Table of Contents

As filed with the Securities and Exchange Commission on September 2, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07717

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

(Exact Name of Registrant as Specified in Charter)

1801 California St., Suite 5200, Denver, Colorado 80202

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: 1-888-233-4339

Dennis P. Gallagher, Esq., 1801 California St., Suite 5200, Denver, CO 80202

(Name and Address of Agent for Service)

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Table of Contents

| Item 1: | Report(s) to Shareholders. |

The Semi-Annual Report is attached.

Table of Contents

TRANSAMERICA VARIABLE FUNDS

TRANSAMERICA ASSET

ALLOCATION VARIABLE FUNDS

Semi-Annual Report

June 30, 2022

|

Table of Contents

| Proxy Voting Policies and Procedures and Quarterly Portfolio Holdings |

1 | |||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| Schedules of Investments |

||||

| 6 | ||||

| Transamerica Asset Allocation – Intermediate Horizon Subaccount |

7 | |||

| Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount |

8 | |||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 16 | ||||

| 19 | ||||

| Appendix A |

Authorized for distribution only when accompanied or preceded by a prospectus. Investors should carefully consider a Fund’s investment goals, risks, charges and expenses before investing. A prospectus contains this and other information; please read it carefully before investing.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Table of Contents

This report is not to be construed as an offering for sale of any contracts participating in the Subaccounts (Series) of the Transamerica Variable Funds or the Transamerica Asset Allocation Variable Funds, or as a solicitation of an offer to buy contracts unless preceded by or accompanied by a current prospectus which contains complete information about charges and expenses.

This report consists of the semi-annual report of the Transamerica Asset Allocation Variable Funds and the semi-annual report of the Calvert VP SRI Balanced Portfolio.

Proxy Voting Policies and Procedures

A description of the proxy voting policies and procedures of the Transamerica Asset Allocation Variable Funds is included in the applicable Statements of Additional Information which are available without charge, upon request: (i) by calling 1-800-755-5801; or (ii) on the SEC’s website at www.sec.gov. In addition, the Transamerica Asset Allocation Variable Funds are required to file Form N-PX, with the complete proxy voting record for the most recent twelve months ended June 30, no later than August 31 of each year. Form N-PX for the twelve months ended June 30, 2022, is available without charge, on the Transamerica Funds website at https://www.transamerica.com/sites/default/files/files/e070d/TAAVF%20N-PX%202021.pdf and on the SEC’s website at http://www.sec.gov.

Quarterly Portfolio Holdings

Each fiscal quarter, Transamerica Asset Allocation Variable Funds will file with the SEC a complete schedule of their monthly portfolio holdings on Form N-PORT. The Subaccounts’ holdings as of the end of the third month of every fiscal quarter, as reported on Form N-PORT, will be publicly available on the SEC’s website at http://www.sec.gov within 60 days of the end of the fiscal quarter.

Table of Contents

TRANSAMERICA FINANCIAL LIFE INSURANCE COMPANY

440 Mamaroneck Avenue

Harrison, New York 10528

To Contract Holders with Interests in

the Transamerica Variable Funds:

We are pleased to present the most recent semi-annual report for the Calvert VP SRI Balanced Portfolio. As required under applicable law, we are sending this annual report to contract holders of Group Variable Annuity Contracts issued by Transamerica Financial Life Insurance Company with unit interests in the Calvert Series Subaccount of the Transamerica Variable Funds, which invests its assets in the Calvert VP SRI Balanced Portfolio, a series of Calvert Variable Series, Inc.

Please call your retirement plan administrator, Transamerica Retirement Solutions, LLC, at (800) 755-5801 if you have any questions regarding these reports.

Table of Contents

On behalf of Transamerica Asset Allocation Variable Funds, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial professional in the future. We value the trust you have placed in us.

This semi-annual report provides certain information about your Subaccount(s) during the period covered by the report. The Securities and Exchange Commission currently requires that annual and semi-annual reports be sent to all contract holders, and we believe it to be an important part of the investment process. This report covers the six-month period ended June 30, 2022.

We believe it is important to understand market conditions over the six-month period covered by this report to provide context for reading this report. The period began on January 1, 2022, with the S&P 500® Index near a record high coming off a year of extremely strong economic and corporate earnings growth, ongoing accommodative monetary policy from the U.S. Federal Reserve (“Fed”) and continuing impacts of the Federal government’s historically unprecedented fiscal stimulus. However, in the early months of the year inflation continued to rise sharply, reaching multi-decade highs. With that came growing market expectations the Fed would soon need to begin a more aggressive tightening cycle than most had expected. As a result, equities declined sharply with some of the largest declines occurring among high growth stocks which have major components of their expected earnings increases further out in the future.

The month of February not only saw inflation continue toward levels not seen since the early 1980s, but also the Russian invasion of Ukraine. In addition to creating a humanitarian crisis, the war in Ukraine also drove energy and food prices higher. Against this backdrop bond yields rose across the yield curve and credit spreads widened. In March 2022, the Fed, by this time facing criticism it might be behind the curve on fighting inflation, hiked interest rates for the first time since 2018 taking the Fed Funds Rate to 0.50%.

Inflation continued to rise into the second quarter, and the Fed intensified its rate hikes by raising the target range on the Fed Funds Rate by 0.50% in May and 0.75% in June, finishing the reporting period at an upper bound of 1.75%. Longer-term rates also jumped, and by mid-June the 10-year U.S. Treasury yield reached 3.50%, its highest level in more than a decade. With the Fed’s tightening cycle now established, recession fears began to emerge as a predominant investor concern rivaling inflation. Stocks fell further, and by the first half of June most major indexes had declined more than 20% from previous highs and officially entered bear market territory. This environment also took a further toll on the credit markets as high yield and investment grade credit spreads reached levels not seen since the initial summer months of the COVID-19 pandemic. By the end of the six-month period ended June 30, 2022, economic growth concerns had reached a point where many considered a recession close to imminent. This sent longer-term bond yields quickly back into decline and to the point where they were essentially flat with those of 2-year Treasuries, signifying the risk of a soon to be inverted yield curve historically coinciding with an upcoming recession.

For the six-month period ended June 30, 2022, the S&P 500® Index returned -19.96%, while the MSCI EAFE Index, representing international developed market equities, returned -19.25%. During the same period, the Bloomberg US Aggregate Bond Index returned -10.29%. Please keep in mind that it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial professional is a key resource to help you build a complete picture of your current and future financial needs. Financial professionals are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial professional, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial professional if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

Marijn Smit

President & Chief Executive Officer

Transamerica Asset Allocation Variable Funds

Tom Wald, CFA

Chief Investment Officer

Transamerica Asset Allocation Variable Funds

Bloomberg US Aggregate Bond Index: Measures investment grade, U.S. dollar denominated, fixed-rate taxable bonds, including Treasuries, government-related and corporate securities, as well as both mortgage- and asset-backed securities.

MSCI EAFE Index: A free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada.

S&P 500® Index: A market-capitalization weighted index of 500 large U.S. companies with common stock listed on the New York Stock Exchange or NASDAQ Stock Market.

The views expressed in this report reflect those of Transamerica Asset Management only and may not necessarily represent the views of Transamerica Asset Allocation Variable Funds. These views are as of the date of this report and subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of Transamerica Asset Allocation Variable Funds. Investing involves risk, including potential loss of principal. The performance data presented represents past performance and does not guarantee future results. Indexes are unmanaged and it is not possible to invest directly in an index.

Table of Contents

(unaudited)

UNIT HOLDER EXPENSES

Transamerica Asset Allocation Variable Funds (each individually, a “Subaccount” and collectively, the “Subaccounts”) is a separate investment account established by Transamerica Financial Life Insurance Company, Inc. (“TFLIC”), and is used as an investment vehicle under certain tax-deferred annuity contracts issued by TFLIC. Each Subaccount invests in underlying subaccounts of Transamerica Variable Funds (“TVF”), a unit investment trust. Subaccount contract holders bear the costs of operating the Subaccount (such as the advisory fee).

The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Subaccounts and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at January 1, 2022, and held for the entire six-month period until June 30, 2022.

ACTUAL EXPENSES

The information in the table below provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table below provides information about hypothetical account values and hypothetical expenses based on the Subaccounts’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Subaccounts’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Subaccount versus other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| Actual Expenses |

Hypothetical Expenses (A) |

|||||||||||||||||||||||

| Subaccount | Beginning Account Value January 1, 2022 |

Ending Account Value June 30, 2022 |

Expenses Paid During Period (B) |

Ending Account Value June 30, 2022 |

Expenses Paid During Period (B) |

Net Annualized Expense Ratio (C) |

||||||||||||||||||

| Transamerica Asset Allocation – Short Horizon Subaccount |

$ | 1,000.00 | $ | 884.80 | $ | 0.93 | $ | 1,023.80 | $ | 1.00 | 0.20 | % | ||||||||||||

| Transamerica Asset Allocation – Intermediate Horizon Subaccount |

1,000.00 | 822.50 | 0.90 | 1,023.80 | 1.00 | 0.20 | ||||||||||||||||||

| Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount |

1,000.00 | 793.60 | 0.89 | 1,023.80 | 1.00 | 0.20 | ||||||||||||||||||

| (A) | 5% return per year before expenses. | |||||||||||

| (B) | Expenses are calculated using each Subaccount’s net annualized expense ratios, as disclosed in the table, multiplied by the average account value for the period, multiplied by the number of days in the period (181 days), and divided by the number of days in the year (365 days). | |||||||||||

| (C) | Net annualized expense ratios, as disclosed in the table, do not include the expenses of the underlying investments in which the Subaccounts invest. The total annual expenses, as stated in the fee table of the Subaccounts’ Prospectus, may differ from the expense ratios disclosed in this report. | |||||||||||

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 4

Table of Contents

Schedules of Investments Composition

At June 30, 2022

(unaudited)

| Transamerica Asset Allocation – Short Horizon Subaccount | ||||

| Asset Allocation | Percentage of Net Assets |

|||

| U.S. Fixed Income Funds |

90.2 | % | ||

| U.S. Equity Funds |

7.6 | |||

| International Equity Fund |

1.9 | |||

| Money Market Fund |

0.2 | |||

| Net Other Assets (Liabilities) |

0.1 | |||

| Total |

100.0 | % | ||

|

|

|

|||

| Transamerica Asset Allocation – Intermediate Horizon Subaccount |

||||

| Asset Allocation | Percentage of Net Assets |

|||

| U.S. Fixed Income Funds |

50.5 | % | ||

| U.S. Equity Funds |

37.0 | |||

| International Equity Fund |

12.2 | |||

| Money Market Fund |

0.3 | |||

| Net Other Assets (Liabilities) |

(0.0 | )* | ||

| Total |

100.0 | % | ||

|

|

|

|||

| Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount |

||||

| Asset Allocation | Percentage of Net Assets |

|||

| U.S. Equity Funds |

51.3 | % | ||

| U.S. Fixed Income Funds |

30.7 | |||

| International Equity Fund |

17.8 | |||

| Money Market Fund |

0.2 | |||

| Net Other Assets (Liabilities) |

0.0 | * | ||

| Total |

100.0 | % | ||

|

|

|

|||

| * | Percentage rounds to less than 0.1% or (0.1)%. |

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 5

Table of Contents

Transamerica Asset Allocation – Short Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2022

(unaudited)

| Shares | Value | |||||||

| INVESTMENT COMPANIES - 99.9% | ||||||||

| International Equity Fund - 1.9% | ||||||||

| Transamerica Variable International Equity (A) (B) |

3,740 | $89,762 | ||||||

|

|

|

|||||||

| Money Market Fund - 0.2% | ||||||||

| Transamerica Variable Government Money Market, 0.00% (A) (B) (C) |

432 | 9,235 | ||||||

|

|

|

|||||||

| U.S. Equity Funds - 7.6% | ||||||||

| Transamerica Variable Large Growth (A) (B) |

766 | 125,664 | ||||||

| Transamerica Variable Large Value Opportunities (A) (B) |

1,146 | 135,413 | ||||||

| Transamerica Variable Small Cap Growth (A) (B) |

4,169 | 41,614 | ||||||

| Transamerica Variable Small Cap Value (A) (B) |

3,164 | 45,048 | ||||||

|

|

|

|||||||

| 347,739 | ||||||||

|

|

|

|||||||

| U.S. Fixed Income Funds - 90.2% | ||||||||

| Transamerica Variable High Quality Bond (A) (B) |

43,370 | 775,064 | ||||||

| Shares | Value | |||||||

| INVESTMENT COMPANIES (continued) | ||||||||

| U.S. Fixed Income Funds (continued) | ||||||||

| Transamerica Variable High Yield Bond (A) (B) |

13,438 | $ 474,202 | ||||||

| Transamerica Variable Inflation-Protected Securities (A) (B) |

26,604 | 777,781 | ||||||

| Transamerica Variable Intermediate Bond (A) (B) |

45,754 | 2,125,883 | ||||||

|

|

|

|||||||

| 4,152,930 | ||||||||

|

|

|

|||||||

| Total Investment Companies |

|

4,599,666 | ||||||

|

|

|

|||||||

| Total Investments |

|

4,599,666 | ||||||

| Net Other Assets (Liabilities) - 0.1% |

5,252 | |||||||

|

|

|

|||||||

| Net Assets - 100.0% |

$4,604,918 | |||||||

|

|

|

|||||||

INVESTMENT VALUATION:

Valuation Inputs (D)

| Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Value | |||||||||||||

| ASSETS |

| |||||||||||||||

| Investments |

| |||||||||||||||

| Investment Companies |

$ | 4,599,666 | $ | — | $ | — | $ | 4,599,666 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 4,599,666 | $ | — | $ | — | $ | 4,599,666 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Affiliated investment in Transamerica Variable Funds. Affiliated interest, dividends, realized and unrealized gains (losses), if any, are broken out within the Statements of Operations. | |

| (B) | Non-income producing security. | |

| (C) | Rate disclosed reflects the yield at June 30, 2022. | |

| (D) | There were no transfers in or out of Level 3 during the six-month period ended June 30, 2022. Please reference the Investment Valuation section of the Notes to Financial Statements for more information regarding investment valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 6

Table of Contents

Transamerica Asset Allocation – Intermediate Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2022

(unaudited)

| Shares | Value | |||||||

| INVESTMENT COMPANIES - 100.0% | ||||||||

| International Equity Fund - 12.2% | ||||||||

| Transamerica Variable International Equity (A) (B) |

71,235 | $1,709,794 | ||||||

|

|

|

|||||||

| Money Market Fund - 0.3% | ||||||||

| Transamerica Variable Government Money Market, 0.00% (A) (B) (C) |

1,868 | 39,980 | ||||||

|

|

|

|||||||

| U.S. Equity Funds - 37.0% | ||||||||

| Transamerica Variable Large Growth (A) (B) |

10,692 | 1,753,018 | ||||||

| Transamerica Variable Large Value Opportunities (A) (B) |

17,903 | 2,114,706 | ||||||

| Transamerica Variable Small Cap Growth (A) (B) |

59,399 | 592,983 | ||||||

| Transamerica Variable Small Cap Value (A) (B) |

49,324 | 702,333 | ||||||

|

|

|

|||||||

| 5,163,040 | ||||||||

|

|

|

|||||||

| U.S. Fixed Income Funds - 50.5% | ||||||||

| Transamerica Variable High Quality Bond (A) (B) |

64,865 | 1,159,197 | ||||||

| Shares | Value | |||||||

| INVESTMENT COMPANIES (continued) | ||||||||

| U.S. Fixed Income Funds (continued) | ||||||||

| Transamerica Variable High Yield Bond (A) (B) |

23,404 | $ 825,885 | ||||||

| Transamerica Variable Inflation-Protected Securities (A) (B) |

58,804 | 1,719,178 | ||||||

| Transamerica Variable Intermediate Bond (A) (B) |

71,836 | 3,337,737 | ||||||

|

|

|

|||||||

| 7,041,997 | ||||||||

|

|

|

|||||||

| Total Investment Companies |

|

13,954,811 | ||||||

|

|

|

|||||||

| Total Investments |

|

13,954,811 | ||||||

| Net Other Assets (Liabilities) - (0.0)% (D) |

(3,390 | ) | ||||||

|

|

|

|||||||

| Net Assets - 100.0% |

$13,951,421 | |||||||

|

|

|

|||||||

INVESTMENT VALUATION:

Valuation Inputs (E)

| Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Value | |||||||||||||

| ASSETS |

||||||||||||||||

| Investments |

||||||||||||||||

| Investment Companies |

$ | 13,954,811 | $ | — | $ | — | $ | 13,954,811 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 13,954,811 | $ | — | $ | — | $ | 13,954,811 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Affiliated investment in Transamerica Variable Funds. Affiliated interest, dividends, realized and unrealized gains (losses), if any, are broken out within the Statements of Operations. | |||||||

| (B) | Non-income producing security. | |||||||

| (C) | Rate disclosed reflects the yield at June 30, 2022. | |||||||

| (D) | Percentage rounds to less than 0.1% or (0.1)%. | |||||||

| (E) | There were no transfers in or out of Level 3 during the six-month period ended June 30, 2022. Please reference the Investment Valuation section of the Notes to Financial Statements for more information regarding investment valuation and pricing inputs. | |||||||

The Notes to Financial Statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 7

Table of Contents

Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2022

(unaudited)

| Shares | Value | |||||||

| INVESTMENT COMPANIES - 100.0% | ||||||||

| International Equity Fund - 17.8% | ||||||||

| Transamerica Variable International Equity (A) (B) |

197,139 | $4,731,755 | ||||||

|

|

|

|||||||

| Money Market Fund - 0.2% | ||||||||

| Transamerica Variable Government Money Market, 0.00% (A) (B) (C) |

193 | 41,164 | ||||||

|

|

|

|||||||

| U.S. Equity Funds - 51.3% | ||||||||

| Transamerica Variable Large Growth (A) (B) |

27,565 | 4,519,625 | ||||||

| Transamerica Variable Large Value Opportunities (A) (B) |

48,475 | 5,725,767 | ||||||

| Transamerica Variable Small Cap Growth (A) (B) |

158,740 | 1,584,705 | ||||||

| Transamerica Variable Small Cap Value (A) (B) |

127,380 | 1,813,792 | ||||||

|

|

|

|||||||

| 13,643,889 | ||||||||

|

|

|

|||||||

| U.S. Fixed Income Funds - 30.7% | ||||||||

| Transamerica Variable High Quality Bond (A) (B) |

31,459 | 562,201 | ||||||

| Shares | Value | |||||||

| INVESTMENT COMPANIES (continued) | ||||||||

| U.S. Fixed Income Funds (continued) | ||||||||

| Transamerica Variable High Yield Bond (A) (B) |

30,393 | $ 1,072,521 | ||||||

| Transamerica Variable Inflation-Protected Securities (A) (B) |

83,444 | 2,439,521 | ||||||

| Transamerica Variable Intermediate Bond (A) (B) |

87,951 | 4,086,472 | ||||||

|

|

|

|||||||

| 8,160,715 | ||||||||

|

|

|

|||||||

| Total Investment Companies |

|

26,577,523 | ||||||

|

|

|

|||||||

| Total Investments |

|

26,577,523 | ||||||

| Net Other Assets (Liabilities) - 0.0% (D) |

2,682 | |||||||

|

|

|

|||||||

| Net Assets - 100.0% |

$26,580,205 | |||||||

|

|

|

|||||||

INVESTMENT VALUATION:

Valuation Inputs (E)

| Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Value | |||||||||||||

| ASSETS |

||||||||||||||||

| Investments |

||||||||||||||||

| Investment Companies |

$ | 26,577,523 | $ | — | $ | — | $ | 26,577,523 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 26,577,523 | $ | — | $ | — | $ | 26,577,523 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Affiliated investment in Transamerica Variable Funds. Affiliated interest, dividends, realized and unrealized gains (losses), if any, are broken out within the Statements of Operations. | |

| (B) | Non-income producing security. | |

| (C) | Rate disclosed reflects the yield at June 30, 2022. | |

| (D) | Percentage rounds to less than 0.1% or (0.1)%. | |

| (E) | There were no transfers in or out of Level 3 during the six-month period ended June 30, 2022. Please reference the Investment Valuation section of the Notes to Financial Statements for more information regarding investment valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 8

Table of Contents

STATEMENTS OF ASSETS AND LIABILITIES

At June 30, 2022

(unaudited)

| Short Horizon | Intermediate Horizon |

Intermediate/Long Horizon |

||||||||||

| Assets: |

||||||||||||

| Affiliated investments, at value (A) |

$ | 4,599,666 | $ | 13,954,811 | $ | 26,577,523 | ||||||

| Receivables and other assets: |

||||||||||||

| Affiliated investments sold |

11,236 | 61 | 11,267 | |||||||||

| Total assets |

4,610,902 | 13,954,872 | 26,588,790 | |||||||||

| Liabilities: |

||||||||||||

| Payables and other liabilities: |

||||||||||||

| Affiliated investments purchased |

5,220 | 1,115 | 4,092 | |||||||||

| Investment advisory fees |

764 | 2,336 | 4,493 | |||||||||

| Total liabilities |

5,984 | 3,451 | 8,585 | |||||||||

| Net assets |

$ | 4,604,918 | $ | 13,951,421 | $ | 26,580,205 | ||||||

| Net assets consist of: |

||||||||||||

| Costs of accumulation units |

$ | (1,040,060 | ) | $ | (3,951,155 | ) | $ | 581,034 | ||||

| Total distributable earnings (accumulated losses) |

5,644,978 | 17,902,576 | 25,999,171 | |||||||||

| Net assets |

$ | 4,604,918 | $ | 13,951,421 | $ | 26,580,205 | ||||||

| Accumulation units |

200,453 | 467,406 | 807,139 | |||||||||

| Unit value |

$ | 22.97 | $ | 29.85 | $ | 32.93 | ||||||

|

|

|

|

|

|

|

|||||||

|

(A) Affiliated investments, at cost |

$ | 4,586,263 | $ | 13,179,825 | $ | 22,671,032 | ||||||

For the period ended June 30, 2022

(unaudited)

| Short Horizon | Intermediate Horizon |

Intermediate/Long Horizon |

||||||||||

| Expenses: |

||||||||||||

| Investment advisory fees |

$ | 5,119 | $ | 15,642 | $ | 30,708 | ||||||

| Net investment income (loss) |

(5,119 | ) | (15,642 | ) | (30,708 | ) | ||||||

| Net realized gain (loss) on: |

||||||||||||

| Affiliated investments |

108,397 | 516,988 | 1,856,217 | |||||||||

| Net change in unrealized appreciation (depreciation) on: |

||||||||||||

| Affiliated investments |

(735,762 | ) | (3,578,423 | ) | (8,970,803 | ) | ||||||

| Net realized and change in unrealized gain (loss) |

(627,365 | ) | (3,061,435 | ) | (7,114,586 | ) | ||||||

| Net increase (decrease) in net assets resulting from operations |

$ | (632,484 | ) | $ | (3,077,077 | ) | $ | (7,145,294 | ) | |||

The Notes to Financial Statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 9

Table of Contents

STATEMENTS OF CHANGES IN NET ASSETS

For the period and year ended:

| Short Horizon | Intermediate Horizon | Intermediate/Long Horizon | ||||||||||||||||||||||

| June 30, 2022 (unaudited) |

December 31, 2021 |

June 30, 2022 (unaudited) |

December 31, 2021 |

June 30, 2022 (unaudited) |

December 31, 2021 |

|||||||||||||||||||

| From operations: | ||||||||||||||||||||||||

| Net investment income (loss) |

$ | (5,119 | ) | $ | (12,154 | ) | $ | (15,642 | ) | $ | (35,496 | ) | $ | (30,708 | ) | $ | (71,656 | ) | ||||||

| Net realized gain (loss) |

108,397 | 225,135 | 516,988 | 1,252,933 | 1,856,217 | 2,179,549 | ||||||||||||||||||

| Net change in unrealized appreciation (depreciation) |

(735,762 | ) | (113,796 | ) | (3,578,423 | ) | 330,815 | (8,970,803 | ) | 1,973,023 | ||||||||||||||

| Net increase (decrease) in net assets resulting from operations |

(632,484 | ) | 99,185 | (3,077,077 | ) | 1,548,252 | (7,145,294 | ) | 4,080,916 | |||||||||||||||

| Unit transactions: |

||||||||||||||||||||||||

| Units sold |

125,097 | 331,796 | 506,769 | 1,248,572 | 894,467 | 1,942,982 | ||||||||||||||||||

| Units redeemed |

(761,387 | ) | (1,107,003 | ) | (1,394,786 | ) | (2,168,930 | ) | (3,159,583 | ) | (3,927,840 | ) | ||||||||||||

| Net increase (decrease) in net assets resulting from unit transactions |

(636,290 | ) | (775,207 | ) | (888,017 | ) | (920,358 | ) | (2,265,116 | ) | (1,984,858 | ) | ||||||||||||

| Net increase (decrease) in net assets |

(1,268,774 | ) | (676,022 | ) | (3,965,094 | ) | 627,894 | (9,410,410 | ) | 2,096,058 | ||||||||||||||

| Net assets: |

||||||||||||||||||||||||

| Beginning of period/year |

5,873,692 | 6,549,714 | 17,916,515 | 17,288,621 | 35,990,615 | 33,894,557 | ||||||||||||||||||

| End of period/year |

$ | 4,604,918 | $ | 5,873,692 | $ | 13,951,421 | $ | 17,916,515 | $ | 26,580,205 | $ | 35,990,615 | ||||||||||||

| Unit transactions - shares: |

||||||||||||||||||||||||

| Units sold |

5,120 | 12,926 | 15,491 | 35,516 | 23,879 | 48,632 | ||||||||||||||||||

| Units redeemed |

(30,906 | ) | (43,066 | ) | (41,815 | ) | (61,605 | ) | (84,062 | ) | (97,456 | ) | ||||||||||||

| Net increase (decrease) |

(25,786 | ) | (30,140 | ) | (26,324 | ) | (26,089 | ) | (60,183 | ) | (48,824 | ) | ||||||||||||

The Notes to Financial Statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 10

Table of Contents

| For a unit outstanding during the period and years indicated: |

Short Horizon | |||||||||||||||||||||||

| June 30, 2022 (unaudited) |

December 31, 2021 |

December 31, 2020 |

December 31, 2019 |

December 31, 2018 |

December 31, 2017 |

|||||||||||||||||||

| Unit value, beginning of period/year |

$ | 25.96 | $ | 25.55 | $ | 23.80 | $ | 21.87 | $ | 22.46 | $ | 21.56 | ||||||||||||

| Investment operations: |

||||||||||||||||||||||||

| Net investment income (loss) (A) |

(0.02 | ) | (0.05 | ) | (0.05 | ) | (0.05 | ) | (0.04 | ) | (0.04 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

(2.97 | ) | 0.46 | 1.80 | 1.98 | (0.55 | ) | 0.94 | ||||||||||||||||

| Total investment operations |

(2.99 | ) | 0.41 | 1.75 | 1.93 | (0.59 | ) | 0.90 | ||||||||||||||||

| Unit value, end of period/year |

$ | 22.97 | $ | 25.96 | $ | 25.55 | $ | 23.80 | $ | 21.87 | $ | 22.46 | ||||||||||||

| Total return |

(11.52 | )%(B) | 1.63 | % | 7.35 | % | 8.80 | % | (2.62 | )% | 4.19 | % | ||||||||||||

| Ratio and supplemental data: |

||||||||||||||||||||||||

| Net assets end of period/year (000’s) |

$ | 4,605 | $ | 5,874 | $ | 6,550 | $ | 5,976 | $ | 5,614 | $ | 5,817 | ||||||||||||

| Expenses to average net assets (C) |

0.20 | %(D) | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||||

| Net investment income (loss) to average net assets |

(0.20 | )%(D) | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | ||||||||||||

| Portfolio turnover rate |

20 | %(B) | 27 | % | 58 | % | 36 | % | 44 | % | 34 | % | ||||||||||||

| (A) | Calculated based on average number of units outstanding. | |

| (B) | Not annualized. | |

| (C) | Does not include expenses of the underlying investments in which the Subaccount invests. | |

| (D) | Annualized. |

| For a unit outstanding during the period and years indicated: |

Intermediate Horizon | |||||||||||||||||||||||

| June 30, 2022 (unaudited) |

December 31, 2021 |

December 31, 2020 |

December 31, 2019 |

December 31, 2018 |

December 31, 2017 |

|||||||||||||||||||

| Unit value, beginning of period/year |

$ | 36.29 | $ | 33.26 | $ | 29.13 | $ | 25.32 | $ | 26.91 | $ | 24.28 | ||||||||||||

| Investment operations: |

||||||||||||||||||||||||

| Net investment income (loss) (A) |

(0.03 | ) | (0.07 | ) | (0.06 | ) | (0.06 | ) | (0.05 | ) | (0.05 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

(6.41 | ) | 3.10 | 4.19 | 3.87 | (1.54 | ) | 2.68 | ||||||||||||||||

| Total investment operations |

(6.44 | ) | 3.03 | 4.13 | 3.81 | (1.59 | ) | 2.63 | ||||||||||||||||

| Unit value, end of period/year |

$ | 29.85 | $ | 36.29 | $ | 33.26 | $ | 29.13 | $ | 25.32 | $ | 26.91 | ||||||||||||

| Total return |

(17.75 | )%(B) | 9.11 | % | 14.19 | % | 15.04 | % | (5.92 | )% | 10.84 | % | ||||||||||||

| Ratio and supplemental data: |

||||||||||||||||||||||||

| Net assets end of period/year (000’s) |

$ | 13,951 | $ | 17,917 | $ | 17,289 | $ | 16,687 | $ | 15,038 | $ | 17,618 | ||||||||||||

| Expenses to average net assets (C) |

0.20 | %(D) | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||||

| Net investment income (loss) to average net assets |

(0.20 | )%(D) | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | ||||||||||||

| Portfolio turnover rate |

20 | %(B) | 38 | % | 73 | % | 23 | % | 37 | % | 40 | % | ||||||||||||

| (A) | Calculated based on average number of units outstanding. | |

| (B) | Not annualized. | |

| (C) | Does not include expenses of the underlying investments in which the Subaccount invests. | |

| (D) | Annualized. |

| For a unit outstanding during the period and years indicated: |

Intermediate/Long Horizon | |||||||||||||||||||||||

| June 30, 2022 (unaudited) |

December 31, 2021 |

December 31, 2020 |

December 31, 2019 |

December 31, 2018 |

December 31, 2017 |

|||||||||||||||||||

| Unit value, beginning of period/year |

$ | 41.50 | $ | 37.00 | $ | 31.76 | $ | 26.82 | $ | 29.04 | $ | 25.48 | ||||||||||||

| Investment operations: |

||||||||||||||||||||||||

| Net investment income (loss) (A) |

(0.04 | ) | (0.08 | ) | (0.06 | ) | (0.06 | ) | (0.06 | ) | (0.05 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

(8.53 | ) | 4.58 | 5.30 | 5.00 | (2.16 | ) | 3.61 | ||||||||||||||||

| Total investment operations |

(8.57 | ) | 4.50 | 5.24 | 4.94 | (2.22 | ) | 3.56 | ||||||||||||||||

| Unit value, end of period/year |

$ | 32.93 | $ | 41.50 | $ | 37.00 | $ | 31.76 | $ | 26.82 | $ | 29.04 | ||||||||||||

| Total return |

(20.64 | )%(B) | 12.16 | % | 16.50 | % | 18.40 | % | (7.65 | )% | 13.97 | % | ||||||||||||

| Ratio and supplemental data: |

||||||||||||||||||||||||

| Net assets end of period/year (000’s) |

$ | 26,580 | $ | 35,991 | $ | 33,895 | $ | 31,976 | $ | 27,015 | $ | 31,431 | ||||||||||||

| Expenses to average net assets (C) |

0.20 | %(D) | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||||

| Net investment income (loss) to average net assets |

(0.20 | )%(D) | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | ||||||||||||

| Portfolio turnover rate |

20 | %(B) | 25 | % | 71 | % | 25 | % | 30 | % | 25 | % | ||||||||||||

| (A) | Calculated based on average number of units outstanding. | |

| (B) | Not annualized. | |

| (C) | Does not include expenses of the underlying investments in which the Subaccount invests. | |

| (D) | Annualized. |

The Notes to Financial Statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 11

Table of Contents

At June 30, 2022

(unaudited)

1. ORGANIZATION

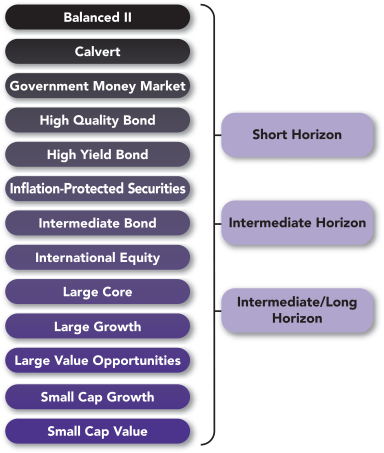

Transamerica Asset Allocation Variable Funds (the “Separate Account”), is a non-diversified separate account of Transamerica Financial Life Insurance Company (“TFLIC”), and is registered as a management investment company under the Investment Company Act of 1940, as amended. The Separate Account applies investment company accounting and reporting guidance. The Separate Account is composed of three different subaccounts (each, a “Subaccount” and collectively, the “Subaccounts”) that are separate investment funds and are as follows. Each Subaccount invests substantially all of its investable assets among certain Transamerica Variable Funds (“TVF”). Certain TVF subaccounts invest substantially all of their investable assets in underlying series of Transamerica Funds (each a “Fund” and collectively, the “Funds”).

| Subaccount |

| Transamerica Asset Allocation – Short Horizon Subaccount (“Short Horizon”) |

| Transamerica Asset Allocation – Intermediate Horizon Subaccount (“Intermediate Horizon”) |

| Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount (“Intermediate/Long Horizon”) |

The only shareholders of the Separate Account are contract holders of the affiliated insurance company variable life and annuity contracts.

Transamerica Asset Management, Inc. (“TAM”) serves as investment adviser for the Subaccounts pursuant to an investment advisory agreement. TAM provides continuous and regular investment advisory services to the Subaccounts. TAM supervises each Subaccount’s investments and conducts its investment program.

TAM is responsible for all aspects of the day-to-day management of the Subaccounts.

TAM’s investment management services also include the provision of supervisory and administrative services to the Subaccounts. These services include performing certain administrative services for the Subaccounts and supervising and overseeing the administrative, clerical, recordkeeping and bookkeeping services provided to the Subaccounts by State Street Bank and Trust Company (“State Street”), to whom TAM has outsourced the provision of certain sub-administration services. To the extent agreed upon by TAM and the Subaccounts from time to time, TAM’s supervisory and administrative services include, but are not limited to: monitoring and verifying the custodian’s daily calculation of the Net Asset Values (“NAV”); shareholder relations functions; compliance services; valuation services; assisting in due diligence and in the oversight and monitoring of certain activities of sub-advisers and certain aspects of Subaccount investments; assisting with Subaccount combinations and liquidations; oversight of the preparation and filing, and review, of all returns and reports, in connection with federal, state and local taxes; oversight and review of regulatory reporting; supervising and coordinating the Subaccounts’ custodian and dividend disbursing agent and monitoring their services to the Subaccounts; assisting the Subaccounts in preparing reports to shareholders; acting as liaison with the Subaccounts’ independent public accountants and providing, upon request, analyses, fiscal year summaries and other audit related services; assisting in the preparation of agendas and supporting documents for and minutes of meetings of trustees and committees of trustees; assisting in the preparation of regular communications with the trustees; and providing personnel and office space, telephones and other office equipment as necessary in order for TAM to perform supervisory and administrative services to the Subaccounts. The Subaccounts pay certain fees and expenses to State Street for sub-administration services which are not administrative services covered by the management agreement with TAM or paid for through the management fees payable thereunder. For the period ended June 30, 2022, (i) the expenses paid to State Street for sub-administration services by the Subaccounts are shown as a part of Other expenses within the Statements of Operations and (ii) the expenses payable to State Street for sub-administration services from the Subaccounts are shown as part of Other accrued expenses within the Statements of Assets and Liabilities.

For each of the Funds, TAM currently acts as a “manager of managers” and has hired sub-advisers to furnish day-to-day investment advice and recommendations to the Funds.

2. SIGNIFICANT ACCOUNTING POLICIES

In preparing the Subaccounts’ financial statements in accordance with Generally Accepted Accounting Principles in the United States of America (“GAAP”), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following is a summary of significant accounting policies followed by the Subaccounts.

Security transactions: Security transactions are accounted for on the trade date. Security gains and losses are calculated on the specific identification basis. Net realized gain (loss) is from investments in units of investment companies.

Operating expenses: The Separate Account accounts separately for the assets, liabilities, and operations of each Subaccount. Each Subaccount will indirectly bear the fees and expenses reflected in the corresponding TVF unit value. These expenses are not reflected in the expenses within the Statements of Operations of the Subaccount and are not included in the Expenses to average net assets, and Net investment income (loss) to average net assets within the Financial Highlights.

Indemnification: In the normal course of business, the Subaccounts enter into contracts that contain a variety of representations that provide general indemnifications. The Subaccounts’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Subaccounts and/or their affiliates that have not yet occurred. However, based on experience, the Subaccounts expect the risk of loss to be remote.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 12

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2022

(unaudited)

3. INVESTMENT VALUATION

All investments in securities are recorded at their estimated fair value. The value of each Subaccount’s investment in a corresponding TVF subaccount is valued at the TVF unit value per share at the official close of the New York Stock Exchange (“NYSE”) each day the NYSE is open for business.

The Subaccounts utilize various methods to measure the fair value of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three levels (“Levels”) of inputs of the fair value hierarchy are defined as follows:

Level 1—Unadjusted quoted prices in active markets for identical securities.

Level 2—Inputs, other than quoted prices included in Level 1, which are observable, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3—Unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available, which may include the Subaccounts’ own assumptions used in determining the fair value of investments.

The inputs used to measure fair value may fall into different Levels of the fair value hierarchy. In such cases, for disclosure purposes, the Level in the fair value hierarchy that is assigned to the fair value measurement of a security is determined based on the lowest Level input that is significant to the fair value measurement in its entirety. Certain investments that are measured at fair value using NAV per share, or its equivalent, using the “practical expedient” have not been classified in the fair value Levels. The hierarchy classification of inputs used to value the Subaccounts’ investments at June 30, 2022, is disclosed within the Investment Valuation section of each Subaccount’s Schedule of Investments.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, but not limited to, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is generally greatest for instruments categorized in Level 3. Due to the inherent uncertainty of valuation, the determination of values may differ significantly from values that would have been realized had a ready market for investments existed, and the differences could be material.

Fair value measurements: Each Subaccount invests substantially all of its investable assets among certain TVF subaccounts and the TVF subaccounts invest all of their investable assets in the Funds. The summary of the inputs used for valuing each Fund’s assets carried at fair value is discussed in the Investment Valuation section of the Funds’ Notes to Financial Statements. Descriptions of the valuation techniques applied to the Subaccounts’ significant categories of assets and liabilities measured at fair value on a recurring basis are as follows:

Investment companies: Certain investment companies are valued at the NAV as the practical expedient. These investment companies are not included within the fair value hierarchy. Certain other investment companies are valued at the actively traded NAV and no valuation adjustments are applied. These investment companies are categorized in Level 1 of the fair value hierarchy.

4. RISK FACTOR

Investing in the Subaccounts involves certain key risks related to the Subaccounts’ trading activity. Please reference the Subaccounts’ prospectus for a more complete discussion of the following risk(s), as well as other risks of investing in the Subaccounts.

Market risk: The market prices of a Fund’s securities and other assets may go up or down, sometimes sharply and unpredictably, due to general market conditions, overall economic trends or events, inflation, changes in interest rates, government actions or interventions, actions taken by the U.S. Federal Reserve or foreign central banks, market disruptions caused by wars, tariffs, trade disputes or other factors, political developments, investor sentiment, the global and domestic effects of a pandemic or other health emergency, and other factors that may or may not be related to the issuer of the security or other asset. The market prices of securities and other assets also may go down due to events or conditions that affect particular sectors, industries, issuers, or geographies. Adverse market conditions may be prolonged and may not have the same impact on all types of securities or other assets. If the value of a Fund’s securities and assets fall, the value of your investment will go down. A Fund may experience a substantial or complete loss on any individual security or asset.

Economies and financial markets throughout the world are increasingly interconnected. Economic, financial or political events, trading and tariff arrangements, the imposition of economic sanctions, public health events (such as the spread of infectious disease), wars,

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 13

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2022

(unaudited)

4. RISK FACTOR (continued)

terrorism, cybersecurity events, technology and data interruptions, natural disasters, and other circumstances in one or more countries or regions could be highly disruptive to, and have profound impacts on, global economies or markets. In the past decade, financial markets throughout the world have experienced increased volatility and decreased liquidity. These conditions may continue or worsen. As a result, whether or not a Fund invests in securities of issuers located in or with significant exposure to the countries directly affected, the value and liquidity of a Fund’s investments may go down. Securities markets may also be susceptible to market manipulation or other fraudulent trade practices, which could disrupt the orderly functioning of these markets or adversely affect the value of securities traded in these markets, including a Fund’s securities.

The pandemic of the novel coronavirus respiratory disease designated COVID-19 has resulted in economic downturns throughout the world, severe losses, particularly to some sectors of the economy and individual issuers, and reduced liquidity of many instruments. There also have been significant disruptions to business operations, including business closures; strained healthcare systems; disruptions to supply chains and employee availability; large fluctuations in consumer demand; and widespread uncertainty regarding the duration and long-term effects of the pandemic. Economic downturns may be prolonged, and political and social instability, continued volatility and decreased liquidity in the securities markets may result. Developing or emerging market countries may be more impacted by the pandemic.

The U.S. government and the Federal Reserve, as well as certain foreign governments and central banks, have taken extraordinary actions to support local and global economies and the financial markets in response to the COVID-19 pandemic. These and other government intervention into the economy and financial markets may not work as intended. In addition, government actions to mitigate the economic impact of the pandemic have resulted in large expansion of government deficits and debt, the long-term consequences of which are not known. Rates of inflation have recently risen, which could adversely affect economies and markets. The pandemic could continue to adversely affect the value and liquidity of a Fund’s investments.

Europe: A number of countries in Europe have experienced severe economic and financial difficulties; and financial markets in Europe and elsewhere have experienced extreme volatility and declines in asset values and liquidity. These difficulties may continue, worsen or spread within or outside Europe. Responses to the financial problems by European governments, central banks and others may not work, may result in conflicts and social unrest and may limit future growth and economic recovery or have other unintended consequences. In January, 2020, through “Brexit,” the United Kingdom withdrew from the European Union. The ramifications of Brexit are unknown, and the implications of possible political, regulatory, economic, and market outcomes could be significant. The United Kingdom has one of the largest economies in Europe and is a major trading partner with European Union countries and the United States. Brexit may create additional and substantial economic stresses for the United Kingdom, including a contraction of the United Kingdom’s economy, decreased trade, capital outflows, devaluation of the British pound, and a decrease in business and consumer spending and investment. The negative impact on not only the United Kingdom and European Union economies but also the broader global economy could be significant. A number of countries in Europe have suffered terror attacks, and additional attacks may occur in the future. Europe has also been struggling with mass migration from the Middle East, Eastern Europe and Africa. The ultimate effects of these events and other socio-political or geopolitical issues could profoundly affect global economies and markets. Whether or not a Fund invests in securities of issuers located in Europe or with significant exposure to European issuers or countries, these events could negatively affect the value and liquidity of a Fund’s investments.

Additional Market Disruption: Russia’s invasion of Ukraine in February, 2022, the resulting responses by the United States and other countries, and the potential for wider conflict, have increased and may continue to increase volatility and uncertainty in financial markets worldwide. The United States and other countries have imposed broad-ranging economic sanctions on Russia and Russian entities and individuals, and may impose additional sanctions, including on other countries that provide military or economic support to Russia. These sanctions, among other things, restrict companies from doing business with Russia and Russian issuers, and may adversely affect companies with economic or financial exposure to Russia and Russian issuers. The extent and duration of Russia’s military actions and the repercussions of such actions are not known. The invasion may widen beyond Ukraine and may escalate, including through retaliatory actions and cyberattacks by Russia and even other countries. These events may result in further and significant market disruptions and may adversely affect regional and global economies including those of Europe and the United States. Certain industries and markets, such as those involving oil, natural gas and other commodities, as well as global supply chains, may be particularly adversely affected. Whether or not a Fund invests in securities of issuers located in Russia, Ukraine and adjacent countries or with significant exposure to issuers in these countries, these events could negatively affect the value and liquidity of a Fund’s investments.

5. FEES AND OTHER AFFILIATED TRANSACTIONS

TAM, the Subaccounts’ investment adviser, is directly owned by Transamerica Life Insurance Company (“TLIC”) and AUSA Holding, LLC (“AUSA”), both of which are indirect, wholly owned subsidiaries of Aegon NV. TLIC is owned by Commonwealth General Corporation (“Commonwealth”). Commonwealth and AUSA are wholly owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is wholly owned by Aegon International B.V., which is wholly owned by Aegon NV, a Netherlands corporation, and a publicly traded international insurance group.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 14

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2022

(unaudited)

5. FEES AND OTHER AFFILIATED TRANSACTIONS (continued)

The Subaccounts purchase interests in the TVF, which in turn, purchase interests in the Funds. The net assets of the Subaccounts will reflect the investment management fee and other expenses incurred by the Funds. TAM serves as the investment manager to each Fund.

All Subaccount holdings in investment companies are considered affiliated. Realized and unrealized gains (losses) are broken out within the Statements of Operations.

Investment advisory fees: TAM provides general investment advice to each Subaccount pursuant to the investment advisory agreement. For its services, each Subaccount pays advisory fees accrued daily and payable monthly, at an annual rate equal to 0.20% of each Subaccount’s daily average net assets.

TFLIC is the legal holder of the assets in the Subaccounts and will at all times maintain assets in the Subaccounts with a total market value of at least equal to the contract liabilities for the Subaccounts.

Certain managing board members and officers of TFLIC are also trustees, officers, or employees of TAM or its affiliates. No interested managing board member, who is deemed an interested person due to current or former service with TAM or an affiliate of TAM receives compensation from the Separate Account. Similarly, none of the Separate Account’s officers or interested trustees receive compensation from the Subaccounts. The independent board members of TFLIC are also trustees of the Funds, for which they receive fees.

Deferred compensation plan: Effective September 23, 2021, the Board has approved the termination of the deferred compensation plan. Payments will be made to applicable current and former Board members consistent with Section 409A of the Code. Under a non-qualified deferred compensation plan effective January 1, 1996, as amended and restated January 1, 2010, available to the trustees, compensation may be deferred that would otherwise be payable by the Separate Account to an independent trustee on a current basis for services rendered as trustee. Deferred compensation amounts will accumulate based on the value of the investment option, as elected by the trustee.

Brokerage commissions: The Subaccounts incurred no brokerage commissions on security transactions placed with affiliates of the investment manager or sub-adviser(s) for the period ended June 30, 2022.

6. PURCHASES AND SALES OF SECURITIES

For the period ended June 30, 2022, the cost of securities purchased and proceeds from securities sold (excluding short-term securities) are as follows:

| Subaccount | Purchases of Securities |

Sales of Securities |

||||||

| Short Horizon |

$ | 1,047,763 | $ | 1,695,442 | ||||

| Intermediate Horizon |

3,157,350 | 4,060,626 | ||||||

| Intermediate/Long Horizon |

6,370,784 | 8,675,326 | ||||||

7. FEDERAL INCOME TAXES

The operations of the Separate Account form a part of, and are taxed with, the operations of TFLIC, a wholly-owned subsidiary of Aegon USA. TFLIC does not expect, based upon current tax law, to incur any income tax upon the earnings or realized capital gains attributable to the Separate Account. Based upon this expectation, no charges are currently being deducted from the Separate Account for federal income tax purposes. The Subaccounts recognize the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Subaccounts’ tax returns remain subject to examination by the Internal Revenue Service and state tax authorities three years from the date of filing for federal purposes and four years from the date of filing for state purposes. Management has evaluated the Subaccounts’ tax provisions taken for all open tax years, and has concluded that no provision for income tax is required in the Subaccounts’ financial statements. If applicable, the Subaccounts recognize interest accrued related to unrecognized tax benefits in relation to interest and penalties expense in Other within the Statements of Operations. The Subaccounts identify their major tax jurisdictions as U.S. Federal, the state of Colorado, and foreign jurisdictions where the Subaccounts make significant investments; however, the Subaccounts are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

8. SUBSEQUENT EVENT

The Board has approved the liquidation of Short Horizon, Intermediate Horizon and Intermediate/Long Horizon Subaccounts effective on or about October 28, 2022.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 15

Table of Contents

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

INVESTMENT ADVISORY AGREEMENTS — CONTRACT RENEWAL

At a meeting of the Managing Board of Transamerica Asset Allocation Variable Funds (the “Trustees” or the “Board”) held on June 15-16, 2022, the Board considered the renewal of the investment advisory agreements (each an “Investment Advisory Agreement” and collectively the “Investment Advisory Agreements”) between Transamerica Asset Management, Inc. (“TAM”) and Transamerica Asset Allocation Variable Funds, on behalf of Transamerica Asset Allocation – Intermediate Horizon Subaccount, Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount, and Transamerica Asset Allocation – Short Horizon Subaccount (each a “Fund” and collectively the “Funds”).

Following its review and consideration, the Board determined that the terms of each Investment Advisory Agreement were reasonable and that the renewal of each of the Investment Advisory Agreements was in the best interests of the applicable Fund and the contract holders. The Board, including the independent members of the Board (the “Independent Board Members”), unanimously approved the renewal of each Investment Advisory Agreement through June 30, 2023.

Prior to reaching their decision, the Board Members requested and received from TAM certain information. They then reviewed such information as they deemed reasonably necessary to evaluate the Investment Advisory Agreements, including information they had previously received from TAM as part of their regular oversight of each Fund, and knowledge they gained over time through meeting with TAM. Among other materials, the Trustees considered comparative fee, expense and performance information prepared by TAM based on information provided by Broadridge Financial Solutions, Inc. (“Broadridge”), an independent provider of mutual fund performance information, as well as fee, expense and profitability information prepared by TAM. In their review, the Board Members also sought to identify instances in which a Fund’s performance, fees, total expenses and/or profitability appeared to be outliers within their respective peer groups or other comparative metrics, and sought to understand the reasons for such comparative positions.

In their deliberations, the Independent Board Members met privately without representatives of TAM present and were represented throughout the process by their independent legal counsel. In considering the proposed continuation of each Investment Advisory Agreement, the Board Members evaluated and weighed a number of considerations that they believed to be relevant in light of the legal advice furnished to them by counsel, including independent legal counsel, and made a decision in the exercise of their own business judgment. They based their decisions on the considerations discussed below, among others, although they did not identify any particular consideration or item of information that was controlling of their decisions, and each Board Member may have attributed different weights to the various factors.

Nature, Extent and Quality of the Services Provided

The Board considered the nature, extent and quality of the services provided by TAM to the applicable Fund in the past and the services anticipated to be provided in the future. The Board also considered the investment approach for each Fund; the experience, capability and integrity of TAM’s senior management; the financial resources of TAM; TAM’s management process; TAM’s responsiveness to any questions by the Board Members; and the professional qualifications and compensation program of the portfolio management team.

The Board noted that the investment management and other services provided by TAM include the design, development and ongoing review and evaluation of each Fund and its investment strategy; risk management oversight and analysis; design, development, implementation and ongoing review and evaluation of a process for the valuation of Fund investments; design, development, implementation and ongoing review and evaluation of a compliance program for the Funds; design, development, implementation and ongoing review and evaluation of a process for the voting of proxies and exercise of rights to consent to corporate action for Fund investments; participation in Board meetings and oversight of preparation of materials for the Board, including materials for Board meetings and regular communications with the Board; oversight of preparation of the Funds’ prospectuses, statements of additional information, shareholder reports and other disclosure materials and regulatory filings for the Funds; and ongoing cash management services for the Funds. The Board considered that TAM’s investment management services also include the provision of supervisory and administrative services to each Fund. The Board also noted that TAM, as part of the services it provides to all Transamerica mutual funds, including the Funds, oversees the services provided by the funds’ custodian, transfer agent, independent accountant and legal counsel and supervises the performance of the recordkeeping and shareholder functions of the funds. The Board noted that it had approved the liquidation of the Funds and that each Fund was expected to be liquidated on or about October 28, 2022, subject to any necessary regulatory approvals.

Investment Performance

In addition, the Board considered the short- and longer-term performance, as applicable, of each Fund in light of its investment objective, policies and strategies, including relative performance against a peer universe of mutual funds, based on Broadridge information, for various trailing periods ended December 31, 2021. Based on these considerations, the Board determined that TAM can provide investment and related services that are appropriate in scope and extent in light of the applicable Fund’s investment objectives, policies and strategies and operations, the competitive landscape of the investment company business and investor needs. The Board’s conclusions as to each Fund’s performance are summarized below. In describing each Fund’s performance relative to its peer universe,

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 16

Table of Contents

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

INVESTMENT ADVISORY AGREEMENTS — CONTRACT RENEWAL (continued)

the summary conclusions characterize performance for the relevant periods in relation to whether it was “above,” “below” or “in line with” the peer universe median and do so using quintile rankings prepared by Broadridge. For simplicity, performance is described as “above” the median if the Fund’s performance ranked anywhere in the first or second quintiles, as “below” the median if it ranked anywhere in the fourth or fifth quintiles, or “in line with” the median if it ranked anywhere in the third quintile (i.e., even if its precise return was somewhat above or somewhat below the precise median return).

When considering each Fund’s performance, the Board Members considered any representations made by TAM regarding the appropriateness of certain peer groups and benchmarks. They recognized that performance reflects a snapshot of a period as of a specific date, and that consideration of performance data for a different period could generate significantly different performance results. The Board Members also recognized that even longer-term performance can be negatively affected by performance over a short-term period when that short-term performance is significantly below the performance of the comparable benchmark or universe of peer funds.

Transamerica Asset Allocation – Intermediate Horizon Subaccount. The Board noted that the performance of the Fund was in line with the median for its peer universe for the past 3-year period and below the median for the past 1-, 5- and 10-year periods. The Board also noted that the performance of the Fund was below its composite benchmark for the past 1-, 3-, 5- and 10-year periods.

Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount. The Board noted that the performance of the Fund was in line with the median for its peer universe for the past 3-year period and below the median for the past 1-, 5- and 10-year periods. The Board also noted that the performance of the Fund was below its composite benchmark for the past 1-, 3-, 5- and 10-year periods.

Transamerica Asset Allocation – Short Horizon Subaccount. The Board noted that the performance of the Fund was above the median for its peer universe for the past 1- and 3-year periods and in line with the median for the past 5- and 10-year periods. The Board also noted that the performance of the Fund was below its composite benchmark for the past 1-, 3-, 5- and 10- year periods.

Investment Advisory Fees and Total Expense Ratios

The Board considered the investment advisory fee and total expense ratio of each Fund, including information comparing the investment advisory fee and total expense ratio of each Fund to the investment advisory fees and total expense ratios of comparable investment companies, based on Broadridge information. On the basis of these considerations, together with the other information it considered, the Board determined that the investment advisory fees to be received by TAM under the Investment Advisory Agreements are reasonable in light of the services provided.

Cost of Services Provided and Level of Profitability

The Board reviewed information provided by TAM about the cost of providing fund management, administration and other services to each Fund by TAM and its affiliates. The Board considered the profitability of TAM and its affiliates in providing these services for each Fund. The Trustees recognized the competitiveness of the investment advisory industry and the importance of an investment adviser’s long-term profitability, including for maintaining company and management stability and accountability.

The Board also considered the allocation methodology used for calculating the profitability of TAM and its affiliates. The Board noted that the revenue and expense allocation methodology used by TAM to estimate its profitability with respect to its relationship with the Funds had been reviewed previously by an independent consultant. The Board Members considered that TAM had not made material changes to this methodology, which had been applied consistently for each Fund.

Based on this information, the Board determined that the profitability of TAM and its affiliates from their relationships with the Funds was not excessive.

Economies of Scale

The Board considered economies of scale with respect to the management of each Fund, whether the Fund had appropriately benefited from any economies of scale and whether there was the potential for realization of any future economies of scale. The Board also considered the existence of economies of scale with respect to management of the Transamerica mutual funds overall and the extent to which the Funds benefited from any economies of scale. The Board recognized that, as a Fund’s assets increase, any economies of scale realized by TAM may not directly correlate with any economies of scale that might be realized by the Fund. The Board considered each Fund’s investment advisory fee schedule and the extent to which TAM shared economies of scale, if any, with the Funds through its undertakings to limit or reimburse Fund expenses and to invest in maintaining and developing its capabilities and services. The Board Members concluded that each Fund’s fee structure reflected an appropriate sharing of any efficiencies or economies of scale to date and noted that they will have the opportunity to periodically reexamine the appropriateness of the investment advisory fees payable to TAM in light of any economies of scale experienced in the future.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 17

Table of Contents

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

INVESTMENT ADVISORY AGREEMENTS — CONTRACT RENEWAL (continued)

Benefits to TAM and/or its Affiliates from their Relationships with the Funds

The Board considered other benefits derived by TAM and/or its affiliates from their relationships with the Funds. The Board noted that TAM does not receive benefits from research obtained with commissions paid to broker-dealers for portfolio transactions (“soft dollars”) as a result of its relationship with the Funds.

Other Considerations

The Board noted that TAM has made a substantial commitment to the recruitment and retention of high quality personnel and maintains the financial, compliance and operational resources reasonably necessary to manage each Fund in a professional manner that is consistent with the best interests of each Fund and the contract holders. In this regard, the Board favorably considered the procedures and policies TAM has in place to enforce compliance with applicable laws and regulations. The Board also noted that TAM has made an entrepreneurial commitment and undertaken certain business risks with respect to the management and success of the Funds.

Conclusion

After consideration of the factors described above, as well as other factors, the Board Members, including the Independent Board Members, concluded that the renewal of each Investment Advisory Agreement was in the best interests of the applicable Fund and the contract holders and voted to approve the renewal of each Investment Advisory Agreement.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2022 |

Page 18

Table of Contents

LIQUIDITY RISK MANAGEMENT PROGRAM

(unaudited)

The Securities and Exchange Commission adopted Rule 22e-4 under the Investment Company Act of 1940, as amended (the “Liquidity Rule”) to promote effective liquidity risk management throughout the open-end investment company industry, thereby reducing the risk that funds will be unable to meet their redemption obligations and mitigating dilution of the interests of fund shareholders. The series of Transamerica Asset Allocation Variable Funds (the “Trust”) (for purposes of this section only, the “Funds”), have adopted and implemented a liquidity risk management program pursuant to the Liquidity Rule (the “Program”). The Managing Board of Trustees of the Trust (the “Board”) has appointed Transamerica Asset Management, Inc. (“TAM”), the investment manager to the Funds, as the Program administrator for the Funds. TAM has established a Liquidity Risk Management Committee (the “Committee”) to manage the Program for the Funds, including oversight of the liquidity risk management process, reporting to the Board, and reviewing the Program’s effectiveness.

The Board met on March 9-10, 2022 (the “Meeting”) to review the Program with respect to the Funds, pursuant to the Liquidity Rule. At the Meeting, the Committee provided the Board with a written report that addressed the operation of the Program during the 2021 reporting period, and assessed the Program’s adequacy and effectiveness, including any material changes to the Program (the “Report”). The Report covered the period from January 1, 2021, through December 31, 2021 (the “Program Reporting Period”). The Report described the Program’s liquidity classification methodology. The Report noted that the Funds utilize analysis from a third-party liquidity metrics service, which takes into account a variety of factors including market, trading and other investment specific considerations. The Report also described the Committee’s methodology in determining whether a Highly Liquid Investment Minimum (a “HLIM”) is necessary and noted that, given the composition of the Funds’ holdings, a HLIM was not currently required for the Funds. The Report noted three material changes to the classification methodology during the Program Reporting Period. The Report reviewed the changes and why the Committee believes the changes are an enhancement to the prior method. The Report also noted that the Program includes provisions reasonably designed to comply with the 15% limit on illiquid investments.