As filed with the Securities and Exchange Commission on September 3, 2014.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07717

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

570 Carillon Parkway, St. Petersburg, Florida 33716

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 299-1800

Tané T. Tyler, Esq., 4600 S. Syracuse St., Suite 1100, Denver, Colorado 80237

(Name and Address of Agent for Service)

Date of fiscal year end: December 31

Date of reporting period: January 1, 2014 – June 30, 2014

Item 1: Report(s) to Shareholders. The Semi-Annual Report is attached.

TRANSAMERICA PARTNERS VARIABLE FUNDS

TRANSAMERICA ASSET

ALLOCATION VARIABLE FUNDS

Semi-Annual Report

June 30, 2014

This report is not to be construed as an offering for sale of any contracts participating in the Subaccounts (Series) of the Transamerica Partners Variable Funds or the Transamerica Asset Allocation Variable Funds, or as a solicitation of an offer to buy contracts unless preceded by or accompanied by a current prospectus which contains complete information about charges and expenses.

This report consists of the semi-annual report of the Transamerica Asset Allocation Variable Funds and the semi-annual reports of the Transamerica Partners Portfolios and the Calvert VP SRI Balanced Portfolio, the underlying portfolios in which the Transamerica Partners Variable Funds invest.

Proxy Voting Policies and Procedures

A description of the proxy voting policies and procedures of the Transamerica Asset Allocation Variable Funds and Transamerica Partners Portfolios is included in the Statement of Additional Information (“SAI”), which is available without charge, upon request: (i) by calling 1-888-233-4339; (ii) on the Subaccounts’ website at www.transamericapartners.com or (iii) on the SEC’s website at www.sec.gov. In addition, the Transamerica Asset Allocation Variable Funds and the Transamerica Partners Portfolios are required to file Form N-PX, with the complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. Form N-PX for the twelve months ended June 30, 2014, will be available without charge, upon request by calling 1-800-851-9777 and on the SEC’s website at http://www.sec.gov.

Quarterly Portfolios

Transamerica Asset Allocation Variable Funds will file their portfolios of investments on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Subaccounts’ Form N-Q is available on the SEC’s website at www.sec.gov. The Subaccounts’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. For information on the operation of the SEC’s Public Reference Room, call 1-800-SEC-0330. You may also obtain a copy of Form N-Q without charge, upon request, by calling 1-888-233-4339. Form N-Q for the corresponding Transamerica Partners Portfolios is also available without charge on the SEC website, at the SEC’s Public Reference Room, or by calling 1-888-233-4339.

TRANSAMERICA FINANCIAL LIFE INSURANCE COMPANY

440 Mamaroneck Avenue

Harrison, New York 10528

June 30, 2014

To Contract Holders with Interests in

the Transamerica Partners Variable Funds:

We are pleased to present the most recent semi-annual reports for the Transamerica Partners Portfolios and for the Calvert VP SRI Balanced Portfolio. As required under applicable law, we are sending these semi-annual reports to contract holders of Group Variable Annuity Contracts issued by Transamerica Financial Life Insurance Company with unit interests in one or more of the subaccounts of Transamerica Partners Variable Funds. Each subaccount available within the Transamerica Partners Variable Funds, other than the Calvert Subaccount, invests its assets in a corresponding mutual fund that is a series of Transamerica Partners Portfolios. The Calvert Subaccount invests in the Calvert VP SRI Balanced Portfolio, a series of Calvert Variable Series, Inc.

Please call your retirement plan administrator, Transamerica Retirement Solutions Corporation (formerly, Diversified Retirement Corporation), at (800) 755-5801 if you have any questions regarding these reports.

Dear Contract Holder,

We would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This semi-annual report is provided to you to show the investments of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all Contract Holders, and we believe it to be an important part of the investment process. This report also provides a discussion of accounting policies as well as matters presented to Contract Holders that may have required their vote.

In order to provide a context for reading this report, we believe it is important to understand market conditions over the previous six months. As 2014 began, bond markets were anticipating the Federal Reserve’s first reduction in bond purchases due in January. At the same time, China’s Central Bank was tightening monetary conditions. The two combined to pressure equities around the globe. Ironically, this boosted U.S. Treasuries throughout January as investors sought a safe haven. In February, U.S. equities bounced back and managed to recapture much of the previous month’s losses. In March and April, large caps managed to hold onto gains while the sell-off resumed for small caps, technology and bio-technology, due in part to lofty valuations. Improving global economics were reported in May and June and helped drive returns for U.S. stocks as well as international equities.

For the six months ended June 30, 2014, the Dow Jones Industrial Average gained 2.68%, the Standard & Poor’s 500® Index gained 7.14%, and the Barclays U.S. Aggregate Bond Index added 3.93%. Please keep in mind that it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisers are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

Transamerica Asset Management, Inc.

Understanding Your Funds’ Expenses

(unaudited)

UNIT HOLDER EXPENSES

Transamerica Asset Allocation Variable Funds (each individually, a “Subaccount” and collectively, the “Subaccounts”) is a separate investment account established by Transamerica Financial Life Insurance Company (“TFLIC”), and is used as an investment vehicle under certain tax-deferred annuity contracts issued by TFLIC. Each Subaccount invests in underlying subaccounts of Transamerica Partners Variable Funds (“TPVF”), a unit investment trust. Subaccount contract holders bear the cost of operating the Subaccount (such as the advisory fee).

The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Subaccounts and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at January 1, 2014, and held for the entire period until June 30, 2014.

ACTUAL EXPENSES

The information in the table under the heading “Actual Expenses” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table under the heading “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Subaccounts’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Subaccounts’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Subaccount versus other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| Actual Expenses |

Hypothetical Expenses(A) |

|||||||||||||||||||||||

| Subaccount Name | Beginning Account Value |

Ending Account Value |

Expenses Paid During Period(B) |

Ending Account Value |

Expenses Paid During Period(B) |

Annualized Expense Ratio(C) |

||||||||||||||||||

| Transamerica Asset Allocation Variable - Short Horizon Subaccount |

$ | 1,000.00 | $ | 1,037.40 | $ | 1.01 | $ | 1,023.80 | $ | 1.00 | 0.20 | % | ||||||||||||

| Transamerica Asset Allocation Variable - Intermediate Horizon Subaccount |

1,000.00 | 1,041.40 | 1.01 | 1,023.80 | 1.00 | 0.20 | ||||||||||||||||||

| Transamerica Asset Allocation Variable - Intermediate/Long Horizon Subaccount |

1,000.00 | 1,044.70 | 1.01 | 1,023.80 | 1.00 | 0.20 | ||||||||||||||||||

| (A) | 5% return per year before expenses. |

| (B) | Expenses are equal to each Subaccount’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days), and divided by the number of days in the year (365 days). |

| (C) | Expense ratios do not include expenses of the investment companies in which the Subaccounts invest. |

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 1

Schedules of Investments Composition

At June 30, 2014

(The following charts summarize the Schedule of Investments of each Subaccount by asset type)

(unaudited)

| Transamerica Asset Allocation Variable - Short Horizon Subaccount |

% of Net Assets |

|||

| Fixed Income |

88.9 | % | ||

| Domestic Equity |

8.7 | |||

| International Equity |

2.2 | |||

| Money Market |

0.2 | |||

| Other Assets and Liabilities - Net |

(0.0 | )* | ||

| Total |

100.0 | % | ||

|

|

|

|||

| Transamerica Asset Allocation Variable - Intermediate Horizon Subaccount |

% of Net Assets |

|||

| Fixed Income |

46.5 | % | ||

| Domestic Equity |

40.9 | |||

| International Equity |

12.3 | |||

| Money Market |

0.3 | |||

| Other Assets and Liabilities - Net |

(0.0 | )* | ||

| Total |

100.0 | % | ||

|

|

|

|||

| Transamerica Asset Allocation Variable - Intermediate/Long Horizon Subaccount |

% of Net Assets |

|||

| Domestic Equity |

54.0 | % | ||

| Fixed Income |

27.8 | |||

| International Equity |

18.0 | |||

| Money Market |

0.2 | |||

| Other Assets and Liabilities - Net |

(0.0 | )* | ||

| Total |

100.0 | % | ||

|

|

|

|||

| * | Percentage rounds to less than 0.1% |

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 2

Transamerica Asset Allocation Variable - Short Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2014

(unaudited)

VALUATION SUMMARY: (E)

| Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

Value at June 30, 2014 |

|||||||||||||

| ASSETS |

||||||||||||||||

| Investment Securities |

||||||||||||||||

| Investment Companies |

$ | 7,074,055 | $ | — | $ | — | $ | 7,074,055 | ||||||||

| Total Investment Securities |

$ | 7,074,055 | $ | — | $ | — | $ | 7,074,055 | ||||||||

NOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Non-income producing security. |

| (B) | Each Subaccount invests substantially all of its assets in an affiliated fund of the Transamerica Partners Variable Funds. |

| (C) | Aggregate cost for federal income tax purposes is $5,903,920. Aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost was $1,170,135. |

| (D) | Percentage rounds to less than 0.1%. |

| (E) | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers between Levels 1 and 2 during the period ended June 30, 2014. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 3

Transamerica Asset Allocation Variable - Intermediate Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2014

(unaudited)

VALUATION SUMMARY: (E)

| Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

Value at June 30, 2014 |

|||||||||||||

| ASSETS |

||||||||||||||||

| Investment Securities |

||||||||||||||||

| Investment Companies |

$ | 20,224,535 | $ | — | $ | — | $ | 20,224,535 | ||||||||

| Total Investment Securities |

$ | 20,224,535 | $ | — | $ | — | $ | 20,224,535 | ||||||||

NOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Non-income producing security. |

| (B) | Each Subaccount invests substantially all of its assets in an affiliated fund of the Transamerica Partners Variable Funds. |

| (C) | Aggregate cost for federal income tax purposes is $14,782,146. Aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost was $5,442,389. |

| (D) | Percentage rounds to less than 0.1%. |

| (E) | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers between Levels 1 and 2 during the period ended June 30, 2014. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 4

Transamerica Asset Allocation Variable - Intermediate/Long Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2014

(unaudited)

VALUATION SUMMARY: (E)

| Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

Value at June 30, 2014 |

|||||||||||||

| ASSETS |

||||||||||||||||

| Investment Securities |

||||||||||||||||

| Investment Companies |

$ | 31,278,790 | $ | — | $ | — | $ | 31,278,790 | ||||||||

| Total Investment Securities |

$ | 31,278,790 | $ | — | $ | — | $ | 31,278,790 | ||||||||

NOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Non-income producing security. |

| (B) | Each Subaccount invests substantially all of its assets in an affiliated fund of the Transamerica Partners Variable Funds. |

| (C) | Aggregate cost for federal income tax purposes is $21,814,694. Aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost was $9,464,096. |

| (D) | Percentage rounds to less than 0.1%. |

| (E) | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers between Levels 1 and 2 during the period ended June 30, 2014. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 5

STATEMENTS OF ASSETS AND LIABILITIES

At June 30, 2014

(unaudited)

| Short Horizon |

Intermediate Horizon |

Intermediate/ Long Horizon |

||||||||||

| Assets: |

||||||||||||

| Investments in affiliated investment companies, at value |

$ | 7,074,055 | $ | 20,224,535 | $ | 31,278,790 | ||||||

| Receivables: |

||||||||||||

| Units sold |

2,018 | 14,596 | 16,195 | |||||||||

| Affiliated investment securities sold |

4,184 | — | — | |||||||||

| Total assets |

7,080,257 | 20,239,131 | 31,294,985 | |||||||||

| Liabilities: |

||||||||||||

| Accounts payable and accrued liabilities: |

||||||||||||

| Units redeemed |

6,202 | — | 7,276 | |||||||||

| Affiliated investment securities purchased |

— | 14,596 | 8,918 | |||||||||

| Investment advisory fees |

1,196 | 3,408 | 5,275 | |||||||||

| Total liabilities |

7,398 | 18,004 | 21,469 | |||||||||

| Net assets |

$ | 7,072,859 | $ | 20,221,127 | $ | 31,273,516 | ||||||

| Net assets consist of: |

||||||||||||

| Costs of accumulation units |

$ | 1,997,058 | $ | 6,450,100 | $ | 14,486,058 | ||||||

| Undistributed (distributions in excess of) net investment income (loss) |

(261,200 | ) | (729,748 | ) | (1,016,101 | ) | ||||||

| Undistributed (accumulated) net realized gain (loss) |

4,166,866 | 9,058,386 | 8,339,463 | |||||||||

| Net unrealized appreciation (depreciation) on: Affiliated investment companies |

1,170,135 | 5,442,389 | 9,464,096 | |||||||||

| Net assets |

$ | 7,072,859 | $ | 20,221,127 | $ | 31,273,516 | ||||||

| Accumulation units |

332,231 | 854,138 | 1,263,257 | |||||||||

| Unit value |

$ | 21.29 | $ | 23.67 | $ | 24.76 | ||||||

| Investments in affiliated investment companies, at cost |

$ | 5,903,920 | $ | 14,782,146 | $ | 21,814,694 | ||||||

STATEMENTS OF OPERATIONS

For the period ended June 30, 2014

(unaudited)

| Short Horizon |

Intermediate Horizon |

Intermediate/ Long Horizon |

||||||||||

| Expenses: |

||||||||||||

| Investment advisory |

$ | 6,837 | $ | 20,119 | $ | 30,261 | ||||||

| Net investment income (loss) |

(6,837 | ) | (20,119 | ) | (30,261 | ) | ||||||

| Net realized gain (loss) on transactions from: |

||||||||||||

| Affiliated investment companies |

70,508 | 481,382 | 472,520 | |||||||||

| Net realized gain (loss) |

70,508 | 481,382 | 472,520 | |||||||||

| Net change in unrealized appreciation (depreciation) on: |

||||||||||||

| Affiliated investment companies |

189,686 | 358,105 | 900,209 | |||||||||

| Net change in unrealized appreciation (depreciation) |

189,686 | 358,105 | 900,209 | |||||||||

| Net realized and change in unrealized gain (loss) |

260,194 | 839,487 | 1,372,729 | |||||||||

| Net increase (decrease) in net assets resulting from operations |

$ | 253,357 | $ | 819,368 | $ | 1,342,468 | ||||||

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 6

STATEMENTS OF CHANGES IN NET ASSETS

For the period and year ended:

| Short Horizon | Intermediate Horizon | Intermediate/Long Horizon | ||||||||||||||||||||||

| June 30, 2014 (unaudited) |

December 31, 2013 |

June 30, 2014 (unaudited) |

December 31, 2013 |

June 30, 2014 (unaudited) |

December 31, 2013 |

|||||||||||||||||||

| From operations: |

||||||||||||||||||||||||

| Net investment income (loss) |

$ | (6,837 | ) | $ | (14,851 | ) | $ | (20,119 | ) | $ | (39,711 | ) | $ | (30,261 | ) | $ | (58,474 | ) | ||||||

| Net realized gain (loss) |

70,508 | 740,897 | 481,382 | 921,391 | 472,520 | 1,000,128 | ||||||||||||||||||

| Net change in unrealized appreciation (depreciation) |

189,686 | (668,118 | ) | 358,105 | 1,566,907 | 900,209 | 4,127,435 | |||||||||||||||||

| Net increase (decrease) in net assets resulting from operations |

253,357 | 57,928 | 819,368 | 2,448,587 | 1,342,468 | 5,069,089 | ||||||||||||||||||

| Unit transactions: |

||||||||||||||||||||||||

| Units sold |

720,194 | 1,408,609 | 1,590,523 | 3,256,968 | 3,414,025 | 2,848,907 | ||||||||||||||||||

| Units redeemed |

(732,642 | ) | (2,861,136 | ) | (2,963,222 | ) | (4,649,264 | ) | (4,084,737 | ) | (5,110,086 | ) | ||||||||||||

| Net increase (decrease) in net assets resulting from unit transactions |

(12,448 | ) | (1,452,527 | ) | (1,372,699 | ) | (1,392,296 | ) | (670,712 | ) | (2,261,179 | ) | ||||||||||||

| Net increase (decrease) in net assets |

240,909 | (1,394,599 | ) | (553,331 | ) | 1,056,291 | 671,756 | 2,807,910 | ||||||||||||||||

| Net assets: |

||||||||||||||||||||||||

| Beginning of period/year |

6,831,950 | 8,226,549 | 20,774,458 | 19,718,167 | 30,601,760 | 27,793,850 | ||||||||||||||||||

| End of period/year |

$ | 7,072,859 | $ | 6,831,950 | $ | 20,221,127 | $ | 20,774,458 | $ | 31,273,516 | $ | 30,601,760 | ||||||||||||

| Undistributed (distributions in excess of) net investment income (loss) |

$ | (261,200 | ) | $ | (254,363 | ) | $ | (729,748 | ) | $ | (709,629 | ) | $ | (1,016,101 | ) | $ | (985,840 | ) | ||||||

| Units outstanding beginning of period/year |

332,920 | 403,808 | 913,876 | 980,782 | 1,291,374 | 1,394,888 | ||||||||||||||||||

| Units sold |

34,507 | 69,050 | 69,559 | 150,607 | 143,924 | 131,770 | ||||||||||||||||||

| Units redeemed |

(35,196 | ) | (139,938 | ) | (129,297 | ) | (217,513 | ) | (172,041 | ) | (235,284 | ) | ||||||||||||

| Units outstanding end of period/year |

332,231 | 332,920 | 854,138 | 913,876 | 1,263,257 | 1,291,374 | ||||||||||||||||||

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 7

FINANCIAL HIGHLIGHTS

For the period or years ended:

| For a unit outstanding throughout each period/year | Short Horizon | |||||||||||||||||||||||

| June 30, 2014 (unaudited) |

December 31, 2013 |

December 31, 2012 |

December 31, 2011 |

December 31, 2010 |

December 31, 2009 |

|||||||||||||||||||

| Unit value |

||||||||||||||||||||||||

| Beginning of period/year |

$ | 20.52 | $ | 20.37 | $ | 18.99 | $ | 18.24 | $ | 16.95 | $ | 14.66 | ||||||||||||

| Investment operations |

||||||||||||||||||||||||

| Net investment income (loss)(A) |

(0.02 | ) | (0.04 | ) | (0.04 | ) | (0.04 | ) | (0.04 | ) | (0.03 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

0.79 | 0.19 | 1.42 | 0.79 | 1.33 | 2.32 | ||||||||||||||||||

| Total investment operations |

0.77 | 0.15 | 1.38 | 0.75 | 1.29 | 2.29 | ||||||||||||||||||

| Unit value |

||||||||||||||||||||||||

| End of period/year |

$ | 21.29 | $ | 20.52 | $ | 20.37 | $ | 18.99 | $ | 18.24 | $ | 16.95 | ||||||||||||

| Total return |

3.74 | %(B) | 0.73 | % | 7.30 | % | 4.07 | % | 7.65 | % | 15.62 | % | ||||||||||||

| Net assets end of period/year (000’s) |

$ | 7,073 | $ | 6,832 | $ | 8,227 | $ | 8,884 | $ | 9,608 | $ | 10,112 | ||||||||||||

| Ratio and supplemental data |

||||||||||||||||||||||||

| Expenses to average net assets(C) |

0.20 | %(D) | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||||

| Net investment income (loss) to average net assets |

(0.20 | )%(D) | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | ||||||||||||

| Portfolio turnover rate(E) |

11 | %(B) | 63 | % | 51 | % | 46 | % | 36 | % | 28 | % | ||||||||||||

| (A) | Calculated based on average number of units outstanding. |

| (B) | Not annualized. |

| (C) | Does not include expenses of the investment companies in which the Subaccount invests. |

| (D) | Annualized. |

| (E) | Does not include the portfolio activity of the investment companies in which the Subaccount invests. |

Note: Prior to January 1, 2010, the financial highlights were audited by another independent registered public accounting firm.

| For a unit outstanding throughout each period/year | Intermediate Horizon | |||||||||||||||||||||||

| June 30, 2014 (unaudited) |

December 31, 2013 |

December 31, 2012 |

December 31, 2011 |

December 31, 2010 |

December 31, 2009 |

|||||||||||||||||||

| Unit value |

||||||||||||||||||||||||

| Beginning of period/year |

$ | 22.73 | $ | 20.10 | $ | 18.17 | $ | 18.13 | $ | 16.22 | $ | 13.46 | ||||||||||||

| Investment operations |

||||||||||||||||||||||||

| Net investment income (loss)(A) |

(0.02 | ) | (0.04 | ) | (0.04 | ) | (0.04 | ) | (0.03 | ) | (0.03 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

0.96 | 2.67 | 1.97 | 0.08 | 1.94 | 2.79 | ||||||||||||||||||

| Total investment operations |

0.94 | 2.63 | 1.93 | 0.04 | 1.91 | 2.76 | ||||||||||||||||||

| Unit value |

||||||||||||||||||||||||

| End of period/year |

$ | 23.67 | $ | 22.73 | $ | 20.10 | $ | 18.17 | $ | 18.13 | $ | 16.22 | ||||||||||||

| Total return |

4.14 | %(B) | 13.07 | % | 10.67 | % | 0.19 | % | 11.81 | % | 20.51 | % | ||||||||||||

| Net assets end of period/year (000’s) |

$ | 20,221 | $ | 20,774 | $ | 19,718 | $ | 21,599 | $ | 24,180 | $ | 24,295 | ||||||||||||

| Ratio and supplemental data |

||||||||||||||||||||||||

| Expenses to average net assets(C) |

0.20 | %(D) | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||||

| Net investment income (loss) to average net assets |

(0.20 | )%(D) | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | ||||||||||||

| Portfolio turnover rate(E) |

17 | %(B) | 54 | % | 37 | % | 42 | % | 25 | % | 34 | % | ||||||||||||

| (A) | Calculated based on average number of units outstanding. |

| (B) | Not annualized. |

| (C) | Does not include expenses of the investment companies in which the Subaccount invests. |

| (D) | Annualized. |

| (E) | Does not include the portfolio activity of the investment companies in which the Subaccount invests. |

Note: Prior to January 1, 2010, the financial highlights were audited by another independent registered public accounting firm.

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 8

FINANCIAL HIGHLIGHTS

For the period or years ended:

| For a unit outstanding throughout each period/year | Intermediate/Long Horizon | |||||||||||||||||||||||

| June 30, 2014 (unaudited) |

December 31, 2013 |

December 31, 2012 |

December 31, 2011 |

December 31, 2010 |

December 31, 2009 |

|||||||||||||||||||

| Unit value |

||||||||||||||||||||||||

| Beginning of period/year |

$ | 23.70 | $ | 19.93 | $ | 17.70 | $ | 17.99 | $ | 15.78 | $ | 12.89 | ||||||||||||

| Investment operations |

||||||||||||||||||||||||

| Net investment income (loss)(A) |

(0.02 | ) | (0.04 | ) | (0.04 | ) | (0.04 | ) | (0.03 | ) | (0.03 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

1.08 | 3.81 | 2.27 | (0.25 | ) | 2.24 | 2.92 | |||||||||||||||||

| Total investment operations |

1.06 | 3.77 | 2.23 | (0.29 | ) | 2.21 | 2.89 | |||||||||||||||||

| Unit value |

||||||||||||||||||||||||

| End of period/year |

$ | 24.76 | $ | 23.70 | $ | 19.93 | $ | 17.70 | $ | 17.99 | $ | 15.78 | ||||||||||||

| Total return |

4.47 | %(B) | 18.93 | % | 12.60 | % | (1.66 | )% | 14.05 | % | 22.42 | % | ||||||||||||

| Net assets end of period/year (000’s) |

$ | 31,274 | $ | 30,602 | $ | 27,794 | $ | 28,003 | $ | 30,991 | $ | 30,478 | ||||||||||||

| Ratio and supplemental data |

||||||||||||||||||||||||

| Expenses to average net assets(C) |

0.20 | %(D) | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||||

| Net investment income (loss) to average net assets |

(0.20 | )%(D) | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | (0.20 | )% | ||||||||||||

| Portfolio turnover rate(E) |

12 | %(B) | 32 | % | 30 | % | 34 | % | 23 | % | 54 | % | ||||||||||||

| (A) | Calculated based on average number of units outstanding. |

| (B) | Not annualized. |

| (C) | Does not include expenses of the investment companies in which the Subaccount invests. |

| (D) | Annualized. |

| (E) | Does not include the portfolio activity of the investment companies in which the Subaccount invests. |

| Note: | Prior to January 1, 2010, the financial highlights were audited by another independent registered public accounting firm. |

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 9

NOTES TO FINANCIAL STATEMENTS

At June 30, 2014

(unaudited)

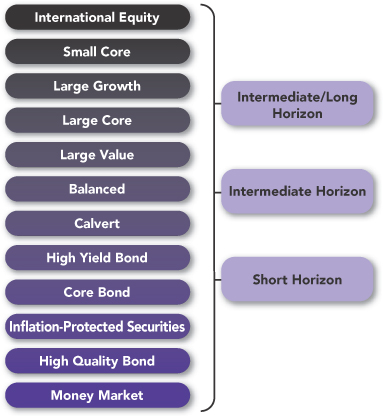

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Transamerica Asset Allocation Variable Funds (the “Separate Account”), is a non-diversified separate account of Transamerica Financial Life Insurance Company (“TFLIC”), and is registered as a management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Separate Account is composed of three different subaccounts that are separate investment funds: Transamerica Asset Allocation Variable—Short Horizon Subaccount (“Short Horizon”), Transamerica Asset Allocation Variable—Intermediate Horizon Subaccount (“Intermediate Horizon”), and Transamerica Asset Allocation Variable—Intermediate/Long Horizon Subaccount (“Intermediate/Long Horizon”), (each, a “Subaccount” and collectively, the “Subaccounts”). Each Subaccount invests substantially all of its investable assets among certain Transamerica Partners Variable Funds (“TPVF”). Certain TPVF subaccounts invest substantially all of their investable assets in the Transamerica Partners Portfolios (the “Portfolios”).

Transamerica Asset Management, Inc. (“TAM”) is responsible for the day-to-day management of the Subaccounts. For each of the Portfolios, TAM currently acts as a “manager of managers” and hires sub-advisers to furnish day-to-day investment advice and recommendations to the Portfolios.

TAM provides continuous and regular investment advisory services to the Portfolios. TAM acts as a manager of managers, providing advisory services that include, without limitation, the design and development of each Portfolio and its investment strategy and the ongoing review and evaluation of that investment strategy including recommending changes in strategy where it believes appropriate or advisable; the selection of one or more sub-advisers for each Portfolio employing a combination of quantitative and qualitative screens, research, analysis and due diligence; oversight and monitoring of sub-advisers and recommending changes to sub-advisers where it believes appropriate or advisable; recommending and implementing fund combinations and liquidations where it believes appropriate or advisable; regular supervision of the Portfolios’ investments; regular review of sub-adviser performance and holdings; ongoing trade oversight and analysis; regular monitoring to ensure adherence to investment process; risk management oversight and analysis; design, development, implementation and regular monitoring of the valuation of portfolio holdings; design, development, implementation and regular monitoring of the compliance process; review of proxies voted by sub-advisers; oversight of preparation, and review, of materials for meetings of the Portfolios’ Board of Trustees, participation in these meetings and preparation of regular communications with the Board; oversight of preparation and review of prospectuses, shareholder reports and other disclosure materials and filings; and oversight of other service providers to the Portfolios, such as the custodian, the transfer agent, the Portfolios’ independent registered public accounting firm and legal counsel; supervision of the performance of recordkeeping and shareholder relations for the Portfolios; and ongoing cash management services. TAM uses a variety of quantitative and qualitative tools to carry out its investment advisory services. Where TAM employs sub-advisers, the sub-advisers carry out and effectuate the investment strategy designed for the Portfolios by TAM and are responsible, subject to TAM’s and the Board of Trustees oversight, among other things, for making decisions to buy, hold or sell a particular security.

In the normal course of business, the Subaccounts enter into contracts that contain a variety of representations that provide general indemnifications. The Subaccounts’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Subaccounts and/or its affiliates that have not yet occurred. However, based on experience, the Subaccounts expect the risk of loss to be remote.

In preparing the Subaccounts’ financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following is a summary of significant accounting policies followed by the Subaccounts.

Operating expenses: The Separate Account accounts separately for the assets, liabilities, and operations of each Subaccount. Each Subaccount will indirectly bear its share of fees and expenses incurred by TPVF. These expenses are not reflected in the expenses in the Statements of Operations and are not included in the ratios to average net assets shown in the Financial Highlights.

Security transactions: Security transactions are recorded on the trade date. Net realized gain (loss) is from investments in units of investment companies.

NOTE 2. SECURITY VALUATIONS

All investments in securities are recorded at their estimated fair value. The value of each Subaccount’s investment in a corresponding subaccount of the TPVF is valued at the unit value per share of each Subaccount at the close of the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, each day the NYSE is open for business. The Subaccounts utilize various methods to measure the fair value of their investments on a recurring basis.

GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

Level 1—Unadjusted quoted prices in active markets for identical securities.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 10

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2014

(unaudited)

NOTE 2. (continued)

Level 2—Inputs, other than quoted prices included in Level 1, that are observable, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3—Unobservable inputs, which may include TAM’s internal valuation committee’s (the “Valuation Committee”) own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the sub-adviser, issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

The Subaccounts’ Board of Trustees has delegated the valuation functions on a day-to-day basis to TAM, subject to board oversight. TAM has formed the Valuation Committee to monitor and implement the fair valuation policies and procedures as approved by the Board of Trustees. These policies and procedures are reviewed at least annually by the Board of Trustees. The Valuation Committee, among other tasks, monitors for when market quotations are not readily available or are unreliable and determines in good faith the fair value of the portfolio investments. For instances in which daily market quotes are not readily available, securities may be valued, pursuant to procedures adopted by the Board of Trustees, with reference to other instruments or indices. Depending on the relative significance of valuation inputs, these instruments may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The Valuation Committee may employ a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the security to determine the fair value of the security. An income-based valuation approach may also be used in which the anticipated future cash flows of the security are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the securities. When the Subaccounts use fair value methods that rely on significant unobservable inputs to determine a security’s value, the Valuation Committee will choose the method that is believed to accurately reflect fair value. These securities are categorized in Level 3 of the fair value hierarchy. The Valuation Committee reviews fair value measurements on a regular and ad hoc basis and may, as deemed appropriate, update the security valuations as well as the fair valuation guidelines.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, but not limited to, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is generally greatest for instruments categorized in Level 3. Due to the inherent uncertainty of valuation, the Valuation Committee’s determination of values may differ significantly from values that would have been realized had a ready market for investments existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches, including a regular review of valuation methodologies, key inputs and assumptions, transactional back-testing, and reviews of any market related activity.

The inputs used to measure fair value may fall into different Levels of the fair value hierarchy. In such cases, for disclosure purposes, the Level in the fair value hierarchy that is assigned to the fair value measurement of a security is determined based on the lowest Level input that is significant to the fair value measurement in its entirety.

Fair value measurements: Descriptions of the valuation techniques applied to the Subaccounts’ major categories of assets and liabilities measured at fair value on a recurring basis are as follows:

Each Subaccount invests substantially all of its investable assets among certain TPVF subaccounts and the TPVF subaccounts invest all of their investable assets in the Portfolios. The summary of the inputs used for valuing each Portfolio’s assets carried at fair value is discussed in Note 2 of the Portfolios’ Notes to Financial Statements, which are attached to this report.

Investment companies: Investment companies are valued at the net asset value (“NAV”) of the underlying funds. These securities are actively traded and no valuation adjustments are applied. Exchange-Traded Funds are stated at the last reported sale price or closing price on the day of valuation taken from the primary exchange where the security is principally traded. They are categorized in Level 1 of the fair value hierarchy.

The hierarchy classification of inputs used to value the Subaccounts’ investments, at June 30, 2014, is disclosed in the Valuation Summary of each Subaccount’s Schedule of Investments.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 11

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2014

(unaudited)

NOTE 3. RELATED PARTY TRANSACTIONS

TAM, the Subaccounts’ investment adviser, is directly owned by Western Reserve Life Assurance Co. of Ohio (“Western Reserve”) and AUSA Holding Company (“AUSA”), both of which are indirect, wholly-owned subsidiaries of Aegon NV. Western Reserve and AUSA are wholly-owned by Aegon USA, LLC (“Aegon USA”), a financial services holding company whose primary emphasis is on life and health insurance, and annuity and investment products. Aegon USA is owned by Aegon US Holding Corporation, which is owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is owned by The Aegon Trust, which is owned by Aegon International B.V., which is owned by Aegon NV, a Netherlands corporation, and a publicly traded international insurance group.

Pursuant to the Investment Advisory Agreement, and subject to further policies as the Board of Trustees may determine, TAM provides general investment advice to each Subaccount, for which it receives a monthly advisory fee that is accrued daily and payable monthly at an annual rate equal to 0.20% of each Subaccount’s average daily net assets.

TFLIC is the legal holder of the assets in the Subaccounts and will at all times maintain assets in the Subaccounts with a total market value of at least equal to the contract liabilities for the Subaccounts.

Certain Managing Board Members and officers of TFLIC are also trustees, officers, or employees of TAM or its affiliates. No interested Managing Board Member receives compensation from the Separate Account. Similarly, none of the Separate Account’s officers receive compensation from the Subaccounts. The independent board members of TFLIC are also trustees of the Transamerica Partners Portfolios for which they receive fees.

Deferred compensation plan: Under a non-qualified deferred compensation plan effective January 1, 2008, as amended and restated (the “Deferred Compensation Plan”), available to the Trustees, compensation payable from the Subaccounts may be deferred that would otherwise be payable by the Separate Account to an Independent Trustee on a current basis for services rendered as Trustee. Deferred compensation amounts will accumulate based on the value of Class A (or comparable) shares of a series of Transamerica Funds (without imposition of sales charge), as elected by the Trustee.

NOTE 4. PURCHASES AND SALES OF SECURITIES

The cost of affiliated investments purchased and proceeds from affiliated investments sold (excluding short-term securities) for the period ended June 30, 2014 were as follows:

| Subaccount Name | Purchases of affiliated investments |

Proceeds from maturities and sales of affiliated investments |

||||||

| Short Horizon |

$ 746,429 | $ 765,698 | ||||||

| Intermediate Horizon |

3,465,812 | 4,858,840 | ||||||

| Intermediate/Long Horizon |

3,598,321 | 4,299,318 | ||||||

There were no transactions in U.S. Government securities during the period ended June 30, 2014.

NOTE 5. FEDERAL INCOME TAX MATTERS

The operations of the Separate Account form a part of, and are taxed with, the operations of TFLIC, a wholly-owned subsidiary of Aegon USA. TFLIC does not expect, based upon current tax law, to incur any income tax upon the earnings or realized capital gains attributable to the Separate Account. Based upon this expectation, no charges are currently being deducted from the Separate Account for federal income tax purposes. The Subaccounts recognize the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Subaccounts’ federal and state tax returns remain subject to examination by the Internal Revenue Service and state tax authorities for the prior three years. Management has evaluated the Subaccounts’ tax provisions taken for all open tax years, and has concluded that no provision for income tax is required in the Subaccounts’ financial statements. If applicable, the Subaccounts recognize interest accrued related to unrecognized tax benefits in interest and penalties expense in Other on the Statements of Operations. The Subaccounts identify their major tax jurisdictions as U.S. Federal, the State of Florida, the State of New York, and foreign jurisdictions where the Subaccounts make significant investments; however, the Subaccounts are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

NOTE 6. ACCOUNTING PRONOUNCEMENTS

In June 2013, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update (“ASU”) No. 2013-08 “Investment Companies: Amendments to the Scope, Measurement and Disclosure Requirements” that creates a two-tiered approach to

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 12

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2014

(unaudited)

NOTE 6. (continued)

assess whether an entity is an investment company. The guidance will also require an investment company to measure non-controlling ownership interests in other investment companies at fair value and will require additional disclosures relating to investment company status, any changes thereto and information about financial support provided or contractually required to be provided to any of the investment company’s investees. The guidance is effective for financial statements with fiscal years beginning on or after December 15, 2013 and interim periods within those fiscal years. The adoption of ASU No. 2013-08 did not have an impact on the Portfolios’ financial statement disclosures.

In June 2014, FASB issued ASU No. 2014-11, “Transfers and Servicing, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures”. The guidance changes the accounting for certain repurchase agreements and expands disclosure requirements related to repurchase agreements, securities lending, repurchase-to-maturity and similar transactions. The guidance is effective for financial statements with fiscal years beginning on or after December 15, 2014 and interim periods within those fiscal years. Management is currently evaluating the implication, if any, of the additional disclosure requirements and its impact on the Portfolios’ financial statements.

NOTE 7. SUBSEQUENT EVENTS

Management has evaluated subsequent events through the date of issuance of the financial statements, and determined that no material events or transactions would require recognition or disclosure in the Subaccounts’ financial statements.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 13

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

INVESTMENT ADVISORY AGREEMENTS — CONTRACT RENEWAL

At a meeting of the Managing Board of Transamerica Asset Allocation Variable Funds (the “Trustees” or the “Board”) held on June 18-19, 2014, the Board considered the renewal of the investment advisory agreements (each an “Investment Advisory Agreement” and collectively the “Investment Advisory Agreements”) between each of Transamerica Asset Allocation – Intermediate Horizon Subaccount, Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount, and Transamerica Asset Allocation – Short Horizon Subaccount (each a “Fund” and collectively the “Funds”) and Transamerica Asset Management, Inc. (“TAM”).

Following its review and consideration, the Board determined that the terms of each Investment Advisory Agreement are reasonable and that the renewal of the Investment Advisory Agreements is in the best interests of the applicable Fund and its shareholders. The Board, including the independent members of the Board (the “Independent Board Members”), unanimously approved the renewal of each Investment Advisory Agreement through June 30, 2015. In reaching their decision, the Board Members requested and received from TAM such information as they deemed reasonably necessary to evaluate the Investment Advisory Agreements. The Board Members also considered information they had previously received from TAM as part of their regular oversight of each Fund, as well as comparative fee, expense, and performance information prepared by TAM based on information provided by Lipper Inc. (“Lipper”), an independent provider of mutual fund performance information, and other fee, expense and profitability information prepared by TAM.

In their deliberations, the Independent Board Members had the opportunity to meet privately without representatives of TAM present and were represented throughout the process by independent legal counsel. In considering the proposed continuation of each Investment Advisory Agreement, the Board Members evaluated a number of considerations that they believed, in light of the legal advice furnished to them by independent legal counsel and/or their own business judgment, to be relevant. They based their decisions on the considerations discussed below, among others, although they did not identify any particular consideration or information that was controlling of their decisions, and each Board Member may have attributed different weights to the various factors.

Nature, Extent and Quality of the Services Provided

The Board considered the nature, extent and quality of the services provided by TAM to the applicable Fund in the past and the services anticipated to be provided in the future. The Board also considered the investment approach for each Fund; the experience, capability and integrity of TAM’s senior management; the financial resources of TAM; and the professional qualifications of TAM’s portfolio management team.

Based on these considerations, the Board determined that TAM can provide investment and related services that are appropriate in scope and extent in light of the applicable Fund’s operations, the competitive landscape of the investment company business and investor needs.

Investment Performance

The Board considered the short- and longer-term performance of each Fund in light of its investment objective, policies and strategies, including relative performance against a peer universe of mutual funds, based on Lipper information, for various trailing periods ended December 31, 2013. On the basis of this information and the Board’s assessment of the nature, extent and quality of the services to be provided by TAM, the Board concluded that TAM is capable of generating a level of investment performance that is appropriate in light of the applicable Fund’s investment objectives, policies and strategies and that is competitive with other investment companies.

Investment Advisory Fees and Total Expense Ratios

The Board considered the investment advisory fee and total expense ratio of each Fund, including information comparing the investment advisory fee and total expense ratio of each Fund to the investment advisory fees and total expense ratios of peer investment companies, based on Lipper information. On the basis of these considerations, together with the other information it considered, the Board determined that the investment advisory fees to be received by TAM under the Investment Advisory Agreements are reasonable in light of the services provided.

Cost of Services Provided and Level of Profitability

The Board reviewed information provided by TAM about the cost of providing fund management, administration and other services to each Fund by TAM and its affiliates. The Board considered the profitability of TAM and its affiliates in providing these services for each Fund, as well as the allocation methodology used for calculating profitability. The Board also considered the assessment prepared by Ernst & Young LLP (“E&Y”), independent registered public accounting firm and auditor to the Funds, to assist the Board’s evaluation of TAM’s profitability analysis. E&Y’s engagement included the review and assessment of the revenue and expense allocation methodology used by TAM to estimate its profitability with respect to its relationship with the Funds, and completion of procedures in respect of the mathematical accuracy of the profitability calculation and its conformity to established allocation methodologies. After considering E&Y’s assessment and information provided by TAM, the Board concluded that, while other allocation methods may also be reasonable, TAM’s profitability methodologies are reasonable.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 14

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

INVESTMENT ADVISORY AGREEMENTS — CONTRACT RENEWAL (continued)

Based on this information, the Board determined that the profitability of TAM and its affiliates from their relationships with the Funds was not excessive.

Economies of Scale

The Board considered economies of scale with respect to the management of each Fund, whether the Fund had appropriately benefited from any economies of scale and whether there was the potential for realization of any further economies of scale. The Board also considered the existence of economies of scale with respect to management of the Transamerica mutual funds overall and the extent to which the Funds benefited from any economies of scale. The Board considered each Fund’s investment advisory fee schedule and the existence of breakpoints, if any, and also considered the extent to which TAM shared economies of scale, if any, with the Funds through investments in maintaining and developing its capabilities and services. The Board Members concluded that each Fund’s fee structure reflected an appropriate sharing of any efficiencies or economies of scale to date and noted that they will have the opportunity to periodically reexamine the appropriateness of the investment advisory fees payable to TAM and whether each Fund has achieved economies of scale in the future.

Benefits to TAM or its Affiliates from their Relationships with the Funds

The Board considered any other benefits derived by TAM and its affiliates from their relationships with the Funds. The Board noted that TAM does not realize soft dollar benefits from its relationship with the Funds.

Other Considerations

The Board noted that TAM has made a substantial commitment to the recruitment and retention of high quality personnel and maintains the financial, compliance and operational resources reasonably necessary to manage each Fund in a professional manner that is consistent with the best interests of each Fund and its shareholders. In this regard, the Board favorably considered the procedures and policies TAM has in place to enforce compliance with applicable laws and regulations. The Board also noted that TAM has made a significant entrepreneurial commitment to the management and success of the Funds.

Conclusion

After consideration of the factors described above, as well as other factors, the Board Members, including the Independent Board Members, concluded that the renewal of each Investment Advisory Agreement is in the best interests of the applicable Fund and its shareholders and voted to approve the renewal of each Investment Advisory Agreement.

| Transamerica Asset Allocation Variable Funds | Semi-Annual Report 2014 |

Page 15

|

Transamerica Partners Portfolios

|

||||||||

| I | ||||||||

(This page intentionally left blank)

Schedules of Investments Composition

At June 30, 2014

(The following charts summarize the Schedule of Investments of each portfolio by asset type)

(unaudited)

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 1

Schedules of Investments Composition (continued)

At June 30, 2014

(The following charts summarize the Schedule of Investments of each portfolio by asset type)

(unaudited)

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 2

Transamerica Partners Money Market Portfolio

SCHEDULE OF INVESTMENTS

At June 30, 2014

(unaudited)

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 3

Transamerica Partners Money Market Portfolio

SCHEDULE OF INVESTMENTS (continued)

At June 30, 2014

(unaudited)

VALUATION SUMMARY: (F)

| Level 1 Quoted Prices |

Level 2 Other Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

Value at June 30, 2014 |

|||||||||||||

| ASSETS |

||||||||||||||||

| Investment Securities |

||||||||||||||||

| Corporate Debt Securities |

$ | — | $ | 31,032,174 | $ | — | $ | 31,032,174 | ||||||||

| Certificates of Deposit |

— | 145,251,992 | — | 145,251,992 | ||||||||||||

| Commercial Paper |

— | 526,548,508 | — | 526,548,508 | ||||||||||||

| Time Deposit |

— | 20,000,000 | — | 20,000,000 | ||||||||||||

| Short-Term U.S. Government Agency Obligations |

— | 38,997,774 | — | 38,997,774 | ||||||||||||

| Repurchase Agreements |

— | 99,616,330 | — | 99,616,330 | ||||||||||||

| Total Investment Securities |

$ | — | $ | 861,446,778 | $ | — | $ | 861,446,778 | ||||||||

NOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Floating or variable rate note. Rate is listed as of June 30, 2014. |

| (B) | Rate shown reflects the yield at June 30, 2014. |

| (C) | Illiquid. Total aggregate fair value of illiquid securities is $41,000,000, or 4.76% of the portfolio’s net assets. |

| (D) | Aggregate cost for federal income tax purposes is $861,446,778. |

| (E) | Percentage rounds to less than 0.01%. |

| (F) | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers between Levels 1 and 2 during the period ended June 30, 2014. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

DEFINITIONS:

| 144A | 144A Securities are registered pursuant to Rule 144A of the Securities Act of 1933. These securities are deemed to be liquid for purposes of compliance limitations on holdings of illiquid securities and may be resold as transactions exempt from registration, normally to qualified institutional buyers. At June 30, 2014, these securities aggregated $401,694,242, or 46.63% of the portfolio’s net assets. | |

| MTN | Medium Term Note |

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 4

Transamerica Partners High Quality Bond Portfolio

SCHEDULE OF INVESTMENTS

At June 30, 2014

(unaudited)

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 5

Transamerica Partners High Quality Bond Portfolio

SCHEDULE OF INVESTMENTS (continued)

At June 30, 2014

(unaudited)

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 6

Transamerica Partners High Quality Bond Portfolio

SCHEDULE OF INVESTMENTS (continued)

At June 30, 2014

(unaudited)

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 7

Transamerica Partners High Quality Bond Portfolio

SCHEDULE OF INVESTMENTS (continued)

At June 30, 2014

(unaudited)

VALUATION SUMMARY: (F)

| Level 1 Quoted Prices |

Level 2 Other |

Level 3 Significant Unobservable Inputs |

Value at June 30, 2014 |

|||||||||||||

| ASSETS |

||||||||||||||||

| Investment Securities |

||||||||||||||||

| U.S. Government Obligations |

$ | — | $ | 43,447,419 | $ | — | $ | 43,447,419 | ||||||||

| U.S. Government Agency Obligations |

— | 60,423,406 | — | 60,423,406 | ||||||||||||

| Foreign Government Obligation |

— | 2,049,374 | — | 2,049,374 | ||||||||||||

| Mortgage-Backed Securities |

— | 53,842,709 | — | 53,842,709 | ||||||||||||

| Asset-Backed Securities |

— | 123,188,047 | — | 123,188,047 | ||||||||||||

| Corporate Debt Securities |

— | 88,155,007 | — | 88,155,007 | ||||||||||||

| Securities Lending Collateral |

17,195,097 | — | — | 17,195,097 | ||||||||||||

| Repurchase Agreement |

— | 15,886,651 | — | 15,886,651 | ||||||||||||

| Total Investment Securities |

$ | 17,195,097 | $ | 386,992,613 | $ | — | $ | 404,187,710 | ||||||||

NOTES TO SCHEDULE OF INVESTMENTS:

| (A) | All or a portion of this security is on loan. The value of all securities on loan is $16,847,642. The amount of securities on loan indicated may not correspond with the securities on loan identified because securities with pending sales are in the process of recall from the brokers. |

| (B) | Floating or variable rate note. Rate is listed as of June 30, 2014. |

| (C) | When-issued security. A conditional transaction in a security authorized for issuance, but not yet issued. |

| (D) | Rate shown reflects the yield at June 30, 2014. |

| (E) | Aggregate cost for federal income tax purposes is $404,986,528. Aggregate gross unrealized appreciation and depreciation for all securities in which there is an excess of value over tax cost were $1,902,389 and $2,701,207, respectively. Net unrealized depreciation for tax purposes is $798,818. |

| (F) | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers between Levels 1 and 2 during the period ended June 30, 2014. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

DEFINITIONS:

| 144A | 144A Securities are registered pursuant to Rule 144A of the Securities Act of 1933. These securities are deemed to be liquid for purposes of compliance limitations on holdings of illiquid securities and may be resold as transactions exempt from registration, normally to qualified institutional buyers. At June 30, 2014, these securities aggregated $46,402,878, or 12.14% of the portfolio’s net assets. | |

| MTN | Medium Term Note |

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 8

Transamerica Partners Inflation-Protected Securities Portfolio

SCHEDULE OF INVESTMENTS

At June 30, 2014

(unaudited)

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 9

Transamerica Partners Inflation-Protected Securities Portfolio

SCHEDULE OF INVESTMENTS (continued)

At June 30, 2014

(unaudited)

| WRITTEN INFLATION-CAPPED OPTIONS: (D) | ||||||||||||||||||||||||||||

| Description | Counterparty | Initial Index |

Floating Rate |

Expiration Date |

Notional Amount |

Premiums Paid (Received) |

Value | |||||||||||||||||||||

| Cap - OTC Eurostat Eurozone |

DUB | 2.50 | HICP Index | 04/26/2022 | EUR 1,070,000 | $ | (74,168 | ) | $ | (11,067 | ) | |||||||||||||||||

| WRITTEN SWAPTIONS ON INTEREST RATE SWAP AGREEMENTS: (D) | ||||||||||||||||||||||||||||

| Description | Counterparty | Floating Rate Index |

Pay/Receive Floating Rate |

Exercise Rate |

Expiration Date |

Notional Amount |

Premiums Paid (Received) |

Value | ||||||||||||||||||||

| Call-OTC 10-Year |

CITI | 3-Month USD LIBOR BBA |

Receive | 2.80 | % | 02/23/2015 | $ 8,900,000 | $ | (108,580 | ) | $ | (148,216 | ) | |||||||||||||||

| Put-OTC 10-Year |

DUB | 3-Month USD LIBOR BBA |

Pay | 3.20 | 06/30/2015 | 8,200,000 | (150,880 | ) | (150,880 | ) | ||||||||||||||||||

| Put-OTC 10-Year |

CITI | 3-Month USD LIBOR BBA |

Pay | 3.80 | 02/23/2015 | 8,900,000 | (108,580 | ) | (16,073 | ) | ||||||||||||||||||

| Put-OTC 10-Year |

DUB | 3-Month USD LIBOR BBA |

Pay | 3.85 | 01/23/2015 | 7,000,000 | (98,305 | ) | (6,618 | ) | ||||||||||||||||||

| Put-OTC 20-Year |

DUB | 6-Month EUR EURIBOR |

Pay | 4.50 | 06/08/2022 | EUR 3,200,000 | (150,269 | ) | (181,750 | ) | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| $ | (616,614 | ) | $ | (503,537 | ) | |||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

CENTRALLY CLEARED SWAP AGREEMENTS: (G)

| INTEREST RATE SWAP AGREEMENTS - FIXED RATE PAYABLE: | ||||||||||||||||||||||||

| Floating Rate Index | Fixed Rate | Expiration Date |

Notional Amount |

Fair Value |

Premiums Paid (Received) |

Net Unrealized Appreciation (Depreciation) |

||||||||||||||||||

| 3-Month USD-LIBOR |

1.54 | % | 08/01/2018 | $ | 6,200,000 | $ | (70,253 | ) | $ | 94 | $ | (70,347 | ) | |||||||||||

| 3-Month USD-LIBOR |

1.56 | 11/30/2018 | 15,100,000 | 27,819 | 275 | 27,544 | ||||||||||||||||||

| 3-Month USD-LIBOR |

2.62 | 07/02/2024 | 3,300,000 | 67 | 69 | (2 | ) | |||||||||||||||||

| 3-Month USD-LIBOR |

3.58 | 03/03/2044 | 800,000 | (52,932 | ) | 19 | (52,951 | ) | ||||||||||||||||

| 3-Month USD-LIBOR |

3.58 | 03/03/2044 | 800,000 | (53,134 | ) | 19 | (53,153 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| $ | (148,433 | ) | $ | 476 | $ | (148,909 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

OVER THE COUNTER SWAP AGREEMENTS: (D)

| INTEREST RATE SWAP AGREEMENTS - FIXED RATE RECEIVABLE: | ||||||||||||||||||||||||||||

| Floating Rate Index | Fixed Rate | Expiration Date |

Counterparty | Notional Amount |

Fair Value |

Premiums Paid (Received) |

Net Unrealized Appreciation (Depreciation) |

|||||||||||||||||||||

| Eurostat Eurozone HICP |

0.00 | % | 11/19/2015 | DUB | EUR 3,135,000 | $ | 2,049 | $ | 4,504 | $ | (2,455 | ) | ||||||||||||||||

| U.S. CPI Urban Consumers NAS |

1.81 | 03/07/2016 | UBS | $ 13,785,000 | 260,756 | 0 | 260,756 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

| $ | 262,805 | $ | 4,504 | $ | 258,301 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

| INTEREST RATE SWAP AGREEMENTS - FIXED RATE PAYABLE: | ||||||||||||||||||||||||||||

| Floating Rate Index | Fixed Rate | Expiration Date |

Counterparty | Notional Amount |

Fair Value |

Premiums Paid (Received) |

Net Unrealized Appreciation (Depreciation) |

|||||||||||||||||||||

| U.S. CPI Urban Consumers NAS |

2.04 | % | 03/07/2018 | UBS | $ | 13,785,000 | $ | 281,499 | $ | 0 | $ | 281,499 | ||||||||||||||||

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 10

Transamerica Partners Inflation-Protected Securities Portfolio

SCHEDULE OF INVESTMENTS (continued)

At June 30, 2014

(unaudited)

| FUTURES CONTRACTS: | ||||||||||||||||

| Description | Type | Contracts | Expiration Date |

Net Unrealized Appreciation (Depreciation) |

||||||||||||

| 10-Year Australian Treasury Bond |

Long | 16 | 09/15/2014 | $ | 40,368 | |||||||||||

| 10-Year Japan Government Bond |

Short | (4 | ) | 09/10/2014 | (17,768 | ) | ||||||||||

| 10-Year U.S. Treasury Note |

Long | 43 | 09/19/2014 | 43,034 | ||||||||||||

| 2-Year U.S. Treasury Note |

Short | (81 | ) | 09/30/2014 | (1,786 | ) | ||||||||||

| 5-Year U.S. Treasury Note |

Long | 255 | 09/30/2014 | 82,936 | ||||||||||||

| 90-Day Eurodollar |

Short | (231 | ) | 06/15/2015 | 18,160 | |||||||||||

| Long U.S. Treasury Bond |

Short | (114 | ) | 09/19/2014 | (149,189 | ) | ||||||||||

| Ultra Long U.S. Treasury Bond |

Short | (62 | ) | 09/19/2014 | (34,245 | ) | ||||||||||

|

|

|

|||||||||||||||

| $ | (18,490 | ) | ||||||||||||||

|

|

|

|||||||||||||||

| FORWARD FOREIGN CURRENCY CONTRACTS: (D) | ||||||||||||||||||

| Currency | Counterparty | Contracts Bought (Sold) |

Settlement Date |

Amount in U.S. Dollars Bought (Sold) |

Net Unrealized Appreciation (Depreciation) |

|||||||||||||

| AUD |

BCLY | (2,001,000 | ) | 07/23/2014 | $ | (1,834,483 | ) | $ | (48,844 | ) | ||||||||

| BRL |

SSB | 6,750,000 | 07/02/2014 | 3,013,931 | 39,138 | |||||||||||||

| BRL |

SSB | (6,750,000 | ) | 07/02/2014 | (2,996,937 | ) | (56,133 | ) | ||||||||||

| CAD |

DUB | (60,000 | ) | 07/23/2014 | (55,027 | ) | (1,168 | ) | ||||||||||

| CAD |

DUB | 47,000 | 07/23/2014 | 42,719 | 1,300 | |||||||||||||

| EUR |

UBS | (12,720,000 | ) | 07/07/2014 | (17,273,913 | ) | (144,091 | ) | ||||||||||

| EUR |

BCLY | (2,824,889 | ) | 09/12/2014 | (3,832,349 | ) | (36,846 | ) | ||||||||||

| GBP |

BCLY | (65,000 | ) | 07/07/2014 | (110,626 | ) | (608 | ) | ||||||||||

| JPY |

BCLY | (126,709,375 | ) | 09/12/2014 | (1,246,611 | ) | (4,823 | ) | ||||||||||

| MXN |

BOA | 27,952,630 | 07/23/2014 | 2,144,239 | 6,543 | |||||||||||||

| MXN |

DUB | (26,785,000 | ) | 07/23/2014 | (2,057,906 | ) | (3,034 | ) | ||||||||||

| NZD |

BOA | (1,144,000 | ) | 07/23/2014 | (984,960 | ) | (14,370 | ) | ||||||||||

|

|

|

|||||||||||||||||

| $ | (262,936 | ) | ||||||||||||||||

|

|

|

|||||||||||||||||

| FORWARD FOREIGN CROSS CURRENCY CONTRACTS: (D) | ||||||||||||||||||

| Currency | Counterparty | Contracts Bought (Sold) |

Settlement Date |

Amount in U.S. Dollars Bought (Sold) |

Net Unrealized Appreciation (Depreciation) |

|||||||||||||

| NOK |

JPM | 13,180,079 | 09/12/2014 | $ | 2,200,274 | $ | (57,524 | ) | ||||||||||

| AUD |

JPM | (2,343,629 | ) | 09/12/2014 | (2,200,274 | ) | 1,892 | |||||||||||

| AUD |

UBS | 2,265,000 | 09/12/2014 | 2,114,945 | 9,681 | |||||||||||||

| NOK |

UBS | (12,970,183 | ) | 09/12/2014 | (2,114,945 | ) | 6,319 | |||||||||||

|

|

|

|||||||||||||||||

| $ | (39,632 | ) | ||||||||||||||||

|

|

|

|||||||||||||||||

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 11

Transamerica Partners Inflation-Protected Securities Portfolio

SCHEDULE OF INVESTMENTS (continued)

At June 30, 2014

(unaudited)

VALUATION SUMMARY: (H)

| Level 1 Quoted Prices |

Level 2 Other |

Level 3 Significant Unobservable Inputs |

Value at June 30, 2014 |

|||||||||||||

| ASSETS |

||||||||||||||||

| Investment Securities |

||||||||||||||||

| U.S. Government Obligations |

$ | — | $ | 259,195,216 | $ | — | $ | 259,195,216 | ||||||||

| Foreign Government Obligations |

— | 20,179,797 | — | 20,179,797 | ||||||||||||

| Mortgage-Backed Security |

— | 63,338 | — | 63,338 | ||||||||||||

| Purchased Options |

28,125 | — | — | 28,125 | ||||||||||||

| Purchased Swaptions |

— | 877,098 | — | 877,098 | ||||||||||||

| Short-Term Investment Company |

2,371,638 | — | — | 2,371,638 | ||||||||||||

| Total Investment Securities |

$ | 2,399,763 | $ | 280,315,449 | $ | — | $ | 282,715,212 | ||||||||

| Derivative Financial Instruments |

||||||||||||||||

| Interest Rate Swap Agreements |

$ | — | $ | 572,190 | $ | — | $ | 572,190 | ||||||||

| Futures Contracts (I) |

184,498 | — | — | 184,498 | ||||||||||||

| Forward Foreign Currency Contracts (I) |

— | 46,981 | — | 46,981 | ||||||||||||

| Forward Foreign Cross Currency Contracts (I) |

— | 17,892 | — | 17,892 | ||||||||||||

| Total Derivative Financial Instruments |

$ | 184,498 | $ | 637,063 | $ | — | $ | 821,561 | ||||||||

| Level 1 Quoted Prices |

Level 2 Other |

Level 3 Significant Unobservable Inputs |

Value at June 30, 2014 |

|||||||||||||

|

LIABILITIES |

||||||||||||||||

| Derivative Financial Instruments |

||||||||||||||||

| Written Options |

$ | (7,500 | ) | $ | — | $ | — | $ | (7,500 | ) | ||||||

| Written Inflation-Capped Options |

— | (11,067 | ) | — | (11,067 | ) | ||||||||||

| Written Swaptions on Interest Rate Swap Agreements |

— | (503,537 | ) | — | (503,537 | ) | ||||||||||

| Interest Rate Swap Agreements |

— | (176,319 | ) | — | (176,319 | ) | ||||||||||

| Futures Contracts (I) |

(202,988 | ) | — | — | (202,988 | ) | ||||||||||

| Forward Foreign Currency Contracts (I) |

— | (309,917 | ) | — | (309,917 | ) | ||||||||||

| Forward Foreign Cross Currency Contracts (I) |

— | (57,524 | ) | — | (57,524 | ) | ||||||||||

| Total Derivative Financial Instruments |

$ | (210,488 | ) | $ | (1,058,364 | ) | $ | — | $ | (1,268,852 | ) | |||||

NOTES TO SCHEDULE OF INVESTMENTS:

| (A) | All or a portion of this security has been segregated by the custodian with the broker as collateral to cover margin requirements for open futures contracts. Total value of securities segregated as collateral to cover margin requirements for open futures contracts is $570,131. |

| (B) | Floating or variable rate note. Rate is listed as of June 30, 2014. |

| (C) | Percentage rounds to less than 0.1%. |

| (D) | Cash in the amount of $500,000 has been segregated by the broker with the custodian as collateral for open swaptions and/or forward foreign currency contracts. |

| (E) | The investment issuer is affiliated with the sub-adviser of the portfolio. |

| (F) | Aggregate cost for federal income tax purposes is $278,321,895. Aggregate gross unrealized appreciation and depreciation for all securities in which there is an excess of value over tax cost were $6,817,136 and $2,423,819, respectively. Net unrealized appreciation for tax purposes is $4,393,317. |

| (G) | Cash in the amount of $458,761 has been segregated by the custodian with the broker as collateral for centrally cleared swaps. |

| (H) | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers between Levels 1 and 2 during the period ended June 30, 2014. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

| (I) | Derivative financial instruments valued at unrealized appreciation (depreciation) on the instrument. |

The notes to the financial statements are an integral part of this report.

| Transamerica Partners Portfolio | Semi-Annual Report 2014 |

Page 12

Transamerica Partners Inflation-Protected Securities Portfolio

SCHEDULE OF INVESTMENTS (continued)

At June 30, 2014

(unaudited)

DEFINITIONS:

| BBA | British Bankers’ Association | |

| BCLY | Barclays Bank PLC | |

| BOA | Bank of America | |

| CITI | Citigroup, Inc. | |

| CPI | Consumer Price Index | |

| DUB | Deutsche Bank AG | |

| EURIBOR | Euro InterBank Offered Rate | |

| HICP | Harmonized Index of Consumer Prices | |

| JPM | JPMorgan Chase Bank | |

| LIBOR | London Interbank Offered Rate | |

| NAS | National Academy of Sciences | |

| NSA | Not Seasonally Adjusted | |

| OTC | Over the Counter | |