Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07655

Driehaus Mutual Funds

(Exact name of registrant as specified in charter)

25 East Erie Street

Chicago, IL 60611

(Address of principal executive offices) (Zip code)

Janet L. McWilliams

Driehaus Capital Management LLC

25 East Erie Street

Chicago, IL 60611

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-587-3800

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

The Reports to Shareholders are attached herewith.

Table of Contents

Table of Contents

Annual Report to Shareholders

December 31, 2016

Investment Philosophy:

The Adviser seeks to achieve superior investment returns primarily by investing in global companies that are currently demonstrating rapid growth in their sales and earnings and which, in its judgment, have the ability to continue or accelerate their growth rates in the future. The Adviser manages the portfolios actively (above average turnover) to ensure that the Funds are fully invested, under appropriate market conditions, in companies that meet these criteria. Investors should note that investments in overseas markets can pose more risks than U.S. investments, and the international Funds’ share prices are expected to be more volatile than those of the U.S.-only Funds. In addition, the Funds’ returns will fluctuate with changes in stock market conditions, currency values, interest rates, government regulations, and economic and political conditions in countries in which the Funds invest. These risks are generally greater when investing in emerging markets.

Driehaus Emerging Markets Growth Fund

Driehaus Emerging Markets Small Cap Growth Fund

Driehaus Frontier Emerging Markets Fund

Driehaus International Small Cap Growth Fund

Driehaus Micro Cap Growth Fund

Table of Contents

| Portfolio Manager Letter, Performance Overview and Schedule of Investments: |

||||

| 1 | ||||

| 8 | ||||

| 18 | ||||

| 25 | ||||

| 33 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| 51 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 69 | ||||

| Board Considerations in Connection with the Annual Review of the Investment Advisory Agreement |

70 | |||

Table of Contents

Driehaus Emerging Markets Growth Fund — Portfolio Managers’ Letter

Dear Fellow Shareholders,

The Driehaus Emerging Markets Growth Fund (“Fund”) returned 5.88% for the year ended December 31, 2016. The Fund’s primary benchmark, the Morgan Stanley Capital International (“MSCI”) Emerging Markets Index (“Benchmark”), returned 11.19% for the year, while the MSCI Emerging Markets Growth Index returned 7.59%.

2016 was a challenging year for the fund as a confluence of macro and political developments facilitated an environment that was particularly difficult for our style. In fact, it was the most challenging environment we have seen since the rotational period of 2009. There was a huge disparity in country and sector performance for the year. Brazil rose 77.8% in US dollar terms while Greece fell by 12.7%. The energy sector rose by 39.5% while the health care sector fell by 7.0%. Dramatic rotations were seen across country, sector and factors, coinciding with a huge shift in sentiment from global growth and deflation concerns in mid-January, to global growth and inflation optimism by year-end. The Fund entered the year with a defensive bias, and underperformed during a year in which the market was led by value and cyclical stocks. To put some numbers to it, the top quintile of value stocks in our factor models outperformed the top quintile of growth stocks by a whopping 11.2 percentage points this past year.

Over the course of 2016, security selection within the utilities and telecommunications sectors contributed to the Fund’s returns versus the Benchmark. From a country perspective, holdings in Russia and Macau made key contributions to performance versus the Benchmark in the past year.

Sberbank of Russia PJSC (Ticker: SBER-MZ LI) made a notable contribution to the Fund’s relative and absolute returns for the year. The Russia-based commercial bank provides a range of corporate and retail banking services. Although loan growth remained muted, solid operating income from lowered operating expenses drove strong growth in its return on equity. The company’s management also has raised expectations for 2017.

PT Telekomunikasi Indonesia Persero Tbk (Ticker: TLKM IJ) was a significant contributor to the Fund’s return. The Indonesia-based company provides telecommunications and network services. Strong revenue and earnings growth drove positive results in 2016. As the year progressed, the company benefitted from increasing data demand and successful pricing strategies. The company also holds a solid market position and analyst expectations have increased throughout the year.

During 2016, stock selection within the industrials sector and an underweight to and security selection within the energy sector detracted from the Fund’s returns versus the Benchmark. At the country level, holdings in Brazil, South Africa and South Korea detracted from Fund performance versus the Benchmark.

Fund holding Suzlon Energy, Ltd. (Ticker: SUEL IN) was a notable detractor from returns. The India-based company produces wind turbines and energy solutions. After posting another quarter of losses in late January, concerns over the company’s issues with debt and profitability prompted a large selloff. Additional unease stemmed from the Indian government’s focus on solar power, which may negatively affect the wind power industry.

A significant detractor from the Fund’s return for the year was Cosmax, Inc. (Ticker: 192820 KS). The South Korea-based company manufactures and distributes cosmetics. Early in the year, its share price tumbled due to poor results in China. Elsewhere around the globe, the company also reported lower than expected results in the US and Indonesia. Although domestic results were favorable, growth for the company continues to hinge on global performance.

The outlook for emerging markets contains a mix of potential positives and negatives, accompanied by some uncertainty. On the plus side, many emerging markets are experiencing growth stabilization or acceleration and improving external positions after having undergone years of slowdowns and adjustments. Should stronger US growth materialize, it could have positive implications for commodity demand and emerging market exports. The longer-term arguments for emerging markets, built on superior demographics, lower debt burdens, and greater scope for productivity improvement, remain in place. We are also witnessing a growing commitment to structural reform among various countries. On the negative side, should US inflation accelerate to the point that monetary tightening expectations rise and the dollar strengthens further, it would

1

Table of Contents

have negative implications for capital flows to emerging markets. US trade policy also remains a risk, as rising protectionism and reduced competitiveness of emerging market exports would weigh on economic growth.

We thank you for your interest in the Driehaus Emerging Markets Growth Fund and would like to express our gratitude to you as shareholders for your confidence in our management capabilities.

Sincerely,

|

|

| ||

| Howard Schwab | Chad Cleaver | Rich Thies | ||

| Lead Portfolio Manager | Portfolio Manager | Portfolio Manager |

Performance is historical and does not represent future results.

Please see the following performance overview page for index descriptions.

2

Table of Contents

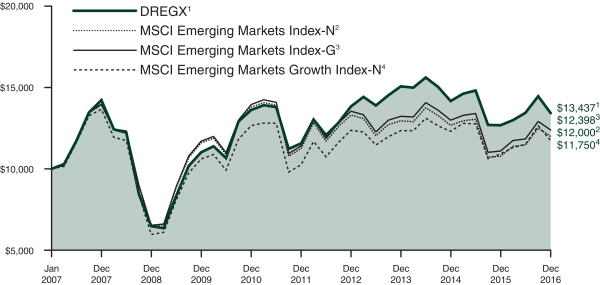

Driehaus Emerging Markets Growth Fund

Performance Overview (unaudited)

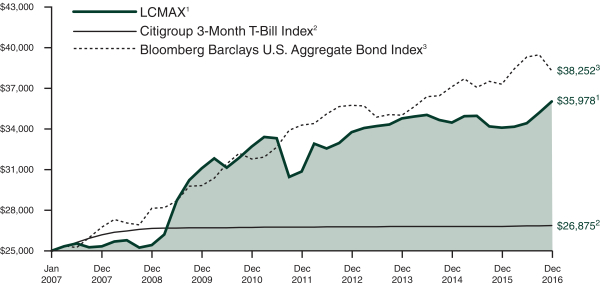

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund over the last 10 fiscal year periods, with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

| Average Annual Total Returns as of 12/31/16 | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||

| Driehaus Emerging Markets Growth Fund (DREGX)1 |

5.88% | –3.76% | 3.02% | 3.00% | ||||||||||||

| MSCI Emerging Markets Index-N2 |

11.19% | –2.55% | 1.28% | 1.84% | ||||||||||||

| MSCI Emerging Markets Index-G3 |

11.60% | –2.19% | 1.64% | 2.17% | ||||||||||||

| MSCI Emerging Markets Growth Index-N4 |

7.59% | –1.67% | 2.73% | 1.63% | ||||||||||||

| 1 | The returns for the periods prior to July 1, 2003, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Emerging Markets Index-Net (MSCI Emerging Markets Index-N) is a market capitalization-weighted index designed to measure equity market performance in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. The benchmark has changed from the Morgan Stanley Capital International Emerging Markets Index-Gross (MSCI Emerging Markets Index-G) to the MSCI Emerging Markets Index-N because the net index is more commonly used industry wide and is a more representative comparison versus the fund because it is presented net of foreign withholding taxes. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Index-Gross (MSCI Emerging Markets Index-G) is a market capitalization-weighted index designed to measure equity market performance in global emerging markets. Data is in U.S. dollars and is calculated with gross dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 4 | The Morgan Stanley Capital International Emerging Markets Growth Index-Net (MSCI Emerging Markets Growth Index-N) is a subset of the MSCI Emerging Markets Index and includes only the MSCI Emerging Markets Index stocks which are categorized as growth stocks. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

3

Table of Contents

Driehaus Emerging Markets Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

4

Table of Contents

Driehaus Emerging Markets Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

5

Table of Contents

Driehaus Emerging Markets Growth Fund

Schedule of Investments

December 31, 2016

| * | All percentages are stated as a percent of net assets at December 31, 2016. |

Notes to Financial Statements are an integral part of this Schedule.

6

Table of Contents

Driehaus Emerging Markets Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

7

Table of Contents

Driehaus Emerging Markets Small Cap Growth Fund — Portfolio Managers’ Letter

Dear Fellow Shareholders,

The Driehaus Emerging Markets Small Cap Growth Fund (“Fund”) returned -9.97% for the year ended December 31, 2016. This return underperformed the Morgan Stanley Capital International (“MSCI”) Emerging Markets Small Cap Index (“Benchmark”), which rose 2.28% for the same period, and the Fund’s secondary benchmark, the MSCI Emerging Markets Index, which advanced 11.19%.

This past year was challenging. Both the Fund’s size bias (small) and its style bias (growth) were deeply out of favor. In fact, this past year brought about one of the most extreme periods of style rotation of the past decade, with the MSCI Emerging Markets Large Cap Value Index returning 17.6% for the year versus -4.5% for the MSCI Emerging Markets Small Cap Growth Index. Since the onset of the stylistic turning point from growth to value in late January 2016, the performance differential between these indices is the widest on record. With value stocks priced at historical extremes at the start of the year, and as macro conditions and growth expectations became slightly better, value was poised to outperform, which it did to dramatic effect.

For 2016, at the sector level, key contributions to performance versus the Benchmark came from security selection within the consumer discretionary and utilities sectors. In addition, an underweight in South Korea and an overweight to the United Kingdom (companies with significant emerging market presence that are listed in the UK) contributed to the fund’s outperformance.

Equatorial Energia SA (Ticker: EQTL3 BZ) was a significant contributor to returns for 2016. The Brazil-based energy company generates and distributes electricity. Its share price has been steadily increasing since 2015 with almost continuously strong performance results. Overall, lower energy losses and strong volume growth in residential consumers drove the company’s earnings growth, which is expected to continue.

Geely Automobile Holdings, Ltd. (Ticker: 175 HK) made a notable contribution to the Fund’s relative and absolute returns for the year. The Hong Kong-based company develops, manufactures and sells automobiles and automobile components in China, Europe, the Middle East, South Korea and Africa. Throughout the year, the company reported positive quarterly revenue gains, helped by the introduction of three new automobile models in 2016. Increased capacity coming online from new factory openings also provided positive momentum that is expected to continue into 2017.

Certain areas detracted from Fund performance during the year. Two sectors that detracted from the performance of the Fund versus the Benchmark were materials and industrials. An underweight to South Africa and security selection within India detracted from Fund performance versus the Benchmark.

Beijing Enterprises Water Group, Ltd. (Ticker: 371 HK) was a significant detractor from relative performance for the year. The Hong Kong-based company operates water reclamation and treatment businesses as well as distribution and consulting services. Although the company reported robust revenue growth, investors were concerned about two business practices. The company’s strategy of using water renovation projects to generate growth, which many analysts see as one-off short-term revenue generators, and its increasing debt level contributed to its declining share price in 2016.

Crompton Greaves Ltd. (Ticker: CRG IN) was a significant detractor from Fund performance for the year. The India-based company provides business solutions to utilities, industries and consumers through transformers, reactors, low tension motors, and switch gears, as well as accompanying systems. Its share price tumbled in March after it announced plans to sell its international operations, which had sustained significant losses. Additionally, as the year progressed, the company’s weak performance coupled with stalled and failed attempts to sell its overseas assets weighed on the company’s forecasts and its share price.

The Fund uses derivatives primarily to hedge a portion of the portfolio, dampen volatility, and manage downside risk. Derivatives held in the Fund generally consisted of put options on exchange-traded funds (ETFs), currency forwards and swaps. During 2016, the derivative positions, in aggregate, detracted from performance while helping the portfolio realize less volatility than the Benchmark.

Despite the challenging environment for emerging market small cap growth equities this past year, we remain optimistic on the long-term return potential and differentiated profile of this segment of the equity market. Investing in companies experiencing earnings inflections has proven successful over a full market

8

Table of Contents

cycle, and we continue to see strong support for this approach within a less efficient segment of emerging market equities.

We thank you for your interest in the Driehaus Emerging Markets Small Cap Growth Fund and would like to express our gratitude to you as shareholders for your confidence in our management capabilities.

Sincerely,

|

| |

| Chad Cleaver, CFA | Howard Schwab | |

| Lead Portfolio Manager | Portfolio Manager |

|

| |

| Rich Thies | Trent DeBruin, CFA | |

| Portfolio Manager | Assistant Portfolio Manager |

Performance is historical and does not represent future results.

Please see the following performance overview page for index descriptions.

9

Table of Contents

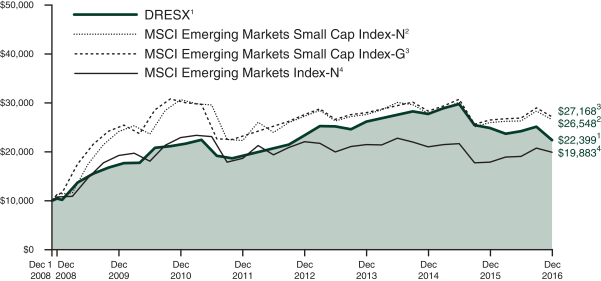

Driehaus Emerging Markets Small Cap Growth Fund

Performance Overview (unaudited)

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund since December 1, 2008 (the date of the Predecessor Limited Partnership’s inception), with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

| Fund Only | Including Predecessor Limited Partnership |

|||||||||||||||||||

| Average Annual Total Returns as of 12/31/16 |

1 Year |

3 Years |

5 Years |

Since Inception |

Since

Inception |

|||||||||||||||

| Driehaus Emerging Markets Small Cap Growth Fund (DRESX)1 |

–9.97% | –5.09% | 4.31% | 1.58% | 10.49% | |||||||||||||||

| MSCI Emerging Markets Small Cap Index-N2 |

2.28% | –1.27% | 3.51% | 0.45% | 12.84% | |||||||||||||||

| MSCI Emerging Markets Small Cap Index-G3 |

2.56% | –0.97% | 3.83% | 0.74% | 13.16% | |||||||||||||||

| MSCI Emerging Markets Index-N4 |

11.19% | –2.55% | 1.28% | 0.24% | 8.87% | |||||||||||||||

| 1 | The Driehaus Emerging Markets Small Cap Growth Fund (the “Fund”) performance shown above includes the performance of the Driehaus Emerging Markets Small Cap Growth Fund, L.P. (the “Predecessor Limited Partnership”), the Fund’s predecessor, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership, which was established on December 1, 2008, was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Limited Partnership’s assets on August 22, 2011. The Predecessor Limited Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Fund. The returns for the periods prior to August 21, 2014, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Emerging Markets Small Cap Index-Net (MSCI Emerging Markets Small Cap Index-N) is a market capitalization-weighted index designed to measure equity market performance of small cap stocks in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. The benchmark has changed from the Morgan Stanley Capital International Emerging Markets Small Cap Index-Gross (MSCI Emerging |

10

Table of Contents

| Markets Small Cap Index-G) to the MSCI Emerging Markets Small Cap Index-N because the net index is more commonly used industry wide and is a more representative comparison versus the fund because it is presented net of foreign withholding taxes. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Small Cap Index-Gross (MSCI Emerging Markets Small Cap Index-G) is a market capitalization-weighted index designed to measure equity market performance of small cap stocks in emerging markets. Data is in U.S. dollars and is calculated with gross dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 4 | The Morgan Stanley Capital International Emerging Markets Index-Net (MSCI Emerging Markets Index-N) is a market capitalization weighted index designed to measure equity market performance in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

11

Table of Contents

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

12

Table of Contents

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

13

Table of Contents

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

December 31, 2016

| (a) | All percentages are stated as a percent of net assets at December 31, 2016. |

| (b) | Excludes purchased options. |

Notes to Financial Statements are an integral part of this Schedule.

14

Table of Contents

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

December 31, 2016

SWAP CONTRACTS

Credit Default Swaps

| Counterparty | Reference Instrument |

Notional Amount(4) |

Buy/Sell Protection(1)(2) |

Pay (Receive) Fixed Rate |

Expiration Date |

Implied Credit Spread(3) |

Upfront Premium Paid (Received) |

Unrealized Appreciation/ (Depreciation) |

Value | |||||||||||||||||||||||||

| Goldman Sachs |

Republic of Turkey, 11.875%, 1/15/30 | $ | 5,000,000 | Buy | 1.00 | % | 6/20/2021 | 2.54 | % | $ | 302,407 | $ | 14,266 | $ | 316,673 | |||||||||||||||||||

| Goldman Sachs |

Republic of Turkey, 11.875%, 1/15/30 | $ | 3,500,000 | Buy | 1.00 | % | 6/20/2021 | 2.54 | % | 238,736 | (17,065 | ) | 221,671 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total Credit Default Swaps |

|

$ | 541,143 | $ | (2,799 | ) | $ | 538,344 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| (1) | If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying investments comprising the referenced index or (ii) receive a net settlement amount in the form of cash or investments equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying investments comprising the referenced index. |

| (2) | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying investments comprising the referenced index or (ii) pay a net settlement amount in the form of cash or investments equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying investments comprising the referenced index. |

| (3) | An implied credit spread is the spread in yield between a U.S. Treasury security and the referenced obligation or underlying investment that are identical in all respects except for the quality rating. Implied credit spreads, represented in absolute terms, utilized in determining the value of credit default swap agreements on corporate and sovereign issues as of period end serve as an indicator of the current status of the payment/performance risk and represent the likelihood of risk of default for the credit derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads, in comparison to narrower credit spreads, represent a deterioration of the referenced entity’s credit soundness and a greater likelihood of risk of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as “Defaulted” indicates a credit event has occurred for the referenced entity or obligation. |

| (4) | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

Interest Rate Swaps

| Counterparty | Notional Amount |

Fixed Rate(1) |

Floating Rate Index(1) | Expiration Date |

Unrealized Appreciation/ (Depreciation) |

|||||||||||

| Morgan Stanley |

KRW 12,500,000,000 | 1.8725 | % | 3-Month KRW KWCDC | 12/12/2026 | $ | (38,405 | ) | ||||||||

| Morgan Stanley |

KRW 12,500,000,000 | 1.89 | % | 3-Month KRW KWCDC | 12/12/2026 | (54,991 | ) | |||||||||

|

|

|

|||||||||||||||

| Total Interest Rate Swaps |

|

$ | (93,396 | ) | ||||||||||||

|

|

|

|||||||||||||||

| (1) | Fund pays the floating rate and receives the fixed rate. |

Notes to Financial Statements are an integral part of this Schedule.

15

Table of Contents

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

December 31, 2016

FORWARD FOREIGN CURRENCY CONTRACTS

| Currency Purchased | Currency Sold | Counterparty | Settlement Date |

Unrealized (Depreciation) | |||||||||||||||||||||||||||

| KRO | 5,851,000,000 | USD | 5,347,774 | MSC | 05/10/17 | $ | (501,308 | ) | |||||||||||||||||||||||

| KRO | 13,000,900,000 | USD | 11,883,278 | MSC | 05/18/17 | (1,113,929 | ) | ||||||||||||||||||||||||

| TWD | 269,680,000 | USD | 8,574,881 | GSC | 02/24/17 | (253,018 | ) | ||||||||||||||||||||||||

| TWD | 328,850,000 | USD | 10,462,934 | GSC | 05/23/17 | (290,292 | ) | ||||||||||||||||||||||||

| USD | 5,000,000 | KRO | 5,851,000,000 | GSC | 05/10/17 | 153,534 | |||||||||||||||||||||||||

| USD | 10,000,000 | KRO | 11,819,000,000 | GSC | 05/18/17 | 209,683 | |||||||||||||||||||||||||

| USD | 1,080,644 | KRO | 1,181,900,000 | MSC | 05/18/17 | 101,612 | |||||||||||||||||||||||||

| USD | 8,000,000 | TWD | 269,680,000 | GSC | 02/24/17 | (321,863 | ) | ||||||||||||||||||||||||

| USD | 10,000,000 | TWD | 328,850,000 | GSC | 05/23/17 | (172,642 | ) | ||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||

| $ | (2,188,223 | ) | |||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||

GSC — Goldman Sachs & Co.

MSC — Morgan Stanley & Company LLC

KRO — South Korean Won (Offshore)

KRW — South Korean Won

TWD — Taiwanese Dollar

USD — United States Dollar

Notes to Financial Statements are an integral part of this Schedule.

16

Table of Contents

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

17

Table of Contents

Driehaus Frontier Emerging Markets Fund — Portfolio Managers’ Letter

Dear Fellow Shareholders,

The Driehaus Frontier Emerging Markets Fund (“Fund”) returned 9.26%1 for the year ended December 31, 2016. This return outperformed the Morgan Stanley Capital International (“MSCI”) Frontier Markets Index (“Benchmark”), which returned 2.66% for the same period.

Global equity markets experienced rotations across countries and sectors during 2016, coinciding with a huge shift in sentiment from global growth and deflation concerns in mid-January, to global growth and inflation optimism by year-end. Within frontier markets, the macro landscape has favored commodity importing nations over the past couple of years, and while this shift has become more advanced in its move, it has largely remained in place. This continues to serve as a tailwind for domestic demand as well as regional allocations favoring countries such as Vietnam, Pakistan and Bangladesh.

Over the course of 2016, key contributions to performance versus the Benchmark came from the Fund’s security selection in the consumer staples sector and an overweight as well as security selection in the utilities sector. In addition, stock selection in Nigeria and Vietnam contributed to performance.

A notable contribution to the Fund’s return for the year came from holding Maple Leaf Cement Factory, Ltd. (Ticker: MLCF PA). The Pakistan-based company produces and sells cement. Throughout the year, Maple Leaf Cement’s strong quarterly results consistently met or beat expectations as infrastructure spending in Pakistan continues to support the pricing power of the cement industry.

Vietnam Dairy Products JSC (Ticker: VNM VN) was a significant contributor to returns during 2016. The Vietnam-based company manufactures, markets, and distributes dairy products. Its share price has been growing steadily since early 2015. Revenue has regularly met investor expectations while the company is aggressively gaining market share. Additionally, the removal of the foreign ownership limitation has also helped drive up its share price as more investors from outside of Vietnam now have access to its shares.

Certain areas detracted from Fund performance during the year. Underweights to the telecommunication services and energy sectors hurt performance of the Fund relative to the Benchmark. Additionally, an underweight to Morocco and an overweight to Botswana detracted from Fund performance versus the Benchmark.

Letshego Holdings, Ltd. (Ticker: LETSHEGO BG) was a significant detractor from the Fund’s performance during 2016. Letshego is a Botswana-based financial services company engaged in short- to medium-term secured and unsecured loans. With heavy exposure to Mozambique, the company saw its share price decline in concert with the deterioration of political and economic conditions in Mozambique during the year. Increased sovereign credit risk, declining commodity prices, and military clashes between two political rivals, all weighed on the company’s businesses in Mozambique.

Equity Group Holdings, Ltd. (Ticker: EQBNK KN) was a significant detractor from the Fund’s performance during 2016. The Kenya-based commercial bank provides financial services to individuals and businesses in Kenya, Uganda, South Sudan, Rwanda, Tanzania, and the Democratic Republic of Congo. The Kenyan President signed a new banking bill into law in August that caps lending rates and raises the floor on interest earning deposit accounts, both of which negatively impact the company. Banks with a higher proportion of retail clients, such as the company, experienced the largest impact.

Over the past two years, the Fund has largely been positioned to benefit from falling commodity prices with overweights in commodity-consuming countries such as Bangladesh and Pakistan, offset by underweights in commodity exporters such as Nigeria and the Middle East markets. Absent a return of a commodities supercycle, which is not our base case, we expect the Fund to benefit from selective positions across the energy and materials sectors, and in countries that present attractive recovery growth opportunities. We added to positions in the energy sector in the last few months of 2016, and more recently have begun to evaluate opportunities to selectively increase the Fund’s exposure to the Middle East.

18

Table of Contents

We thank you for your interest in the Driehaus Frontier Emerging Markets Fund and would like to express our gratitude to you as shareholders for your confidence in our management capabilities.

Sincerely,

|

| |

| Chad Cleaver, CFA | Rich Thies | |

| Lead Portfolio Manager | Portfolio Manager |

| 1 | During this period, the Fund’s returns reflect fee waivers and/or expense reimbursements without which performance would have been lower. |

Performance is historical and does not represent future results.

Please see the following performance overview page for index descriptions.

19

Table of Contents

Driehaus Frontier Emerging Markets Fund

Performance Overview (unaudited)

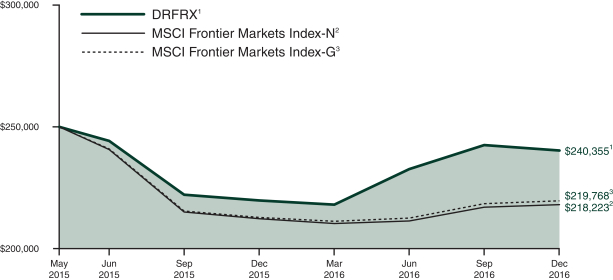

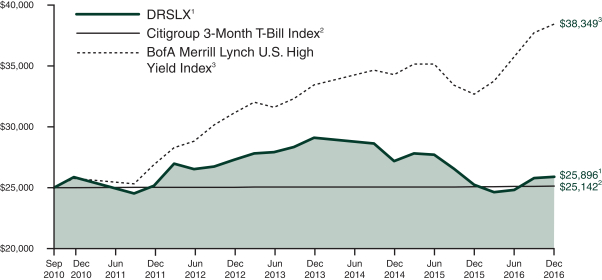

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $250,000 investment (minimum investment) in the Fund since May 4, 2015 (the date of the Fund’s inception), with all dividends and capital gains reinvested, with the indicated index (and dividends reinvested) for the same period.

| Average Annual Total Returns as of 12/31/16 | 1 Year | Since Inception (05/04/15 - 12/31/16) |

||||||

| Driehaus Frontier Emerging Markets Fund (DRFRX)1 |

9.26% | –2.34% | ||||||

| MSCI Frontier Markets Index-N2 |

2.66% | –7.84% | ||||||

| MSCI Frontier Markets Index-G3 |

3.16% | –7.44% | ||||||

| 1 | The returns for the period reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Frontier Markets Index-Net (MSCI Frontier Markets Index-N) provides broad representation of the equity opportunity set in frontier markets while taking investability requirements into consideration within each market. Data is in U.S. dollars and is calculated with net dividend reinvestment. The benchmark has changed from the Morgan Stanley Capital International Frontier Markets Index-Gross (MSCI Frontier Markets Index-G) to the MSCI Frontier Markets Index-N because the net index is more commonly used industry wide and is a more representative comparison versus the fund because it is presented net of foreign withholding taxes. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Frontier Markets Index-Gross (MSCI Frontier Markets Index-G) provides broad representation of the equity opportunity set in frontier markets while taking investability requirements into consideration within each market. Data is in U.S. dollars and is calculated with gross dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

20

Table of Contents

Driehaus Frontier Emerging Markets Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

21

Table of Contents

Driehaus Frontier Emerging Markets Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

22

Table of Contents

Driehaus Frontier Emerging Markets Fund

Schedule of Investments

December 31, 2016

| * | All percentages are stated as a percent of net assets at December 31, 2016. |

Notes to Financial Statements are an integral part of this Schedule.

23

Table of Contents

Driehaus Frontier Emerging Markets Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

24

Table of Contents

Driehaus International Small Cap Growth Fund — Portfolio Managers’ Letter

Dear Fellow Shareholders,

The Driehaus International Small Cap Growth Fund (“Fund”) returned -6.22% for the year ended December 31, 2016. The Fund’s benchmark, the Morgan Stanley Capital International (“MSCI”) All Country World ex USA Small Cap Growth Index (“Benchmark”), returned -0.28%.

The past year presented a challenging environment for the Fund’s investment approach as relative performance was adversely affected by style effects—particularly by low valuation companies with weaker fundamentals that generally outperformed. Not only were growth and quality out of favor, but an improving backdrop for the global economy and commodity markets exacerbated these trends across sectors and geographies. There were three major episodes of volatility during the course of the year, all of which generally involved value outperforming growth names and low-quality outperforming quality companies.

Over the course of 2016, key contributors to performance versus the Benchmark were the Fund’s holdings in the telecommunication services sector and being underweight to the health care sector as compared to the Benchmark. In addition, underweights to South Korea and Hong Kong contributed positively to the performance of the Fund as compared to the Benchmark.

SEB SA (Ticker: SK FP) made significant contributions to the Fund’s return during 2016. The France-based company manufactures household equipment for consumers. Its share price climbed steadily throughout the year on strong earnings and revenue growth. While analysts raised price targets throughout the year, the company continued to meet or beat those expectations. Organic growth in China and Eastern Europe were the primary drivers behind the company’s consistent outperformance.

RPC Group PLC (Ticker: RPC LN) also made significant contributions to the Fund’s return during 2016. The United Kingdom-based company engineers and designs plastic products. Over the last two years, the company has seen its share price steadily advance as it has beaten financial targets quarter after quarter. Additionally, recent acquisitions have provided synergies to the company and met with investor approval.

For 2016, security selection in the information technology and materials sectors detracted from the Fund’s performance versus the Benchmark. At the country level, security selection within Japan and the Netherlands detracted value.

A significant detractor from returns for the year was Euronext NV (Ticker: ENX FP). The Netherlands-based company is a pan-European exchange group offering products and services for equity, fixed income and derivative markets in Paris, Amsterdam, Brussels, Lisbon and London. Early in the year, its share price tumbled due to a disappointing outlook from management. Shares sold off despite strong growth and positive results as management signaled that investors should not anticipate a further reduction in costs.

Okamoto Industries, Inc. (Ticker: 5122 JP) was a notable detractor from the Fund. The Japan-based company manufactures and sells rubber products, including condoms, food wares, plastic films and industrial materials. Although the company’s fundamentals remain strong, several market forces have affected its industry as a whole. The company is being hurt by a combination of Japan’s declining demand for the company’s main product, polyurethane condoms, due to demographic and social trends, and China’s reversal of the one-child policy, expected to reduce what was growing Chinese demand.

Looking into 2017, there are signs of cyclical elements of inflation and nominal gross domestic product growth picking up. However, as of year-end, the market had been quick to accept a more positive growth outlook, especially considering the level of economic policy uncertainty. Our presiding belief is that the US fiscal stimulus will more than offset tighter monetary settings. The major risk to this view is that the economy loses momentum prior to spending increases. Indeed, fiscal stimulus may not accelerate until 2018, but the effect of higher rates and a stronger US dollar is more imminent.

While this was a difficult year for our investment approach, previous cycles and subsequent growth recoveries have reinforced to us the importance of not deviating from our process. We continue to believe that by investing in quality companies with strong earnings growth, we will deliver superior results over the long term and over full market cycles.

25

Table of Contents

As always, we thank you for your interest in the Driehaus International Small Cap Growth Fund and would like to express our gratitude to you as shareholders for your continued confidence in our management capabilities.

Sincerely,

|

|

| ||

| David Mouser | Daniel Burr | Ryan Carpenter | ||

| Lead Portfolio Manager | Portfolio Manager | Assistant Portfolio Manager |

Performance is historical and does not represent future results.

Please see the following performance overview page for index description.

26

Table of Contents

Driehaus International Small Cap Growth Fund

Performance Overview (unaudited)

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund over the last 10 fiscal year periods (which includes performance of the Predecessor Limited Partnership), with all dividends and capital gains reinvested, with the indicated index (and dividends reinvested) for the same period.

| Fund Only | Including Predecessor Limited Partnership |

|||||||||||||||||||

| Average Annual Total Returns as of 12/31/16 |

1 Year | 3 Years | 5 Years | Since Inception (09/17/07 - 12/31/16) |

10 Years | |||||||||||||||

| Driehaus International Small Cap Growth Fund (DRIOX)1 |

–6.22% | 0.34% | 7.83% | 3.85% | 5.90% | |||||||||||||||

| MSCI AC World ex USA Small Cap Growth Index-N2 |

–0.28% | 0.79% | 7.24% | 1.56% | 2.50% | |||||||||||||||

| MSCI AC World ex USA Small Cap Growth Index-G3 |

–0.04% | 1.03% | 7.50% | 1.81% | 2.75% | |||||||||||||||

| 1 | The Driehaus International Small Cap Growth Fund (the “Fund”) performance shown above includes the performance of the Driehaus International Opportunities Fund, L.P. (the “Predecessor Limited Partnership”), the Fund’s predecessor, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership, which was established on August 1, 2002, was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Limited Partnership’s assets on September 17, 2007. The Predecessor Limited Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Fund. The returns for the periods prior to January 1, 2010, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International All Country World ex USA Small Cap Growth Index-Net (MSCI AC World ex USA Small Cap Growth Index-N) is a market capitalization-weighted index designed to measure equity market performance in global developed markets and emerging markets, excluding the U.S., and is composed of stocks which |

27

Table of Contents

| are categorized as small capitalization growth stocks. Data is in U.S. dollars and is calculated with net dividend reinvestment. The benchmark has changed from the Morgan Stanley Capital International All Country World ex USA Small Cap Growth Index-Gross (MSCI AC World ex USA Small Cap Growth Index-G) to the MSCI AC World ex USA Small Cap Growth Index-N because the net index is more commonly used industry wide and is a more representative comparison versus the fund because it is presented net of foreign withholding taxes. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International All Country World ex USA Small Cap Growth Index-Gross (MSCI AC World ex USA Small Cap Growth Index-G) is a market capitalization-weighted index designed to measure equity performance in global developed markets and emerging markets, excluding the U.S., and is composed of stocks which are categorized as small capitalization growth stocks. Data is in U.S. dollars and is calculated with gross dividend reinvestment. Source: Morgan Stanley Capital International, Inc. |

28

Table of Contents

Driehaus International Small Cap Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

29

Table of Contents

Driehaus International Small Cap Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

30

Table of Contents

Driehaus International Small Cap Growth Fund

Schedule of Investments

December 31, 2016

| * | All percentages are stated as a percent of net assets at December 31, 2016. |

Notes to Financial Statements are an integral part of this Schedule.

31

Table of Contents

Driehaus International Small Cap Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

32

Table of Contents

Driehaus Micro Cap Growth Fund — Portfolio Managers’ Letter

Dear Fellow Shareholders,

The Driehaus Micro Cap Growth Fund (“Fund”) returned 17.78% for the year ended December 31, 2016. This return was above the performance of the Fund’s benchmark, the Russell Microcap® Growth Index (the “Benchmark”), which returned 6.86% for the same period.

The past year was filled with surprises. The reversal in the price of oil, Brexit, the US election outcome, and the rise in US rates were just some of the notable and unexpected events of 2016. After a steep market decline at the start of 2016, stocks rallied from mid-February through September. Then a sharp selloff occurred prior to the US election, which drove an epic rally into year-end as investors became bullish on the prospects of a more pro-business White House and Congress. However, there were significant differences between styles with the Russell Microcap Value Index returning 30.59% for the year, outperforming its growth counterpart’s 6.86% return by more than 23 percentage points. A primary driver of this disparity was the meaningful appreciation in bank stocks post-election, which boosted value indexes while biotechs, a large component of growth indexes, lagged meaningfully.

For the year 2016, key contributors to performance versus the Benchmark were the Fund’s selection of holdings in the health care and information technology sectors.

Acacia Communications, Inc. (Ticker: ACIA) was the top contributor to Fund performance for the period. The semiconductor company designs and manufactures digital signal processors (DSP) that enable high speed optical communication networks. A strong optical upgrade cycle, which increased the need for DSPs to handle the dramatic increase in processing needs, drove growth for the company in 2016. Since its initial public offering in May, the company has seen high levels of demand from various markets, including China, with impressive revenue and earnings growth in the second and third quarters of the year.

Celator Pharmaceuticals, Inc. (Ticker: CPXX) also contributed to the Fund’s performance for the period. The biopharmaceutical company is focused on developing treatments for cancer. Company performance in 2016 was driven by two main factors. First, in March, the company reported successful, break-through results for its drug candidate, Vyxeos, from a phase 3 study in the treatment of an acute form of leukemia. It was the industry’s first successful drug in decades to treat this rare disease. Second, as a result of this breakthrough, Celator was able to execute a sale of the company to Jazz Pharmaceuticals in May for well in excess of $1 billion.

During the period, the two sectors that detracted the most value from Fund performance versus the Benchmark were selections within the materials and financials sectors.

A holding in the financial sector that detracted from the Fund’s return during the period was Atlas Financial Holdings, Inc. (Ticker: AFH). Atlas is a specialty insurance company with a focus on the growing niche of “light” commercial vehicles, including taxis, limos and newer livery services such as Uber. The stock lagged as investments in growth weighed on earnings estimates.

American Vanguard Corp. (Ticker: AVD) was also a notable detractor to the Fund’s returns for the period. The company develops and markets chemical products for agricultural, commercial and consumer uses. The market overestimated the effect of the Zika virus on demand for the company’s mosquito control products, and when management downplayed the potential impact on sales, a selloff occurred.

Looking ahead, with a Republican-led White House and Congress, market expectations are for a period of higher economic growth resulting from lower taxes, deregulation and fiscal stimulus. Business and consumer optimism surged at the end of 2016 but how it translates into consumer spending and corporate earnings will largely determine how equities perform in 2017.

Volatility will likely increase as initial optimism about the Trump administration fades and the market’s patience is tested by what has historically been a slow-moving legislative process. A stronger dollar, growing inflation expectations and the Fed’s pace of rate increases may also generate market turbulence. Nonetheless, prospects for economic growth have improved with many sectors poised to benefit. While valuations are high and near-term gains may be capped, growth equities have become relatively attractive on a historical basis.

33

Table of Contents

Thank you for your interest in the Driehaus Micro Cap Growth Fund. We appreciate your confidence in our management capabilities.

Sincerely,

|

| |

| Jeff James | Michael Buck | |

| Portfolio Manager | Assistant Portfolio Manager |

Performance is historical and does not represent future results.

Please see the following performance overview page for index description.

34

Table of Contents

Driehaus Micro Cap Growth Fund

Performance Overview (unaudited)

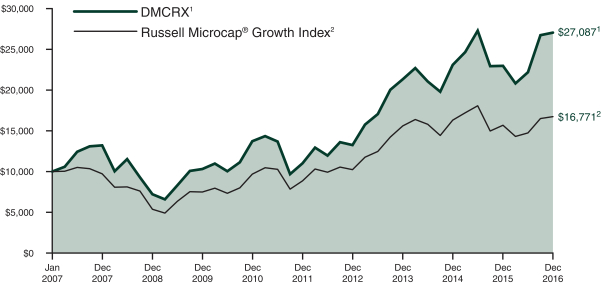

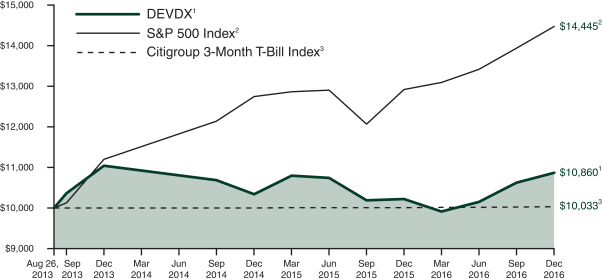

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund over the last 10 fiscal year periods (which includes performance of the Predecessor Limited Partnership), with all dividends and capital gains reinvested, with the indicated index (and dividends reinvested) for the same period.

| Fund Only | Including Predecessor Limited Partnership |

|||||||||||||||||||

| Average Annual Total Returns as of 12/31/16 | 1 Year | 3 Years | Since Inception (11/18/13 - 12/31/16) |

5 Years | 10 Years | |||||||||||||||

| Driehaus Micro Cap Growth Fund (DMCRX)1 |

17.78% | 8.22% | 10.39% | 19.65% | 10.48% | |||||||||||||||

| Russell Microcap® Growth Index2 |

6.86% | 2.33% | 4.50% | 13.53% | 5.31% | |||||||||||||||

| 1 | The Driehaus Micro Cap Growth Fund (the “Fund”) performance shown above includes the performance of the Driehaus Micro Cap Fund, L.P. (the “Predecessor Limited Partnership”), one of the Fund’s predecessors, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership, which was established on July 1, 1996, was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Limited Partnership’s assets together with the assets of the Driehaus Institutional Micro Cap Fund, L.P. on November 18, 2013. The Predecessor Limited Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Fund. The returns reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Russell Microcap® Growth Index is constructed to provide a comprehensive and unbiased barometer of the micro cap growth market. Based on ongoing empirical research of investment manager behavior, the methodology used to determine growth probability approximates the aggregate microcap growth manager's opportunity set. |

35

Table of Contents

Driehaus Micro Cap Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

36

Table of Contents

Driehaus Micro Cap Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

37

Table of Contents

Driehaus Micro Cap Growth Fund

Schedule of Investments

December 31, 2016

| * | All percentages are stated as a percent of net assets at December 31, 2016. |

Notes to Financial Statements are an integral part of this Schedule.

38

Table of Contents

Driehaus Micro Cap Growth Fund

Schedule of Investments

December 31, 2016

Notes to Financial Statements are an integral part of this Schedule.

39

Table of Contents

Statements of Assets and Liabilities

December 31, 2016

| Driehaus Emerging Markets Growth Fund |

Driehaus Emerging Markets Small Cap Growth Fund |

|||||||

| ASSETS: |

||||||||

| Investments, at cost |

$ | 1,188,109,575 | $ | 242,665,893 | ||||

|

|

|

|

|

|||||

| Investments, at fair value |

$ | 1,292,666,958 | $ | 252,460,465 | ||||

| Foreign currency, at fair value* |

2,258,490 | 4,707,005 | ||||||

| Cash |

50,592,469 | 6,804,343 | ||||||

| Swaps, at fair value |

— | 538,344 | ||||||

| Unrealized appreciation on forward foreign currency contracts |

— | 464,829 | ||||||

| Collateral held at custodian for the benefit of brokers |

— | 1,940,353 | ||||||

| Receivables: |

||||||||

| Dividends |

3,146,042 | 142,350 | ||||||

| Investment securities sold |

12,080,597 | 3,651,429 | ||||||

| Fund shares sold |

1,753,191 | 867,528 | ||||||

| Foreign taxes |

563,882 | 443,107 | ||||||

| Net unrealized appreciation on unsettled foreign currency transactions |

— | 26,808 | ||||||

| Prepaid expenses |

15,065 | 33,701 | ||||||

|

|

|

|

|

|||||

|

|

||||||||

| TOTAL ASSETS |

1,363,076,694 | 272,080,262 | ||||||

|

|

|

|

|

|||||

|

|

||||||||

| LIABILITIES: |

||||||||

| Payables: |

||||||||

| Investment securities purchased |

21,760,835 | 4,041,414 | ||||||

| Fund shares redeemed |

3,322,212 | 3,086,783 | ||||||

| Net unrealized depreciation on unsettled foreign currency transactions |

37,593 | — | ||||||

| Due to affiliates |

1,730,164 | 379,548 | ||||||

| Audit and tax fees |

56,010 | 56,010 | ||||||

| Accrued expenses |

297,146 | 113,130 | ||||||

| Swaps, at fair value |

— | 93,396 | ||||||

| Unrealized depreciation on forward foreign currency contracts |

— | 2,653,052 | ||||||

| Written options outstanding, at fair value (premiums received $419,278) |

— | 270,000 | ||||||

|

|

|

|

|

|||||

|

|

||||||||

| TOTAL LIABILITIES |

27,203,960 | 10,693,333 | ||||||

|

|

|

|

|

|||||

|

|

||||||||

| NET ASSETS |

$ | 1,335,872,734 | $ | 261,386,929 | ||||

|

|

|

|

|

|||||

| SHARES OUTSTANDING (Unlimited shares authorized, no par value) |

47,749,026 | 24,525,271 | ||||||

|

|

|

|

|

|||||

| NET ASSET VALUE |

$ | 27.98 | $ | 10.66 | ||||

|

|

|

|

|

|||||

|

|

||||||||

| NET ASSETS CONSISTED OF THE FOLLOWING AT DECEMBER 31, 2016: |

||||||||

| Paid-in capital |

$ | 1,423,495,092 | $ | 341,821,437 | ||||

| Accumulated net investment income (loss) |

(1,925,249 | ) | (935,864 | ) | ||||

| Accumulated net realized gain (loss) |

(190,237,691 | ) | (87,171,470 | ) | ||||

| Unrealized net foreign exchange gain (loss) |

(16,801 | ) | 13,394 | |||||

| Unrealized net appreciation (depreciation) on forward foreign currency contracts |

— | (2,188,223 | ) | |||||

| Unrealized net appreciation (depreciation) on swap contracts |

— | (96,195 | ) | |||||

| Unrealized net appreciation (depreciation) on written options |

— | 149,278 | ||||||

| Unrealized net appreciation (depreciation) on investments |

104,557,383 | 9,794,572 | ||||||

|

|

|

|

|

|||||

| NET ASSETS |

$ | 1,335,872,734 | $ | 261,386,929 | ||||

|

|

|

|

|

|||||

|

|

||||||||

| * | The cost of foreign currency was $2,281,177, $4,705,213, $1,445,326, $15,974 and $0, respectively. |

Notes to Financial Statements are an integral part of this Statement.

40

Table of Contents

Statements of Assets and Liabilities

December 31, 2016

| Driehaus Frontier Emerging Markets Fund |

Driehaus International Small Cap Growth Fund |

Driehaus Micro Cap Growth Fund |

||||||||

| $ | 66,950,224 | $ | 240,879,327 | $ | 322,216,746 | |||||

|

|

|

|

|

|

|

|||||

| $ | 70,040,318 | $ | 259,813,416 | $ | 392,135,710 | |||||

| 1,447,155 | 15,614 | — | ||||||||

| 2,458,048 | 12,755,058 | 3,574,316 | ||||||||

| — | — | — | ||||||||

| — | — | — | ||||||||

| — | — | — | ||||||||

| 111,404 | 397,493 | 62,705 | ||||||||

| 59,273 | 97,041 | 119,694 | ||||||||

| 109,223 | 260,912 | 1,525,102 | ||||||||

| — | — | — | ||||||||

| 1,562 | — | — | ||||||||

| 7,856 | 12,397 | 31,648 | ||||||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| 74,234,839 | 273,351,931 | 397,449,175 | ||||||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| 775,394 | — | — | ||||||||

| — | 2,476,434 | 320,644 | ||||||||

| — | 475 | — | ||||||||

| 11,176 | 347,528 | 419,362 | ||||||||

| 56,010 | 54,593 | 45,360 | ||||||||

| 75,088 | 71,525 | 74,157 | ||||||||

| — | — | — | ||||||||

| — | — | — | ||||||||

| — | — | — | ||||||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| 917,668 | 2,950,555 | 859,523 | ||||||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| $ | 73,317,171 | $ | 270,401,376 | $ | 396,589,652 | |||||

|

|

|

|

|

|

|

|||||

| 7,666,923 | 28,991,787 | 31,340,638 | ||||||||

|

|

|

|

|

|

|

|||||

| $ | 9.56 | $ | 9.33 | $ | 12.65 | |||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| $ | 73,012,004 | $ | 254,204,101 | $ | 345,191,551 | |||||

| (9,860 | ) | — | 316,181 | |||||||

| (2,775,949 | ) | (2,711,565 | ) | (18,837,044 | ) | |||||

| 882 | (25,249 | ) | — | |||||||

| — | — | — | ||||||||

| — | — | — | ||||||||

| — | — | — | ||||||||

| 3,090,094 | 18,934,089 | 69,918,964 | ||||||||

|

|

|

|

|

|

|

|||||

| $ | 73,317,171 | $ | 270,401,376 | $ | 396,589,652 | |||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

Notes to Financial Statements are an integral part of this Statement.

41

Table of Contents

For the Year Ended December 31, 2016

| Driehaus Emerging Markets Growth Fund |

Driehaus Emerging Markets Small Cap Growth Fund |

|||||||

| INVESTMENT INCOME (LOSS): | ||||||||

| Income: |

||||||||

| Dividends* |

$ | 24,469,834 | $ | 5,779,465 | ||||

|

|

|

|

|

|||||

|

|

||||||||

| Total income |

24,469,834 | 5,779,465 | ||||||

|

|

|

|

|

|||||

|

|

||||||||

| Expenses: |

||||||||

| Investment advisory fee |

21,117,427 | 5,911,601 | ||||||

| Administration fee |

757,629 | 339,700 | ||||||

| Professional fees |

244,555 | 79,584 | ||||||

| Audit and tax fees |

77,120 | 113,978 | ||||||

| Federal and state registration fees |

38,000 | 40,000 | ||||||

| Custodian fees |

392,504 | 170,733 | ||||||

| Transfer agent fees |

349,745 | 74,225 | ||||||

| Trustees’ fees |

120,420 | 62,675 | ||||||

| Chief compliance officer fees |

16,726 | 16,726 | ||||||

| Reports to shareholders |

115,697 | 37,829 | ||||||

| Miscellaneous |

83,167 | 49,108 | ||||||

|

|

|

|

|

|||||

| Total expenses |

23,312,990 | 6,896,159 | ||||||

|

|

|

|

|

|||||

|

|

||||||||

| Investment advisory fees recaptured (waived) |

— | — | ||||||

| Transfer agent fees waived |

— | — | ||||||

| Fees paid indirectly |

(333,420 | ) | (87,149 | ) | ||||

|

|

|

|

|

|||||

| Net expenses |

22,979,570 | 6,809,010 | ||||||

|

|

|

|

|

|||||

|

|

||||||||

| Net investment income (loss) |

1,490,264 | (1,029,545 | ) | |||||

|

|

|

|

|

|||||

|

|

||||||||

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, WRITTEN OUTSTANDING OPTIONS AND FOREIGN CURRENCY TRANSACTIONS: |

||||||||

| Net realized gain (loss) from security transactions |

1,811,023 | (14,443,030 | ) | |||||

| Net realized foreign exchange gain (loss) |

(3,986,963 | ) | (1,234,684 | ) | ||||

| Net realized gain (loss) on forward foreign currency contracts |

— | (320,407 | ) | |||||

| Net realized gain (loss) on written options |

— | (1,702,378 | ) | |||||

| Net realized gain (loss) on swap contracts |

— | (491,829 | ) | |||||

| Net change in unrealized foreign exchange gain (loss) |

262,720 | 35,358 | ||||||

| Net change in unrealized appreciation (depreciation) on swap contracts |

— | (96,195 | ) | |||||

| Net change in unrealized appreciation (depreciation) on forward foreign currency contracts |

— | (2,188,223 | ) | |||||

| Net change in unrealized appreciation (depreciation) on written options |

— | 242,854 | ||||||

| Net change in unrealized appreciation (depreciation) on investments |

79,978,937 | (16,707,386 | ) | |||||

|

|

|

|

|

|||||

|

|

||||||||

| Net realized and unrealized gain (loss) on investments, written options and foreign currency transactions |

78,065,717 | (36,905,920 | ) | |||||

|

|

|

|

|

|||||

|

|

||||||||

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 79,555,981 | $ | (37,935,465 | ) | |||

|

|

|

|

|

|||||

|

|

||||||||

| * | Dividends are net of $2,633,090, $642,150, $148,193, $470,097 and $0 non-reclaimable foreign taxes withheld, respectively. |

Notes to Financial Statements are an integral part of this Statement.

42

Table of Contents

Statements of Operations

For the Year Ended December 31, 2016

| Driehaus Frontier Emerging Markets Fund |

Driehaus International Small Cap Growth Fund |

Driehaus Micro Cap Growth Fund |

||||||||

| $ | 1,652,880 | $ | 4,868,285 | $ | 1,261,799 | |||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| 1,652,880 | 4,868,285 | 1,261,799 | ||||||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| 750,484 | 4,713,700 | 3,571,299 | ||||||||

| 106,499 | 286,546 | 234,380 | ||||||||

| 29,399 | 67,218 | 63,157 | ||||||||

| 66,130 | 62,145 | 45,360 | ||||||||

| 26,104 | 25,000 | 62,000 | ||||||||

| 126,571 | 54,266 | 32,050 | ||||||||

| 38,298 | 54,815 | 58,342 | ||||||||

| 41,896 | 57,921 | 56,752 | ||||||||

| 16,726 | 16,726 | 16,726 | ||||||||

| 18,765 | 25,567 | 57,892 | ||||||||

| 31,896 | 42,881 | 39,603 | ||||||||

|

|

|

|

|

|

|

|||||

| 1,252,768 | 5,406,785 | 4,237,561 | ||||||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| (232,622 | ) | — | — | |||||||

| (19,500 | ) | — | — | |||||||

| (3,328 | ) | (69,175 | ) | (118,475 | ) | |||||

|

|

|

|

|

|

|

|||||

| 997,318 | 5,337,610 | 4,119,086 | ||||||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| 655,562 | (469,325 | ) | (2,857,287 | ) | ||||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| (1,000,880 | ) | (1,608,802 | ) | (221,102 | ) | |||||

| (264,887 | ) | (235,724 | ) | — | ||||||

| — | — | — | ||||||||

| — | — | — | ||||||||

| — | — | — | ||||||||

| 1,446 | 9,406 | — | ||||||||

| |

— |

|

— | — | ||||||

| |

— |

|

— | — | ||||||

| |

— |

|

— | — | ||||||

| |

3,666,373 |

|

(18,131,180 | ) | 52,521,417 | |||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| |

2,402,052 |

|

(19,966,300 | ) | 52,300,315 | |||||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

| $ |

3,057,614 |

|

$ | (20,435,625 | ) | $ | 49,443,028 | |||

|

|

|

|

|

|

|

|||||

|

|

|

|||||||||

Notes to Financial Statements are an integral part of this Statement.

43

Table of Contents

Statements of Changes in Net Assets

| Driehaus Emerging Markets Growth Fund |

Driehaus Emerging Markets Small Cap Growth Fund |

|||||||||||||||

| For the year ended December 31, 2016 |

For the year ended December 31, 2015 |

For the year ended December 31, 2016 |

For the year ended December 31, 2015 |

|||||||||||||

| INCREASE (DECREASE) IN NET ASSETS: |

||||||||||||||||

| Operations: |

||||||||||||||||

| Net investment income (loss) |

$ | 1,490,264 | $ | 3,665,087 | $ | (1,029,545 | ) | $ | (2,195,061 | ) | ||||||

| Net realized gain (loss) on investments, written options and foreign currency transactions |

(2,175,940 | ) | (140,031,003 | ) | (18,192,328 | ) | (63,008,129 | ) | ||||||||

| Net change in unrealized gain (loss) on investments, written options and foreign currency transactions |

80,241,657 | (34,604,006 | ) | (18,713,592 | ) | (8,287,636 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

||||||||||||||||

| Net increase (decrease) in net assets resulting from operations |

79,555,981 | (170,969,922 | ) | (37,935,465 | ) | (73,490,826 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

||||||||||||||||

| Distributions to shareholders: |

||||||||||||||||

| Net investment income |

(5,290,378 | ) | — | (450,242 | ) | — | ||||||||||

| Capital gains |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions to shareholders |

(5,290,378 | ) | — | (450,242 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

||||||||||||||||

| Capital share transactions: |

||||||||||||||||

| Proceeds from shares sold |

309,521,714 | 495,687,975 | 129,130,689 | 391,387,204 | ||||||||||||

| Proceeds from shares issued in connection with merger |

— | — | — | — | ||||||||||||

| Reinvestment of distributions |

4,691,045 | — | 313,519 | — | ||||||||||||

| Cost of shares redeemed |

(415,113,177 | ) | (663,624,481 | ) | (262,403,964 | ) | (395,407,314 | ) | ||||||||

| Redemption fees |

86,534 | 108,595 | 14,640 | 54,128 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets derived from capital share transactions |

(100,813,884 | ) | (167,827,911 | ) | (132,945,116 | ) | (3,965,982 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total increase (decrease) in net assets |

(26,548,281 | ) | (338,797,833 | ) | (171,330,823 | ) | (77,456,808 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

||||||||||||||||

| NET ASSETS: |

||||||||||||||||

|

|

||||||||||||||||

| Beginning of period |

$ | 1,362,421,015 | $ | 1,701,218,848 | $ | 432,717,752 | $ | 510,174,560 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of period |

$ | 1,335,872,734 | $ | 1,362,421,015 | $ | 261,386,929 | $ | 432,717,752 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Accumulated net investment income (loss) |

$ | (1,925,249 | ) | $ | 129,107 | $ | (935,864 | ) | $ | (35,177 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

||||||||||||||||

| Capital share transactions are as follows: |

||||||||||||||||

| Shares issued |

11,334,611 | 17,103,216 | 11,418,322 | 29,084,670 | ||||||||||||

| Shares issued in connection with merger (see Note G) |

— | — | — | — | ||||||||||||

| Shares reinvested |

170,089 | — | 29,916 | — | ||||||||||||

| Shares redeemed |

(15,124,739 | ) | (23,146,134 | ) | (23,426,218 | ) | (31,207,479 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) from capital share transactions |

(3,620,039 | ) | (6,042,918 | ) | (11,977,980 | ) | (2,122,809 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

||||||||||||||||

| * | Fund commenced operations on May 4, 2015. |

Notes to Financial Statements are an integral part of this Statement.

44

Table of Contents

Statements of Changes in Net Assets

| Driehaus Frontier Emerging Markets Fund |

Driehaus International Small Cap Growth Fund |

Driehaus Micro Cap Growth Fund | ||||||||||||||||||||

| For the year ended December 31, 2016 |

For the period May 4, 2015 through December 31, 2015* |

For the year ended December 31, 2016 |

For the year ended December 31, 2015 |

For the year ended December 31, 2016 |

For the year ended December 31, 2015 |

|||||||||||||||||

| $ | 655,562 | $ | (24,425 | ) | $ | (469,325 | ) | $ | (572,264 | ) | $ | (2,857,287 | ) | $ | (1,991,209 | ) | ||||||

| (1,265,767 | ) | (1,828,866 | ) | (1,844,526 | ) | 20,693,872 | (221,102 | ) | (6,843,839 | ) | ||||||||||||

| 3,667,819 | (576,843 | ) | (18,121,774 | ) | 14,357,774 | 52,521,417 | (8,070,470 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|||||||||||||||||||||

| 3,057,614 | (2,430,134 | ) | (20,435,625 | ) | 34,479,382 | 49,443,028 | (16,905,518 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|||||||||||||||||||||

| (420,026 | ) | — | — | (972,621 | ) | — | — | |||||||||||||||

| — | — | (3,539,778 | ) | (7,898,573 | ) | — | (11,379,419 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (420,026 | ) | — | (3,539,778 | ) | (8,871,194 | ) | — | (11,379,419 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|||||||||||||||||||||

| 63,249,508 | 22,685,066 | 21,691,545 | 46,284,910 | 165,744,856 | 280,545,434 | |||||||||||||||||

| — | — | — | 79,717,913 | — | — | |||||||||||||||||

| 419,165 | — | 3,236,249 | 8,097,062 | — | 10,743,663 | |||||||||||||||||