Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | Quarterly report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2016

or

| ☐ | Transition report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 |

for the transition period from to

Commission file number: 000-20971

EDGEWATER TECHNOLOGY, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 71-0788538 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 200 Harvard Mill Square, Suite 210 Wakefield, MA |

01880-3209 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (781) 246-3343

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of Common Stock of the Registrant, par value $.01 per share, outstanding at October 31, 2016 was 12,377,512.

Table of Contents

FORM 10-Q FOR THE QUARTER ENDED SEPTEMBER 30, 2016

INDEX

2

Table of Contents

PART I – FINANCIAL INFORMATION

EDGEWATER TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In Thousands, Except Per Share Data)

| September 30, 2016 |

December 31, 2015 |

|||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 12,147 | $ | 11,981 | ||||

| Accounts receivable, net of allowance of $150 |

27,951 | 27,753 | ||||||

| Prepaid expenses and other current assets |

1,398 | 704 | ||||||

|

|

|

|

|

|||||

| Total current assets |

41,496 | 40,438 | ||||||

| Property and equipment, net |

705 | 824 | ||||||

| Intangible assets, net |

9,281 | 11,990 | ||||||

| Goodwill |

29,983 | 29,910 | ||||||

| Deferred tax assets, net |

23,735 | 24,032 | ||||||

| Other assets |

236 | 230 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 105,436 | $ | 107,424 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 651 | $ | 586 | ||||

| Accrued liabilities |

13,138 | 15,486 | ||||||

| Short-term portion of contingent earnout consideration |

6,497 | 7,072 | ||||||

| Deferred revenue |

1,785 | 2,428 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

22,071 | 25,572 | ||||||

| Revolving credit facility |

5,000 | 5,000 | ||||||

| Long-term portion of contingent earnout consideration |

939 | 3,468 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

28,010 | 34,040 | ||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $.01 par value; 2,000 shares authorized, no shares issued or outstanding |

— | — | ||||||

| Common stock, $.01 par value; 48,000 shares authorized, 29,736 shares issued as of September 30, 2016 and December 31, 2015, 12,340 and 11,862 shares outstanding as of September 30, 2016 and December 31, 2015, respectively |

297 | 297 | ||||||

| Paid-in capital |

209,897 | 210,324 | ||||||

| Treasury stock, at cost, 17,396 and 17,874 shares at September 30, 2016 and December 31, 2015, respectively |

(112,598 | ) | (116,464 | ) | ||||

| Accumulated other comprehensive loss |

(544 | ) | (554 | ) | ||||

| Accumulated deficit |

(19,626 | ) | (20,219 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

77,426 | 73,384 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 105,436 | $ | 107,424 | ||||

|

|

|

|

|

|||||

See notes to the unaudited condensed consolidated financial statements.

3

Table of Contents

EDGEWATER TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In Thousands, Except Per Share Data)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Revenue: |

||||||||||||||||

| Service revenue |

$ | 27,032 | $ | 27,184 | $ | 83,811 | $ | 74,483 | ||||||||

| Software revenue |

2,090 | 2,017 | 7,755 | 8,300 | ||||||||||||

| Reimbursable expenses |

1,704 | 1,983 | 5,182 | 5,506 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

30,826 | 31,184 | 96,748 | 88,289 | ||||||||||||

| Cost of revenue: |

||||||||||||||||

| Project and personnel costs |

17,141 | 16,351 | 52,669 | 48,365 | ||||||||||||

| Software costs |

1,341 | 1,094 | 4,693 | 4,604 | ||||||||||||

| Reimbursable expenses |

1,704 | 1,983 | 5,182 | 5,506 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenue |

20,186 | 19,428 | 62,544 | 58,475 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

10,640 | 11,756 | 34,204 | 29,814 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

8,945 | 8,827 | 28,672 | 26,056 | ||||||||||||

| Change in fair value of contingent earnout consideration |

— | — | (928 | ) | — | |||||||||||

| Direct acquisition costs |

— | 321 | 430 | 932 | ||||||||||||

| Fullscope embezzlement costs (loss recovery) |

— | — | — | (250 | ) | |||||||||||

| Depreciation and amortization |

1,011 | 372 | 3,019 | 918 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

9,956 | 9,520 | 31,193 | 27,656 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

684 | 2,236 | 3,011 | 2,158 | ||||||||||||

| Other expense, net |

568 | 650 | 1,761 | 1,274 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

116 | 1,586 | 1,250 | 884 | ||||||||||||

| Tax provision |

73 | 559 | 657 | 303 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 43 | $ | 1,027 | 593 | $ | 581 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income: |

||||||||||||||||

| Currency translation adjustments |

(28 | ) | (74 | ) | 10 | (256 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total comprehensive income |

$ | 15 | $ | 953 | 603 | $ | 325 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per share: |

||||||||||||||||

| Basic net income per share of common stock |

$ | 0.00 | $ | 0.09 | $ | 0.05 | $ | 0.05 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted net income per share of common stock |

$ | 0.00 | $ | 0.08 | $ | 0.04 | $ | 0.04 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used in computing basic net income per share of common stock |

12,253 | 11,568 | 12,057 | 11,463 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used in computing diluted net income per share of common stock |

14,090 | 13,275 | 14,080 | 13,272 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to the unaudited condensed consolidated financial statements.

4

Table of Contents

EDGEWATER TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

| Nine Months Ended September 30, |

||||||||

| 2016 | 2015 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: |

||||||||

| Net income |

$ | 593 | $ | 581 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities, excluding the impact of acquisitions: |

||||||||

| Depreciation and amortization |

3,155 | 1,063 | ||||||

| Share-based compensation expense |

1,039 | 1,258 | ||||||

| Recovery of doubtful accounts |

(24 | ) | — | |||||

| Deferred income taxes |

297 | 261 | ||||||

| Change in fair value of contingent earnout consideration |

(928 | ) | — | |||||

| Accretion of contingent earnout consideration |

1,730 | 1,114 | ||||||

| Excess tax benefit from stock options |

(192 | ) | (192 | ) | ||||

| Gain on disposal of equipment |

— | (10 | ) | |||||

| Changes in operating accounts, net of acquisition: |

||||||||

| Accounts receivable |

(208 | ) | (1,155 | ) | ||||

| Prepaid expenses and other current assets |

(701 | ) | (128 | ) | ||||

| Accounts payable |

65 | 206 | ||||||

| Accrued liabilities and other liabilities |

(3,005 | ) | (1,746 | ) | ||||

| Deferred revenue |

(643 | ) | (402 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

1,178 | 850 | ||||||

|

|

|

|

|

|||||

| CASH FLOWS FROM INVESTING ACTIVITIES: |

||||||||

| Net cash used to acquire Zero2Ten |

— | (4,643 | ) | |||||

| Net cash used to acquire Branchbird |

— | (2,755 | ) | |||||

| Net cash used to acquire M2 Dynamics |

(93 | ) | — | |||||

| Purchases of property and equipment |

(327 | ) | (302 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(420 | ) | (7,700 | ) | ||||

|

|

|

|

|

|||||

| CASH FLOW FROM FINANCING ACTIVITIES: |

||||||||

| Proceeds from employee stock plans and stock option exercises |

2,399 | 1,020 | ||||||

| Payment of contingent earnout consideration |

(3,226 | ) | — | |||||

| Purchase of treasury stock |

— | (306 | ) | |||||

| Excess tax benefit from stock options |

192 | 192 | ||||||

|

|

|

|

|

|||||

| Net cash (used in) provided by financing activities |

(635 | ) | 906 | |||||

|

|

|

|

|

|||||

| Effects of exchange rates on cash |

43 | (24 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in cash and cash equivalents |

166 | (5,968 | ) | |||||

| CASH AND CASH EQUIVALENTS, beginning of period |

11,981 | 26,768 | ||||||

|

|

|

|

|

|||||

| CASH AND CASH EQUIVALENTS, end of period |

$ | 12,147 | $ | 20,800 | ||||

|

|

|

|

|

|||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: |

||||||||

| Cash paid for income taxes |

$ | 215 | $ | 204 | ||||

|

|

|

|

|

|||||

| Issuance of restricted stock awards |

$ | — | $ | 728 | ||||

|

|

|

|

|

|||||

See notes to the unaudited condensed consolidated financial statements.

5

Table of Contents

EDGEWATER TECHNOLOGY, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 1. | ORGANIZATION: |

Edgewater Technology, Inc. helps C-suite executives drive transformational change through its unique selection of business and technology services and channel-based solutions.

Classic consulting disciplines (such as business advisory, process improvement, organizational change management, M&A due diligence, and domain expertise) are blended with technical services (such as digital transformation, technical roadmaps, data and analytics services, custom development and system integration) to help organizations leverage investments in legacy IT assets to create new digital business models.

Implementing both on premise and in the cloud, Edgewater offers two major channel-based services. In the Oracle channel, Edgewater Ranzal provides Business Analytics solutions leveraging Oracle Enterprise Performance Management (“EPM”), Business Intelligence (“BI”) and Big Data technologies. In the Microsoft channel, Edgewater Fullscope delivers Dynamics AX ERP, Business Intelligence and Customer Relationship Management (“CRM”) solutions primarily in the manufacturing space.

In this Quarterly Report on Form 10-Q (the “Form 10-Q”), we use the terms “Edgewater,” “Edgewater Technology,” “we,” “our Company,” “the Company,” “our” and “us” to refer to Edgewater Technology, Inc. and its wholly-owned subsidiaries, which are described in our 2015 Annual Report on Form 10-K, as filed with the Securities and Exchange Commission (the “SEC”) on March 11, 2016 (the “2015 Form 10-K”).

| 2. | BASIS OF PRESENTATION: |

The accompanying unaudited condensed consolidated financial statements have been prepared by Edgewater pursuant to the rules and regulations of the SEC regarding interim financial reporting. Certain information and note disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted pursuant to those rules and regulations, although we believe that the disclosures made are adequate to ensure the information presented is not misleading.

The accompanying unaudited condensed consolidated financial statements reflect all adjustments (which were of a normal, recurring nature) that, in the opinion of management, are necessary to present fairly our financial position, results of operations and cash flows as of and for the interim periods presented. All intercompany transactions have been eliminated in the accompanying unaudited condensed consolidated financial statements. These financial statements should be read in conjunction with the audited financial statements and notes thereto included in our 2015 Form 10-K.

The results of operations for the three and nine months ended September 30, 2016 are not necessarily indicative of the results to be expected for any future period or the full fiscal year. Our revenue and earnings may fluctuate from quarter-to-quarter based on factors within and outside our control, including variability in demand for information technology professional services, the length of the sales cycle associated with our service offerings, the number, size and scope of our projects and the efficiency with which we utilize our employees.

Other comprehensive income consists of net income plus or minus any currency translation adjustments.

| 3. | BUSINESS COMBINATIONS: |

M2 Dynamics Inc. (“M2 Dynamics”): On December 21, 2015, the Company acquired substantially all of the assets and certain liabilities of M2 Dynamics Inc., pursuant to the terms of an Asset Purchase Agreement (the “M2 Dynamics Acquisition”). Headquartered in Irvine, California, M2 Dynamics is an Oracle Platinum Partner providing Oracle EPM and BI solutions and services, primarily to the West Coast and southern regions of the United States. M2 Dynamics joined the Company’s Edgewater Ranzal business in providing clients with information technology consultancy services specializing in Business Analytics and encompassing EPM, BI and Big Data solutions.

The Company initially estimated total fair value of the purchase price consideration to be $19.8 million. The initial cash consideration paid at close consisted of the $16.1 million base purchase price plus $596 thousand attributable to a net working capital adjustment. The total purchase price was increased by $3.0 million, representing the adjusted fair value estimate of additional contingent earnout consideration that may be earned by M2 Dynamics, which is described in more detail below.

6

Table of Contents

During the quarter ended March 31, 2016, the Company increased total purchase price consideration of the M2 Dynamics Acquisition, resulting in an increase to the carrying value of goodwill, by $93 thousand. The increase is attributable to the final true-up of excess net working capital delivered by M2 Dynamics at the closing of the transaction.

The M2 Dynamics financial accounting measurement period was completed during the first quarter of 2016.

The Company, as of September 30, 2016, had accrued $3.6 million in potential future contingent earnout consideration payable to M2 Dynamics related to the completion of the one-year earnout period. The maximum amount of contingent earnout consideration that M2 Dynamics can earn during the earnout period is capped at $6.6 million (and is not impacted by continued employment status of M2 Dynamics shareholders).

In addition to the above payments, the Company incurred approximately $1.2 million in direct transaction costs. Direct acquisition costs were $430 thousand during the three-month period ended March 31, 2016 and $801 thousand during the three-month period ended December 31, 2015. The direct acquisition costs were expensed (within direct acquisition costs on the condensed consolidated statement of comprehensive income) as incurred.

In connection with the M2 Dynamics Acquisition, the Company made certain estimates related to the fair value of assets acquired, liabilities assumed, contingent earnout consideration, identified intangibles and goodwill.

The Company performed a fair value allocation of the purchase price among assets, liabilities and identified intangible assets. The allocation of the purchase price was as follows:

| Total | Life (In Years) | |||||

| (In Thousands) | ||||||

| Accounts receivable |

$ | 2,785 | ||||

| Other assets |

21 | |||||

| Accounts payable and accrued expenses |

(753 | ) | ||||

| Customer relationships |

7,700 | 6 Years | ||||

| Goodwill (deductible for tax purposes) |

10,115 | |||||

|

|

|

|||||

| Total purchase price |

$ | 19,868 | ||||

|

|

|

|||||

The M2 Dynamics Acquisition was accounted for as a purchase transaction, and accordingly, the results of comprehensive income, commencing December 21, 2015, are included in the Company’s accompanying condensed consolidated statement of comprehensive income.

The Company recorded total revenues attributed to M2 Dynamics of $2.9 million and $9.1 million during the three- and nine-month periods ended September 30, 2016, respectively. Non-cash expenses associated with amortization of purchased intangible assets as well as the accretion of contingent earnout consideration totaled $740 thousand and $2.2 million, which was a significant factor in the overall net loss of M2 Dynamics of $(86) thousand and $(44) thousand during the three- and nine-month periods ended September 30, 2016, respectively.

The following table sets forth supplemental pro forma financial information that assumes the acquisition of M2 Dynamics was completed at the beginning of 2015. The information for the three- and nine-month periods ended September 30, 2015 includes the historical results of Edgewater and M2 Dynamics. The pro forma results include estimates and assumptions regarding the amortization of intangible assets recognized as part of the acquisition and income taxes. The pro forma results, as presented, are not necessarily indicative of the results that would have occurred if the acquisition had occurred on the date indicated, or that may result in the future.

| Unaudited Three-Month Period September 30, 2015 |

Unaudited Nine-Month Period September 30, 2015 |

|||||||

| (In Thousands) | (In Thousands) | |||||||

| Pro forma total revenue |

$ | 36,124 | $ | 98,529 | ||||

|

|

|

|

|

|||||

| Pro forma net income |

$ | 1,733 | $ | 1,482 | ||||

|

|

|

|

|

|||||

| Pro forma basic net income per share |

$ | 0.15 | $ | 0.13 | ||||

|

|

|

|

|

|||||

| Pro forma diluted net income per share |

$ | 0.13 | $ | 0.11 | ||||

|

|

|

|

|

|||||

7

Table of Contents

Acquisition of Branchbird LLC (“Branchbird”): On August 17, 2015, the Company acquired substantially all of the assets and liabilities of Branchbird, pursuant to the terms of an Asset Purchase Agreement (the “Branchbird Acquisition”). Headquartered in Chicago, Illinois, Branchbird delivers Big Data solutions to their clients utilizing the Oracle Endeca and Big Data Discovery (BDD) products. The Branchbird Acquisition extends Ranzal’s presence in the Midwest.

The Company determined the total allocable purchase price consideration to be $4.2 million. The initial cash consideration paid at closing was $2.7 million, net of $19 thousand attributable to a net working capital adjustment. The total purchase price was increased by $1.4 million, representing our initial estimate of the fair value of additional contingent earnout consideration that may be earned by Branchbird, which is described in more detail below. In addition to the above payments, the Company incurred approximately $340 thousand in direct transaction costs, which were expensed (within direct acquisition costs on the condensed consolidated statement of comprehensive income) during the year ended December 31, 2015.

An earnout agreement was entered into in connection with the Branchbird Acquisition under which Branchbird is eligible to receive additional contingent consideration. Contingent earnout consideration to be paid, if any, to Branchbird will be based upon the achievement of certain performance measures (and is not impacted by continued employment status of Branchbird owners) over two consecutive one-year earnout periods, concluding on August 16, 2017. The maximum amount of contingent earnout consideration that can be earned by Branchbird is capped at $2.4 million. The Company continuously examines actual results in comparison to financial metrics utilized in the earnout calculation and assesses the carrying value of the contingent earnout consideration. During the three-month period ended June 30, 2016 the Company recorded a change in fair value of the estimated earnout consideration to be achieved (as a result of lower than forecasted revenue performance). This change in estimate resulted in a reversal of $798 thousand (which was recorded as a component of change in fair value of contingent earnout consideration in the accompanying condensed consolidated statements of comprehensive income). As of September 30, 2016, the Company had recorded an accrual of $939 thousand related to Branchbird contingent earnout consideration.

In connection with the Branchbird Acquisition, the Company made certain estimates related to the fair value of assets acquired, liabilities assumed, contingent earnout consideration, identified intangibles and goodwill.

The Company performed a fair value allocation of the purchase price among assets, liabilities and identified intangible assets. The allocation of the purchase price was as follows:

| Total | Life (In Years) | |||||

| (In Thousands) | ||||||

| Accounts receivable |

$ | 540 | ||||

| Other assets |

16 | |||||

| Accounts payable and accrued expenses |

(86 | ) | ||||

| Customer relationships |

2,100 | 5 | ||||

| Goodwill (deductible for tax purposes) |

1,613 | |||||

|

|

|

|||||

| Total purchase price |

$ | 4,183 | ||||

|

|

|

|||||

The Branchbird Acquisition was accounted for as a purchase transaction, and accordingly, the results of operations, commencing August 17, 2015, are included in the Company’s accompanying condensed consolidated statement of comprehensive income. Pro forma financial information related to the Branchbird Acquisition is not presented as the effect of this acquisition was not material to the Company.

Acquisition of Zero2Ten, Inc. (“Zero2Ten”): On March 13, 2015, the Company acquired substantially all of the assets and liabilities of Zero2Ten, pursuant to the terms of an Asset Purchase Agreement (the “Zero2Ten Acquisition”). Headquartered in Alpharetta, Georgia, Zero2Ten is a specialty solution provider of Microsoft’s CRM Cloud product. Zero2Ten has delivered its services to organizations across various vertical markets with an emphasis on manufacturing. The acquisition of Zero2Ten continues our investment in service offerings that complement the Microsoft Dynamics product suite.

The Company determined the total allocable purchase price consideration to be $9.0 million. The initial cash consideration paid at closing was $4.5 million. The cash paid at closing consisted of the $5.0 million purchase price less $457 thousand attributable to a net working capital adjustment. The total purchase price was increased by $4.4 million, representing our initial estimate of the fair value estimate of additional contingent earnout consideration that may be earned by Zero2Ten, which is described in more detail below. In addition to the above payments, the Company incurred approximately $613 thousand in direct transaction costs, which were expensed (within direct acquisition costs on the consolidated statement of comprehensive income) during the year ended December 31, 2015.

8

Table of Contents

An earnout agreement was entered into in connection with the Zero2Ten Acquisition under which Zero2Ten is eligible to receive additional contingent consideration. Contingent earnout consideration to be paid, if any, to Zero2Ten will be based upon the achievement of certain performance measures (and is not impacted by continued employment status of Zero2Ten shareholders) over two consecutive one-year earnout periods, concluding on March 13, 2017.

In March 2016, Zero2Ten completed its first twelve-month earnout period, during which the required performance measurements were achieved. Accordingly, Zero2Ten received additional contingent consideration related to the first earnout period in the amount of $3.9 million.

The Company continuously examines actual results in comparison to financial metrics utilized in the earnout calculation and assesses the carrying value of the contingent earnout consideration. During the three-month period ended June 30, 2016, we reversed $130 thousand of accrued contingent earnout consideration (reported as a part of change in fair value of contingent earnout consideration in our condensed consolidated statements of comprehensive income) associated with the completion of the first earnout period and the projected completion of the second earnout period, as it was determined that current forecasts are slightly below those originally utilized in determining the fair value of the contingent earnout consideration.

The Company, as of September 30, 2016, has accrued $2.9 million in potential future contingent earnout consideration payable to Zero2Ten in connection with the second twelve-month earnout period. The maximum amount of contingent earnout consideration that can be earned by Zero2Ten during the remaining earnout period is capped at $4.3 million.

In connection with the Zero2Ten Acquisition, the Company made certain estimates related to the fair value of assets acquired, liabilities assumed, contingent earnout consideration, identified intangibles and goodwill.

The Company performed a fair value allocation of the purchase price among assets, liabilities and identified intangible assets. The allocation of the purchase price was as follows:

| Total | Life (In Years) | |||||

| (In Thousands) | ||||||

| Accounts receivable |

$ | 1,596 | ||||

| Other assets |

142 | |||||

| Deferred revenue |

(1,158 | ) | ||||

| Accounts payable and accrued expenses |

(580 | ) | ||||

| Customer relationships |

2,800 | 5 | ||||

| Goodwill (deductible for tax purposes) |

6,210 | |||||

|

|

|

|||||

| Total purchase price |

$ | 9,010 | ||||

|

|

|

|||||

The Zero2Ten Acquisition was accounted for as a purchase transaction, and accordingly, the results of operations, commencing March 13, 2015, are included in the Company’s accompanying condensed consolidated statement of comprehensive income. Pro forma financial information related to the Zero2Ten Acquisition is not presented as the effect of this acquisition was not material to the Company.

| 4. | REVENUE RECOGNITION: |

The Company recognizes revenue primarily through the provision of consulting services and the resale of third-party, off-the-shelf software and maintenance.

We generate revenue by providing consulting services under written service contracts with our customers. The service contracts we enter into generally fall into three specific categories: time and materials, fixed-price and retainer.

We consider amounts to be earned once evidence of an arrangement has been obtained, services are delivered, fees are fixed or determinable and collectability is reasonably assured. We establish billing terms at the time at which the project deliverables and milestones are agreed. Our standard payment terms are 30 days from invoice date. Out-of-pocket reimbursable expenses charged to customers are reflected as revenue.

When a customer enters into a time and materials, fixed-price or a periodic retainer-based contract, the Company recognizes revenue in accordance with its evaluation of the deliverables in each contract. If the deliverables represent separate units of accounting, the Company then measures and allocates the consideration from the arrangement to the separate units, based on vendor specific objective evidence (“VSOE”) of the value for each deliverable.

9

Table of Contents

The revenue under time and materials contracts is recognized as services are rendered and performed at contractually agreed upon rates. Revenue pursuant to fixed-price contracts is recognized under the proportional performance method of accounting. We continuously evaluate whether revenue and profitability should be recognized in the current period. We estimate the proportional performance on our fixed-price contracts on a monthly basis utilizing hours incurred to date as a percentage of total estimated hours to complete the project. This method is used because reasonably dependable estimates of costs and revenue earned can be made, based on historical experience and milestones identified in any particular contract. If we do not have a sufficient basis to measure progress toward completion, revenue is recognized upon completion of performance, subject to any warranty provisions or other project management assessments as to the status of work performed.

Estimates of total project costs are continuously monitored during the term of an engagement. There are situations where the number of hours to complete projects may exceed our original estimate, as a result of an increase in project scope, unforeseen events that arise, or the inability of the client or the delivery team to fulfill its responsibilities. Accordingly, recorded revenues and costs are subject to revision throughout the life of a project based on current information and historical trends. Such revisions may result in increases or decreases to revenue and income and are reflected in the condensed consolidated financial statements in the periods in which they are first identified.

If our initial estimates of the resources required or the scope of work to be performed on a contract are inaccurate, or we do not manage the project properly within the planned time period, a provision for estimated losses on incomplete projects may be made. Any known or probable losses on projects are charged to operations in the period in which such losses are determined. A formal project review process takes place quarterly, although projects are continuously evaluated throughout the period. Management reviews the estimated total direct costs on each contract to determine if the estimated amounts are accurate, and estimates are adjusted as needed in the period identified. No material losses were recognized on contracts during the three- or nine-month periods ended September 30, 2016 or 2015.

We also perform services on a periodic retainer basis under infrastructure service contracts, which include monthly hosting and support services. Revenue under periodic retainer-based contracts is recognized ratably over the contract period, as outlined within the respective contract. In the event additional services are required, above the minimum retained or contracted amount, then such services are billed on a time and materials basis.

Typically, the Company provides warranty services on its fixed-price contracts related to providing customers with the ability to have any “design flaws” remedied and/or have our Company “fix” routine defects. The warranty services, as outlined in the respective contracts, are provided for a specific period of time after a project is complete. The Company values the warranty services based upon historical labor hours incurred for similar services at standard billing rates. Revenue related to the warranty provisions within our fixed-price contracts is recognized as the services are performed or the revenue is earned. The warranty period is typically for a 30-60 day period after the project is complete.

Customer prepayments, even if nonrefundable, are deferred (classified as deferred revenue on the condensed consolidated balance sheets) and recognized over future periods as services are performed.

Software revenue represents the resale of certain third-party off-the-shelf software and maintenance and is recorded on a gross basis provided we act as a principal in the transaction, which we have determined based upon several factors, including, but not limited to, the fact that we have credit risk and we set the price to the end user. In the event we do not meet the requirements to be considered a principal in the software sale transaction and act as an agent, software revenue is recorded on a net basis. As cloud-based solutions become more significant, the timing and revenue recognition treatment may differ from historically on-premise solutions, adding further volatility to our software revenue.

The majority of the software sold by the Company is delivered electronically. For software that is delivered electronically, we consider delivery to have occurred when the customer either (a) takes possession of the software via a download (that is, when the customer takes possession of the electronic data on its hardware), or (b) has been provided with access codes that allow the customer to take immediate possession of the software on its hardware pursuant to an agreement or purchase order for the software.

The Company enters into multiple element arrangements which typically include software, post-contract support (or maintenance), and consulting services. Consistent with the software described above, maintenance that is in the form of a pass through transaction is recognized upon delivery of the software, as all related warranty and maintenance is performed by the primary software vendor and not the Company. Maintenance fee revenue for the Company’s software products, which is inconsequential in all years presented, is recognized ratably over the term of the arrangements, which are generally for a one-year period. The Company has established VSOE with respect to the services and maintenance provided based on the price charged when the services are sold separately and the stated renewal rate.

10

Table of Contents

| 5. | SHARE-BASED COMPENSATION: |

Share-based compensation expense under all of the Company’s share-based plans was $260 thousand and $1.0 million for the three- and nine-month periods ended September 30, 2016, respectively. Share-based compensation expense under all of the Company’s share-based plans was $408 thousand and $1.3 million for the three- and nine-month periods ended September 30, 2015, respectively.

Cash received from the employee stock purchase plan (“ESPP”) and through stock option exercises was $377 thousand and $2.4 million during the three- and nine-month periods ended September 30, 2016, respectively. Cash received from ESPP and stock option exercises was $246 thousand and $1.0 million during the three- and nine-month periods ended September 30, 2015, respectively.

As of September 30, 2016, unrecognized compensation expense, net of estimated forfeitures, related to the unvested portion of all share-based compensation arrangements was approximately $845 thousand and is expected to be recognized over a weighted-average period of 1.0 years.

The Company intends to use previously purchased treasury shares for shares issued for options, restricted share awards and ESPP purchases. Shares may also be issued from authorized but unissued share reserves.

| 6. | INCOME TAXES: |

The Company recorded a tax provision of $73 thousand and $657 thousand for the three- and nine-month periods ended September 30, 2016, respectively. The Company recorded a tax provision of $559 thousand and $303 thousand for the three- and nine-month periods ended September 30, 2015, respectively. The reported tax provision for the three- and nine-month periods ended September 30, 2016 is based upon an estimated annual effective tax rate of 62.3% and 52.5%, respectively. The effective tax rates reflected our combined federal and state income tax rates, foreign income tax provisions and the recognition of U.S. deferred tax liabilities for differences between the book and tax basis of goodwill.

We assess the realizability of our deferred tax assets and assess the need for a valuation allowance on an ongoing basis. The periodic assessment of the net carrying value of our deferred tax assets under the applicable accounting rules is highly judgmental. We are required to consider all available positive and negative evidence in evaluating the likelihood that we will be able to realize the benefit of our deferred tax assets in the future. Such evidence includes scheduled reversals of deferred tax liabilities, projected future taxable income, tax planning strategies and the results of recent operations. Since this evaluation requires consideration of events that may occur some years into the future, there is significant judgment involved, and our conclusion could be materially different should certain of our expectations not transpire.

When assessing all available evidence, we consider the extent to which we have generated pre-tax income or losses over the most recent three-year period to be an important piece of objective evidence. As of September 30, 2016 and December 31, 2015, the recorded deferred tax asset valuation allowance balance was $4.5 million.

Our policy is to classify interest and penalties related to unrecognized tax benefits as income tax expense. This policy has been consistently applied in all periods. Interest and penalties related to our unrecognized tax benefits were insignificant for all periods presented. No such amounts were recognized in the three- or nine-month period ended September 30, 2016. We have reviewed the tax positions taken, or to be taken, in our tax returns for all tax years currently open to examination by a taxing authority. We have identified no uncertain tax positions for which it is reasonably possible that the total amount of unrecognized tax benefits will significantly increase or decrease within the twelve months ending September 30, 2017. We remain subject to examination until the statute of limitations expires for each respective tax jurisdiction.

| 7. | FAIR VALUE MEASUREMENT: |

We utilize the following valuation hierarchy for disclosure of the inputs to valuation used to measure fair value. This hierarchy prioritizes the inputs into three broad levels as follows:

| • | Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| • | Level 2 inputs are quoted prices for similar assets and liabilities in active markets or inputs that are observable for the asset or liability, either directly or indirectly through market corroboration, for substantially the full term of the financial instrument. |

| • | Level 3 inputs are unobservable inputs based on our own assumptions used to measure assets and liabilities at fair value. |

11

Table of Contents

A financial asset or liability’s classification within the hierarchy is determined based upon the lowest level input that is significant to the fair value measurement.

As of September 30, 2016 and December 31, 2015, our only financial assets and liabilities required to be measured on a recurring basis were our contingent earnout consideration liabilities.

The following table represents the Company’s fair value hierarchy for its financial assets and liabilities required to be measured on a recurring basis:

| Basis of Fair Value Measurements | ||||||||||||||||

| Balance | Quoted Prices in Active Markets for Identical Items (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

|||||||||||||

| (In Thousands) | ||||||||||||||||

| Balance at September 30, 2016: |

||||||||||||||||

| Financial liabilities: |

||||||||||||||||

| Contingent earnout consideration |

$ | 7,436 | $ | — | $ | — | $ | 7,436 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total financial liabilities |

$ | 7,436 | $ | — | $ | — | $ | 7,436 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at December 31, 2015: |

||||||||||||||||

| Financial liabilities: |

||||||||||||||||

| Contingent earnout consideration |

$ | 10,540 | $ | — | $ | — | $ | 10,540 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total financial liabilities |

$ | 10,540 | $ | — | $ | — | $ | 10,540 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

No financial instruments were transferred into or out of Level 3 classification during the three- or nine-month periods ended September 30, 2016.

The Company has classified its net liability for contingent earnout considerations relating to its Zero2Ten, Branchbird and M2 Dynamics Acquisitions within Level 3 of the fair value hierarchy because the fair value is determined using significant unobservable inputs, which included probability weighted cash flows. A description of these acquisitions is included within Note 3. The contingent earnout payments for each acquisition are based on the achievement of certain revenue and earnings before interest, taxes, and depreciation and amortization targets.

A reconciliation of the beginning and ending Level 3 net liabilities for the nine-month period ended September 30, 2016 is as follows:

| Fair Value Measurements Using Significant Unobservable Inputs (Level 3) |

||||

| (In Thousands) | ||||

| Balance at December 31, 2015 |

$ | 10,540 | ||

| Payment of contingent earnout consideration |

(3,906 | ) | ||

| Adjustment to estimated fair value of contingent earnout consideration (included within Selling, general and administrative expense) |

(928 | ) | ||

| Accretion of contingent earnout consideration (included within other expense, net) |

1,730 | |||

|

|

|

|||

| Ending balance at September 30, 2016 |

$ | 7,436 | ||

|

|

|

|||

As of September 30, 2016 and December 31, 2015, the fair values of our other financial instruments, which include cash and cash equivalents, accounts receivable and accounts payable, approximate the carrying amounts of the respective asset and/or liability due to the short-term nature of these financial instruments.

12

Table of Contents

| 8. | GOODWILL AND INTANGIBLE ASSETS: |

Goodwill increased to $30.0 million as of September 30, 2016 compared to $29.9 million as of December 31, 2015. This increase is the result of adjustments to the initial estimate of purchase price allocation of M2 Dynamics, which is further disclosed within Note 3. With the exception of the acquisition-related increase noted herein, there have been no other changes to the Company’s goodwill balance. The Company continuously evaluates for any triggering events and no such events have occurred during the three or nine month periods ended September 30, 2016. Our annual goodwill and intangible assets measurement date is December 2.

We amortize our intangible assets that have finite lives using either the straight-line method or based on estimated future cash flows to approximate the pattern in which the economic benefit of the asset will be utilized. Amortization expense was $903 thousand and $2.7 million during the three- and nine-month periods ended September 30, 2016, respectively. Amortization expense was $215 thousand and $454 thousand during the three- and nine-month periods ended September 30, 2015, respectively. This amortization expense relates to certain non-competition covenants and customer lists, which expire at various times through 2021.

The Company recorded amortization from capitalized internally developed software (intellectual property) (reported as part of Cost of Revenue—software cost within the condensed consolidated statements of comprehensive income) of $42 thousand and $136 thousand during the three- and nine-month periods ended September 30, 2016, respectively. The Company recorded amortization from capitalized internally developed software of $44 thousand and $145 thousand during the three- and nine-month periods ended September 30, 2015, respectively.

Estimated annual amortization expense of our intangible assets (including amortization expense associated with capitalized software costs) for the current year and the following five years ending December 31, is as follows:

| Amortization Expense |

||||

| (In Thousands) | ||||

| 2016 |

$ | 3,612 | ||

| 2017 |

$ | 2,804 | ||

| 2018 |

$ | 2,240 | ||

| 2019 |

$ | 1,712 | ||

| 2020 |

$ | 1,057 | ||

| 2021 |

$ | 565 | ||

| 9. | ACCRUED EXPENSES AND OTHER LIABILITIES: |

Accrued liabilities as of September 30, 2016 and December 31, 2015 consisted of the following:

| September 30, 2016 |

December 31, 2015 |

|||||||

| (In Thousands) | ||||||||

| Accrued bonuses |

$ | 3,088 | $ | 2,939 | ||||

| Accrued commissions |

2,034 | 1,496 | ||||||

| Accrued vacation |

2,924 | 2,272 | ||||||

| Accrued payroll related liabilities |

1,733 | 2,423 | ||||||

| Accrued software expense |

650 | 1,284 | ||||||

| Accrued contractor fees |

583 | 1,132 | ||||||

| Accrued professional service fees |

296 | 1,016 | ||||||

| Short-term portion of lease abandonment accrual |

— | 437 | ||||||

| Deferred rent |

80 | 220 | ||||||

| Income tax related accruals |

565 | 318 | ||||||

| Other accrued expenses |

1,185 | 1,949 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 13,138 | $ | 15,486 | ||||

|

|

|

|

|

|||||

13

Table of Contents

| 10. | NET INCOME PER SHARE: |

A reconciliation of net income and weighted average shares used in computing basic and diluted net income per share is as follows:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| (In Thousands, Except Per Share Data) | ||||||||||||||||

| Basic net income per share: |

||||||||||||||||

| Net income applicable to common shares |

$ | 43 | $ | 1,027 | $ | 593 | $ | 581 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding |

12,253 | 11,568 | 12,057 | 11,463 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic net income per share of common stock |

$ | 0.00 | $ | 0.09 | $ | 0.05 | $ | 0.05 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted net income per share: |

||||||||||||||||

| Net income applicable to common shares |

$ | 43 | $ | 1,027 | $ | 593 | $ | 581 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding |

12,253 | 11,568 | 12,057 | 11,463 | ||||||||||||

| Dilutive effects of stock options |

1,837 | 1,707 | 2,023 | 1,809 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares, assuming dilutive effect of stock options |

14,090 | 13,275 | 14,080 | 13,272 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted net income per share of common stock |

$ | 0.00 | $ | 0.08 | $ | 0.04 | $ | 0.04 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Share-based awards, inclusive of all grants made under the Company’s equity plans, for which either the stock option exercise price or the fair value of the restricted share award exceeds the average market price over the period, have an anti-dilutive effect on earnings per share, and accordingly, are excluded from the diluted computations for all periods presented. Had such shares been included, shares for the diluted computation would have increased by approximately 69 thousand shares and 68 thousand shares in the three- and nine-month periods ended September 30, 2015, respectively. There were no such anti-dilutive shares outstanding for the three- and nine-month periods ended September 30, 2016. As of September 30, 2016 and 2015, there were approximately 3.5 and 4.0 million share-based awards outstanding, respectively, under the Company’s equity plans.

| 11. | STOCK REPURCHASE PROGRAM: |

In December 2007, our Board of Directors (the “Board”) authorized a stock repurchase program for up to $5.0 million of common stock on the open market or through privately negotiated transactions from time-to-time through December 31, 2008 (the “Stock Repurchase Program”). The Board subsequently amended the Stock Repurchase Program, authorizing both an increase to and an extension of the Stock Repurchase Program. The Stock Repurchase Program, as amended, had a maximum purchase value of shares of $23.1 million (the “Purchase Authorization”) and was set to expire on September 23, 2016 (the “Repurchase Period”). On September 23, 2016, we announced that the Board had approved an extension of the Repurchase Period to September 22, 2017.

The timing and amount of the purchases will be based upon market conditions, securities law considerations and other factors. The Stock Repurchase Program does not obligate the Company to acquire a specific number of shares in any period and may be modified, suspended, extended or discontinued at any time, without prior notice.

The Company did not repurchase any shares of common stock during the three- or nine-month periods ended September 30, 2016. The Company repurchased 27 thousand shares at an aggregate price of $192 thousand and 43 thousand shares at an aggregate price of $306 thousand during the three- and nine-month periods ended September 30, 2015, respectively.

| 12. | REVOLVING LINE OF CREDIT: |

In September 2013, the Company entered into a secured revolving credit facility (the “Credit Facility”). The Credit Facility was modified through an amendment in December 2015, which increased the borrowing base to $15 million (from the previous $10 million) with an additional accordion feature that allows the Company to request an additional $5.0 million as needed, extending the total credit facility borrowing capacity to $20 million over its three-year term. The Credit Facility is collateralized by substantially all assets of the Company and its domestic subsidiaries, and is subject to certain financial covenants. The Company was in compliance with the financial covenants (which are related to interest coverage and leverage) as of September 30, 2016. Under the terms of the Credit Facility, any advances will accrue interest at a variable per annum rate of interest equal to the LIBOR Rate plus 1.5%. Interest is due and payable, in arrears, on a monthly basis. The Company will be obligated to pay an annual commitment fee of 0.15% on the daily undrawn balance of the facility. Any amounts outstanding under the Credit Facility will be due on December 21, 2018. The Company had drawn down $5.0 million of this balance as of September 30, 2016.

14

Table of Contents

| 13. | GEOGRAPHIC INFORMATION |

Total revenue to unaffiliated customers by geographic area were as follows:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| United States |

$ | 26,654 | $ | 26,992 | $ | 82,342 | $ | 75,603 | ||||||||

| Canada |

2,108 | 2,804 | 8,847 | 8,396 | ||||||||||||

| Other International |

2,064 | 1,388 | 5,559 | 4,290 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

$ | 30,826 | $ | 31,184 | $ | 96,748 | $ | 88,289 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Substantially all of the Company’s long-lived assets are located within the United States.

15

Table of Contents

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following information should be read in conjunction with the information contained in the Unaudited Condensed Consolidated Financial Statements and notes thereto appearing elsewhere in this Quarterly Report on Form 10-Q. This Quarterly Report on Form 10-Q contains forward-looking statements that involve risks and uncertainties. See “Risk Factors” and “Special Note Regarding Forward-Looking Statements” included elsewhere herein. We use the terms “we,” “our,” “us,” “Edgewater” and “the Company” in this report to refer to Edgewater Technology, Inc. and its wholly-owned subsidiaries.

Edgewater Technology, Inc. helps C-suite executives drive transformational change through its unique selection of business and technology services and channel-based solutions.

Classic consulting disciplines (such as business advisory, process improvement, organizational change management, M&A due diligence, and domain expertise) are blended with technical services (such as digital transformation, technical roadmaps, data and analytics services, custom development and system integration) to help organizations leverage investments in legacy IT assets to create new digital business models.

Delivering both on premise and in the cloud, Edgewater offers two major channel-based services. In the Oracle channel, Edgewater Ranzal provides Business Analytics solutions leveraging Oracle EPM, BI and Big Data technologies. In the Microsoft channel, Edgewater Fullscope delivers Dynamics AX ERP, Business Intelligence and CRM solutions primarily in the manufacturing space.

Our Services

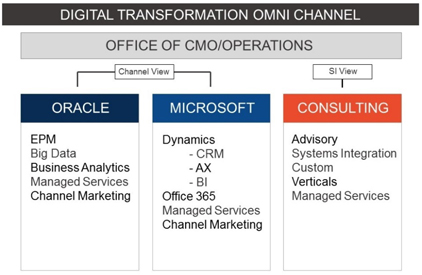

Edgewater offers a full spectrum of services and expertise to ensure the success of our engagements. Our consulting services are categorized into two different components: (1) Channel View and (2) Systems Integration View.

The following diagram illustrates these offerings:

Edgewater has the proven expertise to plan, deliver and manage integration services that improve performance and maximize business results. We focus on deploying new systems and unlocking the value of the existing corporate assets. This proven expertise enables us to bring complex technologies and systems together while minimizing risk, leveraging our clients’ technology investments and delivering tailored solutions.

Factors Influencing Our Results of Operations

Revenue. The Company derives its service revenue from time and materials-based contracts, fixed-price contracts and retainer-based arrangements. Time and materials-based contracts represented 85.2% and 83.8% of service revenue for the three- and nine-month periods ended September 30, 2016, respectively. Time and materials-based contracts represented 80.5% and 83.4% of service

16

Table of Contents

revenue for the three- and nine-month periods ended September 30, 2015, respectively. Revenue under time and materials contracts is recognized as services are rendered and performed at contractually agreed upon rates. Fixed-price contracts represented 8.8% and 11.2% of service revenue for the three- and nine-month periods ended September 30, 2016, respectively. Fixed-price contracts represented 15.3% and 12.1% of service revenue for the three- and nine-month periods ended September 30, 2015, respectively. Revenue pursuant to fixed-price contracts is recognized under the proportional performance method of accounting. Retainer-based contracts represented 6.0% and 5.0% of service revenue during the three- and nine-month periods ended September 30, 2016, respectively. Retainer-based contracts represented 4.2% and 4.5% of service revenue during the three- and nine-month periods ended September 30, 2015, respectively. Revenue under retainer-based contracts is recognized ratably over the contract period, as outlined within the respective contract.

Estimates of total project costs are continuously monitored during the term of an engagement. There are situations where the number of hours to complete projects may exceed (or be less than) our original estimate, as a result of an increase (or decrease) in project scope, unforeseen events that arise, or the inability of the client or the delivery team to fulfill their responsibilities. Accordingly, recorded revenues and costs are subject to revision throughout the life of a project based on current information and historical trends. Such revisions may result in increases or decreases to revenue and income and are reflected in the condensed consolidated financial statements in the periods in which they are first identified.

We anticipate that software revenue will continue to be a significant portion of our revenues. Our reported software revenue represents the resale of certain third-party off-the-shelf software and related maintenance (primarily relates to the resale of Microsoft Dynamics AX product) and has historically been recorded on a gross basis provided we act as principal in the transaction, whereby we have credit risk and we set the price to the end user. In the event we do not meet the requirements to be considered a principal in the software sale transaction and act as an agent, software revenue is recorded on a net basis. As cloud-based solutions become more significant, the timing and revenue recognition treatment may differ from historically on-premise solutions, adding further volatility to our software revenue.

Software revenue is recognized upon delivery, except in the infrequent situation where the Company provides maintenance services, in which case the related maintenance is recognized ratably over the maintenance period (while the software revenue is recognized upon delivery). Software revenue is expected to fluctuate between quarters, dependent on our customers’ demand for such third-party off-the-shelf software. Fluctuations in software revenue may have an impact upon our periodic operating performance, including gross margin.

Operating Expenses. The largest portion of our operating expenses consists of cash and non-cash compensation and benefits associated with our project consulting personnel and related expenses. Non-cash compensation includes share-based compensation expense arising from restricted stock and option grants to employees. Project personnel expenses also consist of payroll costs and related benefits associated with our professional staff. Other related expenses include travel, subcontracting costs, third-party vendor payments and non-billable expenses associated with the delivery of services to our customers. We consider the relationship between project personnel expenses and service revenue to be an important measure of our operating performance. The relationship between project personnel expenses and service revenue is driven largely by the chargeability of our consultant base, the prices we charge our customers and the non-billable costs associated with securing new customer engagements and developing new service offerings. The remainder of our recurring operating expense is composed of expenses associated with the development of our business and the support of our customer-serving professionals, such as professional development and recruiting, marketing and sales, and management and administrative support. Professional development and recruiting expenses consist primarily of recruiting and training content development and delivery costs. Marketing and sales expenses consist primarily of the costs associated with the development and maintenance of our marketing materials and programs. Management and administrative support expenses consist primarily of the costs associated with operations, including finance, information systems, human resources, facilities (including the rent of office space) and other administrative support for project personnel.

We regularly review our fees for services, professional compensation and overhead costs to ensure that our services and compensation are competitive within the industry and that our overhead costs are balanced with our revenue levels. In addition, we monitor the progress of customer projects with customer senior management. We manage the activities of our professionals by closely monitoring engagement schedules and staffing requirements. However, a rapid decline in the demand for the professional services that we provide could result in lower utilization of our professionals than we planned. In addition, because most of our customer engagements are terminable by our customers without penalty, an unanticipated termination of a customer project could require us to maintain underutilized employees. While professional staff levels must be adjusted to reflect active engagements, we must also maintain a sufficient number of consulting professionals to oversee existing customer engagements and to participate in sales activities to secure new customer assignments.

17

Table of Contents

Direct Acquisition Costs. The Company incurred $430 thousand of direct acquisition costs related to the acquisition of substantially all of the assets of M2 Dynamics in the nine-month period ended September 30, 2016. Incurred expenses included investment banking fees, legal fees, accounting and other professional fees directly associated with completion of the acquisitions.

Adjustments to Fair Value of Contingent Consideration. The Company remeasures the estimated carrying value of contingent consideration each quarter, with any changes (income or expense) in the estimated fair value recorded as an operating expense (classified as change in fair value of contingent earnout consideration). Accretion of the contingent earnout liability is classified as other expense on the condensed consolidated statements of comprehensive income. As of September 30, 2016 and December 31, 2015, the Company had $7.4 million and $10.5 million, respectively, accrued in connection with the contingent earnout obligations associated with the Zero2Ten, Branchbird, and M2 Dynamics Acquisitions.

Company Performance Measurement Systems and Metrics. The Company’s management monitors and assesses its operating performance by evaluating key metrics and indicators on an ongoing basis. For example, we regularly review performance information related to annualized revenue per billable consultant, periodic consultant utilization rates, gross profit margins, average bill rates and billable employee headcount. Edgewater has also developed internal Enterprise Performance Management systems which aid us in measuring our operating performance and consultant utilization rates. The matching of sales opportunities to available skill sets in our consultant base is one of our greatest challenges and therefore, we monitor consultant utilization closely. These metrics, along with other operating and financial performance metrics, are used in evaluating management’s overall performance. These metrics and indicators are discussed in more detail under “Results for the Three and Nine Months Ended September 30, 2016, Compared to Results for the Three and Nine Months Ended September 30, 2015,” included elsewhere in this Quarterly Report on Form 10-Q.

Results for the Three and Nine Months Ended September 30, 2016, Compared to Results for the Three and Nine Months Ended September 30, 2015

The financial information that follows has been rounded in order to simplify its presentation. The amounts and percentages below have been calculated using the detailed financial information contained in the unaudited condensed consolidated financial statements, the notes thereto, and the other financial data included in this Quarterly Report on Form 10-Q.

18

Table of Contents

The following table sets forth the percentage of total revenue of items included in our unaudited condensed consolidated statements of comprehensive income:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Revenue: |

||||||||||||||||

| Service revenue |

87.7 | % | 87.2 | % | 86.6 | % | 84.4 | % | ||||||||

| Software revenue |

6.8 | % | 6.5 | % | 8.0 | % | 9.4 | % | ||||||||

| Reimbursable expenses |

5.5 | % | 6.3 | % | 5.4 | % | 6.2 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||

| Cost of revenue: |

||||||||||||||||

| Project and personnel costs |

55.6 | % | 52.5 | % | 54.3 | % | 54.8 | % | ||||||||

| Software costs |

4.4 | % | 3.5 | % | 4.9 | % | 5.2 | % | ||||||||

| Reimbursable expenses |

5.5 | % | 6.3 | % | 5.4 | % | 6.2 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenue |

65.5 | % | 62.3 | % | 64.6 | % | 66.2 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

34.5 | % | 37.7 | % | 35.4 | % | 33.8 | % | ||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

29.0 | % | 28.3 | % | 29.6 | % | 29.5 | % | ||||||||

| Change in fair value of contingent earnout consideration |

— | % | — | % | (1.0 | )% | — | % | ||||||||

| Direct acquisition costs |

— | % | 1.0 | % | 0.5 | % | 1.1 | % | ||||||||

| Fullscope embezzlement costs (loss recovery) |

— | % | — | % | — | % | (0.3 | )% | ||||||||

| Depreciation and amortization |

3.3 | % | 1.2 | % | 3.2 | % | 1.0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

32.3 | % | 30.5 | % | 32.3 | % | 31.3 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

2.2 | % | 7.2 | % | 3.1 | % | 2.5 | % | ||||||||

| Other expense, net |

1.8 | % | 2.1 | % | 1.8 | % | 1.5 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

0.4 | % | 5.1 | % | 1.3 | % | 1.0 | % | ||||||||

| Income tax provision |

0.3 | % | 1.8 | % | 0.7 | % | 0.3 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

0.1 | % | 3.3 | % | 0.6 | % | 0.7 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Revenue. Total revenue decreased by $(358) thousand, or (1.1)%, to $30.8 million during the three-month period ended September 30, 2016, compared to total revenue of $31.2 million in the three-month period ended September 30, 2015. Total revenue increased by $8.5 million, or 9.6%, to $96.7 million during the nine-month period ended September 30, 2016, compared to total revenue of $88.3 million in the nine-month period ended September 30, 2015. Service revenue decreased by $(152) thousand, or (0.6)%, to $27.0 million during the three-month period ended September 30, 2016, compared to service revenue of $27.2 million in the three-month period ended September 30, 2015. Service revenue increased by $9.3 million, or 12.5%, to $83.8 million during the nine-month period ended September 30, 2016, compared to service revenue of $74.5 million in the nine-month period ended September 30, 2015.

Service revenue during the three-month period ended September 30, 2016 was affected by channel disruptions associated with a vendor push to the adoption of cloud-based technologies and our customer’s decision processes around moving to cloud-based solutions. Further, third quarter 2016 service revenue was hindered by a curtailment of IT spending by customers across all of our service offerings as well as underperformance within the United Kingdom. For the nine-month period ended September 30, 2016, service revenue growth was driven primarily by the performance of the M2 Dynamics Acquisition and the full period contribution from the Zero2Ten Acquisition (whose operations began being recorded in ours during March 2015).

As we experience a transition within our EPM and ERP channels from on-premise to hybrid to cloud-based solutions we may experience a disruption in the timing of our customer purchasing habits. This transition may cause fluctuations in our service and software revenue and related margin contributions in the coming quarters. We anticipate that software revenue will continue to represent a meaningful portion of revenues in future years. Because of this, we believe that periodic fluctuations in the amount of revenue recognized by the Company may have a material impact upon our gross margins.

Billable consultant utilization increased to 72.9% and 73.8% during the three- and nine-month periods ended September 30, 2016 compared to 71.9% and 70.7% during the three- and nine-month periods ended September 30, 2015, respectively. Billable headcount, excluding contractors, held relatively constant at 368 as of September 30, 2016, compared to 366 as of September 30, 2015. The consistency of the billable headcount is reflective of the increases related to the M2 Dynamics Acquisition offset by our continued efforts to proactively manage billable headcount.

19

Table of Contents

Annualized service revenue per billable consultant, as adjusted for utilization, was $360 thousand and $374 thousand during the three-month periods ended September 30, 2016 and 2015, respectively. Annualized service revenue per billable consultant, as adjusted for utilization, was $356 thousand and $357 thousand during the nine-month periods ended September 30, 2016 and 2015, respectively. The periodic fluctuations in our annualized service revenue per billable consultant metric continue to reflect the changes in the mix of our service offering revenue generated by our current engagements.

During the three- and nine-month periods ended September 30, 2016, software revenue totaled $2.1 million and $7.8 million, or 6.8% and 8.0% of total revenue, respectively, compared to software revenue of $2.0 million and $8.3 million, or 6.5% and 9.4%, respectively, in the three- and nine-month periods ended September 30, 2015. Our software revenue is primarily related to our resale of Microsoft Dynamics software, cloud-based licenses and maintenance. As cloud-based solutions become more significant, the timing and revenue recognition treatment may differ from historically on-premise solutions, adding further volatility to our software revenue. Software revenue is expected to fluctuate on a period-to-period basis dependent upon our customers’ demand for such third-party off-the-shelf software.

Generally, we are reimbursed for our out-of-pocket expenses incurred in connection with our customers’ consulting projects. Reimbursed expense revenue was $1.7 million and $2.0 million for the three-month periods ended September 30, 2016 and 2015, respectively. Reimbursed expense revenue was $5.2 million for the nine-month period ended September 30, 2016 compared to $5.5 million for the nine-month period ended September 30, 2015. The aggregate amount of reimbursed expenses will fluctuate from period-to-period depending on the number of billable consultants as well the location of our customers, the general fluctuation of travel costs, such as airfare, and the number of our projects that require travel.

The number of customers the Company served during the nine-month period ended September 30, 2016 totaled 617, as compared to 614 customers during the nine-month period ended September 30, 2015. During the first nine months of 2016, we secured first-time engagements with a total of 106 new customers, compared to 108 new customer engagements during the first nine months of 2015.

Cost of Revenue. Cost of revenue primarily consists of project personnel costs principally related to salaries, payroll taxes, employee benefits, software costs and travel expenses for personnel dedicated to customer projects. These costs represent the most significant expense we incur in providing our services. In total, cost of revenue increased by $758 thousand, or 3.9%, to $20.2 million for the three-month period ended September 30, 2016, compared to $19.4 million in the comparative 2015 quarterly period. Cost of revenue increased by $4.1 million, or 7.0%, to $62.5 million during the year-to-date period ended September 30, 2016 compared to $58.5 million in the comparative 2015 year-to-date period. The primary drivers of the 2016 year-over-year increase in total cost of revenue during the three- and nine-month periods ended September 30, 2016, on an absolute dollar basis, were related to increases in salary and salary-related expenses, inclusive of incentive compensation (primarily associated with an increase in average billable headcount over the period). The increase in salary and salary-related expenses, which was primarily associated with the M2 Dynamics Acquisition, were partially offset by strategic management of billable consultant headcount in the core components of our business.

Project and personnel costs represented 55.6% and 54.3% of total revenue during the three- and nine-month periods ended September 30, 2016, respectively, as compared to 52.5% and 54.8% of total revenue during the three- and nine-month periods ended September 30, 2015, respectively.