UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

For the fiscal year ended December 31, 2013

Commission file number 000-21129

| |

|

|

| |

AWARE, INC. |

|

| (Exact Name of Registrant as Specified in Its Charter) |

| |

|

|

|

|

|

| |

Massachusetts |

|

|

04-2911026 |

|

| (State or Other Jurisdiction of |

(I.R.S. Employer Identification No.) |

| Incorporation or Organization) |

|

| |

| 40 Middlesex Turnpike, Bedford, Massachusetts 01730 |

| (Address of Principal Executive Offices) |

| (Zip Code) |

| |

|

|

| |

(781) 276-4000

|

|

|

(Registrant’s Telephone Number, Including Area Code)

|

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

| |

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

| |

Common Stock, par value $.01 per share |

The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer o Accelerated Filer x Non-Accelerated Filer o Smaller Reporting Company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2013 the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based on the closing sale price as reported on the Nasdaq Global Market, was approximately $66,554,082.

The number of shares outstanding of the registrant’s common stock as of February 7, 2014 was 22,624,375

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be delivered to shareholders in connection with the registrant’s Annual Meeting of Shareholders to be held on May 21, 2014 are incorporated by reference into Part III of this Annual Report on Form 10-K.

AWARE, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2013

TABLE OF CONTENTS

| |

|

|

|

|

| |

|

PART I

|

|

|

| |

|

|

|

|

|

Item 1.

|

|

Business

|

|

3

|

|

Item 1A.

|

|

Risk Factors

|

|

12

|

|

Item 1B.

|

|

Unresolved Staff Comments

|

|

17

|

|

Item 2.

|

|

Properties

|

|

18

|

|

Item 3.

|

|

Legal Proceedings

|

|

18

|

|

Item 4.

|

|

Mine Safety Disclosures

|

|

18

|

| |

|

|

|

|

|

PART II

|

| |

|

|

|

|

|

Item 5.

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

19

|

|

Item 6.

|

|

Selected Financial Data

|

|

21

|

|

Item 7.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

22

|

|

Item 7A.

|

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

34

|

|

Item 8.

|

|

Financial Statements and Supplementary Data

|

|

35

|

|

Item 9.

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

58

|

|

Item 9A.

|

|

Controls and Procedures

|

|

58

|

|

Item 9B.

|

|

Other Information

|

|

58

|

| |

|

|

|

|

|

PART III

|

| |

|

|

|

|

|

Item 10.

|

|

Directors, Executive Officers and Corporate Governance

|

|

59

|

|

Item 11.

|

|

Executive Compensation

|

|

59

|

|

Item 12.

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

59

|

|

Item 13.

|

|

Certain Relationships and Related Transactions, and Director Independence

|

|

59

|

|

Item 14.

|

|

Principal Accountant Fees and Services

|

|

59

|

| |

|

PART IV

|

| |

|

|

|

|

|

Item 15.

|

|

Exhibits and Financial Statement Schedule

|

|

60

|

| |

|

|

|

|

|

Signatures

|

|

62

|

PART I

FORWARD LOOKING STATEMENTS

Matters discussed in this Annual Report on Form 10-K relating to future events or our future performance, including any discussion, express or implied, of our anticipated growth, operating results, future earnings per share, market opportunity, plans and objectives, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are often identified by the words “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue,” and similar expressions or variations. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section titled “Risk Factors,” set forth in Item 1A of this Annual Report on Form 10-K and elsewhere in this Report. The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Annual Report on Form 10-K. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report on Form 10-K.

ITEM 1. BUSINESS

Company Overview

Aware, Inc. (“Aware”, “we”, “us”, “our”, or the “Company”) is a leading provider of software and services to the biometrics industry. We have been engaged in this business since 1993. Our software products are used in government and commercial biometrics systems, which are capable of determining or verifying an individual’s identity. The principal applications of biometrics systems include border control, law enforcement, national defense, secure credentialing, access control and background checks.

Our products provide interoperable, standards-compliant, field-proven biometric functionality and are used to capture, verify, format, compress and decompress biometric images as well as aggregate, analyze, process and transport those images within biometric systems. We sell a broad range of software products for fingerprint, facial, and iris modalities. We also offer engineering services related to software customization, integration, and installation, as well as complete systems development. We sell our biometrics software products and services globally through systems integrators, OEMs, and directly to end user customers.

Aware was incorporated in Massachusetts in 1986. We are headquartered at 40 Middlesex Turnpike in Bedford, Massachusetts, and our telephone number at this address is (781) 276-4000. Our website address is www.aware.com. The information on our website is not part of this Form 10-K, unless expressly noted. Our stock is traded on the Nasdaq Global Market under the symbol AWRE.

Industry Background

Biometrics is the measurement of unique, individual physiological characteristics, such as fingerprints, faces, irises, and voices, that can be used to determine or verify an individual’s identity. The biometrics industry offers technology that digitally captures and encodes biometric characteristics and then compares those characteristics against previously encoded biometric data to determine or verify an individual’s identity. Biometrics addresses the limitations inherent in traditional identification and authentication processes, such as paper credentials, passwords, PIN codes and magnetic access cards.

The biometrics industry provides identification solutions for a broad range of government and commercial applications. Principal government biometrics applications include border control, law enforcement, national defense, secure credentialing, access control and background checks. Principal commercial applications include access control for mobile devices, computers, computer networks, and buildings, as well as pre-employment background checks.

We believe that government and commercial entities will continue to adopt and expand the use of biometric-enabled solutions to address the limitations and vulnerabilities of traditional identification processes. We believe the following factors, among others, will contribute to the growth of biometrics solutions: i) government-mandated implementation of identification for employees, citizens, and foreign nationals to enhance national security; ii) military implementations for the identification of terrorists and other hostile persons; iii) increasing threats to personal security encountered in areas such as transportation; iv) government and commercial efforts to detect and reduce fraud, and v) the emergence and adoption of international biometrics standards.

The biometrics industry may be segmented into government and commercial sub-markets. While these markets are similar in many respects and share similar characteristics, other aspects of the markets are different. Important factors that differentiate the government market from the commercial market include: i) principal applications; ii) solutions; and iii) suppliers. We believe that this market-based distinction is important to an understanding of Aware’s business as over 80% of our revenue is derived from government customers.

Government market

Governments were early adopters of biometrics technology and currently represent the largest consumer of the technology. There are sub-sectors within government, such as state, local and national, that use biometric technology. For example, at the local law enforcement level, biometric technology permits more efficient criminal booking and processing and also allows officers in the field to identify potential suspects more reliably and efficiently. Within military organizations, two key applications of biometrics involve: i) the verification and identification of military personnel and contractors; and ii) the collection and processing of biometrics from non-military personnel for the purpose of identifying potential hostile persons. State and local governments also benefit through applications such as background checks, the provision of drivers’ licenses and identification cards and benefits issuance.

At the national level, governments throughout the world have taken steps to improve security in response to heightened concerns over public safety from the threat of terrorism. National governments have mandated increased spending on security measures, implemented new regulations and placed greater emphasis on technology to address growing security concerns. For example, the U.S. Office of Biometric Identity Management currently requires foreign visitors entering the United States to have their two index fingers scanned and a digital photograph taken to establish and verify their identity. The European Union now mandates that e-passports include fingerprint data in addition to a digital photograph. The biometrics industry continues to benefit from these measures because biometric technology provides a reliable means of establishing and verifying identities.

Government biometrics systems typically operate on client/server-based computer networks. Enrollment workstations with peripheral capture devices are used to “enroll” individuals into biometrics systems. Either fixed enrollment workstations or mobile devices are used to capture, process, and format biometric images. Those images are then transported in digital form to centralized matching systems for identification. Examples of capture peripherals include scanners for fingerprint images, cameras for iris and facial images, and handheld devices for mobile capture of fingerprint, iris, and facial images. Other hardware components used in biometrics systems include computer servers to process and transport biometrics images and mainframe computers and servers to store and match those images. In addition, military applications may employ handheld devices that are capable of capturing images and matching those images against image databases that reside on the devices.

Due to the nature of government applications, particularly those involving security, government biometric systems must be capable of accurately and rapidly matching biometric images against large databases of stored images. The ability to accurately and rapidly match images against databases of millions of images is critical because incorrect or delayed results could have severe adverse consequences. These requirements are an important distinguishing characteristic of the government market as compared to the commercial market.

There are a number of vendors that serve the government biometrics market. We believe these vendors may be segmented into three types of suppliers:

|

i)

|

Technology suppliers – Within this category, there are suppliers that provide software and hardware technologies that enable biometrics systems.

|

Biometrics software products provide functionality that: i) captures and formats images; ii) processes and transports images, and iii) matches images. Companies that sell products in this category include: i) Aware; ii) Cognitec Systems GmbH; iii) Neurotechnology; iv) Iritech, Inc.; v) Innovatrics s.r.o.; vi) WCC Group B.V.; vii) Daon, Inc.; and viii) M2Sys Technology (“M2Sys”).

Hardware companies that provide equipment used in biometrics systems includes biometrics-specific vendors, such as Cross Match Technologies, Inc., and Iris ID Systems, Inc., and companies that provide generic computer workstations and computers, such as Hewlett-Packard Development Company, L.P. and Dell, Inc.

|

ii)

|

System integrators – This category of suppliers includes companies that provide system integration services. System integrators purchase hardware and software from biometrics technology vendors, such as those listed immediately above. They then incorporate those components into customized biometrics systems that they build for their end-user customers.

|

Examples of systems integrators include: i) Northrop Grumman Corporation; ii) Lockheed Martin Corporation; iii) Science Applications International Corporation; iv) Hewlett-Packard Enterprise Services; v) International Business Machines; vi) Fujitsu Limited; vii) Computer Science Corporation; vii) Accenture plc; vii) Raytheon Company; and ix) Unisys Corporation.

|

iii)

|

Fully integrated solutions vendors – This category of suppliers includes companies that are fully integrated providers of biometric systems. Such companies combine their in-house hardware and software technologies with their systems integration services to deliver customized biometrics systems to their end-user customers. While these vendors may purchase some components from third parties, we believe such component purchases represent a minor portion of the total systems they deliver.

|

We believe there are three primary fully integrated solutions vendors. They are: i) MorphoTrak and MorphoTrust, divisions of the Safran Group Company (“Safran Morpho”); ii) 3M Cogent Inc. (“3M/Cogent”); and iii) NEC Corporation. We believe that these companies supply a large percentage of the government market.

Commercial market

Commercial users have adopted biometric solutions to solve identity management problems involving the protection of sensitive information, the monitoring of access to secure areas, and the protection of personal information from identity theft. Therefore, principal commercial applications include; i) access control for mobile devices, computers, and computer networks, ii) physical access control to buildings, and iii) pre-employment background checks. The commercial market also encompasses specific solutions for certain industries, such as financial services, retail, gaming, healthcare, and educational testing.

Today, we believe a large portion of the commercial market involves authentication for access control. In this application, biometrics software is typically mated to cards, tokens, reader modules, scanners, smart phones, door locks, and cabinets, such as drug cabinets. The requirements for biometrics matching in these applications are not as robust as in the government market. Many of these applications employ 1-to-1 image matching or 1-to-few image matching. Accordingly, the biometrics technology content in commercial products is generally not as high as in government biometrics systems.

Examples of hardware and software vendors that provide products for the commercial biometrics market in addition to Aware include:

|

|

●

|

Hardware, scanner, and integrated solutions companies, such as: i) DigitalPersona, Inc.; ii) Bioscrypt, Inc., a division of Safran Morpho; iii) Suprema, Inc.; iv) 3M/Cogent; and v) Eyelock, Inc.

|

|

|

●

|

Software platform companies, such as: i) M2Sys; ii) BIO-key International, Inc.; iii) Imprivata, Inc; and iv) Facebanx, a subsidiary of OhHi, Ltd.

|

|

|

●

|

Access control companies, such as: i) Honeywell International, Inc.; ii) HID Global Corporation; iii) Tyco International Ltd.; iv) Lenel Systems International Inc.; v) Stanley Security Limited; vi) IrisGuard, Inc.; and vii) Aurora Biometrics, Inc.; and

|

|

|

●

|

Smart phone companies, such as Apple, Inc. through its acquisition of AuthenTec, Inc.

|

Products and Services

Software products

We supply a broad range of biometrics software products for fingerprint, facial, and iris modalities. Our products capture, verify, format, compress and decompress biometric images as well as aggregate, analyze, process and transport those images within biometric systems. We also sell software maintenance contracts along with our software products. Software maintenance allows customers to receive: i) technical support; and ii) software updates, if and when they are available.

We have four categories of biometrics software products that range from discrete software blocks that customers can use to develop their own solutions to more complete applications that customers can use to reduce or eliminate their development times. Once customers sell systems that make use of these software products, they pay us software license fees based on the number of systems they use.

The four categories of our biometrics software products are described below:

|

|

i)

|

Software Development Kits. Software development kits or (“SDKs”) consist of multiple software libraries, sample applications that show customers how to use the libraries, and documentation. Customers use our SDKs to design their own applications using our libraries. We consider these products to be commercial off-the-shelf (“COTS”) products because they are ready-made products not customized by us for any particular customer. Our SDK products and the functions they perform are:

|

|

|

|

Products for hardware abstraction, autocapture, and quality assurance:

|

|

|

a)

|

FastCapture with LiveScan API;

|

|

|

b)

|

PreFaceTM with Camera API;

|

|

|

c)

|

IrisCheckTM with IrisCam API;

|

|

|

|

Products for biometric data formatting, validation and reading according to ANSI/NIST, ISO/IEC, INCITS, ICAO, FIPS 201, and other U.S. and international standards:

|

|

|

|

Products for compression and decompression of fingerprint, facial, and iris images:

|

|

|

|

Products for biometric authentication:

|

|

|

|

Products for scanning and printing of fingerprint cards:

|

|

|

|

Products for mobile devices:

|

|

|

|

Bundles of products for specific applications:

|

|

|

a)

|

CaptureSuiteTM - for capture of either live scan or card scan fingerprint images;

|

|

|

b)

|

PIVSuiteTM – for registration, identity proofing, and ID card personalization, issuance, and reading; and

|

|

|

c)

|

ICAOSuiteTM - for biometric and biographic enrollment, e-passport personalization and reading, and fingerprint verification.

|

|

|

ii)

|

Software components. Our software component products each include a user interface and one or more software libraries that perform a discrete set of functions. Software components allow customers to develop biometric applications more quickly than using our SDKs. Our set of products in this category is called BioComponentsTM. BioComponents comprises modular, independent, self-contained software components that can operate either independently or in concert with each other performing a specific biometric task. Each biometric capture component has its own configurable user interface, and performs all tasks and workflows required for capture, hardware abstraction, and quality assurance.

|

|

|

iii)

|

Biometric applications. Our products in this category combine a user interface with multiple Aware software libraries into more complete biometrics applications. Our application products and the functions they perform are:

|

|

|

●

|

Universal Registration Client (“URC”)TM. URC is a configurable Windows-based application that performs a variety of biometric data capture, analysis, matching, formatting, and hardware abstraction functions.

|

|

|

●

|

URC Mobile. URC Mobile is a software application for performing biometric enrollment, identification, and screening on mobile biometric devices, such as those used by military personnel in the field.

|

|

|

●

|

FormScannerSE and FormScannerMB. These are two independent applications for scanning and processing of inked fingerprint cards.

|

|

|

●

|

FormScannerSWFT. This product is a version of FormScannerSE that is preconfigured for use in compliance with the “Secure Web Fingerprint Transmission” program of the U.S. Department of Defense.

|

|

|

●

|

Forensic Workbench. Forensic Workbench is a software application for the categorization, processing, and standards-compliant formatting of biometric images and demographic data.

|

|

|

●

|

WebEnroll. WebEnroll provides a reference application with applets for browser-based enrollment of biographic data, fingerprints, and facial images.

|

|

|

iv)

|

Server-based solutions. Our product in this category is called Biometrics Services Platform or BioSPTM. This product is used to build and deploy server-based biometric data processing and workflow solutions. BioSP supports the collection of biometric images from a distributed network, and the subsequent aggregation, analysis, processing and integration of this data into larger systems.

|

In addition to our biometrics software products, we also sell products used in applications involving medical and advanced imaging. Our principal imaging product is Aware JPEG 2000. Our JPEG 2000 image compression software may be used for a variety of applications where compression and decompression of still imagery is required.

Services

We offer engineering services to our customers. The service projects for which we are engaged generally fall into two principal categories:

|

|

i)

|

Systems integrator services – this category of services includes engineering services we provide to our systems integrator customers for assistance with biometrics systems they are developing for their customers. Such services may include software customization, integration, installation, or engineering problem solving.

|

|

|

ii)

|

Direct government services - this category of services arises when government customers contract directly with us for services products involving the development of complete biometrics systems, software development, and engineering problem solving.

|

Hardware products

From 2008 until early 2013, we developed a biometrics software system for a U.S. government customer under a Small Business Innovation Research (“SBIR”) contract. When the software development service project ended in February 2013, we entered into a separate contract to supply hardware products incorporating the developed software as an accommodation to this customer. Hardware products sold to this customer integrate hardware purchased from third parties with software from other third parties as well as software from Aware. We commenced shipments of equipment under this contract in May 2013. While other customers could theoretically purchase the hardware products developed for this customer, we believe that it is unlikely that they will do so, because of the highly customized nature of the products.

Sales and Marketing

As of December 31, 2013, we had a total of 10 employees in our sales and marketing organization. In addition to our employee sales staff, we also engage third party sales agents to represent our products in various foreign countries.

We sell our products and services through three principal channels of distribution:

|

|

i)

|

Systems integrator channel – we sell to systems integrators that incorporate our software products into biometrics systems that are delivered primarily to government end users.

|

|

|

ii)

|

OEM channel – we sell to hardware and software solution providers that incorporate our software products into their products.

|

|

|

iii)

|

Direct channel – we also sell directly to government, and, to a lesser degree, to commercial customers.

|

Revenue from the U.S. Navy represented 21%, 5%, and 10% of total revenue during 2013, 2012, and 2011, respectively. No other customer represented 10% or more of total revenue in any of those years. All of our revenue in 2013, 2012, and 2011 was derived from unaffiliated customers.

Competition

The markets for our products and services are competitive and uncertain. We compete against: i) other companies that provide biometric software solutions; and ii) fully diversified companies that provide biometric software solutions and also act as systems integrators. We can give no assurance that: i) our products and services will succeed in the market; ii) that we will be able to compete effectively; or iii) that competitive pressures will not seriously harm our business.

Many of our competitors are larger than us and have significantly greater financial, technological, marketing and personnel resources than we do. At the other end of the competitive spectrum, we have seen increasing competition from smaller biometrics companies in foreign countries. These smaller foreign competitors have demonstrated a willingness to sell their biometrics software products at low prices.

We can give no assurance that our customers will continue to purchase products from us or that we will be able to compete effectively in obtaining new customers to maintain or grow our business.

Aware’s Strategy

Our strategy is to capitalize on our strong brand and reputation to sell biometrics software products and services into government and commercial markets. We intend to offer a broad portfolio of high quality products that are coupled with expert technical support and services. We expect to continue to employ a three-pronged distribution strategy using systems integrators, OEMs, and direct sales.

Our strategy for growing our biometrics business may include one or more of the following elements:

|

|

i)

|

Product line expansion – We intend to introduce new products that will allow us to sell more software into biometrics systems and projects. Our preference is to develop new products internally by adding resources to our existing engineering staff. To the extent we are unable to develop critical new technologies internally, we may purchase or license such technologies from third parties. Alternatively, we may also acquire biometrics companies provided we believe the acquisition cost is reasonable relative to the estimated future revenue and profits the acquired company may produce.

|

|

|

ii)

|

Geographic expansion – We believe that there are growth opportunities for biometrics projects outside of the United States. We intend to pursue foreign markets through additions to our sales staff, as well as through the use of third party sales agents.

|

|

|

iii)

|

Grow services revenue – We believe that services represent a significant portion of the total biometrics market. We further believe we can grow our services revenue by offering customers high quality engineering services that are delivered responsively at attractive prices. Our services business may benefit from past successes on services projects with other customers.

|

|

|

iv)

|

Commercial market expansion – Historically our revenue has been primarily derived from government biometrics markets. Given the nature of the product solutions required in that market, we have been able to forge a profitable business model. It has been less obvious to us how we replicate that profitable model in commercial markets. As commercial markets grow and product solutions become more complex, we intend to identify opportunities where we can participate profitability.

|

As we attempt to grow our biometrics business, we may make investments in growth initiatives, such as those described above, that may cause our profitability to decline in the near term.

Our strategy does not include growing biometrics hardware revenue. Hardware sales in 2013 financial results are there as an accommodation to an important customer. While we expect that we will have more hardware sales in 2014, our strategy does not include deliberately trying to grow such sales.

Backlog

We generally deliver customer orders as we receive them, and, therefore, have no meaningful backlog of customer orders. We had an atypical backlog situation at the end of 2013 with two direct government customers. As of December 31, 2013, total backlog with these customers was $5.0 million, including $2.7 of hardware sales and $2.3 of services. This backlog is scheduled for delivery during 2014. We are unable to predict whether we will have any significant backlog in future periods.

Research and Development

Our research and development activities are focused on enhancing our existing products and developing new products. Our engineering organization is based in Bedford, Massachusetts. As of December 31, 2013, we had an engineering staff of 37 employees, representing 64% of our total employee staff.

During the years ended December 31, 2013, 2012, and 2011, research and development expenses totaled $4.1 million, $3.5 million, and $3.2 million, respectively. We expect that we will continue to invest substantial funds in research and development activities.

Patents and Intellectual Property

We rely on a combination of nondisclosure agreements and other contractual provisions, as well as patent, trademark, trade secret and copyright law to protect our proprietary rights. We have an active program to protect our proprietary technology through the filing of patents. As of December 31, 2013, we had approximately 124 U.S. and foreign patents, and approximately 79 pending patent applications pertaining to biometrics imaging, medical imaging compression as well as DSL service assurance.

Although we have patented certain aspects of our technology, we rely primarily on trade secrets to protect our intellectual property. We attempt to protect our trade secrets and other proprietary information through agreements with our customers, suppliers, employees and consultants, and through security measures. Each of our employees is required to sign a non-disclosure and non-competition agreement. Although we intend to protect our rights vigorously, we cannot assure you that these measures will be successful. In addition, effective intellectual property protection may be unavailable or limited in certain foreign countries.

Third parties may assert exclusive patent, copyright and other intellectual property rights to technologies that are important to us. From time to time, we receive claims from third parties suggesting that we may be obligated to license such intellectual property rights. If we were found to have infringed any third party’s patents, we could be subject to substantial damages or an injunction preventing us from conducting our business.

Manufacturing & Systems Integration

We do not design or manufacture hardware products, however we provide systems integration services for one U.S. government customer. Our systems integration activities include: i) procuring hardware and software components from third party suppliers; ii) installing Aware and third party software on the purchased hardware; and iii) testing products for quality assurance prior to shipment.

We rely on single source suppliers for certain critical hardware and software components. Our dependence on single source suppliers involves several risks, including limited control over availability, quality, and delivery schedules. Any delays in delivery or shortages of such components could cause delays in the shipment of our products, which could harm our business.

Employees

At December 31, 2013, we employed 58 people, including 37 in engineering, 10 in sales and marketing, and 11 in finance and administration. Of these employees, 56 were based in Massachusetts. None of our employees are represented by a labor union. We consider our employee relations to be good.

We believe that our future success will depend in large part on the service of our technical, sales, marketing and senior management personnel and upon our ability to retain highly qualified technical, sales and marketing and managerial personnel. We cannot assure you that we will be able to retain our key managers and employees or that we will be able to attract and retain additional highly qualified personnel in the future.

Discontinuation of DSL Operations

From the early 1990s until 2013, we operated up to three product lines within the Digital Subscriber Line (“DSL”) industry. Those product lines included: i) DSL silicon intellectual property that we licensed to semiconductor companies; ii) DSL service assurance hardware products that we sold to DSL test equipment companies; and iii) DSL service assurance software products that we licensed to telephone companies and DSL test equipment companies.

As of the end of 2013, we no longer operated any of these DSL product lines. The following summary describes our exit from the DSL business.

Year ended December 31, 2013. In August 2013, our Board of Directors approved the shutdown of our DSL service assurance software product line. We completed the shutdown in 2013, and results for this product line were reported in discontinued operations in our consolidated statements of income and comprehensive income for the three years ended December 31, 2013. This product line was previously a component of our DSL Service Assurance Segment.

Year ended December 31, 2012. In January 2012, our Board of Directors approved the shutdown of our DSL service assurance hardware product line. We completed the shutdown in 2012, and results for this product line were reported in discontinued operations in our consolidated statements of income and comprehensive income for the three years ended December 31, 2013. This product line was previously a component of our DSL Service Assurance Segment.

Year ended December 31, 2009. In November 2009, we sold our DSL semiconductor intellectual property business to one of our customers. The results from the last year of its operations and a gain on the sale of the business were reported in our financial results for 2009.

Notwithstanding the sale of the DSL semiconductor business, we continue to receive royalties from two customers that use our intellectual property in their DSL chipsets. The receipt of DSL royalties is the last remnant of our involvement in the DSL business, and represents a passive business activity as we have no employees or operations dedicated to the generation and/or continuation of that revenue. We simply receive royalty payments from these customers. DSL royalties are reported on a separate line of our consolidated statements of income and comprehensive income called “Royalties.” Royalties declined significantly in 2013 and represented slightly less than 5% of total revenue. We expect royalties to continue to decline in future periods.

Segment Information; Financial Information About Geographic Areas

After the shutdown of our DSL Service Assurance Segment in 2013, we organize ourselves into a single segment that reports to the chief operating decision makers. A summary of our revenue by geographic area is set forth in Note 10 to our consolidated financial statements included elsewhere in this Annual Report.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, are made available free of charge on or through our website at www.aware.com as soon as reasonably practicable after such reports are filed with, or furnished to, the Securities and Exchange Commission (the SEC). The SEC also maintains a website, www.sec.gov, that contains reports and other information regarding issuers that file electronically with the SEC. Such reports, proxy statements, and other information may also be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Washington, DC, 20549 or by calling the SEC at 1-800-SEC-0330.

Copies of our (i) Corporate Governance Principles, (ii) charters for the Audit Committee, Compensation Committee, and Nominating Committee, and (iii) Code of Ethics are available in the Investor Relations section of our website at www.aware.com.

ITEM 1A. RISK FACTORS

Our operating results may fluctuate significantly from period-to-period and are difficult to predict.

Individual orders can represent a meaningful percentage of our revenues and net income in any single quarter and the timing of the receipt of those orders is difficult to predict. The failure to close an order or the deferral or cancellation of an order can result in revenue and net income shortfalls for that quarter. We base our current and future expense levels on our internal operating plans and sales forecasts, and our operating costs are to a large extent fixed. As a result, we may not be able to sufficiently reduce our costs in any quarter to adequately compensate for an unexpected near-term shortfall in revenues, and even a small shortfall could disproportionately and adversely affect financial results for that quarter.

Our financial results may be negatively affected by a number of factors, including the following:

|

|

●

|

the lack or reduction of government funding and the political, budgetary and purchasing constraints of government customers who purchase products and services directly or indirectly from us;

|

|

|

|

the terms of customer contracts that affect the timing of revenue recognition;

|

|

|

|

the size and timing of our receipt of customer orders;

|

|

|

|

significant fluctuations in demand for our products and services;

|

|

|

|

the loss of a key customer or one of its key customers;

|

|

|

|

new competitors, or the introduction of enhanced solutions from new or existing competitors;

|

|

|

|

competitive pressures on selling prices;

|

|

|

|

cancellations, delays or contract amendments by government customers;

|

|

|

|

higher than expected costs, asset write-offs, and other one-time financial charges; and

|

|

|

|

general economic trends and other factors

|

As a result of these factors, we believe that period-to-period comparisons of our revenue levels and operating results are not necessarily meaningful. You should not rely on our quarterly revenue and operating results to predict our future performance.

We derive a significant portion of our revenue directly or indirectly from government customers, and our business may be adversely affected by changes in the contracting or fiscal policies of those governmental entities.

We derive a significant portion of our revenue directly or indirectly from federal, international, state and local governments. We believe that the success and growth of our business will continue to depend on government customers purchasing our products and services either directly through us or indirectly through our channel partners. Changes in government contracting policies or government budgetary constraints may adversely affect our financial performance. Among the factors that could adversely affect our business are:

|

|

|

changes in fiscal policies or decreases in available government funding,

|

|

|

|

changes in government funding priorities;

|

|

|

|

changes in government programs or applicable requirements;

|

|

|

|

the adoption of new laws or regulations or changes to existing laws or regulations;

|

|

|

|

changes in political or social attitudes with respect to security and defense issues;

|

|

|

|

changes in audit policies and procedures of government entities;

|

|

|

|

potential delays or changes in the government appropriations process; and

|

|

|

|

delays in the payment of our invoices by government payment offices.

|

These and other factors could cause government customers or our channel partners to reduce purchases of products and services from us which would have a material adverse effect on our business, financial condition and operating results.

We derive a significant portion of our revenue from third party channel partners.

Our future results depend upon the continued successful distribution of our products through a channel of systems integrators and OEM partners. Systems integrators, including value added resellers, use our software products as a component of the biometrics systems they deliver to their customers. OEMs embed our software products in their technology devices or software products. These channel partners typically sell their products and services to government customers.

Our failure to effectively manage our relationships with these third parties could impair the success of our sales, marketing and support activities. Moreover, the activities of these third parties are not within our direct control. The occurrence of any of the following events could have a material adverse effect on our business, financial condition and operating results:

|

|

|

a reduction in sales efforts by our partners;

|

|

|

|

the failure of our partners to win government awards in which our products are used;

|

|

|

|

a reduction in technical capabilities or financial viability of our partners;

|

|

|

|

a misalignment of interest between us and them;

|

|

|

|

the termination of our relationship with a major systems integrator or OEM; or

|

|

|

|

any adverse effect on a partner’s business related to competition, pricing and other factors.

|

If the biometrics market does not experience significant growth or if our products do not achieve broad acceptance both domestically and internationally, we may not be able to grow our business.

Our revenues are derived primarily from sales of biometrics products and services. We cannot accurately predict the future growth rate or the size of the biometrics market. The expansion of the biometrics market and the market for our biometrics products and services depend on a number of factors, such as:

|

|

|

the cost, performance and reliability of our products and services and the products and services offered by our competitors;

|

|

|

|

the continued growth in demand for biometrics solutions within the government and law enforcement markets as well as the development and growth of demand for biometric solutions in markets outside of government and law enforcement;

|

|

|

|

customers’ perceptions regarding the benefits of biometrics solutions;

|

|

|

|

public perceptions regarding the intrusiveness of these solutions and the manner in which organizations use the biometric information collected;

|

|

|

|

public perceptions regarding the confidentiality of private information;

|

|

|

|

proposed or enacted legislation related to privacy of information;

|

|

|

|

customers’ satisfaction with biometrics solutions; and

|

|

|

|

marketing efforts and publicity regarding biometrics solutions.

|

Even if biometrics solutions gain wide market acceptance, our solutions may not adequately address market requirements and may not continue to gain market acceptance. If biometrics solutions generally or our solutions specifically do not gain wide market acceptance, we may not be able to achieve our anticipated level of growth and our revenues and results of operations would be adversely affected.

We face intense competition from other biometrics solutions providers.

A significant number of established companies have developed or are developing and marketing software and hardware for biometrics products and applications that currently compete with or will compete directly with our offerings. We believe that additional competitors will enter the biometrics market and become significant long-term competitors, and that, as a result, competition will increase. Companies competing with us may introduce solutions that are competitively priced, have increased performance or functionality or incorporate technological advances we have not yet developed or implemented. Our current principal competitors include:

|

|

|

Diversified technology providers that offer integrated biometrics solutions to governments, law enforcement agencies and other organizations. This group of competitors includes companies such as Safran Morpho, a division of the Safran Group Company; 3M Cogent, and NEC Corporation.

|

|

|

|

Component providers that offer biometrics software and hardware components for fingerprint, facial, and iris biometric identification. This group of competitors includes companies such as Cognitec Systems GmbH; Neurotechnology; Iritech, Inc.; Iris ID Systems, Inc.; Innovatrics s.r.o.; WCC Group B.V.; Daon, Inc.; and M2Sys Technology (“M2Sys”).

|

We expect competition to intensify in the near term in the biometrics market. Many current and potential competitors have substantially greater financial, marketing, and research resources than we have. Moreover, low cost foreign competitors from third world and other countries have demonstrated a willingness to sell their products at significantly reduced prices. To compete effectively in this environment, we must continually develop and market new and enhanced solutions and technologies at competitive prices and must have the resources available to invest in significant research and development activities. Our failure to compete successfully could cause our revenues and market share to decline.

The biometrics industry is characterized by rapid technological change and evolving industry standards, which could render our existing products obsolete.

Our future success will depend upon our ability to develop and introduce a variety of new capabilities and enhancements to our existing products in order to address the changing and sophisticated needs of the marketplace. Frequently, technical development programs in the biometrics industry require assessments to be made of the future direction of technology, which is inherently difficult to predict. Delays in introducing new products and enhancements, the failure to choose correctly among technical alternatives or the failure to offer innovative products or enhancements at competitive prices may cause customers to forego purchases of our products and purchase our competitors’ products. We may not have adequate resources available to us or may not adequately keep pace with appropriate requirements in order to effectively compete in the marketplace.

Our software products may have errors, defects or bugs, which could result in delayed or lost revenue, expensive correction, liability to our customers, and claims against us.

Complex software products such as ours may contain errors, defects or bugs. Defects in the products that we develop and sell to our customers could require expensive corrections and result in delayed or lost revenue, adverse customer reaction and negative publicity about us or our products and services. Customers who are not satisfied with any of our products may also bring claims against us for damages, which, even if unsuccessful, would likely be time-consuming to defend, and could result in costly litigation and payment of damages. Such claims could harm our reputation, financial results and competitive position.

Our business may be adversely affected by our use of open source software.

The software industry is making increasing use of open source software in the development of products. We also license and integrate certain open source software components from third parties into our software. Open source software license agreements may require that the software code in these components or the software into which they are integrated be freely accessible under open source terms. Many features we may wish to add to our products in the future may be available as open source software and our development team may wish to make use of this software to reduce development costs and speed up the development process. While we carefully monitor the use of all open source software and try to ensure that no open source software is used in such a way as to require us to disclose the source code to the related product, such use could inadvertently occur. If we were required to make our software freely available, our business could be seriously harmed.

Our intellectual property is subject to limited protection.

Because we are a technology provider, our ability to protect our intellectual property and to operate without infringing the intellectual property rights of others is critical to our success. We regard our technology as proprietary. We rely on a combination of patent, trade secret, copyright, and trademark law as well as confidentiality agreements to protect our proprietary technology, and cannot assure you that we will be able to enforce the patents we own against third parties. Despite our efforts, these measures can only provide limited protection. Unauthorized third parties may try to copy or reverse engineer portions of our products or otherwise obtain and use our intellectual property. If we fail to protect our intellectual property rights adequately, our competitors may gain access to our technology, and our business would thus be harmed.

In the future, we may be involved in legal action to enforce our intellectual property rights relating to our patents, copyrights or trade secrets. Any such litigation could be costly and time-consuming for us, even if we were to prevail. Moreover, even if we are successful in protecting our proprietary information, our competitors may independently develop technologies substantially equivalent or superior to our technology. Accordingly, despite our efforts, we may be unable to prevent third parties from infringing upon or misappropriating our intellectual property or otherwise gaining access to our technology. The misappropriation of our technology or the development of competitive technology could seriously harm our business.

We may be sued by third parties for alleged infringement of their proprietary rights.

Our technology and products may infringe the intellectual property rights of others. A large and increasing number of participants in the technology industry, including companies known as non-practicing entities, have applied for or obtained patents. Some of these patent holders have demonstrated a readiness to commence litigation based on allegations of patent infringement. Third parties have asserted against us in the past and may assert against us in the future patent, copyright and other intellectual property rights to technologies that are important to our business.

Intellectual property rights can be uncertain and involve complex legal and factual questions. Moreover, intellectual property claims, with or without merit, can be time-consuming and expensive to litigate or settle, and could divert management attention away from the execution of our business plan. If we were found to have infringed the proprietary rights of others, we could be subject to substantial damages or an injunction preventing us from conducting our business.

If we are unable to attract and retain key personnel, our business could be harmed.

If any of our key employees were to leave, we could face substantial difficulty in hiring qualified successors and could experience a loss in productivity while any successor obtains the necessary training and experience. Our employment relationships are at-will and we have had key employees leave in the past. We cannot assure you that one or more key employees will not leave in the future. We intend to continue to hire additional highly qualified personnel, including software engineers and sales personnel, but may not be able to attract, assimilate or retain qualified personnel in the future. Any failure to attract, integrate, motivate and retain these employees could harm our business.

We rely on single sources of supply for certain components used in our hardware products.

We commenced sales of biometrics hardware products to a U.S. government customer in 2013. Hardware products sold to this customer integrate hardware and software purchased from third parties. We rely on single source suppliers for certain critical hardware and software components. Our dependence on single source suppliers involves several risks, including limited control over availability, quality, and delivery schedules. Any delays in delivery or shortages of such components could cause delays in the shipment of our products, which could harm our business.

Our business may be affected by government regulations.

Extensive regulation by federal, state, and foreign regulatory agencies could adversely affect us in ways that are difficult for us to predict. In addition, our business may also be adversely affected by: i) the imposition of tariffs, duties and other import restrictions on goods and services we purchase from non-domestic suppliers; or ii) by the imposition of export restrictions on products we sell internationally. Changes in current or future laws or regulations, in the United States or elsewhere, could seriously harm our business.

Adverse economic conditions could harm our business.

Unfavorable changes in economic conditions, including recessions, inflation, turmoil in financial markets, or other changes in economic conditions, could harm our business, results of operations, and financial conditions as a result of:

| |

|

|

|

|

●

|

reduced demand for our products;

|

|

|

|

increased risk of order cancellations or delays;

|

|

|

|

increased pressure on the prices for our products;

|

|

|

|

greater difficulty in collecting accounts receivable; and

|

|

|

|

risks to our liquidity, including the possibility that we might not have access to our cash when needed.

|

We are unable to predict the timing, duration, and severity of any such adverse economic conditions in the U.S. and other countries, but the longer the duration, the greater the risks we face in operating our business.

We may make acquisitions of companies.

We may make acquisitions of companies that offer complementary products, services and technologies. Any acquisitions we may complete involve a number of risks, including the risks of assimilating the operations and personnel of acquired companies, realizing the value of the acquired assets relative to the price paid, distraction of management from our ongoing businesses and potential product disruptions associated with the sale of the acquired company’s products. These factors could have a material adverse effect on our business, financial condition, operating results and cash flows. The consideration we pay for any future acquisitions could include our stock. As a result, future acquisitions could cause dilution to existing shareholders and to earnings per share.

Royalties will likely decline in future periods.

Prior to November 2009, we were a supplier of DSL silicon intellectual property to the semiconductor industry. We continue to receive royalties from two principal customers that use our DSL silicon IP in their DSL chipsets. It is difficult for us to make accurate forecasts of DSL chipset royalty revenue because such revenue depends on factors that are beyond our control. Royalty revenue from both of our licensees declined significantly in 2013. We believe it is likely that royalties will continue to decline in future periods.

The market price of our common stock has been and may continue to be subject to wide fluctuations, and this may make it difficult for shareholders to resell the common stock when they want or at prices they find attractive.

The market price of our common stock, like that of other technology companies, is volatile and is subject to wide fluctuations in response to a variety of factors, including:

|

|

|

quarterly variations in operating results;

|

|

|

|

announcements of technological innovations or new products by us or our competitors,

|

|

|

|

changes in customer relationships, such as the loss of a key customer;

|

|

|

|

recruitment or departure of key personnel;

|

|

|

|

corporate actions we may initiate, such as acquisitions, stock sales or repurchases, dividend declarations, or corporate reorganizations; and

|

Our stock price may also be affected by broader market trends unrelated to our performance. As a result, purchasers of our common stock may be unable at any given time to sell their shares at or above the price they paid for them. Moreover, companies that have experienced volatility in the market price of their stock often are subject to securities class action litigation. If we were the subject of such litigation, it could result in substantial costs and divert management’s attention and resources.

If we are unable to maintain effective internal controls over financial reporting, investors could lose confidence in the reliability of our financial statements, which could result in a decline in the price of our common stock.

As a public company, we are required to enhance and test our financial, internal and management control systems to meet obligations imposed by the Sarbanes-Oxley Act of 2002. Consistent with the Sarbanes-Oxley Act and the rules and regulations of the SEC, management’s assessment of our internal controls over financial reporting and the audit opinion of our independent registered accounting firm as to the effectiveness of our controls is required in connection with our filing of our Annual Report on Form 10-K. If we are unable to identify, implement and conclude that we have effective internal controls over financial reporting or if our independent auditors are unable to conclude that our internal controls over financial reporting are effective, investors could lose confidence in the reliability of our financial statements, which could result in a decrease in the value of our common stock. Our assessment of our internal controls over financial reporting may also uncover weaknesses or other issues with these controls that could also result in adverse investor reaction.

We must make judgments in the process of preparing our financial statements.

We prepare our financial statements in accordance with generally accepted accounting principles and certain critical accounting policies that are relevant to our business. The application of these principles and policies requires us to make significant judgments and estimates. In the event that our judgments and estimates differ from actual results, we may have to change them, which could materially affect our financial position and results of operations.

Moreover, accounting standards have been subject to rapid change and evolving interpretations by accounting standards setting organizations over the past few years. The implementation of new accounting standards requires us to interpret and apply them appropriately. If our current interpretations or applications are later found to be incorrect, we may have to restate our financial statements and the price of our stock could decline.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

We believe that our existing facilities are adequate for our current needs and that additional space sufficient to meet our needs for the foreseeable future will be available on reasonable terms. We currently occupy approximately 72,000 square feet of office space in Bedford, Massachusetts, which serves as our headquarters. This site is used for our research and development, sales and marketing, and administrative activities. We own this facility.

ITEM 3. LEGAL PROCEEDINGS

From time to time we are involved in litigation incidental to the conduct of our business. We are not party to any lawsuit or proceeding that, in our opinion, is likely to seriously harm our business.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is the only class of stock we have outstanding, and it trades on the Nasdaq Global Market under the symbol AWRE. The following table sets forth the high and the low sales prices of our common stock as reported on the Nasdaq Global Market for the periods indicated from January 1, 2012 to December 31, 2013.

| |

|

First

|

|

|

Second

|

|

|

Third

|

|

|

Fourth

|

|

| |

|

Quarter

|

|

|

Quarter

|

|

|

Quarter

|

|

|

Quarter

|

|

|

2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

$ |

6.25 |

|

|

$ |

5.65 |

|

|

$ |

5.64 |

|

|

$ |

6.14 |

|

|

Low

|

|

|

4.58 |

|

|

|

4.50 |

|

|

|

4.80 |

|

|

|

5.06 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

$ |

4.68 |

|

|

$ |

7.50 |

|

|

$ |

6.88 |

|

|

$ |

6.90 |

|

|

Low

|

|

|

2.30 |

|

|

|

3.34 |

|

|

|

5.31 |

|

|

|

5.05 |

|

As of February 6, 2014, we had approximately 108 shareholders of record. This number does not include shareholders from whom shares were held in a “nominee” or “street” name. We paid no dividends in 2011 and 2013. In 2012, we paid a special cash dividend of $1.15 per share on May 25, 2012 and another special cash dividend of $1.80 per share on December 17, 2012. We anticipate that we will continue to reinvest any earnings to finance future operations although we may also pay additional special cash dividends if our board of directors deems it appropriate.

We did not sell any equity securities that were not registered under the Securities Act of 1933 during the three months ended December 31, 2013.

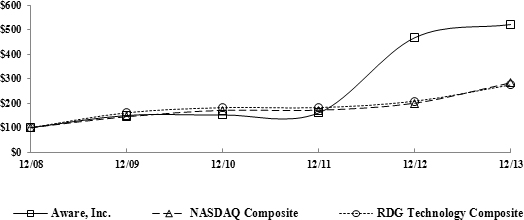

Stock Performance Graph

The following stock performance graph compares the performance of Aware’s cumulative stockholder return with that of a broad market index, the Nasdaq Composite Index, and a published industry index, the RDG Technology Composite Index. The cumulative stockholder returns for shares of Aware’s common stock and for the market and industry indices are calculated assuming $100 was invested on December 31, 2008. Aware paid no cash dividends in 2009, 2010, 2011, and 2013. In 2012, we paid special cash dividends of $2.95 per share. The performance of the market and industry indices is shown on a total return, or dividend reinvested, basis.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Aware, Inc., the NASDAQ Composite Index, and the RDG Technology Composite Index

*$100 invested on 12/31/08 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

| |

|

Value of Investment ($)

|

|

| |

|

12/31/08

|

|

|

12/31/09

|

|

|

12/31/10

|

|

|

12/31/11

|

|

|

12/31/12

|

|

|

12/31/13

|

|

|

Aware, Inc.

|

|

$ |

100.00 |

|

|

$ |

149.73 |

|

|

$ |

151.87 |

|

|

$ |

160.43 |

|

|

$ |

467.26 |

|

|

$ |

520.97 |

|

|

Nasdaq Composite Index

|

|

|

100.00 |

|

|

|

144.88 |

|

|

|

170.58 |

|

|

|

171.30 |

|

|

|

199.99 |

|

|

|

283.39 |

|

|

RDG Technology Composite

|

|

|

100.00 |

|

|

|

160.94 |

|

|

|

181.64 |

|

|

|

181.83 |

|

|

|

208.18 |

|

|

|

274.77 |

|

ITEM 6. SELECTED FINANCIAL DATA

The following selected consolidated financial and operating data set forth below with respect to our consolidated financial statements for the fiscal years ended December 31, 2013, 2012 and 2011 are derived from the consolidated financial statements included elsewhere in this Form 10-K. The data for fiscal years ended December 31, 2010 and 2009 are derived from previously filed consolidated financial statements after giving effect to discontinued operations. The data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our historical consolidated financial statements, and the related notes to the consolidated financial statements, which can be found in Item 7 and Item 8.

|

Year ended December 31,

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

| |

|

(in thousands, except per share data)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Comprehensive Income Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

19,357 |

|

|

$ |

17,304 |

|

|

$ |

16,199 |

|

|

$ |

12,975 |

|

|

$ |

15,856 |

|

|

Operating income (loss) before patent related income

|

|

|

4,538 |

|

|

|

5,043 |

|

|

|

3,500 |

|

|

|

(360 |

) |

|

|

(3,834 |

) |

|

Gain on sale of patent assets

|

|

|

- |

|

|

|

86,394 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Gain on sale of assets

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6,230 |

|

|

Income from continuing operations, net of income taxes

|

|

|

3,752 |

|

|

|

72,383 |

|

|

|

3,581 |

|

|

|

154 |

|

|

|

2,629 |

|

|

Income (loss) from discontinued operations, net of income taxes

|

|

|

(1,156 |

) |

|

|

(76 |

) |

|

|

(1,014 |

) |

|

|

26 |

|

|

|

(1,647 |

) |

|

Net income

|

|

|

2,596 |

|

|

|

72,307 |

|

|

|

2,567 |

|

|

|

180 |

|

|

|

982 |

|

|

Net income per share – basic

|

|

$ |

0.12 |

|

|

$ |

3.32 |

|

|

$ |

0.12 |

|

|

$ |

0.01 |

|

|

$ |

0.05 |

|

|

Net income per share – diluted

|

|

$ |

0.11 |

|

|

$ |

3.28 |

|

|

$ |

0.12 |

|

|

$ |

0.01 |

|

|

$ |

0.05 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

72,660 |

|

|

$ |

71,074 |

|

|

$ |

46,577 |

|

|

$ |

39,949 |

|

|

$ |

39,669 |

|

|

Working capital

|

|

|

75,760 |

|

|

|

73,358 |

|

|

|

48,069 |

|

|

|

43,818 |

|

|

|

42,209 |

|

|

Total assets

|

|

|

89,329 |

|

|

|

85,854 |

|

|

|

57,851 |

|

|

|

53,400 |

|

|

|

51,454 |

|

|

Total liabilities

|

|

|

4,179 |

|

|

|

3,958 |

|

|

|

3,276 |

|

|

|

3,517 |

|

|

|

3,094 |

|

|

Total stockholders’ equity

|

|

|

85,150 |

|

|

|

81,896 |

|

|

|

54,575 |

|

|

|

49,883 |

|

|

|

48,360 |

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS

The following table sets forth, for the years indicated, certain line items from our consolidated statements of income and comprehensive income stated as a percentage of total revenue:

| |

|

Year ended December 31,

|

|

|

Revenue:

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

Software licenses

|

|

|

43 |

% |

|

|

55 |

% |

|

|

48 |

% |

|

Software maintenance

|

|

|

20 |

|

|

|

18 |

|

|

|

16 |

|

|

Services

|

|

|

16 |

|

|

|

15 |

|

|

|

23 |

|

|

Hardware sales

|

|

|

16 |

|

|

|

- |

|

|

|

- |

|

|

Royalties

|

|

|

5 |

|

|

|

12 |

|

|

|

13 |

|

|

Total revenue

|

|

|

100 |

|

|

|

100 |

|

|

|

100 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of hardware sales

|

|

|

12 |

|

|

|

- |

|

|

|

- |

|

|

Cost of services

|

|

|

8 |

|

|

|

9 |

|

|

|

9 |

|

|

Research and development

|

|

|

21 |

|

|