Harding, Loevner Funds, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-07739

Harding, Loevner Funds,

Inc.

(Exact name of registrant as specified in charter)

400 Crossing Boulevard

Fourth

Floor

Bridgewater, NJ 08807

(Address of principal executive offices) (Zip code)

Marcia Y. Lucas

The Northern

Trust Company

50 South LaSalle Street

Chicago, IL 60603

With a copy to:

Stephen H. Bier, Esq.

Dechert LLP

1095 Avenue of the

Americas

New

York, NY 10036

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 435-8105

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2019

Item 1. Reports to Stockholders.

| (a) |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1) |

Harding, Loevner Funds, Inc. HARDING LOEVNER Fundamental. Thinking. Worldwide. Annual Commentary October 31, 2019 Global

Equity Portfolio International Equity Portfolio International Small Companies Portfolio Institutional Emerging Markets Portfolio Emerging Markets Portfolio Frontier Emerging Markets Portfolio Global Equity Research Portfolio International Equity

Research Portfolio Emerging Markets Research Portfolio Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail,

unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a

report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive

shareholder reports and other communications from the Fund electronically by contacting your financial intermediary. You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving

paper copies of your shareholder reports by calling (877) 435-8105 or by sending an email request to hardingloevnerfunds@ntrs.com. If your account is held through a financial intermediary, you can contact your financial intermediary to make your

election. Your election to receive reports in paper will apply to all Funds held with the Fund complex/your financial intermediary. The Prospectus, SAI, and the Fund’s annual and semi-annual reports are also available free of charge on Harding

Loevner’s website at hardingloevnerfunds.com. Reports and other information about the Fund are also available on the EDGAR database on the Commission’s Internet site at SEC.gov or by electronic request at the following e-mail address:

publicinfo@sec.gov. A duplication fee will be applied to written requests and needs to be paid at the time your request is submitted.

As with all mutual funds, the

Securities and Exchange Commission has not approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

HARDING LOEVNER FUNDS

HARDING LOEVNER FUNDS

Global equity investing for institutions is Harding Loevner’s exclusive

focus. Through Harding Loevner Funds it offers distinct global strategies based on its quality-and-growth investment philosophy. It seeks to purchase shares of growing,

financially strong, well-managed companies at favorable prices. Harding Loevner manages each of the Funds’ Portfolios according to a disciplined, research-based investment process. It identifies companies with sustainable competitive advantages

and assesses the durability of their earnings growth by conducting in-depth fundamental research into global industries. In constructing portfolios, Harding Loevner diversifies carefully to limit risk.

RECEIVE INVESTOR MATERIALS ELECTRONICALLY

RECEIVE INVESTOR MATERIALS ELECTRONICALLY

Shareholders may sign up for electronic delivery of

investor materials. By doing so, you will receive the information faster and help us reduce the impact on the environment of providing these materials. To enroll in electronic delivery,

| |

1. |

Go to http://www.icsdelivery.com |

| |

2. |

Select the first letter of your brokerage firm’s name. |

| |

3. |

From the list that follows, select your brokerage firm. If your brokerage firm is not listed, electronic

delivery may not be available. Please contact your brokerage firm. |

| |

4. |

Complete the information requested, including the e-mail address

where you would like to receive notifications for electronic documents. |

Your information will be kept confidential and

will not be used for any purpose other than electronic delivery. If you change your mind, you can cancel electronic delivery at any time and revert to physical delivery of your materials. Just go to http://www.icsdelivery.com, perform the first

three steps above, and follow the instructions for cancelling electronic delivery. If you have any questions, please contact your brokerage firm.

Table of Contents

Contact

|

|

|

| Harding, Loevner Funds, Inc. c/o Northern

Trust Attn: Funds Center C5S 801 South Canal Street

Chicago, IL 60607

Phone: (877) 435-8105 Fax:

(312) 267-3657 www.hardingloevnerfunds.com |

|

Must be preceded or accompanied by a current Prospectus.

Quasar Distributors, LLC, Distributor |

|

|

|

|

|

DAVID LOEVNER, CFA, CIC

CHAIRMAN OF THE FUNDS AND CEO OF THE ADVISER

SIMON HALLETT, CFA

CO-CIO OF THE ADVISER

FERRILL ROLL, CFA

CO-CIO OF THE ADVISER |

Unfortunately, when it comes to investing, we are our own worst enemy. Our reflexes and impulses, molded by

millennia spent confronting a never-ending series of existential threats, have bequeathed us a nervous system uniquely unsuited to the perils of investing in marketable assets. Our instinctive behaviors—to hang with the herd, mimic our

neighbors, and fight or take flight at the first sign of danger—are at odds with the composure, patience, and independence of thought and action essential for success in that activity.

With the threats of predation and deprivation waning, our antiquated nervous systems are particularly maladapted to today’s challenges. We

are subjected to a continual stream of information, not all of it truthful, delivered by methods diabolically designed to devour our limited attention and incite us to immediate action. What remains of our attention is left to contend with an

overabundance of investment choices offering dizzying arrays of exposures and risk profiles. Amid this overload, it is no wonder so many savers give up and opt for a passive approach that, for all its flaws, at least may provide an average return.

As active investors bent on achieving above-average returns, the question we keep returning to, like a fool to his folly, is how best to

continue to overcome the long odds. Each time, we reaffirm our bedrock principles: a consistency of investment philosophy; a focus on process rather than outcomes; a disciplined approach to fundamental research; and a deliberate structuring of

decision making to mitigate our behavioral shortcomings. What links each of these elements is an unflinching focus on the long term. While we’ve frequently laid out the ins and outs of how we invest, we’ve not previously delved into the

importance of a long horizon. In the balance of this letter we will explain specifically why a long-term perspective is critical to our success, the internal structures we have created to foster it, and why none of it would matter were it not for

clients who share our far sightedness.

Forecasting short-term stock price movements is notoriously difficult, but that does not prevent

many from trying. Difficult, however, does not mean impossible and on this thin reed of possibility are pinned the hopes of a disproportionate share of investors. Most will fail. Because short-term swings are dominated by noise and randomness, even

those who find their hopes realized,

at least at first, will owe a debt to providence for an unknown share of their new-found prosperity. In our experience, maintaining a lengthy horizon is a

powerful antidote to the siren song of swift profits, and it is also essential if you hope to disentangle skill from luck.

Over short

horizons, even the sharpest of insights translates into an investment edge that is vanishingly small, barely distinguishable from chance. A negligible edge may be useless at a daily frequency but adds up over time. For instance, you can forecast a

slight decline in temperatures of about one-third of a degree each day in New York’s Central Park between September and December. This prediction is worthless if you want to know the variation in day-to-day temperatures. Best to look out the window if you are planning a fall picnic. But over the entire season, this ostensibly useless projection will track almost the

entire drop in temperature—a source of edge in timing the purchase of a winter coat.

Over short horizons, even the sharpest of insights translates into an investment edge

that is vanishingly small, barely distinguishable from chance.

Long-term thinking promotes a long investment horizon. It

encourages you to look through short-term dislocations and view a price decline as an opportunity rather than a cause for despair. This is especially relevant for fundamental investors who expect to be rewarded for bearing the intrinsic business

risks of the companies they own. Virtually all the value (i.e., discounted cash flow) of a long-lived asset lies not over the next year but far out into the future with minor quarterly variations in operating performance, or stock price, having

almost no bearing on the underlying value of a business.

Long-term thinking is of little use if it’s not matched with long-term

behavior. There is no point in declaring you have a long horizon if the next minute you are riveted by minute-by-minute price changes and assiduously following every

twist and turn in the market. Keep that up and you will soon find that your horizon has become much shorter than you intended. We are hardwired to fear losses far more than we enjoy the prospect of gains. It’s easy to see how investors get

swept up in the modern world’s flow of news and data, especially given our species’ tendency to overweight recent information. To avoid this fate, every opportunity to beat back your behavioral shortcomings must be seized with alacrity.

Harding Loevner’s investment philosophy is predicated on the idea that building a diversified portfolio of the finest companies in

the world while paying careful attention to the price we were paying for their shares had the best chance of

de-

livering superior long-term returns. Despite being armed with knowledge of our value-destroying instincts, it still took painful trial and error to feel our way toward erecting the structures

that allow us to evade them. Our Quality Assessment framework is central to our effort to maintain a focus on long-term company fundamentals rather than short-term stock-price movements. In this framework we look through Michael Porter’s

competitive strategy lens to see the threats and opportunities that shape each industry and examine their effect on its constituent companies. This approach is a far cry from standard financial practice that equates investment risk with observed

share price volatility. We are convinced that, for an unleveraged long-term investor, an understanding of competitive dynamics leads to a more accurate assessment of long-term risks of an investment in a company’s stock than do measures of

short-term price dispersion.

We also encourage long-term thinking in how we task our analysts with assessing the long-term prospects of

the companies in their respective sectors. They typically look ahead seven to ten years, and in some cases as long as twenty years, when forecasting a company’s earnings and cash flows. Businesses where analysts have made a case for protracted

periods of rapid growth include not only Consumer Staples companies such as cosmetics makers, but also some singularly cyclical industrial and transportation businesses.

Another reflection of our emphasis on long-term thinking is our indifference to quarterly

earnings estimates. We neither require nor expect our analysts to produce them. While we have a regard for fundamental research put out by a small number of brokerage house and independent analysts, we put no store in their projections for a single

quarter. We are happy to let others obsess over whether a company can “beat the number.” Our analysts are naturally concerned with quarterly earnings reports to ascertain whether businesses are meeting the targets we’ve set for them.

But fixation on the unexpected difference in financial results over any ninety-day period brings Macbeth’s mournful take on existence to mind: “A tale told by an idiot, full of sound and fury,

signifying nothing.”

We are happy to let others obsess over whether a company can

“beat the number.”

Finally, given our drawn-out investment horizon, for us to

be successful we need clients who share our long-term perspective. Periods of underperformance are inevitable for every truly active manager, no matter how sensible its investment philosophy or disciplined its implementation. We are grateful to

every client who accepts this prolonged and occasionally taxing tradeoff and is willing to bear the risk alongside us.

Sincerely,

|

|

|

|

|

|

David R. Loevner, CFA,

CIC |

|

Simon Hallett, CFA |

|

Ferrill D. Roll,

CFA |

Opinions expressed are those of Harding Loevner and are not intended to be forecasts of future events, a

guarantee of future results, nor investment advice. Please read the separate disclosure page for important information, including the risks of investing in the Portfolios. Past performance is not a guarantee of future results.

PORTFOLIO MANAGEMENT TEAM

|

|

|

|

|

|

PETER BAUGHAN, CFA CO-LEAD PORTFOLIO MANAGER

FERRILL ROLL, CFA CO-LEAD PORTFOLIO MANAGER

SCOTT CRAWSHAW PORTFOLIO

MANAGER JINGYI LI

PORTFOLIO MANAGER

CHRISTOPHER MACK, CFA

PORTFOLIO MANAGER

RICHARD SCHMIDT, CFA

PORTFOLIO MANAGER |

PERFORMANCE SUMMARY

PERFORMANCE SUMMARY

For the Global Equity Portfolio, the Institutional Class rose 11.86%,

the Institutional Class Z rose 11.89%, and the Advisor Class rose 11.60% (net of fees and expenses) in the fiscal year ended October 31, 2019. The Portfolio’s benchmark, the MSCI All Country World Index, rose 12.59% (net of

source taxes).

MARKET REVIEW

MARKET REVIEW

Global stock markets had a volatile fiscal year. After declining sharply toward the

end of 2018 amid rising US-China trade tensions and worries that the US Federal Reserve’s interest rate hikes might trigger a global recession, markets recovered strongly in 2019 to end the trailing

twelve months with double-digit gains.

The US-China trade drama featured whiplash-inducing

developments as optimism about talks turned sour, only to be followed by another apparently positive turn, before again dissolving into recriminations. The year ended at a positive point, with US and Chinese officials beginning a new round of trade

negotiations, China offering to increase its purchases of US agricultural goods, and President Donald Trump indicating a willingness to accede to a “phase one” agreement.

As the year progressed, there were increasing signs that the trade war was weighing on global economic growth. Official GDP growth forecasts

were revised downward in both the US and in Europe. In China, retail sales and manufacturing activity fell amid a sharp decline in bank lending. Germany’s manufacturing sector abruptly contracted in 2019, and the country’s export sales and

orders declined at the fastest rate since the financial crisis in 2008. In September, the Organization for Economic Cooperation and Development (OECD) cut its 2019 forecast for global economic growth to the slowest rate in a decade, citing the

impact of the US-China tariff

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUND FACTS at October 31, 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL NET ASSETS |

|

|

$962.3M |

|

|

|

|

|

|

|

|

|

SALES CHARGE |

|

|

NONE |

|

|

|

|

|

|

|

|

|

NUMBER OF HOLDINGS |

|

|

69 |

|

|

|

|

|

|

|

|

|

TURNOVER (5 YR. AVG.) |

|

|

37% |

|

|

|

|

|

|

|

|

|

REDEMPTION FEE |

|

|

2% FIRST 90 DAYS |

|

|

|

|

|

|

|

| |

|

DIVIDEND POLICY |

|

|

ANNUAL |

|

|

|

|

|

|

|

|

|

|

|

|

INSTITUTIONAL INVESTORS |

|

|

INDIVIDUAL INVESTORS |

|

|

|

|

|

|

|

|

|

|

|

|

|

INST CLASS |

|

INST CLASS Z |

|

|

ADVISOR CLASS |

|

|

|

|

|

|

|

|

|

|

|

TICKER |

|

HLMVX |

|

HLGZX |

|

|

HLMGX |

|

|

|

|

|

|

|

|

|

|

|

CUSIP |

|

412295602 |

|

412295727 |

|

|

412295206 |

|

|

|

|

|

|

|

|

|

|

|

INCEPTION DATE |

|

11/3/2009 |

|

8/1/2017 |

|

|

12/1/1996 |

|

|

|

|

|

|

|

|

|

|

|

MINIMUM INVESTMENT1 |

|

$100,000 |

|

$10,000,000 |

|

|

$5,000 |

|

|

|

|

|

|

|

|

|

|

|

NET EXPENSE RATIO2 |

|

0.93% |

|

0.88% |

|

|

1.12% |

|

|

|

|

|

|

|

|

|

|

|

GROSS EXPENSE RATIO |

|

0.94% |

|

0.91% |

|

|

1.14% |

|

|

|

1Lower minimums available through certain

brokerage firms; 2The net expense ratio is as of October 31, 2019 as the Portfolio is operating below the contractual agreement, which is in effect until February 28, 2020.

All Expense Ratios are as of the Prospectus dated February 28, 2019 unless otherwise noted.

wars on global trade and capital investment. It also reduced its GDP growth estimates for next year for 18 of the G20 economies.

Confronted with anemic economic growth and still no inflationary impulse from ten years of easy money, central banks responded with additional

stimulus. The Federal Reserve cut interest rates in July for the first time since the global financial crisis, and cut them again in late September. The European Central Bank renewed its quantitative easing program and pushed short-term interest

rates deeper into negative territory. China lowered its reserve requirement for banks. Central banks in other countries also moved to cut rates or otherwise create monetary stimulus.

Information Technology (IT), led by the traditionally cyclical semiconductor group, was one of the strongest sectors, alongside Real Estate and

Utilities (normally considered “defensive” sectors). Energy and Materials were the weakest-performing sectors amid declines in the prices of oil and other commodities.

PERFORMANCE ATTRIBUTION

PERFORMANCE ATTRIBUTION

Poor performance from our IT holdings detracted in the fiscal year,

notably US-based graphics chipmaker NVIDIA, which suffered from the the US-China technology dispute. Stocks in Energy also detracted, especially oilfield services company Schlumberger, although this was offset by our underweight in the poorly performing sector.

PERFORMANCE (% TOTAL RETURN)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

for periods ended September 30, 2019 |

|

|

for periods ended October 31, 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

1

YEAR |

|

|

3

YEARS |

|

|

5

YEARS |

|

|

10

YEARS |

|

|

SINCE INCEPTION*

Nov-09 Aug-17

Dec-96 |

|

|

1

YEAR |

|

|

3

YEARS |

|

|

5

YEARS |

|

|

10

YEARS |

|

|

SINCE INCEPTION*

Nov-09 Aug-17

Dec-96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GLOBAL EQUITY PORTFOLIO – INST CLASS |

|

|

-1.83 |

|

|

|

10.64 |

|

|

|

8.44 |

|

|

|

— |

|

|

|

9.52 |

|

|

|

|

|

|

|

|

|

|

|

11.86 |

|

|

|

12.46 |

|

|

|

8.56 |

|

|

|

– |

|

|

|

9.74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GLOBAL EQUITY PORTFOLIO – INST CLASS Z |

|

|

-1.75 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

5.66 |

|

|

|

|

|

|

|

11.89 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

6.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GLOBAL EQUITY PORTFOLIO – ADVISOR CLASS |

|

|

-2.08 |

|

|

|

10.37 |

|

|

|

8.17 |

|

|

|

9.13 |

|

|

|

|

|

|

|

|

|

|

|

7.04 |

|

|

|

11.60 |

|

|

|

12.20 |

|

|

|

8.30 |

|

|

|

9.56 |

|

|

|

|

|

|

|

|

|

|

|

7.14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MSCI ALL COUNTRY WORLD INDEX |

|

|

1.38 |

|

|

|

9.71 |

|

|

|

6.65 |

|

|

|

8.35 |

|

|

|

8.63 |

|

|

|

5.97 |

|

|

|

– |

|

|

|

12.59 |

|

|

|

11.33 |

|

|

|

7.08 |

|

|

|

8.81 |

|

|

|

8.85 |

|

|

|

7.01 |

|

|

|

– |

|

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, November 3, 2009.

Inception of the Institutional Class Z, August 1, 2017. Inception of the Advisor Class, December 1, 1996. Index performance prior to January 1, 2001 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of

an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to

the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com. Performance data shown does not reflect the 2.00% redemption fee imposed on shares held 90 days or

less; otherwise, total returns would be reduced.

Offsetting this, good stocks within Financials contributed positively to relative performance.

Shares of AIA Group, a Hong Kong-based insurer, announced in February that the company had received approval from Chinese regulators to

expand operations to additional provinces. Indian financials HDFC Bank and ICICI Bank rebounded from prior weakness, later aided by the country’s September corporate tax cut. Strong returns from the

Portfolio’s Health Care and Industrials stocks also contributed.

From a geographic perspective, stocks in the US detracted

significantly from relative performance, especially Schlumberger and Walgreens Boots Alliance. Shares of pharmaceutical manufacturer

Regeneron were weaker on continued concerns that drug price reforms would impact revenues, particularly if US proposals to

benchmark drug prices to lower-priced international equivalents were enacted.

The Portfolio benefited from strong stocks in Japan,

where shares of medical information services company M3 rose sharply after the announcement that it would be added to the Nikkei 225

Index. Optical sensor manufacturer Keyence also gained. Pacific ex-Japan was another

contributor, thanks to Hong Kong-based AIA.

The Portfolio’s performance in emerging markets was mixed. While returns from

stocks in India (HDFC Bank and ICICI Bank) and Indonesia (Bank Central Asia) were positive in the fiscal year, they only partially

offset the poor performance of our Chinese holdings. Shares of Baidu, AAC Technologies, and Ctrip.com were all sharply negative.

PERSPECTIVE AND OUTLOOK

PERSPECTIVE AND OUTLOOK

We have been concerned about President Trump’s approach to trade

policy from the outset of his administration. A day after his election in 2016, we predicted “beneficiaries of trade and globalization stand to lose” if consensus assumptions about his future policies proved correct. By the fourth quarter

of last year, new tariffs had been imposed, and their impact was beginning to be felt. We revealed our fear of an emergent trade war becoming “an attack on the bounty of globalization: the efficiencies of

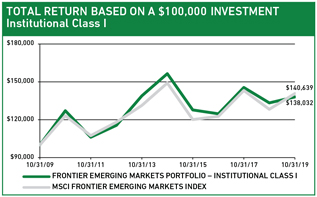

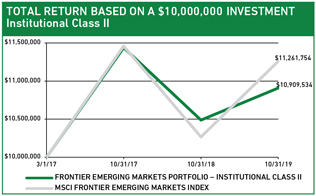

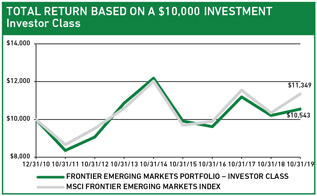

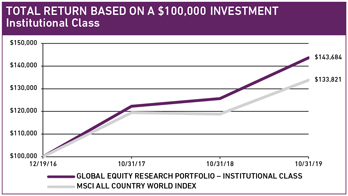

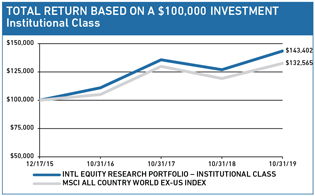

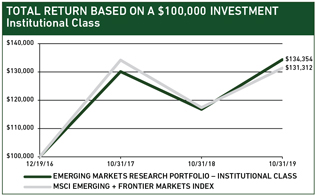

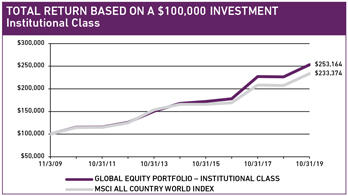

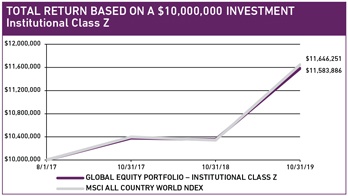

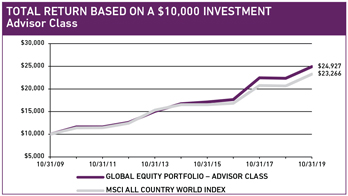

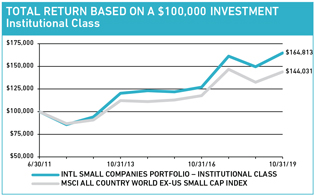

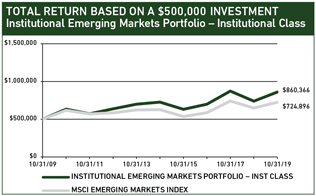

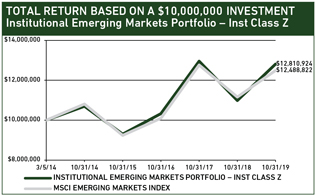

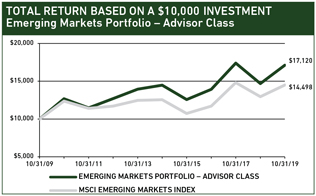

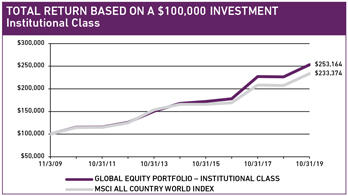

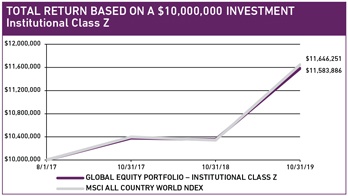

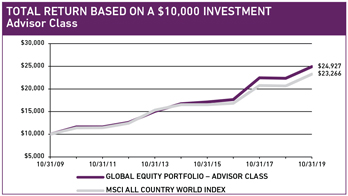

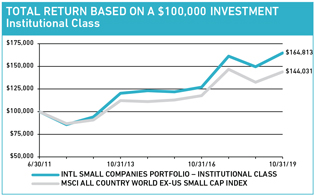

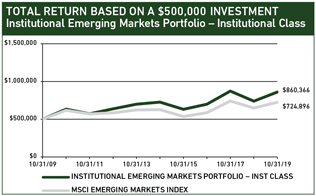

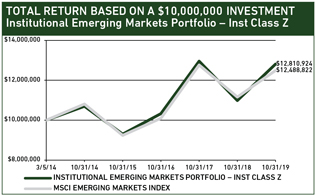

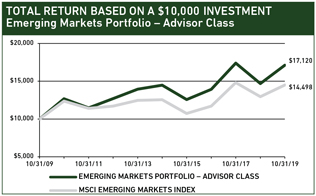

The charts above illustrate the hypothetical return of an investment made in the corresponding share classes.

Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio

distributions or the redemption of Portfolio shares.

global supply chains that have benefited consumers everywhere while bolstering the profits of

those companies most adept at exploiting them.”

We are no longer thinking about the possibility of a hot trade war but rather

grappling with the reality of one. As it has escalated, companies have canceled investment plans, shifted their supply chains out of China, and been forced to choose between accepting lower margins or lower sales. The impact of tariffs is now

showing up in economic data. In August, the US Purchasing Managers Index sank to a 10-year low, while Germany’s Business Climate Index dropped to a nearly 7-year

low. The World Trade Organization (WTO) halved its estimate of growth in world trade in merchandise this year to just 1.2%, the slowest since 2009.

Due to the nature of today’s global trading system the negative effects of the trade war will be further-reaching than its proponents

represented. According to a new WTO report, today more than two-thirds of global trade flows through global value chains (GVCs), with the remainder reflecting the traditional cross-border exchange of finished

products. In “simple” GVCs, companies supply intermediate goods for use in finished production in other countries, for example, Brazilian iron ore exported to China to be made into steel for use in its skyscrapers. In “complex”

GVCs, components cross and re-cross borders in intermediate production before being assembled as a final product. The iPhone is the classic example of such a “made in the world” product of a complex

GVC. Gorilla Glass from Corning factories in Kentucky, semiconductors from Texas Instruments, batteries from Korea, DRAM from Taiwan, and other parts from 40 additional countries are assembled in China and shipped as a finished smartphone to

consumers around the globe. The automobile and aircraft industries exhibit a similarly complex organization of production.

Determining the

impact of tariffs on participants in GVCs is a near-impossible task. The WTO report notes: “One important policy implication is that changes in trade policy can have broad and unanticipated effects. The unilateral imposition of trade protection

on exports from a partner country can have a significant impact on third countries when trade is carried out through GVCs, particularly complex GVCs. Indeed, as many products today are

GEOGRAPHIC EXPOSURE (%) at October 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

COUNTRY/REGION |

|

PORTFOLIO |

|

BENCHMARK1 |

|

|

|

|

|

|

|

|

|

CANADA |

|

0.0 |

|

3.0 |

|

|

|

|

|

|

|

|

|

EMERGING MARKETS |

|

14.5 |

|

11.7 |

|

|

|

|

|

|

|

|

|

EUROPE EMU |

|

8.0 |

|

9.5 |

|

|

|

|

|

|

|

|

|

EUROPE EX-EMU |

|

9.2 |

|

9.1 |

|

|

|

|

|

|

|

|

|

FRONTIER MARKETS2 |

|

0.0 |

|

– |

|

|

|

|

|

|

|

|

|

JAPAN |

|

11.5 |

|

7.4 |

|

|

|

|

|

|

|

|

|

MIDDLE EAST |

|

0.0 |

|

0.2 |

|

|

|

|

|

|

|

|

|

PACIFIC EX-JAPAN |

|

2.8 |

|

3.6 |

|

|

|

|

|

|

|

|

|

UNITED STATES |

|

51.0 |

|

55.5 |

|

|

|

|

|

|

|

|

|

CASH |

|

3.0 |

|

– |

|

|

1MSCI All Country World Index; 2Includes countries with less-developed markets outside the Index.

SECTOR EXPOSURE (%) at October 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

SECTOR |

|

PORTFOLIO |

|

BENCHMARK1 |

|

|

|

|

|

|

|

|

|

COMMUNICATION SERVICES |

|

8.9 |

|

8.8 |

|

|

|

|

|

|

|

|

|

CONSUMER DISCRETIONARY |

|

12.1 |

|

10.8 |

|

|

|

|

|

|

|

|

|

CONSUMER STAPLES |

|

5.5 |

|

8.4 |

|

|

|

|

|

|

|

|

|

ENERGY |

|

2.3 |

|

5.3 |

|

|

|

|

|

|

|

|

|

FINANCIALS |

|

14.2 |

|

16.7 |

|

|

|

|

|

|

|

|

|

HEALTH CARE |

|

17.9 |

|

11.6 |

|

|

|

|

|

|

|

|

|

INDUSTRIALS |

|

12.1 |

|

10.5 |

|

|

|

|

|

|

|

|

|

INFORMATION TECHNOLOGY |

|

18.3 |

|

16.5 |

|

|

|

|

|

|

|

|

|

MATERIALS |

|

5.7 |

|

4.7 |

|

|

|

|

|

|

|

|

|

REAL ESTATE |

|

0.0 |

|

3.3 |

|

|

|

|

|

|

|

|

|

UTILITIES |

|

0.0 |

|

3.4 |

|

|

|

|

|

|

|

|

|

CASH |

|

3.0 |

|

– |

|

|

1MSCI All Country World Index.

already ‘made in the world,’ increasing import protection can even harm exports from the home country.”

So great has been the bounty of the global trading system over our investing careers, it’s certainly the case that we have developed a bias

in favor of businesses that are deeply embedded in complex GVCs. We have found that they tend to have lower and more flexible costs, making them more competitive. They are able to achieve higher and more geographically diversified revenues, and

higher and more stable profit margins, potentially resulting in higher returns on capital. It is for these reasons that our research process leads us to them. If the global trading system is under rising threat from political interference, discount

rates will rise for the shares of those companies most exposed.

Every quarter, we provide a breakdown of the portfolio’s regional and

sector exposures as an exhibit of the diversification of our holdings, and, by implication, of the risks in the portfolio. Internally, we also compute the regional sources of revenues for each portfolio company. Thus, we put at the disposal of the

portfolio managers the aggregate regional revenue breakdown of the companies in their portfolios, as a guide to risks of growth interruption or exposure to long-term trends in the various countries or regions.

We’ve adopted and streamlined the WTO’s taxonomy of enterprises to create a classification by which we can (crudely) estimate the

portfolio’s aggregate exposure to global value chains. Accordingly, we classify our companies as follows:

| |

• |

|

A domestic business is one whose operations are limited to one country. An example is HDFC Bank, which

does almost all its business in its home market of India. |

| |

• |

|

A multi-domestic business is similar to what is commonly known as a multinational corporation (MNC), but

with what we think is a needed twist. An example is the Swiss-based consumer products giant Nestlé. The company is commonly viewed as an MNC since it sells its products in 190 countries.

|

| |

While Nestlé uses raw materials from around the world and there is some trade in Nestlé’s end products, the vast majority of its products are manufactured in the same place

they are sold: in the 80 countries where it has factories. To us, this means Nestlé’s GVC exposure is lower as it is effectively a set of domestic business in multiple countries. |

| |

• |

|

A cross-border business not only has sales in multiple countries but also a complex production chain

that sources components from many countries, assembles in others, and then transports the final product to countries around the world. Examples here include Adidas and Apple. |

Distinguishing our companies in this way yields a picture of our aggregate exposure to each of the three business models. As can be seen in the

table below, our portfolio’s exposure to cross-border businesses is sizable, with nearly 60% by portfolio weight so classified.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

MODEL GLOBAL EQUITY PORTFOLIO END WEIGHT

BY GLOBAL VALUE CHAIN CLASSIFICATION |

|

|

|

|

|

|

|

|

|

|

|

CROSS-BORDER |

|

|

59 |

% |

|

|

|

|

|

|

|

|

MULTI-DOMESTIC |

|

|

19 |

% |

|

|

|

|

|

|

|

|

DOMESTIC |

|

|

22 |

% |

|

|

Source: Harding Loevner Global Equity Model as of October 31, 2019.

If the US-instigated tariff threats have increased the risks of employing complex supply chains, then

discount rates will have also risen for the companies whose businesses depend on them. While each analyst will be making judgments about whether such risks for any one company are adequately (or excessively) discounted in its share price, portfolio

managers need to consider just how many of such judgments, that is, how many cross-border businesses, they are willing to back in their portfolio.

Over the last twelve months, the share prices of companies that we have categorized as cross-border have performed worse than the rest of the

portfolio. This effect was particularly pronounced in the fourth quarter of 2018. Unfortunately, without a similar classification for all stocks in the index, we have no means to quantify the effect on relative performance of this “cross

border” factor apart from other factors.

The effect of tariffs on participants in GVCs is but one, albeit a very important, example

of how political intrusion in the economic sphere impacts our companies. It is clear that we must constantly monitor on many fronts the threats of government intervention. These threats are rising, not only in the form of tariffs, but also as

additional restrictions on technology transfer (e.g., the US ban on sales of certain computer chips to certain Chinese entities), capital restrictions (US threats to restrict investment in Chinese equities, or force Chinese companies to move their

listings from US stock exchanges), or even putative presidential “orders” that US companies abandon the business relationships they have built up in China. Our analysts must grasp how each company manages its supply chain and make a

judgment about whether or not such risks are appropriately discounted in its share price.

TEN LARGEST HOLDINGS at October 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

COMPANY |

|

SECTOR |

|

COUNTRY |

|

% |

|

|

|

|

|

|

|

|

|

|

|

PAYPAL |

|

INFO TECHNOLOGY |

|

US |

|

|

4.2 |

|

|

|

|

|

|

|

|

|

|

|

BOOKING HOLDINGS |

|

CONS DISCRETIONARY |

|

US |

|

|

2.9 |

|

|

|

|

|

|

|

|

|

|

|

ALPHABET |

|

COMM SERVICES |

|

US |

|

|

2.9 |

|

|

|

|

|

|

|

|

|

|

|

VERTEX PHARMA |

|

HEALTH CARE |

|

US |

|

|

2.8 |

|

|

|

|

|

|

|

|

|

|

|

AIA GROUP |

|

FINANCIALS |

|

HONG KONG |

|

|

2.8 |

|

|

|

|

|

|

|

|

|

|

|

ROPER |

|

INDUSTRIALS |

|

US |

|

|

2.7 |

|

|

|

|

|

|

|

|

|

|

|

FIRST REPUBLIC BANK |

|

FINANCIALS |

|

US |

|

|

2.7 |

|

|

|

|

|

|

|

|

|

|

|

M3 |

|

HEALTH CARE |

|

JAPAN |

|

|

2.4 |

|

|

|

|

|

|

|

|

|

|

|

LONZA |

|

HEALTH CARE |

|

SWITZERLAND |

|

|

2.4 |

|

|

|

|

|

|

|

|

|

|

|

VERISK ANALYTICS |

|

INDUSTRIALS |

|

US |

|

|

2.4 |

|

|

|

PORTFOLIO HIGHLIGHTS

PORTFOLIO HIGHLIGHTS

We tend to favor EM-oriented

financial companies because we think that economies where the penetration of financial services is low, the ratio of debt to GDP is modest, and the need for retirement savings and other protection is only beginning to be recognized offer banks and

insurers more opportunities for growth. That preference exposes the portfolio not only to more growth opportunity but also to more market volatility, and results in this period illustrated that trade-off. Two

of our holdings—AIA and Standard Chartered—have significant operations in Hong Kong and China. While their shares have

performed poorly recently as unrest in Hong Kong has escalated, we like their long-term prospects.

AIA, a pan-Asian insurer, boasts Hong Kong as its largest and most profitable market. The company has increasingly prospered by writing policies in Hong Kong for Chinese nationals willing and able to travel there. This

business is sure to have been affected by the unrest that has, at times, shuttered the city’s airport and subways. AIA has long been investing to expand its operations on the mainland, already an important source of growth and significant share

of revenues. In our view, AIA remains one of the most respected brands in all of Asia and in China, preferred by consumers for its multinational pedigree and financial strength, advantages that will outlast the current turmoil in Hong Kong.

Standard Chartered, a UK-domiciled bank with a large presence across Asia, including Hong Kong, also

saw its shares dip. In addition to its Hong Kong operations, the bank is exposed to the disruption of the complex global supply chains of its clients. It books roughly two-thirds of its corporate banking

revenues in a country different from the home country of the client. We have been positively surprised by the resilience of the business (and its shares) given the headwinds from these two sources. In August, the stock rebounded after first-half

results showed that the bank’s business is slowly returning to growth after several years of retrenchment under the new management team led by CEO Bill Winters. We’re attracted to the modestly valued shares, which discount high market

skepticism that the bank can regain the double-digit return on equity that it targets.

Please read the separate disclosures page for

important information, including the risks of investing in the Portfolio.

PORTFOLIO MANAGEMENT TEAM

|

|

|

|

|

|

|

|

|

FERRILL ROLL, CFA

CO-LEAD PORTFOLIO MANAGER

ANDREW WEST, CFA

CO-LEAD PORTFOLIO MANAGER

SCOTT CRAWSHAW

PORTFOLIO MANAGER

BRYAN LLOYD, CFA PORTFOLIO

MANAGER PATRICK TODD, CFA

PORTFOLIO MANAGER

ALEXANDER WALSH, CFA

PORTFOLIO MANAGER |

PERFORMANCE SUMMARY

PERFORMANCE SUMMARY

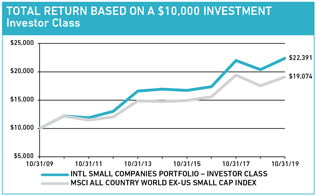

For the International Equity Portfolio, the Institutional Class rose

11.19%, the Institutional Class Z rose 11.29%, and the Investor Class rose 10.79% (net of fees and expenses) in the fiscal year ended October 31, 2019. The Portfolio’s benchmark, the MSCI All Country World ex-US Index, rose 11.27% (net of source taxes).

MARKET REVIEW

MARKET REVIEW

International stock markets had a volatile fiscal year. After falling sharply

toward the end of 2018 amid rising US-China trade tensions and worries that the US Federal Reserve’s interest rate hikes might trigger a global recession, markets recovered strongly in 2019 to end the

trailing twelve months with double-digit gains.

The US-China trade drama featured

whiplash-inducing developments as optimism about talks turned sour, only to be followed by another apparently positive turn, before again dissolving into recriminations. The year ended at a positive point, with US and Chinese officials beginning a

new round of trade negotiations, China offering to increase its purchases of US agricultural goods, and President Donald Trump indicating a willingness to accede to a “phase one” agreement.

As the year progressed, there were increasing signs that the trade war was weighing on global economic growth. Official GDP growth forecasts

were revised downward in both the US and in Europe. In China, retail sales and manufacturing activity fell amid a sharp decline in bank lending. Germany’s manufacturing sector abruptly contracted in 2019, and the country’s export sales and

orders declined at the fastest rate since the financial crisis in 2008. In September, the OECD cut its 2019 forecast for global economic growth to the slowest rate in a decade, citing the impact of the

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUND FACTS at October 31, 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL NET ASSETS |

|

|

$16,101.0M |

|

|

|

|

|

|

|

|

|

SALES CHARGE |

|

|

NONE |

|

|

|

|

|

|

|

|

|

NUMBER OF HOLDINGS |

|

|

60 |

|

|

|

|

|

|

|

|

|

TURNOVER (5 YR. AVG.) |

|

|

17% |

|

|

|

|

|

|

|

|

|

REDEMPTION FEE |

|

|

2% FIRST 90 DAYS |

|

|

|

|

|

|

|

| |

|

DIVIDEND POLICY |

|

|

ANNUAL |

|

|

|

|

|

|

|

|

|

|

|

|

INSTITUTIONAL

INVESTORS |

|

|

INDIVIDUAL INVESTORS |

|

|

|

|

|

|

|

|

|

|

|

|

|

INST CLASS |

|

INST CLASS Z |

|

|

INVESTOR CLASS |

|

|

|

|

|

|

|

|

|

|

|

TICKER |

|

HLMIX |

|

HLIZX |

|

|

HLMNX |

|

|

|

|

|

|

|

|

|

|

|

CUSIP |

|

412295107 |

|

412295719 |

|

|

412295503 |

|

|

|

|

|

|

|

|

|

|

|

INCEPTION DATE |

|

5/11/1994 |

|

7/17/2017 |

|

|

9/30/2005 |

|

|

|

|

|

|

|

|

|

|

|

MINIMUM INVESTMENT1 |

|

$100,000 |

|

$10,000,000 |

|

|

$5,000 |

|

|

|

|

|

|

|

|

|

|

|

NET EXPENSE RATIO |

|

0.81% |

|

0.74% |

|

|

1.13% |

2 |

|

|

|

|

|

|

|

|

|

|

GROSS EXPENSE RATIO |

|

0.81% |

|

0.74% |

|

|

1.14% |

|

|

|

1Lower minimums available

through certain brokerage firms; 2The net expense ratio is as of October 31, 2019 as the Portfolio is operating below the contractual agreement, which is in effect until February 28,

2020.

All Expense Ratios are as of the Prospectus dated February 28, 2019 unless

otherwise noted.

US-China tariff wars on global trade and capital

investment. It also reduced its GDP growth estimates for next year for 18 of the G20 economies.

Confronted with anemic economic growth and

still no inflationary impulse from ten years of easy money, central banks responded with additional stimulus. The Federal Reserve cut interest rates in July for the first time since the global financial crisis, and cut them again in late September.

The European Central Bank renewed its quantitative easing program and pushed short-term interest rates deeper into negative territory. China lowered its reserve requirement for banks. Central banks in other countries also moved to cut rates or

otherwise create monetary stimulus.

Information Technology, led by the traditionally cyclical semiconductor group, was the strongest

sector, followed by Utilities (normally considered a “defensive” sector). Energy and Materials were the weakest-performing sectors amid declines in the prices of oil and other commodities.

PERFORMANCE ATTRIBUTION

PERFORMANCE ATTRIBUTION

Good stock performance within Financials was the largest contributor to

relative returns in the year. Shares of AIA Group, a Hong Kong-based insurer, rose after the company announced in February that it had

received approval from Chinese regulators

PERFORMANCE (% TOTAL RETURN)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

for periods ended September 30, 2019 |

|

|

for periods ended October 31, 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

1 |

|

|

3 |

|

|

5 |

|

|

10 |

|

|

SINCE INCEPTION* |

|

|

1 |

|

|

3 |

|

|

5 |

|

|

10 |

|

|

SINCE INCEPTION* |

|

| |

|

|

|

YEAR |

|

|

YEARS |

|

|

YEARS |

|

|

YEARS |

|

|

May-94 |

|

|

Jul-17 |

|

|

Sep-05 |

|

|

YEAR |

|

|

YEARS |

|

|

YEARS |

|

|

YEARS |

|

|

May-94 |

|

|

Jul-17 |

|

|

Sep-05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTL EQUITY PORTFOLIO – INST CLASS |

|

|

-3.34 |

|

|

|

6.68 |

|

|

|

5.37 |

|

|

|

7.19 |

|

|

|

6.05 |

|

|

|

|

|

|

|

|

|

|

|

11.19 |

|

|

|

8.83 |

|

|

|

5.71 |

|

|

|

7.64 |

|

|

|

6.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTL EQUITY PORTFOLIO – INST CLASS Z |

|

|

-3.25 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

2.82 |

|

|

|

|

|

|

|

11.29 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

4.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTL EQUITY PORTFOLIO – INVESTOR CLASS |

|

|

-3.65 |

|

|

|

6.31 |

|

|

|

5.03 |

|

|

|

6.84 |

|

|

|

|

|

|

|

|

|

|

|

5.91 |

|

|

|

10.79 |

|

|

|

8.46 |

|

|

|

5.36 |

|

|

|

7.29 |

|

|

|

|

|

|

|

|

|

|

|

6.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MSCI ALL COUNTRY WORLD EX-US INDEX |

|

|

-1.23 |

|

|

|

6.33 |

|

|

|

2.90 |

|

|

|

4.46 |

|

|

|

– |

|

|

|

1.79 |

|

|

|

4.19 |

|

|

|

11.27 |

|

|

|

8.07 |

|

|

|

3.82 |

|

|

|

4.94 |

|

|

|

– |

|

|

|

3.25 |

|

|

|

4.42 |

|

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, May 11, 1994.

Inception of the Institutional Class Z, July 17, 2017. Inception of the Investor Class, September 30, 2005. Index performance prior to January 1, 2001 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of

an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to

the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com. Performance data shown does not reflect the 2.00% redemption fee imposed on shares held 90 days or

less; otherwise, total returns would be reduced.

to expand operations to additional provinces. Indian financials HDFC Bank and ICICI Bank rebounded from prior weakness, later aided by the country’s September corporate tax cut. Strong returns from Consumer Staples stocks also contributed, especially French cosmetics manufacturer L’Oréal and Swiss branded-food giant Nestlé.

Poor performance from our Communication Services holdings detracted in the period, especially

telecom services provider China Mobile and Chinese internet search engine Baidu. China’s government eliminated data-roaming charges, decreasing China Mobile’s average revenue per user. Baidu is facing

increased rivalry in online advertising amid China’s slowing economy.

From a geographic perspective, the Portfolio benefited

from strong stock selection in Europe outside the eurozone. In Switzerland, Nestlé, pharmaceutical giant Roche, and hearing-aid

manufacturer Sonova Holdings led performance. In Sweden, industrial equipment manufacturer Atlas Copco boosted relative returns. But that good performance was offset by poor stocks from emerging markets, especially from Chinese

holdings. Baidu, China Mobile, and online social media, payments, and games company Tencent all detracted.

PERSPECTIVE AND OUTLOOK

PERSPECTIVE AND OUTLOOK

We have been concerned about President Trump’s approach to trade

policy from the outset of his administration. A day after his election in 2016, we predicted “beneficiaries of trade and globalization stand to lose” if consensus assumptions about his future policies proved correct. By the fourth quarter

of last year, new tariffs had been imposed, and their impact was beginning to be felt. We revealed our fear of an emergent trade war becoming “an attack on the bounty of globalization: the efficiencies of global supply chains that have

benefited consumers everywhere while bolstering the profits of those companies most adept at exploiting them.”

We are no longer

thinking about the possibility of a hot trade war but rather grappling with the reality of one. As it has escalated, companies have canceled investment plans, shifted their supply

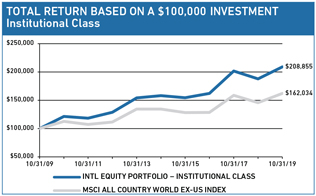

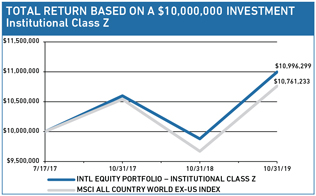

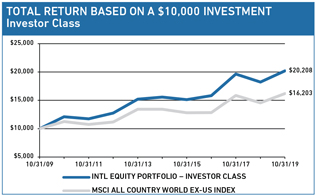

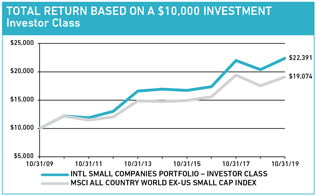

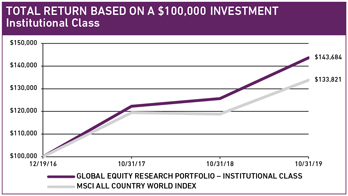

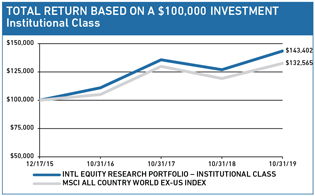

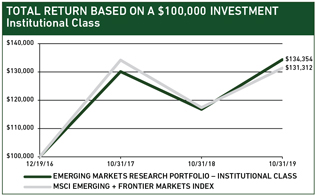

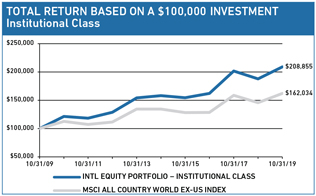

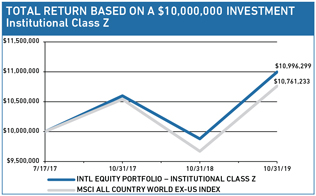

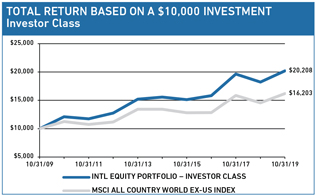

The charts above illustrate the hypothetical return of an investment made in the corresponding share classes.

Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio

distributions or the redemption of Portfolio shares.

chains out of China, and been forced to choose between accepting lower margins or lower sales.

The impact of tariffs is now showing up in economic data. In August, the US Purchasing Managers Index sank to a 10-year low, while Germany’s Business Climate Index dropped to a nearly 7-year low. The World Trade Organization (WTO) halved its estimate of growth in world trade in merchandise this year to just 1.2%, the slowest since 2009.

Due to the nature of today’s global trading system the negative effects of the trade war will be further-reaching than its proponents

represented. According to a new WTO report, today more than two-thirds of global trade flows through global value chains (GVCs), with the remainder reflecting the traditional cross-border exchange of finished

products. In “simple” GVCs, companies supply intermediate goods for use in finished production in other countries, for example, Brazilian iron ore exported to China to be made into steel for use in its skyscrapers. In “complex”

GVCs, components cross and re-cross borders in intermediate production before being assembled as a final product. The iPhone is the classic example of such a “made in the world” product of a complex

GVC. Gorilla Glass from Corning factories in Kentucky, semiconductors from Texas Instruments, batteries from Korea, DRAM from Taiwan, and other parts from 40 additional countries are assembled in China and shipped as a finished smartphone to

consumers around the globe. The automobile and aircraft industries exhibit a similarly complex organization of production.

Determining the

impact of tariffs on participants in GVCs is a near-impossible task. The WTO report notes: “One important policy implication is that changes in trade policy can have broad and unanticipated effects. The unilateral imposition of trade protection

on exports from a partner country can have a significant impact on third countries when trade is carried out through GVCs, particularly complex GVCs. Indeed, as many products today are already ‘made in the world,’ increasing import

protection can even harm exports from the home country.”

GEOGRAPHIC EXPOSURE (%) at October 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

COUNTRY/REGION |

|

PORTFOLIO |

|

BENCHMARK1 |

|

|

|

|

|

|

|

|

|

CANADA |

|

2.9 |

|

6.7 |

|

|

|

|

|

|

|

|

|

EMERGING MARKETS |

|

22.0 |

|

26.2 |

|

|

|

|

|

|

|

|

|

EUROPE EMU |

|

23.2 |

|

21.5 |

|

|

|

|

|

|

|

|

|

EUROPE EX-EMU |

|

25.3 |

|

20.4 |

|

|

|

|

|

|

|

|

|

FRONTIER MARKETS2 |

|

0.0 |

|

– |

|

|

|

|

|

|

|

|

|

JAPAN |

|

11.4 |

|

16.7 |

|

|

|

|

|

|

|

|

|

MIDDLE EAST |

|

2.6 |

|

0.4 |

|

|

|

|

|

|

|

|

|

PACIFIC EX-JAPAN |

|

6.0 |

|

8.1 |

|

|

|

|

|

|

|

|

|

OTHER3 |

|

3.1 |

|

– |

|

|

|

|

|

|

|

|

|

CASH |

|

3.5 |

|

– |

|

|

1MSCI All Country World ex-US Index; 2Includes countries with less-developed markets outside the Index; 3Includes companies

classified in countries outside the Index.

SECTOR EXPOSURE (%) at October 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

SECTOR |

|

PORTFOLIO |

|

BENCHMARK1 |

|

|

|

|

|

|

|

|

|

COMM SERVICES |

|

5.5 |

|

6.7 |

|

|

|

|

|

|

|

|

|

CONSUMER DISCRETIONARY |

|

2.1 |

|

11.6 |

|

|

|

|

|

|

|

|

|

CONSUMER STAPLES |

|

15.4 |

|

9.8 |

|

|

|

|

|

|

|

|

|

ENERGY |

|

4.3 |

|

6.6 |

|

|

|

|

|

|

|

|

|

FINANCIALS |

|

18.8 |

|

21.6 |

|

|

|

|

|

|

|

|

|

HEALTH CARE |

|

10.8 |

|

8.7 |

|

|

|

|

|

|

|

|

|

INDUSTRIALS |

|

12.8 |

|

12.1 |

|

|

|

|

|

|

|

|

|

INFORMATION TECHNOLOGY |

|

19.7 |

|

9.0 |

|

|

|

|

|

|

|

|

|

MATERIALS |

|

7.1 |

|

7.3 |

|

|

|

|

|

|

|

|

|

REAL ESTATE |

|

0.0 |

|

3.2 |

|

|

|

|

|

|

|

|

|

UTILITIES |

|

0.0 |

|

3.4 |

|

|

|

|

|

|

|

|

|

CASH |

|

3.5 |

|

– |

|

|

1MSCI All Country World

ex-USIndex.

So great has been the bounty of the global trading system over our investing careers, it’s

certainly the case that we have developed a bias in favor of businesses that are deeply embedded in complex GVCs. We have found that they tend to have lower and more flexible costs, making them more competitive. They are able to achieve higher and

more geographically diversified revenues, and higher and more stable profit margins, potentially resulting in higher returns on capital. It is for these reasons that our research process leads us to them. If the global trading system is under rising

threat from political interference, discount rates will rise for the shares of those companies most exposed.

Every quarter, we provide a

breakdown of the portfolio’s regional and sector exposures as an exhibit of the diversification of our holdings, and, by implication, of the risks in the portfolio. Internally, we also compute the regional sources of revenues for each portfolio

company. Thus, we put at the disposal of the portfolio managers the aggregate regional revenue breakdown of the companies in their portfolios, as a guide to risks of growth interruption or exposure to long-term trends in the various countries or

regions.

We’ve adopted and streamlined the WTO’s taxonomy of enterprises to create a classification by which we can (crudely)

estimate the portfolio’s aggregate exposure to global value chains. Accordingly, we classify our companies as follows:

| |

• |

|

A domestic business is one whose operations are limited to one country. An example is HDFC Bank,

which does almost all its business in its home market of India. |

| |

• |

|

A multi-domestic business is similar to what is commonly known as a multinational corporation (MNC), but

with what we think is a needed twist. An example is the Swiss-based consumer products giant Nestlé. The company is commonly viewed as an MNC since it sells its products in 190 countries. While Nestlé uses raw materials from around the

world and there is some trade in Nestlé’s end products, the vast majority of its products are manufac-

|

| |

tured in the same place they are sold: in the 80 countries where it has factories. To us, this means Nestlé’s GVC exposure is lower as it is effectively a set of domestic business in

multiple countries. |

| |

• |

|

A cross-border business not only has sales in multiple countries but also a complex production chain

that sources components from many countries, assembles in others, and then transports the final product to countries around the world. Examples here include Adidas and Apple. |

Distinguishing our companies in this way yields a picture of our exposure to each business model. As can be seen in the table below, our

portfolio’s exposure to cross-border businesses is sizable, with more than 50% by portfolio weight so classified.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

MODEL INTERNATIONAL EQUITY PORTFOLIO END WEIGHT

BY GLOBAL VALUE CHAIN CLASSIFICATION |

|

|

|

|

|

|

|

|

|

|

CROSS-BORDER |

|

|

|

58 |

% |

|

|

|

|

|

|

|

|

MULTI-DOMESTIC |

|

|

|

32 |

% |

|

|

|

|

|

|

|

|

DOMESTIC |

|

|

|

10 |

% |

|

|

Source: Harding Loevner International Equity Model as of October 31, 2019.

If the US-instigated tariff threats have increased the risks of employing complex

supply chains, then discount rates will have also risen for the companies whose businesses depend on them. While each analyst will be making judgments about whether such risks for any one company are adequately (or excessively) discounted in its

share price, portfolio managers need to consider just how many of such judgments, that is, how many cross-border businesses, they are willing to back in their portfolio.

Over the last twelve months, the share prices of companies that we have categorized as cross-border have performed worse than those classified

as multi-domestic, although the small handful of domestic companies in the portfolio did even worse (dominated by terrible performance from Chinese internet search provider Baidu). Unfortunately, without a similar classification for all stocks in

the index, we have no means to quantify the effect on relative performance of this “cross-border” factor apart from other factors.

The effect of tariffs on participants in GVCs is but one, albeit a very important, example of how political intrusion in the economic sphere

impacts our companies. It is clear that we must constantly monitor on many fronts the threats of government intervention. These threats are rising, not only in the form of tariffs, but also as additional restrictions on technology transfer (e.g.,

the US ban on sales of certain computer chips to certain Chinese entities), capital restrictions (US threats to restrict investment in Chinese equities, or force Chinese companies to move their listings from US stock exchanges), or even putative

presidential “orders” that US companies abandon the business relationships they have built up in China. Our analysts must grasp how each company manages its supply chain and make a judgment about whether or not such risks are appropriately

discounted in its share price.

TEN LARGEST HOLDINGS at October 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

COMPANY |

|

SECTOR |

|

COUNTRY |

|

% |

|

|

|

|

|

|

|

|

|

|

NESTLÉ |

|

CONS STAPLES |

|

SWITZERLAND |

|

|

|

3.8 |

|

|

|

|

|

|

|

|

|

|

|

ROCHE |

|

HEALTH CARE |

|

SWITZERLAND |

|

|

|

3.8 |

|

|

|

|

|

|

|

|

|

|

|

TSMC |

|

INFO TECHNOLOGY |

|

TAIWAN |

|

|

|

3.8 |

|

|

|

|

|

|

|

|

|

|

|

AIA GROUP |

|

FINANCIALS |

|

HONG KONG |

|

|

|

3.3 |

|

|

|

|

|

|

|

|

|

|

|

ALLIANZ |

|

FINANCIALS |

|

GERMANY |

|

|

|

3.2 |

|

|

|

|

|

|

|

|

|

|

|

SAP |

|

INFO TECHNOLOGY |

|

GERMANY |

|

|

|

3.2 |

|

|

|

|

|

|

|

|

|

|

|

L’OREAL |

|

CONS STAPLES |

|

FRANCE |

|

|

|

3.1 |

|

|

|

|

|

|

|

|

|

|

|

SAMSUNG ELECTRONICS |

|

INFO TECHNOLOGY |

|

SOUTH KOREA |

|

|

|

2.9 |

|

|

|

|

|

|

|

|

|

|

|

ATLAS COPCO |

|

INDUSTRIALS |

|

SWEDEN |

|

|

|

2.8 |

|

|

|

|

|

|

|

|

|

|

|

DBS GROUP |

|

FINANCIALS |

|

SINGAPORE |

|

|

|

2.7 |

|

|

|

PORTFOLIO HIGHLIGHTS

PORTFOLIO HIGHLIGHTS

The International Equity Portfolio has long included large allocations to

Health Care companies, due to their consistent growth and high-quality. Though the Portfolio remains overweight in Health Care relative to the index, we have reduced the Portfolio’s allocation to the sector by a third over the last 12 months.

We shifted this allocation mainly into Consumer Staples, purchasing Canadian roadside retailer Alimentation Couche-Tard and Mexican convenience stores operator and Coca-Coa

bottler FEMSA.

We exited our position in German kidney dialysis

company Fresenius Medical Care after its shares had rebounded following the defeat in November 2018 of the California ballot proposal that would have set controls on the profits

of dialysis providers. However, regulatory threats in the US remain. We are also concerned about how the company’s earnings depend on customers who pay through commercial insurers. There is a high risk that insurers may start increasing pricing

pressure on dialysis providers.

We were reluctant sellers of

Bayer, which we owned into its merger with Monsanto, anticipating synergies between their crop science businesses. Over the past year, however, Bayer’s future has been

clouded by adverse jury verdicts finding Monsanto’s Roundup to blame for some users’ blood cancers. The distraction of the lawsuits to follow will make it difficult for management to deliver upon our prior growth expectations. Moreover,

the company now faces a large and indeterminate legal liability, in the estimation of which we do not have a particular edge.

Portfolio

Management Team Update

As previously announced, Andrew West, a portfolio manager of the International Equity strategy since

2014, became a co-lead portfolio manager of the strategy on January 2, 2019, replacing Alec Walsh. Ferrill Roll continues as the strategy’s other co-lead

portfolio manager.

Please read the separate disclosures page for important information, including the risks of investing in

the Portfolio.

PORTFOLIO MANAGEMENT

|

|

|

| JAFAR RIZVI, CFA CO-LEAD PORTFOLIO MANAGER

ANIX VYAS, CFA CO-LEAD PORTFOLIO MANAGER |

|

|

PERFORMANCE SUMMARY

PERFORMANCE SUMMARY

For the International Small Companies Portfolio, the Institutional

Class gained 10.14% and the Investor Class rose 9.82% (net of fees and expenses) in the fiscal year ended October 31, 2019. The Portfolio’s benchmark, the MSCI All Country World ex-US Small

Cap Index, rose 8.77% (net of source taxes).

MARKET REVIEW

MARKET REVIEW

Stocks of international small companies ended 2018 with their steepest decline

since the recession as the opening salvos of the US-China trade war led to the imposition of new tariffs, the US yield curve flattened after the Federal Reserve indicated additional short-term rate hikes, and

reports of slowing growth in China and Germany sparked a flight to safety. However, stocks recouped much of their earlier losses by the end of March as US-China tensions (temporarily) cooled and central banks

reversed course; the Fed announced a pause to future rate hikes and the unwinding of its balance sheet, while the European and Chinese central banks took steps to lower borrowing costs and encourage loan growth. This momentum continued into July, as

the Fed cut rates for the first time since the financial crisis and the European Central Bank pushed rates further into negative territory.