Q4 2013 ER press release

ABERCROMBIE & FITCH REPORTS FOURTH QUARTER AND FULL YEAR RESULTS

ANNOUNCES BOARD APPROVAL OF $150 MILLION ACCELERATED SHARE REPURCHASE

New Albany, Ohio, February 26, 2014: Abercrombie & Fitch Co. (NYSE: ANF) today reported unaudited fourth quarter results that reflected GAAP net income of $66.1 million and net income per diluted share of $0.85 for the thirteen weeks ended February 1, 2014, compared to GAAP net income of $157.2 million and net income per diluted share of $1.95 for the fourteen weeks ended February 2, 2013. Additionally, the Company reported full year GAAP net income of $54.6 million and net income per diluted share of $0.69 for the fifty-two week period ended February 1, 2014, compared to GAAP net income of $237.0 million and net income per diluted share of $2.85 for the fifty-three week period ended February 2, 2013.

Excluding restructuring charges related to Gilly Hicks, other asset impairment charges, and charges related to its profit improvement initiative, the Company reported adjusted non-GAAP net income of $104.3 million and net income per diluted share of $1.34 for the fourth quarter and adjusted non-GAAP net income of $150.6 million and net income per diluted share of $1.91 for the full year. Relative to initial guidance for the quarter, results for the fourth quarter and full year benefited from a lower tax rate, primarily resulting from a higher proportion of earnings being generated from international operations, as well as an acceleration of expense savings driven by the profit improvement initiative.

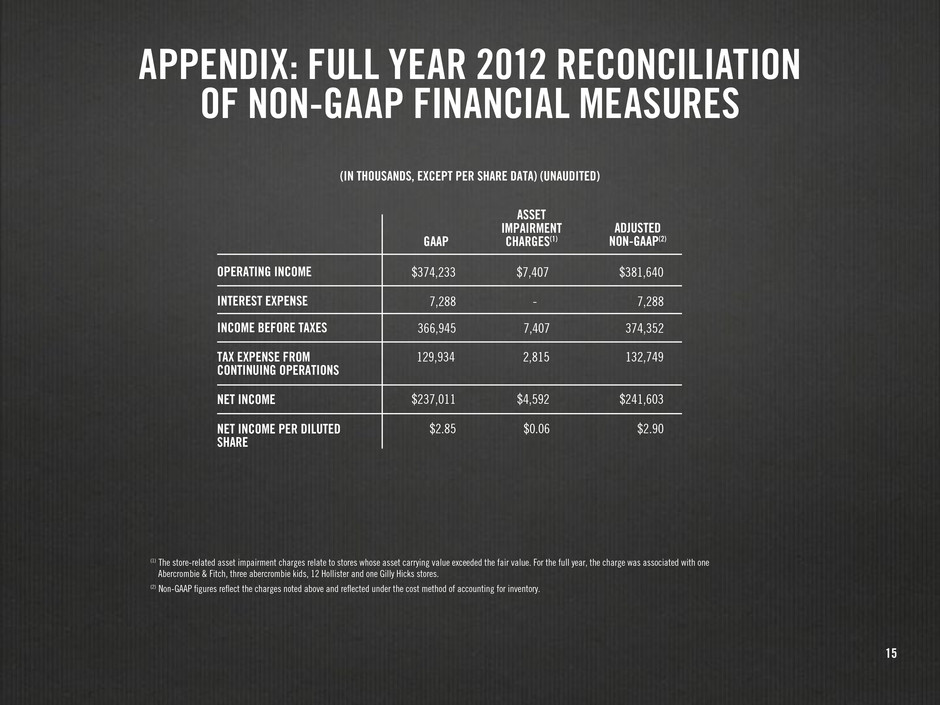

A reconciliation of GAAP to non-GAAP financial measures is included in a table accompanying the consolidated financial statements included with this release.

Mike Jeffries, Chief Executive Officer, said, "2013 was a challenging year, with sales and earnings falling well short of the objectives we set at the beginning of the year. After three years of positive growth in our combined U.S. chain stores plus direct-to-consumer comparable sales metric, that metric turned negative in 2013 against the backdrop of a challenging retail environment, particularly in the teen space. It is important that we return to positive growth, particularly in our core U.S. business, and the steps we are taking as we execute against our long-range strategic plan should put us in a position to achieve this goal.

For the fourth quarter, we are pleased that results exceeded expectations coming into the quarter. Sales from our direct-to-consumer business were particularly strong, representing nearly 25% of sales for the quarter, we saw sequential improvement in our comparable store sales trend, and continued to see strong results in China and Japan. Additionally, we managed expense well, including accelerating savings from our profit improvement initiative.

As we look forward to 2014, there is much work ahead of us, but we are encouraged by the progress we are making as we continue to aggressively execute against our long-range plan objectives, which we believe will generate meaningful improvements in our business, and create significant value for shareholders."

Fourth Quarter Sales Results |

| | | | | | | |

| | | Comparable Sales (2) |

($ in millions) | Net Sales (1) | % Change (1) | Stores | Direct-to-Consumer | Total |

U.S. | $ | 852 |

| (13)% | (15)% | 21% | (8)% |

International | $ | 447 |

| (9)% | (18)% | 28% | (9)% |

Total Company | $ | 1,299 |

| (12)% | (16)% | 24% | (8)% |

| | | | | |

Direct-to-Consumer (3) | $ | 315 |

| 18% | | | |

(1) Net sales for the thirteen weeks ended February 1, 2014 are compared to net sales for the fourteen weeks ended February 2, 2013. Net sales for the thirteen week period ended February 2, 2013 were approximately $82 million less than net sales for the reported fourteen week period ended February 2, 2013. Net sales for U.S. and International include direct-to-consumer net sales.

(2) Fourth quarter comparable sales are compared to the thirteen week period ended February 2, 2013.

(3) Direct-to-consumer net sales include shipping and handling revenue.

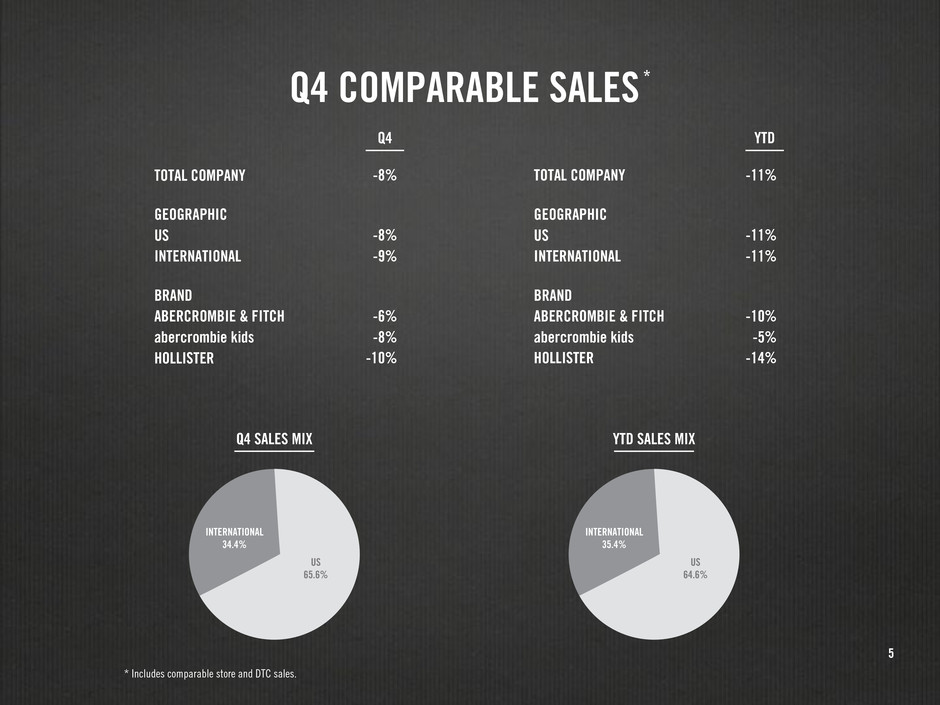

Net sales by brand for the fourth quarter were $477.9 million for Abercrombie & Fitch, $107.9 million for abercrombie kids and $684.1 million for Hollister Co. Comparable sales by brand, including direct-to-consumer, decreased 6% for Abercrombie & Fitch, decreased 8% for abercrombie kids, and decreased 10% for Hollister Co.

Additional Fourth Quarter Results Commentary

The gross profit rate for the fourth quarter was 59.0%, 440 basis points lower than last year, reflecting an increase in promotional activity, including shipping promotions in the direct-to-consumer business.

Stores and distribution expense for the fourth quarter was $505.6 million, down from $569.8 million last year. The stores and distribution expense rate for the quarter was 38.9% of net sales, approximately flat to last year. Stores and distribution expense for the quarter included $0.5 million of charges related to the profit improvement initiative. Savings in store payroll, store management and support and other stores and distribution expenses, including accelerated savings resulting from the profit improvement initiative, were offset by the deleveraging effect of negative comparable sales and higher direct-to-consumer expense.

Marketing, general and administrative expense for the fourth quarter was $118.6 million, down from $122.3 million last year. Marketing, general and administrative expense for the quarter included $3.2 million of charges related to the profit improvement initiative. A decrease in compensation expense, including incentive and equity-based compensation, was partially offset by an increase in marketing expense.

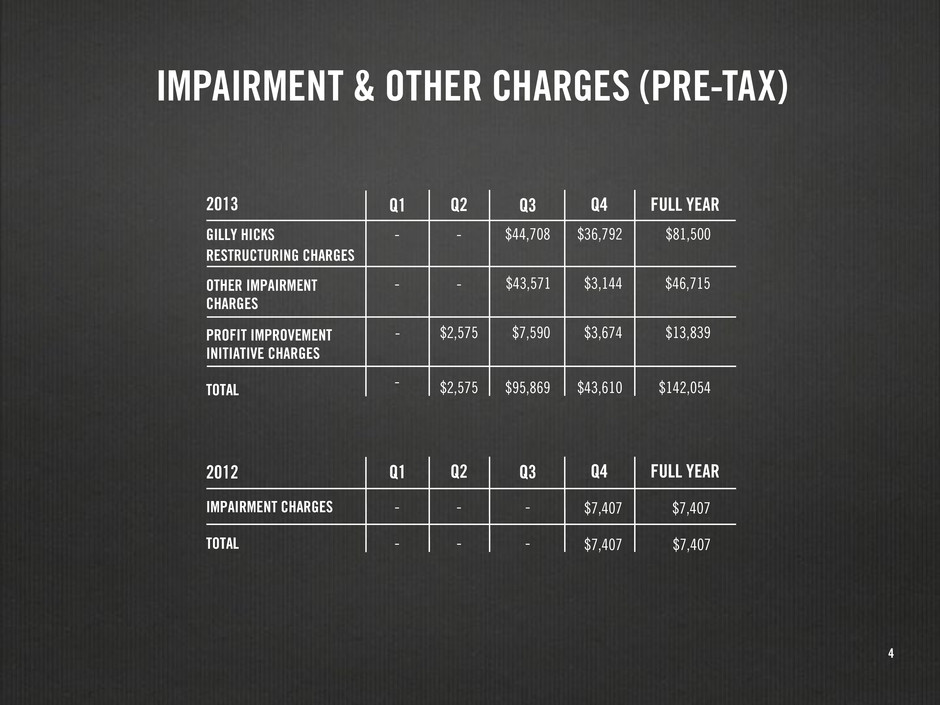

Restructuring charges for the fourth quarter were $36.8 million associated with the restructuring of the Gilly Hicks brand, primarily related to lease exit charges.

Asset impairment charges for the fourth quarter were $3.1 million related to stores previously impaired.

Other operating income for the fourth quarter was $8.0 million compared to $13.7 million last year. Other operating income last year included insurance recoveries of $4.8 million.

The effective tax rate for the fourth quarter was 39.0%. Excluding the effect of restructuring charges related to Gilly Hicks, other store asset impairment charges, and charges related to the profit improvement initiative, the effective tax rate was 31.4% compared to 35.0% last year.

Fourth quarter results include pre-tax expense of $6.1 million, and $5.0 million of after tax expense relating to an aggregation of individually immaterial errors relating to prior accounting periods. The impact reduced fourth quarter diluted earnings per share by $0.06.

Full Year 2013 Sales Results

|

| | | | | | | |

| | | Comparable Sales (2) |

($ in millions) | Net Sales (1) | % Change (1) | Stores | Direct-to-Consumer | Total |

U.S. | $ | 2,659 |

| (14)% | (15)% | 7% | (11)% |

International | $ | 1,458 |

| 2% | (19)% | 25% | (11)% |

Total Company | $ | 4,117 |

| (9)% | (16)% | 13% | (11)% |

| | | | | |

Direct-to-Consumer (3) | $ | 777 |

| 11% | | | |

(1) Net sales for the fifty-two weeks ended February 1, 2014 are compared to net sales for the fifty-three weeks ended February 2, 2013. Net sales for the fifty-two week period ended February 2, 2013 were approximately $63 million less than net sales for the reported fifty-three week period ended February 2, 2013. Net sales for U.S. and International include direct-to-consumer net sales.

(2) Full year comparable sales are compared to the fifty-two week period ended February 2, 2013.

(3) Direct-to-consumer net sales include shipping and handling revenue.

Net sales by brand for the fiscal year were $1.547 billion for Abercrombie & Fitch, $346.7 million for abercrombie kids and $2.128 billion for Hollister Co. Comparable sales by brand, including direct to consumer sales, decreased 10% for Abercrombie & Fitch, decreased 5% for abercrombie kids, and decreased 14% for Hollister Co.

Additional Full Year Results Commentary

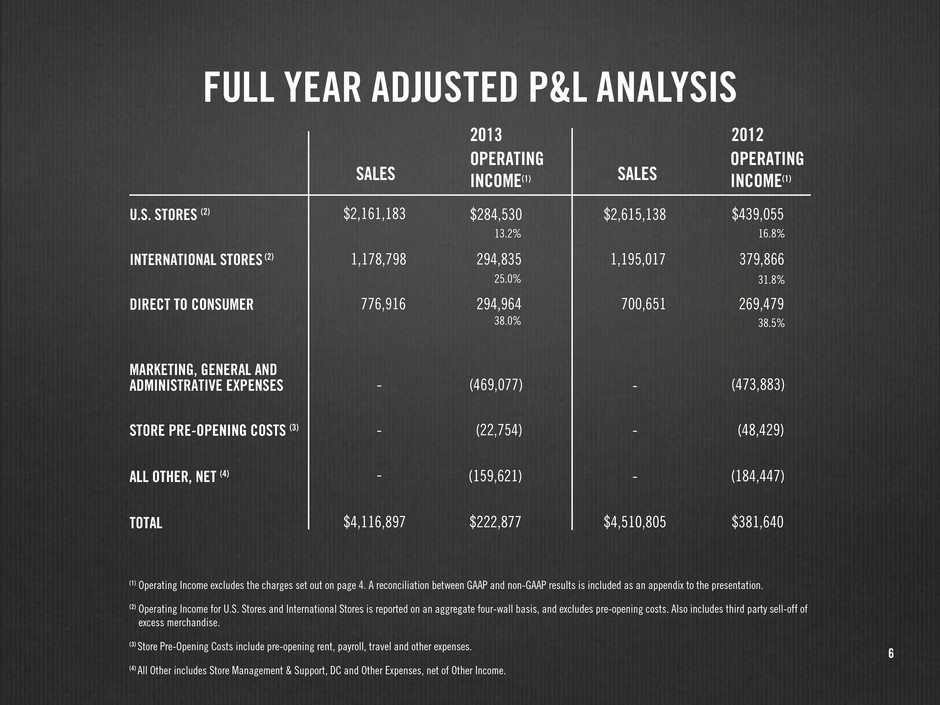

The gross profit rate for the full year was 62.6%, 20 basis points higher than last year.

Stores and distribution expense for the full year was $1.908 billion, down from $1.981 billion last year. The stores and distribution expense rate for the full year was 46.3% of net sales compared to 43.9% of net sales last year. Stores and distribution expense for the full year included $1.1 million of charges related to the profit improvement initiative. Savings in store payroll, store management and support and other stores and distribution expenses, including savings resulting from the profit improvement initiative, were more than offset by the deleveraging effect of negative comparable sales and higher direct-to-consumer expense.

Marketing, general and administrative expense for the full year was $481.8 million, compared to $473.9 million last year. Marketing, general and administrative expense for the full year included $12.7 million in charges related to the profit improvement.

Restructuring charges for the full year were $81.5 million associated with the restructuring of the Gilly Hicks brand, primarily related to store asset impairment and lease exit charges.

Asset impairment charges for the full year were $46.7 million related to stores that had a carrying value that exceeded fair value. The charges were primarily associated with 23 Abercrombie & Fitch, four abercrombie kids and 70 Hollister Co. stores.

Other operating income for the full year was $23.1 million compared to $19.3 million last year. Other operating income included income of $9.0 million and $4.8 million related to business interruption insurance recoveries in Fiscal 2013 and Fiscal 2012, respectively.

The effective tax rate for the full year was 25.5%. Excluding the effect of restructuring charges related to Gilly Hicks, other store asset impairment charges, and charges related to the profit improvement initiative, the effective tax rate was 30.1% compared to 35.4% last year. The tax rate for the full year included a benefit of $6.7 million related to certain discrete tax matters.

The Company ended the year with $530.2 million in inventory at cost, an increase of 24% versus the prior year. Excluding in-transit inventory, inventory increased 16%. On a two year basis, inventory is down 22%.

Total capital expenditures for full year were approximately $164 million, which consisted of approximately $101 million for new stores, store refreshes and remodels, and approximately $63 million related to information technology, distribution center and other home office projects. Capital expenditures came in lower than prior expectations due to projects coming in under budget and timing shifts to Fiscal 2014.

During the fiscal year, the Company repurchased 2.4 million shares of its common stock at an aggregate cost of approximately $115.8 million. As of February 1, 2014, the Company had approximately 16.3 million shares remaining available for purchase under its publicly announced stock repurchase authorizations.

The Company ended the year with $600.1 million in cash and cash equivalents, and borrowings under the Term Loan Agreement of $135.0 million, compared to $643.5 million in cash and cash equivalents and no borrowings last year.

During the fiscal year, the Company opened 20 international Hollister chain stores, including its first stores in Japan, the Middle East and Australia, an Abercrombie & Fitch flagship store in Seoul and four multi-brand outlet stores, three in Europe and one in the U.S. In addition, the Company closed 62 U.S. stores, including 16 Gilly Hicks stores. A summary of store openings and closings for the fourth quarter and full year is included with the financial statement schedules following this release.

Gilly Hicks Update

As previously announced, on November 1, 2013, the Board of Directors approved the closure of the Company's 24 stand-alone Gilly Hicks stores. The Company continues to expect to substantially complete the closures by the end of the first quarter of Fiscal 2014. The Company will continue to offer Gilly Hicks branded intimate apparel through its Hollister stores and direct-to-consumer business.

The Company continues to estimate that it will incur pre-tax charges of approximately $90 million related to the restructuring of the Gilly Hicks brand, of which $81.5 million has been incurred as of February 1, 2014, and is included in Restructuring Charges on the Consolidated Statements of Income. The Company expects the remaining charges to be substantially recognized in the first quarter of Fiscal 2014. These estimates are based on a number of significant assumptions and could change materially.

Excluding the restructuring charges discussed above, the Company incurred an operating loss of approximately $30 million related to its Gilly Hicks operations for the full year.

Cost Savings Update

The Company now expects Fiscal 2014 gross savings from its profit improvement initiative to be at least $175 million, of which approximately $30 million was recognized in Fiscal 2013, and approximately an incremental $145 million is expected to be recognized in Fiscal 2014. The Company expects to realize some additional savings beyond Fiscal 2014. The majority of these savings are included within operating expenses, with a smaller element included in gross margin.

Partially offsetting these savings, the Company expects to increase Fiscal 2014 marketing expenditures by approximately $30 million or greater as compared to Fiscal 2013, with the additional expense skewed disproportionately towards the first half of the year.

Other Developments

The Company also announced that the Board of Directors has approved a $150 million Accelerated Share Repurchase to be executed during the first quarter of Fiscal 2014, pursuant to the existing open share repurchase authorization of 16.3 million shares. The Accelerated Share Repurchase reflects the Board of Directors and the Company's confidence in the Company's ability to achieve significantly improved performance and create sustainable value for shareholders. The Company anticipates additional share repurchases over the course of the year, utilizing free cash flow generated from operations in addition to utilization of existing or additional credit facilities.

As previously announced, on February 20, 2014, the Board of Directors declared a quarterly cash dividend of $0.20 per share on the Class A Common Stock of Abercrombie & Fitch Co. payable on March 18, 2014 to shareholders of record at the close of business on March 6, 2014.

Outlook

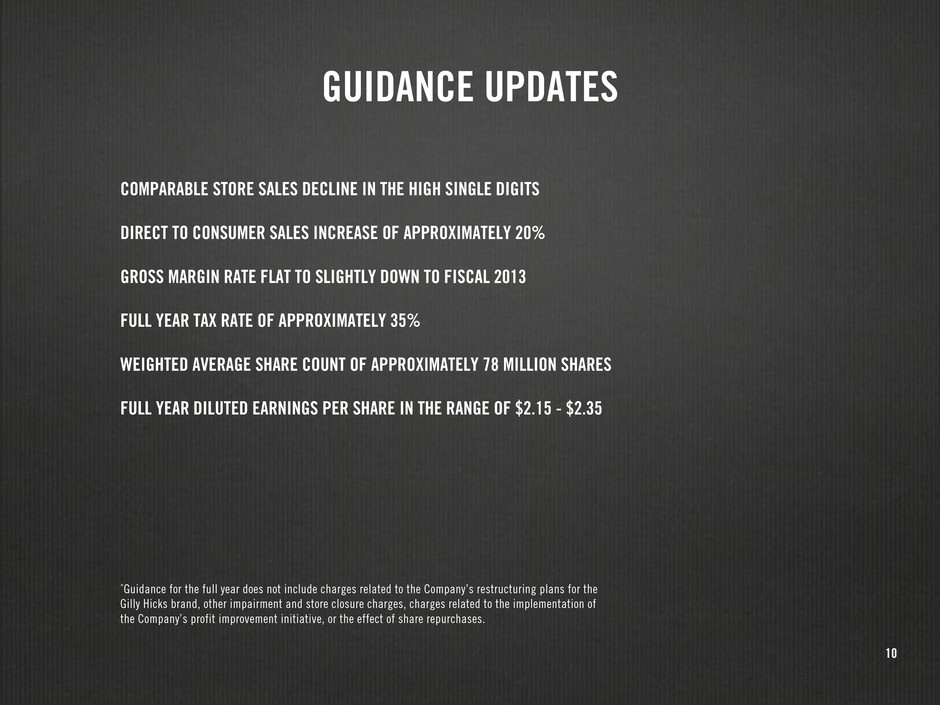

Based on an assumption of a high-single digit decline in comparable store sales and an approximate 20% increase in comparable direct-to-consumer sales, the Company projects full year diluted earnings per share in the range of $2.15 to $2.35. The sales projection does not include any benefit the Company may realize during the year from its strategic long-range plan initiatives, but also does not reflect further potential deterioration in underlying trends.

The guidance assumes gross margin rate for the full year that is flat to down slightly compared to Fiscal 2013, with continuing average unit retail pressure and lower shipping and handling revenues relative to sales offsetting average unit cost improvement and a benefit from the Company's profit improvement initiative.

The above guidance does not include remaining charges related to the Company's restructuring of the Gilly Hicks brand, other impairment and store closure charges, or charges related to the implementation of the Company's profit improvement initiative.

The Company anticipates a full year tax rate of approximately 35%, and base a weighted average share count of approximately 78 million shares excluding the effect of share repurchases, including those pursuant to the announced Accelerated Share Repurchase.

The Company anticipates opening 16 full-price international stores throughout the year, including an Abercrombie & Fitch flagship store in Shanghai in April 2014 and a small number of Abercrombie & Fitch mall-based stores. In addition, the Company plans to open a small number of international and U.S. outlet stores during the fiscal year.

The Company also expects to close approximately 60 to 70 stores in the U.S. during the fiscal year through natural lease expirations.

The Company expects total capital expenditures for the fiscal year to be approximately $200 million or slightly higher, including the effect of timing shifts from Fiscal 2013.

An investor presentation of fourth quarter and full year results will be available in the “Investors” section of the Company's website at www.abercrombie.com at approximately 8:00 AM, Eastern Time, today.

About Abercrombie & Fitch Co.

Abercrombie & Fitch Co. is a leading global specialty retailer of high-quality, casual apparel for Men, Women and kids with an active, youthful lifestyle under its Abercrombie & Fitch, abercrombie, Hollister and Gilly Hicks brands. At the end of the 2013 fiscal year, the Company operated 843 stores in the United States and 163 stores across Canada, Europe, Asia and Australia. The Company also operates e-commerce websites at www.abercrombie.com, www.abercrombiekids.com, www.hollisterco.com and www.gillyhicks.com.

Today at 8:30 AM, Eastern Time, the Company will conduct a conference call. Management will discuss the Company's performance and its plans for the future and will accept questions from participants. To listen to the conference call, dial (877) 852-6561 and ask for the Abercrombie & Fitch Quarterly Call or go to www.abercrombie.com. The international call-in number is (719) 325-4858. This call will be recorded and made available by dialing the replay number (888) 203-1112 or the international number (719) 457-0820 followed by the conference ID number 7867881 or through www.abercrombie.com.

Investor Contact:

ICR, Inc.

(203) 682-8275

Brian Logan

Abercrombie & Fitch

(614) 283-6877

Investor_Relations@abercrombie.com

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

A&F cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this Press Release or made by management or spokespeople of A&F involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the Company's control. Words such as "estimate," "project," "plan," "believe," "expect," "anticipate," "intend," and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise our forward-looking statements. The following factors, in addition to those included in the disclosure under the heading "FORWARD LOOKING STATEMENTS AND RISK FACTORS" in "ITEM 1A. RISK FACTORS" of A&F's Annual Report on Form 10-K for the fiscal year ended February 2, 2013, in some cases have affected and in the future could affect the Company's financial performance and could cause actual results for the 2013 fiscal year and beyond to differ materially from those expressed or implied in any of the forward-looking statements included in this Press Release or otherwise made by management: changes in economic and financial conditions, and the resulting impact on consumer confidence and consumer spending, could have a material adverse effect on our business, results of operations and liquidity; changing fashion trends and consumer preferences, and the ability to manage our inventory commensurate with customer demand, could adversely impact our sales levels and profitability; fluctuations in the cost, availability and quality of raw materials, labor and transportation, could cause manufacturing delays and increase our costs; our growth strategy relies significantly on international expansion, which requires significant capital investment, adds complexity to our operations and may strain our resources and adversely impact current store performance; our international expansion plan is dependent on a number of factors, any of which could delay or prevent successful penetration into new markets or could adversely affect the profitability of our international operations; our direct-to-consumer operations are subject to numerous risks that could adversely impact sales; equity-based compensation awarded under the employment agreement with our Chief Executive Officer could adversely impact our cash flows, financial position or results of operations and could have a dilutive effect on our outstanding Common Stock; our development of a new brand concept could have a material adverse effect on our financial condition or results of operations; fluctuations in foreign currency exchange rates could adversely impact our financial condition and results of operations; our business could suffer if our information technology systems are disrupted or cease to operate effectively; comparable sales, including direct-to-consumer, may continue to fluctuate on a regular basis and impact the volatility of the price of our Common Stock; our market share may be negatively impacted by increasing competition and pricing pressures from companies with brands or merchandise competitive with ours; our ability to attract customers to our stores depends, in part, on the success of the shopping malls or area attractions in which most of our stores are located; our net sales fluctuate on a seasonal basis, causing our results of operations to be susceptible to changes in Back-to-School and Holiday shopping patterns; our failure to protect our reputation could have a material adverse effect on our brands; we rely on the experience and skills of our senior executive officers, the loss of whom could have a material adverse effect on our business; interruption in the flow of merchandise from our key vendors and international manufacturers could disrupt our supply chain, which could result in lost sales and could increase our costs; in a number of our European stores, associates are represented by workers' councils and unions, whose demands could adversely affect our profitability or operating standards for our brands; we depend upon independent third parties for the manufacture and delivery of all our merchandise; our reliance on two distribution centers domestically and two third-party distribution centers internationally makes us susceptible to disruptions or adverse conditions affecting our distribution centers; we may be exposed to risks and costs associated with credit card fraud and identity theft that would cause us to incur unexpected expenses and loss of revenues; our facilities, systems and stores, as well as the facilities and systems of our vendors and manufacturers, are vulnerable to natural disasters, pandemic disease and other unexpected events, any of which could result in an interruption to our business and adversely affect our operating results; our litigation exposure could have a material adverse effect on our financial condition and results of operations; our inability or failure to adequately protect our trademarks could have a negative impact on our brand image and limit our ability to penetrate new markets; fluctuations in our tax obligations and effective tax rate may result in volatility in our operating results; the effects of war or acts of terrorism could have a material adverse effect on our operating results and financial condition; our inability to obtain commercial insurance at acceptable prices or our failure to adequately reserve for self-insured exposures might increase our expenses and adversely impact our financial results; operating results and cash flows at the store level may cause us to incur impairment charges; we are subject to customs, advertising, consumer protection, privacy, zoning and occupancy and labor and employment laws that could require us to modify our current business practices, incur increased costs or harm our reputation if we do not comply; changes in the regulatory or compliance landscape could adversely affect our business and results of operations; our unsecured Amended and Restated Credit Agreement and our Term Loan Agreement include financial and other covenants that impose restrictions on our financial and business operations; compliance with changing regulations and standards for accounting, corporate governance and public disclosure could adversely affect our business, results of operations and reported financial results; our inability to implement our profit improvement plan across all work-streams could have a negative impact on our financial results; and our estimates of the expenses that we may incur in connection with the closures of the Gilly Hicks stores could prove to be inaccurate.

|

| | | | | | | | | | | | | |

| | | | | | | | | |

Abercrombie & Fitch Co. |

Consolidated Statements of Income |

Thirteen Weeks Ended February 1, 2014 and Fourteen Weeks Ended February 2, 2013 |

(in thousands, except per share data) |

| | | | | | | |

| (Unaudited) | | (Unaudited) |

| 2013 | | % of Net Sales | | 2012 | | % of Net Sales |

Net Sales | $ | 1,299,137 |

| | 100.0 | % | | $ | 1,468,531 |

| | 100.0 | % |

| | | | | | | | | |

Cost of Goods Sold | | 532,030 |

| | 41.0 | % | | | 537,879 |

| | 36.6 | % |

| | | | | | | | | |

Gross Profit | | 767,107 |

| | 59.0 | % | | | 930,652 |

| | 63.4 | % |

| | | | | | | | | |

Total Stores and Distribution Expense | | 505,607 |

| | 38.9 | % | | | 569,760 |

| | 38.8 | % |

| | | | | | | | | |

Total Marketing, General and Administrative Expense | | 118,608 |

| | 9.1 | % | | | 122,321 |

| | 8.3 | % |

| | | | | | | | | |

Restructuring Charges | | 36,792 |

| | 2.8 | % | | | — |

| | — | % |

| | | | | | | | | |

Asset Impairment | | 3,144 |

| | 0.2 | % | | | 7,407 |

| | 0.5 | % |

| | | | | | | | | |

Other Operating Income, Net | | (7,994 | ) | | (0.6 | )% | | | (13,663 | ) | | (0.9 | )% |

| | | | | | | | | |

Operating Income (Loss) | | 110,950 |

| | 8.5 | % | | | 244,827 |

| | 16.7 | % |

| | | | | | | | | |

Interest Expense, Net | | 2,513 |

| | 0.2 | % | | | 3,069 |

| | 0.2 | % |

| | | | | | | | | |

Income (Loss) Before Taxes | | 108,437 |

| | 8.3 | % | | | 241,758 |

| | 16.5 | % |

| | | | | | | | | |

Tax Expense (Benefit) | | 42,331 |

| | 3.3 | % | | | 84,529 |

| | 5.8 | % |

| | | | | | | | | |

Net Income (Loss) | $ | 66,106 |

| | 5.1 | % | | $ | 157,229 |

| | 10.7 | % |

| | | | | | | | | |

Net Income (Loss) Per Share: | | | | | | | | | |

Basic | $ | 0.86 | | | | $ | 1.99 | | |

Diluted | $ | 0.85 | | | | $ | 1.95 | | |

| | | | | | | | | |

Weighted-Average Shares Outstanding: | | | | | | | | | |

Basic | | 76,467 |

| | | | | 78,944 |

| | |

Diluted | | 77,568 |

| | | | | 80,554 |

| | |

| | | | | | | | | |

|

| | | | | | | | | | | | | |

| | | | | | | | | |

Abercrombie & Fitch Co. |

Consolidated Statements of Income |

Fifty-Two Weeks Ended February 1, 2014 and Fifty-Three Weeks Ended February 2, 2013 |

(in thousands, except per share data) |

| | | | | | | |

| (Unaudited) | | (Unaudited) |

| 2013 | | % of Net Sales | | 2012 | | % of Net Sales |

Net Sales | $ | 4,116,897 |

| | 100.0 | % | | $ | 4,510,805 |

| | 100.0 | % |

| | | | | | | | | |

Cost of Goods Sold | | 1,541,462 |

| | 37.4 | % | | | 1,694,096 |

| | 37.6 | % |

| | | | | | | | | |

Gross Profit | | 2,575,435 |

| | 62.6 | % | | | 2,816,709 |

| | 62.4 | % |

| | | | | | | | | |

Total Stores and Distribution Expense | | 1,907,687 |

| | 46.3 | % | | | 1,980,519 |

| | 43.9 | % |

| | | | | | | | | |

Total Marketing, General and Administrative Expense | | 481,784 |

| | 11.7 | % | | | 473,883 |

| | 10.5 | % |

| | | | | | | | | |

Restructuring Charges | | 81,500 |

| | 2.0 | % | | | — |

| | — | % |

| | | | | | | | | |

Asset Impairment | | 46,715 |

| | 1.1 | % | | | 7,407 |

| | 0.2 | % |

| | | | | | | | | |

Other Operating Income, Net | | (23,074 | ) | | (0.6 | )% | | | (19,333 | ) | | (0.4 | )% |

| | | | | | | | | |

Operating Income (Loss) | | 80,823 |

| | 2.0 | % | | | 374,233 |

| | 8.3 | % |

| | | | | | | | | |

Interest Expense, Net | | 7,546 |

| | 0.2 | % | | | 7,288 |

| | 0.2 | % |

| | | | | | | | | |

Income (Loss) Before Taxes | | 73,277 |

| | 1.8 | % | | | 366,945 |

| | 8.1 | % |

| | | | | | | | | |

Tax Expense (Benefit) | | 18,649 |

| | 0.5 | % | | | 129,934 |

| | 2.9 | % |

| | | | | | | | | |

Net Income (Loss) | $ | 54,628 |

| | 1.3 | % | | $ | 237,011 |

| | 5.3 | % |

| | | | | | | | | |

Net Income (Loss) Per Share: | | | | | | | | | |

Basic | $ | 0.71 | | | | $ | 2.89 | | |

Diluted | $ | 0.69 | | | | $ | 2.85 | | |

| | | | | | | | | |

Weighted-Average Shares Outstanding: | | | | | | | | | |

Basic | | 77,157 |

| | | | | 81,940 |

| | |

Diluted | | 78,666 |

| | | | | 83,175 |

| | |

| | | | | | | | | |

|

| | | | | | | | |

Abercrombie & Fitch Co. |

Consolidated Balance Sheets |

(in thousands) |

|

| | (Unaudited) | | |

ASSETS | February 1, 2014 | | February 2, 2013 |

| | | | | | |

Current Assets | | | | | |

| Cash and Equivalents | $ | 600,116 |

| | $ | 643,505 |

|

| Receivables | | 65,262 |

| | | 99,622 |

|

| Inventories | | 530,192 |

| | | 426,962 |

|

| Deferred Income Taxes | | 23,540 |

| | | 32,558 |

|

| Other Current Assets | | 100,458 |

| | | 105,177 |

|

| | | | | | |

Total Current Assets | | 1,319,568 |

| | | 1,307,824 |

|

| | | | | | |

Property and Equipment, Net | | 1,131,341 |

| | | 1,308,232 |

|

| | | | | | |

Other Assets | | 403,642 |

| | | 371,345 |

|

| | | | | | |

TOTAL ASSETS | $ | 2,854,551 |

| | $ | 2,987,401 |

|

| | | | | | |

| | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | |

| | | | | | |

Current Liabilities | | | | | |

| Accounts Payable and Outstanding Checks | $ | 130,715 |

| | $ | 140,396 |

|

| Accrued Expenses | | 321,836 |

| | | 398,868 |

|

| Deferred Lease Credits | | 36,165 |

| | | 39,054 |

|

| Short-Term Portion of Borrowings | | 15,000 |

| | | — |

|

| Income Taxes Payable | | 63,508 |

| | | 112,483 |

|

| | | | | | |

Total Current Liabilities | | 567,224 |

| | | 690,801 |

|

| | | | | | |

Long-Term Liabilities | | | | | |

| Deferred Lease Credits | | 140,799 |

| | | 168,397 |

|

| Long-Term Portion of Borrowings | | 120,000 |

| | | — |

|

| Leasehold Financing Obligations | | 60,726 |

| | | 63,942 |

|

| Other Liabilities | | 236,309 |

| | | 245,993 |

|

| | | | | | |

Total Long-Term Liabilities | | 557,834 |

| | | 478,332 |

|

| | | | | | |

Total Shareholders' Equity | | 1,729,493 |

| | | 1,818,268 |

|

| | | | | | |

TOTAL LIABILITIES AND | | | | | |

SHAREHOLDERS' EQUITY | $ | 2,854,551 |

| | $ | 2,987,401 |

|

|

| | | | | | | | | | | | | | | |

Abercrombie & Fitch Co. |

Schedule of Non-GAAP Financial Measures |

Thirteen Weeks Ended February 1, 2014 |

(in thousands, except per share data) |

(Unaudited) |

| GAAP | | Excluded Charges (1) | | Tax True-Up Related to Prior Period Excluded Charges (2) | | Adjusted Non-GAAP (3) |

Income (Loss) Before Taxes | $ | 108,437 |

| | $ | 43,610 |

| | $ | — |

| | $ | 152,047 |

|

| | | | | | | |

Tax Expense (Benefit) | 42,331 |

| | 14,141 |

| | (8,688 | ) | | 47,784 |

|

| | | | | | | |

Net Income (Loss) | $ | 66,106 |

| | $ | 29,469 |

| | $ | 8,688 |

| | $ | 104,263 |

|

| | | | | | | |

Net Income (Loss) Per Diluted Share | $ | 0.85 |

| | $ | 0.38 |

| | $ | 0.11 |

| | $ | 1.34 |

|

| | | | | | | |

Diluted Weighted-Average Shares Outstanding: | 77,568 |

| | | | | | |

(1) Excluded charges for the fourth quarter include $36.8 million in pre-tax charges related to restructuring of the Gilly Hicks brand, $3.1 million in pre-tax charges related to other store asset impairments, and $3.7 million in pre-tax charges related to the Company's profit improvement initiative.

(2) Relates to prior period excluded charges, primarily incurred in the third quarter, for the true-up of the estimated full year tax rate applied as of the third quarter to the final full year tax rate.

(3) Non-GAAP financial measures should not be used as alternatives to net income and net income per diluted share and are also not intended to supersede or replace the Company's GAAP financial measures. The Company believes it is useful to investors to provide the non-GAAP financial measures to assess the Company's operating performance.

|

| | | | | | | | | | | |

Abercrombie & Fitch Co. |

Schedule of Non-GAAP Financial Measures |

Fifty-Two Weeks Ended February 1, 2014 |

(in thousands, except per share data) |

(Unaudited) |

| GAAP | | Excluded Charges (1) | | Adjusted Non-GAAP (2) |

Income (Loss) Before Taxes | $ | 73,277 |

| | $ | 142,054 |

| | $ | 215,331 |

|

| | | | | |

Tax Expense (Benefit) | 18,649 |

| | 46,063 |

| | 64,712 |

|

| | | | | |

Net Income (Loss) | $ | 54,628 |

| | $ | 95,991 |

| | $ | 150,619 |

|

| | | | | |

Net Income (Loss) Per Diluted Share | $ | 0.69 |

| | $ | 1.22 |

| | $ | 1.91 |

|

| | | | | |

Diluted Weighted-Average Shares Outstanding: | 78,666 |

| | | | |

(1) Excluded charges for the full year include $81.5 million in pre-tax charges related to restructuring of the Gilly Hicks brand, $46.7 million in pre-tax charges related to other store asset impairments, and $13.8 million in pre-tax charges related to the Company's profit improvement initiative. For the full year, the asset impairment charge was primarily associated with 23 Abercrombie & Fitch, four abercrombie kids and 70 Hollister stores.

(2) Non-GAAP financial measures should not be used as alternatives to net income and net income per diluted share and are also not intended to supersede or replace the Company's GAAP financial measures. The Company believes it is useful to investors to provide the non-GAAP financial measures to assess the Company's operating performance.

|

| | | | | | | | | | | | | | | | |

Abercrombie & Fitch Co. |

U.S. Store Count |

(Unaudited) |

Thirteen Week Period Ended February 1, 2014 |

| | | | | | | | | | | |

| | | | | | | | | | | |

Store Activity | | Abercrombie & Fitch | | abercrombie | | Hollister | | Gilly Hicks | | Total | |

| | | | | | | | | | | |

November 2, 2013 (1) | | 265 |

| | 140 |

| | 471 |

| | 17 |

| | 893 |

| |

| | | | | | | | | | | |

New | | 1 |

| | — |

| | 1 |

| | — |

| | 2 |

| |

| | | | | | | | | | | |

Closed | | (13 | ) | | (9 | ) | | (14 | ) | | (16 | ) | | (52 | ) | |

| | | | | | | | | | | |

February 1, 2014 | | 253 |

| | 131 |

| | 458 |

| | 1 |

| | 843 |

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

Abercrombie & Fitch Co. |

International Store Count |

(Unaudited) |

Thirteen Week Period Ended February 1, 2014 |

| | | | | | | | | | | |

| | | | | | | | | | | |

Store Activity | | Abercrombie & Fitch | | abercrombie | | Hollister | | Gilly Hicks | | Total | |

| | | | | | | | | | | |

November 2, 2013 (2) | | 22 |

| | 5 |

| | 122 |

| | 7 |

| | 156 |

| |

| | | | | | | | | | | |

New | | — |

| | — |

| | 7 |

| | — |

| | 7 |

| |

| | | | | | | | | | | |

Closed | | — |

| | — |

| | — |

| | — |

| | — |

| |

| | | | | | | | | | | |

February 1, 2014 | | 22 |

| | 5 |

| | 129 |

| | 7 |

| | 163 |

| |

(1) Prior period store counts have been restated to count multi-brand outlet stores as a single store. The change reduced U.S. store counts as of November 2, 2013 by four stores for abercrombie, four stores for Hollister and three stores for Gilly Hicks.

(2) Prior period store counts have been restated to count multi-brand outlet stores as a single store. The change reduced international store counts as of November 2, 2013 by two stores for abercrombie and one store for Gilly Hicks.

|

| | | | | | | | | | | | | | | | |

Abercrombie & Fitch Co. |

U.S. Store Count |

(Unaudited) |

Fifty-Two Week Period Ended February 1, 2014 |

| | | | | | | | | | | |

| | | | | | | | | | | |

Store Activity | | Abercrombie & Fitch | | abercrombie | | Hollister | | Gilly Hicks | | Total | |

| | | | | | | | | | | |

February 2, 2013 (1) | | 266 |

| | 141 |

| | 478 |

| | 17 |

| | 902 |

| |

| | | | | | | | | | | |

New | | 2 |

| | — |

| | 1 |

| | — |

| | 3 |

| |

| | | | | | | | | | | |

Closed | | (15 | ) | | (10 | ) | | (21 | ) | | (16 | ) | | (62 | ) | |

| | | | | | | | | | | |

February 1, 2014 | | 253 |

| | 131 |

| | 458 |

| | 1 |

| | 843 |

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

Abercrombie & Fitch Co. |

International Store Count |

(Unaudited) |

Fifty-Two Week Period Ended February 1, 2014 |

| | | | | | | | | | | |

| | | | | | | | | | | |

Store Activity | | Abercrombie & Fitch | | abercrombie | | Hollister | | Gilly Hicks | | Total | |

| | | | | | | | | | | |

February 2, 2013 | | 19 |

| | 6 |

| | 107 |

| | 7 |

| | 139 |

| |

| | | | | | | | | | | |

New | | 3 |

| | — |

| | 22 |

| | — |

| | 25 |

| |

| | | | | | | | | | | |

Closed | | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) | |

| | | | | | | | | | | |

February 1, 2014 | | 22 |

| | 5 |

| | 129 |

| | 7 |

| | 163 |

| |

(1) Prior period store counts have been restated to count multi-brand outlet stores as a single store. The change reduced U.S. store counts as of February 2, 2013 by three stores for abercrombie, four stores for Hollister and three stores for Gilly Hicks.