Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES |

| EXCHANGE | ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014 |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE |

| SECURITIES | EXCHANGE ACT OF 1934 |

Commission file number: 000-20971

EDGEWATER TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 71-0788538 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 200 Harvard Mill Square, Suite 210 | ||

| Wakefield, Massachusetts | 01880 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (781) 246-3343

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 par value | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer [ ] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

As of June 30, 2014, there were 11,338,866 shares of Common Stock of the Registrant outstanding. The aggregate market value of the Common Stock of the Registrant held by non-affiliates (assuming for these purposes that all executive officers and directors are “affiliates” of the Registrant) as of June 30, 2014 was approximately $77.6 million, computed based upon the closing price of $7.44 per share on June 30, 2014.

As of February 25, 2015, there were 11,467,206 shares of Common Stock of the Registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference portions of the Registrant’s definitive proxy statement for the Registrant’s 2015 annual meeting of stockholders, to be filed with the Securities and Exchange Commission no later than 120 days after the close of its fiscal year, provided that if such proxy statement is not filed with the Commission in such 120-day period, an amendment to this Form 10-K shall be filed no later than the end of the 120-day period.

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this Annual Report on Form 10-K (this “Form 10-K”) may constitute forward-looking statements under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “believe,” “anticipate,” “anticipated,” “expectation,” “continued,” “future,” “forward,” “potential,” “estimate,” “estimated,” “forecast,” “project,” “encourage,” “opportunity,” “goal,” “objective,” “could,” “expect,” “expected,” “intend,” “plan,” “planned,” or the negative of such terms or comparable terminology. These forward-looking statements inherently involve certain risks and uncertainties, although they are based on our current plans or assessments which are believed to be reasonable as of the date of this Form 10-K. Factors that may cause actual results, goals, targets or objectives to differ materially from those contemplated, projected, forecasted, estimated, anticipated, planned or budgeted in such forward-looking statements include, among others, the following possibilities: (1) failure to obtain new customers or retain significant existing customers; (2) the loss of one or more key executives and/or employees; (3) changes in industry trends, such as a decline in the demand for Enterprise Resource Planning and Enterprise Performance Management solutions, custom development and system integration services and/or declines in industry-wide information technology spending, whether on a temporary or permanent basis and/or delays by customers in initiating new projects or existing project milestones; (4) inability to execute upon growth objectives, including new services and growth in entities acquired by our Company; (5) adverse developments and volatility involving geopolitical or technology market conditions; (6) unanticipated events or the occurrence of fluctuations or variability in the matters identified under “Critical Accounting Policies” elsewhere in this Form 10-K; (7) delays in, or the failure of, our sales pipeline being converted to billable work and recorded as revenue; (8) termination by clients of their contracts with us or inability or unwillingness of clients to pay for our services, which may impact our accounting assumptions; (9) inability to recruit and retain professionals with the high level of information technology skills and experience needed to provide our services; (10) failure to expand outsourcing services to generate additional revenue; (11) any changes in ownership of the Company or otherwise that would result in a limitation of the net operating loss carry forward under applicable tax laws; (12) the failure of the marketplace to embrace advisory and product-based consulting services; and/or (13) changes in our utilization levels. In evaluating these statements, you should specifically consider various factors described above as well as the risks outlined under “Item 1A. — Risk Factors .” These factors may cause our actual results to differ materially from those contemplated, projected, anticipated, planned or budgeted in any such forward-looking statements.

Although we believe that the expectations in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, growth, earnings per share or achievements. Neither we nor any other person assumes responsibility for the accuracy and completeness of such statements. Except as required by law, we do not intend to update any of the forward-looking statements after the date of this Form 10-K to conform such statements to actual results.

- 2 -

Table of Contents

Form 10-K

Annual Report

For the Year Ended December 31, 2014

TABLE OF CONTENTS

| Page | ||||||

| PART I | ||||||

| Item 1. |

4 | |||||

| 12 | ||||||

| Item 1A. |

15 | |||||

| Item 1B. |

19 | |||||

| Item 2. |

19 | |||||

| Item 3. |

20 | |||||

| Item 4. |

20 | |||||

| PART II | ||||||

| Item 5. |

21 | |||||

| Item 6. |

25 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

27 | ||||

| Item 7A. |

45 | |||||

| Item 8. |

46 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

78 | ||||

| Item 9A. |

78 | |||||

| Item 9B. |

78 | |||||

| PART III | ||||||

| Item 10. |

79 | |||||

| Item 11. |

79 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

79 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

80 | ||||

| Item 14. |

80 | |||||

| PART IV | ||||||

| Item 15. |

81 | |||||

| OTHER ITEMS | ||||||

| 82 | ||||||

| 82 | ||||||

- 3 -

Table of Contents

PART I

In this Annual Report on Form 10-K, we use the terms “Edgewater Technology,” “Edgewater,” “our Company,” “the Company,” “we,” “our,” and “us” to refer to Edgewater Technology, Inc. and its wholly-owned subsidiaries. A listing of our wholly-owned subsidiaries is included as Exhibit 21.1 to this Annual Report on Form 10-K (“Form 10-K”).

| ITEM 1. | BUSINESS |

AVAILABLE INFORMATION: Background

Edgewater Technology, Inc. maintains executive offices located at 200 Harvard Mill Square, Suite 210, Wakefield, MA 01880-3209. Our telephone number is (781) 246-3343. Our stock is traded on the NASDAQ Global Market under the symbol “EDGW.” Our Internet address is www.edgewater.com. We make available, free of charge, on the Investor Relations section of our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (the “SEC”). Copies are also available, without charge, from Edgewater Technology, Inc., Attn: Investor Relations, 200 Harvard Mill Square, Suite 210, Wakefield, MA 01880-3209 or by emailing ir@edgewater.com. Alternatively, reports filed with the SEC may be viewed or obtained at the SEC Public Reference Room at 100 F Street, NE, Washington, D.C. 20459, or the SEC’s Internet site at www.sec.gov. We do not intend for information contained in our website to be part of this Annual Report on Form 10-K.

Overview

Edgewater is a strategic consulting firm that brings a synergistic blend of specialty services to drive transformational change that (1) improves process, (2) reduces costs and (3) increases revenue. Our solutions are tailored to the C-level executives in the upper mid-market and Global 2000.

We deliver our services across a broad range of industries. We work onsite with our clients, providing a full spectrum of services in: classic consulting and product-based consulting, primarily in enterprise performance management (“EPM”) and enterprise resource planning (“ERP”).

Our Services

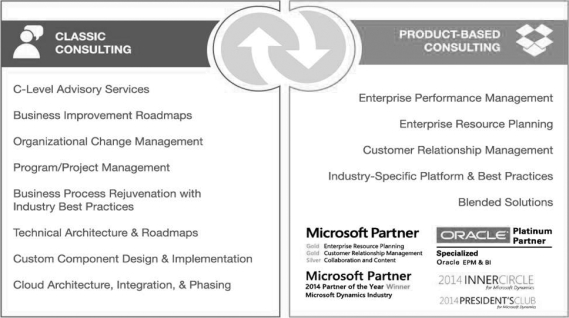

Edgewater offers a full spectrum of services and expertise to ensure the success of our engagements. Our consulting services are consolidated into two major synergistic offerings: (1) Classic Consulting and (2) Product-Based Consulting.

- 4 -

Table of Contents

The following diagram illustrates these offerings:

Edgewater has the proven expertise to plan, deliver and manage integration services that improve performance and maximize business results. We focus on deploying new systems and unlocking the value of the existing corporate assets. This proven expertise enables us to bring complex technologies and systems together while minimizing risk, leveraging our clients’ technology investments and delivering tailored solutions.

Below are Edgewater’s service categories with sample services:

| ¡ | Classic consulting services |

| ¡ | CFO advisory services |

| ¡ | Business improvement roadmaps |

| ¡ | Organizational change management |

| ¡ | Program/project management |

| ¡ | Business process rejuvenation and integrated social media best practices |

| ¡ | Specialized operational, due diligence and technology management expertise to mergers and acquisitions, private equity and venture capital |

| ¡ | Strategic advice, costing, estimates to complete, failing or failed programs or project initiatives |

| ¡ | Independent package selection and Request for Information or Proposal process design and implementation |

| ¡ | Technical architecture and roadmaps |

| ¡ | CIO advisory services |

| ¡ | Strategic technology selections |

| ¡ | Technical evaluation and design |

| ¡ | Custom component design and implementation |

| ¡ | Customer intelligence solutions using web/mobile analytics combined with social intelligence |

| ¡ | Cloud architecture, integration and phasing solutions |

| ¡ | On-going support services |

| ¡ | Infrastructure optimization and redesign, disaster recovery and business continuity specialized design and assistance |

- 5 -

Table of Contents

| ¡ | Product-based consulting services |

| ¡ | Business transformation through the use of packaged software solutions |

| ¡ | Enterprise performance management with Oracle budgeting, planning, consolidation and strategic finance both on premise and in the cloud |

| ¡ | Enterprise resource planning with Microsoft Dynamics AX targeted in process and discrete manufacturing verticals such as CPG, IEM, Chemical, Pharmaceuticals and Food and Beverage |

| ¡ | Customer relationship management with Microsoft Dynamics CRM both on premise and in the cloud |

| ¡ | Industry specific platform and best practice solutions |

| ¡ | Blended solutions; Microsoft CRM/XRM and specialized custom solutions |

| ¡ | Business intelligence analytics |

| ¡ | Design, development and introduction of IP that helps “verticalize” channel product stacks |

| ¡ | Support and training services |

In addition to the above services, the Company also provides synergistic services in the area of data management and analytics. Examples of such services include the following:

| ¡ | Enterprise information management services |

| ¡ | Provide for data related matters: master data management, data governance, logical and physical data base design, data warehouse strategies and design |

| ¡ | Provide practical data architectures and roadmaps to support transactional systems and enterprise performance management through advanced analytics |

| ¡ | Provide forms of data manipulation, transformation and quality services |

| ¡ | Analytics services |

| ¡ | Advise on lead derivation of key financial and operational performance indicators and correlate their measurement, visualization and action for a given organization |

| ¡ | Advise on opportunities for the use of predictive techniques, external data and benchmarks to improve business performance measurement and forecasting |

| ¡ | Advise on the creation and adoption of analytics architectures, roadmaps and supporting organizations |

| ¡ | Advise, design and roadmap analytics-based near real-time to real-time alerting strategies and implementations |

Our consultants are expected to travel and to be onsite with the customer to provide the highest level of service and support in all of these endeavors. We provide varying degrees of customer project assistance and will incorporate customer resources for technology transfer or cost optimization purposes. Independent teams and proper project process and delineation provide conflict-free transition points among all key service offerings as well as independent entry points. Leads for all offerings are internally driven with assistance from the respective vendors for software product solutions.

Customers

Our strategic acquisitions have helped enhance our service and product offerings, increase and diversify our customer base and reduce our reliance on individually significant customers. Service revenue from our five largest customers, as a percentage of total service revenue, was 17.8%, 16.5% and 14.8% for the years ended December 31, 2014, 2013 and 2012, respectively. No single customer represented 10% or more of total revenue during the years ended December 31, 2014, 2013 or 2012. See “Item 1A. — Risk Factors — Our results can be subject to variability as work is completed for a limited number of significant customers, and our results of operations and financial condition could be negatively affected by the loss of a major customer or significant project or the failure to collect a large account receivable.” During 2014, we recorded service revenue from 403

- 6 -

Table of Contents

customers, of which 83 were new customers, as compared to recording service revenue from 387 customers in 2013, of which 92 were new customers. We recorded service revenue from 394 customers in 2012, of which 103 were new customers.

Industry Dynamics and Opportunity

Industry Dynamics. In today’s rapidly shifting macro business environment, businesses are demanding that financial and operational strategies be implemented in the most efficient and complete manner possible. The classic providers, such as the large management consulting firms, large accounting firms and multinational integrators, tend to provide solution services exclusively on large complex platforms, encompassing many players of mixed experience levels and in a myriad of locations. Edgewater’s services are focused and quickly deployed onsite in a specialized solution package, more appropriate to today’s need for faster innovation rollout, pushed deeper into subsidiaries of multinational corporations as well as middle market growth companies.

Expenditures in the information technology market have become a critical success factor in every company’s successful growth. As such, IT expenditures are receiving the scrutiny of the “C-level” officers, when specifically focused on transformational change. Our C-level buyers are looking to purchase rapidly deployable, risk-managed, product-based technology solutions. These solutions maintain the ability for a company to differentiate itself from its competitors with proprietary business process, combined with the leverage of product customization. Edgewater assists clients with these solutions primarily in the Oracle Corporation (“Oracle”) and Microsoft Corporation (“Microsoft”) product channels, while providing the opportunity for a customer to customize its solutions through the utilization of its custom technology consulting services.

There are three major drivers to transformational change today. The first is the permeation of operational analytics driving corporate command and control. This manifests itself in the centralization of operational analytics on a common enterprise-wide platform of planning, budgeting, consolidation and strategic finance, which are provided by Edgewater through its EPM services within the Oracle channel. The second driver of transformational change is the software replacement cycle in manufacturing, insurance and healthcare. Each has its macro drivers (economic, regulatory or demographic), for which the outcome is the same. Core operational systems such as ERP, policy administration and accountable care/service lines must be implemented or replaced. Third, cloud-based services are providing a new and growing opportunity for the middle-market, enabling them to avail themselves of technology usually reserved for larger companies. Edgewater’s classic consulting and product-based services fill the gap in expertise between the internal corporate resources available to a middle-market company and the provisioning of the various cloud providers required to provide an effective enterprise solution.

Companies typically turn to consulting firms, like Edgewater, to fill these internal project gaps for a number of reasons:

| ¡ | For deep industry, product, data and technical expertise; |

| ¡ | To obtain strategic consulting services in an accelerated timeframe; |

| ¡ | To mitigate their business risk with focused onsite project teams; |

| ¡ | To receive an outside objective perspective; |

| ¡ | To obtain EPM- and EIM-related services; |

| ¡ | To obtain product, services and IP related to ERP and CRM; |

| ¡ | To provide cloud architecture and on-ramping services; and/or |

| ¡ | To serve as an agent to plan, manage and implement change. |

Industry Opportunity. Technology has become such an integral part of business that it requires skilled strategic management in its own right. Technology has become a key enabler to business change when the appropriate strategic steps, a meld of business process change and technology, are well laid out and thoughtfully executed. Strategic consulting firms deliver innovative thinking and in-depth vertical industry expertise, along with the ability to implement business process transformation through the judicious use of appropriate

- 7 -

Table of Contents

technologies. We have steadily enhanced our offerings to address the evolving need for strategic advisory and product-based consulting services and plan to continue to grow our competencies in these areas. Our goal is to provide a comprehensive continuum of focused business services, encompassing all facets of business, through the enablement of technology.

Competitive Strengths

Edgewater offers strategic consulting services designed to assist its clients in improving financial and operational performance across their enterprises. We develop business strategies and technology solutions that address their specific needs while providing them with increased competitive advantage. We believe that five core values differentiate us from our competition.

These values include the following:

| (1) | Delivery Excellence — Our history is built upon more than 20 years of proven methodology and well-defined process, in addition to continuous delivery of business and technology solutions that work. Our delivery excellence is a derivative of a well-defined business plan, highly-skilled consultants, strong technical expertise and established implementation and support methodologies. Most importantly, we use an iterative business and technology approach, with an emphasis on quality assurance and project management, to achieve rapid and successful deployment of our solutions. Our delivery history has contributed to our ability to build long-term customer relationships. |

| (2) | Vertical Expertise — We combine vertical industry knowledge with a broad base of key strategic technologies to serve our customers’ needs and deliver tailored and innovative strategies and solutions. We have developed core competencies in primary vertical markets such as: CPG/Manufacturing; Discrete and Process Manufacturing; Energy/Utilities; Healthcare; Hospitality; Insurance; Oil and Gas; Retail; Travel/Entertainment; and various Emerging Markets. |

| (3) | Technology Excellence — We deliver our services by blending proven strategic technologies and business practices to build scalable solutions providing a solid return on investment. Our team of professionals has the business and technology expertise to offer comprehensive strategies and solutions. Our areas of expertise include: |

| • | Classic consulting services; |

| • | EPM solutions in planning; |

| • | Budgeting; |

| • | Consolidation and strategic finance; |

| • | Microsoft Dynamics solutions in the area of CRM and ERP; |

| • | Data analytics; |

| • | Web analytics; |

| • | Advanced data and infrastructure services; and |

| • | Specialized custom IT services. |

| (4) | Client Focus — Edgewater is positioned to provide its customers with onsite services. Edgewater’s client-centric model is well positioned to serve the needs of the Global 2000 for tight, highly-trained, product specialist project teams, as well as the upper middle market whose needs tend to span the full spectrum of our business/IT service offerings. |

| (5) | Adherence to Operational Metrics — Since our inception in 1992, Edgewater’s original management team has built an organization that is defined by a record of operational excellence, tracking key performance indicators and well-defined operating metrics to manage our consulting resources, utilization and gross margin. |

- 8 -

Table of Contents

Business Strategy

Our business strategy is to position our Company as one of the leading providers of transformational classic and product-based consulting services. We believe we can attain this strategic objective by delivering a range of blended solutions through a combination of industry specific classic consulting, advanced product–based software consulting and custom technology consulting services. Clients desire the personal attention provided by onsite industry, financial and strategic expertise buttressed with the ability to speed idea implementation with cost-effective advanced software package solutions. Our ability to begin our services dialogue at the strategy level in business vernacular all the way through specific software product request for proposal response provides a spectrum of sales opportunities with varying degrees of channel control and cost. This spectrum of engagement entry opportunities allows us to serve the upper middle market through the Global 2000 with an appropriate set of services.

The spectrum begins with pure consulting and ends with pure information technology. Smaller organizations such as middle-market companies, subsidiaries of Global 2000, private equity firms and venture capital firms will tend to start at the advisory and classic consulting level, while the Global 2000 tend to initially engage with product-based consulting services.

Additionally, we are able to strengthen our service offerings by focusing upon the development of intellectual property, not only in the area of patents and trademarks, as described below under “— Intellectual Property,” but with respect to the internal development of software. We are able to quickly execute on the internal development of intellectual property given the significant knowledge and expertise we maintain in our product-based consulting channels. We can leverage this intellectual property as a means to accelerate delivery of a solution and as a means to solidify and/or expand our presence in a vertical market.

Marketing, Sales and Strategic Alliances

Marketing. The primary goal of our marketing efforts is to generate sales opportunities by increasing our brand awareness, value proposition and overall domain expertise. Our marketing efforts continue to be closely aligned with our go-to-market strategy, while introducing specific offerings that address business and IT problems faced by our clients. We leverage the core competencies we have developed in delivering our services in key industries and horizontal offerings to increase the efficiency of our marketing efforts. Our marketing function utilizes comprehensive internet marketing strategies that involve integrated activities including, but not limited to: webinars, highly-targeted email campaigns distributed to prospect and client lists developed with specific demographics and attributes and social media outlets to promote our capabilities and services (e.g., both company-driven and domain-specific blogs, social networking and video sharing websites). By leveraging closely coupled internet marketing strategies to promote our services, we are able to reach a wider audience and communicate in a medium that has become more widely accepted and brings in quicker results from a sales and marketing perspective. We also gather key statistics from our websites, blogs, email campaigns and other social media outlets to test, measure and trace our marketing initiatives. This enables us to ensure we are reaching the right target audience with concise and compelling offerings to promote our capabilities. We also author white papers and contribute to articles in trade publications, attend events and participate in targeted industry conferences and tradeshows.

Our marketing department has embarked on an enterprise-wide initiative to bring recent acquisitions under a single master brand concept. Since some of our new offerings are not purely technology oriented, we are in the process of establishing our master brand as “Edgewater,” thus dropping the word “Technology” from our corporate identity.

Sales. Our sales approach is to combine traditional sales with our strength in industries and technology. Our traditional sales function is composed of direct sales professionals and inside sales professionals. Both work closely with our practice directors to identify potential opportunities within each account. Using a consultative selling methodology, target prospects are identified and a pursuit plan is developed for each key account. When

- 9 -

Table of Contents

contact with a target is established, we utilize a blended sales model to demonstrate our expertise, combining consultative selling with traditional sales methods. Once the customer has engaged us, our sales professionals maintain their relationships with the customer by working collaboratively with the consulting professionals who are assigned to the customer.

Strategic Alliances. As part of our sales and marketing effort, we have established working relationships with a number of companies, including: Informatica Corporation, ISO Insurance Technology Solutions, Google, Adobe, Keyteach; Microsoft, Oracle Oracle, FAST, Core Motives, Exact Target, Resco, Experlogix, Scribe, CozyRoc, OpenText, SiteCore, International Business Machines Corporation (“IBM”), Accelatis, Majesco Mastek, Resonant and Webtrends. These alliances generally entail sharing sales leads, joint marketing efforts, making joint customer presentations, negotiating discounts on license fees or other charges and conducting similar activities. Our arrangements with many of these companies are informal and are not subject to definitive written agreements. For those companies with whom we do have definitive written agreements, those agreements are either terminable at will by either party or are for terms of one year or less. We believe we have been successful in establishing alliances with a strong group of companies who are either industry leaders or well-regarded new entrants.

Professional Recruitment, Retention and Development

Our success depends in part upon our ability to recruit and retain business and technology professionals with the high level of skills and experience needed to provide our specialty services. We believe that the combination of professional support, intellectual challenge, corporate culture and compensation we offer will continue to be attractive to these highly-skilled professionals. Our working environment also fosters collaboration, creativity and innovation. We believe that our employees are one of our most valuable assets.

Employees. As of December 31, 2014, Edgewater had 414 employees (excluding contractors). Of these employees, 324 were billable consultants and 90 were product development and management and administrative personnel (composed of sales, marketing, human resources, finance, accounting, internal information systems and administrative support). The average tenure of our employees is approximately 5.4 years and the average “years of experience” is approximately 22 years. Our employees are not represented by a collective bargaining agreement. We believe that our employee relations are strong.

Culture. We believe that our business culture is critically important in hiring and retaining qualified professionals. Our ability to provide effective multidisciplinary teams is dependent upon our ability to develop and sustain a business culture that is common across all disciplines and vertical practices throughout our Company. Our employees are talented and energetic professionals who come from a multitude of professional backgrounds. We believe that this creates an exciting, diverse and creative work environment for our employees.

Compensation. We have competitive compensation programs that have been structured to attract and retain highly-skilled professionals. Edgewater’s compensation programs include competitive base salaries, coupled with cash bonus and equity-based incentive opportunities. Compensation plans may be tied to the achievement of the Company’s financial performance or tied to individual and team performance goals.

Recruiting. We believe that our long-term success will depend upon our ability to attract, retain and motivate highly-skilled employees. Our recruitment department has traditionally conducted its own direct recruiting efforts and coordinated informal and search firm referrals. We believe that our business model, which results in an intellectually stimulating work environment, provides increased opportunities for professional development and a dynamic corporate culture, which enhances our ability to attract and retain top professionals.

Professional Development. We believe that providing our professionals with a wide variety of challenging projects, the opportunity to demonstrate ability and achieve professional advancement are keys to their retention. We work with our professionals to assist them with their professional development by offering internal and

- 10 -

Table of Contents

external learning opportunities. We encourage them to attain industry certifications which strengthen their expertise in both business and technology. We also believe that the working relationships they form on various project teams foster valuable formal and informal mentoring and knowledge sharing.

Competition

We operate in a competitive and rapidly changing market. We also compete with a variety of organizations that offer services similar to those we provide. Our clients often retain us on a non-exclusive, project-by-project basis. We compete with a number of different types of businesses, including:

Traditional management and strategy consulting firms that focus on advising “C”-level executives on organization and corporate strategy. Many of the traditional strategic consulting firms have added services in information technology.

Systems integration and IT consulting firms that design and implement technology solutions, including software installation, for departments and enterprises. These firms have grown in size and scope of services, including the provision of offshore software development services.

Information technology product and service vendors that offer technical consulting to support their own products. Many of these firms have also developed various alliances with systems integration and IT consulting firms to augment their own capabilities.

There is significant competition in the management and IT consulting services space. Mergers or consolidations in our market may create new, larger or better-capitalized competitors with enhanced abilities to attract and retain professionals. The following is a representative list of competitors in the IT and management consulting services space:

| ¡ | Technical Consulting/Systems integrators: Accenture, EDS, Mattersight Corporation (formerly eLoyalty Corporation), Ciber, Inc., IBM Global Services, Business and Decision Group, Caritor, Inc., LogicaCMG, Perficient and Sapient; |

| ¡ | Offshore software development firms: Aztec Software, Cognizant Technology Solutions, Infosys, Ventyx, Mahindra Satyam, Tata and Wipro; |

| ¡ | Management/Business Consulting firms: Bain & Company, Booz-Allen & Hamilton, Boston Consulting Group and McKinsey & Company; |

| ¡ | Enterprise Performance Management / Business Activity Monitoring / Business Intelligence providers: Deloitte & Touche, The Hackett Group, Hitachi Consulting Corporation, Hewlett-Packard, KPMG, PricewaterhouseCoopers and Ernst & Young; and |

| ¡ | Computer hardware, software and service vendors: Hewlett-Packard, IBM, Oracle, Microsoft and SAP. |

We believe that the principal criteria considered by prospective clients when selecting a consulting firm include skills and capabilities of consultants, scope of services, project methodology and approach, technical and industry expertise, reputation and quality of past work, perceived value and a commitment to delivering a solution that works as intended. Due to our ongoing dedication and attention to all of the above characteristics, we believe that we are well positioned against our competitors in our marketplace.

Intellectual Property

We consider our intellectual property to be a valuable asset in a highly competitive industry. We also consider our intellectual property to be an important factor in building brand recognition for quality service and

- 11 -

Table of Contents

performance. Therefore, we have secured certain service marks for “Edgewater,” “Edgewater Consulting,” “Edgewater Technology,” “Edgewater Strategy Services,” “Edgewater Technology-Ranzal,” “Edgewater Ranzal” and “Edgewater Fullscope,” among others. We believe we have secured all rights to trademarks and trade names related to our business.

We rely on a combination of trade secret, copyright and trademark laws to protect our proprietary rights. In particular, we require each of our employees to sign an invention and non-disclosure agreement, which provides that they must maintain the confidentiality of our intellectual property and that any intellectual property that they develop while employed by us is the property of Edgewater. We have developed detailed tools, processes and methodologies which are used in developing software code, scripts, libraries, data models, applications, business processes, frameworks and other technology used within our Company and in customer engagements. See also “Item 1A. — Risk Factors” included elsewhere in this Form 10-K.

Potential Future Strategies, Transactions and Changes

Critical to our ability to create long-term stockholder value, the Company will continue to pursue internal growth initiatives and appropriate business combination transaction alternatives to achieve growth in revenues and profitability. From time to time, we have engaged and we may continue to engage in discussions with various persons regarding potential business combination transactions.

We believe that our current cash balances and our anticipated cash flow from our operations taken together will be adequate for our working capital needs for at least the next twelve months. However, our actual experience may differ significantly from our expectation, particularly if we pursue growth through business combination transactions, which we presently believe will be advantageous to building long-term stockholder value. In addition, other future events may adversely or materially affect our business, expenses or prospects and could affect our available cash or the availability or cost of external financial resources.

We may, in the future, purchase common stock in the open market, in private transactions or otherwise, pursuant to board approved repurchase programs. See “Item 5. — Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” included elsewhere in this Form 10-K. Any future purchases by us will depend on many factors, including, but not limited to, the market price of our common stock, our business strategy, our business and financial position and general economic and market conditions.

Directors and Executive Officers of the Registrant

| Name |

Age | Position with the Company | ||||

| Shirley Singleton |

63 | Chairman of the Board, President and Chief Executive Officer | ||||

| David Clancey |

59 | Executive Vice President, Chief Strategy Officer and Chief Technology Officer | ||||

| Timothy R. Oakes |

47 | Chief Financial Officer, Chief Accounting Officer, Treasurer and Corporate Secretary | ||||

| Robin Ranzal-Knowles |

47 | President, Edgewater Technology-Ranzal, Inc. | ||||

| Kristin Zaepfel |

51 | Vice President, Human Resources | ||||

| Paul Flynn |

65 | Independent Director | ||||

| Paul Guzzi |

72 | Independent Director | ||||

| Nancy Leaming |

68 | Independent Director | ||||

| Michael Loeb |

59 | Independent Director | ||||

| Wayne Wilson |

66 | Lead Independent Director | ||||

- 12 -

Table of Contents

Ms. Singleton currently serves as our Chairman, a position she was elected to in July 2005. Ms. Singleton co-founded Edgewater Technology (Delaware), Inc. (“Edgewater Delaware”) in 1992 and served as President of Edgewater Delaware from 1992 until January 2002. Ms. Singleton has served as President and Chief Executive Officer of our Company (the parent company of Edgewater Delaware) from January 2002 to the present. Prior to co-founding Edgewater Delaware, Ms. Singleton held various management positions from 1982 to 1992 at Logica North America and attained the position of Vice President and General Manager of the Northeast region. Ms. Singleton serves on the Technical Oversight Committee for Partners Healthcare, the Board of Trustees for the North Shore Medical Center and the board of The Commonwealth Institute. Ms. Singleton has served as a Director of our Company since June 2001.

Mr. Clancey has served as Executive Vice President, Chief Strategy Officer and Chief Technology Officer of our Company since June 2006. Before assuming his current title, Mr. Clancey served as our Executive Vice President — Chief Technology Officer from 2001 to 2006 and as Edgewater Delaware’s Senior Vice President —Chief Technology Officer from 1992 until 2001. Mr. Clancey co-founded Edgewater Delaware in 1992 with Ms. Singleton. Prior to co-founding Edgewater Delaware, Mr. Clancey was a Systems Architect and Chief Technology Officer at Logica North America.

Mr. Oakes has served as Chief Financial Officer, Treasurer and Corporate Secretary of our Company since September 2009 and Chief Accounting Officer of our Company since July 2008. Mr. Oakes joined our Company as a Director of Finance in August 2004. Prior to joining Edgewater, Mr. Oakes was a Senior Director of Finance at Symmetricom, Inc. from September 2001 to August 2004. Prior to Symmetricom, Mr. Oakes held various financial management and operational reporting positions with companies in the biotechnology, manufacturing and consulting services industries.

Ms. Ranzal-Knowles has served as President of Edgewater Technology-Ranzal, Inc., a subsidiary of the Company (“Ranzal”), since October 2004. Prior to joining Edgewater, Ms. Ranzal-Knowles was the founder, owner and President of Ranzal and Associates, Inc., from March 1996 to October 2004.

Ms. Zaepfel has served as Vice President of Human Resources of our Company since September 2003. Prior to joining our Company, Ms. Zaepfel served as Senior Vice President of Human Resources for Xchange, Inc. from 1998 to 2003. Ms. Zaepfel has also held various Human Resources positions at such organizations as HPR, Inc., Mellon Bank Corporation and The Boston Company.

Mr. Flynn currently serves as Executive Vice President and Commercial Loan Officer at People’s United Bank, a position he has held since June 30, 2011. From 2007 to June 2011, Mr. Flynn was an Executive Vice President and Commercial Loan Officer at Danversbank. From 2000 to 2007, Mr. Flynn was an Executive Vice President of RBS Business Capital, a division of Citizens Financial Group. From 1986 to 2000, Mr. Flynn was an Executive Vice President for the United States Trust Company. Prior to his time at the United States Trust Company, Mr. Flynn was a Senior Vice President for Patriot Bank, N.A. from 1981 to 1986. From 1977 to 1981, Mr. Flynn was an Assistant Vice President at Chase Commercial Corporation and from 1974 to 1977 Mr. Flynn was an Audit Manager with New England Merchants Bank. Mr. Flynn serves as a Director of the Business Development Corporation of New England. Mr. Flynn was elected as a Director of our Company in July 2005.

Mr. Guzzi has served as the President and Chief Executive Officer of the Greater Boston Chamber of Commerce since 1996. From 1995 to 1996, Mr. Guzzi was Vice President of State and Community Affairs for Boston College. Prior to his position at Boston College, Mr. Guzzi was a consultant for Heidrick & Struggles, an international recruitment firm from 1994 to 1995. From 1991 to 1993, Mr. Guzzi served as a Vice President at Data General Corporation. Prior to his position at Data General Corporation, Mr. Guzzi was a Senior Vice President at Wang Laboratories from 1981 to 1991. Mr. Guzzi was a State Representative in the Massachusetts Legislature from 1971 to 1974 and the Massachusetts Secretary of State from 1975 to 1978. Mr. Guzzi serves as a Trustee of the Citi Center for the Performing Arts and the Vice Chairman of Blue Cross Blue Shield of

- 13 -

Table of Contents

Massachusetts. Mr. Guzzi is also a Board member of the Partners HealthCare Corporation and serves as an Advisory Board member for The Boston Club. Mr. Guzzi has served as a Director of our Company since April 2004.

Ms. Leaming has been an independent consultant since 2005. From June 2003 to June 2005, Ms. Leaming was the Chief Executive Officer and President of Tufts Health Plan, a provider of healthcare insurance. Prior to that, Ms. Leaming served as Tufts Health Plan’s President and Chief Operating Officer from 1998 to 2003, the Chief Operating Officer from 1995 to 1998 and the Chief Operating Officer/Chief Financial Officer from 1986 to 1995. Prior to joining Tufts Health Plan, Ms. Leaming held a variety of management positions in managed care and banking, including Chief Financial Officer of Matthew Thornton Health Plan. Ms. Leaming currently serves as a director of Biogen Idec and Hologic, Inc. Ms. Leaming joined our Board in December 2005.

Mr. Loeb has been the President and CEO of Loeb Enterprises, a New York-based business development lab, since 2005. Mr. Loeb was the President and Chief Executive Officer of the Synapse Group, Inc., a wholly-owned subsidiary of Time Warner, from 1997 to December 2005. Prior to co-founding the Synapse Group, Inc. and becoming its President in 1991, Mr. Loeb had an eight-year career at Time Warner, where he held a number of positions including Consumer Marketing Director for Sports Illustrated and Vice President of Consumer Marketing of Entertainment Weekly. At Time Warner, he also helped introduce SI for Kids. Mr. Loeb was also responsible for starting the direct response division of Deutsch Agency immediately prior to co-founding the Synapse Group, Inc. Mr. Loeb has served as a Director of our Company since April 2000.

Mr. Wilson currently serves as our Lead Independent Director, a position he was elected to in September 2005. Mr. Wilson has been an independent business advisor since 2002. From 1995 to 2002, Mr. Wilson served in various roles, including President, Chief Operating Officer and Chief Financial Officer at PC Connection, Inc., a Fortune 1000 direct marketer of information technology products and services. From 1986 until 1995, he was a partner in the assurance and advisory services practice of Deloitte & Touche LLP. Mr. Wilson also serves as a director of ARIAD Pharmaceuticals, Inc., FairPoint Communications, Inc. and Hologic, Inc. He previously served as a director of Cytyc Corporation. Mr. Wilson has served as a Director of our Company since May 2003.

- 14 -

Table of Contents

| ITEM 1A. | RISK FACTORS |

In addition to other information contained in this Form 10-K, the following risk factors should be carefully considered in evaluating Edgewater and its business because such factors could have a significant impact on our business, operating results and financial condition. These risk factors could cause actual results to materially differ from those projected in any forward-looking statements.

Our business could be adversely affected by a significant or prolonged economic downturn. Our results of operations are affected by the level of business activity of our customers, which in turn is affected by the level of economic activity in the industries and markets that they serve. A decline in the level of business activity of our customers has had and could continue to have a material adverse effect on our revenue and profit margin. Future economic conditions could cause some customers to reduce or defer their expenditures for consulting services. We have implemented and will continue to implement cost-savings initiatives to manage our expenses as a percentage of revenue. However, current and future cost-management initiatives may not be sufficient to avoid reductions in our margins if the economic environment should weaken for a prolonged period.

Our lack of long-term customer contracts reduces the predictability of our revenues because our current contracts may be canceled on short notice and without penalty. Our customers generally retain us on a project-by-project basis, rather than under long-term contracts. As a result, a customer may not engage us for further services once a project is complete. If a significant customer or a number of customers terminate, significantly reduce, or modify their contracts with us, our results of operations would be materially and adversely affected. Consequently, future revenue should not be predicted or anticipated based on the number of customers we have or the number and size of our existing projects. If a customer were to postpone, modify or cancel a project, we would be required to shift our consultants to other projects to minimize the impact on our operating results. We cannot provide assurance that we will be successful in efficiently and effectively shifting our consultants to new projects in the event of project terminations, which could result in reduced service revenue and lower gross margins. If we experience unexpected changes or variability in our revenue, we could experience variations in our quarterly operating results and our actual results may differ materially from the amounts planned and our operating profitability may be reduced or eliminated.

We have significant fixed operating costs, which may be difficult to adjust in response to unanticipated fluctuations in revenue. A high percentage of our operating expenses, particularly salary expense, rent, depreciation expense and amortization of intangible assets, is fixed in advance of any particular quarter. As a result, an unanticipated decrease in the number or average size of, or unanticipated delay in the scheduling for, our projects may cause significant variations in operating results in any particular quarter and could have a material adverse effect on operations for that quarter. An unanticipated termination or decrease in size or scope of a significant project, a customer’s decision not to proceed with a project we anticipated or the completion during the quarter of several significant customer projects could require us to maintain underutilized employees and could have a material adverse effect on our business, financial condition and results of operations.

If we fail to satisfy our customers’ expectations, our existing and continuing business could be adversely affected. Our sales and marketing strategy emphasizes our belief that we have highly referenceable accounts. Therefore, if we fail to satisfy the expectations of our customers, we could damage our reputation and our ability to retain existing customers and attract new customers. In addition, if we fail to deliver and perform on our engagements, we could be liable to our customers for breach of contract. Although most of our contracts limit the amount of any damages to the fees we receive, we could still incur substantial cost, negative publicity and diversion of management resources to defend a claim, and as a result, our business results could suffer.

We may have lower margins, or lose money, on fixed-price contracts. In 2014, 2013 and 2012, fixed-price contracts represented approximately 5.7%, 5.2% and 3.2%, respectively, of our total service revenue. We assume greater financial risk on fixed-price contracts than on time-and-materials or retainer-based engagements, and we cannot assure you that we will be able to successfully price our larger fixed-price contracts. If we fail to

- 15 -

Table of Contents

accurately estimate the resources and time required for an engagement, fail to manage customer expectations effectively or fail to complete fixed-price engagements within planned budgets, on time and to our customers’ satisfaction, we could be exposed to cost overruns, potentially leading to lower gross profit margins or even losses on these engagements.

Competition in the IT and management consulting services market is intense and, therefore, we may lose projects to, or face pricing pressure from, our competitors or prospective customers’ internal IT departments or international outsourcing firms. The market for IT and management consulting providers is highly competitive. In many cases, we compete for specialty IT services work with in-house technical staff, software product companies with extended service organizations and other international IT and management consulting firms, including offshore outsourcing firms. In addition, there are many small, boutique technology management consulting firms who have developed services similar to those offered by us. We believe that competition will continue to be strong and may increase in the future, especially if our competitors continue to reduce their price for IT and management consulting services. Such pricing pressure could have a material impact on our revenues and margins and limit our ability to provide competitive services.

Our target market is rapidly evolving and is subject to continuous technological change. As a result, our competitors may be better positioned to address these developments or may react more favorably to these changes, which could have a material adverse effect on our business. We compete on the basis of a number of factors, many of which are beyond our control. Existing or future competitors may develop or offer IT and management consulting services that provide significant technological, creative, performance, price or other advantages over the services we offer.

Some of our competitors have longer operating histories and significantly greater financial, technical, marketing and managerial resources than we do. There are relatively low barriers of entry into our business. We currently have no patented or other proprietary technology that would preclude or inhibit competitors from entering the IT services market. Therefore, we must rely on the skill of our personnel and the quality of our customer service. The costs to start an IT and management consulting services firm are low. We expect that we will continue to face additional competition from new entrants into the market in the future, offshore providers and larger integrators and we are subject to the risk that our employees may leave us and may start competing businesses. Any one or more of these factors could have a material impact on our business.

Our results can be subject to variability as work is completed for a limited number of significant customers, and our results of operations and financial condition could be negatively affected by the loss of a major customer or significant project or the failure to collect a large account receivable. We have in the past derived, and may in the future derive, a significant portion of our service revenue from a limited number of customers. From year-to-year, revenue from one or more of our customers may exceed 10% of our total service revenue. The loss of a major customer or large project could materially and adversely affect our results of operations. In 2014 and 2013 our top five customers represented 17.8% and 16.5% of our 2014 and 2013 service revenues, respectively. The future receipt of significant commitments from new or existing customers could create future risks such as those described above concerning customer concentration.

We perform varying amounts of work for specific customers from year-to-year. A major customer in one year may not use our services in another year. In addition, we may derive revenue from a major customer that constitutes a large portion of a particular quarter’s total revenue. If we lose any major customers or any of our customers cancel or significantly reduce a large project’s scope, our results of operations and financial condition could be materially and adversely affected. Further, if we fail to collect a large accounts receivable balance, we could be subjected to a material adverse impact on financial results and a decrease in cash flow.

Our business could be adversely affected by local political, social, legal, tax, regulatory or environmental requirements. The local business risks in different cities, states and countries in which we or our current or potential customers operate could have a material impact on our financial condition, results of operations and growth prospects. We sell our classic consulting and product-based consulting services in different cities, states

- 16 -

Table of Contents

and countries and may increasingly become exposed to changing political, social, legal, tax, regulatory and environmental requirements at the local, national or international level. Also, new policies or measures by governments, whether fiscal, tax, regulatory, environmental or other competitive changes, may lead to an increase in additional or unplanned expenditures, discourage our customers or potential customers from purchasing our services and ultimately adversely affect our financial condition, results of operations and growth prospects.

If customers view offshore development as a viable alternative to our service offerings, our pricing, revenue, margins and profitability may be negatively affected. In recent years, international IT service firms have been founded in countries such as India and China, which have well-educated and technically-trained workforces available at wage rates that are substantially lower than U.S. wage rates. While traditionally we have not competed with offshore development, the offshore model has matured and offers an alternative choice when companies evaluate their IT consulting needs. To counteract the alternative of going offshore for IT consulting services, we are focusing on advisory and product-based service offerings, including design and strategy consulting engagements, which are more difficult for offshore development firms to replicate. If we are unable to continually evolve our service offerings or the rate of acceptance of offshore development advances beyond current levels, then our pricing and revenue could be adversely affected.

Because we rely on highly-trained and experienced personnel to design and build complex systems for our customers, an inability to retain existing employees and attract new qualified employees would impair our ability to provide our services to existing and new customers. Our future success depends in large part on our ability to attract new qualified employees and retain existing highly-trained and experienced technical consultants, project management consultants, business analysts and sales and marketing professionals of various experience levels. If we fail to attract new employees or retain our existing employees, we may be unable to complete existing projects or bid for new projects of similar size, which could adversely affect our revenues. While attracting and retaining experienced employees is critical to our business and growth strategy, maintaining our current employee base may also be particularly difficult. Even if we are able to grow and expand our employee base, the additional resources required to attract new employees and retain existing employees may adversely affect our operating margins.

We depend on our key personnel, and the loss of their services may adversely affect our business. We believe that our success depends on the continued employment of the senior management team and other key personnel. This dependence is particularly important to our business because personal relationships are a critical element in obtaining and maintaining customer engagements. If one or more members of the senior management team or other key personnel were unable or unwilling to continue in their present positions, our business could be seriously harmed. Furthermore, other companies seeking to develop in-house business capabilities may hire away some of our key personnel.

Our business could be adversely affected by material changes to our strategic relationship with Oracle America, Inc. Our EPM-related service offering derives a substantial portion of its revenues from a channel relationship with Oracle. This relationship involves Oracle assisted lead generation support with respect to the business intelligence services provided in connection with our EPM-related service offerings. This relationship is governed by an Oracle Partner Network Agreement, which is subject to annual renewal. A failure to renew this relationship, or a material modification or change in Oracle’s partner approach or its contract terms, for any reason, could have a material adverse impact on our results of operations.

Our business could be adversely affected by material changes to our strategic relationship with Microsoft Corporation. Our ERP- and CRM-related product and service offerings derive a substantial portion of revenues from a channel relationship with Microsoft. This relationship involves Microsoft-assisted lead generation support with respect to the services provided by Fullscope. This relationship is governed by a Microsoft Partner Agreement, which is subject to annual renewal. A failure to renew this relationship, or a material modification or change in Microsoft’s partner approach or its contract terms, for any reason, could have a material adverse impact on our results of operations.

- 17 -

Table of Contents

Past or future business combination transactions or other strategic alternatives could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our business. We have, in the past, realized growth, in part, through acquisitions, including our acquisitions of Fullscope, Inc. and Meridian Consulting International, and we anticipate that a portion of our future growth may be accomplished through one or more business combination transactions or other strategic alternatives. The ultimate success of any such transactions will depend upon, among other things, our ability to integrate acquired personnel, operations, products and technologies into our organization effectively, to retain and motivate key personnel of acquired businesses and to retain customers of acquired businesses. We cannot assure you that we will be successful in this regard or that we will be able to identify suitable opportunities, successfully grow acquired businesses, integrate acquired personnel and operations successfully or utilize our cash or equity securities as acquisition currency on acceptable terms to complete any such business combination transactions. These difficulties could disrupt our ongoing business, distract our management and employees, increase our expenses and materially and adversely affect our results of operations. Any such transactions would involve certain other risks, including the reduction of cash and/or working capital, the assumption of additional liabilities, potentially dilutive issuances of equity securities and diversion of management’s attention from operating activities.

We may not be able to protect our intellectual property rights or we may infringe upon the intellectual property rights of others, which could adversely affect our business. Our future success will depend, in part, upon our intellectual property rights and our ability to protect these rights. We do not have any patents or patent applications pending. Existing trade secret and copyright laws afford us only limited protection. Third parties may attempt to disclose, obtain or use our solutions or technologies. This is particularly true in foreign countries where laws or law enforcement practices may not protect our proprietary rights as fully as in the United States. Others may independently develop and obtain patents or copyrights for technologies that are similar or superior to our technologies. If that happens, we may need to license these technologies and we may not be able to obtain licenses on reasonable terms, if at all. If we are unsuccessful in any future intellectual property litigation, we may be forced to do one or more of the following:

| ¡ | Cease selling or using technology or services that incorporate the challenged intellectual property; |

| ¡ | Obtain a license, which may not be available on reasonable terms or at all, to use the relevant technology; |

| ¡ | Configure services to avoid infringement; and |

| ¡ | Refund license fees or other payments that we have previously received. |

Generally, we develop software applications for specific customer engagements. Issues relating to ownership of and rights to use software applications and frameworks can be complicated. Also, we may have to pay economic damages in these disputes, which could adversely affect our results of operations and financial condition.

Fluctuations in our quarterly revenues and operating results may lead to increased volatility of our stock. Our quarterly revenues and operating results can sometimes be volatile. We believe comparisons of prior period operating results cannot be relied upon as indicators of future performance. If our revenues or our operating results in any future period fall below the expectations of securities analysts and investors, the market price of our securities would likely decline.

Factors that may cause our quarterly results to fluctuate in the future include the following:

| ¡ | Variability in market demand for IT and management consulting services; |

| ¡ | General economic or stock market conditions unrelated to our operating performance; |

| ¡ | Length of the sales cycle associated with our service offerings; |

| ¡ | Unanticipated variations in the size, budget, number or progress toward completion of our engagements; |

| ¡ | Unanticipated termination of a major engagement, a customer’s decision not to proceed with an engagement we anticipated or the completion or delay during a quarter of several major customer engagements; |

- 18 -

Table of Contents

| ¡ | Efficiency with which we utilize our employees, or utilization, including our ability to transition employees from completed engagements to new engagements; |

| ¡ | Our ability to manage our operating costs, a large portion of which are fixed in advance of any particular quarter; |

| ¡ | Changes in pricing policies by us or our competitors; |

| ¡ | Seasonality and cyclicality, including the effects of lower utilization rates during periods with disproportionately high holiday and vacation usage experience; |

| ¡ | The timing of customer year-end periods and the impact of spending relative to such year-end periods; |

| ¡ | Our ability to manage future growth; and |

| ¡ | Costs of attracting, retaining and training skilled personnel. |

Some of these factors are within our control, while others are outside of our control.

Volatility of our stock price could result in expensive class action litigation. If our common stock suffers from volatility like the securities of other technology and consulting companies, we could be subject to securities class action litigation similar to that which has been brought against other companies following periods of volatility in the market price of their common stock. The process of defending against these types of claims, regardless of their merit, is costly and often creates a considerable distraction to senior management. Any future litigation could result in substantial additional costs and could divert our resources and senior management’s attention. This could harm our productivity and profitability and potentially adversely affect our stock price.

We may be required to record additional impairment charges against the carrying value of our goodwill and other intangible assets in future quarters. As of December 31, 2014, we had recorded goodwill and intangible assets with a net book value of $12.5 million. We test for impairment at least annually and whenever evidence of impairment exists. We have in the past recorded impairment charges against the carrying value of our goodwill and intangible assets. The carrying value of our goodwill and intangible asset values are measured using a variety of factors, including values of comparable companies, overall stock market and economic data and our own projections of future financial performance. We may be required in the future to record additional impairment charges that could have a material adverse effect on our reported results.

Our operating results could be adversely affected by fluctuations in the value of the U.S. dollar against foreign currencies. As a result of our acquisitions and the international expansion of our EPM-related business, a portion of our revenues and operating expenses are, and will be, denominated in currencies other than the U.S. dollar. As a result, these revenues and operating expenses are affected by fluctuating foreign currency exchange rates. An increase in the U.S. dollar relative to other currencies in which we have revenues will cause our revenues to be lower than with a stable exchange rate. Changes in exchange rates between other foreign currencies and the U.S. dollar can affect the recorded levels of our assets, liabilities and expenses relating to our operations. The primary foreign currencies in which we have exchange rate fluctuation exposure are the Canadian dollar, the euro, the British pound and the South African rand. Exchange rates between these currencies and U.S. dollars have fluctuated significantly in recent years, particularly as the current global financial crisis has unfolded, and may continue to do so in the future. We cannot predict the impact of future exchange rate fluctuations on our operating results.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

We lease 66,027 square feet (33,000 of which was included in the partial lease abandonment recorded in the fourth quarter of 2011) of office space for our corporate headquarters located at 200 Harvard Mill Square, Suite 210, Wakefield, Massachusetts 01880-3209. We also have office facilities in Alabama, Georgia, New Hampshire, New York, Illinois, Montreal and London.

- 19 -

Table of Contents

Our corporate and satellite offices are all leased properties. We do not own any real estate. Our existing properties satisfy our current operating needs; however, we will seek additional space in the event our existing properties are unable to meet our operating requirements in the future.

| ITEM 3. | LEGAL PROCEEDINGS |

We are sometimes a party to litigation incidental to our business. We are not currently involved in any legal proceedings which would be material to our consolidated financial statements. We maintain insurance in amounts, and with coverage and deductibles that we believe are reasonable.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

- 20 -

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Stock Price Information

Our common stock, which has a par value of $0.01 per share, trades on the NASDAQ Global Market under the symbol “EDGW.” On February 25, 2015, there were approximately 1,537 holders of record of our common stock, and approximately 11.5 million shares of our common stock were outstanding. The number of record holders indicated above does not reflect persons or entities that hold their shares of stock in nominee or “street” name through various bankers or brokerage firms.

The following table sets forth the range of high and low trading prices for our common stock as reported by the NASDAQ Global Market for each quarter in 2013 and 2014 and the first quarter of 2015 (through February 25, 2015).

| High | Low | |||||||

| FISCAL 2013: |

||||||||

| First Quarter |

$ | 4.35 | $ | 3.48 | ||||

| Second Quarter |

4.30 | 3.60 | ||||||

| Third Quarter |

7.44 | 4.30 | ||||||

| Fourth Quarter |

7.59 | 5.26 | ||||||

| FISCAL 2014: |

||||||||

| First Quarter |

$ | 7.35 | $ | 5.00 | ||||

| Second Quarter |

8.88 | 6.69 | ||||||

| Third Quarter |

7.79 | 5.60 | ||||||

| Fourth Quarter |

8.20 | 6.36 | ||||||

| FISCAL 2015: |

||||||||

| First Quarter |

$ | 7.70 | $ | 6.56 | ||||

| (through February 25, 2015) |

||||||||

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

In December 2007, our Board of Directors (the “Board”) authorized a stock repurchase program for up to $5.0 million of common stock on the open market or through privately negotiated transactions from time-to-time through December 31, 2008 (the “Stock Repurchase Program”). The Board subsequently amended the Stock Repurchase Program, authorizing both an increase to and an extension of the Stock Repurchase Program. The Stock Repurchase Program, as amended, had a maximum purchase value of shares of $23.1 million (the “Purchase Authorization”) and was set to expire on September 19, 2014 (the “Repurchase Period”). On September 18, 2014, we announced that the Board had approved an extension of the Repurchase Period to September 25, 2015.

The timing and amount of the purchases will be based upon market conditions, securities law considerations and other factors. The Stock Repurchase Program does not obligate the Company to acquire a specific number of shares in any period and may be modified, suspended, extended or discontinued at any time, without prior notice.

- 21 -

Table of Contents

The following table provides information with respect to purchases of our common stock during the quarter ended December 31, 2014:

Issuer Purchases of Equity Securities

| Period | Total Number of Shares Purchased |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

||||||||||||

| October 1 – 31, 2014 |

- | $ | - | - | $ | 9,070,554 | ||||||||||

| November 1 – 30, 2014 |

700 | 6.99 | 700 | 9,065,561 | ||||||||||||

| December 1 – 31, 2014 |

- | - | - | 9,065,561 | ||||||||||||

| Total |

700 | $ | 6.99 | 700 | $ | 9,065,561 | ||||||||||

- 22 -

Table of Contents

Performance Graph

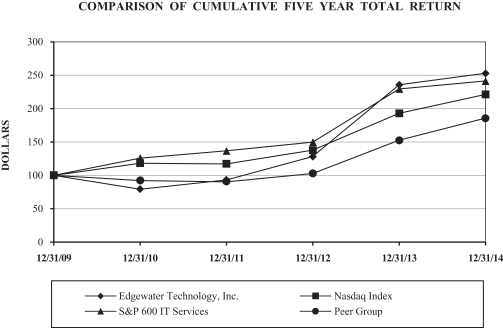

The following chart compares the cumulative total stockholder return and total return analysis, respectively, of our common stock with the cumulative total return on the NASDAQ Composite US Index, the S&P 600 IT Services Index and self-selected peer groups in the technology consulting industry for the five-year period beginning on December 31, 2009 (the closing sale price of our common stock on this date was $2.97) and ending on December 31, 2014, assuming a $100 investment in each and assuming the reinvestment of dividends. We did not pay any dividends during the period. Refer to the footnotes below the graph for a listing of the companies included in our peer groups.

| Company Name / Index |

Base Period 12/31/09 |

INDEXED RETURNS Years Ending |

||||||||||||||||||||||

| 12/31/10 | 12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 | ||||||||||||||||||||

| Edgewater Technology, Inc. |

100 | 79.12 | 92.93 | 127.95 | 235.35 | 252.69 | ||||||||||||||||||

| Nasdaq Index |

100 | 118.02 | 117.04 | 137.47 | 192.62 | 221.02 | ||||||||||||||||||

| S&P 600 IT Services |

100 | 125.63 | 136.33 | 149.44 | 229.16 | 240.92 | ||||||||||||||||||

| Peer Group |

100 | 92.15 | 89.96 | 102.66 | 152.06 | 185.37 | ||||||||||||||||||

| (1) | Our self-selected peer group consists of the following companies: Cartesian, Inc. (formerly Management Network Group); Ciber, Inc; The Hackett Group; L-3 Communications Holding, Inc.; Perficient, Inc.; and Sapient Corporation. |

We believe that the companies included in our peer group are comparable to our Company as they provide similar IT consulting services and expertise to their customers.

The above Performance Graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

- 23 -

Table of Contents

Other Stockholder Matters