As filed with the SEC on March 9, 2012.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07717

| TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS |

570 Carillon Parkway, St. Petersburg, Florida 33716

(Address of Principal Executive Offices) (Zip Code)

Dennis P. Gallagher, Esq. P.O. Box 9012, Clearwater, Florida 33758-9771

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: (727) 299-1800

Date of fiscal year end: December 31

Date of reporting period: January 1, 2011 – December 31, 2011

Item 1: Report(s) to Shareholders. The Annual Report is attached.

TRANSAMERICA PARTNERS VARIABLE FUNDS

TRANSAMERICA ASSET

ALLOCATION VARIABLE FUNDS

Annual Report

December 31, 2011

This report is not to be construed as an offering for sale of any contracts participating in the Subaccounts (Series) of the Transamerica Partners Variable Funds or the Transamerica Asset Allocation Variable Funds, or as a solicitation of an offer to buy contracts unless preceded by or accompanied by a current prospectus which contains complete information about charges and expenses.

This report consists of the annual report of the Transamerica Asset Allocation Variable Funds and the annual reports of the Transamerica Partners Portfolios and the Calvert VP SRI Balanced Portfolio, the underlying portfolios in which the Transamerica Partners Variable Funds invest.

Proxy Voting Policies and Procedures

A description of the proxy voting policies and procedures of the Transamerica Asset Allocation Variable Funds and Transamerica Partners Portfolios is included in the Statement of Additional Information (“SAI”), which is available without charge, upon request: (i) by calling 1-888-233-4339; (ii) on the Subaccounts’ website at www.transamericapartners.com or (iii) on the SEC’s website at www.sec.gov. In addition, the Transamerica Asset Allocation Variable Funds and the Transamerica Partners Portfolios are required to file Form N-PX, with the complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. Form N-PX for the twelve months ended June 30, 2011, is available without charge, upon request by calling 1-800-851-9777 and on the SEC’s website at http://www.sec.gov.

Quarterly Portfolios

Transamerica Asset Allocation Variable Funds will file their portfolios of investments on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Subaccounts’ Form N-Q is available on the SEC’s website at www.sec.gov. The Subaccounts’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. For information on the operation of the SEC’s Public Reference Room, call 1-800-SEC-0330. You may also obtain a copy of Form N-Q without charge, upon request, by calling 1-888-233-4339. Form N-Q for the corresponding Transamerica Partners Portfolios is also available without charge on the SEC website, at the SEC’s Public Reference Room, or by calling 1-888-233-4339.

TRANSAMERICA FINANCIAL LIFE INSURANCE COMPANY

440 Mamaroneck Avenue

Harrison, New York 10528

December 31, 2011

To Contract Holders with Interests in

the Transamerica Partners Variable Funds:

We are pleased to present the most recent annual reports for the Transamerica Partners Portfolios and for the Calvert VP SRI Balanced Portfolio. As required under applicable law, we are sending these annual reports to contract holders of Group Variable Annuity Contracts issued by Transamerica Financial Life Insurance Company with unit interests in one or more of the Transamerica Partners Variable Funds. Each subaccount available within the Transamerica Partners Variable Funds, other than the Calvert Subaccount, invests its assets in a corresponding mutual fund that is a series of Transamerica Partners Portfolios. The Calvert Subaccount invests in the Calvert VP SRI Balanced Portfolio, a series of Calvert Variable Series, Inc.

Please call your retirement plan administrator, Diversified Retirement Corporation, at (800) 755-5801 if you have any questions regarding these reports.

(This page intentionally left blank)

Dear Fellow Shareholder,

On behalf of Transamerica Asset Allocation Variable Funds, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all shareholders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to shareholders that may have required their vote.

We believe it is important to understand market conditions over the last year in order to provide a context for reading this report. As 2011 began, the Federal Reserve was in the middle of a second round of monetary stimulus known as quantitative easing (“QE2”). This effort began pumping what would eventually total $600 billion into the U.S. economy. In response, the U.S. economy and corporate earnings picked up steam throughout the 1st quarter. Equity and bond markets followed suit. During this same time, commodities prices and inflation also surged. In order to fight the inflation the Federal Reserve stimulus was creating, most central banks across the globe tightened monetary policy. In the spring, this global tightening collided with a global supply chain disruption caused by the Japanese tsunami. As a result, the global economy began slowing. As summer arrived, slower growth combined with concerns about high U.S. and European debt levels. Developments came to a head in late summer as the credit rating of the U.S. was lowered and Europe faced the possibility of a default by Greece. As a result, the global equity and corporate bond markets fell sharply while U.S. Treasuries rallied as investors sought safety. Fortunately, commodity prices including oil also fell sharply, putting more disposable income in consumer pockets.

As summer transitioned to fall, the U.S. economy re-strengthened. As a result, the U.S. corporate equity and bond markets responded in the fourth quarter by recovering much of the summer’s losses. For the twelve months ending December 31, 2011, the Dow Jones Industrial Average returned 8.38%, the Standard & Poor’s 500® Index returned 2.11%, and the Barclays Capital U.S. Aggregate Bond Index returned 7.84%. While the U.S. economy re-strengthened, the rest of the global economy continued to experience either slowing growth or contraction as European austerity programs continued to be implemented and European banks began selling Asian assets. As a result, European and Asian markets failed to recover the summer’s losses and the Morgan Stanley Capital International World ex-US Index returned (11.78)% for the year ending December 31, 2011. This serves as a good reminder that it is always important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisers are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

| John K. Carter Chairman of the Board, President & Chief Executive Officer Transamerica Asset Allocation Variable Funds |

Christopher A. Staples Vice President & Chief Investment Officer Transamerica Asset Allocation Variable Funds |

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of the Transamerica Asset Allocation Variable Funds. These views are subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of the Transamerica Asset Allocation Variable Funds.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 1

Understanding Your Funds’ Expenses

(unaudited)

UNIT HOLDER EXPENSES

Transamerica Asset Allocation Variable Funds (individually, a “Subaccount” and collectively, the “Subaccounts”) is a separate investment account established by Transamerica Financial Life Insurance Company, Inc. (“TFLIC”), and is used as an investment vehicle under certain tax-deferred annuity contracts issued by TFLIC. Each Subaccount invests in underlying subaccounts of Transamerica Partners Variable Funds (“TPVF”), a unit investment trust. As a contractholder of a Subaccount, you will bear the ongoing costs of managing the corresponding subaccount in which your Subaccount invests. You will also bear the cost of operating the Subaccount. The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Subaccounts and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at July 1, 2011 and held for the entire period until December 31, 2011.

ACTUAL EXPENSES

The information in the table under the heading “Actual Expenses” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number shown under the heading “Expenses paid during Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table under the heading “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Subaccount’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Subaccount’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Subaccount versus other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| Actual Expenses | Hypothetical Expenses (B) | |||||||||||||||||||||||

| Fund Name |

Beginning Account Value |

Ending Account Value |

Expenses Paid During Period (A) |

Ending Account Value |

Expenses Paid During Period (A) |

Annualized Expense Ratio (C) |

||||||||||||||||||

| Transamerica Asset Allocation Variable Funds - Short Horizon Subaccount |

$ | 1,000.00 | $ | 1,012.20 | $ | 1.01 | $ | 1,024.20 | $ | 1.02 | 0.20 | % | ||||||||||||

| Transamerica Asset Allocation Variable Funds - Intermediate Horizon Subaccount |

1,000.00 | 958.10 | 0.99 | 1,024.20 | 1.02 | 0.20 | % | |||||||||||||||||

| Transamerica Asset Allocation Variable Funds - Intermediate/Long Horizon Subaccount |

1,000.00 | 934.00 | 0.97 | 1,024.20 | 1.02 | 0.20 | % | |||||||||||||||||

| (A) | Expenses are equal to each Subaccount’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days). |

| (B) | 5% return per year before actual expenses. |

| (C) | Expense ratios do not include expenses of the investment companies in which the portfolios invest. |

| Transamerica Asset Allocation Variable Funds Annual Report 2011 |

Page 2

Schedules of Investments Composition

At December 31, 2011

(the following charts summarize the Schedule of Investments of each Subaccount by asset type)

(unaudited)

| Transamerica Asset Allocation Variable Funds - Short Horizon Subaccount |

% of Net Assets |

|||

| Fixed Income |

89.9 | % | ||

| Domestic Equity |

8.0 | |||

| International Equity |

1.9 | |||

| Money Market |

0.2 | |||

| Other Assets and Liabilities - Net |

0.0 | * | ||

|

|

|

|||

| Total |

100.0 | % | ||

|

|

|

|||

| Transamerica Asset Allocation Variable Funds - Intermediate Horizon Subaccount |

% of Net Assets |

|||

| Fixed Income |

50.3 | % | ||

| Domestic Equity |

38.8 | |||

| International Equity |

10.7 | |||

| Money Market |

0.2 | |||

| Other Assets and Liabilities - Net |

0.0 | * | ||

|

|

|

|||

| Total |

100.0 | % | ||

|

|

|

|||

| Transamerica Asset Allocation Variable Funds - Intermediate/Long Horizon Subaccount |

% of Net Assets |

|||

| Domestic Equity |

54.2 | % | ||

| Fixed Income |

29.4 | |||

| International Equity |

16.2 | |||

| Money Market |

0.2 | |||

| Other Assets and Liabilities - Net |

0.0 | * | ||

|

|

|

|||

| Total |

100.0 | % | ||

|

|

|

|||

| * | Amount rounds to less than 0.1%. |

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 3

Transamerica Asset Allocation Variable —

Short Horizon Subaccount

SCHEDULE OF INVESTMENTS

At December 31, 2011

| Shares | Value (000’s) |

|||||||

| INVESTMENT COMPANIES - 100.0%* |

||||||||

| Domestic Equity - 8.0% |

||||||||

| Transamerica Partners Variable Large Growth ‡ |

5,181 | $ | 262 | |||||

| Transamerica Partners Variable Large Value ‡ |

5,657 | 260 | ||||||

| Transamerica Partners Variable Small Core ‡ |

5,172 | 190 | ||||||

| Fixed Income - 89.9% |

||||||||

| Transamerica Partners Variable Core Bond ‡ |

102,897 | 4,195 | ||||||

| Transamerica Partners Variable High Quality Bond ‡ |

78,674 | 1,379 | ||||||

| Transamerica Partners Variable High Yield Bond ‡ |

37,878 | 931 | ||||||

| Transamerica Partners Variable Inflation-Protected Securities ‡ |

53,681 | 1,479 | ||||||

| International Equity - 1.9% |

||||||||

| Transamerica Partners Variable International Equity ‡ |

9,693 | 172 | ||||||

| Money Market - 0.2% |

||||||||

| Transamerica Partners Variable Money Market ‡ |

842 | 18 | ||||||

|

|

|

|||||||

| Total Investment Companies (cost $7,352)** |

8,886 | |||||||

| Other Assets and Liabilities - Net |

(2 | ) | ||||||

|

|

|

|||||||

| Net Assets |

$ | 8,884 | ||||||

|

|

|

|||||||

NOTES TO SCHEDULE OF INVESTMENTS (all amounts in thousands):

| * | Each Subaccount invests its assets in an affiliated fund of Transamerica Partners Variable Funds. |

| ‡ | Non-income producing security. |

| ** | Aggregate cost for federal income tax purposes is $7,352. Aggregate gross/net unrealized appreciation for all securities in which there is an excess of value over tax cost was $1,534. |

VALUATION SUMMARY (all amounts in thousands):*

| Level 1 - Quoted Prices |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Value at 12/31/2011 |

|||||||||||||

| Investment Companies |

$ | 8,886 | $ | — | $ | — | $ | 8,886 | ||||||||

| * | See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 4

Transamerica Asset Allocation Variable —

Intermediate Horizon Subaccount

SCHEDULE OF INVESTMENTS

At December 31, 2011

| Shares | Value (000’s) |

|||||||

| INVESTMENT COMPANIES - 100.0%* |

||||||||

| Domestic Equity - 38.8% |

||||||||

| Transamerica Partners Variable Large Growth ‡ |

64,015 | $ | 3,235 | |||||

| Transamerica Partners Variable Large Value ‡ |

66,360 | 3,055 | ||||||

| Transamerica Partners Variable Small Core ‡ |

57,169 | 2,100 | ||||||

| Fixed Income - 50.3% |

||||||||

| Transamerica Partners Variable Core Bond ‡ |

127,646 | 5,203 | ||||||

| Transamerica Partners Variable High Quality Bond ‡ |

99,406 | 1,743 | ||||||

| Transamerica Partners Variable High Yield Bond ‡ |

54,562 | 1,342 | ||||||

| Transamerica Partners Variable Inflation-Protected Securities ‡ |

93,285 | 2,570 | ||||||

| International Equity - 10.7% |

||||||||

| Transamerica Partners Variable International Equity ‡ |

130,224 | 2,312 | ||||||

| Money Market - 0.2% |

||||||||

| Transamerica Partners Variable Money Market ‡ |

2,048 | 43 | ||||||

|

|

|

|||||||

| Total Investment Companies (cost $19,392)** |

21,603 | |||||||

| Other Assets and Liabilities - Net |

(4 | ) | ||||||

|

|

|

|||||||

| Net Assets |

$ | 21,599 | ||||||

|

|

|

|||||||

NOTES TO SCHEDULE OF INVESTMENTS (all amounts in thousands):

| * | Each Subaccount invests its assets in an affiliated fund of Transamerica Partners Variable Funds. |

| ‡ | Non-income producing security. |

| ** | Aggregate cost for federal income tax purposes is $19,397. Aggregate gross unrealized appreciation/depreciation for all securities in which there is an excess of value over tax cost were $2,722 and $516, respectively. Net unrealized appreciation for tax purposes is $2,206. |

VALUATION SUMMARY (all amounts in thousands):*

| Level 1 - Quoted Prices |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Value at 12/31/2011 |

|||||||||||||

| Investment Companies |

$ | 21,603 | $ | — | $ | — | $ | 21,603 | ||||||||

| * | See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 5

Transamerica Asset Allocation Variable —

Intermediate/Long Horizon Subaccount

SCHEDULE OF INVESTMENTS

At December 31, 2011

| Shares | Value (000’s) |

|||||||

| INVESTMENT COMPANIES - 100.0%* |

||||||||

| Domestic Equity - 54.2% |

||||||||

| Transamerica Partners Variable Large Growth ‡ |

115,270 | $ | 5,826 | |||||

| Transamerica Partners Variable Large Value ‡ |

115,306 | 5,308 | ||||||

| Transamerica Partners Variable Small Core ‡ |

110,342 | 4,052 | ||||||

| Fixed Income - 29.4% |

||||||||

| Transamerica Partners Variable Core Bond ‡ |

100,656 | 4,102 | ||||||

| Transamerica Partners Variable High Quality Bond ‡ |

31,074 | 545 | ||||||

| Transamerica Partners Variable High Yield Bond ‡ |

46,916 | 1,154 | ||||||

| Transamerica Partners Variable Inflation-Protected Securities ‡ |

87,837 | 2,420 | ||||||

| International Equity - 16.2% |

||||||||

| Transamerica Partners Variable International Equity ‡ |

255,889 | 4,544 | ||||||

| Money Market - 0.2% |

||||||||

| Transamerica Partners Variable Money Market ‡ |

2,656 | 56 | ||||||

|

|

|

|||||||

| Total Investment Companies (cost $26,477)** |

28,007 | |||||||

| Other Assets and Liabilities - Net |

(4 | ) | ||||||

|

|

|

|||||||

| Net Assets |

$ | 28,003 | ||||||

|

|

|

|||||||

NOTES TO SCHEDULE OF INVESTMENTS (all amounts in thousands):

| * | Each Subaccount invests its assets in an affiliated fund of Transamerica Partners Variable Funds. |

| ‡ | Non-income producing security. |

| ** | Aggregate cost for federal income tax purposes is $26,501. Aggregate gross unrealized appreciation/depreciation for all securities in which there is an excess of value over tax cost were $2,604 and $1,098, respectively. Net unrealized appreciation for tax purposes is $1,506. |

VALUATION SUMMARY (all amounts in thousands):*

| Investment Securities |

Level 1 - Quoted Prices |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Value at 12/31/2011 |

||||||||||||

| Investment Companies |

$ | 28,007 | $ | — | $ | — | $ | 28,007 | ||||||||

| * | See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 6

STATEMENTS OF ASSETS AND LIABILITIES

At December 31, 2011

(all amounts except unit value in thousands)

| Short Horizon |

Intermediate Horizon |

Intermediate/Long Horizon |

||||||||||

| Assets: |

||||||||||||

| Investments in affiliated investment companies, at value |

$ | 8,886 | $ | 21,603 | $ | 28,007 | ||||||

| Receivables: |

||||||||||||

| Units sold |

8 | 16 | 22 | |||||||||

| Affiliated investment companies sold |

15 | 58 | 43 | |||||||||

|

|

|

|

|

|

|

|||||||

| 8,909 | 21,677 | 28,072 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Liabilities: |

||||||||||||

| Accounts payable and accrued liabilities: |

||||||||||||

| Units redeemed |

2 | 47 | 4 | |||||||||

| Affiliated investment companies purchased |

21 | 27 | 60 | |||||||||

| Investment advisory fees |

2 | 4 | 5 | |||||||||

|

|

|

|

|

|

|

|||||||

| 25 | 78 | 69 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Net Assets |

$ | 8,884 | $ | 21,599 | $ | 28,003 | ||||||

|

|

|

|

|

|

|

|||||||

| Net Assets Consist of: |

||||||||||||

| Cost of accumulation units |

4,749 | 13,346 | 21,084 | |||||||||

| (Accumulated) net investment (loss) |

(222 | ) | (627 | ) | (870 | ) | ||||||

| Undistributed net realized gains |

2,823 | 6,669 | 6,259 | |||||||||

| Net unrealized appreciation on investments in affiliated investment companies |

1,534 | 2,211 | 1,530 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Assets |

$ | 8,884 | $ | 21,599 | $ | 28,003 | ||||||

|

|

|

|

|

|

|

|||||||

| Accumulation units |

468 | 1,189 | 1,583 | |||||||||

|

|

|

|

|

|

|

|||||||

| Unit value |

$ | 18.99 | $ | 18.17 | $ | 17.70 | ||||||

|

|

|

|

|

|

|

|||||||

| Investments in affiliated investment companies, at cost |

$ | 7,352 | $ | 19,392 | $ | 26,477 | ||||||

|

|

|

|

|

|

|

|||||||

STATEMENTS OF OPERATIONS

For the year ended December 31, 2011

(all amounts in thousands)

| Short Horizon |

Intermediate Horizon |

Intermediate/Long Horizon |

||||||||||

| Investment advisory fees |

$ | 19 | $ | 47 | $ | 60 | ||||||

|

|

|

|

|

|

|

|||||||

| Net investment loss |

(19 | ) | (47 | ) | (60 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net realized and unrealized gain (loss) on investments in affiliates: |

||||||||||||

| Realized gain from investments in affiliated investment companies |

315 | 994 | 541 | |||||||||

| Change in net unrealized appreciation (depreciation) on investments in affiliated investment companies |

80 | (836 | ) | (909 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net realized and unrealized gain (loss) on investments in affiliated investment companies |

395 | 158 | (368 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Net increase (decrease) In net assets resulting from operations |

$ | 376 | $ | 111 | $ | (428 | ) | |||||

|

|

|

|

|

|

|

|||||||

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 7

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended:

(all amounts in thousands)

| Short Horizon | Intermediate Horizon | Intermediate/Long Horizon | ||||||||||||||||||||||

| Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

|||||||||||||||||||

| From operations: |

||||||||||||||||||||||||

| Net investment loss |

$ | (19 | ) | $ | (19 | ) | $ | (47 | ) | $ | (47 | ) | $ | (60 | ) | $ | (58 | ) | ||||||

| Net realized gain on investments in affiliated investment companies |

315 | 217 | 994 | 411 | 541 | 236 | ||||||||||||||||||

| Change in net unrealized appreciation (depreciation) on investments in affiliated investment companies |

80 | 508 | (836 | ) | 2,219 | (909 | ) | 3,697 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net assets resulting from operations |

376 | 706 | 111 | 2,583 | (428 | ) | 3,875 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| From unit transactions: |

||||||||||||||||||||||||

| Units sold |

1,591 | 2,071 | 3,096 | 3,088 | 3,376 | 3,680 | ||||||||||||||||||

| Units redeemed |

(2,691 | ) | (3,281 | ) | (5,788 | ) | (5,786 | ) | (5,936 | ) | (7,042 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net decrease in net assets resulting from unit transactions |

(1,100 | ) | (1,210 | ) | (2,692 | ) | (2,698 | ) | (2,560 | ) | (3,362 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total increase (decrease) in net assets |

(724 | ) | (504 | ) | (2,581 | ) | (115 | ) | (2,988 | ) | 513 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net assets: |

||||||||||||||||||||||||

| Beginning of year |

9,608 | 10,112 | 24,180 | 24,295 | 30,991 | 30,478 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| End of year |

$ | 8,884 | $ | 9,608 | $ | 21,599 | $ | 24,180 | $ | 28,003 | $ | 30,991 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Undistributed net investment income |

$ | (222 | ) | $ | (203 | ) | $ | (627 | ) | $ | (580 | ) | $ | (870 | ) | $ | (810 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Units outstanding beginning of year |

527 | 597 | 1,334 | 1,498 | 1,722 | 1,932 | ||||||||||||||||||

| Units sold |

85 | 117 | 169 | 184 | 187 | 226 | ||||||||||||||||||

| Units redeemed |

(144 | ) | (187 | ) | (314 | ) | (348 | ) | (326 | ) | (436 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Units outstanding end of year |

468 | 527 | 1,189 | 1,334 | 1,583 | 1,722 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 8

FINANCIAL HIGHLIGHTS

For the years ended:

| Short Horizon | ||||||||||||||||||||

| For a unit outstanding throughout each period |

December 31, 2011 |

December 31, 2010 |

December 31, 2009 |

December 31, 2008 |

December 31, 2007 |

|||||||||||||||

| Unit value |

||||||||||||||||||||

| Beginning of year |

$ | 18.24 | $ | 16.95 | $ | 14.66 | $ | 16.28 | $ | 15.59 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Investment operations |

||||||||||||||||||||

| From net investment (loss)(A) |

(0.04 | ) | (0.04 | ) | (0.03 | ) | (0.03 | ) | (0.03 | ) | ||||||||||

| From net realized and unrealized gains (loss) on investments in affiliated investment companies |

0.79 | 1.33 | 2.32 | (1.59 | ) | 0.72 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

0.75 | 1.29 | 2.29 | (1.62 | ) | 0.69 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Unit value |

||||||||||||||||||||

| End of year |

$ | 18.99 | $ | 18.24 | $ | 16.95 | $ | 14.66 | $ | 16.28 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return |

4.07 | % | 7.65 | % | 15.62 | % | (9.95 | %) | 4.43 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net assets End of Year (000’s) |

$ | 8,884 | $ | 9,608 | $ | 10,112 | $ | 9,450 | $ | 11,097 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratio and supplemental data |

||||||||||||||||||||

| Expenses to average net assets(B) |

0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||

| Net investment (loss), to average net assets |

(0.20 | %) | (0.20 | %) | (0.20 | %) | (0.20 | %) | (0.20 | %) | ||||||||||

| Portfolio turnover rate(C) |

46 | % | 36 | % | 28 | % | 125 | % | 55 | % | ||||||||||

| Intermediate Horizon | ||||||||||||||||||||

| For a unit outstanding throughout each period |

December 31, 2011 |

December 31, 2010 |

December 31, 2009 |

December 31, 2008 |

December 31, 2007 |

|||||||||||||||

| Unit value |

||||||||||||||||||||

| Beginning of year |

$ | 18.13 | $ | 16.22 | $ | 13.46 | $ | 18.16 | $ | 17.44 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Investment operations |

||||||||||||||||||||

| From net investment (loss)(A) |

(0.04 | ) | (0.03 | ) | (0.03 | ) | (0.03 | ) | (0.04 | ) | ||||||||||

| From net realized and unrealized gains (loss) on investments in affiliated investment companies |

0.08 | 1.94 | 2.79 | (4.67 | ) | 0.76 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

0.04 | 1.91 | 2.76 | (4.70 | ) | 0.72 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Unit value |

||||||||||||||||||||

| End of year |

$ | 18.17 | $ | 18.13 | $ | 16.22 | $ | 13.46 | $ | 18.16 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return |

0.19 | % | 11.81 | % | 20.51 | % | (25.88 | %) | 4.13 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net assets End of Year (000’s) |

$ | 21,599 | $ | 24,180 | $ | 24,295 | $ | 21,990 | $ | 32,583 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratio and supplemental data |

||||||||||||||||||||

| Expenses to average net assets(B) |

0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||

| Net investment (loss), to average net assets |

(0.20 | %) | (0.20 | %) | (0.20 | %) | (0.20 | %) | (0.20 | %) | ||||||||||

| Portfolio turnover rate(C) |

42 | % | 25 | % | 34 | % | 111 | % | 18 | % | ||||||||||

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 9

FINANCIAL HIGHLIGHTS (continued)

For the years ended:

| Intermediate/Long Horizon | ||||||||||||||||||||

| For a unit outstanding throughout each period |

December 31, 2011 |

December 31, 2010 |

December 31, 2009 |

December 31, 2008 |

December 31, 2007 |

|||||||||||||||

| Unit value |

||||||||||||||||||||

| Beginning of year |

$ | 17.99 | $ | 15.78 | $ | 12.89 | $ | 19.30 | $ | 18.56 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Investment operations |

||||||||||||||||||||

| From net investment (loss)(A) |

(0.04 | ) | (0.03 | ) | (0.03 | ) | (0.03 | ) | (0.04 | ) | ||||||||||

| From net realized and unrealized gains (loss) on investments in affiliated investment companies |

(0.25 | ) | 2.24 | 2.92 | (6.38 | ) | 0.78 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

(0.29 | ) | 2.21 | 2.89 | (6.41 | ) | 0.74 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Unit value |

||||||||||||||||||||

| End of year |

$ | 17.70 | $ | 17.99 | $ | 15.78 | $ | 12.89 | $ | 19.30 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return |

(1.66 | %) | 14.05 | % | 22.42 | % | (33.21 | %) | 3.99 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net assets End of Year (000’s) |

$ | 28,003 | $ | 30,991 | $ | 30,478 | $ | 33,453 | $ | 52,704 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratio and supplemental data |

||||||||||||||||||||

| Expenses to average net assets(B) |

0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||

| Net investment (loss), to average net assets |

(0.20 | %) | (0.20 | %) | (0.20 | %) | (0.20 | %) | (0.20 | %) | ||||||||||

| Portfolio turnover rate(C) |

34 | % | 23 | % | 54 | % | 105 | % | 21 | % | ||||||||||

| (A) | Calculation is based on average number of units outstanding. |

| (B) | Ratios exclude expenses incurred by the underlying affiliated investment companies in which the Subaccounts invest. |

| (C) | Does not include the Portfolio activity of the underlying affiliated investment companies. |

| Note: | Prior to January 1, 2010, the financial highlights were audited by another independent registered public accounting firm. |

The notes to the financial statements are an integral part of this report.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 10

NOTES TO FINANCIAL STATEMENTS

At December 31, 2011

(all amounts in thousands)

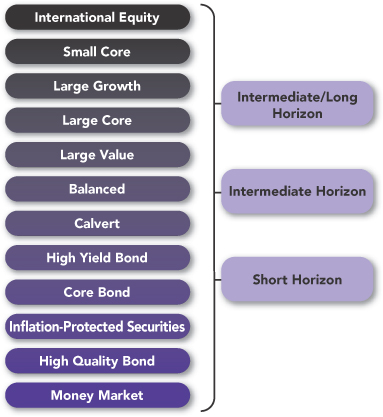

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Transamerica Asset Allocation Variable Funds (the “Separate Account”), is a non-diversified separate account of Transamerica Financial Life Insurance Company (“TFLIC”), and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a management investment company. The Separate Account is composed of three different subaccounts that are separate investment funds: Transamerica Asset Allocation – Short Horizon Subaccount (“Short Horizon”), Transamerica Asset Allocation – Intermediate Horizon Subaccount (“Intermediate Horizon”), and Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount (“Intermediate/Long Horizon”) (individually, a “Subaccount” and collectively, the “Subaccounts”). Each Subaccount invests all of its investable assets among certain Transamerica Partners Variable Funds (“TPVF”). Certain TPVF subaccounts invest all their investable assets in the Transamerica Partners Portfolios.

This report should be read in conjunction with the Subaccounts’ current prospectus, which contains more complete information about the Subaccounts, including investment objectives and strategies.

In the normal course of business, the Separate Account enters into contracts that contain a variety of representations that provide general indemnifications. The Separate Account’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Separate Account and/or its affiliates that have not yet occurred. However, based on experience, the Separate Account expects the risk of loss to be remote.

In preparing the Separate Account’s financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”), estimates or assumptions may be used that affect reported amounts and disclosures. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Separate Account.

Operating expenses: The Separate Account accounts separately for the assets, liabilities, and operations of each Subaccount. Each Subaccount will indirectly bear its share of fees and expenses incurred by TPVF in which it invests. These expenses are not reflected in the expenses in the Statements of Operations and are not included in the ratios to average net assets shown in the Financial Highlights.

Security transactions: Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Net realized gain (loss) from investments in affiliates for the Subaccounts are from investments in units of affiliated investment companies.

NOTE 2. SECURITY VALUATIONS

All investments in securities are recorded at their estimated fair value. The value of each Subaccount’s investment in a corresponding subaccount of TPVF is valued at the unit value per share of each Subaccount determined as of the close of business of the New York Stock Exchange (“NYSE”), normally, 4:00 P.M. Eastern time, each day the NYSE is open for business. The Subaccount utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

Level 1—Unadjusted quoted prices in active markets for identical securities.

Level 2—Inputs, other than quoted prices included in Level 1, that are observable, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3—Unobservable inputs, which may include Transamerica Asset Management, Inc.’s (“TAM”) Valuation Committee’s own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the sub-advisor, issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, but not limited to, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is generally greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different Levels of the fair value hierarchy. In such cases, for disclosure purposes, the Level in the fair value hierarchy that is assigned to the fair value measurement of a security is determined based on the lowest Level input that is significant to the fair value measurement in its entirety.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 11

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2011

(all amounts in thousands)

NOTE 2. (continued)

Fair value measurements: Investment company securities are valued at the net asset value of the underlying subaccounts. These securities are actively traded and no valuation adjustments are applied. They are categorized in Level 1 of the fair value hierarchy.

The hierarchy classification of inputs used to value the Subaccounts’ investments at December 31, 2011 are disclosed in the Valuation Summary of each of the Subaccounts’ Schedule of Investments. Transfers between Levels are considered to have occurred at the end of the reporting period.

There were no transfers into or out of any Levels as described above during the year ended December 31, 2011.

NOTE 3. RELATED PARTY TRANSACTIONS

The Separate Account has entered into an Investment Advisory Agreement with TAM. TAM is directly owned by Western Reserve Life Assurance Co. of Ohio and AUSA Holding Company (“AUSA”), both of which are indirect, wholly-owned subsidiaries of AEGON NV. AUSA is wholly-owned by AEGON USA, LLC (“AEGON USA”), a financial services holding company whose primary emphasis is on life and health insurance, and annuity and investment products. AEGON USA is owned by AEGON US Holding Corporation, which is owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is owned by The AEGON Trust, which is owned by AEGON International B.V., which is owned by AEGON NV, a Netherlands corporation, and a publicly traded international insurance group.

Pursuant to the Investment Advisory Agreement TAM provides general investment advice to each Subaccount. For providing these services and facilities and for bearing the related expenses, TAM receives a monthly fee from each Subaccount which is accrued daily and payable monthly at an annual rate equal to 0.20% of the average daily net assets of each Subaccount.

TFLIC is the legal holder of the assets in the Subaccounts and will at all times maintain assets in the Subaccounts with a total market value of at least equal to the contract liabilities for the Subaccounts.

Certain Managing Board Members and officers of TFLIC are also trustees, officers or employees of TAM or its affiliates. None of the non-independent Managing Board Members so affiliated receive compensation for services as Managing Board Members of the Separate Account. Similarly, none of the Separate Account’s officers receive compensation from the Subaccounts. The independent board members are also trustees of the Transamerica Partners Portfolios for which they receive fees.

Deferred compensation plan: Under a non-qualified deferred compensation plan, effective January 1, 1996, as amended and restated (the “Deferred Compensation Plan”), available to the Trustees, compensation may be deferred that would otherwise be payable by the Trust to an Independent Trustee on a current basis for services rendered as Trustee. Deferred compensation amounts will accumulate based on investment options under Transamerica Partners Institutional Funds and Transamerica Institutional Asset Allocation Funds, or the value of Class A (or comparable) shares of a series of Transamerica Funds (without imposition of sales charge), as elected by the Trustee.

NOTE 4. SECURITIES TRANSACTIONS

The cost of affiliated investments purchased and proceeds from affiliated investments sold for the year ended December 31, 2011 were as follows:

| Purchases of affiliated investments: | Proceeds from maturities and sales affiliated investments: |

|||||||||||||||

| Fund |

Long-term | U.S. Government | Long-term | U.S. Government | ||||||||||||

| Short Horizon |

$ | 4,282 | $ | — | $ | 5,400 | $ | — | ||||||||

| Intermediate Horizon |

9,819 | — | 12,558 | — | ||||||||||||

| Intermediate/Long Horizon |

10,249 | — | 12,869 | — | ||||||||||||

NOTE 5. FEDERAL INCOME TAXES

The operations of the Separate Account form a part of, and are taxed with, the operations of TFLIC, a wholly-owned subsidiary of AEGON USA. TFLIC does not expect, based upon current tax law, to incur any income tax upon the earnings or realized capital gains attributable to the Separate Account. Based upon this expectation, no charges are currently being deducted from the Separate Account for federal income tax purposes. Management has evaluated the Separate Account’s tax positions taken for all open tax years (2008-2010), or expected to be taken in the Separate Account’s 2011 tax returns. Each subaccount is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 12

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2011

(all amounts in thousands)

NOTE 6. ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (“FASB”) issued the authoritative guidance “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” which seeks to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP. The adoption of this disclosure requirement is effective for financial statements interim and annual periods beginning after December 15, 2011. Management is currently evaluating the application of the adoption of the additional disclosure requirements and its impact on the Subaccounts’ financial statements.

In April 2011, FASB issued an amendment to authoritative guidance “Reconsideration of Effective Control for Repurchase Agreements” which amends specifically the criteria required to determine whether a repurchase agreement and similar agreements should be accounted for as sales of financial assets or secured borrowings with commitments. The adoption of this guidance is effective for the first interim or annual period beginning on or after December 15, 2011 prospectively to transactions or modifications of existing transactions that occur on or after the effective date. Management is currently evaluating the application of the adoption of the additional disclosure requirements and its impact on the Subaccounts’ financial statements.

NOTE 7. SUBSEQUENT EVENT

Management has evaluated subsequent events through the date of issuance of the financial statements, and determined that no other material events or transactions would require recognition or disclosure in the Subaccounts’ financial statements.

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 13

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Transamerica Financial Life Insurance Company and the Contractholders of Transamerica Asset Allocation Variable Funds:

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Transamerica Asset Allocation Variable Funds (comprising, respectively, Transamerica Asset Allocation—Short Horizon Subaccount, Transamerica Asset Allocation—Intermediate Horizon Subaccount and Transamerica Asset Allocation—Intermediate/Long Horizon Subaccount) (collectively, the “Subaccounts”) as of December 31, 2011, and the related statements of operations for the year then ended and the statements of changes in net assets and the financial highlights for each of the two years in the period then ended. These financial statements and financial highlights are the responsibility of the Subaccounts’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for periods ended prior to January 1, 2010 were audited by another independent registered public accounting firm whose report, dated March 1, 2010, expressed an unqualified opinion on those financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Subaccounts’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Subaccounts’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2011, by correspondence with the transfer agent and others or by other appropriate auditing procedures where replies from others were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the respective Subaccounts constituting Transamerica Asset Allocation Variable Funds at December 31, 2011, and the results of their operations for the year then ended and the changes in their net assets and the financial highlights for each of the two years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 27, 2012

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 14

BOARD MEMBERS AND OFFICERS

(unaudited)

The Board Members and executive officers of the Trust are listed below. The Board governs each fund and is responsible for protecting the interests of the shareholders. The Board Members are experienced executives who meet periodically throughout the year to oversee the business affairs of each fund and the operation of the Trust by its officers. The Board also reviews the management of each fund’s assets by the investment adviser and its respective sub-adviser. The funds are among the funds advised and sponsored by TAM (collectively, “Transamerica Asset Management Group”). Transamerica Asset Management Group (“TAMG”) consists of Transamerica Funds, Transamerica Series Trust (“TST”), Transamerica Income Shares, Inc. (“TIS”), Transamerica Partners Funds Group (“TPFG”), Transamerica Partners Funds Group II (“TPFG II”), Transamerica Partners Portfolios (“TPP”), and Transamerica Asset Allocation Variable Funds (“TAAVF”) and consists of 159 funds as of the date of this report.

The mailing address of each Board Member is c/o Secretary, 570 Carillon Parkway, St. Petersburg, Florida 33716. The Board Members, their year of birth, their positions with the Trust, and their principal occupations for the past five years (their titles may have varied during that period), the number of funds in TAMG the Board oversees, and other board memberships they hold are set forth in the table below.

| Name and Year |

Position(s) Held |

Term of |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Complex Overseen by Board Member |

Other | |||||

| INTERESTED BOARD MEMBER** |

||||||||||

| John K. Carter (1961) |

Chairman, Board Member, President, and Chief Executive Officer | Since 2007 | Chairman, Board Member, President and Chief Executive Officer, TPP, TPFG, TPFG II and TAAVF (2007 – present); | 159 | N/A | |||||

| Chairman (2007 – present), Board Member (2006 – present), President and Chief Executive Officer (2006 – present), Senior Vice President (1999 – 2006), Chief Compliance Officer, General Counsel and Secretary (1999 – 2006), Transamerica Funds and TST; | ||||||||||

| Chairman (2007 – present), Board Member (2006 – present), President and Chief Executive Officer (2006 – present), Senior Vice President (2002 – 2006), General Counsel, Secretary and Chief Compliance Officer (2002 – 2006), TIS; | ||||||||||

| Chairman, President and Chief Executive Officer (2006 – present), Director (2002 – present), Senior Vice President (1999 – 2006), General Counsel and Secretary (2000 – 2006), Chief Compliance Officer (2004 – 2006), TAM; | ||||||||||

| Chairman, President and Chief Executive Officer (2006 – present), Senior Vice President (1999 – 2006), Director (2002 – present), General Counsel and Secretary (2001 – 2006), Transamerica Fund Services, Inc. (“TFS”); | ||||||||||

| Vice President, AFSG Securities Corporation (2001 – 2010); | ||||||||||

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 15

| Name and Year |

Position(s) Held |

Term of |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Complex Overseen by Board Member |

Other Directorships | |||||

| Chairman and Board Member (2008 – 2010), President (2007 – 2010), Chief Executive Officer (2006 – 2010), Vice President, Secretary and Chief Compliance Officer (2003 – 2006), Transamerica Investors, Inc. (“TII”); | ||||||||||

| Senior Vice President, General Counsel and Secretary, Transamerica Index Funds, Inc. (“TIF”) (2002 – 2004); and | ||||||||||

| Director, (2008 – present), Vice President, Transamerica Investment Services, Inc. (“TISI”) (2003 – 2005) and Transamerica Investment Management, LLC (“TIM”) (2001 – 2005). | ||||||||||

| Alan F. Warrick (1948) |

Interested Board Member | Since 2012 | Board Member, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (January 2012 – present); | 159 | N/A | |||||

| Consultant, AEGON USA (2010 – present); | ||||||||||

| Senior Advisor, Lovell Minnick Equity Partners (2010 – present); |

||||||||||

| Retired (2010 – present); and | ||||||||||

| Managing Director for Strategic Business Development, AEGON USA (1994 – 2010). | ||||||||||

| INDEPENDENT BOARD MEMBERS*** |

||||||||||

| Sandra N. Bane (1952) |

Board Member | Since 2008 | Retired (1999 – present);

Board Member, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2008 – present);

Board Member, TII (2003 – 2010); and

Partner, KPMG (1975 – 1999). |

159 | Big 5 Sporting Goods (2002 – present); AGL Resources, Inc. (energy services holding company) (2008 – present) | |||||

| Leo J. Hill (1956) |

Lead Independent Board Member | Since 2007 | Principal, Advisor Network Solutions, LLC (business consulting) (2006 – present);

Board Member, TST (2001 – present);

Board Member, Transamerica Funds and

TIS

Board Member, TPP, TPFG, TPFG II and TAAVF (2007 – present); |

159 | N/A | |||||

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 16

| Name and Year of |

Position(s) Held with Trust |

Term of Office and Length of Time Served* |

Principal Occupation(s) During |

Number of Funds in Complex Overseen by Board Member |

Other Directorships | |||||

| Board Member, TII (2008 – 2010); | ||||||||||

| President, L. J. Hill & Company (a holding company for privately-held assets) (1999 – present); | ||||||||||

| Market President, Nations Bank of Sun Coast Florida (1998 – 1999); | ||||||||||

| Chairman, President and Chief Executive Officer, Barnett Banks of Treasure Coast Florida (1994 – 1998); | ||||||||||

| Executive Vice President and Senior Credit Officer, Barnett Banks of Jacksonville, Florida (1991 – 1994); and | ||||||||||

| Senior Vice President and Senior Loan Administration Officer, Wachovia Bank of Georgia (1976 – 1991). | ||||||||||

| David W. Jennings (1946) |

Board Member | Since 2009 | Board Member, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2009 – present); | 159 | N/A | |||||

| Board Member, TII (2009 – 2010); | ||||||||||

| Managing Director, Hilton Capital (2010 – present); | ||||||||||

| Principal, Maxam Capital Management, LLC (2006 – 2008); and | ||||||||||

| Principal, Cobble Creek Management LP (2004 –2006). | ||||||||||

| Russell A. Kimball, Jr. (1944) |

Board Member | Since 2007 | General Manager, Sheraton Sand Key Resort (1975 – present); | 159 | N/A | |||||

| Board Member, TST (1986 – present); | ||||||||||

| Board Member, Transamerica Funds, (1986 –1990), (2002 – present); | ||||||||||

| Board Member, TIS (2002 – present); | ||||||||||

| Board Member, TPP, TPFG, TPFG II and TAAVF (2007 – present); and | ||||||||||

| Board Member, TII (2008 – 2010). | ||||||||||

| Eugene M. Mannella (1954) |

Board Member | Since 1993 | Chief Executive Officer, HedgeServ Corporation (hedge fund administration) (2008 – present); | 159 | N/A | |||||

| Self-employed consultant (2006 – present); | ||||||||||

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 17

| Name and Year of |

Position(s) Held |

Term of |

Principal Occupation(s) During |

Number of Funds in Complex Overseen by Board Member |

Other | |||||

| Managing Member and Chief Compliance Officer, HedgeServ Investment Services, LLC (limited purpose broker-dealer) (April 2011 – present); | ||||||||||

| President, ARAPAHO Partners LLC (limited purpose broker-dealer) (1998 – 2008); | ||||||||||

| Board Member, TPP, TPFG, TPFG II and TAAVF (1993 – present); | ||||||||||

| Board Member, Transamerica Funds, TST and TIS (2007 – present); | ||||||||||

| Board Member, TII (2008 – 2010); and | ||||||||||

| President, International Fund Services (alternative asset administration) (1993 – 2005). | ||||||||||

| Norman R. Nielsen, Ph.D. (1939) |

Board Member | Since 2007 | Retired (2005 – present);

Board Member, Transamerica Funds, TST and TIS (2006 – present);

Board Member, TPP, TPFG, TPFG II and TAAVF (2007 – present);

Board Member, TII (2008 – 2010); |

159 | Buena Vista University Board of Trustees (2004 – present) | |||||

| Director, Aspire Resources, Inc. (formerly, Iowa Student Loan Service Corporation) (2006 –present); | ||||||||||

| Director, League for Innovation in the Community Colleges (1985 – 2005); | ||||||||||

| Director, Iowa Health Systems (1994 – 2003); | ||||||||||

| Director, U.S. Bank (1985 – 2006); and | ||||||||||

| President, Kirkwood Community College (1985 – 2005). | ||||||||||

| Joyce G. Norden (1939) |

Board Member | Since 1993 | Retired (2004 – present);

Board Member, TPFG, TPFG II and TAAVF (1993 – present);

Board Member, TPP (2002 – present);

Board Member, Transamerica Funds, TST and TIS (2007 – present); |

159 | Board of Governors, Reconstruction -ist Rabbinical College (2007 – present) | |||||

| Board Member, TII (2008 – 2010); and | ||||||||||

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 18

| Name and Year of |

Position(s) Held |

Term of |

Principal Occupation(s) During |

Number of Funds in Complex Overseen by Board Member |

Other | |||||

| Vice President, Institutional Advancement, Reconstructionist Rabbinical College (1996 – 2004). | ||||||||||

| Patricia L. Sawyer (1950) |

Board Member | Since 1993 | Retired (2007 – present);

President/Founder, Smith & Sawyer LLC (management consulting) (1989 – 2007);

Board Member, Transamerica Funds, TST and TIS (2007 – present);

Board Member, TII (2008 – 2010);

Board Member, TPP, TPFG, TPFG II and TAAVF (1993 – present); |

159 | Honorary Trustee, Bryant University (1996 – present) | |||||

| Trustee, Chair of Finance Committee and Chair of Nominating Committee (1987 – 1996), Bryant University; | ||||||||||

| Vice President, American Express (1987 – 1989); | ||||||||||

| Vice President, The Equitable (1986 – 1987); and | ||||||||||

| Strategy Consultant, Booz, Allen & Hamilton (1982 – 1986). | ||||||||||

| John W. Waechter (1952) |

Board Member | Since 2007 | Attorney, Englander and Fischer, LLP (2008 – present);

Retired (2004 – 2008);

Board Member, TST and TIS (2004 – present);

Board Member, Transamerica Funds (2005 – present);

Board Member, TPP, TPFG, TPFG II and TAAVF (2007 – present);

Board Member, TII (2008 – 2010);

Employee, RBC Dain Rauscher (securities dealer) (2004);

Executive Vice President, Chief Financial Officer and Chief Compliance Officer, William R. Hough & Co. (securities dealer) (1979 – 2004); and

Treasurer, The Hough Group of Funds (1993 – 2004). |

159 | Operation PAR, Inc. (2008 – present); West Central Florida Council – Boy Scouts of America (2008 – present) | |||||

| * | Each Board Member shall hold office until: 1) his or her successor is elected and qualified or 2) he or she resigns, retires or his or her term as a Board Member is terminated in accordance with the Trust’s Declaration of Trust. |

| ** | May be deemed an “interested person” (as that term is defined in the 1940 Act) of the Trust because of his current or former service with TAM or an affiliate of TAM. |

| *** | Independent Board Member means a Board Member who is not an “interested person” (as defined under the 1940 Act) of the Trust. |

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 19

OFFICERS

The mailing address of each officer is c/o Secretary, 570 Carillon Parkway, St. Petersburg, Florida 33716. The following table shows information about the officers, including their year of birth, their positions held with the Trust and their principal occupations during the past five years (their titles may have varied during that period). Each officer will hold office until his or her successor has been duly elected or appointed or until his or her earlier death, resignation or removal.

| Name and Year of Birth |

Position |

Term of Office |

Principal Occupation(s) or | |||

| John K. Carter (1961) |

Chairman, Board Member, President, and Chief Executive Officer | Since 2007 | See the table above. | |||

| Dennis P. Gallagher (1970) |

Vice President, General Counsel and Secretary | Since 2007 | Vice President, General Counsel and Secretary, Transamerica Funds, TST and TIS (2006 – present);

| |||

| Vice President, General Counsel and Secretary, TPP, TPFG, TPFG II and TAAVF (2007 – present); | ||||||

| Vice President, General Counsel and Secretary, TII, (2006 – 2010); | ||||||

| Director, Senior Vice President, General Counsel, Operations and Secretary, TAM (2006 – present); | ||||||

| Director, Senior Vice President, General Counsel, Chief Administrative Officer and Secretary, TFS (2006 – present); | ||||||

| Assistant Vice President, TCI (2007 – present); | ||||||

| Director, Deutsche Asset Management (1998 – 2006); and | ||||||

| Corporate Associate, Ropes & Gray LLP (1995 – 1998). | ||||||

| Christopher A. Staples (1970) |

Vice President and Chief Investment Officer | Since 2007 | Vice President and Chief Investment Officer (2007 – present), Senior Vice President – Investment Management (2006 – 2007), Vice President – Investment Management (2005 – 2006), Transamerica Funds, TST and TIS; | |||

| Vice President and Chief Investment Officer, TPP, TPFG, TPFG II and TAAVF (2007 – present); | ||||||

| Vice President and Chief Investment Officer (2007 – 2010); Vice President – Investment Administration (2005 – 2007), TII; | ||||||

| Director (2005 – present), Senior Vice President – Investment Management (2006 – present) and Chief Investment Officer (2007 – present), TAM; | ||||||

| Director, TFS (2005 – present); and | ||||||

| Assistant Vice President, Raymond James & Associates (1999 – 2004). | ||||||

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 20

| Name and Year of Birth |

Position |

Term of Office |

Principal Occupation(s) or | |||

| Elizabeth Strouse (1974) |

Vice President, Treasurer and Principal Financial Officer | Since 2010 | Vice President, Treasurer and Principal Financial Officer (December 2011 –present), Assistant Treasurer (2010 – December 2011), Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF;

| |||

| Director, Fund Financial Services (2009 – present), TFS;

| ||||||

| Director, Fund Administration, TIAA-CREF (2007 – 2009); and | ||||||

| Manager (2006 – 2007) and Senior (2003 – 2006) Accounting and Assurance, PricewaterhouseCoopers, LLC. | ||||||

| Robert S. Lamont, Jr. (1973) |

Vice President, Chief Compliance Officer and Conflicts of Interest Officer | Since 2010 | Vice President, Chief Compliance Officer and Conflicts of Interest Officer, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2010 – present); | |||

| Vice President and Senior Counsel, TAM and TFS (2007 – present); | ||||||

| Senior Counsel, United States Securities and Exchange Commission (2004 – 2007); and | ||||||

| Associate, Dechert, LLP (1999 – 2004). | ||||||

| Bradley O. Ackerman (1966) |

Deputy Chief Compliance Officer and Anti-Money Laundering Officer | Since 2009 | Deputy Chief Compliance Officer, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (January 2012 – present);

| |||

| Anti-Money Laundering Officer, TPP, TPFG, TPFG II and TAAVF (2009 – present);

| ||||||

| Anti-Money Laundering Officer, Transamerica Funds, TST and TIS (2007 – present); | ||||||

| Senior Compliance Officer, TAM (2007 – present); and | ||||||

| Director, Institutional Services, Rydex Investments (2002 – 2007). | ||||||

| Sarah L. Bertrand (1967) |

Assistant Secretary | Since 2009 | Assistant Secretary, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2009 – present); | |||

| Assistant Secretary, TII (2009 – 2010); | ||||||

| Assistant Vice President and Director, Legal Administration, TAM and TFS (2007 – present); | ||||||

| Assistant Secretary and Chief Compliance Officer, 40|86 Series Trust and 40|86 Strategic Income Fund (2000 – 2007); and | ||||||

| Second Vice President and Assistant Secretary, Legal and Compliance, 40|86 Capital Management, Inc. (1994 – 2007). | ||||||

| Timothy J. Bresnahan (1968) |

Assistant Secretary | Since 2009 | Assistant Secretary, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2009 – present);

| |||

| Assistant Secretary, TII (2009 – 2010); | ||||||

| Counsel, TAM (2008 – present); | ||||||

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 21

| Name and Year of Birth |

Position |

Term of Office |

Principal Occupation(s) or Employment During Past 5 Years | |||

| Counsel (contract), Massachusetts Financial Services, Inc. (2007); | ||||||

| Assistant Counsel, BISYS Fund Services Ohio, Inc. (2005 – 2007); and | ||||||

| Associate, Greenberg Traurig, P.A. (2004 – 2005). | ||||||

| Margaret A. Cullem-Fiore (1957) |

Assistant Secretary | Since 2010 | Assistant Secretary, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2010 – present);

Assistant Vice President, TCI (2009 – present);

Vice President and Senior Counsel, TAM and TFS (2006 – present);

Vice President and Senior Counsel, Transamerica Financial Advisors, Inc. (2004 – 2007); and

Vice President and Senior Counsel, Western Reserve Life Assurance Co. of Ohio (2006). | |||

| * | Elected and serves at the pleasure of the Board of the Trust. |

If an officer has held offices for different funds for different periods of time, the earliest applicable date is shown. No officer of the Trust, except for the Chief Compliance Officer, receives any compensation from the Trust.

Additional information about the Funds’ Board Members can be found in the Statement of Additional Information, available, without charge, upon request, by calling toll free 1-888-233-4339 or on the Trust’s website at www.transamericainvestments.com

| Transamerica Asset Allocation Variable Funds |

Annual Report 2011 |

Page 22

Transamerica Partners Portfolios

I

(This page intentionally left blank)

MARKET ENVIRONMENT

While not without volatility, 2011 proved to be a very good environment for bond investors. Over the course of the year market participants were faced with an unprecedented downgrade of the U.S. credit rating, a political debate in Washington over raising the debt ceiling, and a European sovereign debt crisis. The result was longer term Treasuries generating a return of 29.9% according to Barclays Capital index data. The economic recovery continued to gain traction in the first few months of the year only to fade in response to a variety of negative headlines surrounding uncertainty in Washington, slower U.S. growth, and Europe’s debt woes. Increased volatility was also brought on as investors weighed the effects of unrest in the Middle East and the tsunami in Japan. In the U.S., economic data painted a slightly brighter picture with fourth quarter 2010 gross domestic product numbers being revised upward from 2.8% to 3.1%. This combined with continued employment momentum lead to positive excess returns. In the spring, this trend reversed with a series of negative data points related to job growth, housing prices and economic output. This coupled with uncertainty surrounding the Greek debt crisis and the political debate in Washington D.C. caused market participants to shed risk and seek the relative safety of U.S. Treasuries. Spreads on higher beta fixed income sectors moved broadly wider over the second quarter with the exception of asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”). During the third quarter, Standard & Poor’s unprecedented downgrade of the U.S. sovereign credit rating and continued concern over Europe drove fixed income markets. Against this backdrop, interest rates fell and spreads widened. Despite this, most spread sectors exhibited positive total returns but lagged the performance of Treasuries. The last few months of the year were characterized by more positive domestic economic data led by jobless claims. This seemed to overshadow the lingering issues still entrenched in Europe. Spreads ground modestly tighter albeit on lower volumes as dealers closed up their books in anticipation of year end. Many strategists have begun to quietly speak of a “decoupling” from Europe but we don’t feel that the U.S. has completely overcome this concern.

PERFORMANCE

For the year ended December 31, 2011, Transamerica Partners High Quality Bond Portfolio (“Portfolio”) returned 2.16%. By comparison, its benchmark, the Bank of America Merrill Lynch U.S. Corporate & Government, 1-3 Years Index (“Index”), returned 1.56%.

STRATEGY REVIEW

The year 2011 has not been the story of economic recovery that many investors were predicting at the end of last year. Our overweight to certain spread sectors was rewarded as demand for high quality fixed income was strong as investors looked to shed risk and seek out alternatives to low-yielding money markets. The net result was that sector allocation was the largest contributor to performance for 2011 as Merganser’s overweight’s to ABS and commercial mortgage-backed securities (“CMBS”) drove the outperformance versus the index.

In the asset-backed sector, spreads tightened throughout the year due to strong investor appetite for high quality AAA rated paper. Heavy equipment holding CNH Equipment Trust posted a high single digit return as portions of the heavy equipment segment continue to see upgrades in subordinated tranches. Auto lease holding Avis Budge Rental Car Funding AESOP LLC also enjoyed strong performance as an off the run sector that saw spread tightening.

In the corporate sector, total returns for 2011 were positive as U.S. Treasury yields fell dramatically; however, excess returns versus the benchmark were negative due to dramatic spread widening. Throughout the year, financials were far and away the largest detractor from performance in the Portfolio from a sector allocation standpoint. Positions in Bank of America Corp. and American Express Credit Corp. both exhibited negative total returns for the year. This was slightly offset by our industrial corporate holdings in companies such as CVS Caremark Corp. and Airgas, Inc. Merganser’s selection of high quality investment grade securities consistently added to returns while minimizing credit risk.

CMBS was one of the few spread sectors to post positive excess return versus U.S. Treasuries in 2011. Consistent with all sectors in which we invest, Merganser’s focus in CMBS is in the highest quality tranches at the top of the capital structure. Our diligent stress testing and focus on the top tier tranches of the capital structure has allowed us to capture this spread tightening while avoiding potential troublesome pockets of the market. In particular, Wachovia Bank Commercial Mortgage Series 2007-C30 Class APB and Greenwich Capital Commercial Funding Corp. Series 2006-GG7 Class A2 were top performers in the sector for the Portfolio.

The Portfolio also benefited from its duration positioning throughout 2011. The Portfolio maintained an overweight in the 3-5 year band which benefited from Treasury curve flattening. Additionally, the Portfolio was able to pick up additional yield which contributed to total return.

Douglas A. Kelly, CFA

Peter S. Kaplan, CFA

Co-Portfolio Managers

Merganser Capital Management, Inc.

MARKET ENVIRONMENT