000101578012/312020Q1false19,86318,70825,92622,24686177007000.010.011,000,0001,000,000403,000403,000403,000403,0000.010.01400,000,000400,000,000221,032,420222,622,333221,032,420222,622,3330.140.1429.3829.382,650.002,650.0069,000796,00070,000756,000100,000979,00092,0002,700,00075,0001,440,00080,000897,000—————————————————————No32131.22.9520223.8020274.5020282.9520223.8020274.5020285.8754.4355.303.162020-04-222020-05-132020-05-196.6700010157802020-01-012020-03-31xbrli:shares00010157802020-04-30iso4217:USD00010157802019-01-012019-03-310001015780us-gaap:FinancialServiceMember2020-01-012020-03-310001015780us-gaap:FinancialServiceMember2019-01-012019-03-310001015780etfc:FeesAndServiceChargesMember2020-01-012020-03-310001015780etfc:FeesAndServiceChargesMember2019-01-012019-03-31iso4217:USDxbrli:shares00010157802020-03-3100010157802019-12-310001015780us-gaap:PreferredStockMember2019-12-310001015780us-gaap:CommonStockMember2019-12-310001015780us-gaap:AdditionalPaidInCapitalMember2019-12-310001015780us-gaap:RetainedEarningsMember2019-12-310001015780us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001015780us-gaap:RetainedEarningsMemberus-gaap:AccountingStandardsUpdate201613Member2020-01-012020-03-310001015780us-gaap:AccountingStandardsUpdate201613Member2020-01-012020-03-310001015780us-gaap:RetainedEarningsMember2020-01-012020-03-310001015780us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001015780us-gaap:RetainedEarningsMemberus-gaap:PreferredClassAMember2020-01-012020-03-310001015780us-gaap:PreferredClassAMember2020-01-012020-03-310001015780us-gaap:RetainedEarningsMemberus-gaap:PreferredClassBMember2020-01-012020-03-310001015780us-gaap:PreferredClassBMember2020-01-012020-03-310001015780us-gaap:CommonStockMember2020-01-012020-03-310001015780us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001015780us-gaap:PreferredStockMember2020-03-310001015780us-gaap:CommonStockMember2020-03-310001015780us-gaap:AdditionalPaidInCapitalMember2020-03-310001015780us-gaap:RetainedEarningsMember2020-03-310001015780us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001015780us-gaap:PreferredStockMember2018-12-310001015780us-gaap:CommonStockMember2018-12-310001015780us-gaap:AdditionalPaidInCapitalMember2018-12-310001015780us-gaap:RetainedEarningsMember2018-12-310001015780us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-3100010157802018-12-310001015780us-gaap:RetainedEarningsMember2019-01-012019-03-310001015780us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310001015780us-gaap:RetainedEarningsMemberus-gaap:PreferredClassAMember2019-01-012019-03-310001015780us-gaap:PreferredClassAMember2019-01-012019-03-310001015780us-gaap:RetainedEarningsMemberus-gaap:PreferredClassBMember2019-01-012019-03-310001015780us-gaap:PreferredClassBMember2019-01-012019-03-310001015780us-gaap:CommonStockMember2019-01-012019-03-310001015780us-gaap:AdditionalPaidInCapitalMember2019-01-012019-03-310001015780us-gaap:PreferredStockMember2019-03-310001015780us-gaap:CommonStockMember2019-03-310001015780us-gaap:AdditionalPaidInCapitalMember2019-03-310001015780us-gaap:RetainedEarningsMember2019-03-310001015780us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-3100010157802019-03-310001015780etfc:Covid19Member2020-01-012020-03-310001015780us-gaap:AvailableforsaleSecuritiesMember2020-03-310001015780us-gaap:HeldtomaturitySecuritiesMember2020-03-310001015780etfc:ReceivablesFromBrokerDealersAndClearingOrganizationsMember2020-01-012020-03-310001015780etfc:MorganStanleyMember2020-01-012020-03-310001015780etfc:GradifiMember2019-12-092019-12-090001015780etfc:GradifiMemberus-gaap:TechnologyBasedIntangibleAssetsMember2019-12-092019-12-090001015780etfc:GradifiMemberus-gaap:TechnologyBasedIntangibleAssetsMember2020-01-012020-03-310001015780etfc:GradifiMember2020-01-012020-03-310001015780etfc:OptionsContractMember2019-10-070001015780etfc:ActiveTraderPricingMember2019-10-070001015780etfc:MoneyMarketFundsAndSweepDepositsRevenueMember2020-01-012020-03-310001015780etfc:OrderFlowRevenueMember2019-01-012019-03-310001015780etfc:OrderFlowRevenueMember2020-01-012020-03-310001015780etfc:MoneyMarketFundsAndSweepDepositsRevenueMember2019-01-012019-03-310001015780us-gaap:InvestmentAdvisoryManagementAndAdministrativeServiceMember2020-01-012020-03-310001015780us-gaap:InvestmentAdvisoryManagementAndAdministrativeServiceMember2019-01-012019-03-310001015780etfc:MutualFundServiceFeesMember2020-01-012020-03-310001015780etfc:MutualFundServiceFeesMember2019-01-012019-03-310001015780etfc:ForeignExchangeRevenueMember2020-01-012020-03-310001015780etfc:ForeignExchangeRevenueMember2019-01-012019-03-310001015780etfc:ReorganizationFeesMember2020-01-012020-03-310001015780etfc:ReorganizationFeesMember2019-01-012019-03-310001015780us-gaap:FinancialServiceOtherMember2020-01-012020-03-310001015780us-gaap:FinancialServiceOtherMember2019-01-012019-03-310001015780srt:ArithmeticAverageMemberus-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780srt:ArithmeticAverageMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2020-03-310001015780srt:ArithmeticAverageMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780srt:ArithmeticAverageMemberus-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2019-12-310001015780srt:ArithmeticAverageMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2019-12-310001015780srt:ArithmeticAverageMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2019-12-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-03-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2020-03-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2020-03-310001015780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2020-03-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2020-03-310001015780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2020-03-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2020-03-310001015780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2020-03-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2020-03-310001015780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2020-03-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-03-310001015780us-gaap:FairValueMeasurementsRecurringMember2020-03-310001015780us-gaap:LoansReceivableMemberus-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780us-gaap:LoansReceivableMemberus-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-03-310001015780us-gaap:LoansReceivableMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:LoansReceivableMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780us-gaap:FairValueMeasurementsNonrecurringMember2020-03-31xbrli:pure0001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2019-12-310001015780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2019-12-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2019-12-310001015780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2019-12-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2019-12-310001015780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2019-12-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2019-12-310001015780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialMortgageBackedSecuritiesMember2019-12-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001015780us-gaap:FairValueMeasurementsRecurringMember2019-12-310001015780us-gaap:LoansReceivableMemberus-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001015780us-gaap:LoansReceivableMemberus-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMember2019-12-310001015780us-gaap:LoansReceivableMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:LoansReceivableMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001015780us-gaap:FairValueMeasurementsNonrecurringMember2019-12-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-03-310001015780us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-03-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-03-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2020-03-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-03-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2020-03-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberetfc:AgencyDebtSecuritiesMember2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberetfc:AgencyDebtSecuritiesMember2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberetfc:AgencyDebtSecuritiesMember2020-03-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-03-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:RealEstateLoanMember2020-03-310001015780us-gaap:RealEstateLoanMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780us-gaap:RealEstateLoanMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-03-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberetfc:SecuritiesBasedLendingMember2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberetfc:SecuritiesBasedLendingMemberus-gaap:FairValueInputsLevel2Member2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberetfc:SecuritiesBasedLendingMember2020-03-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310001015780us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2019-12-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2019-12-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberetfc:AgencyDebtSecuritiesMember2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberetfc:AgencyDebtSecuritiesMember2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberetfc:AgencyDebtSecuritiesMember2019-12-310001015780us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:RealEstateLoanMember2019-12-310001015780us-gaap:RealEstateLoanMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2019-12-310001015780us-gaap:RealEstateLoanMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:CarryingReportedAmountFairValueDisclosureMemberetfc:SecuritiesBasedLendingMember2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberetfc:SecuritiesBasedLendingMemberus-gaap:FairValueInputsLevel2Member2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberetfc:SecuritiesBasedLendingMember2019-12-310001015780us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2019-12-310001015780etfc:FullyPaidLendingProgramMember2019-12-310001015780us-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780srt:MaximumMemberus-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780us-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2020-03-310001015780srt:MaximumMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780srt:MaximumMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2020-03-310001015780us-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2019-12-310001015780srt:MaximumMemberus-gaap:RealEstateLoanMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2019-12-310001015780us-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2019-12-310001015780srt:MaximumMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2019-12-310001015780srt:MaximumMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputAppraisedValueMemberus-gaap:FairValueInputsLevel3Member2019-12-3100010157802019-01-012019-12-310001015780us-gaap:ExchangeClearedMember2020-03-310001015780us-gaap:ExchangeClearedMember2019-12-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-03-310001015780us-gaap:USTreasuryAndGovernmentMember2020-03-310001015780us-gaap:USTreasurySecuritiesMember2020-03-310001015780us-gaap:AssetBackedSecuritiesMember2020-03-310001015780us-gaap:CommercialMortgageBackedSecuritiesMember2020-03-310001015780etfc:AgencyDebtSecuritiesMember2020-03-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001015780us-gaap:USTreasuryAndGovernmentMember2019-12-310001015780us-gaap:USTreasurySecuritiesMember2019-12-310001015780us-gaap:AssetBackedSecuritiesMember2019-12-310001015780us-gaap:CommercialMortgageBackedSecuritiesMember2019-12-310001015780etfc:AgencyDebtSecuritiesMember2019-12-310001015780us-gaap:CreditCardReceivablesMember2020-03-310001015780us-gaap:AutomobileLoanMember2020-03-310001015780us-gaap:StudentLoanMember2020-03-310001015780us-gaap:CreditCardReceivablesMember2019-12-310001015780us-gaap:AutomobileLoanMember2019-12-310001015780us-gaap:StudentLoanMember2019-12-3100010157802019-10-012019-12-310001015780us-gaap:CollateralPledgedMember2020-03-310001015780us-gaap:CollateralPledgedMember2019-12-310001015780us-gaap:AccountingStandardsUpdate201613Member2020-01-012020-03-310001015780etfc:Covid19Member2020-01-012020-03-310001015780us-gaap:RealEstateLoanMember2020-03-310001015780us-gaap:RealEstateLoanMemberetfc:FinancingReceivables30To89DaysPastDueMember2020-03-310001015780etfc:FinancingReceivables90To179DaysPastDueMemberus-gaap:RealEstateLoanMember2020-03-310001015780us-gaap:RealEstateLoanMemberetfc:FinancingReceivablesEqualtoGreaterthan180DaysPastDueMember2020-03-310001015780us-gaap:HomeEquityMember2020-03-310001015780etfc:FinancingReceivables30To89DaysPastDueMemberus-gaap:HomeEquityMember2020-03-310001015780etfc:FinancingReceivables90To179DaysPastDueMemberus-gaap:HomeEquityMember2020-03-310001015780etfc:FinancingReceivablesEqualtoGreaterthan180DaysPastDueMemberus-gaap:HomeEquityMember2020-03-310001015780etfc:SecuritiesBasedLendingMember2020-03-310001015780etfc:SecuritiesBasedLendingMemberetfc:FinancingReceivables30To89DaysPastDueMember2020-03-310001015780etfc:FinancingReceivables90To179DaysPastDueMemberetfc:SecuritiesBasedLendingMember2020-03-310001015780etfc:SecuritiesBasedLendingMemberetfc:FinancingReceivablesEqualtoGreaterthan180DaysPastDueMember2020-03-310001015780etfc:FinancingReceivables30To89DaysPastDueMember2020-03-310001015780etfc:FinancingReceivables90To179DaysPastDueMember2020-03-310001015780etfc:FinancingReceivablesEqualtoGreaterthan180DaysPastDueMember2020-03-310001015780us-gaap:RealEstateLoanMember2019-12-310001015780us-gaap:RealEstateLoanMemberetfc:FinancingReceivables30To89DaysPastDueMember2019-12-310001015780etfc:FinancingReceivables90To179DaysPastDueMemberus-gaap:RealEstateLoanMember2019-12-310001015780us-gaap:RealEstateLoanMemberetfc:FinancingReceivablesEqualtoGreaterthan180DaysPastDueMember2019-12-310001015780us-gaap:HomeEquityMember2019-12-310001015780etfc:FinancingReceivables30To89DaysPastDueMemberus-gaap:HomeEquityMember2019-12-310001015780etfc:FinancingReceivables90To179DaysPastDueMemberus-gaap:HomeEquityMember2019-12-310001015780etfc:FinancingReceivablesEqualtoGreaterthan180DaysPastDueMemberus-gaap:HomeEquityMember2019-12-310001015780etfc:SecuritiesBasedLendingMember2019-12-310001015780etfc:SecuritiesBasedLendingMemberetfc:FinancingReceivables30To89DaysPastDueMember2019-12-310001015780etfc:FinancingReceivables90To179DaysPastDueMemberetfc:SecuritiesBasedLendingMember2019-12-310001015780etfc:SecuritiesBasedLendingMemberetfc:FinancingReceivablesEqualtoGreaterthan180DaysPastDueMember2019-12-310001015780etfc:FinancingReceivables30To89DaysPastDueMember2019-12-310001015780etfc:FinancingReceivables90To179DaysPastDueMember2019-12-310001015780etfc:FinancingReceivablesEqualtoGreaterthan180DaysPastDueMember2019-12-310001015780etfc:EtradeLineOfCreditMember2020-03-310001015780etfc:EtradeLineOfCreditMember2019-12-310001015780us-gaap:LtvLessThan80PercentMemberus-gaap:RealEstateLoanMember2020-03-310001015780us-gaap:LtvLessThan80PercentMemberus-gaap:RealEstateLoanMember2019-12-310001015780us-gaap:LtvLessThan80PercentMemberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:LtvLessThan80PercentMemberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:RealEstateLoanMemberus-gaap:Ltv80To100PercentMember2020-03-310001015780us-gaap:RealEstateLoanMemberus-gaap:Ltv80To100PercentMember2019-12-310001015780us-gaap:Ltv80To100PercentMemberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:Ltv80To100PercentMemberus-gaap:HomeEquityMember2019-12-310001015780etfc:LTV100To120PercentMemberus-gaap:RealEstateLoanMember2020-03-310001015780etfc:LTV100To120PercentMemberus-gaap:RealEstateLoanMember2019-12-310001015780etfc:LTV100To120PercentMemberus-gaap:HomeEquityMember2020-03-310001015780etfc:LTV100To120PercentMemberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:RealEstateLoanMemberetfc:LTVGreaterThan120PercentMember2020-03-310001015780us-gaap:RealEstateLoanMemberetfc:LTVGreaterThan120PercentMember2019-12-310001015780etfc:LTVGreaterThan120PercentMemberus-gaap:HomeEquityMember2020-03-310001015780etfc:LTVGreaterThan120PercentMemberus-gaap:HomeEquityMember2019-12-310001015780etfc:FICOScoreGreaterThan720Memberus-gaap:RealEstateLoanMember2020-03-310001015780etfc:FICOScoreGreaterThan720Memberus-gaap:RealEstateLoanMember2019-12-310001015780etfc:FICOScoreGreaterThan720Memberus-gaap:HomeEquityMember2020-03-310001015780etfc:FICOScoreGreaterThan720Memberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:RealEstateLoanMemberetfc:FICOScore719To700Member2020-03-310001015780us-gaap:RealEstateLoanMemberetfc:FICOScore719To700Member2019-12-310001015780etfc:FICOScore719To700Memberus-gaap:HomeEquityMember2020-03-310001015780etfc:FICOScore719To700Memberus-gaap:HomeEquityMember2019-12-310001015780etfc:FICOScore699To680Memberus-gaap:RealEstateLoanMember2020-03-310001015780etfc:FICOScore699To680Memberus-gaap:RealEstateLoanMember2019-12-310001015780etfc:FICOScore699To680Memberus-gaap:HomeEquityMember2020-03-310001015780etfc:FICOScore699To680Memberus-gaap:HomeEquityMember2019-12-310001015780etfc:FICOScore679To660Memberus-gaap:RealEstateLoanMember2020-03-310001015780etfc:FICOScore679To660Memberus-gaap:RealEstateLoanMember2019-12-310001015780etfc:FICOScore679To660Memberus-gaap:HomeEquityMember2020-03-310001015780etfc:FICOScore679To660Memberus-gaap:HomeEquityMember2019-12-310001015780etfc:FICOScore659To620Memberus-gaap:RealEstateLoanMember2020-03-310001015780etfc:FICOScore659To620Memberus-gaap:RealEstateLoanMember2019-12-310001015780etfc:FICOScore659To620Memberus-gaap:HomeEquityMember2020-03-310001015780etfc:FICOScore659To620Memberus-gaap:HomeEquityMember2019-12-310001015780etfc:FICOScoreLessThan620Memberus-gaap:RealEstateLoanMember2020-03-310001015780etfc:FICOScoreLessThan620Memberus-gaap:RealEstateLoanMember2019-12-310001015780etfc:FICOScoreLessThan620Memberus-gaap:HomeEquityMember2020-03-310001015780etfc:FICOScoreLessThan620Memberus-gaap:HomeEquityMember2019-12-310001015780srt:MaximumMemberetfc:FinancingReceivableConvertedtoAmortizingPercentageMemberetfc:OneToFourFamilyBenchmarkMember2020-01-012020-03-310001015780etfc:FinancingReceivablesStateRiskMemberstpr:CAetfc:OneToFourFamilyandHomeEquityBenchmarkMember2020-01-012020-03-310001015780etfc:FinancingReceivablesStateRiskMemberstpr:NYetfc:OneToFourFamilyandHomeEquityBenchmarkMember2020-01-012020-03-310001015780etfc:FinancingReceivablesStateRiskMemberstpr:NYetfc:OneToFourFamilyandHomeEquityBenchmarkMember2019-01-012019-12-310001015780etfc:FinancingReceivablesStateRiskMemberstpr:CAetfc:PastDueMortgageLoansMember2020-01-012020-03-310001015780etfc:FinancingReceivablesStateRiskMemberetfc:PastDueMortgageLoansMemberstpr:NY2020-01-012020-03-310001015780etfc:FinancingReceivablesStateRiskMemberstpr:CAetfc:ImpairedMortgageLoansMember2020-01-012020-03-310001015780etfc:FinancingReceivablesStateRiskMemberetfc:ImpairedMortgageLoansMemberstpr:NY2020-01-012020-03-310001015780us-gaap:RealEstateLoanMemberus-gaap:NonperformingFinancingReceivableMember2020-03-310001015780us-gaap:RealEstateLoanMemberus-gaap:NonperformingFinancingReceivableMember2019-12-310001015780us-gaap:NonperformingFinancingReceivableMemberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:NonperformingFinancingReceivableMemberus-gaap:HomeEquityMember2019-12-310001015780us-gaap:NonperformingFinancingReceivableMember2020-03-310001015780us-gaap:NonperformingFinancingReceivableMember2019-12-310001015780us-gaap:RealEstateLoanMemberetfc:CollateralDependentLoansMember2020-03-310001015780etfc:CollateralDependentLoansMemberus-gaap:HomeEquityMember2020-03-310001015780us-gaap:RealEstateLoanMemberetfc:CollateralDependentLoansMember2020-01-012020-03-310001015780etfc:CollateralDependentLoansMemberus-gaap:HomeEquityMember2020-01-012020-03-310001015780etfc:FinancingReceivablesStateRiskMemberstpr:CAetfc:CollateralDependentLoansMember2020-01-012020-03-310001015780etfc:FinancingReceivablesStateRiskMemberstpr:NYetfc:CollateralDependentLoansMember2020-01-012020-03-310001015780us-gaap:RealEstateLoanMember2020-01-012020-03-310001015780us-gaap:HomeEquityMember2020-01-012020-03-310001015780us-gaap:RealEstateLoanMember2018-12-310001015780us-gaap:HomeEquityMember2018-12-310001015780us-gaap:AutomobileLoanMember2018-12-310001015780us-gaap:RealEstateLoanMember2019-01-012019-03-310001015780us-gaap:HomeEquityMember2019-01-012019-03-310001015780us-gaap:AutomobileLoanMember2019-01-012019-03-310001015780us-gaap:RealEstateLoanMember2019-03-310001015780us-gaap:HomeEquityMember2019-03-310001015780us-gaap:AutomobileLoanMember2019-03-310001015780us-gaap:RealEstateLoanMember2020-01-010001015780us-gaap:HomeEquityMember2020-01-01etfc:loan0001015780us-gaap:RealEstateLoanMemberetfc:ReAgeExtensionorInterestCapitalizationwithInterestRateReductionMember2020-01-012020-03-310001015780etfc:OtherwithoutInterestRateReductionMemberus-gaap:RealEstateLoanMember2020-01-012020-03-310001015780etfc:ReAgeExtensionorInterestCapitalizationwithInterestRateReductionMemberus-gaap:HomeEquityMember2020-01-012020-03-310001015780etfc:OtherwithoutInterestRateReductionMemberus-gaap:HomeEquityMember2020-01-012020-03-310001015780etfc:ReAgeExtensionorInterestCapitalizationwithInterestRateReductionMember2020-01-012020-03-310001015780etfc:OtherwithoutInterestRateReductionMember2020-01-012020-03-310001015780us-gaap:RealEstateLoanMemberetfc:ReAgeExtensionorInterestCapitalizationwithInterestRateReductionMember2019-01-012019-03-310001015780etfc:OtherwithoutInterestRateReductionMemberus-gaap:RealEstateLoanMember2019-01-012019-03-310001015780etfc:ReAgeExtensionorInterestCapitalizationwithInterestRateReductionMemberus-gaap:HomeEquityMember2019-01-012019-03-310001015780etfc:OtherwithoutInterestRateReductionMemberus-gaap:HomeEquityMember2019-01-012019-03-310001015780etfc:ReAgeExtensionorInterestCapitalizationwithInterestRateReductionMember2019-01-012019-03-310001015780etfc:OtherwithoutInterestRateReductionMember2019-01-012019-03-310001015780etfc:FinancingReceivablesStateRiskMemberstpr:CAetfc:OneToFourFamilyandHomeEquityBenchmarkMember2019-01-012019-12-310001015780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2020-03-310001015780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2019-12-310001015780us-gaap:FairValueHedgingMember2020-01-012020-03-310001015780us-gaap:InterestIncomeMember2020-01-012020-03-310001015780us-gaap:InterestIncomeMember2019-01-012019-03-310001015780us-gaap:InterestIncomeMemberus-gaap:USTreasuryAndGovernmentMember2020-01-012020-03-310001015780us-gaap:InterestIncomeMemberus-gaap:USTreasuryAndGovernmentMember2019-01-012019-03-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:InterestIncomeMember2020-01-012020-03-310001015780us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:InterestIncomeMember2019-01-012019-03-310001015780srt:ParentCompanyMemberetfc:MaturingInJune2024Memberus-gaap:RevolvingCreditFacilityMember2020-03-310001015780etfc:FhlbSecuredCreditFacilityMemberetfc:ETradeBankMemberus-gaap:MaturityOnDemandMember2020-03-310001015780etfc:ETradeBankMemberetfc:FederalReserveBankDiscountWindowMemberus-gaap:MaturityOvernightMember2020-03-310001015780etfc:MaturingInJuneNextYearMemberetfc:ETradeSecuritiesMemberus-gaap:RevolvingCreditFacilityMember2020-03-310001015780etfc:SecuredCommittedLineofCreditMemberetfc:MaturingInJuneNextYearMemberetfc:ETradeSecuritiesMember2020-03-310001015780etfc:UnsecuredUncommittedLineofCreditMemberetfc:MaturingInJuneNextYearMemberetfc:ETradeSecuritiesMember2020-03-310001015780etfc:UnsecuredUncommittedLineofCreditMemberetfc:ETradeSecuritiesMember2020-03-310001015780etfc:SecuredUncommittedLineofCreditMemberetfc:ETradeSecuritiesMember2020-03-310001015780etfc:SeniorNotesInterestBearingTwoAndNineFivePercentMemberus-gaap:CorporateDebtSecuritiesMember2020-03-310001015780etfc:SeniorNotesInterestBearingThreeandEightPercentMemberus-gaap:CorporateDebtSecuritiesMember2020-03-310001015780etfc:SeniorNotesInterestBearingFourandFivePercentMemberus-gaap:CorporateDebtSecuritiesMember2020-03-310001015780us-gaap:CorporateDebtSecuritiesMember2020-03-310001015780etfc:SeniorNotesInterestBearingTwoAndNineFivePercentMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310001015780etfc:SeniorNotesInterestBearingThreeandEightPercentMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310001015780etfc:SeniorNotesInterestBearingFourandFivePercentMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310001015780us-gaap:CorporateDebtSecuritiesMember2019-12-310001015780etfc:SeniorNotesInterestBearingTwoAndNineFivePercentMemberus-gaap:CorporateDebtSecuritiesMember2020-01-012020-03-310001015780etfc:SeniorNotesInterestBearingThreeandEightPercentMemberus-gaap:CorporateDebtSecuritiesMember2020-01-012020-03-310001015780etfc:SeniorNotesInterestBearingFourandFivePercentMemberus-gaap:CorporateDebtSecuritiesMember2020-01-012020-03-310001015780etfc:SeniorNotesInterestBearingTwoAndNineFivePercentMemberus-gaap:CorporateDebtSecuritiesMember2019-01-012019-12-310001015780etfc:SeniorNotesInterestBearingThreeandEightPercentMemberus-gaap:CorporateDebtSecuritiesMember2019-01-012019-12-310001015780etfc:SeniorNotesInterestBearingFourandFivePercentMemberus-gaap:CorporateDebtSecuritiesMember2019-01-012019-12-310001015780us-gaap:PreferredStockMember2020-01-012020-03-310001015780us-gaap:SeriesAPreferredStockMember2020-03-310001015780us-gaap:SeriesAPreferredStockMember2019-12-310001015780us-gaap:SeriesBPreferredStockMember2020-03-310001015780us-gaap:SeriesBPreferredStockMember2019-12-310001015780us-gaap:SeriesAPreferredStockMember2020-01-012020-03-310001015780us-gaap:SeriesBPreferredStockMember2020-01-012020-03-310001015780us-gaap:SeriesAPreferredStockMember2019-01-012019-03-310001015780us-gaap:SeriesBPreferredStockMember2019-01-012019-03-310001015780us-gaap:CommonStockMember2020-01-012020-03-310001015780us-gaap:CommonStockMember2019-01-012019-03-310001015780us-gaap:SubsequentEventMemberus-gaap:CommonStockMember2020-04-012020-06-300001015780us-gaap:CommonStockMemberetfc:CurrentShareRepurchaseProgramMember2019-07-310001015780us-gaap:CommonStockMemberetfc:CurrentShareRepurchaseProgramMember2020-01-012020-03-310001015780us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-12-310001015780us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-12-310001015780us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-01-012020-03-310001015780us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-03-310001015780us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-03-310001015780us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-03-310001015780us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001015780us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310001015780us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:SeriesAPreferredStockMember2020-03-310001015780us-gaap:SeriesBPreferredStockMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-03-310001015780etfc:ETradeSecuritiesMember2020-03-310001015780etfc:ETradeFuturesMembersrt:MinimumMember2020-03-310001015780etfc:ETradeFuturesMember2020-03-310001015780etfc:ETradeSecuritiesMember2019-12-310001015780etfc:ETradeFuturesMember2019-12-310001015780etfc:ETradeSecuritiesMember2020-01-012020-03-310001015780srt:ParentCompanyMember2020-03-310001015780srt:ParentCompanyMember2019-12-310001015780etfc:ETradeBankMember2020-03-310001015780etfc:ETradeBankMember2019-12-310001015780etfc:EtradeSavingsBankMember2020-03-310001015780etfc:EtradeSavingsBankMember2019-12-310001015780etfc:CapitalConservationBufferMembersrt:MinimumMember2020-03-310001015780etfc:AxajoComplaintMember2003-01-012003-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2020

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission File Number 1-11921

E TRADE Financial Corporation

TRADE Financial Corporation E*TRADE Financial Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | | 94-2844166 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification Number) |

671 N. Glebe Road, Arlington, Virginia 22203

(Address of principal executive offices and Zip Code)

(646) 521-4340

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | ETFC | The NASDAQ Stock Market LLC |

| | NASDAQ Global Select Market |

_____________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | | ☐ |

Non-accelerated filer ¨ | | | Smaller reporting company | | ☐ |

| | | Emerging growth company | | ☐ |

| | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

As of April 30, 2020, there were 221,046,419 shares of common stock outstanding.

E*TRADE FINANCIAL CORPORATION

FORM 10-Q QUARTERLY REPORT

For the Quarter Ended March 31, 2020

TABLE OF CONTENTS

| | | | | | | | |

| PART I | FINANCIAL INFORMATION | |

| | |

| Item 1. |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| PART II | | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | |

E*TRADE Q1 2020 10-Q | Page i

Unless otherwise indicated, references to "the Company," "we," "us," "our," "E*TRADE" and "E*TRADE Financial" mean E*TRADE Financial Corporation and its subsidiaries, and references to the parent company mean E*TRADE Financial Corporation but not its subsidiaries.

E*TRADE, E*TRADE Financial, E*TRADE Bank, E*TRADE Savings Bank, the Converging Arrows logo, Power E*TRADE, Equity Edge Online, E*TRADE Advisor Services, E*TRADE Advisor Network, Liberty and Gradifi are trademarks or registered trademarks of E*TRADE Financial Corporation in the United States and in other countries. All other trademarks are the property of their respective owners.

E*TRADE Q1 2020 10-Q | Page ii

PART I

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. These statements discuss, among other things:

•our future plans, objectives, outlook, strategies, expectations and intentions relating to our business and future financial and operating results and the assumptions that underlie these matters

•our capital plan initiatives

•the timing and payment of dividends on our common and preferred stock

•the payment of dividends from our subsidiaries to our parent company

•the management of our legacy mortgage loan portfolio

•our ability to comply with future changes to government regulations

•our ability to maintain required regulatory capital ratios

•our ability to meet upcoming debt obligations

•the integration and related restructuring costs of past and any future acquisitions

•the expected outcome of existing or new litigation

•our ability to execute our business plans and manage risk

•future sources of revenue, expense and liquidity

•the ability of our technology solution and referral program for advisors to attract and retain customers seeking specialized services and sophisticated advice

•the expected impact of the adoption of the amended accounting guidance governing the accounting for credit losses

•the expected impact from and responses to the elimination of retail commissions for online US listed stock, exchange-traded funds (ETF), and options trades

•the consummation of the proposed merger with Morgan Stanley and the anticipated benefits thereof

•the current and expected impact of the coronavirus (COVID-19) pandemic, and the measures taken by governmental authorities in response thereto

•any other statement that is not historical in nature

These statements may be identified by the use of words such as "assume," "expect," "believe," "may," "will," "should," "anticipate," "intend," "plan," "estimate," "continue" and similar expressions.

We caution that actual results could differ materially from those discussed in these forward-looking statements. Important factors that could contribute to our actual results differing materially from any forward-looking statements include, but are not limited to:

•changes in business, economic or political conditions

•performance, volume and volatility in the equity and capital markets

•changes in interest rates or interest rate volatility

•our ability to manage our balance sheet size and capital levels

•disruptions or failures of our information technology systems or those of our third-party service providers

•cyber security threats, system disruptions and other potential security breaches or incidents

•customer demand for financial products and services

•our ability to continue to compete effectively and respond to aggressive competition within our industry, such as through the elimination of retail commissions for online US listed stock, ETF and options trades

E*TRADE Q1 2020 10-Q | Page 1

•our ability to participate in consolidation opportunities in our industry, to complete consolidation transactions and to realize synergies or implement integration plans

•our ability to manage our significant risk exposures effectively

•the occurrence of risks associated with our advisory services

•our ability to manage credit risk with customers and counterparties

•our ability to service our corporate debt and, if necessary, to raise additional capital

•changes in government regulation, including interpretations, or actions by our regulators, including those that may result from the implementation and enforcement of regulatory reform legislation

•adverse developments in any existing or new investigations, disciplinary actions or litigation

•changes in actual or forecasted assumptions impacting the measurement of expected credit losses

•the consummation of the proposed merger with Morgan Stanley and the anticipated benefits thereof

•the scope and duration of the COVID-19 pandemic and actions taken by governmental authorities to contain the financial and economic impact of the outbreak

By their nature forward-looking statements are not guarantees of future performance or results and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. Actual future results may vary materially from expectations expressed or implied in this report or any of our prior communications. Investors should also consider the risks and uncertainties described elsewhere in this report, including under Part II. Item 1A. Risk Factors and Part I. Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part I. Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the Securities and Exchange Commission (SEC), which are incorporated herein by reference. The forward-looking statements contained in this report reflect our expectations only as of the date of this report. Investors should not place undue reliance on forward-looking statements, as we do not undertake to update or revise forward-looking statements, except as required by law.

E*TRADE Q1 2020 10-Q | Page 2

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

The following discussion should be read in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this document and with the Annual Report on Form 10-K for the year ended December 31, 2019. Company Overview

E*TRADE is a financial services company that provides brokerage and related products and services for traders, investors, stock plan administrators and participants, and registered investment advisors (RIAs). Founded on the principle of innovation, we aim to enhance the financial independence of customers through a powerful digital offering that includes tools and educational materials, complemented by professional advice and support, catering to the complex and unique needs of customers to help meet their near- and long-term investing goals. We provide these services through our digital platforms and network of industry-licensed customer service representatives and financial consultants, over the phone, by email and online via two national financial centers, and in-person at 30 regional financial centers across the United States. We also operate federally chartered savings banks with the primary purpose of maximizing the value of deposits generated through our brokerage business.

We operate directly and through several subsidiaries, many of which are overseen by governmental and self-regulatory organizations (SROs). Our most important subsidiaries are described below:

•E*TRADE Securities LLC (E*TRADE Securities) is a registered broker-dealer that clears and settles customer transactions

•E*TRADE Bank is a federally chartered savings bank that provides Federal Deposit Insurance Corporation (FDIC) insurance on certain qualifying amounts of customer deposits and provides other banking and cash management capabilities

•E*TRADE Savings Bank, a subsidiary of E*TRADE Bank, is a federally chartered savings bank that provides FDIC insurance on certain qualifying amounts of customer deposits and provides custody solutions for RIAs

•E*TRADE Financial Corporate Services, Inc. (E*TRADE Financial Corporate Services) is a provider of software and services for managing equity compensation plans and student loan and financial wellness benefits to our corporate clients

•E*TRADE Futures LLC (E*TRADE Futures) is a registered non-clearing Futures Commission Merchant (FCM) that provides retail futures transaction capabilities for our customers

•E*TRADE Capital Management LLC (E*TRADE Capital Management) is an RIA that provides investment advisory services for our customers

E*TRADE Q1 2020 10-Q | Page 3

Delivering a powerful digital offering for our customers is a core pillar of our business strategy and we believe our focus on being a digital leader in the financial services industry is a competitive advantage. We offer a broad range of products and services to customers through the following channels:

•Retail: Our retail channel services individual brokerage and banking customers that utilize our web, mobile and/or active trading platforms to meet trading, investing and/or banking needs.

•Institutional: Our institutional channels include Corporate Services and Advisor Services. We provide stock plan, student loan and financial wellness solutions for public and private companies globally through our corporate services channel. We provide custody services to independent RIAs through our advisor services channel.

Our business strategy is focused on leveraging our brand, hybrid support model, and technology to grow our retail and institutional channels while generating robust earnings growth and maximizing shareholder returns.

Leverage our brand, hybrid support model, and leading technology for scale and growth

E*TRADE's unrivaled and tech-forward brand is synonymous with digital brokerage and drives outsized awareness and consideration among business-to-customer and business-to-business audiences. Our customers benefit from digitally led experiences, complemented by professional advice and support. We cater to the complex and unique needs of traders, investors, stock plan administrators and participants, and independent RIAs. We are able to serve peak volumes across channels with capacity for growth through our strong and scalable infrastructure.

Empower self-directed retail customers through a powerful digital offering and professional guidance

E*TRADE has three core digital offerings for the retail investor—trading, investing, and banking. We maintain a leading position among active and derivatives traders through the Power E*TRADE web-based platform and support model. We connect customers with a range of easy to use wealth management solutions. We are also advancing digital banking capabilities to complement our existing product set and increase engagement with customers and prospects.

Capitalize on symbiotic institutional channels to drive growth

E*TRADE's corporate services and advisor services channels are critical for growth. We aim to expand on our #1 position in stock plan administration through innovative digital solutions, complementary service offerings and expert support—driving growth in retail and institutional relationships. We plan to leverage the power of E*TRADE's brand, digital ethos, and our broad customer base to grow the advisor services channel. We also plan to connect retail customers and stock plan participants seeking higher touch services to top-tier advisors through our referral network—driving asset growth and retention.

Generate robust earnings growth and shareholder returns

We aim to deliver superior returns on customer assets by capturing the full value of our retail and institutional relationships and leveraging E*TRADE's highly scalable model to generate robust earnings growth and maximize shareholder returns.

E*TRADE Q1 2020 10-Q | Page 4

PRODUCTS AND SERVICES

Our hybrid delivery model is available through the following award-winning digital platforms which are complemented by professional advice and support.

| | | | | | | | | | | |

Platforms for Retail Channel(1) | | Platforms for Institutional Channels(1) | |

| Web | | Equity Edge Online(2) |

| Our easy to use site is the primary channel to interact with customers and prospects | | Equity Edge Online is the #1 rated platform in the stock plan administration industry that offers automation and flexibility |

| | | |

| | | |

| | | |

| Mobile | | Gradifi |

| Our industry leading mobile applications include integrations with leading mobile artificial intelligence assistants | | Gradifi is a scalable, streamlined platform that offers student loan and financial wellness benefits |

| | | |

| | | |

| | | |

| Active Trading Platforms | | Liberty |

| Active derivatives trading platforms include sophisticated trading tools, advanced portfolio and market tracking, and idea generation and analysis | | Liberty is intuitive technology built for RIAs that simplifies the investment and management of client assets |

| | | |

| | | |

| | | |

| Complemented by professional advice and support | | | |

| Customer Service | | Financial Consultants |

| Customer service is available 24/7 via phone, email or chat from industry licensed representatives. White glove service is available for our highest-tiered customers | | Financial consultants are available by phone or at branches to provide one-on-one investing advice |

| | | |

| | | |

| | | |

| Active Trader Services | | Corporate Services |

| Active trader services includes specialized support for sophisticated customers with advanced knowledge and skill

| | Corporate services support includes personalized service on a global scale driven by dedicated relationship and service managers backed by comprehensive training and education |

| | | |

| | | |

| | | |

| | | Advisor Services |

| | | Advisor services support includes dedicated relationship managers who act as a single point of contact for specialized support |

| | | |

| | | |

(1)In August 2019, E*TRADE was rated the #1 online broker in Kiplinger's 2019 Best Online Brokers Review. In the current year, we maintained our #1 ranking for Mobile Trading, Options Trading, and Web-based Platform (Power E*TRADE) in Stockbrokers.com's 2020 review of Best Online Brokers for Stock Trading. We also finished Best in Class for research, education, active trading, futures trading, and IRA accounts. In March 2020, E*TRADE was also named Best Broker for ease of trading and beginning options traders in Investopedia's 2020 Online Broker review.

(2)In September 2019, Equity Edge Online was rated #1 in Loyalty and Overall Satisfaction for the eighth consecutive year in the Group Five Stock Plan Administration Benchmark Study.

E*TRADE Q1 2020 10-Q | Page 5

We deliver a broad range of products and services through our retail and institutional channels across the following five product areas: Trading, Investing, Banking and Cash Management, Corporate Services and Advisor Services.

Trading

The Company delivers automated trade order placement and execution services, offering our customers a full range of investment vehicles, including US equities, ETFs, options, bonds, futures, American depositary receipts and non-proprietary mutual funds. We also offer margin accounts, enabling qualifying customers to borrow against their securities, supported by robust customer tools to analyze positions and understand collateral requirements. The Company also offers a fully paid lending program which allows customers to earn income on certain securities when they permit us to lend these securities.

The Company markets trading products and services to active traders and self-directed investors. Products and services are delivered through web, mobile, and active trading platforms. Trading tools are supported by guidance, including options, futures and fixed income specialists available on-call for customers. Other tools and resources include independent research and analytics, live and on-demand education, market commentary, trading ideas, strategies, and screeners for major asset classes.

Investing

The Company endeavors to help investors build wealth and address their long-term investing needs through a suite of managed products, asset allocation models, and other services. These include our Core Portfolios, Blend Portfolios, Dedicated Portfolios, and Fixed Income Portfolios. The Company offers self-directed digital tools across web and mobile platforms, including mutual fund and ETF screeners, All-Star Lists, a collection of pre-built ETF or mutual fund portfolios based on time frame and risk tolerance, an assortment of planning and allocation tools, thematic investing opportunities, education and editorial content. Investors also have access to a wide selection of ETFs and mutual funds, including approximately 2,300 ETFs and more than 4,600 no-load, no-transaction fee mutual funds.

The Company also offers guidance through a team of licensed financial consultants and Chartered Retirement Planning CounselorsSM at our 30 regional financial centers and through our two national financial centers by phone, email and online. Customers can also receive complimentary portfolio reviews and personalized investment recommendations.

Banking and Cash Management

The Company's banking and cash management capabilities include deposit accounts insured by the FDIC, which are fully integrated into customer brokerage accounts. E*TRADE Bank's deposit account offerings include the Premium Savings Account, which provides a higher yield to savings account customers as compared to our other deposit products. Among other features, E*TRADE Bank's customers can transfer to and from accounts at E*TRADE and elsewhere for free, and checking account customers have access to debit cards with ATM fee refunds, online and mobile bill pay, and mobile check deposits. We also offer the E*TRADE Line of Credit, a securities-based lending program, which allows customers to borrow against the market value of securities pledged as collateral.

E*TRADE Q1 2020 10-Q | Page 6

Corporate Services

Through our industry-leading platform, Equity Edge Online, the Company offers fully-automated employee stock plan and employee stock purchase plan administration, as well as comprehensive accounting, reporting and scenario modeling tools. The integrated stock plan solutions include multi-currency settlement and delivery, and streamlined tax calculation. Additionally, corporate clients are offered 10b5-1 plan design and implementation, along with SEC filing assistance and automated solutions. Participants have full access to E*TRADE's robust investing and trading capabilities, including tailored education and planning tools, and dedicated stock plan service representatives. Comprehensive financial wellness and student loan solutions have been introduced to complement our existing corporate services offering with the acquisition of Gradifi, Inc. (Gradifi) in December 2019. Refer to Note 2—Acquisitions and Restructuring for further details.

Corporate Services is an important driver of account and asset growth, serving as a conduit to the retail channel. Over the trailing 12 months, there were $101 billion of gross inflows into our corporate services channel, primarily driven by new corporate client implementations and new grants and employee stock purchase plan transactions. Over this same period, domestic stock plan participants generated $38 billion of net proceeds through transactions of vested assets. These participant proceeds represent a key source of net new assets for the retail customer channel.

Advisor Services

Through our proprietary technology platform, Liberty, the Company offers sophisticated modeling, rebalancing, reporting, and practice management capabilities that are fully customizable for the RIA. E*TRADE's financial consultants can refer retail customers to pre-qualified RIAs on our custody platform through our referral program, the E*TRADE Advisor Network, which is offered through our two national and 30 regional financial centers. We expect the E*TRADE Advisor Network will improve the Company's ability to drive asset growth and retain customers seeking specialized services and sophisticated advice.

Significant Events

Proposed merger with Morgan Stanley

On February 20, 2020, the Company entered into an Agreement and Plan of Merger (the Merger Agreement) with Morgan Stanley under which Morgan Stanley agreed to acquire the Company in an all-stock transaction. The acquisition is subject to customary closing conditions, including regulatory approvals and approval by the Company's shareholders, and is expected to close in the fourth quarter of 2020. Please refer to Note 2—Acquisitions and Restructuring for additional details.

Global economy disrupted as COVID-19 declared a pandemic

In March 2020, the World Health Organization declared the outbreak of COVID-19 a pandemic. The Company responded by executing its business continuity plan and transitioning nearly all of its workforce to a remote working environment to prioritize the safety of its employees and customers. The pandemic, and actions taken by governmental authorities to contain its financial and economic impact, has resulted in significant market volatility, with the Chicago Board Options Exchange Volatility Index (VIX) setting record levels and major indices entering bear market territory for the first time in over a decade, driving lower equity market valuations and a significant reduction in interest rates. As a result, the Company experienced lower margin balances and sequential declines in net interest margin, net interest income and other related revenues. While these decreases were offset by increased trading-based revenues resulting from record customer engagement, we cannot be certain that such levels will persist should the scope and duration of the disruption be prolonged.

E*TRADE Q1 2020 10-Q | Page 7

Financial Performance

Our net revenue is generated primarily from net interest income, commissions and fees and service charges:

•Net interest income is largely impacted by the size of our balance sheet, our balance sheet mix, and average yields on our assets and liabilities. Net interest income is driven primarily from interest earned on investment securities, margin receivables, securities lending, and our legacy loan portfolio, less interest incurred on interest-bearing liabilities, including deposits, customer payables, corporate debt and other borrowings.

•Commissions revenue is generated by customer trades and is largely impacted by trade volume and trade type, specifically options contract charges.

•Fees and service charges revenue is primarily impacted by order flow revenue, fees earned from customer cash held by third parties, advisor management and custody fees, and mutual fund service fees.

Our net revenue is offset by non-interest expenses, the largest of which are compensation and benefits and advertising and market development.

E*TRADE Q1 2020 10-Q | Page 8

Key Performance Metrics

Management monitors customer activity and corporate metrics to evaluate the Company’s performance. The most significant of these are displayed below.

Customer Activity Metrics

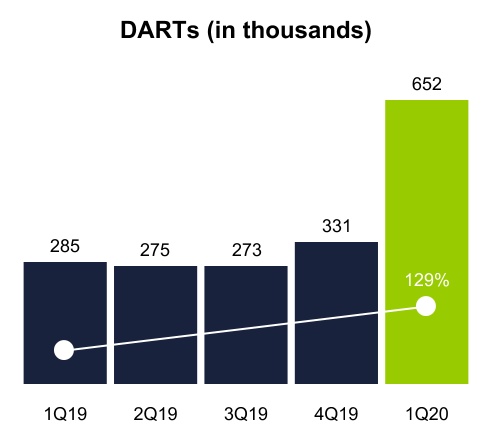

Daily Average Revenue Trades (DARTs) is an important measure of customer trading activity and is a key driver of trading-based revenue. DARTs were 651,746 and 285,004 for the three months ended March 31, 2020 and 2019, respectively. DARTs volume is impacted by market sentiment as well as volatility of the equity markets.

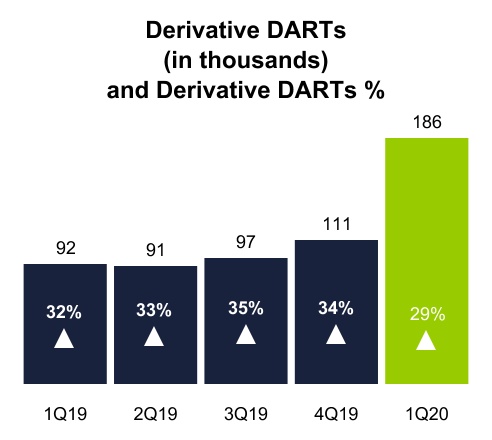

Derivative DARTs, a key component of overall DARTs that represents advanced trading activities by our customers, is the daily average number of options and futures trades, and Derivative DARTs percentage is the mix of options and futures trades as a component of total DARTs. We expect that options trades will be the primary driver of commissions revenue in future periods. Derivative DARTs were 186,065 and 91,940 for the three months ended March 31, 2020 and 2019, respectively. Derivative DARTs represented 29% and 32% of total DARTs for the three months ended March 31, 2020 and 2019, respectively.

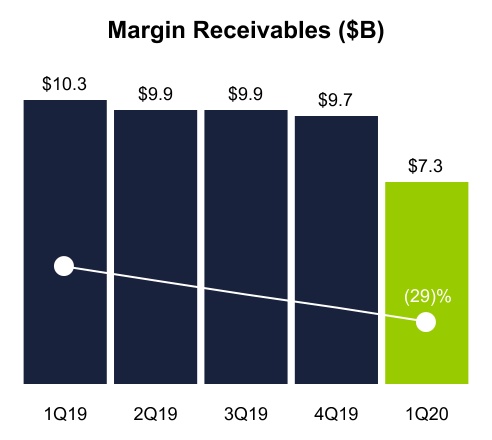

Margin receivables represent credit extended to customers to finance their purchases of securities by borrowing against securities they own and is a key driver of net interest income. Margin receivables were $7.3 billion and $10.3 billion at March 31, 2020 and 2019, respectively, contracting meaningfully in late March 2020 as equity market valuations decreased. Average margin receivables balances are significant drivers of net interest income. Average margin receivables were $9.4 billion and $9.8 billion for the three months ended March 31, 2020 and 2019, respectively.

E*TRADE Q1 2020 10-Q | Page 9

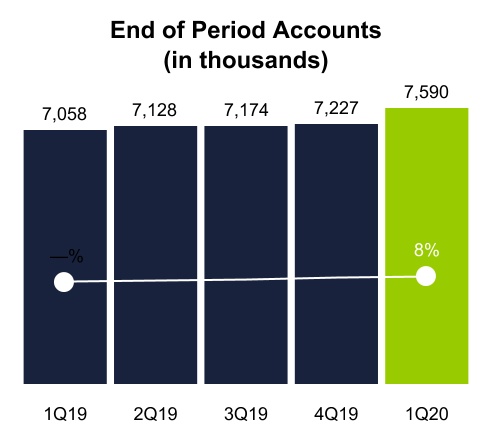

End of period accounts and net new accounts are indicators of our ability to attract and retain customers. Net new accounts represent gross new accounts less accounts attrited during the period. The following table presents end of period accounts by channel:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 1Q 2020 | | 4Q 2019 | | 3Q 2019 | | 2Q 2019 | | 1Q 2019 |

| End of period retail accounts | | | | | | 5,498,596 | | | 5,169,757 | | | 5,130,138 | | | 5,122,669 | | | 5,088,597 | |

| End of period advisor services accounts | | | | | | 144,453 | | | 148,198 | | | 150,401 | | | 151,275 | | | 151,222 | |

| End of period corporate services accounts | | | | | | 1,946,956 | | | 1,908,836 | | | 1,893,881 | | | 1,853,875 | | | 1,817,983 | |

| End of period accounts | | | | | | 7,590,005 | | | 7,226,791 | | | 7,174,420 | | | 7,127,819 | | | 7,057,802 | |

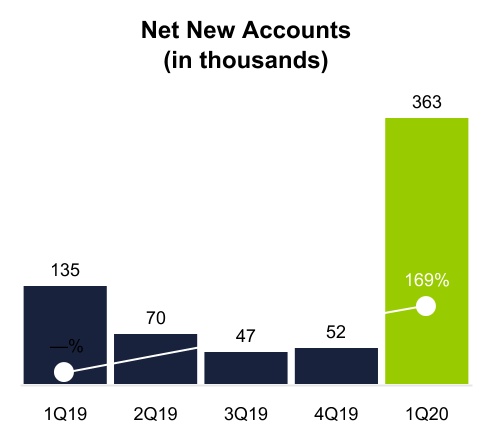

The following table presents net new accounts and annualized growth rates by channel:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 1Q 2020 | | 4Q 2019 | | 3Q 2019 | | 2Q 2019 | | 1Q 2019 |

| Net new retail accounts | | | | | | 328,839 | | 39,619 | | 7,469 | | 34,072 | | 80,830 |

| Net new advisor services accounts | | | | | | (3,745) | | (2,203) | | (874) | | 53 | | (19) |

| Net new corporate services accounts | | | | | | 38,120 | | 14,955 | | 40,006 | | 35,892 | | 54,154 |

| Net new accounts | | | | | | 363,214 | | 52,371 | | 46,601 | | 70,017 | | 134,965 |

| | | | | | | | | | | | | | |

| Net new retail account growth rate | | | | | | 25.4 | % | | 3.1 | % | | 0.6 | % | | 2.7 | % | | 6.5 | % |

| Net new advisor services account growth rate | | | | | | (10.1) | % | | (5.9) | % | | (2.3) | % | | 0.1 | % | | (0.1) | % |

| Net new corporate services account growth rate | | | | | | 8.0 | % | | 3.2 | % | | 8.6 | % | | 7.9 | % | | 12.3 | % |

| Net new total account growth rate | | | | | | 20.1 | % | | 2.9 | % | | 2.6 | % | | 4.0 | % | | 7.8 | % |

E*TRADE Q1 2020 10-Q | Page 10

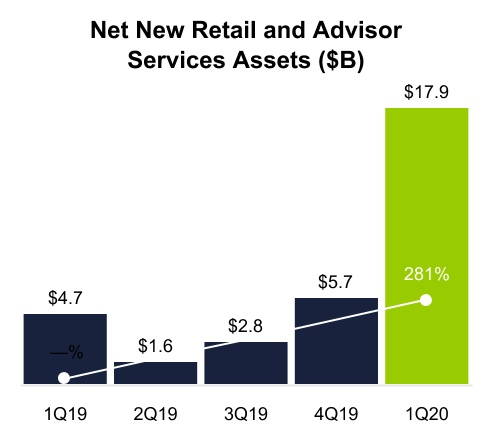

Net new retail and advisor services assets equals total inflows to new and existing retail and advisor services accounts less total outflows from closed and existing retail and advisor services accounts. The net new retail and advisor services assets metric is a general indicator of the use of our products and services by new and existing retail and advisor services customers. Net new retail and advisor services assets exclude the effects of market movements in the value of retail and advisor services assets. Net new retail and advisor services assets were $17.9 billion and $4.7 billion for the three months ended March 31, 2020 and 2019, respectively, as we experienced record customer engagement during the three months ended March 31, 2020. The following table presents annualized net new retail and advisor services assets growth rates:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 1Q 2020 | | 4Q 2019 | | 3Q 2019 | | 2Q 2019 | | 1Q 2019 |

| Net new retail assets growth rate | | | | | | 20.2 | % | | 7.0 | % | | 3.4 | % | | 2.1 | % | | 6.8 | % |

| Net new advisor services assets growth rate | | | | | | (7.1) | % | | (2.3) | % | | 0.8 | % | | (1.2) | % | | (3.5) | % |

| Net new retail and advisor services assets growth rate | | | | | | 18.8 | % | | 6.5 | % | | 3.2 | % | | 1.9 | % | | 6.2 | % |

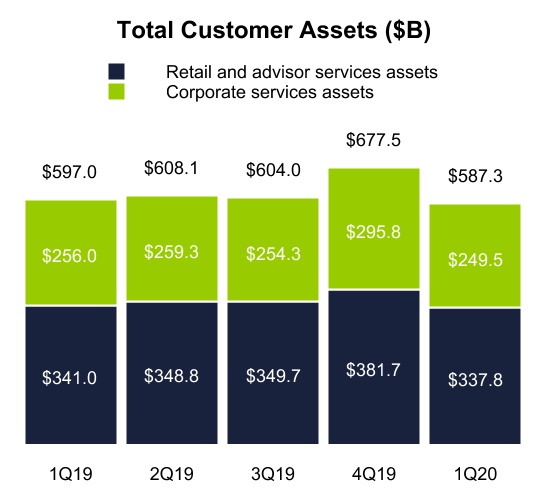

Total customer assets is an indicator of the value of our relationship with our customers. An increase generally indicates that the use of our products and services is expanding. Changes in this metric are also driven by changes in the valuations of our customers' underlying securities. The net decrease in customer assets during the three months ended March 31, 2020 was driven by the decline in equity market valuations in the second half of the quarter. The following table presents the significant components of total customer assets (dollars in billions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 1Q 2020 | | 4Q 2019 | | 3Q 2019 | | 2Q 2019 | | 1Q 2019 |

| Security holdings | | | | | | $ | 253.2 | | | $ | 310.7 | | | $ | 284.7 | | | $ | 286.6 | | | $ | 279.3 | |

| Cash and deposits | | | | | | 84.6 | | | 71.0 | | | 65.0 | | | 62.2 | | | 61.7 | |

| Retail and advisor services assets | | | | | | 337.8 | | | 381.7 | | | 349.7 | | | 348.8 | | | 341.0 | |

| Corporate services vested assets | | | | | | 135.8 | | | 159.1 | | | 138.9 | | | 142.3 | | | 140.6 | |

| Retail, advisor services, and corporate services vested assets | | | | | | 473.6 | | | 540.8 | | | 488.6 | | | 491.1 | | | 481.6 | |

| Corporate services unvested holdings | | | | | | 113.7 | | | 136.7 | | | 115.4 | | | 117.0 | | | 115.4 | |

| Total customer assets | | | | | | $ | 587.3 | | | $ | 677.5 | | | $ | 604.0 | | | $ | 608.1 | | | $ | 597.0 | |

E*TRADE Q1 2020 10-Q | Page 11

Customer cash and deposits is a significant component of total customer assets and is a key driver of net interest income as well as fees and service charges revenue, which includes fees earned on customer cash held by third parties. The following table presents the significant components of total customer cash and deposits (dollars in billions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 1Q 2020 | | 4Q 2019 | | 3Q 2019 | | 2Q 2019 | | 1Q 2019 |

| Sweep deposits: | | | | | | | | | | | | | | |

| Brokerage sweep deposits | | | | | | $ | 38.1 | | | $ | 27.9 | | | $ | 30.8 | | | $ | 31.7 | | | $ | 38.6 | |

Bank sweep deposits(1) | | | | | | 0.7 | | | 6.4 | | | — | | | | — | | | — | |

| Customer payables | | | | | | 16.0 | | | 12.8 | | | 11.2 | | | 10.6 | | | 10.6 | |

Savings, checking, and other banking assets(2) | | | | | | 3.3 | | | 4.3 | | | 9.6 | | | 8.6 | | | 7.7 | |

| Total on-balance sheet customer cash and deposits | | | | | | 58.1 | | | 51.4 | | | 51.6 | | | 50.9 | | | 56.9 | |

| Brokerage sweep deposits at unaffiliated financial institutions | | | | | | 15.4 | | | 16.9 | | | 11.7 | | | 9.6 | | | 3.0 | |

Bank sweep deposits at unaffiliated financial institutions(1) | | | | | | 9.1 | | | 0.8 | | | — | | | | — | | | | — | |

| Money market funds and other | | | | | | 2.0 | | | 1.9 | | | 1.7 | | | 1.7 | | | 1.8 | |

Total customer cash held by third parties(3) | | | | | | 26.5 | | | 19.6 | | | 13.4 | | | 11.3 | | | 4.8 | |

| Total customer cash and deposits | | | | | | $ | 84.6 | | | $ | 71.0 | | | $ | 65.0 | | | $ | 62.2 | | | $ | 61.7 | |

(1)Beginning in Q4 2019, bank sweep deposits include Premium Savings Accounts participating in the newly established bank sweep deposit account program. Refer to MD&A—Balance Sheet Overview for additional information.

(2)Savings, checking, and other banking assets include $1.0 billion, $6.3 billion, $5.1 billion, and $3.8 billion of deposits at December 31, 2019, September 30, 2019, June 30, 2019, and March 31, 2019, respectively in our Premium Savings Account product. These balances were converted to our bank sweep deposit account program beginning in Q4 2019 and during the three months ended March 31, 2020, with all new Premium Savings Accounts now automatically enrolled in the program.

(3)Customer cash held by third parties is held outside E*TRADE and includes sweep deposit accounts and money market funds at unaffiliated financial institutions, net of deposit balances from unaffiliated institutions held on-balance sheet. Customer cash held by third parties is not reflected in the Company's consolidated balance sheet and is not immediately available for liquidity purposes.

The following table presents the average balances and net fees earned on brokerage and bank sweep deposits held at unaffiliated financial institutions (dollars in billions, fees in basis points):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1Q 2020 | | 4Q 2019 | | 3Q 2019 | | 2Q 2019 | | 1Q 2019 |

| | | | | | | | | |

| Brokerage sweep deposits at unaffiliated financial institutions | $ | 15.4 | | | $ | 14.7 | | | $ | 11.0 | | | $ | 3.7 | | | $ | 3.4 | |

Brokerage sweep deposit fees(1) | 148 | | | 179 | | | 218 | | | 221 | | | 221 | |

| Bank sweep deposits at unaffiliated financial institutions | $ | 5.5 | | | $ | 0.3 | | | $ | — | | | $ | — | | | $ | — | |

Bank sweep deposit fees(1) | 8 | | | 6 | | | — | | | — | | | — | |

(1)Fees are net of interest paid.

E*TRADE Q1 2020 10-Q | Page 12

Corporate Metrics:

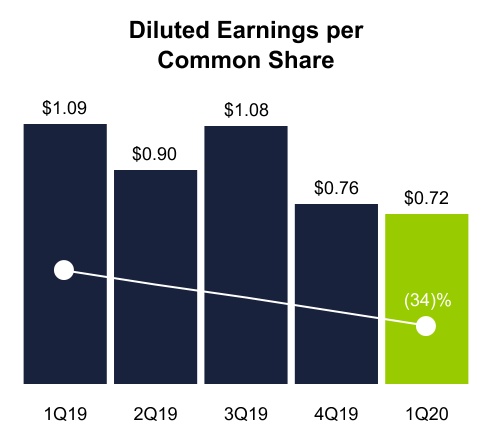

Diluted earnings per common share is the portion of a company's profit allocated to each diluted share of common stock and is a key indicator of the Company's profitability. Diluted earnings per common share was $0.72 and $1.09 for the three months ended March 31, 2020 and 2019, respectively. See MD&A—Earnings Overview for further details.

Operating margin is the percentage of net revenue that results in income before income taxes and is an indicator of the Company's profitability. Operating margin was 36% and 52% for the three months ended March 31, 2020 and 2019, respectively.

Adjusted operating margin is a non-GAAP measure that provides useful information about our ongoing operating performance by excluding the provision (benefit) for credit losses, which is not viewed as key factor governing our investment in the business and is excluded by management when evaluating operating margin performance. Adjusted operating margin was 37% and 50% for the three months ended March 31, 2020 and 2019, respectively. See MD&A—Earnings Overview for a reconciliation of adjusted operating margin to operating margin.

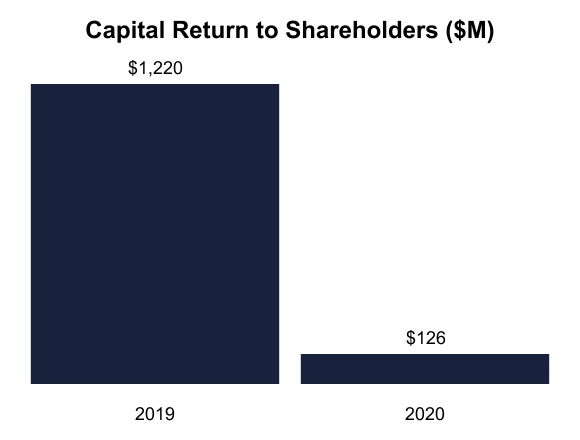

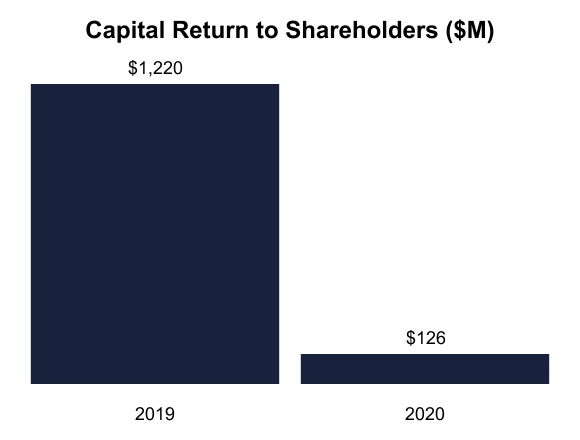

Capital return to shareholders represents the amount of earnings returned to shareholders through share repurchases and common stock dividends and Capital return percentage to shareholders is capital returned to shareholders as a percentage of net income available to common shareholders. Capital return to shareholders was $126 million and $1.2 billion for the three months ended March 31, 2020 and the year ended December 31, 2019, respectively, and included common stock dividends of $31 million and $135 million, respectively, for the same periods. Capital return percentage to shareholders was 78% and 133% for the same periods. The Company repurchased 2.1 million shares for $95 million during the three months

E*TRADE Q1 2020 10-Q | Page 13

ended March 31, 2020 prior to suspending share repurchases in connection with the proposed merger with Morgan Stanley. The Company also returned capital to shareholders in the form of shares withheld for taxes of $13 million and $20 million for the three months ended March 31, 2020 and the year ended December 31, 2019, respectively.

Return on common equity is calculated by dividing net income available to common shareholders by average common shareholders' equity, which excludes preferred stock. Return on common equity was 11% and 19% for the three months ended March 31, 2020 and 2019, respectively.

Adjusted return on common equity is a non-GAAP measure calculated by dividing adjusted net income available to common shareholders by average common shareholders' equity, which excludes preferred stock. Adjusted net income available to common shareholders is a non-GAAP measure which excludes the provision (benefit) for credit losses, which is not viewed as key factor governing our investment in the business and is excluded by management when evaluating return on common equity performance. Adjusted return on common equity was 12% and 18% for the three months ended March 31, 2020 and 2019, respectively. See MD&A—Earnings Overview for a reconciliation of adjusted net income available to common shareholders to net income and adjusted return on common equity to return on common equity.

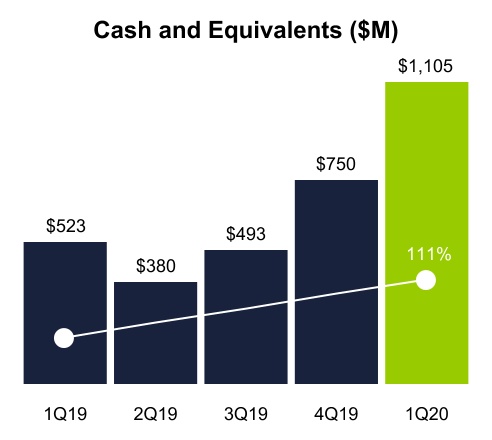

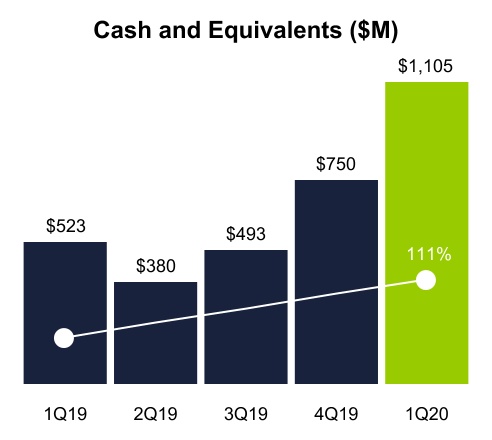

Corporate cash, a non-GAAP measure, is a component of cash and equivalents and represents the primary source of capital above and beyond the capital deployed in our regulated subsidiaries. Cash and equivalents was $1.1 billion and $523 million at March 31, 2020 and 2019, respectively, while corporate cash was $438 million and $329 million for the same periods. See MD&A—Liquidity and Capital Resources for a reconciliation of corporate cash to cash and equivalents.

E*TRADE Q1 2020 10-Q | Page 14

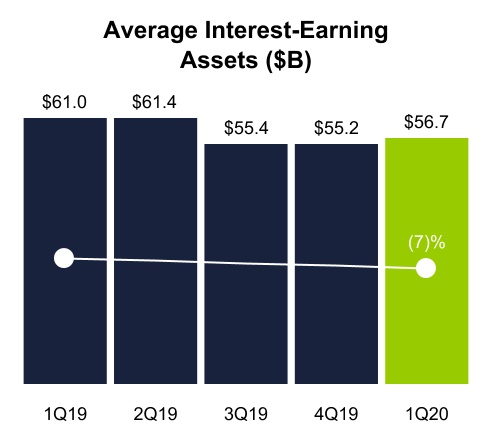

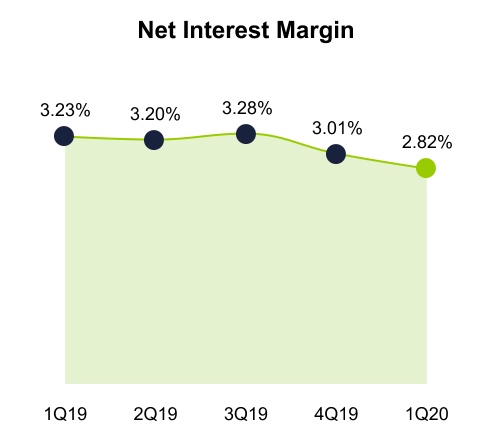

Average interest-earning assets, along with net interest margin, are indicators of our ability to generate net interest income. Average interest-earning assets were $56.7 billion and $61.0 billion for the three months ended March 31, 2020 and 2019, respectively.

Net interest margin is a measure of the net yield on our average interest-earning assets. Net interest margin is calculated for a given period by dividing the annualized sum of net interest income by average interest-earning assets. Net interest margin was 2.82% and 3.23% for the three months ended March 31, 2020 and 2019, respectively.

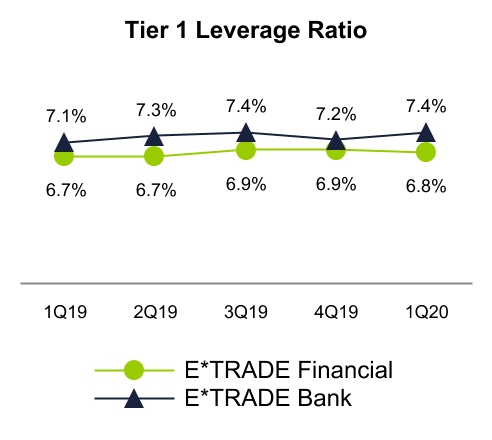

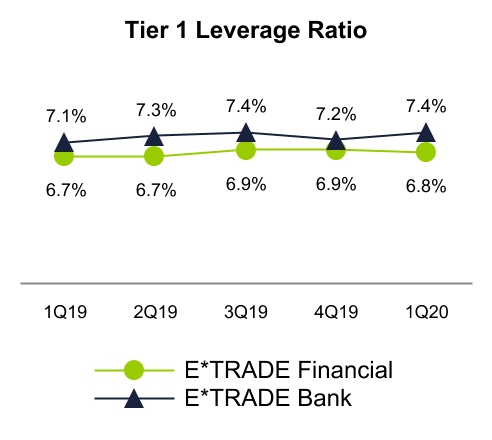

Tier 1 leverage ratio is an indicator of capital adequacy for E*TRADE Financial and E*TRADE Bank. Tier 1 leverage ratio is Tier 1 capital divided by adjusted average assets for leverage capital purposes. E*TRADE Financial's Tier 1 leverage ratio was 6.8% and 6.7% at March 31, 2020 and 2019, respectively. E*TRADE Bank's Tier 1 leverage ratio was 7.4% and 7.1% at March 31, 2020 and 2019, respectively. The internal threshold for E*TRADE Financial's Tier 1 leverage ratio is 6.5% and the internal threshold for E*TRADE Bank's Tier 1 leverage ratio is 7.0%. See MD&A—Liquidity and Capital Resources for additional information, including the calculation of regulatory capital ratios.

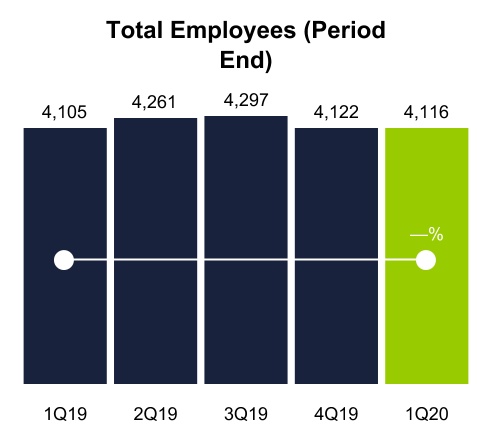

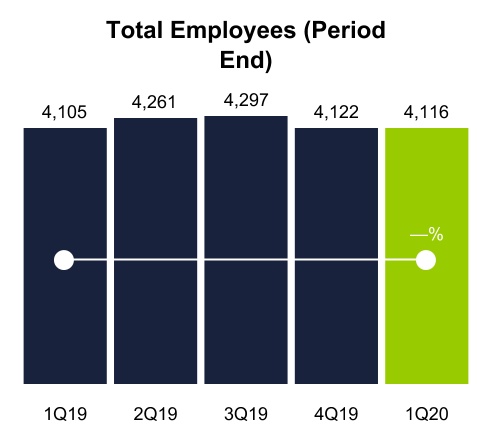

Total employees is the key driver of compensation and benefits expense, our largest non-interest expense category. Total employees were 4,116 and 4,105 at March 31, 2020 and 2019, respectively.

E*TRADE Q1 2020 10-Q | Page 15

We generated net income of $181 million on total net revenue of $707 million for the three months ended March 31, 2020. The following chart presents a reconciliation of net income for the three months ended March 31, 2019 to net income for the three months ended March 31, 2020 (dollars in millions):

(1)Includes advertising and market development, professional services, depreciation and amortization, FDIC insurance premiums, amortization of other intangibles and other non-interest expenses.

E*TRADE Q1 2020 10-Q | Page 16

The following table presents significant components of the consolidated statements of income (dollars in millions, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Three Months Ended March 31, | | | | Variance | | | | | | |

| | | | | | | | | | | | | | 2020 vs. 2019 | | | | | | |

| | | | | | | | | | 2020 | | 2019 | | Amount | | % | | | | |

| Net interest income | | | | | | | | | $ | 400 | | | $ | 492 | | | $ | (92) | | | (19) | % | | | | |

| Total non-interest income | | | | | | | | | 307 | | | 263 | | | 44 | | | 17 | % | | | | |