UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07705

Virtus Asset Trust

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9668

(Address of principal executive offices) (Zip code)

Kevin J. Carr, Esq.

Senior Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-4506

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 243-1574

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| Virtus Seix Core Bond Fund |

| Virtus Seix Corporate Bond Fund |

| Virtus Seix Floating Rate High Income Fund |

| Virtus Seix Georgia Tax-Exempt Bond Fund* |

| Virtus Seix High Grade Municipal Bond Fund* |

| Virtus Seix High Income Fund |

| Virtus Seix High Yield Fund |

| Virtus Seix Investment Grade Tax-Exempt Bond Fund* |

| Virtus Seix North Carolina Tax-Exempt Bond Fund* |

| Virtus Seix Short-Term Bond Fund |

| Virtus Seix Short-Term Municipal Bond Fund |

| Virtus Seix Total Return Bond Fund |

| Virtus Seix U.S. Government Securities Ultra-Short Bond Fund |

| Virtus Seix U.S. Mortgage Fund |

| Virtus Seix Ultra-Short Bond Fund |

| Virtus Seix Virginia Intermediate Municipal Bond Fund* |

|

Message to

Shareholders |

1 | |

|

Disclosure of Fund

Expenses |

2 | |

|

Key Investment

Terms |

6 | |

| Fund | Fund

Summary |

Schedule

of Investments |

|

Virtus Seix Core Bond Fund (“Seix Core Bond

Fund”) |

9 | 52 |

|

Virtus Seix Corporate Bond Fund (“Seix Corporate Bond

Fund”) |

12 | 55 |

|

Virtus Seix Floating Rate High Income Fund (“Seix Floating Rate High Income

Fund”) |

15 | 58 |

|

Virtus Seix Georgia Tax-Exempt Bond Fund (“Seix Georgia Tax-Exempt Bond

Fund”) |

17 | 71 |

|

Virtus Seix High Grade Municipal Bond Fund (“Seix High Grade Municipal Bond

Fund”) |

20 | 73 |

|

Virtus Seix High Income Fund (“Seix High Income

Fund”) |

22 | 75 |

|

Virtus Seix High Yield Fund (“Seix High Yield

Fund”) |

24 | 81 |

|

Virtus Seix Investment Grade Tax-Exempt Bond Fund (“Seix Investment Grade Tax-Exempt Bond

Fund”) |

26 | 87 |

|

Virtus Seix North Carolina Tax-Exempt Bond Fund (“Seix North Carolina Tax-Exempt Bond

Fund”) |

28 | 90 |

|

Virtus Seix Short-Term Bond Fund (“Seix Short-Term Bond

Fund”) |

31 | 92 |

|

Virtus Seix Short-Term Municipal Bond Fund (“Seix Short-Term Municipal Bond

Fund”) |

34 | 94 |

|

Virtus Seix Total Return Bond Fund (“Seix Total Return Bond

Fund”) |

37 | 96 |

|

Virtus Seix U.S. Government Securities Ultra-Short Bond Fund (“Seix U.S. Government Securities Ultra-Short Bond

Fund”) |

40 | 100 |

|

Virtus Seix U.S. Mortgage Fund (“Seix U.S. Mortgage

Fund”) |

43 | 104 |

|

Virtus Seix Ultra-Short Bond Fund (“Seix Ultra-Short Bond

Fund”) |

46 | 106 |

|

Virtus Seix Virginia Intermediate Municipal Bond Fund (“Seix Virginia Intermediate Municipal Bond

Fund”) |

49 | 109 |

|

Statements of Assets and

Liabilities |

111 | |

|

Statements of

Operations |

120 | |

|

Statements of Changes in Net

Assets |

128 | |

|

Financial

Highlights |

141 | |

|

Notes to Financial

Statements |

150 | |

|

Report of Independent Registered Public Accounting

Firm |

179 | |

|

Tax Information

Notice |

180 | |

|

Consideration of Advisory and Subadvisory Agreements by the Board of

Trustees |

181 | |

|

Fund Management

Tables |

187 | |

President, Virtus Mutual Funds

| Beginning

Account Value July 1, 2018 |

Ending

Account value December 31, 2018 |

Annualized

Expense Ratio |

Expenses

Paid During Period* | |||||

|

Seix Core Bond

Fund |

||||||||

| Class A | $ 1,000.00 | $ 1,016.00 | 0.64 % | $ 3.25 | ||||

| Class I | 1,000.00 | 1,015.80 | 0.50 | 2.54 | ||||

| Class R | 1,000.00 | 1,014.70 | 0.91 | 4.62 | ||||

| Class R6 | 1,000.00 | 1,016.30 | 0.36 | 1.83 | ||||

|

Seix Corporate Bond

Fund |

||||||||

| Class A | 1,000.00 | 998.70 | 0.95 | 4.79 | ||||

| Class C | 1,000.00 | 995.10 | 1.65 | 8.30 | ||||

| Class I | 1,000.00 | 999.80 | 0.70 | 3.53 | ||||

|

Seix Floating Rate High Income

Fund |

||||||||

| Class A | 1,000.00 | 982.20 | 0.94 | 4.70 | ||||

| Class C | 1,000.00 | 979.30 | 1.52 | 7.58 | ||||

| Class I | 1,000.00 | 983.80 | 0.62 | 3.10 | ||||

| Class R6 | 1,000.00 | 983.10 | 0.52 | 2.60 | ||||

|

Seix Georgia Tax-Exempt Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,009.70 | 0.75 | 3.80 | ||||

| Class I | 1,000.00 | 1,010.20 | 0.65 | 3.29 | ||||

|

Seix High Grade Municipal Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,012.60 | 0.79 | 4.01 | ||||

| Class I | 1,000.00 | 1,013.40 | 0.65 | 3.30 | ||||

|

Seix High Income

Fund |

||||||||

| Class A | 1,000.00 | 961.00 | 1.03 | 5.09 | ||||

| Class I | 1,000.00 | 962.00 | 0.80 | 3.96 | ||||

| Class R | 1,000.00 | 960.10 | 1.22 | 6.03 | ||||

| Class R6 | 1,000.00 | 962.80 | 0.64 | 3.17 | ||||

|

Seix High Yield

Fund |

||||||||

| Class A | 1,000.00 | 980.50 | 0.82 | 4.09 | ||||

| Class I | 1,000.00 | 981.40 | 0.64 | 3.20 | ||||

| Class R | 1,000.00 | 979.40 | 1.04 | 5.19 | ||||

| Class R6 | 1,000.00 | 980.70 | 0.53 | 2.65 | ||||

|

Seix Investment Grade Tax-Exempt Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,012.10 | 0.79 | 4.01 | ||||

| Class I | 1,000.00 | 1,012.00 | 0.64 | 3.25 | ||||

|

Seix North Carolina Tax-Exempt Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,010.10 | 0.80 | 4.05 | ||||

| Class I | 1,000.00 | 1,010.80 | 0.65 | 3.29 |

| Beginning

Account Value July 1, 2018 |

Ending

Account value December 31, 2018 |

Annualized

Expense Ratio |

Expenses

Paid During Period* | |||||

|

Seix Short-Term Bond

Fund |

||||||||

| Class A | $1,000.00 | $1,011.50 | 0.80% | $4.06 | ||||

| Class C | 1,000.00 | 1,008.70 | 1.57 | 7.95 | ||||

| Class I | 1,000.00 | 1,012.50 | 0.60 | 3.04 | ||||

|

Seix Short-Term Municipal Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,009.50 | 0.65 | 3.29 | ||||

| Class I | 1,000.00 | 1,010.40 | 0.48 | 2.43 | ||||

|

Seix Total Return Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,013.60 | 0.70 | 3.55 | ||||

| Class I | 1,000.00 | 1,014.00 | 0.46 | 2.34 | ||||

| Class R | 1,000.00 | 1,011.80 | 0.89 | 4.51 | ||||

| Class R6 | 1,000.00 | 1,014.80 | 0.31 | 1.57 | ||||

|

Seix U.S. Government Securities Ultra-Short Bond

Fund |

||||||||

| Class A** | 1,000.00 | 1,007.90 | 0.63 | 2.76 | ||||

| Class I | 1,000.00 | 1,010.10 | 0.41 | 2.08 | ||||

| Class R6 | 1,000.00 | 1,009.90 | 0.26 | 1.32 | ||||

|

Seix U.S. Mortgage

Fund |

||||||||

| Class A | 1,000.00 | 1,015.90 | 0.90 | 4.57 | ||||

| Class C | 1,000.00 | 1,012.00 | 1.65 | 8.37 | ||||

| Class I | 1,000.00 | 1,016.90 | 0.70 | 3.56 | ||||

|

Seix Ultra-Short Bond

Fund |

||||||||

| Class A** | 1,000.00 | 1,004.80 | 0.65 | 2.86 | ||||

| Class I | 1,000.00 | 1,007.30 | 0.40 | 2.02 | ||||

|

Seix Virginia Intermediate Municipal Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,011.90 | 0.79 | 4.01 | ||||

| Class I | 1,000.00 | 1,012.60 | 0.65 | 3.30 |

| * | Expenses are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

| ** | July 23, 2018, is the date the Class started accruing expenses. Expenses are equal to the Fund Class’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (159) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

| Beginning

Account Value July 1, 2018 |

Ending

Account value December 31, 2018 |

Annualized

Expense Ratio |

Expenses

Paid During Period* | |||||

|

Seix Core Bond

Fund |

||||||||

| Class A | $ 1,000.00 | $ 1,021.98 | 0.64 % | $ 3.26 | ||||

| Class I | 1,000.00 | 1,022.68 | 0.50 | 2.55 | ||||

| Class R | 1,000.00 | 1,020.62 | 0.91 | 4.63 | ||||

| Class R6 | 1,000.00 | 1,023.39 | 0.36 | 1.84 |

| Beginning

Account Value July 1, 2018 |

Ending

Account value December 31, 2018 |

Annualized

Expense Ratio |

Expenses

Paid During Period* | |||||

|

Seix Corporate Bond

Fund |

||||||||

| Class A | $1,000.00 | $1,020.42 | 0.95% | $4.84 | ||||

| Class C | 1,000.00 | 1,016.89 | 1.65 | 8.39 | ||||

| Class I | 1,000.00 | 1,021.68 | 0.70 | 3.57 | ||||

|

Seix Floating Rate High Income

Fund |

||||||||

| Class A | 1,000.00 | 1,020.47 | 0.94 | 4.79 | ||||

| Class C | 1,000.00 | 1,017.54 | 1.52 | 7.73 | ||||

| Class I | 1,000.00 | 1,022.08 | 0.62 | 3.16 | ||||

| Class R6 | 1,000.00 | 1,022.58 | 0.52 | 2.65 | ||||

|

Seix Georgia Tax-Exempt Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,021.42 | 0.75 | 3.82 | ||||

| Class I | 1,000.00 | 1,021.93 | 0.65 | 3.31 | ||||

|

Seix High Grade Municipal Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,021.22 | 0.79 | 4.02 | ||||

| Class I | 1,000.00 | 1,021.93 | 0.65 | 3.31 | ||||

|

Seix High Income

Fund |

||||||||

| Class A | 1,000.00 | 1,020.01 | 1.03 | 5.24 | ||||

| Class I | 1,000.00 | 1,021.17 | 0.80 | 4.08 | ||||

| Class R | 1,000.00 | 1,019.06 | 1.22 | 6.21 | ||||

| Class R6 | 1,000.00 | 1,021.98 | 0.64 | 3.26 | ||||

|

Seix High Yield

Fund |

||||||||

| Class A | 1,000.00 | 1,021.07 | 0.82 | 4.18 | ||||

| Class I | 1,000.00 | 1,021.98 | 0.64 | 3.26 | ||||

| Class R | 1,000.00 | 1,019.96 | 1.04 | 5.30 | ||||

| Class R6 | 1,000.00 | 1,022.53 | 0.53 | 2.70 | ||||

|

Seix Investment Grade Tax-Exempt Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,021.22 | 0.79 | 4.02 | ||||

| Class I | 1,000.00 | 1,021.98 | 0.64 | 3.26 | ||||

|

Seix North Carolina Tax-Exempt Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,021.17 | 0.80 | 4.08 | ||||

| Class I | 1,000.00 | 1,021.93 | 0.65 | 3.31 | ||||

|

Seix Short-Term Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,021.17 | 0.80 | 4.08 | ||||

| Class C | 1,000.00 | 1,017.29 | 1.57 | 7.98 | ||||

| Class I | 1,000.00 | 1,022.18 | 0.60 | 3.06 | ||||

|

Seix Short-Term Municipal Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,021.93 | 0.65 | 3.31 | ||||

| Class I | 1,000.00 | 1,022.79 | 0.48 | 2.45 | ||||

|

Seix Total Return Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,021.68 | 0.70 | 3.57 | ||||

| Class I | 1,000.00 | 1,022.89 | 0.46 | 2.35 | ||||

| Class R | 1,000.00 | 1,020.72 | 0.89 | 4.53 | ||||

| Class R6 | 1,000.00 | 1,023.64 | 0.31 | 1.58 | ||||

|

Seix U.S. Government Securities Ultra-Short Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,022.03 | 0.63 | 3.21 | ||||

| Class I | 1,000.00 | 1,023.14 | 0.41 | 2.09 | ||||

| Class R6 | 1,000.00 | 1,023.89 | 0.26 | 1.33 | ||||

|

Seix U.S. Mortgage

Fund |

||||||||

| Class A | 1,000.00 | 1,020.67 | 0.90 | 4.58 | ||||

| Class C | 1,000.00 | 1,016.89 | 1.65 | 8.39 | ||||

| Class I | 1,000.00 | 1,021.68 | 0.70 | 3.57 | ||||

|

Seix Ultra-Short Bond

Fund |

||||||||

| Class A | 1,000.00 | 1,021.93 | 0.65 | 3.31 | ||||

| Class I | 1,000.00 | 1,023.19 | 0.40 | 2.04 |

| Beginning

Account Value July 1, 2018 |

Ending

Account value December 31, 2018 |

Annualized

Expense Ratio |

Expenses

Paid During Period* | |||||

|

Seix Virginia Intermediate Municipal Bond

Fund |

||||||||

| Class A | $1,000.00 | $1,021.22 | 0.79% | $4.02 | ||||

| Class I | 1,000.00 | 1,021.93 | 0.65 | 3.31 |

| * | Expenses are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

| U.S. Government Securities | 57% | |

| Mortgage-Backed Securities | 26 | |

| Agency | 20% | |

| Non-Agency | 6 | |

| Corporate Bonds and Notes | 12 | |

| Financials | 5 | |

| Energy | 2 | |

| All other Corporate Bonds and Notes | 5 | |

| Asset-Backed Securities | 5 | |

| Credit Card | 4 | |

| Other | 1 | |

| Total | 100% |

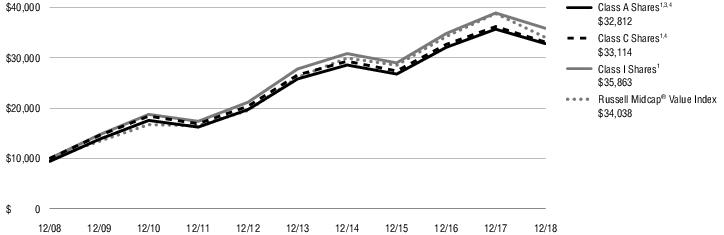

| 1 Year | 5 Years | 10 Years | Since

inception |

Inception

date | ||||||||

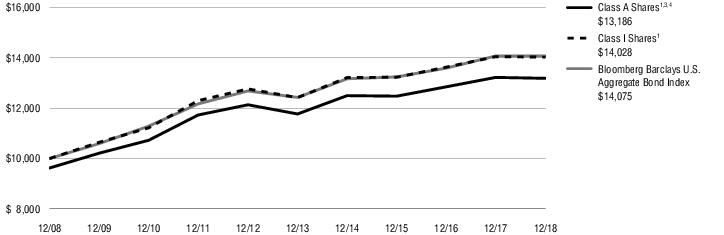

| Class A Shares at NAV2 | -0.28% | 2.30% | 3.20% | —% | — | |||||||

| Class A Shares at POP3,4 | -4.02 | 1.52 | 2.80 | — | — | |||||||

| Class I Shares at NAV2 | -0.14 | 2.47 | 3.44 | — | — | |||||||

| Class R Shares at NAV2 | -0.54 | 2.05 | — | 2.64 | 7/31/09 | |||||||

| Class R6 Shares at NAV2 | -0.02 | — | — | 1.62 | 8/3/15 | |||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | 0.01 | 2.52 | 3.48 | — 5 | — | |||||||

| Fund Expense Ratios6: A Shares: Gross 0.89%, Net 0.64%; I Shares: Gross 0.62%, Net 0.50%; R Shares: Gross 1.09%, Net 0.91%; R6 Shares: Gross 0.47%, Net 0.36%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The index returned 3.31% since inception of Class R shares and 1.72% since inception of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

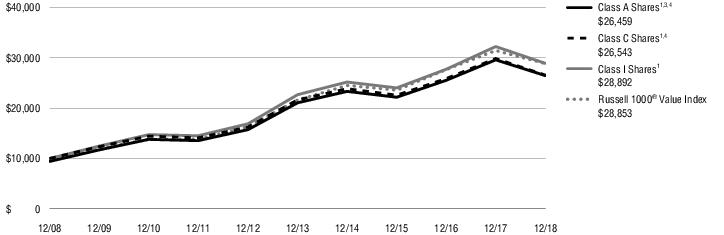

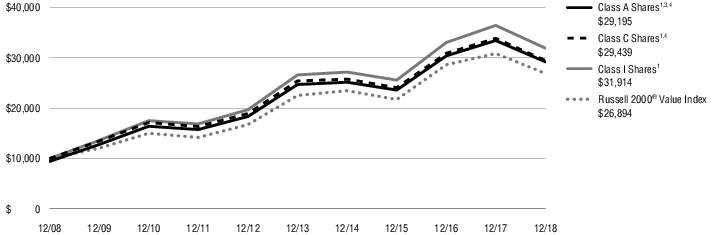

| 1 Year | 5 Years | 10 Years | ||||||

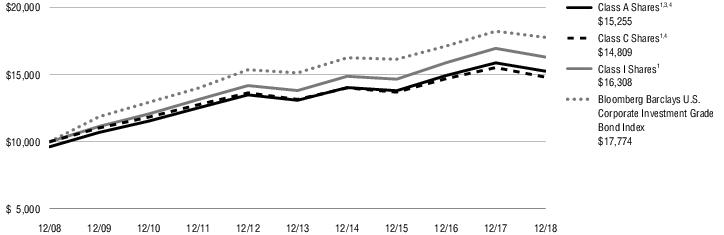

| Class A Shares at NAV2 | -3.90% | 3.11% | 4.71% | |||||

| Class A Shares at POP3,4 | -7.51 | 2.32 | 4.31 | |||||

| Class C Shares at NAV and with CDSC2,4 | -4.61 | 2.40 | 4.00 | |||||

| Class I Shares at NAV2 | -3.81 | 3.38 | 5.01 | |||||

| Bloomberg Barclays U.S. Corporate Investment Grade Bond Index | -2.51 | 3.28 | 5.92 | |||||

| Fund Expense Ratios5: A Shares: Gross 1.50%, Net 0.95%; C Shares: Gross 2.22%, Net 1.65%; I Shares: Gross 1.25%, Net 0.70%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

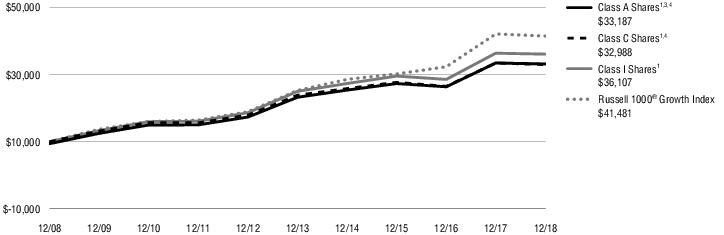

| 1 Year | 5 Years | 10 Years | Since

inception |

Inception

date | ||||||||

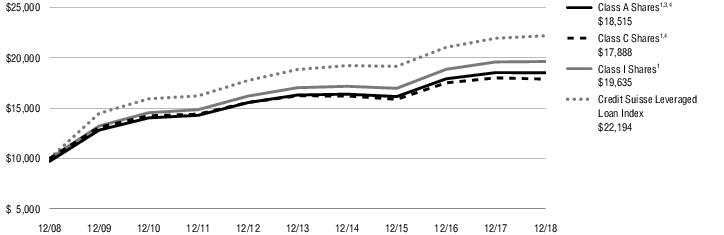

| Class A Shares at NAV2 | -0.11% | 2.57% | 6.65% | —% | — | |||||||

| Class A Shares at POP3,4 | -2.85 | 2.00 | 6.35 | — | — | |||||||

| Class C Shares at NAV and with CDSC2,4 | -0.68 | 1.97 | 5.99 | — | — | |||||||

| Class I Shares at NAV2 | 0.22 | 2.88 | 6.98 | — | — | |||||||

| Class R6 Shares at NAV2 | 0.20 | — | — | 3.51 | 2/1/15 | |||||||

| Credit Suisse Leveraged Loan Index | 1.14 | 3.33 | 8.30 | 3.65 5 | — | |||||||

| Fund Expense Ratios6: A Shares: Gross 1.00%, Net 0.96%; C Shares: Gross 1.66%, Net 1.54%; I Shares: Gross 0.74%, Net 0.64%; R6 Shares: Gross 0.64%, Net 0.54%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

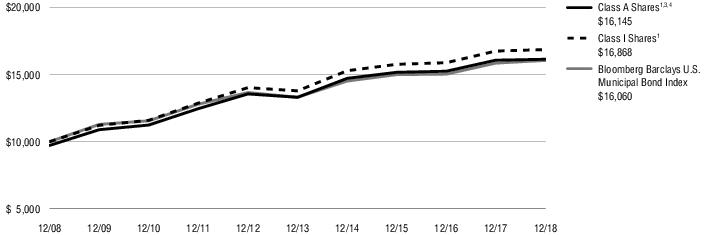

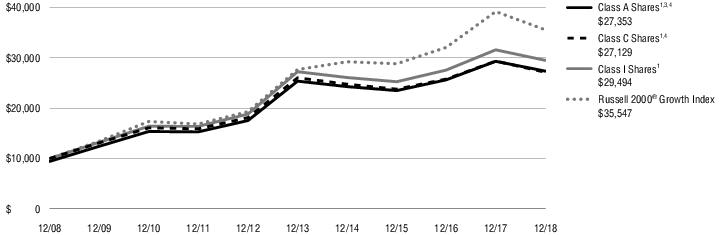

| 1 Year | 5 Years | 10 Years | ||||||

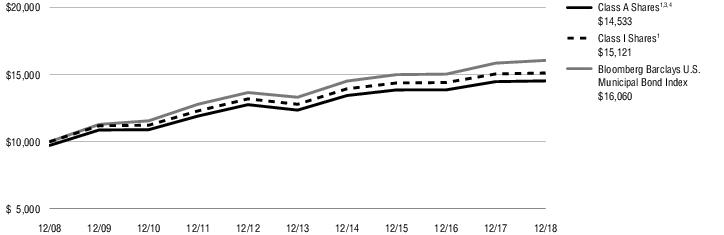

| Class A Shares at NAV2 | 0.38% | 3.30% | 4.10% | |||||

| Class A Shares at POP3,4 | -2.38 | 2.72 | 3.81 | |||||

| Class I Shares at NAV2 | 0.47 | 3.40 | 4.22 | |||||

| Bloomberg Barclays U.S. Municipal Bond Index | 1.28 | 3.82 | 4.85 | |||||

| Fund Expense Ratios5: A Shares: Gross 1.01%, Net 0.76%; I Shares: Gross 0.86%, Net 0.66%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

| 1 Year | 5 Years | 10 Years | ||||||

| Class A Shares at NAV2 | 0.44% | 3.94% | 5.20% | |||||

| Class A Shares at POP3,4 | -2.32 | 3.36 | 4.91 | |||||

| Class I Shares at NAV2 | 0.67 | 4.11 | 5.37 | |||||

| Bloomberg Barclays U.S. Municipal Bond Index | 1.28 | 3.82 | 4.85 | |||||

| Fund Expense Ratios5: A Shares: Gross 0.97%, Net 0.77%; I Shares: Gross 0.87%, Net 0.62%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

| 1 Year | 5 Years | 10 Years | Since

inception |

Inception

date | ||||||||

| Class A Shares at NAV2 | -3.42% | 2.90% | 10.60% | —% | — | |||||||

| Class A Shares at POP3,4 | -7.04 | 2.12 | 10.18 | — | — | |||||||

| Class I Shares at NAV2 | -3.20 | 3.13 | 10.87 | — | — | |||||||

| Class R Shares at NAV2 | -3.59 | 2.73 | — | 7.44 | 7/31/09 | |||||||

| Class R6 Shares at NAV2 | -3.05 | — | — | 2.75 | 8/1/14 | |||||||

| Bloomberg Barclays U.S. Corporate High Yield Bond Index | -2.08 | 3.83 | 11.12 | — 5 | — | |||||||

| Fund Expense Ratios6: A Shares: Gross 1.18%, Net 1.04%; I Shares: Gross 0.91%, Net 0.81%; R Shares: Gross 1.32%, Net 1.23%; R6 Shares: Gross 0.76%, Net 0.65%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The index returned 8.05% since inception of Class R shares and 3.54% since inception of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

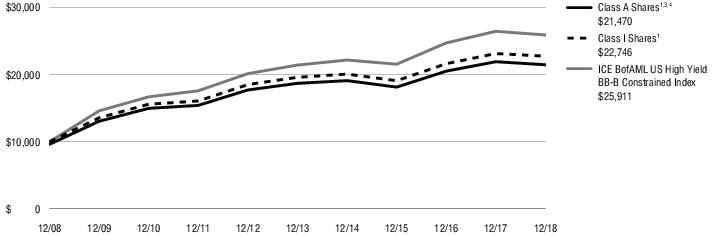

| 1 Year | 5 Years | 10 Years | Since

inception |

Inception

date | ||||||||

| Class A Shares at NAV2 | -2.07% | 2.80% | 8.35% | —% | — | |||||||

| Class A Shares at POP3,4 | -5.74 | 2.01 | 7.94 | — | — | |||||||

| Class I Shares at NAV2 | -1.70 | 3.02 | 8.57 | — | — | |||||||

| Class R Shares at NAV2 | -2.10 | 2.61 | — | 6.11 | 7/31/09 | |||||||

| Class R6 Shares at NAV2 | -1.74 | — | — | 3.85 | 8/1/16 | |||||||

| ICE BofAML U.S. High Yield BB-B Constrained Index | -2.04 | 3.88 | 9.99 | — 5 | — | |||||||

| Fund Expense Ratios6: A Shares: Gross 1.00%, Net 0.83%; I Shares: Gross 0.77%, Net 0.65%; R Shares: Gross 1.23%, Net 1.05%; R6 Shares: Gross 0.66%, Net 0.54%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The index returned 7.48% since inception of Class R shares and 3.57% since inception of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

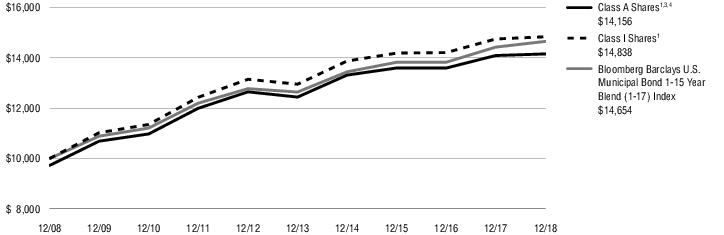

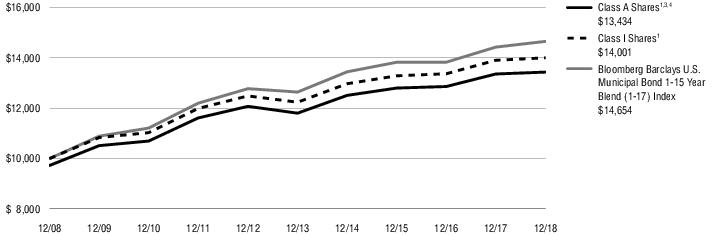

| 1 Year | 5 Years | 10 Years | ||||||

| Class A Shares at NAV2 | 0.45% | 2.61% | 3.83% | |||||

| Class A Shares at POP3,4 | -2.31 | 2.04 | 3.54 | |||||

| Class I Shares at NAV2 | 0.60 | 2.75 | 4.02 | |||||

| Bloomberg Barclays U.S. Municipal Bond 1-15 Year Blend (1-17) Index | 1.58 | 3.00 | 3.90 | |||||

| Fund Expense Ratios5: A Shares: Gross 1.02%, Net 0.76%; I Shares: Gross 0.82%, Net 0.61%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

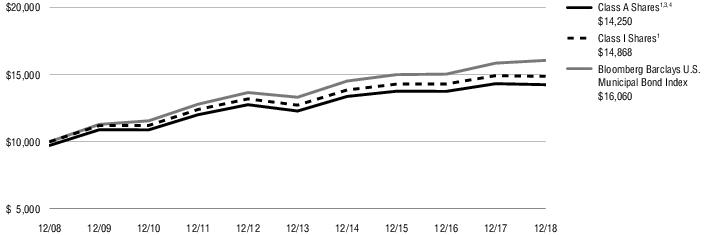

| 1 Year | 5 Years | 10 Years | ||||||

| Class A Shares at NAV2 | -0.52% | 3.01% | 3.89% | |||||

| Class A Shares at POP3,4 | -3.26 | 2.43 | 3.61 | |||||

| Class I Shares at NAV2 | -0.37 | 3.16 | 4.05 | |||||

| Bloomberg Barclays U.S. Municipal Bond Index | 1.28 | 3.82 | 4.85 | |||||

| Fund Expense Ratios5: A Shares: Gross 1.16%, Net 0.81%; I Shares: Gross 1.11%, Net 0.66%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

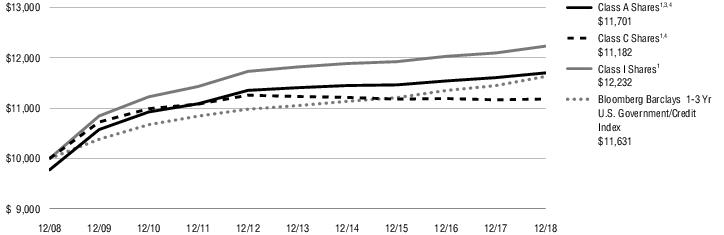

| 1 Year | 5 Years | 10 Years | ||||||

| Class A Shares at NAV2 | 0.81% | 0.51% | 1.81% | |||||

| Class A Shares at POP3,4 | -1.46 | 0.05 | 1.58 | |||||

| Class C Shares at NAV and with CDSC2,4 | 0.14 | -0.09 | 1.12 | |||||

| Class I Shares at NAV2 | 1.11 | 0.69 | 2.03 | |||||

| Bloomberg Barclays 1-3 Year U.S. Government/Credit Index | 1.60 | 1.03 | 1.52 | |||||

| Fund Expense Ratios5: A Shares: Gross 1.53%, Net 0.80%; C Shares: Gross 2.35%, Net 1.57%; I Shares: Gross 1.35%, Net 0.60%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.25% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

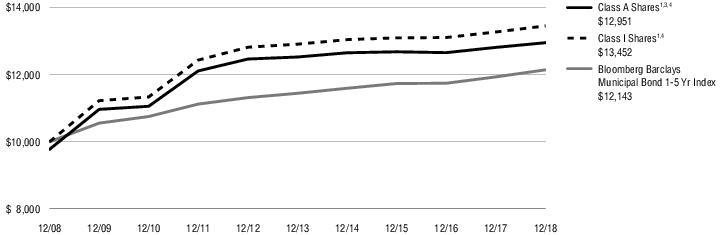

| 1 Year | 5 Years | 10 Years | ||||||

| Class A Shares at NAV2 | 1.10% | 0.67% | 2.85% | |||||

| Class A Shares at POP3,4 | -1.18 | 0.21 | 2.62 | |||||

| Class I Shares at NAV2 | 1.37 | 0.83 | 3.01 | |||||

| Bloomberg Barclays Municipal Bond 1-5 Year Index | 1.77 | 1.19 | 1.96 | |||||

| Fund Expense Ratios5: A Shares: Gross 1.01%, Net 0.66%; I Shares: Gross 0.83%, Net 0.49%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.25% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

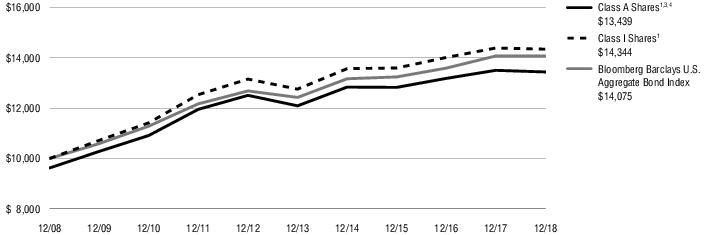

| 1 Year | 5 Years | 10 Years | Since

inception |

Inception

date | ||||||||

| Class A Shares at NAV2 | -0.48% | 2.13% | 3.39% | —% | — | |||||||

| Class A Shares at POP3,4 | -4.21 | 1.35 | 3.00 | — | — | |||||||

| Class I Shares at NAV2 | -0.32 | 2.37 | 3.67 | — | — | |||||||

| Class R Shares at NAV2 | -0.79 | 1.80 | — | 3.08 | 2/13/09 | |||||||

| Class R6 Shares at NAV2 | -0.17 | — | — | 1.75 | 8/1/14 | |||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | 0.01 | 2.52 | 3.48 | — 5 | — | |||||||

| Fund Expense Ratios6: A Shares: Gross 0.98%, Net 0.70%; I Shares: Gross 0.57%, Net 0.46%; R Shares: Gross 0.93%, Net 0.93%; R6 Shares: Gross 0.43%, Net 0.31%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The index returned 3.58% since inception of Class R shares and 1.97% since inception of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

| Mortgage-Backed Securities | 85% | |

| Agency | 85% | |

| U.S. Government Securities | 12 | |

| Short-Term Investment | 2 | |

| Asset-Backed Security | 1 | |

| Total | 100% |

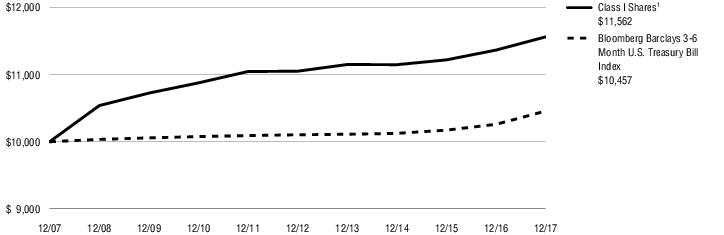

| 1 Year | 5 Years | 10 Years | Since

inception |

Inception

date | ||||||||

| Class A Shares at NAV2 | —% | —% | —% | 0.79% | 7/24/2018 | |||||||

| Class I Shares at NAV2 | 1.73 3 | 0.91 | 1.46 | — | — | |||||||

| Class R6 Shares at NAV2 | 1.88 | — | — | 1.53 | 8/1/16 | |||||||

| Bloomberg Barclays 3-6 Month U.S. Treasury Bill Index | 1.92 | 0.69 | 0.45 | — 4 | — | |||||||

| Fund Expense Ratios5: A Shares: Gross 0.75%, Net 0.67%; I Shares: Gross 0.50%, Net 0.42%; R6 Shares: Gross 0.38%, Net 0.27%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | Total Return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the NAV at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual report and semiannual report. |

| 4 | The index returned 0.97% since inception of Class A shares and 1.22% since inception of Class R6 shares. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

| Mortgage-Backed Securities | 93% | |

| Agency | 91% | |

| Non-Agency | 2 | |

| Short-Term Investment | 6 | |

| Asset-Backed Security | 1 | |

| Total | 100% |

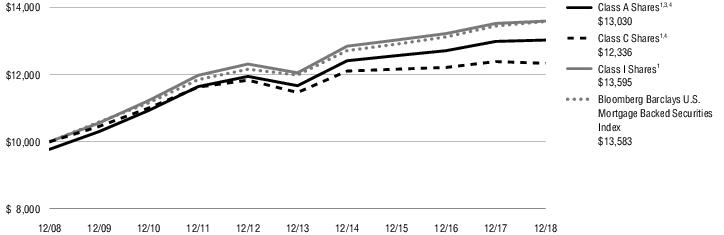

| 1 Year | 5 Years | 10 Years | ||||||

| Class A Shares at NAV2 | 0.31% | 2.23% | 2.92% | |||||

| Class A Shares at POP3,4 | -1.94 | 1.77 | 2.68 | |||||

| Class C Shares at NAV and with CDSC2,4 | -0.43 | 1.47 | 2.12 | |||||

| Class I Shares at NAV2 | 0.52 | 2.44 | 3.12 | |||||

| Bloomberg Barclays U.S. Mortgage Backed Securities Index | 0.99 | 2.53 | 3.11 | |||||

| Fund Expense Ratios5: A Shares: Gross 1.89%, Net 0.91%; C Shares: Gross 1.99%, Net 1.66%; I Shares: Gross 1.06%, Net 0.71%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.25% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

| Mortgage-Backed Securities | 27% | |

| Agency | 21% | |

| Non-Agency | 6 | |

| U.S. Government Securities | 26 | |

| Corporate Bonds and Notes | 25 | |

| Financials | 12 | |

| Health Care | 3 | |

| Consumer Discretionary | 2 | |

| Information Technology | 2 | |

| Utilities | 2 | |

| All other Corporate Bonds and Notes | 4 | |

| Asset-Backed Securities | 17 | |

| Credit Card | 9 | |

| Automobiles | 6 | |

| Student Loan | 2 | |

| Short-Term Investment | 4 | |

| Municipal Bond | 1 | |

| Total | 100% |

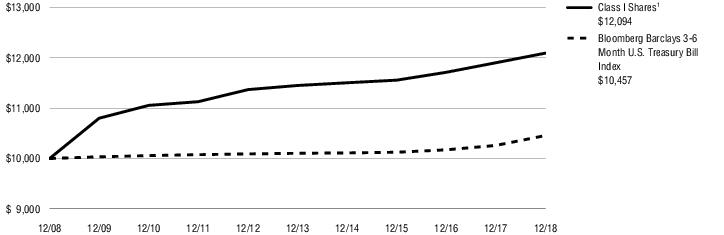

| 1 Year | 5 Years | 10 Years | Since

inception |

Inception

date | ||||||||

| Class A Shares at NAV2 | —% | —% | —% | 0.48% | 7/24/2018 | |||||||

| Class I Shares at NAV2 | 1.61 | 1.10 | 1.92 | — | — | |||||||

| Bloomberg Barclays 3-6 Month U.S. Treasury Bill Index | 1.92 | 0.69 | 0.45 | 0.97 3 | — | |||||||

| Fund Expense Ratios4: A Shares: Gross 0.87%, Net 0.66%; I Shares: Gross 0.62%, Net 0.41%. | ||||||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | The since inception index return is from the inception date of Class A shares. |

| 4 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

| 1 Year | 5 Years | 10 Years | ||||||

| Class A Shares at NAV2 | 0.57% | 2.62% | 3.28% | |||||

| Class A Shares at POP3,4 | -2.20 | 2.05 | 3.00 | |||||

| Class I Shares at NAV2 | 0.71 | 2.73 | 3.42 | |||||

| Bloomberg Barclays U.S. Municipal Bond 1-15 Year Blend (1-17) Index | 1.58 | 3.00 | 3.90 | |||||

| Fund Expense Ratios5: A Shares: Gross 1.10%, Net 0.80%; I Shares: Gross 0.94%, Net 0.66%. | ||||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. | |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.75% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC charges for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective July 23, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlight tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual fee waiver in effect through April 30, 2020. Gross Expense: Does not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with the underlying funds. |

| Total

Value at December 31, 2018 |

Level

2 Significant Observable Inputs | ||

| Debt Securities: | |||

| Asset-Backed Securities | $ 7,076 | $ 7,076 | |

| Corporate Bonds and Notes | 17,450 | 17,450 | |

| Mortgage-Backed Securities | 36,064 | 36,064 | |

| U.S. Government Securities | 81,414 | 81,414 | |

| Total Investments | $142,004 | $142,004 |

| Over-the-counter credit default swaps - buy protection(1) outstanding as of December 31, 2018 were as follows: | |||||||||||||

| Reference Entity | Payment

Frequency |

Counterparty | Fixed

Rate |

Expiration

Date |

Notional

Amount(2) |

Value | Premiums

Paid (Received) |

Unrealized

Appreciation |

Unrealized

(Depreciation) | ||||

| Westpac Banking Corp. | QTR | JPM | 1.000% | 12/20/23 | (1,700) USD | $(19) | $(24) | $5 | $— | ||||

| Total | $(19) | $(24) | $5 | $— | |||||||||

| (1) | If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either: (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying investments comprising the referenced index; or (ii) receive a net settlement amount in the form of cash or investments equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying investments comprising the referenced index. |

| (2) | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Assets: | |||||

| Debt Securities: | |||||

| Corporate Bonds and Notes | $38,673 | $ — | $38,673 | ||

| U.S. Government Security | 1,309 | — | 1,309 | ||

| Short-Term Investment | 393 | 393 | — | ||

| Liabilities: | |||||

| Other Financial Instruments: | |||||

| Over-the-Counter Credit Default Swap | (19) | — | (19) | ||

| Total Investments | $40,356 | $393 | $39,963 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs |

Level

3 Significant Unobservable Inputs | ||||

| Debt Securities: | |||||||

| Asset-Backed Securities | $ 3,572 | $ — | $ 3,572 | $ — | |||

| Corporate Bonds and Notes | 58,887 | — | 33,515 | 25,372 | |||

| Leveraged Loans | 4,992,101 | — | 4,977,054 | 15,047 | |||

| Equity Securities: | |||||||

| Common Stocks | 27,332 | 23,217 | — | 4,115 | |||

| Preferred Stocks | 883 | 862 | — | 21 | |||

| Rights | 292 | — | — | 292 | |||

| Convertible Preferred Stock | — (1) | — | — (1) | — | |||

| Total Investments | $5,083,067 | $24,079 | $5,014,141 | $44,847 |

| (1) | Amount is less than $500. |

| Total | Asset-Backed

Securities |

Corporate

Bonds And Notes |

Leveraged

Loans |

Common

Stocks |

Preferred

Stocks |

Right | |||||||

| Investments in Securities | |||||||||||||

| Balance as of December 31, 2017: | $ 122,806 | $ 3,910 | $ 35,539 | $ 76,342 | $ 6,645 | $ — | $370 | ||||||

| Accrued discount/(premium) | 54 | 2 | 52 | — | — | — | — | ||||||

| Realized gain (loss) | 9,363 | 83 | 21 | (285) | 9,544 | — | — | ||||||

| Change in unrealized appreciation (depreciation)(c) | (4,418) | — (d) | 698 | 653 | (5,655) | (36) | (78) | ||||||

| Purchases | 8,570 | — | — | 4,658 | 3,855 | 57 | — | ||||||

| Sales (b) | (100,782) | (3,995) | (10,938) | (75,575) | (10,274) | — | — | ||||||

| Transfers into Level 3(a) | 10,147 | — | — | 10,147 | — | — | — | ||||||

| Transfers from Level 3(a) | (893) | — | — | (893) | — | — | — | ||||||

| Balance as of December 31, 2018 | $ 44,847 | $ — | $25,372 (e) | $ 15,047 | $ 4,115 | $ 21 | $292 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Debt Securities: | |||||

| Municipal Bonds | $70,702 | $ — | $70,702 | ||

| Short-Term Investment | 3,716 | 3,716 | — | ||

| Total Investments | $74,418 | $3,716 | $70,702 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Debt Securities: | |||||

| Municipal Bonds | $47,763 | $ — | $47,763 | ||

| Short-Term Investment | 1,153 | 1,153 | — | ||

| Total Investments | $48,916 | $1,153 | $47,763 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs |

Level

3 Significant Unobservable Inputs | ||||

| Debt Securities: | |||||||

| Corporate Bonds and Notes | $268,480 | $ — | $268,221 | $259 | |||

| Leveraged Loans | 17,036 | — | 17,036 | — | |||

| Equity Securities: | |||||||

| Common Stocks | 1,334 | 1,294 | — | 40 | |||

| Preferred Stock | 1,085 | 1,085 | — | — | |||

| Warrants | — (1) | — (1) | — | — | |||

| Convertible Preferred Stock | — (1) | — | — (1) | — | |||

| Total Investments | $287,935 | $2,379 | $285,257 | $299 |

| (1) | Amount is less than $500. |

| Total

Value at December 31, 2018 |

Level

2 Significant Observable Inputs |

Level

3 Significant Unobservable Inputs | |||

| Debt Securities: | |||||

| Corporate Bonds and Notes | $258,256 | $257,979 | $277 | ||

| Leveraged Loans | 16,824 | 16,824 | — | ||

| Equity Securities: | |||||

| Common Stock | 33 | — | 33 | ||

| Total Investments | $275,113 | $274,803 | $310 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Debt Securities: | |||||

| Municipal Bonds | $317,232 | $ — | $317,232 | ||

| Short-Term Investment | 5,776 | 5,776 | — | ||

| Total Investments | $323,008 | $5,776 | $317,232 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Debt Securities: | |||||

| Municipal Bonds | $14,082 | $ — | $14,082 | ||

| Short-Term Investment | 1,403 | 1,403 | — | ||

| Total Investments | $15,485 | $1,403 | $14,082 |

| Total

Value at December 31, 2018 |

Level

2 Significant Observable Inputs | ||

| Debt Securities: | |||

| Asset-Backed Securities | $ 430 | $ 430 | |

| Corporate Bonds and Notes | 2,096 | 2,096 | |

| Mortgage-Backed Securities | 1,386 | 1,386 | |

| U.S. Government Securities | 5,128 | 5,128 | |

| Total Investments | $9,040 | $9,040 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Debt Securities: | |||||

| Municipal Bonds | $18,956 | $ — | $18,956 | ||

| Short-Term Investment | 2,049 | 2,049 | — | ||

| Total Investments | $21,005 | $2,049 | $18,956 |

| Forward foreign currency exchange contracts as of December 31, 2018 were as follows: | |||||||

| Currency

Purchased |

Currency

Amount Purchased |

Currency

Sold |

Currency

Amount Sold |

Counterparty | Settlement

Date |

Unrealized

Appreciation |

Unrealized

(Depreciation) |

| AUD | 13,834 | USD | 10,120 | JPM | 01/14/19 | $ — | $(37) |

| CNH | 74,062 | USD | 10,664 | JPM | 01/29/19 | — | (64) |

| Forward foreign currency exchange contracts as of December 31, 2018 were as follows: | ||||||||

| Currency

Purchased |

Currency

Amount Purchased |

Currency

Sold |

Currency

Amount Sold |

Counterparty | Settlement

Date |

Unrealized

Appreciation |

Unrealized

(Depreciation) | |

| EUR | 13,773 | USD | 15,681 | JPM | 01/14/19 | $319 | $— | |

| KRW | 11,315,000 | USD | 10,118 | JPM | 01/15/19 | — | (118) | |

| Total | $319 | $(219) | ||||||

| Over-the-counter credit default swaps - buy protection(1) outstanding as of December 31, 2018 were as follows: | |||||||||||||

| Reference Entity | Payment

Frequency |

Counterparty | Fixed

Rate |

Expiration

Date |

Notional

Amount(2) |

Value | Premiums

Paid (Received) |

Unrealized

Appreciation |

Unrealized

(Depreciation) | ||||

| Westpac Banking Corp. | QTR | JPM | 1.000% | 12/20/23 | (26,300) USD | $(301) | $(373) | $72 | $— | ||||

| Total | $(301) | $(373) | $72 | $— | |||||||||

| Footnote Legend | |

| (1) | If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either: (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying investments comprising the referenced index; or (ii) receive a net settlement amount in the form of cash or investments equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying investments comprising the referenced index. |

| (2) | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

| Total

Value at December 31, 2018 |

Level

2 Significant Observable Inputs | ||

| Assets: | |||

| Debt Securities: | |||

| Asset-Backed Securities | $ 21,294 | $ 21,294 | |

| Corporate Bonds and Notes | 56,968 | 56,968 | |

| Mortgage-Backed Securities | 110,143 | 110,143 | |

| U.S. Government Securities | 246,875 | 246,875 | |

| Other Financial Instruments: | |||

| Forward Foreign Currency Exchange Contract | 319 | 319 | |

| Liabilities: | |||

| Other Financial Instruments: | |||

| Forward Foreign Currency Exchange Contracts | (219) | (219) | |

| Over-the-Counter Credit Default Swap | (301) | (301) | |

| Total Investments | $435,079 | $435,079 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Debt Securities: | |||||

| Asset-Backed Security | $ 19,853 | $ — | $ 19,853 | ||

| Mortgage-Backed Securities | 1,067,365 | — | 1,067,365 | ||

| U.S. Government Securities | 148,298 | — | 148,298 | ||

| Short-Term Investment | 25,025 | 25,025 | — | ||

| Total Investments | $1,260,541 | $25,025 | $1,235,516 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Debt Securities: | |||||

| Asset-Backed Security | $ 295 | $ — | $ 295 | ||

| Mortgage-Backed Securities | 22,142 | — | 22,142 | ||

| U.S. Government Security | 121 | — | 121 | ||

| Short-Term Investment | 1,357 | 1,357 | — | ||

| Total Investments | $23,915 | $1,357 | $22,558 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Debt Securities: | |||||

| Asset-Backed Securities | $10,588 | $ — | $10,588 | ||

| Corporate Bonds and Notes | 15,435 | — | 15,435 | ||

| Mortgage-Backed Securities | 16,713 | — | 16,713 | ||

| Municipal Bond | 771 | — | 771 | ||

| U.S. Government Securities | 15,912 | — | 15,912 | ||

| Short-Term Investment | 2,140 | 2,140 | — | ||

| Total Investments | $61,559 | $2,140 | $59,419 |

| Total

Value at December 31, 2018 |

Level

1 Quoted Prices |

Level

2 Significant Observable Inputs | |||

| Debt Securities: | |||||

| Municipal Bonds | $22,927 | $ — | $22,927 | ||

| Short-Term Investment | 419 | 419 | — | ||

| Total Investments | $23,346 | $419 | $22,927 |

| Seix Core Bond Fund | Seix Corporate Bond Fund | Seix Floating Rate High Income Fund | |||

| Assets | |||||

|

Investment in securities at

value(1) |

$ 142,004 | $ 40,375 | $ 5,083,067 | ||

|

Foreign currency at

value(2) |

— | 6 | — | ||

|

Cash

|

3,029 | 319 | 100,717 | ||

| Receivables | |||||

|

Investment securities sold

|

1,378 | — | 246,499 | ||

|

Fund shares sold

|

38 | 1 | 36,869 | ||

|

Dividends and interest

|

859 | 392 | 15,889 | ||

|

Prepaid expenses

|

30 | 30 | 281 | ||

|

Other assets

|

6 | 2 | 253 | ||

|

Total

assets |

147,344 | 41,125 | 5,483,575 | ||

| Liabilities | |||||

|

Swaps at

value(3) |

— | 19 | — | ||

| Payables | |||||

|

Fund shares repurchased

|

647 | 5 | 52,523 | ||

|

Investment securities purchased

|

1,123 | — | 123,226 | ||

|

Dividend distributions

|

11 | — | 4,014 | ||

|

Investment advisory fees

|

16 | 5 | 1,501 | ||

|

Distribution and service fees

|

3 | 5 | 56 | ||

|

Administration and accounting

fees |

15 | 5 | 554 | ||

|

Transfer agent and sub-transfer agent fees and expenses

|

40 | 10 | 1,255 | ||

|

Professional fees

|

24 | 24 | 9 | ||

|

Trustee deferred compensation plan

|

6 | 2 | 253 | ||

|

Other accrued

expenses |

10 | 2 | 545 | ||

|

Total

liabilities |

1,895 | 77 | 183,936 | ||

|

Net

Assets |

$ 145,449 | $ 41,048 | $ 5,299,639 | ||

| Net Assets Consist of: | |||||

|

Capital paid in on shares of beneficial

interest |

$ 151,038 | $ 42,392 | $ 5,935,779 | ||

|

Accumulated earnings

(loss) |

(5,589) | (1,344) | (636,140) | ||

|

Total Net

Assets |

$ 145,449 | $ 41,048 | $ 5,299,639 | ||

| Net Assets: | |||||

|

Class

A |

$ 5,993 | $ 345 | $ 68,213 | ||

|

Class

C |

$ — | $ 5,459 | $ 45,588 | ||

|

Class

I |

$ 136,247 | $ 35,244 | $ 4,380,792 | ||

|

Class

R |

$ 3,095 | $ — | $ — | ||

|

Class

R6 |

$ 114 | $ — | $ 805,046 | ||

| Shares Outstanding (unlimited number of shares authorized, no par value): | |||||

|

Class

A |

578,664 | 42,337 | 8,217,948 | ||

|

Class

C |

— | 672,808 | 5,490,460 | ||

|

Class

I |

13,150,396 | 4,347,101 | 527,786,475 | ||

|

Class

R |

298,459 | — | — | ||

|

Class

R6 |

11,006 | — | 96,938,520 | ||

| Net Asset Value and Redemption Price Per Share: | |||||

|

Class

A |

$ 10.36 | $ 8.15 | $ 8.30 | ||

|

Class

C |

$ — | $ 8.11 | $ 8.30 | ||

|

Class

I |

$ 10.36 | $ 8.11 | $ 8.30 | ||

|

Class

R |

$ 10.37 | $ — | $ — | ||

|

Class

R6 |

$ 10.36 | $ — | $ 8.30 |

| Seix Core Bond Fund | Seix Corporate Bond Fund | Seix Floating Rate High Income Fund | |||

| Offering Price per Share (NAV/(1-Maximum Sales Charge)): | |||||

|

Class

A |

$ 10.76 | $ 8.47 | $ 8.53 | ||

|

Maximum Sales Charge - Class

A |

3.75% | 3.75% | 2.75% | ||

|

(1) Investment in securities at

cost |

$ 140,704 | $ 40,655 | $ 5,415,886 | ||

|

(2) Foreign currency at

cost |

$ — | $ 6 | $ — | ||

|

(3) Includes premiums paid on over-the-counter credit default

swaps |

— | (24) | — |

| Seix Georgia Tax-Exempt Bond Fund | Seix High Grade Municipal Bond Fund | Seix High Income Fund | |||

| Assets | |||||

|

Investment in securities at

value(1) |

$ 74,418 | $ 48,916 | $ 287,935 | ||

|

Cash

|

— | 1 | 2,940 | ||

| Receivables | |||||

|

Investment securities sold

|

— | — | 2,257 | ||

|

Fund shares sold

|

2,746 | 116 | 582 | ||

|

Receivable from adviser

|

21 | — | — | ||

|

Dividends and interest

|

1,070 | 419 | 4,940 | ||

|

Prepaid expenses

|

16 | 18 | 40 | ||

|

Other assets

|

3 | 2 | 14 | ||

|

Total

assets |

78,274 | 49,472 | 298,708 | ||

| Liabilities | |||||

|

Cash

overdraft |

— (a) | — | — | ||

| Payables | |||||

|

Fund shares repurchased

|

474 | 864 | 3,490 | ||

|

Dividend distributions

|

553 | 22 | 45 | ||

|

Investment advisory fees

|

— | 2 | 129 | ||

|

Distribution and service fees

|

— (a) | 1 | 8 | ||

|

Administration and accounting

fees |

8 | 6 | 31 | ||

|

Transfer agent and sub-transfer agent fees and expenses

|

20 | 11 | 89 | ||

|

Professional fees

|

24 | 24 | 24 | ||

|

Trustee deferred compensation plan

|

3 | 2 | 14 | ||

|

Other accrued

expenses |

3 | 4 | 23 | ||

|

Total

liabilities |

1,085 | 936 | 3,853 | ||

|

Net

Assets |

$ 77,189 | $ 48,536 | $ 294,855 | ||

| Net Assets Consist of: | |||||

|

Capital paid in on shares of beneficial

interest |

$ 76,016 | $ 48,172 | $ 401,837 | ||

|

Accumulated earnings

(loss) |

1,173 | 364 | (106,982) | ||

|

Total Net

Assets |

$ 77,189 | $ 48,536 | $ 294,855 | ||

| Net Assets: | |||||

|

Class

A |

$ 3,114 | $ 6,767 | $ 14,327 | ||

|

Class

I |

$ 74,075 | $ 41,769 | $ 264,435 | ||

|

Class

R |

$ — | $ — | $ 11,166 | ||

|

Class

R6 |

$ — | $ — | $ 4,927 | ||

| Shares Outstanding (unlimited number of shares authorized, no par value): | |||||

|

Class

A |

303,818 | 582,371 | 2,404,239 | ||

|

Class

I |

7,237,941 | 3,595,328 | 44,431,334 | ||

|

Class

R |

— | — | 1,874,988 | ||

|

Class

R6 |

— | — | 828,404 | ||

| Net Asset Value and Redemption Price Per Share: | |||||

|

Class

A |

$ 10.25 | $ 11.62 | $ 5.96 | ||

|

Class

I |

$ 10.23 | $ 11.62 | $ 5.95 | ||

|

Class

R |

$ — | $ — | $ 5.96 | ||

|

Class

R6 |

$ — | $ — | $ 5.95 | ||

| Offering Price per Share (NAV/(1-Maximum Sales Charge)): | |||||

|

Class

A |

$ 10.54 | $ 11.95 | $ 6.19 | ||

|

Maximum Sales Charge - Class

A |

2.75% | 2.75% | 3.75% | ||

|

(1) Investment in securities at

cost |

$ 73,356 | $ 48,101 | $ 315,782 |

| (a) | Amount is less than $500. |

| Seix High Yield Fund | Seix Investment Grade Tax-Exempt Bond Fund | Seix North Carolina Tax-Exempt Bond Fund | |||

| Assets | |||||

|

Investment in securities at

value(1) |

$ 275,113 | $ 323,008 | $ 15,485 | ||

|

Cash

|

9,515 | 2 | — (a) | ||

| Receivables | |||||

|

Investment securities sold

|

2,293 | — | — | ||

|

Fund shares sold

|

291 | 1,977 | 127 | ||

|

Receivable from adviser

|

— | — | 9 | ||

|

Dividends and interest

|

4,700 | 3,738 | 208 | ||

|

Prepaid expenses

|

47 | 26 | 15 | ||

|

Other assets

|

13 | 14 | 1 | ||

|

Total

assets |

291,972 | 328,765 | 15,845 | ||

| Liabilities | |||||

| Payables | |||||

|

Fund shares repurchased

|

767 | 6,021 | 47 | ||

|

Investment securities purchased

|

— | 5,383 | — | ||

|

Dividend distributions

|

54 | 156 | 93 | ||

|

Investment advisory fees

|

88 | 37 | — | ||

|

Distribution and service fees

|

1 | 2 | — (a) | ||

|

Administration and accounting

fees |

29 | 32 | 3 | ||

|

Transfer agent and sub-transfer agent fees and expenses

|

72 | 78 | 4 | ||

|

Professional fees

|

26 | 24 | 24 | ||

|

Trustee deferred compensation plan

|

13 | 14 | 1 | ||

|

Other accrued

expenses |

20 | 18 | 1 | ||

|

Total

liabilities |

1,070 | 11,765 | 173 | ||

|

Net

Assets |

$ 290,902 | $ 317,000 | $ 15,672 | ||

| Net Assets Consist of: | |||||

|

Capital paid in on shares of beneficial

interest |

$ 368,615 | $ 317,388 | $ 15,741 | ||

|

Accumulated earnings

(loss) |

(77,713) | (388) | (69) | ||

|

Total Net

Assets |

$ 290,902 | $ 317,000 | $ 15,672 | ||

| Net Assets: | |||||

|

Class

A |

$ 2,910 | $ 9,999 | $ 466 | ||

|

Class

I |

$ 286,931 | $ 307,001 | $ 15,206 | ||

|

Class

R |

$ 52 | $ — | $ — | ||

|

Class

R6 |

$ 1,009 | $ — | $ — | ||

| Shares Outstanding (unlimited number of shares authorized, no par value): | |||||

|

Class

A |

381,825 | 873,644 | 47,859 | ||

|

Class

I |

36,704,618 | 26,853,460 | 1,557,082 | ||

|

Class

R |

6,621 | — | — | ||

|

Class

R6 |

129,029 | — | — | ||

| Net Asset Value and Redemption Price Per Share: | |||||

|

Class

A |

$ 7.62 | $ 11.45 | $ 9.74 | ||

|

Class

I |

$ 7.82 | $ 11.43 | $ 9.77 | ||

|

Class

R |

$ 7.82 | $ — | $ — | ||

|

Class

R6 |

$ 7.82 | $ — | $ — | ||

| Offering Price per Share (NAV/(1-Maximum Sales Charge)): | |||||

|

Class

A |

$ 7.92 | $ 11.77 | $ 10.02 | ||

|

Maximum Sales Charge - Class

A |

3.75% | 2.75% | 2.75% | ||

|

(1) Investment in securities at

cost |

$ 295,189 | $ 320,549 | $ 15,618 |

| (a) | Amount is less than $500. |

| Seix Short-Term Bond Fund | Seix Short-Term Municipal Bond Fund | Seix Total Return Bond Fund | |||

| Assets | |||||

|

Investment in securities at

value(1) |

$ 9,040 | $ 21,005 | $ 435,280 | ||

|

Foreign currency at

value(2) |

— | — | 110 | ||

|

Cash

|

124 | — (a) | 2,694 | ||

|

Unrealized appreciation on forward foreign currency exchange

contracts |

— | — | 319 | ||

| Receivables | |||||

|

Investment securities sold

|