|

| | | |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of |

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

|

Marathon Oil Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

|

| | | |

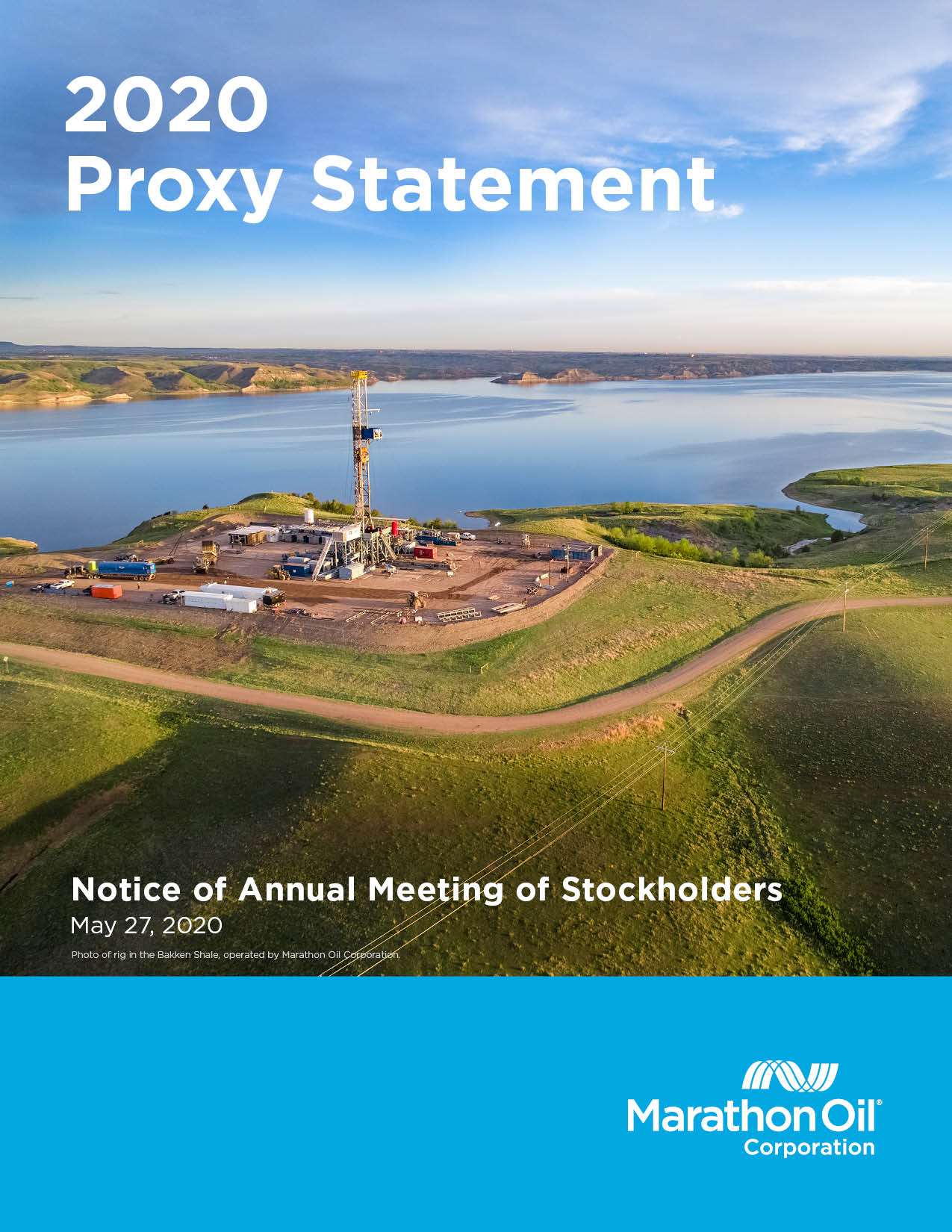

April 9, 2020 Dear Marathon Oil Corporation Stockholder, 2019 was another year of differentiated execution for Marathon Oil. We believe in our strategy and our framework for success, which is underpinned by our multi-basin portfolio and our balance sheet strength. Unfortunately, today, our industry is facing the unprecedented combination of a significant decrease in global energy demand due to the COVID-19 (Coronavirus) outbreak, paired with an oversupplied market exacerbated by an unforeseen response from OPEC and Russia.

| |

With this dramatic drop in commodity prices, we’re taking action to maintain our strong financial foundation that positions us to navigate a challenging oil price environment ahead. In addition, we are taking steps to protect the health of our employees and contractors consistent with our core values. Your Board of Directors and management cordially invite you to attend our 2020 Annual Meeting of Stockholders, to be held in the Conference Center Auditorium of the Marathon Oil Tower, 5555 San Felipe Street, Houston, Texas, on Wednesday, May 27, 2020, at 10:00 a.m. Central Time. In the event it is not possible or advisable to hold our Annual Meeting in person because of the Coronavirus, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. If we take this step, we will announce the decision to do so in advance. We value the communication we have established with our stockholders. We look forward to continuing to hear your views, and we ask for your continued support as we work to maximize the value of your investment in our Company. We are making our proxy materials accessible over the Internet, which allows us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. Please read the Proxy Statement for more information about how to access the proxy materials over the Internet. | | 2019 HIGHLIGHTS |

| » Best safety performance in company history » Returned approximately $510MM to stockholders, including $350MM of share repurchases and $160MM of dividends » Simplified international portfolio, elimination of over $970MM of asset retirement obligations » Added over 1,000 gross operated drilling locations » Investment grade credit rating at all primary rating agencies |

On April 15, 2020, we plan to mail to our U.S. stockholders a notice explaining how to access our 2020 Proxy Statement and 2019 Annual Report, request a printed copy of these materials, and vote online. All other stockholders will continue to receive copies of the Proxy Statement and Annual Report by mail. You can find information about the matters to be voted on at the meeting in the 2020 Proxy Statement. Your vote is important. Whether or not you plan to attend the meeting, we encourage you to vote promptly so that your shares will be represented and properly voted at the meeting.

|

|

| | | | |

Sincerely, | | | | |

| | | | |

Lee M. Tillman | | | Gregory H. Boyce | |

Chairman, President and Chief Executive Officer | Independent Lead Director |

|

| | |

| | |

| NOTICE OF THE 2020 ANNUAL MEETING OF STOCKHOLDERS |

| |

|

| | |

À | l | ¶ |

TIME AND DATE: | PLACE: | RECORD DATE: |

Wednesday, May 27, 2020 10:00 a.m. Central Time | Conference Center Auditorium of the Marathon Oil Tower 5555 San Felipe St., Houston, TX 77056 | March 31, 2020 |

As part of our effort to maintain a healthy and safe environment at our Annual Meeting, we are closely monitoring statements issued by the World Health Organization and the Centers for Disease Control and Prevention regarding the Coronavirus. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting remotely on the Broadridge Virtual Shareholder Meeting Platform (VSM Platform). If we take this step, we will announce the decision to do so in advance via a press release and by filing the information with the SEC as supplemental proxy materials. Regardless, the meeting will still be held on Wednesday, May 27, 2020, 10:00 a.m. Central Time. If the meeting is held via the VSM Platform, you will be able to participate in the Annual Meeting, vote your shares electronically and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/MRO2020 and entering your 16-digit control number. |

| |

AGENDA |

At the 2020 Annual Meeting of Stockholders (Annual Meeting) for Marathon Oil Corporation (Marathon Oil or Company), stockholders will be asked to vote on the following proposals: |

ITEM 1: Elect 8 directors to serve until the 2021 Annual Meeting (read more on p. 3). |

þ | Your Board recommends a vote FOR the election of each director nominee. |

ITEM 2: Ratify the selection of PricewaterhouseCoopers LLP as our independent auditor for 2020 (read more on p. 50). |

þ | Your Board recommends a vote FOR Proposal 2. |

ITEM 3: Approve on an advisory basis our 2019 named executive officer compensation (read more on p. 52). |

þ | Your Board recommends a vote FOR Proposal 3. |

Other Business: Stockholders will also transact any other business that properly comes before the meeting.

A list of stockholders entitled to vote at the meeting will be available at the meeting. If you plan to attend the meeting, you will need to show proof of your stock ownership, such as a recent account statement, letter or proxy from your broker or other intermediary, along with a photo identification. If the meeting is held via the VSM Platform, you will be able to access the list of stockholders entitled to vote at the meeting by visiting www.virtualshareholdermeeting.com/MRO2020, entering your 16-digit control number, and clicking on “Registered Shareholder List.” You will need to complete an attestation form to access the list.

The Notice of Internet Availability of Proxy Materials (Notice) is being mailed, and the attached proxy statement is being made available, to our stockholders on or about April 15, 2020. Please read the attached proxy statement carefully and submit your vote as soon as possible. Your vote is important. Whether the meeting is held at the Conference Center Auditorium of the Marathon Oil Tower or the VSM Platform, we hope you will vote as soon as possible. You can ensure that your shares are voted at the meeting by using our internet or telephone voting system, or by completing, signing and returning a proxy card. |

| | | |

BY INTERNET | BY TELEPHONE | BY MAIL | IN PERSON |

: | ( | + | î |

Visit www.proxyvote.com or scan the QR code on your Notice or proxy card with a smart phone. You will need the 16-digit number included in your Notice, proxy card or voting instructions. | Dial 1-800-690-6903 and follow the recorded instructions. You will need the 16-digit number included in your Notice, proxy card or voting instructions. | Only if you received a proxy card by mail, you may send your completed and signed proxy card in the envelope provided. | You may vote in person at the Annual Meeting in certain circumstances outlined in this proxy. |

By order of our Board of Directors,

Reginald D. Hedgebeth

Secretary

April 15, 2020

TABLE OF CONTENTS

|

| | |

| | |

PROPOSAL 1: ELECTION OF DIRECTORS | | |

Director Qualifications and Nominations | | |

Director Independence | | |

Director Diversity | | |

| | |

Nominees for Director | | |

CORPORATE GOVERNANCE | | |

Board of Directors | | |

Committees of our Board | | |

| | |

| | |

| | |

| | |

Our Board’s Role in Risk Oversight | | |

Risk Assessment Related to our Compensation Structure | | |

Corporate Governance Principles | | |

Code of Business Conduct | | |

Policy for Reporting Business Ethics Concerns | | |

| | |

Communications from Interested Parties | | |

Compensation Committee Interlocks and Insider Participation | | |

DIRECTOR COMPENSATION | | |

| | |

| | |

| | |

2019 Director Compensation Table | | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | |

COMPENSATION COMMITTEE REPORT | | |

| | |

| | |

|

| | |

COMPENSATION DISCUSSION AND ANALYSIS | | |

Executive Summary | | |

Compensation Philosophy | | |

Compensation Governance and Best Practices | | |

Pay for Performance | | |

How We Determine Executive Compensation | | |

Elements of Our Executive Compensation | | |

2019 Total Target Direct Compensation Overview | | |

Base Salary | | |

Annual Cash Bonus | | |

Long-Term Incentives | | |

Other Benefits | | |

Stock Ownership Requirements | | |

Tax Considerations | | |

EXECUTIVE COMPENSATION | | |

Summary Compensation Table | | |

Grants of Plan-Based Awards in 2019 | | |

| | |

| | |

Post-Employment Benefits | | |

| | |

Potential Payments Upon Termination or Change in Control | | |

| | |

TRANSACTIONS WITH RELATED PERSONS | | |

AUDIT AND FINANCE COMMITTEE REPORT | | |

PROPOSAL 2: RATIFICATION OF INDEPENDENT AUDITOR FOR 2019 | | |

PROPOSAL 3: ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | | |

| | |

| | |

MARATHON OIL | TABLE OF CONTENTS

ABOUT MARATHON OIL CORPORATION

Company Overview

We are an independent exploration and production company based in Houston, Texas. Our strategy is to drive multi-year corporate returns improvement by focusing our capital investment in the lower cost, higher margin U.S. resource plays (the Eagle Ford in Texas, the Bakken in North Dakota, STACK and SCOOP in Oklahoma and Northern Delaware in New Mexico). We prioritize generating sustainable cash flow over a wide range of commodity prices and returning capital to stockholders, underpinned by differentiated execution across our multi-basin portfolio and an investment grade balance sheet.

|

| | | | | | | | | | |

FRAMEWORK FOR SUCCESS |

CORPORATE RETURNS | | FREE CASH FLOW | | RETURN OF CAPITAL | | DIFFERENTIATED EXECUTION |

Portfolio transformation and focused capital allocation drive multi-year corporate returns improvement through capital efficient oil growth | | Prioritized sustainable cash flow generation over a wide range of commodity prices | | Returned incremental capital to stockholders in addition to peer competitive dividend, funded through free cash flow, not dispositions | | Continuous improvement in capital efficiency and operating costs while enhancing our resource base; delivering on our commitments |

|

POWERED BY OUR FOUNDATION |

MULTI-BASIN PORTFOLIO | | BALANCE SHEET STRENGTH |

Capital allocation flexibility, broad market access, supplier diversification, rapid sharing of best practices, platform for talent development | | Financial flexibility to execute business plan across broad range of pricing |

We believe the Company has a track record of delivering on this strategy, as outlined below.

|

| | | | | |

OBJECTIVES | | 2018 ($65/bbl WTI, $3.15 HH, $26.50 NGL) | | 2019 ($57/bbl WTI, $2.55 HH, $18.00 NGL) |

| |

| |

þ | Capital Discipline | | $2.3B development capital consistent with initial guidance | | $2.4B development capital consistent with initial guidance |

|

þ | Corporate Returns | | >50% CROIC1 improvement (2017 to 2019) on price normalized* basis |

|

þ | Free Cash Flow | | Generated post-dividend Free Cash Flow |

|

þ | Return of Capital | | $700MM of buybacks $170MM of dividends | | $350MM of buybacks $160MM of dividends |

|

þ | Capital Efficient Oil Growth | | Approx. 30% U.S. Oil Growth outperformed initial guidance midpoint | | 13% U.S. Oil Growth outperformed initial guidance midpoint |

|

þ | Resource Capture and Enhancement | | Over 1,000 locations added through organic enhancement initiatives, bolt-ons/trades, and Resource Play Exploration; hundreds of locations upgraded to top tier returns |

* Price normalized to $50 WTI, $2.50 HH, $15 NGL

1 CROIC = Cash return on invested capital; calculated by taking cash flow (Operating Cash Flow before working capital + net interest after tax) divided by (average Stockholder’s Equity + average Net Debt)

MARATHON OIL | PROXY SUMMARY 1

|

| | | |

GOVERNANCE HIGHLIGHTS |

Our commitment to strong governance practices is illustrated by the following: |

» Annual election of directors » Independent Lead Director » Single class of voting stock | » Majority voting standard for directors in uncontested elections » Proxy access by-law » No stockholder rights plan |

|

|

COMPENSATION AND GOVERNANCE PRACTICES |

|

| |

WHAT WE DO |

þ | Emphasize at-risk compensation designed to link pay to performance |

þ | Engage an independent compensation consultant to advise the Committee |

þ | Maintain stock ownership requirements for executive officers and directors |

þ | Maintain “double-trigger” change in control cash payments and accelerated equity vesting |

þ | Dedicate significant time to robust executive succession planning and leadership development each year |

þ | Incorporate compensation clawback provisions in annual and long-term incentives |

þ | Offer minimal use of perquisites and no related tax gross-ups |

|

| |

WHAT WE DON’T DO |

ý | Offer employment agreements to our executive officers |

ý | Provide gross-up payments to cover excess parachute payment excise taxes for executive officers |

ý | Allow margin, derivative or speculative transactions, such as hedges, pledges and margin accounts, by executive officers and directors |

ý | Reward executives for excessive, inappropriate or unnecessary risk-taking |

| |

|

| | |

FOCUS ON HEALTH, ENVIRONMENTAL, SAFETY AND CORPORATE RESPONSIBILITY |

Our Board’s key oversight role includes reviewing the sustainability of our operations and the strength of our risk management efforts. Our Board has four standing committees that assist with this oversight: Audit and Finance; Compensation; Corporate Governance and Nominating; and Health, Environmental, Safety and Corporate Responsibility (HESCR). The HESCR Committee plays a vital role in our sustainability efforts and includes directors with experience in this area. One of the principle functions of the HESCR Committee is to identify, evaluate and monitor health, environmental, safety, social, public policy and political trends, issues and concerns that could affect our business activities and performance. In addition, in early 2019, the HESCR committee explicitly added climate change risk oversight to its charter to highlight the importance of understanding climate risk.

|

|

| | |

VOTING ROADMAP | Our Board’s |

Recommendation |

Proposal No. 1: Election of Directors | FOR |

Our Board of Directors believes that all of the director nominees listed in the Proxy Statement have the requisite qualifications to provide effective oversight of the Company’s business and management. | |

Proposal No. 2: Ratification of Independent Auditor for 2020 | FOR |

Our Audit and Finance Committee and Board of Directors believe that the retention of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2020 is in the best interest of the Company and its stockholders. | |

Proposal No. 3: Advisory Vote to Approve the Compensation of our Named Executive Officers | FOR |

We are seeking a non-binding, advisory vote to approve, and our Board of Directors recommends the approval of, the 2019 compensation paid to our named executive officers, which is described in the section of this Proxy Statement entitled “Executive Compensation.” | |

2 MARATHON OIL | PROXY SUMMARY

|

|

PROPOSAL 1: ELECTION OF DIRECTORS |

Under our Restated Certificate of Incorporation, directors are elected for terms expiring at the next succeeding Annual Meeting of stockholders. We currently have 8 directors whose terms expire in 2020. Each director is nominated for a one-year term expiring at the 2021 Annual Meeting.

Directors are elected by a majority of votes cast. For a director to be elected, the number of shares cast “FOR” a director must exceed the number of votes cast “AGAINST” that director. Abstentions will have no effect in director elections. If any nominee for whom you have voted becomes unable to serve, your proxy may be voted for another person designated by our Board of Directors (Board).

Our By-laws require any incumbent who does not receive sufficient votes to promptly tender his or her resignation to our Board. Our Corporate Governance and Nominating Committee will recommend to our Board whether to accept or reject the tendered resignation or take other action. Our Board will act on the tendered resignation, taking into account the Corporate Governance and Nominating Committee’s recommendation, and publicly disclose its decision regarding the tendered resignation within 90 days after certification of the election results. In the event of a vacancy, our Board may fill the position or decrease the size of our Board.

|

|

DIRECTOR QUALIFICATIONS AND NOMINATIONS |

Our Corporate Governance Principles set forth the process for director selection and director qualifications. In summary, the chair of the Corporate Governance and Nominating Committee, the CEO, and the secretaries of the Compensation Committee and Corporate Governance and Nominating Committee generally work with a third-party professional search firm to review director candidates and their credentials when the Board believes there is a need. At least one member of the Corporate Governance and Nominating Committee, the Independent Lead Director and the CEO meet with the potential director candidate. This screening process applies to nominees recommended by the Corporate Governance and Nominating Committee, as well as nominees recommended by our stockholders in accordance with our By-laws or applicable law. Once a director has been selected either by our Board to serve until the next annual meeting or by election at the annual meeting, they undergo orientation and training. The Corporate Governance and Nominating Committee is responsible for reviewing with our Board the appropriate skills and characteristics required of directors. Directors should be individuals of substantial accomplishment with demonstrated leadership capabilities, and they should represent all stockholders rather than any special interest group or constituency. Selection of director nominees includes a consideration of numerous skills and qualifications, including:

| |

» | an evaluation of their independence, |

| |

» | their business or professional experience, |

| |

» | their integrity and judgment, |

| |

» | their record of public service, |

| |

» | their ability to devote sufficient time to the affairs of the Company, |

| |

» | their diversity, including diversity of backgrounds and experience they will bring to our Board, and |

| |

» | the Company’s needs at that particular time. |

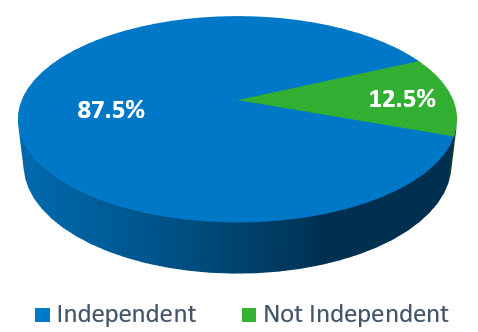

All of our directors, other than our CEO, are independent. In accordance with applicable laws, regulations, our Corporate Governance Principles and the rules of the New York Stock Exchange (NYSE), the Board must affirmatively determine the independence of each director and director nominee. The Corporate Governance and Nominating Committee considers all relevant facts and circumstances including, without limitation, transactions during the previous year between the Company and the director directly, immediate family members of the director, organizations with which the director is affiliated, and the frequency and dollar amounts associated with these transactions. The Corporate Governance and Nominating Committee further

MARATHON OIL | PROPOSAL 1: ELECTION OF DIRECTORS 3

considers whether the transactions were at arm’s length in the ordinary course of business and whether the transactions were consummated on terms and conditions similar to those of unrelated parties. The Corporate Governance and Nominating Committee then makes a recommendation to the Board with respect to the independence of each director and director nominee.

As part of the determination, the Corporate Governance and Nominating Committee considered: survivor pension benefits to Mr. Deaton’s mother; product purchases by the Company in the ordinary course of business from Air Products & Chemicals, of which Mr. Deaton is the Independent Lead Director and product and services purchases by the Company in the ordinary course of business from National Oilwell Varco, of which Ms. Donadio is a director; various charitable contributions paid by the Company to various organizations on which Ms. Donadio, Mr. Few and Mr. Foshee hold directorships; and fees paid in arm’s length transactions on terms and conditions similar to those of unrelated parties to Citigroup, of which Ms. Donadio’s immediate family member is an investment banking associate.

Based on these considerations, the standards in our Corporate Governance Principles and the recommendation of the Corporate Governance and Nominating Committee, the Board determined that Gregory H. Boyce, Chadwick C. Deaton, Marcela E. Donadio, Jason B. Few, Douglas L. Foshee, M. Elise Hyland and J. Kent Wells are independent. As CEO of the Company, Mr. Tillman is not independent.

|

| | | |

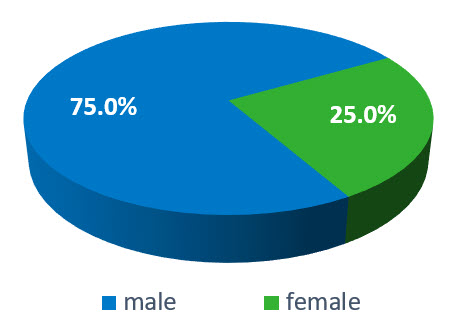

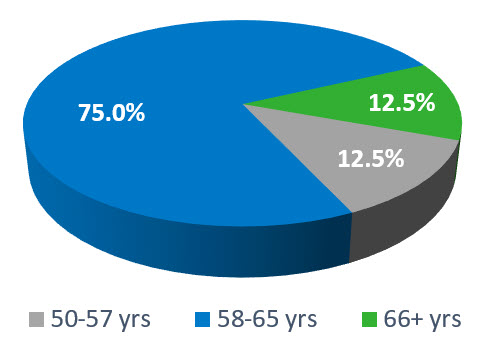

GENDER | INDEPENDENCE | TENURE | AGE |

Two of our eight directors, including the chairs of the Audit and Finance and HESCR Committees, are female. | The NYSE requires that independent directors must comprise the majority of the Board. The Board has determined that each of the nominees, other than Mr. Tillman, meet the NYSE’s independence standards. | 50% of our Board has joined within the last three years. The average tenure of the director nominees is less than five years, which we believe reflects a balance of company experience and new perspectives. | The average age of the director nominees is 61 years. |

| | | |

The Corporate Governance and Nominating Committee is responsible for reviewing with our Board the appropriate size and composition of the Board. When considering the director nominees, our Board will look at a diverse pool of candidates, considering each candidate’s business or professional experience, demonstrated leadership ability, integrity and judgment, record of public service, diversity, financial and technological acumen and international experience. We view and define diversity in its broadest sense, which includes gender, ethnicity, age, education, experience and leadership qualities.

4 MARATHON OIL | PROPOSAL 1: ELECTION OF DIRECTORS

|

|

BOARD SKILLS AND EXPERIENCE DIVERSITY MATRIX |

Our directors have a diversity of experience and skills that span a broad range of industries in the public and not-for-profit sectors. They bring to our Board a wide variety of skills, qualifications, and viewpoints that strengthen our Board’s ability to carry out its oversight role on behalf of our stockholders. The table below summarizes key qualifications, skills and attributes each director brings to our Board. The lack of a mark for a particular item does not mean the director does not possess that qualification or skill. However, a mark indicates a specific area of focus or expertise that the director brings to our Board. More details on each director’s qualifications, skills and attributes are included in the director biographies on the subsequent pages.

|

| | | | | | | | | |

| | Tillman | Boyce | Deaton | Donadio | Few | Foshee | Hyland | Wells |

Ç | Public Company CEO Experience working as a CEO of a public company | l | l | l | | l | l | | |

ë | Financial Oversight/Accounting Senior executive level experience in financial accounting and reporting, auditing, corporate financing and/or internal controls or experience in the financial services | l | l | l | l | l | l | l | l |

A | E&P Industry Experience Experience as executives or directors in, or in other leadership positions working with, the exploration and production industry | l | | l | l | l | l | | l |

Ï | Engineering Expertise Expertise through relevant undergraduate or graduate in engineering disciplines | l | l | | | | | l | l |

® | Public Policy/Regulatory Experience in or a strong understanding of the regulatory issues facing the oil and gas industry and public policy on a local, state and national level | l | l | l | l | l | l | l | l |

P | HES Experience Experience in managing matters related to health, environmental, safety and social responsibility in executive and operating roles | l | l | l | | l | l | l | l |

¸ | International Global business or international experience | l | l | l | l | l | l | l | l |

: | Information Technology Experience in or strong understanding of the information technology and cyber security issues facing the oil and gas industry | | | | | l | | | l |

Í | Risk Management Executive experience managing risk | l | l | l | l | l | l | l | l |

î | Outside Public Boards | — | 1 | 3 | 2 | 1 | — | 1 | — |

MARATHON OIL | PROPOSAL 1: ELECTION OF DIRECTORS 5

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH NOMINEE

|

| | |

Gregory H. Boyce |

| | BUSINESS EXPERIENCE » Independent Lead Director, Marathon Oil Corporation (since 2019) » Former Executive Chairman and Chairman, Peabody Energy Corporation, a private-sector coal company, St. Louis, MO (Executive Chairman in 2015 and Chairman 2007-2015) » Chief Executive Officer, Peabody (2006-2015); Chief Executive Officer Elect, Peabody (2005); President, Peabody (2003-2008); Chief Operating Officer, Peabody (2003-2005) » Chief Executive Officer - Energy, Rio Tinto plc (2000-2003) » President and Chief Executive Officer, Kennecott Energy Company (1994-1999) » President, Kennecott Minerals company (1993-1994) » Joined Kennecott in 1977 and served in positions of increasing responsibility OTHER CURRENT POSITIONS » Trustee, Heard Museum » Advisory Council, University of Arizona’s Lowell Institute of Mineral Resources » Business Council Member and past board member, U.S.-China Business Council EDUCATION » B.S. (mining engineering), University of Arizona » Advanced Management Program, Graduate School of Business at Harvard University Mr. Boyce’s former role as a chief executive officer has provided him with experience running a major corporation with international operations, including developing strategic insight and direction for his company, and exposed him to many of the same issues we face in our business, including markets, competitors, operational, regulatory, technology and financial matters.

|

Former Executive Chairman, Chairman, CEO, President and COO, Peabody Energy Corporation Age: 65 Director since: 2008 Independent Lead Director since: 2019 Committees: AFC, COMP, CGN Current Public Company Boards: Newmont Goldcorp Corporation Public Company Boards During Past 5 Years: Peabody Monsanto Company

| |

|

|

| | |

Chadwick C. Deaton |

| | BUSINESS EXPERIENCE » Former Executive Chairman and Chairman, Baker Hughes Incorporated, an oilfield services company, Houston, TX (Executive Chairman 2012-2013 and Chairman 2004-2012) » Chief Executive Officer, Baker Hughes (2004-2011) » President, Baker Hughes (2008-2010) » President and Chief Executive Officer, Hanover Compressor Company (2002-2004) » Senior Advisor to Schlumberger Oilfield Services (1999-2001) » Executive Vice President, Schlumberger Oilfield Services (1998-1999) OTHER CURRENT POSITIONS » Board Member, Ariel Corporation » Board Member, Piri Technologies » Board Member, University of Wyoming Foundation » Member, Society of Petroleum Engineers » Wyoming Governor’s Engineering Task Force EDUCATION » B.S. (geology), University of Wyoming Mr. Deaton’s over 30 years of executive and management experience in the energy business, including over 15 years of senior executive experience in the oilfield services industry, provides him valuable knowledge, experience and management leadership regarding many of the same issues that we face as a publicly traded company in the oil and gas industry. His service on the boards of other publicly traded companies has provided him exposure to different industries and approaches to governance. |

Former Executive Chairman, Chairman and CEO, Baker Hughes Incorporated Age: 67 Director since: 2014 Committees: COMP, CGN, HESCR Current Public Company Boards: Air Products and Chemicals, Inc. (Independent Lead Director) CARBO Ceramics Inc. Transocean Ltd. (Chairman)

| |

|

6 MARATHON OIL | PROPOSAL 1: ELECTION OF DIRECTORS

|

| | |

Marcela E. Donadio |

| | BUSINESS EXPERIENCE » Former Partner, Ernst & Young LLP, a multinational professional services firm, Houston, TX (1989-2014) » Americas Oil & Gas Sector Leader, Ernst & Young LLP (2007-2014) » Audit Partner for multiple oil & gas companies, Ernst & Young LLP (1989-2014) » Joined Ernst & Young LLP in 1976 and served in positions of increasing responsibility, including various energy industry leadership positions OTHER CURRENT POSITIONS » Board Member, Theatre Under the Stars » Trustee, Great Commission Foundation of the Episcopal Diocese of Texas » Member, Corporation Development Committee, Massachusetts Institute of Technology » Member of National Board, LSU Foundation EDUCATION » B.S. (accounting), Louisiana State University Ms. Donadio has audit and public accounting experience with a specialization in domestic and international operations in all segments of the energy industry, and is a licensed certified public accountant in the State of Texas. Her comprehensive knowledge of public company financial reporting regulations and compliance requirements contributes valuable expertise to our Board. She also has a deep understanding of the strategic issues affecting companies in the oil and gas industry. In addition, her extensive audit and public accounting experience in the energy industry, both domestic and international, uniquely qualifies her to serve as a member of our Audit and Finance Committee. The Board has determined that she qualifies as an “Audit Committee Financial Expert” under the SEC rules based on these attributes, education and experience. |

Former Partner, Ernst & Young LLP Age: 65 Director since: 2014 Committees: AFC (financial expert), COMP, HESCR Current Public Company Boards: National Oilwell Varco, Inc. Norfolk Southern Corporation | |

|

|

| | |

Jason B. Few |

| | BUSINESS EXPERIENCE » President, CEO and Chief Commercial Officer, FuelCell Energy, Inc., a global leader in molten carbonate fuel cell technology focused on enabling a world empowered by clean energy » President and Director, Sustayn, L.L.C., a privately-held cloud-based waste and recycling optimization company (2018-2019) » Founder and Senior Managing Partner, BJF Partners, L.L.C., a privately-held strategic transformation consulting firm (since 2016) » Senior Advisor, Verve Industrial Protection, a privately-held software company (since 2016) » President and CEO and Director, Continuum Energy, an energy products and services company (2013-2016) » President, Reliant Energy and EVP & Chief Customer Officer, NRG (2008-2012) OTHER CURRENT POSITIONS » Board Member, Memorial Hermann Healthcare System » Board Member and past Chairman, American Heart Association EDUCATION » BBA (computer systems in business), Ohio University School of Business » MBA, Northwestern University, J.L. Kellogg Mr. Few’s broad understanding of advanced technologies, combined with his extensive energy industry experience adds valuable insight to our Company. His service on other publicly traded company boards has given him valuable insight and exposure to a variety of industries and approaches. |

President, CEO and Chief Commercial Officer, FuelCell Energy, Inc. Age: 53 Director since: 2019 Committees: AFC, CGN Current Public Company Boards: FuelCell Energy, Inc. | |

|

MARATHON OIL | PROPOSAL 1: ELECTION OF DIRECTORS 7

|

| | |

Douglas L. Foshee |

| | BUSINESS EXPERIENCE » Founder and Owner, Sallyport Investments, LLC, an energy investment company (since 2012) » Chairman, President and Chief Executive Officer, El Paso Corporation (2003-2012) » Executive Vice President and Chief Operating Officer, Halliburton Company (2003) » Executive Vice President and Chief Financial Officer, Halliburton Company (2001-2003) » Chairman, President and Chief Executive Officer, Nuevo Energy Company (1996-2001) » Chief Operating Officer, Chief Executive Officer, and other capacities, Torch Energy Advisors Inc. (1993-1996) » Joined ARCO International Oil in 1992 and served in positions of increasing responsibility OTHER CURENT POSITIONS » Founder and Board Member, NextOp Vets » Founder, Houstonians for Great Public Schools » Regional Board Member, KIPP Houston » Board of Trustees, Rice University » Chair, Rice Management Company » Council of Overseers at Jesse H. Jones Graduate School of Management at Rice University » Board Member, Texas Business Hall of Fame Foundation » Board Member, Welch Foundation » Board Member, Houston Endowment, Inc. EDUCATION » MBA, Jesse H. Jones School at Rice University » BBA, Southwest Texas State University » Graduate, Southwestern Graduate School of Banking at Southern Methodist University As a former chairman, president and CEO of a public oil and gas exploration and production company with over 30 years of energy industry experience, Mr. Foshee has a comprehensive knowledge and understanding of our business, provides superb leadership to our management team, and provides the Board with essential insight and guidance from an inside perspective on the day-to-day operations of our Company. |

Founder and Owner, Sallyport Investments, LLC Age: 60 Director since: 2018 Committees: COMP, CGN Public Company Boards During Past 5 Years: Cameron International | |

|

|

| | |

M. Elise Hyland |

| | BUSINESS EXPERIENCE » Former Senior Vice President, EQT Corporation and Senior Vice President and Chief Operating Officer, EQT Midstream Services, LLC (2017-2018) » Executive Vice President of Midstream Operations and Engineering, EQT Midstream Services, LLC (2013-2017) » President of Commercial Operations, EQT Midstream Services, LLC (2010-2013) » President of Equitable Gas Company, a previously owned entity of EQT (2007-2010) » Joined EQT Corporation in 2000 and served in positions of increasing responsibility in finance, strategic planning and customer service » Joined Alcoa, Inc. in 1980 and held roles of increasing responsibility in research, materials and business development leading to her appointment as Manager of the Alloy Design Group at Alcoa Research Laboratories OTHER CURRENT POSITIONS » Director, Washington Gas Light Company, a private company EDUCATION » MBA, Tepper School of Business at Carnegie-Mellon University » M.S. and B.S. (Metallurgical Engineering and Materials Science), Carnegie-Mellon University Ms. Hyland has over 15 years of executive level management in both the midstream and manufacturing industries. Through her strong engineering background and leadership, she brings commercial acumen and valuable insight into marketing fundamentals and key issues our Company faces as a publicly traded company in the oil and gas industry. |

Former Senior Vice President, EQT Corporation Age: 60 Director since: 2018 Committees: AFC, HESCR Current Public Company Boards: Entergy Corporation Public Company Boards During the Past 5 Years: EQT Midstream Partners, LP

| |

|

8 MARATHON OIL | PROPOSAL 1: ELECTION OF DIRECTORS

|

| | |

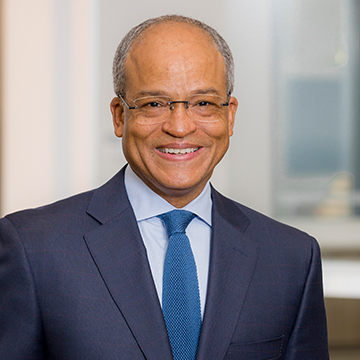

Lee M. Tillman |

| | BUSINESS EXPERIENCE » Chairman (2019-present), Director (2013-2019), President and Chief Executive Officer of Marathon Oil Corporation, Houston, TX (2013-present) » Vice President of Engineering, ExxonMobil Development Company » North Sea Production Manager and Lead Country Manager, ExxonMobil subsidiaries in Stavanger, Norway, 2007-2010 » Acting Vice President, ExxonMobil Upstream Research Company, 2006-2007 » Joined Exxon Corporation in 1989 as a research engineer and served in positions of increasing responsibility OTHER CURRENT POSITIONS » Board Member, American Heart Association » Board Member, American Petroleum Institute » Board Member, American Exploration & Production Council » Member, University of Houston Energy Advisory Board » Member, Engineering Advisory Council and Chemical Engineering Advisory Council of Texas A&M University » Member, National Petroleum Council » Member, Business Roundtable » Member, Society of Petroleum Engineers » Member, Celebration of Reading Committee within the Barbara Bush Houston Literacy Foundation » Chairman of the Board, Spindletop Charities EDUCATION » B.S. (chemical engineering), Texas A&M University » Ph.D. (chemical engineering), Auburn University As our Chairman, President and CEO, Mr. Tillman sets our Company’s strategic direction under the Board’s guidance. He has extensive knowledge and experience in global operations, project execution and leading edge technology in the oil and gas industry gained through his executive and management positions with our Company and ExxonMobil. His knowledge and hands-on experience with the day-to-day issues affecting our business provide the Board with invaluable information necessary to direct the business and affairs of our Company. |

Chairman (since 2019), President and CEO of Marathon Oil Corporation Age: 58 Director since: 2013 Chairman since: 2019 | |

|

|

| | |

J. Kent Wells |

| | BUSINESS EXPERIENCE » Former Chief Executive Officer and President, Fidelity Exploration & Production Company, an oil and natural gas production company (2011-2015) and Vice Chairman of MDU Resources, the parent company of Fidelity (2013-2015) » Senior Vice President, BP America (2007-2011) » General Manager, Abu Dhabi Company for Onshore Oil Operations (2005-2007) » Vice President, BP America (Rockies 2000-2002 and Gulf of Mexico 2002-2005) EDUCATION » BS (mechanical engineering), Queen’s University Mr. Wells has more than 35 years of experience in the oil and gas industry. His former service as CEO and President of Fidelity Exploration & Production Company and other senior leadership positions provide valuable experience in overseeing many issues that our Company may face.

|

Former CEO and President, Fidelity Exploration & Production Company and Vice Chairman of MDU Resources, the parent company of Fidelity Age: 63 Director since: 2019 Committees: COMP, HESCR Public Company Boards During the Past 5 Years: Newfield Exploration Company MDU Resources

| |

|

MARATHON OIL | PROPOSAL 1: ELECTION OF DIRECTORS 9

|

| |

Proposal 1 | For the reasons stated above, your Board of Directors recommends a vote FOR Proposal 1 electing each nominee standing for election as a director. |

þ |

Our business and affairs are managed under the direction of our Board, which met 12 times in 2019. Aggregate attendance for Board and committee meetings was over 95% for the full year. No director attended less than 75% of Board or committee meetings in 2019. Under our Corporate Governance Principles, directors are expected to attend the Annual Meeting. All of our directors nominated at the 2019 Annual Meeting, except Gregory Boyce, attended the 2019 Annual Meeting in person.

Our Corporate Governance Principles require our non-employee directors to meet at regularly scheduled executive sessions. An offer of an executive session is extended to non-employee directors at each regularly scheduled Board meeting. In 2019, the non-employee directors held seven independent executive sessions.

A significant portion of our Board’s oversight responsibilities is carried out through our four standing committees, each of which is comprised solely of independent non-employee directors.

Our four standing committees are the Audit and Finance Committee, the Compensation Committee, the Corporate Governance and Nominating Committee, and the Health, Environmental, Safety and Corporate Responsibility Committee.

|

| | | | |

COMMITTEE CHARTERS | | COMMITTEE COMPOSITION | | COMMITEE OPERATIONS |

Each committee’s written charter, adopted by our Board, is available on our website at www.marathonoil.com under About—Board of Directors—Committees and Charters.

| | Each committee is comprised solely of independent directors as defined under the rules of the NYSE. All members of the Audit and Finance and Compensation Committees meet the additional independence standards under the Securities Exchange Act of 1934 (Exchange Act) Rule 10A-3. | | Each committee reports its actions and recommendations to the Board, receives reports from senior management, annually evaluates its performance and has the authority to retain outside advisors. Committee chairs have the opportunity to call for executive sessions at each meeting. |

10 MARATHON OIL | GOVERNANCE

The following tables show each committee’s current membership, principal functions and number of meetings in 2019.

|

| |

AUDIT AND FINANCE Marcela E. Donadio Chair |

Members: 4 » Independent: 4 » 2019 Meetings: 7* Audit Committee Financial Experts: 1 |

* Including 5 in-person meetings. The Committee met with the Company’s internal audit organization and independent auditor at 4 of the meetings, with and without management present. |

Key Oversight Responsibilities: » Appoints, compensates and oversees the work of the independent auditor. » Reviews and approves in advance all audit, audit-related, tax and permissible non-audit services to be performed by the independent auditor. » Meets separately with the independent auditor, the internal auditors and management with respect to the status and results of their activities annually reviewing and approving the audit plans. » Reviews, evaluates and assures the rotation of the lead audit partner. » Reviews with management, and if appropriate the internal auditors, our disclosure controls and procedures and management’s conclusions about their efficacy. » Reviews, approves, where applicable, and discusses with management, the independent auditor and the internal auditors, as appropriate, the annual and quarterly financial statements, earnings press releases, reports of internal control over financial reporting, and the annual report. » Discusses with management guidelines and policies for risk assessment and management. » Reviews and recommends to our Board dividends, certain financings, loans, guarantees and other uses of credit. » Reviews codes of conduct and compliance activities. |

Members: Marcela E. Donadio†, Chair Gregory H. Boyce Jason B. Few M. Elise Hyland |

† Audit Committee Financial Expert (as defined under the Securities and Exchange Commission’s (SEC) rules), in each case as determined by the Board. |

|

| |

COMPENSATION Douglas L. Foshee Chair |

Members: 5 » Independent: 5 » 2019 Meetings: 7 |

Key Oversight Responsibilities: » Reviews and recommends to our Board all matters of policy and procedure relating to executive officer compensation. » Reviews and approves corporate philosophy, goals and objectives relevant to the CEO’s compensation, and determines and recommends to the independent directors for approval the CEO’s compensation level based on our Board’s performance evaluation. » Determines and approves the compensation of the other executive officers, and reviews the executive officer succession plan. » Administers our incentive compensation plans and equity-based plans, and confirms the certification of the achievement of performance levels under our incentive compensation plans. » Engages and oversees external independent compensation consultant. » Reviews with management and recommends for inclusion in our annual Proxy Statement our Compensation Discussion and Analysis. |

Members: Douglas L. Foshee, Chair Gregory H. Boyce Chadwick C. Deaton Marcela E. Donadio J. Kent Wells |

MARATHON OIL | GOVERNANCE 11

|

| |

CORPORATE GOVERNANCE AND NOMINATING Chadwick C. Deaton Chair |

Members: 4 » Independent: 4 » 2019 Meetings: 3 |

Key Oversight Responsibilities: » Reviews and recommends to our Board the appropriate size and composition of our Board, including candidates for election or re-election as directors, the criteria to be used for the selection of director candidates, the composition and functions of our Board committees, and all matters relating to the development and effective functioning of our Board. » Reviews and recommends to our Board each committee’s membership and chair, including a determination of whether one or more Audit and Finance Committee members qualifies as a “financial expert” under applicable law. » Assesses and recommends corporate governance practices, including reviewing and recommending to our Board certain governance policies. » Oversees the evaluation process of our Board and all committees. » Reviews and, if appropriate, approves related person transactions. |

Members: Chadwick C. Deaton, Chair Gregory H. Boyce Jason B. Few Douglas L. Foshee |

|

| |

HEALTH, ENVIRONMENTAL, SAFETY AND CORPORATE RESPONSIBILITY M. Elise Hyland Chair |

Members: 4 » Independent: 4 » 2019 Meetings: 2 |

Key Oversight Responsibilities: » Reviews and recommends Company policies, programs, and practices concerning broad health, environmental, climate change, safety, social, public policy and political issues. » Identifies, evaluates and monitors health, environmental, safety, social, public policy and political trends, issues and concerns that could affect the Company’s business activities and performance. » Reviews legislative and regulatory issues affecting our businesses and operations. » Reviews our political, charitable and educational contributions. |

Members: M. Elise Hyland, Chair Chadwick C. Deaton Marcela E. Donadio J. Kent Wells |

|

| |

BOARD OVERVIEW |

» Chairman of the Board and Chief Executive Officer: Lee M. Tillman* » Independent Lead Director: Gregory H. Boyce* » Active engagement by all directors » 7 of our 8 director nominees are independent » All members of the Audit and Finance Committee, Compensation Committee, Corporate Governance and Nominating Committee, and Health, Environmental, Safety and Corporate Responsibility Committee are independent Our Board believes that continuing to combine the position of Chairman and CEO is in the best interest of our Company and its stockholders. |

* The non-employee directors selected Mr. Boyce to serve as Independent Lead Director and Mr. Tillman to serve as Chairman, effective February 1, 2019. |

|

|

BOARD LEADERSHIP STRUCTURE |

We believe that independent Board oversight is essential. Our Board does not have a policy regarding whether the roles of the Chairman and CEO should be separate, but rather makes this determination on the basis of what is best for our Company at a given point in time.

Our Corporate Governance Principles require that non-employee directors, all of which are independent, meet at regularly scheduled executive sessions without the CEO present. The independent lead director presides at these meetings. In addition, our Corporate Governance Principles require that all our principal committees be comprised of entirely independent directors.

12 MARATHON OIL | GOVERNANCE

|

|

INDEPENDENT DIRECTOR LEADERSHIP |

As Independent Lead Director, Mr. Boyce is responsible for: |

» presiding at independent executive sessions of independent directors; » reviewing with Mr. Tillman the proposed Board and committee meeting agendas; » serving as a liaison between the independent directors and Mr. Tillman in discussing issues from the independent executive sessions and ensuring the flow of information; » reviewing and recommending to Mr. Tillman the retention of consultants who report directly to our Board or committees thereof; » overseeing Board performance; and » establishing effective communications with stakeholder groups. |

|

| |

BOARD AND COMMITTEE EVALUATIONS |

Each year, our Board performs a rigorous full Board evaluation. In addition, each committee also performs an annual evaluation. The evaluation process is managed by the Corporate Secretary’s office with oversight from the Corporate Governance and Nominating Committee. In 2019, the evaluation process consisted of:

|

þ | Evaluation questionnaires - each director and committee member completed a formal questionnaire. This allows each director and committee member to identify potential improvements.

|

þ | Individual interviews - our Independent Lead Director met with each director individually to solicit feedback and have an in-depth conversation.

|

þ | Independent Lead Director feedback to Board and Chairman - the Independent Lead Director communicated the feedback to the Board and also separately to the Chairman. In addition, each committee chair reported the feedback to his/her committee.

|

As a result of the evaluation process, the Board has implemented changes to the Board and committee meetings.

|

|

|

OUR BOARD’S ROLE IN RISK OVERSIGHT |

While our Board and its committees oversee risk management, Company management is responsible for the day-to-day management of risk. We have a robust enterprise risk management process for identifying, assessing and managing risk, and monitoring risk mitigation strategies. Our CEO and CFO and a committee of executive officers and senior managers work across the business to manage each enterprise level risk and to identify emerging risks. Responsibility for risk oversight by our Board and its committees is delegated as set forth below:

| |

» | The Audit and Finance Committee annually reviews our enterprise risk management process and the latest assessment of risks and key mitigation strategies. It regularly reviews risks associated with financial and accounting matters and reporting. It reviews operational risks, including cyber-security, monitors compliance with legal and regulatory requirements and internal control systems, and reviews risks associated with financial strategies and the Company’s capital structure. |

| |

» | The Corporate Governance and Nominating Committee reviews the Board’s and Company’s governance policies and procedures to ensure adherence to best practices and legal requirements. The Corporate Governance and Nominating Committee also reviews director succession planning and committee assignments to ensure the directors’ skills and backgrounds are utilized to the best interests of the Company. |

| |

» | The Compensation Committee reviews the executive compensation program to ensure it does not encourage excessive risk-taking. It also reviews our executive compensation, incentive compensation and succession plans to ensure we have appropriate practices in place to support the retention and development of the talent necessary to achieve our business goals and objectives. |

| |

» | The Health, Environmental, Safety and Corporate Responsibility Committee regularly reviews and oversees operational risks, including those relating to health, environment, safety, security and climate change. It reviews risks associated with social, political and environmental trends, issues and concerns, |

MARATHON OIL | GOVERNANCE 13

domestic and international, which affect or could affect our business activities, performance and reputation.

| |

» | Our Board receives regular updates from the committees about these activities, and reviews additional risks not specifically within the purview of any particular committee and risks of a more strategic nature. Key risks associated with the strategic plan are reviewed annually at our Board’s strategy meeting and periodically throughout the year. |

|

|

RISK ASSESSMENT RELATED TO OUR COMPENSATION STRUCTURE |

The Compensation Committee regularly evaluates and considers the role of executive compensation programs in ensuring that our executive officers take only appropriate and prudent risks, and that compensation opportunities do not motivate excessive risk-taking. The practices we employ include:

| |

» | All executive officer compensation decisions are made by either the Compensation Committee, which is comprised solely of independent directors, or by the independent directors, for CEO compensation. |

| |

» | The Compensation Committee is advised by an independent compensation consultant that performs no other work for executive management or our Company. |

| |

» | Our executives do not have employment agreements. |

| |

» | The Compensation Committee manages our compensation programs to be competitive with those of peer companies and also monitors our programs against trends in executive compensation on an annual basis against the broader oil and gas industry and general industry of similar market capitalization. |

| |

» | Our compensation programs are intended to balance short-term and long-term incentives. |

| |

» | Our long-term incentives feature multiple award vehicles and multi-year vesting criteria aligned with long-term ownership, and our executive officers are also subject to ongoing stock ownership requirements. |

| |

» | Our annual cash bonus program is based on a balanced set of multiple objective metrics that are not predominantly influenced by commodity prices. In addition, the Compensation Committee considers the achievement of individual performance goals and overall corporate performance. |

| |

» | Annual cash bonuses are determined and paid to executive officers only after the Audit and Finance Committee has reviewed audited financial statements for the performance year. |

| |

» | Annual cash bonuses and performance share unit awards are capped. |

| |

» | The Compensation Committee regularly evaluates share utilization in our 2019 Incentive Compensation Plan by reviewing overhang levels (dilutive impact of equity compensation on our stockholders) and annual run rates (the aggregate shares awarded as a percentage of total outstanding shares). |

| |

» | Our clawback policy applies to annual cash bonuses and is generally triggered with respect to an executive officer in the event of a material accounting restatement due to noncompliance with financial reporting requirements or an act of fraud by that executive officer. Our long-term incentive awards for executive officers have similar provisions. |

|

|

CORPORATE GOVERNANCE PRINCIPLES |

Our Corporate Governance Principles address our Board’s general function, including its responsibilities, Board size, director elections and limits on the number of Board memberships. These principles also address Board independence, committee composition, the process for director selection and director qualifications, our Board’s performance review, the Board’s planning and oversight functions, director compensation and director retirement and resignation. The Corporate Governance Principles are available on our website at www.marathonoil.com under About—Board of Directors—Committees and Charters—Governance and Nominating.

14 MARATHON OIL | GOVERNANCE

Our Code of Business Conduct, which applies to our directors, officers and employees, is available on our website at www.marathonoil.com under Investors—Corporate Governance. In addition, our Code of Ethics for Senior Financial Officers, applies to the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, is available on our website at www.marathonoil.com under Investors—Corporate Governance.

We intend to disclose any amendments and any waivers to our Code of Ethics for Senior Financial Officers on our website at www.marathonoil.com under Investors—Corporate Governance within four business days. The waiver information will remain on the website for at least 12 months after the initial disclosure of such waiver.

|

|

POLICY FOR REPORTING BUSINESS ETHICS CONCERNS |

Our Policy for Reporting Business Ethics Concerns establishes procedures for the receipt and treatment of business ethics concerns received by the Company, including those regarding accounting, internal accounting controls, or auditing matters. The Policy for Reporting Business Ethics Concerns is available on our website at www.marathonoil.com under Investors—Corporate Governance—Policies and Reporting—Policies.

Our Trading of Securities by Directors, Officers and Employee Policy prohibits our directors and officers from pledging, hedging and trading in derivatives of our stock. Excluding derivative securities issued by the Company, no director or officer of the Company may purchase or sell, directly or indirectly through family members or other persons or entities, any financial instrument including, but not limited to, put or call options, the price for which is affected in whole or in part by changes in the price of Company’s securities (including common or preferred stock, debt securities and derivative securities), or conduct any hedging transactions related to such securities. The policy does not apply to non-officer employees.

|

|

COMMUNICATIONS FROM INTERESTED PARTIES |

All interested parties, including security holders, may send communications to our Board through the Corporate Secretary office. You may communicate with our outside directors, individually or as a group, by emailing non-managedirectors@marathonoil.com. You may communicate with the Chairs of each of our Board’s committees by email as follows:

|

| |

Committee Chair | Email Address |

Audit and Finance Committee | auditandfinancechair@marathonoil.com |

Compensation Committee | compchair@marathonoil.com |

Corporate Governance and Nominating Committee | corpgovchair@marathonoil.com |

Health, Environmental, Safety and Corporate Responsibility Committee | hescrchair@marathonoil.com |

The Corporate Secretary will forward to the directors all communications that, in his judgment, are appropriate for consideration by the directors. Examples of communications that would not be considered appropriate for consideration by the directors include commercial solicitations and matters not relevant to the Company’s affairs.

|

|

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION |

Messrs. Boyce, Deaton and Foshee and Ms. Donadio, served on the Compensation Committee for all of 2019. Mr. Wells served on the Compensation Committee since May 29, 2019, and Mr. Foshee became the chair of the Compensation Committee on February 27, 2019. There are no matters relating to interlocks or insider participation that we are required to report.

MARATHON OIL | GOVERNANCE 15

Our Board determines annual retainers and other compensation for non-employee directors. Mr. Tillman, the only director who is also an employee, receives no additional compensation for his service on our Board or as Chairman. Non-employee director compensation is intended to attract qualified directors, ensure that they are fairly compensated for their contributions to our performance, and align the interests of directors and stockholders.

Following are the annual cash retainers and fees we paid our non-employee directors for 2019:

|

| | | | |

Type of Fee | Amount ($) | | 10 years with no increase in directors’ cash retainer |

Annual Board Retainer | $150,000 | | |

Additional Fee for Independent Lead Director | $25,000 | | |

Additional Fee for Audit and Finance Committee Chair | $25,000 | | |

Additional Fee for Compensation Committee Chair | $25,000 | | |

Additional Fee for Corporate Governance and Nominating Committee Chair | $12,500 | | |

Additional Fee for Health, Environmental, Safety and Corporate Responsibility Chair | $12,500 | | |

Directors do not receive meeting fees for attendance at Board or committee meetings.

Non-employee directors may defer up to 100% of their annual retainer into an unfunded account under the Company’s Deferred Compensation Plan for Non-Employee Directors (DCP). These deferred amounts may be invested in certain investment options, which generally mirror the investment options offered to employees under the Marathon Oil Company Thrift Plan (Thrift Plan).

|

|

EQUITY-BASED COMPENSATION AND STOCK OWNERSHIP REQUIREMENTS |

For 2019, non-employee directors received an annual common stock unit award valued at $175,000. These awards were credited to an account on the first business day of the calendar year, based on the closing stock price on the grant date. Directors may elect to defer settlement of their common stock units until after they cease serving on our Board under the Company’s DCP. Directors who make such a deferral election receive dividend equivalents in the form of additional common stock units, which will be settled in common stock.

Directors who elect not to defer their common stock units receive dividend equivalents in cash, payment of which is deferred until the distribution date of the related common stock units. These awards vest and are payable shortly after the earlier of (a) the third anniversary of the grant date, or (b) the director’s departure from our Board. |

| | |

Director stock ownership requirement of 5x annual cash retainer | | In 2019, we increased our stock ownership guidelines requiring each non-employee director to hold five times the value of his or her annual cash retainer in Marathon Oil stock. Directors have five years from their initial election to our Board to meet this requirement. Directors who do not hold the required level of stock ownership due to fluctuations in the price of our common stock are expected to hold the awards they receive until they have met their requirement. The Corporate Governance and Nominating Committee reviews each non-employee director’s progress toward the requirements during the first quarter of each year. Each non-employee director meets the requisite threshold other than Ms. Hyland, Mr. Few and Mr. Wells, who are still within the five-year window.

|

16 MARATHON OIL | DIRECTOR COMPENSATION

Under our matching gifts programs, we will annually match up to $10,000 in contributions made by non-employee directors to certain tax-exempt educational institutions. This annual limit is based on the date of the director’s gift to the institution. We will also make a donation to a charity of the director’s choice equal to the amount of his or her contribution to the Marathon Oil Company Employees Political Action Committee (MEPAC) for contributions above $200. MEPAC contributions are subject to a $5,000 annual limit.

|

|

2019 DIRECTOR COMPENSATION TABLE |

|

| | | | | | | | | |

Name | Fees Earned or Paid in Cash ($) | Stock Awards (1) ($) | All Other Compensation (2) ($) | Total ($) |

Gregory H. Boyce | $175,000 | | $175,000 | (3) | — |

| | $350,000 | |

Chadwick C. Deaton | $162,500 | | $175,000 | (4) | $5,000 | | $342,500 | |

Marcela E. Donadio | $175,000 | | $175,000 | (4) | — |

| | $350,000 | |

Jason B. Few (5) | $112,500 | | $131,250 | | — |

| | $243,750 | |

Douglas L. Foshee | $168,750 | | $175,000 | | — |

| | $343,750 | |

M. Elise Hyland | $162,500 | | $175,000 | (3) | — |

| | $337,500 | |

J. Kent Wells (5) | $112,500 | | $131,250 | (4) | — |

| | $243,750 | |

(1) Represents the amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2019, in accordance with generally accepted accounting principles in the United States regarding stock compensation, for the annual common stock unit award. These amounts are also equal to the grant date fair value of the awards. The aggregate number of stock unit awards outstanding as of December 31, 2019 for each director is as follows: Mr. Boyce, 60,760; Mr. Deaton, 32,659; Ms. Donadio, 32,659; Mr. Few, 7,547; Mr. Foshee, 20,317; Ms. Hyland, 20,405; and Mr. Wells, 7,635.

(2) Represents contributions made under our matching gifts programs. In addition, spouses were allowed to accompany directors on company aircraft for business travel. These additional passengers did not result in an aggregate incremental cost to the Company.

(3) Mr. Boyce and Ms. Hyland deferred 50% of their annual common stock unit award under the DCP.

(4) Messrs. Deaton and Wells, and Ms. Donadio, deferred 100% of their annual common stock unit award under the Marathon Oil Corporation Deferred Compensation Plan for Non-Employee Directors.

(5) Messrs. Few and Wells were elected to the Board effective April 1, 2019.

MARATHON OIL | DIRECTOR COMPENSATION 17

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS |

The following table shows the beneficial owners of five percent or more of the Company’s common stock, based on information available as of March 10, 2020:

|

| | | | |

Name and Address

of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Outstanding Shares |

The Vanguard Group, Inc.

100 Vanguard Blvd.

Malvern, PA 19355 | 94,282,334 | (1) | 11.78% | |

BlackRock, Inc.

55 East 52nd Street

New York, NY 10055 | 83,865,971 | (2) | 10.50% | |

Macquarie Group Limited and associated entities 50 Martin Place Sydney, New South Wales, Australia

Macquarie Investment Management Holdings Inc. and Macquarie Investment Management Business Trust 2005 Market Street Philadelphia, PA 19103

Macquarie Investment Management Austria Kapitalanlage AG L3, Kaerntner Strasse 28 Vienna C4 1010, Austria | 66,459,965 | (3) | 8.30% | |

Invesco Ltd.

1555 Peachtree Street NE, Suite 1800

Atlanta, GA 30309 | 54,979,840 | (4) | 6.90% | |

State Street Corporation State Street Financial Center One Lincoln Street Boston, MA 02111 | 43,653,102 | (5) | 5.46% | |

(1) Based on its Schedule 13G/A filed with the SEC on February 12, 2020, The Vanguard Group, Inc., as an investment advisor, beneficially owns 94,282,334 shares, has sole voting power over 1,168,180 shares, shared voting power over 220,854 shares, sole dispositive power over 92,935,393 shares, and shared dispositive power over 1,346,941 shares. Vanguard Fiduciary Trust Company, a wholly owned subsidiary of Vanguard, is the beneficial owner of 906,479 shares as a result of its serving as investment manager of collective trust accounts. Vanguard Investments Australia, Ltd., a wholly owned subsidiary of Vanguard, is the beneficial owner of 689,574 shares as a result of its serving as investment manager of Australian investment offerings.

(2) Based on its Schedule 13G/A filed with the SEC on February 4, 2020, BlackRock, Inc., through itself and as the parent holding company or control person over certain subsidiaries, beneficially owns 83,865,971 shares, has sole voting power over 75,348,560 shares, sole dispositive power over 83,865,971 shares, and shared voting and shared dispositive power over no shares.

(3) Based on its Schedule 13G/A filed with the SEC on February 13, 2020, Macquarie Group Limited through its subsidiaries Macquarie Bank Limited, Macquarie Investment Management Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Australia Limited, Macquarie

18 MARATHON OIL | SECURITY OWNERSHIP

Investment Management Holdings Inc. and Macquarie Investment Management Business Trust (all aforementioned entities collectively referred to herein as Macquarie), beneficially owns 66,459,965 shares. Macquarie Group Limited, through its subsidiaries, has no sole or shared voting power and no sole or shared dispositive power over any shares. Macquarie Bank Limited, through its subsidiaries, has sole voting and sole dispositive power over 5,400 shares, and shared voting and shared dispositive power over no shares. Macquarie Investment Management Holdings Inc., through its subsidiary, Macquarie Investment Management Business Trust has sole voting and sole dispositive power over 64,857,529 shares, and shared voting and shared dispositive power over no shares. Macquarie Investment Management Australia Limited has sole voting and sole dispositive power over 21,500 shares, and shared voting and shared dispositive power over no shares. Macquarie Investment Management Austria Kapitalanlage AG has sole voting and sole dispositive power over 58,649 shares, and shared voting and shared dispositive power over no shares.

(4) Based on its Schedule 13G filed with the SEC on February 13, 2020, Invesco Ltd., together with certain of its subsidiaries and in its capacity as a parent holding company to its investment advisors, beneficially owns 54,979,840 shares, has sole voting power over 52,198,981 shares, sole dispositive power over 54,979,840 shares, and shared voting and shared dispositive power over no shares.

(5) Based on its Schedule 13G filed with the SEC on February 14, 2020, State Street Corporation, together with certain of its direct or indirect subsidiaries, beneficially owns 43,653,102 shares, has sole voting and sole dispositive power over no shares, shared voting power over 39,773,707 shares, and shared dispositive power over 43,553,862 shares.

MARATHON OIL | SECURITY OWNERSHIP 19

|

|

SECURITY OWNERSHIP OF MANAGEMENT |

The following table shows the number of shares of Marathon Oil common stock beneficially owned as of

March 10, 2020, by each director, by each executive officer named in the Summary Compensation Table and by all directors and executive officers as a group. Unless otherwise indicated by footnote, we believe, based on the information furnished to us, that the persons named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them. Unless otherwise provided, the address of each individual listed below is c/o 5555 San Felipe, Houston, Texas 77056.

|

| | | | | | | | | | | | | |

Name | Shares(1) | Restricted

Stock(2) | Stock Options or Restricted Stock Units Exercisable Prior to May 11, 2020(3) | Total Shares(4) | % of Total

Outstanding |

Gregory H. Boyce | 56,654 |

| | — |

| | 63,699 |

| | 120,353 |

| | * |

Chadwick C. Deaton | 25,645 |

| | — |

| | 45,451 |

| | 71,096 |

| | * |

Marcela E. Donadio | 20,263 |

| | — |

| | 45,451 |

| | 65,714 |

| | * |

Jason B. Few | — |

| | — |

| | 20,339 |

| | 20,339 |

| | * |

Douglas L. Foshee | 60,000 |

| | — |

| | 33,109 |

| | 93,109 |

| | * |

M. Elise Hyland | — |

| | — |

| | 33,196 |

| | 33,196 |

| | * |

J. Kent Wells | — |

| | — |

| | 20,428 |

| | 20,428 |

| | * |

Lee M. Tillman | 407,182 |

| | 170,455 |

| | 1,988,604 |

| | 2,566,241 |

| | * |

Reginald D. Hedgebeth | 9,006 |

| | 140,618 |

| | 160,763 |

| | 310,387 |

| | * |

T. Mitchell Little | 144,879 |

| | 182,304 |

| | 409,670 |

| | 736,853 |

| | * |

Patrick J. Wagner | 67,751 |

| | 140,563 |

| | 213,481 |

| | 421,795 |

| | * |

Dane E. Whitehead | 114,995 |

| | 159,970 |

| | 225,640 |

| | 500,605 |

| | * |

All Directors and Executive Officers as a group (13 persons) (1)(2)(3) | | 5,157,722 |

| | * |

| |

* | Does not exceed 1% of the common shares outstanding. |

(1) Includes all shares held, if any, under the Marathon Oil Thrift Plan, a Dividend Reinvestment and Direct Stock Purchase Plan, the Company’s DCP and in brokerage accounts.

(2) Reflects shares of restricted stock which are subject to limits on sale and transfer and can be forfeited under certain conditions.

(3) Includes options and restricted stock units exercisable within sixty days of March 10, 2020.

(4) None of the shares are pledged as security.

20 MARATHON OIL | SECURITY OWNERSHIP

|

|

COMPENSATION COMMITTEE REPORT |

The Compensation Committee has reviewed with management the Company’s Compensation Discussion and Analysis for 2019. Based on that review, the Compensation Committee has recommended to our Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

COMPENSATION COMMITTEE

Douglas L. Foshee, Chair

Gregory H. Boyce

Chadwick C. Deaton

Marcela E. Donadio

J. Kent Wells

MARATHON OIL | COMPENSATION COMMITTEE 21

|

|

COMPENSATION DISCUSSION AND ANALYSIS |

The following Compensation Discussion and Analysis describes in detail the compensation paid to the named executive officers (NEOs) listed in the Summary Compensation Table. It is designed to provide stockholders with an understanding of our compensation principles and practices and insight into our decision-making process as it relates to the compensation of our NEOs.

|

| | | | |

2019 NAMED EXECUTIVE OFFICERS |

| | | | |

Lee M. Tillman | T. Mitchell (“Mitch”) Little | Dane E. Whitehead | Patrick J. (“Pat”) Wagner | Reginald D. (“Reggie”) Hedgebeth |

Chairman, President and Chief Executive Officer | Executive Vice President, Operations | Executive Vice President and Chief Financial Officer | Executive Vice President, Corporate Development and Strategy | Executive Vice President, General Counsel and Chief Administrative Officer |

|

| | | |

Table of Contents Highlights: | | Page |

I. | Executive Summary | | |

II. | Compensation Philosophy | | |

III. | Compensation Governance and Best Practices | | |

IV. | Pay for Performance | | |

V. | How We Determine Executive Compensation | | |

VI. | Elements of Our Executive Compensation Program | | |

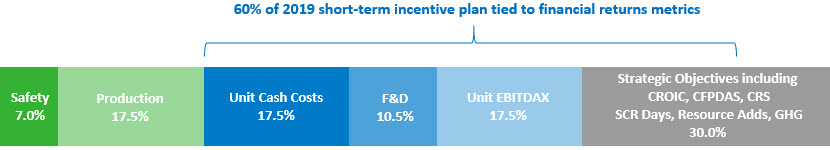

Current Market Environment

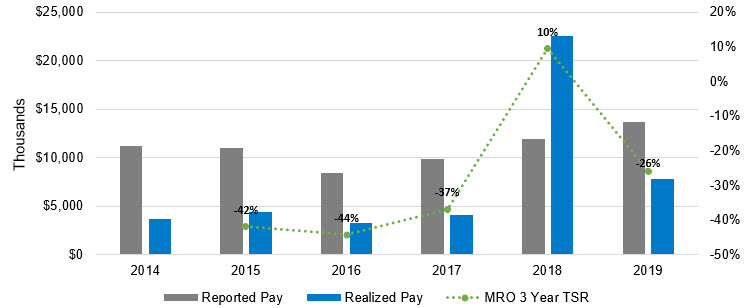

This Compensation Discussion and Analysis focuses on the Company’s 2019 compensation programs, actions and outputs relative to the Company’s 2019 performance. Those outcomes considered the 2019 financial, operating, safety and environmental achievements against plan objectives, and stock price performance on an absolute and relative basis through the end of 2019.

Unfortunately, today, our industry is facing the unprecedented combination of a significant decrease in global energy demand due to the COVID-19 (Coronavirus) outbreak, paired with an oversupplied market exacerbated by an unforeseen response from OPEC and Russia. With this dramatic drop in commodity prices, the Company has experienced a stock price decline since the end of 2019, consistent with its peer companies and the broader oil and gas industry. The Company is committed to taking action to maintain our strong financial foundation that positions us to navigate a challenging oil price environment ahead.

As described further here, the Company’s executive compensation programs strongly align realized compensation outcomes with the Company’s absolute and relative stock price performance. We will determine the near-term outcomes of this year’s stock price performance after the conclusion of 2020, and describe those outcomes in next year’s Compensation Discussion and Analysis.

22 MARATHON OIL | COMPENSATION DISCUSSION & ANALYSIS

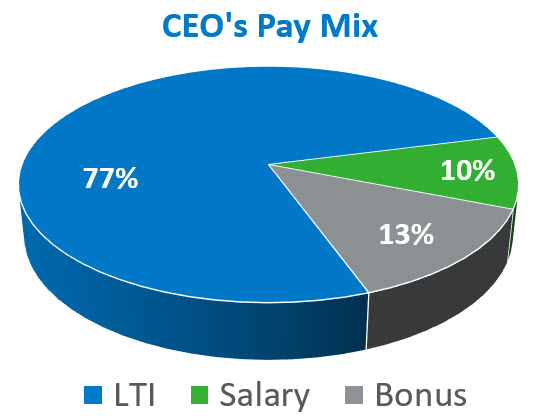

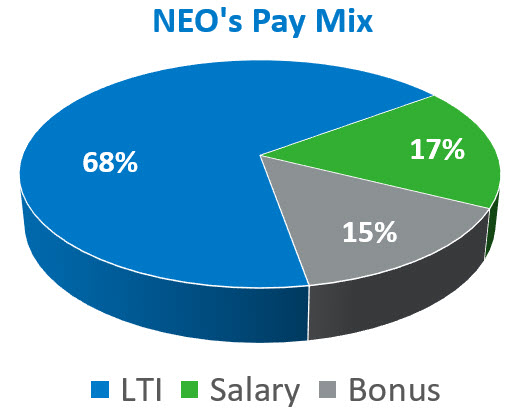

2019 Operational & Financial Highlights