant events or changes in circumstances indicate that the recorded goodwill of a reporting unit may be below that reporting unit’s fair value. Our businesses operate in highly cyclical industries, such as commercial aerospace and oil & gas, and as such our estimates of future cash flows, market demand, the cost of capital, and forecasted growth rates and other factors may fluctuate, which may lead to changes in estimated fair value and, therefore, impairment charges in future periods. For the 2016 goodwill impairment evaluation, one reporting unit with goodwill of $470.8 million has a fair value that exceeds carrying value by 14%, and one reporting unit with goodwill of $114.4 million has a fair value that exceeds carrying value by 12%. Additionally, we have a significant amount of property, plant and equipment and acquired intangible assets that may be subject to impairment testing, depending on factors such as market conditions, the demand for our products, and facility utilization levels. Any determination requiring the impairment of a significant portion of goodwill or other long-lived assets has had, and may in the future have, a negative impact on our financial condition and results of operations.

Risks Associated with Strategic Capital Projects. From time-to-time, we undertake strategic capital projects in order to enhance, expand and/or upgrade our facilities and operational capabilities. For instance, over the last several years we have undertaken major expansions of our titanium and premium-melt nickel-based alloy, superalloy and specialty alloy production capabilities, and finished product commissioning of a new advanced hot-rolling and processing facility. Our ability to achieve the anticipated increased revenues or otherwise realize acceptable returns on these investments or other strategic capital projects that we may undertake is subject to a number of risks, many of which are beyond our control, including a variety of market, operational, permitting, and labor-related factors. In addition, the cost to implement any given strategic capital project ultimately may prove to be greater than originally anticipated. If we are not able to achieve the anticipated results from the implementation of any of our strategic capital projects, or if we incur unanticipated implementation costs or delays, our results of operations and financial position may be materially adversely affected.

Dependence on Critical Raw Materials Subject to Price and Availability Fluctuations. We rely to a substantial extent on third parties to supply certain raw materials that are critical to the manufacture of our products. Purchase prices and availability of these critical raw materials are subject to volatility. At any given time we may be unable to obtain an adequate supply of these critical raw materials on a timely basis, on price and other terms acceptable, or at all.

If suppliers increase the price of critical raw materials, we may not have alternative sources of supply. In addition, to the extent that we have quoted prices to customers and accepted customer orders for products prior to purchasing necessary raw materials, or have existing contracts, we may be unable to raise the price of products to cover all or part of the increased cost of the raw materials.

The manufacture of some of our products is a complex process and requires long lead times. As a result, we may experience delays or shortages in the supply of raw materials. If unable to obtain adequate and timely deliveries of required raw materials, we may be unable to timely manufacture sufficient quantities of products. This could cause us to lose sales, incur additional costs, delay new product introductions, or suffer harm to our reputation.

We acquire certain important raw materials that we use to produce specialty materials, including nickel, zirconium, niobium, chromium, cobalt, and titanium sponge, from foreign sources. Some of these sources operate in countries that may be subject to unstable political and economic conditions. These conditions may disrupt supplies or affect the prices of these materials.

Availability of Energy Resources. We rely upon third parties for our supply of energy resources consumed in the manufacture of our products. The prices for and availability of electricity, natural gas, oil and other energy resources are subject to volatile market conditions. These market conditions often are affected by political and economic factors beyond our control. Disruptions in the supply of energy resources could temporarily impair the ability to manufacture products for customers. Further, increases in energy costs, or changes in costs relative to energy costs paid by competitors, has and may continue to adversely affect our profitability. To the extent that these uncertainties cause suppliers and customers to be more cost sensitive, increased energy prices may have an adverse effect on our results of operations and financial condition.

Risks Associated with Environmental Matters. We are subject to various domestic and international environmental laws and regulations that govern the discharge of pollutants, and disposal of wastes, and which may require that we investigate and remediate the effects of the release or disposal of materials at sites associated with past and present operations. We could incur substantial cleanup costs, fines and civil or criminal sanctions, third party property damage or personal injury claims as a result of violations or liabilities under these laws or non-compliance with environmental permits required at our facilities. We are currently involved in the investigation and remediation of a number of our current and former sites as well as third party sites. We also could be subject to future laws and regulations that govern greenhouse gas emissions and various matters related to climate change, which could increase our operating costs.

With respect to proceedings brought under the federal Superfund laws, or similar state statutes, we have been identified as a potentially responsible party (PRP) at approximately 42 of such sites, excluding those at which we believe we have no future liability. Our involvement is limited or de minimis at approximately 25 of these sites, and the potential loss exposure with respect to 12 individual sites is not considered to be material.

We are a party to various cost-sharing arrangements with other PRPs at most of the sites. The terms of the cost-sharing arrangements are subject to non-disclosure agreements as confidential information. Nevertheless, the cost-sharing arrangements generally require all PRPs to post financial assurance of the performance of the obligations or to pre-pay into an escrow or trust account their share of anticipated site-related costs. In addition, the Federal government, through various agencies, is a party to several such arrangements.

We believe that we operate our businesses in compliance in all material respects with applicable environmental laws and regulations. However, from time-to-time, we are a party to lawsuits and other proceedings involving alleged violations of, or liabilities arising from, environmental laws. When our liability is probable and we can reasonably estimate our costs, we record environmental liabilities in our financial statements. In many cases, we are not able to determine whether we are liable or if liability is probable to reasonably estimate the loss or range of loss. Estimates of our liability remain subject to additional uncertainties, including the nature and extent of site contamination, available remediation alternatives, the extent of corrective actions that may be required, and the participation number and financial condition of other PRPs, as well as the extent of their responsibility for the remediation. We intend to adjust our accruals to reflect new information as appropriate. Future adjustments could have a material adverse effect on our results of operations in a given period, but we cannot reliably predict the amounts of such future adjustments. At December 31, 2016, our reserves for environmental matters totaled approximately $16 million. Based on currently available information, we do not believe that there is a reasonable possibility that a loss exceeding the amount already accrued for any of the sites with which we are currently associated (either individually or in the aggregate) will be an amount that would be material to a decision to buy or sell our securities. Future developments,

administrative actions or liabilities relating to environmental matters, however, could have a material adverse effect on our financial condition or results of operations.

Risks Associated with Current or Future Litigation and Claims. A number of lawsuits, claims and proceedings have been or may be asserted against us relating to the conduct of our currently and formerly owned businesses, including those pertaining to product liability, patent infringement, commercial, government contracting, employment, employee and retiree benefits, taxes, environmental, health and safety and occupational disease, and stockholder and corporate governance matters. Due to the uncertainties of litigation, we can give no assurance that we will prevail on all claims made against us in the lawsuits that we currently face or that additional claims will not be made against us in the future. While the outcome of litigation cannot be predicted with certainty, and some of these lawsuits, claims or proceedings may be determined adversely to us, we do not believe that the disposition of any such pending matters is likely to have a material adverse effect on our financial condition or liquidity, although the resolution in any reporting period of one or more of these matters could have a material adverse effect on our results of operations for that period. Also, we can give no assurance that any other matters brought in the future will not have a material effect on our financial condition, liquidity or results of operations.

Labor Matters. We have approximately 8,500 full-time employees, of which approximately 15% are located outside the United States. Approximately 40% of our workforce is covered by various collective bargaining agreements (CBAs), predominantly with the USW. At various times, our CBAs expire and are subject to renegotiation. The Company has CBAs with approximately 800 full-time employees that expire in 2017. Generally, collective bargaining agreements that expire may be terminated after notice by the union. After termination, the union may authorize a strike. A labor dispute, which could lead to a strike, lockout, or other work stoppage by the employees covered by one or more of the collective bargaining agreements, could have a material adverse effect on production at one or more of our facilities and, depending upon the length of such dispute or work stoppage, on our operating results. There can be no assurance that we will succeed in concluding collective bargaining agreements to replace those that expire.

Export Sales. We believe that export sales will continue to account for a significant percentage of our future revenues. Risks associated with export sales include: political and economic instability, including weak conditions in the world’s economies; accounts receivable collection; export controls; changes in legal and regulatory requirements; policy changes affecting the markets for our products; changes in tax laws and tariffs; trade duties; and exchange rate fluctuations (which may affect sales to international customers and the value of profits earned on export sales when converted into dollars). Any of these factors could materially adversely affect our results for the period in which they occur.

Risks Associated with Indebtedness. Our substantial indebtedness could adversely affect our business, financial condition or results of operations and prevent us from fulfilling our obligations under our outstanding indebtedness. As of December 31, 2016, our total consolidated indebtedness was approximately $1.9 billion. This substantial level of indebtedness increases the risk that we may be unable to generate enough cash to pay amounts due in respect of our indebtedness. Our substantial indebtedness could have important consequences to our stockholders and significant effects on our business. For example, it could:

| |

• | make it more difficult for us to satisfy our obligations with respect to our outstanding indebtedness; |

| |

• | increase our vulnerability to general adverse economic and industry conditions; |

| |

• | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, our strategic growth initiatives and development efforts and other general corporate purposes; |

| |

• | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| |

• | restrict us from taking advantage of business opportunities; |

| |

• | place us at a competitive disadvantage compared to our competitors that have less indebtedness; and |

| |

• | limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions, debt service requirements, execution of our business strategy or other general corporate purposes. |

In addition, the agreements that govern our current indebtedness contain, and the agreements that may govern any future indebtedness that we may incur may contain, financial and other restrictive covenants that could limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default that, if not cured or waived, could result in the acceleration of all of our debt.

Risks Associated with Retirement Benefits. At December 31, 2016, our U.S. qualified defined benefit pension plan (U.S. Plan)was approximately 70% funded as calculated in accordance with U.S. generally accepted accounting principles. Based upon current regulations and actuarial studies, we expect to make a $135 million cash contribution to the U.S. Plan in 2017, and we currently expect to continue to have average annual funding requirements of approximately $135 million for the next few years, using an expected 7.75% rate of return on pension plan assets. However, these estimates are subject to significant uncertainty, including potential changes to mortality tables with revised longevity estimates, and the performance of our pension trust

assets. Depending on the timing and amount, a requirement that we fund our U.S. Plan could have a material adverse effect on our results of operations and financial condition.

Risks Associated with Acquisition and Disposition Strategies. We intend to continue to strategically position our businesses in order to improve our ability to compete. Strategies we employ to accomplish this may include seeking new or expanding existing specialty market niches for our products, expanding our global presence, acquiring businesses complementary to existing strengths, and continually evaluating the performance and strategic fit of our existing business units. From time-to-time, management holds discussions with management of other companies to explore acquisitions, joint ventures, and other business combination opportunities as well as possible business unit dispositions. As a result, the relative makeup of the businesses comprising our Company is subject to change. Acquisitions, joint ventures, and other business combinations involve various inherent risks, such as: assessing accurately the value, strengths, weaknesses, contingent and other liabilities and potential profitability of acquisition or other transaction candidates; the potential loss of key personnel of an acquired business; our ability to achieve identified financial and operating synergies, growth or other benefits anticipated to result from an acquisition or other transaction; and unanticipated changes in business and economic conditions affecting an acquisition or other transaction. International acquisitions and other transactions could be affected by export controls, exchange rate fluctuations, domestic and foreign political conditions, changes in tax laws and a deterioration in domestic and foreign economic conditions.

Risks Associated with Information Technology. Information technology infrastructure is critical to supporting business objectives; failure of our information technology infrastructure to operate effectively could adversely affect our business. We depend heavily on information technology infrastructure to achieve our business objectives. If a problem occurs that impairs this infrastructure, the resulting disruption could impede our ability to record or process orders, manufacture and ship in a timely manner, or otherwise carry on business in the normal course. Any such events could cause us to lose customers or revenue and could require us to incur significant expense to remediate.

As we integrate, implement and deploy new information technology processes and information infrastructure across our operations, we could experience disruptions in our business that could have an adverse effect on our business, financial condition, results of operations and cash flow.

Cyber Security Threats. Increased global information technology threats, security requirements, vulnerabilities, and a rise in sophisticated and targeted international computer crime pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. We believe that ATI faces the threat of such cyber attacks due to the markets we serve, the products we manufacture, the locations of our operations, and global interest in our technology. Due to the evolving nature of cyber security threats, the scope and impact of any incident cannot be predicted. We continually work to safeguard our systems and mitigate potential risks. Despite our efforts to protect sensitive information and confidential and personal data, our facilities and systems and those of our third-party service providers may be vulnerable to security breaches. This could lead to disclosure, modification or destruction of proprietary and other key information, defective products, production downtimes, operational disruptions, and remediation costs, which in turn could adversely affect our reputation, competitiveness and results of operations.

Internal Controls Over Financial Reporting. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Insurance. We have maintained various forms of insurance, including insurance covering claims related to our properties and risks associated with our operations. Our existing property and liability insurance coverages contain exclusions and limitations on coverage. From time-to-time, in connection with renewals of insurance, we have experienced additional exclusions and limitations on coverage, larger self-insured retentions and deductibles, and significantly higher premiums. As a result, in the future our insurance coverage may not cover claims to the extent that it has in the past and the costs that we incur to procure insurance may increase significantly, either of which could have an adverse effect on our results of operations.

Political and Social Turmoil. The war on terrorism as well as political and social turmoil could put pressure on economic conditions in the United States and worldwide. These political, social and economic conditions could make it difficult for us, our suppliers, and our customers to forecast accurately and plan future business activities, and could adversely affect the financial condition of our suppliers and customers and affect customer decisions as to the amount and timing of purchases from us. As a result, our business, financial condition and results of operations could be materially adversely affected.

Risks Associated with Government Contracts. Some of our operating units perform contractual work directly or indirectly for the U.S. Government, which requires compliance with laws and regulations relating to the performance of Government contracts. Various claims (whether based on U.S. Government or Company audits and investigations or otherwise) could be asserted against us related to our U.S. Government contract work. Depending on the circumstances and the outcome, such proceedings could result in fines, penalties, compensatory and treble damages or the cancellation or suspension of payments under one or more U.S. Government contracts. Under government regulations, a company, or one or more of its operating divisions or units, can also be suspended or debarred from government contracts based on the results of investigations.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our principal domestic facilities for our HPMC segment include melting operations and production facilities that perform processing and finishing operations. Domestic melting operations are located in Monroe and Bakers, NC, and Lockport, NY (vacuum induction melting, vacuum arc re-melt, electro-slag re-melt, plasma melting), Richland, WA (electron beam melting), and Albany, OR (vacuum arc re-melt). Production of high performance materials, most of which are in long product form, takes place at our domestic facilities in Monroe and Bakers, NC, Lockport, NY, Richburg, SC, Albany, OR, and Oakdale, PA. Our production of zirconium and related specialty alloys takes place at facilities located in Millersburg, OR and Huntsville, AL. Our production of highly engineered forgings, castings, and machined components takes place at facilities in Cudahy and Coon Valley, WI, East Hartford, CT, Albany, OR, Irvine, CA, Portland, IN, Lebanon, KY, Billerica, MA, and Salem, OR.

Our principal domestic locations for melting stainless steel and other flat-rolled specialty materials are located in Brackenridge and Latrobe, PA. Hot-rolling is performed at our domestic facilities in Brackenridge and Washington, PA. Finishing of our flat-rolled products takes place at our domestic facilities located in Brackenridge, Vandergrift, Washington, Rochester, Monaca, and Zelienople, PA, and in Waterbury, CT, New Bedford, MA, Louisville, OH, and Bridgeview, IL.

Substantially all of our properties are owned, and three of our properties are subject to mortgages or similar encumbrances securing borrowings under certain industrial development authority financings.

We also own or lease facilities in a number of foreign countries, including France, Germany, the United Kingdom, Poland, and the People’s Republic of China. We own and/or lease and operate facilities for melting and re-melting, machining and bar mill operations, laboratories and offices located in Sheffield, England. We own highly engineered forging and machining operations in Stalowa Wola, Poland. Through our STAL joint venture, we operate facilities for finishing Precision Rolled Strip products in the Xin-Zhuang Industrial Zone, Shanghai, China.

Our executive offices, located in PPG Place in Pittsburgh, PA, are leased.

Although our facilities vary in terms of age and condition, we believe that they have been well maintained and are in sufficient condition for us to carry on our activities.

Item 3. Legal Proceedings

From time-to-time, we become involved in various lawsuits, claims and proceedings relating to the conduct of our current and formerly owned businesses, including those pertaining to product liability, patent infringement, commercial, government contracting, employment, employee and retiree benefits, taxes, environmental, health and safety and occupational disease, and stockholder and corporate governance matters. While we cannot predict the outcome of any lawsuit, claim or proceeding, our management believes that the disposition of any pending matters is not likely to have a material adverse effect on our financial condition or liquidity. The resolution in any reporting period of one or more of these matters, including those described above, however, could have a material adverse effect on our results of operations for that period.

Information relating to legal proceedings is included in Note 21. Commitments and Contingencies of the Notes to Consolidated Financial Statements and incorporated herein by reference.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Common Stock Prices

Our common stock is traded on the New York Stock Exchange (symbol ATI). At February 2, 2017, there were 3,561 record holders of Allegheny Technologies Incorporated common stock. We paid a quarterly cash dividend of $0.08 per share of common stock outstanding for the first three quarters of 2016 and the fourth quarter of 2015. A quarterly dividend of $0.18 per share of common stock outstanding was paid for the first three quarters of 2015. Effective with the fourth quarter of 2016, our Board of Directors decided to suspend the quarterly dividend. The payment of dividends and the amount of such dividends depends upon matters deemed relevant by our Board of Directors, such as our results of operations, financial condition, cash requirements, future prospects, any limitations imposed by law, credit agreements or senior securities, and other factors deemed relevant and appropriate. Our Asset Based Lending (ABL) Revolving Credit Facility restricts our ability to pay dividends in certain circumstances. For more information on the restrictions under our ABL facility, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Financial Condition and Liquidity - Dividends.”

The ranges of high and low sales prices for shares of our common stock for the quarterly periods ended on the dates indicated were as follows:

|

| | | | | | | | | | | | | | | | |

2016 | | March 31 | | June 30 | | September 30 | | December 31 |

High | | $ | 18.38 |

| | $ | 18.03 |

| | $ | 18.67 |

| | $ | 19.20 |

|

Low | | $ | 7.08 |

| | $ | 10.93 |

| | $ | 12.27 |

| | $ | 13.15 |

|

|

| | | | | | | | | | | | | | | | |

2015 | | March 31 | | June 30 | | September 30 | | December 31 |

High | | $ | 35.10 |

| | $ | 37.76 |

| | $ | 31.02 |

| | $ | 19.10 |

|

Low | | $ | 27.12 |

| | $ | 29.05 |

| | $ | 13.66 |

| | $ | 10.15 |

|

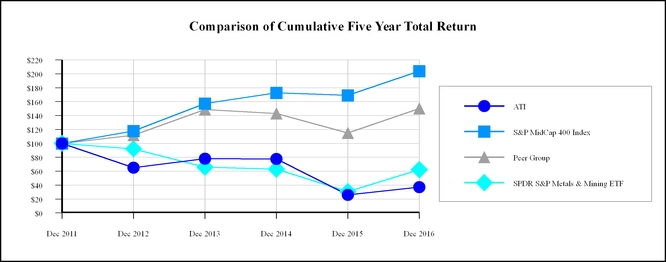

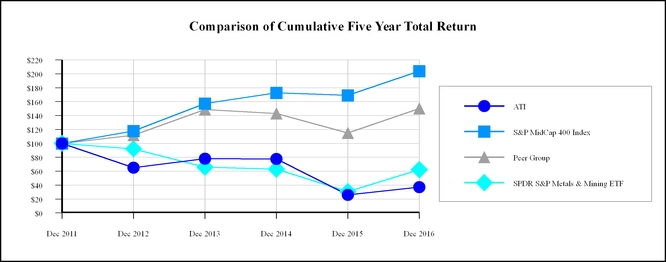

Cumulative Total Stockholder Return

The graph set forth below shows the cumulative total stockholder return (i.e., price change plus reinvestment of dividends) on our common stock from December 31, 2011 through December 31, 2016, as compared to the S&P MidCap 400 Index and a Peer Group of companies. We have included the SPDR S&P Metals and Mining Index ETF because our stock price trading and volatility trends with the performance of that index. We believe that the Peer Group of companies, which is defined below, is representative of companies in our industry that have served similar markets during the applicable periods. The total stockholder return for the Peer Group is weighted according to the respective issuer’s stock market capitalization at the beginning of each period. The graph assumes that $100 was invested on December 31, 2011. The stock performance information included in this graph is based on historical results and is not necessarily indicative of future stock price performance.

|

| | | | | | | | | | | | | | | | | |

Company / Index | | Dec 2011 | | Dec 2012 | | Dec 2013 | | Dec 2014 | | Dec 2015 | | Dec 2016 |

ATI | | 100.00 | | 64.89 |

| | 78.00 |

| | 77.52 |

| | 25.79 |

| | 37.11 |

|

S&P MidCap 400 Index | | 100.00 | | 117.88 |

| | 157.37 |

| | 172.74 |

| | 168.98 |

| | 204.03 |

|

Peer Group | | 100.00 | | 111.53 |

| | 148.47 |

| | 142.97 |

| | 114.93 |

| | 150.21 |

|

SPDR S&P Metals & Mining ETF | | 100.00 | | 92.12 |

| | 85.90 |

| | 62.99 |

| | 30.52 |

| | 62.07 |

|

Source: Standard & Poor’s | | | | | | | | | | | | |

Peer Group companies for the cumulative five year total return period ended December 31, 2016 were as follows:

|

| | | | |

| | | | |

AK Steel Holding Corporation | | Materion Corp | | Steel Dynamics, Inc. |

Alcoa Inc. | | Nucor Corp. | | The Timken Company |

Carpenter Technology Corporation | | Precision Castparts Corp. | | Timken Steel Corporation |

Castle (A M) & Co. | | Reliance Steel & Aluminum Co. | | United States Steel Corporation |

Commercial Metals Company | | RTI International Metals, Inc. | | Universal Stainless & Alloy Products, Inc. |

Kennametal Inc. | | Schnitzer Steel Industries, Inc. | | Worthington Industries, Inc. |

Alcoa Inc. was included in the total shareholder return Peer Group through October 31, 2016 when it was separated into Alcoa Corp and Arconic. Precision Castparts Corp. was included through January 29, 2016 when it was acquired by Berkshire Hathaway Inc. RTI International Metals Inc. was included through July 22, 2015 when it was acquired by Alcoa Inc. Effective in 2014, The Timken Company spun off its steel business into a new public company, Timken Steel Corporation, which was included in the total shareholder return Peer Group starting on June 19, 2014 when it began trading.

Item 6. Selected Financial Data

|

| | | | | | | | | | | | | | | | | | | | |

(In millions) | | | | | | | | | | |

For the Years Ended December 31, | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

Revenue by Market: | | | | | | | | | | |

Aerospace & Defense | | $ | 1,590.4 |

| | $ | 1,514.0 |

| | $ | 1,446.3 |

| | $ | 1,394.5 |

| | $ | 1,584.5 |

|

Oil & Gas | | 280.8 |

| | 538.0 |

| | 752.3 |

| | 706.8 |

| | 837.6 |

|

Automotive | | 232.8 |

| | 293.8 |

| | 414.4 |

| | 348.3 |

| | 363.7 |

|

Electrical Energy | | 232.6 |

| | 368.1 |

| | 430.2 |

| | 459.4 |

| | 571.5 |

|

Medical | | 195.8 |

| | 220.7 |

| | 211.0 |

| | 207.7 |

| | 211.5 |

|

Subtotal - Key Markets | | 2,532.4 |

| | 2,934.6 |

| | 3,254.2 |

| | 3,116.7 |

| | 3,568.8 |

|

Food Equipment & Appliances | | 172.2 |

| | 217.3 |

| | 248.8 |

| | 251.7 |

| | 215.4 |

|

Construction/Mining | | 160.6 |

| | 226.3 |

| | 295.6 |

| | 287.5 |

| | 364.2 |

|

Electronics/Communication/Computers | | 109.7 |

| | 126.4 |

| | 154.6 |

| | 153.1 |

| | 170.0 |

|

Transportation | | 77.6 |

| | 129.5 |

| | 172.1 |

| | 136.3 |

| | 196.1 |

|

Other | | 82.1 |

| | 85.5 |

| | 98.1 |

| | 98.2 |

| | 152.4 |

|

Total | | $ | 3,134.6 |

| | $ | 3,719.6 |

| | $ | 4,223.4 |

| | $ | 4,043.5 |

| | $ | 4,666.9 |

|

|

| | | | | | | | | | | | | | | | | | | | |

(In millions, except per share amounts) | | | | | | | | | | |

For the Years Ended December 31, | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

Results of Operations: | | | | | | | | | | |

Sales: | |

| | | | | | | | |

High Performance Materials & Components | | $ | 1,930.4 |

| | $ | 1,985.9 |

| | $ | 2,006.8 |

| | $ | 1,944.8 |

| | $ | 2,314.0 |

|

Flat Rolled Products | | 1,204.2 |

| | 1,733.7 |

| | 2,216.6 |

| | 2,098.7 |

| | 2,352.9 |

|

Total Sales | | $ | 3,134.6 |

| | $ | 3,719.6 |

| | $ | 4,223.4 |

| | $ | 4,043.5 |

| | $ | 4,666.9 |

|

Segment operating profit (loss): | |

| | | | | | | | |

High Performance Materials & Components | | $ | 168.7 |

| | $ | 157.1 |

| | $ | 234.8 |

| | $ | 159.6 |

| | $ | 315.7 |

|

Flat Rolled Products | | (163.0 | ) | | (241.9 | ) | | (47.0 | ) | | (147.8 | ) | | 19.7 |

|

Total segment operating profit (loss) | | $ | 5.7 |

| | $ | (84.8 | ) | | $ | 187.8 |

| | $ | 11.8 |

| | $ | 335.4 |

|

Income (loss) from continuing operations before income taxes | | $ | (734.0 | ) | | $ | (478.0 | ) | | $ | 1.5 |

| | $ | (154.8 | ) | | $ | 232.3 |

|

Income tax provision (benefit) | | (106.9 | ) | | (112.1 | ) | | (8.7 | ) | | (63.6 | ) | | 72.4 |

|

Income (loss) from continuing operations | | (627.1 | ) | | (365.9 | ) | | 10.2 |

| | (91.2 | ) | | 159.9 |

|

Income (loss) from discontinued operations, net of tax | | — |

| | — |

| | (0.6 | ) | | 252.8 |

| | 7.9 |

|

Net income (loss) | | (627.1 | ) | | (365.9 | ) | | 9.6 |

| | 161.6 |

| | 167.8 |

|

Less: Net income attributable to noncontrolling interests | | 13.8 |

| | 12.0 |

| | 12.2 |

| | 7.6 |

| | 9.4 |

|

Net income (loss) attributable to ATI | | $ | (640.9 | ) | | $ | (377.9 | ) | | $ | (2.6 | ) | | $ | 154.0 |

| | $ | 158.4 |

|

Basic net income (loss) per common share | |

| | | | | | | | |

Continuing operations attributable to ATI per common share | | $ | (5.97 | ) | | $ | (3.53 | ) | | $ | (0.02 | ) | | $ | (0.93 | ) | | $ | 1.42 |

|

Discontinued operations attributable to ATI per common share | | — |

| | — |

| | (0.01 | ) | | 2.37 |

| | 0.07 |

|

Basic net income (loss) attributable to ATI per common share | | $ | (5.97 | ) | | $ | (3.53 | ) | | $ | (0.03 | ) | | $ | 1.44 |

| | $ | 1.49 |

|

Diluted net income (loss) per common share | |

| | | | | | | | |