Securities Act of 1933 Registration No. 333-09341

Investment Company Act of 1940 Registration No. 811-07739

SECURITIES AND EXCHANGE COMMISSION

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933☒

(Check appropriate box or boxes)

Bridgewater, New Jersey 08807

| Name and Address of Agent for Service: |

Copies to: |

| Marcia Y. Lucas, Esq. The Northern Trust Company 333 South Wabash Ave Chicago, Illinois 60604 |

Stephen H. Bier, Esq. Dechert LLP 1095 Avenue of the Americas New York, New York 10036-6797 |

| Portfolio Summaries | |

| Global Equity Portfolio | |

| International Equity Portfolio | |

| International Small Companies Portfolio | |

| Institutional Emerging Markets Portfolio - Institutional Class | |

| Chinese Equity Portfolio | |

| Frontier Emerging Markets Portfolio - Institutional Class I | |

| Frontier Emerging Markets Portfolio - Institutional Class II | |

| Global Equity Research Portfolio | |

| International Equity Research Portfolio | |

| Emerging Markets Research Portfolio | |

| Investment Objectives and Investment Process | |

| Additional Information on Portfolio Investment Strategies and Risks | |

| Management of the Fund | |

| Shareholder Information | |

| Distribution of Fund Shares | |

| Financial Highlights | |

| Privacy Notice |

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

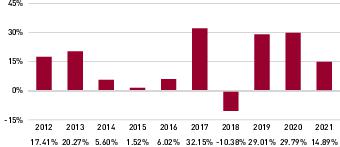

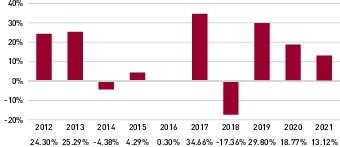

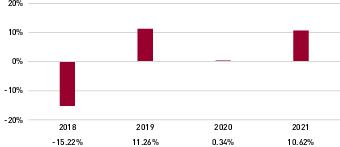

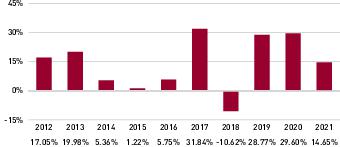

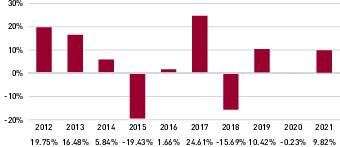

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Global Equity Portfolio – Institutional Class | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

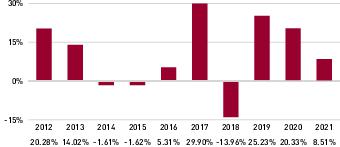

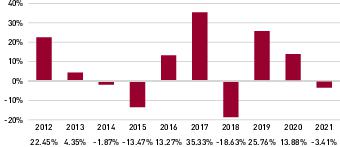

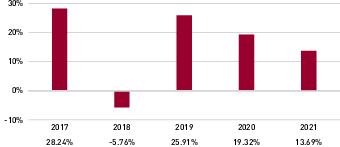

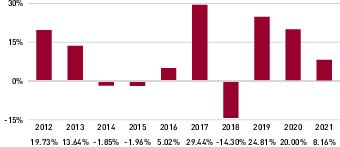

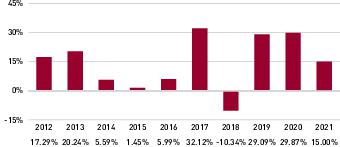

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Harding Loevner International Equity Portfolio – Institutional Class | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World ex-U.S. (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

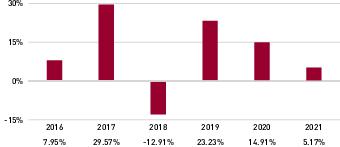

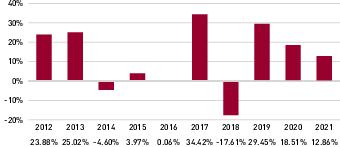

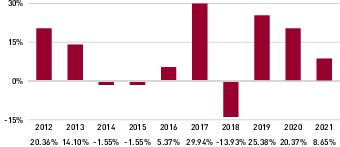

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Harding Loevner International Small Companies Portfolio – Institutional Class | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World ex-U.S. Small Cap (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

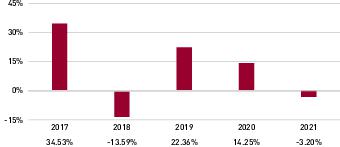

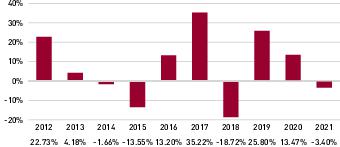

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Harding Loevner Institutional Emerging Markets Portfolio – Institutional Class | |||

| Return Before Taxes |

- |

|

|

| Return After Taxes on Distributions1 |

- |

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

- |

|

|

| MSCI Emerging Markets (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

- |

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| Fee Waiver and/or Expense Reimbursement2 |

- |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement2 |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

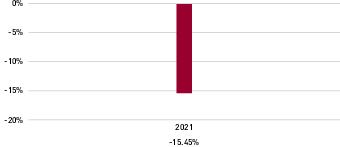

(for the Periods Ended December 31, 2021)

| |

1-Year |

Since Inception 12/16/2020 |

| Chinese Equity Portfolio – Institutional Class | ||

| Return Before Taxes |

- |

- |

| Return After Taxes on Distributions |

- |

- |

| Return After Taxes on Distributions and Sale of Portfolio Shares |

- |

- |

| MSCI China All Shares Index USD Net |

- |

- |

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

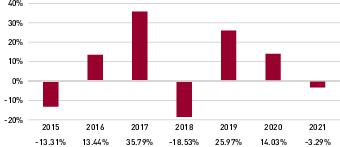

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Harding Loevner Frontier Emerging Markets Portfolio – Institutional Class I | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI Frontier Emerging Markets (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| Fee Waiver and/or Expense Reimbursement2 |

- |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement2 |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

Since Inception 03/01/2017 |

| Frontier Emerging Markets Portfolio – Institutional Class II | ||

| Return Before Taxes |

|

|

| Return After Taxes on Distributions1 |

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

| MSCI Frontier Emerging Markets (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| Fee Waiver and/or Expense Reimbursement2 |

- |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement2 |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

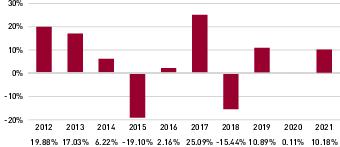

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

Since Inception 12/19/2016 |

| Global Equity Research Portfolio – Institutional Class | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| Fee Waiver and/or Expense Reimbursement2 |

- |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement2 |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

Since Inception 12/17/2015 |

| International Equity Research Portfolio – Institutional Class | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World ex-U.S. (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| Fee Waiver and/or Expense Reimbursement2 |

- |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement2 |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

Since Inception 12/19/2016 |

| Emerging Markets Research Portfolio – Institutional Class | |||

| Return Before Taxes |

- |

|

|

| Return After Taxes on Distributions1 |

- |

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

- |

|

|

| MSCI Emerging+Frontier Markets (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

- |

|

|

| Portfolio |

Objective |

| Global Equity Global Equity Research |

Seeks long-term capital appreciation through investments in equity securities of companies based both inside and outside the United States |

| International Equity International Equity Research |

Seeks long-term capital appreciation through investments in equity securities of companies based outside the United States |

| International Small Companies |

Seeks long-term capital appreciation through investments in equity securities of small companies based outside the United States |

| Chinese Equity |

Seeks long-term capital appreciation through investments in equity securities of Chinese companies |

| Institutional Emerging Markets Emerging Markets Research |

Seeks long-term capital appreciation through investments in equity securities of companies based in emerging markets |

| Frontier Emerging Markets |

Seeks long-term capital appreciation through investments in equity securities of companies based in frontier and smaller emerging markets |

and Risks

and Techniques

| Portfolio |

Aggregate Advisory Fees |

| Global Equity |

0.74% |

| International Equity |

0.66% |

| International Small Companies |

0.95% |

| Chinese Equity Portfolio |

0.95% |

| Institutional Emerging Markets |

0.96% |

| Frontier Emerging Markets |

1.35% |

| Global Equity Research |

0.70% |

| International Equity Research |

0.70% |

| Emerging Markets Research |

1.00% |

Harding, Loevner Funds, Inc.

c/o The Northern Trust Company

P.O. Box 4766

Chicago, Illinois 60680-4766

The Northern Trust Company

Attn: Harding, Loevner Funds, Inc.

333 South Wabash Avenue

Attn: Funds Center, Floor 38

Chicago, Illinois 60604

| Portfolio |

Minimum Initial Investment (by Class) | ||||

| |

$5,000 |

$100,000 |

$500,000 |

$10,000,000 |

$25,000,000 |

| Global Equity |

Advisor Class† |

Institutional Class |

|

|

|

| International Equity |

Investor Class† |

Institutional Class |

|

|

|

| International Small Companies |

Investor Class† |

Institutional Class |

|

|

|

| Institutional Emerging Markets‡ |

|

|

Institutional Class |

|

|

| Emerging Markets†‡ |

Advisor Class† |

|

|

|

|

| Frontier Emerging Markets |

Investor Class† |

Institutional Class I |

|

Institutional Class II |

|

| Global Equity Research |

|

Institutional Class |

|

|

|

| International Equity Research |

|

Institutional Class |

|

|

|

| Emerging Markets Research |

|

Institutional Class |

|

|

|

| Chinese Equity |

|

Institutional Class |

|

|

|

| |

Global Equity Portfolio Institutional Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$42.41 |

$35.38 |

$35.68 |

$40.84 |

$32.53 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income (loss)(1) |

(0.14) |

(0.06) |

0.09 |

0.13 |

0.09 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

14.30 |

7.33 |

3.45 |

(0.13) |

8.74 |

| Net increase (decrease) from investment operations |

14.16 |

7.27 |

3.54 |

— |

8.83 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

— |

(0.24) |

(0.12) |

(0.14) |

(0.13) |

| Net realized gain from investments |

(2.64) |

— |

(3.72) |

(5.02) |

(0.39) |

| Total distributions |

(2.64) |

(0.24) |

(3.84) |

(5.16) |

(0.52) |

| Net asset value, end of year |

$ 53.93 |

$ 42.41 |

$ 35.38 |

$ 35.68 |

$ 40.84 |

| Total Return |

34.57% |

20.63% |

11.86% |

(0.35)% |

27.58% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$1,354,918 |

$1,043,741 |

$684,764 |

$619,347 |

$790,097 |

| Expenses to average net assets |

0.88% |

0.92% |

0.93% |

0.94% |

0.93% |

| Expenses to average net assets (net of fees waived/reimbursed) |

0.88% |

0.92% |

0.93% |

0.94% |

0.93% |

| Net investment income (loss) to average net assets |

(0.28)% |

(0.15)% |

0.28% |

0.34% |

0.25% |

| Portfolio turnover rate |

59% |

63% |

39% |

42% |

33% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

International Equity Portfolio Institutional Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$23.76 |

$22.72 |

$20.74 |

$22.64 |

$18.37 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(1) |

0.34 |

0.23 |

0.29 |

0.31 |

0.23 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

6.80 |

1.19 |

1.98 |

(1.83) |

4.22 |

| Net increase (decrease) from investment operations |

7.14 |

1.42 |

2.27 |

(1.52) |

4.45 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.21) |

(0.38) |

(0.29) |

(0.20) |

(0.18) |

| Net realized gain from investments |

— |

— |

— |

(0.18) |

— |

| Total distributions |

(0.21) |

(0.38) |

(0.29) |

(0.38) |

(0.18) |

| Net asset value, end of year |

$ 30.69 |

$ 23.76 |

$ 22.72 |

$ 20.74 |

$ 22.64 |

| Total Return |

30.16% |

6.25% |

11.19% |

(6.86)% |

24.47% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$18,268,498 |

$13,596,900 |

$13,766,876 |

$11,995,592 |

$11,107,736 |

| Expenses to average net assets |

0.80% |

0.81% |

0.81% |

0.81% |

0.82% |

| Expenses to average net assets (net of fees waived/reimbursed) |

0.80% |

0.81% |

0.81% |

0.81% |

0.82% |

| Net investment income to average net assets |

1.17% |

1.01% |

1.35% |

1.34% |

1.22% |

| Portfolio turnover rate |

14% |

17% |

30% |

10% |

12% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

International Small Companies Portfolio Institutional Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$17.14 |

$15.64 |

$15.29 |

$16.67 |

$13.72 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(1) |

0.06 |

0.08 |

0.12 |

0.13 |

0.11 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

5.63 |

1.53 |

1.24 |

(1.30) |

3.41 |

| Net increase (decrease) from investment operations |

5.69 |

1.61 |

1.36 |

(1.17) |

3.52 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.03) |

(0.11) |

(0.13) |

(0.06) |

(0.16) |

| Net realized gain from investments |

— |

— |

(0.88) |

(0.15) |

(0.41) |

| Total distributions |

(0.03) |

(0.11) |

(1.01) |

(0.21) |

(0.57) |

| Net asset value, end of year |

$ 22.80 |

$ 17.14 |

$ 15.64 |

$ 15.29 |

$ 16.67 |

| Total Return |

33.16% |

10.34% |

10.14% |

(7.15)% |

26.98% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$549,895 |

$337,166 |

$272,252 |

$151,283 |

$144,170 |

| Expenses to average net assets |

1.16% |

1.34% |

1.38% |

1.39% |

1.41% |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.14% |

1.15% |

1.15% |

1.15% |

1.15% |

| Net investment income to average net assets |

0.29% |

0.50% |

0.78% |

0.75% |

0.72% |

| Portfolio turnover rate |

13% |

30% |

37% |

52% |

19% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

Institutional Emerging Markets Portfolio Institutional Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$21.23 |

$21.25 |

$18.43 |

$21.94 |

$17.65 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(1) |

0.09 |

0.12 |

0.24 |

0.19 |

0.19 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

4.37 |

0.19 |

2.76 |

(3.53) |

4.20 |

| Net increase (decrease) from investment operations |

4.46 |

0.31 |

3.00 |

(3.34) |

4.39 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.10) |

(0.33) |

(0.18) |

(0.17) |

(0.10) |

| Net realized gain from investments |

— |

— |

— |

— |

— |

| Total distributions |

(0.10) |

(0.33) |

(0.18) |

(0.17) |

(0.10) |

| Net asset value, end of year |

$ 25.59 |

$ 21.23 |

$ 21.25 |

$ 18.43 |

$ 21.94 |

| Total Return |

21.03% |

1.38% |

16.43% |

(15.33)% |

25.08% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$5,774,486 |

$4,847,707 |

$4,864,702 |

$3,978,321 |

$4,386,511 |

| Expenses to average net assets |

1.22% |

1.28% |

1.27% |

1.27% |

1.28% |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.15% |

1.28% |

1.27% |

1.27% |

1.28% |

| Net investment income to average net assets |

0.33% |

0.59% |

1.18% |

0.84% |

0.97% |

| Portfolio turnover rate |

13% |

23% |

17% |

24% |

17% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

Chinese Equity Portfolio Institutional Class |

| |

2021(1) |

| Net asset value, beginning of year |

$10.00 |

| Increase (Decrease) in Net Assets from Operations |

|

| Net investment income (loss)(2) |

(0.02) |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

(0.62) |

| Net increase (decrease) from investment operations |

(0.64) |

| Distributions to Shareholders from: |

|

| Net investment income |

— |

| Net realized gain from investments |

— |

| Net asset value, end of year |

$ 9.36 |

| Total Return |

(6.40)%(A) |

| Ratios/Supplemental Data: |

|

| Net assets, end of year (000’s) |

$3,942 |

| Expenses to average net assets |

7.00%(B) |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.15%(B) |

| Net investment income (loss) to average net assets |

(0.23)%(B) |

| Portfolio turnover rate |

17%(A) |

| |

|

| (A) |

Not Annualized. |

| (B) |

Annualized. |

| (1) |

For the period from December 16, 2020 (commencement of operations) through October 31, 2021. |

| (2) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

Frontier Emerging Markets Portfolio Institutional Class I | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$6.92 |

$7.80 |

$7.62 |

$8.50 |

$7.35 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(1) |

0.06 |

0.10 |

0.14 |

0.11 |

0.05 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

2.12 |

(0.82) |

0.14 |

(0.82) |

1.17 |

| Net increase (decrease) from investment operations |

2.18 |

(0.72) |

0.28 |

(0.71) |

1.22 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.13) |

(0.16) |

(0.10) |

(0.17) |

(0.07) |

| Net asset value, end of year |

$ 8.97 |

$ 6.92 |

$ 7.80 |

$ 7.62 |

$ 8.50 |

| Total Return |

31.74% |

(9.50)% |

3.59% |

(8.47)% |

16.82% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$96,905 |

$73,376 |

$144,742 |

$220,367 |

$266,844 |

| Expenses to average net assets |

1.64% |

1.68% |

1.63% |

1.62% |

1.71% |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.64% |

1.68% |

1.63% |

1.62% |

1.71% |

| Net investment income to average net assets |

0.75% |

1.44% |

1.72% |

1.24% |

0.69% |

| Portfolio turnover rate |

30% |

21% |

31% |

20% |

28% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

Frontier Emerging Markets Portfolio Institutional Class II | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017(1)(2) |

| Net asset value, beginning of year |

$6.95 |

$7.82 |

$7.63 |

$8.50 |

$7.43 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(3) |

0.09 |

0.14 |

0.17 |

0.14 |

0.08 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

2.13 |

(0.84) |

0.13 |

(0.83) |

0.99 |

| Net increase (decrease) from investment operations |

2.22 |

(0.70) |

0.30 |

(0.69) |

1.07 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.14) |

(0.17) |

(0.11) |

(0.18) |

— |

| Net asset value, end of year |

$ 9.03 |

$ 6.95 |

$ 7.82 |

$ 7.63 |

$ 8.50 |

| Total Return |

32.18% |

(9.26)% |

4.01% |

(8.31)% |

14.40%(A) |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$117,689 |

$116,911 |

$128,742 |

$163,794 |

$166,698 |

| Expenses to average net assets |

1.55% |

1.60% |

1.55% |

1.56% |

1.58%(B) |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.35% |

1.35% |

1.35% |

1.35% |

1.35%(B) |

| Net investment income to average net assets |

1.05% |

1.95% |

2.19% |

1.51% |

1.47%(B) |

| Portfolio turnover rate |

30% |

21% |

31% |

20% |

28%(A) |

| |

|

| (A) |

Not Annualized. |

| (B) |

Annualized. |

| (1) |

For the period from March 1, 2017 (commencement of class operations) through October 31, 2017. |

| (2) |

All per share amounts and net asset values have been adjusted as a result of the share dividend effected after the close of business on December 1, 2017. |

| (3) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

Global Equity Research Portfolio Institutional Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017(1) |

| Net asset value, beginning of year |

$12.76 |

$12.57 |

$12.06 |

$12.23 |

$10.00 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(2) |

0.10 |

0.10 |

0.14 |

0.10 |

0.08 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

4.11 |

0.78 |

1.40 |

0.23 |

2.15 |

| Net increase (decrease) from investment operations |

4.21 |

0.88 |

1.54 |

0.33 |

2.23 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.09) |

(0.15) |

(0.09) |

(0.18) |

— |

| Net realized gain from investments |

(0.29) |

(0.54) |

(0.94) |

(0.32) |

— |

| Total distributions |

(0.38) |

(0.69) |

(1.03) |

(0.50) |

— |

| Net asset value, end of year |

$ 16.59 |

$ 12.76 |

$ 12.57 |

$ 12.06 |

$ 12.23 |

| Total Return |

33.45% |

7.15% |

14.36% |

2.74% |

22.30%(A) |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$9,856 |

$7,387 |

$6,895 |

$5,452 |

$5,308 |

| Expenses to average net assets |

1.75% |

2.04% |

1.96% |

2.64% |

3.49%(B) |

| Expenses to average net assets (net of fees waived/reimbursed) |

0.80% |

0.80% |

0.83% |

0.90% |

0.90%(B) |

| Net investment income to average net assets |

0.67% |

0.80% |

1.18% |

0.76% |

0.80%(B) |

| Portfolio turnover rate |

39% |

44% |

44% |

45% |

36%(A) |

| |

|

| (A) |

Not Annualized. |

| (B) |

Annualized. |

| (1) |

For the period from December 19, 2016 (commencement of class operations) through October 31, 2017. |

| (2) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

International Equity Research Portfolio Institutional Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$12.01 |

$12.03 |

$11.59 |

$13.11 |

$11.10 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(1) |

0.14 |

0.14 |

0.18 |

0.14 |

0.12 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

3.03 |

0.07 |

1.17 |

(0.93) |

2.26 |

| Net increase (decrease) from investment operations |

3.17 |

0.21 |

1.35 |

(0.79) |

2.38 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.15) |

(0.14) |

(0.13) |

(0.14) |

(0.17) |

| Net realized gain from investments |

(0.32) |

(0.09) |

(0.78) |

(0.59) |

(0.20) |

| Total distributions |

(0.47) |

(0.23) |

(0.91) |

(0.73) |

(0.37) |

| Net asset value, end of year |

$ 14.71 |

$ 12.01 |

$ 12.03 |

$ 11.59 |

$ 13.11 |

| Total Return |

26.76% |

1.73% |

12.93% |

(6.43)% |

22.26% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$15,295 |

$12,494 |

$19,458 |

$9,305 |

$9,479 |

| Expenses to average net assets |

1.45% |

1.40% |

1.42% |

1.78% |

2.26% |

| Expenses to average net assets (net of fees waived/reimbursed) |

0.75% |

0.75% |

0.79% |

0.90% |

0.90% |

| Net investment income to average net assets |

0.99% |

1.20% |

1.62% |

1.07% |

0.99% |

| Portfolio turnover rate |

38% |

51% |

44% |

43% |

55% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

Emerging Markets Research Portfolio Institutional Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017(1) |

| Net asset value, beginning of year |

$11.21 |

$11.42 |

$10.82 |

$13.01 |

$10.00 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(2) |

0.10 |

0.09 |

0.15 |

0.12 |

0.10 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

2.04 |

0.17 |

1.35 |

(1.34) |

2.91 |

| Net increase (decrease) from investment operations |

2.14 |

0.26 |

1.50 |

(1.22) |

3.01 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.07) |

(0.14) |

(0.09) |

(0.23) |

— |

| Net realized gain from investments |

(0.13) |

(0.33) |

(0.81) |

(0.74) |

— |

| Total distributions |

(0.20) |

(0.47) |

(0.90) |

(0.97) |

— |

| Net asset value, end of year |

$ 13.15 |

$ 11.21 |

$ 11.42 |

$ 10.82 |

$ 13.01 |

| Total Return |

19.18% |

2.19% |

15.05% |

(10.24)% |

30.10%(A) |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$9,065 |

$7,367 |

$7,198 |

$5,702 |

$5,880 |

| Expenses to average net assets |

2.30% |

2.40% |

2.29% |

2.90% |

3.72%(B) |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.15% |

1.15% |

1.19% |

1.30% |

1.30%(B) |

| Net investment income to average net assets |

0.76% |

0.83% |

1.35% |

0.93% |

1.04%(B) |

| Portfolio turnover rate |

45% |

67% |

58% |

55% |

46%(A) |

| |

|

| (A) |

Not Annualized. |

| (B) |

Annualized. |

| (1) |

For the period from December 19, 2016 (commencement of class operations) through October 31, 2017. |

| (2) |

Net investment income per share was calculated using the average shares outstanding method. |

[This page is not part of the Prospectus]

| Portfolio Summaries | |

| Global Equity Portfolio | |

| International Equity Portfolio | |

| International Small Companies Portfolio | |

| Emerging Markets Portfolio | |

| Frontier Emerging Markets Portfolio | |

| Investment Objectives and Investment Process | |

| Additional Information on Portfolio Investment Strategies and Risks | |

| Management of the Fund | |

| Shareholder Information | |

| Distribution of Fund Shares | |

| Financial Highlights | |

| Privacy Notice |

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Global Equity Portfolio – Advisor Class | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Harding Loevner International Equity Portfolio – Investor Class | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World ex-U.S. (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| Fee Waiver and/or Expense Reimbursement2 |

- |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement2 |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Harding Loevner International Small Companies Portfolio – Investor Class | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World ex-U.S. Small Cap (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Harding Loevner Emerging Markets Portfolio – Advisor Class | |||

| Return Before Taxes |

- |

|

|

| Return After Taxes on Distributions1 |

- |

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

- |

|

|

| MSCI Emerging Markets (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

- |

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| Fee Waiver and/or Expense Reimbursement2 |

- |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement2 |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Harding Loevner Frontier Emerging Markets Portfolio – Investor Class | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI Frontier Emerging Markets (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

| Portfolio |

Objective |

| Global Equity |

Seeks long-term capital appreciation through investments in equity securities of companies based both inside and outside the United States |

| International Equity |

Seeks long-term capital appreciation through investments in equity securities of companies based outside the United States |

| International Small Companies |

Seeks long-term capital appreciation through investments in equity securities of small companies based outside the United States |

| Emerging Markets |

Seeks long-term capital appreciation through investments in equity securities of companies based in emerging markets |

| Frontier Emerging Markets |

Seeks long-term capital appreciation through investments in equity securities of companies based in frontier and smaller emerging markets |

and Risks

and Techniques

| Portfolio |

Aggregate Advisory Fees |

| Global Equity |

0.74% |

| International Equity |

0.66% |

| International Small Companies |

0.95% |

| Emerging Markets |

0.97% |

| Frontier Emerging Markets |

1.35% |

Harding, Loevner Funds, Inc.

c/o The Northern Trust Company

P.O. Box 4766

Chicago, Illinois 60680-4766

The Northern Trust Company

Attn: Harding, Loevner Funds, Inc.

333 South Wabash Avenue

Attn: Funds Center, Floor 38

Chicago, Illinois 60604

| Portfolio |

Minimum Initial Investment (by Class) | ||||

| |

$5,000 |

$100,000 |

$500,000 |

$10,000,000 |

$25,000,000 |

| Global Equity |

Advisor Class |

Institutional Class† |

|

|

|

| International Equity |

Investor Class |

Institutional Class† |

|

|

|

| International Small Companies |

Investor Class |

Institutional Class† |

|

|

|

| Institutional Emerging Markets†‡ |

|

|

Institutional Class†‡ |

|

|

| Emerging Markets‡ |

Advisor Class‡ |

|

|

|

|

| Frontier Emerging Markets |

Investor Class |

Institutional Class I† |

|

Institutional Class II† |

|

| Global Equity Research |

|

Institutional Class† |

|

|

|

| International Equity Research |

|

Institutional Class† |

|

|

|

| Emerging Markets Research |

|

Institutional Class† |

|

|

|

| Chinese Equity |

|

Institutional Class† |

|

|

|

| |

Global Equity Portfolio Advisor Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$42.41 |

$35.30 |

$35.60 |

$40.78 |

$32.47 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income (loss)(1) |

(0.24) |

(0.12) |

0.03 |

0.07 |

0.01 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

14.29 |

7.33 |

3.43 |

(0.15) |

8.73 |

| Net increase (decrease) from investment operations |

14.05 |

7.21 |

3.46 |

(0.08) |

8.74 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

— |

(0.10) |

(0.04) |

(0.08) |

(0.04) |

| Net realized gain from investments |

(2.64) |

— |

(3.72) |

(5.02) |

(0.39) |

| Total distributions |

(2.64) |

(0.10) |

(3.76) |

(5.10) |

(0.43) |

| Net asset value, end of year |

$ 53.82 |

$ 42.41 |

$ 35.30 |

$ 35.60 |

$ 40.78 |

| Total Return |

34.28% |

20.47% |

11.60% |

(0.57)% |

27.28% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$53,483 |

$53,112 |

$48,181 |

$90,567 |

$75,244 |

| Expenses to average net assets |

1.09% |

1.11% |

1.12% |

1.14% |

1.14% |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.09% |

1.11% |

1.12% |

1.14% |

1.14% |

| Net investment income (loss) to average net assets |

(0.48)% |

(0.32)% |

0.09% |

0.18% |

0.02% |

| Portfolio turnover rate |

59% |

63% |

39% |

42% |

33% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

International Equity Portfolio Investor Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$23.70 |

$22.66 |

$20.65 |

$22.55 |

$18.30 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income (loss)(1) |

0.24 |

0.16 |

0.22 |

0.21 |

0.19 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

6.80 |

1.18 |

1.98 |

(1.80) |

4.18 |

| Net increase (decrease) from investment operations |

7.04 |

1.34 |

2.20 |

(1.59) |

4.37 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.13) |

(0.30) |

(0.19) |

(0.13) |

(0.12) |

| Net realized gain from investments |

— |

— |

— |

(0.18) |

— |

| Total distributions |

(0.13) |

(0.30) |

(0.19) |

(0.31) |

(0.12) |

| Net asset value, end of year |

$ 30.61 |

$ 23.70 |

$ 22.66 |

$ 20.65 |

$ 22.55 |

| Total Return |

29.74% |

5.91% |

10.79% |

(7.16)% |

24.04% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$408,864 |

$337,348 |

$395,339 |

$411,712 |

$644,243 |

| Expenses to average net assets |

1.12% |

1.13% |

1.13% |

1.14% |

1.14% |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.12% |

1.13% |

1.13% |

1.14% |

1.14% |

| Net investment income to average net assets |

0.83% |

0.69% |

1.03% |

0.92% |

0.95% |

| Portfolio turnover rate |

14% |

17% |

30% |

10% |

12% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

International Small Companies Portfolio Investor Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$16.94 |

$15.48 |

$15.16 |

$16.55 |

$13.64 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income (loss)(1) |

—(2) |

0.04 |

0.09 |

0.10 |

0.05 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

5.58 |

1.51 |

1.21 |

(1.29) |

3.42 |

| Net increase (decrease) from investment operations |

5.58 |

1.55 |

1.30 |

(1.19) |

3.47 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.01) |

(0.09) |

(0.10) |

(0.05) |

(0.15) |

| Net realized gain from investments |

— |

— |

(0.88) |

(0.15) |

(0.41) |

| Total distributions |

(0.01) |

(0.09) |

(0.98) |

(0.20) |

(0.56) |

| Net asset value, end of year |

$ 22.51 |

$ 16.94 |

$ 15.48 |

$ 15.16 |

$ 16.55 |

| Total Return |

32.84% |

10.07% |

9.82% |

(7.35)% |

26.71% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$49,757 |

$39,696 |

$57,095 |

$57,912 |

$50,292 |

| Expenses to average net assets |

1.50% |

1.67% |

1.70% |

1.75% |

1.80% |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.40% |

1.40% |

1.40% |

1.40% |

1.40% |

| Net investment income to average net assets |

0.01% |

0.28% |

0.63% |

0.58% |

0.37% |

| Portfolio turnover rate |

13% |

30% |

37% |

52% |

19% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| (2) |

Amount was less than $0.005 per share. |

| |

Emerging Markets Portfolio Advisor Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$55.48 |

$55.65 |

$48.21 |

$57.46 |

$46.27 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(1) |

0.12 |

0.26 |

0.58 |

0.42 |

0.43 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

11.55 |

0.40 |

7.28 |

(9.24) |

11.02 |

| Net increase (decrease) from investment operations |

11.67 |

0.66 |

7.86 |

(8.82) |

11.45 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.22) |

(0.83) |

(0.42) |

(0.40) |

(0.26) |

| Net realized gain from investments |

— |

— |

— |

(0.03) |

— |

| Total distributions |

(0.22) |

(0.83) |

(0.42) |

(0.43) |

(0.26) |

| Net asset value, end of year |

$ 66.93 |

$ 55.48 |

$ 55.65 |

$ 48.21 |

$ 57.46 |

| Total Return |

21.04% |

1.11% |

16.46% |

(15.47)% |

24.93% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$3,813,331 |

$3,739,209 |

$4,274,314 |

$3,459,157 |

$4,014,977 |

| Expenses to average net assets |

1.31% |

1.36% |

1.37% |

1.40% |

1.42% |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.28% |

1.36% |

1.37% |

1.40% |

1.42% |

| Net investment income to average net assets |

0.18% |

0.49% |

1.10% |

0.73% |

0.84% |

| Portfolio turnover rate |

15% |

18% |

19% |

24% |

17% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

Frontier Emerging Markets Portfolio Investor Class | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017 |

| Net asset value, beginning of year |

$6.88 |

$7.75 |

$7.57 |

$8.43 |

$7.28 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income (loss)(1) |

0.03 |

0.08 |

0.11 |

0.07 |

0.04 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

2.11 |

(0.83) |

0.13 |

(0.79) |

1.15 |

| Net increase (decrease) from investment operations |

2.14 |

(0.75) |

0.24 |

(0.72) |

1.19 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.10) |

(0.12) |

(0.06) |

(0.14) |

(0.04) |

| Net asset value, end of year |

$ 8.92 |

$ 6.88 |

$ 7.75 |

$ 7.57 |

$ 8.43 |

| Total Return |

31.14% |

(9.70)% |

3.24% |

(8.75)% |

16.40% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$9,542 |

$10,327 |

$20,560 |

$25,388 |

$30,981 |

| Expenses to average net assets |

2.14% |

2.12% |

2.00% |

2.06% |

2.13% |

| Expenses to average net assets (net of fees waived/reimbursed) |

2.00% |

2.00% |

2.00% |

2.00% |

2.00% |

| Net investment income to average net assets |

0.35% |

1.17% |

1.38% |

0.87% |

0.48% |

| Portfolio turnover rate |

30% |

21% |

31% |

20% |

28% |

| |

|

| (1) |

Net investment income per share was calculated using the average shares outstanding method. |

[This page is not part of the Prospectus]

| Portfolio Summaries | |

| Global Equity Portfolio | |

| International Equity Portfolio | |

| Institutional Emerging Markets Portfolio | |

| Investment Objectives and Investment Process | |

| Additional Information on Portfolio Investment Strategies and Risks | |

| Management of the Fund | |

| Shareholder Information | |

| Distribution of Fund Shares | |

| Financial Highlights | |

| Privacy Notice |

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Global Equity Portfolio – Institutional Class Z | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

10-Year |

| Harding Loevner International Equity Portfolio – Institutional Class Z | |||

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions1 |

|

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

|

|

|

| MSCI All Country World ex-U.S. (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

|

|

|

(Fees Paid Directly from Your Investment)

| Maximum Sales Charge (Load) Imposed on Purchases (As a Percentage of Offering Price) |

|

| Redemption Fee (As a Percentage of Amount Redeemed within 90 days or Less from the Date of Purchase) |

|

(Expenses that You Pay Each Year as a Percentage of the Value of Your Investment)

| Management Fees |

|

| Distribution (Rule 12b-1) Fees |

|

| Other Expenses1 |

|

| Total Annual Portfolio Operating Expenses |

|

| Fee Waiver and/or Expense Reimbursement2 |

- |

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement2 |

|

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

| |

| |

(for the Periods Ended December 31, 2021)

| |

1-Year |

5-Year |

Since Inception 03/05/2014 |

| Harding Loevner Institutional Emerging Markets Portfolio – Institutional Class Z | |||

| Return Before Taxes |

- |

|

|

| Return After Taxes on Distributions1 |

- |

|

|

| Return After Taxes on Distributions and Sale of Portfolio Shares1 |

- |

|

|

| MSCI Emerging Markets (Net) Index (Reflects No Deduction for Fees, Expenses, or U.S. Taxes) |

- |

|

|

| Portfolio |

Objective |

| Global Equity |

Seeks long-term capital appreciation through investments in equity securities of companies based both inside and outside the United States |

| Institutional Emerging Markets |

Seeks long-term capital appreciation through investments in equity securities of companies based in emerging markets |

| International Equity |

Seeks long-term capital appreciation through investments in equity securities of companies based outside the United States |

and Risks

and Techniques

| Portfolio |

Aggregate Advisory Fees |

| Global Equity |

0.74% |

| International Equity |

0.66% |

| Institutional Emerging Markets |

0.96% |

Harding, Loevner Funds, Inc.

c/o The Northern Trust Company

P.O. Box 4766

Chicago, Illinois 60680-4766

The Northern Trust Company

Attn: Harding, Loevner Funds, Inc.

333 South Wabash Avenue

Attn: Funds Center, Floor 38

Chicago, Illinois 60604

| |

Global Equity Portfolio Institutional Class Z | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017(1)(2) |

| Net asset value, beginning of year |

$42.39 |

$35.36 |

$35.67 |

$40.84 |

$39.33 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income (loss)(3) |

(0.10) |

(0.02) |

0.11 |

0.17 |

(0.01) |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

14.30 |

7.31 |

3.44 |

(0.15) |

1.52 |

| Net increase (decrease) from investment operations |

14.20 |

7.29 |

3.55 |

0.02 |

1.51 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

— |

(0.26) |

(0.14) |

(0.17) |

— |

| Net realized gain from investments |

(2.64) |

— |

(3.72) |

(5.02) |

— |

| Total distributions |

(2.64) |

(0.26) |

(3.86) |

(5.19) |

— |

| Net asset value, end of year |

$ 53.95 |

$ 42.39 |

$ 35.36 |

$ 35.67 |

$ 40.84 |

| Total Return |

34.66% |

20.76% |

11.89% |

(0.26)% |

3.80%(A) |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$379,781 |

$289,320 |

$229,355 |

$140,359 |

$46,493 |

| Expenses to average net assets |

0.81% |

0.85% |

0.88% |

0.91% |

1.21%(B) |

| Expenses to average net assets (net of fees waived/reimbursed) |

0.80% |

0.84% |

0.88% |

0.90% |

0.90%(B) |

| Net investment income (loss) to average net assets |

(0.20)% |

(0.05)% |

0.32% |

0.43% |

(0.05)%(B) |

| Portfolio turnover rate |

59% |

63% |

39% |

42% |

33%(A) |

| |

|

| (A) |

Not Annualized. |

| (B) |

Annualized. |

| (1) |

For the period from August 1, 2017 (commencement of class operations) through October 31, 2017. |

| (2) |

All per share amounts and net asset values have been adjusted as a result of the reverse share split effected after the close of business on December 1, 2017. |

| (3) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

International Equity Portfolio Institutional Class Z | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017(1)(2) |

| Net asset value, beginning of year |

$23.76 |

$22.72 |

$20.75 |

$22.64 |

$21.35 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(3) |

0.37 |

0.25 |

0.30 |

0.40 |

0.02 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

6.79 |

1.18 |

1.98 |

(1.90) |

1.27 |

| Net increase (decrease) from investment operations |

7.16 |

1.43 |

2.28 |

(1.50) |

1.29 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.23) |

(0.39) |

(0.31) |

(0.21) |

— |

| Net realized gain from investments |

— |

— |

— |

(0.18) |

— |

| Total distributions |

(0.23) |

(0.39) |

(0.31) |

(0.39) |

— |

| Net asset value, end of year |

$ 30.69 |

$ 23.76 |

$ 22.72 |

$ 20.75 |

$ 22.64 |

| Total Return |

30.25% |

6.32% |

11.29% |

(6.79)% |

6.00%(A) |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$3,235,428 |

$2,165,343 |

$1,938,763 |

$1,342,804 |

$166,923 |

| Expenses to average net assets |

0.72% |

0.73% |

0.75% |

0.74% |

0.99%(B) |

| Expenses to average net assets (net of fees waived/reimbursed) |

0.72% |

0.73% |

0.75% |

0.74% |

0.80%(B) |

| Net investment income to average net assets |

1.25% |

1.08% |

1.42% |

1.77% |

0.33%(B) |

| Portfolio turnover rate |

14% |

17% |

30% |

10% |

12%(A) |

| |

|

| (A) |

Not Annualized. |

| (B) |

Annualized. |

| (1) |

All per share amounts and net asset values have been adjusted as a result of the reverse share split effected after the close of business on December 1, 2017. |

| (2) |

For the period from July 17, 2017 (commencement of operations) through October 31, 2017. |

| (3) |

Net investment income per share was calculated using the average shares outstanding method. |

| |

Institutional Emerging Markets Portfolio Institutional Class Z | ||||

| |

2021 |

2020 |

2019 |

2018 |

2017(1) |

| Net asset value, beginning of year |

$21.28 |

$21.28 |

$18.45 |

$21.94 |

$17.71 |

| Increase (Decrease) in Net Assets from Operations |

|

|

|

|

|

| Net investment income(2) |

0.11 |

0.15 |

0.27 |

0.22 |

0.22 |

| Net realized and unrealized gain (loss) on investments and foreign currency-related transactions |

4.38 |

0.20 |

2.76 |

(3.52) |

4.21 |

| Net increase (decrease) from investment operations |

4.49 |

0.35 |

3.03 |

(3.30) |

4.43 |

| Distributions to Shareholders from: |

|

|

|

|

|

| Net investment income |

(0.12) |

(0.35) |

(0.20) |

(0.19) |

(0.20) |

| Net realized gain from investments |

— |

— |

— |

— |

— |

| Total distributions |

(0.12) |

(0.35) |

(0.20) |

(0.19) |

(0.20) |

| Net asset value, end of year |

$ 25.65 |

$ 21.28 |

$ 21.28 |

$ 18.45 |

$ 21.94 |

| Total Return |

21.11% |

1.55% |

16.61% |

(15.21)% |

25.43% |

| Ratios/Supplemental Data: |

|

|

|

|

|

| Net assets, end of year (000’s) |

$719,400 |

$626,632 |

$557,924 |

$391,583 |

$458,288 |

| Expenses to average net assets |

1.13% |

1.19% |

1.19% |

1.20% |

1.23% |

| Expenses to average net assets (net of fees waived/reimbursed) |

1.07% |

1.11% |

1.11% |

1.11% |

1.12% |

| Net investment income to average net assets |

0.41% |

0.76% |

1.34% |

1.00% |

1.12% |

| Portfolio turnover rate |

13% |

23% |

17% |

24% |

17% |

| |

|

| (1) |

All per share amounts and net asset values have been adjusted as a result of the reverse share split effected after the close of business on December 1, 2017. |

| (2) |

Net investment income per share was calculated using the average shares outstanding method. |

[This page is not part of the Prospectus]

| Name, Address and Year of Birth |

Position with the Fund |

Term of Office and Length of Time Served* |

Principal Occupation During Past Five Years |

Number of Portfolios in Fund Complex Overseen By Director |

Other Directorships |

| David R. Loevner** c/o Harding Loevner LP 1230 Ida Dr. Ste. 3 ½ PO Box 383 Wilson, WY 83014 1954 |

Director and Chairman of the Board of Directors |

Indefinite; Director and Chairman of the Board since 1996. |

Harding Loevner LP, Chairman and Chief Executive Officer 1989 – present; Harding Loevner Funds, plc, Director, 2007 – present. |

10 |

None. |

| Name, Address and Year of Birth |

Position with the Fund |

Term of Office and Length of Time Served* |

Principal Occupation During Past Five Years |

Number of Portfolios in Fund Complex Overseen By Director |

Other Directorships |

| Alexandra K. Lynn*** Affiliated Managers Group, Inc. 777 South Flagler Drive West Palm Beach, FL 33401 1979 |

Director |

Indefinite; Director since 2021. |

Affiliated Managers Group, Inc., 2009– present (Chief Administrative Officer, 2018 – present) |

10 |

None. |

| Name, Address and Year of Birth |

Position with the Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past Five Years |

Number of Portfolios in Fund Complex Overseen By Director |

Other Directorships |

| Carolyn N. Ainslie c/o Harding Loevner LP 400 Crossing Boulevard Fourth Floor Bridgewater, NJ 08807 1958 |

Director |

Indefinite; Director since 2014; Member of the Audit Committee since 2015 – Present and Co – Chairperson June – December 2017 and Chairperson since 2018; Member of the Governance Committee since March 2018. |

Bill & Melinda Gates Foundation, Chief Financial Officer, 2018 – present; Princeton University, Vice President for Finance and Treasurer, 2008 – 2018. |

10 |

None. |

| Jill R. Cuniff c/o Harding Loevner LP 400 Crossing Boulevard Fourth Floor Bridgewater, NJ 08807 1964 |

Director |

Indefinite; Director since 2018; Member of the Audit Committee since 2018; Member of the Governance Committee since March 2018. |

Edge Asset Management, President and Director, 2009 – 2016. |

10 |

None. |

| Name, Address and Year of Birth |

Position with the Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past Five Years |

Number of Portfolios in Fund Complex Overseen By Director |

Other Directorships |

| R. Kelly Doherty c/o Harding Loevner LP 400 Crossing Boulevard Fourth Floor Bridgewater, NJ 08807 1958 |

Director |

Indefinite; Director since 2004; Lead Independent Director since 2014; Member of the Governance Committee since March 2018. |

Caymen Partners (private investment vehicles), Managing Partner, 1999 – present. |

10 |

Selective Insurance Group, Inc. |

| Charles W. Freeman, III c/o Harding Loevner LP 400 Crossing Boulevard Fourth Floor Bridgewater, NJ 08807 1964 |

Director |

Indefinite; Director since 2008; Member of the Governance Committee since March 2018. |

U.S. Chamber of Commerce, Senior Vice President for Asia, 2018 – present; Bower Group Asia, Managing Director, China, December 2016 –2017; Forbes-Tate, LLC, International Principal, 2014 – 2016.. |

10 |

None. |

| Jason Lamin c/o Harding Loevner LP 400 Crossing Boulevard Fourth Floor Bridgewater, NJ 08807 1974 |

Director |

Indefinite; Director since 2021; Member of the Audit Committee since 2021; Member of the Governance Committee beginning March 2021. |

Lenox Park Solutions, Inc. (FinTech Company), Founder and Chief Executive Officer, 2009 – present. |

10 |

None. |

| Eric Rakowski c/o Harding Loevner LP 400 Crossing Boulevard Fourth Floor Bridgewater, NJ 08807 1958 |

Director |

Indefinite; Director since 2008; Chairman of the Governance Committee since March 2018. |

University of California at Berkeley School of Law, Professor, 1990 – present. |

10 |

AMG Funds (46 portfolios); AMG Pantheon Fund (1 portfolio); AMG Pantheon Master Fund (1 portfolio); AMG Pantheon Subsidiary Fund, LLC (1 portfolio); Parnassus Funds (5 portfolios). |

| Name, Address and Year of Birth |

Position(s) with the Fund |

Term of Office and Length of Time Served* |

Principal Occupation During Past Five Years |

| Richard T. Reiter Harding Loevner LP 400 Crossing Boulevard Fourth Floor Bridgewater, NJ 08807 1966 |

President |

1 year; since 2011 |

Harding Loevner LP, President and Chief Operating Officer, 1996 – present. |

| Tracy L. Dotolo Foreside Management Services, LLC 10 High Street, Suite 302 Boston, MA 02110 1976 |

Chief Financial Officer and Treasurer |

1 year; since 2019 |

Director at Foreside, Inc. 2016 – present; Vice President – Global Fund Services at JPMorgan Chase 2009 – 2016. |

| Aaron J. Bellish Harding Loevner LP 400 Crossing Boulevard Fourth Floor Bridgewater, NJ 08807 1979 |

Assistant Treasurer |

1 year; since 2012 |