UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

þ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2011 or

¨ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

COMMISSION FILE NUMBER 0-28720

(Exact Name of Registrant as Specified in its Charter)

DELAWARE | 73-1479833 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

40 Washington Street, Westborough, Massachusetts 01581

(Address of Principal Executive Offices) (Zip Code)

(617) 861-6050

(Registrant’s Telephone Number, Including Area Code)

Securities registered under Section 12(b) of the Act:

None

Securities registered under Section 12(g) of the Act:

Common Stock, $0.001 Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | o | Accelerated Filer | þ | Non-accelerated filer | o | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the common stock held by non-affiliates of the registrant based on the last sale price of such stock as reported by the Over-the-Counter Bulletin Board on June 30, 2011 (the last business day of the Registrant's most recently completed second fiscal quarter) was approximately $101,275,449

As of May 10, 2012, the registrant had 311,390,478 shares of Common Stock outstanding.

Explanatory Note

The filing of the Annual Report on Form 10-K inadvertently left out certain exhibits, which are attached hereto to this amended filing.

DOCUMENTS INCORPORATED BY REFERENCE

No documents are incorporated by reference into this Annual Report except those Exhibits so incorporated as set forth in the Exhibit Index

PAID, INC.

FORM 10-K

FOR THE YEARS ENDED DECEMBER 31, 2011, 2010, AND 2009

TABLE OF CONTENTS

PART I | |||

PART II | |||

PART III | |||

PART IV | |||

-2-

PART I

Forward Looking Statements

This Annual Report on Form 10-K contains certain forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding the Company and its business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates", "could", "may", "should", "will", "would", and similar expressions or variations of such words are intended to identify forward-looking statements in this report. Additionally, statements concerning future matters such as the development of new services, technology enhancements, purchases of equipment, credit arrangements, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements.

Although forward-looking statements in this Annual Report reflect the good faith judgment of the Company's management, such statements can be based only on facts and factors currently known by the Company. Further, whether actual results will conform to our expectations and predictions is subject to a number of known and unknown risks and uncertainties, including the risks and uncertainties discussed in this Annual Report; general economic, market, or business conditions; the opportunities that may be presented to and pursued by us; competitive actions by other companies; changes in laws or regulations; and other circumstances, many of which are beyond our control. Thus, actual results and outcomes may differ materially from results and outcomes discussed in this report. Although the Company believes that its plans, intentions and expectations reflected in these forward-looking statements are reasonable, the Company can give no assurance that its plans, intentions or expectations will be achieved. For a more complete discussion of these risk factors, see Item 1A, "Risk Factors".

For example, the Company's ability to achieve positive cash flow and to become profitable may be adversely affected as a result of a number of factors that could thwart its efforts. These factors include the Company's inability to successfully implement the Company's business and revenue model, tour or event cancellations, higher costs than anticipated, the Company's inability to sell its products and services to a sufficient number of customers, the introduction of competing products by others, the Company's failure to attract sufficient interest in and traffic to its sites, the Company's inability to complete development of its sites, the failure of the Company's operating systems, and the Company's inability to increase its revenues as rapidly as anticipated. If the Company is not profitable in the future, it will not be able to continue its business operations.

Except as required by applicable laws, we do not intend to publish updates or revisions of any forward-looking statements we make to reflect new information, future events or otherwise. Readers are urged to review carefully and to consider the various disclosures made by the Company in this Annual Report, which attempts to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

Item 1. Business

Overview

PAID, Inc. (the “Company”) was incorporated in Delaware on August 9, 1995. The Company's main web address is located at www.paid.com, which offers updated information on various aspects of our operations. Information contained in the Company's website shall not be deemed to be a part of this Annual Report. The Company's principal executive offices are located at 40 Washington Street, Westborough, Massachusetts 01581, and the Company's telephone number is (617) 861-6050.

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K with the Securities and Exchange Commission (the “SEC”). These reports, any amendments to these reports, proxy and information statements and certain other documents we file with the SEC are available through the SEC's website at www.sec.gov or free of charge on our website as soon as reasonably practicable after we file the documents with the SEC. The public may also read and copy these reports and any other materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Our Business

The Company's primary focus is to provide brand-related services to businesses, celebrity clients in the entertainment industry as well as charitable organizations. PAID's brand management, brand marketing, social media marketing, product design and merchandising, website design; development and hosting services are designed to grow each client's customer base in size, loyalty and revenue generation. We offer entertainers and business entities comprehensive web-presence and related services supporting and managing clients' official websites and fan-community services including e-commerce, VIP ticketing, live event fan experiences, user-generated content, client content publishing and distribution, fan forums, social network

-3-

management, social media marketing, customer data capture, management and analysis. PAID's brand support services also include design and production of print, audio and video promotion marketing materials for client branded products and events. In addition to sourcing, designing and marketing, PAID sells merchandise for celebrities and businesses, through official website stores and other web-based outlets as well as on-tour and retail outlets. Our celebrity services proprietary content management system and our use of both off-the-shelf best of class and proprietary software applications provides an opportunity for our clients to offer a Direct-To-Consumer solution enabling more information, merchandise and experiences directly to their customers and communities while optimizing our ability to capture customer data and build robust customer data-bases for them. We provide business management tools for online retailers, through AuctionInc, which is home to our patented shipping calculator and automated auction checkout and order processing system. This system provides the fundamental structure for our celebrity web hosting and development services, and for individuals seeking a professional and interactive presence on the Internet.

All the sales for our celebrity and entertainment services, other than retail and tour merchandise, are made through the client's official website and official social network site and PAID's proprietary content managed system. A customer interested in a membership, merchandise, fan experience or ticket would use our system to make purchases, and then depending on the sale, the Company either ships the merchandise, or delivers the fan experience at a concert or other event. The services offered by a client depend upon the client's desire and willingness to offer different initiatives. Not all clients and customer bases are the same and the Company works closely with its different clients to cater to their unique needs. Our services also include video production, marketing, management, sponsorship, mobile marketing, and website development and management. We provide services for artists and organizations such as Aerosmith, The Moody Blues, Stand Up 2 Cancer, Deep Purple, comedian Ron White, Rockapella and others.

AuctionInc Software. AuctionInc is a suite of online shipping management tools assisting businesses with e-commerce storefronts, shipping solutions, inventory management, and auction processing. The application was designed originally to reduce overhead costs for auction sales, but over time the functionality and core business is strictly focused on shipping calculations. The product does have tools to assist with other aspects of the fulfillment process, but the main purpose of the product is to provide accurate shipping calculations and packaging algorithms that provide customers with the best possible shipping solutions.

The AuctionInc system was originally designed to assist and improve just the Company's sales, but management realized that there was a need for an order management system for individuals and businesses that sell on the Internet, specifically at auction. In 2000 the Company's technology team focused its attention on the core fundamental piece of the system called the Shipping Calculator. The Company recognized the potential importance of the calculator and filed for a patent before launching it to the public in April of 2001. The Company obtained its first patent on the shipping calculator in January 2008, and the second patent in April 2011. The product is modular based and we continue to develop new tools and products for its customers.

Industry Background

Growth of the Internet and the Web

The Internet enables millions of people worldwide to share information, communicate and conduct business electronically. The growth in the number of Web users is being driven by the increasing importance of the Internet as a communications medium, an information resource, and a sales and distribution channel. The Internet has also evolved into a unique marketing channel. Unlike the traditional marketing channels, Internet retailers do not have many of the overhead costs borne by traditional retailers. The Internet offers the opportunity to create a large, geographically dispersed customer base more quickly than traditional retailers. The Internet also offers customers a broader selection of goods to purchase, provides sellers the opportunity to sell their goods more efficiently to a broader base of buyers and allows business transactions to occur at all hours.

State of Viral Communities on the Internet

The massive growth of online communities over the past decade has reached viral proportions. Internet communities are built revolving around ideas, music, individuals, artists, writers, or any tangible or intangible entity, and new content can be distributed within minutes of exposure. Artists can announce tours or other news, sell premium tickets to fan club members, sell merchandise, and other fan experiences. Viral communities and viral marketing are a phenomenon that web users are embracing with vigor. As traffic and communities continue to grow, more services will be required to sustain the appetite of these users.

-4-

Business Strategy

Our mission is to increase the Company's market share and revenues by providing products and services that grow each of our client's customer bases in size, loyalty and revenue generation. As the Company continues to support our clients in earning more, owning more and keeping more of the business they are responsible for having created in the first place, we continue to strengthen our reputation, add new clients to our client base and share in the increase in revenues across the aggregate of the Company's client roster. Our strategy to achieve our mission is based upon the following:

During 2011 we experienced continued expansion of our Direct-to-Consumer marketing, ecommerce and fulfillment services, celebrity web-hosting, merchandising and fan experience programs. We believe there will be an increase in online and social communities that will create an opportunity for more celebrity web store management, fan community monetization and fulfillment services. It is our view that our services and programs will become more desirable as these communities and social interaction increases. Our proprietary Content Management System was built to handle news, events, ticketing, fan experiences, e-commerce, video, music streaming, mobile services, downloads and forums. Our Customer Relationship Management was developed to facilitate the capture, analysis and management of customer data.

Fulfillment: The Company continues to increase fulfillment services by adding new business relationships to our fulfillment client roster. The Company is increasing new business development efforts - adding experienced sales and marketing personnel, targeting a greater number and wider range of companies in need of fulfillment services. The Company is providing fulfillment services as a partner to companies in a growing sector of commerce, ecommerce and social commerce service providers with ecommerce platforms which facilitate engagement and monetization of consumers via social media networks, distributed affiliate sites, and advertising networks but which do not offer inventory management and pick-pack-ship fulfillment services themselves.

The Company recognizes that fulfillment is a customer-facing service wherein the action of delivering a product to a customer provides the Company with the opportunity to 'touch' the customer multiple times throughout the fulfillment cycle. The Company sees this as an opportunity to incorporate into the fulfillment process increased sales and marketing tools and practices which result in an increase in per-customer purchases and new customer referrals.

Consumer Data Management: The monetization of consumer data continues to prove to be a growing and profitable business practice. The Company manages fan and customer communities also known as affinity groups which are representative of taste-makers and trend-setters whose interests and behaviors are valuable to the Company and the Company's clients as well as to a much greater range of marketers generally. These affinity groups can be quantified and qualified by the Company owing to the Company's established direct-to-consumer communication channels and practices, our robust Customer Relationship Management system and our consumer data analytics capabilities.

Our key objectives include the capture, analysis and monetization of consumer data with both short and longer term goals. We believe that by knowing the consumer better, we are able to turn consumers into customers. By targeting the customer with greater accuracy, delivering messages the customer has expressed interest in receiving, the Company can offer our customers and our clients' customers products and services they want to buy. Doing so reduces cost of sale, enables quicker inventory turns, results in higher margins and profits and also engenders customer trust and loyalty. Customer loyalty provides for a business-to-customer relationship in which the customer is positively inclined to share information about themselves - consumer data. Loyal customers engage in greater numbers and when incented by contests, VIP experiences, various promotions and product discounts, loyal fans/customers are willing to share information about themselves, their likes, dislikes, affiliations and consumer behaviors. The compilation and analysis of this consumer data can be fashioned into a suite of predictive modeling tools and made available as a B-to-B product for marketers of goods and services across a broad range of industries.

Strategic Partnerships: Our growth strategy includes strategic partnerships with music business industry leaders in providing software solutions which enable Direct-To-Consumer ecommerce. We have partnered with these companies to provide inventory management and pick-pack-ship fulfillment services for their clients including- John Legend, Carly Simon, Taye Diggs, as well as breakout indie artists, Fitz and the Tantrums and Silversun Pickups. We also partner with providers of turnkey solutions for their celebrity clients for design, product development, manufacturing and sales in all channels of retail distribution: live events, web stores, sponsorships, and third-party licensing. We provide web store development, ecommerce, inventory management and pick-pack-ship services to their celebrity clients including Slash, Slayer, Alice Cooper, and others.

-5-

We expect the above plan will enable us to increase our celebrity services and offer a wider variety of management services providing more resources for a sales and a marketing campaign to promote the Company.

In providing our services, our business plan includes the payment of advances to some clients on merchandise and VIP programs and appearances, and recoupment of those advances from the artists' and celebrities' share of profits, as agreed upon in any agreement with the artist or celebrity.

The business strategy described above is intended to enhance our opportunities in the online e-commerce market. However, there are a number of factors that may impact our plans and inhibit our success. See “Risk Factors” included in Item 1A. Therefore, we have no guarantees and can provide no assurances, that our plans will be successful.

Marketing and Sales

Successful branding of our corporate identity and services is the key to our success. We changed our name to PAID, Inc. at the end of 2003 and have consolidated our websites and brands under one Internet presence.

In 2011 we added additional sales and marketing personnel and employed cutting edge technology to drive the awareness and to deliver our products and services to a larger audience. Promoting and marketing PAID's celebrity services will continue by using various mediums of marketing; social engine marketing; “adword” campaigns, search engine optimization, email marketing, social media marketing, traditional print media and public relations methods, and presence at industry conferences and trade shows. However, as our celebrity services continue to gain exposure, we have had substantial opportunity to grow our business through referrals. Networking and referral business is a large portion of sales and marketing for these types of services. As we market and promote our celebrity services, we also will be supporting our proprietary content management system, increasing our CRM capabilities with enhanced marketing services, and continue to invest in our shipping calculator products.

The Company is extending its sales and marketing initiatives by incorporating sales and marketing materials and outreach into fulfillment and customer service activities.

The Company will continue to market AuctionInc throughout 2012. In the past, representatives of the Company attended trade shows, events and conferences to analyze the potential for AuctionInc and to narrow the Company's marketing base. Based on experience with existing partnerships that promote AuctionInc, the Company believes that creating partnerships is an effective marketing tool to promote and encourage new registrations. The Company will continue to seek new partnerships. The Company may promote the AuctionInc product line in trade publications to reach small and midsize companies.

Although we believe that this marketing strategy, if successful, will lead to increased revenues, and attract more users to our site, we have no commitments that our marketing will be successful or our sales will increase. There are a number of factors that may impact our plans and inhibit our success. See “Risk Factors” included in Item 1A. Therefore, we have no guarantees and can provide no assurances that our plans will be successful.

Revenue Sources

In 2011, our revenues were derived from our online merchandise and fulfillment operations, client services and touring programs. Although we expect that this revenue model will generate increased revenue, if we are not successful in implementing this model, if the entertainment industry and fans do not accept the services we provide, if costs are higher than anticipated, or if revenues do not increase as rapidly as hoped, we may not be able to generate positive cash flow. There are a number of factors that may impact our plans and inhibit our success. See “Risk Factors” included in Item 1A. Therefore, we have no guarantees and can provide no assurances, that our plans will be successful.

Competition

Our web hosting software program, AuctionInc software suite, is proprietary. We received two patents related to our online action shipping calculator in January 2008 and April 2011. We do not have any other patents for our designs or innovations and we may not be able to obtain copyright, patent or other protection for our proprietary technologies or for the processes developed by our employees. Legal standards relating to intellectual property rights in computer software are still developing and this area of the law is evolving with new technologies. Our intellectual property rights do not guarantee any competitive advantage and may not sufficiently protect us against competitors with similar technology. To protect our interest in our intellectual property, we restrict access by others to our proprietary software. In addition, we have federally registered the “PAID” and "Rockin' Coffee" marks. We believe that our products and other proprietary rights do not infringe on the

-6-

proprietary rights of third parties. However, there can be no assurance that third parties will not assert infringement claims against us in the future with respect to current or future products or other works of ours. This assertion may require us to enter into royalty arrangements or result in costly litigation.

We also utilize free open-source technology in certain areas. Unlike proprietary software, open-source software has publicly available source code and can be copied, modified and distributed with minimal restrictions. The client websites we build are developed on a Coldfusion proprietary content management and ecommerce engine. We use open source software and technology as well to support the growing social and viral opportunities on the Internet. By using 'best-of-breed' products and tools we can maximize our clients opportunities while minimizing our costs which we are able to pass on to our customers.

Research and Development

Over the past 2 years the Company has not made additional investments in research and development.

Employees

The Company currently has 32 full time equivalent employees. We believe that our future success will depend in part on our continued ability to attract, hire and retain qualified personnel. We have no collective bargaining agreements and consider the relationship with our employees to be good.

Government Regulation

We are not currently subject to direct federal, state or local regulation, and laws or regulations applicable to access or commerce on the Internet, other than regulations applicable to businesses generally. However, due to the increasing popularity and use of the Internet and other online services, it is possible that a number of laws and regulations may be adopted with respect to the Internet or other online services covering issues such as user privacy, freedom of expression, pricing, content and quality of products and services, taxation, advertising, intellectual property rights and information security.

Item 1A. Risk Factors

You should carefully consider the risks and uncertainties described below before deciding to invest in shares of our common stock. If any of the following risks or uncertainties actually occurs, our business, prospects, financial condition and operating results would likely suffer, possibly materially. In that event, the market price of our common stock could decline and you could lose all or part of your investment.

Risks Relating to the Company

We have experienced significant operating losses.

Our business and prospects must be considered in light of the risks, expenses and difficulties that are inherent in our business. The risks include:

• | our ability to anticipate and adapt to a developing market; |

• | our ability to attract new businesses in the entertainment market for our brand-related services; |

• | our ability to engage musical artists and celebrities and name brands, to service a sustainable fan base for each musical artist and celebrity, and to sell merchandise, VIP tickets, fan experiences and other services; |

• | dependence upon the level of hits to our artists' sites and on sites that we use to sell our products and services; |

• | the popularity and success of the artists and name brands who receive our services; |

• | artist tour activities and fan attendance; |

• | our ability to recoup any advance paid to an artist or celebrity for merchandise, artist appearances, and VIP programs; |

• | our ability to engage organizations for web site development and sponsorship; |

• | our ability to market, license and enforce our patented shipping calculator; and |

• | development of equal or superior Internet portals, auctions and related services by competitors. |

To address these risks, we must, among other things, successfully market celebrities, musical artists, and name brands and service their fan or consumer base, increase traffic to their web sites, maintain our customer base, attract significant numbers of new customers and clients, respond to competitive developments, implement and execute successfully our business strategy and continue to develop and upgrade our technologies and customer services. We cannot offer any assurances that we will be successful in addressing these risks.

We incurred substantial losses each year since 1999. There can be no assurance that we will be profitable in the

-7-

future.

Our capital is limited and we may need additional financing to continue operations.

We require substantial working capital to fund our business. Additional funds or authorized common stock may be necessary for our Company to continue its operations and to make recoupable advances for merchandise, artist appearances, and VIP programs. If we are unable to obtain financing in the amounts desired and on acceptable terms, or at all, or issue stock, we could be required to reduce significantly the scope of our expenditures or limit our ability to engage an artist, which would have a material adverse effect on our business potential and the market price of our common stock. If we raise additional funds by issuing equity securities, our shareholders will be further diluted. Based on our cash position as of December 31, 2011, we may need additional capital to fund our anticipated operating expenses over the next 12 months. If we require additional funding, there can be no assurances that the financing will be obtained, or if obtained, that funding will be obtained on reasonably acceptable terms.

We are unable to guarantee that the marketplace will accept our software products.

The software markets are characterized by rapid technological change, frequent new product enhancements, uncertain product life cycles, changes in customer demands and evolving industry standards. Our software products could be rendered obsolete if products based on new technologies are introduced or new industry standards emerge, or if we do not obtain adequate intellectual property protection. We are unable to provide any assurances that the marketplace will accept our software products and services, or that we will be able to provide these products and services at a profit.

Our operating results are unpredictable and are expected to fluctuate in the future.

You should not rely on the results for any period as an indication of future performance. Our operating results are unpredictable and are expected to fluctuate in the future due to a number of factors, many of which are outside our control. These factors beyond our control include:

• | our ability to engage well known celebrities, musical artists, and businesses in the entertainment industry with name brands for merchandise sales, web site and fan management, as well as other entities for web site development and sponsorship; |

• | our ability to engage celebrities for ticket sales services; |

• | our ability to significantly increase our customer base and traffic to our web sites, manage our inventory mix and the mix of products offered, liquidate our inventory in a timely manner, maintain gross margins, and maintain customer satisfaction; |

• | our ability to market and sell our software products; |

• | the availability and pricing of merchandise from vendors; |

• | consumer confidence in encrypted transactions in the Internet environment; |

• | the timing, cost and availability of advertising on our web sites and other entities' web sites; |

• | popularity of celebrities; |

• | the amount and timing of costs related to expansion of our operations and the hiring of experienced personnel; |

• | the announcement or introduction of new types of services or products by our competitors; |

• | technical difficulties with respect to consumer and fan use of our web sites; |

• | our ability to make acquisitions of complementary business and technologies; |

• | governmental regulation by federal or local governments; and |

• | general economic conditions and economic conditions specific to the Internet and electronic commerce. |

As a strategic response to changes in the competitive environment, we may from time to time make certain service, marketing or supply decisions or acquisitions that could have a material adverse effect on our results of operations and financial condition. In 2011, our revenues were derived from our celebrity services, fulfillment services, and ticketing and fan experiences.

The successful operation of our business depends upon the supply of critical technology elements from other third parties, including our Internet service provider and technology licensors.

Our operations depend on a number of third parties for Internet/telecom access, delivery services, and software services. We have limited control over these third parties and no long-term relationships with any of them. We rely on an Internet service provider to connect our web sites to the Internet. From time to time, we have experienced temporary interruptions in our web sites' connection and also our telecommunications access. We license technology and related databases from third parties for certain elements of our properties. Furthermore, we are dependent on hardware suppliers for

-8-

prompt delivery, installation, and service of servers and other equipment to deliver our products and services. Our internally developed software depends on an operating system, database and server software that was developed and produced by and licensed from third parties. We have from time to time discovered errors and defects in the software from these third parties and, in part, rely on these third parties to correct these errors and defects in a timely manner. Any errors, failures, interruptions, or delays experienced in connection with these third-party technologies and information services could negatively impact our relationship with users and adversely affect our brand and our business, and could expose us to liabilities to third parties.

We rely on third parties for our order fulfillment, and failures on the part of these third parties could harm our business.

We use overnight courier and delivery services for substantially all of our merchandise and products. We use third party manufacturers to produce our merchandise. Should these vendors be unable to deliver our products for a sustained time period as a result of a strike, war, act of terrorism, business failure, or other reason, our business, results of operations and financial condition would be adversely affected. If, due to computer systems failures or other problems related to these third-party service providers, we experience any delays in shipment, our business, results of operations and financial condition would be adversely affected.

Our failure to manage growth could place a significant strain on our management, operational and financial resources.

Growth places a significant strain on our management, operational and financial resources, and has placed significant demands on our management, which currently includes only three executive officers. In order to manage growth, we will be required to expand existing operations, particularly with respect to customer service and merchandising, to improve existing and implement new operational, financial and inventory systems, procedures and controls.

We have experienced a significant strain on our resources because of:

• | the need to manage relationships with our clients, including musical artists, businesses in the entertainment industry with name brands, and other celebrities; |

• | the need to manage relationships with various technology licensors, advertisers, other web sites and services, Internet service providers and other third parties; |

• | difficulties in hiring and retaining skilled personnel necessary to support our businesses; |

• | the need to train and manage a growing employee base; and |

• | pressures for the continued development of our financial and information management systems. |

Difficulties we may encounter in dealing successfully with the above risks could seriously harm our operations. We cannot offer any assurance that our current personnel, systems, procedures and controls will be adequate to support our future operations or that management will be able to identify, hire, train, retain, motivate and manage required personnel.

If our acquisitions are not successful, or if we are not able to structure future acquisitions in a financially efficient manner, there could be an adverse effect on our business and operations.

If appropriate opportunities present themselves, we may acquire businesses, technologies, services or products that we believe will help us develop and expand our business. The process of integrating an acquired business, technology, service or product may result in operating difficulties and expenditures which we cannot anticipate and may absorb significant management attention that would otherwise be available for further development of our existing business. Moreover, the anticipated benefits of any acquisition may not be realized. Any future acquisitions of other businesses, technologies, services or products might require us to obtain additional equity or debt financing, which might not be available to us on favorable terms or at all, and might be dilutive. Additionally, we may not be able to successfully identify, negotiate or finance future acquisitions or to integrate acquisitions with our current business.

Our Company's success still depends upon the continued services of its current management and other relationships.

We are substantially dependent on the continued services of our management, Gregory Rotman, our President and Chief Executive Officer; Christopher Culross, our Chief Financial Officer, and Richard Rotman, our Chief Operating Officer, Vice President, and Secretary, and with the President of our celebrity services group, Keith Garde. These individuals have acquired specialized knowledge and skills with respect to our Company and our operations and relationships with our clients. As a result, if any of these individuals were to leave our Company, we could face substantial difficulty in hiring qualified successors and could experience a loss in revenue while any successor obtains the necessary training and experience or builds new relationships. We do not maintain any key person life insurance.

-9-

Loss of our key relationships, management and other personnel could result in the loss of key tours.

The live music business is uniquely dependent upon personal relationships, as promoters and executives leverage their existing network of relationships with artists, agents and managers in order to secure the rights to the live music tours and events which are critical to our success. Due to the importance of those industry contacts to our business, the loss of any of our officers, relationships or other key personnel could adversely affect our operations.

Our Company's success will depend on our ability to attract and retain qualified personnel.

We believe that our future success will depend upon our ability to identify, attract, hire, train, motivate and retain other highly skilled managerial, merchandising, accounting, technical consulting, marketing and customer service personnel. We cannot offer assurances that we will be successful in attracting, assimilating or retaining the necessary personnel, and the failure to do so could have a material adverse effect on our business.

Our success depends upon market awareness of our brand.

Development and awareness of our Company will depend largely on our success in increasing our customer and client base. If vendors do not perceive us as an effective marketing and sales channel for their merchandise, or artists do not perceive our Company as offering an entertaining and desirable way to purchase services and merchandise through websites we develop, we may be unsuccessful in promoting and maintaining our brand. If celebrities, musical artists or sports figures do not recognize or trust our name, they will be less likely to engage us for our services. To attract and retain customers and to promote and maintain our Company in response to competitive pressures, we may find it necessary to increase our marketing, networking, and advertising budgets and otherwise to increase substantially our financial commitment to creating and maintaining brand loyalty among vendors, clients and consumers. We will need to continue to devote substantial financial and other resources to increase and maintain the awareness of our online brands among web site users, advertisers and e-commerce entities that we have advertising relationships with through:

• | web advertising, marketing, and social media; |

• | traditional media advertising campaigns; and |

• | providing a high quality user experience. |

Our results of operations could be seriously harmed if our investment of financial and other resources, in an attempt to achieve or maintain a leading position in Internet commerce or to promote and maintain our brand, does not generate a corresponding increase in net revenue, or if the expense of developing and promoting our online brands becomes excessive.

System failures could result in interruptions in our service, which could harm our business.

A key element of our strategy is to generate a high volume of traffic to, and use of, our web sites, and the web sites that we manage. Accordingly, the satisfactory performance, reliability and availability of these web sites, transaction processing systems, network infrastructure and delivery and shipping systems are critical to our operating results, as well as our reputation and our ability to attract and retain customers and maintain adequate customer service levels.

We periodically have experienced minor systems interruptions, including Internet disruptions. Some of the interruptions are due to upgrading our equipment to increase speed and reliability. During these upgrades the outages have generally lasted for a few hours, and even longer, on occasion. Any systems interruptions, including Internet disruptions, which result in the unavailability of these web sites or reduced order fulfillment performance would reduce the volume of goods sold, which could harm our business. In addition to placing increased burdens on our engineering staff, these outages create a large number of user questions and complaints that need to be responded to by our personnel. We cannot offer assurances that:

• | we will be able to accurately project the rate or timing of increases if any, in the use of our web sites; |

• | we will be able to expand and upgrade on a timely basis our systems and infrastructure to accommodate increases in the use of these web sites; |

• | we will have uninterrupted access to the Internet; |

• | our users will be able to reach these web sites; |

• | communications via these web sites will be secure; |

• | we or our suppliers' network will be able to timely achieve or maintain a sufficiently high capacity of data transmission, especially if the customer usage of these web sites increases. |

Any disruption in the Internet access to our web sites or any systems failures could significantly reduce consumer demand for our services, diminish the level of traffic to our web sites, impair our reputation and reduce our commerce and advertising revenues.

-10-

We do not have redundant systems, a disaster recovery plan or alternate providers with respect to our communications hardware and computer hardware.

Our main servers are located within 15 minutes from our corporate headquarters. Our Massachusetts facilities are not protected from fire, flood, power loss, telecommunication failure, break-in and similar events. We do not presently have fully redundant systems, a formal disaster recovery plan or alternative providers of hosting services. A substantial interruption in these systems would have a material adverse effect on our business, results of operations and financial condition.

Our servers are also vulnerable to computer viruses, physical or electronic break-ins, attempts by third parties to deliberately exceed the capacity of our systems and similar disruptive problems. Computer viruses, break-ins or other problems caused by third parties could lead to interruptions, delays, loss of data or cessation in service to users of our services and products and could seriously harm our business and results of operations.

There are certain provisions of Delaware law that could have anti‑takeover effects.

Certain provisions of Delaware law and our Certificate of Incorporation, and Bylaws could make an acquisition of our Company by means of a tender offer, a proxy contest or otherwise, and the removal of our incumbent officers and directors more difficult. Our Certificate of Incorporation and Bylaws do not provide for cumulative voting in the election of directors. Our Bylaws include advance notice requirements for the submission by stockholders of nominations for election to the Board of Directors and for proposing matters that can be acted upon by stockholders at a meeting.

We are subject to the anti‑takeover provisions of Section 203 of the Delaware General Corporation Law (the “DGCL”), which will prohibit us from engaging in a “business combination” with an “interested stockholder” for three years after the date of the transaction in which the person became an interested stockholder unless the business combination is approved in a prescribed manner. Generally, a "business combination" includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. Generally, an "interested stockholder" is a person who, together with affiliates and associates, owns (or within three years prior to the determination of interested stockholder status, did own) 15% or more of a corporation's voting stock. The existence of this provision would be expected to have an anti-takeover effect with respect to transactions not approved in advance by the Board of Directors, including discouraging attempts that might result in a premium over the market price for the shares of common stock held by stockholders. Section 203 could adversely affect the ability of stockholders to benefit from certain transactions which are opposed by the Board or by stockholders owning 15% of our common stock, even though such a transaction may offer our stockholders the opportunity to sell their stock at a price above the prevailing market price.

Our success is dependent in part on our ability to obtain and maintain proprietary protection for our technologies and processes.

Our most important intellectual property relates to the software for our AuctionInc products, our web-hosting services and our research center. We do not have any patents or patent applications for our designs or innovations, except for our patent with respect to our online auction shipping calculator, one of our software products. We may not be able to obtain copyright, patent or other protection for our proprietary technologies or for the processes developed by our employees. Legal standards relating to intellectual property rights in computer software are still developing and this area of the law is evolving with new technologies. Our intellectual property rights do not guarantee any competitive advantage and may not sufficiently protect us against competitors with similar technology.

As part of our confidentiality procedures, we generally enter into agreements with our employees and consultants and limit access to and distribution of our software, documentation and other proprietary information. We cannot offer assurances that the steps we have taken will prevent misappropriation of our technology or that agreements entered into for that purpose will be enforceable. Notwithstanding the precautions we have taken, it might be possible for a third party to copy or otherwise obtain and use our software or other proprietary information without authorization or to develop similar software independently. Policing unauthorized use of our technology is difficult, particularly because the global nature of the Internet makes it difficult to control the ultimate destination or security of software or other data transmitted. The laws of other countries may afford our Company little or no effective protection of its intellectual property. Because our success in part relies upon our technologies, if proper protection is not available or can be circumvented, our business may suffer.

Intellectual property infringement claims would harm our business.

We may in the future receive notices from third parties claiming infringement by our software or other aspects of our business. Any future claim, with or without merit, could result in significant litigation costs and diversion of resources, including the attention of management, and require us to enter into royalty and licensing agreements, which could have a material adverse effect on our business, results of operations and financial condition. Royalty and licensing agreements, if required, may not be available on terms acceptable to the Company or at all. In the future, we may also need to file lawsuits to enforce our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of the proprietary rights of others. This litigation, whether successful or unsuccessful, could result in substantial costs and diversion of resources,

-11-

which could have a material adverse effect on our business, results of operations and financial condition.

Our success is dependent on licensed technologies.

We rely on a variety of technologies that we license from third parties. We license some of our software from third party vendors. We have two perpetual licenses for the proprietary software eCMS and acquired the source codes for the software. We also rely on encryption and authentication technology licensed from a third party through an online user agreement to provide the security and authentication necessary to effect secure transmission of confidential information.

We cannot make any assurances that these third-party technology licenses will continue to be available to us on commercially reasonable terms. Although no single software vendor licensor provides us with irreplaceable software, the termination of a license and the need to obtain and install new software on our systems would interrupt our operations. Our inability to maintain or obtain upgrades to any of these technology licenses could result in delays in completing our proprietary software enhancements and new developments until equivalent technology could be identified, licensed or developed and integrated. These delays would materially and adversely affect our business, results of operations and financial condition.

We may be exposed to liability for content retrieved from our web sites.

We may be exposed to liability for content retrieved from our web sites. Our exposure to liability from providing content on the Internet is currently uncertain. Due to third party use of information and content downloaded from our web sites, we may be subject to claims relating to:

• | the content and publication of various materials based on defamation, libel, negligence, personal injury and other legal theories; |

• | copyright, trademark or patent infringement and wrongful action due to the actions of third parties; and |

• | other theories based on the nature and content of online materials made available through our web sites. |

Our exposure to any related liability could result in us incurring significant costs and could drain our financial and other resources. We do not maintain insurance specifically covering these claims. Liability or alleged liability could further harm our business by diverting the attention and resources of our management and by damaging our reputation in our industry and with our customers.

The Company may be exposed to potential risks relating to our significant deficiencies and material weaknesses in our internal controls over financial reporting.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX 404”), the Securities and Exchange Commission adopted rules requiring public companies to include a report of management on the company's internal control over financial reporting in their annual reports, including Form 10-K. In addition, the independent registered public accounting firm auditing a company's financial statements also must attest to and report on the effectiveness of the Company's internal control over financial reporting as well as the operating effectiveness of the Company's internal controls. We have identified significant deficiencies and material weaknesses in our internal controls and have taken steps to remediate them as cost-effectively as possible. Based on these significant deficiencies and material weaknesses, investors and others may lose confidence in the reliability of our financial statements and our ability to obtain equity or debt financing could suffer.

Risks Associated With Our Industry

The market for online services is intensely competitive with low barriers to entry.

The market for Internet products and services is very competitive. Barriers to entry are relatively low, and current and new competitors can launch new sites at a relatively low cost using commercially available software. We currently or potentially compete with a variety of other companies depending on the type of merchandise and sales format offered to customers. These competitors include:

• | other companies that manage celebrity web sites or that sell concert tour tickets online, such as Live Nation/Ticketmaster/VIP Nation, MusicToday, Ground Control, Artist Arena, and FanAsylum; |

• | a number of indirect competitors that specialize in electronic commerce or derive a substantial portion of their revenue from electronic commerce, including Internet Shopping Network, Shopping.com, Amazon and Ebay |

• | a variety of other companies that offer merchandise similar to ours but through physical auctions and with which we compete for sources of supply. |

We believe that the principal competitive factors affecting our market are the ability to engage celebrities, musical artists, and businesses in the entertainment industry with name brands, the tour activities of our musical artists, and ability to attract customers at favorable customer acquisition costs, operate the web sites in an uninterrupted manner and with acceptable

-12-

speed, provide effective customer service and obtain merchandise at satisfactory prices. We cannot offer any assurances that we can maintain our competitive position against current and potential competitors, especially those with greater financial, marketing, customer support, technical and other resources.

Current competitors have established or may establish cooperative relationships among themselves or directly with celebrities, and musical artists, and with vendors to obtain exclusive or semi‑exclusive sources of merchandise. Accordingly, it is possible that new competitors or alliances may emerge and rapidly acquire market share. Increased competition is likely to result in reduced operating margins, loss of market share and a diminished brand franchise, any one of which could materially adversely affect our business, results of operations and financial condition. Many of our current and potential competitors have significantly greater financial, marketing, customer support, technical and other resources than the Company. As a result, these competitors may be able to secure merchandise from vendors on more favorable terms than we can, and they may be able to respond more quickly to changes in customer preferences or to devote greater resources to the development, promotion and sale of their merchandise than we can.

Our success in providing services and merchandise depends upon the popularity of the musical artist, celebrity, and other entities that we serve.

We provide a full line of services for musical artists, and celebrities, as well as other entities with name brands, including sales of merchandise, online ticketing and fan experiences, and a fan web site. Our success depends in part on the level of popularity of a particular artist, the depth of the fan base, and the continued popularity of the artist. The Company can be adversely affected, and incur substantial loss of revenue, if an entire tour, or one or more shows within a tour, is terminated due to lack of interest, illness, death, or for any other reason. In the event that a show or tour is canceled or postponed, the Company may incur losses for that show, or fail to recoup any advance monies paid to the artist. In addition, we may not be able to obtain sufficient insurance coverage at reasonable costs to adequately protect us against the death, disability or other failure of such artists to continue engaging in revenue-generating activities under those arrangements.

Any inability to fund the significant up-front cash requirements associated with our touring business could result in the loss of key tours.

To secure a tour, including global tours by major artists, or to establish a relationship, we are often asked to advance funds to the artist or celebrity prior to the sale of any tickets for that tour. If we do not have sufficient cash on hand or capacity under any credit agreement to obtain cash to advance the necessary funds for any given tour, we would not be able to secure the artist and our revenue would be negatively impacted.

The live entertainment business is highly sensitive to public tastes and dependent on our ability to secure popular artists and other live entertainment events, and we may be unable to anticipate or respond to changes in consumer preferences, which may result in decreased demand for our services.

Our ability to generate revenue from our entertainment operations is highly sensitive to rapidly changing public tastes and dependent on the availability of popular artists, brands and events. Our success depends in part on our ability to anticipate the tastes of consumers and to offer events that appeal to them. Since we rely on unrelated parties to create and perform live entertainment content, such as concerts, musical performances, or appearances, any unwillingness to tour or lack of availability of popular artists, could limit our ability to generate revenue. In particular, there are a limited number of artists that can headline a major North American or global tour or who can sell out larger venues. If those key artists do not continue to tour, or if we are unable to secure the rights to their future tours, then our business would be adversely affected.

In addition, we often agree to pay an artist an upfront recoupable advance for artist or celebrity appearances, VIP programs, and merchandise, prior to our receiving any operating income. We may agree to advance funds for the artist to record an album, or to pre-fund other artist or brand ventures, and agree to recoup the advance based on future sales. Therefore, if the public is not receptive to the tour, merchandise, album, or other venture, we may incur a loss depending on the amount of any advance or incurred costs relative to any revenue earned. We may not have cancellation insurance policies in place to cover our losses if a performer cancels a tour. Furthermore, consumer preferences change from time to time, and our failure to anticipate, identify or react to these changes could result in reduced demand for our services, which would adversely affect our operating results and profitability.

We may be adversely affected by the deterioration in economic conditions, which could affect consumer and corporate spending and our ability to raise capital, and, therefore, significantly adversely impact our operating results.

A decline in attendance at or reduction in the number of live entertainment events may have an adverse effect on our revenue and operating income. The impact of slowdowns on our business is difficult to predict, but they may result in reductions in ticket sales, sponsorship opportunities and our ability to generate revenue. The risks associated with our businesses may become more acute in periods of slowing economy or recession, which may be accompanied by a decrease in attendance at live entertainment events. Instability in the financial markets as a result of recession or otherwise, as well as

-13-

insufficient financial sector liquidity, also could affect the cost of capital and energy suppliers and our ability to raise capital.

Our business depends on discretionary consumer and corporate spending. Many factors related to corporate spending and discretionary consumer spending, including economic conditions affecting disposable consumer income such as employment, fuel prices, interest and tax rates and inflation can significantly impact our operating results. Business conditions, as well as various industry conditions, including corporate marketing and promotional spending and interest levels, can also significantly impact our operating results. These factors can affect attendance at our events, premium seats, sponsorship, advertising and hospitality spending, concession and souvenir sales, as well as the financial results of sponsors of our venues, events and the industry. Negative factors such as challenging economic conditions, public concerns over additional terrorism and security incidents, particularly when combined, can impact corporate and consumer spending, and one negative factor can impact our results more than another. There can be no assurance that consumer and corporate spending will not be adversely impacted by economic conditions, thereby possibly impacting our operating results and growth.

Market consolidation has created and continues to create companies that are larger and have greater resources than us.

As the online commerce market continues to grow, other companies may enter into business combinations or alliances that strengthen their competitive positions. For example, in early 2010, Live Nation merged with Ticketmaster. The effects that any completed and pending acquisitions and strategic plans may have on us cannot be predicted with accuracy, but some of these companies that maintain divisions that compete with us are aligned with companies that are larger or better established than us. Even though some of the competitive services offered by these companies may comprise a small amount of their business, their potential access to greater financial, marketing and technical resources would put them in a stronger competitive position as compared to our Company. In addition, these companies include television broadcasters with access to unique content and substantial marketing resources that may not be available to our Company.

Security breaches and credit card fraud could harm our business.

We rely on encryption and authentication technology licensed from a third party through an online user agreement to provide the security and authentication necessary to effect secure transmission of confidential information. We believe that a significant barrier to electronic commerce and communications is the secure transmission of confidential information over public networks. We cannot give assurances that advances in computer capabilities, new discoveries in the field of cryptography or other events or developments will not result in a compromise or breach of the algorithms we use to protect customer transaction data. If this compromise of our security were to occur, it could have a material adverse effect on our business, results of operations and financial condition. A party who is able to circumvent our security measures could misappropriate proprietary information or cause interruptions in our operations. To the extent that activities of our Company or third-party contractors involve the storage and transmission of proprietary information, such as credit card numbers, security breaches could expose us to a risk of loss or litigation and possible liability. We may be required to expend significant capital and other resources to protect against the threat of security breaches or to alleviate problems caused by these breaches. We cannot offer assurances that our security measures will prevent security breaches or that failure to prevent these security breaches will not have a material adverse effect on our business.

Our industry may be exposed to increased government regulation.

Our Company is not currently subject to direct regulation by any government agency, other than regulations applicable to businesses generally, and laws or regulations directly applicable to access to, or commerce on, the Internet. Today there are relatively few laws specifically directed towards online services, other than to protect user privacy or children. However, due to the increasing popularity and use of the Internet, it is possible that a number of laws and regulations may be adopted with respect to the Internet, covering issues such as user privacy, freedom of expression, pricing, content and quality of products and services, fraud, taxation, advertising, intellectual property rights and information security. Compliance with additional regulation could hinder our growth or prove to be prohibitively expensive.

The applicability to the Internet of existing laws in various jurisdictions governing issues such as property ownership, sales tax, libel and personal privacy is uncertain and may take years to resolve. In addition, because our service is available over the Internet in multiple states, and we sell to numerous consumers resident in these states, these jurisdictions may claim that we are required to qualify to do business as a foreign corporation in each state. Our failure to qualify as a foreign corporation in a jurisdiction where it is required to do so could subject our Company to taxes and penalties for the failure to qualify. Any new legislation or regulation, or the application of laws or regulations from jurisdictions whose laws do not currently apply to our business, could have a material adverse effect our business, results of operations and financial condition.

-14-

Risks Associated with our Common Stock

Our stock price has been and may continue to be very volatile.

The market price of the shares of our common stock has been, and is likely to be, highly volatile. During the 24 months prior to December 31, 2011, our stock price as traded on the OTC Bulletin Board has ranged from a high of $0.60 per share to a low of $0.08 per share. The variance in our share price makes it difficult to forecast with any certainty the stock price at which you may be able to buy or sell your shares of our common stock. The market price for our stock could be subject to wide fluctuations in response to factors that are out of our control such as:

• | actual or anticipated variations in our results of operations, |

• | announcements of new products, services or technological innovations by our competitors; |

• | developments with respect to patents, copyrights or proprietary rights; |

• | short selling our common stock and stock price manipulation; |

• | developments in Internet regulation; and |

• | general conditions and trends in the Internet, entertainment and electronic commerce industries. |

The trading prices of many technology companies' stock have experienced extreme price and volume fluctuations. These fluctuations often have been unrelated or disproportionate to the operating performance of these companies. These broad market factors may adversely affect the market price of our common stock. These market fluctuations, as well as general economic, political and market conditions such as recessions or interest rate fluctuations, may adversely affect the market price of our common stock. Any negative change in the public's perception of the prospects of Internet or e-commerce companies could depress our stock price regardless of our results.

We have issued options, warrants that have had and will have a dilutive effect on our shareholders.

We have issued numerous options, and convertible securities to acquire our common stock that have had a dilutive effect on our shareholders. We depend on our ability to issue stock and options to conserve cash. We compensate a number of employees and consultants through stock option grants under the Company's 2001 Non-Qualified Stock Option Plan and more recently under the 2011 Non-Qualified Stock Option Plan. One hundred twenty million shares were registered under the 2001 plan since its inception in 2001, and thirty million shares were registered in 2011 under the 2011 plan. Typically, shares are immediately exercised by the employee or consultant. In 2011, employees received options for 2,280,344 shares equal to $526,600 in compensation, and consultants and professionals received 7,211,585 shares equal to $1,693,900 in compensation. Dilution is more substantial when our stock price is low.

We may have difficulty obtaining additional financing as a result of the significant number of shares that have been issued and the few remaining shares available for issuance.

New investors may either decline to make an investment in our Company due to the large number of shares outstanding and the few remaining shares that are authorized and available for issuance.

“Penny stock” regulations may impose certain restrictions on marketability of securities.

The SEC adopted regulations which generally define "penny stock" to be an equity security that has a market price of less than $5.00 per share. Our common stock may be subject to rules that impose additional sales practice requirements on broker-dealers who sell these securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 or $300,000 together with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of these securities and have received the purchaser's prior written consent to the transaction.

Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the "penny stock" rules may restrict the ability of broker-dealers to sell our common stock and may affect the ability to sell our common stock in the secondary market.

The market for our Company's securities is limited and may not provide adequate liquidity.

Our common stock is currently traded on the OTC Bulletin Board (“OTCBB”), a regulated quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter equity securities. As a result, an investor may find it more difficult to dispose of, or obtain accurate quotations as to the price of, our securities than if the securities were

-15-

traded on the Nasdaq Stock market, or another national exchange. There is a limited number of active market makers of our common stock. In order to trade shares of our common stock you must use one of these market makers unless you trade your shares in a private transaction. In the twelve months prior to December 31, 2011, the actual daily trading volume ranged from a low of 26,500 shares of common stock to a high of over 4.3 million shares of common stock with 17 days exceeding a trading volume of 1,000,000 shares. Selling our shares can be more difficult because smaller quantities of shares are bought and sold and news media coverage about us is limited. These factors result in a limited trading market for our common stock and therefore holders of our Company's stock may be unable to sell shares purchased should they desire to do so.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

As of December 31, 2011 the Company maintained its principal office and fulfillment center in Worcester, Massachusetts, and its corporate office in Boston, Massachusetts, both on a tenant-at-will basis. Effective December 7, 2011, the Company entered into an operating lease which expires in April 2016, for 26,061 square feet of office and warehouse space located in Westborough, Massachusetts. The Company closed its Boston office, and occupied the new facility on January 13, 2012. The Company expects to consolidate all of its operations into this new facility in the first half of 2012.

Item 3. Legal Proceedings

From time to time we may be a party to various legal proceedings arising in the ordinary course of our business. Our management is not aware of any litigation outstanding, threatened or pending as of the date hereof by or against us or our properties which we believe would be material to our financial condition or results of operations.

Item 4. Mine Safety Disclosure

None.

-16-

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities

Our common stock, par value $.001 per share, is presently traded on the Over-the-Counter Bulletin Board (“OTCBB”) under the symbol, "PAYDE.OB".

The following table sets forth the high and low bid information for our common stock as reported by OTCBB for the twelve quarters ended December 31, 2011. The quotations from the OTCBB reflect inter-dealer prices without retail mark-up, mark-down, or commission and may not represent actual transactions.

2009 | High | Low | ||||||

Quarter ended March 31, 2009 | $ | 0.23 | $ | 0.08 | ||||

Quarter ended June 30, 2009 | $ | 0.42 | $ | 0.10 | ||||

Quarter ended September 30, 2009 | $ | 0.55 | $ | 0.31 | ||||

Quarter ended December 31, 2009 | $ | 0.60 | $ | 0.28 | ||||

2010 | High | Low | ||||||

Quarter ended March 31, 2010 | $ | 0.52 | $ | 0.27 | ||||

Quarter ended June 30, 2010 | $ | 0.40 | $ | 0.23 | ||||

Quarter ended September 30, 2010 | $ | 0.39 | $ | 0.17 | ||||

Quarter ended December 31, 2010 | $ | 0.40 | $ | 0.23 | ||||

2011 | High | Low | ||||||

Quarter ended March 31, 2011 | $ | 0.34 | $ | 0.22 | ||||

Quarter ended June 30, 2011 | $ | 0.49 | $ | 0.23 | ||||

Quarter ended September 30, 2011 | $ | 0.39 | $ | 0.20 | ||||

Quarter ended December 31, 2011 | $ | 0.27 | $ | 0.12 | ||||

As of May 10, 2012, there were approximately 1,563 holders of record of our common stock. Because many of the shares are held by brokers and other institutions on behalf of stockholders, the Company is unable to estimate the total number of individual stockholders represented by these holders of record.

We have not previously paid cash dividends on our common stock, and intend to utilize current resources to operate the business; thus, it is not anticipated that cash dividends will be paid on our common stock in the foreseeable future.

Equity Compensation Plan Information

Number of Securities To be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available For Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) | |||||

(a) | (b) | (c) | |||||

Equity Compensation Plans Approved by Security Holders | 13,121,952 | $ | 0.104 | — | |||

Equity Compensation Plans Not Approved by Security Holders | 4,061,332 | $ | 0.107 | 19,047,447 | |||

Total | 17,183,284 | $ | 0.105 | 19,047,447 | |||

-17-

Refer to Note 9, Notes to Financial Statements for the Years ended December 31, 2011, 2010, and 2009 incorporated by reference herein from Part II, Item 8, of this Annual Report, for a discussion of the material features of the stock options, warrants and related stock plans.

Recent Sales of Unregistered Securities

None.

Repurchase of Equity Securities

None.

Performance Graph

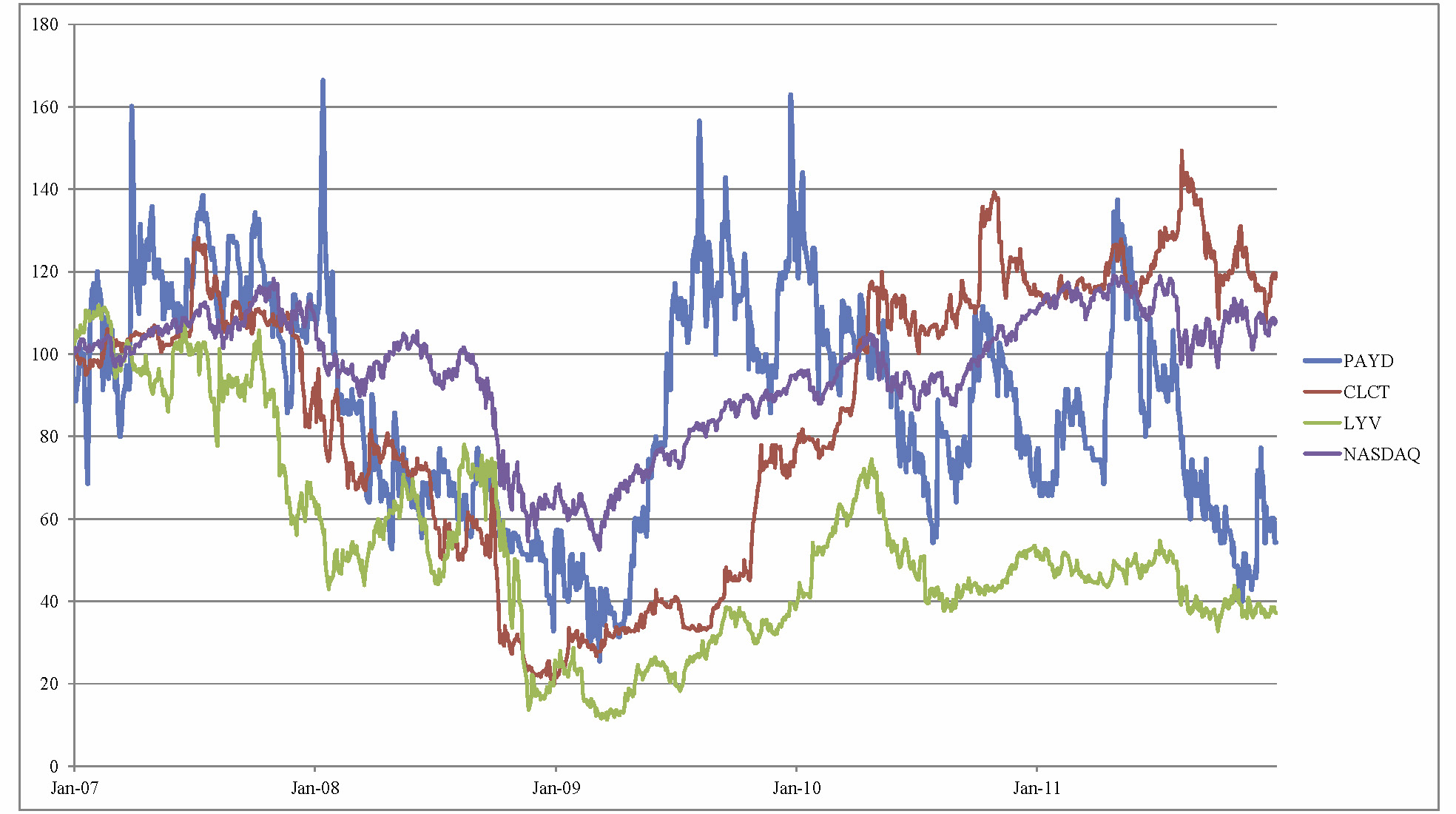

The following graph compares the annual percentage change in our cumulative total stockholder return on our common stock during the period commencing on December 31, 2006 and ending on December 31, 2011 (as measured by dividing (i) the sum of (A) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (B) the difference between our share price at the end and the beginning of the measurement period; by (B) our share price at the beginning of the measurement period) with the cumulative total return of the Nasdaq Stock Exchange Composite Index and two peer issuers, Live Nation, Inc. (NYSE: LYV) and Collectors Universe (NASDAQ: CLCT) during such period. We have not paid any dividends on our common stock, and we do not include dividends in the representation of our performance. The stock price performance on the graph below does not necessarily indicate future price performance.

Company/Index | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||

PAID, INC. | $ | 100 | $ | 111 | $ | 54 | $ | 134 | $ | 74 | $ | 54 | ||||||

Nasdaq Stock Exchange Composite Index | $ | 100 | $ | 110 | $ | 65 | $ | 94 | $ | 110 | $ | 108 | ||||||