Table of Contents

As filed with the Securities and Exchange Commission on November 12, 2014

File No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Pre-Effective Amendment No. | ¨ |

| Post-Effective Amendment No. | ¨ |

DRIEHAUS MUTUAL FUNDS

(Exact Name of Registrant as Specified in Charter)

25 East Erie Street

Chicago, Illinois 60611

(Address of Principal Executive Offices, Zip Code)

Registrant’s Telephone Number, including Area Code (312) 587-3800

Janet L. McWilliams, Esq.

Driehaus Capital Management LLC

25 East Erie Street

Chicago, Illinois 60611

(Name and Address of Agent for Service)

Copy to:

Cathy G. O’Kelly, Esq.

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

It is proposed that this filing will become effective on December 12, 2014 pursuant to Rule 488.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

Table of Contents

Driehaus International Discovery Fund

, 2014

Dear Shareholder:

As a shareholder of Driehaus International Discovery Fund, you are being asked to consider and approve the proposed reorganization of the Driehaus International Discovery Fund into the Driehaus International Small Cap Growth Fund (together with the Driehaus International Discovery Fund, the “Funds”), both series of the Driehaus Mutual Funds (the “Trust”). The Board of Trustees of the Trust recommends that you vote for the reorganization. The reorganization will allow you to continue your investment in the Driehaus Mutual Funds in a Fund with the same investment objective, similar investment strategies and restrictions and a better performance record.

The Funds’ adviser, Driehaus Capital Management LLC, is paying all costs of the reorganization. We urge you to vote FOR the reorganization, which is intended to qualify as a tax-free reorganization for federal income tax purposes.

A proxy statement/prospectus, as well as a question and answer sheet to address frequently asked questions, are enclosed to provide you additional information about the reorganization. On February 11, 2015, there will be a Special Meeting of Shareholders to consider the reorganization.

If you have any questions regarding the reorganization or need assistance in voting, please call Driehaus Capital Management LLC’s Relationship Management Department at (888) 636-8835.

Sincerely,

Robert H. Gordon

President

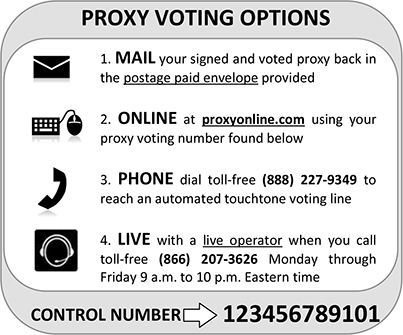

DRIEHAUS MUTUAL FUNDS

In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, regardless of whether or not you plan to attend the meeting. You may vote by mail, telephone or over the Internet. To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide or speak to a live operator. To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide.

Table of Contents

Question and Answer Sheet

| Q. | Why am I receiving this proxy statement/prospectus? |

| A. | You are receiving this proxy statement/prospectus because you are a shareholder of the Driehaus International Discovery Fund. All shareholders of record of the Driehaus International Discovery Fund as of the close of business on November 28, 2014 are being asked to consider and approve the proposed reorganization of the Driehaus International Discovery Fund into the Driehaus International Small Cap Growth Fund (together with the Driehaus International Discovery Fund, the “Funds”), both series of the Driehaus Mutual Funds (the “Trust”). |

| Q. | Why has the reorganization been proposed for the Driehaus International Discovery Fund? |

| A. | Driehaus Capital Management LLC (“DCM” or the “Adviser”), the Funds’ investment adviser, has proposed the reorganization as a part of a plan to address the lack of expected asset growth and relatively poor performance of the Driehaus International Discovery Fund. The reorganization will allow you to continue your Driehaus Mutual Funds investment in a Fund with an identical investment objective, similar investment strategies and restrictions and a better performance record. Although the Driehaus International Small Cap Growth Fund has a higher management fee, the combined Fund is expected to have lower non-management fee expenses than the Driehaus International Discovery Fund. |

| Q. | What is the Board’s recommendation? |

| A. | The Trust’s Board of Trustees (the “Board”) recommends that you vote FOR the reorganization. |

| Q. | Why is my vote important? |

| A. | For the reorganization to be approved, a majority of the shares of the Driehaus International Discovery Fund entitled to vote, present in person or by proxy, must vote FOR the reorganization. Shareholders are entitled to one vote for each full share held and fractional votes for fractional shares held. |

| Q. | When would the reorganization take place? |

| A. | If approved at the Special Meeting of Shareholders on February 11, 2015, the reorganization is expected to occur on or about March 9, 2015, or as soon as practicable after shareholder approval is obtained. |

| Q. | Will I receive new shares in exchange for my current shares? |

| A. | Yes. Upon approval and completion of the reorganization, your shares of the Driehaus International Discovery Fund will be exchanged for shares of the Driehaus International Small Cap Growth Fund. |

| Q. | Who is paying the costs of the reorganization? |

| A. | DCM is paying all the costs of the reorganization, including the preparation, filing, printing and mailing of the proxy statement/prospectus, accounting and legal fees, costs |

Table of Contents

| of solicitation and other administrative or operational costs related to the reorganization. DCM also will pay any explicit transaction costs related to Driehaus International Discovery Fund’s sale of portfolio holdings that are required in order to comply with Driehaus International Small Cap Growth Fund’s investment policy to invest, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in equity securities of non-U.S. small capitalization companies. |

| Q. | Will the reorganization create a taxable event for me? |

| A. | The reorganization is intended to qualify as a reorganization for federal income tax purposes, so that you will recognize no gain or loss as a direct result of the reorganization. Prior to the closing of the reorganization, the Driehaus International Discovery Fund expects to distribute all its net investment income and net capital gains, if any. Such a distribution may be taxable to you for federal income tax purposes. |

| Q. | Will the reorganization change my privileges as a shareholder? |

| A. | No. The shareholder privileges available to you after the reorganization will be the same as those you currently enjoy. |

| Q. | How will the reorganization affect the value of my investment? |

| A. | The value of your investment will not change as a result of the reorganization. On the closing date you will receive a number of shares with the same aggregate value as you held immediately before the reorganization. |

| Q. | How can I vote? |

| A. | You may vote in any one of several ways. You may sign, date and return your proxy card in the enclosed postage-paid envelope, you may vote by telephone or on the Internet (see enclosed proxy card for voting instructions), or you may vote in person at the Special Meeting. If you submit a proxy and wish to change your vote, you may withdraw it at the Meeting and then vote in person or you may submit a superseding vote by mail, telephone or on the Internet. |

| Q. | What happens if the reorganization is not approved? |

| A. | The proposed reorganization will occur only if the shareholders approve the proposal. If shareholders do not approve the reorganization, the Driehaus International Discovery Fund will continue in existence and the Board may take other action. |

Table of Contents

DRIEHAUS MUTUAL FUNDS

25 EAST ERIE STREET

CHICAGO, ILLINOIS 60611

DRIEHAUS INTERNATIONAL DISCOVERY FUND

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 11, 2015

Notice is hereby given that a Special Meeting of Shareholders of the Driehaus International Discovery Fund, a series of Driehaus Mutual Funds, will be held at the offices of Driehaus Capital Management LLC, 25 East Erie Street, Chicago, Illinois 60611, on February 11, 2015 at 10:00 a.m. Central time, for the purposes of considering the proposal set forth below:

To approve an Agreement and Plan of Reorganization (which is attached hereto as Exhibit A) providing for the transfer of all of the assets and all of the liabilities of the Driehaus International Discovery Fund to the Driehaus International Small Cap Growth Fund solely in exchange for shares of the Driehaus International Small Cap Growth Fund. The shares so received will be distributed to shareholders of the Driehaus International Discovery Fund in complete liquidation of the Driehaus International Discovery Fund and the Driehaus International Discovery Fund will be terminated as soon as practicable thereafter. These actions are referred to as the “Reorganization.”

Shareholders of record of the Driehaus International Discovery Fund as of the close of business on November 28, 2014 are entitled to notice of, and to vote at, the meeting or any adjournment of the meeting.

SHAREHOLDERS ARE REQUESTED TO EXECUTE AND RETURN PROMPTLY THE ACCOMPANYING PROXY CARD, WHICH IS BEING SOLICITED BY THE BOARD OF TRUSTEES OF DRIEHAUS MUTUAL FUNDS. YOU MAY EXECUTE THE PROXY CARD AS DESCRIBED ON THE PROXY CARD. EXECUTING THE PROXY CARD IS IMPORTANT TO ENSURE A QUORUM AT THE MEETING. PROXIES MAY BE REVOKED AT ANY TIME BEFORE THEY ARE EXERCISED BY SUBMITTING A WRITTEN NOTICE OF REVOCATION OR A SUBSEQUENTLY EXECUTED PROXY OR BY ATTENDING THE MEETING AND VOTING IN PERSON.

By Order of the Board of Trustees,

Diane J. Drake

Secretary

DRIEHAUS MUTUAL FUNDS

, 2014

Table of Contents

PROXY STATEMENT/PROSPECTUS

DATED , 2014

RELATING TO THE ACQUISITION OF THE ASSETS

AND ASSUMPTION OF THE LIABILITIES OF

DRIEHAUS INTERNATIONAL DISCOVERY FUND

BY AND IN EXCHANGE FOR SHARES OF

DRIEHAUS INTERNATIONAL SMALL CAP GROWTH FUND

DRIEHAUS MUTUAL FUNDS

25 EAST ERIE STREET

CHICAGO, ILLINOIS 60611

(800) 560-6111

This Proxy Statement/Prospectus is furnished in connection with the solicitation of proxies by the Board of Trustees of Driehaus Mutual Funds (the “Trust”) in connection with the Special Meeting of Shareholders (the “Meeting”) of the Driehaus International Discovery Fund (the “Target Fund”), to be held on February 11, 2015 at 10:00 a.m. Central time at the offices of Driehaus Capital Management LLC, 25 East Erie Street, Chicago, Illinois 60611. At the Meeting, shareholders of the Target Fund will be asked to consider and approve a proposed reorganization, as described in the Agreement and Plan of Reorganization, which is attached hereto as Exhibit A (the “Reorganization Agreement”), that will result in the transfer of all the assets and liabilities of the Target Fund to the Driehaus International Small Cap Growth Fund (the “Acquiring Fund”) solely in exchange for voting shares of beneficial interest (“shares”) of the Acquiring Fund and the distribution of the shares so received to shareholders of the Target Fund in complete liquidation of the Target Fund followed by the termination of the Target Fund as soon as practicable thereafter (the “Reorganization”). The Acquiring Fund and the Target Fund are collectively referred to as the “Funds.”

THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Reorganization Agreement provides that the Target Fund will transfer all of its assets and liabilities to the Acquiring Fund in exchange for shares of the Acquiring Fund in an amount equal in value to the aggregate net assets of the Target Fund as of the close of the New York Stock Exchange on the business day immediately prior to the closing date (the “Valuation Time”). The closing shall occur on March 9, 2015 or such other date as the parties may agree (the “Closing Date”).

On or as soon as is practicable after the Closing Date, the Target Fund will make a liquidating distribution to its shareholders of the Acquiring Fund’s shares received so that a holder of shares in the Target Fund will receive a number of shares of the Acquiring Fund with the same aggregate net asset value as the shares the shareholder had in the Target Fund, in each case determined as of the Valuation Time. If the Reorganization is completed, shareholders of the Target Fund will become shareholders of the Acquiring Fund and the Target Fund will be terminated.

The Trust is an open-end, management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Driehaus Capital Management LLC (“DCM”) is the investment adviser to the Funds. BNY Mellon Investment Servicing (US) Inc. (“BNY Mellon”) serves as administrator and transfer agent to the Funds. Driehaus Securities LLC (“DS LLC”), an affiliate of the Adviser, serves as the distributor of the Funds.

i

Table of Contents

This Proxy Statement/Prospectus sets forth concisely the information that a shareholder of the Target Fund should know before voting on the Reorganization, and should be retained for future reference.

The following documents have been filed with the SEC and are incorporated into this Proxy Statement/Prospectus by reference: (i) the prospectus of the Funds and other equity funds of the Trust, dated April 30, 2014, as supplemented through the date of this Proxy Statement/Prospectus, a copy of which is included with this Proxy Statement/Prospectus; (ii) the statement of additional information of the Funds and other equity funds of the Trust, dated April 30, 2014, as supplemented through the date of this Proxy Statement/Prospectus; (iii) the statement of additional information relating to the Reorganization, dated [ , 2014] (the “Merger SAI”); and (iv) the unaudited financial statements of the Funds included in the Semi-Annual Report of the Funds and other equity funds of the Trust for the period ended June 30, 2014. A copy of the Acquiring Fund’s unaudited financial statements for the period ended June 30, 2014 is included with this Proxy Statement/Prospectus. Only information relating to the Funds is incorporated by reference and no other parts of the prospectus, statement of additional information or semi-annual report are incorporated by reference herein.

Shareholders may receive free copies of the Funds’ annual report, semi-annual report, prospectus, statement of additional information or the Merger SAI without charge by writing to Driehaus Mutual Funds, P.O. Box 9817, Providence, Rhode Island 02940, or by calling toll-free (800) 560-6111. Copies of certain of these documents are also available on the Funds’ website at http://www.driehaus.com/Fund-Reports.php.

The Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and in accordance therewith files reports, proxy statements and other information with the SEC. You may review and copy information about the Funds, including the prospectus and the statement of additional information (for a duplication fee), at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549; at the Northeast Regional Office (3 World Financial Center, New York, New York 10281) and at the Midwest Regional Office (175 West Jackson Boulevard, Suite 900, Chicago, Illinois 60661). You may call the SEC at (202)551-5850 for information about the operation of the public reference room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

Share of the Funds are not deposits or obligations of, or guaranteed or endorsed by, any financial institution, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and involve risk, including the possible loss of the principal amount invested.

This Proxy Statement/Prospectus is expected to be sent to shareholders beginning on or about December , 2014.

ii

Table of Contents

| 1 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

iii

Table of Contents

This Synopsis is designed to allow you to compare the current fees, investment goals, policies and restrictions, investment risks, and distribution, purchase, exchange and redemption procedures of the Driehaus International Discovery Fund (or the “Target Fund”) and the Driehaus International Small Cap Growth Fund (or the “Acquiring Fund”). It is a summary of certain information contained elsewhere in this Proxy Statement/Prospectus, or incorporated by reference into this Proxy Statement/Prospectus. Shareholders should read this entire Proxy Statement/Prospectus carefully. For more complete information, please read the enclosed prospectus.

The Reorganization

Background. Pursuant to the Reorganization Agreement (which is attached hereto as Exhibit A), the Target Fund will transfer all of its assets and liabilities to the Acquiring Fund solely in exchange for voting shares of the Acquiring Fund. The Target Fund will distribute the shares that it receives to its shareholders in complete liquidation of the Target Fund and will thereafter be terminated. The result of the Reorganization is that shareholders of the Driehaus International Discovery Fund will become shareholders of the Driehaus International Small Cap Growth Fund. No sales charges will be imposed in connection with the Reorganization.

The Board of Trustees of the Trust (the “Board”), including the Trustees who are not “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act, considered the proposed Reorganization at a meeting held on October 23, 2014. After a thorough review of all aspects of the Reorganization and for the reasons set forth below (see “Reasons for the Reorganization”), the Board has concluded that the Reorganization would be in the best interests of each Fund, and that the interests of existing shareholders would not be diluted as a result of the transactions contemplated by the Reorganization. If the Reorganization is not approved by shareholders, the Target Fund will continue in existence and other action may be taken by the Board. The Board recommends that you vote for the approval of the Reorganization.

Reasons for the Reorganization. In reaching its decision, the Board considered the following factors: (1) the Acquiring Fund has an identical investment objective and similar investment strategies and restrictions as those of the Target Fund; (2) the Reorganization will allow Target Fund shareholders to continue their investment in the Driehaus Mutual Funds in a Fund with a better performance record; (3) the combined Fund is expected to have a larger asset base and a lower non-management fee expense ratio than each of the Target Fund and the Acquiring Fund; (4) the various alternatives to the Reorganization (e.g., liquidation of the Target Fund); (5) the Adviser has agreed to pay the costs of the Reorganization; and (6) the Reorganization is intended to qualify as a reorganization for U.S. federal income tax purposes, resulting in no gain or loss being recognized by the Target Fund or its shareholders as a direct result of the Reorganization.

Federal Income Tax Consequences. The Reorganization is intended to qualify for U.S. federal income tax purposes as a reorganization. If the Reorganization so qualifies, neither the Target Fund nor its shareholders will recognize any gain or loss as a direct result of the transactions contemplated by the Reorganization. As a condition to the closing of the Reorganization, the Funds will receive an opinion from counsel to the Trust substantially to that effect. No tax ruling from the Internal Revenue Service regarding the Reorganization has been requested. The opinion of counsel is not binding on the Internal Revenue Service and does not preclude the Internal Revenue Service from adopting a contrary position.

Distributions. Before the Reorganization, the Target Fund expects to distribute all of its net investment income and net capital gains, if any, to its shareholders. Such distributions may be taxable to the Target Fund’s shareholders for federal income tax purposes.

Table of Contents

The Trust

The Trust is an open-end management investment company, which offers redeemable shares in different series. The Trust is a Delaware statutory trust organized under an Agreement and Declaration of Trust dated May 31, 1996, as subsequently amended and restated as of June 6, 2013 (the “Declaration of Trust”). The Trust may issue an unlimited number of shares in one or more series or classes as the Board may authorize. The Driehaus International Discovery Fund commenced operations on December 31, 1998. After succeeding to the assets of the Driehaus International Opportunities Fund, L.P., the Driehaus International Small Cap Growth Fund commenced operations on September 17, 2007.

Investment Goals, Strategies and Restrictions

This section will help you compare the investment goals, strategies and restrictions of the Acquiring Fund with those of the Target Fund. Please be aware that this is only a brief discussion. More complete information may be found in the Funds’ prospectus.

The Funds have identical investment objectives and similar investment strategies and restrictions. Both Funds seek to maximize capital appreciation. Both Funds use a growth style of investment in equity securities, including common and preferred stocks, American Depositary Receipts and Global Depositary Receipts. For the Driehaus International Discovery Fund, there are no restrictions on the capitalization of companies whose securities the Fund may buy. Under normal market conditions, the Driehaus International Discovery Fund invests substantially all (no less than 65%) of its assets in at least three countries other than the United States. Under normal market conditions, the Driehaus International Small Cap Growth Fund invests at least 80% of its net assets (plus the amount of borrowings for investment purposes) in the equity securities of non-U.S. small capitalization companies. The Adviser currently considers non-U.S. small capitalization companies to be companies located in the same countries and within the same market capitalization range at the time of investment as those included in the MSCI All Country World ex USA Small Cap Growth Index. As of April 30, 2014, approximately 92% of the MSCI All Country World ex USA Small Cap Growth Index consisted of companies with a market capitalization of less than $5 billion. In addition, while the Driehaus International Small Cap Growth Fund invests primarily in the equity securities of non-U.S. companies, it may invest up to a maximum of 20% of its assets in equity securities of U.S. companies.

Both Funds may invest substantial portions of their assets in emerging markets from time to time and in companies with limited operating histories. Both Funds also invest in a low number of issuers, making them both non-diversified funds.

Investment decisions for both Funds’ growth style of investing are based on the determination that a company’s revenue and earnings growth can materially exceed market expectations and that the security is at an attractive entry point. This decision involves evaluating fundamental factors, including the company’s business model, the competitive landscape, upcoming product introductions and recent and projected financial metrics. The decision is also based on the evaluation of technical or market factors, including price and volume trends, relative strength and institutional interest. To a lesser extent, the Adviser also utilizes macroeconomic or country-specific analyses to evaluate the sustainability of a company’s growth rate. Both Funds sell holdings for a variety of reasons, including the deterioration of the earnings profile, the violation of specific technical thresholds, to shift into securities with more compelling risk/reward characteristics or to alter sector or country exposure.

The Funds also have identical investment restrictions, except that the Driehaus International Small Cap Growth Fund has an additional non-fundamental investment restriction to invest, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in equity securities of non-U.S. small capitalization companies (the “Names Rule Requirement”).

2

Table of Contents

Investment Risks

An investment in the Driehaus International Discovery Fund is subject to the same types of risks as an investment in the Driehaus International Small Cap Growth Fund, except that the Driehaus International Discovery Fund is also subject to medium-sized company risk. Below are the main risks of investing in the Driehaus International Small Cap Growth Fund:

Market Risk. The Fund is subject to market risk, which is the possibility that stock prices overall will decline over short or even long periods. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. These fluctuations are expected to have a substantial influence on the value of the Fund’s shares.

Growth Stock Risk. Growth stocks are typically priced higher than other stocks, in relation to earnings and other measures, because investors believe they have more growth potential. This potential may or may not be realized and, if it is not realized, may result in a loss to the Fund. Growth stock prices also tend to be more volatile than the overall market.

Foreign Securities and Currencies Risk. The Fund invests in foreign securities. Investing outside the United States involves different risks than domestic investments. The following risks may be associated with foreign investments: less liquidity; greater volatility; political instability; restrictions on foreign investment and repatriation of capital; less complete and reliable information about foreign companies; reduced government supervision of some foreign securities markets; lower responsiveness of foreign management to shareholder concerns; economic issues or developments in foreign countries; fluctuation in exchange rates of foreign currencies and risks of devaluation; imposition of foreign withholding and other taxes; dependence of emerging market companies upon commodities which may be subject to economic cycles; and emerging market risk such as limited trading volume, expropriation, devaluation or other adverse political or social developments.

To the extent portfolio securities are issued by foreign issuers or denominated in foreign currencies, the Fund’s investment performance is affected by the strength or weakness of the U.S. dollar against these currencies.

Emerging Market Risk. The Fund invests in emerging markets and therefore, the risks described above for foreign securities are typically increased. Investments in securities of issuers located in such countries are speculative and subject to certain special risks. The small size, limited trading volume and relative inexperience of the securities markets in these countries may make the Fund’s investments in such countries illiquid and more volatile than investments in more developed countries, and the Fund may be required to establish special custodial or other arrangements before making investments in these countries. There may be little financial or accounting information available with respect to issuers located in these countries, and it may be difficult as a result to assess the value or prospects of an investment in such issuers.

Small-Sized Company Risk. The Fund invests in companies that are smaller, less established, with less liquid markets for their stock, and therefore may be riskier investments. While small-sized companies generally have the potential for rapid growth, the securities of these companies often involve greater risks than investments in larger, more established companies because small-sized companies may lack the management experience, financial resources, product diversification and competitive strengths of larger companies. In addition, in many instances the securities of small-sized companies are traded only over-the-counter or on a regional securities exchange, and the frequency and volume of their trading is substantially less than is typical of larger companies. The value of securities of smaller, less well-known issuers can be more volatile than that of larger issuers.

3

Table of Contents

Nondiversification. Because the Fund may invest a greater percentage of assets in a particular issuer or a small number of issuers, it may be subject to greater risks and larger losses than diversified funds. The value of the Fund may vary more as a result of changes in the financial condition or the market’s assessment of the issuers than a more diversified fund.

Allocation Risk. The Fund’s overall risk level will depend on the countries and market sectors in which the Fund is invested. Because the Fund may have significant weightings in a particular company, country, industry or market sector, the value of Fund shares may be affected by events that adversely affect that company, country, industry or market sector and may fluctuate more than that of a less focused fund.

High Rates of Turnover. It is anticipated that the Fund will experience high rates of portfolio turnover, which may result in payment by the Fund of above-average transaction costs and could result in the payment by shareholders of taxes on above-average amounts of realized investment gains, including net short-term capital gains, which are taxed as ordinary income for federal income tax purposes.

Manager Risk. How the Fund’s investment adviser manages the Fund will impact the Fund’s performance. The Fund may lose money if the investment adviser’s investment strategy does not achieve the Fund’s objective or the investment adviser does not implement the strategy successfully.

Fees and Expenses

The following comparative fee table shows the fees for the Driehaus International Discovery Fund and the Driehaus International Small Cap Growth Fund as of December 31, 2013. The pro forma fees and expenses show the Driehaus International Small Cap Growth Fund’s fees assuming that the Reorganization occurred on June 30, 2014.

Shareholder Fees and Annual Operating Expenses

(As a Percentage of Average Net Assets)

Because all Driehaus Mutual Funds are no-load investments, neither the Driehaus International Small Cap Growth Fund nor the Driehaus International Discovery Fund charges any shareholder fees (such as sales loads) when you buy or sell shares of the Funds unless you sell your shares within 60 days after purchase. In that case, the Funds’ redemption fee of 2.00% of the amount redeemed may apply. Effective January 1, 2014, the Driehaus International Discovery Fund’s annual management fee was reduced from 1.35% (on the first $1 billion of average daily net assets and 1.25% thereafter) to 1.25% (on all assets) of average daily net assets.

4

Table of Contents

This table describes the fees and expenses that you pay if you buy and hold Fund shares.

| Driehaus International Discovery Fund |

Driehaus International Small Cap Growth Fund |

Pro Forma – Driehaus International Small Cap Growth Fund |

||||||||||

| Shareholder Fees (fees paid directly from your investment) |

||||||||||||

| Maximum Sales Charge Imposed on Purchases |

None | None | None | |||||||||

| Maximum Deferred Sales Charge |

None | None | None | |||||||||

| Maximum Sales Charge Imposed on Reinvested Dividends |

None | None | None | |||||||||

| Redemption Fee (as a % of amount redeemed within 60 days of purchase) |

2.00 | % | 2.00 | % | 2.00 | % | ||||||

| Exchange Fee |

None | None | None | |||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

||||||||||||

| Management Fee |

1.25 | %(1) | 1.50 | % | 1.50 | % | ||||||

| Other Expenses |

0.30 | % | 0.23 | % | 0.20 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total Annual Fund Operating Expenses |

1.55 | %(2) | 1.73 | % | 1.70 | % | ||||||

| (1) | The management fee has been restated to reflect the reduction in the rate, effective January 1, 2014. |

| (2) | For the pro forma period July 1, 2013 to June 30, 2014, the Management Fee was 1.30% and Other Expenses were 0.35%, which would result in Total Annual Fund Operating Expenses of 1.65% for the pro forma period. |

Example

This example is intended to help you compare the cost of investing in the Funds with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in a Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Fund |

1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||

| Driehaus International Discovery Fund |

$ | 158 | $ | 490 | $ | 845 | $ | 1,845 | ||||||||

| Driehaus International Small Cap Growth Fund |

$ | 176 | $ | 545 | $ | 939 | $ | 2,041 | ||||||||

| Pro Forma – Driehaus International Small Cap Growth Fund |

$ | 173 | $ | 536 | $ | 923 | $ | 2,009 | ||||||||

Portfolio Turnover

The Funds pay transaction costs, such as commissions, when they buy and sell securities (or “turn over” their portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Funds’ performance. During the most recent fiscal year, the Driehaus International Discovery Fund’s portfolio turnover rate was 156% of the

5

Table of Contents

average value of its portfolio and the Driehaus International Small Cap Growth Fund’s portfolio turnover rate was 320% of the average value of its portfolio.

Investment Adviser

Driehaus Capital Management LLC, 25 East Erie Street, Chicago, Illinois 60611, is the investment adviser to the Funds. DCM is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. DCM was organized in 1982 and as of , 2014 managed approximately $ in assets. DCM is responsible for providing investment advisory and management services to the Funds, subject to the direction of the Board.

The Driehaus International Discovery Fund currently is managed by Joshua Rubin. Prior to assuming sole portfolio manager responsibilities on September 12, 2014, Mr. Rubin served as an assistant portfolio manager of the Fund since May 1, 2013. Mr. Rubin has responsibility for making investment decisions on behalf of the Fund. Mr. Rubin earned a B.S.F.S. in International Politics from Georgetown University. Prior to joining the Adviser in 2012, Mr. Rubin was a portfolio manager for Marsico Capital Management where he co-managed an emerging markets mutual fund. He also served as an emerging markets senior analyst, leading the global energy, industrials and materials research efforts for Marsico’s six other funds. Prior to this role, Mr. Rubin was an analyst at the investment bank George K. Baum & Company.

David Mouser has assisted in the management of Driehaus International Small Cap Growth Fund since its inception on September 17, 2007 and became the lead portfolio manager on May 1, 2012. Mr. Mouser is responsible for making investment decisions on behalf of the Fund. Since September, 2005, Mr. Mouser was the assistant portfolio manager for the Driehaus International Opportunities Fund, L.P., the predecessor limited partnership to the Fund. Mr. Mouser joined the Adviser in 1999 upon completion of his B.S. degree in Finance from the University of Dayton. Prior to assuming portfolio management responsibilities, Mr. Mouser was an investment analyst with the Adviser.

Daniel Burr has been the co-portfolio manager for the Driehaus International Small Cap Growth Fund since May 1, 2014. He has responsibility for making investment decisions on behalf of the Fund. Mr. Burr received his B.S. in applied economics and business management from Cornell University in 2000 and completed his M.B.A. in 2006 with concentrations in finance and accounting from the University of Chicago Booth School of Business. Mr. Burr began his career at First Manhattan Consulting Group as an analyst from 2000 to 2001. Prior to joining Driehaus in 2013, Mr. Burr worked at Oberweis Asset Management, leaving with the title of senior international equity analyst. He joined the Adviser in 2013 as an investment analyst to the Fund prior to becoming co-portfolio manager.

Ryan Carpenter has been the assistant portfolio manager of the Driehaus International Small Cap Growth Fund since May 1, 2010. He has investment decision-making responsibilities for the Fund, subject to Messrs. Mouser’s and Burr’s approval. Mr. Carpenter joined the Adviser in 2007, upon completion of his B.A. degree in Finance from the University of Illinois at Chicago. Mr. Carpenter is also the portfolio manager for the Adviser’s International Realty strategy. Prior to assuming portfolio management responsibilities, Mr. Carpenter was an investment analyst with the Adviser.

The Funds’ Statement of Additional Information provides additional information about the portfolio managers’ compensation, other accounts managed and ownership of securities in the Funds.

Investment Advisory Fees

Each Fund pays the Adviser an annual investment management fee on a monthly basis as follows:

6

Table of Contents

| Fund |

As a percentage of average daily net assets |

|||

| Driehaus International Discovery Fund |

1.25 | % | ||

| Driehaus International Small Cap Growth Fund |

1.50 | % | ||

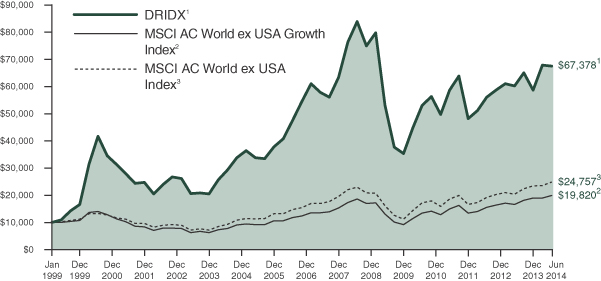

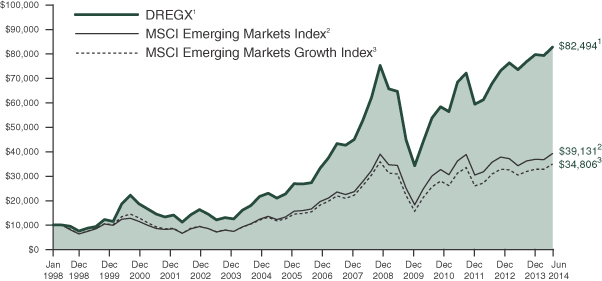

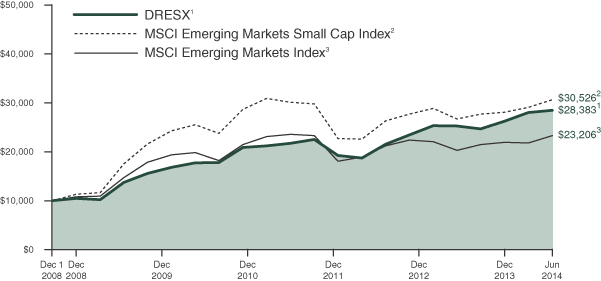

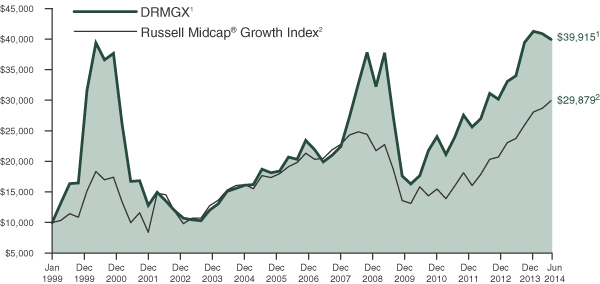

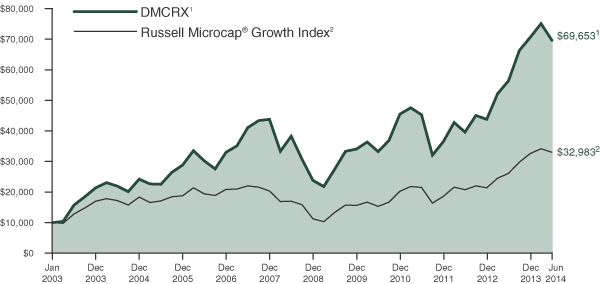

Performance

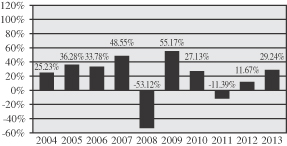

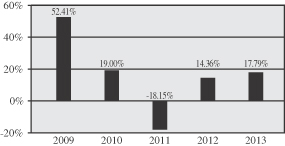

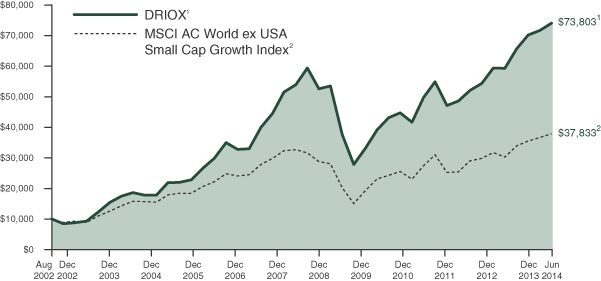

The bar charts and tables provide some indication of the risks of investing in the Funds. The bar charts shows the volatility—or variability—of a Fund’s annual total returns over time, and shows that Fund performance can change from year to year. The tables show a Fund’s average annual total returns for certain time periods compared to the returns of one or more broad-based securities indices. Of course, a Fund’s past performance (before and after taxes) is not necessarily an indication of its future performance. Updated performance information is available by visiting www.driehaus.com or by calling (800) 560-6111.

The Driehaus International Small Cap Growth Fund’s performance shown below includes the performance of the Driehaus International Opportunities Fund, L.P. (the “Predecessor Limited Partnership”), the Fund’s predecessor, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Predecessor Limited Partnership was established on August 1, 2002 and the Fund succeeded to the Predecessor Limited Partnership’s assets on September 17, 2007. The Predecessor Limited Partnership was not registered under the 1940 Act, and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Driehaus International Small Cap Growth Fund. After-tax performance returns are not included for the Predecessor Limited Partnership. The Predecessor Limited Partnership was not a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and therefore did not distribute current or accumulated earnings and profits and was not subject to the diversification and source of income requirements applicable to regulated investment companies.

The tables show returns on a before-tax and after-tax basis. After-tax returns are calculated using the highest historic marginal individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown in the table. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

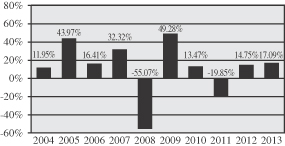

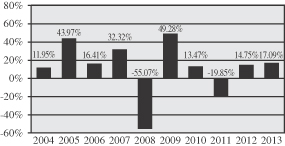

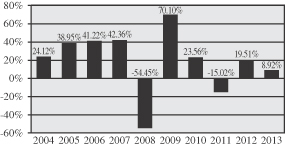

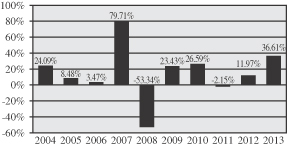

Annual Returns for the Years Ended December 31 — Driehaus International Discovery Fund

During the periods shown in the bar chart, the highest return for a quarter was 26.81% (quarter ended 6/30/09) and the lowest return for a quarter was –33.41% (quarter ended 9/30/08).

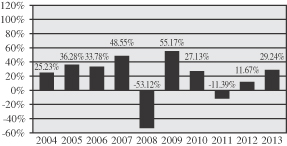

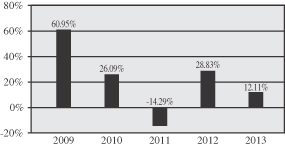

Annual Returns for the Years Ended December 31 — Driehaus International Small Cap Growth Fund

During the periods shown in the bar chart, the highest return for a quarter was 24.89% (quarter ended 6/30/09) and the lowest return for a quarter was –29.85% (quarter ended 9/30/08).

7

Table of Contents

Average Annual Total Returns as of December 31, 2013

| 1 year | 5 years | 10 years | ||||||||||

| Driehaus International Discovery Fund |

||||||||||||

| Returns Before Taxes |

17.09 | % | 12.78 | % | 7.36 | % | ||||||

| Returns After Taxes and Distributions |

17.09 | % | 12.66 | % | 6.01 | % | ||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

9.68 | % | 10.23 | % | 5.98 | % | ||||||

| MSCI All Country World ex USA Growth Index (reflects no deductions for fees, expenses or taxes) |

15.86 | % | 13.28 | % | 7.70 | % | ||||||

| MSCI All Country World ex USA Index (reflects no deductions for fees, expenses or taxes) |

15.78 | % | 13.32 | % | 8.03 | % | ||||||

| Fund Only | Including Predecessor Limited Partnership |

|||||||||||||||

| 1 year | 5 years | Since Inception (9/17/07- 12/31/13) |

10 Years | |||||||||||||

| Driehaus International Small Cap Growth Fund |

||||||||||||||||

| Returns Before Taxes |

29.24 | % | 20.33 | % | 5.57 | % | 14.90 | % | ||||||||

| Returns After Taxes and Distributions |

24.54 | % | 19.37 | % | 4.25 | % | N/A | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

18.07 | % | 16.38 | % | 3.88 | % | N/A | |||||||||

| MSCI All Country World ex USA Small Cap Growth Index (reflects no deductions for fees, expenses or taxes) |

18.82 | % | 18.77 | % | 2.18 | % | 9.50 | % | ||||||||

The Funds’ Purchase, Exchange and Redemption Procedures

The Driehaus International Small Cap Growth Fund is closed to new investors. An investor may purchase Driehaus International Small Cap Growth Fund shares and reinvest dividends and capital gains they receive on holdings of Fund shares in additional shares of the Fund if they are:

| • | A current Fund shareholder; |

| • | A participant in a qualified retirement plan that offers the Fund as an investment option or that has the same or a related plan sponsor as another qualified retirement plan that offers the Fund as an investment option; or |

| • | A financial advisor or registered investment adviser whose clients have Fund accounts. |

Investors may open a new account in the Driehaus International Small Cap Growth Fund if they:

| • | Are an employee of the Adviser or its affiliates or a Trustee of the Trust; |

| • | Exchange shares of another Driehaus Mutual Fund for shares of the Fund; |

8

Table of Contents

| • | Hold shares of the Fund in another account, provided the new account and the existing account are registered under the same address of record, the same primary Social Security Number or Taxpayer Identification Number, the same name(s), and the same beneficial owner(s); or |

| • | Are a financial advisor or registered investment adviser whose clients have Fund accounts. |

These restrictions apply to investments made directly through Driehaus Securities LLC, the Funds’ distributor, as well as investments made through intermediaries. Intermediaries that maintain omnibus accounts are not allowed to open new sub-accounts for new investors unless the investor meets the criteria listed above. Once an account is closed, additional investments will not be accepted unless the investor meets the criteria listed above. Investors may be required to demonstrate eligibility to purchase shares of the Fund before an investment is accepted. The Driehaus International Small Cap Growth Fund reserves the right to (i) eliminate any of the exceptions listed above and impose additional restrictions on purchases of Fund shares; and (ii) make additional exceptions that, in its judgment, do not adversely affect the Adviser’s ability to manage the Fund.

Generally, the procedures for purchasing, redeeming and exchanging shares of the Funds are identical.

Purchase Procedures. Shares of each Fund may be purchased directly from Driehaus Mutual Funds by mail, telephone or wire. Shares may also be purchased through investment dealers or other financial institutions.

The minimum initial purchase requirement for both Funds is $10,000 for regular accounts and $2,000 for IRAs. The minimum subsequent purchase requirement is $2,000 for regular accounts, $500 for IRA accounts, $100 for the automatic investment plan (monthly) and $300 for the automatic investment plan (quarterly).

Fund shares may be purchased at a price per share equal to the net asset value (“NAV”) next calculated after receipt of your purchase in good form. The NAV of each Fund is calculated as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally, 3:00 p.m. Central time) on each day the NYSE is open for trading. The NAV per share is determined by dividing the difference between the values of a Fund’s assets and liabilities by the number of its shares outstanding.

Exchange Privileges. Shares of a Fund that have been held for the applicable escrow period may be exchanged for shares of any other Driehaus Mutual Fund in an identically registered account, provided the Fund(s) has (have) the same transfer agent, is (are) available for purchase, the Fund(s) to be acquired is (are) registered for sale in the investor’s state of residence and they have met the minimum initial investment requirements. Procedures applicable to the purchase and redemption of a Fund’s shares are also applicable to exchanging shares, including the prices that investors receive and pay for the shares they exchange. Shareholders will automatically have the ability to exchange shares of any Driehaus Mutual Fund, subject to the qualifications noted above, by telephone unless a shareholder indicates on their application that they do not want this privilege. The Funds reserve the right to limit the number of exchanges between Funds and to reject any exchange order. The Funds reserve the right to modify or discontinue the exchange privilege at any time upon 60 days’ written notice. For federal income tax purposes, an exchange is treated the same as a sale and a shareholder may recognize a capital gain or loss upon an exchange, depending upon the cost or other basis of the shares exchanged. The 2.00% redemption fee also applies to shareholders who exchange their shares for any other Driehaus Mutual Fund shares within 60 days of purchase.

9

Table of Contents

Redemption Procedures. Shareholders may redeem shares by mail, telephone or wire. Redemptions are made at a Fund’s net asset value per share next calculated after receipt of a redemption order in good form. If a shareholder’s account balance drops below $5,000 due to redemptions ($1,500 for IRA Accounts), the Funds or an authorized financial institution may redeem the shareholder’s remaining shares and close the account. However, the shareholder will always be given at least 30 days’ notice to give him time to add to his account and avoid an involuntary redemption.

If a shareholder’s address of record has changed within the last 30 days, a redemption request exceeds $100,000, a shareholder requests that proceeds be sent to an address or an account that is different from the address or account of record, a redemption amount is to be wired to a bank other than one previously authorized or wire transfer instructions have been changed within 30 days of the request, then the Funds or an authorized financial institution will require a medallion signature guarantee.

Redemptions in Kind. Both Funds generally intend to pay all redemptions in cash. However, the Funds may pay you for shares you sell by “redeeming in kind”; that is, by giving you marketable securities if your requests over a 90-day period total more than $250,000 or 1% of the net assets of the relevant Fund, whichever is less. An in-kind redemption is taxable for federal income tax purposes in the same manner as a redemption for cash.

Dividend Policies. The Funds generally declare and pay dividends annually and distribute net capital gains, if any, at least annually. Shareholders will receive dividends and distributions in the form of additional shares unless they have elected to receive payment in cash. Dividends are taxable in the same manner for federal income tax purposes whether they are received in shares or cash.

INFORMATION RELATING TO THE REORGANIZATION

Description of the Reorganization. The following summary is qualified in its entirety by reference to the Reorganization Agreement, which is found in Exhibit A. The Reorganization Agreement provides for the Reorganization to occur on or about March 9, 2015, or such other date as to which the parties may agree.

The Reorganization Agreement provides that all of the assets and liabilities of the Driehaus International Discovery Fund will be transferred to the Driehaus International Small Cap Growth Fund. In exchange for the transfer of these assets and liabilities, the Driehaus International Small Cap Growth Fund will issue a number of its full and fractional voting shares to the Driehaus International Discovery Fund, equal in value to the aggregate net asset value of the Driehaus International Discovery Fund, calculated based on the value of the Driehaus International Discovery Fund’s assets, net of its liabilities, as of the Valuation Time.

Following the transfer of all the assets and liabilities in exchange for the Driehaus International Small Cap Growth Fund shares, the Driehaus International Discovery Fund will distribute all the shares of the Driehaus International Small Cap Growth Fund pro rata to its shareholders of record in complete liquidation. Shareholders of the Driehaus International Discovery Fund will receive a number of shares of the Driehaus International Small Cap Growth Fund with the same aggregate net asset value as the shares the shareholder had in the Driehaus International Discovery Fund as of the Valuation Time. Such distribution will be accomplished by the establishment of accounts in the names of the Driehaus International Discovery Fund’s shareholders on the share records of the Driehaus International Small Cap Growth Fund’s transfer agent. Each account will receive the respective pro rata number of full and fractional shares of the Driehaus International Small Cap Growth Fund due to the shareholders of the Driehaus International Discovery Fund. The Driehaus International Discovery Fund thereafter will be

10

Table of Contents

terminated. The Funds do not issue share certificates to shareholders. Shares of the Driehaus International Small Cap Growth Fund to be issued will have no preemptive or conversion rights.

The Reorganization Agreement contains customary representations, warranties and conditions. The Reorganization Agreement provides that the consummation of the Reorganization is conditioned upon, among other things: (i) approval of the Reorganization by a majority of the Driehaus International Discovery Fund’s shareholders; and (ii) the receipt by the Funds of a tax opinion substantially to the effect that the transfers made pursuant to the Reorganization will not result in the recognition of gain or loss for federal income tax purposes by the Funds or the shareholders of the Target Fund. The Reorganization Agreement may be terminated if, before the Closing Date, any of the required conditions have not been met, the representations and warranties are not true, or the Board determines that the Reorganization is not in the best interests of a Fund.

Costs of Reorganization. The Adviser has agreed to pay the expenses incurred in connection with the Reorganization. Reorganization expenses include, without limitation: (a) expenses associated with the preparation and filing of this Proxy Statement/Prospectus; (b) postage; (c) printing; (d) accounting fees; (e) legal fees incurred by each Fund; (f) solicitation costs of the transaction; and (g) other related administrative or operational costs. The Adviser has also agreed to pay any explicit transaction costs related to the Target Fund’s sale of portfolio holdings that are required in order to comply with the Acquiring Fund’s investment policy, under normal market conditions, to invest at least 80% of its net assets (plus the amount of borrowings for investment purposes) in equity securities of non-U.S. small capitalization companies (the Names Rule Requirement).

FEDERAL INCOME TAX CONSEQUENCES

The Reorganization is intended to qualify for U.S. federal income tax purposes as a reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended. If it so qualifies, neither the Target Fund nor its shareholders will recognize gain or loss as a direct result of the Reorganization; the basis of the Driehaus International Small Cap Growth Fund shares received by the Target Fund’s shareholders will be the same as the basis of the Target Fund shares exchanged therefor; and the holding period of the Driehaus International Small Cap Growth Fund shares received will include the holding period of the Target Fund shares exchanged therefor, provided that the shares exchanged were held as capital assets at the time of the Reorganization. As a condition to the closing of the Reorganization, the Funds will receive an opinion from counsel to the Trust substantially to that effect. No tax ruling from the Internal Revenue Service regarding the Reorganization has been requested. The opinion of counsel is not binding on the Internal Revenue Service and does not preclude the Internal Revenue Service from adopting a contrary position.

The sale of securities by the Target Fund before the Reorganization, whether in the ordinary course of business or in anticipation of the Reorganization, could result in taxable distributions to Target Fund shareholders prior to the effective time of the Reorganization.

After the Reorganization, the Acquiring Fund’s ability to use the Target Fund’s or the Acquiring Fund’s pre-Reorganization capital losses, if any, may be limited under certain federal income tax rules applicable to reorganizations of this type. Therefore, in certain circumstances, shareholders may pay federal income tax sooner, or may pay more federal income taxes, than they would have had the Reorganization not occurred. The effect of these potential limitations will depend on a number of factors, including the amount of the losses, the amount of gains to be offset, the exact timing of the Reorganization and the amount of unrealized capital gains in the Funds at the time of the Reorganization. As of December 31, 2013, the Funds had capital loss carryforwards as follows:

11

Table of Contents

| Target Fund | Acquiring Fund | |||||||

| Expiration: |

||||||||

| December 31, 2016 |

$ | 119,874,502 | $ | — | ||||

| December 31, 2017 |

$ | 109,113,076 | $ | — | ||||

| Not subject to expiration: |

— | — | ||||||

| Total |

$ | 228,987,578 | $ | — | ||||

|

|

|

|

|

|||||

For net capital losses arising in taxable years beginning after December 22, 2010 (“post-enactment losses”), a Fund will generally be able to carryforward such capital losses indefinitely. A Fund’s net capital losses from taxable years beginning on or prior to December 22, 2010 (“pre-enactment losses”), however, will remain subject to their current expiration dates and can be used only after the post-enactment losses.

In addition, shareholders of the Target Fund will receive a proportionate share of any taxable income and gains realized by the Acquiring Fund and not distributed to its shareholders prior to the Reorganization when such income and gains are eventually distributed by the Acquiring Fund. As a result, shareholders of the Target Fund may receive a greater amount of taxable distributions than they would have had the Reorganization not occurred.

The preceding is only a general summary of certain U.S. federal income tax consequences to shareholders of the Target Fund. Shareholders should consult their own tax advisers concerning the potential tax consequences of the Reorganization to them, including foreign, state and local tax consequences.

The following table sets forth as of June 30, 2014: (i) the unaudited capitalization of the Acquiring Fund; (ii) the unaudited capitalization of the Target Fund; and (iii) the unaudited pro forma combined capitalization of the Acquiring Fund, assuming the Reorganization has taken place. The capitalizations are likely to be different on the Closing Date as a result of daily share purchase and redemption activity.

| Fund |

Net Assets | Net Asset Value Per Share |

Shares Outstanding |

|||||||||

| Driehaus International Discovery Fund |

$ | 118,578,396 | $ | 32.04 | 3,700,739 | |||||||

| Driehaus International Small Cap Growth Fund |

$ | 252,629,412 | $ | 11.43 | 22,107,999 | |||||||

| Pro Forma – Driehaus International Small Cap Growth Fund |

$ | 371,207,808 | $ | 11.43 | 32,484,982 | |||||||

REASONS FOR THE REORGANIZATION

DCM and the Board have considered possible solutions for investors of the Target Fund as a result of continued underperformance. DCM has recommended to the Board that the Target Fund be merged into the Acquiring Fund, which has many comparable characteristics. Both Funds have always had a primary objective of maximizing capital appreciation, which they pursue using a growth style of investing. They each invest in equity securities of non-U.S. companies and make investment decisions using the same investment philosophy. The key difference between the two Funds is that the Target Fund has no restriction on the market capitalization of the companies whose securities it may buy, while the Acquiring Fund must, under normal market conditions, invest at least 80% of its net assets (plus the

12

Table of Contents

amount of borrowings for investment purposes) in the equity securities of non-U.S. small-capitalization companies. The Funds’ risks, policies and restrictions are otherwise substantially similar. On October 23, 2014, the Board, including the Trustees who are not “interested persons” (within the meaning of the 1940 Act), voted to approve the Reorganization and to recommend its approval to shareholders of the Target Fund.

In determining to recommend that the shareholders of the Target Fund approve the Reorganization, the Board considered the factors described below, among others:

• In light of the Target Fund’s relatively poor performance, small size and net redemptions, DCM no longer considers the Target Fund to be viable.

• DCM has proposed merging the Target Fund into the Acquiring Fund because DCM believes the Acquiring Fund is the best investment fit for Target Fund shareholders given that the investment objective of the Target and Acquiring Funds is the same and the investment strategies are similar, with similar investment restrictions.

• The Acquiring Fund has a long-term investment performance record that is substantially stronger than that of the Target Fund.

• The Acquiring Fund has a better performance record relative to its peers than does the Target Fund.

• DCM has represented that the Acquiring Fund has sufficient capacity to permit DCM to effectively manage the assets received from the Target Fund.

• DCM will pay the costs associated with the Reorganization, including the explicit transaction costs related to any trades by the Target Fund that are required in order for the Acquiring Fund to continue to comply with the Names Rule Requirement at the time of the Reorganization.

• The Reorganization will provide Target Fund shareholders with a continuing investment alternative managed by DCM and is expected to be accomplished on a tax-free basis.

• The non-management fee expense ratio of the Acquiring Fund is lower than that of the Target Fund.

• The higher management fee of the Acquiring Fund over that of the Target Fund reflects the capacity constraints of the Acquiring Fund that do not exist in the Target Fund.

• The total expense ratio of the Acquiring Fund ranked at the 30% percentile (1% being the highest expense ratio) in comparison to its Lipper peer group as of June 30, 2014.

• If the Target Fund continues to have net redemptions, its expense ratio will increase, potentially to a level close to that of the Acquiring Fund.

The Board concluded that the Reorganization would not result in the dilution of the interests of current shareholders in either the Target Fund or the Acquiring Fund.

The Board noted that the services available to shareholders of the Target Fund would be identical to those available to shareholders of the Acquiring Fund.

13

Table of Contents

The Reorganization is intended to qualify as a reorganization for U.S. federal income tax purposes, resulting in no gain or loss being recognized by the Target Fund or its shareholders as a direct result of the Reorganization.

The Board also considered the alternatives to the Reorganization.

Based on all of the foregoing, the Board concluded that the Target Fund’s participation in the Reorganization would be in the best interests of the Target Fund and would not dilute the interests of the Target Fund’s existing shareholders.

The Board recommends that shareholders of the Target Fund vote FOR the Reorganization.

General. The Trust is an open-end management investment company established as a Delaware statutory trust pursuant to the Declaration of Trust. The Trust is also governed by its By-Laws and applicable Delaware state law.

Shares. The Trust is authorized to issue an unlimited number of shares of beneficial interest, without par value, from an unlimited number of series of shares. Currently, the Trust consists of nine separate investment series. The shares of the Funds have no preference as to conversion features, exchange privileges or other attributes, and have no preemptive rights.

Voting Rights. On any matter submitted to a vote of shareholders, all shares entitled to vote are voted on by individual series, except that: (i) when so required by the 1940 Act, the shares are voted in the aggregate and not by individual series; and (ii) when the Trustees of the Trust have determined that the matter only affects the interest of one or more series, then only shareholders of such series are entitled to vote.

Shareholder Meetings. The Trust is not required to hold annual meetings of shareholders, but may hold special meetings of shareholders under certain circumstances. A special meeting of shareholders may be called at any time by the Trustees or on the written request of shareholders owning at least one-tenth of the outstanding shares entitled to vote.

Election and Term of Trustees. The Trust’s affairs are supervised by the Board under the laws governing statutory trusts in the State of Delaware. Subject to 1940 Act requirements, Trustees may be elected by shareholders or appointed in accordance with the Trust’s Declaration of Trust. Under the Declaration of Trust, Trustees hold office during the lifetime of the Trust and until its termination, or until their successors are duly elected and qualified, or until their death, removal or resignation. A Trustee may be removed at any time by written instrument signed by at least 80% (two-thirds with cause) of the number of Trustees prior to such removal or with or without cause by a vote of shareholders owning at least two-thirds of the outstanding shares entitled to vote. Pursuant to the Trust’s Governance Guidelines and Procedures, each Independent Trustee who has joined the Board after January 1, 2011 shall retire no later than December 31 of the year in which the Independent Trustee reaches the age of 75 (the “Retirement Date”). Trustees who are “interested persons” (within the meaning of the 1940 Act) and Independent Trustees who joined the Board prior to January 1, 2011 are not subject to the Retirement Date.

14

Table of Contents

Shareholder Liability. Pursuant to Delaware state law and the Trust’s Declaration of Trust, shareholders of the Funds generally are not personally liable for the acts, omissions or obligations of the Trustees or the Trust.

Trustee Liability. Pursuant to Delaware state law and the Declaration of Trust, Trustees are not personally liable to any person other than the Trust and the shareholders for any act, omission or obligation of the Trust or another Trustee. Pursuant to the Declaration of Trust, no person who is or has been a Trustee shall be subject to any personal liability to the Trust or shareholders except for liability arising from failure to perform his or her duties in conformance with the Declaration of Trust or from his or her own bad faith, willful misfeasance, gross negligence or reckless disregard of his or her duties. The Trust generally indemnifies Trustees against all liabilities and expenses incurred by reason of being a Trustee, except subject to applicable law.

The foregoing is only a summary of certain rights of shareholders of the Funds under the Trust’s governing charter documents, by-laws and state law, and is not a complete description of provisions contained in those sources. Shareholders should refer to the provisions of those documents and state law directly for a more thorough description.

Information concerning the operation and management of the Funds is included in the current prospectus relating to the Funds, the relevant portions of which are incorporated herein by reference and a copy of which accompanies this Proxy Statement/Prospectus. Additional information about the Funds is included in the Statement of Additional Information for the Funds dated April 30, 2014, which is available upon request and without charge by calling (800) 560-6111.

Householding. In order to provide greater convenience to shareholders and cost savings to the Funds by reducing the number of duplicate shareholder mailings, only one copy of most financial reports, proxy statements and prospectuses will be mailed to households, even if more than one person in a household owns shares of the Fund.

Interest of Certain Persons in the Reorganization. The Adviser may be deemed to have an interest in the Reorganization because it provides investment advisory services to the Funds pursuant to advisory agreements with the Funds. Future growth of the Funds can be expected to increase the total amount of fees payable to the Adviser.

Fiscal Year End and Financial Statements. The fiscal year end of each Fund is December 31.

The financial statements of the Funds contained in the Funds’ annual report to shareholders for the fiscal year ended December 31, 2013 have been audited by Ernst & Young LLP, their independent auditor. The unaudited financial statements for the Funds for the period ended June 30, 2014 are incorporated by reference into this Proxy Statement/Prospectus, and a copy of the Acquiring Fund’s unaudited financial statements for the period ended June 30, 2014 is included with this Proxy Statement/Prospectus. The Funds will furnish, without charge, a copy of their most recent semi-annual or annual report, on request. Requests should be directed to the Funds at P.O. Box 9817, Providence, Rhode Island 02940, or by calling (800) 560-6111.

Federal Income Tax Considerations. For a discussion of the federal income tax issues relating to buying, holding, exchanging and selling any of the Funds’ shares, please see the accompanying prospectus.

15

Table of Contents

General Information. This Proxy Statement/Prospectus is being furnished in connection with the solicitation of proxies by the Board. It is expected that the solicitation of proxies will be primarily by mail. Officers and service contractors of the Trust may also solicit proxies by the Internet or by other means. D.F. King has been engaged to assist in the solicitation of proxies. The total costs of solicitation (including the printing and mailing of this Proxy Statement/Prospectus, meeting notice and form of proxy, as well as any necessary supplementary solicitations) are expected to be $ and will be borne by the Adviser.

Voting Rights and Required Vote. Shareholders of the Target Fund are entitled to one vote for each full share held and fractional votes for fractional shares held. One-third of the shares of the Target Fund entitled to vote, present in person or by proxy, constitutes a quorum. Approval of the Reorganization with respect to the Target Fund requires the vote of a majority of the shares of the Fund entitled to vote, present in person or by proxy. Any shareholder giving a proxy may revoke it at any time before it is exercised by submitting to the Trust a written notice of revocation or a subsequently executed proxy or by attending the Meeting and voting in person. The proposed Reorganization will be voted upon only by the shareholders of the Target Fund.

Shares represented by a properly executed proxy will be voted in accordance with the instructions thereon, or if no specification is made, the shares will be voted “FOR” the approval of the Reorganization. It is not anticipated that any matters other than the approval of the Reorganization will be brought before the Meeting. Should other business properly be brought before the Meeting, it is intended that the accompanying proxies will be voted in accordance with the judgment of the persons named as such proxies. For the purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated as shares that are present but which have not been voted. For this reason, abstentions and broker non-votes will have the effect of a “no” vote for purposes of obtaining the requisite approval of the Reorganization.

If sufficient votes in favor of the proposal set forth in the Notice of the Special Meeting are not received by the time scheduled for the Meeting, the shareholders present in person or by proxy at the Meeting and entitled to vote at the Meeting, whether or not sufficient to constitute a quorum, may adjourn the Meeting. Any business that might have been transacted at the Meeting originally called may be transacted at any such adjourned session(s) at which a quorum is present.

Record Date and Outstanding Shares. Only shareholders of record of the Driehaus International Discovery Fund at the close of business on November 28, 2014 (the “Record Date”) are entitled to notice of and to vote at the Meeting and any postponement or adjournment thereof. At the close of business on the Record Date, shares of the Driehaus International Discovery Fund were outstanding and entitled to vote.

Security Ownership of Certain Beneficial Owners and Management

Target Fund. As of the Record Date, the officers and Trustees of the Trust as a group, beneficially owned % of the outstanding shares of the Driehaus International Discovery Fund.

The following table sets forth the holdings of the shares of the Driehaus International Discovery Fund as of the Record Date, of each person known to own, control, or hold with power to vote 5% or

16

Table of Contents

more of the Fund’s outstanding voting securities, and the estimated pro forma percentages of ownership of the combined Fund after the Reorganization:

| Name and Address |

Percentage Ownership | Estimated Pro Forma Percentage of the Combined Fund After the Reorganization |

Acquiring Fund. As of the Record Date, the officers and Trustees of the Trust as a group, beneficially owned % of the outstanding shares of the Driehaus International Small Cap Growth Fund.

The following table sets forth the holdings of the shares of the Driehaus International Small Cap Growth Fund as of the Record Date, of each person known to own, control, or hold with power to vote 5% or more of the Fund’s outstanding voting securities, and the estimated pro forma percentages of ownership of the combined Fund after the Reorganization:

| Name and Address |

Percentage Ownership | Estimated Pro Forma Percentage of the Combined Fund After the Reorganization |

[Control Persons. As of the Record Date, to the best of the knowledge of the Trust, there were no control persons, as defined by the 1940 Act, of either Fund.]

The Board knows of no other business to be brought before the Meeting. However, if any other matters come before the Meeting, it is the intention that proxies that do not contain specific restrictions to the contrary will be voted on such matters in accordance with the judgment of the persons named in the enclosed form of proxy.

Shareholder inquiries may be addressed by calling (888) 636-8835.

Shareholders who do not expect to be present at the Meeting are requested to vote using the methods described on the enclosed proxy card.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to be held on February 11, 2015:

The Notice of Special Meeting and the Proxy Statement/Prospectus are available at www.proxyonline.com/docs/driehaus.pdf .

17

Table of Contents

By Order of the Board of Trustees,

Diane J. Drake

Secretary

DRIEHAUS MUTUAL FUNDS

18

Table of Contents

AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (the “Agreement”) is made as of this 23rd day of October, 2014 by Driehaus Mutual Funds, a Delaware statutory trust (the “Trust”), on behalf of and between Driehaus International Small Cap Growth Fund (the “Acquiring Fund”) and Driehaus International Discovery Fund (the “Target Fund” and, together with the Acquiring Fund, the “Funds”); and Driehaus Capital Management LLC (the “Adviser”), the investment adviser to the Funds (for purposes of Section 9.1 of the Agreement only).

This Agreement is intended to be, and is adopted as, a plan of reorganization within the meaning of Section 368 of the United States Internal Revenue Code of 1986, as amended (the “Code”), and the Treasury Regulations promulgated thereunder. The reorganization will consist of: (i) the transfer of all of the assets of the Target Fund to the Acquiring Fund in exchange for voting shares of beneficial interest, no par value per share, of the Acquiring Fund (“Acquiring Fund Shares”) and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution of the Acquiring Fund Shares to the shareholders of the Target Fund as part of the termination, dissolution and complete liquidation of the Target Fund as provided herein, all upon the terms and conditions set forth in this Agreement (the “Reorganization”).

WHEREAS, each Fund is a separate series of the Trust, and the Trust is an open-end, management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”);

WHEREAS, the Board of Trustees of the Trust has determined that the Reorganization, with respect to the Acquiring Fund, is in the best interests of the Acquiring Fund and that the interests of the existing shareholders of the Acquiring Fund will not be diluted as a result of the Reorganization; and

WHEREAS, the Board of Trustees of the Trust has determined that the Reorganization, with respect to the Target Fund, is in the best interests of the Target Fund and that the interests of the existing shareholders of the Target Fund will not be diluted as a result of the Reorganization.