| ⌧ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| □ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

06-1456680

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

One Hamden Center, 2319 Whitney Avenue, Suite 3B, Hamden, CT

|

|

06518

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(203) 859-6800

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

TACT

|

NASDAQ Global Market

|

|

Large accelerated filer □

|

Accelerated filer ⌧

|

|

Non-accelerated filer □

|

Smaller reporting company ⌧

|

|

Emerging growth company □

|

|

|

PART I.

|

|

|

Business

|

1

|

|

|

Risk Factors

|

5

|

|

|

Unresolved Staff Comments

|

11

|

|

|

Properties

|

11

|

|

|

Legal Proceedings

|

11

|

|

|

Mine Safety Disclosures

|

11

|

|

|

|

|

|

|

|

PART II.

|

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

12

|

|

|

Selected Financial Data

|

14

|

|

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

14

|

|

|

Quantitative and Qualitative Disclosures About Market Risk

|

26

|

|

|

Financial Statements and Supplementary Data

|

26

|

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

26

|

|

|

Controls and Procedures

|

26

|

|

|

Other Information

|

27

|

|

|

|

|

|

|

|

PART III.

|

|

|

Directors, Executive Officers and Corporate Governance

|

28

|

|

|

Executive Compensation

|

28

|

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

28

|

|

|

Certain Relationships and Related Transactions, and Director Independence

|

28

|

|

|

Principal Accounting Fees and Services

|

28

|

|

|

|

|

|

|

|

PART IV.

|

|

|

Exhibits, Financial Statement Schedules

|

29

|

|

|

Form 10-K Summary

|

31

|

|

|

SIGNATURES

|

|

|

|

|

|

|

|

32

|

||

|

|

|

|

|

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

|

|

|

|

F-1

|

||

|

|

|

|

|

Name

|

|

Age

|

|

Position

|

|

|

Bart C. Shuldman

|

|

|

62

|

|

Chairman of the Board and Chief Executive Officer

|

|

Steven A. DeMartino

|

|

|

50

|

|

President, Chief Financial Officer, Treasurer and Secretary

|

|

Donald E. Brooks

|

|

|

67

|

|

Senior Vice President-Engineering

|

|

Tracey S. Chernay

|

|

|

60

|

|

Senior Vice President, Casino, Gaming and Lottery Sales

|

|

Andrew J. Hoffman

|

|

|

62

|

|

Senior Vice President, Operations

|

|

David B. Peters

|

41

|

Vice President and Chief Accounting Officer

|

|||

|

Raymond T. Walsh, Jr.

|

34

|

Senior Vice President, Global Sales

|

|||

| ● |

delays between our expenditures to develop and market new or enhanced products and consumables and the generation of sales from those products;

|

| ● |

the geographic distribution of our sales and our supply chain;

|

| ● |

market acceptance of our products, both domestically and internationally;

|

| ● |

development of new competitive products by others;

|

| ● |

our responses to price competition;

|

| ● |

our level of research and development activities;

|

| ● |

changes in the amount that we spend to develop, acquire or license new products, consumables, technologies or businesses;

|

| ● |

changes in the amount we spend to promote our products and services;

|

| ● |

changes in the cost of satisfying our warranty obligations and servicing our installed base of products;

|

| ● |

availability of third-party components at reasonable prices;

|

| ● |

general economic and industry conditions, including changes in interest rates affecting returns on cash balances and investments, that affect customer demand;

|

| ● |

fluctuations of world-wide oil and gas prices;

|

| ● |

the dependence of our supply chain on a few, foreign third-party manufacturers and suppliers;

|

| ● |

severe weather events, public health crises, and other external events out of our control that can disrupt our operations or the operations of our customers’ or

suppliers’ facilities; and

|

| ● |

changes in accounting rules.

|

| ● |

technologically advanced products that satisfy the user demands;

|

| ● |

superior customer service;

|

| ● |

high levels of quality and reliability; and

|

| ● |

dependable and efficient distribution networks.

|

| ● |

loss of channel and the ability to bring new products to market;

|

| ● |

concentration of credit risk, including disruption in distribution should the distributors and / or resellers’ financial condition deteriorate;

|

| ● |

reduced visibility to end user demand and pricing issues which makes forecasting more difficult;

|

| ● |

distributors or resellers leveraging their buying power to change the terms of pricing, payment and product delivery schedules; and

|

| ● |

direct competition should a distributor or reseller decide to manufacture printers internally or source printers from a competitor.

|

| ● |

the imposition of additional duties, tariffs, quotas, taxes, trade barriers, capital flow restrictions and other charges on imports and exports by the United States

or the governments of the countries in which we or our manufacturers and suppliers operate;

|

| ● |

delays in the delivery of cargo due to port security considerations, labor disputes such as dock strikes, and our reliance on a limited number of shipping and air

carriers, which may experience capacity issues that adversely affect our ability to ship inventory in a timely manner or for an acceptable cost;

|

| ● |

fluctuations in the value of the U.S. Dollar against foreign currencies, which could restrict sales, or increase costs of purchasing, in foreign countries;

|

| ● |

economic or political instability in any of the countries in which we or our manufacturers or suppliers operate, which could result in a reduction in demand for our

products due to political and economic instability or impair our foreign assets;

|

| ● |

a reduced ability or inability to sell in or purchase from certain markets as a result of export or import restrictions;

|

| ● |

potentially limited intellectual property protection in certain countries, such as China, may limit recourse against infringing products or cause us to refrain from

selling in certain geographic territories; and

|

| ● |

reliance on a limited number of shipping and air carriers who may experience capacity issues that adversely affect our ability to ship inventory in a timely manner

or for an acceptable cost; and

|

| ● |

economic uncertainties and adverse economic conditions (including inflation and recession).

|

| ● |

changes in our business, operations or prospects;

|

| ● |

developments in our relationships with our customers;

|

| ● |

announcements of new products or services by us or by our competitors;

|

| ● |

announcement or completion of acquisitions by us or by our competitors;

|

| ● |

changes in existing or adoption of additional government regulations;

|

| ● |

unfavorable or reduced analyst coverage; and

|

| ● |

prevailing domestic and international market and economic conditions.

|

|

Location

|

Operations Conducted

|

|

Size

(Approx. Sq.

Ft.)

|

|

Owned or

Leased

|

Lease Expiration

Date

|

|||

|

Hamden, Connecticut

|

Executive offices and sales office

|

|

|

11,100

|

|

Leased

|

April 30, 2027

|

||

|

Ithaca, New York*

|

Hardware design and development, assembly and service facility

|

|

|

73,900

|

|

Leased

|

May 31, 2021

|

||

|

Las Vegas, Nevada

|

Software design and development, service center and casino and gaming sales office

|

|

|

19,600

|

|

Leased

|

October 31, 2022

|

||

|

Doncaster, UK

|

Sales office and service center

|

|

|

6,000

|

|

Leased

|

August 26, 2026

|

||

|

Macau, China

|

Sales office

|

|

|

180

|

|

Leased

|

June 30, 2020

|

||

|

|

|

|

|

110,780

|

|

|

|

||

|

|

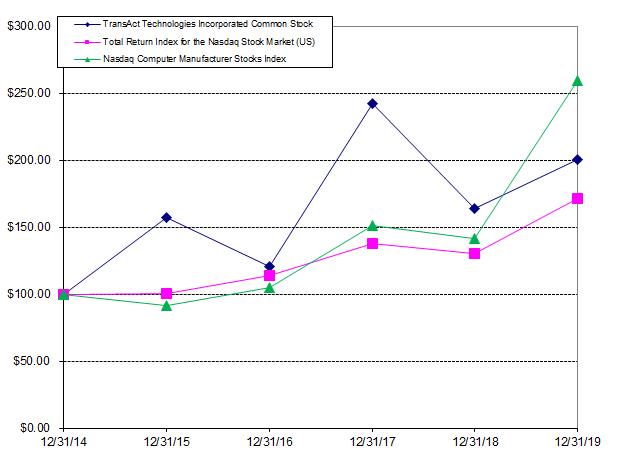

12/31/14

|

12/31/15

|

12/31/16

|

12/31/17

|

12/31/18

|

12/31/19

|

||||||||||||||||||

|

TransAct Technologies Incorporated Common Stock

|

$

|

100.00

|

$

|

157.04

|

$

|

120.66

|

$

|

242.23

|

$

|

164.17

|

$

|

200.55

|

||||||||||||

|

CRSP Total Return Index for the Nasdaq Stock Market (U.S.)

|

$

|

100.00

|

$

|

100.48

|

$

|

113.55

|

$

|

137.83

|

$

|

130.33

|

$

|

170.96

|

||||||||||||

|

Nasdaq Computer Hardware Stocks Index

|

$

|

100.00

|

$

|

91.05

|

$

|

104.94

|

$

|

150.94

|

$

|

141.35

|

$

|

259.32

|

||||||||||||

|

|

Year Ended December 31,

|

|||||||||||||||||||

|

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||

|

Consolidated Statement of Operations Data:

|

||||||||||||||||||||

|

Net sales

|

$

|

45,748

|

$

|

54,587

|

$

|

56,311

|

$

|

57,235

|

$

|

59,676

|

||||||||||

|

Gross profit

|

21,935

|

26,743

|

26,662

|

23,799

|

24,978

|

|||||||||||||||

|

Operating expenses

|

21,592

|

19,984

|

19,848

|

18,599

|

20,510

|

|||||||||||||||

|

Operating income

|

343

|

6,759

|

6,814

|

5,200

|

4,468

|

|||||||||||||||

|

Net income

|

516

|

5,426

|

3,211

|

3,617

|

3,092

|

|||||||||||||||

|

Net income per share:

|

||||||||||||||||||||

|

Basic

|

0.07

|

0.73

|

0.43

|

0.48

|

0.40

|

|||||||||||||||

|

Diluted

|

0.07

|

0.70

|

0.42

|

0.47

|

0.39

|

|||||||||||||||

|

Dividends declared and paid per share

|

0.36

|

0.36

|

0.35

|

0.32

|

0.32

|

|||||||||||||||

|

|

December 31,

|

|||||||||||||||||||

|

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||

|

Consolidated Balance Sheet Data:

|

||||||||||||||||||||

|

Total assets

|

$

|

36,061

|

$

|

34,956

|

$

|

33,950

|

$

|

32,042

|

$

|

32,569

|

||||||||||

|

Shareholders’ equity

|

25,926

|

27,567

|

26,014

|

24,109

|

25,728

|

|||||||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2019

|

December 31, 2018

|

$ |

|

%

|

|||||||||||||||||||

|

Food service technology

|

$

|

6,104

|

13.3

|

%

|

$

|

5,086

|

9.3

|

%

|

$

|

1,018

|

20.0

|

%

|

||||||||||||

|

POS automation and banking

|

5,758

|

12.6

|

%

|

7,273

|

13.3

|

%

|

(1,515

|

)

|

(20.8

|

%)

|

||||||||||||||

|

Casino and gaming

|

21,529

|

47.1

|

%

|

26,593

|

48.7

|

%

|

(5,064

|

)

|

(19.0

|

%)

|

||||||||||||||

|

Lottery

|

1,291

|

2.8

|

%

|

3,093

|

5.7

|

%

|

(1,802

|

)

|

(58.3

|

%)

|

||||||||||||||

|

Printrex

|

1,166

|

2.6

|

%

|

1,297

|

2.4

|

%

|

(131

|

)

|

(10.1

|

%)

|

||||||||||||||

|

TSG

|

9,900

|

21.6

|

%

|

11,245

|

20.6

|

%

|

(1,345

|

)

|

(12.0

|

%)

|

||||||||||||||

|

$

|

45,748

|

100.0

|

%

|

$

|

54,587

|

100.0

|

%

|

$

|

(8,839

|

)

|

(16.2

|

%)

|

||||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2019

|

December 31, 2018

|

$ |

|

%

|

|||||||||||||||||||

|

Food service technology

|

$

|

6,104

|

13.3

|

%

|

$

|

5,086

|

9.3

|

%

|

$

|

1,018

|

20.0

|

%

|

||||||||||||

|

POS automation and banking

|

5,758

|

12.6

|

%

|

7,273

|

13.3

|

%

|

(1,515

|

)

|

(20.8

|

%)

|

||||||||||||||

|

Casino and gaming

|

21,529

|

47.1

|

%

|

26,593

|

48.7

|

%

|

(5,064

|

)

|

(19.0

|

%)

|

||||||||||||||

|

Lottery

|

1,291

|

2.8

|

%

|

3,093

|

5.7

|

%

|

(1,802

|

)

|

(58.3

|

%)

|

||||||||||||||

|

Printrex

|

1,166

|

2.6

|

%

|

1,297

|

2.4

|

%

|

(131

|

)

|

(10.1

|

%)

|

||||||||||||||

|

TSG

|

9,900

|

21.6

|

%

|

11,245

|

20.6

|

%

|

(1,345

|

)

|

(12.0

|

%)

|

||||||||||||||

|

|

$

|

45,748

|

100.0

|

%

|

$

|

54,587

|

100.0

|

%

|

$

|

(8,839

|

)

|

(16.2

|

%)

|

|||||||||||

|

|

||||||||||||||||||||||||

|

International*

|

$

|

10,416

|

22.8

|

%

|

$

|

11,069

|

20.3

|

%

|

$

|

(653

|

)

|

(5.9

|

%)

|

|||||||||||

| * |

International sales do not include sales of products made to domestic distributors or other customers who in turn ship those products to international destinations.

|

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2019

|

December 31, 2018

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

5,522

|

90.5

|

%

|

$

|

4,640

|

91.2

|

%

|

$

|

882

|

19.0

|

%

|

||||||||||||

|

International

|

582

|

9.5

|

%

|

446

|

8.8

|

%

|

136

|

30.5

|

%

|

|||||||||||||||

|

|

$

|

6,104

|

100.0

|

%

|

$

|

5,086

|

100.0

|

%

|

$

|

1,018

|

20.0

|

%

|

||||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2019

|

December 31, 2018

|

$ |

|

%

|

|||||||||||||||||||

|

Hardware

|

$

|

4,169

|

68.3

|

%

|

$

|

4,555

|

89.6

|

%

|

$

|

(386

|

)

|

(8.5

|

%)

|

|||||||||||

|

Software, labels and other recurring revenue

|

1,935

|

31.7

|

%

|

531

|

10.4

|

%

|

1,404

|

264.4

|

%

|

|||||||||||||||

|

|

$

|

6,104

|

100.0

|

%

|

$

|

5,086

|

100.0

|

%

|

$

|

1,018

|

20.0

|

%

|

||||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2019

|

December 31, 2018

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

5,714

|

99.2

|

%

|

$

|

7,122

|

97.9

|

%

|

$

|

(1,408

|

)

|

(19.8

|

%)

|

|||||||||||

|

International

|

44

|

0.8

|

%

|

151

|

2.1

|

%

|

(107

|

)

|

(70.9

|

%)

|

||||||||||||||

|

|

$

|

5,758

|

100.0

|

%

|

$

|

7,273

|

100.0

|

%

|

$

|

(1,515

|

)

|

(20.8

|

%)

|

|||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2019

|

December 31, 2018

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

13,076

|

60.7

|

%

|

$

|

17,518

|

65.9

|

%

|

$

|

(4,442

|

)

|

(25.4

|

%)

|

|||||||||||

|

International

|

8,453

|

39.3

|

%

|

9,075

|

34.1

|

%

|

(622

|

)

|

(6.9

|

%)

|

||||||||||||||

|

|

$

|

21,529

|

100.0

|

%

|

$

|

26,593

|

100.0

|

%

|

$

|

(5,064

|

)

|

(19.0

|

%)

|

|||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2019

|

December 31, 2018

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

1,290

|

99.9

|

%

|

$

|

3,046

|

98.5

|

%

|

$

|

(1,756

|

)

|

(57.6

|

%)

|

|||||||||||

|

International

|

1

|

0.1

|

%

|

47

|

1.5

|

%

|

(46

|

)

|

(97.9

|

%)

|

||||||||||||||

|

|

$

|

1,291

|

100.0

|

%

|

$

|

3,093

|

100.0

|

%

|

$

|

(1,802

|

)

|

(58.3

|

%)

|

|||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2019

|

December 31, 2018

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

961

|

82.4

|

%

|

$

|

1,028

|

79.3

|

%

|

$

|

(67

|

)

|

(6.5

|

%)

|

|||||||||||

|

International

|

205

|

17.6

|

%

|

269

|

20.7

|

%

|

(64

|

)

|

(23.8

|

%)

|

||||||||||||||

|

|

$

|

1,166

|

100.0

|

%

|

$

|

1,297

|

100.0

|

%

|

$

|

(131

|

)

|

(10.1

|

%)

|

|||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2019

|

December 31, 2018

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

8,769

|

88.6

|

%

|

$

|

10,164

|

90.4

|

%

|

$

|

(1,395

|

)

|

(13.7

|

%)

|

|||||||||||

|

International

|

1,131

|

11.4

|

%

|

1,081

|

9.6

|

%

|

50

|

4.6

|

%

|

|||||||||||||||

|

|

$

|

9,900

|

100.0

|

%

|

$

|

11,245

|

100.0

|

%

|

$

|

(1,345

|

)

|

(12.0

|

%)

|

|||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2019

|

2018

|

Change

|

Total Sales - 2019

|

Total Sales - 2018

|

|||||||||||||||

|

Year ended

|

$

|

21,935

|

$

|

26,743

|

(18.0

|

%)

|

47.9

|

%

|

49.0

|

%

|

||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2019

|

2018

|

Change

|

Total Sales - 2019

|

Total Sales - 2018

|

|||||||||||||||

|

Year ended

|

$

|

4,393

|

$

|

4,576

|

(4.0

|

%)

|

9.6

|

%

|

8.4

|

%

|

||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2019

|

2018

|

Change

|

Total Sales - 2019

|

Total Sales - 2018

|

|||||||||||||||

|

Year ended

|

$

|

8,033

|

$

|

7,203

|

11.5

|

%

|

17.6

|

%

|

13.2

|

%

|

||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2019

|

2018

|

Change

|

Total Sales - 2019

|

Total Sales - 2018

|

|||||||||||||||

|

Year ended

|

$

|

9,166

|

$

|

8,205

|

11.7

|

%

|

20.0

|

%

|

15.0

|

%

|

||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2019

|

2018

|

Change

|

Total Sales – 2019

|

Total Sales – 2018

|

|||||||||||||||

|

Year ended

|

$

|

343

|

$

|

6,759

|

(94.9

|

%)

|

0.7

|

%

|

12.4

|

%

|

||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2018

|

December 31, 2017

|

$ |

|

%

|

|||||||||||||||||||

|

Food service technology

|

$

|

5,086

|

9.3

|

%

|

$

|

4,862

|

8.6

|

%

|

$

|

224

|

4.6

|

%

|

||||||||||||

|

POS automation and banking

|

7,273

|

13.3

|

%

|

7,905

|

14.0

|

%

|

(632

|

)

|

(8.0

|

%)

|

||||||||||||||

|

Casino and gaming

|

26,593

|

48.7

|

%

|

18,615

|

33.1

|

%

|

7,978

|

42.9

|

%

|

|||||||||||||||

|

Lottery

|

3,093

|

5.7

|

%

|

9,805

|

17.4

|

%

|

(6,712

|

)

|

(68.5

|

%)

|

||||||||||||||

|

Printrex

|

1,297

|

2.4

|

%

|

1,052

|

1.9

|

%

|

245

|

23.3

|

%

|

|||||||||||||||

|

TSG

|

11,245

|

20.6

|

%

|

14,072

|

25.0

|

%

|

(2,827

|

)

|

(20.1

|

%)

|

||||||||||||||

|

|

$

|

54,587

|

100.0

|

%

|

$

|

56,311

|

100.0

|

%

|

$

|

(1,724

|

)

|

(3.1

|

%)

|

|||||||||||

|

|

||||||||||||||||||||||||

|

International*

|

$

|

11,069

|

20.3

|

%

|

$

|

7,591

|

13.5

|

%

|

$

|

3,478

|

45.8

|

%

|

||||||||||||

| * |

International sales do not include sales of products made to domestic distributors or other customers who in turn ship those products to international destinations.

|

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2018

|

December 31, 2017

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

4,640

|

91.2

|

%

|

$

|

4,488

|

92.3

|

%

|

$

|

152

|

3.4

|

%

|

||||||||||||

|

International

|

446

|

8.8

|

%

|

374

|

7.7

|

%

|

72

|

19.3

|

%

|

|||||||||||||||

|

|

$

|

5,086

|

100.0

|

%

|

$

|

4,862

|

100.0

|

%

|

$

|

224

|

4.6

|

%

|

||||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2018

|

December 31, 2017

|

$ |

|

%

|

|||||||||||||||||||

|

Hardware

|

$

|

4,555

|

89.6

|

%

|

$

|

4,758

|

97.9

|

%

|

$

|

(203

|

)

|

(4.3

|

%)

|

|||||||||||

|

Software, labels and other recurring revenue

|

531

|

10.4

|

%

|

104

|

2.1

|

%

|

427

|

410.6

|

%

|

|||||||||||||||

|

|

$

|

5,086

|

100.0

|

%

|

$

|

4,862

|

100.0

|

%

|

$

|

224

|

4.6

|

%

|

||||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2018

|

December 31, 2017

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

7,122

|

97.9

|

%

|

$

|

7,596

|

96.1

|

%

|

$

|

(474

|

)

|

(6.2

|

%)

|

|||||||||||

|

International

|

151

|

2.1

|

%

|

309

|

3.9

|

%

|

(158

|

)

|

(51.1

|

%)

|

||||||||||||||

|

|

$

|

7,273

|

100.0

|

%

|

$

|

7,905

|

100.0

|

%

|

$

|

(632

|

)

|

(8.0

|

%)

|

|||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2018

|

December 31, 2017

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

17,518

|

65.9

|

%

|

$

|

13,608

|

73.1

|

%

|

$

|

3,910

|

28.7

|

%

|

||||||||||||

|

International

|

9,075

|

34.1

|

%

|

5,007

|

26.9

|

%

|

4,068

|

81.2

|

%

|

|||||||||||||||

|

|

$

|

26,593

|

100.0

|

%

|

$

|

18,615

|

100.0

|

%

|

$

|

7,978

|

42.9

|

%

|

||||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2018

|

December 31, 2017

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

3,046

|

98.5

|

%

|

$

|

8,626

|

88.0

|

%

|

$

|

(5,580

|

)

|

(64.7

|

%)

|

|||||||||||

|

International

|

47

|

1.5

|

%

|

1,179

|

12.0

|

%

|

(1,132

|

)

|

(96.0

|

%)

|

||||||||||||||

|

|

$

|

3,093

|

100.0

|

%

|

$

|

9,805

|

100.0

|

%

|

$

|

(6,712

|

)

|

(68.5

|

%)

|

|||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2018

|

December 31, 2017

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

1,028

|

79.3

|

%

|

$

|

849

|

80.7

|

%

|

$

|

179

|

21.1

|

%

|

||||||||||||

|

International

|

269

|

20.7

|

%

|

203

|

19.3

|

%

|

66

|

32.5

|

%

|

|||||||||||||||

|

|

$

|

1,297

|

100.0

|

%

|

$

|

1,052

|

100.0

|

%

|

$

|

245

|

23.3

|

%

|

||||||||||||

|

|

Year Ended

|

Year Ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2018

|

December 31, 2017

|

$ |

|

%

|

|||||||||||||||||||

|

Domestic

|

$

|

10,164

|

90.4

|

%

|

$

|

13,553

|

96.3

|

%

|

$

|

(3,389

|

)

|

(25.0

|

%)

|

|||||||||||

|

International

|

1,081

|

9.6

|

%

|

519

|

3.7

|

%

|

562

|

108.3

|

%

|

|||||||||||||||

|

|

$

|

11,245

|

100.0

|

%

|

$

|

14,072

|

100.0

|

%

|

$

|

(2,827

|

)

|

(20.1

|

%)

|

|||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2018

|

2017

|

Change

|

Total Sales - 2018

|

Total Sales - 2017

|

|||||||||||||||

|

Year ended

|

$

|

26,743

|

$

|

26,662

|

0.3

|

%

|

49.0

|

%

|

47.3

|

%

|

||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2018

|

2017

|

Change

|

Total Sales - 2018

|

Total Sales - 2017

|

|||||||||||||||

|

Year ended

|

$

|

4,576

|

$

|

4,303

|

6.3

|

%

|

8.4

|

%

|

7.6

|

%

|

||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2018

|

2017

|

Change

|

Total Sales - 2018

|

Total Sales - 2017

|

|||||||||||||||

|

Year ended

|

$

|

7,203

|

$

|

7,561

|

(4.7

|

%)

|

13.2

|

%

|

13.4

|

%

|

||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2018

|

2017

|

Change

|

Total Sales - 2018

|

Total Sales - 2017

|

|||||||||||||||

|

Year ended

|

$

|

8,205

|

$

|

7,984

|

2.8

|

%

|

15.0

|

%

|

14.2

|

%

|

||||||||||

|

|

December 31,

|

Percent

|

Percent of

|

Percent of

|

||||||||||||||||

|

|

2018

|

2017

|

Change

|

Total Sales – 2018

|

Total Sales – 2017

|

|||||||||||||||

|

Year ended

|

$

|

6,759

|

$

|

6,814

|

(0.8

|

%)

|

12.4

|

%

|

12.1

|

%

|

||||||||||

| ● |

We reported a net income of $0.5 million.

|

| ● |

We recorded depreciation and amortization of $1.4 million and share-based compensation expense of $0.7 million.

|

| ● |

Accounts receivable decreased $1.6 million, or 20%, primarily due to strong collections on receivables during the fourth quarter of 2019.

|

| ● |

Inventories decreased $0.8 million, or 6%, primarily due to the utilization of inventory on hand to fulfill sales.

|

| ● |

Prepaid income taxes decreased $0.6 million, or 71%, primarily due to an income tax refund received in the fourth quarter of 2019.

|

| ● |

Other current and long-term assets increased $0.3 million, or 47%, due primarily to an advanced payment of royalty fees to a technology partner for food service

technology.

|

| ● |

Accounts payable decreased $0.5 million, or 15%, primarily due to the utilization of inventory on hand to fulfill sales requiring a lower level of inventory

purchases during the second half of 2019.

|

| ● |

Accrued liabilities and other liabilities increased $0.4 million, or 11%, due primarily to an increase in deferred revenue related to our food service technology

service contracts and software subscriptions.

|

| ● |

We reported a net income of $5.4 million.

|

| ● |

We recorded depreciation and amortization of $1.0 million and share-based compensation expense of $0.6 million.

|

| ● |

Accounts receivable decreased $2.7 million, or 25%, primarily due to the collection of past due receivables from 2017 sales made to our former international

casino and gaming distributor.

|

| ● |

Inventories increased $4.0 million, or 46%, primarily due to the buildup of inventory on hand to support future anticipated sales in the casino and gaming market

and food service technology market.

|

| ● |

Accounts payable decreased $0.3 million, or 9%, primarily due to the timing of inventory purchases in 2017 compared to 2018.

|

| ● |

Accrued liabilities and other liabilities decreased $0.2 million, or 5%, due primarily to a decrease in our accrued incentive compensation.

|

|

Financial Covenant

|

|

Requirement/Restriction

|

|

Calculation at December 31, 2019

|

|

Operating cash flow / Total debt service

|

|

Minimum of 1.25 times

|

|

0

|

|

Funded debt / EBITDA

|

|

Maximum of 3.0 times

|

|

0 times

|

|

|

Payments due by period

|

|||||||||||||||||||

|

(In thousands)

|

Total

|

Less than

1 year

|

1-3 years

|

3-5 years

|

More than

5 years

|

|||||||||||||||

|

Operating lease obligations

|

$

|

3,344

|

$

|

1,042

|

$

|

1,145

|

$

|

541

|

$

|

616

|

||||||||||

|

Purchase obligations

|

9,056

|

$

|

9,056

|

$

|

-

|

–

|

–

|

|||||||||||||

|

Total

|

$

|

12,400

|

$

|

10,098

|

$

|

1,145

|

$

|

541

|

$

|

616

|

||||||||||

|

We did not design and maintain effective controls over user access within the Company’s ERP system,

Oracle, to ensure appropriate segregation of duties and to adequately restrict user access to appropriate personnel. Specifically, the provisioning and user recertification controls are not designed to ensure users maintain proper

segregation of duties and therefore could have inappropriate access rights. (the “Access Control Weakness”).

|

|

We did not design and maintain effective controls over the completeness and accuracy of information

included in key spreadsheets supporting our accounting records (the “Spreadsheet Control Weakness”).

|

|

To address the Access Control Weakness, we are utilizing the services of an Oracle consulting firm to

assist us in analyzing and reviewing Oracle access for all users. During the first quarter of 2020, we completed the analysis and have developed an action plan to modify the designated Oracle responsibilities for each employee with respect

to whom a conflict was identified to remove any Oracle transactional responsibilities that we believe are conflicting and, in some instances, we will reassign those responsibilities to a different employee to ensure proper segregation of

duties. We have begun the design and testing of the new Oracle responsibilities created. In addition, we plan to enhance and implement provisioning and user certification controls to ensure we maintain the appropriate segregation of

duties within Oracle following the analysis.

|

|

To address the Spreadsheet Control Weakness, for each key spreadsheet using Oracle data, we plan to

evaluate and determine (1) if a standard Oracle report exists containing the same information as the spreadsheet, and if so, we would utilize the standard Oracle report (without modification) instead of the spreadsheet to support our

accounting records and (2) if a standard Oracle report cannot be used, we will implement a new key control whereby an employee performs a formal validation that the information from Oracle is completely and accurately transferred

(automatically or manually) to a spreadsheet by verifying totals and other information on a test basis. For all other key spreadsheets, we plan to design and implement a new key control to validate completeness and accuracy of information

supporting our accounting records. During the first quarter of 2020, we began the process of evaluating each key spreadsheet based on the above criteria, and for several key spreadsheets, we implemented a new key control to validate the

completeness and accuracy of the information contained within and supporting each such spreadsheet.

|

|

Plan category

|

(a)

Number of

securities to be

issued upon exercise

of outstanding options,

warrants and rights

|

(b)

Weighted-average

exercise price of

outstanding

options, warrants

and rights

|

(c)

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a)

|

|||||||||

|

Equity compensation plans approved by security holders:

|

||||||||||||

|

2005 Equity Incentive Plan

|

363,500

|

$

|

9.18

|

–

|

||||||||

|

2014 Equity Incentive Plan

|

869,543

|

8.29

|

332,541

|

|||||||||

|

Total

|

1,233,043

|

$

|

8.56

|

332,541

|

||||||||

|

(a)

|

The following documents are filed as part of this Form 10-K:

|

|

1.

|

Financial Statements.

|

|

Report of Independent Registered Public Accounting Firm

|

|

Consolidated Balance Sheets as of December 31, 2019 and 2018

|

|

Consolidated Statements of Income for the years ended December 31, 2019, 2018, and 2017

|

|

Consolidated Statements of Comprehensive Income for the years ended December 31, 2019, 2018 and 2017

|

|

Consolidated Statements of Changes in Shareholders' Equity for the years ended December 31, 2019, 2018 and

2017

|

|

Consolidated Statements of Cash Flows for the years ended December 31, 2019, 2018 and 2017

|

|

Notes to Consolidated Financial Statements

|

|

2.

|

Schedules.

|

|

Certificate of Incorporation of TransAct Technologies Incorporated (conformed copy) (incorporated by reference to Exhibit 3(i) of the Company’s

Quarterly Report on Form 10-Q (SEC File No. 000-21121) filed with the SEC on August 9, 2019).

|

|

|

Certificate of Designation, Series A Preferred Stock, filed with the Secretary of State of Delaware on December 2, 1997 (incorporated by reference

to Exhibit C of the Company’s Current Report on Form 8-K (SEC File No. 000-21121) filed with the SEC on February 18, 1999).

|

|

|

Certificate of Designation, Series B Preferred Stock, filed with the Secretary of State of Delaware on April 6, 2000 (incorporated by reference to

Exhibit 3.1(c) of the Company’s Quarterly Report on Form 10-Q (SEC File No. 000-21121) filed with the SEC on May 8, 2000).

|

|

|

Amended and Restated By-laws of the Company (incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form 8-K (SEC File No.

000-21121) filed with the SEC on August 2, 2019).

|

|

|

Specimen Common Stock Certificate (incorporated by reference to Exhibit 4.1 of the Company’s Registration Statement on Form S-1/A (No. 333-06895)

filed with the SEC on August 1, 1996).

|

|

|

Description of Securities (incorporated by reference to Exhibit 4.2 of the Company's Annual Report on Form 10-K (SEC File No. 000-21121) filed with

the SEC on March 16, 2020.

|

|

|

10.1(x)

|

2005 Equity Incentive Plan (incorporated by reference to Exhibit 99.1 of the Company’s Current Report on Form 8-K (SEC File No. 000-21121) filed

with the SEC on June 1, 2005).

|

|

10.2(x)

|

2014 Equity Incentive Plan (incorporated by reference to Exhibit 10.1 of the Company’s Current Report on Form 8-K (SEC File No. 000-21121) filed

with the SEC on May 19, 2014).

|

|

10.3(x)

|

Amendment to 2014 Equity Incentive Plan approved by Shareholders on May 22, 2017 (incorporated by reference to Exhibit 10.1 of the Company’s

Quarterly Report on Form 10-Q (SEC File No. 000-21121) filed with the SEC on August 9, 2017).

|

|

10.4(x)

|

2014 Equity Incentive Plan Time-based Restricted Stock Unit Agreement (incorporated by reference to Exhibit 10.2 of the Company's Quarterly Report

on Form 10-Q (SEC File No. 000-21121) filed with the SEC on May 6, 2016).

|

|

10.5(x)

|

2014 Equity Incentive Plan Performance-based Restricted Stock Unit Agreement (incorporated by reference to Exhibit 10.1 of the Company's Quarterly

Report on Form 10-Q (SEC File No. 000-211121) filed with the SEC on August 8, 2016).

|

|

10.6(x)

|

Employment Agreement, dated July 31, 1996, by and between TransAct and Bart C. Shuldman (incorporated by reference to Exhibit 10.20 of the

Company’s Registration Statement on Form S-1/A (No. 333-06895) filed with the SEC on August 1, 1996).

|

|

10.7(x)

|

Severance Agreement by and between TransAct and Steven A. DeMartino, dated June 1, 2004 (incorporated by reference to Exhibit 10.8 of the Company’s

Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 16, 2005).

|

|

10.8(x)

|

Severance Agreement by and between TransAct and Tracey S. Chernay, dated July 29, 2005 (incorporated by reference to Exhibit 10.9 of the Company’s

Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 14, 2008).

|

|

10.9(x)

|

Amendment to Employment Agreement, effective January 1, 2008, by and between TransAct and Bart C. Shuldman (incorporated by reference to Exhibit

10.10 of the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 16, 2009).

|

|

10.10(x)

|

Amendment to Severance Agreement by and between TransAct and Steven A. DeMartino, effective January 1, 2008 (incorporated by reference to Exhibit

10.12 of the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 16, 2009).

|

|

10.11(x)

|

Amendment to Severance Agreement by and between TransAct and Tracey S. Chernay, effective January 1, 2008 (incorporated by reference to Exhibit

10.14 of the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 16, 2009).

|

|

Lease Agreement by and between Bomax Properties and Ithaca, dated as of March 23, 1992 (incorporated by reference to Exhibit 10.14 of the Company’s

Registration Statement on Form S-1 (No. 333-06895) filed with the SEC on June 26, 1996).

|

|

|

Second Amendment to Lease Agreement by and between Bomax Properties and Ithaca, dated December 2, 1996 (incorporated by reference to Exhibit 10.27 of the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 31, 1998).

|

|

|

Agreement regarding the Continuation and Renewal of Lease by and between Bomax Properties, LLC and TransAct, dated July 18, 2001 (incorporated by reference to Exhibit 10.8 of the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 29, 2002).

|

|

|

Amendment No. 1 to Lease Agreement between Bomax Properties, LLC and TransAct (incorporated by reference to Exhibit 10.16 of the Company’s

Quarterly Report on Form 10-Q (SEC File No. 000-21121) filed with the SEC on May 10, 2012).

|

|

|

Amendment No. 2 to Lease Agreement between Bomax Properties, LLC and TransAct, dated January 14, 2016 (incorporated by reference to Exhibit 10.13

of the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 11, 2016).

|

|

|

Amendment No. 3 to Lease Agreement between Bomax Properties, LLC and TransAct, dated February 28, 2020 (incorporated by reference to Exhibit 10.1

to the Company’s Current Report on Form 8-K (SEC File No. 000-21121) filed with the SEC on March 4, 2020).

|

|

|

Lease Agreement by and between Las Vegas Airport Properties LLC and TransAct dated December 2, 2004 (incorporated by reference to Exhibit 10.13 of

the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 16, 2005).

|

|

|

First Amendment to Lease Agreement by and between Las Vegas Airport Properties LLC and TransAct dated August 31, 2009 (incorporated by reference to

Exhibit 10.19 of the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 16, 2010).

|

|

|

Second Amendment to Lease Agreement by and between The Realty Associates Fund IX LP and TransAct dated June 30, 2015 (incorporated by reference to

Exhibit 10.2 of the Company’s Quarterly Report on Form 10-Q (SEC File No. 000-21121) filed with the SEC on August 7, 2015).

|

|

|

Lease Agreement by and between 2319 Hamden Center I, L.L.C. and TransAct dated November 27, 2006 (incorporated by reference to Exhibit 10.14 of the

Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 15, 2007).

|

|

|

First Amendment to Lease by and between 2319 Hamden Center I, L.L.C. and TransAct dated January 3, 2017 (incorporated by reference to Exhibit 10.20

of the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 16, 2017).

|

|

|

Amended and Restated Revolving Credit and Security Agreement between TransAct and TD Banknorth, N.A. dated November 28, 2006 (incorporated by

reference filed with the Company's Annual Report on Form 10-K (SEC File No. 000-21121)for the year ended December 31, 2006).

|

|

|

First Amendment to Amended and Restated Revolving Credit and Security Agreement between TransAct and TD Banknorth, N.A. effective September 30,

2007 (incorporated by reference to Exhibit 10.20 of the Company’s Quarterly Report on Form 10-Q (SEC File No. 000-21121) filed with the SEC on November 9, 2007).

|

|

|

Second Amendment to Amended and Restated Revolving Credit and Security Agreement between TransAct and TD Bank, N.A. effective November 22, 2011

(incorporated by reference to Exhibit 10.25 of the Company’s Annual Report on Form 10-K (SEC File No. 000-21121) filed with the SEC on March 12, 2012).

|

|

|

Third Amendment to Amended and Restated Revolving Credit and Security Agreement effective September 7, 2012 (incorporated by reference to Exhibit

10.26 of the Company’s Current Report on Form 8-K (SEC File No. 000-21121) filed with the SEC on September 11, 2012).

|

|

|

Fourth Amendment to Amended and Restated Revolving Credit and Security Agreement effective November 26, 2014 (incorporated by reference to Exhibit

99.1 of the Company’s Current Report on Form 8-K (SEC File No. 000-21121) filed with the SEC on December 1, 2014).

|

|

|

Fifth Amendment to Amended and Restated Revolving Credit and Security Agreement effective November 21, 2017 (incorporated by reference to Exhibit

99.1 to the Company’s Current Report on Form 8-K (SEC File No. 000-21121) filed with the SEC on November 22, 2017).

|

|

|

Subsidiaries of the Company (incorporated by reference to Exhibit 21 of the Company's Annual Report on Form 10-K (SEC File No. 000-21121) filed with

the SEC on March 16, 2020).

|

|

|

Consent of PricewaterhouseCoopers LLP (incorporated by reference to Exhibit 23 of the Company's Annual Report on Form 10-K (SEC File No. 000-21121)

filed witht he SEC on March 16, 2020.

|

|

|

Rule 13a-14(a) Certification of Chief Executive Officer in accordance with Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

Rule 13a-14(a) Certification of Chief Financial Officer in accordance with Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the

Sarbanes-Oxley Act of 2002.

|

|

|

101.INS

|

XBRL Instance Document.

|

|

101.SCH

|

XBRL Taxonomy Extension Schema Document.

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase Document.

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document.

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase Document.

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase Document.

|

| (x) |

Management contract or compensatory plan or arrangement.

|

|

(a)

|

Exhibits.

|

|

(b)

|

Financial Statement Schedules.

|

|

|

TRANSACT TECHNOLOGIES INCORPORATED

|

|

|

|

|

|

|

|

By:

|

/s/ Steven A. DeMartino

|

|

|

Name:

|

Steven A. DeMartino

|

|

|

Title:

|

President, Chief Financial Officer, Treasurer and Secretary

|

|

Financial Statements

|

|

|

F-3

|

|

|

F-4

|

|

|

F-5

|

|

|

F-6

|

|

|

F-7

|

|

|

F-8

|

|

|

F-9

|

|

|

December 31,

2019

|

December 31,

2018

|

||||||

|

Assets:

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

4,203

|

$

|

4,691

|

||||

|

Accounts receivable, net

|

6,418

|

8,025

|

||||||

|

Note receivable

|

1,017

|

–

|

||||||

|

Inventories, net

|

12,099

|

12,835

|

||||||

|

Prepaid income taxes

|

180

|

809

|

||||||

|

Other current assets

|

998

|

677

|

||||||

|

Total current assets

|

24,915

|

27,037

|

||||||

|

|

||||||||

|

Fixed assets, net

|

2,244

|

2,272

|

||||||

|

Right-of-use asset

|

2,855

|

–

|

||||||

|

Goodwill

|

2,621

|

2,621

|

||||||

|

Deferred tax assets

|

2,565

|

2,198

|

||||||

|

Intangible assets, net

|

817

|

797

|

||||||

|

Other assets

|

44

|

31

|

||||||

|

11,146

|

7,919

|

|||||||

|

Total assets

|

36,061

|

34,956

|

||||||

|

|

||||||||

|

Liabilities and Shareholders’ Equity:

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$

|

2,960

|

$

|

3,483

|

||||

|

Accrued liabilities

|

3,041

|

2,765

|

||||||

|

Lease liability

|

945

|

–

|

||||||

|

Deferred revenue

|

700

|

384

|

||||||

|

Total current liabilities

|

7,646

|

6,632

|

||||||

|

|

||||||||

|

Deferred revenue, net of current portion

|

219

|

265

|

||||||

|

Lease liability, net of current portion

|

2,104

|

–

|

||||||

|

Deferred rent, net of current portion

|

–

|

250

|

||||||

|

Other liabilities

|

166

|

242

|

||||||

|

|

2,489

|

757

|

||||||

|

Total liabilities

|

10,135

|

7,389

|

||||||

|

Commitments and contingencies (Note 15)

|

||||||||

|

Shareholders’ equity:

|

||||||||

|

Preferred stock, $0.01 value, 4,800,000 authorized, none issued and outstanding

|

–

|

–

|

||||||

|

Preferred stock, Series A, $0.01 par value, 200,000 authorized, none issued and

outstanding

|

–

|

–

|

||||||

|

Common stock, $0.01 par value, 20,000,000 authorized at December 31, 2019 and 2018;

11,515,090 and 11,463,141 shares issued; 7,470,248 and 7,418,299 shares outstanding, at December 31, 2019 and 2018, respectively

|

115

|

115

|

||||||

|

Additional paid-in capital

|

32,604

|

32,129

|

||||||

|

Retained earnings

|

25,348

|

27,515

|

||||||

|

Accumulated other comprehensive loss, net of tax

|

(31

|

)

|

(82

|

)

|

||||

|

Treasury stock, 4,044,842 shares, at cost

|

(32,110

|

)

|

(32,110

|

)

|

||||

|

Total shareholders’ equity

|

25,926

|

27,567

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

36,061

|

$

|

34,956

|

||||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2019

|

2018

|

2017

|

|||||||||

|

|

||||||||||||

|

Net sales

|

$

|

45,748

|

$

|

54,587

|

$

|

56,311

|

||||||

|

Cost of sales

|

23,813

|

27,844

|

29,649

|

|||||||||

|

|

||||||||||||

|

Gross profit

|

21,935

|

26,743

|

26,662

|

|||||||||

|

|

||||||||||||

|

Operating expenses:

|

||||||||||||

|

Engineering, design and product development

|

4,393

|

4,576

|

4,303

|

|||||||||

|

Selling and marketing

|

8,033

|

7,203

|

7,561

|

|||||||||

|

General and administrative

|

9,166

|

8,205

|

7,984

|

|||||||||

|

|

21,592

|

19,984

|

19,848

|

|||||||||

|

|

||||||||||||

|

Operating income

|

343

|

6,759

|

6,814

|

|||||||||

|

Interest and other income (expense):

|

||||||||||||

|

Interest expense

|

(28

|

)

|

(27

|

)

|

(33

|

)

|

||||||

|

Interest income

|

17

|

–

|

–

|

|||||||||

|

Other, net

|

35

|

(266

|

)

|

(9

|

)

|

|||||||

|

|

24

|

(293

|

)

|

(42

|

)

|

|||||||

|

|

||||||||||||

|

Income before income taxes

|

367

|

6,466

|

6,772

|

|||||||||

|

Income tax (benefit) provision

|

(149

|

)

|

1,040

|

3,561

|

||||||||

|

Net income

|

$

|

516

|

$

|

5,426

|

$

|

3,211

|

||||||

|

|

||||||||||||

|

Net income per common share:

|

||||||||||||

|

Basic

|

$

|

0.07

|

$

|

0.73

|

$

|

0.43

|

||||||

|

Diluted

|

$

|

0.07

|

$

|

0.70

|

$

|

0.42

|

||||||

|

|

||||||||||||

|

Shares used in per-share calculation:

|

||||||||||||

|

Basic

|

7,466

|

7,444

|

7,423

|

|||||||||

|

Diluted

|

7,677

|

7,759

|

7,592

|

|||||||||

|

|

||||||||||||

|

Dividends declared and paid per common share:

|

$

|

0.36

|

$

|

0.36

|

$

|

0.35

|

||||||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2019

|

2018

|

2017

|

|||||||||

|

|

||||||||||||

|

Net income

|

$

|

516

|

$

|

5,426

|

$

|

3,211

|

||||||

|

Foreign currency translation adjustment, net of tax

|

51

|

17

|

10

|

|||||||||

|

|

||||||||||||

|

Comprehensive income

|

$

|

567

|

$

|

5,443

|

$

|

3,221

|

||||||

|

Common Stock

|

Additional

Paid-in

|

Retained

|

Treasury

|

Accumulated

Other

Comprehensive

|

Total

|

|||||||||||||||||||||||

|

|

Shares

|

Amount

|

Capital

|

Earnings

|

Stock

|

Income (Loss)

|

Equity

|

|||||||||||||||||||||

|

Balance, December 31, 2016

|

7,333,364

|

$

|

112

|

$

|

29,701

|

$

|

24,157

|

$

|

(29,752

|

)

|

$

|

(109

|

)

|

$

|

24,109

|

|||||||||||||

|

Issuance of shares from exercise of stock options

|

166,600

|

2

|

1,041

|

–

|

–

|

–

|

1,043

|

|||||||||||||||||||||

|

Issuance of common stock on restricted stock units

|

8,300

|

– |

– |

– |

– |

– |

– |

|||||||||||||||||||||

|

Issuance of common stock on deferred stock units

|

8,663

|

–

|

–

|

–

|

–

|

–

|

–

|

|||||||||||||||||||||

|

Relinquishment of stock awards and deferred stock units to pay withholding taxes

|

(2,368

|

)

|

–

|

(29

|

)

|

–

|

–

|

–

|

(29

|

)

|

||||||||||||||||||

|

Purchase of treasury stock

|

(36,465

|

)

|

–

|

–

|

–

|

(358

|

)

|

–

|

(358

|

)

|

||||||||||||||||||

|

Dividends declared and paid on common stock

|

–

|

–

|

–

|

(2,581

|

)

|

–

|

–

|

(2,581

|

)

|

|||||||||||||||||||

|

Share-based compensation expense

|

–

|

–

|

609

|

–

|

–

|

–

|

609

|

|||||||||||||||||||||

|

Adjustment upon adoptions of ASU 2016-09

|

–

|

–

|

31

|

(31

|

)

|

–

|

–

|

–

|

||||||||||||||||||||

|

Foreign currency translation adjustment, net of tax

|

–

|

–

|

–

|

–

|

–

|

10

|

10

|

|||||||||||||||||||||

|

Net income

|

–

|

–

|

–

|

3,211

|

–

|

–

|

3,211

|

|||||||||||||||||||||

|

Balance, December 31, 2017

|

7,478,094

|

$

|

114

|

$

|

31,353

|

$

|

24,756

|

$

|

(30,110

|

)

|

$

|

(99

|

)

|

$

|

26,014

|

|||||||||||||

|

Issuance of shares from exercise of stock options

|

58,146

|

1

|

415

|

–

|

–

|

–

|

416

|

|||||||||||||||||||||

|

Issuance of common stock on restricted stock units

|

33,935

|

–

|

–

|

–

|

–

|

–

|

–

|

|||||||||||||||||||||

|

Issuance of common stock on deferred stock units

|

23,578

|

–

|

–

|

–

|

–

|

–

|

–

|

|||||||||||||||||||||

|

Relinquishment of stock awards and deferred stock units to pay withholding taxes

|

(19,044

|

)

|

–

|

(268

|

)

|

–

|

–

|

–

|

(268

|

)

|

||||||||||||||||||

|

Purchase of treasury stock

|

(156,410

|

)

|

–

|

–

|

–

|

(2,000

|

)

|

–

|

(2,000

|

)

|

||||||||||||||||||

|

Dividends declared and paid on common stock

|

–

|

–

|

–

|

(2,667

|

)

|

–

|

–

|

(2,667

|

)

|

|||||||||||||||||||

|

Share-based compensation expense

|

–

|

–

|

629

|

–

|

–

|

–

|

629

|

|||||||||||||||||||||

|

Foreign currency translation adjustment, net of tax

|

–

|

–

|

–

|

–

|

–

|

17

|

17

|

|||||||||||||||||||||

|

Net income

|

–

|

–

|

–

|

5,426

|

–

|

–

|

5,426

|

|||||||||||||||||||||

|

Balance, December 31, 2018

|

7,418,299

|

$

|

115

|

$

|

32,129

|

$

|