☐ |

Preliminary Proxy Statement |

☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Under Rule 14a-12 |

☒ |

No fee required. |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

☐ |

Fee paid previously with preliminary materials: |

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

CARRIAGE SERVICES, INC. 3040 Post Oak Boulevard, Suite 300 Houston, Texas 77056 |

March 29, 2024

Dear Fellow Shareholder:

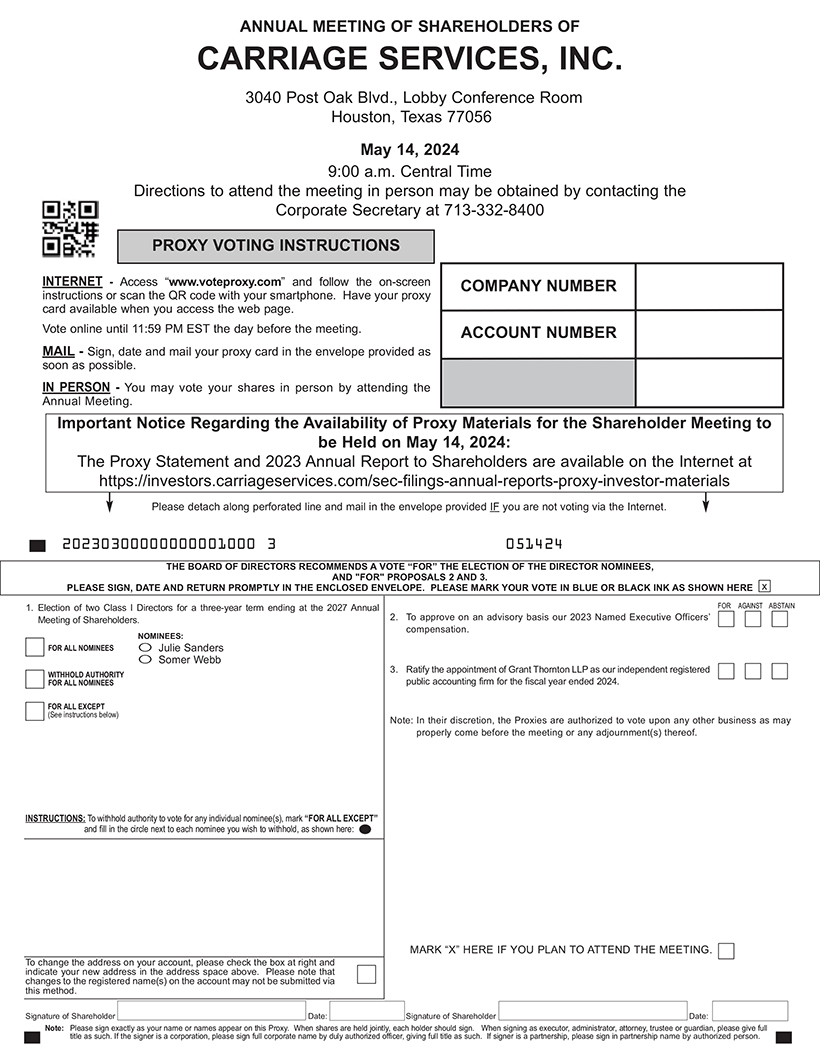

We are pleased to invite you to the 2024 Annual Meeting of Shareholders of Carriage Services, Inc. (“Carriage”). The Annual Meeting will be held at 3040 Post Oak Boulevard, Lobby Conference Room, Houston, Texas 77056 on Tuesday, May 14, 2024, at 9:00 a.m., Central Time. Whether or not you plan to attend the Annual Meeting, we ask that you participate by casting your vote at your earliest convenience.

2023 will be remembered as a milestone year in Carriage’s history, as we finalized Mel Payne’s CEO succession plan that he first announced in June 2021, added diverse new skill sets to our Board with the addition of three new Directors, acquired and began the integration of one of the highest revenue generating businesses in the Company’s history, and continued our shareholder engagement focus, acting upon much of the feedback we received, which will be highlighted throughout this Proxy Statement.

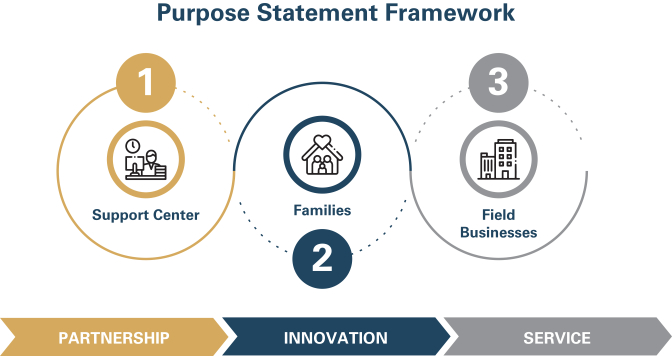

As we wrap up the first quarter of 2024 and look forward to the journey ahead for our Company, we are excited about our vision of the future of Carriage, which we recently highlighted with our new purpose statement: ‘Creating premier experiences through innovation, empowered partnership, and elevated service.’ This new purpose statement continues to build upon the foundation that set us apart when we were founded in 1991 by Mel and, by embracing this new cultural mindset, will be central to our growth and continued journey as leaders in the funeral and cemetery profession. With this renewed focus, we will prioritize innovative thought, challenging norms, and fostering strong partnerships leading to exceptional service across the Carriage family, all of which we believe will support our strategic initiatives and drive value creation for our shareholders.

As Non-Executive Chairman and Vice Chairman of the Board of Directors, we encourage our shareholders to take the time to get to know the story of Carriage, our history, vision, and strategy, and the people who are leading our Company to new heights by embracing our rich history and unique culture while continuously working to identify areas where we can get even better. Before voting your shares, we encourage you to read our releases and reach out if you have questions or would like to learn more. Both our Board and Executive Management team will be happy to visit with you, or put you in touch with any one of our wonderful leaders located throughout the country.

As we have done many times before, we invite all shareholders to visit any of our businesses or travel to Houston to meet our Support Center team, where you can see our teams working towards creating a premier experience through innovation, empowered partnership, and elevated service for our Company and the families we serve.

We hope you can join us on May 14th and we encourage you to read the Notice of Annual Meeting and Proxy Statement, which contains information about the voting options, instructions, and descriptions of the proposals for this meeting. It is important that your voice is heard and your shares are represented at the Annual Meeting by casting your vote as soon as possible. Thank you for your belief in, and support of, Carriage and the people who serve our families and drive high performance every day across our portfolio of funeral homes and cemeteries.

Sincerely,

| Chad Fargason Non-Executive |

|

Carlos R. Quezada. Vice Chair of the Board and |

|

CARRIAGE SERVICES, INC.

3040 Post Oak Boulevard, Suite 300

Houston, Texas 77056

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

|

|

DATE & TIME: May 14, 2024 9:00 a.m. Central Time |

MEETING AGENDA 1. Elect two (2) class I directors to serve until the 2027 Annual Meeting;

2. To approve, on an advisory basis, our 2023 Named Executive Officers’ compensation; and

3. Ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ended 2024. | ||

|

|

PLACE: Carriage Services, Inc. 3040 Post Oak Boulevard, Lobby Conference Room, Houston, Texas 77056 | |||

|

|

RECORD DATE: March 15, 2024 |

| YOUR VOTE IS IMPORTANT - YOU CAN VOTE IN ONE OF THREE WAYS: |

|

VIA THE INTERNET Visit the website listed on your

|

|

BY MAIL Sign, date and return your proxy card in the enclosed envelope |

|

IN PERSON Attend the Annual Meeting | |||||

We are pleased to continue taking advantage of the Notice & Access method of delivery for our Annual Report, Proxy Statement and other Proxy materials (collectively the “Proxy Materials”). The Proxy Materials will be available online as described in this Proxy Statement and hard copies will not be delivered, unless expressly requested by a shareholder.

On or about March 29, 2024, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) detailing how to access the Proxy Materials electronically and how to submit your proxy via the Internet. You are entitled to vote if you were a shareholder of record on March 15, 2024. The Notice also provides instructions on how to request and obtain paper copies of the Proxy Materials and proxy card or voting instruction form, as applicable. We continue to believe this process provides our shareholders with a convenient way to access the Proxy Materials and submit their proxies online, while reducing the environmental impact of our Annual Meeting and lowering the costs of printing and distribution.

If your shares are held in a stock brokerage account or by a financial institution or other record holder, follow the voting instructions on the form that you receive from them. The availability of telephone and internet voting will depend on their voting process. Please note that you will need the control number provided on your Notice of Internet Availability of Proxy Materials in order to submit your proxy online.

By order of the Board of Directors,

Steven D. Metzger

President & Secretary

March 29, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING

TO BE HELD ON TUESDAY, MAY 14, 2024

The Notice of Annual Meeting of Shareholders, the Proxy Statement and the 2023 Annual Report to Shareholders are available at

www.carriageservices.com.

TABLE OF CONTENTS

PROXY STATEMENT

This Proxy Statement is being furnished to you by the Board of Directors (our “Board”) of Carriage Services, Inc. (“Carriage Services,” “Carriage,” the “Company,” “we,” “us” or “our”) for use at our 2024 Annual Meeting of Shareholders (our “Annual Meeting”).

Annual Meeting Date and Location

We intend to hold our Annual Meeting in person at our offices at 3040 Post Oak Boulevard, Lobby Conference Room, Houston, Texas 77056, on Tuesday, May 14, 2024, at 9:00 a.m., Central Time. If you plan to attend in person, please use the main lobby entrance where you will see an area to check in prior to entering the room.

In the event circumstances change to prevent or limit an in-person meeting, we may implement additional procedures or limitations on meeting attendees or determine that alternate Annual Meeting arrangements are advisable or required (i.e., a virtual-only meeting). If we determine that such alternative arrangements are advisable or required, then we will announce our decision and post additional information on our Investors Relations website at www.carriageservices.com and file a notice with the SEC. Please check this website in advance of the Annual Meeting date if you are planning to attend in person.

Delivery of Proxy Materials

Mailing Date and Delivery of Proxy Materials

On or about March 29, 2024, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice of Availability”) to our shareholders containing instructions on how to access the Proxy Materials and submit your proxy online. We have made these Proxy Materials available to you over the internet or, upon your request, have delivered paper copies of these materials to you by mail, in connection with the solicitation of proxies by the Board for our Annual Meeting.

Shareholders Sharing the Same Address

Each shareholder of record will receive one Notice of Internet Availability, regardless of whether you have the same address as another registered shareholder. If your shares are held in “street name” (that is, in the name of a financial institution, broker or other holder of record), applicable rules permit brokerage firms and the Company, under certain circumstances, to send one Notice of Internet Availability to multiple shareholders who share the same address. This practice is known as “householding.” Householding saves printing and postage costs by reducing duplicate mailings. If you hold your shares through a broker, you may have consented to reducing the number of copies of materials delivered to your address. In the event that you wish to revoke a “householding” consent you previously provided, you must contact your broker to revoke your consent. You may also contact the Company directly to request copies of materials by submitting a written request to our Corporate Secretary at 3040 Post Oak Boulevard, Suite 300, Houston, TX 77056. If your household is receiving multiple copies of the Notice of Availability and you wish to request delivery of a single copy, you should contact your broker directly.

Questions and Answers About Our Annual Meeting and Voting

Why am I receiving these proxy materials?

Our Board is soliciting your proxy to vote at our Annual Meeting because you owned shares of our common stock, par value $.01 per share (the “Common Stock”) at the close of business on March 14, 2024, the record date for our Annual Meeting (the “Record Date”), and are therefore entitled to vote at our Annual Meeting.

This Proxy Statement, along with a proxy card, is made accessible, free of charge to you, via the Internet at http://investors.carriageservices.com/annuals-proxies.cfm, or if elected, mailed to our shareholders on or about March 29, 2024. This Proxy Statement summarizes the information that you need to know in

2024 Proxy Statement 1

Proxy Statement

order to cast your vote at our Annual Meeting. As a shareholder, your vote is very important and our Board strongly encourages you to exercise your right to vote. You do not need to attend our Annual Meeting in person to vote your shares. Whether or not you plan to attend our Annual Meeting, we encourage you to vote your shares by voting via the Internet or completing, signing, dating and returning the enclosed proxy card in the envelope provided. See “About Our Annual Meeting – How do I vote my shares?” below.

What am I voting on and how does our Board recommend that I vote?

| Proposal Number |

Subject of Proposal | Recommended Vote |

For details see pages starting on | |||

| 1 | Elect Julie Sanders and Somer Webb to our Board as Class I Directors. |

FOR each nominee |

7 | |||

| 2 |

Approve, on an advisory basis, our Named Executive Officers’ compensation, as presented in this Proxy Statement. |

FOR the proposal |

57 | |||

| 3 |

Ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

FOR the proposal |

59 | |||

We will also transact any other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Our Board has appointed Carlos R. Quezada, our Vice Chairman of the Board and Chief Executive Officer (“CEO”) and Steven D. Metzger, our President and Secretary, as the management proxy holders for our Annual Meeting. For shareholders who have their shares voted by duly submitting a proxy via the Internet, by mail, or in person at our Annual Meeting, the management proxy holders will vote all shares represented by such valid proxies as our Board recommends, unless a shareholder appropriately specifies otherwise.

Who is entitled to vote at the meeting?

You may receive notice of and vote at our Annual Meeting if you were a shareholder of record as of the close of business on the Record Date. As of the Record Date, there were 15,149,686 shares of Common Stock outstanding and entitled to vote.

How many votes can I cast?

You are entitled to one vote for each share of Common Stock you owned on the Record Date on all matters presented at our Annual Meeting.

Why is my vote important?

Your vote is important regardless of how many shares of Common Stock you own. Please take the time to vote. Please read the instructions below, choose the way to vote that is easiest and most convenient to you and cast your vote as soon as possible.

What is the difference between a shareholder of record and a “street name” holder?

Most shareholders hold their shares through a financial institution, broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned in street name.

| • | Shareholder of Record. If your shares are registered directly in your name with American Stock Transfer & Trust Company, LLC, our transfer agent, you are considered to be the shareholder of record with respect to those shares, and you have the right to grant your voting proxy directly with the Company or to vote in person at our Annual Meeting. |

| • | Street Name Shareholder. If your shares are held by a financial institution, broker or other nominee, you are considered the beneficial owner of shares held in “street name” and your financial institution, |

2 Carriage Services

Proxy Statement

| broker or other nominee is the shareholder of record. As the beneficial owner, you have the right to direct your financial institution, broker or other nominee how to vote your shares and are also invited to attend our Annual Meeting. However, since you are not the shareholder of record, you may not vote these shares in person at our Annual Meeting unless you obtain a legal proxy from the shareholder of record prior to attending our Annual Meeting giving you the right to vote the shares. In order to vote your shares, you will need to follow the directions your financial institution, broker or other nominee provides to you. |

How do I vote my shares?

Shareholders of Record. There are three ways to vote:

| INTERNET |

To vote via the internet, go to “www.voteproxy.com” and follow the on-screen instructions or scan the QR code with your smartphone. Have your proxy card available when you access the web page. You may vote online until 11:59 p.m., Central Time the day before the Annual Meeting. | |

| BY MAIL |

If you requested a copy of this Proxy Statement and proxy card and would like to vote by mail, please send your completed and signed proxy card in the prepaid envelope provided so that it is received in the mail by us by May 13, 2024. The shares you own will be voted according to the instructions on the proxy card that you provide. If you return your proxy card but do not mark your voting preference, the individuals named as proxies will vote your shares FOR all of the proposals described in this Proxy Statement. | |

| IN PERSON |

If you attend our Annual Meeting, you may vote by delivering your completed proxy card in person or by completing a ballot, which will be available at our Annual Meeting. Attending our Annual Meeting without delivering your completed proxy card or completing a ballot will not count as a vote. Submitting a proxy prior to our Annual Meeting will not prevent you from attending our Annual Meeting and voting in person. | |

Street Name Shareholder. There are three ways to vote:

| BY METHODS LISTED ON VOTING INSTRUCTION FORM |

Please refer to the voting instruction form or other information forwarded by your financial institution, broker or other nominee to determine whether you may submit a proxy by telephone or electronically on the Internet, following the instructions on the voting instruction form or other information they provided to you. | |

| BY MAIL |

You may indicate your vote by completing and signing your voting instruction card or other information forwarded by your financial institution, broker or other nominee and returning it to them in the manner specified in their instructions. | |

| IN PERSON WITH A PROXY FROM THE RECORD HOLDER |

You may vote in person at our Annual Meeting if you obtain a legal proxy from your financial institution, broker or other nominee. Please consult the voting instruction form or other information sent to you by the record holder to determine how to obtain a legal proxy in order to vote in person at our Annual Meeting. | |

May I change or revoke my vote?

Yes, if you are a shareholder of record, you may change your vote or revoke your proxy at any time before your shares are voted at the meeting by:

| • | submitting written notice of revocation no later than May 13, 2024 to our home office, which is located at 3040 Post Oak Boulevard, Suite 300, Houston, Texas 77056, Attn: Corporate Secretary; |

| • | timely submitting a proxy with new voting instructions using the Internet voting system; |

| • | submitting a later dated proxy with new voting instructions by mail that is received at our home office by May 13, 2024; or |

| • | attending our Annual Meeting and voting your shares in person. |

If you are a street name shareholder and you vote by proxy, you may change your vote by submitting new voting instructions to your financial institution, broker or other nominee in accordance with such entity’s procedures. Please refer to the materials that your financial institution, broker or other nominee provided to you.

2024 Proxy Statement 3

Proxy Statement

What is a quorum?

A quorum is the presence at our Annual Meeting, in person or by proxy, of the holders of a majority of the outstanding shares of our Common Stock entitled to vote on a matter at our Annual Meeting. There must be a quorum for our Annual Meeting to be held. If a quorum is not present, our Annual Meeting may be adjourned or postponed until a quorum is reached. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of votes considered to be present at our Annual Meeting for the purpose of establishing a quorum.

What are “broker non-votes” and abstentions and how do they affect voting results?

If you hold your shares in “street name,” you will receive instructions from your financial institution, broker or other nominee describing how to vote your shares. If you do not instruct your financial institution, broker or other nominee how to vote your shares, they may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the New York Stock Exchange (the “NYSE”).

There are also non-discretionary matters for which financial institutions, brokers and other nominees do not have discretionary authority to vote unless they receive timely instructions from you. When a financial institution, broker or other nominee does not have discretion to vote on a particular matter and you have not given timely instructions on how the financial institution, broker or other nominee should vote your shares, a “broker non-vote” results. Although any broker non-vote would be counted as present at the meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

If your shares are held in street name and you do not give voting instructions, pursuant to NYSE Rule 452, the record holder will not be permitted to vote your shares with respect to Proposal 1 (Election of the Class I Directors) and Proposal 2 (Advisory Vote to Approve our Named Executive Officer Compensation) and your shares will be considered “broker non-votes” with respect to these proposals. If your shares are held in street name and you do not give voting instructions, the record holder will nevertheless be entitled to vote your shares with respect to Proposal 3 (Ratification of the Appointment of Grant Thornton LLP) in the discretion of the record holder.

Abstentions occur when shareholders are present at our Annual Meeting in person or by proxy but fail to vote or voluntarily withhold their vote for any of the matters upon which the shareholders are voting. Abstentions will have no effect on the election of directors but will have the effect of a vote against the other proposals being considered at the meeting.

What vote is required to approve each proposal?

| • | Proposal 1 (Election of the Class I Directors): To be elected, each director nominee must receive the affirmative vote of at least a majority of the votes of the shares of Common Stock present in person or represented by proxy at our Annual Meeting and entitled to vote on the proposal. This means that the director nominees with more votes cast in favor of than votes withheld from the election will be elected. Broker non-votes will have no effect on the outcome of the vote for directors. |

| • | Proposal 2 (Advisory Vote to Approve our Named Executive Officers’ Compensation): Approval of this proposal requires the affirmative vote of the holders of at least a majority of the outstanding shares of Common Stock present in person or represented by proxy at our Annual Meeting and entitled to vote on the proposal. In accordance with applicable Delaware law, abstentions will have no effect “for” or “against” this proposal. Broker non-votes will have no effect on the outcome of the vote on this proposal. While this vote is required by law, it will neither be binding on us, our Board or our Compensation Committee, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on, us, our Board or our Compensation Committee. However, our Compensation Committee will take into account the outcome of the vote when considering future executive compensation decisions. |

| • | Proposal 3 (Ratification of the Appointment of Grant Thornton LLP): Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending |

4 Carriage Services

Proxy Statement

| December 31, 2024 requires the affirmative vote of the holders of at least a majority of the outstanding shares of Common Stock present in person or represented by proxy at our Annual Meeting and entitled to vote on the proposal. In accordance with applicable Delaware law, abstentions will have no effect “for” or “against” this proposal. |

Who will bear the cost of soliciting votes for our Annual Meeting?

We will bear the entire cost of soliciting proxies, including the cost of the preparation, assembly, uploading to and hosting on the Internet, and printing and mailing of this Proxy Statement, the proxy card and any additional information furnished to our shareholders in connection with our Annual Meeting. In addition to this solicitation by internet or mail, certain directors, officers and employees may also solicit proxies on our behalf by use of mail, telephone, facsimile, electronic means, in person or otherwise. These persons will not receive any additional compensation for assisting in the solicitation but may be reimbursed for reasonable out-of-pocket expenses in connection with the solicitation. We reimburse financial institutions, brokers, custodians, nominees and fiduciaries for their reasonable charges and expenses to forward our proxy materials to the beneficial owners of our Common Stock.

Where can I find the voting results?

We will report the voting results in a Current Report on Form 8-K with the SEC within four business days of our Annual Meeting.

May I propose actions for consideration at next year’s Annual Meeting or nominate individuals to serve as directors?

You may submit proposals for consideration at future annual meetings. See “Shareholder Proposals for the 2025 Annual Meeting” for information regarding the submission of shareholder proposals for next year’s Annual Meeting.

How do I get directions to the Annual Meeting?

For directions to the Annual Meeting, please contact our Corporate Secretary at (713) 332-8400.

2024 Proxy Statement 5

PROXY SUMMARY

WHO WE ARE

Carriage was founded on the shared values of honesty, integrity, and a belief in the power of people. This foundation unites us in our new purpose statement: “Creating a premier experience through innovation, empowered partnership, and elevated service.” We are a consolidator and provider of funeral and cemetery services and merchandise in the United States, operating funeral homes and cemeteries nationwide. Our Common Stock is publicly traded on the NYSE, under the symbol CSV.

|

WHAT’S NEW!

Meet our new Board members as of 2023. Each brings a unique skillset and background that supports the Company’s long-term growth strategy.

|

||||||||

|

Chad Fargason

SKILLS & QUALIFICATIONS • Financial Investments • Complex Portfolio Management • Strategic Growth Objectives • Capital Allocation Analysis • Business Valuation |

Julie Sanders

SKILLS & QUALIFICATIONS • Financial/Audit Leadership • Leading Transformative Initiatives • Large-Scale Business Enhancements • Capital Allocation Analysis |

Somer Webb

SKILLS & QUALIFICATIONS • Financial Leadership • Financial Planning & Analysis • Driving Growth Through Business Intelligence • Strategic Growth Through Acquisition • Capital Allocation Analysis |

||||||

PROPOSAL NO. 1:

ELECTION OF CLASS I DIRECTORS

We currently have seven directors on our Board who each serve staggered three-year terms. At our Annual Meeting, the shareholders will elect two individuals to serve as our Class I Directors for a new three-year term expiring on the date of our 2027 Annual Meeting and until their successors are duly elected and qualified. This classification of our Board may have the effect of delaying or preventing changes in control of our Company.

Our Corporate Governance Committee has recommended that we nominate Julie Sanders and Somer Webb for election at our Annual Meeting to serve as our Class I Directors for new three-year terms. Proxies may be voted for each of the Class I Directors. The biographical description for Ms. Sanders and Ms. Webb are included below.

As a result of the feedback we collected from our shareholders, the Company’s Board announced in 2023 that it would be focused on enhancing governance, including identifying new Board members with diverse skills, experiences, expertise, age, gender and backgrounds to align with the Company’s strategic vision. On June 15, 2023, Dr. Achille Messac resigned as a member of the Board, as a Class II director. On June 21, 2023, upon the recommendation of our Corporate Governance Committee, the Board elected Chad Fargason to serve as a Class II director until the Company’s 2025 Annual Meeting. Additionally, on that same day, the Board elected Melvin C. Payne to serve as Executive Chairman of the Board. On July 5, 2023, upon the recommendation of our Corporate Governance Committee, the Board elected Somer Webb to serve as a Class I director until the Company’s 2024 Annual Meeting. On July 24, 2023, Barry K. Fingerhut resigned as a member of the Board, as a Class I director. On July 25, 2023, upon the recommendation of our Corporate Governance Committee, the Board elected Julie Sanders to serve as a Class II director until the Company’s 2025 Annual Meeting.

On February 22, 2024, Mr. Payne, the Company’s founder and former CEO, stepped down as Executive Chairman of the Board and transitioned to serving as special advisor to the Board. In connection with stepping down as Executive Chairman, Mr. Payne, who is currently a Class I director, will remain on the Board until our 2024 Annual Meeting, when the term for Class I directors is scheduled to expire. On March 7, 2024, upon the recommendation of our Corporate Governance Committee, the Board elected Mr. Fargason to serve as the Company’s first ever Non-Executive Chairman of the Board.

On March 7, 2024, upon the recommendation of our Corporate Governance Committee, the Board realigned the Company’s classes of directors to provide for equal apportionment among the three classes, as contemplated by the Company’s Amended and Restated Certificate of Incorporation, as a result of Mr. Payne not seeking election to another term as a Class I director. To facilitate the class realignment, on March 7, 2024, Ms. Sanders resigned from the Board as a Class II director, and, effective March 7, 2024, was re-elected by the Board to serve as a Class I director until the Company’s 2024 Annual Meeting.

Directors are elected by a majority of votes cast. Our bylaws, which were amended and restated during 2023 in connection with our focus on governance and responsiveness to shareholder feedback, provide that in an uncontested election, if the nominee director does not receive a majority of the votes cast, the nominee must promptly deliver a written resignation to our Board, which shall be immediately accepted and the directorship will become vacant and the Board may either fill the vacancy by a majority vote or decrease the size of our Board. In the event of a contested election of directors, our bylaws provide that directors will be elected by the vote of a plurality of the votes of the shares present in person or represented by proxy and entitled to vote in the election of directors.

2024 Proxy Statement 7

Proposal No. 1 Election of Class I Directors

| Independence

|

Diversity*

|

Age*

|

Tenure*

| |||

| * Independent Directors only | ||||||

| Skills and Qualifications | ||

| Industry Experience |

| |

| Senior Leadership Experience |

| |

| Risk Oversight and Management Experience |

| |

| Operations Experience |

| |

| Regulatory Experience |

| |

| Finance / Accounting |

| |

Our Board believes that each of our directors is highly qualified to serve as a member of our Board. In particular, our Board seeks individuals who demonstrate:

| • | A deep, genuine belief, understanding and commitment to our being the best mission and our guiding principles; |

| • | Business and investment savvy, including an owner-oriented attitude and conviction that Carriage has evolved into a high value, superior investment platform; and |

| • | An ability to make a meaningful contribution and engagement to our Board’s oversight of all elements and linkages of our high performance culture. |

Described below are the principal occupations, positions and directorships for at least the past five years of our director nominees and continuing directors, as well as certain information regarding their individual experience, qualifications, attributes and skills that led our Board to conclude that they should serve on our Board. There are no family relationships among any of our directors or executive officers.

8 Carriage Services

Proposal No. 1 Election of Class I Directors

Nominees for Director

| Julie Sanders

Senior Vice President and Chief Audit Executive of Dell Technologies

Age: 55 Director since 2023 (Class I)

Committees: • Compensation • Audit • Corporate Gov. |

Julie Sanders currently serves as Senior Vice President and Chief Audit Executive at Dell Technologies (“Dell”), a publicly traded, technology and services company. Ms. Sanders joined Dell in 2002, and has held a variety of finance, accounting and management roles. Prior to her Chief Audit Executive appointment in 2021, Ms. Sanders was previously Senior Vice President, Global Auditing & Consulting, from 2018 to 2021, and Senior Vice President, Global Revenue, from 2014 to 2018, for Dell. In these leadership roles, Ms. Sanders was responsible for global revenue recognition, revenue operations and global accounting, along with overseeing financial planning and analysis for Dell’s commercial business. Before joining Dell, Ms. Sanders served as Chief Financial Officer for Jardine Foods and Merinta, and also held accounting and finance management positions at Bear Stearns and J. Crew. Ms. Sanders began her career at KPMG, LLP. Ms. Sanders holds a B.B.A. in Accounting from Baylor University and is a Certified Public Accountant.

Additional Qualifications: Ms. Sanders brings to the Board over 30 years of financial and audit leadership experience, along with extensive experience in transformative initiatives as it relates to financial systems, including the development and implementation of large-scale enhancements and capabilities. | |

| Somer Webb

Chief Financial Officer of Authority Brands

Age: 45 Director since 2023 (Class I)

Committees: • Compensation (Chair) • Audit • Corporate Gov. |

Somer Webb currently serves as Chief Financial Officer (“CFO”) of Authority Brands, a leading home service franchise brands company that includes 15 brands operated across more than 2,000 locations. Prior to her CFO appointment in January 2024, she was previously CFO for Solo Brands, Inc., a direct-to-consumer platform company for outdoor and lifestyle brands, from May 2022 to December 2023, and was CFO for Kent Outdoors, a sporting goods manufacturer, from January 2022 to May 2022. Prior to Kent Outdoors, she spent six years with Worldwide Express, a global logistics provider, where she held a variety of roles of increasing responsibility beginning in 2016 and ultimately served as CFO from February 2019 to January 2022. Before joining Worldwide Express, she held leadership positions at Southwest Airlines, DaVita Healthcare Partners, Match Group, Amazon, and Yum Brands. Ms. Webb holds a B.B.A. in Management Information Systems from Baylor University and an M.B.A. from The University of Texas at Arlington.

Additional Qualifications: Ms. Webb has over 15 years of financial leadership experience at both public and private companies, along with extensive experience in capital allocation strategies, financial planning and analysis, M&A valuation and integration, and driving organic growth through business intelligence insights. |

You may not cumulate your votes in the election of the Class I Director nominees. You may withhold authority to vote for the nominee for director. If a nominee becomes unable to serve as a director before our Annual Meeting (or decides not to serve), the individuals named as proxies will vote, in accordance with instructions provided, for such other nominee as we may designate as a replacement or substitute, or our Board may reduce the size of the Board to eliminate the vacancy.

BOARD RECOMMENDATION

| FOR THE REASONS STATED ABOVE, THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE CLASS I DIRECTOR NOMINEES. |

2024 Proxy Statement 9

Proposal No. 1 Election of Class I Directors

Continuing Directors

| Chad Fargason

Non-Executive Chairman of the Board and Senior Portfolio Manager for Vaughn Nelson Investment Management

Age: 51 Director since 2023 (Class II)

Committees: • Compensation • Audit • Corporate Gov. (Chair) |

Chad Fargason currently serves as Senior Portfolio Manager for Vaughan Nelson Investment Management, an investment manager with approximately $15 billion under management. Mr. Fargason has been with Vaughan Nelson for more than ten years. Prior to joining Vaugh Nelson, he spent ten years with the global investment firm, KKR & Co., Inc. Mr. Fargason holds a B.A. in Mathematics from Rice University and both a Masters and Ph.D in Mathematics from Duke University.

Additional Qualifications: Mr. Fargason serves as our Chairman of the Board and brings extensive experience and insight into financial investments, capital allocation, valuations and assessing investment opportunities to pursue strategic growth objectives, providing the Board expertise on similar issues which are aligned with the Company’s long-term growth strategy. | |

| Douglas B. Meehan

Co-Chief Investment Officer for van Biema Value Partners, LLC

Age: 52 Director since 2018 (Class III)

Committees: • Compensation • Audit • Corporate Gov. |

Douglas B. Meehan currently serves as the Co-Chief Investment Officer for van Biema Value Partners, LLC, an investment management firm, where he has worked since 2012. Prior to joining van Biema Value Partners, Mr. Meehan worked as a research analyst at a proprietary securities fund within Sentinel Real Estate Corp., a privately held real estate investment advisor in New York. He also worked with Duma Capital Partners, a multi-strategy hedge fund, as a research analyst. Mr. Meehan received a B.A. in Philosophy from Columbia University, a Ph.D in Philosophy and Cognitive Science from the City University of New York Graduate Center, and an M.B.A. from Columbia Business School, where he participated in the Applied Value Investing Program.

Additional Qualifications: Mr. Meehan brings to the Board his extensive financial markets and real estate experience, as well as experience with sophisticated transactions. |

10 Carriage Services

Proposal No. 1 Election of Class I Directors

| Donald D. Patteson, Jr.

Former Chairman of the Board of Directors and Chief Executive Officer of Sovereign Business Forms, Inc. (“Sovereign”)

Age: 78 Director since 2011 (Class III)

Committees: • Compensation • Audit (Chair) • Corporate Gov. |

Donald D. Patteson, Jr. was the founder and, prior to its sale in June 2014, the Chairman of the Board of Directors of Sovereign Business Forms, Inc. (“Sovereign”), a consolidator in a segment of the printing industry. He also served as Chief Executive Officer of Sovereign from August 1996 until his retirement in August 2008. Prior to founding Sovereign, he served as Managing Director of Sovereign Capital Partners, an investment firm specializing in leveraged buyouts. He also served on the Board of Directors of Rosetta Resources Inc. and Cal Dive International, Inc. until 2015. Mr. Patteson received a B.A. and an M.B.A. with a concentration in finance from the University of Texas.

Additional Qualifications: Mr. Patteson brings to the Board his executive experience as a Chief Executive Officer and Chief Financial Officer, enabling him to provide the Board with executive and financial management expertise, as well as experience with major financial transactions. | |

| Melvin C. Payne

Co-Founder of Carriage, Former Executive Chairman of the Board and Former CEO

Age: 81 Director since 1991 (Class I)

Committees: • None |

Melvin C. Payne, co-founder of Carriage, has been a director since our inception in 1991 and currently serves as a special advisor to the Board and the Company. Mr. Payne was previously our Chairman from December 1996 until February 2024, and previously served as our CEO until June 21, 2023. Prior to co-founding Carriage, Mr. Payne held a variety of financial and executive leadership roles, including serving as an Executive Vice President for WEDGE Group where he focused on leveraged buyouts; serving as Chief Financial Officer and then President and Chief Executive Officer for Independent Refining Company; serving as Head of the Chemical Division for Texas Commerce Bank; and overseeing the analysis and private placement of industrial and commercial loans at Prudential Insurance Company.

Additional Qualifications: Mr. Payne, a Vietnam Veteran, earned a B.S. in Chemical Engineering from Mississippi State University and an M.B.A. from Tulane University. As co-founder and prior CEO, Mr. Payne brings to the Board a unique knowledge of the Company, along with his passion for our Company. |

2024 Proxy Statement 11

Proposal No. 1 Election of Class I Directors

| Carlos R. Quezada

Vice Chairman of the Board and CEO

Age: 53 Director since 2022 (Class II)

Committees: • None |

Carlos R. Quezada was named our Chief Executive Officer in June 2023 and also serves as our Vice Chairman of the Board. Mr. Quezada joined the Company in 2020 as Vice President of Cemetery Sales and Marketing. He was promoted to Senior Vice President of Sales and Marketing in 2021. On June 1, 2021, he was appointed Executive Vice President and Chief Operating Officer. Immediately before being named the Company’s CEO, Mr. Quezada served as its President and Chief Operating Officer, along with being previously appointed Vice Chair of the Board of Directors on February 22, 2023. Before joining our Company, Carlos R. Quezada was a Managing Director at Service Corporation International (“SCI”) from 2009 to 2020. At SCI, he played influential roles in both sales and operations, reinforcing his expertise in these areas.

Additional Qualifications: Mr. Quezada’s professional experience spans more than two decades in the hospitality industry, holding diverse leadership positions, including Chief Executive Officer, President, and Chief Operating Officer for privately held multi-unit entities in the sector, providing the Board with executive and operational experience and insight. | |

12 Carriage Services

BOARD LEADERSHIP & CORPORATE GOVERNANCE

2023: Shareholder Feedback and Prioritizing Corporate Governance

Since Carriage’s 2023 Annual Meeting of Shareholders, we have made a number of significant changes to support our focus on corporate governance, including:

|

Partnering with a third-party executive search firm to recruit three new directors to serve on Carriage’s Board

|

Amending our bylaws to require the resignation of any director who fails to receive a majority of votes cast by shareholders in an uncontested election; and |

The Board’s election of Chad Fargason to serve as the Company’s first ever Non-Executive Chairman of the Board

| ||||||

2023 was a year during which Carriage sought feedback from many of our shareholders and prioritized the evolution of our corporate governance framework. Since a thoughtful approach to governance begins with the individuals serving on the Board, Carriage partnered with a third-party executive search firm and recruited three new independent directors to help drive this focus. Concurrent with the addition of three new directors in 2023, two incumbent directors resigned from the Board.

Each of these three new directors brings a diverse skill set, deep experience, and a fresh perspective that directly aligns with Carriage’s long-term growth strategy, with a particular emphasis on financial acumen, capital allocation experience, and valuation expertise. Two of the three directors, Julie Sanders and Somer Webb, have been nominated by the Board this year to serve three-year terms as Class I directors. The third recently added director, Chad Fargason, was elected by the Board in March of this year to serve as the Company’s first ever Non-Executive Chairman of the Board.

In addition to listening to, and acting upon, the feedback from our shareholders regarding greater diversity on our Board, we also amended our bylaws to ensure that only directors who receive a majority of the votes cast in an uncontested election, will serve on our Board moving forward.

2024: Maintaining the Focus on Feedback and Improvement

As will be discussed in greater detail in the “Compensation Discussion and Analysis” section of this Proxy Statement, the Board and Executive Management team are committed to building upon the momentum demonstrated in 2023. Among the focuses in 2024:

| Our Compensation Committee and Executive Management team have partnered with Pearl Meyer to identify a new peer group and redesign both short-term and long-term executive incentive compensation programs; |

The Board and Executive Management team are currently finalizing stock ownership guidelines for both directors and officers; and

|

The Company has consulted with advisors on enhancing its disclosures related to its sustainability efforts.

| ||||||

2024 Proxy Statement 13

Corporate Governance

Risk Oversight of the Board

We believe that the oversight function of our Board and its committees, combined with active dialogue with management about effective risk management relative to continuously assessing for the right quality of staff at all levels, provides our Company with the appropriate framework to help ensure effective risk oversight.

Additionally, a significant amount of time is spent by our Board and committees, in partnership with management, discussing how we identify, assess and manage our most significant risk exposures with respect to our Company, leadership and people. For example, our Audit Committee routinely meets with our internal audit and external audit teams and the Board is involved in regular discussions during operational and strategic reviews with the Company’s Executive Management team, as well as discussions surrounding the programs, policies, processes and controls related to the Company’s financial activities and performance; controllership and financial reporting; executive officer development and evaluation; compliance with the Company’s Code of Business Conduct and Ethics; applicable laws and regulations; information technology; and internal audits. Our Board also relies on each of its committees to help administer its oversight duties for those areas which they have oversight responsibilities. For example, on February 22, 2023, our Board adopted revisions to the Company’s Code of Business Conduct and Ethics based on recommendations from the Audit Committee following its periodic review, which included, among other things, clarifying existing compliance requirements and expanding certain policies, including those related to bribery and kickbacks, antitrust, political activity and improper influence on auditors, all of which are reasonably designed to support the Company’s compliance with applicable rules and regulations and mitigate related compliance risks.

Director Qualification, Experience and Tenure

Our Corporate Governance Committee is responsible for reviewing the requisite skills and characteristics of new Board members as well as the composition of our Board, with significant input from our Executive Management team. It is the position of our Corporate Governance Committee that, as a company of our size in the specialized field of the funeral and cemetery industry, it is important for our directors to understand, support and align with our culture.

While it is difficult to define what the perfect director candidate looks like for Carriage, we believe diversity of all kinds, including, but not limited to, experience, age, gender, ethnic background, skills, perspective and background are important contributing factors to effective decision-making. Thus, the Corporate Governance Committee believes it is in the best interest of Carriage to identify the best candidates for its board, cognizant of diversity in all forms and will continue to find ways to ensure that it is doing so.

For Carriage, diversity of all kinds, including, but not limited to, experience, age, gender, ethnic background, skills, perspective and background are important contributing factors to effective decision-making. Thus, the Corporate Governance Committee believes it is in the best interest of Carriage to identify the best candidates for its board, cognizant of diversity in all forms, and will continue to find ways to ensure that it is doing so.

None of our directors serve on any other public company boards and we prefer candidates who are focused on helping Carriage achieve our long-term growth objectives, rather than serving on numerous public company boards. We currently have no established term limits or age restrictions, as we do not wish to risk losing the contribution of directors who have been able to develop historical insight and a deep understanding of our unique industry and operating model.

We currently have seven directors on our Board who each serve staggered three-year terms. Five directors are independent. The average age of all directors currently serving on our Board is 59 years. The average age of all independent directors is 56 years. The average tenure of all independent directors is 4.2 years.

14 Carriage Services

Corporate Governance

Director Nomination Process

Our Corporate Governance Committee, with assistance from internal and external resources as the Corporate Governance Committee desires, identifies potential candidates for our Board based upon the criteria set forth above. Once a potential candidate is identified and the individual expresses a willingness to be considered for election to our Board, our Corporate Governance Committee and Mr. Fargason will request information from the candidate, review the individual’s qualifications, and conduct one or more interviews with the candidate. When this process is complete, our Corporate Governance Committee tenders its recommendation to our full Board for consideration.

Our Corporate Governance Committee will also consider candidates recommended by shareholders in the same manner. A stockholder may recommend nominees for director by giving our Corporate Secretary a written notice not less than 90 days prior to the anniversary date of the immediately preceding Annual Meeting. For our 2025 Annual Meeting of Shareholders, the deadline will be February 13, 2025, based upon this year’s meeting occurring on May 14, 2024. The notice must include, amongst other things, the name and address of the stockholder giving notice and the number of shares of Common Stock beneficially owned by the stockholder, as well as the nominee’s full name, age, business address, principal occupation or employment, the number of shares of Common Stock that the nominee beneficially owns, any other information about the nominee that must be disclosed in proxy solicitations under Regulation 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the nominee’s written consent to the nomination and to serve, if elected.

Organization and Committees of Our Board

All members of the Board are strongly encouraged to attend each meeting of the Board and meetings of the Board committees on which they serve, as well as our Annual Meeting. Due to the Board’s review of strategic alternatives last year, our Board held eighteen (18) regularly scheduled meetings and acted by unanimous written consent eight (8) additional times during the calendar year 2023. During this period each of our then current Board members attended all of the meetings of our Board, except for Mr. Payne who was unable to attend the meeting held on February 22, 2023, along with Mr. Fingerhut being unable to attend the meeting held on July 5, 2023. In addition, each year we hold the Annual Meeting on the same day as our Board and committee meetings such that all directors may attend the Annual Meeting. All of our then current directors attended the 2023 Annual Meeting of Stockholders.

Our Board has a Compensation, Audit and Corporate Governance Committee. The current members of each committee as of the Record Date are identified in the table below. Each of these committees has its own charter, and a copy of the current version is available on our website at www.carriageservices.com. The functions of each committee and the number of meetings held during 2023 are described below.

| Director |

Compensation | Audit | Corporate Governance | |||

| Melvin C. Payne(*)(**) |

— | — | — | |||

| Chad Fargason(I)(C) |

X | X | Chair | |||

| Douglas B. Meehan(I) |

X | X | X | |||

| Donald D. Patteson, Jr.(I) |

X | Chair | X | |||

| Carlos R. Quezada(*) |

— | — | — | |||

| Julie Sanders(I) |

X | X | X | |||

| Somer Webb(I) |

Chair | X | X | |||

| (*) | Neither Mr. Payne nor Mr. Quezada is independent as Former Executive Chairman, and CEO of the Company, respectively. |

| (**) | Mr. Payne will be resigning from the Board effective as of the date of the 2024 Annual Meeting. |

| (I) | Independent Director. |

| (C) | Non-Executive Chairman of the Board. |

2024 Proxy Statement 15

Corporate Governance

Compensation Committee

Our Compensation Committee’s principal functions and responsibilities are to:

| • | review, evaluate and approve our executive officer compensation plans, policies and programs; |

| • | recommend to our Board non-employee director compensation plans, policies and programs; |

| • | produce the Compensation Committee Report on executive compensation for inclusion in our proxy statement for our Annual Meeting of Shareholders; |

| • | administer, review and approve grants under our stock incentive plans; and |

| • | perform such other functions as our Board may assign from time to time. |

Generally, our Board has charged our Compensation Committee with the overall responsibility for establishing, implementing and monitoring the compensation for our executive officers and senior leadership team. Executive compensation matters are presented to the Compensation Committee in a variety of ways, including: (1) at the request of our Compensation Committee Chair or two or more members of the Compensation Committee or two members of our Board, (2) in accordance with our Compensation Committee’s agenda, which is reviewed by our Compensation Committee members and other directors on an annual basis, (3) by our CEO or (4) by our Compensation Committee’s outside compensation consultant.

To the extent permitted by applicable law, our Compensation Committee may delegate some or all of its authority under its charter to its chair, any one of its members, or any subcommittees it may form when it deems such action appropriate. Mr. Quezada, as our CEO, makes recommendations on compensation decisions for those other than himself based on the individual performance of each executive officer or senior leader and the Company’s overall performance. Management’s role in determining executive compensation includes:

| • | developing, summarizing and presenting compensation information and analysis to enable our Compensation Committee to execute its responsibilities, as well as addressing specific requests for information from our Compensation Committee; |

| • | developing recommendations for individual executive officer and senior leadership bonus plans for consideration by our Compensation Committee and reporting to our Compensation Committee regarding achievement against the bonus plans; |

| • | preparing long-term incentive award recommendations for our Compensation Committee’s approval; and |

| • | attending our Compensation Committee’s meetings as requested in order to provide additional information, respond to questions and otherwise assist our Compensation Committee. |

Our Compensation Committee makes all final decisions regarding executive officer compensation.

Our Compensation Committee held three (3) regularly scheduled meetings during 2023 and acted by unanimous written consent one (1) additional time. Each of our then current members of the Compensation Committee was present at all meetings. Our Board has determined that all members of the committee are independent under the listing standards of the NYSE and the rules of the SEC. Each of the members of the committee is considered to be a “non-employee director” under Rule 16b-3 of the Exchange Act, and an “outside director” under Section 162(m) of the Internal Revenue Code of 1986, as amended.

16 Carriage Services

Corporate Governance

Audit Committee

Our Audit Committee’s principal functions and responsibilities are to:

| • | assist our Board in fulfilling its oversight responsibilities regarding the: |

| • | integrity of our financial statements and financial reporting process, and our systems of internal accounting and financial controls; |

| • | qualifications and independence of the independent registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other review or attestation services for Carriage; |

| • | performance of our internal audit function and independent auditors; |

| • | whistleblower hotline and associated reporting procedures; and |

| • | compliance by Carriage with legal and regulatory requirements. |

| • | perform such other functions as our Board may assign to our Audit Committee from time to time. |

In connection with these purposes, our Audit Committee annually selects, engages and evaluates the performance and ongoing qualifications of, and determines the compensation for, our independent registered public accounting firm and confirms its independence. The Audit Committee also reviews our annual and quarterly financial statements and meets with our Executive Management team and independent registered public accounting firm regarding the adequacy of our financial controls and our compliance with legal, tax and regulatory matters and significant internal policies.

Our Audit Committee held five (5) regularly scheduled meetings during 2023 and did not act by unanimous written consent. Each of our then current members of the Audit Committee was present at all meetings. All members of our Audit Committee are independent as defined in the NYSE’s listing standards and by Rule 10A-3 promulgated under the Exchange Act. Our Board has determined that each member of our Audit Committee is financially literate and that Mr. Patteson has the necessary accounting and financial expertise to serve as Chair. Our Board has also determined that Mr. Patteson and Mses. Sanders and Webb are “audit committee financial experts” following a determination that they each met the criteria for such designation under the SEC’s rules and regulations. See the “Audit Committee Report” on page 58 for additional information regarding our Audit Committee.

Corporate Governance Committee.

Our Corporate Governance Committee’s principal functions and responsibilities are to:

| • | assist our Board by identifying individuals qualified to become Board members, and to recommend to our Board the director nominees for the next Annual Meeting of Shareholders; |

| • | assist our Board with succession planning for our CEO and other members of the Executive Leadership team; |

| • | lead our Board in its annual review of the performance of our Board and its committees; |

| • | review the Company’s compliance programs, including, but not limited to, the Code of Business Conduct and Ethics and the Insider Trading and Anti-Hedging Policy; and |

| • | perform such other functions as our Board may assign to our Corporate Governance Committee from time to time. |

Our Corporate Governance Committee held five (5) regularly scheduled meetings during 2023 and did not act by unanimous written consent. Each of our then current members of the Corporate Governance Committee was present at all meetings, except for Mr. Fingerhut who was unable to attend the meeting held on July 5, 2023.

2024 Proxy Statement 17

Corporate Governance

Director Independence

In accordance with applicable laws, regulations, our Corporate Governance Guidelines, and the rules of the NYSE, our Board must affirmatively determine the independence of each director and director nominee. Accordingly, our Board determined that Mses. Sanders and Webb and Messrs. Fargason, Meehan, and Patteson do not have a material relationship with Carriage (either directly or as a partner, stockholder or officer of an organization that has a material relationship with Carriage) and are “independent” as defined under the NYSE’s listing standards and by the SEC under Item 407(a) of Regulation S-K.

Neither Mr. Payne nor Mr. Quezada is independent because Mr. Quezada is an employee of Carriage and currently serves as our CEO, and Mr. Payne was an employee of Carriage until February 22, 2024.

Board’s Interaction with Shareholders

Our CEO and Executive Management team are responsible for establishing effective communication with our shareholders. Independent directors are not precluded from meeting with shareholders, but where appropriate, our CEO or other members of our Executive Management Team should be present at such meetings.

Shareholders and other interested parties may contact any member of our Board or any of its committees by addressing any correspondence in care of Carriage Services, Inc., 3040 Post Oak Boulevard, Suite 300, Houston, Texas 77056; Attn: Corporate Secretary. In the case of communications addressed to the independent directors, our Corporate Secretary will send appropriate shareholder communications to the Chairman. In the case of communications addressed to a committee of our Board, our Corporate Secretary will send appropriate shareholder communications to the Chairman of such committee.

Annual Evaluations

In accordance with our Corporate Governance Guidelines, our Board members perform annual self-evaluations. These self-evaluations are conducted through written questionnaires circulated, typically in January prior to the first regularly scheduled meeting of the Board. At the first regularly scheduled Board meeting before the Annual Meeting of Shareholders, detailed results of the self-evaluations are provided to the Corporate Governance Committee Chairman and discussed at the Board meeting.

Corporate Governance Guidelines, Business Conduct and Ethics

Our Company is committed to integrity, reliability and transparency in our disclosures to the public. To evidence this commitment, our Board has adopted charters for its committees, Corporate Governance Guidelines, and a Code of Business Conduct and Ethics. These documents, in addition to our bylaws, provide the framework for our corporate governance.

A complete copy of the current version of each of these documents is accessible through our website at www.carriageservices.com or you may receive copies free of charge by writing to us at Carriage Services, Inc., 3040 Post Oak Boulevard, Suite 300, Houston, Texas 77056, Attn: Corporate Secretary.

Compensation Committee Interlocks and Insider Participation

During 2023, Mses. Sanders and Webb and Messrs. Fargason, Meehan, and Patteson served on our Compensation Committee. None of Mses. Sanders and Webb and Messrs. Fargason, Meehan, and Patteson at any time have been an officer or employee of our Company, nor had any substantial business dealings with us that would require disclosure in accordance with our Related Party Transactions Review Policy. Prior to their resignations from the Board on June 15, 2023 and July 25, 2023 respectively, Dr. Achille Messac and Barry Fingerhut also served on our Compensation Committee and neither had been an officer or employee of our Company nor had any substantial business dealings with us that would require disclosure in accordance with our Related Party Transactions Review Policy.

18 Carriage Services

Corporate Governance

None of our Named Executive Officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or our Compensation Committee.

|

GovernanceHighlights:

✔ Non-Executive Chairman of the Board elected in 2024;

✔ Approximately 40% of our independent directors are women;

✔ Reduced the average age of our independent directors by ~12 years,

✔ Adopted a majority voting requirement in uncontested Director elections in 2023;

✔ No shareholder rights plan or “poison pill”;

✔ Annual Board and Committee evaluation process; and

✔ Anti-hedging policies applicable to all Directors and Officers.

|

2024 Proxy Statement 19

Carriage Culture

Driving Positive Social and Environmental Impacts

Our Commitment to an Empowered and Enduring

Company, Culture, and Partnership with our Communities

At Carriage, we focus on empowering people to make thoughtful and broadly meaningful decisions throughout our Company and within our community. Our focus when it comes to building and continuously developing a company and culture of empowered leaders has been, and always will be, people.

Social Impact

Investment in People

Everything begins with our employees. We empower our team to make decisions that will have a positive and lasting impact, not only on the client families who we are privileged to serve, but also within our communities, ultimately resulting in long-term value for our shareholders. In order to equip, position and motivate our employees to make these important, and often local decisions, we are intentional in creating a culture driven by education, awareness, and resources. We have written extensively over the years about our unique culture and encourage our shareholders to review prior releases for greater insight.

In combination with this focus on culture, we also invest holistically in our employees, from education and development (e.g. health and safety training, tuition reimbursement programs, etc.) to financial wellness (e.g. an employee stock purchase plan, 401k Plan with a company match, etc.) to an overall focus on physical and mental well-being (free biometric screenings resulting in discounts on health insurance, discounts on gym memberships, an employee assistance program, etc.). We have an internal “Wellness Committee” which is comprised of a number of Carriage employees who have a passion for, and are focused on, continuing to build upon a program of enhanced and broad wellness opportunities for our approximately 2,600 employees.

People Driven Purpose

Our focus on people and culture begins with our employees, who then lead the service provided to our client families along with our partnership with the numerous communities of which we are a part. As it relates to our focus on partnership with our client families and our communities, our businesses are intimately involved with their respective communities at a local level. We encourage any shareholder who would like to learn more about the unique relationships between our businesses and their local communities to reach out to one of our Managing Partners.

At a broader level of support and engagement, “Carriage Cares” is our 501(c)(3) non-profit organization which is overseen by a committee of employees. While currently entirely funded by our employees, Carriage Cares was initially established years ago to support fellow employees who were adversely impacted by natural disasters. The purpose and reach of Carriage Cares has since grown through the passion of its committee members who have worked together to expand our fundraising focus in an effort to identify opportunities within the various communities across the country for our businesses to give back, not only with financial contributions to support local charitable causes, but also through “roll up our sleeves” volunteer opportunities. During 2023, Carriage Cares’ community initiatives included support for the Stocking Project by Mrs. Claus, the Boys and Girls Clubs of Greater Houston, and the Mission of Yahweh. Carriage Cares also received over $30,000 in donations from our employees during 2023, reflecting our employees’ sincere generosity and support for the Carriage Cares mission. We are extremely proud of our Carriage Cares team, their employee-led projects and the generosity of our employees, all of which reflects our “People Driven Purpose” culture.

20 Carriage Services

Carriage Culture

Diverse Leadership

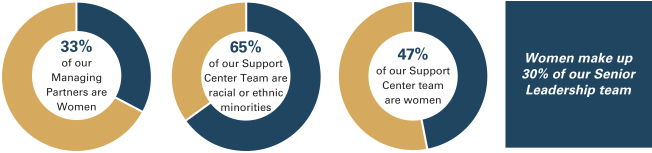

As it relates to our focus on people, we also believe diversity is a key component to our success and can be found in a number of areas, including thought, gender, race, ethnicity, age and life experience, among many other areas. Diversity, in all senses of the word, continues to expand within Carriage. For example, within our decentralized owner/operator model, our entrepreneurial Managing Partners who lead our businesses, are our most critical leaders. Over the course of the past several years, we have seen the number of women serving in our Managing Partner roles steadily increase each year. More specifically, the number of women leading our businesses has more than doubled during this short time. For 2023, we continued this trend and we now have thirty-nine (39) women serving as Managing Partners for our businesses. Notably, many of our top producing Sales Managers are women and two of the three most recent additions to our Senior Leadership team, and the two most recent additions to our Board, are women.

| Managing Partners Diversity |

|

|

||

|

77% increase of Female Managing Partners since 2018

| ||

|

⬛ Women

|

Among our Support Center team of 124 employees, as of December 31, 2023, forty-seven percent (47%) are women and sixty-five percent (65%) are racial or ethnic minorities.

It is important to note that none of these numbers are driven by a standardized approach to diversity. These figures are entirely organic and the result of a culture where we will always seek out the very best talent, regardless of gender, race or age. We will continue to focus on recruiting the very best talent which, in our experience, naturally leads to a broadly diverse team.

With that said, it is our thought diversity of which we are most proud and focused. From our businesses to our Support Center, we encourage our employees to be independent thinkers and drive thoughtful

2024 Proxy Statement 21

Carriage Culture

decision-making supported by both data and creativity. We do not subscribe to a “playbook” approach that should be followed by every business, but rather an encouragement to know your employees, customers, and your community and then build a customized approach that best serves those unique stakeholders. One size most certainly does not fit all at Carriage.

The Right Who’s Making the Right Decisions

We believe that when you empower people to make decisions and provide them with resources, you will see positive and lasting results occur organically. For example, as it relates to environmental matters, as our businesses are updated or remodeled, or where we expand our business, we empower our Managing Partners to use energy-efficient lighting, heating, and cooling at their businesses. Managing Partners also have the autonomy to add electric vehicles to their fleets or implement other programs that demonstrate our commitment to operating our businesses in a sustainable manner. A perfect example of this empowerment includes our Las Vegas, NV businesses’ “Memories Taking Root” program offered to the families we serve in that community. On behalf of each family we serve at those businesses, we make a donation to the U.S. Forest Service’s Plant-A-Tree program, with tree seedlings planted in our National Forests. To date, we have made donations to the Plant-A-Tree program that supports planting approximately 880 trees in our National Forests. We are grateful to offer our families in Las Vegas, NV this positive way to commemorate loved ones while creating a beneficial and lasting impact on our environment, a program we may consider expanding in the future to more of our businesses across the country.

Additionally, we partner with and support our Managing Partners and the businesses they lead from our Support Center, which occupies approximately 48,000 square feet of leased office space in Houston, Texas. The home of our Support Center has obtained a LEED Silver Certification, an ENERGY STAR Certified score of 94 and was a MetLife ESG Challenge Award Winner in 2020.

| Moreover, we operate cemeteries across several states that have been challenged in recent years by drought and other water usage issues, such as California, Nevada and Idaho. While we have a duty to perpetually maintain and irrigate these cemeteries, our Managing Partners are sensitive to water issues affecting their local communities. As part of an effort to lessen our impact on municipal water sources in those communities, along with being good community partners, we use, where available, water resources drawn from on-site wells or reclaimed water sources for our cemetery maintenance, irrigation and other activities, as opposed to utilizing municipal or other resource-constrained water sources. As of the date of this Proxy Statement, eighteen (18) of our thirty-one, or approximately 58%, of our cemeteries utilized on-site wells or reclaimed water sources for our cemetery maintenance, irrigation and other activities, with one cemetery in the process of completing an on-site well. |

58% of our cemeteries utilized on-site wells or reclaimed water sources for our cemetery maintenance, irrigation and other activities | |||||

We believe our decentralized approach to operating our businesses leads to not only growth in local markets, but shows our commitment to being good community and environmental partners, along with demonstrating the difference our people and businesses can make in the communities they serve, environmental or otherwise, particularly when they are empowered to lead and customize these local approaches.

Experienced Leadership & Continuous Education, Growth, and Improvement

Leading this “First Who, Then What” approach to culture and decision-making, is our purpose-built Executive Management team and Board, who each bring a unique background and set of skills that help drive the Company’s current focus on continuous improvement in all areas, including governance and social and environmental responsibilities. We are committed to seeking feedback from our various stakeholders and finding ways to continuously improve based on these conversations. While we made

22 Carriage Services

Carriage Culture

significant progress in 2023, as detailed in this Proxy Statement, we have much more opportunity in front of us and look forward to reporting our continued improvement in the years ahead.

As part of our Board’s strategic and risk oversight, the Board continually assesses whether changes to our corporate governance policies and practices are appropriate with regular reviews and updates to not only those policies, but also to our by-laws and committee charters. Our Board is also encouraged to continuously learn and grow through various avenues, including customized questionnaires and discussions surrounding key hypotheticals involving the Company’s future, invitations to attend our regular operations leadership calls to learn more about what is driving performance, as well as educational opportunities both presented during Board and Committee meetings, as well as support to gain additional education outside of meetings.

We encourage our shareholders to take the time to learn more about the unique background of each individual member of the Company’s Executive Management team and Board to better understand these individuals, their stories, and the impact he or she has had on Carriage’s unique culture.

2024 Proxy Statement 23

DIRECTOR COMPENSATION

General

We compensate our non-employee directors through cash payments or unrestricted shares of Common Stock, as elected by the Board member, including retainers. Our Director Compensation Policy provides the following:

| Annual Retainer(1) | |||||

| Board – Independent Director |

$140,000 | ||||

| Board – Chairman(2) |

$ 10,000 | ||||

| Audit Committee |

|

|

| ||

| Chair |

$ 10,000 | ||||

| Member |

$ — | ||||

| Compensation Committee |

|

|

| ||

| Chair |

$ 5,000 | ||||

| Member |

$ — | ||||

| Corporate Governance Committee |

|

|

| ||

| Chair |

$ 5,000 | ||||

| Member |

$ — | ||||

| (1) | Paid on a quarterly basis in either cash or Common Stock. Retainers are not paid to employee directors. |

| (2) | The Chairman receives this annual retainer in addition to the retainer paid to other Independent Directors. |

Our Director Compensation Policy provides the option for any director to elect to receive their annual retainer, which is paid in quarterly installments, in unrestricted shares of our Common Stock by providing to us written notice. The number of shares of such Common Stock shall be determined by dividing the cash amount of the retainer by the closing price of our Common Stock on the date of grant, which shall be the last business day of each quarter. Such Common Stock shall vest immediately upon grant. Any written notice to receive the retainer in Common Stock shall remain in effect until notice otherwise is made in writing.

Our Director Compensation Policy also provides that any new independent director will receive a grant of $25,000 (in addition to the independent director annual retainer prorated at the time the new director is admitted to the Board) upon appointment or election to the Board, which can be taken in cash or unrestricted shares of our Common Stock. The number of shares of such Common Stock will be determined by dividing the cash amount by the closing price of our Common Stock on the date of grant, which will be the date of admission to the Board. Pursuant to our Director Compensation Policy any such new director grant shall vest immediately.

Our Director Compensation Policy further provides that our employee directors are not separately compensated for their service as directors.

24 Carriage Services

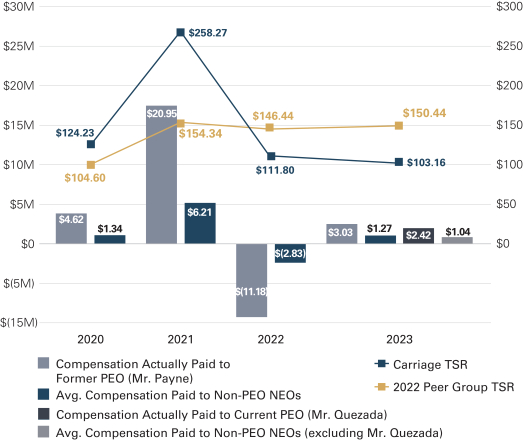

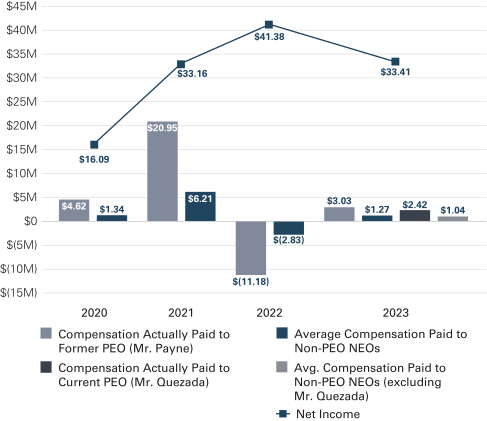

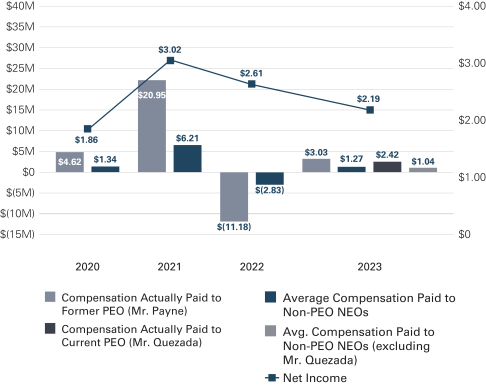

Director Compensation