ex_694515.htm

Exhibit 10.1

PURCHASE AND SALE AGREEMENT

For

FARMOUT ASSIGNMENT

This Purchase and Sale Agreement for Farmout Assignment (this “Agreement”) is entered into this 26th day of June, 2024, to be effective as of June 1, 2024, (the “Effective Date”) by and between U.S. Energy Corp, a Delaware corporation, whose address is 1616 S. Voss, Houston, Texas 77057 (“USEG” or “Buyer”) and Wavetech Helium, Inc., a Colorado corporation, whose address is 1801 Broadway, Suite 600, Denver, Colorado 80202 (“Wavetech” or “Seller”). USEG and Wavetech are sometimes referred to herein individually as a “Party” and collectively as the “Parties.”

WHEREAS, effective February 8, 2022, Wavetech entered into an agreement (the “Farmout Agreement”) with Falcon Energy Partners, LLC, Tom and Jo Swanson Trust, and Zana Resources, LLC (collectively “Farmors”) under which Wavetech has the exclusive right to earn all of Farmors’ right, title and interest in the following within the area depicted on Exhibit “A” attached hereto (the “Property”): (i) all oil, gas, minerals, leases, assignments, conveyances, partial assignments, or other interests of any nature or kind, specifically including helium, and (ii) all substances produced in association with all formations (insofar as (i) and (ii) cover formations below the top of the Potlach Anhydrite formation in Toole County, Montana (the “Covered Depths”)), (such rights as to (i) and (ii) as to the Covered Depths the “Earned Interests”);

WHEREAS, Wavetech’s right under the Farmout to an assignment from Farmors of the Earned Interests vests upon the drilling of two wells on the Property (“Earning Wells”) commenced on or before July 1, 2024 (the “Commencement Deadline”) to the top of the Precambrian formation (the “Earning Conditions”); and

WHEREAS, USEG desires to purchase and receive from Wavetech an assignment of eighty-two and one-half percent (82.5%) of Wavetech’s rights and obligations under the Farmout Agreement (the “Assigned Rights”), and Wavetech desires to sell and deliver to USEG the Assigned Rights, subject to all rights of Farmors, with Seller excepting and reserving the remaining seventeen and one-half percent (17.5%) of Wavetech’s rights and obligations under the Farmout Agreement (the “Seller Reserved Interest”).

NOW THEREFORE, for the mutual benefits and covenants contained herein, and for other good and valuable consideration, the Parties agree to the following terms and conditions:

| |

1.

|

Purchase and Sale. Subject to the terms herein, Buyer agrees to purchase and receive the Assigned Rights from Seller, and Seller agrees to sell and deliver the Assigned Rights to Buyer.

|

| |

2.

|

Purchase Price. On the date of Closing, Buyer will pay or deliver to Seller the following (the “Purchase Price”):

|

| |

a.

|

Cash. Two million dollars ($2,000,000.00) (the “Cash”), plus

|

| |

b.

|

Shares. Two million six hundred thousand (2,600,000) shares of U.S. Energy restricted common stock (the “Shares”), and

|

| |

c.

|

The Carried Working Interest. The “Carried Working Interest” means Buyer’s commitment to cover, pay for and be liable for one hundred percent (100%) of all Seller Costs attributable to the Seller Reserved Interest during the Carry Period. The “Carry Period” is the Effective Date of this Agreement through the date that the Seller Costs attributable to the Seller Reserved Interest total twenty-million dollars ($20,000,000.00) (the “Carry Amount”). “Seller Costs” are all capital costs, including costs relating to project exploration, appraisal, development, of drilling, completing, and equipping any and all wells to the extent that such costs are chargeable to or payable by Seller under the Joint Operating Agreement attached hereto as Exhibit “B,” naming Buyer as the Operator (the “JOA”). Monthly lease operating expenses (including without limitation rental payments, lease maintenance payments and title curative expenses and payments) (“LOE”) shall not be considered Seller Costs and shall be accounted as per Exhibit “C” attached to the JOA. During the Carry Period, LOE shall be netted against revenue. In the event that there is not sufficient revenue to cover LOE during a particular month, then during the Carry Period, any negative LOE will be carried forward to the next operating month and offset against future net revenue until the cumulative negative LOE is fully offset. Buyer has the option to apply a portion or all of the negative LOE to the outstanding Carry Amount. Following expiration of the Carry Period, Seller shall be liable for all costs and expenses under the JOA attributable to its working interests.

|

| |

3.

|

Closing. Upon execution of this Agreement (“Closing”), Seller shall deliver to Farmors by notice mutually acceptable to Seller and Buyer that effective upon execution of this Agreement:

|

| |

a.

|

The Parties have entered into this Agreement.

|

| |

b.

|

Buyer or its designee will be the operator of any Earning Wells under the rights granted in Section 1.3 of the Farmout Agreement.

|

| |

c.

|

Upon satisfaction of the Earning Conditions and receiving an assignment under Section 1.2 of the Farmout Agreement, Seller will assign to Buyer an undivided eighty-two and one-half percent (82.5%) of the Earned Interests.

|

| |

d.

|

Buyer has assumed all rights of Seller under Section 1.4 of the Farmout Agreement to receive assistance from Farmors in clarifying title and preparing, executing, filing and/or recording instruments to perfect title to the Assigned Interests as that term is defined in the Farmout Agreement.

|

| |

e.

|

Buyer is assuming the position of Seller under Section 1.5 of the Farmout regarding coordination of operations with Farmors.

|

| |

f.

|

Buyer is assuming Seller’s rights to receive Property Documents under Section 1.7 of the Farmout Agreement.

|

| |

g.

|

Buyer is assuming Seller’s obligation under Section 1.9.1 of the Farmout Agreement to offer unsuccessful wells (among the initial two wells) to Farmors and to receive Farmors’ election thereunder. Any Farmout election shall cover both Buyer’s and Seller’s ownership interest in the well, plus a leasehold interest in the well only insofar as the leasehold interest covers the wellbore.

|

| |

h.

|

Buyer is assuming the obligation to provide drilling reports and data to Farmors under Section 2.2.

|

| |

4.

|

Seller Representations and Warranties. Seller represents and warrants that as of Closing:

|

| |

a.

|

Seller’s Representations and Warranties in Farmout Agreement. All of Seller’s representations and warranties under Section 3.2 of the Farmout agreement are true in all material respects.

|

| |

b.

|

Farmors’ Representations and Warranties in Farmout Agreement. To the best of Seller’s knowledge, Farmors’ representations and warranties under Section 3.1 of the Farmout Agreement are true in all material respects.

|

| |

c.

|

Authority of Seller. Seller has all requisite power and authority to carry on its business as presently conducted and to execute and deliver this Agreement and perform it obligations under this Agreement. The execution and delivery of this Agreement and consummation of the transactions contemplated hereby and the fulfillment of and compliance with the terms and conditions hereof will not violate, or be in conflict with, any material provision of Seller’s governing documents or any material provision of any agreement or instrument to which it is a party or by which it is bound, or, to its knowledge, any judgement, decree, order, statute, rule or regulation applicable to it.

|

| |

d.

|

Enforceability. The execution, delivery and performance of this Agreement and the transactions contemplated herein have been duly and validly authorized by all requisite corporate action on behalf of Seller. This Agreement constitutes Seller’s legal, valid, and binding obligation, enforceable in accordance with its terms and conditions subject, however, to the effects of bankruptcy, insolvency, reorganization, moratorium and similar laws for the protection of creditors, as well as to general principles of equity, regardless of whether such enforceability is considered in a proceeding in equity or at law. Assuming the due authorization, execution, and delivery of this Agreement by Buyer, this Agreement is legal, valid and binding with respect to Seller and is enforceable in accordance with its terms.

|

| |

e.

|

No Conflicts. The execution, delivery, performance and consummation of this Agreement and the transactions contemplated hereunder does not and will not: (a) violate, conflict with or constitute a default or an event that, with notice or lapse of time or both, would be a default, breach or violation under any term or provision of the governing documents of Seller; (b) result in a material default or an event that, with notice or lapse of time or both, would be a material default, breach or violation under any material term or provision of any agreement, contract, promissory note, indenture, mortgage, deed, deed of trust or lease to which Seller is a party or by which Seller or its interest in the Farmout Agreement is bound; or (c) violate, conflict with or constitute a breach of in any material respect any law applicable to Seller or by which Seller or its interest in the Farmout Agreement is bound.

|

| |

f.

|

Brokers’ Fees. Seller has not incurred and will not incur any liability, contingent or otherwise, for brokers’ or finders’ fees resulting from the Farmout Agreement, this Agreement or the transactions contemplated hereunder for which Buyer will have any responsibility whatsoever.

|

| |

g.

|

Bankruptcy. There are no bankruptcy, reorganization or arrangement proceedings pending, being contemplated by or, to Seller’s knowledge, threatened against Seller.

|

| |

h.

|

Material Contracts. There are no contracts or agreements of Seller and to Seller’s knowledge, Farmors, that would have a materially adverse impact on Buyer’s ability to conduct operations under the Farmout Agreement or the JOA.

|

| |

i.

|

Preferential Rights and Consents. There are no preferential purchase rights or consent to transfer requirements affecting Seller’s interest under the Farmout Agreement, in the Assigned Rights or in the Earned Interests, or which may be applicable to the transactions contemplated herein.

|

| |

j.

|

Marketing and Transportation Agreements. No portion of the Assigned Rights or Earned Interests is subject to or dedicated to any production sales, marketing, gathering, transportation, processing, or similar agreements which will not be released prior to the consummation of the transactions contemplated herein.

|

| |

k.

|

Knowledge and Experience. Seller is sophisticated in the evaluation, purchase, ownership and operation of entities like Buyer who own and operate oil, gas and helium exploration and production properties, pipelines, wells and related facilities. In making its decision to enter into this Agreement and to consummate the transactions contemplated hereunder, Seller has solely relied on (i) the representations and warranties of Buyer set forth in Section 5, (ii) its own independent investigation and evaluation of Buyer, (iii) public information regarding the Shares and (iv) the advice of its own legal, financial, tax, economic, environmental, engineering, geological and geophysical advisors and not on any comments, statements, projections of other material made or given by any representative, consultant or advisor of Buyer. Seller hereby acknowledges that, other than the representations and warranties made by Buyer in Section 5, neither Buyer nor any representatives, consultants, or advisors of Buyer or its affiliates will make or have made any representation or warranty, express or implied, at law of in equity, with respect to the Shares.

|

| |

l.

|

Well Commencement Deadline. The Commencement Deadline has been extended to September 1, 2024.

|

| |

m.

|

Rentals. All rentals and other lease maintenance payments due up to the date of Closing under the Leases to keep them in force and effect have been paid timely and accurately.

|

| |

n.

|

Swanson Interests. Seller acknowledges that a material inducement to Buyer’s entering into this Agreement is Seller’s entering into a binding commitment in writing (“Commitment”) with Tom Swanson and any other lessees under any oil and gas lease to which Tom Swanson is a lessee (“Swanson Parties”) covering the Property, or any option of any Swanson Party to acquire any oil and gas lease covering the Property (collectively, a “Swanson Interest”) to assign such interest to Buyer upon satisfaction of the Earning Conditions.

|

| |

o.

|

Capital Raise. Seller acknowledges that notwithstanding anything to the contrary in this Agreement, Buyer is not responsible for any obligation or payment under the terms or any interpretation of the Section 1.11 (Capital Raise) of the Farmout Agreement. Seller indemnifies Buyer as to the conditions or obligations of the Section 1.11 of the Farmout Agreement.

|

| |

p.

|

Securities Law Compliance.

|

(i) Seller is an accredited investor as defined in Regulation D under the Securities Act of 1933, as amended (the “Securities Act”). Seller (A) is acquiring the Shares for its own account and not with a view to distribution, as that term is used in Section 2(11) of the Securities Act, (B) has sufficient knowledge and experience in financial and business matters so as to be able to evaluate the merits and risk of an investment in the Shares and is able financially to bear the risks thereof, and (C) understands that the Shares will, upon issuance, be characterized as “restricted securities” under state and federal securities laws and that under such laws and applicable regulations cannot be resold unless the resale of the Shares is registered under the Securities Act or unless an exemption from registration is available.

(ii) Seller has experience in analyzing and investing in companies similar to Buyer and is capable of evaluating the merits and risks of its decisions with respect to such matters and has the capacity to protect its own interests.

(iii) Seller has not been offered the Shares by any form of general solicitation or advertising, including, but not limited to, advertisements, articles, notices or other communications published in any newspaper, magazine, or other similar media or television or radio broadcast or any seminar or meeting where, to Seller’s knowledge, those individuals that have attended have been invited by any such or similar means of general solicitation or advertising.

(iv) To the extent necessary, Seller has retained and relied upon appropriate professional advice regarding the investment, tax and legal merits and consequences of the Shares.

(v) Seller has had an opportunity to discuss Buyer’s business, management and financial affairs with the members of Buyer’s management and has had an opportunity to ask questions of the officers and other representatives of Buyer, which questions, if any, were answered to its satisfaction.

(vi) Seller (A) is aware of, has received and had an opportunity to review (i) the Buyer’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (SEC) on March 26, 2024; (ii) the Buyer’s Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 17, 2024, and (iii) the Buyer’s Quarterly Reports on Form 10-Q and current reports on Form 8-K from January 1, 2024, to the date of such Seller’s entry into this Agreement (which filings can be accessed by going to https://www.sec.gov/edgar/searchedgar/companysearch.html, typing “US Energy Corp” in the “Name, ticker symbol, or CIK” field, and clicking the “Search” button), in each case (i) through (iii), including, but not limited to, the audited and unaudited financial statements, description of business, risk factors, results of operations, certain transactions and related business disclosures described therein and an independent investigation made by it of the Buyer; and (B) is not relying on any oral representation of the Buyer or any other person, nor any written representation or assurance from the Buyer; in connection with Seller’s acceptance of the Shares and investment decision in connection therewith.

(vii) Neither the Buyer, nor any other party, has supplied Seller any information regarding the Shares or an investment in the Shares other than as contained in this Agreement, and Seller is relying on its own investigation and evaluation of the Buyer and the Shares and not on any other information.

(viii) Seller acknowledges that it is a sophisticated investor capable of assessing and assuming investment risks with respect to securities, including the Shares, and further acknowledges that the Buyer is entering into this Agreement with the Seller, in reliance on this acknowledgment and with Seller’s understanding, acknowledgment and agreement that the Buyer is privy to material non-public information regarding the Buyer (collectively, the “Non-Public Information”), which Non-Public Information may be material to a reasonable investor, such as Seller, when making investment disposition decisions, including the decision to enter into this Agreement, and Seller’s decision to enter into the Agreement is being made with full recognition and acknowledgment that the Buyer is privy to the Non-Public Information, irrespective of whether such Non-Public Information has been provided to Seller. Seller hereby waives any claim, or potential claim, it has or may have against the Buyer relating to the Buyer’s possession of Non-Public Information. Seller has specifically requested that the Buyer not provide it with any Non-Public Information. Seller understands and acknowledges that the Buyer would not enter into this Agreement in the absence of the representations and warranties set forth in this paragraph, and that these representations and warranties are a fundamental inducement to the Buyer in entering into this Agreement.

(ix) Seller represents, warrants, and agrees that the Buyer is under no obligation to register or qualify the Shares under the Securities Act or under any state securities law, or to assist such Seller in complying with any exemption from registration and qualification.

(x) Seller confirms and acknowledges that it is familiar with the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, but not limited to Rule 13d-1 thereof, and Schedules 13D and 13G, thereunder, including, but not limited to Seller’s potential obligation to timely file a Schedule 13D or Schedule 13G (as applicable, the “Schedule”) with the Securities and Exchange Commission in connection with its acquisition of the Shares. Seller further confirms and acknowledges that it is solely Seller’s obligation to determine whether a Schedule is due and to file the Schedule, and the Company is under no obligation to assist Seller with such filing or provide any advice to Seller in connection therewith whatsoever.

(xi) Seller understands and agrees that a legend has been or will be placed on any certificate(s) or other document(s) evidencing the Shares in substantially the following form:

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED OR ANY STATE SECURITIES ACT. THE SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT BE SOLD, TRANSFERRED, PLEDGED OR HYPOTHECATED UNLESS (I) THEY SHALL HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED AND ANY APPLICABLE STATE SECURITIES ACT, OR (II) THE CORPORATION SHALL HAVE BEEN FURNISHED WITH AN OPINION OF COUNSEL, SATISFACTORY TO COUNSEL FOR THE CORPORATION.”

In the event that Seller has breached any representation, warranty or covenant contained in this Agreement, Seller shall indemnify, defend, hold harmless and release Buyer, its affiliates, and its and their officers, directors, managers, representatives and employees (“Buyer Indemnified Parties”) from and against any and all claims, demands, losses, damages, suits, liabilities, judgments, causes of action, fines, penalties, interest and expenses (including reasonable attorneys’ fees) brought upon or suffered by any Buyer Indemnified Party relating to such breach. THE DEFENSE, INDEMNIFICATION, HOLD HARMLESS AND RELEASE PROVIDED FOR IN THIS AGREEMENT SHALL BE APPLICABLE WHETHER OR NOT THE LIABILITIES, LOSSES, COSTS, EXPENSES AND DAMAGES IN QUESTION AROSE OR RESULTED SOLELY OR IN PART FROM THE SOLE, ACTIVE, PASSIVE, CONCURRENT OR COMPARATIVE NEGLIGENCE, STRICT LIABILITY OR OTHER FAULT OR VIOLATION OF LAW OF OR BY ANY BUYER INDEMNIFIED PARTY.

| |

5.

|

Buyer Representations and Warranties. Buyer represents and warrants that:

|

| |

a.

|

Authority of Buyer. Buyer has all requisite power and authority to carry on its business as presently conducted and to execute and deliver this Agreement and perform it obligations under this Agreement. The execution and delivery of this Agreement and consummation of the transactions contemplated hereby and the fulfillment of and compliance with the terms and conditions hereof will not violate, or be in conflict with, any material provision of Buyer’s governing documents or any material provision of any agreement or instrument to which it is a party or by which it is bound, or, to its knowledge, any judgement, decree, order, statute, rule or regulation applicable to it.

|

| |

b.

|

Enforceability. The execution, delivery and performance of this Agreement and the transactions contemplated hereunder have been duly and validly authorized by all requisite corporate action on behalf of Buyer. This Agreement constitutes Buyer’s legal, valid, and binding obligation, enforceable in accordance with its terms and conditions, subject, however, to the effects of bankruptcy, insolvency, reorganization, moratorium and similar laws for the protection of creditors, as well as to general principles of equity, regardless of whether such enforceability is considering in a proceeding in equity or at law. Assuming the due authorization, execution, and delivery of this Agreement by Seller, this Agreement is legal, valid and binding with respect to Buyer and is enforceable in accordance with its terms.

|

| |

c.

|

No Conflicts. The execution, delivery, performance and consummation of this Agreement and the transactions contemplated hereunder does not and will not: (i) violate, conflict with or constitute a default or an event that, with notice or lapse of time or both, would be a default, breach or violation under any term or provision of the governing documents of Buyer; (ii) result in a material default or an event that, with notice or lapse of time or both, would be a material default, breach or violation under any material term or provision of any agreement, contract, promissory note, indenture, mortgage, deed, deed of trust or lease to which Buyer is a party or by which Buyer is bound; or (iii) violate, conflict with or constitute a breach of in any material respect any law applicable to Buyer or by which Buyer is bound.

|

| |

d.

|

Brokers’ Fees. Seller has not incurred and will not incur any liability, contingent or otherwise, for brokers’ or finders’ fees resulting from the Farmout Agreement, this Agreement or the transactions contemplated hereunder for which Buyer will have any responsibility whatsoever.

|

| |

e.

|

Bankruptcy. There are no bankruptcy, reorganization or arrangement proceedings pending, being contemplated by or, to Seller’s knowledge, threatened against Seller.

|

| |

f.

|

No Distribution. Buyer is purchasing the Assigned Rights for its own account and not with the intent to make a distribution in violation of the Securities Act of 1933, as amended (and the rules and regulations pertaining thereto), or in violation of any other applicable securities laws.

|

| |

g.

|

Knowledge and Experience. Buyer is sophisticated in the evaluation, purchase, ownership and operation of oil and gas exploration and production properties. In making its decision to enter into this Agreement and to consummate the transactions contemplated hereby, Buyer has solely relied on (i) the representations and warranties of Seller set forth in Section 4, (ii) its own independent investigation and evaluation of the Farmout Agreement, and the Assigned Rights (iii) on public information regarding the Farmout Agreement and the Assigned Rights and (iv) on the advice of its own legal, financial, tax, economic, environmental, engineering, geological and geophysical advisors and not on any comments, statements, projections or other material made or given by any representative, consultant or advisor of Seller. Buyer hereby acknowledges that, other than the representations and warranties made by Seller in Section 5, neither Seller nor any representatives, consultants, or advisors of Seller of its affiliates will make or have made any representation or warranty, express or implied, at law of in equity, with respect to the Assigned Rights. Buyer is able to bear the risks of the acquisition of the Assigned Rights, in accordance with and as set forth in this Agreement, and understands the risks of, and other considerations related to an assignment of the Assigned Rights to Buyer and the ownership and operation of the Earned Interests.

|

| |

h.

|

NASDAQ Notice. Prior to the issuance of the Shares, Buyer has provided to NASDAQ (i) minutes signed by Buyer’s Board of Directors approving the issuance of the Shares and execution of this Agreement, and (ii) a copy of the PSA in materially final form. Immediately following Closing, Buyer will provide to Nasdaq a copy of the fully executed PSA.

|

In the event that Buyer has breached any representation, warranty or covenant contained in this Agreement, Buyer shall indemnify, defend, hold harmless and release Seller, its affiliates, and its and their officers, directors, managers, representatives and employees (“Seller Indemnified Parties”) from and against any and all claims, demands, losses, damages, suits, liabilities, judgments, causes of action, fines, penalties, interest and expenses (including reasonable attorneys’ fees) brought upon or suffered by any Seller Indemnified Party relating to such breach. THE DEFENSE, INDEMNIFICATION, HOLD HARMLESS AND RELEASE PROVIDED FOR IN THIS AGREEMENT SHALL BE APPLICABLE WHETHER OR NOT THE LIABILITIES, LOSSES, COSTS, EXPENSES AND DAMAGES IN QUESTION AROSE OR RESULTED SOLELY OR IN PART FROM THE SOLE, ACTIVE, PASSIVE, CONCURRENT OR COMPARATIVE NEGLIGENCE, STRICT LIABILITY OR OTHER FAULT OR VIOLATION OF LAW OF OR BY ANY SELLER INDEMNIFIED PARTY.

| |

6.

|

Survival of Representations, Warranties and Covenants. The representations, warranties and covenants of Buyer and Seller hereunder shall survive indefinitely.

|

| |

7.

|

Joint Operating Agreement. The Parties’ rights and obligations regarding operation under the Farmout Agreement, the drilling, completion and equipping of any future wells, the production therefrom, the sale of production from the wells, and the treatment, handling, gathering or transportation of such production prior to the point of first sale to an affiliated or non-affiliated entity of Buyer shall conducted under and in accordance with the JOA.

|

| |

8.

|

Assignment of Oil and Gas Leases. Any Earned Interests under the Farmout Agreement shall be assigned under a Partial Assignment of Oil and Gas Leases substantially in the form of Exhibit “C” (the “Assignment”) along with all required state and/or federal assignments and transfers. In the event either Party fails to execute and deliver to the other the Assignment or comply with any other material term of this Agreement, remedies at law may be inadequate, and the non-breaching Party may, without limiting any other remedy available at law or in equity, enforce an injunction, restraining order, specific performance, and other forms of equitable relief or money damages or any combination thereof.

|

| |

a.

|

Incorporated by Reference. All of the Exhibits and Schedules (if any) referenced in this Agreement are attached hereto and incorporated herein by reference.

|

| |

b.

|

Further Assurances. After the Closing, Seller shall execute and deliver, and shall otherwise cause to be executed and delivered, from time to time, such further instruments, notices, division orders, transfer orders, and other documents, and do such other and future acts and things as may be reasonably necessary to more fully and effectively grant, convey, and assign the Assigned Rights to Buyer.

|

| |

c.

|

Unlisted Seller Leases. In the event that on or after delivery of the Assignment it is determined that Seller owned or was credited with at the Effective Date any right, title and interests in any leases, mineral interests and associated property in the Property that were not included in Exhibit “A” of the Assignment, Seller shall, effective as of the later of the date of acquisition of such property by Seller or the effective date of the Assignment, upon request of Buyer, convey to Buyer in the same form as the Assignment, an undivided eighty-two and one-half percent (82.5%) interest in all of Seller’s right, title and interests in such leases, mineral interests and associated property whereupon such property and the Seller Reserved Interest therein shall become subject to this Agreement (without a purchase price adjustment) and the JOA, where applicable.

|

| |

d.

|

Post-Closing Seller Acquired Interests. In the event that after Closing Seller or any affiliate of Seller acquires any right, title or interest in any oil and gas leases, mineral interests and associated property in the Property, whether by lease, deed or assignment (a “New Interest”) Seller shall notify Buyer and upon request of Buyer, Seller shall assign to Buyer in the same form as the Assignment, eighty-two and one-half percent (82.5%) of all of Seller’s right, title and interest in such entire New Interest to the extent that it lies within the Property and any contiguous portion thereof outside of the Property, effective as of the effective date of Seller’s acquisition thereof whereupon such New Interest shall become subject to this Agreement and the JOA, where applicable. Upon receipt of such assignment, Buyer shall reimburse Seller for eighty-two and one-half percent (82.5%) of any bonus or other consideration paid by Seller for such New Interest.

|

| |

e.

|

Applicable Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Texas, notwithstanding any conflict of laws provisions that would require the application of the law of another jurisdiction, provided, however that with regard to the construction and enforcement of the Assignment and any title to the Leases, Minerals, Contracts, Easements and Wells, the laws of the State of Montana shall apply.

|

| |

f.

|

Jurisdiction and Venue. Any claims, disputes or suits under this Agreement, the Assignment or the JOA (“Disputes”) shall be brought in and litigated exclusively in state or federal courts residing in Harris County, Texas. The Parties consent to the exclusive jurisdiction and venue in such courts for such purposes.

|

| |

g.

|

WAIVER OF RIGHTS TO JURY TRIAL. In any Disputes the Parties agree that they hereby waive all rights to trial by jury.

|

| |

h.

|

Notices. All notices that are required or authorized to be given to any Party hereto as a result of this Agreement, shall be given in writing and delivered by personal messenger, or by registered mail, overnight mail or by electronic mail or fax, addressed to the Party to which such notice is given as set forth below. All notices shall be deemed properly delivered on the date confirmation of delivery of the same is received or on the date of any Party’s refusal to accept delivery of the same.

|

Buyer Contact Information

U.S. Energy Corp.

Attn: Ryan Smith

1616 S. Voss

Houston, Texas 77057

Email: Ryan@usnrg.com

Phone: 303-993-3200

Seller Contact Information:

Wavetech Helium, Inc.

Attn: Edward Gendelman

1801 Broadway, Suite 600

Denver, Colorado 80202

Email: egendelman@wavetechenergy.com

Phone: 303-534-3383

| |

i.

|

Amendments. This Agreement may not be amended except by an instrument expressly modifying this Agreement signed by both Parties. Except for waivers specifically provided for in this Agreement, no waiver by either Party of any breach of any provision of this Agreement shall be binding unless made expressly in writing. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of any other provision hereof (regardless of whether similar), nor shall any such waiver constitute a continuing waiver unless expressly so provided. Delay in the exercise, or non-exercise, of any such right is not a waiver of that right.

|

| |

j.

|

Successors and Assigns. This Agreement shall be binding upon, and shall inure to the benefit of, the Parties, and their respective successors and assigns. Notwithstanding anything to the contrary herein, this Agreement is not a binding agreement between the Parties unless and until this Agreement is duly executed in writing by representatives of the Parties and delivered by the Parties. Capitalized terms not defined herein shall be given their definition under the Farmout Agreement.

|

| |

k.

|

Other Agreements. This Agreement is the exclusive Agreement among the Parties regarding the subject matter hereof and the transactions provided for under this Agreement.

|

| |

l.

|

Confidentiality and Press Releases. The Parties agree that the terms and conditions of this Agreement, including its existence, shall be treated as confidential. No Party shall issue any press release, make a public filing or otherwise make any disclosure with respect to this Agreement unless done so in compliance with Section 4 of the Farmout Agreement and then only with the prior written consent of the other Party; provided that if there are any legally mandated disclosures of this Agreement (including under the rules of any stock exchange), the Party required to make such disclosures shall (i) immediately notify the other Party of the existence, terms and circumstances surrounding such legal requirement, (ii) consult with the other Party on the advisability of taking legal available steps to resist or narrow such required disclosure, (iii) assist the Party required to make the disclosure in seeking a protective order or other appropriate remedy, and (iv) in all events disclose only that information which it is advised by counsel that it is legally required to disclose.

|

| |

m.

|

Counterpart Execution. This Agreement may be executed in multiple counterparts (including by facsimile or .pdf signature), each of which shall be considered an original once Buyer and Seller have executed and delivered a counterpart of this Agreement, and all of which taken together shall constitute one and the same agreement.

|

[Signatures on following page.]

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first set forth above.

| |

U.S. ENERGY CORP. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Ryan Smith |

|

| |

Name: |

Ryan Smith |

|

| |

Title: |

President and Chief Executive Officer |

|

| |

|

|

|

| |

|

|

|

| |

WAVETECH HELIUM, INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Edward Gendelman |

|

| |

Name: |

Edward Gendelman |

|

| |

Title: |

Chief Executive Officer |

|

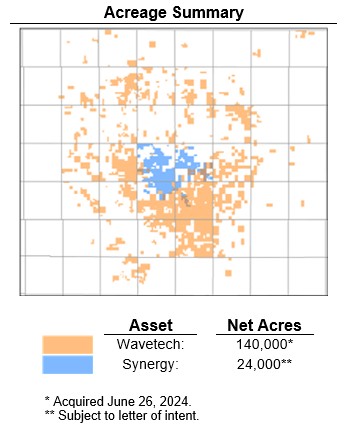

EXHIBIT A

(Property Map)

Attached to and made a part of that Purchase and Sale Agreement for Farmout Assignment dated June [___], 2024 by and between U.S. Energy Corp. and Wavetech Helium, Inc. [To clarify, this will be the map used in Farmout Agreement.]

EXHIBIT B

(Joint Operating Agreement)

Attached to and made a part of that Purchase and Sale Agreement for Farmout Assignment dated June [___], 2024 by and between U.S. Energy Corp. and Wavetech Helium, Inc.

Exhibit C

(Partial Assignment)

Attached to and made a part of that Purchase and Sale Agreement for Farmout Assignment dated June [___], 2024 by and between U.S. Energy Corp. and Wavetech Helium, Inc.

PARTIAL ASSIGNMENT OF OIL AND GAS LEASES

This Partial Assignment of Oil and Gas Leases (the “Assignment”) dated effective as of _________ (the “Effective Date”), is by and between Wavetech Helium, Inc., a Colorado corporation, whose address is 1801 Broadway, Suite 600, Denver Colorado 80202 (“Assignor”) and U.S. Energy Corp., a Delaware corporation, whose address is 1616 S. Voss, Houston, Texas 77057 (“Assignee”).

WHEREAS, Assignor currently owns interests in those certain oil and gas leases and other property rights and interests listed on Exhibit “A” (the “Leases”); and

NOW THEREFORE, for Ten Dollars and other good and valuable consideration (the receipt and sufficiency of which are hereby acknowledged), Assignor does hereby grant, bargain, sell, convey, assign, transfer, set over and deliver to Assignee an undivided eighty-two and one-half (82.5%) percent of all of Assignor’s right, title and interest in and to: (i) the Leases, (ii) all right of ways and easements insofar as they are used or useful in exercising rights under the Leases or on lands pooled therewith (the “Easements”), and (iii) the Farmout Agreement (the Leases, Easements and Farmout Agreement are herein referred to collectively as the “Assets”).

TO HAVE AND TO HOLD the Assets unto Assignee, its successors and assigns, forever, subject to the following terms and conditions:

1. SPECIAL WARRANTY. ASSIGNOR AGREES TO WARRANT AND FOREVER DEFEND DEFENSIBLE TITLE TO THE ASSETS UNTO ASSIGNEE AGAINST THE CLAIMS AND DEMANDS OF ALL PERSONS CLAIMING, OR TO CLAIM THE SAME, OR ANY PART THEREOF, BY, THROUGH OR UNDER ASSIGNOR, BUT NOT OTHERWISE. ASSIGNOR ASSIGNS ALL RIGHTS UNDER WARRANTIES AND REPRESENTATIONS OF ITS PREDECESSORS IN TITLE INSOFAR AS THEY COVER THE ASSETS.

2. Subject to PSA. This Assignment is made subject to that certain Purchase and Sale Agreement for Farmout Assignment effective as of June 1, 2024, by and between Assignor and Assignee (the “Agreement”). The Agreement contains certain representations, warranties, covenants and agreements between Assignor and Assignee, some of which survive the delivery of this Assignment, as provided for therein and shall not be merged into this Assignment or be otherwise negated by the execution or delivery of this Assignment. This Assignment shall not be construed to amend the Agreement or vary the rights or obligations of either Assignor or Assignee from those set forth in the Agreement. In the event of any conflict between this Assignment and the Agreement, the terms of the Agreement shall control. Any defined term used herein but not otherwise defined shall have the meaning ascribed to such term in the Agreement.

3. Further Assurances. From and after the date hereof, Assignor shall execute and deliver, and shall otherwise cause to be executed and delivered, from time to time, such further instruments, notices, division orders, transfer orders, and other documents, and do such other and future acts and things as may be reasonably necessary to more fully and effectively grant, convey, and assign the Assets to Assignee and complete the transactions provided for under the Agreement and this Assignment.

4. Recording. Assignee shall record an executed copy of this Assignment in the relevant county deed records. In lieu of recording this Assignment in its entirety, Assignee may record a memorandum of this Assignment in a form mutually acceptable to Assignor and Assignee.

5. Choice of Law, Jurisdiction. Insofar as permitted by otherwise applicable law, this Assignment and all matters related thereto shall be governed by and construed under the laws of the State of Texas (without regard to conflict of law provisions thereof that would apply the provisions of the laws of another jurisdiction, provided, however that with regard to the construction and enforcement of this Assignment and any title to the Leases and Easements, the laws of the State of Montana shall apply. Any claims, disputes or suits (“Disputes”) under this Assignment or the JOA shall be brought in and litigated exclusively in state or federal courts residing in Harris County, Texas. The Parties consent to the exclusive jurisdiction and venue in such courts for such purposes.

6. WAIVER OF RIGHTS TO JURY TRIAL. In any dispute arising out of this Agreement, the JOA or the Assignment, the Parties agree that they hereby waive all rights to trial by jury.

7. Successors and Assigns. This Assignment binds and inures to the benefit each of Assignor and Assignee and their successors and assigns.

8. Counterpart Execution. This Assignment may be executed in several counterparts and all of such counterparts together shall constitute one and the same instrument.

IN WITNESS WHEREOF, this Assignment has been executed by the parties hereto effective as of the Effective Date.

| |

ASSIGNOR: |

|

| |

|

|

|

| |

Wavetech Helium, Inc. |

|

| |

|

|

|

| |

By: |

|

|

| |

Name: |

Edward Gendelman |

|

| |

Title: |

CEO |

|

| |

|

|

|

| |

|

|

|

| |

ASSIGNEE: |

|

| |

|

|

|

| |

U.S. Energy Corp. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

|

|

| |

Name: |

Ryan Smith |

|

| |

Title: |

President and Chief Executive Officer |

|

| STATE OF COLORADO |

) |

|

| |

) |

ss: |

| COUNTY OF DENVER |

) |

|

The foregoing instrument was acknowledged before me on this ______ day of _______, 2024, by __________, as ___________ for Wavetech Helium, Inc., a Colorado corporation, on behalf of such corporation.

(SEAL)

| |

|

| |

Notary Public in and for the State of Texas |

| |

|

| |

My Commission Expires: |

| STATE OF TEXAS |

) |

|

| |

) |

ss: |

| COUNTY OF HARRIS_ |

) |

|

The foregoing instrument was acknowledged before me on this ______ day of _______, 2024, by __________, as ___________ for U.S. Energy Corp., a Delaware corporation, on behalf of such corporation

(SEAL)

| |

|

| |

Notary Public in and for the State of Texas |

| |

|

| |

My Commission Expires: |

EXHIBIT A TO ASSIGNMENT

Attached to and made a part of that Assignment dated __, 2024 by and between Wavetech Helium, Inc, and U.S. Energy Corp.

INCLUDE ALL ASSETS DESCRIBED IN THE ASSIGNMENT FROM FARMORS TO ASSIGNOR UNDER THE FARMOUT AGREEMENT.

TO BE COMPLETED PRIOR TO EXECUTION OF THE ASSIGNMENT.