UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

OR

For the transition period from to

Commission File Number

(Exact Name of Registrant as Specified in Its Charter)

| ||

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

(Address of Principal Executive Offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

(Former name, former address, and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act

Title of Each Class |

| Trading Symbol |

| Name of Each Exchange on Which Registered |

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer ☐ | Accelerated filer ☐ | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: As of November 06, 2023,

Table of Contents

| PAGE | ||

3 | |||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 27 | ||

43 | |||

43 | |||

44 | |||

44 | |||

82 | |||

82 | |||

82 | |||

82 | |||

83 | |||

88 | |||

2

PART I.

ITEM 1. FINANCIAL STATEMENTS

Seelos Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except share and per share data)

(Unaudited)

| September 30, |

| December 31, | |||

2023 | 2022 | |||||

Assets |

|

|

|

| ||

Current assets |

|

|

|

| ||

Cash | $ | | $ | | ||

Grant receivable | | — | ||||

Prepaid expenses and other current assets |

| |

| | ||

Total current assets |

| |

| | ||

Operating lease right-of-use asset |

| |

| | ||

Total assets | $ | | $ | | ||

Liabilities and stockholders’ equity |

|

|

| |||

Current liabilities |

|

|

| |||

Accounts payable | $ | | $ | | ||

Accrued expenses |

| |

| | ||

Licenses payable |

| — |

| | ||

Short-term portion of convertible notes payable, at fair value |

| |

| | ||

Warrant liabilities, at fair value |

| |

| | ||

Operating lease liability |

| |

| | ||

Total current liabilities |

| |

| | ||

Convertible notes payable, at fair value |

| |

| | ||

Operating lease liability, long-term |

| — |

| | ||

Total liabilities |

| |

| | ||

Commitments and contingencies (note 12) |

|

|

|

| ||

Stockholders’ equity (deficit) |

|

|

|

| ||

Preferred stock, $ |

|

| ||||

Common stock, $ |

| |

| | ||

Additional paid-in-capital |

| |

| | ||

Accumulated deficit |

| ( |

| ( | ||

Total stockholders’ equity (deficit) |

| ( |

| ( | ||

Total liabilities and stockholders’ equity (deficit) | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

Seelos Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

For the Three Months and Nine Months Ended September 30, 2023 and 2022

(In thousands, except share and per share data)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | |||||

Revenue | ||||||||||||

$ | | $ | — | $ | | $ | — | |||||

Total revenue | | — | | — | ||||||||

Operating expense | ||||||||||||

Research and development | | | | | ||||||||

General and administrative |

| |

| |

| |

| | ||||

Total operating expense |

| |

| |

| |

| | ||||

Loss from operations |

| ( |

| ( |

| ( |

| ( | ||||

Other income (expense) |

|

|

|

| ||||||||

Interest income |

| |

| |

| |

| | ||||

Interest expense |

| ( |

| ( |

| ( |

| ( | ||||

Change in fair value of convertible notes |

| ( |

| ( |

| ( |

| ( | ||||

Loss on extinguishment of debt | ( | — | ( | — | ||||||||

Loss on issuance of common stock and warrants | — | — | ( | — | ||||||||

Change in fair value of warrant liabilities |

| |

| ( |

| |

| | ||||

Total other income (expense) |

| |

| ( |

| |

| ( | ||||

Net income (loss) and comprehensive income (loss) | $ | | $ | ( | $ | ( | $ | ( | ||||

Total income (loss) per share basic | $ | $ | ( | $ | ( | $ | ( | |||||

Total loss per share-diluted | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Weighted-average common shares outstanding used for basic | | | | | ||||||||

Weighted-average common shares outstanding used for diluted |

| |

| |

| |

| | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

Seelos Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Stockholders’ Equity (Deficit)

For the Three Months Ended September 30, 2023 and 2022

(In thousands, except share data)

(Unaudited)

Additional | Total | |||||||||||||

Common Stock | Paid-In | Accumulated | Stockholders’ | |||||||||||

| (Shares) |

| (Amount) |

| Capital |

| Deficit |

| Equity | |||||

Balance as of June 30, 2023 | | $ | | $ | | $ | ( | $ | ( | |||||

Stock-based compensation expense | — | — | | — | | |||||||||

Issuance of common stock, warrant exercise |

| |

| |

| |

| — |

| | ||||

Issuance of common stock for payment of convertible notes payable and interest | | | | — | | |||||||||

Issuance of common stock and warrants, net of issuance costs |

| |

| |

| |

| — |

| | ||||

Issuance of common stock, ESPP |

| |

| — |

| |

| — |

| | ||||

Net income |

| — |

| — |

| — |

| |

| | ||||

Balance as of September 30, 2023 | | $ | | $ | | $ | ( | $ | ( | |||||

Additional | Total | |||||||||||||

Common Stock | Paid-In | Accumulated | Stockholders’ | |||||||||||

| (Shares) |

| (Amount) |

| Capital |

| Deficit |

| Equity | |||||

Balance as of June 30, 2022 |

| | $ | | $ | | $ | ( | $ | | ||||

Stock-based compensation expense |

| — |

| — |

| |

| — |

| | ||||

Issuance of common stock for prepaid services |

| |

| — |

| |

| — |

| | ||||

Issuance of common stock for license acquired |

| |

| — |

| — |

| — |

| — | ||||

Issuance of common stock in at-the-market offering, net of issuance costs |

| |

| |

| |

| — |

| | ||||

Issuance of common stock, ESPP |

| |

| — |

| |

| — |

| | ||||

Net loss |

| — |

| — |

| — |

| ( |

| ( | ||||

Balance as of September 30, 2022 |

| | $ | | $ | | $ | ( | $ | | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

Seelos Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Stockholders’ Equity (Deficit)

For the Nine Months Ended September 30, 2023 and 2022

(In thousands, except share data)

(Unaudited)

Additional | Total | |||||||||||||

Common Stock | Paid-In | Accumulated | Stockholders’ | |||||||||||

| (Shares) |

| (Amount) |

| Capital |

| Deficit |

| Equity | |||||

Balance as of December 31, 2022 |

| | $ | | $ | | $ | ( | $ | ( | ||||

Stock-based compensation expense |

| — |

| — |

| |

| — |

| | ||||

Issuance of common stock for prepaid services |

| |

| — |

| |

| — |

| | ||||

Repurchase and retirement of common stock |

| ( |

| ( |

| |

| — |

| — | ||||

Issuance of common stock and warrants |

| |

| |

| |

| — |

| | ||||

Issuance of common stock, warrants exercised |

| |

| |

| |

| — |

| | ||||

Issuance of common stock, convertible note amendment consideration |

| |

| |

| |

| — |

| | ||||

Issuance of common stock for payment of convertible notes payable and interest | | | | — | | |||||||||

Issuance of common stock in at-the-market offering, net of issuance costs | | — | | — | | |||||||||

Issuance of common stock, ESPP |

| |

| — |

| |

| — |

| | ||||

Net loss |

| — |

| — |

| — |

| ( |

| ( | ||||

Balance as of September 30, 2023 | | $ | | $ | | $ | ( | $ | ( | |||||

Additional | Total | |||||||||||||

Common Stock | Paid-In | Accumulated | Stockholders’ | |||||||||||

| (Shares) |

| (Amount) |

| Capital |

| Deficit |

| Equity | |||||

Balance as of December 31, 2021 |

| | $ | | $ | | $ | ( | $ | | ||||

Stock-based compensation expense |

| — |

| — |

| |

| — |

| | ||||

Issuance of common stock, options exercised |

| |

| — |

| |

| — |

| | ||||

Issuance of common stock for prepaid services |

| |

| — |

| |

| — |

| | ||||

Issuance of common stock for license acquired |

| |

| |

| |

| — |

| | ||||

Issuance of common stock in at-the-market offering, net of issuance costs |

| |

| |

| |

| — |

| | ||||

Issuance of common stock, ESPP |

| |

| — |

| |

| — |

| | ||||

Net loss | — | — | — | ( | ( | |||||||||

Balance as of September 30, 2022 |

| | $ | | $ | | $ | ( | $ | | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

Seelos Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

For the Nine Months Ended September 30, 2023 and 2022

(In thousands)

(Unaudited)

Nine Months Ended September 30, | ||||||

| 2023 |

| 2022 | |||

Cash flows from operating activities | ||||||

Net loss | $ | ( | $ | ( | ||

Adjustments to reconcile net loss to net cash used in operating activities |

|

|

|

| ||

Stock-based compensation expense |

| |

| | ||

Change in fair value of warrant liability |

| ( |

| ( | ||

Change in fair value of convertible notes payable | | | ||||

Research and development expense - license amendment | — | | ||||

Loss on issuance of common stock and warrants |

| |

| — | ||

Amortization of right-of-use asset |

| |

| — | ||

Net loss on extinguishment of debt | | — | ||||

Changes in operating assets and liabilities |

|

| ||||

Grant receivable |

| ( |

| — | ||

Prepaid expenses and other current assets |

| |

| ( | ||

Accounts payable |

| |

| | ||

Accrued expenses |

| ( |

| | ||

Derivative liability |

| — |

| ( | ||

Lease liability |

| ( |

| — | ||

Licenses payable | ( | | ||||

Net cash used in operating activities |

| ( |

| ( | ||

Cash flows (used in) provided by financing activities |

|

|

|

| ||

Payment on convertible notes | ( | — | ||||

Proceeds from issuance of common stock and warrants | | — | ||||

Proceeds from issuance of common stock in at-the-market offering | | | ||||

Payment of deferred offering costs | — | ( | ||||

Payment for repurchase of common stock | ( | — | ||||

Proceeds from exercise of options |

| — |

| | ||

Proceeds from sales of common stock under ESPP |

| |

| | ||

Net cash (used in) provided by financing activities |

| |

| | ||

Net (decrease) increase in cash |

| ( |

| ( | ||

Cash, beginning of period |

| |

| | ||

Cash, end of period | $ | | $ | | ||

Supplemental disclosure of cash flow information: |

|

|

|

| ||

Cash paid for interest | $ | | $ | | ||

Cash paid for income taxes | $ | — | $ | — | ||

Non-cash investing and financing activities: |

|

|

|

| ||

Fair value of warrants issued | $ | | $ | — | ||

Fair value of warrants issued in extinguishment of convertible notes | $ | | $ | — | ||

Increase in principal in extinguishment of convertible notes | $ | | $ | — | ||

Issuance of common stock for license payable | $ | — | $ | | ||

Deferred offering costs, accrued but not paid | $ | | $ | | ||

Issunce of common stock for cashless exercise | $ | | $ | — | ||

Issunce of common stock for modification of convertible debt | $ | | $ | — | ||

Issuance of common stock for pincipal payments on convertible notes | $ | | $ | — | ||

Issuance of common stock for interest payments on convertible notes | $ | | $ | — | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

7

Seelos Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. | Organization and Description of Business |

Seelos Therapeutics, Inc. (together with its subsidiaries, the “Company”) is a clinical-stage biopharmaceutical company focused on achieving efficient development of products that address significant unmet needs in Central Nervous System (“CNS”) disorders and other rare disorders. The Company’s lead programs are SLS-002 for the potential treatment of acute suicidal ideation and behavior in patients with major depressive disorder (“ASIB in MDD”) and SLS-005 for the potential treatment of Amyotrophic Lateral Sclerosis (“ALS”) and Spinocerebellar Ataxia (“SCA”). SLS-005 for the potential treatment of Sanfilippo Syndrome currently requires additional natural history data, which is being considered. Additionally, the Company is developing several preclinical programs, most of which have well-defined mechanisms of action, including: SLS-004, SLS-006 and SLS-007 for the potential treatment of Parkinson’s Disease (“PD”). On March 29, 2023, the Company announced that it plans to focus the majority of its resources on the Phase II study of SLS-002 for ASIB in MDD and the fully enrolled Phase II/III study of SLS-005 in ALS. The Company further announced that it has temporarily paused additional enrollment of patients in the SLS-005-302 study in SCA. Patients already enrolled will continue in the study and data will continue to be collected in order to make decisions for resuming enrollment in the future. The Company also announced that it is pausing all non-essential preclinical work.

2. | Liquidity and Going Concern |

The accompanying condensed consolidated unaudited financial statements have been prepared assuming the Company will continue to operate as a going concern, which contemplates the realization of assets and settlement of liabilities in the normal course of business, and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from uncertainty related to its ability to continue as a going concern.

The Company has generated limited revenues, has incurred operating losses since inception, and expects to continue to incur significant operating losses for the foreseeable future and may never become profitable. As of September 30, 2023, the Company had million in cash and an accumulated deficit of $

On September 21, 2023, the Company entered into a Securities Purchase Agreement (the “September 2023 Securities Purchase Agreement”) with certain purchasers identified on the signature pages thereto (the “Purchasers”), pursuant to which, on September 25, 2023, the Company issued and sold

8

On March 10, 2023, the Company entered into a Securities Purchase Agreement (the “March 2023 Securities Purchase Agreement”) with a life sciences-focused investment fund (the “Investor”), pursuant to which, on March 14, 2023, the Company issued and sold an aggregate of

On May 12, 2022, the Company entered into an Open Market Sale AgreementSM (the “Sale Agreement”) with Jefferies LLC, as sales agent (the “Agent”), pursuant to which the Company may offer and sell shares of its common stock from time to time through the Agent (the “ATM Offering”). The Company also filed a prospectus supplement, dated May 12, 2022, with the SEC in connection with the ATM Offering (the “Prospectus Supplement”) under the Company’s existing Registration Statement. Pursuant to the Prospectus Supplement, the Company may offer and sell shares having an aggregate offering price of up to $

On November 21, 2022, the Company received a written notice from Nasdaq indicating that, for the last thirty consecutive business days, the bid price for its common stock had closed below the minimum $

9

On November 1, 2023, the Company received an additional written notice from Nasdaq indicating that, for the last thirty consecutive business days, the bid price for its common stock had closed below the minimum $

Pursuant to the Registration Statement, the Company may offer from time to time any combination of debt securities, common and preferred stock, and warrants. As of September 30, 2023, the Company had approximately $

The Company evaluated whether there are any conditions and events, considered in the aggregate, that raise substantial doubt about its ability to continue as a going concern within one year beyond the filing of this Quarterly Report on Form 10-Q. Based on such evaluation and the Company’s current plans (including the ongoing clinical programs for SLS-002, SLS-005, and other product candidates), which are subject to change, management believes that the Company’s existing cash and cash equivalents as of September 30, 2023 are not sufficient to satisfy its operating cash needs and that there is substantial doubt about its ability to continue as a going concern for the year after the filing of this Quarterly Report on Form 10-Q.

The Company’s future liquidity and capital funding requirements will depend on numerous factors, including:

| ● | its ability to raise additional funds to finance its operations; |

| ● | its ability to maintain compliance with the listing requirements of the Nasdaq Capital Market; |

| ● | the outcome, costs and timing of clinical trial results for the Company’s current or future product candidates; |

| ● | potential litigation expenses; |

| ● | the emergence and effect of competing or complementary products or product candidates; |

| ● | its ability to maintain, expand and defend the scope of its intellectual property portfolio, including the amount and timing of any payments the Company may be required to make, or that it may receive, in connection with the licensing, filing, prosecution, defense and enforcement of any patents or other intellectual property rights; |

10

| ● | its ability to retain its current employees and the need and ability to hire additional management and scientific and medical personnel; |

| ● | the terms and timing of any collaborative, licensing, or other arrangements that it has or may establish; |

| ● | the trading price of its common stock; and |

| ● | its ability to increase the number of authorized shares as may be required to facilitate future financing events. |

The Company may raise substantial additional funds, and if it does so, it may do so through one or more of the following: issuance of additional debt or equity and/or the completion of a licensing or other commercial transaction for one or more of the Company’s product candidates. If the Company is unable to maintain sufficient financial resources, its business, financial condition, and results of operations will be materially and adversely affected. This could affect future development and business activities and potential future clinical studies and/or other future ventures. Failure to obtain additional equity or debt financing will have a material, adverse impact on the Company’s business operations. There can be no assurance that the Company will be able to obtain the needed financing on acceptable terms or at all. Additionally, equity or convertible debt financings will likely have a dilutive effect on the holdings of the Company’s existing stockholders.

3. | Significant Accounting Policies |

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto as of and for the year ended December 31, 2022, included in the Company’s Annual Report on Form 10-K (the “Annual Report”) filed with the SEC on March 10, 2023. The accompanying financial statements have been prepared by the Company in accordance with United States generally accepted accounting principles (“U.S. GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. In the opinion of management, the accompanying unaudited condensed consolidated financial statements for the periods presented reflect all adjustments, consisting of only normal, recurring adjustments, necessary to fairly state the Company’s financial position, results of operations and cash flows. The December 31, 2022 condensed consolidated balance sheet was derived from audited financial statements, but it does not include all U.S. GAAP disclosures. The unaudited condensed consolidated financial statements for the interim periods are not necessarily indicative of results for the full year. The preparation of these unaudited condensed consolidated financial statements requires the Company to make estimates and judgments that affect the amounts reported in the financial statements and the accompanying notes. The Company’s actual results may differ from these estimates under different assumptions or conditions.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. The most significant estimates in the Company’s financial statements relate to the valuation of warrants, valuation of convertible notes payable, and the valuation of stock options. These estimates and assumptions are based on current facts, historical experience and various other factors believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the recording of expenses that are not readily apparent from other sources. Actual results may differ materially and adversely from these estimates. To the extent there are material differences between the estimates and actual results, the Company’s future results of operations will be affected.

Fair Value Measurements

The Company follows the accounting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures (“ASC 820”), for its fair value measurements of financial assets and liabilities measured at fair value on a recurring basis. Under this accounting guidance, fair value is defined as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or a liability.

11

The accounting guidance requires fair value measurements be classified and disclosed in one of the following three categories:

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Observable inputs other than Level 1 prices, for similar assets or liabilities that are directly or indirectly observable in the marketplace.

Level 3: Unobservable inputs which are supported by little or no market activity and that are financial instruments whose values are determined using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the determination of fair value requires significant judgment or estimation.

The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. Assets and liabilities measured at fair value are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

Fair Value Option

As permitted under FASB ASC Topic 825, Financial Instruments (“ASC 825”), the Company elected the fair value option to account for its November 2021 and December 2021 convertible notes (collectively, the “2021 Convertible Notes”). In accordance with ASC 825, the Company records these convertible notes at fair value with changes in fair value recorded in the Condensed Consolidated Statement of Operations and Comprehensive Loss. As a result of applying the fair value option, direct costs and fees related to the convertible notes were expensed as incurred and were not deferred.

Stock-based Compensation

The Company expenses stock-based compensation to employees, non-employees and board members over the requisite service period based on the estimated grant-date fair value of the awards and forfeitures rates. The Company accounts for forfeitures as they occur. Stock-based awards with graded-vesting schedules are recognized on a straight-line basis over the requisite service period for each separately vesting portion of the award. The Company estimates the fair value of stock option grants using the Black-Scholes option pricing model, and the assumptions used in calculating the fair value of stock-based awards represent management’s best estimates and involve inherent uncertainties and the application of management’s judgment. All stock-based compensation costs are recorded in general and administrative or research and development costs in the statements of operations based upon the underlying individual’s role at the Company.

Performance share awards are initially valued based on the Company’s closing stock price on the date of grant. The number of performance share awards that vest will be determined based on the achievement of specified performance milestones by the end of the performance period. Compensation expense for performance awards is recognized over the service period and will vary based on remeasurement during the performance period. If achievement of the performance milestone is not probable of achievement during the performance period, compensation expense is reversed.

Income (Loss) Per Common Share

Basic income (loss) per share is computed by dividing net income (loss) applicable to common stockholders by the weighted average number of shares of common stock outstanding during each period. Diluted loss per share includes the effect, if any, from the potential exercise or conversion of securities, such as convertible debt, warrants, performance-based restricted stock unit awards and stock options that would result in the issuance of incremental shares of common stock. For warrants that are liability-classified, during periods when the impact is dilutive, the Company assumes share settlement of the instruments as of the beginning of the reporting period and adjusts the numerator to remove the change in fair value of the warrant liability and adjusts the denominator to include the dilutive shares calculated using the treasury stock method.

12

The following table sets forth the computation of basic and diluted income (loss) per share (in thousands):

| Three Months Ended September 30, |

| Nine Months Ended September 30, | |||||||||

2023 | 2022 | 2023 | 2022 | |||||||||

Numerator: |

|

| ||||||||||

Net income (loss) attributable to common stockholders - basic | $ | | $ | ( | $ | ( |

| $ | ( | |||

Less: change in fair value of warrant liabilities |

| ( |

| — |

| — |

| — | ||||

Net income (loss) attributable to common stockholders - diluted | $ | ( | $ | ( | $ | ( |

| $ | ( | |||

Denominator: |

|

|

|

|

|

|

|

| ||||

Weighted average common shares outstanding- basic |

| |

| |

| |

| | ||||

Effect of dilutive securities |

| |

| — |

| — |

| — | ||||

Weighted average common shares outstanding - diluted |

| |

| |

| |

| | ||||

Net income (loss) per share attributable to common stockholders - basic | $ | | $ | ( | $ | ( |

| $ | ( | |||

Net income (loss) per share attributable to common stockholders - diluted | $ | ( | $ | ( | $ | ( |

| $ | ( | |||

The following potentially dilutive securities outstanding for the three and nine months ended September 30, 2023 and 2022 have been excluded from the computation of diluted weighted average shares outstanding, as they would be anti-dilutive (in thousands):

Three Months | Nine Months | |||||||

Ended September 30, | Ended September 30, | |||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | |

Outstanding stock options | | | | | ||||

Outstanding warrants |

| |

| |

| |

| |

Convertible debt |

| |

| |

| |

| |

| |

| |

| |

| | |

Amounts in the table reflect the common stock equivalents of the noted instruments.

Recent Accounting Pronouncements

In August 2020, the FASB issued Accounting Standards Update (“ASU”) No. 2020-06: Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity (“ASU 2020-06”). This standard simplifies the accounting for convertible debt instruments by removing the separation models for convertible debt with a cash conversion feature, as well as convertible instruments with a beneficial conversion feature. As a result, entities will account for a convertible debt instrument wholly as debt, unless certain other conditions are met. The elimination of these models will reduce non-cash interest expense for entities that have issued a convertible instrument that was within the scope of those models before the adoption of ASU 2020-06. Additionally, ASU 2020-06 requires the application of the if-converted method for calculating diluted earnings per share and precludes the use of the treasury stock method for certain debt instruments. The provisions of ASU 2020-06 are applicable for the Company beginning after January 1, 2024, with early adoption permitted no earlier than fiscal years beginning after December 15, 2020, and an entity should adopt the provisions at the beginning of its annual fiscal year. The Company has decided to early adopt the provisions of ASU 2020-06 as of January 1, 2023, and the Company does not expect the adoption of ASU 2020-06 to have an impact on its consolidated financial statements and related disclosures.

In June 2022, the FASB issued ASU No. 2022-03: ASC Subtopic 820 - Value Measurement of Equity Securities Subject to Contractual Sale Restrictions (“ASU 2022-03”). ASU 2022-03 amends ASC 820 to clarify that a contractual sales restriction is not considered in measuring an equity security at fair value and to introduce new disclosure requirements for equity securities subject to contractual sale restrictions that are measured at fair value. ASU 2022-03 applies to both holders and issuers of equity and equity-linked securities measured at fair value. The amendments in ASU 2022-03 are effective for the Company for fiscal years beginning after December 15, 2023, and the interim periods within those fiscal years. Early adoption is permitted for both interim and annual

13

financial statements that have not yet been issued or made available for issuance. The Company is evaluating the impact of this pronouncement on its consolidated financial statements and related disclosures.

4. | Fair Value Measurement |

The following tables present information about the Company’s financial assets and liabilities measured at fair value on a recurring basis and indicate the level of the fair value hierarchy utilized to determine such fair values. There were

The Company’s financial assets and liabilities measured at fair value at September 30, 2023 and December 31, 2022 are as follows (in thousands):

Fair Value Measurements | ||||||||||||

as of September 30, 2023 | ||||||||||||

| (Level 1) |

| (Level 2) |

| (Level 3) |

| Total | |||||

Assets: | ||||||||||||

Cash | $ | | $ | — | $ | — | $ | | ||||

Liabilities: |

|

|

|

|

|

|

| |||||

Convertible notes payable, at fair value | $ | — | $ | — | $ | | $ | | ||||

Warrant liabilities, at fair value |

| — |

| — |

| |

| | ||||

$ | — | $ | — | $ | | $ | | |||||

Fair Value Measurements | ||||||||||||

as of December 31, 2022 | ||||||||||||

| (Level 1) |

| (Level 2) |

| (Level 3) |

| Total | |||||

Assets: | ||||||||||||

Cash | $ | | $ | — | $ | — | $ | | ||||

Liabilities: |

|

|

|

|

|

|

|

| ||||

Convertible notes payable, at fair value | $ | — | $ | — | $ | | $ | | ||||

Warrant liabilities, at fair value |

| — |

| — |

| |

| | ||||

$ | — | $ | — | $ | | $ | | |||||

The fair value of the Company’s money market funds is based on quoted active market prices for the funds and is determined using the market approach.

The Company measures the 2021 Convertible Notes and warrant liabilities at fair value based on significant inputs not observable in the market, which causes them to be classified as a Level 3 measurement within the fair value hierarchy. These valuations use assumptions and estimates the Company believes would be made by a market participant in making the same valuation. The Company assesses these assumptions and estimates on an on-going basis as additional data impacting the assumptions and estimates are obtained. Changes in the fair value of the convertible notes payable and warrant liabilities related to updated assumptions and estimates are recognized within the Condensed Consolidated Statements of Operations and Comprehensive Loss.

The fair value of the 2021 Convertible Notes and warrant liabilities may change significantly as additional data is obtained, impacting the Company’s assumptions regarding probabilities of outcomes used to estimate the fair value of the liabilities. The estimates of fair value may not be indicative of the amounts that could be realized in a current market exchange. Accordingly, the use of different market assumptions and/or different valuation techniques may have a material effect on the estimated fair value amounts, and such changes could materially impact the Company’s results of operations in future periods.

14

2021 Convertible Notes

The 2021 Convertible Notes are valued using a Monte Carlo simulation model. The following assumptions were used in determining the fair value of the 2021 Convertible Notes as of September 30, 2023 and December 31, 2022:

| September 30, 2023 |

| December 31, 2022 |

| |||

Risk-free interest rate |

| | % | | % | ||

Volatility |

| | % | | % | ||

Dividend yield |

| — | % | — | % | ||

Contractual term (years) |

|

| |||||

Stock price | $ | | $ | | |||

Warrant Liabilities

The common stock warrant liabilities are recorded at fair value using the Black-Scholes option pricing model.

The following assumptions were used in determining the fair value of the warrant liabilities valued using the Black-Scholes option pricing model as of September 30, 2023 and December 31, 2022:

| September 30, 2023 |

| December 31, 2022 |

| |||

Risk-free interest rate |

| % | | % | |||

Volatility |

| % | | % | |||

Dividend yield |

| — | % | — | % | ||

Expected term (years) |

|

| |||||

Weighted-average fair value | $ | $ | | ||||

The following table is a reconciliation for the common stock warrant liabilities and convertible notes measured at fair value using Level 3 unobservable inputs (in thousands):

Convertible notes, | |||||||||

| Warrant liabilities |

| Derivative liability |

| at fair value | ||||

Balance as of December 31, 2021 | $ | | $ | | $ | | |||

Settlement of derivative liability |

| — |

| ( |

| — | |||

Principal payment of convertible notes, at fair value | — | — | ( | ||||||

Issuance of derivative liability | — | — | — | ||||||

Change in fair value measurement of derivative liability |

| — |

| — |

| — | |||

Change in fair value measurement of convertible notes |

| — |

| — |

| | |||

Change in fair value measurement of warrant liability |

| ( |

| — |

| — | |||

Balance as of December 31, 2022 | $ | | $ | — | $ | | |||

Principal payment of convertible notes, at fair value |

| — |

| — |

| ( | |||

Interest payment of convertible notes, at fair value |

| — |

| — |

| ( | |||

Issuance of convertible note | — | — | | ||||||

Loss on extinguishment of debt | — | — | | ||||||

Change in fair value measurement of convertible notes | — | — | | ||||||

Fair value of warrants issued | | — | — | ||||||

Warrant exercised | ( | — | — | ||||||

Change in fair value measurement of warrant liability |

| ( |

| — |

| — | |||

Balance as of September 30, 2023 | $ | | $ | — | $ | | |||

For the three and nine months ended September 30, 2023, and the year ended December 31, 2022, the changes in fair value of the convertible notes and warrant liability primarily resulted from the volatility of the Company’s common stock and the change in risk-free interest rates.

15

5. | Prepaid Expenses and Other Current Assets |

Prepaid expenses and other current assets are comprised of the following (in thousands):

| September 30, | December 31, | ||||

| 2023 |

| 2022 | |||

Prepaid insurance | $ | | $ | | ||

Prepaid clinical costs |

| |

| | ||

Other |

| |

| | ||

Prepaid expenses and other current assets | $ | | $ | | ||

6.Common Stock Offerings

March 2023 Registered Direct Offering

On March 10, 2023, the Company entered into the March 2023 Securities Purchase Agreement, pursuant to which the Company issued and sold an aggregate of

The March 2023 Pre-Funded Warrants were exercisable immediately upon issuance and had an exercise price of $

The combined purchase price for one share and one accompanying March 2023 Common Warrant to purchase

On May 19, 2023, the Company entered into the 2023 Purchase Agreement Amendment pursuant to which the Investor agreed to, among other things, waive certain restrictions on issuing and registering shares of common stock contained within the 2023 Securities Purchase Agreement to permit the Company to make the May Through September Payments (as defined below) in a combination of cash and shares of common stock as contemplated in the 2021 Note Amendment (as defined below). In consideration for entering into the 2023 Purchase Agreement Amendment, on May 19, 2023, the Company issued to the Investor warrants to purchase up to an aggregate of

September 2023 Registered Direct Offering

On September 21, 2023, The Company entered into the September 2023 Securities Purchase Agreement with certain Purchasers, pursuant to which the Company agreed to issue and sell

The exercise price of the September 2023 Warrants was $

16

September 2023 Warrants remain outstanding. As a result of the exercise of the September 2023 Warrants the Company recognized a $

7. | License Agreements |

Specific information pertaining to each of the Company’s significant license agreements is discussed in its audited financial statements included in the Annual Reports on Form 10-K for the years ended December 31, 2022 and 2021, including their nature and purpose, the significant rights and obligations of the parties, and specific accounting policy elections. The following represents updates for the three and nine months ended September 30, 2023, if applicable, to the Company’s significant license agreements:

Acquisition of Assets from Phoenixus AG f/k/a Vyera Pharmaceuticals, AG and Turing Pharmaceuticals AG (“Vyera”)

On April 8, 2022, Seelos Corporation (“STI”), a wholly-owned subsidiary of the Company, and Vyera, entered into an amendment (the “Amendment”) to the Asset Purchase Agreement by and between STI and Vyera, dated March 6, 2018 (as amended by a first amendment thereto entered into on May 18, 2018, a second amendment thereto entered into on December 31, 2018, a third amendment thereto entered into on October 15, 2019 and a fourth amendment thereto entered into on February 15, 2021, the “Vyera Purchase Agreement”). Pursuant to the Vyera Purchase Agreement, STI acquired the assets and liabilities of Vyera related to a product candidate currently referred to as SLS-002 (intranasal ketamine) (the “Vyera Assets”) and agreed, among other things, to make certain development and commercialization milestone payments and royalty payments related to the Vyera Assets (the “Milestone and Royalty Payment Obligations”) and further agreed that in the event that the Company sold, directly or indirectly, all or substantially all of the Vyera Assets to a third party, then the Company would pay Vyera an amount equal to

Pursuant to the Vyera Purchase Agreement, as amended by the Amendment, STI agreed to (i) make a cash payment to Vyera in the aggregate amount of $

On December 22, 2022, the Company entered into a Share Repurchase Agreement (the “Repurchase Agreement”) with Vyera, pursuant to which the Company agreed to repurchase the Initial Shares and the July 2022 Shares previously issued to Vyera for an aggregate purchase price of $

The Company paid the $

On January 3, 2023, the Company paid $

On January 10, 2023, STI entered into Amendment No. 6 to the Vyera Purchase Agreement (“Amendment No. 6”) with Vyera, pursuant to which, STI agreed to make two cash payments to Vyera of $

17

lieu of issuing the January 2023 Shares to Vyera. The Company paid the $

Acquisition of License from Stuart Weg, MD

On August 29, 2019, the Company entered into an amended and restated exclusive license agreement with Stuart Weg, M.D. (the “Weg License Agreement”), pursuant to which the Company was granted an exclusive worldwide license to certain intellectual property and regulatory materials related to SLS-002. Under the terms of the Weg License Agreement, the Company paid an upfront license fee of $

The remaining potential regulatory and commercial milestones are not yet considered probable, and

8. | Accrued Expenses |

Accrued expenses are comprised of the following (in thousands):

| September 30, |

| December 31, | |||

| 2023 |

| 2022 | |||

Professional fees | $ | | $ | | ||

Personnel related |

| |

| | ||

Outside research and development services |

| |

| | ||

Insurance | | — | ||||

Other |

| |

| | ||

Accrued expenses, net | $ | | $ | | ||

9. | Debt |

Convertible Notes

November 2021 and December 2021 Convertible Notes and Private Placement

On November 23, 2021, the Company entered into a Securities Purchase Agreement (the “2021 Lind Securities Purchase Agreement”) with Lind Global Asset Management V, LLC (“Lind”) pursuant to which, among other things, on November 23, 2021 (the “Closing Date”), the Company issued and sold to Lind, in a private placement transaction (the “Private Placement”), in exchange for the payment by Lind of $

Commencing August 23, 2022, and from time to time and before the Maturity Date, Lind has the option to convert any portion of the then-outstanding Principal Amount of the 2021 Note into shares of common stock at a price per share of $

18

Subject to certain exceptions, the Company will be required to direct proceeds from any subsequent debt financings (including subordinated debt, convertible debt or mandatorily redeemable preferred stock but other than purchase money debt or capital lease obligations or other indebtedness incurred in the ordinary course of business) to repay the 2021 Note, unless waived by Lind in advance.

Beginning on November 23, 2022, the 2021 Note amortizes in monthly installments equal to the quotient of (i) the then-outstanding Principal Amount of the 2021 Note, divided by (ii) the number of months remaining until the Maturity Date. All amortization payments shall be payable, at the Company’s sole option, in cash, shares of common stock or a combination of both. In addition, commencing on the last business day of the first month following November 23, 2022, the Company will pay, on a monthly basis, all interest that has accrued and remains unpaid on the then-outstanding Principal Amount of the 2021 Note. Any portion of an amortization payment or interest payment that is paid in shares of common stock shall be priced at

On May 19, 2023, the Company entered into Amendment No. 3 (the “2021 Note Amendment”) to the 2021 Note, pursuant to which the Company and Lind agreed, among other things, that: (A) effective as of May 19, 2023, the outstanding Principal Amount was increased by $

On September 13, 2023, pursuant to an Irrevocable Waiver, Lind agreed to unilaterally, unconditionally, irrevocably and permanently waive its right to assert that any Event of Default (as defined in the 2021 Note) would be deemed to occur pursuant to the 2021 Note or that the Company breached the 2021 Note if the Company failed to satisfy the Minimum Cash Condition at any time on or after September 15, 2023 and through and including September 30, 2023 (the “Waiver Period”), in each case solely in connection with the Company’s failure to satisfy the Minimum Cash Condition during the Waiver Period.

19

On September 21, 2023, and concurrently with the execution of the September 2023 Securities Purchase Agreement, the Company entered into a letter agreement with Lind related to the 2021 Note (the “Letter Agreement”), pursuant to which the Company and Lind agreed that, in lieu of, and in full satisfaction of, both the monthly payment that would otherwise have been due under the 2021 Note on September 23, 2023 and the interest payment that would otherwise have been due on September 29, 2023, (i) the Company would, by no later than September 29, 2023, pay to Lind cash in an aggregate amount equal to $

On September 30, 2023, the Company and Lind entered into an Amendment No. 4 to the 2021 Note and Amendment to Letter Agreement (the “Amendment”), pursuant to which the Company and Lind agreed, among other things, that: (A) effective as of September 30, 2023, the outstanding principal amount of the 2021 Note was increased by $

On December 2, 2021, the Company entered into two separate securities purchase agreements with certain accredited investors on substantially the same terms as the 2021 Lind Securities Purchase Agreement, pursuant to which the Company sold, in private placement transactions, in exchange for the payment by the accredited investors of an aggregate of $

During the year ended December 31, 2021, the Company received aggregate gross proceeds of $

20

During the nine months ended September 30, 2023, the Company made principal payments of $

The 2021 Note contains certain restrictive covenants and event of default provisions, including a covenant requiring the Company to maintain an aggregate minimum balance equal to

10. | Stockholders’ Equity |

Preferred Stock

The Company is authorized to issue

Common Stock

The Company has authorized

Warrants

September 2023 Warrants

On September 21, 2023, the Company entered into the September 2023 Securities Purchase Agreement, pursuant to which the Company issued and sold an aggregate of

21

May 2023 Warrants

On May 19, 2023, the Company entered into the 2023 Purchase Agreement Amendment, pursuant to which the Investor agreed to, among other things, waive certain restrictions on issuing and registering shares of common stock contained within the 2023 Securities Purchase Agreement to permit the Company to make the May Through September Payments in a combination of cash and shares of common stock as contemplated in the 2021 Note Amendment. In consideration for entering into the 2023 Purchase Agreement Amendment, on May 19, 2023, the Company issued to the Investor warrants to purchase up to an aggregate of

As of September 30, 2023, May 2023 Warrants to purchase

March 2023 Warrants

On March 10, 2023, the Company entered into a securities purchase agreement with a life sciences-focused investment fund pursuant to which the Company issued and sold an aggregate of

During the nine months ended September 30, 2023, March 2023 Pre-Funded Warrants to purchase approximately

September 2020 Warrants

On September 4, 2020, the Company entered into a securities purchase agreement with certain institutional investors pursuant to which the Company issued and sold an aggregate of

During the nine months ended September 30, 2023 and 2022,

August 2019 Warrants

On August 23, 2019, the Company entered into a securities purchase agreement with certain institutional investors pursuant to which the Company issued and sold an aggregate of

During the nine months ended September 30, 2023 and 2022,

22

Series A Warrants

On January 24, 2019, STI and the Company closed a private placement with certain accredited investors pursuant to which, among other things, the Company issued warrants representing the right to acquire

During the nine months ended September 30, 2023 and 2022,

A summary of warrant activity during the nine months ended September 30, 2023 is as follows (share amounts in thousands):

|

| Weighted- | |||||

Weighted- | Average | ||||||

Average | Remaining | ||||||

Exercise | Contractual Life | ||||||

| Warrants |

| Price |

| (in years) | ||

Outstanding as of December 31, 2022 |

| | $ | |

| ||

Issued |

| | $ | |

| ||

Exercised |

| ( | $ | |

| ||

Cancelled |

| ( | $ | |

| ||

Outstanding as of September 30, 2023 |

| | $ | |

| ||

Exercisable as of September 30, 2023 |

| | $ | |

| ||

The September 2023 Warrants, the May 2023 Warrants, the March 2023 Common Warrants, the March 2023 Pre-Funded Warrants and the Series A Warrants were recognized as a liability at their fair value upon issuance. The warrant liability is remeasured to the then fair value prior to their exercise or at period end for warrants that are unexercised, and the gain or loss recognized in earnings during the period.

11. | Stock-based Compensation |

The Company has the Seelos Therapeutics, Inc. Amended and Restated 2012 Stock Long Term Incentive Plan (the “2012 Plan”), which provides for the issuance of incentive and non-incentive stock options, restricted and unrestricted stock awards, stock unit awards and stock appreciation rights. Options and restricted stock units granted generally vest over a period of to

23

On May 15, 2020, the Company’s stockholders approved the Company’s 2020 Employee Stock Purchase Plan (the “ESPP”), whereby qualified employees are allowed to purchase limited amounts of the Company’s common stock at the lesser of

On July 28, 2019, the Compensation Committee adopted the Seelos Therapeutics, Inc. 2019 Inducement Plan (the “2019 Inducement Plan”), which became effective on August 12, 2019. The 2019 Inducement Plan provides for the grant of equity-based awards in the form of stock options, stock appreciation rights, restricted stock, unrestricted stock, stock units, including restricted stock units, performance units and cash awards, solely to prospective employees of the Company or an affiliate of the Company provided that certain criteria are met. Awards under the 2019 Inducement Plan may only be granted to an individual, as a material inducement to such individual to enter into employment with the Company, who (i) has not previously been an employee or director of the Company or (ii) is rehired following a bona fide period of non-employment with the Company. The maximum number of shares available for grant under the 2019 Inducement Plan is

Stock options

During the nine months ended September 30, 2023, the Company granted

During the nine months ended September 30, 2023, the Company also granted

During the nine months ended September 30, 2023, the Company also granted

The fair value of stock option grants is estimated on the date of grant using the Black-Scholes option-pricing model. The Company was historically a private company and lacked sufficient company-specific historical and implied volatility information. Therefore, it estimates its expected stock volatility based on a weighted average blend of the historical volatility of a publicly traded set of peer companies, as well as its own historical volatility. Additionally, due to an insufficient history with respect to stock option activity and post-vesting cancellations, the expected term assumption for employee grants is based on a permitted simplified method, which is based on the vesting period and contractual term for each tranche of awards. The risk-free interest rate is determined by reference to the U.S. Treasury yield curve in effect for time periods approximately equal to the expected term of the award. Expected dividend yield is zero based on the fact that the Company has never paid cash dividends and does not expect to pay any cash dividends in the foreseeable future.

During the nine months ended September 30, 2023,

24

The following assumptions were used in determining the fair value of the stock options granted during the nine months ended September 30, 2023 and 2022:

Nine Months Ended | ||||||

| September 30, 2023 |

| September 30, 2022 | |||

Risk-free interest rate |

|

| ||||

Volatility |

|

| ||||

Dividend yield |

| —% |

| —% | ||

Expected term (years) |

|

| ||||

Weighted-average fair value |

| $ |

| $ | ||

A summary of stock option activity during the nine months ended September 30, 2023 is as follows (share amounts in thousands):

|

| Weighted- |

| |||||||

Weighted- | Average | Total | ||||||||

Average | Remaining | Aggregate | ||||||||

Stock | Exercise | Contractual | Intrinsic | |||||||

| Options |

| Price |

| Life (in years) |

| Value | |||

Outstanding as of December 31, 2022 |

| | $ | |

|

| ||||

Granted |

| |

| |

|

| ||||

Exercised | — | — | ||||||||

Forfeited |

| ( |

| |

|

| ||||

Expired | ( | | ||||||||

Outstanding as of September 30, 2023 |

| | $ | |

| $ | — | |||

Vested and expected to vest as of September 30, 2023 |

| | $ | |

| $ | — | |||

Exercisable as of September 30, 2023 |

| | $ | |

| $ | — | |||

As of September 30, 2023, unrecognized stock-option compensation expense of $

Performance Stock Award

During the year ended December 31, 2021, the Company’s Board of Directors awarded a performance stock unit award to the Company’s Chief Executive Officer for

The following table summarizes the total stock-based compensation expense resulting from share-based awards recorded in the Company’s condensed consolidated statements of operations (in thousands):

Three Months Ended | Nine Months Ended | |||||||||||

September 30, | September 30, | |||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | |||||

Research and development | $ | | $ | | $ | | $ | | ||||

General and administrative |

| |

| |

| |

| | ||||

$ | | $ | | $ | | $ | | |||||

25

12. | Commitments and Contingencies |

Leases

In March 2021, the Company entered into an

Under the new office space rental agreement in October 2022, in exchange for the new operating lease liability, the Company recognized a right-of-use asset of approximately $

As of September 30, 2023, future minimum lease payments for the Company’s operating lease with a non-cancelable term is as follows (in thousands):

| Operating | ||

Leases | |||

Year Ended December 31, 2023 | $ | | |

Year Ended December 31, 2024 |

| | |

Total |

| | |

Less present value discount |

| ( | |

Operating lease liabilities | $ | | |

For the nine months ended September 30, 2023 and 2022, rent expense totaled $

Contractual Commitments

The Company has entered into long-term agreements with certain manufacturers and suppliers that require it to make contractual payment to these organizations. The Company expects to enter into additional collaborative research, contract research, manufacturing, and supplier agreements in the future, which may require up-front payments and long-term commitments of cash.

Litigation

As of September 30, 2023, there was no material litigation against or involving the Company.

26

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Disclosures Regarding Forward-Looking Statements

The following should be read in conjunction with the unaudited condensed consolidated financial statements and the related notes that appear elsewhere in this report as well as in conjunction with the Risk Factors section and in our Annual Report on Form 10- K for the year ended December 31, 2022 as filed with the United States Securities and Exchange Commission (“SEC”) on March 10, 2023 (the “Form 10-K”). This report and the Form 10-K include forward-looking statements made based on current management expectations pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended.

This report includes “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Those statements include statements regarding the intent, belief or current expectations of Seelos Therapeutics, Inc. and its subsidiaries (“we,” “us,” “our,” the “Company” or “Seelos”) and our management team. Any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those projected in the forward-looking statements. These risks and uncertainties include but are not limited to those risks and uncertainties set forth in Part II, Item 1A of this report. In light of the significant risks and uncertainties inherent in the forward-looking statements included in this report, the inclusion of such statements should not be regarded as a representation by us or any other person that our objectives and plans will be achieved. Further, these forward-looking statements reflect our view only as of the date of this report. Except as required by law, we undertake no obligations to update any forward-looking statements and we disclaim any intent to update forward-looking statements after the date of this report to reflect subsequent developments. Accordingly, you should also carefully consider the factors set forth in other reports or documents that we file from time to time with the SEC.

We have common law trademark rights in the unregistered marks “Seelos Therapeutics, Inc.,” “Seelos,” and the Seelos logo in certain jurisdictions. Solely for convenience, trademarks and tradenames referred to in this Quarterly Report on Form 10-Q appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Overview

We are a clinical-stage biopharmaceutical company focused on achieving efficient development of products that address significant unmet needs in Central Nervous System (“CNS”) disorders and other rare disorders.

Recent Developments

Top Line Results from SLS-002 Phase 2 Study in Adults with Major Depressive Disorder at Imminent Risk of Suicide

On September 20, 2023, we announced top line results from our double-blind, placebo-controlled cohort (Part 2) of our Phase 2 study of SLS-002 (intranasal racemic ketamine) for Acute Suicidal Ideation and Behavior in adults with Major

27

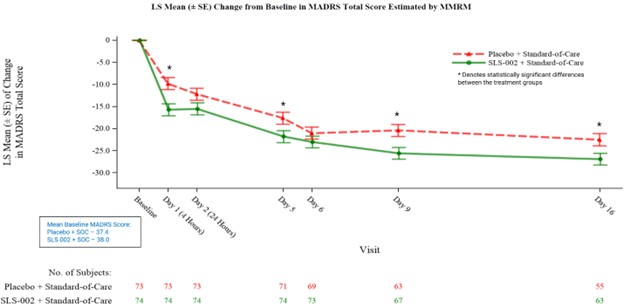

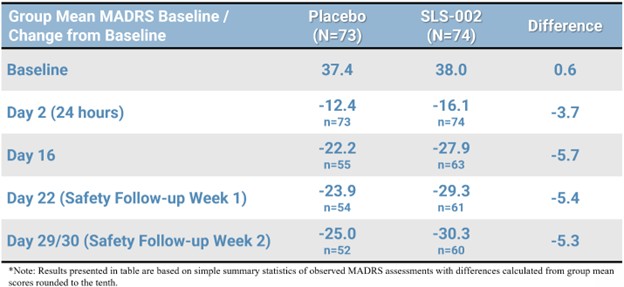

Depressive Disorder. SLS-002 versus placebo demonstrated early and persistent reductions in symptoms of depression as assessed by the Montgomery-Åsberg Depression Rating Scale (“MADRS”).1 The graph below presents results from the mixed model for repeated measures (“MMRM”) analysis of change from baseline in MADRS total score.

Target enrollment of this study was 220 patients, however, due to financial constraints, only 147 patients diagnosed with MDD requiring psychiatric hospitalization due to significant risk of suicide were randomized. The data from the 147 subjects (67% of target enrollment) were evaluated using the protocol-defined methods of analysis. Due to the limited sample size, the study did not meet the pre-defined primary endpoint (MADRS ANCOVA at 24 hours post dosing). However, assuming the same treatment difference and standard deviation, analyses showed that the study would have achieved statistical significance for the primary endpoint, had the study reached full enrollment (220 patients).

Detailed Summary of Key Efficacy Endpoints

| ● | MADRS results at 4 hours after dosing demonstrated a statistically significant change relative to placebo (p <0.001, 5.9 point LS2 mean treatment difference) |

| ● | MADRS results at 24 hours after dosing utilizing 2-way ANCOVA3 with baseline MADRS as a covariate (the pre-defined primary endpoint/analysis) demonstrated clinically meaningful results, but did not achieve statistical significance under the methodology used (p=0.069, 3.3 point LS mean treatment difference) |

| o | MADRS results at 24 hours after dosing utilizing an exploratory ANOVA (t-test) analysis demonstrated statistically significant change relative to placebo (p=0.049, 3.6 point mean treatment difference) |

| ● | MADRS results at Day 16 demonstrated a statistically significant change relative to placebo (p=0.012, 4.4 point LS mean treatment difference) – demonstrating persistence of effect |

| ● | Meaningful results further supported by (proportion of SLS-002 subjects versus placebo, respectively): |

| o | MADRS Response Rate, defined as ≥ 50% reduction from baseline, at Day 16 (75.7% versus 47.9%) p<0.001 |

| o | MADRS Remission Rate, defined as a total score ≤ 12, at Day 16 (62.2% versus 32.9%) p<0.001 |

1 Montgomery-Åsberg Depression Rating Scale (MADRS) scale range 0-60, higher scores indicating more severe depression.

2 Least Squares (LS) Means are means estimated from a linear model that are adjusted for other effects defined in the model.

3 ANCOVA is short for Analysis of Covariance. The analysis of covariance is a combination of an ANOVA and a regression analysis.

28

| ● | MADRS at end of 2-week safety follow up (Day 29/30) revealed continued improvement, demonstrating no evidence of return of symptoms. |

Clinically meaningful reduction in acute suicidality was demonstrated with SLS-002 over placebo. Both groups continued to improve over time.

| ● | Sheehan-Suicidality Tracking Scale (“S-STS”) Total Score4: (Mean baseline total scores were 21.4 for SLS-002 and 21.0 for placebo) |

o | 4 hour change from baseline was -15.1 for SLS-002 and -12.0 for placebo (p=0.022) |

o | 24 hour change from baseline was -15.5 for SLS-002 and -12.1 for placebo (p=0.008) |

| ● | Clinical Global Impression of Severity for Suicidal Ideation and Behavior (“CGIS-S/IB”)5 : (Mean baseline scores were 4.0 for both SLS-002 and placebo) |

o | 4 hour change from baseline was -1.5 for SLS-002 and -1.1 for placebo (p=0.011) |

o | 24 hour change from baseline was -1.7 for SLS-002 and -1.4 for placebo (p=0.102) |

The table below represents the observed MADRS summary statistics, including the assessments collected at the safety follow-up visits.

Detailed Summary of Safety Results

SLS-002 was well-tolerated with no new or unique safety signals identified and there were no deaths reported in the study. At least one treatment-emergent adverse event was reported in 52.7% of subjects treated with SLS-002 versus 39.7% treated with placebo; the majority of adverse events were mild or moderate and transient in nature. The most common treatment-emergent adverse events (≥5% and >placebo) were dizziness (18.9% versus 2.7%), euphoric mood (6.8% versus 0%) and suicidal ideation (5.4% versus 2.7%). There were 5 serious adverse events (3 with SLS-002, 2 with placebo), all for suicidality, all judged unrelated to the study drug, and all resolved.

4 Sheehan-Suicidality Tracking Scale (S-STS) is a clinician-rated scale, which includes 13 suicidality items that are rated on a scale ranging from 0 (not at all) to 4 (extremely), which yields a total score ranging from 0 to 52.

5 Clinical Global Impression of Severity for Suicidal Ideation and Behavior (CGIS-SI/B) is a 5-point clinician-rated measure of suicidality-specific symptom severity, ranging from 1 (not at all suicidal) to 5 (among the most extremely suicidal).

29

Specific scales were utilized to measure the three most common known adverse events associated with ketamine treatments, which are dissociation, hemodynamic effects and sedation. The data below support that SLS-002 may reduce the frequency and severity of these most common effects compared to what is reported with other ketamine treatments.

Clinician-Administered Dissociative States Scale (“CADSS”)6

| ● | At no point did the placebo-adjusted mean change from pre-dose baseline exceed the threshold of clinically meaningful dissociation (>4) |

| ● | Placebo-adjusted mean change from pre-dose baseline (at 40 minutes – correlating roughly with maximum plasma concentrations) = 3.9 after first dose and 1.8 at 1 hour post first dose |

| ● | Placebo-adjusted mean change from pre-dose baseline 2.5 on Day 4 (at 40 minutes) after second dose and 1.4 on Day 8 (at 40 minutes) after third dose |

Hemodynamic Effects

| ● | 6 subjects who received SLS-002 had an adverse event reported of either increased blood pressure or hypertension, all events were mild (except 1 moderate), all were transient and resolved |

| ● | In review of mean vital sign data for SLS-002, minimal changes were observed |

| o | Systolic blood pressure at Baseline was 122.7 mmHg, with maximum mean values of 126.7 mmHg on days 1 and 11 (1 hour post dose) |

| o | Diastolic blood pressure at Baseline was 77.7 mmHg, with maximum mean values of 81.1 mmHg on Day 8 (1 hour post dose) |

Modified Observer’s Assessment of Alertness/Sedation Scale (“MOAA/S”)7

| ● | Maximum sedation (MOAA/S score < 5) occurred approximately 15 minutes after dosing on day 1 (placebo adjusted % of subjects 25.5%) with attenuation over time |

This study randomized 147 subjects diagnosed with MDD requiring psychiatric hospitalization due to significant risk of suicide and severe depression as confirmed by the rating scales as discussed above. In addition, subjects had to have at least one suicide attempt.

After admission to the emergency room or hospital, each subject participated in a 1- to 2-day screening phase, a 16-day treatment phase, including clinical standard of care, during which the study drug was administered 2 times per week (total of 5 doses), and a 2-week safety follow-up phase for a total of up to 5 weeks of study participation. Subjects were treated as inpatients for approximately 7 days (including screening), and assuming the subject met readiness for discharge criteria, were discharged on Day 6 to continue the trial as outpatients. At study completion, all subjects were well-connected with follow-up care to ensure their safety.

Registered Direct Offering

On September 21, 2023, we entered into a securities purchase agreement (the “September 2023 Securities Purchase Agreement”) with certain purchasers identified on the signature pages thereto, pursuant to which we agreed to issue and sell 15,000,000 shares (the “RDO Shares”) of our common stock and accompanying common stock warrants to purchase up to 10,010,010 shares of our common stock (the “September 2023 Warrants”) in a registered direct offering (the “September 2032 RDO”). The RDO Shares and the September 2023 Warrants were offered by us pursuant to our shelf registration statement on Form S-3 (File No. 333-251356) filed with the SEC on December 15, 2020, as amended by Amendment No. 1 thereto filed with the SEC on December 22, 2020 and declared effective on December 23, 2020 (the “Registration Statement”).

6 Clinician-Administered Dissociative States Scale (CADSS) is a standardized instrument used to measure present-state dissociative symptoms. The scale includes 23 subjective items to be answered by the subject according to a 5-point scale (0 = not at all, 1 = mild, 2 = moderate, 3 = severe, and 4 = extreme). CADSS total score range is 0-92; a higher score reflects a more severe condition.

7 Modified Observer’s Assessment of Alertness/Sedation Scale (MOAA/S) is a 6 point scale with a score of 5 defined as responds readily to name, and a score of 0 defined as does not respond to painful stimulus.

30

The exercise price of the September 2023 Warrants was $0.325 per share, subject to adjustment as provided therein, and the September 2023 Warrants were immediately exercisable upon issuance and were to expire on the date that is five years following the original issuance date. In addition, the September 2023 Warrants contained an alternative “cashless exercise” provision whereby a September 2023 Warrant could be exchanged cashlessly for shares of our common stock at the rate of 0.999 of a share of our common stock per full share otherwise issuable upon a cash exercise. On September 26, 2023 and September 27, 2023, the holders of the September 2023 Warrants cashlessly exchanged their September 2023 Warrants in full for an aggregate of 2,222,222 and 7,777,778 shares of common stock, respectively, and no September 2023 Warrants remain outstanding

The combined purchase price for one RDO Share and accompanying September 2023 Warrants to purchase shares of our common stock for each RDO Share purchased was $0.30. The closing of the September 2023 RDO occurred on September 25, 2023. The aggregate net proceeds from the September 2023 RDO, after deducting the fees payable to financial advisors and other estimated offering expenses, were approximately $4.1 million. We intend to use the aggregate net proceeds to repay $0.7 million of principal and accrued interest under that certain Convertible Promissory Note No. 1 issued to Lind Global Asset Management V, LLC (“Lind”) on November 23, 2021, as amended on December 10, 2021, February 8, 2023 and May 19, 2023 (as so amended, the “2021 Note”) as required by the Letter Agreement (as defined below) and the remainder for general corporate purposes and to advance the development of our product candidates. We may also use the net proceeds from the September 2023 RDO to make periodic principal and interest payments under, or to repay a portion of, the 2021 Note.

Letter Agreement Regarding 2021 Note

On September 21, 2023, and concurrently with the execution of the September 2023 Securities Purchase Agreement, we entered into the Letter Agreement with Lind related to the 2021 Note. Pursuant to the Letter Agreement, we and Lind agreed that, in lieu of, and in full satisfaction of, both the monthly principal payment that would otherwise have been due under the 2021 Note on September 23, 2023 and the interest payment that would otherwise have been due on September 29, 2023, (i) we would, by no later than September 29, 2023, pay to Lind cash in an aggregate amount of $0.7 million and (ii) Lind will have the right, at any time and from time to time, between the date of the closing of the September 2023 RDO and the date that is 45 days after the closing of the September 2023 RDO, to convert the remaining amount of the monthly payment that would have otherwise been due on September 24, 2023 in the aggregate amount of up to $0.4 million into shares of our common stock at the lower of (a) the then-current Conversion Price (as defined in the 2021 Note, which is currently $6.00 per share) and (b) 85% of the average of the five (5) lowest daily volume-weighted average price during the twenty (20) trading days prior to the delivery by Lind of the applicable conversion notice (the “Subsequent Conversion Right”). Pursuant to the Letter Agreement, Lind further agreed that (A) the payment date for the monthly payment under the 2021 Note that would otherwise have been due on October 23, 2023, and (B) the interest payment date for the interest payment under the 2021 Note that would otherwise have been due on October 31, 2023, shall be November 9, 2023.

Amendment No. 4 to 2021 Note