UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07655

| Driehaus Mutual Funds | ||

| (Exact name of registrant as specified in charter) |

| 25 East Erie Street | ||

| Chicago, IL 60611 | ||

| (Address of principal executive offices) (Zip code) |

Janet L. McWilliams

Driehaus Capital Management LLC

25 East Erie Street

| Chicago, IL 60611 | ||

| (Name and address of agent for service) |

Registrant's telephone number, including area code: 312-587-3800

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Item 1. Reports to Stockholders.

| (a) | The Reports to Shareholders are attached herewith. |

Table of Contents

| Performance Overview and Schedule of Investments: | |

| Driehaus Emerging Markets Growth Fund | 1 |

| Driehaus Emerging Markets Small Cap Growth Fund | 6 |

| Driehaus Global Fund | 10 |

| Driehaus International Small Cap Growth Fund | 14 |

| Driehaus Micro Cap Growth Fund | 19 |

| Driehaus Small Cap Growth Fund | 24 |

| Driehaus Small/Mid Cap Growth Fund | 29 |

| Driehaus Event Driven Fund | 34 |

| Statements of Assets and Liabilities | 40 |

| Statements of Operations | 42 |

| Statements of Changes in Net Assets | 44 |

| Financial Highlights | 48 |

| Notes to Financial Statements | 58 |

| Fund Expense Examples | 80 |

| Shareholder Information | 83 |

| Board Review of Liquidity Risk Management Program | 84 |

| Board Considerations in Connection with the Review of an Amendment to the Investment Advisory Agreement for Driehaus Global Fund (formerly Emerging Markets Opportunities Fund) | 85 |

| Results of Special Meeting of Shareholders of Driehaus Mutual Funds | 86 |

PROXY VOTING POLICIES AND PROCEDURES AND PROXY VOTING RECORD

A description of the Funds’ policies and procedures with respect to the voting of proxies relating to the Funds’ portfolio securities is available without charge, upon request, by calling 1-800-560-6111. This information is also available on the Funds’ website at www.driehaus.com/fund-resources.

Information regarding how the Funds voted proxies related to portfolio securities during the 12-month period ended June 30, 2023 is available without charge, upon request, by calling 1-800-560-6111. This information is also available on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

Each Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form NPORT. The Funds’ Form NPORT is available electronically on the SEC’s website at http://www.sec.gov. Each Fund’s complete schedule of portfolio holdings is also available on the Fund’s website at www.driehaus.com/fund-resources.

Driehaus Emerging Markets Growth Fund

Performance Overview (unaudited)

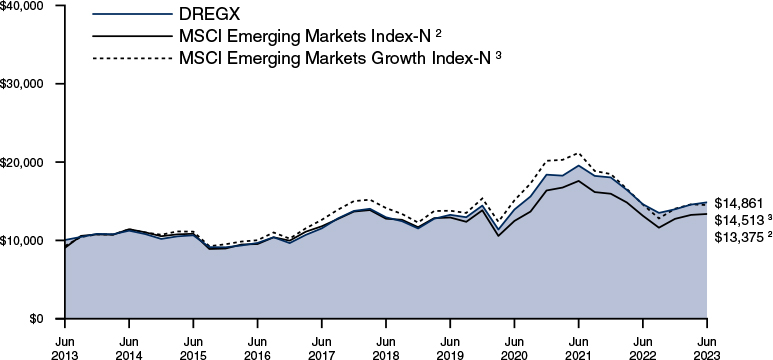

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment (minimum investment) in the Fund over the last 10 fiscal year periods, with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

The performance data shown represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Principal value and investment returns will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Performance data represents the rate that an investor would have earned (or lost), during the given periods, on an investment in the Fund (assuming reinvestment of all dividends and distributions). Average annual total return reflects annualized change. Since Fund performance is subject to change after the period-end, please call (800) 560-6111 or visit www.driehaus.com/performance for more current performance information. The gross expense ratios for the Investor Class and Institutional Class are 1.36% and 1.13%, respectively, as of the most recent prospectus dated April 30, 2023, as supplemented through the date of this report.

| Average Annual Total Returns as of 6/30/23 | 1 Year | 3 Years | 5 Years | 10 Years |

| Driehaus Emerging Markets Growth Fund Investor Class (DREGX) | 1.67% | 2.14% | 2.79% | 4.04% |

| Driehaus Emerging Markets Growth Fund Institutional Class (DIEMX)1 | 1.94% | 2.37% | 3.02% | 4.17% |

| MSCI Emerging Markets Index-N2 | 1.75% | 2.32% | 0.93% | 2.95% |

| MSCI Emerging Markets Growth Index-N3 | -0.45% | -1.36% | 0.53% | 3.79% |

| 1 | The returns for the periods prior to July 17, 2017 (institutional share class inception date) include the performance of the investor share class. |

| 2 | The Morgan Stanley Capital International Emerging Markets Index-Net (MSCI Emerging Markets Index-N) is a market capitalization-weighted index designed to measure equity market performance in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Growth Index-Net (MSCI Emerging Markets Growth Index-N) is a subset of the MSCI Emerging Markets Index and includes only the MSCI Emerging Markets Index stocks which are categorized as growth stocks. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 1 |

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| COMMON STOCKS — 94.68% | ||||||||

| FAR EAST — 64.43% | ||||||||

| China — 20.38% | ||||||||

| AIA Group Ltd. 1 | 2,484,400 | $ | 25,232,808 | |||||

| Alibaba Group Holding Ltd. 1,* | 2,124,800 | 22,118,808 | ||||||

| China Railway Group Ltd. - H | 11,817,000 | 7,819,089 | ||||||

| China Resources Beer Holdings Co. Ltd. | 2,770,000 | 18,304,777 | ||||||

| Galaxy Entertainment Group Ltd. * | 6,540,000 | 41,664,496 | ||||||

| H World Group Ltd. - ADR 2,* | 291,045 | 11,286,725 | ||||||

| Haidilao International Holding Ltd. 1 | 2,965,000 | 6,556,833 | ||||||

| Industrial & Commercial Bank of China Ltd. - H | 91,675,000 | 48,992,185 | ||||||

| Lenovo Group Ltd. | 19,882,000 | 20,833,885 | ||||||

| Meituan - B 1,* | 787,664 | 12,351,294 | ||||||

| NetEase, Inc. | 961,300 | 18,619,338 | ||||||

| New Oriental Education & Technology Group, Inc. - SP ADR 2,* | 442,386 | 17,469,823 | ||||||

| PDD Holdings, Inc. 2,* | 100,382 | 6,940,411 | ||||||

| PetroChina Co. Ltd. - H | 36,888,000 | 25,613,471 | ||||||

| Ping An Insurance Group Co. of China Ltd. - H | 4,484,500 | 28,642,131 | ||||||

| Proya Cosmetics Co. Ltd. - A | 1,398,295 | 21,665,747 | ||||||

| Shenzhen Mindray Bio-Medical Electronics Co. Ltd. - A | 272,024 | 11,256,870 | ||||||

| Sungrow Power Supply Co. Ltd. - A | 383,234 | 6,173,216 | ||||||

| Tencent Holdings Ltd. | 2,774,645 | 117,648,220 | ||||||

| Tencent Music Entertainment Group - ADR 2,* | 1,231,299 | 9,086,987 | ||||||

| Trip.com Group Ltd. - ADR 2,* | 848,456 | 29,695,960 | ||||||

| 507,973,074 | ||||||||

| India — 17.25% | ||||||||

| Bandhan Bank Ltd. 1,* | 4,089,148 | 12,099,240 | ||||||

| Bharti Airtel Ltd. | 1,077,509 | 11,558,104 | ||||||

| Cipla Ltd. | 1,231,548 | 15,259,269 | ||||||

| Dabur India Ltd. | 906,141 | 6,338,580 | ||||||

| DLF Ltd. | 3,604,700 | 21,609,466 | ||||||

| HDFC Bank Ltd. - ADR 2 | 358,333 | 24,975,810 | ||||||

| Hindustan Aeronautics Ltd. | 304,488 | 14,102,372 | ||||||

| Housing Development Finance Corp. Ltd. | 1,088,116 | 37,540,311 | ||||||

| ICICI Bank Ltd. - SP ADR 2 | 2,252,631 | 51,990,723 | ||||||

| Indian Hotels Co. Ltd. | 1,011,210 | 4,848,492 | ||||||

| ITC Ltd. | 5,372,292 | 29,622,925 | ||||||

| KPIT Technologies Ltd. | 1,198,711 | 15,980,785 | ||||||

| Larsen & Toubro Ltd. | 1,063,996 | 32,172,576 | ||||||

| Mahindra & Mahindra Ltd. | 477,779 | 8,488,881 | ||||||

| Max Healthcare Institute Ltd. * | 2,954,933 | 21,621,796 | ||||||

| NTPC Ltd. | 8,995,612 | 20,776,163 | ||||||

| One 97 Communications, Ltd. * | 1,519,016 | 16,104,137 | ||||||

| Power Grid Corp. of India Ltd. | 9,065,246 | 28,260,367 | ||||||

| Reliance Industries Ltd. | 1,394,511 | 43,468,424 | ||||||

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| Sun Pharmaceutical Industries Ltd. | 1,017,822 | $ | 13,058,638 | |||||

| 429,877,059 | ||||||||

| Taiwan — 12.08% | ||||||||

| Accton Technology Corp. | 1,061,000 | 11,934,346 | ||||||

| ASPEED Technology, Inc. | 232,000 | 21,368,308 | ||||||

| Chunghwa Telecom Co. Ltd. | 3,115,000 | 11,666,968 | ||||||

| Delta Electronics, Inc. | 3,228,000 | 35,773,768 | ||||||

| eMemory Technology, Inc. | 203,000 | 14,529,643 | ||||||

| Hon Hai Precision Industry Co. Ltd. | 2,722,000 | 9,896,485 | ||||||

| Sinbon Electronics Co. Ltd. | 1,309,000 | 15,551,424 | ||||||

| Taiwan Semiconductor | ||||||||

| Manufacturing Co. Ltd. | 661,000 | 12,210,873 | ||||||

| Taiwan Semiconductor | ||||||||

| Manufacturing Co. Ltd. - SP ADR 2 | 1,539,304 | 155,346,560 | ||||||

| Unimicron Technology Corp. | 2,228,000 | 12,669,886 | ||||||

| 300,948,261 | ||||||||

| South Korea — 8.63% | ||||||||

| Hanwha Aerospace Co. Ltd. | 147,390 | 14,274,636 | ||||||

| LG Energy Solution Ltd. * | 32,468 | 13,688,255 | ||||||

| Macquarie Korea Infrastructure Fund | 1,259,181 | 12,153,601 | ||||||

| Samsung Electronics Co. Ltd. | 2,518,416 | 138,672,251 | ||||||

| SK Hynix, Inc. | 413,472 | 36,329,472 | ||||||

| 215,118,215 | ||||||||

| Indonesia — 2.95% | ||||||||

| Bank Central Asia Tbk PT | 22,055,175 | 13,526,405 | ||||||

| Bank Mandiri Persero Tbk PT | 119,444,000 | 41,567,393 | ||||||

| Telkom Indonesia Persero Tbk PT | 34,952,900 | 9,350,691 | ||||||

| United Tractors Tbk PT | 5,787,000 | 8,975,047 | ||||||

| 73,419,536 | ||||||||

| Thailand — 1.40% | ||||||||

| Airports of Thailand PCL - NVDR * | 8,168,400 | 16,599,554 | ||||||

| Bangkok Dusit Medical | ||||||||

| Services PCL - NVDR | 13,832,700 | 10,847,273 | ||||||

| SCB X PCL - NVDR | 2,459,100 | 7,404,067 | ||||||

| 34,850,894 | ||||||||

| Philippines — 0.76% | ||||||||

| BDO Unibank, Inc. | 5,045,840 | 12,635,198 | ||||||

| International Container Terminal Services, Inc. | 1,697,107 | 6,268,168 | ||||||

| 18,903,366 | ||||||||

| Japan — 0.50% | ||||||||

| Disco Corp. | 79,000 | 12,525,134 | ||||||

| Singapore — 0.48% | ||||||||

| United Overseas Bank Ltd. | 582,900 | 12,095,909 | ||||||

| Total FAR EAST | ||||||||

| (Cost $1,324,952,854) | 1,605,711,448 | |||||||

Notes to Financial Statements are an integral part of this Schedule.

| 2 |

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| NORTH AMERICA — 10.46% | ||||||||

| Mexico — 4.59% | ||||||||

| America Movil SAB de CV 2,* | 829,349 | $ | 17,947,112 | |||||

| Arca Continental SAB de CV | 1,754,200 | 18,004,198 | ||||||

| Corp Inmobiliaria Vesta SAB de CV | 6,678,500 | 21,677,716 | ||||||

| Fomento Economico Mexicano SAB de CV - SP ADR 2 | 201,001 | 22,278,951 | ||||||

| Grupo Financiero Banorte SAB de CV - O | 4,185,592 | 34,434,484 | ||||||

| 114,342,461 | ||||||||

| United States — 4.11% | ||||||||

| Copa Holdings SA - A | 136,328 | 15,075,150 | ||||||

| Liberty Media Corp.-Liberty Formula One - C * | 197,409 | 14,860,950 | ||||||

| MercadoLibre, Inc. * | 15,434 | 18,283,116 | ||||||

| Samsonite International SA 1,* | 6,895,500 | 19,499,053 | ||||||

| Southern Copper Corp. | 68,539 | 4,916,988 | ||||||

| Tenaris SA - ADR | 531,460 | 15,917,227 | ||||||

| Yum China Holdings, Inc. | 245,316 | 13,860,354 | ||||||

| 102,412,838 | ||||||||

| Canada — 1.76% | ||||||||

| Cameco Corp. 2 | 559,869 | 17,540,696 | ||||||

| First Quantum Minerals Ltd. | 378,509 | 8,954,499 | ||||||

| Franco-Nevada Corp. 2 | 121,797 | 17,368,252 | ||||||

| 43,863,447 | ||||||||

| Total NORTH AMERICA | ||||||||

| (Cost $217,320,283) | 260,618,746 | |||||||

| SOUTH AMERICA — 8.84% | ||||||||

| Brazil — 7.90% | ||||||||

| Banco do Brasil SA | 4,796,100 | 49,581,670 | ||||||

| Direcional Engenharia SA * | 1,382,292 | 5,672,703 | ||||||

| Equatorial Energia SA | 2,565,000 | 17,201,067 | ||||||

| Hapvida Participacoes e Investimentos SA 1,* | 18,530,500 | 16,989,452 | ||||||

| Iguatemi SA | 1,933,700 | 9,050,210 | ||||||

| Petroleo Brasileiro SA - SP ADR 2 | 1,193,519 | 16,506,368 | ||||||

| PRIO SA * | 1,628,200 | 12,646,247 | ||||||

| Raia Drogasil SA | 2,401,152 | 14,808,491 | ||||||

| Rumo SA | 1,661,400 | 7,723,730 | ||||||

| SLC Agricola SA | 1,641,545 | 13,113,302 | ||||||

| Telefonica Brasil SA - ADR 2 | 874,405 | 7,983,318 | ||||||

| Vale SA - SP ADR 2 | 1,334,541 | 17,909,540 | ||||||

| WEG SA | 971,300 | 7,671,895 | ||||||

| 196,857,993 | ||||||||

| Peru — 0.65% | ||||||||

| Credicorp Ltd. 2 | 109,960 | 16,234,494 | ||||||

| Argentina — 0.29% | ||||||||

| Grupo Financiero Galicia SA - ADR 2,* | 414,545 | 7,130,174 | ||||||

| Total SOUTH AMERICA | ||||||||

| (Cost $191,670,469) | 220,222,661 | |||||||

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| MIDDLE EAST — 5.35% | ||||||||

| United Arab Emirates — 2.30% | ||||||||

| Abu Dhabi National Oil Co for | ||||||||

| Distribution PJSC | 10,256,242 | $ | 10,938,196 | |||||

| Abu Dhabi Ports Co. PJSC * | 10,562,920 | 18,513,142 | ||||||

| Dubai Electricity & Water | ||||||||

| Authority PJSC | 21,170,189 | 15,100,979 | ||||||

| Emaar Properties PJSC | 7,334,874 | 12,892,693 | ||||||

| 57,445,010 | ||||||||

| Saudi Arabia — 2.26% | ||||||||

| Dr Sulaiman Al Habib Medical | ||||||||

| Services Group Co. | 246,951 | 18,894,167 | ||||||

| Nahdi Medical Co. | 253,274 | 11,531,033 | ||||||

| Saudi Arabian Oil Co. 1 | 2,977,437 | 25,790,707 | ||||||

| 56,215,907 | ||||||||

| Qatar — 0.44% | ||||||||

| Qatar Gas Transport Co. Ltd. | 9,740,053 | 10,898,846 | ||||||

| Israel — 0.35% | ||||||||

| Elbit Systems Ltd. | 41,410 | 8,667,641 | ||||||

| Total MIDDLE EAST | ||||||||

| (Cost $128,043,276) | 133,227,404 | |||||||

| EUROPE — 5.21% | ||||||||

| Greece — 1.14% | ||||||||

| National Bank of Greece SA * | 2,435,385 | 15,830,996 | ||||||

| OPAP SA | 728,027 | 12,695,556 | ||||||

| 28,526,552 | ||||||||

| Italy — 0.88% | ||||||||

| PRADA SpA | 3,253,700 | 21,891,697 | ||||||

| Spain — 0.63% | ||||||||

| Banco Bilbao Vizcaya | ||||||||

| Argentaria SA | 2,031,178 | 15,604,938 | ||||||

| Poland — 0.52% | ||||||||

| Dino Polska SA 1,* | 111,978 | 13,082,776 | ||||||

| Ireland — 0.51% | ||||||||

| Linde PLC 2 | 33,564 | 12,790,569 | ||||||

| Netherlands — 0.49% | ||||||||

| BE Semiconductor Industries NV | 112,271 | 12,176,256 | ||||||

| United Kingdom — 0.46% | ||||||||

| Unilever PLC | 219,383 | 11,434,655 | ||||||

| Turkey — 0.37% | ||||||||

| BIM Birlesik Magazalar AS | 1,413,613 | 9,262,087 | ||||||

| Jersey, C.I. — 0.21% | ||||||||

| WNS Holdings Ltd. - ADR 2,* | 70,182 | 5,173,817 | ||||||

| Russia — 0.00% | ||||||||

| Polyus PJSC *,^ | 63,751 | 0 | ||||||

| Total EUROPE | ||||||||

| (Cost $139,488,980) | 129,943,347 | |||||||

Notes to Financial Statements are an integral part of this Schedule.

| 3 |

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| AFRICA — 0.39% | ||||||||

| South Africa — 0.39% | ||||||||

| Standard Bank Group Ltd. | 1,043,005 | $ | 9,847,558 | |||||

| Total AFRICA | ||||||||

| (Cost $10,391,639) | 9,847,558 | |||||||

| Total COMMON STOCKS | ||||||||

| (Cost $2,011,867,501) | 2,359,571,164 | |||||||

| RIGHTS — 0.00% | ||||||||

| FAR EAST — 0.00% | ||||||||

| South Korea — 0.00% | ||||||||

| Macquarie Korea Infrastructure Fund * | 96,218 | 10,953 | ||||||

| Total FAR EAST | ||||||||

| (Cost $0) | 10,953 | |||||||

| Total RIGHTS | ||||||||

| (Cost $0) | 10,953 | |||||||

| SHORT TERM INVESTMENTS — 6.00% | ||||||||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 4.98% 3 | ||||||||

| (Cost $149,456,539) | 149,456,539 | 149,456,539 | ||||||

| TOTAL INVESTMENTS | ||||||||

| (Cost $2,161,324,040) | 100.68 | % | $ | 2,509,038,656 | ||||

| Liabilities in Excess of Other | ||||||||

| Assets | (0.68 | )% | (16,972,774 | ) | ||||

| Net Assets | 100.00 | % | $ | 2,492,065,882 | ||||

| Security Type | Percent of Net Assets | |||

| Rights | 0.00 | % | ||

| Common Stocks | 94.68 | % | ||

| Short Term Investments | 6.00 | % | ||

| Total Investments | 100.68 | % | ||

| Liabilities In Excess of Other Assets | (0.68 | )% | ||

| Net Assets | 100.00 | % | ||

| Regional Weightings | Percent of Net Assets | |||

| Far East | 64.43 | % | ||

| North America | 16.46 | % | ||

| South America | 8.84 | % | ||

| Middle East | 5.35 | % | ||

| Europe | 5.21 | % | ||

| Africa | 0.39 | % | ||

| ADR American Depositary Receipt |

| NVDR Non-Voting Depositary Receipt |

| PCL Public Company Limited |

| PJSC Public Joint Stock Company |

| PLC Public Limited Company |

| SP ADR Sponsored American Depositary Receipt |

| 1 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $153,720,971, which represents 6% of Net Assets (see Note F in the Notes to Financial Statements). |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | 7 day current yield as of June 30, 2023 is disclosed. |

| ^ | Security valued at fair value as determined in good faith by the Adviser, in accordance with procedures established by, and under the general supervision of, the Trust’s Board of Trustee. The security is valued using significant unobservable inputs. |

| * | Non-income producing security. |

Percentages are stated as a percent of net assets.

Notes to Financial Statements are an integral part of this Schedule.

| 4 |

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Industry | Percent of Net Assets | |||

| Aerospace & Defense | 1.49 | % | ||

| Automobiles | 0.34 | % | ||

| Banks | 15.01 | % | ||

| Beverages | 2.35 | % | ||

| Broadline Retail | 1.90 | % | ||

| Capital Markets | 0.49 | % | ||

| Chemicals | 0.51 | % | ||

| Communications Equipment | 0.48 | % | ||

| Construction & Engineering | 1.60 | % | ||

| Consumer Staples Distribution & Retail | 1.94 | % | ||

| Diversified Consumer Services | 0.70 | % | ||

| Diversified Telecommunication Services | 1.17 | % | ||

| Electric Utilities | 1.82 | % | ||

| Electrical Equipment | 1.11 | % | ||

| Electronic Equipment, Instruments & Components | 2.97 | % | ||

| Energy Equipment & Services | 0.64 | % | ||

| Entertainment | 1.71 | % | ||

| Financial Services | 2.16 | % | ||

| Food Products | 0.53 | % | ||

| Ground Transportation | 0.31 | % | ||

| Health Care Equipment & Supplies | 0.45 | % | ||

| Health Care Providers & Services | 2.74 | % | ||

| Hotels, Restaurants & Leisure | 5.34 | % | ||

| Household Durables | 0.23 | % | ||

| Industry | Percent of Net Assets | |||

| Independent Power and Renewable Electricity Producers | 0.83 | % | ||

| Insurance | 2.16 | % | ||

| Interactive Media & Services | 4.72 | % | ||

| Metals & Mining | 1.98 | % | ||

| Money Market Fund | 6.00 | % | ||

| Multi-Utilities | 0.60 | % | ||

| Oil, Gas & Consumable Fuels | 6.48 | % | ||

| Passenger Airlines | 0.60 | % | ||

| Personal Care Products | 1.58 | % | ||

| Pharmaceuticals | 1.13 | % | ||

| Professional Services | 0.21 | % | ||

| Real Estate Management & Development | 2.62 | % | ||

| Semiconductors & Semiconductor Equipment | 10.61 | % | ||

| Software | 0.64 | % | ||

| Specialty Retail | 0.44 | % | ||

| Technology Hardware, Storage & Peripherals | 6.40 | % | ||

| Textiles, Apparel & Luxury Goods | 1.66 | % | ||

| Tobacco | 1.19 | % | ||

| Transportation Infrastructure | 1.66 | % | ||

| Wireless Telecommunication Services | 1.18 | % | ||

| Liabilities In Excess of Other Assets | (0.68 | )% | ||

| TOTAL | 100.00 | % | ||

Notes to Financial Statements are an integral part of this Schedule.

| 5 |

Driehaus Emerging Markets Small Cap Growth Fund

Performance Overview (unaudited)

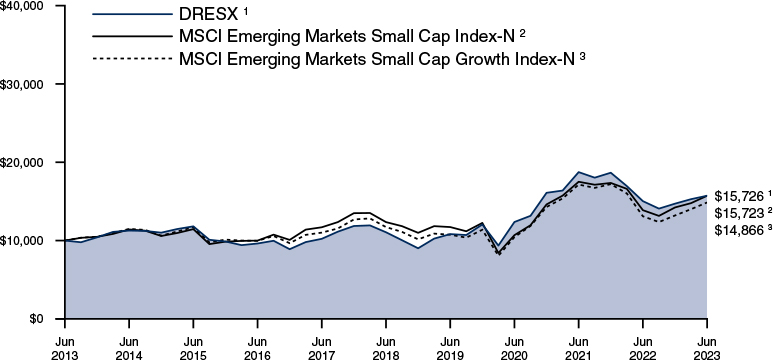

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment (minimum investment) in the Fund over the last 10 fiscal year periods (which includes performance of the Predecessor Limited Partnership’s inception), with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

The performance data shown represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Principal value and investment returns will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The Fund will charge a redemption fee of 2.00% on shares held less than sixty (60) days. Performance data represents the rate that an investor would have earned (or lost), during the given periods, on an investment in the Fund (assuming reinvestment of all dividends and distributions). Average annual total return reflects annualized change. Since Fund performance is subject to change after the period-end, please call (800) 560-6111 or visit www.driehaus.com/performance for more current performance information. The gross expense ratio is 1.45% as of the most recent prospectus dated April 30, 2023, as supplemented through the date of this report.

| Average Annual Total Returns as of 6/30/23 | 1 Year | 3 Years | 5 Years | 10 Years |

| Driehaus Emerging Markets Small Cap Growth Fund (DRESX)1 | 4.60% | 8.32% | 7.29% | 4.63% |

| MSCI Emerging Markets Small Cap Index-N2 | 13.28% | 13.72% | 4.93% | 4.63% |

| MSCI Emerging Markets Small Cap Growth Index-N3 | 13.47% | 12.48% | 4.86% | 4.04% |

| 1 | The returns reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Emerging Markets Small Cap Index-Net (MSCI Emerging Markets Small Cap Index-N) is a market capitalization-weighted index designed to measure equity market performance of small cap stocks in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Small Cap Growth Index-Net (MSCI Emerging Markets Small Cap Growth Index-N) is a market capitalization-weighted index designed to measure equity market performance of small cap growth stocks in emerging markets. |

| Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 6 |

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| COMMON STOCKS — 95.53% | ||||||||

| FAR EAST — 67.34% | ||||||||

| India — 25.90% | ||||||||

| APL Apollo Tubes Ltd. | 65,272 | $ | 1,040,296 | |||||

| Apollo Hospitals Enterprise Ltd. | 21,554 | 1,341,676 | ||||||

| AU Small Finance Bank Ltd. 1 | 112,166 | 1,033,499 | ||||||

| BLS International Services Ltd. * | 213,173 | 540,233 | ||||||

| CIE Automotive India Ltd. | 95,850 | 603,576 | ||||||

| Data Patterns India Ltd. | 51,764 | 1,181,527 | ||||||

| Indian Hotels Co. Ltd. | 408,978 | 1,960,944 | ||||||

| Jindal Steel & Power Ltd. | 191,813 | 1,363,209 | ||||||

| Kajaria Ceramics Ltd. | 73,321 | 1,125,909 | ||||||

| KPIT Technologies Ltd. | 116,726 | 1,556,149 | ||||||

| L&T Finance Holdings Ltd. | 452,457 | 706,413 | ||||||

| Linde India Ltd. * | 19,992 | 1,053,999 | ||||||

| Macrotech Developers Ltd. 1,* | 165,338 | 1,373,384 | ||||||

| Max Healthcare Institute Ltd. * | 251,462 | 1,839,994 | ||||||

| Navin Fluorine International | ||||||||

| Ltd. | 23,800 | 1,308,250 | ||||||

| Oberoi Realty Ltd. | 99,520 | 1,197,148 | ||||||

| One 97 Communications, Ltd. * | 104,052 | 1,103,127 | ||||||

| PB Fintech Ltd. * | 150,616 | 1,282,552 | ||||||

| Radico Khaitan Ltd. | 54,382 | 802,207 | ||||||

| Rainbow Children’s Medicare | ||||||||

| Ltd. | 114,194 | 1,341,500 | ||||||

| Sula Vineyards Ltd. | 236,649 | 1,321,919 | ||||||

| Syngene International Ltd. 1 | 89,292 | 834,046 | ||||||

| TVS Motor Co. Ltd. | 66,451 | 1,076,759 | ||||||

| Varun Beverages Ltd. | 137,511 | 1,348,424 | ||||||

| 28,336,740 | ||||||||

| China — 17.48% | ||||||||

| Akeso, Inc. 1,* | 122,000 | 553,388 | ||||||

| Bosideng International | ||||||||

| Holdings Ltd. | 1,100,000 | 464,666 | ||||||

| Estun Automation Co. Ltd. - A | 388,278 | 1,501,622 | ||||||

| Hygeia Healthcare Holdings | ||||||||

| Co. Ltd. 1 | 492,200 | 2,673,444 | ||||||

| Jiangsu Hengli Hydraulic Co. | ||||||||

| Ltd. - A | 166,550 | 1,476,989 | ||||||

| Jiumaojiu International | ||||||||

| Holdings Ltd. 1 | 301,000 | 495,001 | ||||||

| Man Wah Holdings Ltd. | 2,317,600 | 1,551,535 | ||||||

| Pacific Basin Shipping Ltd. | 4,390,000 | 1,339,474 | ||||||

| Proya Cosmetics Co. Ltd. - A | 68,848 | 1,066,759 | ||||||

| Silergy Corp. | 93,000 | 1,158,519 | ||||||

| SITC International Holdings Co. | ||||||||

| Ltd. | 901,000 | 1,649,885 | ||||||

| Sunresin New Materials Co. Ltd. | ||||||||

| - A | 208,116 | 1,790,360 | ||||||

| Yadea Group Holdings Ltd. 1 | 594,000 | 1,355,016 | ||||||

| Yihai International Holding | ||||||||

| Ltd. * | 359,000 | 773,254 | ||||||

| Zhejiang Weixing New Building | ||||||||

| Materials Co. Ltd. - A | 450,768 | 1,274,762 | ||||||

| 19,124,674 | ||||||||

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| Taiwan — 14.06% | ||||||||

| Accton Technology Corp. | 120,000 | $ | 1,349,784 | |||||

| ASPEED Technology, Inc. | 17,700 | 1,630,255 | ||||||

| Chroma ATE, Inc. | 69,000 | 556,846 | ||||||

| Eclat Textile Co. Ltd. | 33,000 | 530,650 | ||||||

| eMemory Technology, Inc. | 25,000 | 1,789,365 | ||||||

| Lite-On Technology Corp. | 318,000 | 1,058,921 | ||||||

| Lotes Co. Ltd. | 68,753 | 1,903,777 | ||||||

| Sinbon Electronics Co. Ltd. | 181,000 | 2,150,350 | ||||||

| Voltronic Power Technology | ||||||||

| Corp. | 31,550 | 1,995,285 | ||||||

| Wiwynn Corp. | 53,000 | 2,422,231 | ||||||

| 15,387,464 | ||||||||

| South Korea — 3.38% | ||||||||

| HPSP Co. Ltd. | 24,202 | 527,733 | ||||||

| Hyundai Mipo Dockyard Co. | ||||||||

| Ltd. * | 9,963 | 638,137 | ||||||

| Park Systems Corp. | 7,612 | 1,091,138 | ||||||

| Samsung Engineering Co. Ltd. * | 67,024 | 1,445,391 | ||||||

| 3,702,399 | ||||||||

| Vietnam — 2.36% | ||||||||

| FPT Corp. | 660,680 | 2,582,219 | ||||||

| Kazakhstan — 1.61% | ||||||||

| Kaspi.KZ JSC 1 | 22,166 | 1,764,414 | ||||||

| Indonesia — 1.41% | ||||||||

| BFI Finance Indonesia Tbk PT | 5,455,100 | 520,909 | ||||||

| Merdeka Battery Materials Tbk | ||||||||

| PT * | 18,969,800 | 1,024,881 | ||||||

| 1,545,790 | ||||||||

| Thailand — 1.14% | ||||||||

| Bumrungrad Hospital PCL - | ||||||||

| NVDR | 194,400 | 1,240,567 | ||||||

| Total FAR EAST | ||||||||

| (Cost $63,887,768) | 73,684,267 | |||||||

| MIDDLE EAST — 10.62% | ||||||||

| Saudi Arabia — 6.70% | ||||||||

| Arabian Drilling Co. * | 38,020 | 1,572,055 | ||||||

| Dallah Healthcare Co. | 34,917 | 1,568,827 | ||||||

| Leejam Sports Co. JSC | 29,748 | 1,026,802 | ||||||

| Mouwasat Medical Services Co. | 20,115 | 1,304,131 | ||||||

| Nahdi Medical Co. | 22,912 | 1,043,135 | ||||||

| Saudi Airlines Catering Co. | 30,900 | 816,673 | ||||||

| 7,331,623 | ||||||||

| United Arab Emirates — 2.95% | ||||||||

| Abu Dhabi Ports Co. PJSC * | 807,845 | 1,415,873 | ||||||

| Emirates Central Cooling Systems Corp. | 3,688,182 | 1,815,523 | ||||||

| 3,231,396 | ||||||||

| Qatar — 0.97% | ||||||||

| Qatar Gas Transport Co. Ltd. | 948,814 | 1,061,696 | ||||||

| Total MIDDLE EAST | ||||||||

| (Cost $10,313,773) | 11,624,715 | |||||||

Notes to Financial Statements are an integral part of this Schedule.

| 7 |

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| NORTH AMERICA — 9.32% | ||||||||

| Mexico — 4.19% | ||||||||

| FIBRA Macquarie Mexico 1 | 393,400 | $ | 697,074 | |||||

| Prologis Property Mexico SA de | ||||||||

| CV | 220,500 | 816,199 | ||||||

| Ternium SA - SP ADR 2 | 40,608 | 1,610,107 | ||||||

| TF Administradora Industrial S | ||||||||

| de RL de CV | 331,600 | 632,708 | ||||||

| Vista Energy SAB de CV * | 34,190 | 824,663 | ||||||

| 4,580,751 | ||||||||

| Canada — 3.03% | ||||||||

| Filo Corp. * | 89,700 | 1,747,618 | ||||||

| Ivanhoe Mines Ltd. - A * | 171,494 | 1,566,392 | ||||||

| 3,314,010 | ||||||||

| United States — 2.10% | ||||||||

| Copa Holdings SA - A | 9,683 | 1,070,746 | ||||||

| Parade Technologies Ltd. | 35,455 | 1,229,052 | ||||||

| 2,299,798 | ||||||||

| Total NORTH AMERICA | ||||||||

| (Cost $8,307,918) | 10,194,559 | |||||||

| SOUTH AMERICA — 6.54% | ||||||||

| Brazil — 5.75% | ||||||||

| Cury Construtora e | ||||||||

| Incorporadora SA | 178,504 | 598,344 | ||||||

| Orizon Valorizacao de Residuos | ||||||||

| SA * | 189,800 | 1,472,196 | ||||||

| PRIO SA * | 221,400 | 1,719,616 | ||||||

| Santos Brasil Participacoes SA | 513,800 | 1,080,566 | ||||||

| SLC Agricola SA | 178,200 | 1,423,531 | ||||||

| 6,294,253 | ||||||||

| Argentina — 0.79% | ||||||||

| Pampa Energia SA - SP ADR | ||||||||

| 1,2,* | 19,842 | 859,556 | ||||||

| Total SOUTH AMERICA | ||||||||

| (Cost $5,277,228) | 7,153,809 | |||||||

| EUROPE — 1.71% | ||||||||

| Poland — 1.71% | ||||||||

| Dino Polska SA 1,* | 15,992 | 1,868,401 | ||||||

| Total EUROPE | ||||||||

| (Cost $1,516,658) | 1,868,401 | |||||||

| Total COMMON STOCKS | ||||||||

| (Cost $89,303,345) | 104,525,751 | |||||||

| PREFERRED STOCKS — 0.98% | ||||||||

| SOUTH AMERICA — 0.98% | ||||||||

| Brazil — 0.98% | ||||||||

| Bradespar SA, 5.56% 3 | 230,500 | 1,070,134 | ||||||

| Total SOUTH AMERICA | ||||||||

| (Cost $1,138,624) | 1,070,134 | |||||||

| Total PREFERRED STOCKS | ||||||||

| (Cost $1,138,624) | 1,070,134 | |||||||

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| SHORT TERM INVESTMENTS — 5.67% | ||||||||

| Northern Institutional | ||||||||

| U.S. Government Select | ||||||||

| Portfolio (Shares Class), | ||||||||

| 4.98% 4 | ||||||||

| (Cost $6,209,982) | 6,209,982 | $ | 6,209,982 | |||||

| TOTAL INVESTMENTS | ||||||||

| (Cost $96,651,951) | 102.18 | % | $ | 111,805,867 | ||||

| Liabilities in Excess of Other | ||||||||

| Assets | (2.18 | )% | (2,388,254 | ) | ||||

| Net Assets | 100.00 | % | $ | 109,417,613 | ||||

| JSC | Joint Stock Company |

| NVDR | Non-Voting Depositary Receipt |

| PCL | Public Company Limited |

| PJSC | Public Joint Stock Company |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $13,507,223, which represents 12% of Net Assets (see Note F in the Notes to Financial Statements). |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

| 4 | 7 day current yield as of June 30, 2023 is disclosed. |

| * | Non-income producing security. |

Percentages are stated as a percent of net assets.

| Security Type | Percent of Net Assets | |||

| Common Stocks | 95.53 | % | ||

| Preferred Stocks | 0.98 | % | ||

| Short Term Investments | 5.67 | % | ||

| Total Investments | 102.18 | % | ||

| Liabilities In Excess of Other Assets | (2.18 | )% | ||

| Net Assets | 100.00 | % | ||

| Regional Weightings | Percent of Net Assets | |||

| Far East | 67.34 | % | ||

| North America | 14.99 | % | ||

| Middle East | 10.62 | % | ||

| South America | 7.52 | % | ||

| Europe | 1.71 | % | ||

Notes to Financial Statements are an integral part of this Schedule.

| 8 |

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Industry | Percent of Net Assets | |||

| Aerospace & Defense | 1.08 | % | ||

| Automobile Components | 0.55 | % | ||

| Automobiles | 2.22 | % | ||

| Banks | 0.95 | % | ||

| Beverages | 3.17 | % | ||

| Biotechnology | 0.51 | % | ||

| Building Products | 2.20 | % | ||

| Chemicals | 3.80 | % | ||

| Commercial Services & Supplies | 2.09 | % | ||

| Communications Equipment | 1.23 | % | ||

| Construction & Engineering | 1.32 | % | ||

| Consumer Finance | 2.08 | % | ||

| Consumer Staples Distribution & Retail | 2.66 | % | ||

| Electric Utilities | 0.79 | % | ||

| Electrical Equipment | 1.82 | % | ||

| Electronic Equipment, Instruments & Components | 5.22 | % | ||

| Energy Equipment & Services | 1.44 | % | ||

| Equity Real Estate Investment Trusts | 1.97 | % | ||

| Financial Services | 1.66 | % | ||

| Food Products | 2.01 | % | ||

| Health Care Providers & Services | 10.34 | % | ||

| Hotels, Restaurants & Leisure | 3.18 | % | ||

| Industry | Percent of Net Assets | |||

| Household Durables | 1.97 | % | ||

| Insurance | 1.17 | % | ||

| IT Services | 2.36 | % | ||

| Life Sciences Tools & Services | 0.76 | % | ||

| Machinery | 3.30 | % | ||

| Marine | 2.73 | % | ||

| Metals & Mining | 8.62 | % | ||

| Money Market Fund | 5.67 | % | ||

| Oil, Gas & Consumable Fuels | 3.29 | % | ||

| Passenger Airlines | 0.98 | % | ||

| Personal Care Products | 0.97 | % | ||

| Professional Services | 0.49 | % | ||

| Real Estate Management & Development | 2.35 | % | ||

| Semiconductors & Semiconductor Equipment | 5.79 | % | ||

| Software | 1.42 | % | ||

| Technology Hardware, Storage & Peripherals | 3.18 | % | ||

| Textiles, Apparel & Luxury Goods | 0.90 | % | ||

| Transportation Infrastructure | 2.28 | % | ||

| Water Utilities | 1.66 | % | ||

| Liabilities In Excess of Other Assets | (2.18 | )% | ||

| TOTAL | 100.00 | % | ||

Notes to Financial Statements are an integral part of this Schedule.

| 9 |

Driehaus Global Fund

Performance Overview (unaudited)

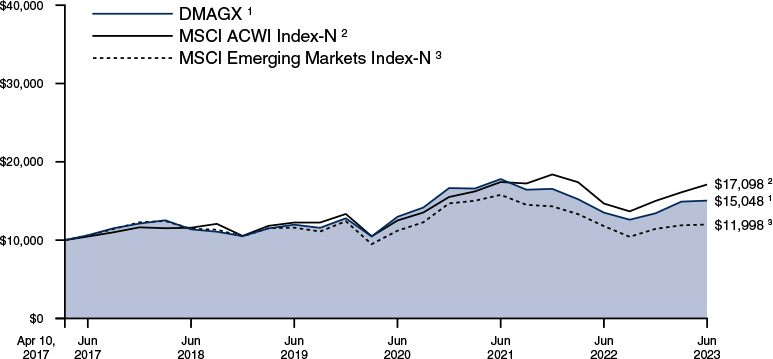

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment (minimum investment) in the Fund since April 10, 2017 (the date of the fund’s inception), with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

The performance data shown represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Principal value and investment returns will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The Fund will charge a redemption fee of 2.00% on shares held less than sixty (60) days. Performance data represents the rate that an investor would have earned (or lost), during the given periods, on an investment in the Fund (assuming reinvestment of all dividends and distributions). Average annual total return reflects annualized change. Since Fund performance is subject to change after the period-end, please call (800) 560-6111 or visit www.driehaus.com/performance for more current performance information. The gross expense ratio is 1.12% as of the most recent prospectus dated April 30, 2023, as supplemented through the date of this report.

| Average Annual Total Returns as of 6/30/23 | 1 Year | 3 Years | 5 Years | Since Inception (4/10/17 - 6/30/23) |

| Driehaus Global Fund (DMAGX)1 | 11.34% | 5.05% | 5.75% | 6.79% |

| MSCI ACWI Index-N*,2 | 16.53% | 10.99% | 8.10% | 9.00% |

| MSCI Emerging Markets Index-N3 | 1.75% | 2.32% | 0.93% | 2.97% |

| * | Effective April 30, 2023, the Fund elected to change its benchmark index from the MSCI Emerging Markets Index-Net to the MSCI ACWI Index Net. The Fund believes the composition of the MSCI ACWI Index Net more accurately reflects the Fund’s current investment strategy and portfolio characteristics. |

| 1 | Prior to April 30, 2023, the Driehaus Global Fund was known as the Driehaus Emerging Markets Opportunities Fund, and prior to January 29, 2020, the Driehaus Emerging Markets Opportunities Fund was known as the Driehaus Multi-Asset Growth Economies Fund. The returns for the period reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International All Country World Index-Net (MSCI ACWI Index-N) is a market capitalization-weighted index designed to measure equity market performance in global developed markets and emerging markets. Data is in U.S. dollars and is calculate with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Index-Net (MSCI Emerging Markets Index-N) is a market capitalization-weighted index designed to measure equity market performance in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 10 |

Driehaus Global Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| COMMON STOCKS — 95.91% | ||||||||

| NORTH AMERICA — 57.40% | ||||||||

| United States — 51.52% | ||||||||

| Alphabet, Inc. - A * | 6,576 | $ | 787,147 | |||||

| Amazon.com Ltd. * | 5,396 | 703,423 | ||||||

| Apple, Inc. | 7,933 | 1,538,764 | ||||||

| Applied Materials, Inc. | 3,373 | 487,533 | ||||||

| Arista Networks, Inc. * | 2,419 | 392,023 | ||||||

| Boston Scientific Corp. * | 5,437 | 294,087 | ||||||

| Broadcom, Inc. | 488 | 423,306 | ||||||

| Chipotle Mexican Grill, Inc. * | 197 | 421,383 | ||||||

| Eli Lilly & Co. | 1,522 | 713,788 | ||||||

| Equinix, Inc. | 333 | 261,052 | ||||||

| Exact Sciences Corp. * | 2,815 | 264,329 | ||||||

| Exxon Mobil Corp. | 13,084 | 1,403,259 | ||||||

| Ingredion, Inc. | 4,359 | 461,836 | ||||||

| Intuitive Surgical, Inc. * | 803 | 274,578 | ||||||

| JPMorgan Chase & Co. | 6,220 | 904,637 | ||||||

| Lam Research Corp. | 841 | 540,645 | ||||||

| Lamb Weston Holdings, Inc. | 2,519 | 289,559 | ||||||

| Liberty Media Corp.-Liberty | ||||||||

| Formula One - C * | 6,789 | 511,076 | ||||||

| LKQ Corp. | 9,923 | 578,213 | ||||||

| Marriott International, Inc. - A | 1,596 | 293,169 | ||||||

| Marvell Technology, Inc. | 4,409 | 263,570 | ||||||

| Mastercard, Inc. - A | 1,289 | 506,964 | ||||||

| MercadoLibre, Inc. * | 184 | 217,966 | ||||||

| Meta Platforms, Inc. - A * | 3,662 | 1,050,921 | ||||||

| Microsoft Corp. | 6,285 | 2,140,294 | ||||||

| Molson Coors Beverage Co. - B | 7,064 | 465,094 | ||||||

| MongoDB, Inc. * | 1,467 | 602,922 | ||||||

| Monolithic Power Systems, Inc. | 768 | 414,897 | ||||||

| Netflix, Inc. * | 2,936 | 1,293,279 | ||||||

| NVIDIA Corp. | 2,354 | 995,789 | ||||||

| Oracle Corp. | 3,846 | 458,020 | ||||||

| PACCAR, Inc. | 6,688 | 559,451 | ||||||

| Palo Alto Networks, Inc. * | 1,986 | 507,443 | ||||||

| Prologis, Inc. | 2,155 | 264,268 | ||||||

| Regions Financial Corp. | 17,268 | 307,716 | ||||||

| Roper Technologies, Inc. | 1,243 | 597,634 | ||||||

| Samsonite International SA 1,* | 172,554 | 487,947 | ||||||

| ServiceNow, Inc. * | 1,136 | 638,398 | ||||||

| Southern Copper Corp. | 8,889 | 637,697 | ||||||

| The Boeing Co. * | 3,103 | 655,229 | ||||||

| Uber Technologies, Inc. * | 19,894 | 858,824 | ||||||

| Vertex Pharmaceuticals, Inc. * | 1,688 | 594,024 | ||||||

| Walmart, Inc. | 5,041 | 792,344 | ||||||

| Yum! Brands, Inc. | 2,766 | 383,229 | ||||||

| 27,237,727 | ||||||||

| Canada — 4.62% | ||||||||

| Alimentation Couche-Tard, Inc. | 9,400 | 482,009 | ||||||

| Cameco Corp. 2 | 17,533 | 549,309 | ||||||

| Dollarama, Inc. | 7,000 | 474,082 | ||||||

| Franco-Nevada Corp. | 3,000 | 427,575 | ||||||

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| Nutrien Ltd. 2 | 8,659 | $ | 511,314 | |||||

| 2,444,289 | ||||||||

| Mexico — 1.26% | ||||||||

| Grupo Financiero Banorte SAB | ||||||||

| de CV - O | 80,971 | 666,141 | ||||||

| Total NORTH AMERICA | ||||||||

| (Cost $27,183,554) | 30,348,157 | |||||||

| FAR EAST — 19.09% | ||||||||

| Japan — 6.67% | ||||||||

| Japan Airport Terminal Co. Ltd. | 14,200 | 642,285 | ||||||

| Kikkoman Corp. | 6,400 | 365,495 | ||||||

| Nintendo Co. Ltd. | 9,100 | 414,854 | ||||||

| Panasonic Holdings Corp. | 52,800 | 647,430 | ||||||

| Sony Group Corp. | 9,900 | 893,675 | ||||||

| Unicharm Corp. | 15,200 | 565,210 | ||||||

| 3,528,949 | ||||||||

| India — 3.62% | ||||||||

| Apollo Hospitals Enterprise Ltd. | 4,666 | 290,445 | ||||||

| ICICI Bank Ltd. - SP ADR 2 | 20,889 | 482,118 | ||||||

| KPIT Technologies Ltd. | 16,900 | 225,305 | ||||||

| Max Healthcare Institute Ltd. * | 57,668 | 421,968 | ||||||

| One 97 Communications, Ltd. * | 20,624 | 218,649 | ||||||

| Titan Co. Ltd. | 7,458 | 277,695 | ||||||

| 1,916,180 | ||||||||

| Taiwan — 3.36% | ||||||||

| ASPEED Technology, Inc. | 3,000 | 276,314 | ||||||

| Delta Electronics, Inc. | 33,986 | 376,644 | ||||||

| Sinbon Electronics Co. Ltd. | 17,136 | 203,582 | ||||||

| Taiwan Semiconductor | ||||||||

| Manufacturing Co. Ltd. | 49,668 | 917,534 | ||||||

| 1,774,074 | ||||||||

| South Korea — 2.02% | ||||||||

| Samsung Electronics Co. Ltd. | 19,366 | 1,066,356 | ||||||

| China — 1.31% | ||||||||

| AIA Group Ltd. 1 | 31,400 | 318,914 | ||||||

| Tencent Holdings Ltd. | 8,853 | 375,378 | ||||||

| 694,292 | ||||||||

| Singapore — 0.83% | ||||||||

| United Overseas Bank Ltd. | 21,200 | 439,927 | ||||||

| Philippines — 0.74% | ||||||||

| BDO Unibank, Inc. | 156,000 | 390,637 | ||||||

| Indonesia — 0.54% | ||||||||

| Bank Central Asia Tbk PT | 462,045 | 283,371 | ||||||

| Total FAR EAST | ||||||||

| (Cost $7,737,528) | 10,093,786 | |||||||

| EUROPE — 18.87% | ||||||||

| United Kingdom — 4.33% | ||||||||

| AstraZeneca PLC - SP ADR 2 | 5,320 | 380,752 | ||||||

| RELX PLC | 11,298 | 376,910 | ||||||

| Rolls-Royce Holdings PLC * | 269,575 | 518,393 | ||||||

| Shell PLC | 15,824 | 476,670 | ||||||

| Unilever PLC | 10,273 | 535,448 | ||||||

| 2,288,173 | ||||||||

Notes to Financial Statements are an integral part of this Schedule.

| 11 |

Driehaus Global Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| France — 3.44% | ||||||||

| Accor SA | 14,270 | $ | 531,007 | |||||

| Danone SA | 4,560 | 279,453 | ||||||

| LVMH Moet Hennessy Louis | ||||||||

| Vuitton SE | 211 | 198,954 | ||||||

| Safran SA | 1,840 | 288,346 | ||||||

| Schneider Electric SE | 2,874 | 522,139 | ||||||

| 1,819,899 | ||||||||

| Germany — 2.72% | ||||||||

| adidas AG | 2,051 | 398,157 | ||||||

| RWE AG | 12,980 | 565,620 | ||||||

| SAP SE | 3,492 | 477,033 | ||||||

| 1,440,810 | ||||||||

| Netherlands — 2.11% | ||||||||

| Airbus SE | 3,980 | 575,435 | ||||||

| ASML Holding NV | 742 | 538,194 | ||||||

| 1,113,629 | ||||||||

| Italy — 2.02% | ||||||||

| PRADA SpA | 55,300 | 372,072 | ||||||

| UniCredit SpA | 30,016 | 697,980 | ||||||

| 1,070,052 | ||||||||

| Spain — 1.93% | ||||||||

| Banco Bilbao Vizcaya | ||||||||

| Argentaria SA | 85,841 | 659,491 | ||||||

| Iberdrola SA | 27,517 | 359,339 | ||||||

| 1,018,830 | ||||||||

| Switzerland — 1.39% | ||||||||

| ABB Ltd. | 9,539 | 375,272 | ||||||

| The Swatch Group AG | 1,235 | 361,105 | ||||||

| 736,377 | ||||||||

| Jersey, C.I. — 0.93% | ||||||||

| Ferguson PLC 2 | 3,118 | 490,493 | ||||||

| Total EUROPE | ||||||||

| (Cost $9,385,626) | 9,978,263 | |||||||

| SOUTH AMERICA — 0.55% | ||||||||

| Brazil — 0.55% | ||||||||

| Banco do Brasil SA | 28,300 | 292,563 | ||||||

| Total SOUTH AMERICA | ||||||||

| (Cost $180,731) | 292,563 | |||||||

| Total COMMON STOCKS | ||||||||

| (Cost $44,487,439) | 50,712,769 | |||||||

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| SHORT TERM INVESTMENTS — 4.90% | ||||||||

| Northern Institutional | ||||||||

| U.S. Government Select | ||||||||

| Portfolio (Shares Class), | ||||||||

| 4.98% 3,4 | ||||||||

| (Cost $2,590,443) | 2,590,443 | $ | 2,590,443 | |||||

| TOTAL INVESTMENTS | ||||||||

| (Cost $47,077,882) | 100.81 | % | $ | 53,303,212 | ||||

| Liabilities in Excess of Other | ||||||||

| Assets | (0.81 | )% | (429,578 | ) | ||||

| Net Assets | 100.00 | % | $ | 52,873,634 | ||||

| PLC | Public Limited Company |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $806,861, which represents 2% of Net Assets (see Note F in the Notes to Financial Statements). |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | 7 day current yield as of June 30, 2023 is disclosed. |

| 4 | All or a portion of this security is pledged as collateral for short sales or derivatives transactions. |

| * | Non-income producing security. |

Percentages are stated as a percent of net assets.

| Security Type | Percent of Net Assets | |||

| Common Stocks | 95.91 | % | ||

| Short Term Investments | 4.90 | % | ||

| Total Investments | 100.81 | % | ||

| Liabilities In Excess of Other Assets | (0.81 | )% | ||

| Net Assets | 100.00 | % |

| Regional Weightings | Percent of Net Assets | |||

| North America | 62.29 | % | ||

| Far East | 19.09 | % | ||

| Europe | 18.88 | % | ||

| South America | 0.55 | % | ||

Notes to Financial Statements are an integral part of this Schedule.

| 12 |

Driehaus Global Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Industry | Percent of Net Assets | |||

| Aerospace & Defense | 3.85 | % | ||

| Banks | 9.69 | % | ||

| Beverages | 0.88 | % | ||

| Biotechnology | 1.62 | % | ||

| Broadline Retail | 2.63 | % | ||

| Chemicals | 0.97 | % | ||

| Communications Equipment | 0.74 | % | ||

| Consumer Staples Distribution & Retail | 2.41 | % | ||

| Distributors | 1.09 | % | ||

| Electric Utilities | 0.68 | % | ||

| Electrical Equipment | 1.70 | % | ||

| Electronic Equipment, Instruments & Components | 1.10 | % | ||

| Entertainment | 4.20 | % | ||

| Financial Services | 1.37 | % | ||

| Food Products | 2.64 | % | ||

| Ground Transportation | 1.62 | % | ||

| Health Care Equipment & Supplies | 1.08 | % | ||

| Health Care Providers & Services | 1.35 | % | ||

| Hotels, Restaurants & Leisure | 3.08 | % | ||

| Household Durables | 2.91 | % | ||

| Household Products | 1.07 | % | ||

| Independent Power and Renewable Electricity | ||||

| Producers | 1.07 | % | ||

| Industry | Percent of Net Assets | |||

| Industrial Real Estate Investment Trusts | 0.50 | % | ||

| Insurance | 0.60 | % | ||

| Interactive Media & Services | 4.19 | % | ||

| IT Services | 1.14 | % | ||

| Machinery | 1.06 | % | ||

| Metals & Mining | 2.02 | % | ||

| Money Market Fund | 4.90 | % | ||

| Oil, Gas & Consumable Fuels | 4.59 | % | ||

| Personal Care Products | 1.01 | % | ||

| Pharmaceuticals | 2.07 | % | ||

| Professional Services | 0.72 | % | ||

| Semiconductors & Semiconductor Equipment | 9.18 | % | ||

| Software | 9.55 | % | ||

| Specialized Real Estate Investment Trusts | 0.49 | % | ||

| Technology Hardware, Storage & Peripherals | 4.93 | % | ||

| Textiles, Apparel & Luxury Goods | 3.96 | % | ||

| Trading Companies & Distributors | 0.93 | % | ||

| Transportation Infrastructure | 1.22 | % | ||

| Liabilities In Excess of Other Assets | (0.81 | )% | ||

| TOTAL | 100.00 | % | ||

Notes to Financial Statements are an integral part of this Schedule.

| 13 |

Driehaus International Small Cap Growth Fund

Performance Overview (unaudited)

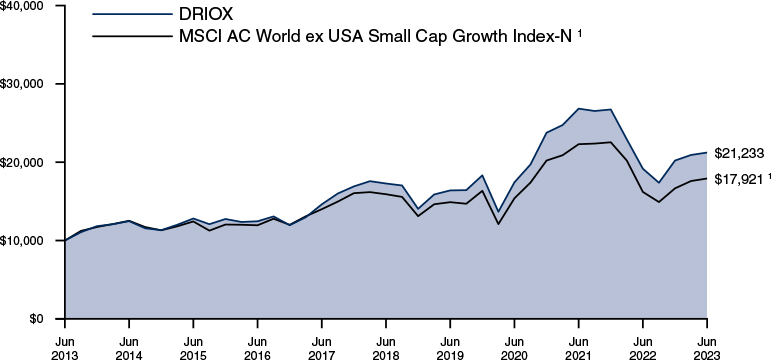

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment (minimum investment) in the Fund over the last 10 fiscal year periods, with all dividends and capital gains reinvested, with the indicated index (and dividends reinvested) for the same period.

The performance data shown represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Principal value and investment returns will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The Fund will charge a redemption fee of 2.00% on shares held less than sixty (60) days. Performance data represents the rate that an investor would have earned (or lost), during the given periods, on an investment in the Fund (assuming reinvestment of all dividends and distributions). Average annual total return reflects annualized change. Since Fund performance is subject to change after the period-end, please call (800) 560-6111 or visit www.driehaus.com/performance for more current performance information. The gross expense ratio is 1.16% as of the most recent prospectus dated April 30, 2023, as supplemented through the date of this report.

| Average Annual Total Returns as of 6/30/23 | 1 Year | 3 Years | 5 Years | 10 Years |

| Driehaus International Small Cap Growth Fund (DRIOX) | 10.78% | 6.79% | 4.20% | 7.82% |

| MSCI AC World ex USA Small Cap Growth Index-N1 | 10.61% | 5.21% | 2.41% | 6.01% |

| 1 | The Morgan Stanley Capital International All Country World ex USA Small Cap Growth Index-Net (MSCI AC World ex USA Small Cap Growth Index-N) is a market capitalization-weighted index designed to measure equity market performance in global developed markets and emerging markets, excluding the U.S., and is composed of stocks which are categorized as small capitalization growth stocks. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 14 |

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| COMMON STOCKS — 94.71% | ||||||||

| EUROPE — 51.11% | ||||||||

| United Kingdom — 10.74% | ||||||||

| Abcam PLC - SP ADR 1,* | 124,360 | $ | 3,043,089 | |||||

| Balfour Beatty PLC | 372,204 | 1,611,751 | ||||||

| ConvaTec Group PLC 2 | 1,114,605 | 2,906,968 | ||||||

| Cranswick PLC | 23,151 | 955,038 | ||||||

| Fevertree Drinks PLC | 72,698 | 1,124,291 | ||||||

| Network International Holdings | ||||||||

| PLC 2,* | 261,289 | 1,272,927 | ||||||

| OSB Group PLC | 173,799 | 1,063,781 | ||||||

| Pets at Home Group PLC | 320,177 | 1,535,216 | ||||||

| Rolls-Royce Holdings PLC * | 1,306,600 | 2,512,596 | ||||||

| Serco Group PLC | 1,175,125 | 2,323,681 | ||||||

| WH Smith PLC | 125,663 | 2,477,699 | ||||||

| Yellow Cake PLC 2,* | 246,991 | 1,284,886 | ||||||

| 22,111,923 | ||||||||

| Germany — 9.23% | ||||||||

| AIXTRON SE | 60,152 | 2,042,616 | ||||||

| Covestro AG 2,* | 42,740 | 2,223,877 | ||||||

| CTS Eventim AG & Co KGaA | 23,137 | 1,463,326 | ||||||

| Fielmann AG | 19,608 | 1,044,882 | ||||||

| Gerresheimer AG | 40,892 | 4,603,397 | ||||||

| GFT Technologies SE | 22,283 | 628,669 | ||||||

| HUGO BOSS AG | 37,548 | 2,934,803 | ||||||

| KION Group AG | 38,457 | 1,550,228 | ||||||

| Rheinmetall AG | 3,866 | 1,059,099 | ||||||

| Scout24 SE 2 | 22,994 | 1,457,032 | ||||||

| 19,007,929 | ||||||||

| Denmark — 3.94% | ||||||||

| Ambu A/S - B * | 145,919 | 2,392,105 | ||||||

| GN Store Nord AS * | 60,885 | 1,522,646 | ||||||

| ISS A/S | 98,707 | 2,088,102 | ||||||

| Royal Unibrew A/S | 23,547 | 2,107,771 | ||||||

| 8,110,624 | ||||||||

| Italy — 3.93% | ||||||||

| Amplifon SpA | 46,267 | 1,697,065 | ||||||

| Banco BPM SpA | 483,360 | 2,245,127 | ||||||

| Leonardo SpA | 242,078 | 2,748,767 | ||||||

| Saipem SpA * | 1,011,891 | 1,408,962 | ||||||

| 8,099,921 | ||||||||

| Switzerland — 3.71% | ||||||||

| Burckhardt Compression | ||||||||

| Holding AG | 1,493 | 876,732 | ||||||

| Comet Holding AG | 5,271 | 1,347,280 | ||||||

| Flughafen Zurich AG | 11,285 | 2,347,320 | ||||||

| Siegfried Holding AG * | 1,754 | 1,450,402 | ||||||

| Tecan Group AG | 4,185 | 1,608,185 | ||||||

| 7,629,919 | ||||||||

| France — 3.67% | ||||||||

| Coface SA | 108,322 | 1,494,190 | ||||||

| Edenred | 27,842 | 1,864,978 | ||||||

| IPSOS | 13,744 | 764,760 | ||||||

| SES-imagotag SA * | 6,145 | 630,529 | ||||||

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| Sopra Steria Group SACA | 14,045 | $ | 2,804,019 | |||||

| 7,558,476 | ||||||||

| Netherlands — 2.78% | ||||||||

| BE Semiconductor Industries | ||||||||

| NV | 13,464 | 1,460,227 | ||||||

| Corbion NV | 28,596 | 682,991 | ||||||

| Fugro NV * | 229,873 | 3,581,403 | ||||||

| 5,724,621 | ||||||||

| Finland — 2.65% | ||||||||

| Metso OYJ | 451,795 | 5,451,689 | ||||||

| Ireland — 2.43% | ||||||||

| Glanbia PLC | 270,982 | 4,003,718 | ||||||

| James Hardie Industries PLC * | 37,330 | 995,814 | ||||||

| 4,999,532 | ||||||||

| Austria — 1.82% | ||||||||

| DO & CO AG * | 27,399 | 3,743,699 | ||||||

| Spain — 1.54% | ||||||||

| Indra Sistemas SA | 168,438 | 2,130,862 | ||||||

| Viscofan SA | 14,913 | 1,030,781 | ||||||

| 3,161,643 | ||||||||

| Sweden — 1.46% | ||||||||

| Note AB * | 46,182 | 972,368 | ||||||

| The Thule Group AB 2 | 69,310 | 2,039,273 | ||||||

| 3,011,641 | ||||||||

| Belgium — 1.36% | ||||||||

| Lotus Bakeries NV | 219 | 1,738,882 | ||||||

| Shurgard Self Storage Ltd. | 23,318 | 1,065,212 | ||||||

| 2,804,094 | ||||||||

| Norway — 0.90% | ||||||||

| Aker Solutions ASA | 314,861 | 1,140,188 | ||||||

| Schibsted ASA - A | 41,025 | 720,451 | ||||||

| 1,860,639 | ||||||||

| Poland — 0.59% | ||||||||

| Dino Polska SA 2,* | 10,408 | 1,216,003 | ||||||

| Jersey, C.I. — 0.36% | ||||||||

| WNS Holdings Ltd. - ADR 1,* | 10,090 | 743,835 | ||||||

| Total EUROPE | ||||||||

| (Cost $92,744,570) | 105,236,188 | |||||||

| FAR EAST — 30.11% | ||||||||

| Japan — 20.52% | ||||||||

| ABC-Mart, Inc. | 36,400 | 1,978,096 | ||||||

| Asahi Intecc Co. Ltd. | 69,800 | 1,374,220 | ||||||

| Asics Corp. | 146,800 | 4,542,878 | ||||||

| Azbil Corp. | 49,400 | 1,563,508 | ||||||

| Calbee, Inc. | 35,300 | 667,891 | ||||||

| Capcom Co. Ltd. | 51,800 | 2,053,375 | ||||||

| CKD Corp. | 91,400 | 1,499,201 | ||||||

| Fujitec Co. Ltd. | 43,850 | 1,122,642 | ||||||

| Fukuoka Financial Group, Inc. | 57,200 | 1,182,236 | ||||||

| Goldwin, Inc. | 22,400 | 1,907,189 | ||||||

| Harmonic Drive Systems, Inc. | 43,400 | 1,398,730 | ||||||

| Hoshizaki Corp. | 87,300 | 3,134,302 | ||||||

| IHI Corp. | 42,900 | 1,163,550 | ||||||

Notes to Financial Statements are an integral part of this Schedule.

| 15 |

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| Kusuri no Aoki Holdings Co. | ||||||||

| Ltd. | 37,100 | $ | 2,091,027 | |||||

| MINEBEA MITSUMI, Inc. | 64,354 | 1,220,580 | ||||||

| MonotaRO Co. Ltd. | 162,990 | 2,081,450 | ||||||

| Morinaga & Co. Ltd. | 75,900 | 2,375,466 | ||||||

| NET One Systems Co. Ltd. | 56,700 | 1,245,610 | ||||||

| Nichias Corp. | 53,630 | 1,117,785 | ||||||

| Rohto Pharmaceutical Co. Ltd. | 106,900 | 2,409,850 | ||||||

| Sundrug Co. Ltd. | 87,400 | 2,592,508 | ||||||

| Tokai Carbon Co. Ltd. | 147,200 | 1,354,970 | ||||||

| Visional, Inc. * | 17,500 | 972,313 | ||||||

| Yokogawa Electric Corp. | 64,600 | 1,195,819 | ||||||

| 42,245,196 | ||||||||

| India — 2.50% | ||||||||

| APL Apollo Tubes Ltd. | 62,019 | 988,450 | ||||||

| Indian Hotels Co. Ltd. | 204,461 | 980,338 | ||||||

| KPIT Technologies Ltd. | 90,873 | 1,211,486 | ||||||

| Max Healthcare Institute Ltd. * | 201,583 | 1,475,021 | ||||||

| One 97 Communications, Ltd. * | 47,417 | 502,700 | ||||||

| 5,157,995 | ||||||||

| Taiwan — 1.75% | ||||||||

| Hiwin Technologies Corp. | 160,000 | 1,225,326 | ||||||

| Lotes Co. Ltd. | 37,000 | 1,024,534 | ||||||

| Vanguard International | ||||||||

| Semiconductor Corp. | 478,000 | 1,357,479 | ||||||

| 3,607,339 | ||||||||

| South Korea — 1.69% | ||||||||

| HD Hyundai Electric Co. Ltd. | 27,088 | 1,343,399 | ||||||

| HPSP Co. Ltd. | 25,465 | 555,273 | ||||||

| KT Corp. | 34,223 | 774,702 | ||||||

| LEENO Industrial, Inc. | 3,461 | 388,900 | ||||||

| Park Systems Corp. | 2,846 | 407,958 | ||||||

| 3,470,232 | ||||||||

| Indonesia — 1.22% | ||||||||

| Indosat Tbk PT | 2,603,200 | 1,501,561 | ||||||

| Sumber Alfaria Trijaya Tbk PT | 5,899,000 | 1,016,467 | ||||||

| 2,518,028 | ||||||||

| China — 0.87% | ||||||||

| New Horizon Health Ltd. 2,* | 257,000 | 903,481 | ||||||

| Topsports International | ||||||||

| Holdings Ltd. 2 | 1,028,000 | 894,384 | ||||||

| 1,797,865 | ||||||||

| Australia — 0.79% | ||||||||

| Cochlear Ltd. | 6,740 | 1,032,623 | ||||||

| Paladin Energy Ltd. * | 1,194,949 | 587,704 | ||||||

| 1,620,327 | ||||||||

| Thailand — 0.46% | ||||||||

| Bumrungrad Hospital PCL - | ||||||||

| NVDR | 149,000 | 950,846 | ||||||

| Singapore — 0.31% | ||||||||

| Hafnia Ltd. | 129,433 | 632,536 | ||||||

| Total FAR EAST | ||||||||

| (Cost $58,746,227) | 62,000,364 | |||||||

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| NORTH AMERICA — 11.04% | ||||||||

| Canada — 8.59% | ||||||||

| Boardwalk REIT | 43,974 | $ | 2,064,347 | |||||

| Boyd Group Services, Inc. | 5,400 | 1,030,270 | ||||||

| CAE, Inc. * | 109,900 | 2,459,736 | ||||||

| Cameco Corp. | 72,500 | 2,270,636 | ||||||

| Element Fleet Management | ||||||||

| Corp. | 179,700 | 2,737,381 | ||||||

| K92 Mining, Inc. * | 153,154 | 664,756 | ||||||

| Kinaxis, Inc. * | 26,911 | 3,845,444 | ||||||

| Major Drilling Group | ||||||||

| International, Inc. * | 111,833 | 771,582 | ||||||

| Xenon Pharmaceuticals, Inc. 1,* | 47,908 | 1,844,458 | ||||||

| 17,688,610 | ||||||||

| United States — 1.41% | ||||||||

| Samsonite International SA 2,* | 1,029,600 | 2,911,497 | ||||||

| Mexico — 1.04% | ||||||||

| Banco del Bajio SA 2 | 196,446 | 600,114 | ||||||

| GCC SAB de CV | 180,686 | 1,540,534 | ||||||

| 2,140,648 | ||||||||

| Total NORTH AMERICA | ||||||||

| (Cost $20,196,681) | 22,740,755 | |||||||

| MIDDLE EAST — 1.31% | ||||||||

| Israel — 1.31% | ||||||||

| Nice Ltd. - SP ADR 1,* | 13,019 | 2,688,423 | ||||||

| Total MIDDLE EAST | ||||||||

| (Cost $2,702,308) | 2,688,423 | |||||||

| SOUTH AMERICA — 1.14% | ||||||||

| Brazil — 1.14% | ||||||||

| Embraer SA - SP ADR 1,* | 151,169 | 2,337,073 | ||||||

| Total SOUTH AMERICA | ||||||||

| (Cost $1,942,544) | 2,337,073 | |||||||

| Total COMMON STOCKS | ||||||||

| (Cost $176,332,330) | 195,002,803 | |||||||

| PREFERRED STOCKS — 1.06% | ||||||||

| EUROPE — 1.06% | ||||||||

| Germany — 1.06% | ||||||||

| FUCHS PETROLUB SE, 2.96% 3 | 55,124 | 2,180,966 | ||||||

| Total EUROPE | ||||||||

| (Cost $2,013,550) | 2,180,966 | |||||||

| Total PREFERRED STOCKS | ||||||||

| (Cost $2,013,550) | 2,180,966 | |||||||

Notes to Financial Statements are an integral part of this Schedule.

| 16 |

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| SHORT TERM INVESTMENTS — 3.84% | ||||||||

| Northern Institutional | ||||||||

| U.S. Government Select | ||||||||

| Portfolio (Shares Class), | ||||||||

| 4.98% 4 | ||||||||

| (Cost $7,908,278) | 7,908,278 | $ | 7,908,278 | |||||

| TOTAL INVESTMENTS | ||||||||

| (Cost $186,254,158) | 99.61 | % | $ | 205,092,047 | ||||

| Other Assets In Excess of | ||||||||

| Liabilities | 0.39 | % | 804,859 | |||||

| Net Assets | 100.00 | % | $ | 205,896,906 | ||||

| ADR | American Depositary Receipt |

| NVDR | Non-Voting Depositary Receipt |

| PCL | Public Company Limited |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Foreign security denominated and/or traded in U.S. dollars. |

| 2 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $17,710,442, which represents 9% of Net Assets (see Note F in the Notes to Financial Statements). |

| 3 | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

| 4 | 7 day current yield as of June 30, 2023 is disclosed. |

| * | Non-income producing security. |

Percentages are stated as a percent of net assets.

| Security Type | Percent of Net Assets | |||

| Common Stocks | 94.71 | % | ||

| Preferred Stocks | 1.06 | % | ||

| Short Term Investments | 3.84 | % | ||

| Total Investments | 99.61 | % | ||

| Other Assets In Excess of Liabilities | 0.39 | % | ||

| Net Assets | 100.00 | % | ||

| Regional Weightings | Percent of Net Assets | |||

| Europe | 52.17 | % | ||

| Far East | 30.11 | % | ||

| North America | 14.88 | % | ||

| Middle East | 1.31 | % | ||

| South America | 1.14 | % | ||

Notes to Financial Statements are an integral part of this Schedule.

| 17 |

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Industry | Percent of Net Assets | |||

| Aerospace & Defense | 5.40 | % | ||

| Banks | 1.95 | % | ||

| Beverages | 1.57 | % | ||

| Biotechnology | 2.38 | % | ||

| Building Products | 0.54 | % | ||

| Chemicals | 3.13 | % | ||

| Commercial Services & Supplies | 4.47 | % | ||

| Construction & Engineering | 2.52 | % | ||

| Construction Materials | 1.23 | % | ||

| Consumer Staples Distribution & Retail | 3.36 | % | ||

| Diversified Telecommunication Services | 0.38 | % | ||

| Electrical Equipment | 0.65 | % | ||

| Electronic Equipment, Instruments & Components | 3.47 | % | ||

| Energy Equipment & Services | 1.23 | % | ||

| Entertainment | 1.71 | % | ||

| Financial Services | 3.62 | % | ||

| Food Products | 5.22 | % | ||

| Health Care Equipment & Supplies | 3.74 | % | ||

| Health Care Providers & Services | 2.44 | % | ||

| Hotels, Restaurants & Leisure | 0.47 | % | ||

| Household Durables | 0.74 | % | ||

| Insurance | 0.72 | % | ||

| Interactive Media & Services | 0.71 | % | ||

| Industry | Percent of Net Assets | |||

| IT Services | 3.30 | % | ||

| Leisure Products | 0.99 | % | ||

| Life Sciences Tools & Services | 3.73 | % | ||

| Machinery | 9.06 | % | ||

| Media | 0.72 | % | ||

| Metals & Mining | 1.18 | % | ||

| Money Market Fund | 3.84 | % | ||

| Oil, Gas & Consumable Fuels | 1.70 | % | ||

| Personal Care Products | 1.17 | % | ||

| Professional Services | 0.83 | % | ||

| Real Estate Management & Development | 0.52 | % | ||

| Residential Real Estate Investment Trusts (REITs) | 1.00 | % | ||

| Semiconductors & Semiconductor Equipment | 2.82 | % | ||

| Software | 3.77 | % | ||

| Specialty Retail | 3.85 | % | ||

| Textiles, Apparel & Luxury Goods | 5.98 | % | ||

| Trading Companies & Distributors | 1.63 | % | ||

| Transportation Infrastructure | 1.14 | % | ||

| Wireless Telecommunication Services | 0.73 | % | ||

| Other Assets In Excess of Liabilities | 0.39 | % | ||

| TOTAL | 100.00 | % | ||

Notes to Financial Statements are an integral part of this Schedule.

| 18 |

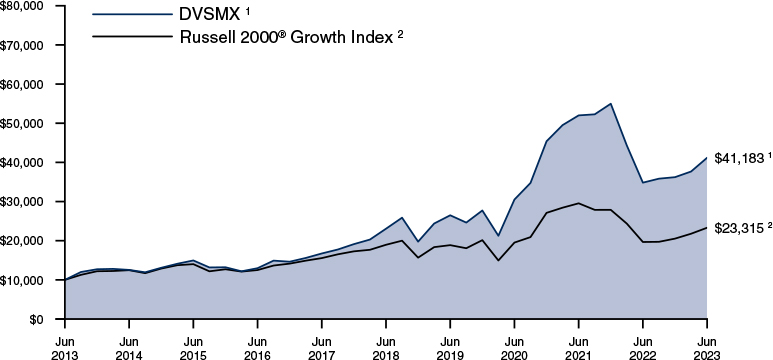

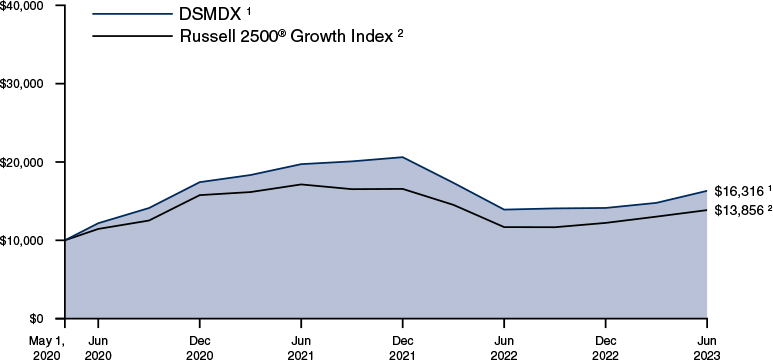

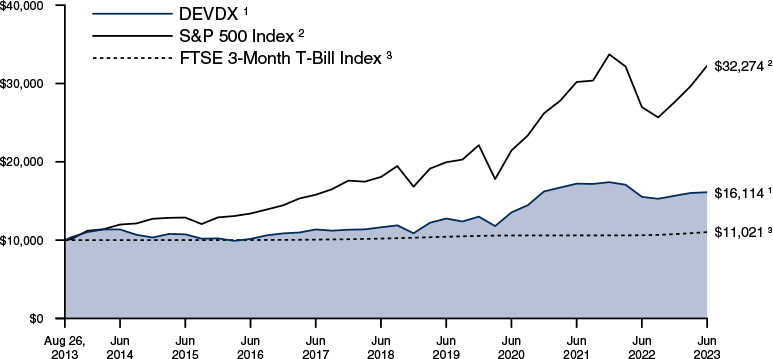

Driehaus Micro Cap Growth Fund

Performance Overview (unaudited)

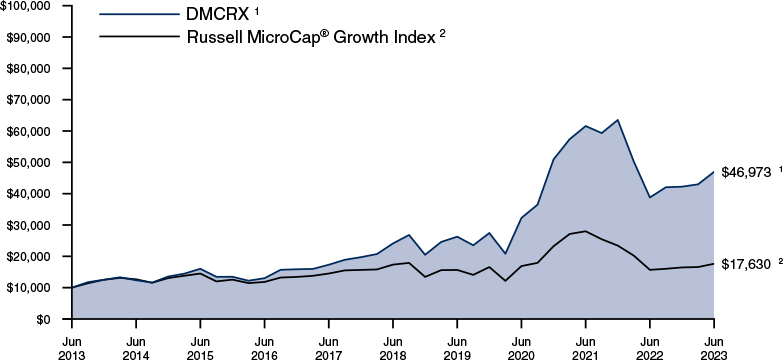

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment (minimum investment) in the Fund over the last 10 fiscal year periods (which includes performance of the Predecessor Limited Partnership), with all dividends and capital gains reinvested, with the indicated index (and dividends reinvested) for the same period.

The performance data shown represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Principal value and investment returns will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The Fund will charge a redemption fee of 2.00% on shares held less than sixty (60) days. Performance data represents the rate that an investor would have earned (or lost), during the given periods, on an investment in the Fund (assuming reinvestment of all dividends and distributions). Average annual total return reflects annualized change. Since Fund performance is subject to change after the period-end, please call (800) 560-6111 or visit www.driehaus.com/performance for more current performance information. The gross expense ratio is 1.42% as of the most recent prospectus dated April 30, 2023, as supplemented through the date of this report.

| Average Annual Total Returns as of 6/30/23 | 1 Year | 3 Years | Fund Only 5 Years | Since Inception (11/18/13 - 6/30/23) | Including Predecessor Limited Partnership 10 Years |

| Driehaus Micro Cap Growth Fund (DMCRX)1 | 21.11% | 13.35% | 14.26% | 15.59% | 16.73% |

| Russell Microcap® Growth Index2 | 12.41% | 1.45% | 0.32% | 4.36% | 5.83% |

| 1 | The Driehaus Micro Cap Growth Fund (the “Fund”) performance shown above includes the performance of the Driehaus Micro Cap Fund, L.P. (the “Predecessor Limited Partnership”), one of the Fund’s predecessors, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership, which was established on July 1, 1996, was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Limited Partnership’s assets together with the assets of the Driehaus Institutional Micro Cap Fund, L.P. on November 18, 2013. The Predecessor Limited Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Fund. The returns for periods prior to November 18, 2016, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Russell Microcap® Growth Index measures the performance of the microcap growth segment of the U.S. equity market. It includes those Russell Microcap companies that are considered more growth oriented relative to the overall market as defined by FTSE Russell’s leading style methodology. The Russell Microcap® Growth Index is constructed to provide a comprehensive and unbiased barometer for the microcap growth segment of the market. Data is calculated with net dividend reinvestment. Source: FTSE Russell. |

| 19 |

Driehaus Micro Cap Growth Fund

Schedule of Investments

June 30, 2023 (unaudited)

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| COMMON STOCKS — 98.97% | ||||||||

| HEALTH CARE — 33.37% | ||||||||

| Biotechnology — 16.99% | ||||||||

| 89bio, Inc. * | 48,544 | $ | 919,909 | |||||

| ACELYRIN, Inc. * | 80,420 | 1,680,778 | ||||||

| ADMA Biologics, Inc. * | 211,150 | 779,143 | ||||||

| Aerovate Therapeutics, Inc. * | 34,155 | 585,758 | ||||||

| Apellis Pharmaceuticals, Inc. * | 8,032 | 731,715 | ||||||

| Astria Therapeutics, Inc. * | 72,107 | 600,651 | ||||||

| Biohaven Ltd. * | 48,840 | 1,168,253 | ||||||

| Biomea Fusion, Inc. * | 61,586 | 1,351,813 | ||||||

| Chinook Therapeutics, Inc. * | 6,440 | 247,425 | ||||||

| Crinetics Pharmaceuticals, Inc. * | 159,013 | 2,865,414 | ||||||

| Day One Biopharmaceuticals, | ||||||||

| Inc. * | 54,841 | 654,802 | ||||||

| Dynavax Technologies Corp. * | 118,792 | 1,534,793 | ||||||

| Ideaya Biosciences, Inc. * | 29,414 | 691,229 | ||||||

| ImmunoGen, Inc. * | 131,829 | 2,487,613 | ||||||

| Ironwood Pharmaceuticals, Inc. | ||||||||

| * | 50,031 | 532,330 | ||||||

| KalVista Pharmaceuticals, Inc. * | 65,319 | 587,871 | ||||||

| Merus NV 1,* | 77,403 | 2,038,021 | ||||||

| Mineralys Therapeutics, Inc. * | 33,427 | 569,930 | ||||||

| Morphic Holding, Inc. * | 36,972 | 2,119,605 | ||||||

| Nuvalent, Inc. - A * | 79,574 | 3,355,636 | ||||||

| REVOLUTION Medicines, Inc. * | 24,501 | 655,402 | ||||||

| SpringWorks Therapeutics, Inc. | ||||||||

| * | 44,670 | 1,171,247 | ||||||

| Vaxcyte, Inc. * | 41,944 | 2,094,683 | ||||||

| Veracyte, Inc. * | 46,410 | 1,182,063 | ||||||

| Viridian Therapeutics, Inc. * | 9,382 | 223,198 | ||||||

| Xenon Pharmaceuticals, Inc. 1,* | 123,851 | 4,768,263 | ||||||

| 35,597,545 | ||||||||

| Health Care Equipment & Supplies — 9.75% | ||||||||

| Alphatec Holdings, Inc. * | 174,528 | 3,138,013 | ||||||

| EDAP TMS SA - ADR 1,* | 89,486 | 825,061 | ||||||

| Establishment Labs Holdings, | ||||||||

| Inc. 1,* | 23,650 | 1,622,627 | ||||||

| Inspire Medical Systems, Inc. * | 7,677 | 2,492,261 | ||||||

| LeMaitre Vascular, Inc. | 11,534 | 776,008 | ||||||

| PROCEPT BioRobotics Corp. * | 26,995 | 954,273 | ||||||

| RxSight, Inc. * | 53,088 | 1,528,934 | ||||||

| Tactile Systems Technology, | ||||||||

| Inc. * | 48,344 | 1,205,216 | ||||||

| TransMedics Group, Inc. * | 62,626 | 5,259,332 | ||||||

| Treace Medical Concepts, Inc. * | 103,288 | 2,642,107 | ||||||

| 20,443,832 | ||||||||

| Pharmaceuticals — 4.84% | ||||||||

| DICE Therapeutics, Inc. * | 68,018 | 3,160,116 | ||||||

| Harrow Health, Inc. * | 53,829 | 1,024,904 | ||||||

| Structure Therapeutics, Inc. * | 72,764 | 3,024,800 | ||||||

| Shares, Principal Amount, or Number of Contracts | Value | |||||||

| Terns Pharmaceuticals, Inc. * | 74,596 | $ | 652,715 | |||||

| Ventyx Biosciences, Inc. * | 69,478 | 2,278,878 | ||||||

| 10,141,413 | ||||||||

| Health Care Providers & Services — 1.30% | ||||||||

| Hims & Hers Health, Inc. * | 204,384 | 1,921,210 | ||||||

| NeoGenomics, Inc. * | 49,777 | 799,916 | ||||||

| 2,721,126 | ||||||||

| Health Care Technology — 0.49% | ||||||||

| Phreesia, Inc. * | 32,878 | 1,019,547 | ||||||

| Total HEALTH CARE | ||||||||

| (Cost $50,002,740) | 69,923,463 | |||||||

| INDUSTRIALS — 18.41% | ||||||||

| Machinery — 5.02% | ||||||||

| Blue Bird Corp. * | 62,346 | 1,401,538 | ||||||

| Energy Recovery, Inc. * | 61,424 | 1,716,801 | ||||||

| Federal Signal Corp. | 47,596 | 3,047,572 | ||||||

| The Shyft Group, Inc. | 60,740 | 1,339,924 | ||||||