UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2014

or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to .

Commission file number: 0-21121

______________________________________________________________________

______________________________________________________________________

(Exact name of registrant as specified in its charter)

|

Delaware

|

06-1456680

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

One Hamden Center, 2319 Whitney Avenue, Suite 3B, Hamden, CT

|

06518

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code 203-859-6800

______________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class - Common Stock, par value $.01 per share

|

Name of Exchange on which Registered - NASDAQ Global Market

|

______________________________________________________________________

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer ý

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity stock held by non-affiliates of the Registrant was approximately $82,400,000 based on the last sale price on June 30, 2014.

As of February 27, 2015, the number of shares outstanding of the Registrant’s common stock, $0.01 par value, was 7,784,804.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement to be filed with the Securities and Exchange Commission within 120 days after the year covered by this Form 10-K with respect to the 2015 Annual Meeting of Stockholders are incorporated by reference into Part III hereof.

INDEX

|

Item 1.

|

1

|

|

|

Item 1A.

|

4

|

|

|

Item 1B.

|

9

|

|

|

Item 2.

|

9

|

|

|

Item 3.

|

9

|

|

|

Item 4.

|

9

|

|

|

Item 5.

|

9

|

|

|

Item 6.

|

11

|

|

|

Item 7.

|

11

|

|

|

Item 7A.

|

23

|

|

|

Item 8.

|

23

|

|

|

Item 9.

|

23

|

|

|

Item 9A.

|

23

|

|

|

Item 9B.

|

24

|

|

|

Item 10.

|

24

|

|

|

Item 11.

|

25

|

|

|

Item 12.

|

25

|

|

|

Item 13.

|

25

|

|

|

Item 14.

|

25

|

|

|

Item 15.

|

25

|

|

|

SIGNATURES

|

||

|

26

|

||

|

CONSOLIDATED FINANCIAL STATEMENTS

|

||

|

F-1

|

||

|

EXHIBITS

|

||

The Company

TransAct Technologies Incorporated (“TransAct” or the “Company”) was incorporated in June 1996 and began operating as a stand-alone business in August 1996 as a spin-off of the printer business that was formerly conducted by certain subsidiaries of Tridex Corporation. We completed an initial public offering on August 22, 1996.

TransAct designs, develops and sells market-specific solutions, including printers, terminals, software and other products for transaction-based and other industries. These world-class products are sold under the Epic, EPICENTRAL®, Ithaca®, RESPONDER® and Printrex® brand names. Known and respected worldwide for innovative designs and real-world service reliability, our thermal, inkjet and impact printers and terminals generate top-quality labels and transaction records such as receipts, tickets, coupons, register journals and other documents as well as printed logging and plotting of data. We focus on the following core markets: food safety, banking and point-of-sale (“POS”), casino and gaming, lottery, and Printrex (which serves the oil and gas, medical and mobile printing markets). We sell our products to original equipment manufacturers (“OEMs”), value-added resellers ("VARs"), selected distributors, as well as directly to end-users. Our product distribution spans across the Americas, Europe, the Middle East, Africa, Asia, Australia, the Caribbean Islands and the South Pacific. TransAct also provides world-class printer service, spare parts, accessories and printing supplies to its growing worldwide installed base of printers. Through our TransAct Services Group (“TSG”) we provide a complete range of supplies and consumables used in the printing and scanning activities of customers in the hospitality, banking, retail, casino and gaming, government and oil and gas exploration markets. Through our webstore, www.transactsupplies.com, and our direct selling team, we address the on-line demand for these products. We have one primary operating,global research and development and eastern region service center located in Ithaca, NY. In addition, we have a casino and gaming sales headquarters and western region service center in Las Vegas, NV, a sales and service center for the oil and gas industry in Houston, TX, a European sales and service center in the United Kingdom, a sales office located in Macau and two other sales offices located in the United States. Our executive offices are located at One Hamden Center, 2319 Whitney Avenue, Suite 3B, Hamden, CT, 06518, with a telephone number of (203) 859-6800.

On August 19, 2011, we completed the acquisition of Printrex, Inc. (“Printrex”) for $4,000,000 in cash and potential future contingent consideration. Printrex is a leading manufacturer of specialty printers primarily sold into the oil and gas exploration and medical and mobile printing markets. Printrex serves commercial and industrial customers primarily in the United States, Canada, Europe and Asia. This acquisition was completed to complement our existing product offerings.

Financial Information about Segments

We operate in one reportable segment, the design, development, assembly and marketing of transaction printers and terminals and providing related software, services, supplies and spare parts. Information about our net sales, gross profit and assets can be found in our Consolidated Financial Statements on pages F-3 and F-4 hereof.

Products, Services and Distribution Methods

Printers and terminals

TransAct designs, develops, assembles and markets a broad array of transaction-based and specialty printers and terminals utilizing inkjet, thermal and impact printing technology for applications, primarily in the food safety, banking and POS, casino and gaming, lottery, oil and gas, medical and mobile printing markets. Our printers and terminals are configurable and offer customers the ability to choose from a variety of features and functions. Options typically include interface configuration, mounting configuration, paper cutting devices, paper handling capacities and cabinetry color. In addition to our configurable printers and terminals, we design and assemble custom printers for certain OEM customers. In collaboration with these customers, we provide engineering and manufacturing expertise for the design and development of specialized printers.

Food safety, banking and POS: During 2012 in an effort to address the Food Safety Modernization Act, we developed a food safety terminal, a hardware device that consists of a touchscreen and one or two thermal print mechanisms, that prints easy-to-read expiration and "enjoy by" date labels to help restaurants effectively manage food rotation and spoilage. In the food safety market, we use an internal sales representative to manage sales of our terminals through distribution, as well as a dedicated internal sales force to solicit sales directly from end-users.

Our banking and POS printers include hundreds of optional configurations that can be selected to meet particular customer needs. We believe that this is a significant competitive strength, as it allows us to satisfy a wide variety of printing applications that our customers request. In the banking market, we sell printers that are used by banks, credit unions and other financial institutions to print receipts and/ or validate checks at bank teller stations. In the POS market, we sell several models of printers utilizing inkjet, thermal and impact printing technology. Our printers are used primarily by retailers in the restaurant (including fine dining, casual dining, and fast food), hospitality, and specialty retail industries to print receipts for consumers, validate checks, or print on linerless labels or other inserted media. In the POS market, we primarily sell our products through a network of domestic and international distributors and resellers. We use an internal sales force to manage sales through our distributors and resellers, as well as to solicit sales directly from end-users. In the banking market, we primarily sell our products directly to end-user banks and financial institutions through the use of our internal sales force.

Lottery: We supply lottery printers to Lottomattica’s GTECH Corporation (“GTECH”), our largest customer and the world’s largest provider of lottery terminals. These printers are designed for high-volume, high-speed printing of lottery tickets for various lottery applications. Sales of our lottery products are made directly to GTECH and managed by an internal sales representative.

Casino and gaming: We sell several models of printers used in slot machines and video lottery terminals (“VLT’s”) and other gaming machines that print tickets or receipts instead of issuing coins (“ticket-in, ticket-out” or “TITO”) at casinos, racetracks (“racinos”) and other gaming venues worldwide. These printers utilize thermal printing technology and can print tickets or receipts in monochrome or two-color (depending upon the model), and offer various other features such as jam resistant bezels and a dual port interface that enables casinos to print coupons and promotions. In addition, we sell printers using thermal printing technology for use in non-casino establishments, including game types such as Amusements with Prizes (“AWP”), Skills with Prizes (“SWP”), Fixed Odds Betting Terminals (“FOBT”) and other off-premise gaming type machines around the world. We sell our products primarily to (1) slot machine manufacturers, who incorporate our printers into slot machines and, in turn, sell completed slot machines directly to casinos and other gaming establishments and (2) through our primary worldwide distributor, Suzo-Happ Group. We also maintain a dedicated internal sales force to solicit sales from slot manufacturers and casinos, as well as to manage sales through our distributor.

1

We also offer a software solution, the EPICENTRALTM Print System (“EPICENTRALTM”), that enables casino operators to create promotional coupons and marketing messages and print them in real-time at the slot machine. With EPICENTRALTM, casinos can utilize the system to create multiple promotions and incentives to either increase customer time spent on the casino floor or encourage additional visits to generate more revenue to the casinos.

Printrex: Printrex printers include wide format, rack mounted and vehicle mounted thermal printers used by customers to log and plot oil field and down hole well drilling data in the oil and gas exploration industry. During 2012, we launched two new color printers for this market, the Printrex 920 and Printrex 980. The Printrex 920 is the first full-color printer designed from the ground up to perform in the adverse environment of a well logging truck or off-shore platform. Using thermal printer technology, it can print in black and white, or in full color using proprietary color paper, without the need for inkjet cartridges or ribbons. The Printrex 980 is the fastest full color printer available for plotting continuous logs in the data centers of the large oil field service companies. This printer uses proprietary inkjet cartridges. In 2015, we expect to launch the Responder MP2™, our first printer for the large machine-to-machine (M2M) vertical market. The Responder MP2™ is an all-in-one mobile printing solution for a number of vehicles, including fire, police, EMS, insurance, public utilities and delivery. In addition, we sell wide format thermal printers used to print test results in ophthalmology devices in the medical industry, as well as vehicle mounted printers used to print schematics and certain other critical information in emergency services vehicles and other mobile printing applications. We primarily sell our Printrex products directly to oil field service and drilling companies and OEM’s, as well as through regional distributors in the United States, Europe, Canada and Asia. We also maintain a dedicated internal sales force with a sales office located in Houston, Texas.

TSG:Through TSG, we proactively market the sale of consumable products (including inkjet cartridges, ribbons, receipt paper, color thermal paper and other printing supplies), replacement parts, maintenance and repair services and testing services for all of our products and certain competitor’s products. Our maintenance services include the sale of extended warranties, multi-year maintenance contracts, 24-hour guaranteed replacement product service called TransAct XpressSM, and other repair services for our printers. Within the United States, we provide repair services through our eastern region service center in Ithaca, NY, our western region service center in Las Vegas, NV and our oil and gas industry service center in Houston, TX. Internationally, we provide repair services through our European service center located in Doncaster, United Kingdom, and through partners strategically located around the world.

We also provide customers with telephone sales and technical support, and a personal account representative to handle orders, shipping and general information. Technical and sales support personnel receive training on all of our manufactured products and our services.

In addition to personalized telephone and technical support, we also market and sell consumable products 24 hours a day, seven days a week, via our online webstore www.transactsupplies.com.

Sources and Availability of Raw Materials

We design our products to optimize product performance, quality, reliability and durability. These designs combine cost efficient materials, sourcing and assembly methods with high standards of workmanship. Approximately 95% of our printer production is primarily through one third-party contract manufacturer in Asia and to a lesser extent one other in Asia and one in Mexico. The remaining 5% of our products are assembled in our Ithaca, NY facility largely on a configure-to-order basis using components and subassemblies that have been sourced from vendors and contract manufacturers around the world.

We procure component parts and subassemblies for use in the assembly of our products in Ithaca, NY. Critical component parts and subassemblies include inkjet, thermal and impact print heads, printing/cutting mechanisms, power supplies, motors, injection molded plastic parts, LCD screens, circuit boards and electronic components, which are obtained from domestic and foreign suppliers at competitive prices. As a result of the majority of our production being performed by our contract manufacturers, purchases of component parts have declined while purchases of fully-assembled printers produced by our contract manufacturers have increased. We typically strive to maintain more than one source for our component parts, subassemblies and fully assembled printers to reduce the risk of parts shortages or unavailability. However, we could experience temporary disruption if certain suppliers ceased doing business with us, as described below.

We currently buy substantially all of our thermal print mechanisms, an important component of our thermal printers, and fully assembled printers for several of our printer models, from one foreign contract manufacturer, and to a much lesser extent, two other foreign contract manufacturers. Although we believe that other contract manufacturers could provide similar thermal print mechanisms or fully assembled printers, on comparable terms, a change in contract manufacturers could cause a delay in manufacturing and possible loss of sales, which may have a material adverse effect on our operating results. Although we do not have a supply agreement with our foreign contract manufacturers, our relationship with them remains strong and we have no reason to believe that they will discontinue their supply of thermal print mechanisms to us during 2015 or that their terms to us will be any less favorable than they have been historically.

Hewlett-Packard Company (“HP”) is the sole supplier of inkjet cartridges that are used in all of our banking inkjet printers. In addition, we also sell a substantial number of HP inkjet cartridges as a consumable product through TSG. Although other inkjet cartridges that are compatible with our banking inkjet printers are available, the loss of the supply of HP inkjet cartridges could have a material adverse effect on both the sale of our inkjet printers and TSG consumable products. Our relationship with HP remains stable and we have no reason to believe that HP will discontinue its supply of inkjet cartridges to us or that their terms to us will be materially different than they have been historically. The inkjet cartridges we purchase from HP are used not only in our inkjet printers for the banking and POS market, but also in other manufacturer’s printing devices across several other markets.

ZINK Imaging Inc. (“ZINK”) is the sole supplier of proprietary color thermal paper used in our Printrex 920 oil and gas printer. We had a supply agreement with ZINK to exclusively supply us with ZINK color thermal paper for the oil and gas industry at fixed prices through December 31, 2014. We plan to renew this agreement during 2015. The loss of the supply of ZINK color thermal paper would have a material adverse effect on the sale of Printrex 920 printers and ZINK color thermal paper.

2

Canon, Inc. (“Canon”) is the sole supplier of inkjet cartridges and other consumable items (“Canon Consumables”) that are used in our Printrex 980 oil and gas printer. The loss of supply of Canon Consumables would have a material adverse effect on the sale of Printrex 980 printers and the Canon Consumables. We have a supply agreement with Canon to supply us with Canon Consumables until May 2017. Prices under this agreement were fixed through May 2013, but may be changed during the remainder of the agreement if the exchange rate fluctuates significantly between the Japanese yen and the U.S. dollar.

Patents and Proprietary Information

TransAct relies on a combination of trade secrets, patents, employee and third party nondisclosure agreements, copyright laws and contractual rights to establish and protect its proprietary rights in its products. We hold 29 United States and 30 foreign patents and have 8 United States and 12 foreign patent applications pending pertaining to our products. The duration of these patents range from 3 to 17 years. The expiration of any individual patent would not have a significant negative impact on our business. We regard certain manufacturing processes and designs to be proprietary and attempt to protect them through employee and third-party nondisclosure agreements and similar means. It may be possible for unauthorized third parties to copy certain portions of our products or to reverse engineer or otherwise obtain and use, to our detriment, information that we regard as proprietary. Moreover, the laws of some foreign countries do not afford the same protection to our proprietary rights as do the laws of the United States. There can be no assurance that legal protections we rely upon to protect our proprietary position will be adequate or that our competitors will not independently develop technologies that are substantially equivalent or superior to our technologies.

Seasonality

Restaurants typically reduce purchases of new food safety equipment in the fourth quarter due to the increased volume of transactions in that holiday period.

Working Capital

Inventory, accounts receivable, and accounts payable levels, payment terms, and where applicable, return policies are in accordance with the general practices of the industry and standard business procedures. See also Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Certain Customers

GTECH has been our most significant customer. In December 2009, we signed a new five-year agreement effective November 20, 2009, with GTECH (the “GTECH Thermal Printer Agreement”). Under the terms of the agreement, we provide GTECH with their latest generation thermal lottery printers for various lottery applications. The terms of the agreement require that GTECH exclusively purchase all of its requirements for thermal on-line lottery printers from us and that we exclusively sell such printers to GTECH through May 8, 2015. We are currently in negotiations with GTECH to extend the agreement.

Sales to GTECH and other customers representing 10% or more of our total net sales were as follows:

|

Year ended December 31,

|

|||||||||||

|

2014

|

2013

|

2012

|

|||||||||

|

GTECH

|

16% | 12% | 18% | ||||||||

|

Eurocoin Ltd.

|

11% | 12% | 15% | ||||||||

Backlog

Our backlog of firm orders was approximately $11,356,000 as of February 27, 2015, compared to $4,778,000 as of February 28, 2014. Based on customers’ current delivery requirements, we expect to ship our entire current backlog during 2015.

Competition

The market for transaction-based and specialty printing solutions is extremely competitive, and we expect such competition to continue in the future. We compete with a number of companies, many of which have greater financial, technical and marketing resources than us. We believe our ability to compete successfully depends on a number of factors both within and outside our control, including durability, reliability, quality, design capability, product customization, price, customer support, success in developing new products, manufacturing expertise and capacity, supply of component parts and materials, strategic relationships with suppliers, the timing of new product introductions by us and our competitors, general market, economic and political conditions and, in some cases, the uniqueness of our products.

In the food safety market, we compete with Avery Dennison Corporation, Ecolab Inc. and Integrated Control Corp. We compete in this market based largely on our ability to provide highly specialized products, custom engineering and ongoing technical support.

In the banking and POS market, our major competitor is Epson America, Inc., which holds a dominant market position of the POS markets into which we sell. We also compete, to a much lesser extent, with CognitiveTPG, Star Micronics America, Inc., Citizen -- CBM America Corporation, Pertech Industries, Inc., Addmaster, and Samsung/Bixolon. Certain competitors of ours have greater financial resources, lower costs attributable to higher volume production and sometimes offer lower prices than us.

In the casino and gaming market (consisting principally of slot machine and video lottery terminal transaction printing and promotional coupon printing), we compete with several companies including FutureLogic, Inc., Nanoptix, Inc., Custom Engineering SPA and others. Certain of our products sold for casino and gaming applications compete based upon our ability to provide highly specialized products, custom engineering and ongoing technical support.

In the lottery market (consisting principally of on-line lottery transaction printing), we hold a leading position, based largely on our long-term purchase agreement with GTECH. We compete in this market based solely on our ability to provide specialized, custom-engineered products to GTECH.

In the Printrex market, we compete with the Imaging Systems Group, Inc. (“iSys”), Neuralog Inc., GSI Group and others. We compete in this market based largely on our ability to provide specialized, custom-engineered products.

3

The TSG business is highly fragmented, and we compete with numerous competitors of various sizes, including POS and internet resellers, depending on the geographic area.

Our strategy for competing in our markets is to continue to develop new products (hardware and software) and product line extensions, to increase our geographic market penetration, to take advantage of strategic relationships, and to lower product costs by sourcing certain products overseas. Although we believe that our products, operations and relationships provide a competitive foundation, there can be no assurance that we will compete successfully in the future. In addition, our products utilize certain inkjet, thermal and impact printing technology. If other technologies, or variations to existing technologies, were to evolve or become available to us, it is possible that we would incorporate these technologies into our products. Alternatively, if such technologies were to evolve or become available to our competitors, our products could become obsolete, which would have a significant negative impact on our business.

Research and Development Activities

Research, development, and engineering expenditures represent costs incurred in the experimental or laboratory sense aimed at discovery and/or application of new knowledge in developing a new product or process, or in bringing about significant improvement in an existing product or process. We spent approximately $4,302,000, $4,065,000, and $4,239,000 in 2014, 2013 and 2012, respectively, on engineering, design and product development efforts in connection with specialized engineering and design to introduce new hardware and software products and to customize or improve existing products.

Costs incurred in researching and developing a computer software product are charged to expense until technological feasibility has been established, at which point all material software costs are capitalized within Intangible assets in our Consolidated Balance Sheets until the product is available for sale to customers. While judgment is required in determining when technological feasibility of a product is established, we have determined that it is reached after all high-risk development issues have been documented in a formal detailed plan design. The amortization of these costs will be included in cost of sales over the estimated life of the product. During 2010 we began the development of EPICENTRALTM, , which enables casino customers to print coupons and promotions at the slot machine. Unamortized development costs for such software were approximately $169,000 and $370,000 as of December 31, 2014 and 2013, respectively. The total amount charged to cost of sales for capitalized software development costs were approximately $201,000, $199,000, and $189,000 in 2014, 2013 and 2012, respectively.

Environment

We are not aware of any material noncompliance with federal, state and local provisions that have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment.

Employees

As of December 31, 2014, TransAct and our subsidiaries employed 129 persons, all of whom were full-time employees. None of our employees are unionized, and we consider our relationships with our employees to be good.

Financial Information About Geographic Areas

For financial information regarding our geographic areas see Note 16 – Geographic Area Information in the Notes to the Consolidated Financial Statements. Risks related to our foreign operations are described in Item 1A below.

Trademarks, Service Marks and Copyrights

We own or have rights to trademarks, service marks, trade names and copyrights that we use in connection with the operation of our business, including our corporate names, logos and website names. Other trademarks, service marks and trade names appearing in this annual report on Form 10-K are the property of their respective owners. The trademarks we own include TransAct®, EPICENTRAL®, Ithaca®, RESPONDER® and Printrex®. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this annual report on Form 10-K are listed without the ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks, trade names and copyrights.

Available Information

We make available free of charge through our internet website, www.transact-tech.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). You may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. This information is also available at www.sec.gov. The reference to these website addresses does not constitute incorporation by reference of the information contained on the websites and should not be considered part of this document.

We maintain a Code of Business Conduct that includes our code of ethics that is applicable to all employees, including our Chief Executive Officer, Chief Financial Officer and Controller. This Code, which requires continued observance of high ethical standards such as honesty, integrity and compliance with the law in the conduct of our business, is available for public access on our internet website. Any person may request a copy of our Code of Business Conduct free of charge by calling (203) 859-6800.

Item 1A. Risk Factors

Investors should carefully consider the risks, uncertainties and other factors described below, as well as other disclosures in Management’s Discussion and Analysis of Financial Condition and Results of Operations, because they could have a material adverse effect on our business, financial condition, operating results, and growth prospects. The risks described below are not the only ones facing our Company. Additional risks not known to us now or that we currently deem immaterial may also impair our business operations.

We assume no obligation (and specifically disclaim any such obligation) to update these Risk Factors or any other forward-looking statements contained in this Annual Report to reflect actual results, changes in assumptions or other factors affecting such forward-looking statements, except as required by law.

4

Our operating results and financial condition may fluctuate.

Our operating results and financial condition may fluctuate from quarter to quarter and year to year and are likely to continue to vary due to a number of factors, many of which are not within our control. If our operating results do not meet the expectations of securities analysts or investors, who may derive their expectations by extrapolating data from recent historical operating results, the market price of our common stock will likely decline. Fluctuations in our operating results and financial condition may be due to a number of factors, including, but not limited to, those identified throughout this “Risk Factors” section:

|

|

·

|

market acceptance of our products, both domestically and internationally;

|

|

|

·

|

development of new competitive products by others;

|

|

|

·

|

our responses to price competition;

|

|

|

·

|

our level of research and development activities;

|

|

|

·

|

changes in the amount that we spend to develop, acquire or license new products, consumables, technologies or businesses;

|

|

|

·

|

changes in the amount we spend to promote our products and services;

|

|

|

·

|

changes in the cost of satisfying our warranty obligations and servicing our installed base of printers;

|

|

|

·

|

delays between our expenditures to develop and market new or enhanced products and consumables and the generation of sales from those products;

|

|

|

·

|

the geographic distribution of our sales;

|

|

|

·

|

availability of third-party components at reasonable prices;

|

|

|

·

|

general economic and industry conditions, including changes in interest rates affecting returns on cash balances and investments, that affect customer demand;

|

|

|

·

|

severe weather events (such as hurricanes) that can disrupt or interrupt the operation of our customers or suppliers facilities; and

|

|

|

·

|

changes in accounting rules.

|

Due to all of the foregoing factors, and the other risks discussed in this report, quarter-to-quarter comparisons of our operating results may not be an indicator of future performance.

Our revenue and profitability depend on our ability to continue to develop, on a timely basis, new products and technologies which are free from hardware or software anomalies and cannot be fraudulently manipulated.

The success of newer products such as the Ithaca® 9700 food safety terminal and the Printrex® 920 and Printrex® 980 oil and gas color printers is dependent on how quickly customers in the related markets accept them given the very little market penetration these products have experienced since they are new and innovative and have limited competition. Additionally, the success of innovative technology, such as printing coupons and promotions at the slot machine using EPICENTRAL™, is dependent on our casino customers' acceptance of such technology. While we have designed EPICENTRAL™ to support our customers' existing investment in our Epic 950® thermal casino printers, such acceptance may nevertheless only build gradually over time or not at all. Delays in acceptance by our customers of new technologies may adversely affect our operations.

Our success depends upon our ability to adapt our capabilities and processes to meet the demands of producing new and innovative products. Because our newer products are generally more technologically sophisticated than those we have produced in the past, we must continually refine our capabilities to meet the needs of our product innovation. If we cannot efficiently adapt our infrastructure to meet the needs of our product innovations in a timely manner, our business could be negatively impacted.

Infringement on the proprietary rights of others could put us at a competitive disadvantage, and any related litigation could be time consuming and costly.

Third parties may claim that we violated their intellectual property rights. To the extent of a violation of a third party’s patent or other intellectual property right, we may be prevented from operating our business as planned and may be required to pay damages, to obtain a license, if available, or to use a non-infringing method, if possible, to accomplish our objectives. Any of these claims, with or without merit, could result in costly litigation and divert the attention of key personnel. If such claims are successful, they could result in costly judgments or settlements. Refer to Item 3. “Legal Proceedings” for discussion surrounding litigation we were involved in regarding alleged misappropriation of unspecified trade secrets and confidential information.

General economic conditions could have a material adverse effect on our business, operating results and financial condition.

Global economic growth has slowed and has resulted in recessions in numerous countries, including many of those in North America, Europe and Asia, where the Company does substantially all of its business. If these economic conditions continue to persist, or if they worsen, a number of negative effects on our business could result, including customers or potential customers reducing or delaying orders, the insolvency of key suppliers which could result in production delays, the inability of customers to obtain credit, and the insolvency of one or more customers. Any of these effects could impact our ability to effectively manage inventory levels and collect receivables, create unabsorbed costs due to lower net sales, and ultimately decrease our net sales and profitability including write-downs of assets.

We rely on resellers to sell our products and services.

We use a variety of distribution channels, including OEMs and distributors, to market our products. We may be adversely impacted by any conflicts that could arise between and among our various sales channels.

Our dependence upon resellers exposes us to numerous risks, including:

|

|

·

|

loss of channel and the ability to bring new products to market;

|

|

|

·

|

concentration of credit risk, including disruption in distribution should the resellers’ financial condition deteriorate;

|

|

|

·

|

reduced visibility to end user demand and pricing issues which makes forecasting more difficult;

|

|

|

·

|

resellers leveraging their buying power to change the terms of pricing, payment and product delivery schedules; and

|

|

|

·

|

direct competition should a reseller decide to manufacture printers internally or source printers from a competitor.

|

5

We cannot guarantee that resellers will not reduce, delay or eliminate purchases from us, which could have a material adverse effect upon the business, consolidated results of operations and financial condition.

We have outsourced a large portion of the assembly of our printers to four contract manufacturers and will be dependent on them for the manufacturing of such printers. A failure by these contract manufacturers, or any disruption in such manufacturing or the flow of product from these manufacturers, may adversely affect our business results.

In an effort to achieve additional cost savings and operation benefits, we have continued to outsource the manufacturing and assembly of our printers to contract manufacturers in Asia. Approximately 80% of our printer manufacturing is conducted by one third party manufacturer in Asia.

However, to the extent we rely on a third-party service provider for manufacturing services, we may incur increased business continuity risks. We will no longer be able to exercise control over the assembly of certain of our products or any related operations or processes, including the internal controls associated with operations and processes conducted and the quality of our products assembled by contract manufacturers. If we are unable to effectively develop and implement our outsourcing strategy, we may not realize cost structure efficiencies and our operating and financial results could be materially adversely affected.

In addition, if any of our contract manufacturers experiences business difficulties or fails to meet our manufacturing needs, then we may be unable to meet production requirements, may lose revenue and may not be able to maintain relationships with our customers. Without the contract manufacturers continuing to manufacture our products and the continuing operation of the contract manufacturers’ facilities, we will have limited means for the final assembly of a majority of our products until we are able to secure the manufacturing capability at another facility or develop an alternative manufacturing facility, which could be costly and time consuming and have a material adverse effect on our operating and financial results.

The increased elements of risk that arise from conducting certain operating processes in foreign jurisdictions may lead to an increase in reputational risk.

Although we carry business interruption insurance to cover lost revenue and profits in an amount we consider adequate, this insurance does not cover all possible situations. In addition, the business interruption insurance would not compensate us for the loss of opportunity and potential adverse impact, both short-term and long-term, on relations with our existing customers resulting from our inability to produce products for them.

The contract manufacturers have access to our intellectual property, which increases the risk of infringement or misappropriation of this intellectual property.

Political, social or economic instability in regions in which our manufacturers are located, could cause disruptions in trade, including exports to the U.S.

A significant portion of our printers are manufactured by contract manufacturers overseas and are exported to the U.S. Any such disruption in trade, including exports to the U.S., could adversely affect our business results. Events that could cause disruptions to such exports to the U.S. include:

|

|

·

|

the imposition of additional trade law provisions or regulations;

|

|

|

·

|

reliance on a limited number of shipping and air carriers who may experience capacity issues that adversely affect our ability to ship inventory in a timely manner or for an acceptable cost;

|

|

|

·

|

the imposition of additional duties, tariffs and other charges on imports and exports;

|

|

|

·

|

economic uncertainties and adverse economic conditions (including inflation and recession);

|

|

|

·

|

fluctuations in the value of the U.S. Dollar against foreign currencies;

|

|

|

·

|

significant labor disputes, such as dock strikes;

|

|

|

·

|

significant delays in the delivery of cargo due to port security considerations;

|

|

|

·

|

financial or political instability in any of the countries in which our printers are manufactured.

|

We source some of our component parts and consumable products from sole source suppliers; any disruptions may impact our ability to manufacture and sell our products.

A disruption in the supply of such component parts and consumable products could have a material adverse effect on our operations and financial results.

We sell a significant portion of our products internationally and purchase important components from foreign suppliers. These circumstances create a number of risks.

We sell a significant amount of our products to customers outside the United States. Shipments to international customers are expected to continue to account for a material portion of net sales. Risks associated with sales and purchases outside the United States include:

|

|

·

|

fluctuating foreign currency rates could restrict sales, or increase costs of purchasing, in foreign countries;

|

|

|

·

|

foreign governments may impose burdensome tariffs, quotas, taxes, trade barriers or capital flow restrictions;

|

|

|

·

|

political and economic instability may reduce demand for our products or put our foreign assets at risk;

|

|

|

·

|

restrictions on the export or import of technology may reduce or eliminate the ability to sell in or purchase from certain markets; and

|

|

|

·

|

potentially limited intellectual property protection in certain countries, such as China, may limit recourse against infringing products or cause us to refrain from selling in certain geographic territories.

|

We face risks associated with manufacturing forecasts.

If we fail to predict our manufacturing requirements accurately, we could incur additional costs or experience manufacturing delays, which could cause us to lose orders or customers and result in lower net sales. We currently use a rolling 12-month forecast based primarily on our anticipated product orders and our product order history to help determine our requirements for components and materials. It is very important that we accurately predict both the demand for our products and the lead-time required to obtain the necessary components and raw materials.

6

Lead times for materials and components that we order vary significantly and depend on factors such as the specific supplier, the size of the order, contract terms, and demand for each component at a given time. If we underestimate our requirements, we may have inadequate manufacturing capacity or inventory, which could interrupt manufacturing of our products and result in delays in shipments and net sales. If we overestimate our requirements, we could have excess inventory of parts. In addition, delays in the manufacturing of our products could cause us to lose orders or customers.

In the lottery market, we have been dependent on sales to one large customer; the loss of this customer or reduction in orders from this customer could materially affect our sales.

We expect that sales to one large customer will continue to represent a material percentage of our net sales for the foreseeable future. A reduction, delay or cancellation in orders from this customer, including reductions or delays due to market, economic, or competitive conditions in the industries in which we serve, could have a material adverse effect upon our results of operations.

Our success will depend on our ability to sustain and manage growth.

As part of our business strategy, we intend to pursue a growth strategy. Assuming this growth occurs, it will require the expansion of distribution relationships in international markets, the successful development and marketing of new products for our existing and new markets, expanded customer service and support, and the continued implementation and improvement of our operational, financial and management information systems.

To the extent that we seek growth through acquisitions, our ability to manage our growth will also depend on our ability to integrate businesses that have previously operated independently. We may not be able to achieve this integration without encountering difficulties or experiencing the loss of key employees, customers or suppliers. It may be difficult to design and implement effective financial controls for combined operations and differences in existing controls for each business may result in weaknesses that require remediation when the financial controls and reporting functions are combined. As we pursue acquisitions, we may incur legal, accounting and other transaction related expenses for unsuccessful acquisition attempts that could adversely affect our results of operations in the period in which they are incurred.

There can be no assurance that we will be able to successfully implement our growth strategy, or that we can successfully manage expanded operations, if they occur. As we expand, we may from time to time experience constraints that will adversely affect our ability to satisfy customer demand in a timely fashion. Failure to manage growth effectively could adversely affect our results of operations and financial condition.

We compete in highly competitive markets, which are likely to become more competitive. Competitors may be able to respond more quickly to new or emerging technology and changes in customer requirements.

We face significant competition in developing and selling our printers, terminals, software, transaction supplies and services. Our principal competitors have substantial marketing, financial, development and personnel resources. To remain competitive, we believe we must continue to provide:

|

|

·

|

technologically advanced products that satisfy the user demands;

|

|

|

·

|

superior customer service;

|

|

|

·

|

high levels of quality and reliability; and

|

|

|

·

|

dependable and efficient distribution networks.

|

We cannot ensure we will be able to compete successfully against current or future competitors. Increased competition may result in price reductions, lower gross profit margins and loss of market share, and could require increased spending on research and development, sales and marketing and customer support. Some competitors may make strategic acquisitions or establish cooperative relationships with suppliers or companies that produce complementary products. Any of these factors could reduce our earnings.

We depend on key personnel, the loss of which could materially impact our business.

Our future success will depend in significant part upon the continued service of certain key management and other personnel and our continuing ability to attract and retain highly qualified managerial, technical and sales and marketing personnel. There can be no assurance that we will be able to recruit and retain such personnel. The loss of either Bart C. Shuldman, the Company's Chairman of the Board and Chief Executive Officer, or Steven A. DeMartino, the Company’s President, Chief Financial Officer, Treasurer and Secretary, or the loss of certain groups of key employees, could have a material adverse effect on our results of operations.

If we are unable to enforce our patents or if it is determined that we infringe patents held by others it could damage our business.

Prosecuting and defending patent lawsuits is very expensive. We are committed to aggressively asserting and defending our technology and related intellectual property, which we have spent a significant amount of money to develop. These factors could cause us to become involved in new patent litigation in the future. The expense of prosecuting or defending these future lawsuits could also have a material adverse effect on our business, financial condition and results of operations.

If we were to lose a patent lawsuit in which another party is asserting that our products infringe its patents, we would likely be prohibited from marketing those products and could also be liable for significant damages. Either or both of these results may have a material adverse effect on our business, financial condition and results of operations. If we lose a patent lawsuit in which we are claiming that another party’s products are infringing our patents and thus, are unable to enforce our patents, it may have a material adverse effect on our business, financial condition and results of operations. In addition to disputes relating to the validity or alleged infringement of other parties' rights, we may become involved in disputes relating to our assertion of our own intellectual property rights. Whether we are defending the assertion of intellectual property rights against us or asserting our intellectual property rights against others, intellectual property litigation can be complex, costly, protracted, and highly disruptive to business operations by diverting the attention and energies of management and key technical personnel. Plaintiffs in intellectual property cases often seek injunctive relief, and the measures of damages in intellectual property litigation are complex and often subjective or uncertain. Thus, any adverse determinations in this type of litigation could subject us to significant liabilities and costs. During the course of these lawsuits there may be public announcements of the results of hearings, motions, and other interim proceedings or developments in the litigation. If securities analysts or investors perceive these results to be negative, it could harm the market price of our stock.

7

The inability to protect intellectual property could harm our reputation, and our competitive position may be materially damaged.

Our intellectual property is valuable and provides us with certain competitive advantages. Copyrights, patents, trade secrets and contracts are used to protect these proprietary rights. Despite these precautions, it may be possible for third parties to copy aspects of our products or, without authorization, to obtain and use information which we regard as trade secrets.

Our stock price may fluctuate significantly.

The market price of our common stock could fluctuate significantly in response to variations in quarterly operating results and other factors, such as:

|

|

·

|

changes in our business, operations or prospects;

|

|

|

·

|

developments in our relationships with our customers;

|

|

|

·

|

announcements of new products or services by us or by our competitors;

|

|

|

·

|

announcement or completion of acquisitions by us or by our competitors;

|

|

|

·

|

changes in existing or adoption of additional government regulations;

|

|

|

·

|

unfavorable or reduced analyst coverage; and

|

|

|

·

|

prevailing domestic and international market and economic conditions.

|

In addition, the stock market has experienced significant price fluctuations in recent years. Broad market fluctuations, general economic conditions and specific conditions in the industries in which we operate may adversely affect the market price of our common stock.

Limited trading volume and a reduction in analyst coverage of our capital stock may contribute to its price volatility.

Our common stock is traded on the NASDAQ Global Market. During the year ended December 31, 2014, the average daily trading volume for our common stock as reported by the NASDAQ Global Market was approximately 24,000 shares. We are uncertain whether a more active trading market in our common stock will develop. In addition, many investment banks no longer find it profitable to provide securities research on micro-cap and small-cap companies. As a result, relatively small trades may have a significant impact on the market price of our common stock, which could increase the volatility and depress the price of our common stock.

Future sales of our common stock may cause our stock price to decline.

In the future, we may sell additional shares of our common stock in public or private offerings, and we may also issue additional shares of our common stock to finance future acquisitions. Shares of our common stock are also available for future sale pursuant to stock options that we have granted to our employees, and in the future we may grant additional stock options and other forms of equity compensation to our employees. Sales of our common stock or the perception that such sales could occur may adversely affect prevailing market prices for shares of our common stock and could impair our ability to raise capital through future offerings.

If market conditions deteriorate or future results of operations are less than expected, a valuation allowance may be required for all or a portion of our deferred tax assets.

We currently have deferred tax assets, which may be used to reduce taxable income in the future. We assess the realization of these deferred tax assets on a quarterly basis, and if we determine that it is more likely than not that some portion of these assets will not be realized, an income tax valuation allowance is recorded. If market conditions deteriorate or future results of operations are less than expected, or there is a change to applicable tax rules, future assessments may result in a determination that it is more likely than not that some or all of our net deferred tax assets are not realizable. As a result, we may need to establish a valuation allowance for all or a portion of our net deferred tax assets, which may have a material adverse effect on our business, results of operations and financial condition.

We cannot provide any assurance that current laws, or any laws enacted in the future, will not have a material adverse effect on our business.

Our operations are subject to laws, rules, regulations, including environmental regulations, government policies and other requirements in each of the jurisdictions in which we conduct business. Changes in laws, rules, regulations, policies or requirements could result in the need to modify our products and could affect the demand for our products, which may have an adverse impact on our future operating results. If we do not comply with applicable laws, rules and regulations we could be subject to costs and liabilities and our business may be adversely impacted.

Intangible computer software costs may not be recoverable.

Costs incurred in researching and developing a computer software product are charged to expense until technological feasibility has been established, at which point all material software costs are capitalized within Intangible assets in our Consolidated Balance Sheets until the product is available for general release to customers. While judgment is required in determining when technological feasibility of a product is established, we have determined that it is reached after all high-risk development issues have been documented in a formal detailed plan design. The amortization of these costs will be included in cost of sales over the estimated life of the product. To the extent technological feasibility of products is not achieved, related capitalized computer software costs may not be recoverable.

Our business could be adversely affected by actual or threatened terrorist attacks or the related heightened security measures, military actions and other efforts to combat terrorism.

Our business could be adversely affected by actual or threatened terrorist attacks or the related heightened security measures, military actions and other efforts to combat terrorism. It is possible that terrorist attacks could be directed at important locations for the gaming industry. Heightened security measures and other efforts to combat terrorism may also have an adverse effect on the gaming industry by reducing tourism. Any of these developments could also negatively affect the general economy and consumer confidence. Any downturn in the economy or in the gaming industry in particular could reduce demand for our products and adversely affect our business and results of operations. In addition, heightened security measures may cause certain governments to restrict the import/export of goods, which may have an adverse effect on our ability to buy/sell goods.

8

Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial also may adversely impact our business. Should any risks or uncertainties develop into actual events, these developments could have material adverse effects on our business, financial condition, and results of operations.

Item 2. Properties.

Our principal facilities as of December 31, 2014 are listed below and we believe that all facilities generally are in good condition, adequately maintained and suitable for their present and currently contemplated uses.

|

Location

|

Operations Conducted

|

Size

(Approx. Sq. Ft.)

|

Owned or

Leased

|

Lease Expiration

Date

|

|||

|

Hamden, Connecticut

|

Executive offices and Printrex and TSG sales office

|

11,100 |

Leased

|

April 23, 2017

|

|||

|

Ithaca, New York

|

Global engineering, design, assembly and service facility

|

73,900 |

Leased

|

May 31, 2016

|

|||

|

Las Vegas, Nevada

|

Service center and casino and gaming sales office

|

13,700 |

Leased

|

December 31, 2016

|

|||

|

Doncaster, United Kingdom

|

Sales office and service center

|

2,800 |

Leased

|

August 1, 2016

|

|||

|

Houston, Texas

|

Sales office and service center

|

1,350 |

Leased

|

April 30, 2015

|

|||

|

Georgia and New York

|

Two regional sales offices

|

300 |

Leased

|

Various

|

|||

|

Macau, China

|

Sales office

|

180 |

Leased

|

June 30, 2015

|

|||

| 103,330 | |||||||

On June 8, 2012, Avery Dennison Corporation (“AD”) filed a civil complaint against the Company and a former employee of the Company and of AD, in the Court of Common Pleas (the “Court”) in Lake County, Ohio (the “AD Lawsuit”). The complaint alleged that this former employee and the Company misappropriated unspecified trade secrets and confidential information from AD related to the design of our food safety terminals. The complaint requested a preliminary and permanent injunction against the Company from manufacturing and selling our Ithaca® 9700 and 9800 food safety terminals. On July 16, 2012, the Company filed its answer, affirmative defenses and counterclaims, seeking all available damages including legal fees. A hearing on the plaintiff's motion for preliminary injunction took place in August 2012, and in November 2012, the Court denied this request. AD filed an appeal of the Court’s ruling to the Eleventh Appellate District, which heard oral arguments on the appeal on July 16, 2013. On July 23, 2013, AD requested that the Eleventh Appellate District enjoin the Company’s further sale and marketing of the food safety terminals, pending the appeals court's decision. On July 29, 2013, the Company opposed this request. On October 15, 2013, the Eleventh District Court of Appeals affirmed the lower court’s decision in the Company’s favor and denied AD’s further request of an injunction pending the Court of Appeal’s decision. On October 24, 2013, AD filed a motion seeking that the Court of Appeals reconsider its decision. On April 16, 2014, the Court of Appeals denied AD’s motion to reconsider its decision. On July 28, 2014, AD filed a motion requesting leave from the Court to file an amended complaint and indicating that it has elected to pursue only its claim for damages, dropping its claim for injunctive relief. On September 4, 2014, the Court granted AD’s motion to file an amended complaint. On September 25, 2014, the Company filed its answer, affirmative defenses and counterclaims with respect to the amended complaint, seeking all available damages including legal fees. On January 30, 2015, the Company filed a motion for summary judgment seeking judgment in favor of the Company on all counts as to the Company. On the same day, AD filed two motions for partial summary judgment. On February 17, 2015, the Company opposed both of AD’s motions, and AD opposed the Company’s motion. On February 23, 2015, the Company filed a reply brief in support of its motion for summary judgment. A trial was scheduled to begin on April 21, 2015, however, on March 25, 2015 the parties executed a confidential settlement agreement and release (the “Settlement Agreement”) in which the parties mutually agreed to resolve the dispute that was the subject of the lawsuit filed by AD against the Company to the parties’ mutual satisfaction. Under the terms of the Settlement Agreement, the Company agreed to pay AD $3,600,000 payable on or before April 8, 2015 and also to qualify certain AD labels for use on the Company’s food safety terminals at an estimated cost of $25,000. The Company recorded the total expense of $3,625,000 in the fourth quarter 2014 as an operating expense included in the line item “Legal fees and settlement expenses associated with lawsuit” on the Consolidated Statement of Operations and as a current liability included in the line item “Accrued lawsuit settlement expenses” on the Consolidated Balance Sheet.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is traded on the NASDAQ Global Market under the symbol TACT. As of February 27, 2015, there were 379 holders of record of the common stock. The high and low bid sales prices of the common stock reported during each quarter of the years ended December 31, 2014 and 2013 were as follows:

|

Year Ended

|

Year Ended

|

||||||||||||||

|

December 31, 2014

|

December 31, 2013

|

||||||||||||||

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

First Quarter

|

$ | 12.99 | $ | 9.80 | $ | 8.20 | $ | 7.15 | |||||||

|

Second Quarter

|

11.50 | 9.12 | 8.50 | 7.22 | |||||||||||

|

Third Quarter

|

10.44 | 6.45 | 13.19 | 7.75 | |||||||||||

|

Fourth Quarter

|

6.95 | 5.19 | 15.23 | 11.54 | |||||||||||

In September 2012, we announced that our Board of Directors approved the initiation of a quarterly cash dividend program which is subject to the Board’s approval each quarter. On May 6, 2014, our Board of Directors declared an increase to the quarterly cash dividend from $0.07 per share to $0.08 per share. Dividends declared and paid on our common stock totaled $2,556,000 or $0.31 per share and $2,317,000 or $0.27 per share, in 2014 and 2013, respectively . On February 4, 2015, our Board of Directors approved the first quarter 2015 dividend in the amount of $0.08 per share payable on or about March 13, 2015 to common shareholders of record at the close of business on February 20, 2015.

9

Issuer Purchases of Equity Securities

On August 11, 2014, our Board of Directors approved a new stock repurchase program (the “Stock Repurchase Program”). Under the Stock Repurchase Program, we are authorized to repurchase up to $7,500,000 of our outstanding shares of common stock from time to time in the open market through July 31, 2015, depending on market conditions, share price and other factors. On November 3, 2014, our Board of Directors modified the Stock Repurchase Program to include the repurchase of up to $4,000,000 of the Company’s outstanding shares through April 30, 2015 pursuant to a Rule 10b5-1 trading plan though our Board ended this trading plan effective March 31, 2015. We use the cost method to account for treasury stock purchases, under which the price paid for the stock is charged to the treasury stock account. Repurchases of our common stock are accounted for as of the settlement date. From August 11, 2014 through December 31, 2014, we purchased 434,998 shares of our common stock for approximately $2,634,000 at an average price per share of $6.06. In 2013, under a prior purchase program and an open market transaction, we purchased 604,161 shares of common stock for approximately $5,194,000 at an average price of $8.60. From January 1, 2005 through December 31, 2014, we repurchased a total of 3,222,036 shares of common stock for approximately $25,161,000, at an average price of $7.81 per share. See “Liquidity and Capital Resources” below for more information.

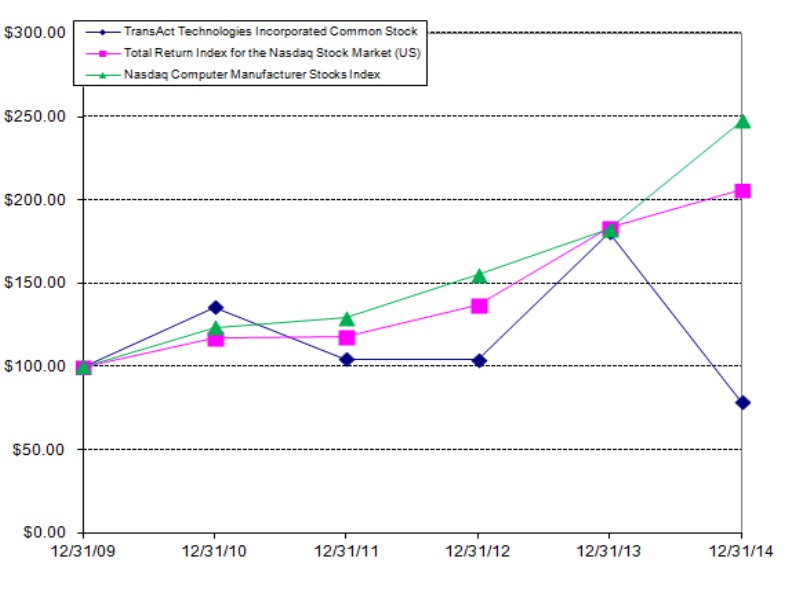

CORPORATE PERFORMANCE GRAPH

The following graph compares the cumulative total return on the Company’s Common Stock from December 31, 2009 through December 31, 2014, with the CRSP Total Return Index for the Nasdaq Stock Market (U.S.) and the Nasdaq Computer Manufacturer Stocks Index. The graph assumes that $100 was invested on December 31, 2009 in each of TransAct’s common stock, the CRSP Total Return Index for the Nasdaq Stock Market (U.S.) and the Nasdaq Computer Manufacturer Stocks Index, and that all dividends were reinvested.

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG

TRANSACT TECHNOLOGIES INCORPORATED COMMON STOCK,

THE CRSP TOTAL RETURN INDEX FOR THE NASDAQ STOCK MARKET (U.S.),

AND THE NASDAQ COMPUTER MANUFACTURER STOCKS INDEX

|

12/31/09

|

12/31/10

|

12/31/11

|

12/31/12

|

12/31/13

|

12/31/14

|

||||||||||||||||||

|

TransAct Technologies Incorporated Common Stock

|

$ | 100.00 | $ | 135.73 | $ | 104.61 | $ | 104.03 | $ | 180.55 | $ | 78.82 | |||||||||||

|

CRSP Total Return Index for the Nasdaq Stock Market (U.S.)

|

$ | 100.00 | $ | 117.55 | $ | 117.91 | $ | 137.29 | $ | 183.26 | $ | 206.09 | |||||||||||

|

Nasdaq Computer Manufacturer Stocks Index

|

$ | 100.00 | $ | 123.53 | $ | 129.51 | $ | 155.26 | $ | 182.65 | $ | 247.60 | |||||||||||

10

Item 6. Selected Financial Data (in thousands, except per share amounts)

The following is summarized from our audited financial statements of the past five years:

|

Year ended December 31,

|

|||||||||||||||||||

|

2014

|

2013

|

2012

|

2011

|

2010

|

|||||||||||||||

|

Consolidated Statement of Operations Data:

|

|||||||||||||||||||

|

Net sales

|

$ | 53,108 | $ | 60,141 | $ | 68,386 | $ | 65,969 | $ | 63,194 | |||||||||

|

Gross profit

|

21,711 | 25,092 | 25,982 | 24,626 | 22,548 | ||||||||||||||

|

Operating expenses

|

25,483 | 18,475 | 20,380 | 17,637 | 16,687 | ||||||||||||||

|

Operating (loss) income

|

(3,772) | 6,617 | 5,602 | 6,989 | 5,861 | ||||||||||||||

|

Net (loss) income

|

(2,421)

|

4,935 | 3,621 | 4,676 | 3,904 | ||||||||||||||

|

Net (loss) income per share:

|

|||||||||||||||||||

|

Basic

|

(0.29) | 0.57 | 0.40 | 0.50 | 0.42 | ||||||||||||||

|

Diluted

|

(0.29) | 0.57 | 0.40 | 0.49 | 0.41 | ||||||||||||||

|

Dividends declared and paid per share

|

0.31 | 0.27 | 0.06 | - | - | ||||||||||||||

|

December 31,

|

|||||||||||||||||||

|

2014

|

2013

|

2012

|

2011

|

2010

|

|||||||||||||||

|

Consolidated Balance Sheet Data:

|

|||||||||||||||||||

|

Total assets

|

$ | 35,491 | $ | 40,408 | $ | 45,228 | $ | 42,740 | $ | 43,621 | |||||||||

|

Working capital

|

18,361 | 24,871 | 25,492 | 27,222 | 25,525 | ||||||||||||||

|

Shareholders’ equity

|

25,394 | 32,521 | 33,369 | 35,313 | 31,134 | ||||||||||||||

This discussion should be read in conjunction with the Consolidated Financial Statements and notes thereto.

Forward Looking Statements

Certain statements included in this report, including without limitation statements in this Management’s Discussion and Analysis of Financial Condition and Results of Operations, which are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by the use of forward-looking terminology, such as “may”, “will”, “expect”, “intend”, ”estimate”, “anticipate”, “believe”, “project” or “continue” or the negative thereof or other similar words. All forward-looking statements involve risks and uncertainties, including, but not limited to those listed in Item 1A of this Annual Report. Actual results may differ materially from those discussed in, or implied by, the forward-looking statements. The forward-looking statements speak only as of the date of this report and we assume no duty to update them.

Overview

During 2014, we completed the transition of our business towards new, value-added products and technologies that address large and diversified growth markets while moving away from the low margin, commoditized POS market. During the past three years we have spent significant time and resources developing new products such as the Ithaca® 9700 food safety terminal, EPICENTRAL™ software for the casino and gaming industry and our Printrex® 920 and 980 color printers for the oil and gas industry. With this development phase now behind us, we can reduce these expenses going forward as we believe we now have the right products to effectively compete in our markets.

During 2014, our sales and operating results declined due mainly to what we believe is a general weakness in the replacement cycle in the domestic casino and gaming market. In an effort to address the ongoing challenges of the domestic casino market and the related impact to our operating results, during the fourth quarter of 2014 we initiated cost reduction actions that will reduce expenses by at least $1 million on an annual basis beginning in the first quarter of 2015. While it is difficult to predict when a rebound will occur in the domestic casino and gaming market, with a lower overall cost structure and focus on sales execution we expect 2015 to be a much improved year..

During 2014, our total net sales decreased 12% to approximately $53,108,000. See the table below for a breakdown of our sales by market:

|

Year ended

|

Year ended

|

Change

|

|||||||||||||||||||||

|

(In thousands)

|

December 31, 2014

|

December 31, 2013

|

$ | % | |||||||||||||||||||

|

Food safety, banking and POS

|

$ | 9,308 | 17.5% | $ | 11,296 | 18.8% | $ | (1,988) | (17.6%) | ||||||||||||||

|

Casino and gaming

|

22,731 | 42.8% | 27,300 | 45.4% | (4,569) | (16.7%) | |||||||||||||||||

|

Lottery

|

4,761 | 9.0% | 4,450 | 7.4% | 311 | 7.0% | |||||||||||||||||

|

Printrex

|

3,910 | 7.4% | 4,335 | 7.2% | (425) | (9.8%) | |||||||||||||||||

|

TSG

|

12,398 | 23.3% | 12,760 | 21.2% | (362) | (2.8%) | |||||||||||||||||

|

Total net sales

|

$ | 53,108 | 100.0% | $ | 60,141 | 100.0% | $ | (7,033) | (11.7%) | ||||||||||||||

Sales of our food safety, banking and POS products decreased 18% in 2014 compared to 2013. During 2014, our Ithaca® 9700 food safety terminal sales declined 50% due to a large initial stocking order to a distributor that occurred in 2013 that did not repeat in 2014. However, we expect this distributor to begin ordering product again in 2015. However, we have received corporate approval from a growing number of large, national brand restaurants for the Ithaca 9700 and we expect this product to be a significant contributor to our revenue growth in 2015 and beyond. In the banking market, we focus mainly on supplying printers for use in bank teller stations at banks and financial institutions primarily in the U.S. Opportunities in the banking market are project oriented and, as a result, our banking printer sales can fluctuate significantly year-to-year. During 2014, our banking printer sales decreased 31%. In the POS market, we focus primarily on supplying printers that print receipts or linerless labels for customers in the restaurant, hospitality and specialty retail markets. Sales of our POS printers increased 9% in 2014 primarily driven by sales of our Ithaca ® 9000 printers to McDonald’s as they accelerated a rollout of these printers for a new initiative. Our focus for 2015 will be on sales execution with the goal of increasing market penetration with each of our new products.

11