UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to __________

Commission File Number 0-29657

SILVER DRAGON RESOURCES

INC.

(Exact name of registrant as specified in its

charter)

| Delaware | 33-0727323 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) |

200 Davenport Road Toronto,

Ontario, M5R

1J2

(Address of principal executive offices) (Zip Code)

(416) 223-8500

(Registrant’s telephone

number, including area code)

Securities registered under Section 12(b) of the Exchange Act:

| Title of Each Class: | Name of Each Exchange on Which Registered |

| N/A | N/A |

Securities registered under Section 12(g) of the Exchange Act:

Common Stock $0.0001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ ] No [x]

1

Explanatory Note

Silver Dragon Resources Inc. (the “Company” or “we”) is filing

this Amendment No. 1 (the “Amendment”) to our annual report on Form 10-K for the

year ended December 31, 2013, filed on March 31, 2014 (the “Original Filing”) to

provide the interactive data files required by Item 601(b)(101) of Regulation

S-K and Sections 405 and 406T of Regulation S-T, which were

inadvertently omitted.

No changes have been made to the Original Filing other than to add the

information as described above. This Amendment should be read in conjunction

with the Original Filing. This Amendment speaks as of the date of the Original

Filing, does not reflect events that may have occurred after the date of the

Original Filing and does not modify or update in any way the disclosures made in

the Original Filing, except as required to reflect the revisions discussed

above.

Indicate by check mark whether the registrant has submitted electronically and posted on the corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [x] No[ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer [ ] | Non-accelerated filer [ ] | Accelerated filer [ ] | Smaller reporting company [x] |

| (Do not check if smaller reporting company) |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [x]

As of June 30, 2013, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was not greater than $2,679,996, based upon the closing sale price on that date of the common stock as reported by Yahoo! Finance, which reports the share price as an amount rounded to the nearest whole cent. As of March 31, 2014, there were 267,999,611 shares of the registrant’s common stock outstanding, par value $0.0001.

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

TABLE OF CONTENTS

3

NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this Annual Report on Form 10-K that are subject to risks and uncertainties. Forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “1933 Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), are subject to the “safe harbor” created by those sections. The forward-looking statements in this report are based on our management’s beliefs and assumptions and on information currently available to our management. You can identify forward-looking statements by terms such as “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,” “will” or “would” and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance, time frames or achievements to be materially different from any future results, performance, time frames or achievements expressed or implied by the forward-looking statements. We discuss many of these risks, uncertainties and other factors in this document in greater detail under the heading “Risk Factors.” We believe it is important to communicate our expectations to our investors. However, there will be events that we are not able to predict accurately, or over which we have no control. The risks described in “Risk Factors” included in this report, as well as any other cautionary language in this report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Before you invest in our common stock (“Common Stock”), you should be aware that the occurrence of the events described in “Risk Factors” and elsewhere in this report could harm our business.

The forward-looking statements and associated risks set forth in this Annual Report include or relate to, among other things, (a) our future plans and expectations, (b) anticipated trends in the mining industry, (c) our ability to obtain and retain sufficient capital for future operations, and (d) our anticipated needs for working capital. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business”. The forward-looking statements herein are based on current expectations that involve a number of risks and uncertainties. Such forward-looking statements are based on assumptions described herein. The assumptions are based on judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying the forward-looking statements are reasonable, any such assumption could prove to be inaccurate and therefore there can be no assurance that the results contemplated in forward-looking statements will be realized. In addition, as disclosed in “Risk Factors”, there are a number of other risks inherent in our business and operations, which could cause our operating results to vary markedly and adversely from prior results or the results contemplated by the forward-looking statements. Management decisions, including budgeting, are subjective in many respects and periodic revisions must be made to reflect actual conditions and business developments, the impact of which may cause us to alter marketing, capital investment and other expenditures, which may also materially adversely affect our results of operations. In light of significant uncertainties inherent in the forward-looking information included in the report statement, the inclusion of such information should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date of this filing. You should read this document completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify our forward-looking statements by these cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

NOTE REGARDING TECHNICAL REPORTS AND MINERALIZATION

This Form 10-K was prepared pursuant to Industry Guide 7. Under Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The Company has not established any reserves on any of its properties.

The Company’s property interests are located in China, and the Company’s corporate headquarters are located in Canada. From time to time, the Company, the companies in which it has equity interests, and/or third parties with which they have contracted have found it necessary or advisable to prepare reports regarding such property interests in accordance with the laws and regulations of other jurisdictions, including National Instrument 43-101 (“NI 43-101”) in Canada and the laws and regulations of China. Certain of these reports, such as the preliminary feasibility study for the Company’s Dadi Silver Polymetallic project located in Inner Mongolia, China, are referenced in this report (collectively, the “Non-US Reports”). Such Non-US Reports have not been prepared in accordance with the rules and regulations promulgated by the Securities and Exchange Commission (“SEC”), including Industry Guide 7. The standards for identification of “reserves” in certain jurisdictions, including Canada, differ from those of the SEC, and any “reserves” reported in the Non-US Reports do not constitute reserves under applicable SEC rules and regulations. In addition, the standards for disclosure of mineralization in certain jurisdictions, including Canada, permit the disclosure of certain types of mineralization that do not qualify as “reserves”. Investors are cautioned that units of mineralization disclosed under such standards have not been determined to have economic or legal viability. In addition, there may be uncertainty as to the existence of such mineralization. Further, while the laws and regulations of certain jurisdictions permit or require the disclosure of economic projections contained in preliminary economic assessments and preliminary feasibility studies involving mineral properties without defined “reserves”, the staff of the SEC does not generally permit U.S. companies to include such preliminary economic projections in their filings with the SEC. Accordingly, the Non-US Reports (notwithstanding any reference thereto contained in this Form 10-K) are not incorporated into this Form 10-K, and readers are cautioned not to assume that any part of the mineral deposits discussed in the Non-US Reports will ever be converted to reserves. Investors are also cautioned that the information contained in each of the Non-US Reports was prepared as of the date stated in such Non-U.S. Report. Any reference to a Non-US Report contained herein should not be considered to update any forward-looking statement contained in such Non-US Report.

4

EXCHANGE RATES

The Company’s functional currency is the U.S. dollar. The Company also uses the Chinese Yuan and Canadian dollars and converts to the U.S. dollar and states conversion rates where applicable.

METRIC CONVERSION TABLE AND ABBREVIATIONS

For ease of reference, the following conversion factors are provided:

| 1 tonne | = 1,000 kg or 2,204.6 lbs | 1 kilogram | = 2.204 pounds or 32.151 |

| troy oz | |||

| 1 hectare | = 10,000 square meters | 1 hectare | = 2.471 acres |

The following abbreviations may be used herein:

| Ag | = silver | m2 | = square meter |

| Au | =gold | ||

| g | = gram | m3 | = cubic meter |

| g/t | = grams per tonne | mg | = milligram |

| Ha | = hectare | mg/m3 | = milligrams per cubic meter |

| Km | = kilometer | T or t | = tonne |

| Km2 | = square kilometers | oz | = troy ounce |

| Kg | = kilogram | ppm | = parts per million |

| m | = meter | Ma | = million years |

Note: All units in this report are stated in metric measurements unless otherwise noted.

5

GLOSSARY OF MINING TERMS

“Alteration” means any change in the mineral composition of a rock brought about by physical or chemical means.

“Assay” means a measure of the valuable mineral content.

“Development stage” means a project that is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

“Diamond drilling” means rotary drilling using diamond-set or diamond-impregnated bits, to produce a solid continuous core of rock sample.

“Dip” means the angle that a structural surface, a bedding or fault plane, makes with the horizontal, measured perpendicular to the strike of the structure.

“Disseminated” means minerals that occur as scattered particles in the rock.

“Exploration stage” means a prospect that is not in either the development or production stage.

“Fault” means a surface or zone of rock fracture along which there has been displacement.

“Feasibility study” means a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production.

“Formation” means a distinct layer of sedimentary rock of similar composition.

“Geochemistry” means the study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere.

“Geophysics” means the study of the mechanical, electrical and magnetic properties of the earth’s crust.

“Grade” means the quantity of metal per unit weight of host rock.

“Heap leach” means a mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed to dissolve metals i.e. gold, copper etc.; the solutions containing the metals are then collected and treated to recover the metals.

“Host rock” means the rock in which a mineral or an ore body may be contained.

“In-situ” means in its natural position.

“Mapped” or “geological mapping” means the recording of geologic information including rock units and the occurrence of structural features, attitude of bedrock, and mineral deposits on maps.

“Mineral” means a naturally occurring inorganic crystalline material having a definite chemical composition.

“Mineralization” means a natural accumulation or concentration in rocks or soil of one or more potentially economic minerals, also the process by which minerals are introduced or concentrated in a rock.

“Mineralized material” means material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

“Outcrop” means that part of a geologic formation or structure that appears at the surface of the earth.

6

“Production stage” means a project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

“Quartz” means a mineral composed of silicon dioxide, SiO2 (silica).

“Rock” means indurated naturally occurring mineral matter of various compositions.

“Sampling and analytical variance/precision” means an estimate of the total error induced by sampling, sample preparation and analysis.

“Sediment” means particles transported by water, wind, gravity or ice.

“Sedimentary rock” means rock formed at the earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited.

“Strike” means the direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal.

“Strip” means to remove barren rock or overburden in order to expose ore.

“Sulfide” means a mineral including sulfur (“S”) and iron (“Fe”) as well as other elements; metallic sulfur-bearing mineral often associated with gold mineralization.

7

Part I

Available Information

We file annual, quarterly, current reports, proxy statements and other information with the SEC. You may read and copy documents that have been filed with the SEC at their Public Reference Room, 450 Fifth Street, N. W. Washington DC. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. You can also obtain copies of our SEC filings by going to their website at www.sec.gov.

Item 1. Description of Business

Corporate Overview and History

Silver Dragon Resources Inc. was initially incorporated in the State of Delaware on May 9, 1996 under the name American Electric Automobile Company Inc. On July 16, 2002, we amended our Certificate of Incorporation to change our name to American Entertainment & Animation Corporation. On February 25, 2005, we again amended our Certificate of Incorporation to change our name to “Silver Dragon Resources Inc.” to reflect our current business focus on silver.

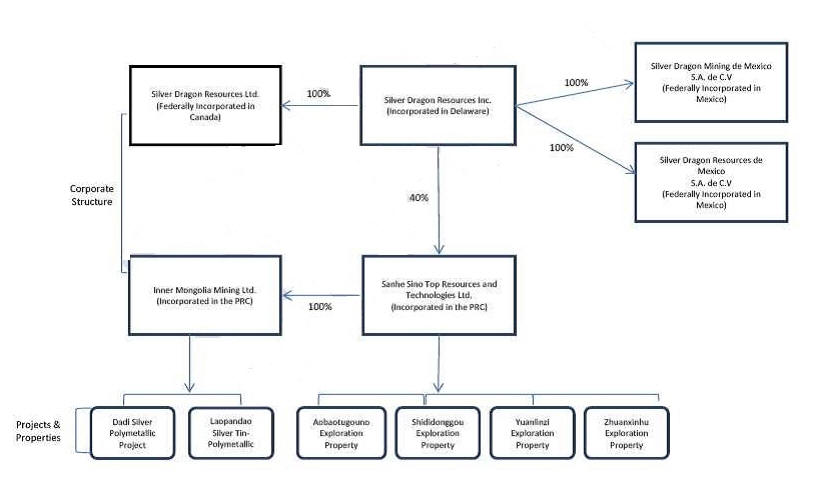

The following organizational chart sets forth (i) our wholly and partially owned direct and indirect subsidiaries, (ii) certain properties in which we have an interest:

Our interest in Sanhe Sino-Top Resources and Technologies Ltd. (“Sino-Top”) may be diluted and we may be subject to bankruptcy, insolvency and/or dissolution. See the disclosures below and “Risk Factors”.

8

Business Overview

We are engaged in the acquisition and exploration of silver and other mineral properties. We are an exploration stage company, have no known reserves and have never generated any revenues from our operations. No assurances can be given that we will ever have any known reserves or generate any such revenues.

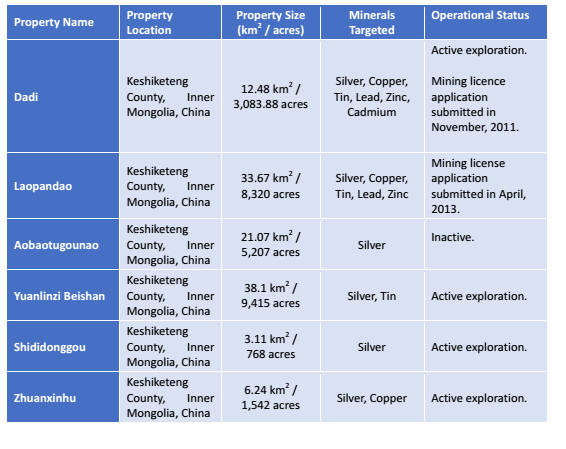

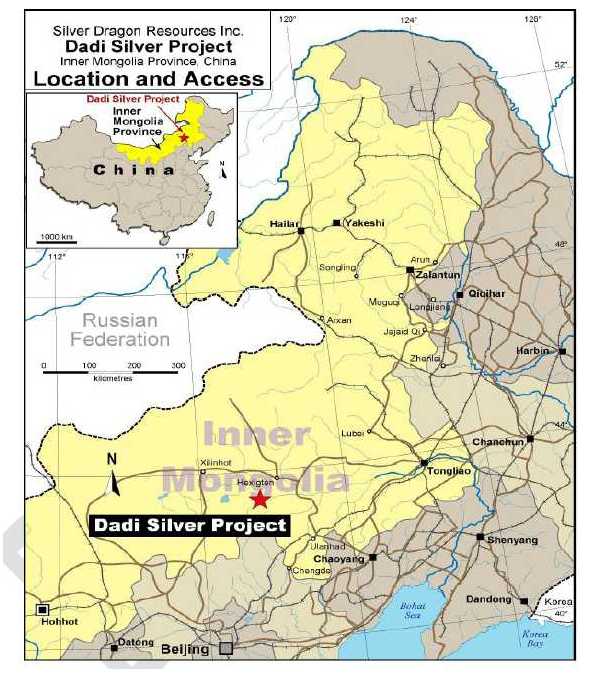

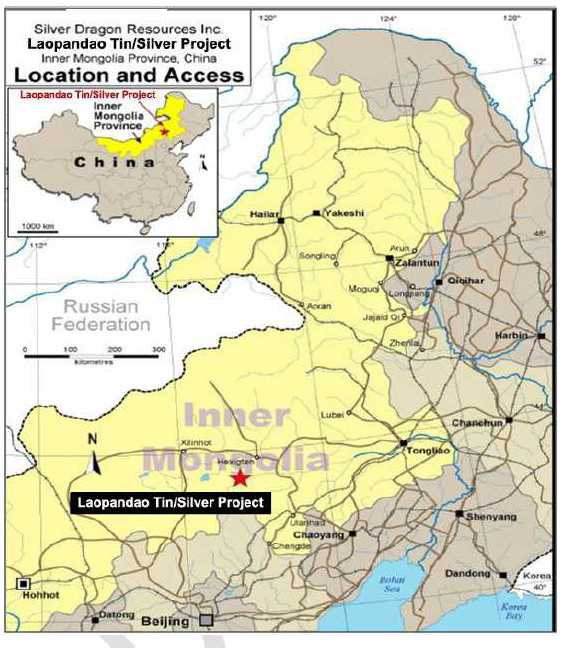

We are a mineral exploration company focused on the exploration of six properties located in the Erbahuo Silver District in Northern China (Inner Mongolia), namely, the Dadi, Laopandao, Aobaotugounao, Shididonggou, Yuanlinzi and Zhuanxinhu properties (collectively, the “Sino-Top Properties”), in which we have a 40% indirect interest by virtue of our equity holdings in Sanhe Sino-Top Resources and Technologies, Ltd. (“Sino-Top’’). Our equity holdings in Sino-Top may be diluted. See below.

Sino-Top Joint Venture

On March 16, 2006, we entered into an asset purchase agreement (the “Asset Purchase Agreement”) pursuant to which we originally acquired a 60% interest in Sino-Top from Sino Silver Corp. (“Sino Silver”). Sino-Top is operated as a joint venture under a joint venture agreement dated January 20, 2005 originally between Sino Silver and certain other parties, as amended on each of March 16, 2006, October 31, 2006, July 4, 2008, March 20, 2009, July 3, 2009, December 12, 2009 and September 13, 2011, and currently between the Company, Gansu Shengda Group Ltd. (Shengda), a private Chinese conglomerate (“Shengda”), and five individual persons (as so amended, the “Joint Venture Agreement”). Pursuant to the Asset Purchase Agreement, we acquired all of Sino Silver’s interest in Sino-Top and became a party to the Joint Venture Agreement. Sino-Top holds certain exploration and mining rights to certain properties in the Erbahuo Silver District in Northern China. The total purchase price under the Asset Purchase Agreement was $650,000 plus 4,000,000 shares of our restricted Common Stock, all of which has been delivered to Sino Silver.

In March 2007, we increased our interest from 60% to 90% in exchange for 2 million restricted common shares of the Company. On July 4, 2008, we signed a definitive agreement to sell 50% of Sino-Top to five individual persons. Immediately prior to such time, such individuals collectively owned 10% of Sino-Top. Therefore, immediately following such sale, these five individuals collectively owned 60% of Sino-Top, and we owned the remaining 40%. On November 20, 2008, Shengda agreed to acquire 52% of the equity interests in Sino-Top from those five individuals. As a result of the foregoing conveyances, we currently own a 40% equity interest in Sino-Top, the aforementioned five individuals own an aggregate of 8%, and Shengda owns 52%. We understand that one of such five individuals, Zhou Lin (who owns 6.8%), holds such common shares on behalf of Huaguan Industrial Corp. Due to name changes and translation issues, the “Comprehensive Gross Exploration Department,” “North China Comprehensive Geological Brigade,” “North China non-ferrous geological survey brigade” and “HIC” all refer to the same organization, which is Silver Dragon Resources Inc.’s Chinese joint venture partner, now more formally called “Exploration Unit of Tianjin North China Geological Exploration Bureau” or “Huaguan Industrial Corp” (“HIC”).

Sino-Top is governed by its board of directors, which makes decisions on all major issues regarding the joint venture and in accordance with the Sino-foreign Cooperative Joint Venture law of P.R. China and the articles of association. The general manager, which is presently Mr. Zhuang Haichao, is appointed by the board and is responsible for implementing the resolutions of the board and managing the daily operations of the joint venture. The board currently consists of five members, with two members appointed by Shengda, two members appointed by Silver Dragon, and one member appointed by the five natural person owners of Sino-Top. In general, the board may pass a resolution by a majority vote of the directors. Among other things, the board has the power and authority to distribute cash or assets from time to time to the shareholders in proportion to such shareholders’ equity interests in Sino-Top. No shareholder has the obligation to pay additional capital contribution to the joint venture. If the board deems it necessary, each party may but is not obliged to contribute additional capital to the joint venture in accordance with the timing and amount as decided by the board. The parties operate under an arrangement whereby any contributions to Sino-Top are funded by Shengda and Silver Dragon at a ratio of 5:4; i.e., Shengda funds approximately 55.56% and Silver Dragon funds approximately 44.44%, with the other joint venture partners not making any capital contributions. Our interest in Sino-Top may be diluted if the board authorizes the issuance of additional securities in a manner that does not allow us to contribute capital in accordance with the foregoing arrangement or in the event that we are extended the opportunity to so contribute but are unable to do so due to insufficient funds.

Sino-Top renewed its business license on February 15, 2012. The license was issued by the Industrial and Commercial Administration Agency of Sanhe City, China, extending the business operating period to March 24, 2023 and increasing the registered capital to $7,270,000. The business license scope covers the exploration and development of deposits of copper, lead, zinc, silver, gold and associated metals, and sales of developed products from the properties operated by Sino-Top.

9

Sino-Top currently holds the exploration rights to the following six properties: Dadi, Laopandao, Aobaotugounao, Shididonggou, Yuanlinzi and Zhuanxinhu properties. For a description of the Sino-Top Properties and Sino-Top’s activities on such properties, see “Item 2 – Description of Properties”.

Status of Sino-Top Joint Venture Funding

The Sino-Top board met on May 9, 2013 and passed resolutions regarding corporate operation plans, the budget and the funding schedule for 2013. The 2013 funding gap is Renminbi (“RMB”)90,000,000 or $14,490,000. In accordance with the investment ratio of 5:4, Shengda should contribute RMB50,000,000 or $8,050,000 and Silver Dragon should contribute RMB40,000,000 or $6,440,000. The funding gap shall be filled in four installments, with the first payment of RMB10,000,000 or $1,610,000 to be made before May 31, 2013, the second payment of RMB20,000,000 or $3,220,000 before June 30, 2013, the third payment of RMB30,000,000 or $4,830,000 before September 30, 2013 and the fourth payment of RMB 30,000,000 of $4,830,000 before December 31, 2013. To date, Shengda has contributed RMB19,655,600 or $3,164,552 for part of their contribution (of which RMB12,355,600 or $1,989,252 was contributed before December 31, 2013). The Company’s required contributions totaling RMB40,000,000 or $6,440,000 were to be contributed as follows: RMB4,440,000 or $716,840 before May 31, RMB8,890,000 or $1,431,290 before June 30, RMB13,330,000 or $2,146,130 before September 30, and RMB13,340,000 or $2,147,740 before December 31, 2013. The Company has not been able to make any of these contributions. All amounts based on the noon exchange rate reported by the Bank of Canada on March 28, 2014.

At the recent Sino-Top board of directors meeting held on March 29, 2014, the 2014 budget was finalized. The total budget for 2014 is RMB171,000,000 or $27,531,000 and the Company's contribution is RMB76,000,000 or $12,236,000. The Company's investment in Sino-Top will be diluted to 20% if it does not make a contribution of RMB50,000,000 or $8,050,000 by April 8, 2014 and a further contribution of RMB26,000,000 or $4,186,000 by June 15, 2014, with no further contributions. These are cumulative amounts and include past contributions which were not made by the Company.

Potential Transaction with Investor

In 2013, the Company began to engage in discussions with an investor based in China, Man Kwan Fong, regarding a potential transaction that, if completed, would have involved the investor making a secured loan to the Company and taking over control of the management and board of directors of the Company. On November 29 and December 31, 2013, the Company received advances totaling $1,069,279 from the investor; however, the parties have not resolved definitive agreements, nor has the investor funded the remaining amounts required to complete the initial closing. Due to funding delays by the investor and changes in the investor’s offer, the Company’s board of directors has determined not to proceed with the contemplated transaction. The Company is seeking to resolve the treatment of the initial $1,069,279 with the investor, and may be required to return such funds, with or without interest, to the investor.

Sale of Interest in Chifeng

As previously disclosed, on May 28, 2012, the Company entered into a definitive agreement to sell its 70% interest in Chifeng Silver Dragon Resources & Technologies, Ltd. (“Chifeng”), which then owned the Erbahuo silver mine located on the boundary of Wengniute County and Keshiketeng County, Inner Mongolia. The Company sold such interest to Deng Zuoping, a private Chinese investor, for RMB 7.4 million or US$1,164,020, of which RMB1 million was to be paid within three business days after signing the agreement, RMB5 million was to be paid before July 15, 2012 and RMB1.4 million was to be paid by November 1, 2012. On June 1, 2012, an initial deposit of RMB1.0 million or $157,300 was received, of which $12,584 was contributed to Chifeng for expenses incurred until the date of the sale. Concurrently with such payment, we transferred to the purchaser title to our interest in Chifeng. Of the remaining payments, RMB5 million or $790,980 was paid to the Company during the fourth quarter of 2012. During 2013, RMB900,000 or $146,141 was paid. In addition, in the third quarter of 2013, RMB400,000 or $64,880 was added to the costs in connection with the Chifeng sale. As at December 31, 2013, RMB100,000 or $16,520 remained outstanding. This balance was received on January 3, 2014.

Strategic Evaluation

Our management and board of directors are assessing recent developments, our financial position and related risks, and evaluating our alternatives. These alternatives may include dissolution or bankruptcy. See “Risk Factors”.

Competition

We currently face strong competition from other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the companies engaged in mineral resource exploration with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. We also compete with other mineral resource exploration companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. Such competition could adversely impact our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties or to acquire additional properties.

Regulatory obligations and government approvals in China

Exploration for and exploitation of mineral resources in China is governed by the Mineral Resources Law of the People’s Republic of China (“PRC”) of 1986, amended effective January 1, 1997, and the Implementation Rules for the Mineral Resources Law of the PRC, effective March 26, 1994. In order to further implement these laws, on February 12, 1998, the State Council issued three sets of regulations: (i) Regulation for Registering to Explore Mineral Resources Using the Block System, (ii) Regulation for Registering to Mine Mineral Resources, and (iii) Regulation for Transferring Exploration and Mining Rights (together with the mineral resources law and implementation rules being referred to herein as “Mineral Resources Law”).

Under Mineral Resources Law, the Ministry of Land and Resources and its local authorities (the “MLR”) is in charge of the supervision of mineral resource exploration and development. The mineral resources administration authorities of provinces, autonomous regions and municipalities, under the jurisdiction of the State, are in charge of the supervision of mineral resource exploration and development in their respective administration areas. The PRC’s governments of provinces, autonomous regions and municipalities, under the jurisdiction of the State, are in charge of coordinating the supervision by the mineral resources administration authorities on the same level.

The Mineral Resources Law, together with the Constitution of the PRC, provides that mineral resources are owned by the State, and the State Council, the highest executive organization of the State, which regulates mineral resources on behalf of the State. The ownership rights of the State include the rights to: (i) occupy, (ii) use, (iii) earn, and (iv) dispose of, mineral resources, regardless of the rights of owners or users of the land under which the mineral resources are located. Therefore, the State is free to authorize third parties to enjoy its rights to legally occupy and use mineral resources and may collect resource taxes and royalties pursuant to its right to earn. In this way, the State can control and direct the development and use of the mineral resources of the PRC.

10

Mineral resources licenses

China has adopted, under the Mineral Resources Law, a licensing system for the exploration and exploitation of mineral resources. The MLR is responsible for approving applications for exploration licenses and mining licenses. The approval of the MLR is also required to transfer exploration licenses and mining licenses.

Applicants must meet certain conditions as required by related rules/regulations. Pursuant to the Regulations for Registering to Mine Mineral Resources, the applicant for mining rights must present the required documents, including a plan for development and use of the mineral resources and an environmental impact evaluation report. The Mineral Resources Law allows individuals to exploit sporadic resources, sand, rocks and clay for use as construction materials and a small quantity of mineral resources for sustenance. However, individuals are prohibited from mining mineral resources that are more appropriately mined at a certain scale by a company, specified minerals that are subject to protective mining by the State and certain other designated mineral resources.

Once granted, all exploration and mining rights under the licenses are protected by the State from encroachment or disruption under the Mineral Resources Law. It is a criminal offence to steal, seize or damage exploration facilities, or disrupt the working order of exploration areas.

Exploration rights

In order to conduct exploration, a Sino-foreign cooperative joint venture (“CJV”) must apply to the MLR for an exploration license. Owners of exploration licenses are “licensees”. The period of validity of an exploration license can be no more than three years. An exploration license area is described by a “basic block”. An exploration license for metallic and non-metallic minerals has a maximum of 40 basic blocks. When mineral resources that are feasible for economic development have been discovered, a licensee may apply for the right to develop such mineral resources. The period of validity of the exploration license can be extended by application and each extension can be for no more than two years. The annual use fee for an exploration license is RMB 100 per square kilometer for the first three years and increases by RMB 100 per square kilometer for each subsequent year, subject to a maximum fee of RMB 500 per square kilometer.

During the term of the exploration license, the licensee has the privileged priority to obtain mining rights to the mineral resources in the exploration area, provided that the licensee meets the qualifying conditions for mining rights owners. An exploration licensee has the rights, among others, to: (i) explore without interference within the area under license during the license term, (ii) construct the exploration facilities, and (iii) pass through other exploration areas and adjacent ground to access the licensed area.

After the licensee acquires the exploration license, the licensee is obliged to, among other things: (i) begin exploration within the prescribed term, (ii) explore according to a prescribed exploration work scheme, (iii) comply with State laws and regulations regarding labor safety, water and soil conservation, land reclamation and environmental protection, (iv) make detailed reports to local and other licensing authorities, (v) close and occlude the wells arising from exploration work, (vi) take other measures to protect against safety concerns after the exploration work is completed, and (vii) complete minimum exploration expenditures as required by the Regulations for Registering to Explore Resources Using the Block.

Mining rights

In order to conduct mining activities, a CJV must also apply for a mining license from the MLR. Owners of mining rights, or “concessionaires”, are granted a mining license to mine for a term of no more than ten to thirty years, depending on the magnitude or size of the mining project. A mining license owner may extend the term of a mining license with an application 30 days prior to expiration of the term. The annual use fee for a mining license is RMB 1,000 per square kilometer per year.

A mining license owner has the rights, among others, to: (i) conduct mining activities during the term and within the mining area prescribed by the mining license, (ii) sell mineral products (except for mineral products that the State Council has identified for unified purchase by designated units), (iii) construct production and living facilities within the mine area, and (iv) use the land necessary for production and construction, in accordance with applicable laws.

A mining license owner is required to, among other things: (i) conduct mine construction or mining activities within a defined time period, (ii) conduct efficient production, rational mining and comprehensive use of the mineral resources, (iii) pay resources tax and mineral resources compensation (royalties) pursuant to applicable laws, (iv) comply with State laws and regulations regarding labor safety, water and soil conservation, land reclamation and environmental protection, (v) be subject to the supervision and management by the departments in charge of geology and mineral resources, and (vi) complete and present mineral reserves forms and mineral resource development and use statistics reports, in accordance with applicable law.

11

Transfer of exploration and mining rights

A mining company may transfer its exploration or mining licenses to others, subject to the approval of MLR.

An exploration license may only be transferred if the transferor: (i) held the exploration license for two years after the date that the license was issued, or discovered minerals in the exploration block, which are able to be explored or mined further, (ii) has a valid and subsisting exploration license, (iii) completed the stipulated minimum exploration expenditures, (iv) paid the user fees and the price for exploration rights pursuant to the relevant regulations, and (v) obtained the necessary approval from the authorized department in charge of the minerals.

Mining rights may only be transferred if the transferor needs to change the ownership of such mining rights because it is: (i) engaging in a merger or split, (ii) entering into equity or cooperative joint ventures with others, (iii) selling its enterprise assets, or (iv) engaging in a similar transaction that will result in an alteration of the property ownership of the enterprise.

Additionally, when state-owned assets or state funds are involved in a transfer of exploration licenses and mining licenses, the related state-owned assets rules and regulations apply and a proper evaluation report must be completed and filed with the MLR.

Speculation in exploration and mining rights is prohibited. The penalties for speculation are that the rights of the speculator may be revoked, illegal income from speculation confiscated and a fine levied.

Environmental laws

In the past ten years, Chinese laws and policies regarding environmental protection have moved towards stricter compliance standards and stronger enforcement. In accordance with the Environmental Protection Law of the PRC adopted by the Standing Committee of the PRC National People’s Congress on 26 December 1989, the General Administration of Environmental Protection Bureau under the State Council sets national environmental protection standards. The various local environmental protection bureaus may set stricter local standards for environmental protection. CJVs are required to comply with the stricter of the two standards.

The basic laws in China governing environmental protection in the mineral industry sector of the economy are the Environmental Protection Law and the Mineral Resources Law. Applicants for mining licenses must submit environmental impact assessments, and those projects that fail to meet environmental protection standards will not be granted licenses. In addition, after the exploration, a licensee must take further actions for environmental protection, such as performing water and soil maintenance. After the mining licenses have expired or a licensee stops mining during the license period and the mineral resources have not been fully developed, the licensee shall perform other obligations such as water and soil maintenance, land recovery and environmental protection in compliance with the original development scheme, or must pay the costs of land recovery and environmental protection. After closing the mine, the mining enterprise must perform water and soil maintenance, land recovery and environmental protection in compliance with mine closure approval reports, or must pay certain costs, which include the costs of land recovery and environmental protection.

Compliance with environmental laws

We are responsible for providing a safe working environment, not disrupting archaeological sites, and conducting our activities to prevent unnecessary damage to the area in which our mineral claim is located. At this time, we do not believe that the cost of compliance at the federal, state and local levels will be significant.

We intend to secure all necessary permits required for exploration. We anticipate no discharge of water into active streams, creeks, rivers, lakes or other bodies of water regulated by environmental law or regulation. We also anticipate that no endangered species will be disturbed. Restoration of the disturbed land will be completed according to law, and all holes, pits and shafts will be sealed upon abandonment of the mineral claims. During the exploration phase that we are in now, compliance costs are nil or nominal. It is difficult to estimate the cost of compliance with the environmental laws, because the full nature and extent of our proposed activities cannot be determined until we start our operations.

12

We believe we are in compliance with the environment laws, and that we will continue to be able to comply with such laws in the future.

Land and construction

The holder of an exploration license or mining license should apply for land use right with MLR to conduct exploration or mining activities on the land covered by the exploration license or mining license. The license holder should file an application to MLR for the land use right with its exploration license or mining license. If the application is approved by the competent government authority, the MLR would issue an approval to the land use right applicant. Then, the local MLR would enter into a land use right contract with the license holder. The license holder should pay relevant price and fees in accordance with the contract and then obtain a land use right certificate from MLR. In practice, instead of obtaining a long-term land use right, an exploration license holder may apply for a temporary land use right, which would normally be valid for 2 years and may be renewed upon application.

The company should also apply for other zoning and construction permits to conduct construction on the land. PRC laws require a company to obtain the land zoning permit and construction zoning permit with the local zoning authorities under the Ministry of Construction (‘‘MOCON’’). Then, the company is required to enter into a construction contract with a qualified constructor and file the construction contract to the local construction authorities under the MOCON and obtain a construction permit. After the construction is completed, the company should apply for the construction authorities and related environmental and fire departments for the check and acceptance of the construction. Upon the pass of check and acceptance, the company should apply with local housing authorities to register the constructed buildings in its own name and obtain a housing ownership certificate.

Foreign Exchange Controls

Pursuant to PRC foreign exchange regulations, foreign exchange dealings are administered by the State Administration of Foreign Exchange and its local agencies (the “SAFE”) and transacted through designated financial institutions. CJVs are required to conduct their corporate activities in accordance with the relevant PRC foreign exchange rules/regulations.

CJVs are entitled to borrow funds from overseas within such CJVs’ total investment amount. Once such loan agreements have been registered with the SAFE in accordance with the formal requirements, the principal and interest of loan can be paid out of China.

The shareholder of a CJV is entitled to transfer the funds out of China when it sells its equity in the CJV to a Chinese buyer, but such transfer of money should be approved by SAFE.

The PRC government imposes control over the convertibility between Renminbi and foreign currencies. Under the PRC foreign exchange regulations, payments for “current account” transactions, including remittance of foreign currencies for payment of dividends, profit distributions, interest and operation-related expenditures, may be made without prior approval but are subject to procedural requirements. Strict foreign exchange control continues to apply to “capital account” transactions, such as direct foreign investment and foreign currency loans. These capital account transactions must be approved by or registered with the PRC State Administration of Foreign Exchange, or “SAFE”. Further, any capital contribution by an offshore shareholder to its PRC subsidiaries should be approved by the Ministry of Commerce in China or its local counterparts.

On August 29, 2008, SAFE promulgated the Circular on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign- invested Enterprises, or “Circular 142”, to regulate the conversion by foreign invested enterprises (“FIEs”), of foreign currency into Renminbi by restricting how the converted Renminbi may be used. Circular 142 requires that Renminbi converted from the foreign currency-dominated capital of a FIE may only be used for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC unless specifically provided for otherwise. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Compliance with Circular 142 may delay or inhibit our ability to complete such transactions, which could affect our ability to expand business.

13

Employees

As of March 31, 2014, the Company had no employees. The services of our Chief Executive Officer and other personnel are provided on a consulting basis.

Item 1A.Risk factors

You should consider each of the following risk factors and any other information set forth in this Form 10-K and the other reports we file with the SEC, including our financial statements and related notes, in evaluating our business and prospects. The risks and uncertainties described below are not the only ones that might affect our operations and business. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, may also impair our business or operations.

Risks relating to our Business

We have inadequate capital to pay our debts and to fund our business as currently planned, and we therefore face a risk of bankruptcy and/or loss of our assets.

As of December 31, 2013, we had a cash balance of $226,937 and current debt obligations in the amount of $5,961,246. We do not have sufficient funds to satisfy our current debt obligations. Should our creditors seek or demand payment, we do not have the resources to pay or satisfy any such claims. Thus, we face a risk of bankruptcy.

As discussed in Item 1, we received advances totaling $1,069,279 from an investor in contemplation of a secured loan and change of control transaction that has not closed. This amount is included within our current debt obligations. Due to funding delays by the investor and changes in the investor’s offer, the Company's board of directors has determined not to proceed with the contemplated transaction. The Company is seeking to resolve the treatment of the advance with the investor; however, no assurance can be provided as to the resolution of this matter. The Company may be required to return the advances to the investor, with or without interest, and may incur additional costs and expenses with respect to this matter.

In addition to having insufficient cash to pay our debts, we have no funds to support any business operations. We have been unable to satisfy our commitment to fund 44.44% of owners’ contributions to the Sino-Top joint venture, and our funding of an aggregate of RMB40,000,000 or $6,440,000 to Sino-Top is overdue. There is a significant risk that our inability to fund Sino-Top will result in a dilution of our 40% equity ownership in Sino-Top.

At the recent Sino-Top board of directors meeting held on March 29, 2014, the 2014 budget was finalized. The total budget for 2014 is RMB171,000,000 or $27,531,000 and the Company's contribution is RMB76,000,000 or $12,236,000. The Company's investment in Sino-Top will be diluted to 20% if it does not make a contribution of RMB50,000,000 or $8,050,000 by April 8, 2014 and a further contribution of RMB26,000,000 or $4,186,000 by June 15, 2014, with no further contributions. These are cumulative amounts and include past contributions which were not made by the Company.

To pay our debts and to fund any future operations, we require significant new funds, which we may not be able to obtain. In addition to the funds we require to liquidate our $5,961,246 in current debt obligations, and the funds we require to satisfy our RMB76,000,000 or $12,236,000 required contributions to Sino-Top, we estimate that we must raise approximately $1,200,000 to fund capital requirements and general corporate expenses for the next 12 months.

We have historically satisfied our working capital requirements through the private issuances of equity securities and convertible notes. We may continue to seek additional funds through such channels and from collaboration and other arrangements with corporate partners. However, we may not be able to obtain adequate funds when needed or funding that is on terms acceptable to us. Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

| • | investors’ perception of, and demand for, securities of Chinese-based mining exploration companies; |

| • | economic, political and other conditions in China; |

| • | conditions of the U.S. and other capital markets in which we may seek to raise funds; |

| • | our future results of operations, financial condition and cash flows; |

| • | the terms of our existing indebtedness; |

| • | regulatory restrictions; |

| • | the limited liquidity of our common stock; and |

| • | the limited number of shares of common stock we have authorized and unissued. |

If we fail to obtain sufficient funds to satisfy our debt obligations before a valid demand for payment by our creditors, and/or if we fail to obtain sufficient funds to satisfy our capital requirements and general corporate expenses, we will need to sell certain or all of our property interests in China (assuming the existence of an interested buyer and our ability to do so under applicable regulations), refrain from financially contributing to the future operations of Sino-Top, or, as mentioned above, go into bankruptcy proceedings. In the event of bankruptcy, our creditors would assert claims that could result in the total liquidation of the Company or, failing that, our creditors could acquire control of the Company and our existing stockholders could lose their entire investment.

Dilution of our interest in Sino-Top and the loss of other assets and operations may result in our company being deemed an investment company, which may require us to limit our activities and dissolve our company.

Operational difficulties and our inability to obtain adequate funding in recent years has resulted in our interests in certain assets being lost or diluted and our staff being reduced. Our principal asset is currently our 40% equity interest in Sino-Top, and if we are unable to satisfy capital contributions to Sino-Top we anticipate being diluted to a 20% equity interest in Sino-Top. Dilution or loss of our assets may result in the SEC or other parties alleging that we are, or we may otherwise be deemed, an investment company that is required to register under the Investment Company Act of 1940, as amended, and analogous state laws. Registration under such Act would be a significant financial and operational burden and is unlikely to be feasible for our company. If we were deemed an investment company and we failed to register under such Act, we would be subject to significant legal restrictions, including being prohibited from engaging in the following activities, except where incidental to our dissolution: offering or selling any security or any interest in a security; purchasing, redeeming, retiring or otherwise acquiring any security or any interest in a security; controlling an investment company that engages in any of these activities; engaging in any business in interstate commerce; or controlling any company that is engaged in any business in interstate commerce. In addition, certain or all of our contracts might not be enforceable and civil and criminal actions could be brought against us and related persons. Our management and board of directors are assessing this risk and evaluating our alternatives. As a result of this risk, we may be required to significantly limit our business activities and dissolve.

Our breaches of covenants under our convertible financing arrangements may have material adverse effects.

As of December 31, 2013, but for the forbearance agreements between us and four lenders under our convertible financing arrangements, we would have been in breach or default under the covenants for some or all of our convertible financing arrangements. Our forbearance agreements with such lenders, in the aggregate, provide that if we pay such lenders $3,319,114 on or before June 30, 2014, such payments will constitute payment in full of any and all obligations due and owing under our outstanding promissory notes owed to these lenders. However, we do not have the funds necessary to make such payments, and there can be no assurances that we will be able to make any or all of such payments prior to such deadline. Upon the expiration of the forbearance agreements, if we are unable to pay such amounts or extend such agreements, we may therefore be in default under such financing arrangements. Depending upon the financing arrangement, a default may mean that the lender is entitled to default interest, acceleration of amounts due and/or other special rights, to impose additional penalties against us, and/or to refrain from taking certain actions such as advancing additional funds to us or converting existing indebtedness into equity. Such breaches or defaults may therefore increase the size of our indebtedness, increase our costs, increase the amount of funding that we will require, accelerate our funding needs, prevent us from raising additional funds from the affected lenders and prevent such lenders from converting existing indebtedness into equity. We have not paid default interest in connection with the repayment of any notes. There may be a risk that a lender claims default interest on notes previously paid. Defaults may also make it more difficult for us for us to raise funding from other sources, and cause cross-defaults under other obligations. Defaults may result in litigation, bankruptcy, loss of assets or our ceasing operations altogether. Such defaults may also affect our stock price, which would increase the dilution resulting from any conversion of those convertible notes that convert at a discount to market. There can be no assurance that we will be successful in eliminating such defaults, paying our debts when due or negotiating other satisfactory arrangements with our lenders.

14

None of the properties in which we have an interest or the right to earn an interest has, and none may ever be discovered to have, any known reserves.

We have no known bodies of commercial ore or economic deposits and have not defined or delineated any proven or probable reserves on any of our properties. We may never discover any silver or other minerals from mineralized material in commercially exploitable quantities and any identified mineralized deposit may never qualify as a commercially mineable (or viable) reserve. In addition, we are in the early stages of exploration and substantial additional work will be required in order to determine if any economic deposits exist on our properties. Substantial expenditures are required to establish ore reserves through drilling and metallurgical and other testing techniques. No assurance can be given that any level of recovery of any ore reserves will be realized or that any identified mineral deposit will ever qualify as a commercial mineable ore body that can be legally and economically exploited.

Even if commercial quantities of minerals were to be discovered on the properties in which we own an interest, those properties might not be brought into a state of commercial production. Estimates of mineralization are inherently imprecise and depend to some extent on statistical inferences drawn from limited drilling, which may prove unreliable. Fluctuations in the market prices of minerals may render reserves and deposits containing relatively lower grades of mineralization uneconomic. Material changes in mineralized material, grades or recovery rates may affect the economic viability of projects. Finding mineral deposits is dependent on a number of factors, not the least of which are the technical skills of exploration personnel involved. The commercial viability of a mineral deposit, once discovered, is also dependent on a number of factors, some of which are particular attributes of the deposit, such as size, grade and proximity to infrastructure and resource markets, as well as factors independent of the attributes of the deposit, such as government regulations and metal prices. Most of these factors are beyond the control of the entity conducting such mineral exploration.

These risks may limit or prevent us from making a profit from the exploration and development of the properties in which we have an interest and could negatively affect the value of our securities.

All of the properties in which we hold an interest are subject to one material agreement and are located in one geographical area in China, making us vulnerable to risks resulting from lack of diversification.

All of the properties in which we hold an interest are concentrated in one geographical area in China, with such interest being subject to one material agreement. As a result, we have no diversification contractually, operationally or geographically, and we are therefore disproportionately exposed to the impact of any failure of the joint venture governing our properties, as well as to any disruptions in our operations in China as a result of any lack of availability of equipment, facilities, personnel or services, significant governmental regulation, natural disasters or otherwise. Due to the concentrated nature of our property portfolio, a number of the properties could experience the same adverse conditions at the same time, resulting in a relatively greater impact on our results of operations than they might have on other companies that have a more diversified portfolio of properties. Any such disruptions or failures could have a material adverse effect on our financial condition and results of operations.

We are exposed to a variety of risks due to the fact that all of our property interests are held through a partially-owned subsidiary.

All of our current property interests are held through a partially owned subsidiary, and we may enter into similar corporate or contractual structures in the future. As a result of holding all of our property interests through such vehicles, there are limits to our control with regard to the management, operations, compliance and strategic direction of the ventures. For example, joint ventures and partially owned subsidiaries can often require unanimous approval of the owners for certain fundamental decisions such as an increase or reduction of registered capital, merger, division, dissolution, dividends, amendments of constating documents, and the pledge of assets. In particular, under our Joint Venture Agreement governing Sino-Top, we occupy only two of the five seats on the board and accordingly, have limited ability to influence the venture. In addition, we have no protection against dilution of our present interest in Sino-Top. As such, as discussed above our interest in Sino-Top will be diluted to 20% if we cannot meet the contribution requirements established at the Sino-Top board of directors meeting held on March 29, 2014, with no further contributions.

15

While we provide strategic management and operational advice to our partially owned subsidiary and its other equity owners, we cannot always ensure that it is operated in compliance with applicable standards or laws. If such an entity is not operated effectively, efficiently or lawfully, including as a result of weaknesses in the policies, procedures and controls implemented by the other equity owners, our investment in the relevant project could be adversely affected. In addition, any negative publicity associated with operations that are ineffective or inefficiently operated, particularly relating to any resulting accidents or environmental incidents, could harm our reputation and therefore our prospects and potentially our financial condition. Furthermore, any failure of other equity owners to meet their obligations to us or to third parties, or any disputes with respect to the parties’ respective rights and obligations, could have a material adverse effect on the joint ventures or their properties and, therefore, could have a material adverse effect on our results of operations, financial performance, cash flows and share price.

Estimates of mineral deposits and operating costs or profitability associated with mining activities are based on interpretation and assumptions and are inherently imprecise.

From time to time, we may publish on our website, in press releases or through other public channels estimates of mineral deposits and associated operating costs or profitability. However, until mineral deposits are actually mined and processed, the quantity of mineral deposit and expected operating costs and profitability must be considered as estimates only, and no assurances can be given that the indicated levels of metals will be produced or that we will receive the price assumed. Any such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Estimates can be imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. In addition, estimates made at a given time may significantly change when new information becomes available. Furthermore, fluctuations in the market price of metals, as well as increased capital or production costs or reduced recovery rates may render mineral deposit extraction uneconomic. No assurances can be given that any mineral deposit estimate will ultimately be reclassified as proven or probable mineral reserves or that mineralization can be mined or processed profitably. If our mineral deposit estimates and related projections are inaccurate or are reduced in the future, our future cash flows, earnings, results of operations and financial condition could be adversely impacted.

Third parties have successfully challenged in the past, and could challenge in the future, title for the properties in which we have an interest.

Neither we nor Sino-Top has obtained title insurance for our properties. Title to the properties in which we have an interest may be challenged in the future. In Mexico, as previously disclosed, we lost title to the property interests in which we held an interest, and we will never recover the rights we lost. If we were to be subjected to additional challenges over title to our assets or encounter other issues relating to our title, we would likely incur significant costs and lose valuable time in defending such matters. If such challenges against us were to be successful, as they have been in the past, we could lose part or all of our interest in the respective properties and our business could be materially adversely affected.

Our staffing may be inadequate to support our legal and planned business requirements.

As of the date of this filing, the Company had no employees. The services of our Chief Executive Officer and other personnel are provided by consultants on contract. This reduced level of staffing is primarily a result of the Company’s limited financial resources. Our limited staffing may adversely affect our ability to fulfill our SEC reporting and other legal requirements, including improvements to our disclosure controls and procedures and our internal control over financial reporting, and to execute our planned business activities, including the raising of necessary capital. Limitations on staffing may require us to restrict our planned business activities. It also increases our reliance upon the efforts of Marc Hazout, our President and principal financial and accounting officer, who is serving as our principal executive, financial and accounting officer as of the date of this filing and provides his services under a consulting agreement. Any loss of contracted individuals, including any loss of Mr. Hazout’s services, could have a material adverse effect on the Company.

Additional personnel with technical training or experience in exploring for, starting and operating an exploration program will be needed in respect of the properties in which we have an interest. If such personnel cannot be effectively supervised or retained, mining operations may need to be suspended or terminated, which could result in the loss of your investment.

Additional contractors must be recruited and retained in order to perform surveying, exploration and excavation of the properties in which we have an interest. Management must rely on the personnel it has hired or retained to assist them in making critical engineering and business decisions. Consequently, our operations, earnings and ultimate financial success could suffer irreparable harm if management is unable to supervise and retain qualified personnel to carry out these tasks. As a result, operations with respect to the properties in which we have an interest may need to be suspended or terminated, which could result in the loss of your investment.

16

Our success also depends on the ability to hire and retain skilled operating, marketing, technical, financial and management personnel. In the mining sector, competition in connection with hiring and retaining skilled, dependable personnel is intense. We or our joint venture partners may not offer salaries or benefits that are competitive with those offered by our competitors, who may have significantly more resources when compared to us. As such, even if we or our joint venture partners were to succeed in hiring skilled personnel, it may not be possible to retain them.

We have concluded that neither our disclosure controls and procedures nor our internal control over financial reporting was effective as of December 31, 2013. Failure to improve them could lead to errors in our financial statements and could adversely affect the Company.

As a public company, we are required to comply with the periodic reporting obligations of the Exchange Act including preparing annual reports, quarterly reports and current reports. Our failure to prepare and disclose the requisite information in a timely manner could subject us to penalties under federal securities laws, expose us to lawsuits and restrict our ability to access financing. In addition, we are required under applicable law and regulations to integrate our systems of disclosure controls and procedures and internal control over financial reporting. We conducted an evaluation, under the supervision and with the participation of our principal executive officer and principal financial officer, of the effectiveness of our disclosure controls and procedures (as such term is defined in Rules 13a15 (e) and 15d15(e) under the Exchange Act) and our internal control over financial reporting, each as of December 31, 2013. Based on such evaluation, our principal executive officer and principal financial officer concluded that, as of such date, our disclosure controls and procedures and our internal controls over financial reporting were not effective. If we fail to improve our disclosure controls and procedures and internal control over financial reporting, we may not be able to produce reliable financial reports and investors may lose confidence in us, either of which could harm our business and negatively impact the trading price of our Common Stock.

We are an exploration stage company, and based on our negative cash flows from operating activities there is uncertainty as to our ability to continue as a going concern.

From inception, we have generated limited revenues and have experienced negative cash flows from operating losses. We anticipate continuing to incur such operating losses and negative cash flows for the foreseeable future, and to accumulate increasing deficits as we increase our expenditures for exploration and mining of minerals, infrastructure, research and development and general corporate purposes. Any increases in our operating expenses will require us to achieve significant revenue before we can attain profitability. Our history of operating losses and negative cash flows from operating activities will result in our continued dependence on external financing arrangements. In the event that we are unable to achieve or sustain profitability or are otherwise unable to secure additional external financing, we may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern. Any such inability to continue as a going concern may result in our security holders losing their entire investment. There is no guarantee that we will generate revenues or secure additional external financing. Our financial statements, which have been prepared in accordance with the United States Generally Accepted Accounting Principles (‘‘GAAP’’), contemplate that we will continue as a going concern and do not contain any adjustments that might result if we were unable to continue as a going concern. Changes in our operating plans, our existing and anticipated working capital needs, the acceleration or modification of our expansion plans, lower than anticipated revenues, increased expenses, potential acquisitions or other events will all affect our ability to continue as a going concern. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

The reports of independent auditors of our consolidated financial statements included in this annual report contain explanatory paragraphs which note our recurring operating losses since inception, our lack of capital and lack of long term contracts related to our business plans, and that these conditions give rise to substantial doubt about our ability to continue as a going concern. In the event that we are unable to successfully achieve future profitable operations and obtain additional sources of financing to sustain our operations, we may be unable to continue as a going concern. See “Management’s Plan of Operation” and our consolidated financial statements and notes thereto included in this annual report.

17

We have a history of operating losses and we anticipate future losses.

Since we changed our business focus to silver exploration, we have generated no revenues. We incurred losses of $2,907,682 and $5,239,185 for the fiscal years ended December 31, 2013 and 2012 respectively. We have accumulated losses since inception of $48,197,148. We anticipate that losses will continue until such time as revenue from operations is sufficient to offset our operating costs, which may never occur. If we are unable to generate our revenues and to increase them sufficiently to cover our costs, our financial condition will worsen and you could lose some or all of your investment.

Because we do not have sufficient capital, we may have limited our exploration activity, which may result in a loss of your investment.

Because we are small and do not have much capital, we have limited our exploration activity and we may not be able to complete exploration programs as planned. In that event, an existing ore body may go undiscovered. Without an ore body, we cannot generate revenues, in which case, you will lose your investment.

Because our property interests are located in China, our activities are subject to foreign (Chinese) governmental regulations that may subject us to penalties for failure to comply, may limit our ability to conduct exploration activities and could cause us to delay or abandon our projects.

Various regulatory requirements affect our current and future activities, including exploration activities on our property. Exploration activities require permits from various foreign (Chinese) federal, state and local governmental authorities and are subject to laws and regulations governing, among other things, prospecting, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, and others that currently or in the future may have a substantial adverse impact on us. Exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that we obtain permits from various governmental agencies.

Licensing and permitting requirements are subject to changes in laws and regulations and in various operating circumstances. There can be no assurance that we will be able to obtain or maintain all necessary licenses and/or permits that may be required for our activities or that such permits will be obtainable on reasonable terms or on a timely basis or that such laws and regulations will not have an adverse effect on any project which we might undertake. If we are unable to obtain the necessary licenses or permits for our exploration activities, we might have to change or abandon our planned exploration for such non-permitted properties and/or to seek other joint venture arrangements. In such event, we may be forced to sell or abandon our property interest.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing exploration activities to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining activities may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

Any change in or amendments to current laws, regulations and permits governing activities of mineral exploration companies, or more stringent implementation thereof, could require increases in exploration expenditures, or require delays in exploration or abandonment of new mineral properties. The cost of compliance with changes in governmental regulations has a potential to increase our expenses.

Chinese regulatory restrictions may limit our ability to receive and use our cash effectively.

We are exposed to the risks associated with foreign exchange controls and restrictions in China due to the fact that a portion of our cash is denominated in Renminbi, which is currently not freely exchangeable. The PRC government imposes control over the convertibility between Renminbi and foreign currencies. Under the PRC foreign exchange regulations, payments for “current account” transactions, including remittance of foreign currencies for payment of dividends, profit distributions, interest and operation-related expenditures, may be made without prior approval but are subject to procedural requirements. Strict foreign exchange control continues to apply to “capital account” transactions, such as direct foreign investment and foreign currency loans. These capital account transactions must be approved by or registered with the PRC State Administration of Foreign Exchange, or “SAFE”. Further, any capital contribution by an offshore shareholder to its PRC subsidiaries should be approved by the Ministry of Commerce in China or its local counterparts. We cannot assure you that we are able to meet all of our foreign currency obligations to remit profits out of China or to fund operations in China.

18

Because all of our assets, our officers and our directors are located outside the United States of America, it may be difficult for an investor to enforce within the United States any judgments obtained against us, our officer or our director.